2Q 2014 Earnings Release July 21, 2014

2 Important Cautionary Statement The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2013 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This presentation includes non-GAAP financial measures to describe SunTrust’s performance. The reconciliations of those measures to GAAP measures are provided within or in the appendix of this presentation. In this presentation, the Company presents net interest income and net interest margin on a fully taxable-equivalent (“FTE”) basis, and ratios on an annualized basis. The FTE basis adjusts for the tax-favored status of income from certain loans and investments. The Company believes this measure to be the preferred industry measurement of net interest income and provides relevant comparison between taxable and non-taxable amounts. This presentation contains forward-looking statements. Statements regarding future levels of swap income are forward-looking statements. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” “initiatives,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could"; such statements are based upon the current beliefs and expectations of management and on information currently available to management. Such statements speak as of the date hereof, and we do not assume any obligation to update the statements made herein or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward- looking statements. Factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2013 and in other periodic reports that we file with the SEC. Those factors include: as one of the largest lenders in the Southeast and Mid-Atlantic U.S. and a provider of financial products and services to consumers and businesses across the U.S., our financial results have been, and may continue to be, materially affected by general economic conditions, particularly unemployment levels and home prices in the U.S., and a deterioration of economic conditions or of the financial markets may materially adversely affect our lending and other businesses and our financial results and condition; legislation and regulation, including the Dodd-Frank Act, as well as future legislation and/or regulation, could require us to change certain of our business practices, reduce our revenue, impose additional costs on us, or otherwise adversely affect our business operations and/or competitive position; we are subject to capital adequacy and liquidity guidelines and, if we fail to meet these guidelines, our financial condition would be adversely affected; loss of customer deposits and market illiquidity could increase our funding costs; we rely on the mortgage secondary market and GSEs for some of our liquidity; our framework for managing risks may not be effective in mitigating risk and loss to us; we are subject to credit risk; our ALLL may not be adequate to cover our eventual losses; we may have more credit risk and higher credit losses to the extent that our loans are concentrated by loan type, industry segment, borrower type, or location of the borrower or collateral; we will realize future losses if the proceeds we receive upon liquidation of NPAs are less than the carrying value of such assets; a downgrade in the U.S. government's sovereign credit rating, or in the credit ratings of instruments issued, insured or guaranteed by related institutions, agencies or instrumentalities, could result in risks to us and general economic conditions that we are not able to predict; weakness in the real estate market, including the secondary residential mortgage loan markets, has adversely affected us and may continue to adversely affect us; we are subject to certain risks related to originating and selling mortgages, and may be required to repurchase mortgage loans or indemnify mortgage loan purchasers as a result of breaches of representations and warranties, borrower fraud, or certain breaches of our servicing agreements, and this could harm our liquidity, results of operations, and financial condition; we face certain risks as a servicer of loans, and may be terminated as a servicer or master servicer, be required to repurchase a mortgage loan or reimburse investors for credit losses on a mortgage loan, or incur costs, liabilities, fines and other sanctions if we fail to satisfy our servicing obligations, including our obligations with respect to mortgage loan foreclosure actions; financial difficulties or credit downgrades of mortgage and bond insurers may adversely affect our servicing and investment portfolios; we are subject to risks related to delays in the foreclosure process; we face risks related to recent mortgage settlements; we may continue to suffer increased losses in our loan portfolio despite enhancement of our underwriting policies and practices; our mortgage production and servicing revenue can be volatile; changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity; changes in interest rates could also reduce the value of our MSRs and mortgages held for sale, reducing our earnings; the fiscal and monetary policies of the federal government and its agencies could have a material adverse effect on our earnings; clients could pursue alternatives to bank deposits, causing us to lose a relatively inexpensive source of funding; consumers may decide not to use banks to complete their financial transactions, which could affect net income; we have businesses other than banking which subject us to a variety of risks; hurricanes and other disasters may adversely affect loan portfolios and operations and increase the cost of doing business; negative public opinion could damage our reputation and adversely impact business and revenues; we rely on other companies to provide key components of our business infrastructure; a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors and other service providers, including as a result of cyber attacks, could disrupt our businesses, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses; the soundness of other financial institutions could adversely affect us; we depend on the accuracy and completeness of information about clients and counterparties; competition in the financial services industry is intense and could result in losing business or margin declines; maintaining or increasing market share depends on market acceptance and regulatory approval of new products and services; we might not pay dividends on our common stock; our ability to receive dividends from our subsidiaries could affect our liquidity and ability to pay dividends; disruptions in our ability to access global capital markets may adversely affect our capital resources and liquidity; any reduction in our credit rating could increase the cost of our funding from the capital markets; we have in the past and may in the future pursue acquisitions, which could affect costs and from which we may not be able to realize anticipated benefits; we are subject to certain litigation, and our expenses related to this litigation may adversely affect our results; we may incur fines, penalties and other negative consequences from regulatory violations, possibly even inadvertent or unintentional violations; we depend on the expertise of key personnel, and if these individuals leave or change their roles without effective replacements, operations may suffer; we may not be able to hire or retain additional qualified personnel and recruiting and compensation costs may increase as a result of turnover, both of which may increase costs and reduce profitability and may adversely impact our ability to implement our business strategies; our accounting policies and processes are critical to how we report our financial condition and results of operations, and require management to make estimates about matters that are uncertain; changes in our accounting policies or in accounting standards could materially affect how we report our financial results and condition; our stock price can be volatile; our disclosure controls and procedures may not prevent or detect all errors or acts of fraud; our financial instruments carried at fair value expose us to certain market risks; our revenues derived from our investment securities may be volatile and subject to a variety of risks; and we may enter into transactions with off-balance sheet affiliates or our subsidiaries.

3 2Q 14 Summary Earnings • Net income available to common shareholders of $387 million; earnings per share of $0.72 • Non-recurring items, primarily the resolution of certain legacy mortgage matters, partially offset by the sale of RidgeWorth Capital Management, negatively impacted earnings by $0.09 per share • Excluding the above items, earnings were $436 million, or $0.81 per share; up 19% from the prior year Revenue • Net interest income generally stable relative to prior quarter • Adjusted noninterest income1 up from prior quarter due to higher investment banking income and broad-based fee income growth Expenses • Adjusted expenses1 slightly higher relative to prior quarter Balance Sheet • Average performing loans increased 2% sequentially, driven by growth in the commercial and consumer loan portfolios • Average client deposits increased 2% sequentially with continued favorable mix shift Credit and Capital • Nonperforming loans declined 3% from prior quarter and 21% from prior year • Net charge-off ratio remained at 0.35% • Tier 1 common ratio estimated to be 9.7% on a Basel I and Basel III basis2 1. Please refer to the appendix for noninterest income and expense adjustment details 2. Please refer to the appendix for a Basel I to Basel III reconciliation

