Miami, FL February 10, 2012 Aleem Gillani Chief Financial Officer Credit Suisse Financial Services Forum

1 Important Cautionary Statement About Forward-Looking Statements The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2010 Annual Report on Form 10-K, Quarterly Reports on Form 10- Q, and Current Reports on Form 8-K. This presentation includes non-GAAP financial measures to describe SunTrust’s performance. The reconciliations of those measures to GAAP measures are provided within or in the appendix of this presentation. In this presentation, net interest income and net interest margin are presented on a fully taxable-equivalent (“FTE”) basis, and ratios are presented on an annualized basis. The FTE basis adjusts for the tax-favored status of income from certain loans and investments. The Company believes this measure to be the preferred industry measurement of net interest income and provides relevant comparison between taxable and non-taxable amounts. This presentation contains forward-looking statements. Statements about expected expense reductions, future levels of the efficiency ratio, and our plans to return capital to investors in the future are forward looking statements. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “objectives,” “initiatives,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Such statements are based upon the current beliefs and expectations of management and on information currently available to management. Such statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Part I, Item 1A, “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2010, and in Part II, “Item 1A. Risk Factors” in our Quarterly Report on Form 10-Q for the periods ended March 31, 2011, June 30, 2011, and September 30, 2011, and also include those risks discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of our 10-K and 10-Qs and elsewhere in periodic reports that we file with the SEC. Those factors include: difficult market conditions have adversely affected our industry; concerns over market volatility continue; the Dodd-Frank Act makes fundamental changes in the regulation of the financial services industry, some of which may adversely affect our business; we are subject to capital adequacy and liquidity guidelines and, if we fail to meet these guidelines, our financial condition would be adversely affected; emergency measures designed to stabilize the U.S. banking system are beginning to wind down; we are subject to credit risk; our ALLL may not be adequate to cover our eventual losses; we will realize future losses if the proceeds we receive upon liquidation of nonperforming assets are less than the carrying value of such assets; weakness in the economy and in the real estate market, including specific weakness within our geographic footprint, has adversely affected us and may continue to adversely affect us; weakness in the real estate market, including the secondary residential mortgage loan markets, has adversely affected us and may continue to adversely affect us; we are subject to certain risks related to originating and selling mortgages. We may be required to repurchase mortgage loans or indemnify mortgage loan purchasers as a result of breaches of representations and warranties, borrower fraud, or certain borrower defaults, which could harm our liquidity, results of operations, and financial condition; we are subject to risks related to delays in the foreclosure process; we may continue to suffer increased losses in our loan portfolio despite enhancement of our underwriting policies; as a financial services company, adverse changes in general business or economic conditions could have a material adverse effect on our financial condition and results of operations; changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital or liquidity; the fiscal and monetary policies of the federal government and its agencies could have a material adverse effect on our earnings; depressed market values for our stock may require us to write down goodwill; clients could pursue alternatives to bank deposits, causing us to lose a relatively inexpensive source of funding; consumers may decide not to use banks to complete their financial transactions, which could affect net income; we have businesses other than banking which subject us to a variety of risks; hurricanes and other natural or man-made disasters may adversely affect loan portfolios and operations and increase the cost of doing business; negative public opinion could damage our reputation and adversely impact business and revenues; the soundness of other financial institutions could adversely affect us; we rely on other companies to provide key components of our business infrastructure; we rely on our systems, employees, and certain counterparties, and certain failures could materially adversely affect our operations; we depend on the accuracy and completeness of information about clients and counterparties; regulation by federal and state agencies could adversely affect the business, revenue, and profit margins; competition in the financial services industry is intense and could result in losing business or margin declines; maintaining or increasing market share depends on market acceptance and regulatory approval of new products and services; we might not pay dividends on your common stock; disruptions in our ability to access global capital markets may negatively affect our capital resources and liquidity; any reduction in our credit rating could increase the cost of our funding from the capital markets; we have in the past and may in the future pursue acquisitions, which could affect costs and from which we may not be able to realize anticipated benefits; we are subject to certain litigation, and our expenses related to this litigation may adversely affect our results; we depend on the expertise of key personnel, and if these individuals leave or change their roles without effective replacements, our operations may suffer; we may not be able to hire or retain additional qualified personnel and recruiting and compensation costs may increase as a result of turnover, both of which may increase costs and reduce profitability and may adversely impact our ability to implement our business strategies; our accounting policies and processes are critical to how we report our financial condition and results of operations and require management to make estimates about matters that are uncertain; changes in our accounting policies or in accounting standards could materially affect how we report our financial results and condition; our stock price can be volatile; our disclosure controls and procedures may not prevent or detect all errors or acts of fraud; our financial instruments carried at fair value expose us to certain market risks; our revenues derived from our investment securities may be volatile and subject to a variety of risks; and we may enter into transactions with off-balance sheet affiliates or our subsidiaries.

2 The SunTrust Franchise

3 A Leading Bank with an Attractive Southeastern Footprint Franchise Overview Attractive Operating Footprint 1. Source: SNL Financial, five-year population growth, 2010-2015, MSA + counties not in any MSA, at 2/8/2012. 2. Source: SNL Financial, five-year projected household income change, 2010-2015, MSA + counties not in any MSA, at 2/8/2012. 3. Source: SNL Financial, as of 6/30/2011 based on MSAs. Superior Growth Characteristics Projected Population Growth = 6.2%1 – National Average = 3.9% Projected HH Income Growth = 14.0%2 – National Average = 12.4% Relevance Within Our Markets Top 3 Deposit Market Share Rank in 20 of our Top 25 MSAs3 – Top 25 MSAs represent 86% of our total MSA deposits – Our Top 25 MSA average deposit market share is 15%

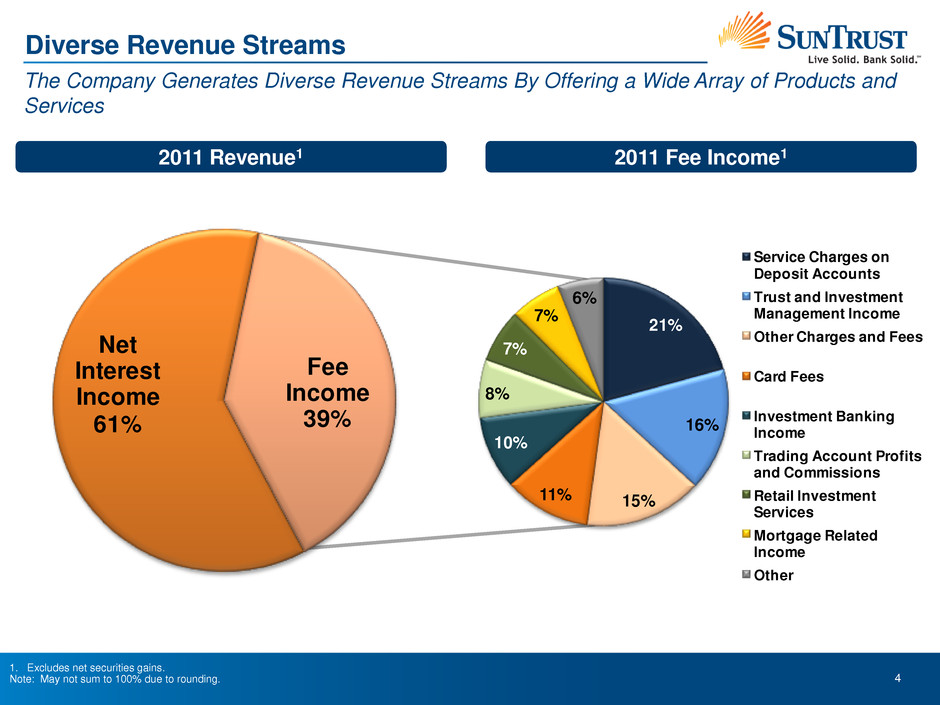

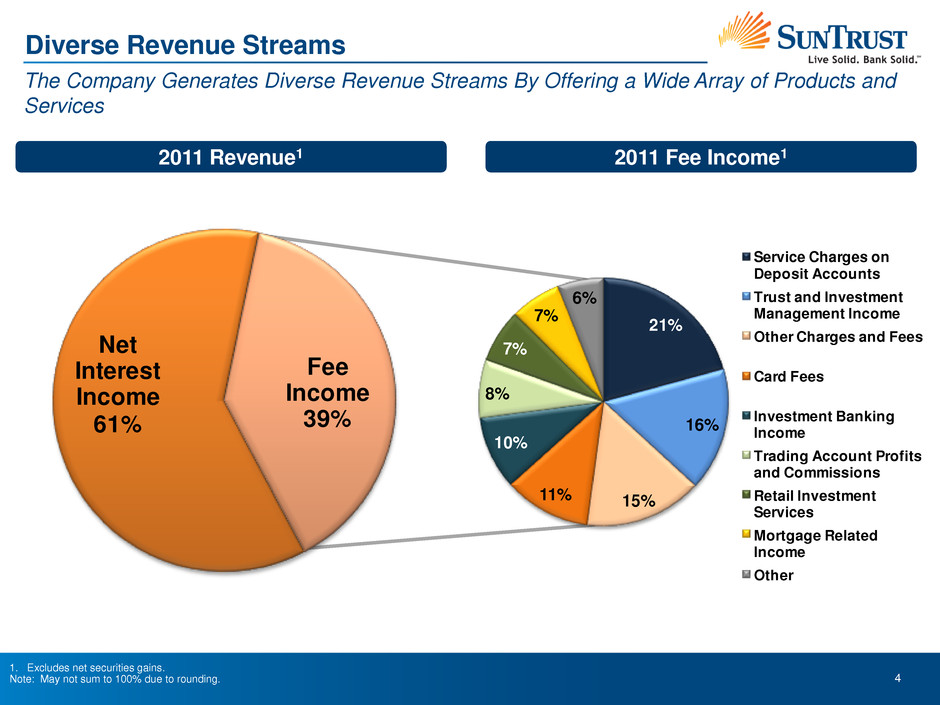

4 Diverse Revenue Streams The Company Generates Diverse Revenue Streams By Offering a Wide Array of Products and Services 2011 Revenue1 1. Excludes net securities gains. Note: May not sum to 100% due to rounding. Net Interest Income 61% Fee Income 39% 21% 16% 15%11% 10% 8% 7% 7% 6% Service Charges on Deposit Accounts Trust and Investment Management Income Other Charges and Fees Card Fees Investment Banking Income Trading Account Profits and Commissions Retail Investment Services Mortgage Related Income Other 2011 Fee Income1

