2Q 2016 Earnings Presentation July 22, 2016

2 Important Cautionary Statement This presentation should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2015 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. Non-GAAP Financial Measures This presentation includes non-GAAP financial measures to describe SunTrust’s performance. The reconciliations of those measures to GAAP measures are provided within or in the appendix of this presentation beginning on slide 22. In this presentation, consistent with Securities and Exchange Commission Industry Guide 3, the Company presents total revenue, net interest income, net interest margin, and efficiency ratios on a fully taxable equivalent (“FTE”) and annualized basis. The FTE basis adjusts for the tax-favored status of net interest income from certain loans and investments using a federal tax rate of 35% and state income taxes where applicable to increase tax-exempt interest income to a taxable-equivalent basis. The Company believes this measure to be the preferred industry measurement of net interest income and it enhances comparability of net interest income arising from taxable and tax-exempt sources. Total revenue-FTE equals net interest income-FTE plus noninterest income. The Company presents the following additional non-GAAP measures because many investors find them useful. Specifically: • The Company presents certain capital information on a tangible basis, including tangible common equity, the ratio of tangible common equity to tangible assets, and tangible book value per share. These measures exclude the after-tax impact of purchase accounting intangible assets. The Company believes these measures are useful to investors because, by removing the effect of intangible assets that result from merger and acquisition activity (the level of which may vary from company to company), it allows investors to more easily compare the Company’s capital adequacy to other companies in the industry. These measures are used by management to analyze capital adequacy of the Company. • Similarly, the Company presents an efficiency ratio-FTE and a tangible efficiency ratio-FTE. The efficiency ratio is computed by dividing noninterest expense by total revenue. Efficiency ratio-FTE is computed by dividing noninterest expense by total revenue-FTE. The tangible efficiency ratio-FTE excludes the amortization related to intangible assets and certain tax credits. The Company believes this measure is useful to investors because, by removing the impact of amortization (the level of which may vary from company to company), it allows investors to more easily compare the Company’s efficiency to other companies in the industry. This measure is also utilized by management to assess the efficiency of the Company and its lines of business. • The Company presents the Basel III Common Equity Tier 1 (CET1), on a fully-phased in basis. The fully phased-in ratio consider a 250% risk-weighting for MSRs and deduction from capital of certain carryforward DTAs, the overfunded pension asset, and other intangible assets. The Company believes these measures may be useful to investors who wish to understand the Company's current compliance with future regulatory requirements. Important Cautionary Statement about Forward-Looking Statements This presentation contains forward-looking statements. Statements regarding future levels of the efficiency ratio, net interest margin, regulatory assessments, net charge-offs, loan loss provision expense, nonperforming loans, mortgage production income, and service charge on deposits are forward-looking statements. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” “initiatives,” “opportunity,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could"; such statements are based upon the current beliefs and expectations of management and on information currently available to management. Such statements speak as of the date hereof, and we do not assume any obligation to update the statements made herein or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward- looking statements. Factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Part I, Item 1A., “Risk Factors,” in our Annual Report on Form 10-K for the year ended December 31, 2015 and in other periodic reports that we file with the SEC. Those factors include: current and future legislation and regulation could require us to change our business practices, reduce revenue, impose additional costs, or otherwise adversely affect business operations or competitiveness; we are subject to increased capital adequacy and liquidity requirements and our failure to meet these would adversely affect our financial condition; the fiscal and monetary policies of the federal government and its agencies could have a material adverse effect on our earnings; our financial results have been, and may continue to be, materially affected by general economic conditions, and a deterioration of economic conditions or of the financial markets may materially adversely affect our lending and other businesses and our financial results and condition; changes in market interest rates or capital markets could adversely affect our revenue and expenses, the value of assets and obligations, and the availability and cost of capital and liquidity; our earnings may be affected by volatility in mortgage production and servicing revenues, and by changes in carrying values of our MSRs and mortgages held for sale due to changes in interest rates; disruptions in our ability to access global capital markets may adversely affect our capital resources and liquidity; we are subject to credit risk; we may have more credit risk and higher credit losses to the extent that our loans are concentrated by loan type, industry segment, borrower type, or location of the borrower or collateral; we rely on the mortgage secondary market and GSEs for some of our liquidity; loss of customer deposits could increase our funding costs; we are subject to litigation, and our expenses related to this litigation may adversely affect our results; we may incur fines, penalties and other negative consequences from regulatory violations, possibly even inadvertent or unintentional violations; we are subject to certain risks related to originating and selling mortgages, and may be required to repurchase mortgage loans or indemnify mortgage loan purchasers as a result of breaches of representations and warranties, or borrower fraud, and this could harm our liquidity, results of operations, and financial condition; we face certain risks as a servicer of loans; we are subject to risks related to delays in the foreclosure process; clients could pursue alternatives to bank deposits, causing us to lose a relatively inexpensive source of funding; consumers and small businesses may decide not to use banks to complete their financial transactions, which could affect net income; we have businesses other than banking which subject us to a variety of risks; negative public opinion could damage our reputation and adversely impact business and revenues; we rely on other companies to provide key components of our business infrastructure; competition in the financial services industry is intense and we could lose business or suffer margin declines as a result; maintaining or increasing market share depends on market acceptance and regulatory approval of new products and services; our ability to receive dividends from our subsidiaries or other investments could affect our liquidity and ability to pay dividends; any reduction in our credit rating could increase the cost of our funding from the capital markets; we have in the past and may in the future pursue acquisitions, which could affect costs and from which we may not be able to realize anticipated benefits; we depend on the expertise of key personnel, and if these individuals leave or change their roles without effective replacements, operations may suffer; we may not be able to hire or retain additional qualified personnel and recruiting and compensation costs may increase as a result of turnover, both of which may increase costs and reduce profitability and may adversely impact our ability to implement our business strategies; our framework for managing risks may not be effective in mitigating risk and loss to us; our controls and procedures may not prevent or detect all errors or acts of fraud; we are at risk of increased losses from fraud; a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors and other service providers, including as a result of cyber-attacks, could disrupt our businesses, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses; the soundness of other financial institutions could adversely affect us; we depend on the accuracy and completeness of information about clients and counterparties; our accounting policies and processes are critical to how we report our financial condition and results of operation, and they require management to make estimates about matters that are uncertain; depressed market values for our stock and adverse economic conditions sustained over a period of time may require us to write down some portion of our goodwill; our financial instruments measured at fair value expose us to certain market risks; our stock price can be volatile; we might not pay dividends on our stock; and certain banking laws and certain provisions of our articles of incorporation may have an anti-takeover effect.

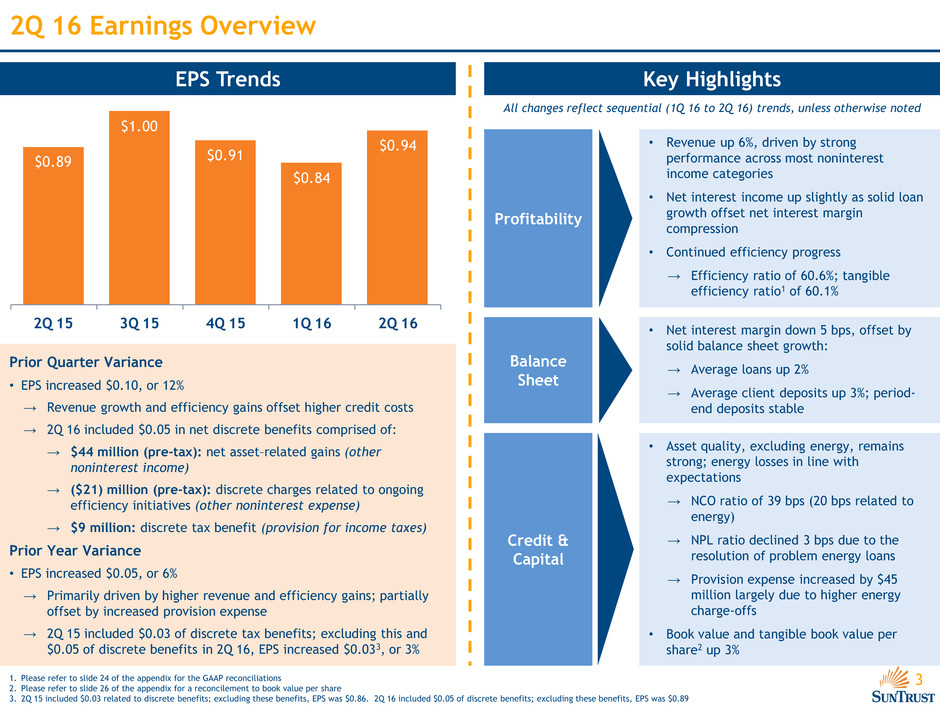

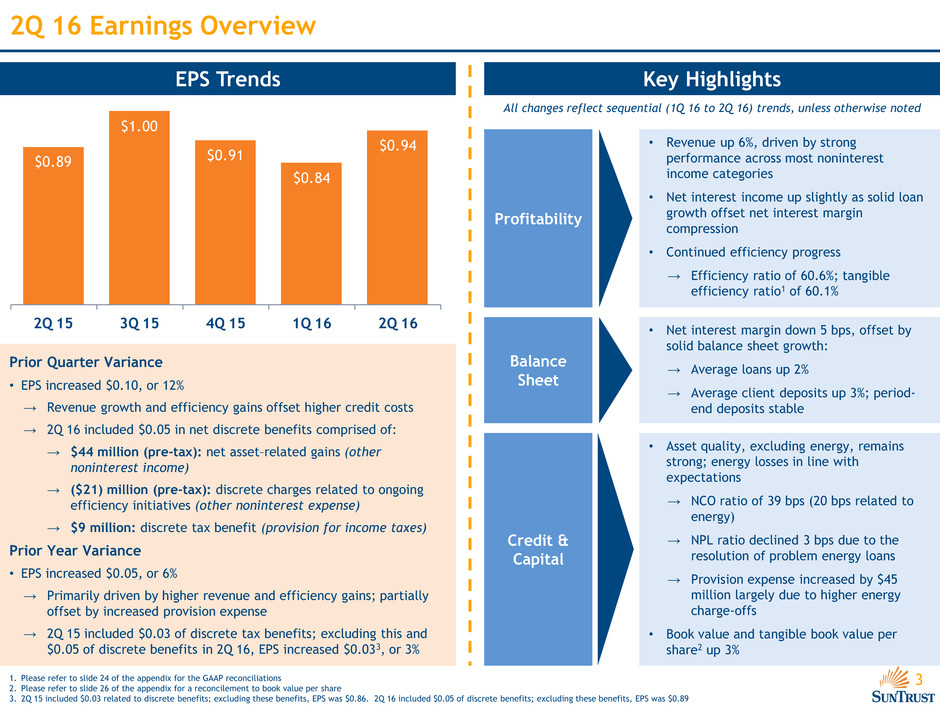

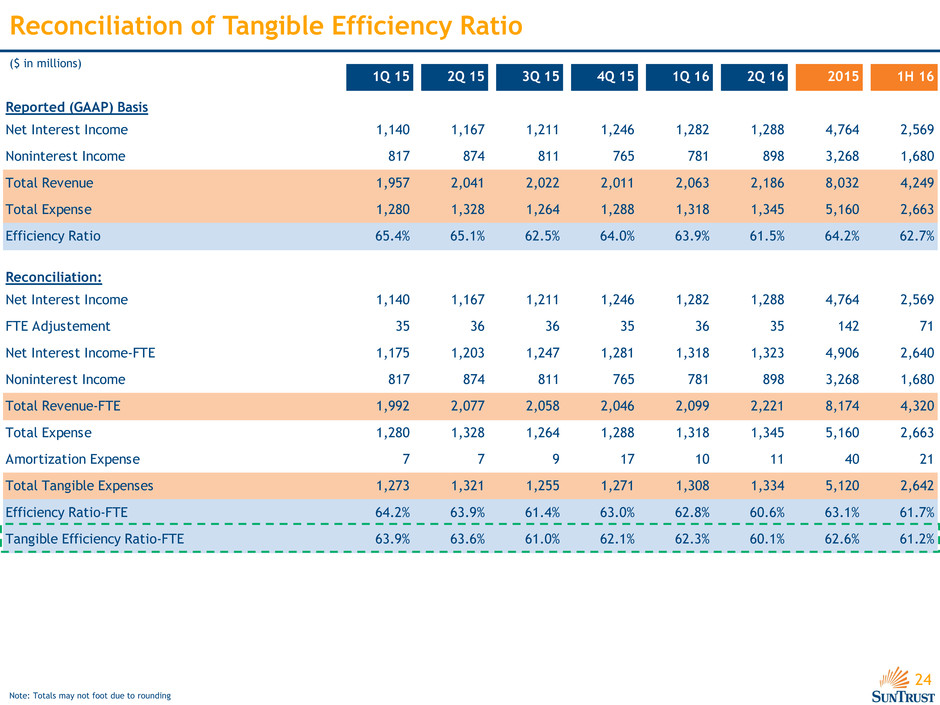

3 2Q 16 Earnings Overview 1. Please refer to slide 24 of the appendix for the GAAP reconciliations 2. Please refer to slide 26 of the appendix for a reconcilement to book value per share 3. 2Q 15 included $0.03 related to discrete benefits; excluding these benefits, EPS was $0.86. 2Q 16 included $0.05 of discrete benefits; excluding these benefits, EPS was $0.89 Prior Quarter Variance • EPS increased $0.10, or 12% → Revenue growth and efficiency gains offset higher credit costs → 2Q 16 included $0.05 in net discrete benefits comprised of: → $44 million (pre-tax): net asset–related gains (other noninterest income) → ($21) million (pre-tax): discrete charges related to ongoing efficiency initiatives (other noninterest expense) → $9 million: discrete tax benefit (provision for income taxes) Prior Year Variance • EPS increased $0.05, or 6% → Primarily driven by higher revenue and efficiency gains; partially offset by increased provision expense → 2Q 15 included $0.03 of discrete tax benefits; excluding this and $0.05 of discrete benefits in 2Q 16, EPS increased $0.033, or 3% EPS Trends Profitability • Revenue up 6%, driven by strong performance across most noninterest income categories • Net interest income up slightly as solid loan growth offset net interest margin compression • Continued efficiency progress → Efficiency ratio of 60.6%; tangible efficiency ratio1 of 60.1% Balance Sheet • Net interest margin down 5 bps, offset by solid balance sheet growth: → Average loans up 2% → Average client deposits up 3%; period- end deposits stable Credit & Capital • Asset quality, excluding energy, remains strong; energy losses in line with expectations → NCO ratio of 39 bps (20 bps related to energy) → NPL ratio declined 3 bps due to the resolution of problem energy loans → Provision expense increased by $45 million largely due to higher energy charge-offs • Book value and tangible book value per share2 up 3% $0.89 $1.00 $0.91 $0.84 $0.94 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 Key Highlights All changes reflect sequential (1Q 16 to 2Q 16) trends, unless otherwise noted