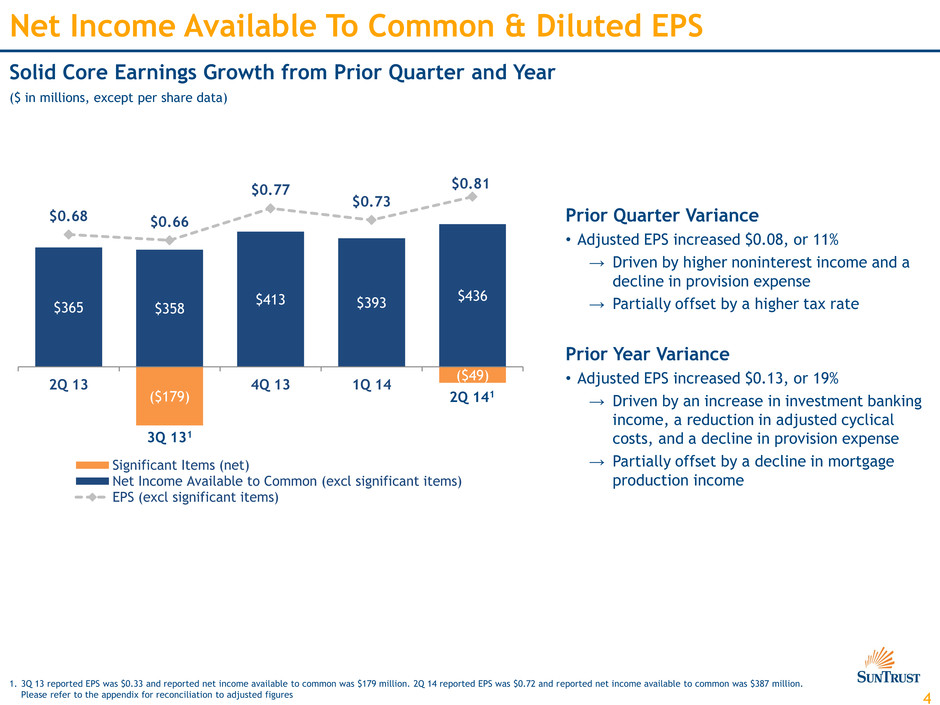

4 Net Income Available To Common & Diluted EPS Solid Core Earnings Growth from Prior Quarter and Year ($ in millions, except per share data) 1. 3Q 13 reported EPS was $0.33 and reported net income available to common was $179 million. 2Q 14 reported EPS was $0.72 and reported net income available to common was $387 million. Please refer to the appendix for reconciliation to adjusted figures Prior Quarter Variance • Adjusted EPS increased $0.08, or 11% → Driven by higher noninterest income and a decline in provision expense → Partially offset by a higher tax rate Prior Year Variance • Adjusted EPS increased $0.13, or 19% → Driven by an increase in investment banking income, a reduction in adjusted cyclical costs, and a decline in provision expense → Partially offset by a decline in mortgage production income 3Q 131 2Q 141 $365 $358 $413 $393 $436 ($179) ($49) $0.68 $0.66 $0.77 $0.73 $0.81 2Q 13 4Q 13 1Q 14 Significant Items (net) Net I come Available to Common (excl significant items) EPS (excl significant items)

5 Net Interest Income - FTE Net Interest Income Flat ($ in millions) Prior Quarter Variance • Net interest income generally stable relative to prior quarter, as solid loan growth was offset by loan yield compression • Net interest margin declined 8 bps, primarily driven by a 7 bp decline in loan yields Prior Year Variance • Net interest income flat → Loan growth and lower deposit costs were offset by lower loan yields • Net interest margin declined 14 bps, primarily due to lower loan yields, partially offset by lower deposit rates $1,242 $1,240 $1,247 $1,239 $1,244 3.25% 3.19% 3.20% 3.19% 3.11% 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 Net Interest Income Net Interest Margin

6 $855 $743 $807 $789 $855 $3 ($63) $7 $2 $102 2Q 13 4Q 13 1Q 14 2Q 14 Adjusted Noninterest Income¹ Adjustment Items¹ Noninterest Income Adjusted Noninterest Income1 Higher Relative to Prior Quarter ($ in millions) Prior Quarter Variance • Adjusted noninterest income1 increased $66 million → Investment banking income up $31 million due to higher client-driven transaction volumes → Mortgage production income, retail investment services, and card fees also increased Prior Year Variance • Adjusted noninterest income1 flat → A decline in mortgage production income was offset by increases in investment banking, retail investment services, and mortgage servicing $814 $791 $858 $957 $680 1. Noninterest income on a GAAP basis was $858 million, $680 million, $814 million, $791 million, and $957 million for 2Q 13, 3Q 13, 4Q 13, 1Q 14, and 2Q 14, respectively. Please refer to the appendix for noninterest income adjustment details Note: Totals may not foot due to rounding 3Q 13

7 $1,387 $1,311 $1,361 $1,321 $1,338 $419 $36 $179 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 Adjusted Noninterest Expense Adjustment Items Noninterest Expense1 Adjusted Expenses Slightly Higher Relative to Prior Quarter and Down from Prior Year ($ in millions) $1,730 1. In accordance with recently issued GAAP, amortization of affordable housing investments of $10 million, $12 million, and $16 million were reclassified and are now presented in provision for income taxes for the three months ended June 30, 2013, September 30, 2013 and December 31, 2013, respectively. Previously, the amortization was presented in other noninterest expense 2. Noninterest expense on a GAAP basis was $1,730 million, $1,357 million, and $1,517 million for 3Q 13, 1Q 14, and 2Q 14, respectively. Please refer to the appendix for noninterest expense adjustment details 3. Please refer to the appendix for details on cyclical costs Note: Totals may not foot due to rounding Prior Quarter Variance • Adjusted noninterest expense1,2 increased 1% → Outside processing and software increased $11 million → Operating losses up $18 million3 → Partially offset by seasonal decline in personnel costs Prior Year Variance • Adjusted noninterest expense1,2 declined $49 million → Primarily driven by lower cyclical costs3 $1,357 1,2 1,2 $1,517

