Exhibit 13.1

SunTrust

|

SunTrust Banks, Inc.

2002 Annual Report |

| |

| |

| |

| |

| |

| Performing well in unsettled times… |

|

| demonstrating the capacity to do even better |

| | |

About the Company

SunTrust Banks, Inc., with year-end 2002 assets of $117.3 billion, is one of the nation’s largest and strongest financial holding companies.

Through its flagship subsidiary, SunTrust Bank, the Company provides deposit, credit, and trust and investment services. Other subsidiaries provide mortgage banking, credit-related insurance, asset management, brokerage and capital market services. SunTrust’s customer base encompasses a broad range of individuals and families, high-net-worth clients, businesses and institutions.

SunTrust enjoys leading market positions in some of the highest-growth markets in the United States and also serves customers in selected markets nationally. The Company’s priorities include consistency in financial performance, quality in customer service and a strong commitment to all segments of the communities it serves.

SunTrust’s 1,184 retail branches and 2,286 ATMs are located primarily in Florida, Georgia, Maryland, Tennessee, Virginia and the District of Columbia. In addition, SunTrust provides customers with a selection of technology-based banking channels including Internet, PC and Telephone Banking. Our Internet address is www.suntrust.com.

As of December 31, 2002, SunTrust had total assets under advisement of $162.6 billion. This includes $121.1 billion in trust assets as well as $17.0 billion in retail brokerage assets. SunTrust’s mortgage servicing portfolio grew to $57.1 billion at year end.

Sun Trust 2002 Annual Report

to our shareholders |

|

|

| L. Phillip Humann

Chairman, President and

Chief Executive Officer |

| |

SunTrust ended 2002

looking relatively good. | With its weak economy and unsettled business climate, 2002 was in many ways a year we are happy to have behind us. * For banks in general, the year was marked by slower revenue growth, higher credit quality costs and weaker performance than we have seen in some time. In addition, visible problems at a handful of well-known institutions seemed at times to cast a shadow over the rest of the industry. * SunTrust’s results, inevitably, reflected industry-wide pressures. Even so, we ended 2002 looking relatively good in most key measures of financial performance, strength and stability––especially when compared with other large U.S. banks. | |

| |

| | | |

financial highlights

SunTrust Banks, Inc.

| | Year Ended December 31 | |

| |

| |

(Dollars in millions except per share data) | | 2002 | | 2001 | | 2000 | |

| |

|

| |

|

| |

|

| |

For the Year | | | | | | | | | | |

| Income before extraordinary gain | | $ | 1,331.8 | | $ | 1,369.2 | | $ | 1,294.1 | |

| Extraordinary gain, net of taxes | | | — | | | 6.3 | | | — | |

| | |

|

| |

|

| |

|

| |

| Net income | | $ | 1,331.8 | | $ | 1,375.5 | | $ | 1,294.1 | |

| | |

|

| |

|

| |

|

| |

| Common dividends paid | | $ | 489.5 | | $ | 463.5 | | $ | 443.4 | |

| | |

|

| |

|

| |

|

| |

Per Common Share | | | | | | | | | | |

| Income – diluted before extraordinary gain | | $ | 4.66 | | $ | 4.70 | | $ | 4.30 | |

| Extraordinary gain | | | — | | | 0.02 | | | — | |

| | |

|

| |

|

| |

|

| |

| Net income – diluted | | $ | 4.66 | | $ | 4.72 | | $ | 4.30 | |

| | |

|

| |

|

| |

|

| |

| Dividends declared | | $ | 1.72 | | $ | 1.60 | | $ | 1.48 | |

| Common stock closing price | | | 56.92 | | | 62.70 | | | 63.00 | |

| Book value | | | 31.04 | | | 28.97 | | | 27.81 | |

| | |

|

| |

|

| |

|

| |

Financial Ratios | | | | | | | | | | |

| Return on average total assets less net unrealized gains on securities | | | 1.26 | % | | 1.37 | % | | 1.35 | % |

| Return on average total assets | | | 1.23 | | | 1.34 | | | 1.32 | |

| Return on average realized shareholders’ equity | | | 19.07 | | | 21.74 | | | 21.46 | |

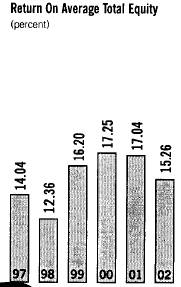

| Return on average total shareholders’ equity | | | 15.26 | | | 17.04 | | | 17.25 | |

| Net interest margin (taxable-equivalent) | | | 3.41 | | | 3.58 | | | 3.55 | |

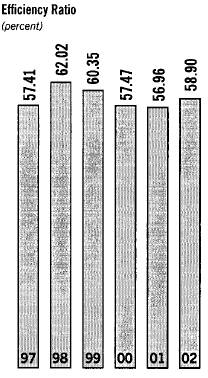

| Efficiency ratio | | | 58.90 | | | 56.96 | | | 57.47 | |

| Tier 1 capital ratio | | | 7.47 | | | 8.02 | | | 7.09 | |

| Total capital ratio | | | 11.62 | | | 12.18 | | | 10.85 | |

| | |

|

| |

|

| |

|

| |

Selected Average Balances | | | | | | | | | | |

| Total assets | | $ | 108,516.1 | | $ | 102,884.2 | | $ | 98,397.8 | |

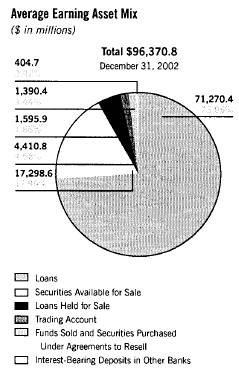

| Earning assets | | | 96,370.8 | | | 92,034.1 | | | 88,609.0 | |

| Loans | | | 71,270.4 | | | 70,023.0 | | | 70,044.3 | |

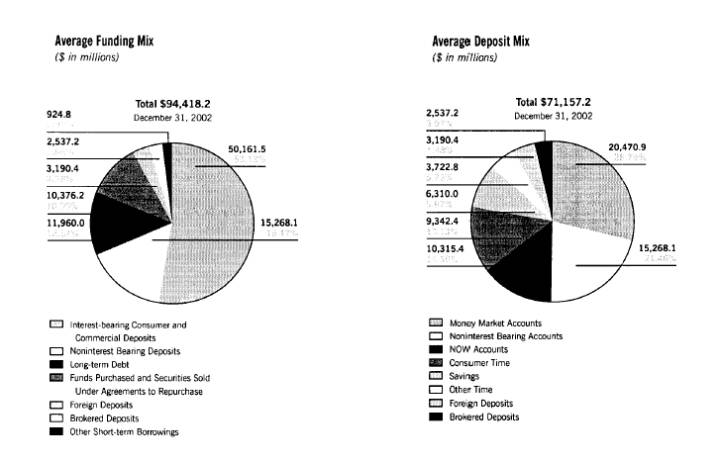

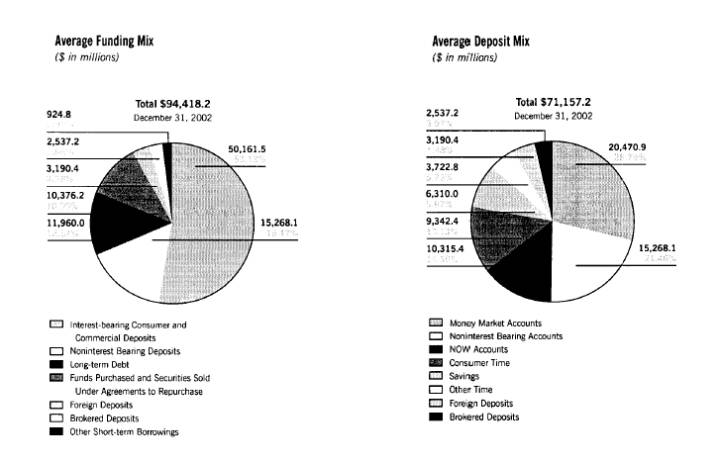

| Deposits | | | 71,157.2 | | | 64,568.7 | | | 66,691.9 | |

| Realized shareholders’ equity | | | 6,984.6 | | | 6,328.0 | | | 6,031.6 | |

| Total shareholders’ equity | | | 8,725.7 | | | 8,073.8 | | | 7,501.9 | |

| Common shares – diluted (thousands) | | | 286,052 | | | 291,584 | | | 300,956 | |

| | |

|

| |

|

| |

|

| |

At December 31 | | | | | | | | | | |

| Total assets | | $ | 117,322.5 | | $ | 104,740.6 | | $ | 103,660.4 | |

| Earning assets | | | 104,759.6 | | | 93,327.5 | | | 92,147.8 | |

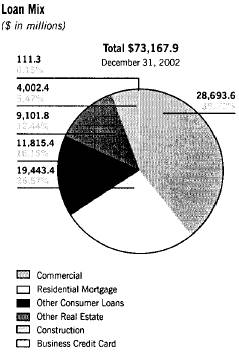

| Loans | | | 73,167.9 | | | 68,959.2 | | | 72,239.8 | |

| Allowance for loan losses | | | 930.1 | | | 867.1 | | | 874.5 | |

| Deposits | | | 79,706.6 | | | 67,536.4 | | | 69,533.3 | |

| Realized shareholders’ equity | | | 7,260.0 | | | 6,704.3 | | | 6,296.4 | |

| Total shareholders’ equity | | | 8,769.5 | | | 8,359.6 | | | 8,239.2 | |

| Common shares outstanding (thousands) | | | 282,505 | | | 288,602 | | | 296,266 | |

| Market value of investment in common stock of The Coca-Cola Company (48,266,496 shares) | | $ | 2,116 | | $ | 2,276 | | $ | 2,941 | |

| | |

|

| |

|

| |

|

| |

| In this report, SunTrust presents a return on average assets less net unrealized gains on securities and a return on average realized equity. These performance measures exclude the net unrealized gains on the Company’s securities portfolio. Due to its ownership of 48 million shares of common stock of The Coca-Cola Company, the Company believes this is a more indicative performance measure when being compared to other companies. |