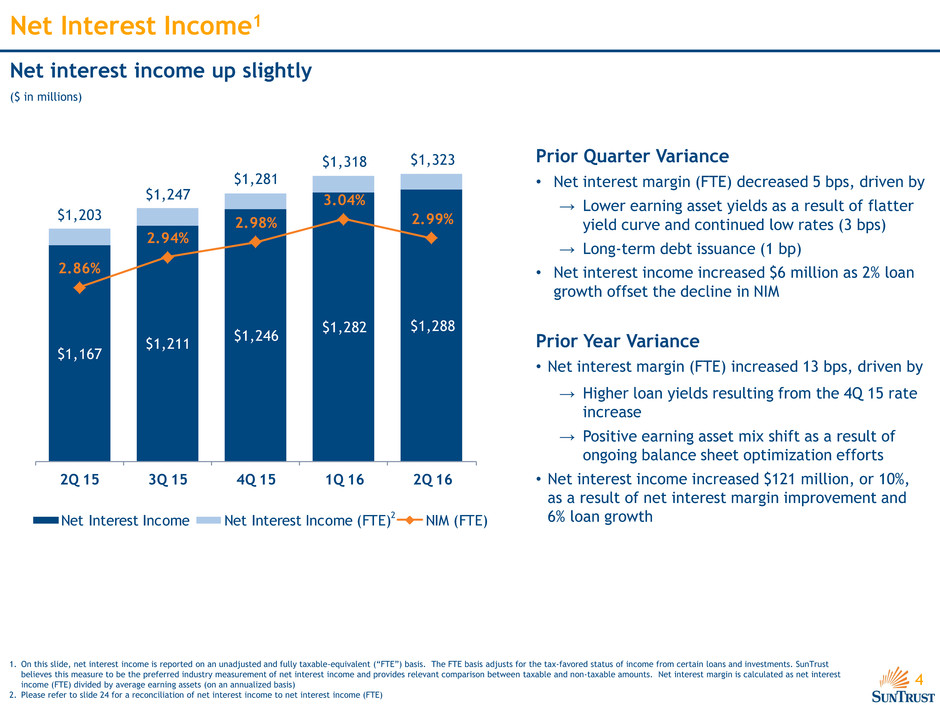

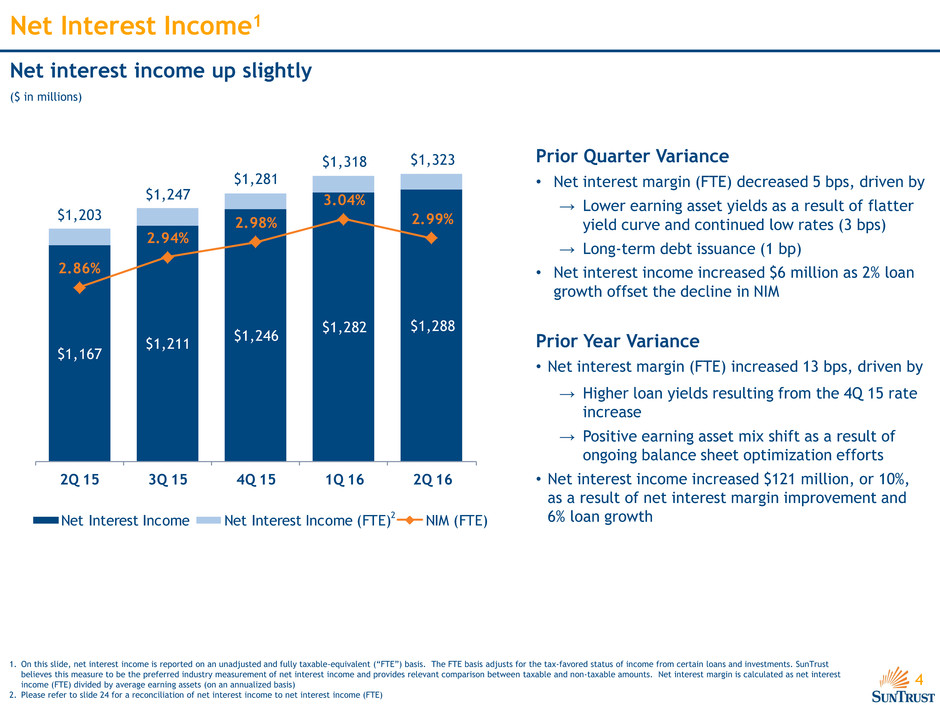

4 Net Interest Income1 Net interest income up slightly ($ in millions) Prior Quarter Variance • Net interest margin (FTE) decreased 5 bps, driven by → Lower earning asset yields as a result of flatter yield curve and continued low rates (3 bps) → Long-term debt issuance (1 bp) • Net interest income increased $6 million as 2% loan growth offset the decline in NIM Prior Year Variance • Net interest margin (FTE) increased 13 bps, driven by → Higher loan yields resulting from the 4Q 15 rate increase → Positive earning asset mix shift as a result of ongoing balance sheet optimization efforts • Net interest income increased $121 million, or 10%, as a result of net interest margin improvement and 6% loan growth $1,167 $1,211 $1,246 $1,282 $1,288 $1,203 $1,247 $1,281 $1,318 $1,323 2.86% 2.94% 2.98% 3.04% 2.99% 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 Net Interest I o e Net Interest Income (FTE) NIM (FTE) 1. On this slide, net interest income is reported on an unadjusted and fully taxable-equivalent (“FTE”) basis. The FTE basis adjusts for the tax-favored status of income from certain loans and investments. SunTrust believes this measure to be the preferred industry measurement of net interest income and provides relevant comparison between taxable and non-taxable amounts. Net interest margin is calculated as net interest income (FTE) divided by average earning assets (on an annualized basis) 2. Please refer to slide 24 for a reconciliation of net interest income to net interest income (FTE) 2

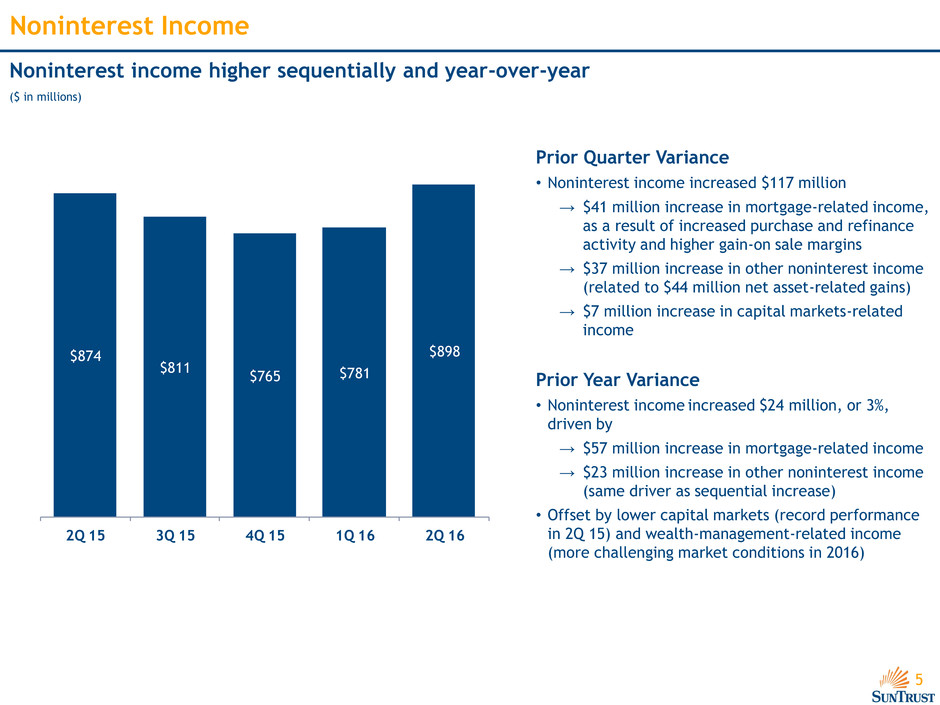

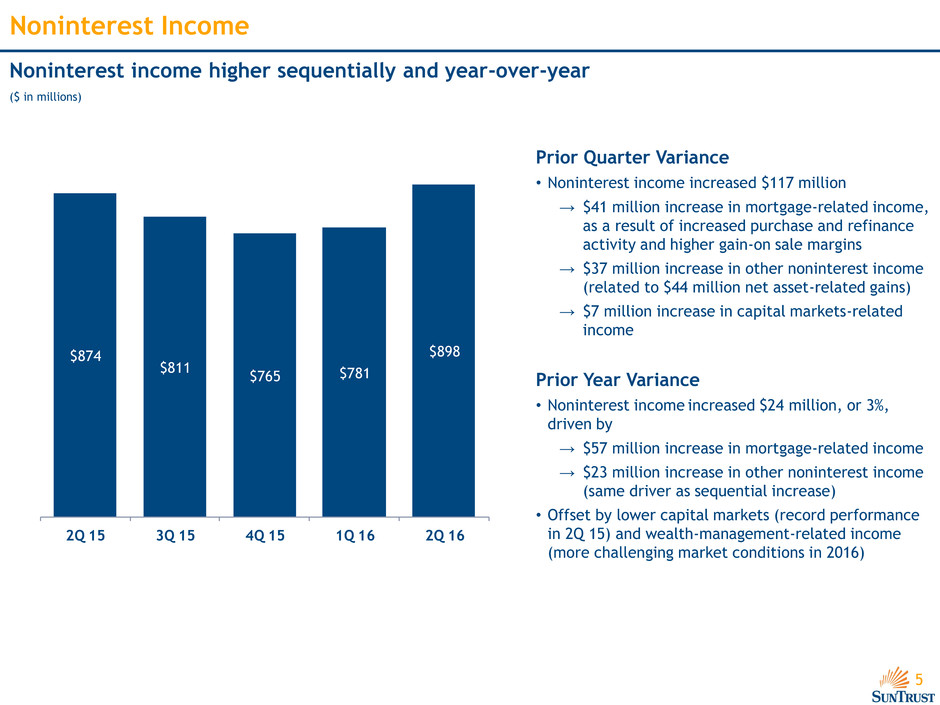

5 Noninterest Income Noninterest income higher sequentially and year-over-year ($ in millions) Prior Quarter Variance • Noninterest income increased $117 million → $41 million increase in mortgage-related income, as a result of increased purchase and refinance activity and higher gain-on sale margins → $37 million increase in other noninterest income (related to $44 million net asset-related gains) → $7 million increase in capital markets-related income Prior Year Variance • Noninterest income increased $24 million, or 3%, driven by → $57 million increase in mortgage-related income → $23 million increase in other noninterest income (same driver as sequential increase) • Offset by lower capital markets (record performance in 2Q 15) and wealth-management-related income (more challenging market conditions in 2016) $874 $811 $765 $781 $898 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16

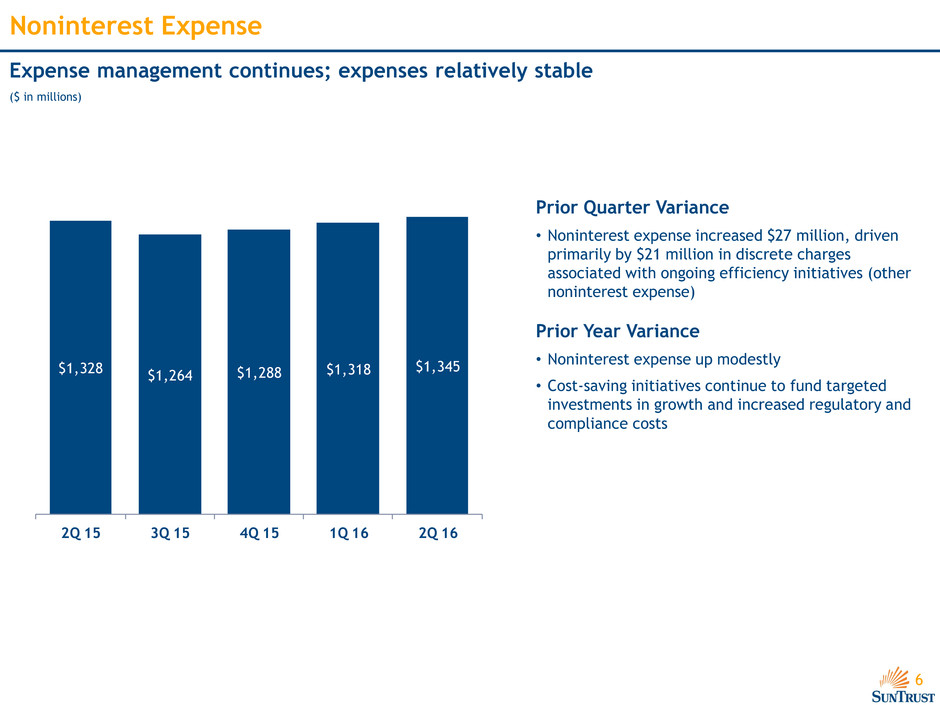

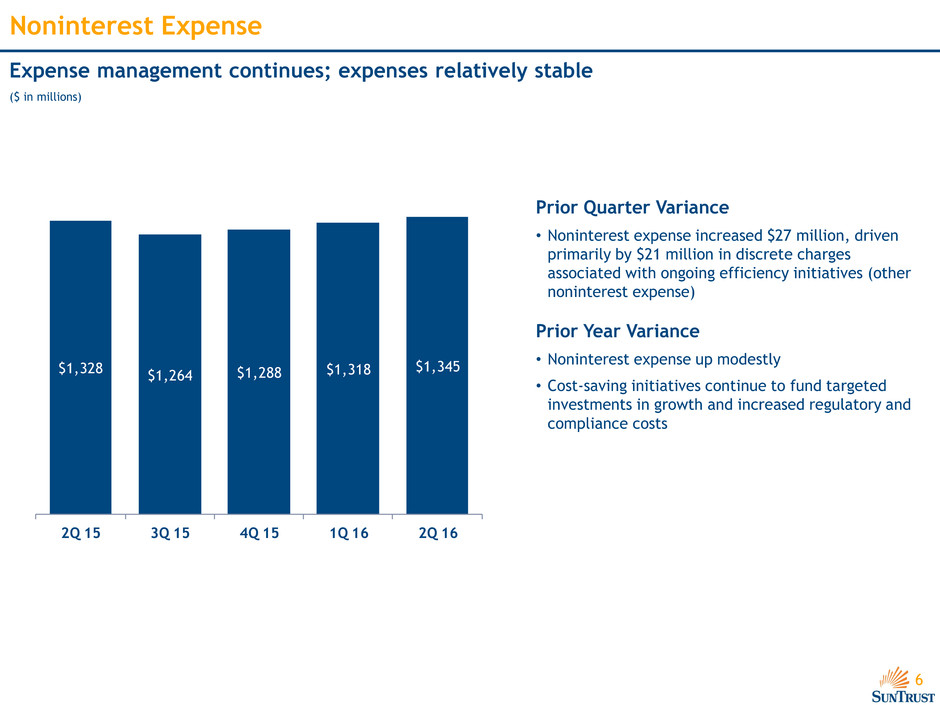

6 Noninterest Expense Expense management continues; expenses relatively stable ($ in millions) Prior Quarter Variance • Noninterest expense increased $27 million, driven primarily by $21 million in discrete charges associated with ongoing efficiency initiatives (other noninterest expense) Prior Year Variance • Noninterest expense up modestly • Cost-saving initiatives continue to fund targeted investments in growth and increased regulatory and compliance costs $1,328 $1,264 $1,288 $1,318 $1,345 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16