5 2011 Performance Review

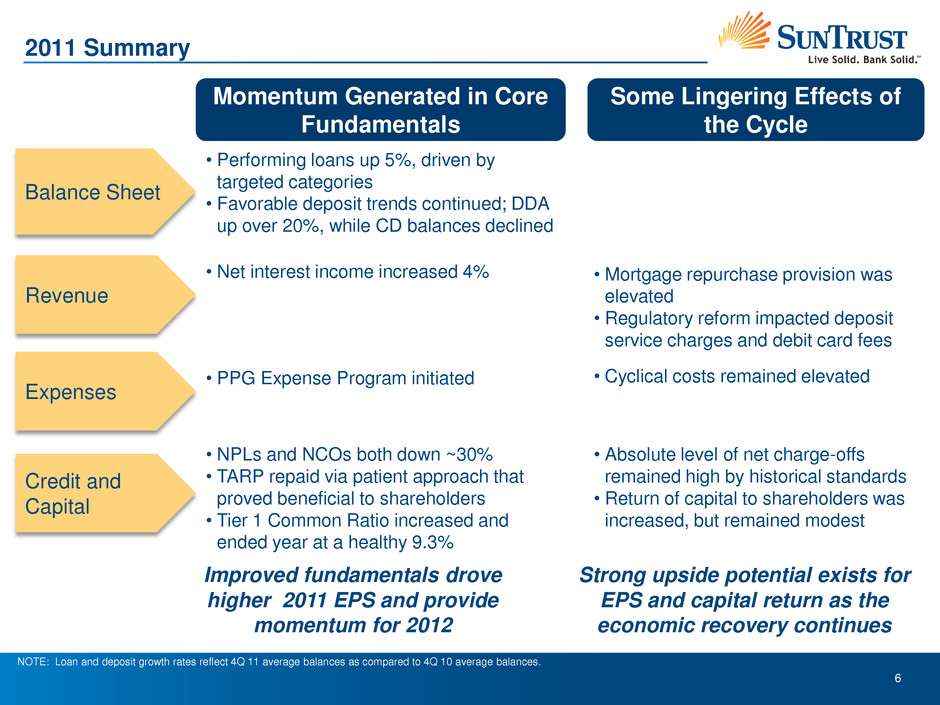

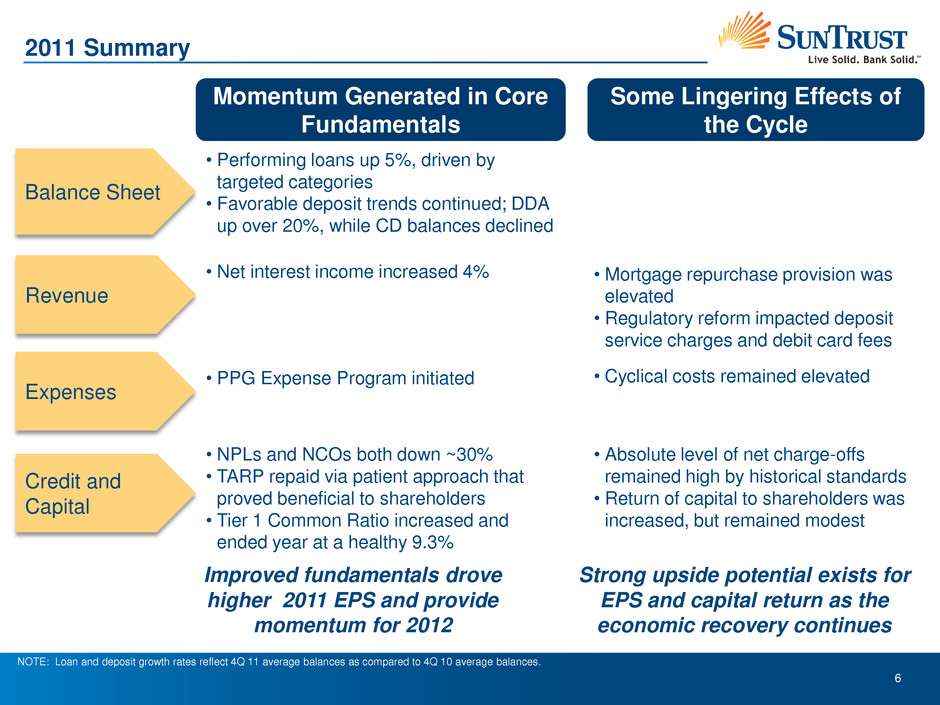

6 Balance Sheet Revenue Expenses Credit and Capital • Performing loans up 5%, driven by targeted categories • Favorable deposit trends continued; DDA up over 20%, while CD balances declined • Net interest income increased 4% • PPG Expense Program initiated • NPLs and NCOs both down ~30% • TARP repaid via patient approach that proved beneficial to shareholders • Tier 1 Common Ratio increased and ended year at a healthy 9.3% 2011 Summary NOTE: Loan and deposit growth rates reflect 4Q 11 average balances as compared to 4Q 10 average balances. Momentum Generated in Core Fundamentals Some Lingering Effects of the Cycle • Mortgage repurchase provision was elevated • Regulatory reform impacted deposit service charges and debit card fees • Cyclical costs remained elevated • Absolute level of net charge-offs remained high by historical standards • Return of capital to shareholders was increased, but remained modest Improved fundamentals drove higher 2011 EPS and provide momentum for 2012 Strong upside potential exists for EPS and capital return as the economic recovery continues

7 Momentum in Core Fundamentals: Loans ($ in billions, average balances) $123.8 $108.3 $110.7 $111.1 $111.1 $112.2 $116.4 4Q 08 4Q 09 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 Growth in Performing Loans Has Accelerated in Recent Quarters

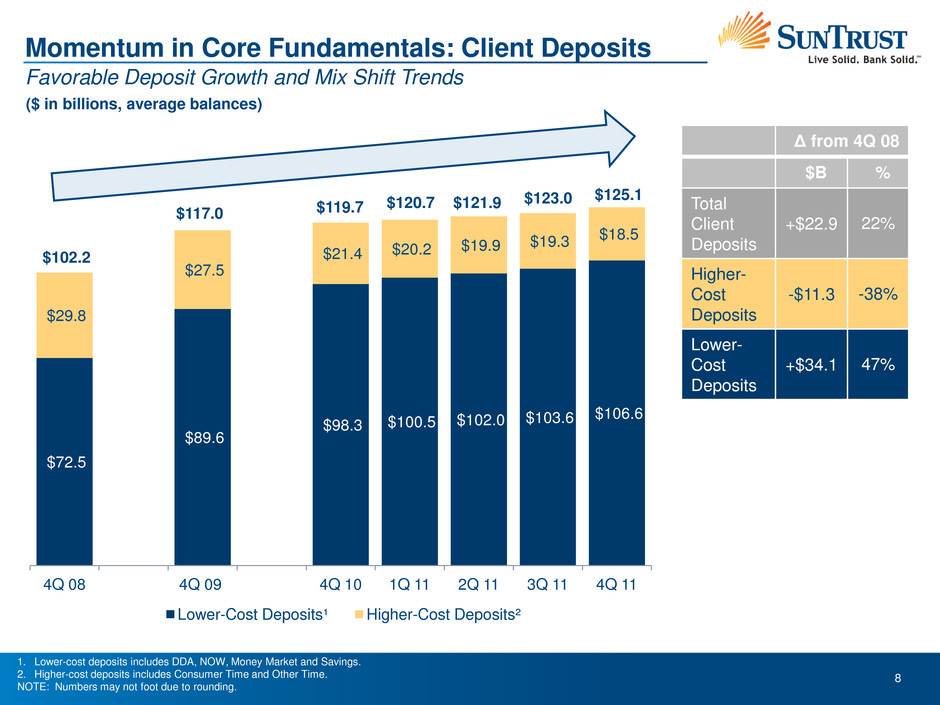

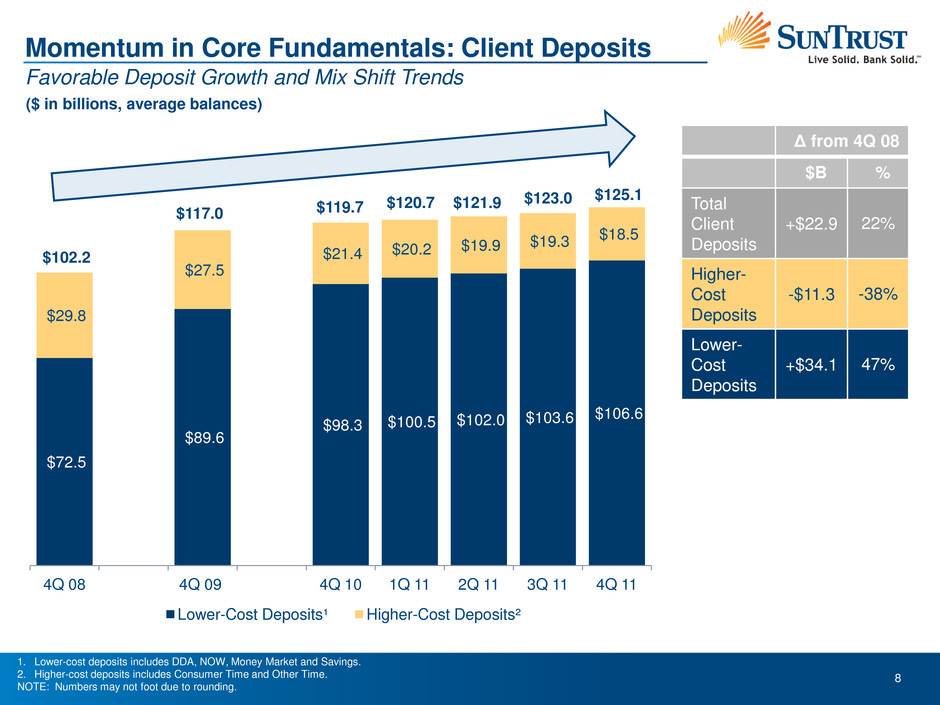

8 Momentum in Core Fundamentals: Client Deposits Favorable Deposit Growth and Mix Shift Trends 1. Lower-cost deposits includes DDA, NOW, Money Market and Savings. 2. Higher-cost deposits includes Consumer Time and Other Time. NOTE: Numbers may not foot due to rounding. Δ from 4Q 08 $B % Total Client Deposits +$22.9 22% Higher- Cost Deposits -$11.3 -38% Lower- Cost Deposits +$34.1 47% $72.5 $89.6 $98.3 $100.5 $102.0 $103.6 $106.6 $29.8 $27.5 $21.4 $20.2 $19.9 $19.3 $18.5 4Q 08 4Q 09 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 Lower-Cost Deposits¹ Higher-Cost Deposits² $102.2 $119.7 $117.0 $120.7 $121.9 $123.0 $125.1 ($ in billions, average balances)