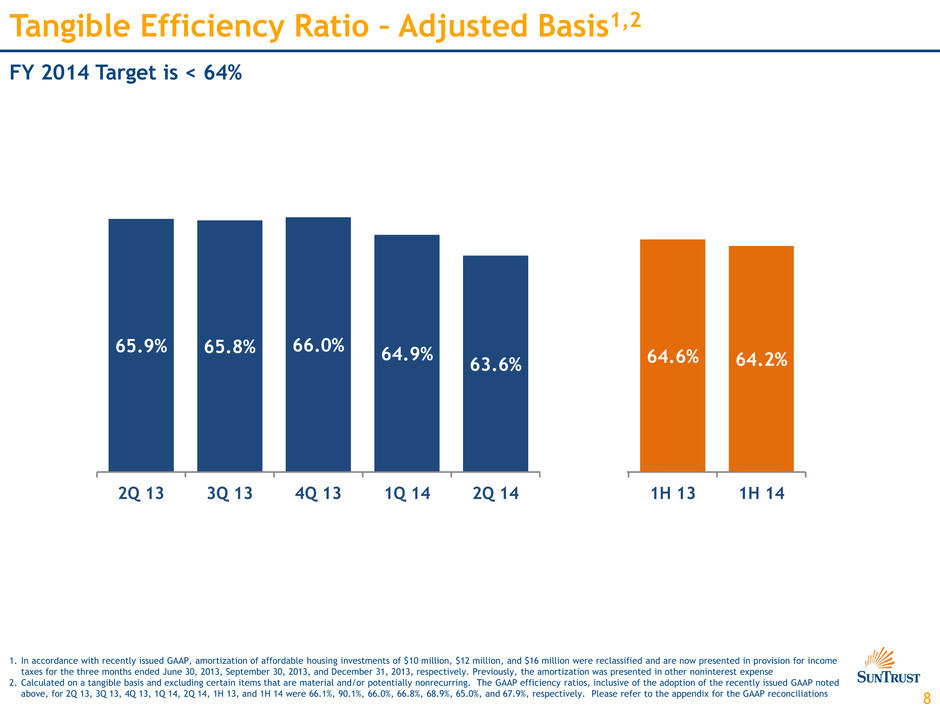

8 Tangible Efficiency Ratio – Adjusted Basis1,2 FY 2014 Target is < 64% 1. In accordance with recently issued GAAP, amortization of affordable housing investments of $10 million, $12 million, and $16 million were reclassified and are now presented in provision for income taxes for the three months ended June 30, 2013, September 30, 2013, and December 31, 2013, respectively. Previously, the amortization was presented in other noninterest expense 2. Calculated on a tangible basis and excluding certain items that are material and/or potentially nonrecurring. The GAAP efficiency ratios, inclusive of the adoption of the recently issued GAAP noted above, for 2Q 13, 3Q 13, 4Q 13, 1Q 14, 2Q 14, 1H 13, and 1H 14 were 66.1%, 90.1%, 66.0%, 66.8%, 68.9%, 65.0%, and 67.9%, respectively. Please refer to the appendix for the GAAP reconciliations 65.9% 65.8% 66.0% 64.9% 63.6% 64.6% 64.2% 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 1H 13 1H 14

9 $179 $146 $128 $110 $113 0.59% 0.47% 0.40% 0.35% 0.35% 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 Net Charge-offs NCOs to Average Loans (annualized) Credit Quality Asset Quality Remains Strong; Improvement Moderating ($ in millions) Net Charge-offs Provision for Credit Losses Allowance for Loan and Lease Losses Nonperforming Loans $146 $95 $101 $102 $73 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 $1,141 $1,037 $971 $925 $899 0.94% 0.83% 0.76% 0.72% 0.69% 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 Nonperforming Loans Nonperforming Loan Ratio $2,125 $2,071 $2,044 $2,040 $2,003 1.75% 1.67% 1.60% 1.58% 1.55% 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 ALLL ($) ALLL Ratio

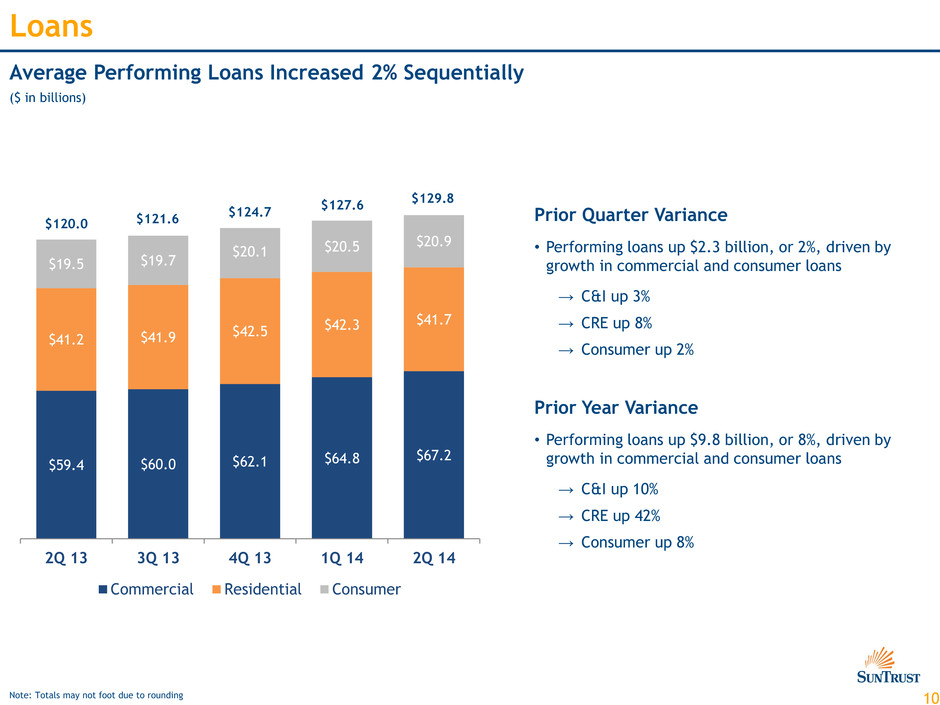

10 $59.4 $60.0 $62.1 $64.8 $67.2 $41.2 $41.9 $42.5 $42.3 $41.7 $19.5 $19.7 $20.1 $20.5 $20.9 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 Commercial Residential Consumer Loans Average Performing Loans Increased 2% Sequentially ($ in billions) $124.7 $129.8 $120.0 $121.6 Note: Totals may not foot due to rounding Prior Quarter Variance • Performing loans up $2.3 billion, or 2%, driven by growth in commercial and consumer loans → C&I up 3% → CRE up 8% → Consumer up 2% Prior Year Variance • Performing loans up $9.8 billion, or 8%, driven by growth in commercial and consumer loans → C&I up 10% → CRE up 42% → Consumer up 8% $127.6

11 $38.7 $38.6 $39.1 $39.0 $40.0 $26.0 $25.4 $26.5 $27.7 $29.2 $41.8 $43.0 $42.8 $42.8 $43.0 $5.8 $5.8 $5.8 $6.0 $6.2 $14.2 $13.7 $13.3 $12.9 $12.1 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 DDA NOW Money Market Savings Time Deposits Average Client Deposits Increased 2% Sequentially with Continued Favorable Mix Shift ($ in billions) 1. Lower-cost deposits include DDA, NOW, Money Market and Savings Note: Totals may not foot due to rounding $128.4 $130.5 $126.6 $127.5 $126.6 Prior Quarter Variance • Client deposits increased 2% → Lower-cost deposits1 increased $2.9 billion, or 2% → Time deposits declined $0.8 billion, or 6% Prior Year Variance • Client deposits increased 3% → Lower-cost deposits1 up $6.0 billion, or 5% → Time deposits declined $2.1 billion, or 15%