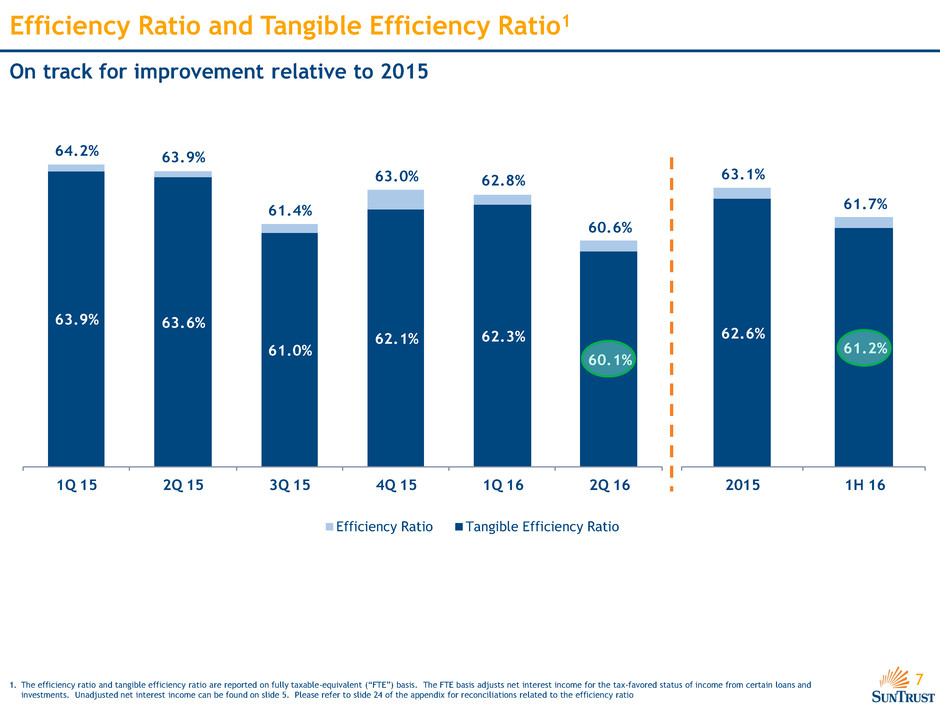

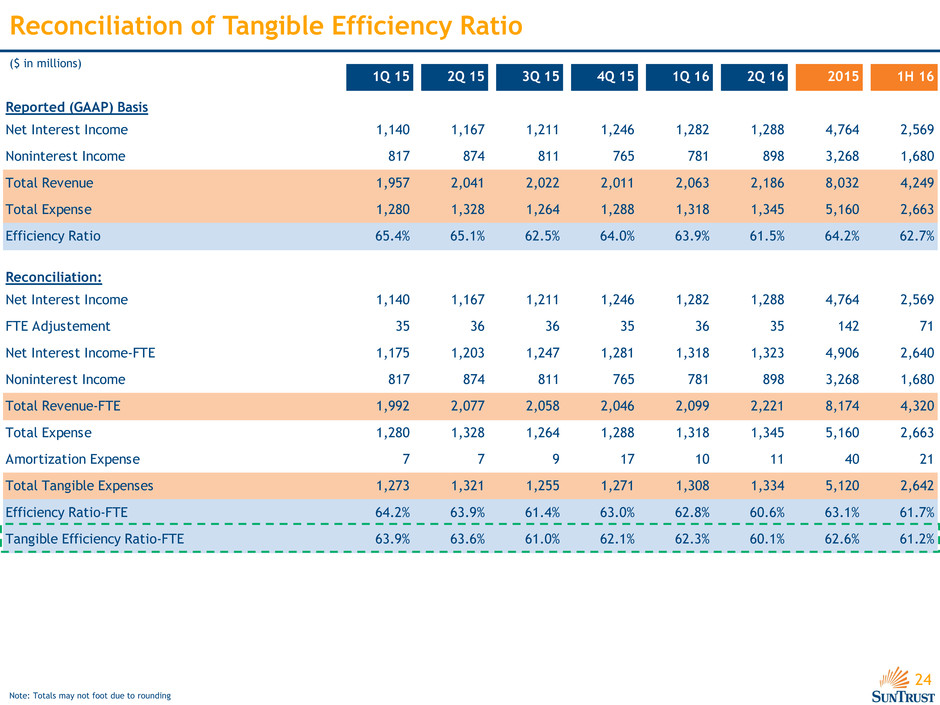

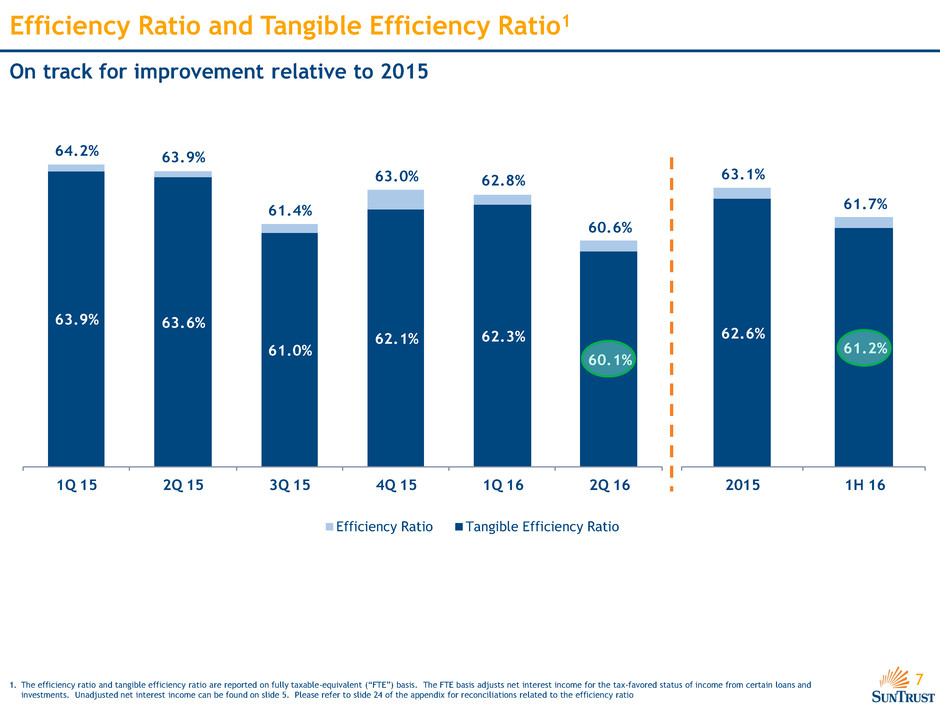

7 Efficiency Ratio and Tangible Efficiency Ratio1 On track for improvement relative to 2015 63.9% 63.6% 61.0% 62.1% 62.3% 60.1% 64.2% 63.9% 61.4% 63.0% 62.8% 60.6% 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 62.6% 61.2% 63.1% 61.7% 2015 1H 16 1. The efficiency ratio and tangible efficiency ratio are reported on fully taxable-equivalent (“FTE”) basis. The FTE basis adjusts net interest income for the tax-favored status of income from certain loans and investments. Unadjusted net interest income can be found on slide 5. Please refer to slide 24 of the appendix for reconciliations related to the efficiency ratio 63.9% 63.6% 61.0% 62.1% 62.3% 60.1% 64.2% 63.9% 61.4% 63.0% 62.8% 60.5% 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 Efficiency Ratio Tangible Efficiency Ratio

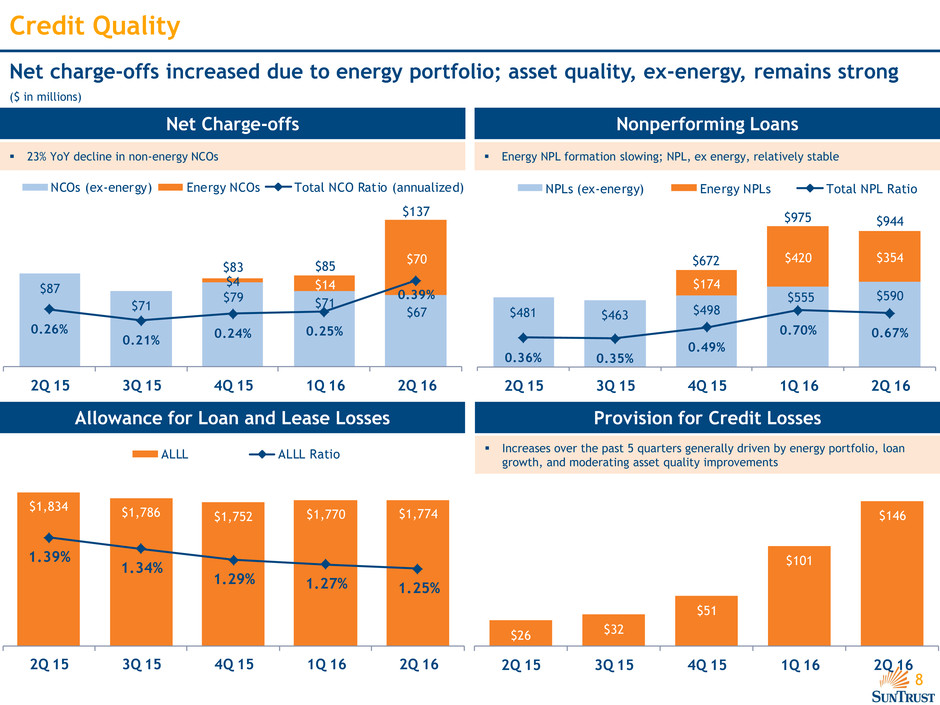

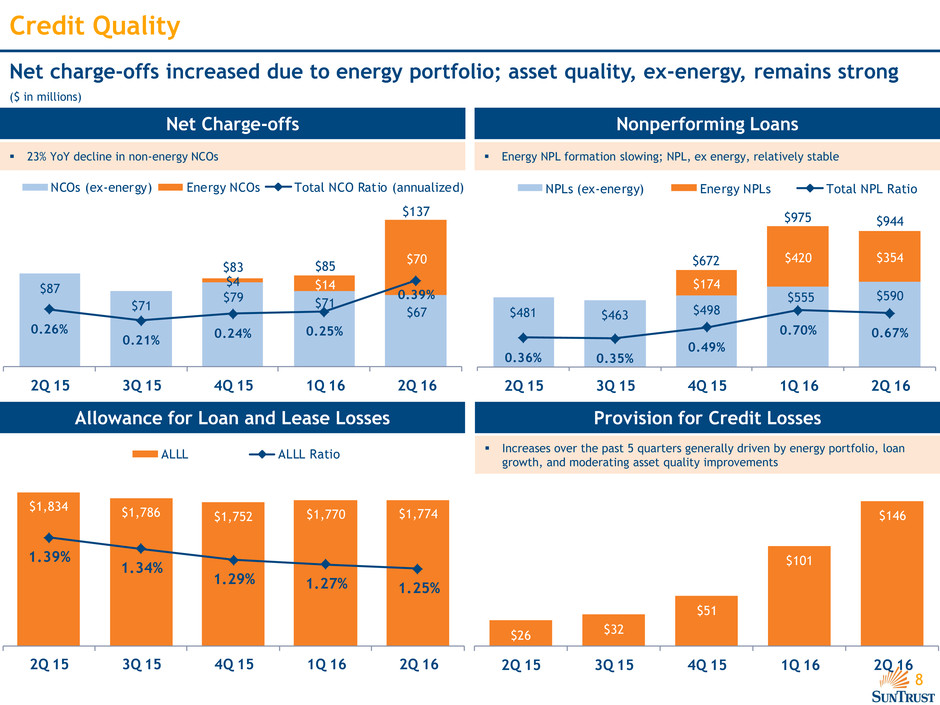

8 $26 $32 $51 $101 $146 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 Increases over the past 5 quarters generally driven by energy portfolio, loan growth, and moderating asset quality improvements Net charge-offs increased due to energy portfolio; asset quality, ex-energy, remains strong Credit Quality ($ in millions) Energy NPL formation slowing; NPL, ex energy, relatively stable 23% YoY decline in non-energy NCOs Nonperforming Loans Net Charge-offs Provision for Credit Losses Allowance for Loan and Lease Losses $87 $71 $79 $71 $67 $4 $14 $70 0.26% 0.21% 0.24% 0.25% 0.39% 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 NCOs (ex-energy) Energy NCOs Total NCO Ratio (annualized) $1,834 $1,786 $1,752 $1,770 $1,774 1.39% 1.34% 1.29% 1.27% 1.25% 2Q 15 3 4 1 6 2 ALLL ALLL Ratio $481 $463 $498 $555 $590 74 420 $354 0.36% 0.35% 0.49% 0.70% 0.67% 2Q 15 3 15 4 15 1 16 2Q 16 NPLs (ex-energy) Energy NPLs Total NPL Ratio $83 $85 $137 $975 $672 $944

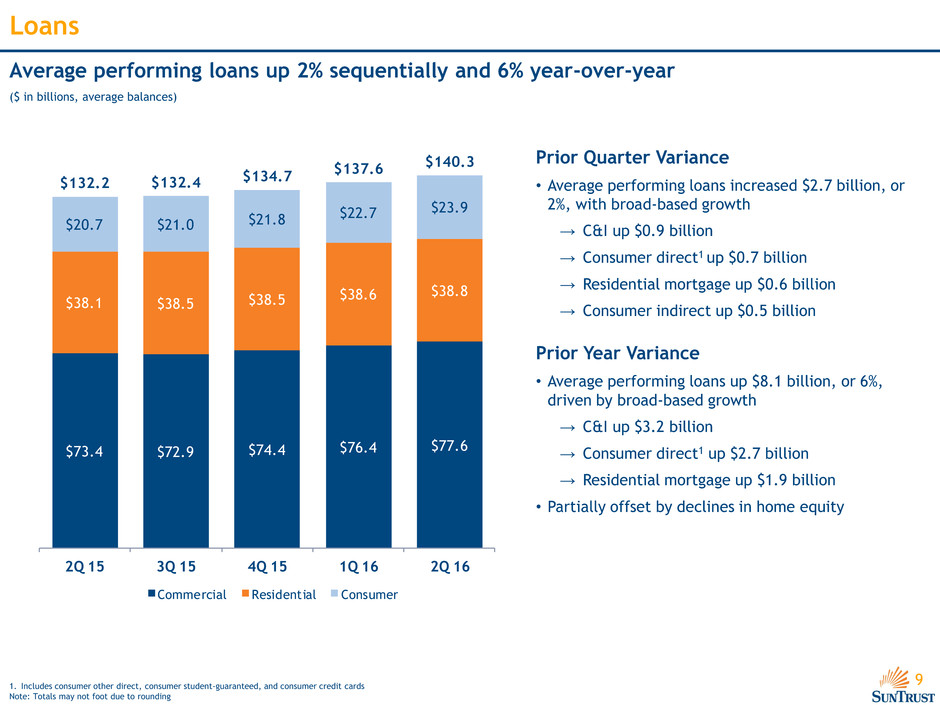

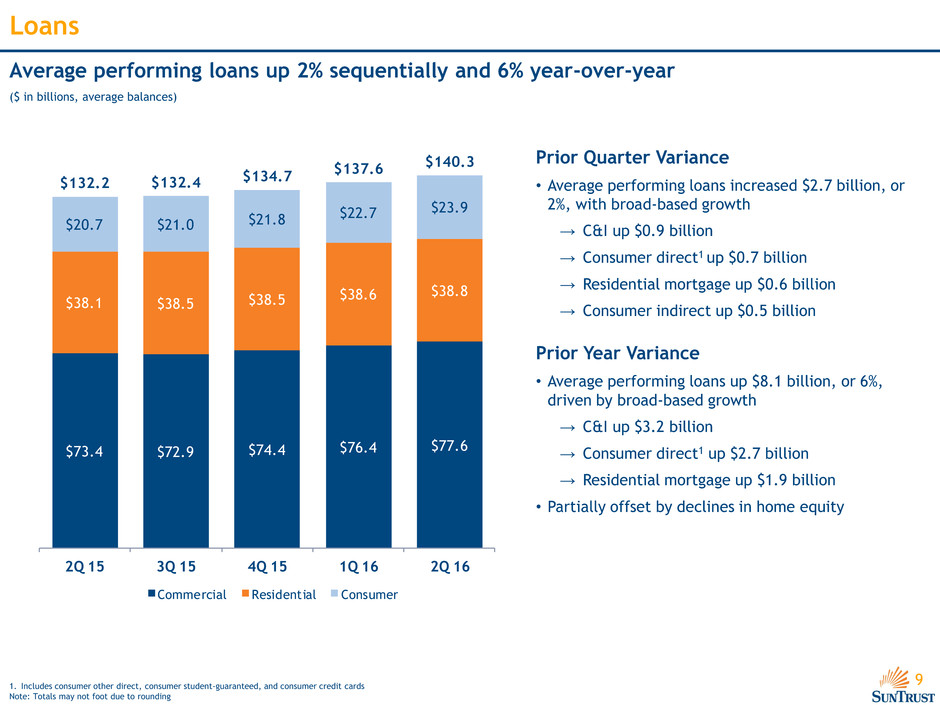

9 Loans Average performing loans up 2% sequentially and 6% year-over-year ($ in billions, average balances) 1. Includes consumer other direct, consumer student-guaranteed, and consumer credit cards Note: Totals may not foot due to rounding Prior Quarter Variance • Average performing loans increased $2.7 billion, or 2%, with broad-based growth → C&I up $0.9 billion → Consumer direct1 up $0.7 billion → Residential mortgage up $0.6 billion → Consumer indirect up $0.5 billion Prior Year Variance • Average performing loans up $8.1 billion, or 6%, driven by broad-based growth → C&I up $3.2 billion → Consumer direct1 up $2.7 billion → Residential mortgage up $1.9 billion • Partially offset by declines in home equity $73.4 $72.9 $74.4 $76.4 $77.6 $38.1 $38.5 $38.5 $38.6 $38.8 $20.7 $21.0 $21.8 $22.7 $23.9 $132.2 $132.4 $134.7 $137.6 $140.3 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 Commercial Residential Consumer