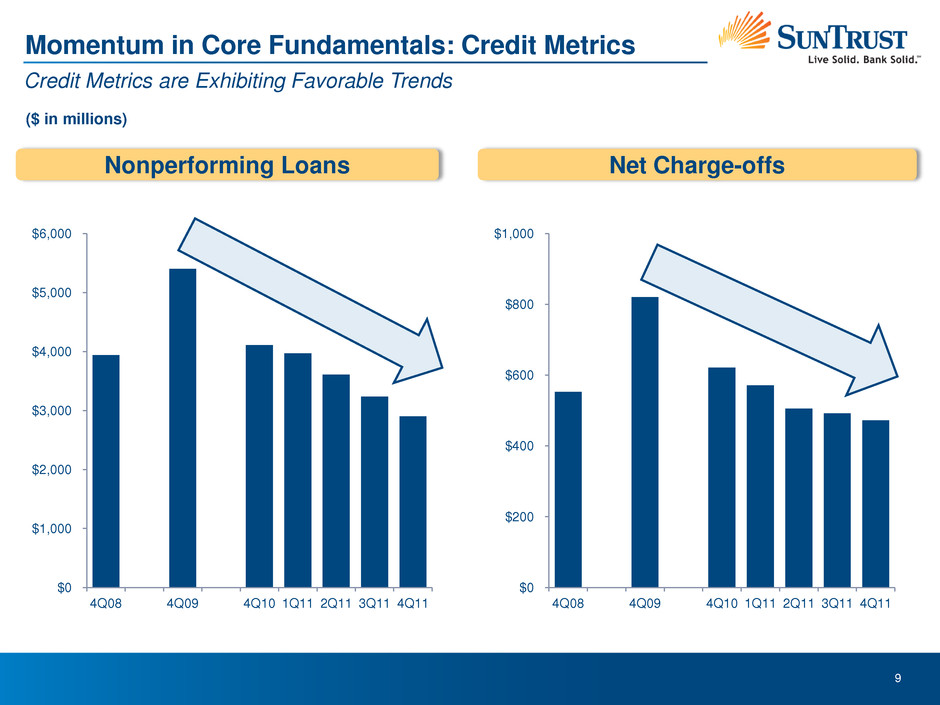

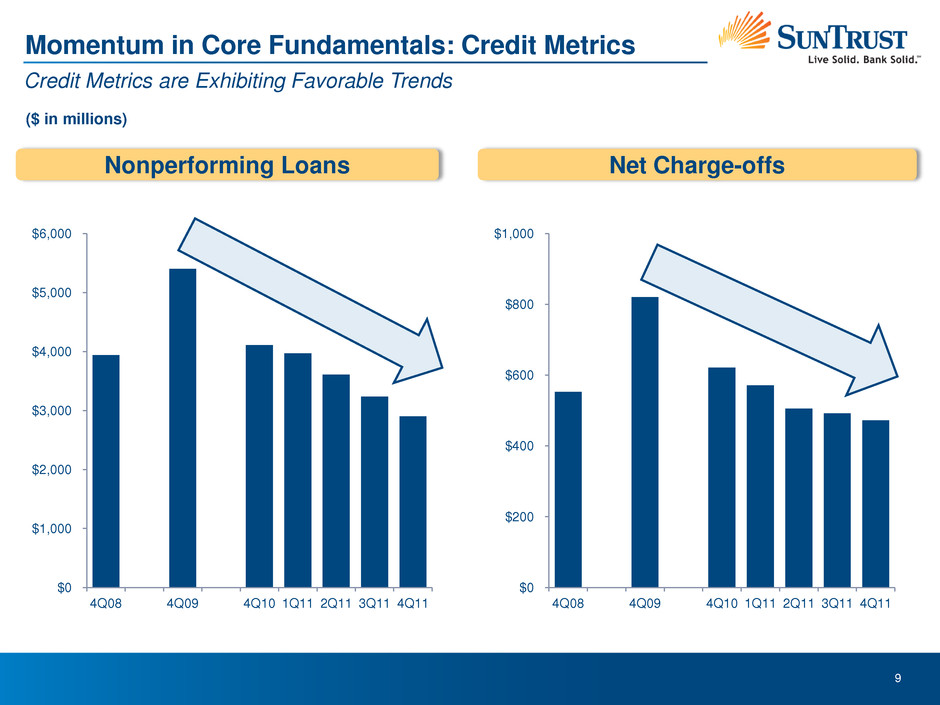

9 Credit Metrics are Exhibiting Favorable Trends Momentum in Core Fundamentals: Credit Metrics ($ in millions) $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 4Q08 4Q09 4Q10 1Q11 2Q11 3Q11 4Q11 $0 $200 $400 $600 $800 $1,000 4Q08 4Q09 4Q10 1Q11 2Q11 3Q11 4Q11 Nonperforming Loans Net Charge-offs

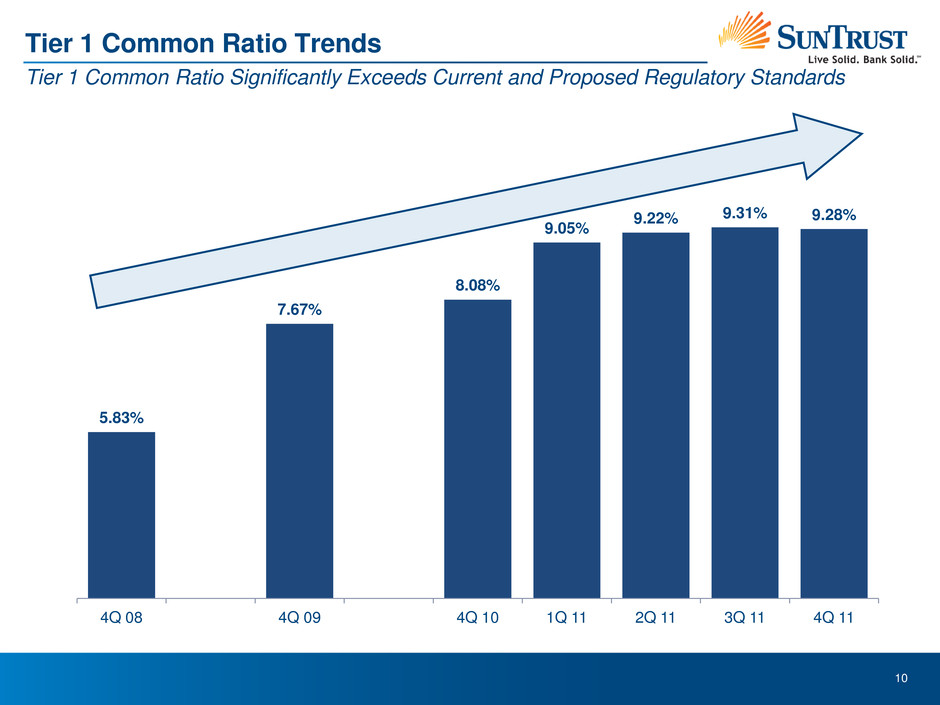

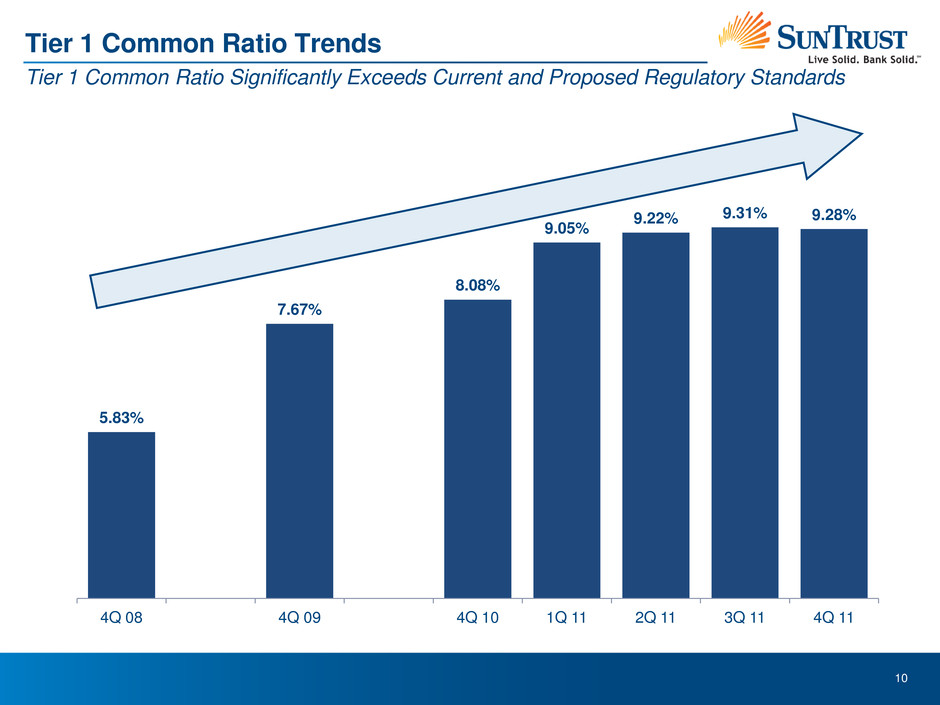

10 Tier 1 Common Ratio Trends Tier 1 Common Ratio Significantly Exceeds Current and Proposed Regulatory Standards 5.83% 7.67% 8.08% 9.05% 9.22% 9.31% 9.28% 4Q 08 4Q 09 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11