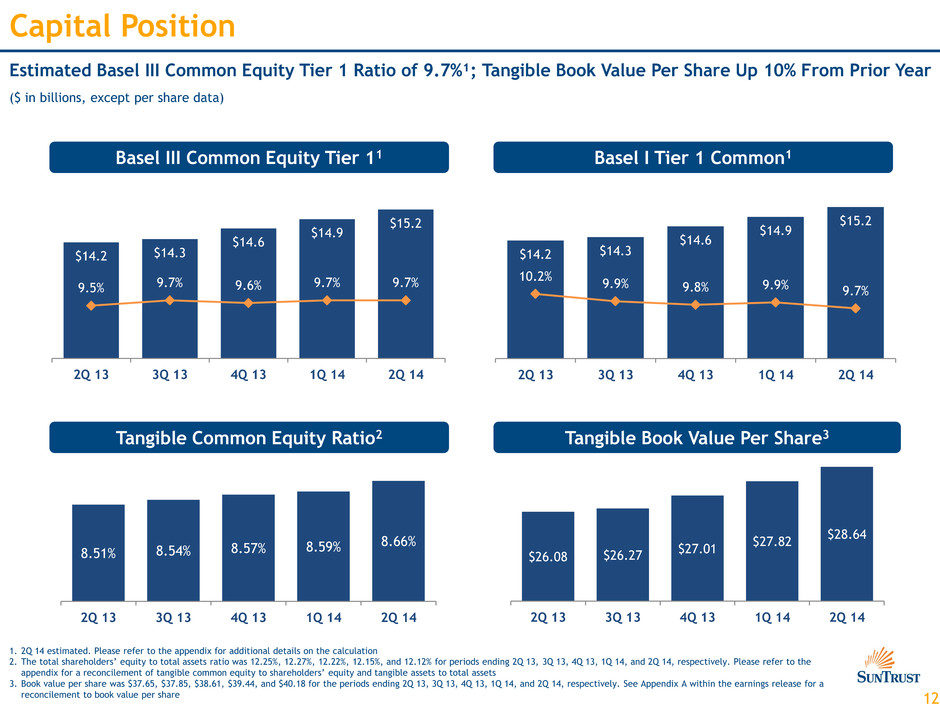

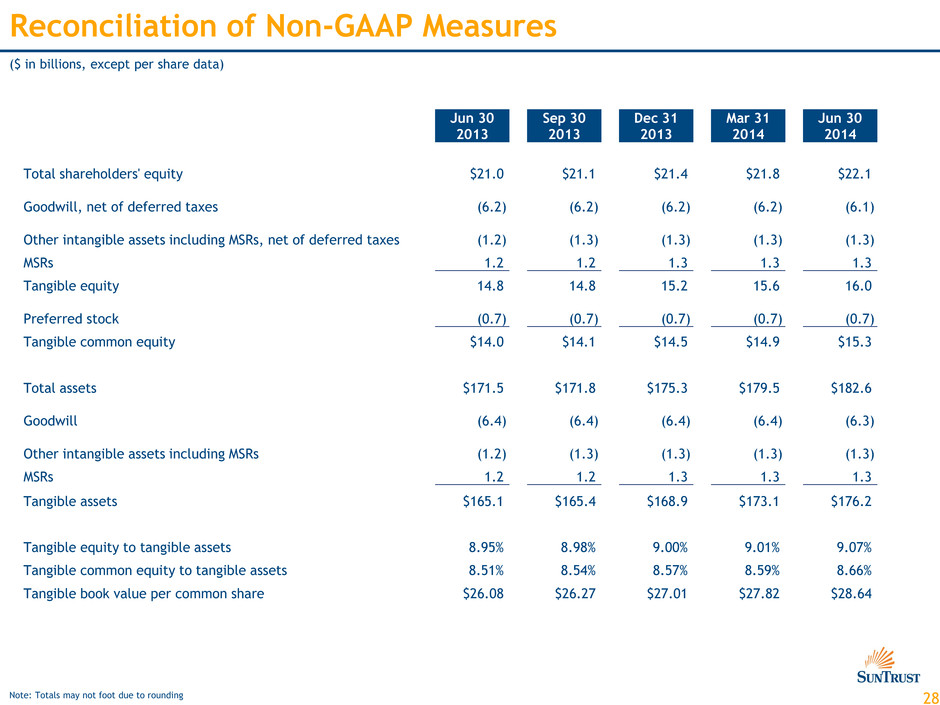

12 Capital Position Estimated Basel III Common Equity Tier 1 Ratio of 9.7%¹; Tangible Book Value Per Share Up 10% From Prior Year ($ in billions, except per share data) Tangible Common Equity Ratio2 Tangible Book Value Per Share3 1. 2Q 14 estimated. Please refer to the appendix for additional details on the calculation 2. The total shareholders’ equity to total assets ratio was 12.25%, 12.27%, 12.22%, 12.15%, and 12.12% for periods ending 2Q 13, 3Q 13, 4Q 13, 1Q 14, and 2Q 14, respectively. Please refer to the appendix for a reconcilement of tangible common equity to shareholders’ equity and tangible assets to total assets 3. Book value per share was $37.65, $37.85, $38.61, $39.44, and $40.18 for the periods ending 2Q 13, 3Q 13, 4Q 13, 1Q 14, and 2Q 14, respectively. See Appendix A within the earnings release for a reconcilement to book value per share 8.51% 8.54% 8.57% 8.59% 8.66% 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 $26.08 $26.27 $27.01 $27.82 $28.64 2Q 13 Q 13 Q 13 1Q 14 2Q 14 Basel III Common Equity Tier 11 Basel I Tier 1 Common1 $14.2 $14.3 $14.6 $14.9 $15.2 9.5% 9.7% 9.6% 9.7% 9.7% 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 $14.2 $14.3 $14.6 $14.9 $15.2 10.2% 9.9% 9.8% 9.9% 9.7% 2Q 13 3Q 13 Q 13 1Q 14 2Q 14