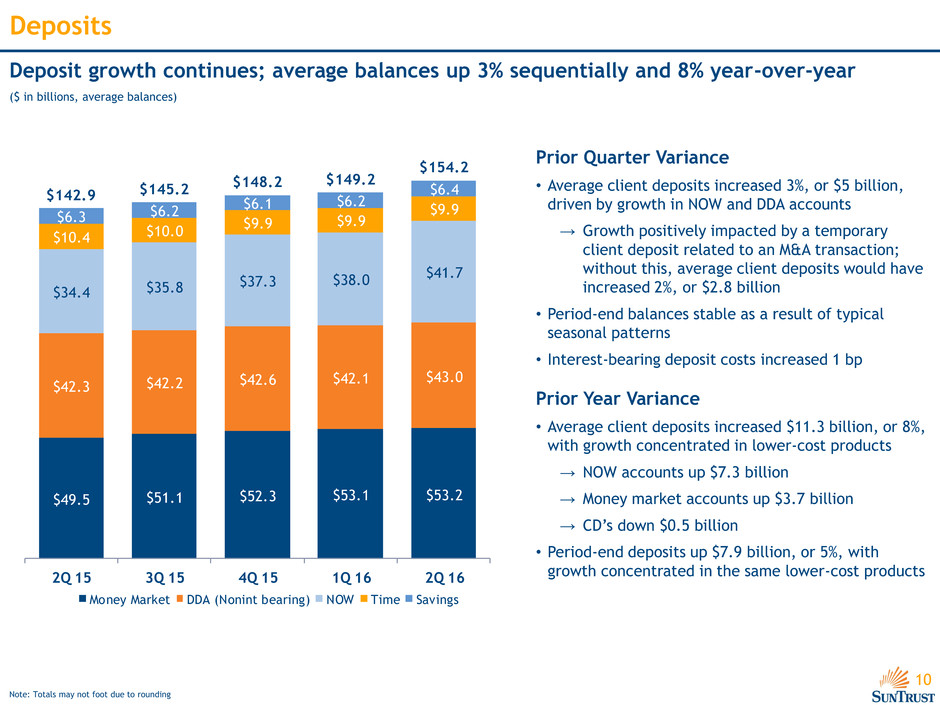

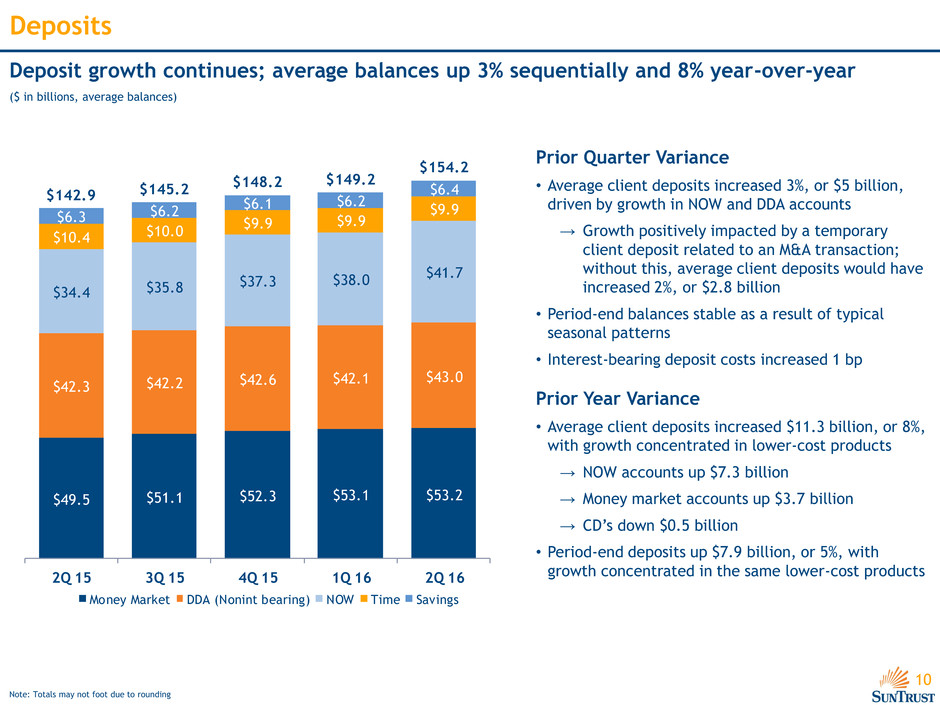

10 Deposits Deposit growth continues; average balances up 3% sequentially and 8% year-over-year Note: Totals may not foot due to rounding Prior Quarter Variance • Average client deposits increased 3%, or $5 billion, driven by growth in NOW and DDA accounts → Growth positively impacted by a temporary client deposit related to an M&A transaction; without this, average client deposits would have increased 2%, or $2.8 billion • Period-end balances stable as a result of typical seasonal patterns • Interest-bearing deposit costs increased 1 bp Prior Year Variance • Average client deposits increased $11.3 billion, or 8%, with growth concentrated in lower-cost products → NOW accounts up $7.3 billion → Money market accounts up $3.7 billion → CD’s down $0.5 billion • Period-end deposits up $7.9 billion, or 5%, with growth concentrated in the same lower-cost products ($ in billions, average balances) $49.5 $51.1 $52.3 $53.1 $53.2 $42.3 $42.2 $42.6 $42.1 $43.0 $34.4 $35.8 $37.3 $38.0 $41.7 $10.4 $10.0 $9.9 $9.9 $9.9 $6.3 $6.2 $6.1 $6.2 $6.4 $142.9 $145.2 $148.2 $149.2 $154.2 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 Money Market DDA (Nonint bearing) NOW Time Savings

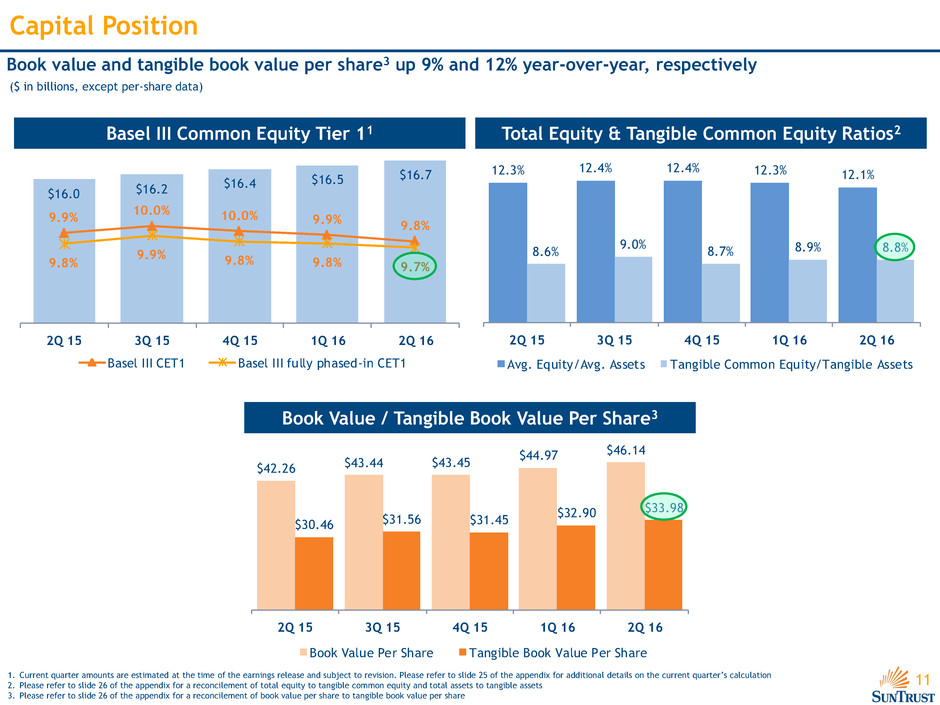

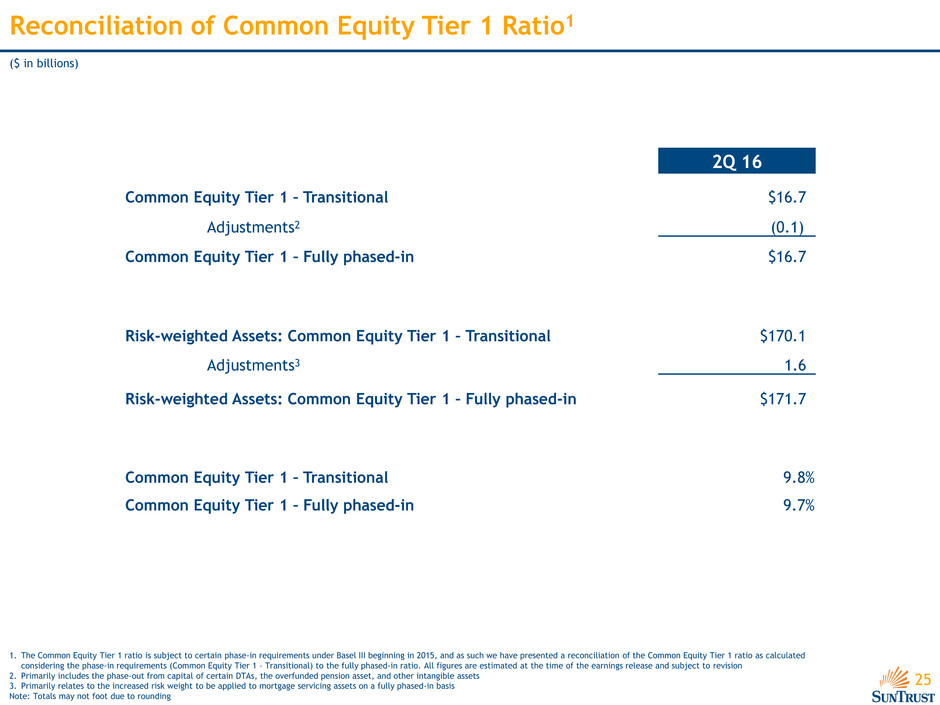

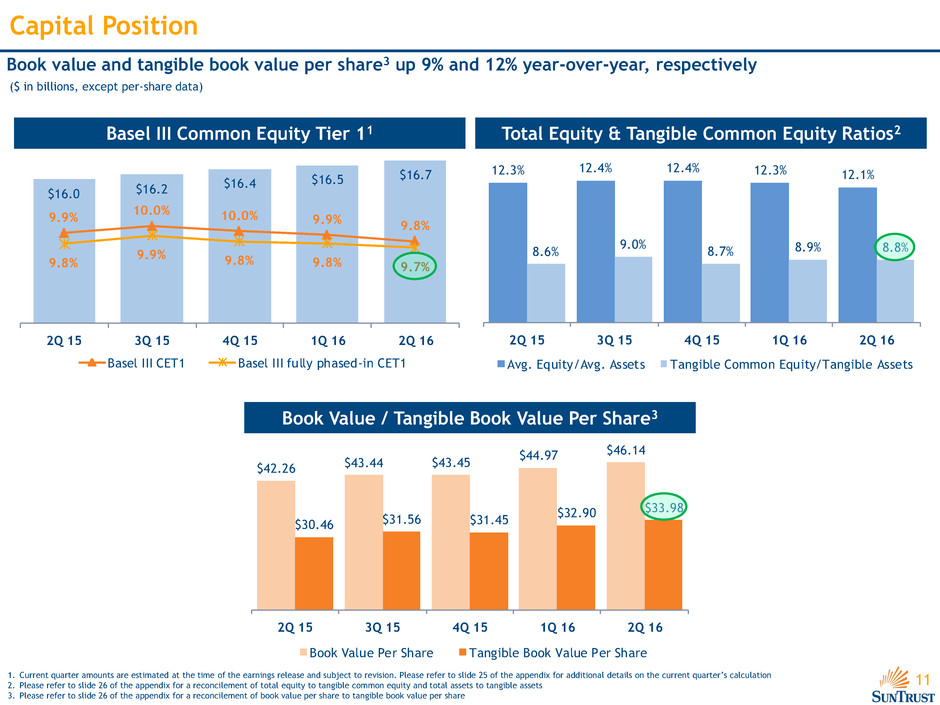

11 Capital Position Book value and tangible book value per share3 up 9% and 12% year-over-year, respectively ($ in billions, except per-share data) Total Equity & Tangible Common Equity Ratios2 1. Current quarter amounts are estimated at the time of the earnings release and subject to revision. Please refer to slide 25 of the appendix for additional details on the current quarter’s calculation 2. Please refer to slide 26 of the appendix for a reconcilement of total equity to tangible common equity and total assets to tangible assets 3. Please refer to slide 26 of the appendix for a reconcilement of book value per share to tangible book value per share Basel III Common Equity Tier 11 $16.0 $16.2 $16.4 $16.5 $16.7 9.9% 10.0% 10.0% 9.9% 9.8% 9.8% 9.9% 9.8% 9.8% 9.7% 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 Basel III CET1 Basel III fully phased-in CET1 12.3% 12.4% 12.4% 12.3% 12.1% 8.6% 9.0% 8.7% 8.9% 8.8% 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 Avg. Equity/Avg. Assets Tangible Common Equity/Tangible Assets Book Value / Tangible Book Value Per Share3 $30.46 $31.56 $31.45 $32.90 $33.98 $42.26 $43.44 $43.45 $44.97 $46.14 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 Book Value Per Share Tangible Book Value Per Share