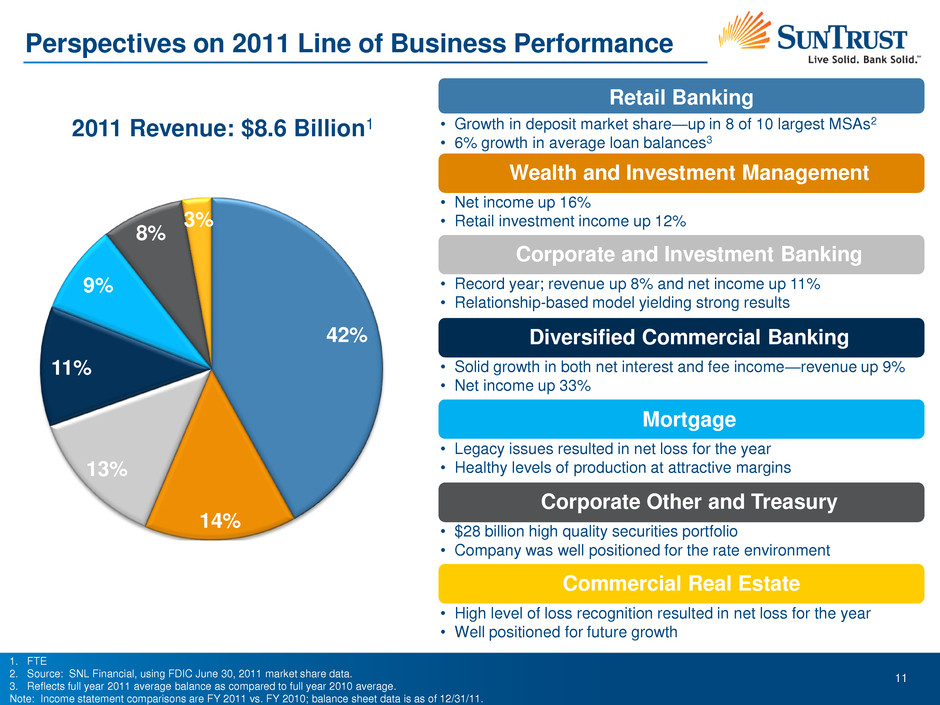

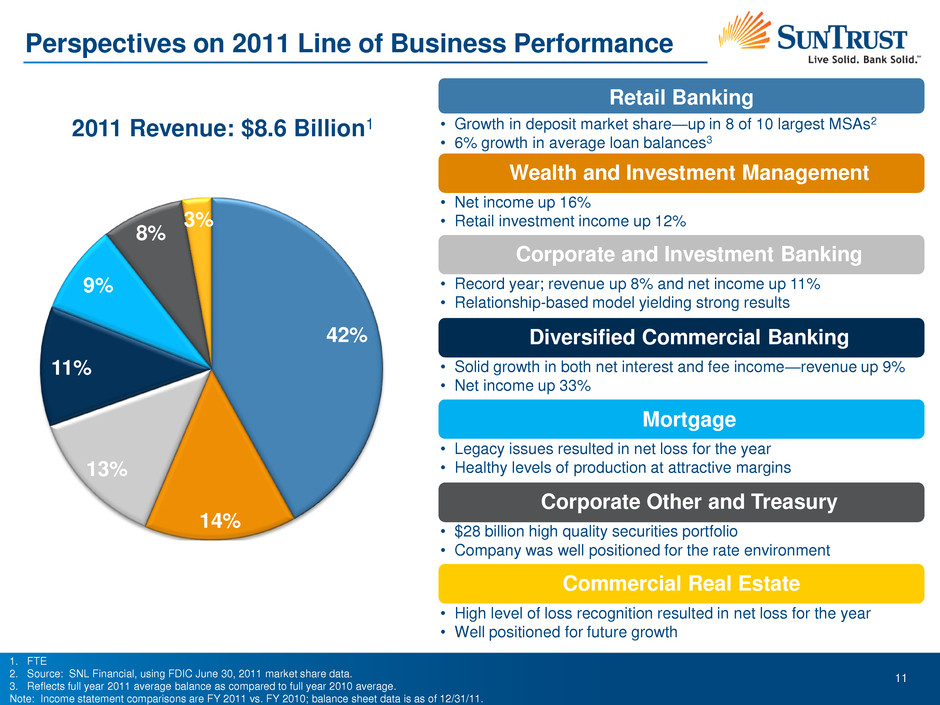

11 Perspectives on 2011 Line of Business Performance 1. FTE 2. Source: SNL Financial, using FDIC June 30, 2011 market share data. 3. Reflects full year 2011 average balance as compared to full year 2010 average. Note: Income statement comparisons are FY 2011 vs. FY 2010; balance sheet data is as of 12/31/11. • Growth in deposit market share—up in 8 of 10 largest MSAs2 • 6% growth in average loan balances3 42% 14% 13% 11% 9% 8% 3% Retail Banking Wealth and Investment Management Corporate and Investment Banking Diversified Commercial Banking Mortgage Corporate Other and Treasury Commercial Real Estate • Net income up 16% • Retail investment income up 12% • Record year; revenue up 8% and net income up 11% • Relationship-based model yielding strong results • Solid growth in both net interest and fee income—revenue up 9% • Net income up 33% • Legacy issues resulted in net loss for the year • Healthy levels of production at attractive margins • $28 billion high quality securities portfolio • Company was well positioned for the rate environment • High level of loss recognition resulted in net loss for the year • Well positioned for future growth 2011 Revenue: $8.6 Billion1