| |

| | 2 | Sun Trust 2002 Annual Report |

| | | | | | | | | | | | |

| For us, however, “relatively good” is not good enough. It is satisfying, therefore, that 2002 also brought with it tangible evidence of SunTrust’s capacity to deliver demonstrably better results in a more accommodating economic and market environment. |

| |

2002 brought tangible evidence of SunTrust’s capacity

to deliver demonstrably better results in a more accommodating environment. |

| |

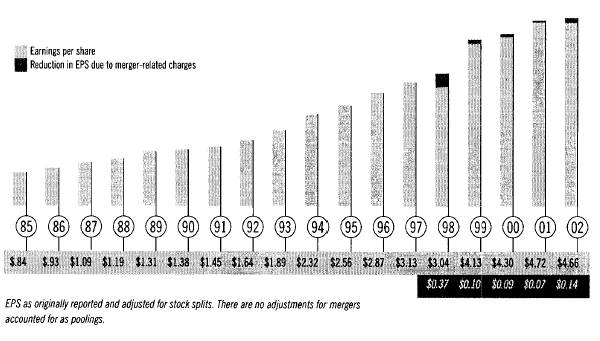

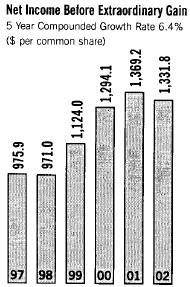

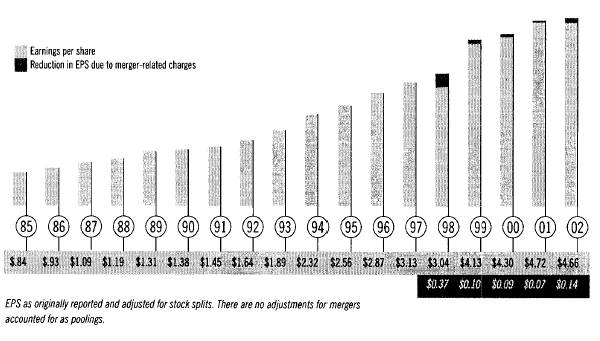

| For the year, SunTrust reported net income of $1.33 billion. This compared with $1.38 billion in 2001. On a per share basis, net income in 2002 was $4.66, compared with $4.72 in the prior year. It is important to note that the year’s reported earnings were reduced by $39.8 million, or $.14 per share, in after-tax merger charges connected with our acquisition of the Florida franchise of Huntington Bancshares, Inc. That transaction was announced in 2001 and the merger integration completed, smoothly, in early 2002. |

| |

|

|

| |

| Earnings as originally reported. There are no adjustments for mergers accounted for as poolings. |

| |

| Given the harshness of the environment, SunTrust’s performance last year was respectable. That said, shareholders should know our 2002 results don’t suggest the kind of growth we consider either satisfactory or indicative of our Company’s true earnings potential. |

| |

| Shareholders and others desiring a detailed discussion of the year’s financial performance are encouraged to review the Management’s Discussion and Analysis section of this report. In this letter I will talk in more general terms about our results. Perhaps more important, I will also tell you why I think it’s reasonable for shareholders to feel optimistic about our prospects for 2003 and beyond. |

| | | |

Sun Trust 2002 Annual Report | 3 | |

| |

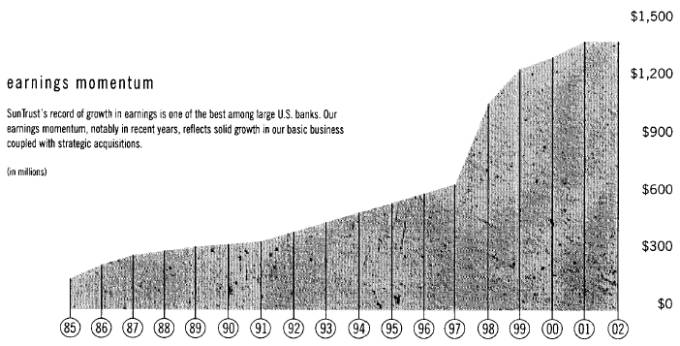

bottom line consistency |

|

SunTrust’s emphasis on consistency in “bottom line” results is reflected in earnings per share (EPS) growth over an extended period. |

|

|

| |

|

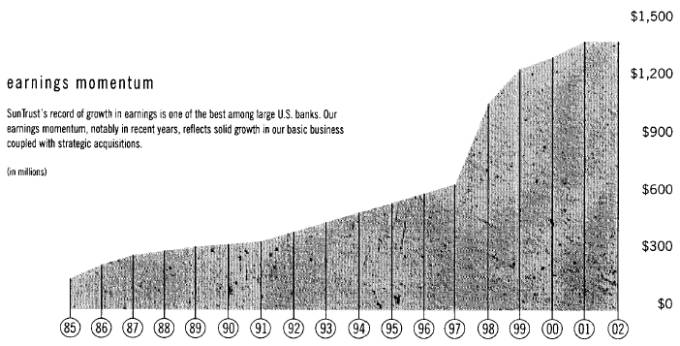

| Operating Earnings Momentum |

| 2002 pressures notwithstanding, SunTrust can point to a multi-year record of generally consistent growth in operating earnings. Not many other large U.S. banks can say the same. We think shareholders deserve consistency in core performance, not surprises, and we strive to deliver it despite industry pressures and ups and downs of the economy. |

| |

| There has, properly, been much recent discussion in the business community about the validity of operating earnings versus earnings reported according to generally accepted accounting principles (called “GAAP earnings”). We fully embrace the view that GAAP earnings are the earnings that matter. But we also consider it appropriate to present operating earnings – which exclude merger-related charges – as an additional indicator of SunTrust’s basic business performance over time. |

| |

| SunTrust’s operating earnings differed from our GAAP earnings in just five recent instances. Each time, the only one-time charges excluded were costs incurred directly and specifically in connection with merger activity that took place outside our day-to-day business. We are proud that we have not taken either so-called “restructuring” or credit-related one-time charges. Although these charges were not uncommon in our industry in 2002, we believe them to be ultimately incompatible with the interests of our shareholders. |

| |

| 4 | Sun Trust 2002 Annual Report |

| | | | |

| Stock Trends: In Line with the Industry |

| Mirroring the poor performance of the stock market as a whole, the performance of SunTrust stock in 2002 was not, to say the least, what we would have liked it to be. |

| |

| As has been the case since mid-1998, the market tended to lump all banks together and our shares traded more or less in line with our peer group. The problem is that the performance of the group was lackluster. |

| |

| 2002’s experience confirmed the wisdom of not trying to predict future market movements. We remain convinced, however, that over time the price of SunTrust shares will improve in line with our improving performance. We also realistically hope to outperform our peers as we have in the past. We are doing the right things to make that happen. |

| |

| Meanwhile, the Board of Directors in February 2003 approved a 5% increase in the dividend on SunTrust common stock, bringing our annual dividend to $1.80 per share. Our dividend history is another reflection of the premium we place on consistency. |

| |

| Maintaining Strong Credit Quality |

| With economic growth elusive, credit quality emerged as the number one concern for banks in 2002. The issue was framed by highly visible bankruptcies of some major corporations that, in turn, sparked announcements of related credit losses at several large U.S. banks. In addition, bank loans to certain large borrowers came under increased regulatory scrutiny under “shared national credit” (SNC) examinations by the Federal Reserve. |

| |

dividend history |

|

|

|

Sun Trust 2002 Annual Report | 5 | |

| | | |

| SunTrust fared well in its SNC examinations, and our exposure to the more notorious bankruptcies of the year was manageable. Yet we still experienced our share of the industry’s credit challenges, especially in our portfolio of loans to large corporate borrowers. Nonperforming assets were down from the prior year but still higher than in normal times. Charge-offs were up from a year ago as we moved aggressively to recognize problems and get them behind us – without taking any special charge to earnings. |

| |

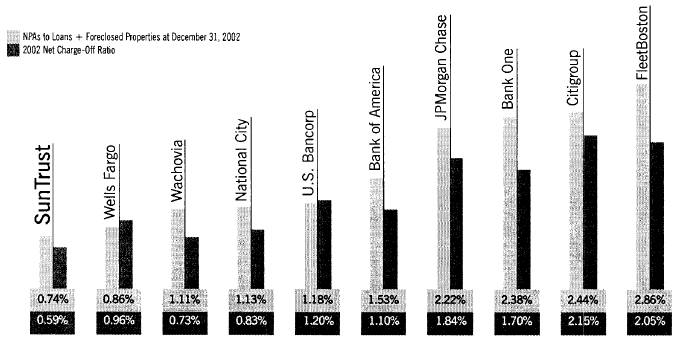

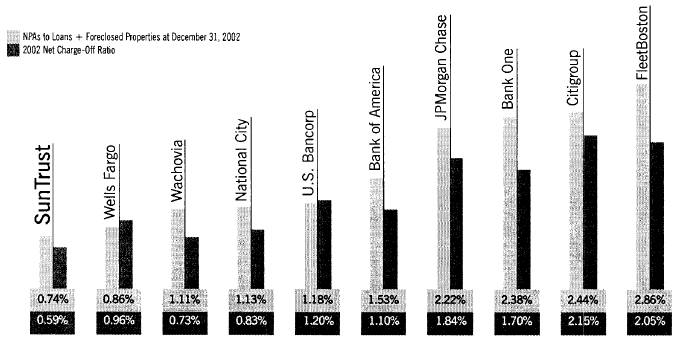

| Historically, SunTrust has done better than most during times of credit weakness. That continued to be the case in 2002. |

| |

strong credit quality |

| |

SunTrust continued to outperform the largest U.S. banks in two key indicators of credit quality: nonperforming assets (NPAs) as a percentage of loans and foreclosed properties, and net charge-offs as a percentage of loans. |

|

|

|

Top 10 U.S. banks based on December 31,2002 assets.