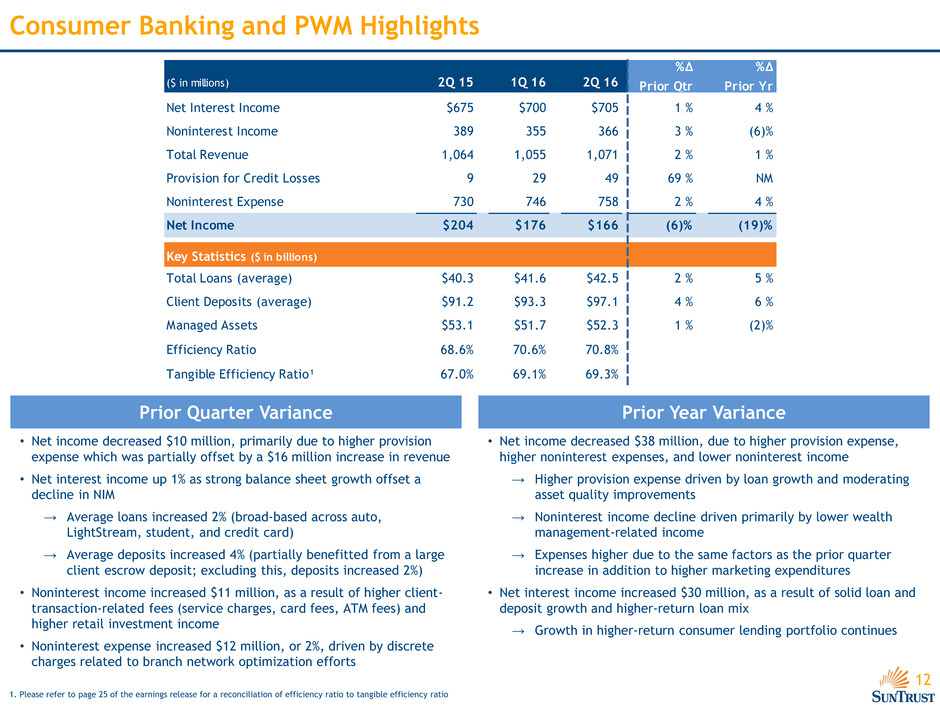

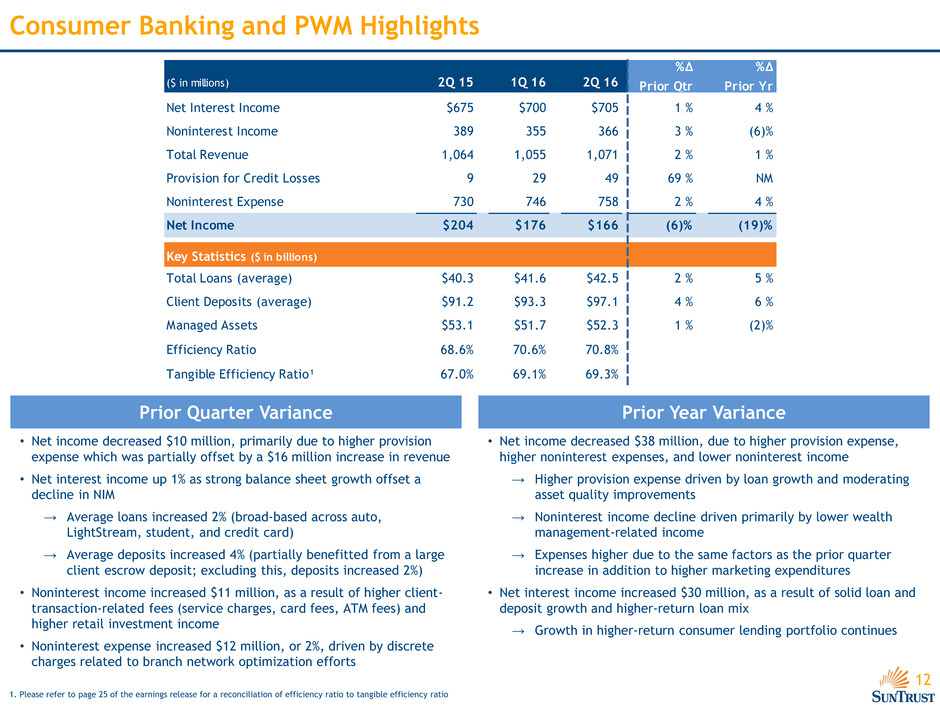

12 Consumer Banking and PWM Highlights • Net income decreased $10 million, primarily due to higher provision expense which was partially offset by a $16 million increase in revenue • Net interest income up 1% as strong balance sheet growth offset a decline in NIM → Average loans increased 2% (broad-based across auto, LightStream, student, and credit card) → Average deposits increased 4% (partially benefitted from a large client escrow deposit; excluding this, deposits increased 2%) • Noninterest income increased $11 million, as a result of higher client- transaction-related fees (service charges, card fees, ATM fees) and higher retail investment income • Noninterest expense increased $12 million, or 2%, driven by discrete charges related to branch network optimization efforts Prior Quarter Variance • Net income decreased $38 million, due to higher provision expense, higher noninterest expenses, and lower noninterest income → Higher provision expense driven by loan growth and moderating asset quality improvements → Noninterest income decline driven primarily by lower wealth management-related income → Expenses higher due to the same factors as the prior quarter increase in addition to higher marketing expenditures • Net interest income increased $30 million, as a result of solid loan and deposit growth and higher-return loan mix → Growth in higher-return consumer lending portfolio continues Prior Year Variance ($ in millions) 2Q 15 1Q 16 2Q 16 %Δ Prior Qtr %Δ Prior Yr Net Interest Income $675 $700 $705 1 % 4 % Noninterest Income 389 355 366 3 % (6)% Total Revenue 1,064 1,055 1,071 2 % 1 % Provision for Credit Losses 9 29 49 69 % NM Noninterest Expense 730 746 758 2 % 4 % Net Income $204 $176 $166 (6)% (19)% Key Statistics ($ in billions) Total Loans (average) $40.3 $41.6 $42.5 2 % 5 % Client Deposits (average) $91.2 $93.3 $97.1 4 % 6 % Managed Assets $53.1 $51.7 $52.3 1 % (2)% Efficiency Ratio 68.6% 70.6% 70.8% Tangible Efficiency Ratio¹ 67.0% 69.1% 69.3% 1. Please refer to page 25 of the earnings release for a reconciliation of efficiency ratio to tangible efficiency ratio

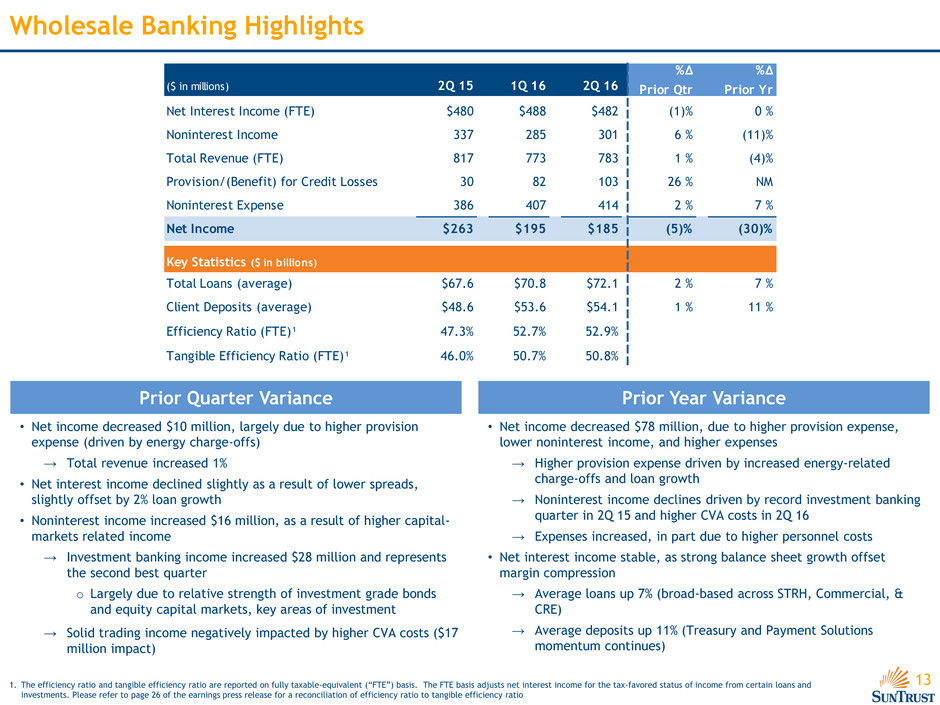

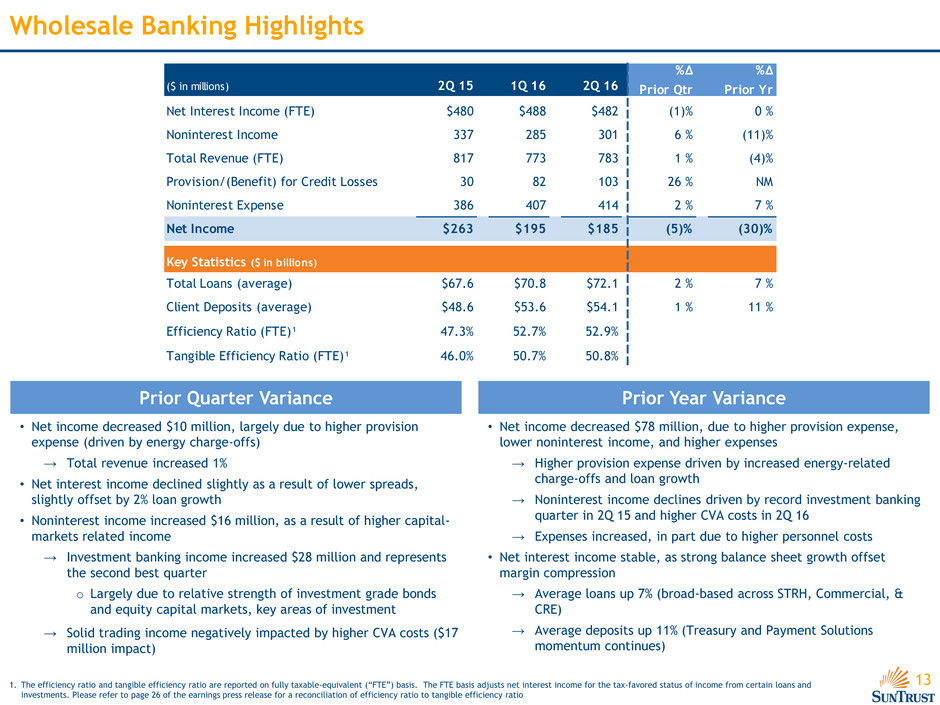

13 Wholesale Banking Highlights • Net income decreased $10 million, largely due to higher provision expense (driven by energy charge-offs) → Total revenue increased 1% • Net interest income declined slightly as a result of lower spreads, slightly offset by 2% loan growth • Noninterest income increased $16 million, as a result of higher capital- markets related income → Investment banking income increased $28 million and represents the second best quarter o Largely due to relative strength of investment grade bonds and equity capital markets, key areas of investment → Solid trading income negatively impacted by higher CVA costs ($17 million impact) Prior Quarter Variance • Net income decreased $78 million, due to higher provision expense, lower noninterest income, and higher expenses → Higher provision expense driven by increased energy-related charge-offs and loan growth → Noninterest income declines driven by record investment banking quarter in 2Q 15 and higher CVA costs in 2Q 16 → Expenses increased, in part due to higher personnel costs • Net interest income stable, as strong balance sheet growth offset margin compression → Average loans up 7% (broad-based across STRH, Commercial, & CRE) → Average deposits up 11% (Treasury and Payment Solutions momentum continues) Prior Year Variance ($ in millions) 2Q 15 1Q 16 2Q 16 %Δ Prior Qtr %Δ Prior Yr Net Interest Income (FTE) $480 $488 $482 (1)% 0 % Noninterest Income 337 285 301 6 % (11)% Total Revenue (FTE) 817 773 783 1 % (4)% Provision/(Benefit) for Credit Losses 30 82 103 26 % NM Noninterest Expense 386 407 414 2 % 7 % Net Income $263 $195 $185 (5)% (30)% Key Statistics ($ in billions) Total Loans (average) $67.6 $70.8 $72.1 2 % 7 % Client Deposits (average) $48.6 $53.6 $54.1 1 % 11 % Efficiency Ratio (FTE)¹ 47.3% 52.7% 52.9% Tangible Efficiency Ratio (FTE)¹ 46.0% 50.7% 50.8% 1. The efficiency ratio and tangible efficiency ratio are reported on fully taxable-equivalent (“FTE”) basis. The FTE basis adjusts net interest income for the tax-favored status of income from certain loans and investments. Please refer to page 26 of the earnings press release for a reconciliation of efficiency ratio to tangible efficiency ratio

14 Mortgage Banking Highlights Prior Quarter Variance • Net income increased $19 million, as a result of higher noninterest income • Net interest income declined slightly, due to lower loan spreads (also applies to prior year) • Noninterest income increased $41 million as a result of increases in production income, partially offset by declines in servicing income → Production income increased $51 million as a result of higher purchase and refinance activity, in addition to higher gain-on- sale margins o Production volume up 46%, application volume up 22% → As anticipated, servicing income decreased $10 million, due to higher decay expense • Net income up 10%, driven by the same factors as the sequential increase • Noninterest income increased $60 million as a result of increases in both production and servicing income → Production income higher for the same reason as quarterly variance o Purchase volume up 17%; refinance volume up 7% → Servicing income higher due to improved hedge performance and portfolio acquisitions o Servicing portfolio up 6% • Strong revenue growth, combined with disciplined expense management, drove improvement in efficiency ratio Prior Year Variance ($ in millions) 2Q 15 1Q 16 2Q 16 %Δ Prior Qtr %Δ Prior Yr Net Interest Income $123 $112 $111 (1)% (10)% Noninterest Income 105 124 165 33 % 57 % Total Revenue 228 236 276 17 % 21 % Provision/(Benefit) for Credit Losses (13) (10) (6) NM (54)% Noninterest Expense 180 174 178 2 % (1)% Net Income $58 $45 $64 42 % 10 % Key Statistics ($ in billions) Servicing Portfolio for Others (EOP) $118.4 $121.3 $125.4 3 % 6 % Production Volume $6.5 $5.0 $7.3 46 % 12 % Application Volume $8.8 $9.2 $11.2 22 % 27 % Efficiency Ratio 78.9% 74.1% 64.6%