12 Journey to Improved Profitability and Shareholder Returns

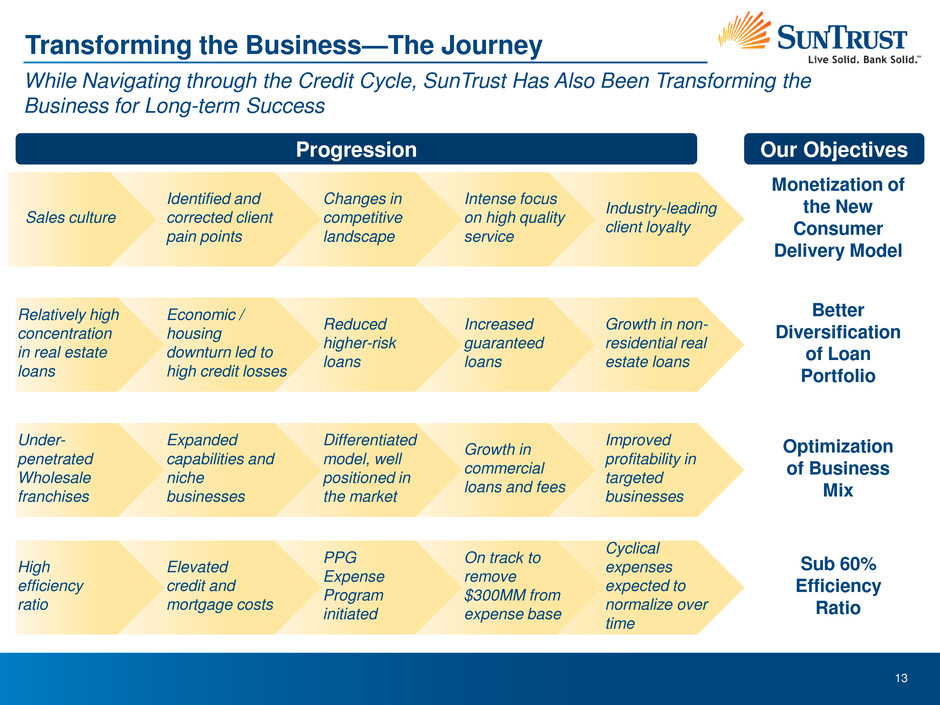

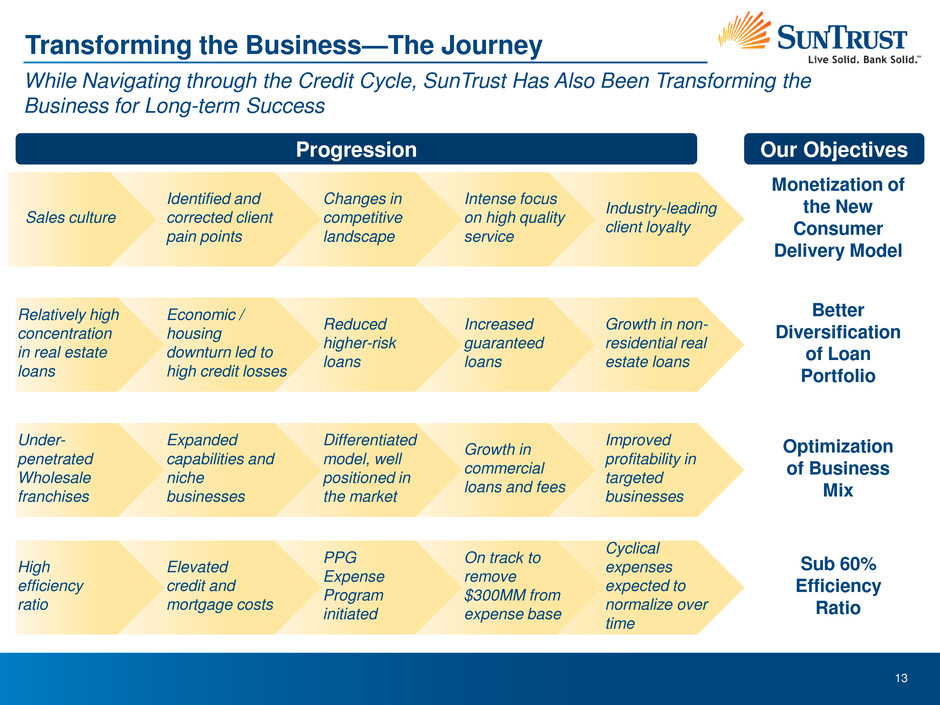

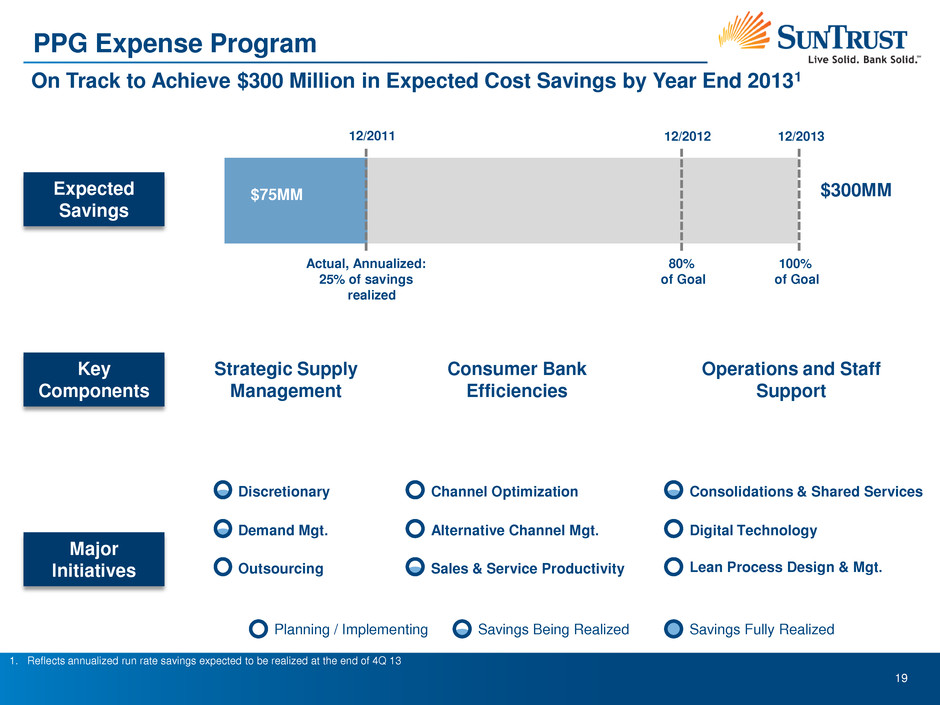

13 Transforming the Business—The Journey While Navigating through the Credit Cycle, SunTrust Has Also Been Transforming the Business for Long-term Success Sales culture Intense focus on high quality service Industry-leading client loyalty Identified and corrected client pain points Changes in competitive landscape Monetization of the New Consumer Delivery Model Under- penetrated Wholesale franchises Growth in commercial loans and fees Expanded capabilities and niche businesses Differentiated model, well positioned in the market Optimization of Business Mix Improved profitability in targeted businesses High efficiency ratio On track to remove $300MM from expense base Elevated credit and mortgage costs PPG Expense Program initiated Sub 60% Efficiency Ratio Progression Our Objectives Cyclical expenses expected to normalize over time Economic / housing downturn led to high credit losses Relatively high concentration in real estate loans Increased guaranteed loans Reduced higher-risk loans Better Diversification of Loan Portfolio Growth in non- residential real estate loans

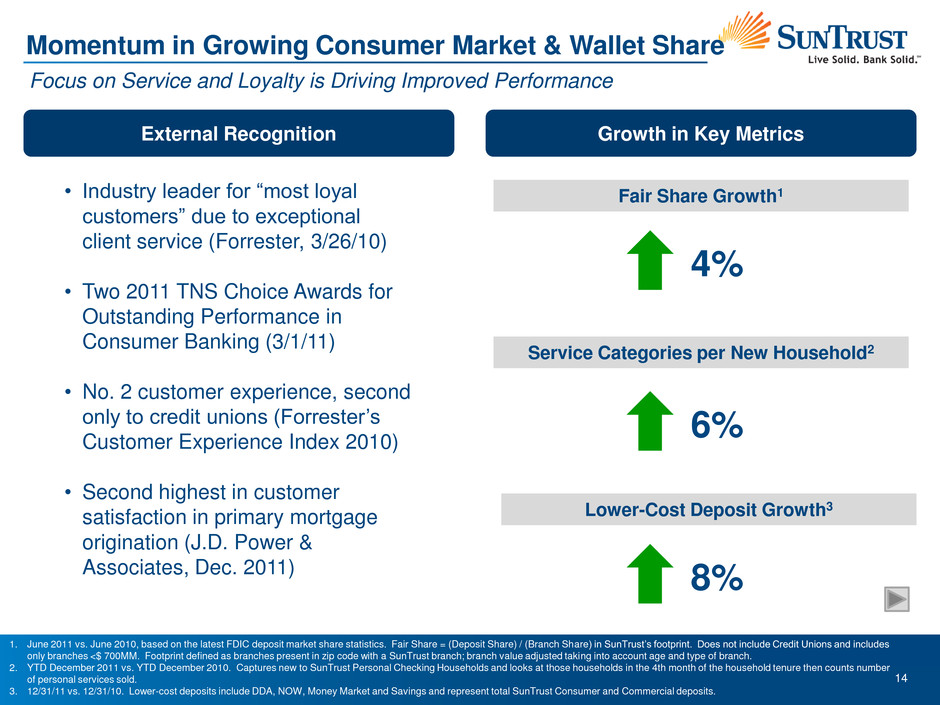

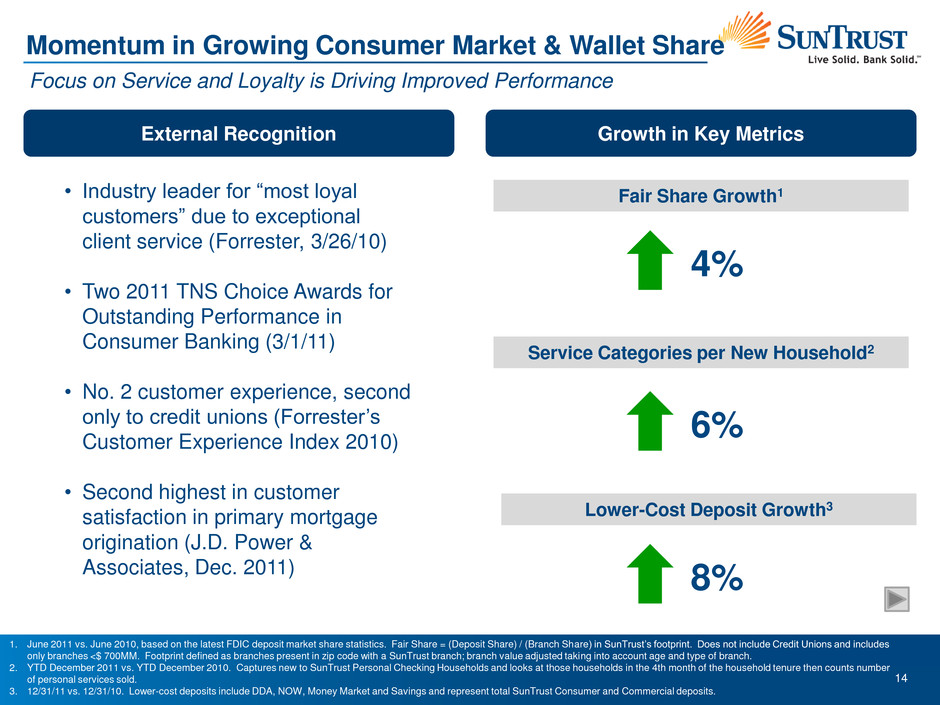

14 Momentum in Growing Consumer Market & Wallet Share Focus on Service and Loyalty is Driving Improved Performance External Recognition Growth in Key Metrics Fair Share Growth1 Service Categories per New Household2 • Industry leader for “most loyal customers” due to exceptional client service (Forrester, 3/26/10) • Two 2011 TNS Choice Awards for Outstanding Performance in Consumer Banking (3/1/11) • No. 2 customer experience, second only to credit unions (Forrester’s Customer Experience Index 2010) • Second highest in customer satisfaction in primary mortgage origination (J.D. Power & Associates, Dec. 2011) Lower-Cost Deposit Growth3 6% 4% 8% 1. June 2011 vs. June 2010, based on the latest FDIC deposit market share statistics. Fair Share = (Deposit Share) / (Branch Share) in SunTrust’s footprint. Does not include Credit Unions and includes only branches <$ 700MM. Footprint defined as branches present in zip code with a SunTrust branch; branch value adjusted taking into account age and type of branch. 2. YTD December 2011 vs. YTD December 2010. Captures new to SunTrust Personal Checking Households and looks at those households in the 4th month of the household tenure then counts number of personal services sold. 3. 12/31/11 vs. 12/31/10. Lower-cost deposits include DDA, NOW, Money Market and Savings and represent total SunTrust Consumer and Commercial deposits.