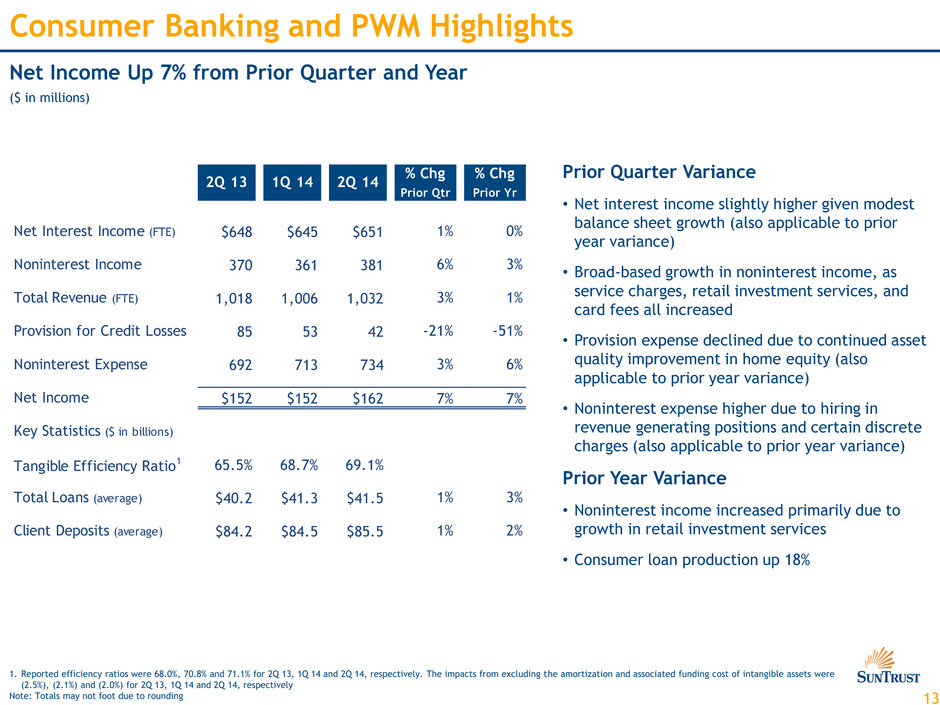

13 Consumer Banking and PWM Highlights Net Income Up 7% from Prior Quarter and Year ($ in millions) 1. Reported efficiency ratios were 68.0%, 70.8% and 71.1% for 2Q 13, 1Q 14 and 2Q 14, respectively. The impacts from excluding the amortization and associated funding cost of intangible assets were (2.5%), (2.1%) and (2.0%) for 2Q 13, 1Q 14 and 2Q 14, respectively Note: Totals may not foot due to rounding Prior Quarter Variance • Net interest income slightly higher given modest balance sheet growth (also applicable to prior year variance) • Broad-based growth in noninterest income, as service charges, retail investment services, and card fees all increased • Provision expense declined due to continued asset quality improvement in home equity (also applicable to prior year variance) • Noninterest expense higher due to hiring in revenue generating positions and certain discrete charges (also applicable to prior year variance) Prior Year Variance • Noninterest income increased primarily due to growth in retail investment services • Consumer loan production up 18% 2Q 13 1Q 14 2Q 14 % Chg Prior Qtr % Chg Prior Yr Net Interest Income (FTE) $648 $645 $651 1% 0% Noninterest Income 370 361 381 6% 3% Total Revenue (FTE) 1,018 1,006 1,032 3% 1% Provision for Credit Losses 85 53 42 -21% -51% Noninterest Expense 692 713 734 3% 6% Net Income $152 $152 $162 7% 7% Key Statistics ($ in billions) Tangible Efficiency Ratio1 65.5% 68.7% 69.1% Total Loans (aver ge) $40.2 $41.3 $41.5 1% 3% Client Deposits (average) $84.2 $84.5 $85.5 1% 2%

14 Wholesale Banking Highlights Strong Overall Performance Continued ($ in millions) 1. 1Q 14 reported noninterest expense, net income, and efficiency ratio were $418 million, $179 million, and 59.3%, respectively. Adjusted figures are the result of excluding the $36 million legacy affordable housing impairment charge in noninterest expense 2. Reported efficiency ratios were 50.2%, 59.2% and 50.7% for 2Q 13, 1Q 14 and 2Q 14, respectively. The impacts from excluding the amortization of intangible assets, the associated funding cost of intangible assets, and the adjustment noted above were (1.0%), (6.1%) and (0.8%) for 2Q 13, 1Q 14 and 2Q 14, respectively Prior Quarter Variance • Net interest income increased given strong loan and deposit growth (also applicable to prior year variance) Broad-based loan growth across industry verticals and lines of business (also applicable to prior year variance) • Notable growth in noninterest income due to higher investment banking income (also applicable to prior year variance) • Provision expense declined due to continued strong asset quality performance (also applicable to prior year variance) Prior Year Variance • Noninterest expense increased due to hiring related to expansion efforts 1 1 1 2Q 13 1Q 14 Adjusted 2Q 14 % Chg Prior Qtr % Chg Prior Yr Net Interest Income (FTE) $425 $430 $449 5% 6% Noninterest Income 288 275 312 14% 8% Total Revenue (FTE) 713 705 761 8% 7% Provision for Credit Losses 12 23 7 -69% -42% Adjusted Noninterest Expense 359 382 385 1% 7% Adjusted Net Income $228 $202 $245 21% 7% Key Statistics ($ in billions) Adjusted Tangible Efficiency Ratio2 49.2% 53.0% 49.9% Total Loans (average) $53.5 $58.9 $61.4 4% 15% Client Deposits (av r ge) $38.7 $42.1 $42.9 2% 11%

15 Mortgage Banking Highlights Further Profitability Progress ($ in millions) Prior Quarter Variance • Noninterest income was up 19%, as increased production volume and the gain on the sale of government guaranteed mortgages were partially offset by a decline in servicing income • Provision declined due to continued asset quality improvements (also applicable to prior year variance) Prior Year Variance • Noninterest income lower due to a decline in production income, partially offset by higher servicing income • Adjusted noninterest expense1 declined due to a reduction in cyclical costs and the execution of cost saving efforts 1. 2Q 14 reported noninterest expense, net income, and efficiency ratio were $367 million, ($84) million, and 141.8%, respectively. Adjusted figures are the result of excluding $179 million of operating losses related to specific legacy mortgage matters from noninterest expense. Please refer to the appendix for reconciliation of noninterest expense Note: Totals may not foot due to rounding 2Q 13 1Q 14 2Q 14 Adjusted % Chg Prior Qtr % Chg Prior Yr Net Interest Income (FTE) $141 $134 $140 4% -1% Noninterest Income 131 100 119 19% -9% Total Revenue (FTE) 272 234 259 11% -5% Provision for Credit Losses 49 26 24 -8% -51% Adjusted Noninterest Expense 340 189 188 -1% -45% Adjusted Net Income / (Loss) ($69) $14 $31 NM NM Key Statistics ($ in billions) Adjusted Efficiency Ratio 124.8% 80.5% 72.6% Total Loans (ave ag ) $27.6 $28.3 $27.8 -2% 1% Client Deposits (average) $3.7 $1.9 $2.2 17% -41% Production Volume $9.1 $3.1 $4.1 31% -55% 1 1 1

Appendix

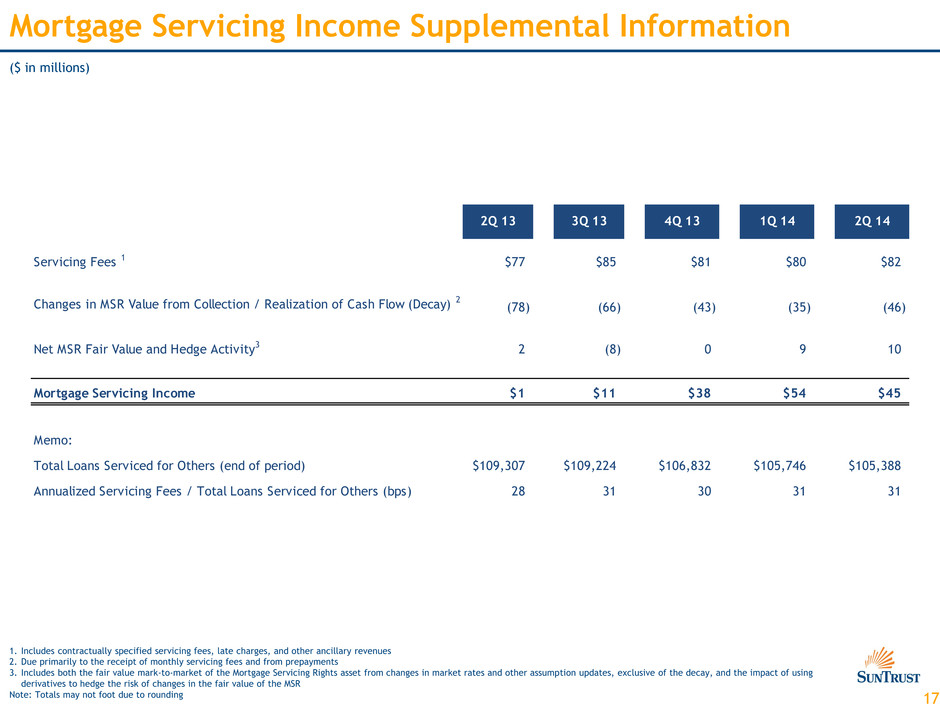

17 Mortgage Servicing Income Supplemental Information ($ in millions) 1. Includes contractually specified servicing fees, late charges, and other ancillary revenues 2. Due primarily to the receipt of monthly servicing fees and from prepayments 3. Includes both the fair value mark-to-market of the Mortgage Servicing Rights asset from changes in market rates and other assumption updates, exclusive of the decay, and the impact of using derivatives to hedge the risk of changes in the fair value of the MSR Note: Totals may not foot due to rounding 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 Servicing Fees 1 $77 $85 $81 $80 $82 (78) (66) (43) (35) (46) Net MSR Fair Value and Hedge Activity3 2 (8) 0 9 10 Mortgage Servicing Income $1 $11 $38 $54 $45 Memo: Total Loans Serviced for Others (end of period) $109,307 $109,224 $106,832 $105,746 $105,388 Annualized Servicing Fees / Total Loans Serviced for Others (bps) 28 31 30 31 31 Changes in MSR Value from Collection / Realization of Cash Flow (Decay) 2