Source: SNL Financial and company reports. |

|

| To put things in perspective, our level of nonperforming assets as a percentage of total loans and foreclosed properties remained one of the lowest among major banks. Charge-offs, while high for us, still compared very well with the competition. And based on our current risk assessment as well as our historic loss experience, we are appropriately reserved. |

| |

| Countering the Impact of a Weak Economy |

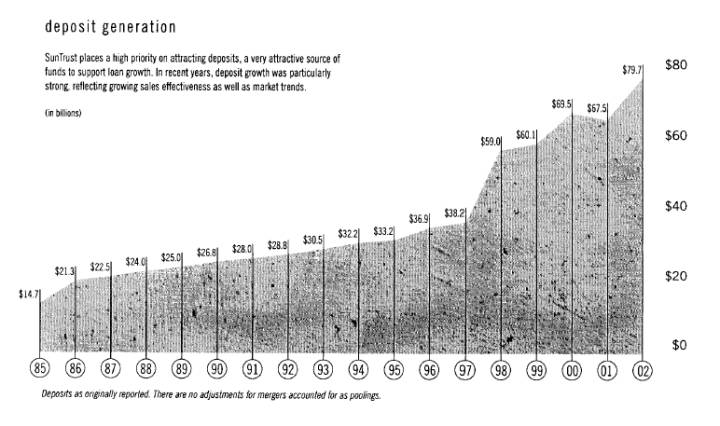

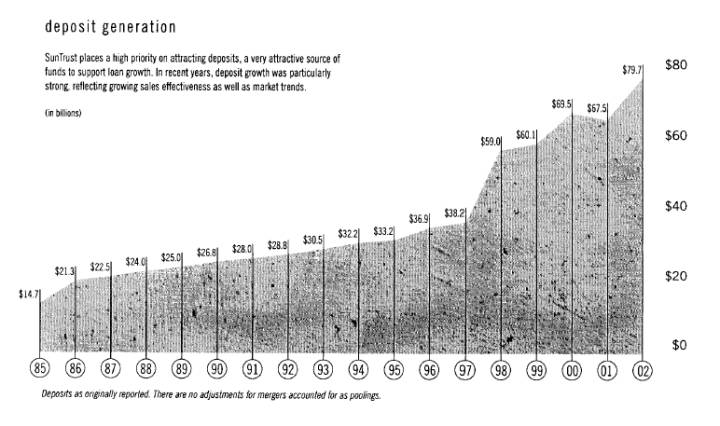

| A series of bright spots in our 2002 earnings picture helped soften the financial impact of the sluggish economy. For example, several loan categories – including home equity, small business and automobile lending – showed strong growth. With record levels of refinance activity, our Mortgage business had a blockbuster year. And customer deposits continued to grow at a strong pace, reflecting our growing sales effectiveness as well as market trends. |

| |

| 6 | Sun Trust 2002 Annual Report |

| | | |

| But as is typical in periods of prolonged economic weakness, many business customers cut back on their bank borrowing. So for us, as for most other banks, total loan growth was weak. Further, we took deliberate action to position our balance sheet for the higher rate environment that comes with a strong economic recovery. As a strong recovery failed to materialize, unusually low interest rates put a squeeze on our net interest margin. As a result of all this, net interest income, our largest revenue component, was essentially flat for the year. |

| |

| Noninterest income was also hurt by the economy. For example, trust and investment fees, a major driver of noninterest income, were up 4% last year. Even though 4% doesn’t look so bad given a 23% drop in the S&P 500 Index, it is not the kind of growth we generally expect – or get – from this key business line. |

| |

| The impact of weaker market-driven fees was offset to some degree by some positive trends. For example, we added a record number of new clients in our trust, investment and brokerage businesses. We enjoyed strong sales results of fee-based products in both our Retail and Commercial business lines. 2002 was also another year of excellent performance by our debt capital markets area, where results were up substantially over the prior year. |

| |

|

|

|

Sun Trust 2002 Annual Report | 7 | |

| | | |

| Enhancing Revenue Potential |

| The pervasive financial impact of the weak economy is masking what we think is SunTrust’s underlying earnings potential. Through a deliberate program of investment, selective acquisitions and concentrated management attention, we have worked to enhance the Company’s revenue generation capacity. In 2002, for example: |

| |

| • | We reconfigured our geographic banking organization to intensify local market focus, to streamline behind-the-scenes management processes and to make it easier to implement product innovations. |

|

investment, selective acquisitions and |

| focused management |

| have worked to enhance the Company’s |

| revenue-generation capacity |

| |

| • | The completion of our “One Bank” initiative – the largest systems consolidation effort in SunTrust’s history – enhances consistency in customer service, improves efficiency and prepares us operationally to handle significant new growth. |

| | |

| • | Our wealth management capabilities were enhanced, including expansion of our financial planning capability and entry into new markets by our family office affiliate, Asset Management Advisors (AMA), and Alexander Key Investments, our full-service brokerage unit. |

| | |

| • | SunTrust Robinson Humphrey, our capital markets arm, demonstrated its potential by achieving significant growth in relationships with commercial clients despite the worst equity markets in recent memory. |

| | |

| • | Our position in several fast-growing Florida markets was strengthened, and our merger integration skills illustrated, with the seamless integration of the former Huntington Bancshares Florida franchise. The transition was completed with virtually no customer disruption. |

| | |

| • | In another merger development that reflects our focus on high-growth markets, we announced in January 2003 plans to purchase Lighthouse Financial Services, Inc., owner of the largest mortgage lender on Hilton Head Island, South Carolina. |

| | |

| • | Creation of a senior sales executive position, impressive sales results in a cross-section of businesses and the installation of higher sales, service and retention standards for 2003 underscore our determination to deepen existing customer relationships as well as add new ones. |

| | |

| 8 | Sun Trust 2002 Annual Report |

| | | | | | |

| | |

| • | The volume of new accounts opened through our SunTrust Online telephone banking service and also via our redesigned website – www.suntrust.com – was again up substantially from prior year levels, illustrating the payoff from our investment in technology-based delivery channels. |

| | |

| Finally, recognizing that successful implementation of business initiatives ultimately depends on the quality of our workforce, we stepped up programs aimed at attracting and retaining top people. For example, our corporate diversity program was expanded with more than 2,500 managers participating in formal diversity training. Our in-house training arm, SunTrust University, offers nearly 1,400 training and developmental courses, including an expanded library of online training tools. |

| |

| SunTrust’s Conservative Operating Approach |

| SunTrust’s ability to emerge relatively unscathed from the turbulence of 2002 is in part attributable to a traditionally conservative approach to our business that has sometimes seemed out of step with our industry. We have, frankly, been skeptical at times when positive market recognition accrued to financial services institutions where rapid expansion was apparently not matched by a full understanding of the risks involved. But in 2002, amidst heightened public, media and government scrutiny, SunTrust’s brand of conservatism seemed to be more valued. |

| |

conservative loan portfolio |

|

SunTrust’s traditionally conservative approach to our business is reflected in the composition of our loan portfolio. We emphasize lower risk loan categories, such as residential mortgages and loans to smaller and mid-sized businesses, and a high degree of diversification. Equally important, SunTrust has avoided higher risk loan categories such as consumer credit card, Latin America and sub-prime lending. |

|

|

|

Sun Trust 2002 Annual Report | 9 | |

| | | | |

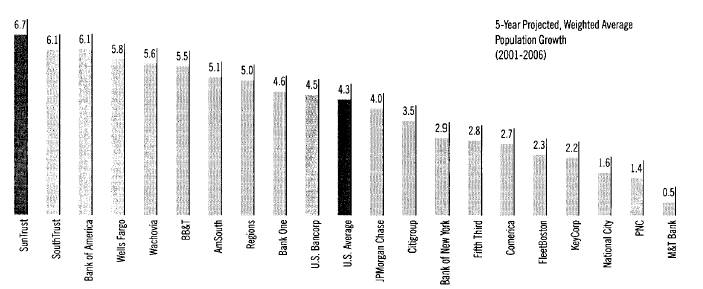

a high-growth footprint |

|

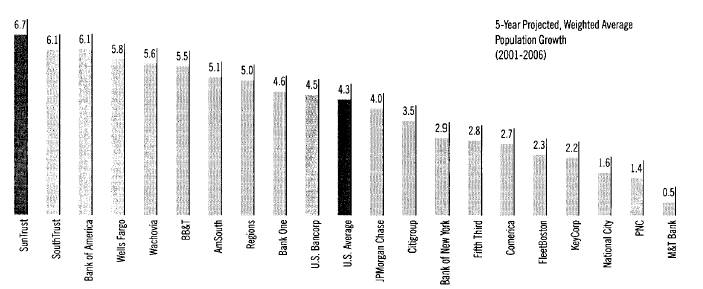

The 6.7% projected population growth rate for SunTrust’s “footprint” is not only the highest among large U.S. banks, but significantly higher than the national average. We capitalize on the growth opportunities our markets present by offering highly competitive products and services to a broadly defined client base. |

|

|

|

Top 20 banks by market capitalization excluding Mellon, State Street and Northern Trust as of August 14,2002. Weighted average based on MSA deposits.