15 Momentum in Diversifying the Loan Portfolio Targeted Portfolios Have Increased While the Real Estate Concentration Has Been Reduced 1. Consumer includes direct consumer loans (other than student guaranteed), consumer indirect loans, and consumer credit cards. 2. Guaranteed includes guaranteed student loans and guaranteed residential mortgages. 3. Construction includes both commercial and residential construction. NOTE: Numbers reflect period end balances and may not sum to 100% due to rounding. C&I 40% Consumer¹ 10% Guaranteed² 11% Resi Mtg. - Non Guar. 19% Home Equity 13% CRE 4% Construction³ 2% Loan Portfolio Composition – 12/31/11 Total Loans: $122.5B C&I 39% Consumer¹ 8% Guaranteed² 3% Resi Mtg. - Non Guar. 23% Home Equity 15% CRE 6% Construction³ 6% Loan Portfolio Composition – 12/31/09 Total Loans: $113.7B

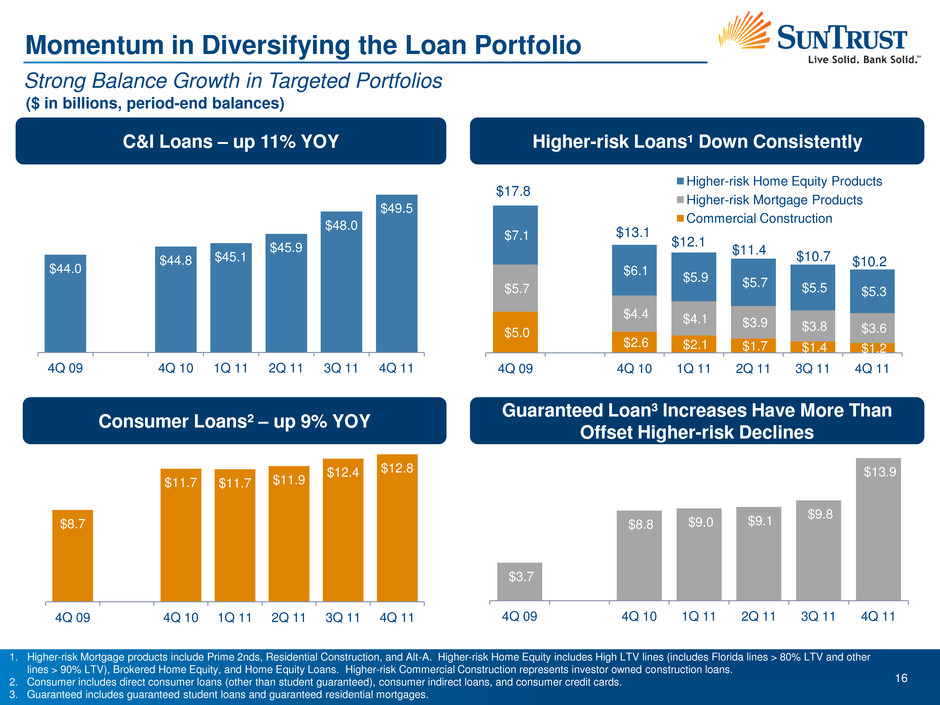

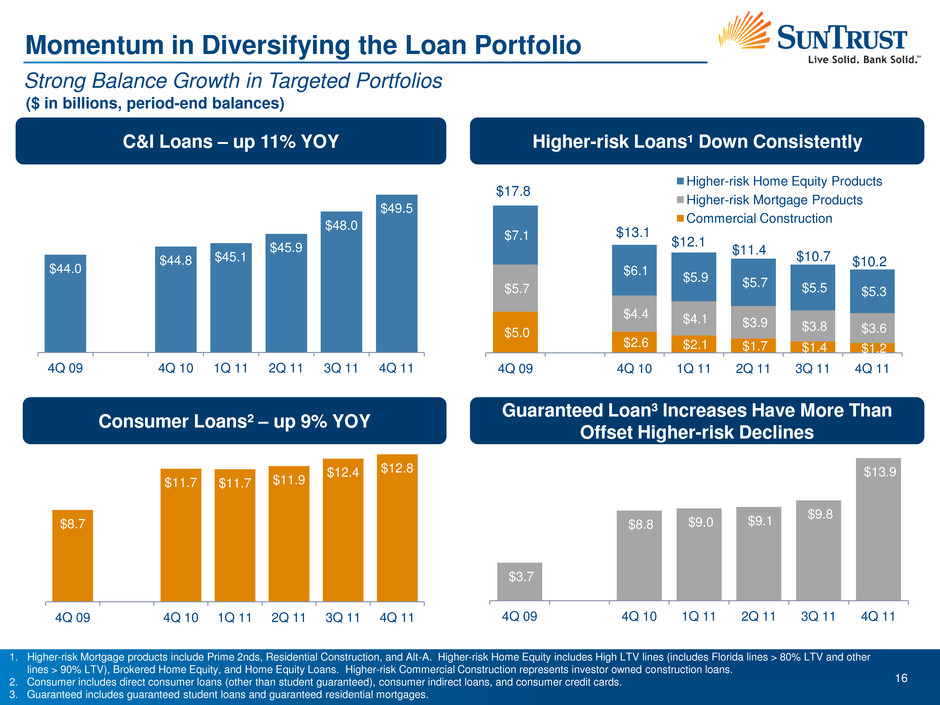

16 Momentum in Diversifying the Loan Portfolio Strong Balance Growth in Targeted Portfolios C&I Loans – up 11% YOY Consumer Loans² – up 9% YOY ($ in billions, period-end balances) 1. Higher-risk Mortgage products include Prime 2nds, Residential Construction, and Alt-A. Higher-risk Home Equity includes High LTV lines (includes Florida lines > 80% LTV and other lines > 90% LTV), Brokered Home Equity, and Home Equity Loans. Higher-risk Commercial Construction represents investor owned construction loans. 2. Consumer includes direct consumer loans (other than student guaranteed), consumer indirect loans, and consumer credit cards. 3. Guaranteed includes guaranteed student loans and guaranteed residential mortgages. $5.0 $2.6 $2.1 $1.7 $1.4 $1.2 $5.7 $4.4 $4.1 $3.9 $3.8 $3.6 $7.1 $6.1 $5.9 $5.7 $5.5 $5.3 4Q 09 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 Higher-risk Home Equity Products Higher-risk Mortgage Products Commercial Construction Higher-risk Loans¹ Down Consistently Guaranteed Loan³ Increases Have More Than Offset Higher-risk Declines $11.4 $10.7 $10.2 $13.1 $12.1 $17.8 $8.7 $11.7 $11.7 $11.9 $12.4 $12.8 4Q 09 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 $44.0 $44.8 $45.1 $45.9 $48.0 $49.5 4Q 09 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 $3.7 $8.8 $9.0 $9.1 $9.8 $13.9 4Q 09 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11

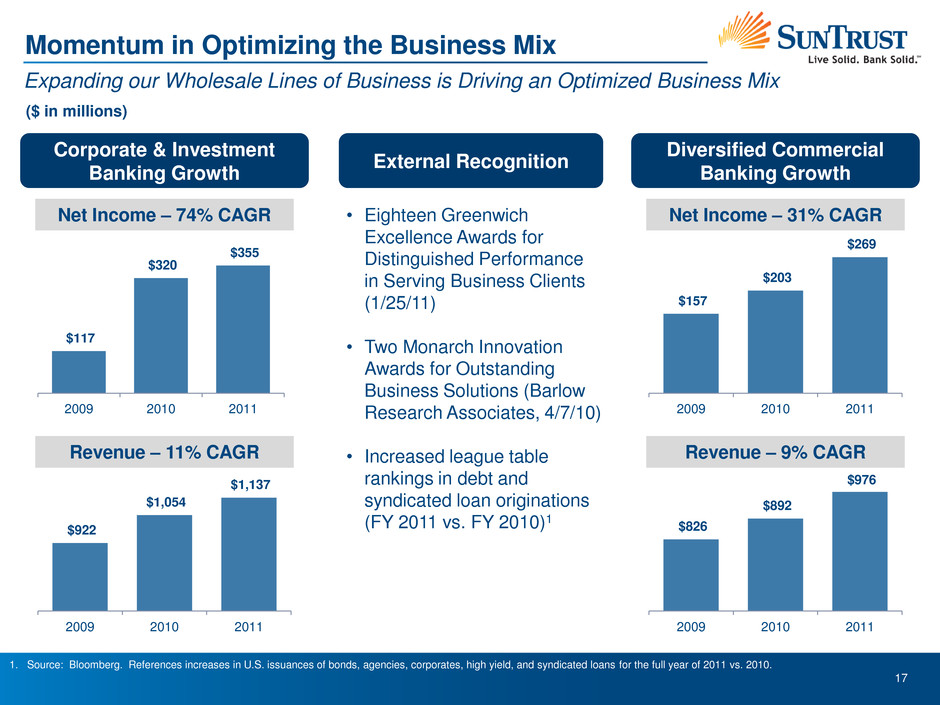

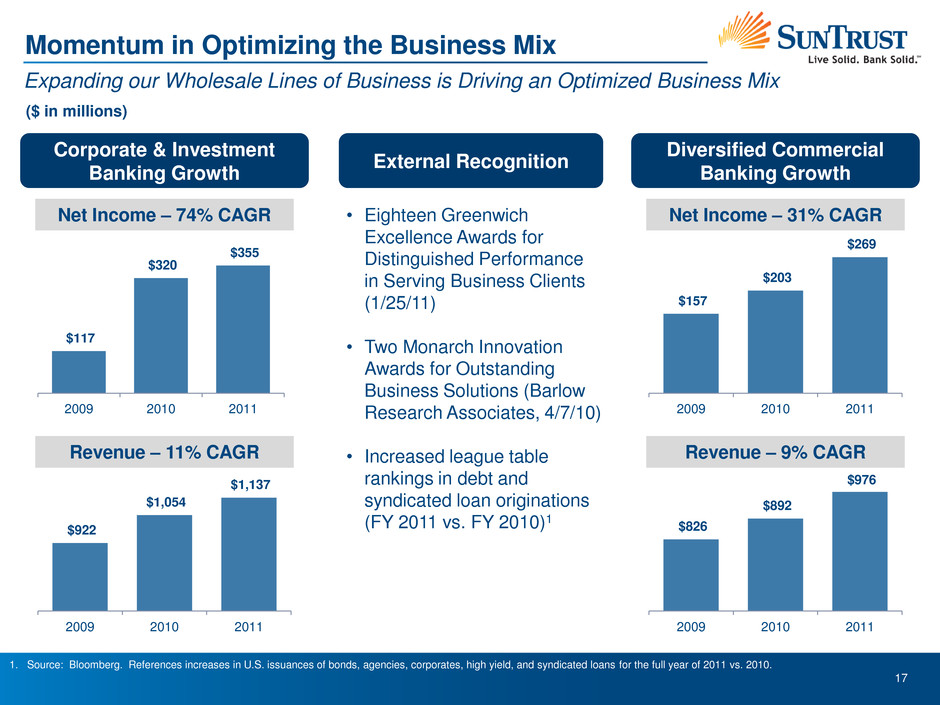

17 Momentum in Optimizing the Business Mix Expanding our Wholesale Lines of Business is Driving an Optimized Business Mix External Recognition Corporate & Investment Banking Growth 1. Source: Bloomberg. References increases in U.S. issuances of bonds, agencies, corporates, high yield, and syndicated loans for the full year of 2011 vs. 2010. Net Income – 74% CAGR Revenue – 11% CAGR Diversified Commercial Banking Growth Net Income – 31% CAGR Revenue – 9% CAGR ($ in millions) • Eighteen Greenwich Excellence Awards for Distinguished Performance in Serving Business Clients (1/25/11) • Two Monarch Innovation Awards for Outstanding Business Solutions (Barlow Research Associates, 4/7/10) • Increased league table rankings in debt and syndicated loan originations (FY 2011 vs. FY 2010)1 $117 $320 $355 2009 2010 2011 $922 $1,054 $1,137 2009 2010 2011 $157 $203 $269 2009 2010 2011 $826 $892 $976 2009 2010 2011