18 Additional Noninterest Expense Disclosure ($ in millions) 1. Adjusted to exclude certain October 10, 2013 8-K items. Adjusted figures provided as they remove certain items that are material and/or potentially non-recurring. Operating losses adjusted from $350 million to $27 million due to $323 million of operating losses associated with specific legacy mortgage and other related legal matters. Collections services adjusted from $126 million to $30 million due to the impact of the $96 million servicing advances allowance increase 2. Adjusted to exclude certain July 3, 2014 8-K items and other legacy mortgage-related matters. Adjusted figures provided as they remove certain items that are material and/or potentially non- recurring. Operating losses adjusted from $218 million to $39 million due to $179 million of operating losses associated with the aforementioned items Note: Totals may not foot due to rounding $81 $125 $75 $42 Cyclical Costs Consist of: 1 Credit-Related Expenses and Operating Losses (Cyclical Costs) $63 2 $72 $27 $42 $21 $39 $1 $4 $38 $30 $27 $15 $16 $14 $13 $13 $6 $8 2Q 13 3Q 13 Adjusted 4Q 13 1Q 14 2Q 14 Adjusted Operating Losses Other Real Estate (Other Exp.) Collections Services (Other Exp.) Credit Services (Other Exp.)

19 $102 $102 $98 $84 1Q 14 2Q 14 3Q 14 4Q 14 2015 Qrtrly Average Commercial Loan Swap Interest Income ($ in millions) Key Points • Swap income is expected to remain fairly stable in 3Q 14, then decline in 4Q 14 through 2015 • SunTrust receives a fixed rate and pays a floating rate (LIBOR) on the notional value of these swaps • As these swaps mature, asset sensitivity increases → As of June 30, 2014, an instantaneous 100 bps increase in rates would result in a 3.2% increase in net interest income over the next twelve months → For every $1 billion of commercial loan swaps that matures, asset sensitivity increases by ~0.2% Actual Forecast1 1. Forecast swap income assumes LIBOR unchanged relative to 06/30/14 levels ~$35 - $40

20 30 – 89 Day Delinquencies by Loan Class ($ in millions) 1. Excludes delinquencies on all federally guaranteed mortgages 2. Excludes delinquencies on federally guaranteed student loans 3. Excludes delinquencies on federally guaranteed mortgages and student loans from the calculation 4. Excludes mortgage loans guaranteed by GNMA that SunTrust has the option, but not the obligation, to repurchase Note: Totals may not foot due to rounding Memo: 30-89 Accruing Delinquencies 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 2Q 14 Loan Balance Commercial & industrial 0.14% 0.08% 0.08% 0.09% 0.07% $61,337 Commercial real estate 0.34% 0.10% 0.09% 0.11% 0.07% 6,105 Commercial construction 0.01% 0.01% 0.14% 0.25% 0.04% 1,096 Total Commercial Loans 0.16% 0.08% 0.08% 0.10% 0.07% $68,538 Residential mortgages – guaranteed - - - - - $661 Residential mortgages – nonguaranteed 0.70% 0.65% 0.61% 0.50% 0.46% 24,173 Home equity products 0.78% 0.82% 0.80% 0.73% 0.72% 14,519 Residential construction 1.07% 0.72% 0.67% 1.71% 0.76% 508 Total Residential Loans¹ 0.74% 0.71% 0.69% 0.60% 0.56% $39,861 Guaranteed student loans - - - - - $5,420 Other direct 0.64% 0.56% 0.64% 0.49% 0.59% 3,675 Indirect 0.44% 0.49% 0.66% 0.57% 0.54% 11,501 Credit cards 0.89% 0.91% 0.93% 0.82% 0.81% 749 Total Consumer Loans² 0.50% 0.52% 0.67% 0.56% 0.56% $21,345 Total SunTrust - excluding government-guaranteed delinquencies³ 0.40% 0.35% 0.36% 0.32% 0.29% $123,663 Impact of excluding government-guaranteed 0.31% 0.30% 0.38% 0.35% 0.34% 6,081 Total SunTrust - including government-guaranteed delinquencies4 0.71% 0.65% 0.74% 0.67% 0.63% $129,744

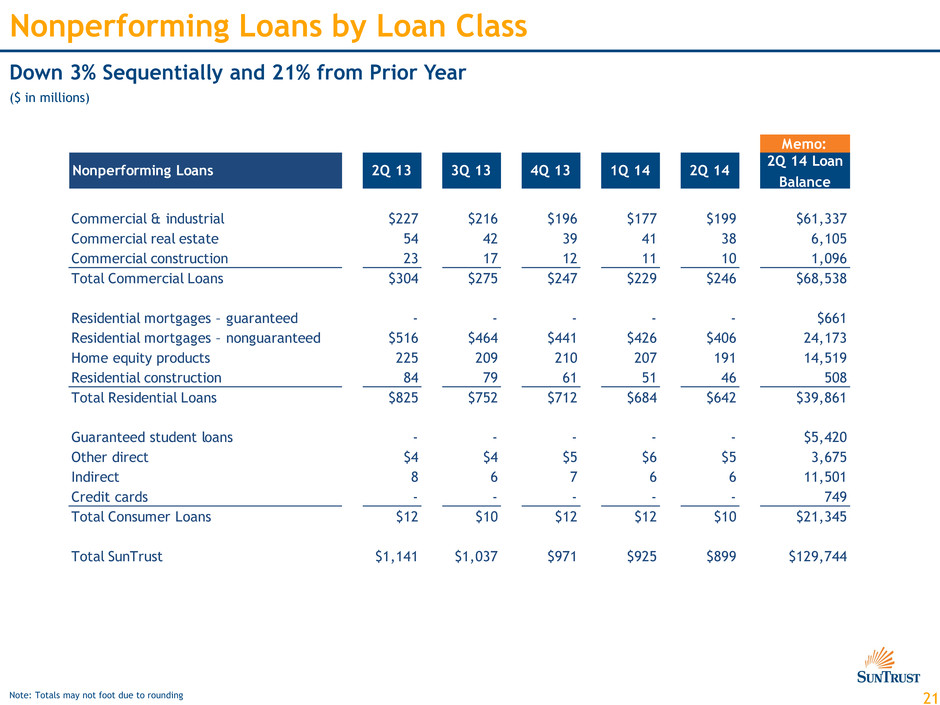

21 Nonperforming Loans by Loan Class Down 3% Sequentially and 21% from Prior Year ($ in millions) Note: Totals may not foot due to rounding Memo: Nonperforming Loans 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 2Q 14 Loan Balance Commercial & industrial $227 $216 $196 $177 $199 $61,337 Commercial real estate 54 42 39 41 38 6,105 Commercial construction 23 17 12 11 10 1,096 Total Commercial Loans $304 $275 $247 $229 $246 $68,538 Residential mortgages – guaranteed - - - - - $661 Residential mortgages – nonguaranteed $516 $464 $441 $426 $406 24,173 Home equity products 225 209 210 207 191 14,519 Residential construction 84 79 61 51 46 508 Total Residential Loans $825 $752 $712 $684 $642 $39,861 Guaranteed student loans - - - - - $5,420 O her direct $4 $4 $5 $6 $5 3,675 Indirect 8 6 7 6 6 11,501 Credit cards - - - - - 749 Total Consumer Loans $12 $10 $12 $12 $10 $21,345 Total SunTrust $1,141 $1,037 $971 $925 $899 $129,744