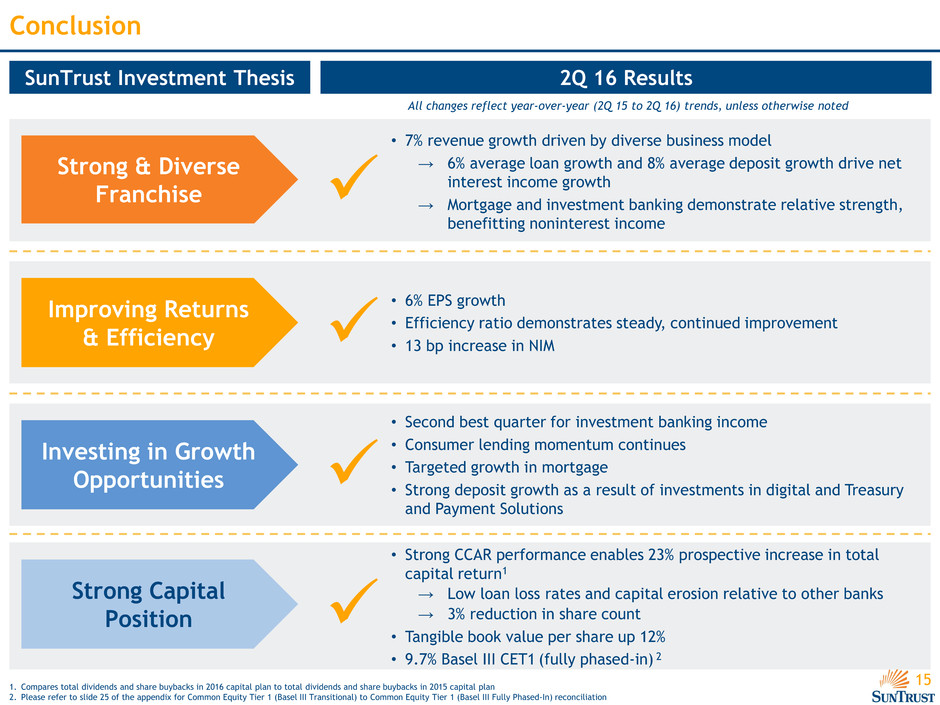

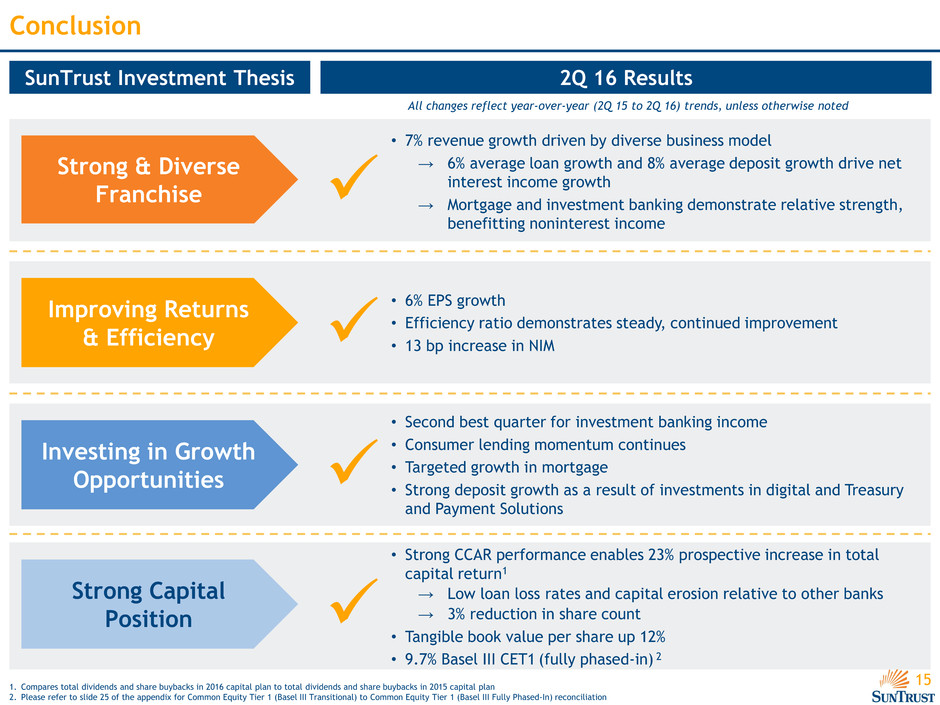

15 2Q 16 Results Conclusion SunTrust Investment Thesis • 7% revenue growth driven by diverse business model → 6% average loan growth and 8% average deposit growth drive net interest income growth → Mortgage and investment banking demonstrate relative strength, benefitting noninterest income Strong & Diverse Franchise • 6% EPS growth • Efficiency ratio demonstrates steady, continued improvement • 13 bp increase in NIM Improving Returns & Efficiency • Second best quarter for investment banking income • Consumer lending momentum continues • Targeted growth in mortgage • Strong deposit growth as a result of investments in digital and Treasury and Payment Solutions Investing in Growth Opportunities Strong Capital Position • Strong CCAR performance enables 23% prospective increase in total capital return1 → Low loan loss rates and capital erosion relative to other banks → 3% reduction in share count • Tangible book value per share up 12% • 9.7% Basel III CET1 (fully phased-in) 2 1. Compares total dividends and share buybacks in 2016 capital plan to total dividends and share buybacks in 2015 capital plan 2. Please refer to slide 25 of the appendix for Common Equity Tier 1 (Basel III Transitional) to Common Equity Tier 1 (Basel III Fully Phased-In) reconciliation All changes reflect year-over-year (2Q 15 to 2Q 16) trends, unless otherwise noted

Appendix

17 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 EPS $0.89 $1.00 $0.91 $0.84 $0.94 Tangible Efficiency Ratio (FTE) 1 63.6% 61.0% 62.1% 62.3% 60.1% Net Interest Margin (FTE) 2.86% 2.94% 2.98% 3.04% 2.99% Return on Average Assets 1.03% 1.13% 1.01% 0.93% 1.00% Average Performing Loans ($ in billions) $132.2 $132.4 $134.7 $137.6 $140.3 Average Client Deposits ($ in billions) $142.9 $145.2 $148.2 $149.2 $154.2 NPL Ratio 0.36% 0.35% 0.49% 0.70% 0.67% NCO Ratio 0.26% 0.21% 0.24% 0.25% 0.39% ALLL Ratio 1.39% 1.34% 1.29% 1.27% 1.25% Basel III Common Equity Tier 1 Ratio (fully phased-in) 2 9.8% 9.9% 9.8% 9.8% 9.7% Tangible Book Value Per Share 3 $30.46 $31.56 $31.45 $32.90 $33.98 Balance Sheet Credit & Capital Profitability 5-Quarter Financial Highlights 1. The efficiency ratios (FTE) for 2Q 15, 3Q 15, 4Q 15, 1Q 16, and 2Q 16 were 63.9%, 61.4%, 63.0%, 62.8%, and 60.6% respectively. Refer to slide 24 of the appendix for the GAAP reconciliations 2. Please refer to slide 25 of the appendix for Common Equity Tier 1 (Basel III Transitional) to Common Equity Tier 1 (Basel III Fully Phased-In) reconciliation 3. Book value per share was $42.26 $43.44, $43.45, $44.97, and $46.14 for the periods ending 2Q 15, 3Q 15, 4Q 15, 1Q 16, and 2Q 16 respectively. Refer to slide 26 of the appendix for a reconcilement to book value per share Key Metrics

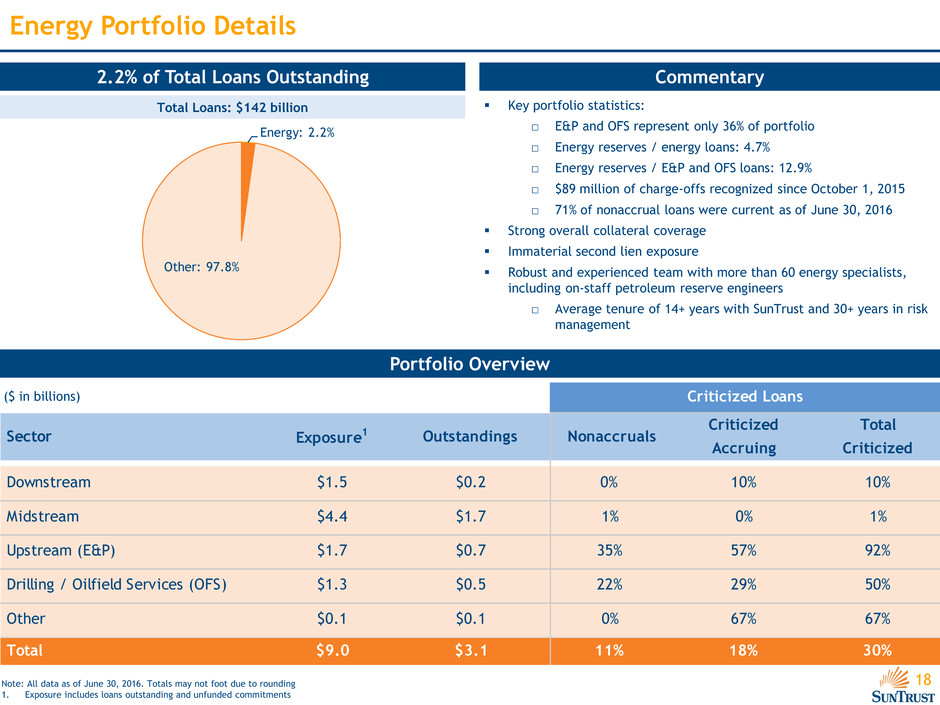

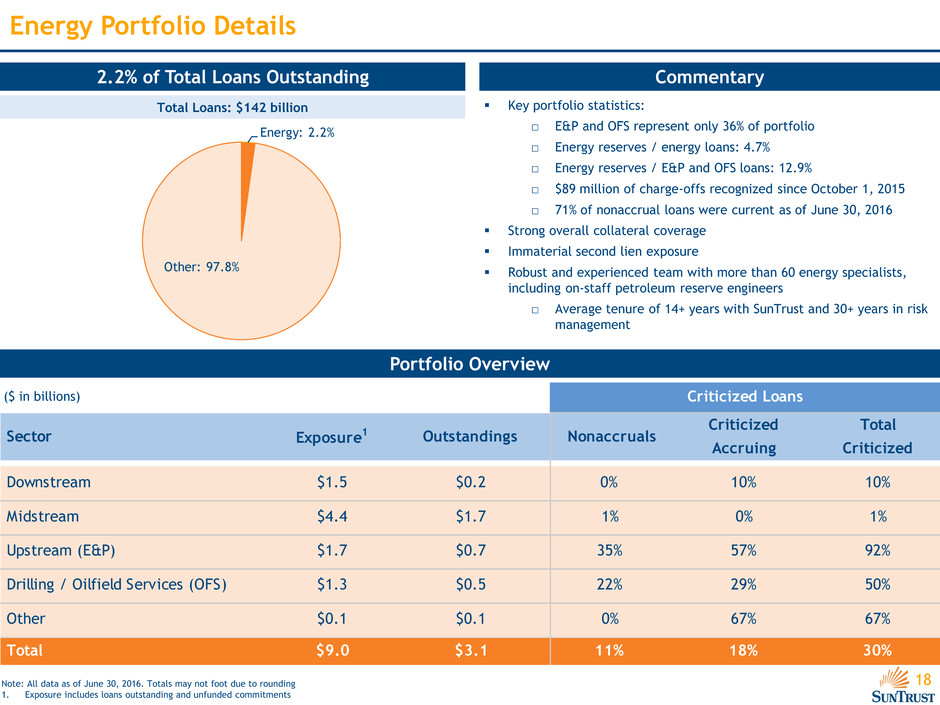

18 Energy Portfolio Details ($ in billions) Note: All data as of June 30, 2016. Totals may not foot due to rounding 1. Exposure includes loans outstanding and unfunded commitments Commentary Key portfolio statistics: □ E&P and OFS represent only 36% of portfolio □ Energy reserves / energy loans: 4.7% □ Energy reserves / E&P and OFS loans: 12.9% □ $89 million of charge-offs recognized since October 1, 2015 □ 71% of nonaccrual loans were current as of June 30, 2016 Strong overall collateral coverage Immaterial second lien exposure Robust and experienced team with more than 60 energy specialists, including on-staff petroleum reserve engineers □ Average tenure of 14+ years with SunTrust and 30+ years in risk management Portfolio Overview 2.2% of Total Loans Outstanding Total Loans: $142 billion Sect r Exposure1 Outstandings Nonaccruals Criticized Accruing Total Criticized Downstre m $1.5 $0.2 0% 10% 10% Midstrea $4.4 $1.7 1% 0% 1% Upstream (E&P) $1.7 $0.7 35% 57% 92% Drilling / Oilfield Services (OFS) $1.3 $0.5 22% 29% 50% Other $0.1 $0.1 0% 67% 67% Total $9.0 $3.1 11% 18% 30% Criticized Loans Energy: 2.2% Other: 97.8%

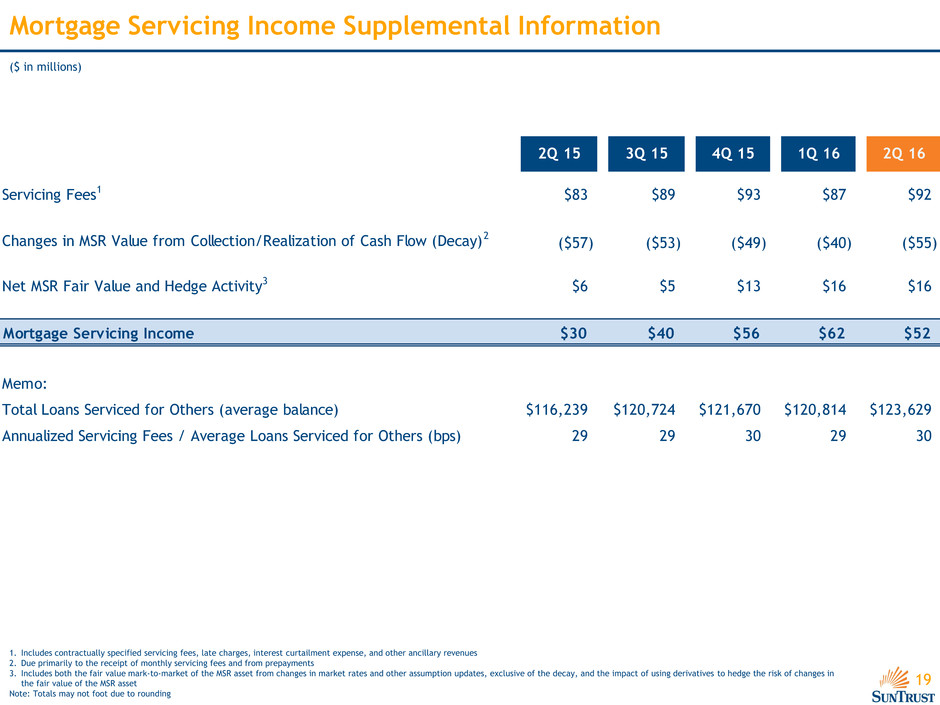

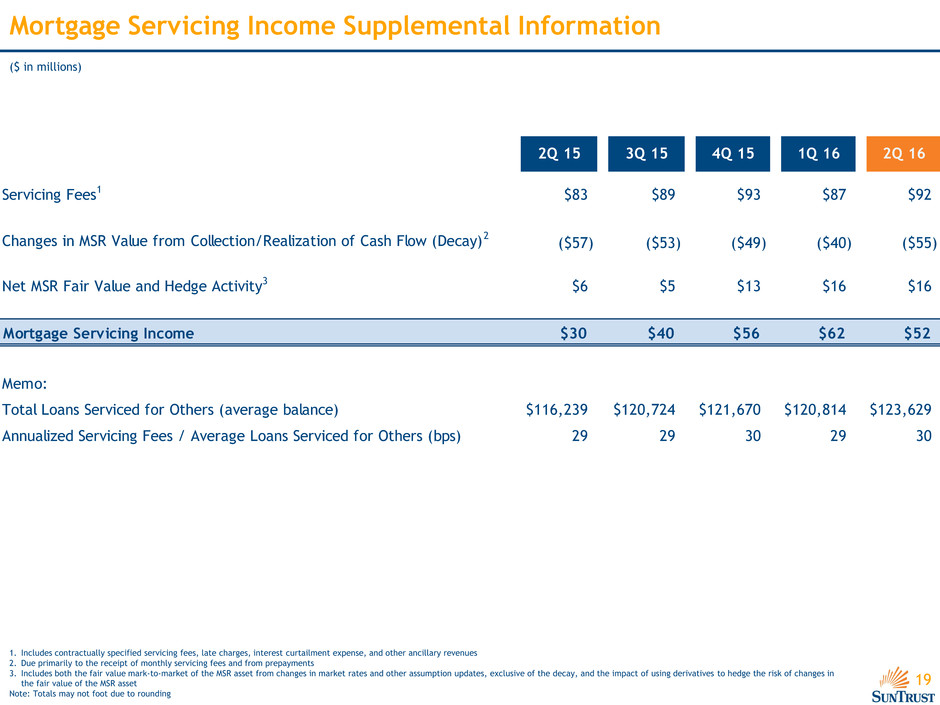

19 Mortgage Servicing Income Supplemental Information ($ in millions) 1. Includes contractually specified servicing fees, late charges, interest curtailment expense, and other ancillary revenues 2. Due primarily to the receipt of monthly servicing fees and from prepayments 3. Includes both the fair value mark-to-market of the MSR asset from changes in market rates and other assumption updates, exclusive of the decay, and the impact of using derivatives to hedge the risk of changes in the fair value of the MSR asset Note: Totals may not foot due to rounding 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 Servicing Fees1 $83 $89 $93 $87 $92 ($57) ($53) ($49) ($40) ($55) Net MSR Fair Value and Hedge Activity3 $6 $5 $13 $16 $16 Mortgage Servicing Income $30 $40 $56 $62 $52 Memo: Total Loans Serviced for Others (average balance) $116,239 $120,724 $121,670 $120,814 $123,629 Annualized Servicing Fees / Average Loans Serviced for Others (bps) 29 29 30 29 30 Changes in MSR Value from Collection/Realization of Cash Flow (Decay)2