Source: Claritas demographic data and SNL Financial. |

|

| Our conservative approach is reflected in different aspects of our operation: in our measured growth over time... our fundamentally risk-averse balance sheet... our disciplined approach to mergers and acquisitions... and in our resistance to esoteric financial or accounting strategies. SunTrust, for example, has made very limited use of off-balance sheet financing vehicles. |

| |

| Merits of Positive Differentiation |

| SunTrust benefited in 2002 from distinctive strengths that historically have differentiated us from the competition. They also figure prominently in our growth strategies. |

| |

| Perhaps most visible is our strong Southeast/Mid-Atlantic geographic franchise. With almost 1,200 well-placed branches, we enjoy leading positions in some of the most attractive, high-growth banking markets in the United States. |

| |

| We work to capitalize on the organic growth opportunities our markets present by offering highly competitive products and services to a broadly defined client base. In addition, our operating model emphasizes the role of local management – and local decision making – in product and service delivery. |

| |

| For most individual customers, the “face” of SunTrust is not our Atlanta headquarters. Rather, it is one of our 50-plus local banks, each headed by a local executive empowered to bring the full range of SunTrust capabilities to bear on client needs. Or perhaps it is our mortgage subsidiary, which in 2002 ranked as a national leader in customer satisfaction. |

| |

| 10 | Sun Trust 2002 Annual Report |

| | | |

| SunTrust takes seriously its commitment to all segments of the communities in which we operate. In addition to our product offerings, that commitment is reflected in a wide range of activities ranging from corporate contributions to specialized loan programs to employee volunteerism and leadership in civic affairs. |

| |

| Behind-the-scenes support is provided by a highly rated technology and information infrastructure. Its increasing effectiveness reflects significant capital investment in recent years. |

| |

| Balancing Revenue and Efficiency |

| As economic clouds clear, we expect to see the positive impact of earnings enhancement moves to become much more pronounced. But we are not counting on, nor waiting for, an improved economy alone to lift our performance. |

| |

focus on efficiency | As 2003 began, a series of targeted profit acceleration initiatives was getting underway in each of our key business lines. They are designed to spur revenue growth even if a strong economic recovery is slow in coming. At the same time, recognizing that we can’t control the economy, we continue to focus with intensity on something we can control – expenses. |

| |

One indication of our focus on efficiency is a steady drop in our “core” staff level. This reduction was accomplished primarily through attrition. | In 2002, as it became clear that economy-related earnings pressures were not easing, expense control moved to center stage as a corporate priority. We instituted measures ranging from a company-wide hiring holiday at mid-year to tough decisions later to freeze executive salaries, forego management bonuses and eliminate an employee profit-sharing-type program. |

| |

| Over the past few years, SunTrust has been doing a better job at keeping operating expense growth in line. One indication of our success is a steady drop in our “core” staff level; that is, our employee base not counting people added as a result of acquisitions. Importantly, this reduction was accomplished primarily through attrition and a disciplined approach to new hiring. In a year when announcements of broad-scale employee layoffs were almost commonplace in the financial services industry, SunTrust chose not to take such an action. |

|

It is unavoidable that our people feel the pinch of corporate belt-tightening moves. But our approach to expense control reflects a long-standing belief that expense targets must be achieved without irreparably damaging the employee morale essential for providing quality customer service. |

|

Corporate Governance

In the wake of inexcusable misdeeds by some major U.S. corporations, issues of corporate governance became, understandably, the subject of intense public policy focus in 2002. |

Year-end core staff levels are adjusted for acquisitions and divestitures. | |

| |

Sun Trust 2002 Annual Report | 11 | |

| | | |

| |

| In line with national trends, we announced in mid-2002 that we were instituting a number of investor-oriented measures. Included was the creation of a new Compensation and Governance Committee of our Board of Directors. It is composed entirely of independent directors. We declared our intent to expense the cost of stock options awarded to employees each year. And we noted that, in accordance with newly crafted government requirements, our Chief Executive Officer and Chief Financial Officer had formally attested to the accuracy of the Company’s financial statements. |

| |

| At SunTrust the high value we place on corporate integrity overall surely covers areas like financial management and financial reporting. Moves by national policy makers to raise the standards in these areas for all publicly held companies are, in our view, very much to the good. |

| |

| A Closing Perspective |

| Before inviting your attention to the financial section of this report, let me observe that while 2002 was in some ways a year we are happy to have behind us, it was not without its positive dimensions. Perhaps most satisfying, it underscored the capacity of our organization not only to withstand the impact of a weak economy, but to maintain a steady, forward momentum despite it. |

| |

| 2002 also brought out the best in our people, many of whom were confronted with a problematic industry environment for the first time in their careers. My thanks go to all our employees for their extra effort in 2002. |

| |

| I also thank our Board of Directors – to which we were pleased to welcome Karen Hastie Williams, partner in the Washington, D.C. law firm of Crowell & Moring – for its perspective and insight in a year when Board-related issues were making front-page news across the country. |

| |

| Our shareholders deserve a special word of appreciation for their understanding that SunTrust is not entirely immune to market forces. |

| |

| Finally, to our customers, thank you for your business. We remain committed to meeting your financial services needs. |

| |

| /s/ L. P HILLIP H UMANN |

|

|

| L. Phillip Humann

Phillip Humann

Chairman, President and Chief Executive Officer |

| |

| 12 | Sun Trust 2002 Annual Report |

| | | |

selected financial data

selected financial data

| | Year Ended December 31 | |

| |

| |

(In millions except per share and other data) | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | | 1997 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Summary of Operations | | | | | | | | | | | | | | | | | | | |

| Interest and dividend income | | $ | 5,135.2 | | $ | 6,279.6 | | $ | 6,845.4 | | $ | 5,960.2 | | $ | 5,675.9 | | $ | 5,238.2 | |

| Interest expense | | | 1,891.5 | | | 3,027.0 | | | 3,736.9 | | | 2,814.7 | | | 2,746.8 | | | 2,453.5 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Net interest income | | | 3,243.7 | | | 3,252.6 | | | 3,108.5 | | | 3,145.5 | | | 2,929.1 | | | 2,784.7 | |

| Provision for loan losses | | | 469.8 | | | 275.2 | | | 134.0 | | | 170.4 | | | 214.6 | | | 225.1 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Net interest income after provision for loan losses | | | 2,773.9 | | | 2,977.4 | | | 2,974.5 | | | 2,975.1 | | | 2,714.5 | | | 2,559.6 | |

Noninterest income1 | | | 2,391.7 | | | 2,155.8 | | | 1,773.6 | | | 1,625.9 | | | 1,653.9 | | | 1,329.2 | |

Noninterest expense2, 4 | | | 3,342.3 | | | 3,113.5 | | | 2,828.5 | | | 2,905.3 | | | 2,870.1 | | | 2,389.2 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Income before provision for income taxes and extraordinary gain | | | 1,823.3 | | | 2,019.7 | | | 1,919.6 | | | 1,695.7 | | | 1,498.3 | | | 1,499.6 | |

| Provision for income taxes | | | 491.5 | | | 650.5 | | | 625.5 | | | 571.7 | | | 527.3 | | | 523.7 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Income before extraordinary gain | | | 1,331.8 | | | 1,369.2 | | | 1,294.1 | | | 1,124.0 | | | 971.0 | | | 975.9 | |

Extraordinary gain, net of taxes3 | | | — | | | 6.3 | | | — | | | 202.6 | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Net income | | $ | 1,331.8 | | $ | 1,375.5 | | $ | 1,294.1 | | $ | 1,326.6 | | $ | 971.0 | | $ | 975.9 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Net interest income (taxable-equivalent) | | $ | 3,283.2 | | $ | 3,293.4 | | $ | 3,148.4 | | $ | 3,188.0 | | $ | 2,973.5 | | $ | 2,832.6 | |

Per Common Share | | | | | | | | | | | | | | | | | | | |

| Diluted | | | | | | | | | | | | | | | | | | | |

| | Income before extraordinary gain | | $ | 4.66 | | $ | 4.70 | | $ | 4.30 | | $ | 3.50 | | $ | 3.04 | | $ | 3.04 | |

| | Extraordinary gain | | | — | | | 0.02 | | | — | | | 0.63 | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | Net income | | | 4.66 | | | 4.72 | | | 4.30 | | | 4.13 | | | 3.04 | | | 3.04 | |

| Basic | | | | | | | | | | | | | | | | | | | |

| | Income before extraordinary gain | | | 4.71 | | | 4.76 | | | 4.35 | | | 3.54 | | | 3.08 | | | 3.08 | |

| | Extraordinary gain | | | — | | | 0.02 | | | — | | | 0.64 | | | — | | | — | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | Net income | | | 4.71 | | | 4.78 | | | 4.35 | | | 4.18 | | | 3.08 | | | 3.08 | |

| Dividends declared | | | 1.72 | | | 1.60 | | | 1.48 | | | 1.38 | | | 1.00 | | | 0.925 | |

| Market price: | | | | | | | | | | | | | | | | | | | |

| | High | | | 70.20 | | | 72.35 | | | 68.06 | | | 79.81 | | | 87.75 | | | 75.25 | |

| | Low | | | 51.48 | | | 57.29 | | | 41.63 | | | 60.44 | | | 54.00 | | | 44.13 | |

| | Close | | | 56.92 | | | 62.70 | | | 63.00 | | | 68.81 | | | 76.50 | | | 71.38 | |

Selected Average Balances | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 108,516.1 | | $ | 102,884.2 | | $ | 98,397.8 | | $ | 92,820.8 | | $ | 85,536.9 | | $ | 76,017.3 | |

| Earning assets | | | 96,370.8 | | | 92,034.1 | | | 88,609.0 | | | 82,255.7 | | | 74,880.9 | | | 66,944.0 | |

| Loans | | | 71,270.4 | | | 70,023.0 | | | 70,044.3 | | | 62,749.4 | | | 57,590.5 | | | 51,788.1 | |

| Deposits | | | 71,157.2 | | | 64,568.7 | | | 66,691.9 | | | 57,842.1 | | | 53,725.3 | | | 51,673.7 | |

| Realized shareholders’ equity | | | 6,984.6 | | | 6,328.0 | | | 6,031.6 | | | 6,368.3 | | | 5,641.4 | | | 5,116.7 | |

| Total shareholders’ equity | | | 8,725.7 | | | 8,073.8 | | | 7,501.9 | | | 8,190.7 | | | 7,853.6 | | | 6,953.4 | |

At December 31 | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 117,322.5 | | $ | 104,740.6 | | $ | 103,660.4 | | $ | 95,390.0 | | $ | 93,169.9 | | $ | 82,840.8 | |

| Earning assets | | | 104,759.6 | | | 93,327.5 | | | 92,147.8 | | | 85,193.4 | | | 81,295.1 | | | 72,258.9 | |

| Loans | | | 73,167.9 | | | 68,959.2 | | | 72,239.8 | | | 66,002.8 | | | 61,540.6 | | | 55,476.4 | |

| Allowance for loan losses | | | 930.1 | | | 867.1 | | | 874.5 | | | 871.3 | | | 944.6 | | | 933.5 | |

| Deposits | | | 79,706.6 | | | 67,536.4 | | | 69,533.3 | | | 60,100.5 | | | 59,033.3 | | | 54,580.8 | |

| Long-term debt | | | 11,879.8 | | | 12,660.6 | | | 8,945.4 | | | 6,017.3 | | | 5,807.9 | | | 4,010.4 | |

| Realized shareholders’ equity | | | 7,260.0 | | | 6,704.3 | | | 6,296.4 | | | 6,064.0 | | | 6,090.4 | | | 5,263.9 | |

| Total shareholders’ equity | | | 8,769.5 | | | 8,359.6 | | | 8,239.2 | | | 7,626.9 | | | 8,178.6 | | | 7,312.1 | |