22 Net Charge-off Ratios by Loan Class Note: Totals may not foot due to rounding Stable Sequentially and Down 24 bps from Prior Year ($ in millions) Memo: Net Charge-offs % Average Loans (annualized) 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 2Q 14 Loan Balance Commercial & industrial 0.30% 0.27% 0.16% 0.11% 0.15% $61,337 Commercial real estate 0.24% 0.04% 0.43% -0.03% 0.12% 6,105 Commercial construction -0.34% 0.71% -1.40% 1.32% 0.72% 1,096 Total Commercial Loans 0.29% 0.26% 0.16% 0.12% 0.15% $68,538 Residential mortgages – guaranteed - - - - - $661 Residential mortgages – nonguaranteed 0.94% 0.66% 0.54% 0.39% 0.66% 24,173 Home equity products 1.55% 1.15% 1.06% 1.10% 0.79% 14,519 Residential construction 4.80% 3.28% 5.94% 3.65% -0.99% 508 Total Residential Loans 1.13% 0.82% 0.75% 0.64% 0.64% $39,861 Guaranteed student loans - - - - - $5,420 O her direct 1.11% 0.91% 0.84% 1.05% 1.05% 3,675 Indirect 0.17% 0.31% 0.37% 0.40% 0.40% 11,501 Credit cards 3.13% 2.81% 2.86% 2.65% 2.65% 749 Total Consumer Loans 0.34% 0.39% 0.42% 0.47% 0.47% $21,345 Total SunTrust 0.59% 0.47% 0.40% 0.35% 0.35% $129,744

23 Net Charge-offs by Loan Class Note: Totals may not foot due to rounding Stable Sequentially and Down 37% from Prior Year ($ in millions) Memo: Net Charge-offs ($) 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 2Q 14 Loan Balance Commercial & industrial $42 $38 $22 $16 $22 $61,337 Commercial real estate 3 - 6 (1) 1 6,105 Commercial construction (1) 1 (3) 4 3 1,096 Total Commercial Loans $44 $39 $25 $19 $26 $68,538 Residential mortgages – guaranteed - - - - - $661 Residential mortgages – nonguaranteed $54 $39 $33 $23 $39 24,173 Home equity products 57 44 40 40 29 14,519 Residential construction 8 5 9 5 -1 508 Total Residential Loans $119 $88 $82 $68 $67 $39,861 Guaranteed student loans - - - - - $5,420 Other direct $6 $6 $6 $8 $8 3,675 Indirect 5 9 10 11 7 11,501 Credit cards 5 4 5 4 5 749 Total Consumer Loans $16 $19 $21 $23 $20 $21,345 Total SunTrust $179 $146 $128 $110 $113 $129,744

24 Reconciliation of Noninterest Income ($ in millions) 1. Adjusted revenue and expenses are provided as they remove certain items that are material and/or potentially non-recurring. Adjusted figures are intended to provide management and investors information on trends that are more comparable across periods and potentially more comparable across institutions Note: Totals may not foot due to rounding 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 Reported Noninterest Income $858 $680 $814 $791 $957 Adjustment Items: Securities Gains 0 (0) 1 (1) (1) Fair Value Items (Trading Income) 10 (4) 10 (2) (7) Fair Value Items (Mortgage Production) (7) 4 (4) 5 4 GSE Mortgage Repurchase Settlements (Mortgage Production Related Income) - (63) - - - RidgeWorth Sale (Other Income) - - - - 105 Total Adjustments 3 (63) 7 2 102 Adjusted Noninterest Income 1 $855 $743 $807 $789 $855 Memo: Reported Trading Income $49 $33 $57 $49 $47 - Fair Value Items 10 (4) 10 (2) (7) Adjusted Trading Income $39 $37 $47 $51 $54

25 Reconciliation of Noninterest Expense ($ in millions) 1. In accordance with recently issued GAAP, amortization of affordable housing investments of $10 million, $12 million and $16 million were reclassified and are now presented in provision for income taxes for the three months ended June 30, 2013, September 30, 2013 and December 31, 2013, respectively. Previously, the amortization was presented in other noninterest expense 2. Adjusted revenue and expenses are provided as they remove certain items that are material and/or potentially non-recurring. Adjusted figures are intended to provide management and investors information on trends that are more comparable across periods and potentially more comparable across institutions Note: Totals may not foot due to rounding 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 Reported Noninterest Expense 1 $1,387 $1,730 $1,361 $1,357 $1,517 Adjustment Items: Legacy Affordable Housing Impairment (Other Noninterest Expense) - - - 36 - Settlement of Certain Legacy Legal Matters (Operating Losses) - 323 - - 179 Mortgage Servicing Advances Allowance Increase (Other Noninterest Expense) - 96 - - - Total Adjustments - 419 - 36 179 Adjusted Noninterest Expense 2 $1,387 $1,311 $1,361 $1,321 $1,338

26 Reconciliation of Efficiency Ratio ($ in millions) 1. In accordance with recently issued GAAP, amortization of affordable housing investments of $10 million, $12 million and $16 million were reclassified and are now presented in provision for income taxes for the three months ended June 30, 2013, September 30, 2013 and December 31, 2013, respectively. Previously, the amortization was presented in other noninterest expense 2. Adjusted revenue and expenses are provided as they remove certain items that are material and/or potentially non-recurring. Adjusted figures are intended to provide management and investors information on trends that are more comparable across periods and potentially more comparable across institutions Note: Totals may not foot due to rounding 1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 1H 13 1H 14 Reported (GAAP) Basis Total Revenue - FTE $2,114 $2,100 $1,920 $2,061 $2,030 $2,201 $4,214 $4,231 Total Noninterest Expense 1,353 1,387 1,730 1,361 1,357 1,517 2,740 2,874 Amortization of Intangibles 6 6 6 5 3 4 12 7 Efficiency Ratio 64.0% 66.1% 90.1% 66.0% 66.8% 68.9% 65.0% 67.9% Tangible Efficiency Ratio1 63.7% 65.8% 89.8% 65.8% 66.7% 68.8% 64.7% 67.8% Adjusted Basis Reported Revenue - FTE $2,114 $2,100 $1,920 $2,061 $2,030 $2,201 $4,214 $4,231 Adjustment Items: Securities Gains / (Losses) 2 0 (0) 1 (1) (1) 2 (2) Fair Value Items (Trading) (10) 10 (4) 10 (2) (7) 1 (9) Fair Value Items (Mortgage) (3) (7) 4 (4) 5 4 (11) 9 GSE Mortgage Repurchase Settlements - - (63) - - - - - RidgeWorth Sale - - - - 105 - 105 Adjusted Revenue2 - FTE $2,125 $2,097 $1,984 $2,054 $2,029 $2,099 $4,222 $4,128 Reported Noninterest Expense $1,353 $1,387 $1,730 $1,361 $1,357 $1,517 $2,740 $2,874 Adjustment Items: Legacy Affordable Housing Impairment - - - - 36 - - 36 Settlement of Certain Legacy Legal Matters - - 323 - - 179 - 179 Mortgage Servicing Advances Allowance Increase - - 96 - - - - - Adjusted Expense2 $1,353 $1,387 $1,311 $1,361 $1,321 $1,338 $2,740 $2,659 Efficiency Ratio - Adjusted Basis 63.7% 66.1% 66.1% 66.3% 65.1% 63.7% 64.9% 64.4% Tangible Efficiency Ratio - Adjusted Basis1 63.4% 65.9% 65.8% 66.0% 64.9% 63.6% 64.6% 64.2%