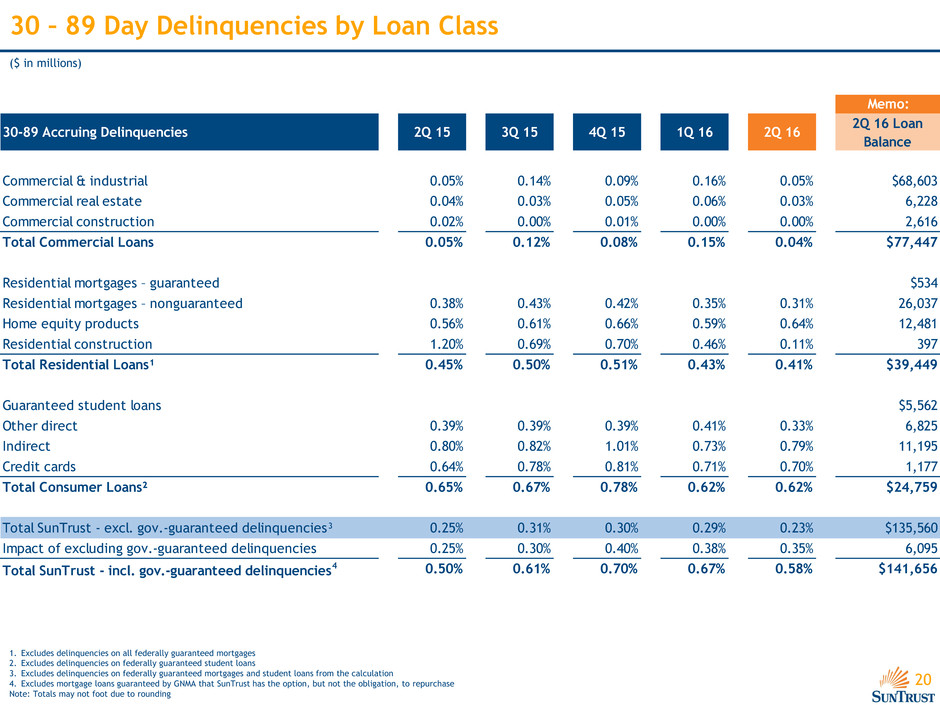

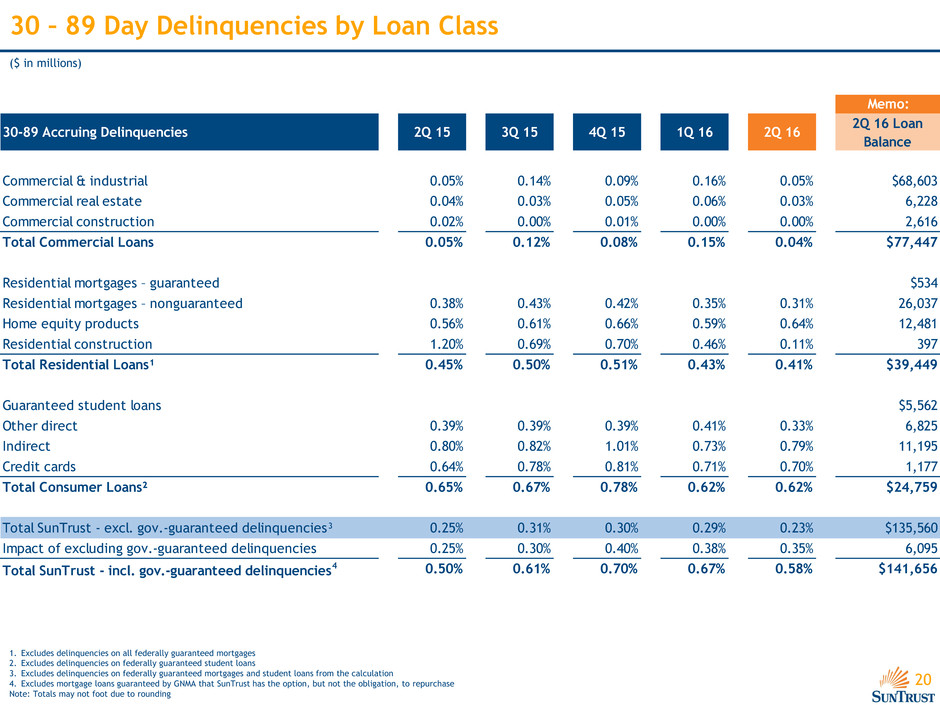

20 30 – 89 Day Delinquencies by Loan Class ($ in millions) 1. Excludes delinquencies on all federally guaranteed mortgages 2. Excludes delinquencies on federally guaranteed student loans 3. Excludes delinquencies on federally guaranteed mortgages and student loans from the calculation 4. Excludes mortgage loans guaranteed by GNMA that SunTrust has the option, but not the obligation, to repurchase Note: Totals may not foot due to rounding Memo: 30-89 Accruing Delinquencies 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 2Q 16 Loan Balance Commercial & industrial 0.05% 0.14% 0.09% 0.16% 0.05% $68,603 Commercial real estate 0.04% 0.03% 0.05% 0.06% 0.03% 6,228 Commercial construction 0.02% 0.00% 0.01% 0.00% 0.00% 2,616 Total Commercial Loans 0.05% 0.12% 0.08% 0.15% 0.04% $77,447 Residential mortgages – guaranteed $534 Residential mortgages – nonguaranteed 0.38% 0.43% 0.42% 0.35% 0.31% 26,037 Home equity products 0.56% 0.61% 0.66% 0.59% 0.64% 12,481 Residential construction 1.20% 0.69% 0.70% 0.46% 0.11% 397 Total Residential Loans¹ 0.45% 0.50% 0.51% 0.43% 0.41% $39,449 Guaranteed student loans $5,562 Other direct 0.39% 0.39% 0.39% 0.41% 0.33% 6,825 Indirect 0.80% 0.82% 1.01% 0.73% 0.79% 11,195 Credit cards 0.64% 0.78% 0.81% 0.71% 0.70% 1,177 Total Consumer Loans² 0.65% 0.67% 0.78% 0.62% 0.62% $24,759 Total SunTrust - excl. gov.-guaranteed delinquencies³ 0.25% 0.31% 0.30% 0.29% 0.23% $135,560 Impact of excluding gov.-guaranteed delinquencies 0.25% 0.30% 0.40% 0.38% 0.35% 6,095 Total SunTrust - incl. gov.-guaranteed delinquencies 4 0.50% 0.61% 0.70% 0.67% 0.58% $141,656

21 Nonperforming Loans by Loan Class Note: Totals may not foot due to rounding ($ in millions) Memo: Nonperforming Loans 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 2Q 16 Loan Balance Commercial & industrial $140 $122 $308 $565 $491 $68,603 Commercial real estate 17 15 10 10 10 6,228 Commercial construction 1 1 1 2 2 2,616 Total Commercial Loans $158 $138 $319 $577 $503 $77,447 Residential mortgages – guaranteed $534 Residential mortgages – nonguaranteed 147 156 184 198 194 26,037 Home equity products 153 146 145 180 226 12,481 Residential construction 18 16 16 12 13 397 Total Residential Loans $318 $318 $344 $390 $433 $39,449 Guaranteed student loans $5,562 Other direct 4 4 6 5 5 6,825 Indirect 1 3 3 3 4 11,195 Credit cards - - - - - 1,177 Total Consumer Loans $5 $7 $9 $8 $8 $24,759 Total SunTrust $481 $463 $672 $975 $944 $141,656 NPLs / Total Loans 0.36% 0.35% 0.49% 0.70% 0.67%

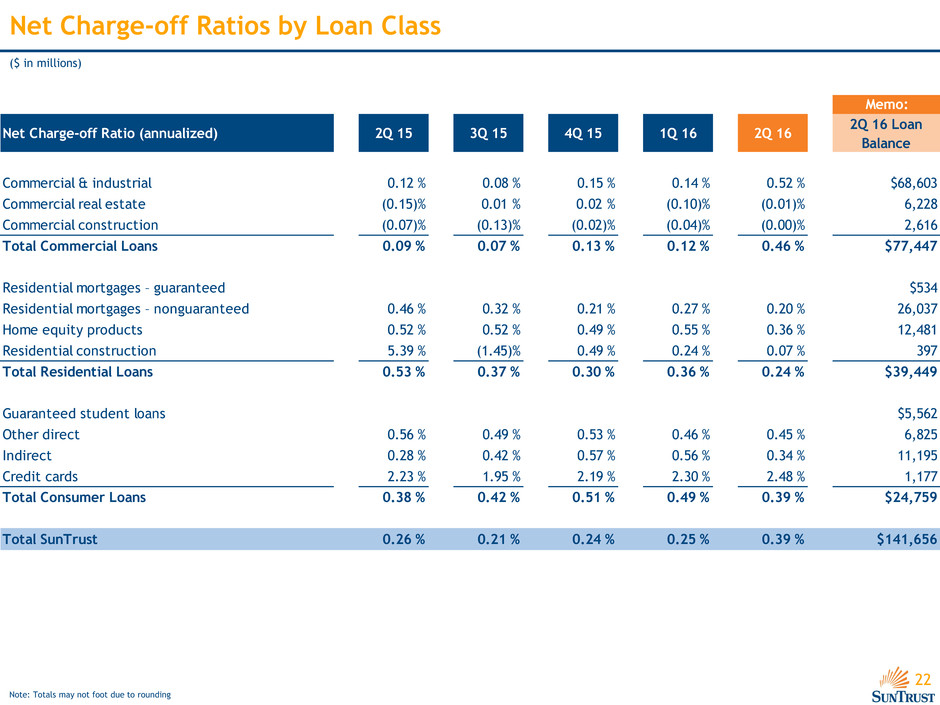

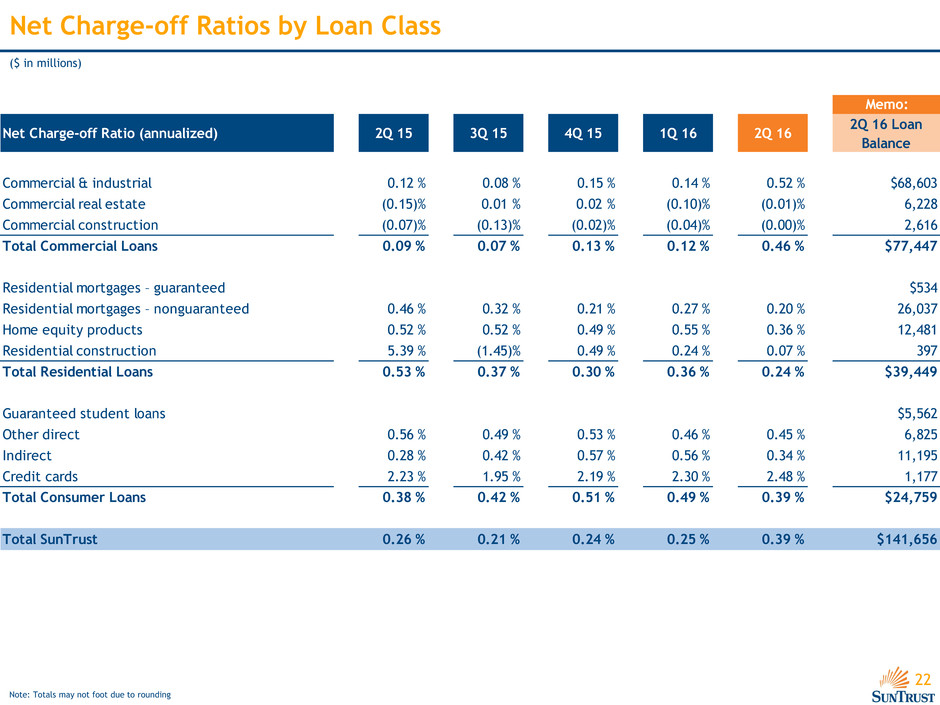

22 Net Charge-off Ratios by Loan Class Note: Totals may not foot due to rounding ($ in millions) Memo: Net Charge-off Ratio (annualized) 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 2Q 16 Loan Balance Commercial & industrial 0.12 % 0.08 % 0.15 % 0.14 % 0.52 % $68,603 Commercial real estate (0.15)% 0.01 % 0.02 % (0.10)% (0.01)% 6,228 Commercial construction (0.07)% (0.13)% (0.02)% (0.04)% (0.00)% 2,616 Total Commercial Loans 0.09 % 0.07 % 0.13 % 0.12 % 0.46 % $77,447 Residential mortgages – guaranteed $534 Residential mortgages – nonguaranteed 0.46 % 0.32 % 0.21 % 0.27 % 0.20 % 26,037 Home equity products 0.52 % 0.52 % 0.49 % 0.55 % 0.36 % 12,481 Residential construction 5.39 % (1.45)% 0.49 % 0.24 % 0.07 % 397 Total Residential Loans 0.53 % 0.37 % 0.30 % 0.36 % 0.24 % $39,449 Guaranteed student loans $5,562 Other direct 0.56 % 0.49 % 0.53 % 0.46 % 0.45 % 6,825 Indirect 0.28 % 0.42 % 0.57 % 0.56 % 0.34 % 11,195 Credit cards 2.23 % 1.95 % 2.19 % 2.30 % 2.48 % 1,177 Total Consumer Loans 0.38 % 0.42 % 0.51 % 0.49 % 0.39 % $24,759 Total SunTrust 0.26 % 0.21 % 0.24 % 0.25 % 0.39 % $141,656