Ratios and Other Data | | | | | | | | | | | | | | | | | | | |

| Return on average assets less net unrealized gains on securities | | | 1.26 | % | | 1.37 | % | | 1.35 | % | | 1.48 | % | | 1.18 | % | | 1.34 | % |

| Return on average total assets | | | 1.23 | | | 1.34 | | | 1.32 | | | 1.43 | | | 1.14 | | | 1.28 | |

| Return on average realized shareholders’ equity | | | 19.07 | | | 21.74 | | | 21.46 | | | 20.83 | | | 17.21 | | | 19.07 | |

| Return on average total shareholders’ equity | | | 15.26 | | | 17.04 | | | 17.25 | | | 16.20 | | | 12.36 | | | 14.04 | |

| Net interest margin | | | 3.41 | | | 3.58 | | | 3.55 | | | 3.88 | | | 3.97 | | | 4.23 | |

| Efficiency ratio | | | 58.90 | | | 56.96 | | | 57.47 | | | 60.35 | | | 62.02 | | | 57.41 | |

| Total shareholders’ equity to assets | | | 7.47 | | | 7.98 | | | 7.95 | | | 8.00 | | | 8.78 | | | 8.83 | |

| Allowance to year-end loans | | | 1.27 | | | 1.26 | | | 1.21 | | | 1.32 | | | 1.53 | | | 1.68 | |

| Nonperforming assets to total loans plus OREO and other repossessed assets | | | 0.74 | | | 0.87 | | | 0.61 | | | 0.43 | | | 0.40 | | | 0.43 | |

| Common dividend payout ratio | | | 36.8 | | | 33.7 | | | 34.3 | | | 33.4 | | | 32.9 | | | 30.4 | |

| Full-service banking offices | | | 1,184 | | | 1,128 | | | 1,129 | | | 1,114 | | | 1,079 | | | 1,072 | |

| ATMs | | | 2,286 | | | 1,944 | | | 1,991 | | | 1,968 | | | 1,839 | | | 1,691 | |

| Full-time equivalent employees | | | 27,622 | | | 28,391 | | | 28,268 | | | 30,222 | | | 30,452 | | | 29,442 | |

| Average common shares – diluted (thousands) | | | 286,052 | | | 291,584 | | | 300,956 | | | 321,174 | | | 319,711 | | | 320,932 | |

| Average common shares – basic (thousands) | | | 282,495 | | | 287,702 | | | 297,834 | | | 317,079 | | | 314,908 | | | 316,436 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | |

1Includes securities gains of $204.5 million and $100.2 million and securities losses of $114.9 million related to the securities portfolio repositioning in 2002, 2001 and 1999, respectively. An additional $52.9 million security gain was recorded in 2001 on the sale of Star Systems, Inc. |

2Includes merger-related expenses of $16.0 million in 2002 related to the acquisition of Huntington-Florida and $42.4 million in 2000, $45.6 million in 1999 and $119.4 million in 1998 related to the acquisition of Crestar. |

3Represents the gain on the early extinguishment of long-term debt in 2001, net of $3.4 million in taxes, and the gain on sale of the Company’s consumer credit card portfolio in 1999, net of $124.6 million in taxes. |

4Includes expenses of $32.0 million from the proposal to acquire the former Wachovia Corporation in 2001. |

| |

| selected financial data | 14 | Sun Trust 2002 Annual Report |

| | | | | | | | | | | | | | | | | | | | | | |

management’s discussion

This narrative will assist readers in their analysis of the accompanying consolidated financial statements and supplemental financial information. It should be read in conjunction with the Consolidated Financial Statements and Notes on pages 53 through 93. In Management’s Discussion, net interest income, net interest margin and the efficiency ratio are presented on a fully taxable-equivalent (FTE) basis, which is adjusted for the tax-favored status of income from certain loans and investments. The Company believes this measure to be the preferred industry measurement of net interest income and provides relevant comparison between taxable and non-taxable amounts. Certain reclassifications have been made to prior year financial statements and related information to conform them to the 2002 presentation.

SunTrust has made, and may continue to make, various forward-looking statements with respect to financial and business matters. The following discussion contains forward-looking statements that involve inherent risks and uncertainties. Actual results may differ materially from those contained in these forward-looking statements. For additional information regarding forward-looking statements, see “A Warning About Forward-looking Information” on page 51 of this Annual Report. In addition, the preparation of the financial statements, upon which this Management’s Discussion is based, requires management to make estimates which impact these financial statements. Included in the Notes to the Consolidated Financial Statements, which start on page 59, are the most significant accounting policies used in the preparation of these statements as required by generally accepted accounting principles. These Notes should be read in conjunction with the reader’s review of SunTrust’s financial statements and results of operations.

Critical Accounting Policies

The Company’s accounting policies are integral to understanding the results reported. Accounting policies are described in detail in Note 1 to the Consolidated Financial Statements. The Company’s most complex accounting policies require management’s judgment to ascertain the valuation of assets, liabilities, commitments and contingencies. A variety of factors could affect the ultimate value that is obtained either when earning income, recognizing an expense, recovering an asset or relieving a liability. In many instances, we use a discount factor to determine the present value of assets and liabilities. A change in the discount factor could increase or decrease the values of those assets and liabilities. That change could result in either a beneficial or adverse impact on our financial results. The Company has established detailed policies and control procedures that are intended to ensure valuation methods are well controlled and applied consistently from period to period. In addition, the policies and procedures are intended to ensure that the process for changing methodologies occurs in an appropriate manner. The following is a brief description of the Company’s current accounting policies involving significant management valuation judgments.

Allowance for Loan Losses

The allowance for loan losses represents management’s estimate of losses inherent in the existing loan portfolio. The allowance for loan losses is increased by the provision for loan losses charged to expense and reduced by loans charged off, net of recoveries. The allowance for loan losses is determined based on management’s assessment of several factors: reviews and evaluations of specific loans, changes in the nature and volume of the loan portfolio, current economic conditions and the related impact on segments of the loan portfolio, historical loan loss experiences and the level of classified and nonperforming loans.

Loans are considered impaired if, based on current information and events, it is probable that SunTrust will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. The measurement of impaired loans is based on either the fair value of the underlying collateral, the present value of the future cash flows discounted at the historical effective interest rate stipulated in the loan agreement, or the estimated market value of the loan. In measuring the fair value of the collateral, management uses assumptions (e.g., discount rate) and methodologies (e.g., comparison to the recent selling price of similar assets) consistent with those that would be utilized by unrelated third parties.

Changes in the financial condition of individual borrowers, economic conditions, historical loss experience, or the condition of the various markets in which collateral may be sold may affect the required level of the allowance for loan losses and the associated provision for loan losses. Should cash flow assumptions or market conditions change, a different amount may be reported for the allowance for loan losses and the associated provision for loan losses.

Estimates of Fair Value

The estimation of fair value is significant to a number of SunTrust’s assets, including trading account assets, loans held for sale, available-for-sale investment securities, mortgage servicing rights (“MSRs”), other real estate owned, other repossessed assets, as well as assets and liabilities associated with derivative financial instruments. These are all recorded at either fair value or at the lower of cost or fair value. Fair values are volatile and may be influenced by a number of factors. Circumstances that could cause estimates of the fair value of certain assets and liabilities to change include a change in prepayment speeds, discount rates, or market interest rates.

Fair values for trading account assets, most available-for-sale investment securities and most derivative financial instruments are based on quoted market prices. If quoted market prices are not available, fair values are based on the quoted prices of similar instruments. The fair values of loans held for sale are based on anticipated liquidation values, while the fair values of mortgage servicing rights are based on discounted cash flow analysis utilizing dealer consensus prepayment speeds and market discount rates. The fair values of other real estate owned are typically determined based on appraisals by third parties, less estimated costs to sell.

Estimates of fair value are also required in performing an impairment analysis of goodwill. The Company reviews goodwill for impairment at least once annually and whenever events or circumstances indicate the carrying value may not be recoverable. An impairment would be indicated if the carrying value exceeds the fair value of a reporting unit.

Recent Accounting Developments

The Company adopted the provisions of several new accounting pronouncements in the current year, including Statement of Financial Accounting Standards (“SFAS”) Nos. 144, 145, 146, 147,148 and the disclosure requirements of FASB Interpretation (“FIN”) Nos. 45 and 46. The provisions of these pronouncements and the related impact to the Company are discussed in the Recent Accounting Developments section of Note 1 to the Consolidated Financial Statements beginning on page 59.

Sun Trust 2002 Annual Report | 15 | management’s discussion |

management’s discussion

Earnings Overview

SunTrust’s net income for 2002 totaled $1,331.8 million, or $4.66 per diluted share, down 3.2% from the net income of $1,375.5 million, or $4.72 per diluted share, earned in 2001. Results included the following items:

• | After-tax merger-related expenses totaling $39.8 million, or $0.14 per diluted share, associated with the Huntington-Florida franchise acquisition in 2002. |

| |

• | One Bank initiative costs of $36.5 million, net of tax, or $0.13 per diluted share, and $35.5 million, or $0.12 per diluted share, for the Company’s enhancements during 2002 and 2001, respectively, to customer-based systems that will yield further operating efficiencies in the future. |

| |

• | After-tax securities gains of $133.0 million, or $0.46 per diluted share, and $65.1 million, or $0.22 per diluted share, related to the balance sheet repositioning during 2002 and 2001, respectively. |

| |

• | After-tax merger-related expenses totaling $20.2 million, or $0.07 per diluted share, associated with the Company’s proposal to acquire the former Wachovia Corporation in 2001. |

| |

• | Extraordinary gain of $6.3 million, net of tax, or $0.02 per diluted share, for the early extinguishments of long-term debt in 2001. |

Impacting operating results was the continued decline of interest rates in 2002. Net interest income decreased $10.1 million to $3,283.2 million, and the net interest margin decreased 17 basis points in 2002. Net interest income was favorably impacted by mortgage refinancing experienced during 2002, which led to an increase in average loans to be sold in the secondary market from $2.9 billion in 2001 to $4.4 billion in 2002.