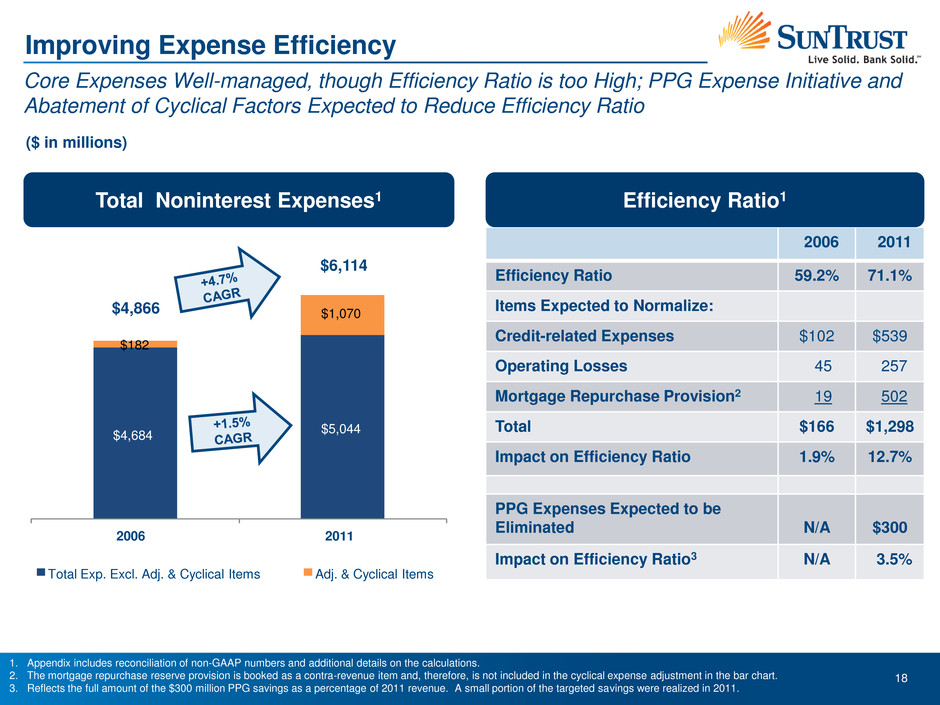

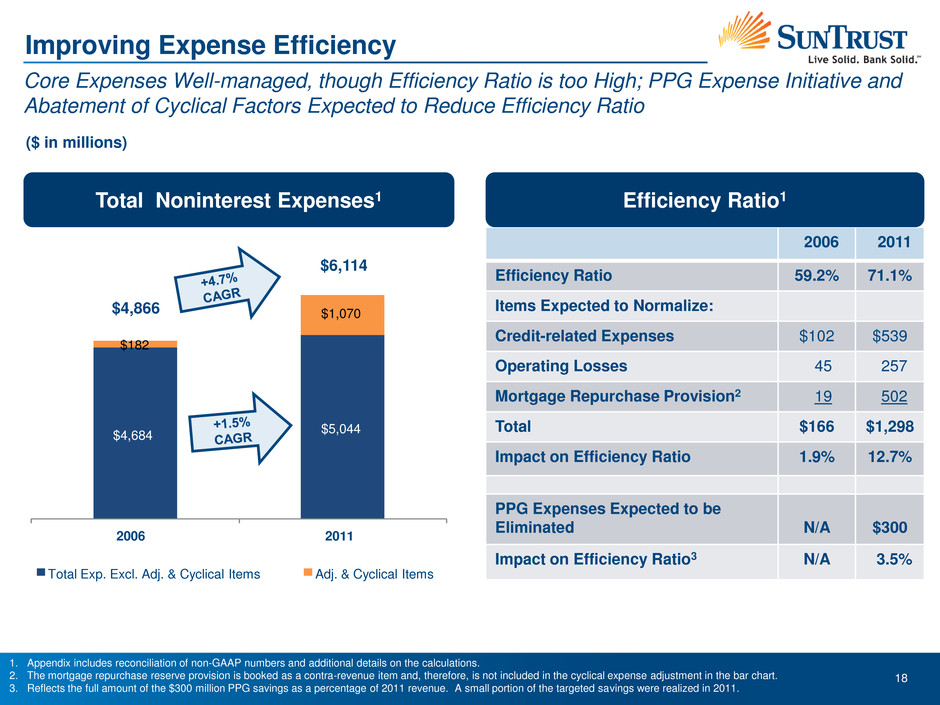

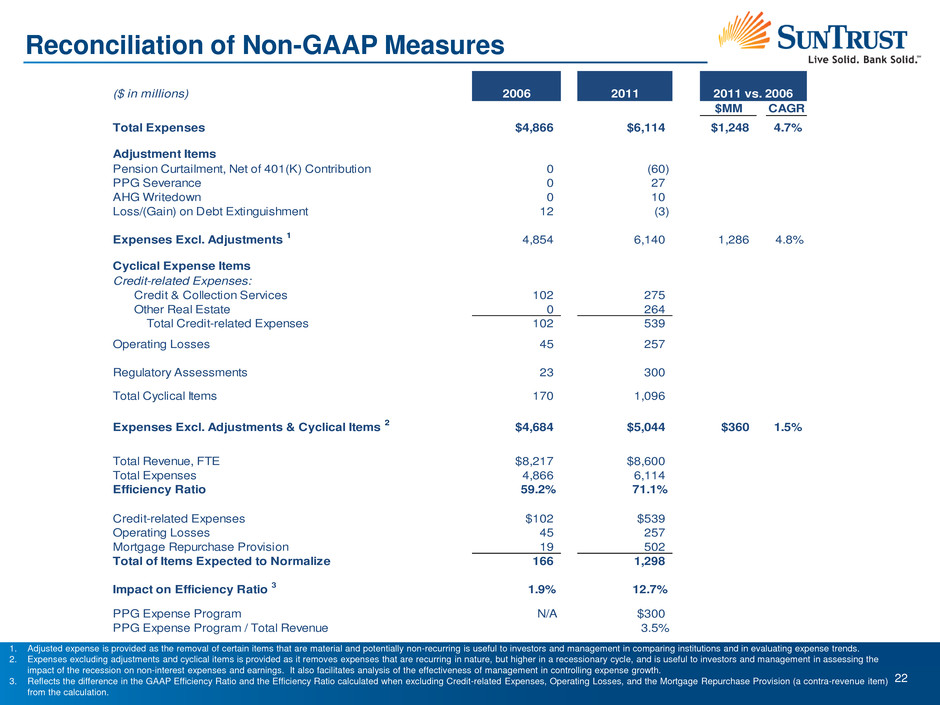

18 Improving Expense Efficiency Core Expenses Well-managed, though Efficiency Ratio is too High; PPG Expense Initiative and Abatement of Cyclical Factors Expected to Reduce Efficiency Ratio 1. Appendix includes reconciliation of non-GAAP numbers and additional details on the calculations. 2. The mortgage repurchase reserve provision is booked as a contra-revenue item and, therefore, is not included in the cyclical expense adjustment in the bar chart. 3. Reflects the full amount of the $300 million PPG savings as a percentage of 2011 revenue. A small portion of the targeted savings were realized in 2011. 2006 2011 Efficiency Ratio 59.2% 71.1% Items Expected to Normalize: Credit-related Expenses $102 $539 Operating Losses 45 257 Mortgage Repurchase Provision2 19 502 Total $166 $1,298 Impact on Efficiency Ratio 1.9% 12.7% PPG Expenses Expected to be Eliminated N/A $300 Impact on Efficiency Ratio3 N/A 3.5% ($ in millions) $4,684 $5,044 $182 $1,070 2006 2011 Total Exp. Excl. Adj. & Cyclical Items Adj. & Cyclical Items $4,866 $6,114 Total Noninterest Expenses1 Efficiency Ratio1

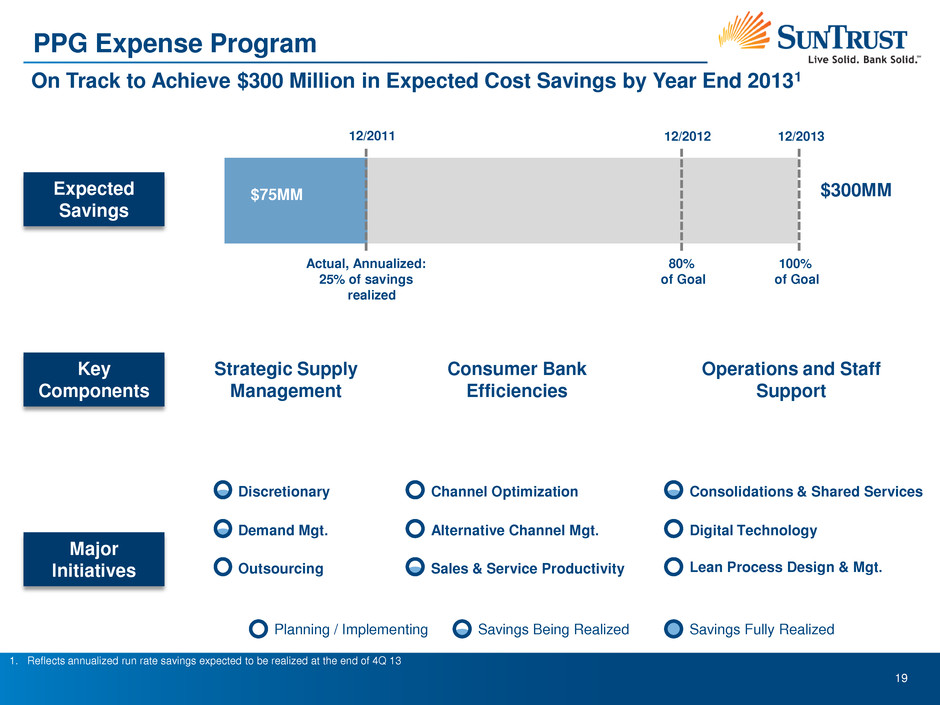

19 On Track to Achieve $300 Million in Expected Cost Savings by Year End 20131 Expected Savings Key Components Major Initiatives 1. Reflects annualized run rate savings expected to be realized at the end of 4Q 13 PPG Expense Program Consumer Bank Efficiencies Strategic Supply Management Planning / Implementing Savings Being Realized Savings Fully Realized Discretionary Outsourcing Demand Mgt. Channel Optimization Alternative Channel Mgt. Sales & Service Productivity Consolidations & Shared Services Digital Technology Lean Process Design & Mgt. 12/2013 12/2012 80% of Goal 100% of Goal $300MM Actual, Annualized: 25% of savings realized $75MM 12/2011 Operations and Staff Support