27 Reconciliation of Basel III Common Equity Tier 1 Ratio1 ($ in billions) 2Q 14 Basel I Tier 1 Common $15.2 Adjustments from Basel I to Basel III 2 0.0 Basel III Common Equity Tier 13 $15.2 Risk-weighted Assets - Basel I $155.9 Adjustments from Basel I to Basel III 4 0.4 Risk-weighted Assets - Basel III 3 $156.3 Tier 1 Common Ratio (Basel I) 9.7% Common Equity Tier 1 Ratio (Basel III)3 9.7% 1. The Tier 1 common ratio is a financial measure that is used by regulators, bank management, and investors to assess the capital position of financial services companies. The Common Equity Tier 1 ratio as calculated for Basel III is considered non-GAAP, and as such we have presented a reconciliation to the Tier 1 common ratio under Basel I that is currently used by regulators. All figures are estimated at the time of the earnings release and subject to revision 2. Improved treatment of mortgage servicing assets essentially offset by disallowed deferred tax assets 3. The Basel III calculations of Common Equity Tier 1, risk-weighted assets, and the Common Equity Tier 1 ratio are based upon the Company's interpretation of the final Basel III rules issued by the Federal Reserve on July 2, 2013, on a fully-phased-in basis. The Company's interpretation of the rules is subject to change, and as such, so are its estimated Basel III calculations 4. The largest differences between the risk-weighted assets as calculated under Basel I versus Basel III for SunTrust relate to the risk-weightings for certain commercial loans, unfunded commitments, derivatives and mortgage servicing assets

28 Reconciliation of Non-GAAP Measures ($ in billions, except per share data) Jun 30 Sep 30 Dec 31 Mar 31 Jun 30 2013 2013 2013 2014 2014 Total shareholders' equity $21.0 $21.1 $21.4 $21.8 $22.1 Goodwill, net of deferred taxes (6.2) (6.2) (6.2) (6.2) (6.1) Other intangible assets including MSRs, net of deferred taxes (1.2) (1.3) (1.3) (1.3) (1.3) MSRs 1.2 1.2 1.3 1.3 1.3 Tangible equity 14.8 14.8 15.2 15.6 16.0 Preferred stock (0.7) (0.7) (0.7) (0.7) (0.7) Tangible common equity $14.0 $14.1 $14.5 $14.9 $15.3 Total assets $171.5 $171.8 $175.3 $179.5 $182.6 Goodwill (6.4) (6.4) (6.4) (6.4) (6.3) Other intangible assets including MSRs (1.2) (1.3) (1.3) (1.3) (1.3) MSRs 1.2 1.2 1.3 1.3 1.3 Tangible assets $165.1 $165.4 $168.9 $173.1 $176.2 Tangible equity to tangible assets 8.95% 8.98% 9.00% 9.01% 9.07% Tangible common equity to tangible assets 8.51% 8.54% 8.57% 8.59% 8.66% Tangible book value per common share $26.08 $26.27 $27.01 $27.82 $28.64 Note: Totals may not foot due to rounding

29 Income Statement ($ in millions, except per share data) 3Q 13 Reported Earnings Impact from Significant 3Q 13 Items 3Q 13 Adjusted Earnings 2Q 14 Reported Earnings Impact from Significant 2Q 14 Items 2Q 14 Adjusted Earnings NET INTEREST INCOME $1,208 $1,208 $1,209 $1,209 Provision for Credit Losses 95 95 73 73 NET INTEREST INCOME AFTER PROVISION FOR CREDIT LOSSES 1,113 1,113 1,136 1,136 NONINTEREST INCOME Service charges on deposit accounts 168 168 160 160 Trust and investment management income 133 133 116 116 Retail investment services 68 68 76 76 Other charges and fees 91 91 91 91 Investment banking income 99 99 119 119 Trading Income 33 33 47 47 Card fees 77 77 82 82 Mortgage production related income / (loss) (10) (63) 53 52 52 Mortgage servicing related income 11 11 45 45 Other noninterest income 10 10 170 105 65 Net securities gains - - (1) (1) Total noninterest income 680 (63) 743 957 105 852 NONINTEREST EXPENSE Employee compensation and benefits 682 682 763 763 Net occupancy expense 86 86 83 83 Outside processing and software 190 190 181 181 Equipment expense 45 45 42 42 Marketing and customer development 34 34 30 30 Amortization of intangible assets 6 6 4 4 Operating losses 350 323 27 218 179 39 FDIC premium/regulatory exams 45 45 40 40 Other noninterest expense 292 96 196 156 156 Total noninterest expense 1,730 419 1,311 1,517 179 1,338 INCOME BEFORE PROVISION FOR INCOME TAXES 63 (482) 545 576 (74) 650 Provision/(benefit) for income taxes (133) (303) 170 173 (25) 198 INCOME INCLUDING INCOME ATTRIBUTABLE TO NONCONTROLLING INTEREST 196 (179) 375 403 (49) 452 Net income attributable to noncontrolling interest 7 7 4 4 NET INCOME 189 (179) 368 399 (49) 448 NET INCOME AVAILABLE TO COMMON SHAREHOLDERS 179 (179) 358 387 (49) 436 EPS - DILUTED $0.33 ($0.33) $0.66 $0.72 ($0.09) $0.81 Reconciliation of 3Q 13 and 2Q 14 Income Statements 1. Reflects the pre-tax impact of mortgage repurchase settlements with Fannie Mae and Freddie Mac. 2. Reflects the pre-tax impact from the settlement of certain legal matters. 3. In accordance with recently issued GAAP, amortization of affordable housing investments of $12 million was reclassified and is now presented in provision for income taxes for 3Q 13. Previously, the amortization was presented in other noninterest expense. 4. Reflects the pre-tax impact from the mortgage servicing advances allowance increase. 5. Reflects the benefit for income taxes impact related to footnotes 1 – 3 ($191) and the other tax items ($113) referred to in the October 10, 2013 8-K. 6. Reflects the pre-tax gain associated with the RidgeWorth sale. 7. Reflects the pre-tax impact from the settlement of certain legacy mortgage-related matters. 8. Reflects the benefit for income taxes impact related to footnotes 6 - 7 Note: Totals may not foot due to rounding 1 2 4 5 3 3 6 7 8