Operating results for 2002 were impacted by a weak economy, which resulted in credit deterioration in the large corporate portfolio. Results were negatively impacted by a $194.6 million increase in the provision for loan losses. Net charge-offs were $422.3 million, or 0.59% of average loans for 2002, compared to $272.4 million, or 0.39% of average loans for 2001. The 2002 loan loss provision of $469.8 million was 70.7% higher than the $275.2 million recorded in 2001. These increases were primarily due to increased large corporate charge-offs due to the weakened economy. Additionally impacting the increase was $45.3 million of additional provision expense in 2002 related to the Huntington-Florida acquisition in order to conform the Huntington-Florida portfolio to SunTrust’s credit standards.

Noninterest income increased 10.9% to $2,391.7 million for 2002. Noninterest income, excluding securities gains and losses, was $2,187.1 million, a 9.2% increase compared to 2001. This increase was driven by a $159.2 million, or 21.2%, increase in service charges on deposit accounts and other charges and fees as the Company benefited from increased usage of products and services, a more consistent pricing strategy throughout the Company’s markets and a lower earnings credit rate. Also positively impacting noninterest income was a $68.5 million, or 63.1%, increase in investment banking income due to improvements in the performance of the Company’s capital markets business and the addition of the institutional business of Robinson-Humphrey during the third quarter of 2001. Additionally, the Company benefited from increases of $28.9 million, or 26.8%, in retail investment services and $18.4 million, or 3.8%, in trust and investment management income. Mortgage production related income increased $29.1 million, or 15.6%, due to significant refinancing activity in 2002, while mortgage servicing related income decreased $104.0 million due to accelerated amortization of mortgage servicing rights resulting from increased prepayments.

Noninterest expense for 2002 was $3,342.3 million, a 7.3% increase compared to 2001. Noninterest expense, excluding merger-related expenses, increased $212.7 million or 6.8% compared to 2001. Personnel expenses increased $160.0 million, or 9.0%, primarily attributable to increased benefits costs and the acquisitions of Huntington-Florida, the institutional business of Robinson-Humphrey and AMA Holdings, Inc., as well as expenses related to the now-completed One Bank initiative. Also negatively impacting personnel expenses was increased incentive payments resulting from record mortgage production. Mortgage production for 2002 was $30.8 billion compared to $24.2 billion in 2001. The $34.2 million, or 5.9%, increase in other noninterest expense is mainly attributable to an expense of $25.0 million related to the standardization of the financial performance of the Company’s affordable housing business. Also impacting noninterest expense was an increase in net occupancy expense of $18.8 million, or 8.9%, due to the acquisitions of Huntington-Florida and the institutional business of Robinson-Humphrey. Amortization of intangible assets increased $12.6 million, or 27.3%, due to amortization of intangibles related to the Huntington-Florida acquisition. In 2001, the Company recorded $41.7 million of goodwill amortization that is no longer being amortized in conjunction with the provisions of SFAS No. 142.

management’s discussion | 16 | Sun Trust 2002 Annual Report |

Business Segments

Prior to 2001, the Company’s segment disclosures were aligned with its geographic regions as defined by its former multiple bank charters. During 2000, as a result of the consolidation of its multiple bank charters into a single legal entity, the Company began to redefine its operating model and created a line of business management structure to overlay its former multiple bank management structure. Beginning in January 2001, the Company implemented significant changes to its internal management reporting system to begin to measure and manage certain business activities by line of business. For more financial details on business segment disclosures, please see Note 23 – Business Segment Reporting in the Notes to the Financial Statements. The lines of business are defined as follows:

Retail

The Retail line of business includes loans, deposits, and other fee-based services for consumer and private banking clients, as well as business clients with less than $5 million in sales. Retail serves clients through an extensive network of traditional and in-store branches, ATMs, and the Internet (www.suntrust.com). In addition to serving the retail market, the Retail line of business serves as an entry point for other lines of business. When client needs change and expand, Retail refers clients to the Private Client Services, Mortgage and Commercial lines of business.

Commercial

The Commercial line of business provides enterprises with a full array of financial solutions, including traditional commercial lending, treasury management, financial risk management products and corporate card services. The primary customer segments served by this line of business include “Commercial” ($5 million to $50 million in annual revenues), “Middle Market” ($50 million to $250 million in annual revenues), “Commercial Real Estate” (entities that specialize in Commercial Real Estate activities), “Financial Institutions” (correspondent banking entities), and “Government/Not-for-Profit” entities. Also included in this segment are specialty groups that operate both within and outside of the SunTrust footprint, such as Receivables Capital Management (factoring services), Affordable Housing (tax credits related to community development) and Premium Assignment Corporation (insurance premium financing).

Corporate and Investment Banking

Corporate & Investment Banking serves firms with over $250 million in annual revenues in a variety of industries both inside and outside the SunTrust footprint. Industry Specialties include Media & Communications, Energy, Healthcare, Franchise & Distributor Finance, Restaurants, Agrifoods, Fabrics & Furnishings, Business Services, Retail & Consumer, and Technology.

Corporate & Investment Banking is comprised of the following units: Corporate Banking, Treasury Management, International Banking, SunTrust Leasing, SunTrust Robinson-Humphrey Debt Capital Markets, SunTrust Robinson-Humphrey Equity Capital Markets and SunTrust Equity Partners. These units offer commercial lending and treasury management services, as well as numerous products and services outside of the traditional commercial lending environment.

Private Client Services

Private Client Services (“PCS”) provides a full array of asset management products and professional services to both individual and institutional clients. PCS’ primary segments include brokerage, individual wealth management, and institutional investment management and administration. Individual clients seeking brokerage services may choose between PCS’ discount/online, mid-tier, or full service brokerage offerings. PCS also offers professional investment management and trust services to clients seeking active management of their financial resources. Institutional investment management and administration is comprised of Trusco Capital Management, Inc. (“Trusco”), Retirement Services, Endowment & Foundation Services, Corporate Trust, and Stock Transfer. Retirement Services provides administration and custody services for 401(k) and employee defined benefit plans. Endowment & Foundation Services also provides administration and custody services to non-profit organizations, including government agencies, colleges and universities, community charities and foundations, and hospitals. Corporate Trust targets issuers of tax-exempt and corporate debt and asset-based securities, as well as corporations and attorneys requiring escrow and custodial services. Trusco is a registered investment advisor that acts as the investment manager for PCS’ institutional clients and the STI Classic Funds.

Mortgage

The Mortgage line of business originates mortgage loans through retail, broker and correspondent channels. These loans are securitized and sold in the secondary market with servicing rights retained or held in the Company’s residential loan portfolio. The line of business services loans for its own residential mortgage portfolio as well as for others.

Corporate/Other

Corporate/Other (“Other”) includes the investment securities portfolio, long-term debt, capital, derivative instruments, short-term liquidity and funding activities, balance sheet risk management, office premises and certain support activities not currently allocated to the aforementioned Lines of Business. The major components of the Other line of business include Enterprise Information Services, which is the primary data processing and operations group; the Corporate Real Estate group, which manages the company’s facilities; Marketing, which handles advertising, product management and customer information functions; SunTrust Online, which handles customer phone inquiries and phone sales and manages the Internet banking function; Human Resources, which includes the recruiting, training and employee benefit administration functions; Finance, which includes accounting, budgeting, planning, audit, tax, treasury, risk management and internal control. Other functions included in the Other line of business are asset quality administration, loan review, legal and compliance, branch operations, corporate strategies development and the executive management group. The Other line of business also contains certain expenses that have not been allocated to the primary lines of business, eliminations, and the residual offsets derived from matched-maturity funds transfer pricing and provision for loan losses/credit risk premium allocations.

Sun Trust 2002 Annual Report | 17 | management’s discussion |

management’s discussion

The following table for SunTrust’s reportable business segments compares total income before taxes for the twelve months ended December 31, 2002 to the same period last year:

TABLE 1 Total Contribution Before Taxes And Extraordinary Items

| | Twelve Months Ended | |

| |

| |

(Dollars in millions) | | December 31, 2002 | | December 31, 2001 | |

| |

| |

| |

| Retail | | $ | 770.1 | | $ | 875.2 | |

| Commercial | | | 447.5 | | | 401.9 | |

| Corporate and Investment Banking | | | 185.9 | | | 194.6 | |

| Mortgage | | | 161.5 | | | 123.2 | |

| Private Client Services | | | 212.5 | | | 227.9 | |

| Corporate/Other | | | 85.3 | | | 237.7 | |

| | |

|

| |

|

| |

| | Total Consolidated FTE Adjusted | | | 1,862.8 | | | 2,060.5 | |

| FTE Adjustments | | | (39.5 | ) | | (40.8 | ) |

| | |

|

| |

|

| |

| | Total Consolidated | | $ | 1,823.3 | | $ | 2,019.7 | |

| | | |

|

| |

|

| |

The following table for SunTrust’s reportable business segments compares average loans and average deposits for the twelve months ended December 31, 2002 to the same period last year:

TABLE 2 Average Loans And Deposits By Line Of Business

| | Twelve Months Ended | |

| |

| |

(Dollars in millions) | | December 31, 2002 | | December 31, 2001 | |

| |

| |

| |

Lines of Business | | Average

loans | | Average

deposits | | Average

loans | | Average

deposits | |

| |

| |

| |

| |

| |

| Retail | | $ | 21,702.8 | | $ | 51,516.3 | | $ | 18,316.5 | | $ | 45,457.7 | |

| Commercial | | | 20,354.9 | | | 9,788.2 | | | 18,814.6 | | | 7,580.4 | |

| Corporate and Investment Banking | | | 15,352.6 | | | 1,381.6 | | | 17,579.8 | | | 1,454.3 | |

| Mortgage | | | 12,137.4 | | | 1,013.9 | | | 13,409.8 | | | 785.9 | |

| Private Client Services | | | 1,588.8 | | | 1,530.7 | | | 1,265.0 | | | 1,324.2 | |

The following analysis details the operating results for each line of business for the twelve months ended December 31, 2002 and 2001.