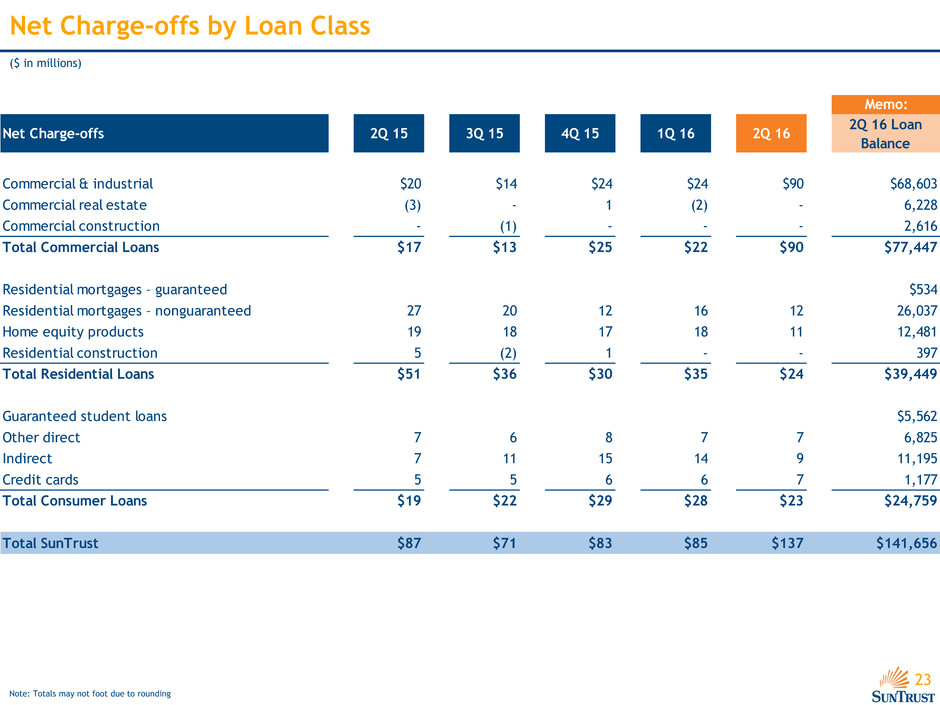

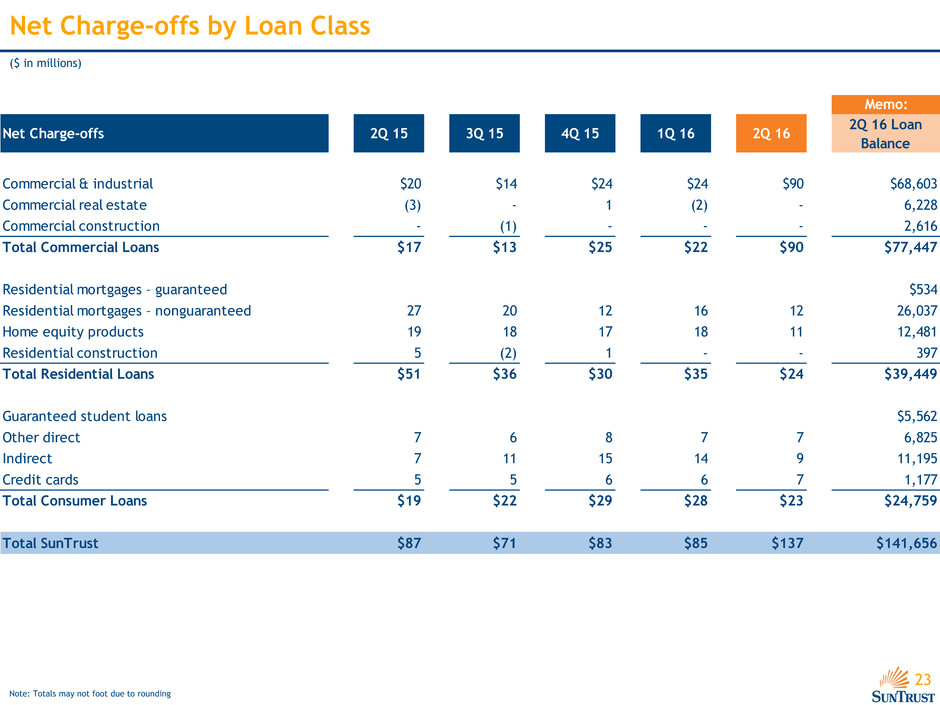

23 Net Charge-offs by Loan Class Note: Totals may not foot due to rounding ($ in millions) Memo: Net Charge-offs 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 2Q 16 Loan Balance Commercial & industrial $20 $14 $24 $24 $90 $68,603 Commercial real estate (3) - 1 (2) - 6,228 Commercial construction - (1) - - - 2,616 Total Commercial Loans $17 $13 $25 $22 $90 $77,447 Residential mortgages – guaranteed $534 Residential mortgages – nonguaranteed 27 20 12 16 12 26,037 Home equity products 19 18 17 18 11 12,481 Residential construction 5 (2) 1 - - 397 Total Residential Loans $51 $36 $30 $35 $24 $39,449 Guaranteed student loans $5,562 Other direct 7 6 8 7 7 6,825 Indirect 7 11 15 14 9 11,195 Credit cards 5 5 6 6 7 1,177 Total Consumer Loans $19 $22 $29 $28 $23 $24,759 Total SunTrust $87 $71 $83 $85 $137 $141,656

24 Reconciliation of Tangible Efficiency Ratio ($ in millions) Note: Totals may not foot due to rounding 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 2015 1H 16 Reported (GAAP) Basis Net Interest Income 1,140 1,167 1,211 1,246 1,282 1,288 4,764 2,569 Noninterest Income 817 874 811 765 781 898 3,268 1,680 Total Revenue 1,957 2,041 2,022 2,011 2,063 2,186 8,032 4,249 Total Expense 1,280 1,328 1,264 1,288 1,318 1,345 5,160 2,663 Efficiency Ratio 65.4% 65.1% 62.5% 64.0% 63.9% 61.5% 64.2% 62.7% Reconciliation: Net Interest Income 1,140 1,167 1,211 1,246 1,282 1,288 4,764 2,569 FTE Adjustement 35 36 36 35 36 35 142 71 Net Interest Income-FTE 1,175 1,203 1,247 1,281 1,318 1,323 4,906 2,640 Noninterest Income 817 874 811 765 781 898 3,268 1,680 Total Revenue-FTE 1,992 2,077 2,058 2,046 2,099 2,221 8,174 4,320 Total Expense 1,280 1,328 1,264 1,288 1,318 1,345 5,160 2,663 Amortization Expense 7 7 9 17 10 11 40 21 Total Tangible Expenses 1,273 1,321 1,255 1,271 1,308 1,334 5,120 2,642 Efficiency Ratio-FTE 64.2% 63.9% 61.4% 63.0% 62.8% 60.6% 63.1% 61.7% Tangible Efficiency Ratio-FTE 63.9% 63.6% 61.0% 62.1% 62.3% 60.1% 62.6% 61.2%

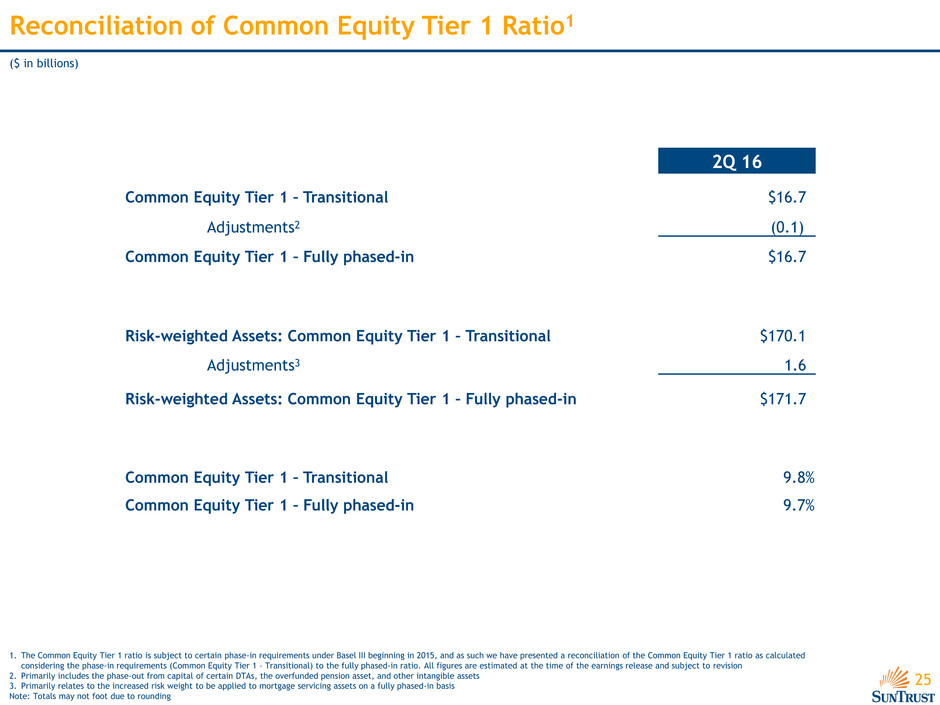

25 Reconciliation of Common Equity Tier 1 Ratio1 ($ in billions) 2Q 16 Common Equity Tier 1 – Transitional $16.7 Adjustments2 (0.1) Common Equity Tier 1 – Fully phased-in $16.7 Risk-weighted Assets: Common Equity Tier 1 – Transitional $170.1 Adjustments3 1.6 Risk-weighted Assets: Common Equity Tier 1 – Fully phased-in $171.7 Common Equity Tier 1 – Transitional 9.8% Common Equity Tier 1 – Fully phased-in 9.7% 1. The Common Equity Tier 1 ratio is subject to certain phase-in requirements under Basel III beginning in 2015, and as such we have presented a reconciliation of the Common Equity Tier 1 ratio as calculated considering the phase-in requirements (Common Equity Tier 1 – Transitional) to the fully phased-in ratio. All figures are estimated at the time of the earnings release and subject to revision 2. Primarily includes the phase-out from capital of certain DTAs, the overfunded pension asset, and other intangible assets 3. Primarily relates to the increased risk weight to be applied to mortgage servicing assets on a fully phased-in basis Note: Totals may not foot due to rounding

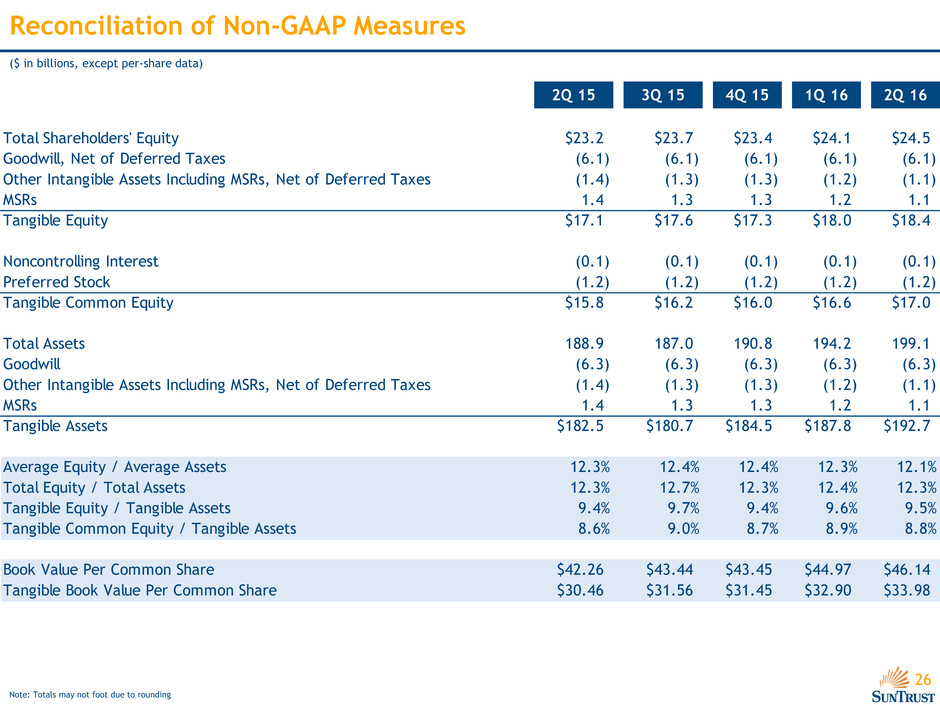

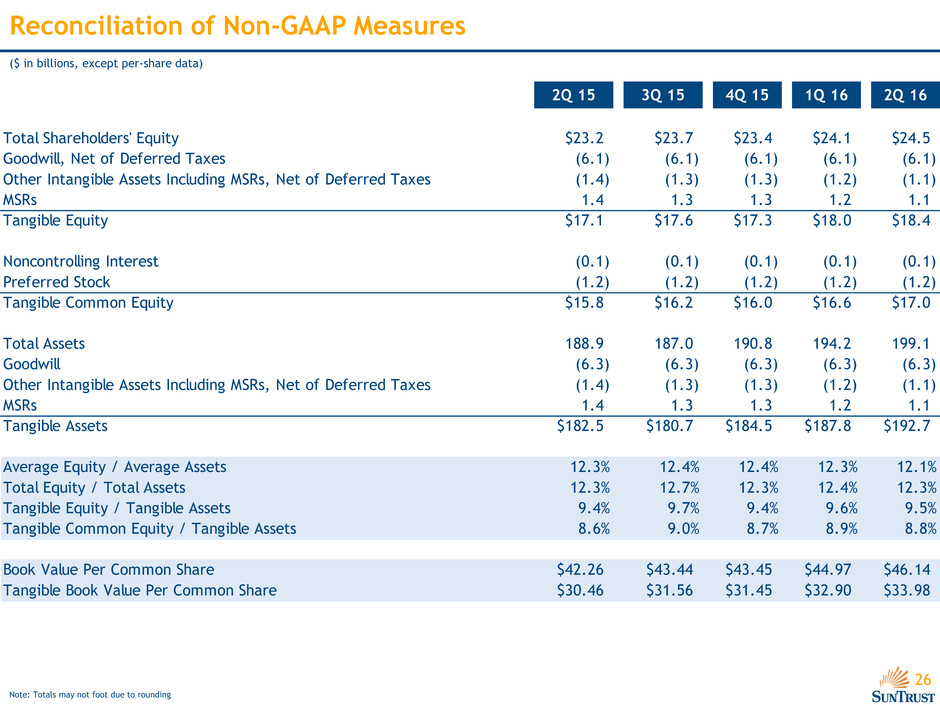

26 Reconciliation of Non-GAAP Measures ($ in billions, except per-share data) Note: Totals may not foot due to rounding 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 Total Shareholders' Equity $23.2 $23.7 $23.4 $24.1 $24.5 Goodwill, Net of Deferred Taxes (6.1) (6.1) (6.1) (6.1) (6.1) Other Intangible Assets Including MSRs, Net of Deferred Taxes (1.4) (1.3) (1.3) (1.2) (1.1) MSRs 1.4 1.3 1.3 1.2 1.1 Tangible Equity $17.1 $17.6 $17.3 $18.0 $18.4 Noncontrolling Interest (0.1) (0.1) (0.1) (0.1) (0.1) Preferred Stock (1.2) (1.2) (1.2) (1.2) (1.2) Tangible Common Equity $15.8 $16.2 $16.0 $16.6 $17.0 Total Assets 188.9 187.0 190.8 194.2 199.1 Goodwill (6.3) (6.3) (6.3) (6.3) (6.3) Other Intangible Assets Including MSRs, Net of Deferred Taxes (1.4) (1.3) (1.3) (1.2) (1.1) MSRs 1.4 1.3 1.3 1.2 1.1 Tangible Assets $182.5 $180.7 $184.5 $187.8 $192.7 Average Equity / Average Assets 12.3% 12.4% 12.4% 12.3% 12.1% Total Equity / Total Assets 12.3% 12.7% 12.3% 12.4% 12.3% Tangible Equity / Tangible Assets 9.4% 9.7% 9.4% 9.6% 9.5% Tangible Common Equity / Tangible Assets 8.6% 9.0% 8.7% 8.9% 8.8% Book Value Per Common Share $42.26 $43.44 $43.45 $44.97 $46.14 Tangible Book Value Per Common Share $30.46 $31.56 $31.45 $32.90 $33.98