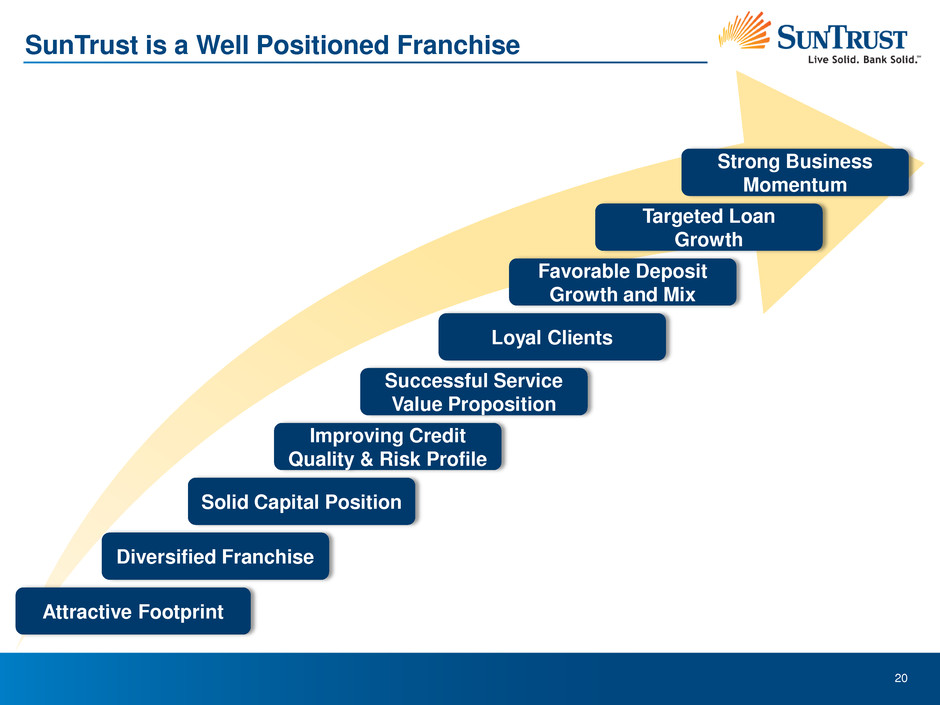

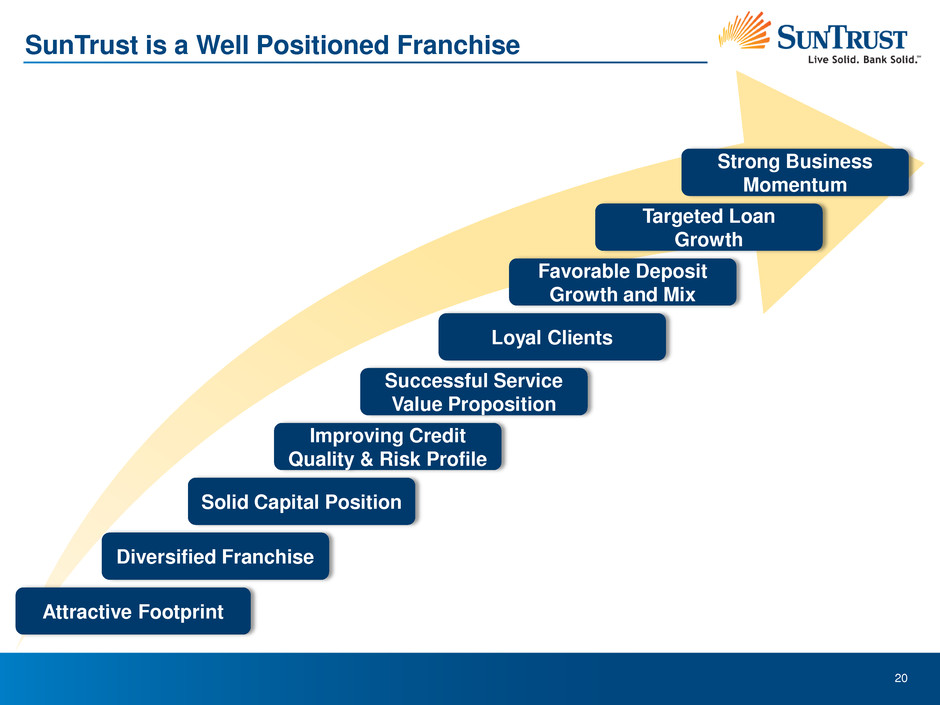

20 Attractive Footprint Diversified Franchise Loyal Clients Successful Service Value Proposition Solid Capital Position Strong Business Momentum Improving Credit Quality & Risk Profile Favorable Deposit Growth and Mix Targeted Loan Growth SunTrust is a Well Positioned Franchise

Miami, FL February 10, 2012 Aleem Gillani Chief Financial Officer Credit Suisse Financial Services Forum

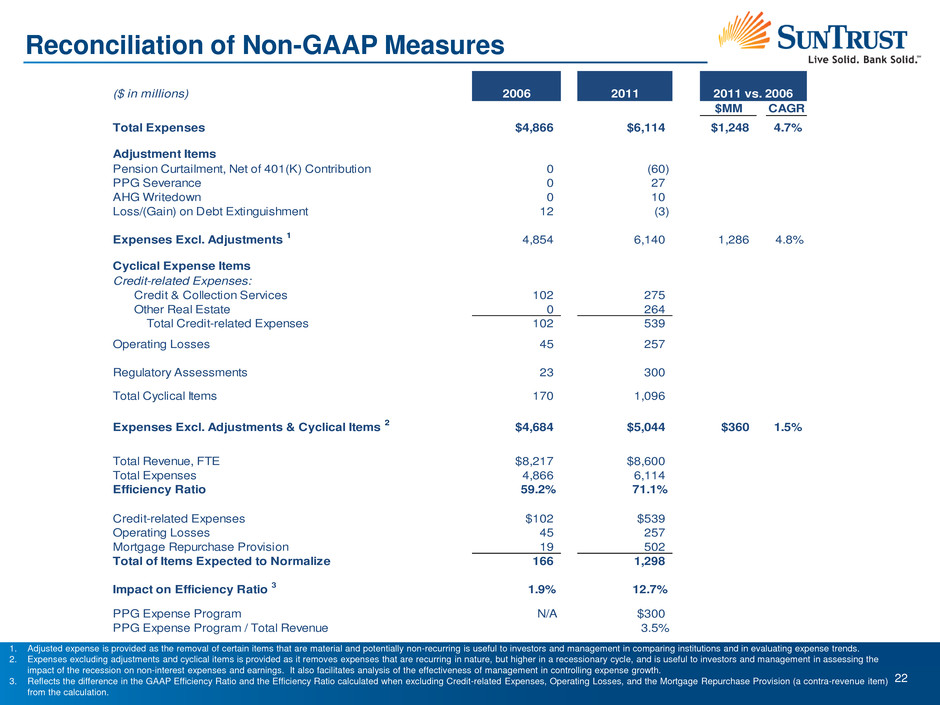

22 Reconciliation of Non-GAAP Measures 1. Adjusted expense is provided as the removal of certain items that are material and potentially non-recurring is useful to investors and management in comparing institutions and in evaluating expense trends. 2. Expenses excluding adjustments and cyclical items is provided as it removes expenses that are recurring in nature, but higher in a recessionary cycle, and is useful to investors and management in assessing the impact of the recession on non-interest expenses and earnings. It also facilitates analysis of the effectiveness of management in controlling expense growth. 3. Reflects the difference in the GAAP Efficiency Ratio and the Efficiency Ratio calculated when excluding Credit-related Expenses, Operating Losses, and the Mortgage Repurchase Provision (a contra-revenue item) from the calculation. ($ in millions) 2006 2011 $MM CAGR Total Expenses $4,866 $6,114 $1,248 4.7% Adjustment Items Pension Curtailment, Net of 401(K) Contribution 0 (60) PPG Severance 0 27 AHG Writedown 0 10 Loss/(Gain) on Debt Extinguishment 12 (3) Expenses Excl. Adjustments 1 4,854 6,140 1,286 4.8% Cyclical Expense Items Credit-related Expenses: Credit & Collection Services 102 275 Other Real Estate 0 264 Total Credit-related Expenses 102 539 Operating Losses 45 257 Regulatory Assessments 23 300 Total Cyclical Items 170 1,096 Expenses Excl. Adjustments & Cyclical Items 2 $4,684 $5,044 $360 1.5% Total Revenue, FTE $8,217 $8,600 Total Expenses 4,866 6,114 Efficiency Ratio 59.2% 71.1% Credit-related Expenses $102 $539 Operating Losses 45 257 Mortgage Repurchase Provision 19 502 Total of Items Expected to Normalize 166 1,298 Impact on Efficiency Ratio 3 1.9% 12.7% PPG Expense Program N/A $300 PPG Expense Program / Total Revenue 3.5% 2011 vs. 2006