Retail

Retail’s full year 2002 income before taxes was $770.1 million, $105.1 million or 12.0% lower than full year 2001. The decrease in net income is attributable to a decrease in net interest revenue on deposits. Net interest revenue for deposits declined as the lower interest rate environment depressed funds transfer credit rates on deposits. Higher fee income partially offset the impact of lower net interest revenue.

As losses in the consumer lending portfolio grew in 2002 (primarily due to charge-offs in the indirect auto lending portfolio), the provision for loan loss increased by $53.1 million.

Average loan balances showed strong growth in 2002, increasing $3.4 billion or 18.5% from 2001. Loan balances acquired from Huntington-Florida provided 38.2% of the year over year increase. Deposit balances also experienced double digit growth. Average deposit balances for 2002 grew $6.1 billion or 13.3% year over year. Deposit balances acquired from Huntington-Florida provided 53.7% of the 2002 growth.

Commercial

Commercial’s income before taxes for the year ended December 31, 2002 grew by $45.6 million or 11.4% from the comparable 2001 period. Net interest income increased $2.2 million to $560.1 million for 2002 from $557.9 million for 2001. Factoring fees in the amount of $26.4 million, which were classified as noninterest income in 2002, were recorded in net interest income in 2001. Interest income from the acquisition of Huntington-Florida of $12.0 million is included in the 2002 numbers.

Net interest income from loans increased due to higher volumes. Average loans grew by $1.5 billion, or 8.2%, year over year. Huntington-Florida loan volume totaled $625.0 million in 2002. Deposit volume increased by $2.2 billion, or 29.1% year over year. Huntington-Florida volume of $185.0 million is included in the growth for 2002. The volume increase reflects SunTrust’s commitment to raise core deposit levels in addition to limited industrial investment opportunity among clients and prospects as a result of a depressed economic outlook.

management’s discussion | 18 | Sun Trust 2002 Annual Report |

Noninterest income increased $41.2 million to $304.5 million for 2002 from $263.3 million for 2001. The increase was primarily due to $26.4 million of factoring fees, included in noninterest income in 2002, that were included in net interest income in 2001. Noninterest expense decreased by $10.0 million, or 2.6%, for the year.

Corporate and Investment Banking

Corporate and Investment Banking’s income before taxes decreased $8.7 million, or 4.5% in 2002 compared to 2001. The provision for loan losses increased $79.8 million between the current and prior year.

As compared to 2001, the current year’s net interest income declined $77.5 million and noninterest revenue increased $110.4 million, resulting in $33.0 million net improvement in total revenue. The decline in net interest income is attributable to lower loan balances associated with the significant level of public debt issuance, weak loan demand related to current economic conditions, and a conscious effort to exit marginally profitable relationships. The 27.3% increase in noninterest revenue was mainly due to a $70.0 million increase from SunTrust Robinson-Humphrey Equity Capital Markets, acquired during the third quarter of 2001, as well as strong growth in deposit account service charges and letters of credit fees. The combination of lower net interest income and higher noninterest income improved the mix of noninterest income to total revenue from 56.4% in 2001 to 68.6% in 2002.

Noninterest expense decreased $38.2 million, or 10.0%, as expenses were better managed under a challenging operating environment.

Mortgage

The Mortgage line of business’ 2002 income before taxes was up $38.3 million or 31.1% compared with 2001. Driven by record low interest rates, mortgage loan production reached a record $30.8 billion in 2002, a 27.5% increase from the prior year.

Net interest income was up $132.7 million or 54.5% over the comparable period. The higher net interest income was principally a result of wider spreads and higher mortgage loans held for sale volume resulting from the record mortgage loan production.

Noninterest income was down $69.7 million in 2002 compared with 2001. Higher mortgage servicing rights amortization expense resulting from record loan payoff levels as well as higher amortization expense on existing serviced loans more than offset gains in production-related income. Noninterest expense increased $25.3 million or 7.8% in 2002 compared with 2001 principally due to increases in volume-related expenses such as commission-based compensation that varies with loan production.

Private Client Services

Private Client Services’ income before taxes decreased $15.4 million, or 6.7%, for the year ended December 31, 2002 compared to the same period in 2001.

Trust and investment management income increased 4.0% over prior year. Assets under management as of December 31, 2002 and December 31, 2001 were both approximately $89.6 billion. Despite the significant decline in the equity markets, trust and investment management income has been able to moderately increase due to assets under management remaining relatively stable throughout 2002. Assets under management did not decline to the same extent as the equity markets due to strong net new business and an appreciation in bond values. Retained business is satisfactory given market conditions and is comparable with prior periods; however, new business is up significantly compared to 2001. Assets under management include individually managed assets, the STI Classic Funds, institutional assets managed by Trusco Capital Management, and participant-directed retirement accounts. As of December 31, 2002, SunTrust’s total assets under advisement were approximately $162.6 billion, which included $24.5 billion held in non-managed corporate trust accounts and $17.0 billion in retail brokerage accounts, including $1.3 billion in Alexander Key.

Retail investment income increased 27.5% over prior year. The increase is primarily due to an increase in broker production and the number of brokers. The Company launched its full-service brokerage division, Alexander Key, during the second quarter of 2002, and has continued to build its broker network. Thus far the division has generated nominal revenue.

Noninterest expense increased 15.6% over prior year. The increase in noninterest expense is due to higher incentive expense associated with the increase in new business and continued investment in the core business, new product capabilities, and new distribution channels.

The increase over prior year in assets and liabilities is due to loan growth of 25.6% and deposit growth of 15.6%; however, net interest revenue decreased 11.1% due to interest rate spreads compressing as a result of the 2002 decline in interest rates. The Company is not aware of any material credit risk within Private Client Services’ loan portfolio.

Corporate/Other

The Corporate/Other line of business’ income before taxes decreased from $237.7 million in 2001 to $85.3 million in 2002. Net interest income increased by $20.9 million, or 3.2%, as a result of the residual offsets derived from matched maturity funds transfer pricing.

The provision for loan losses increased $53.6 million, primarily due to $45.3 million recorded in the first quarter of 2002, to bring the Huntington-Florida loan portfolio into compliance with SunTrust’s credit standards.

Noninterest revenue decreased $14.0 million in 2002 compared to 2001. Security gains were $48.3 million higher in 2002 than 2001 but were offset by declines between the two years in other charges and fees, trading account profits and other noninterest income.

Noninterest expense increased $105.6 million in 2002 compared to the prior year. This increase is primarily the result of increased amortization of intangibles expense from the Huntington-Florida acquisition and the dividend expense associated with the preferred shares issued by a real estate trust subsidiary.

Average total liabilities declined $8.5 billion, or 25.4%, in 2002 compared to 2001, primarily as a result of consumer and commercial deposit growth from the other business lines that eliminated the need for borrowings.

Sun Trust 2002 Annual Report | 19 | management’s discussion |

management’s discussion

Cash Basis Financial Data

Effective January 1, 2002, in accordance with the provisions of Statement of Financial Accounting Standards (“SFAS”) No. 142, “Goodwill and Other Intangible Assets”, SunTrust no longer amortizes goodwill. Table 3 presents financial data excluding the impact of the after-tax amortization of goodwill, core deposit intangibles and other intangible assets.

TABLE 3 Cash Basis Selected Financial Data

| | Year Ended December 31 | |

| |

| |

(In millions except per share data) | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | | 1997 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Operations | | | | | | | | | | | | | | | | | | | |

| Noninterest expense | | $ | 3,283.4 | | $ | 3,057.6 | | $ | 2,793.1 | | $ | 2,869.1 | | $ | 2,827.0 | | $ | 2,350.7 | |

| Net income | | | 1,370.4 | | | 1,414.9 | | | 1,326.0 | | | 1,359.1 | | | 1,010.3 | | | 1,011.2 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Goodwill and Core Deposit Intangibles (CDI) | | | | | | | | | | | | | | | | | | | |

| Goodwill average balance | | $ | 919.4 | | $ | 469.8 | | $ | 488.9 | | $ | 511.5 | | $ | 524.9 | | $ | 389.0 | |

| CDI average balance | | | 194.3 | | | 19.8 | | | 23.7 | | | 30.3 | | | 19.4 | | | 21.7 | |

| Other intangible asset average balance | | | 9.6 | | | 0.5 | | | 0.9 | | | 2.5 | | | 3.4 | | | 4.5 | |

| Goodwill amortization (after tax) | | | — | | | 36.1 | | | 27.9 | | | 27.8 | | | 34.2 | | | 30.6 | |

| CDI amortization (after tax) | | | 37.5 | | | 3.1 | | | 3.8 | | | 4.5 | | | 4.2 | | | 3.9 | |

| Other intangible asset amortization (after tax) | | | 1.1 | | | 0.1 | | | 0.1 | | | 0.3 | | | 0.8 | | | 0.7 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | |

| management’s discussion | 20 | Sun Trust 2002 Annual Report |

| | | | | | | | | | | | | | | | | | | | | |

TABLE 4 Analysis Of Changes In Net Interest Income1

| | 2002 Compared to 2001

Increase (Decrease) Due to | | 2001 Compared to 2000

Increase (Decrease) Due to | |

| |

| |

| |

(In millions on a taxable- equivalent basis) | | Volume | | Rate | | Net | | Volume | | Rate | | Net | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Interest Income | | | | | | | | | | | | | | | | | | | |

| Loans | | | | | | | | | | | | | | | | | | | |

| | Taxable | | $ | 75.9 | | $ | (1,017.7 | ) | $ | (941.8 | ) | $ | (6.0 | ) | $ | (683.7 | ) | $ | (689.7 | ) |

| | Tax-exempt2 | | | 10.2 | | | (17.7 | ) | | (7.5 | ) | | 4.1 | | | (8.7 | ) | | (4.6 | ) |

| Securities available for sale | | | | | | | | | | | | | | | | | | | |

| | Taxable | | | 60.7 | | | (276.0 | ) | | (215.3 | ) | | 86.6 | | | (34.1 | ) | | 52.5 | |

| | Tax-exempt2 | | | (3.0 | ) | | (4.7 | ) | | (7.7 | ) | | (1.6 | ) | | 1.9 | | | 0.3 | |

| Funds sold and securities purchased under agreements to resell | | | 5.2 | | | (31.9 | ) | | (26.7 | ) | | (11.0 | ) | | (30.6 | ) | | (41.6 | ) |

| Loans held for sale | | | 95.0 | | | (26.1 | ) | | 68.9 | | | 107.8 | | | (6.9 | ) | | 100.9 | |

| Interest-bearing deposits | | | 5.2 | | | (3.9 | ) | | 1.3 | | | 4.1 | | | 0.8 | | | 4.9 | |

| Trading assets | | | 8.2 | | | (25.0 | ) | | (16.8 | ) | | 26.1 | | | (13.6 | ) | | 12.5 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | Total Interest income | | | 257.4 | | | (1,403.0 | ) | | (1,145.6 | ) | | 210.1 | | | (774.9 | ) | | (564.8 | ) |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Interest Expense | | | | | | | | | | | | | | | | | | | |

| NOW accounts | | | 19.2 | | | (46.0 | ) | | (26.8 | ) | | 5.6 | | | (11.8 | ) | | (6.2 | ) |

| Money Market accounts | | | 125.1 | | | (325.9 | ) | | (200.8 | ) | | 141.6 | | | (140.9 | ) | | 0.7 | |

| Savings deposits | | | 6.6 | | | (93.0 | ) | | (86.4 | ) | | (12.5 | ) | | (44.5 | ) | | (57.0 | ) |

| Consumer time deposits | | | 12.6 | | | (134.2 | ) | | (121.6 | ) | | (44.1 | ) | | (15.6 | ) | | (59.7 | ) |

| Brokered deposits | | | (3.7 | ) | | 18.5 | | | 14.8 | | | (39.3 | ) | | (61.3 | ) | | (100.6 | ) |

| Foreign deposits | | | (66.5 | ) | | (109.3 | ) | | (175.8 | ) | | (229.5 | ) | | (152.7 | ) | | (382.2 | ) |

| Other time deposits | | | (5.2 | ) | | (93.3 | ) | | (98.5 | ) | | (14.5 | ) | | (20.9 | ) | | (35.4 | ) |

| Funds purchased and securities sold under agreements to repurchase | | | (30.8 | ) | | (241.0 | ) | | (271.8 | ) | | 30.8 | | | (269.8 | ) | | (239.0 | ) |

| Other short-term borrowings | | | (19.9 | ) | | (29.4 | ) | | (49.3 | ) | | 2.6 | | | (37.1 | ) | | (34.5 | ) |

| Long-term debt | | | (30.8 | ) | | (88.5 | ) | | (119.3 | ) | | 269.9 | | | (65.8 | ) | | 204.1 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | Total interest expense | | | 6.6 | | | (1,142.1 | ) | | (1,135.5 | ) | | 110.6 | | | (820.4 | ) | | (709.8 | ) |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | Net change in net interest income | | $ | 250.8 | | $ | (260.9 | ) | $ | (10.1 | ) | $ | 99.5 | | $ | 45.5 | | $ | 145.0 | |

| | | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | | |

| | 1 | Changes in net interest income are attributed to either changes in average balances (volume change) or changes in average rates (rate change) for earning assets and sources of funds on which interest is received or paid. Volume change is calculated as change in volume times the previous rate, while rate change is change in rate times the previous volume. The rate/volume change, change in rate times change in volume, is allocated between volume change and rate change at the ratio each component bears to the absolute value of their total. |

| | 2 | Interest income includes the effects of taxable-equivalent adjustments (reduced by the nondeductible portion of interest expense)using a federal income tax rate of 35% and, where applicable, state income taxes to increase tax-exempt interest income to a taxable-equivalent basis. |

| | | | | | | | | | | | | | | | | | | | | | |

TABLE 5 Loan Portfolio By Types Of Loans

| | At December 31 | |

| |

| |

(In millions) | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | | 1997 | |

| |

| |

| |

| |

| |

| |

| |

| Commercial | | $ | 28,693.6 | | $ | 28,945.9 | | $ | 30,781.1 | | $ | 26,933.5 | | $ | 24,589.6 | | $ | 19,043.7 | |

| Real estate | | | | | | | | | | | | | | | | | | | |

| | Construction | | | 4,002.4 | | | 3,627.3 | | | 2,966.1 | | | 2,457.1 | | | 2,085.0 | | | 1,809.8 | |

| | Residential mortgages | | | 19,443.4 | | | 17,297.1 | | | 19,953.0 | | | 19,619.3 | | | 16,880.9 | | | 17,297.2 | |

| | Other | | | 9,101.8 | | | 8,152.0 | | | 8,121.4 | | | 7,794.9 | | | 8,254.3 | | | 7,457.6 | |

| Credit card | | | 111.3 | | | 92.0 | | | 76.8 | | | 77.4 | | | 1,563.5 | | | 2,195.6 | |

| Consumer loans | | | 11,815.4 | | | 10,844.9 | | | 10,341.4 | | | 9,120.6 | | | 8,167.3 | | | 7,672.5 | |

| | |

| |

| |

| |

| |

| |

| |

| | Total loans | | $ | 73,167.9 | | $ | 68,959.2 | | $ | 72,239.8 | | $ | 66,002.8 | | $ | 61,540.6 | | $ | 55,476.4 | |

| | | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Sun Trust 2002 Annual Report | 21 | management’s discussion |

management’s discussion

TABLE 6 Consolidated Daily Average Balances, Income/Expense And Average Yields Earned And Rates Paid

| | 2002 | | 2001 | | 2000 | |

| |

| |

| |

| |

(Dollars in millions; yields on taxable-equivalent basis ) | | Average Balances | | Income/ Expense | | Yields/

Rates | | Average

Balances | | Income/

Expense | | Yields/

Rates | | Average

Balances | | Income/

Expense | | Yields/

Rates | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans: 1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Taxable | | $ | 69,981.0 | | $ | 3,920.9 | | | 5.60 | % | $ | 68,892.8 | | $ | 4,862.7 | | | 7.06 | % | $ | 68,968.8 | | $ | 5,552.4 | | | 8.05 | % |

| | Tax-exempt2 | | | 1,289.4 | | | 70.8 | | | 5.49 | | | 1,130.2 | | | 78.4 | | | 6.94 | | | 1,075.5 | | | 83.0 | | | 7.72 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | Total loans | | | 71,270.4 | | | 3,991.7 | | | 5.60 | | | 70,023.0 | | | 4,941.1 | | | 7.06 | | | 70,044.3 | | | 5,635.4 | | | 8.05 | |

| Securities available for sale | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Taxable | | | 16,890.3 | | | 818.6 | | | 4.85 | | | 15,904.8 | | | 1,033.9 | | | 6.50 | | | 14,593.7 | | | 981.4 | | | 6.73 | |

| | Tax-exempt 2 | | | 408.3 | | | 28.0 | | | 6.85 | | | 448.7 | | | 35.7 | | | 7.95 | | | 469.7 | | | 35.4 | | | 7.54 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Total securities available for sale | | | 17,298.6 | | | 846.6 | | | 4.89 | | | 16,353.5 | | | 1,069.6 | | | 6.54 | | | 15,063.4 | | | 1,016.8 | | | 6.75 | |

| Funds sold and securities purchased under agreements to resell | | | 1,390.4 | | | 24.5 | | | 1.76 | | | 1,250.3 | | | 51.2 | | | 4.09 | | | 1,439.8 | | | 92.8 | | | 6.44 | |

| Loans held for sale | | | 4,410.8 | | | 280.4 | | | 6.36 | | | 2,949.9 | | | 211.5 | | | 7.17 | | | 1,451.1 | | | 110.6 | | | 7.62 | |

| Interest-bearing deposits | | | 404.7 | | | 7.0 | | | 1.73 | | | 167.6 | | | 5.8 | | | 3.43 | | | 39.9 | | | 0.9 | | | 2.17 | |

| Trading assets | | | 1,595.9 | | | 24.5 | | | 1.54 | | | 1,289.8 | | | 41.3 | | | 3.20 | | | 570.5 | | | 28.8 | | | 5.06 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | Total earning assets | | | 96,370.8 | | | 5,174.7 | | | 5.37 | | | 92,034.1 | | | 6,320.5 | | | 6.87 | | | 88,609.0 | | | 6,885.3 | | | 7.77 | |

| Allowance for loan losses | | | (924.3 | ) | | | | | | | | (876.3 | ) | | | | | | | | (869.0 | ) | | | | | | |

| Cash and due from banks | | | 3,343.2 | | | | | | | | | 3,383.4 | | | | | | | | | 3,316.4 | | | | | | | |

| Premises and equipment | | | 1,621.2 | | | | | | | | | 1,599.7 | | | | | | | | | 1,625.4 | | | | | | | |

| Other assets | | | 5,373.4 | | | | | | | | | 4,043.3 | | | | | | | | | 3,362.2 | | | | | | | |

| Unrealized gains on securities available for sale | | | 2,731.8 | | | | | | | | | 2,700.0 | | | | | | | | | 2,353.8 | | | | | | | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | Total assets | | $ | 108,516.1 | | | | | | | | $ | 102,884.2 | | | | | | | | $ | 98,397.8 | | | | | | | |

| | | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Liabilities and Shareholders’ Equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NOW accounts | | $ | 10,315.4 | | $ | 74.5 | | | 0.72 | % | $ | 8,471.3 | | $ | 101.2 | | | 1.20 | % | $ | 8,035.4 | | $ | 107.4 | | | 1.34 | % |

| Money Market accounts | | | 20,470.9 | | | 326.8 | | | 1.60 | | | 15,830.1 | | | 527.6 | | | 3.33 | | | 12,093.6 | | | 526.9 | | | 4.36 | |

| Savings | | | 6,310.0 | | | 85.1 | | | 1.35 | | | 6,066.6 | | | 171.5 | | | 2.83 | | | 6,434.2 | | | 228.5 | | | 3.55 | |