INTEGRATION TIMELINE SUMMARY

To date, we’ve successfully completed more than 44 % of the merger

integration milestones (812 of 1,865 total integration milestones).

Regulatory Approval (8/04-9/04)

Change control process installed

(9/04)

Shareholder Approval (9/15/04)

Customer and employee impacts

cataloged

Leadership positions identified

8/31/04, 9/22/04

Added five new banking regions

Memphis, South Carolina, Triad,

Triangle, Mecklenburg) 7/19/04

NCF Consumer and Small

Business checking product rolled

out to SunTrust legacy footprint

Established and communicated

management positions:

Group LOBs

Region Presidents

Region LOBs

Market Presidents

Group Functional support

Commercial Team leads

Region Credit and Marketing

Operations unit managers

All revenue producing

relationships

Legal Closing

10/1/04

Procurement rollout 10/6/04

(anticipate $10MM in savings

by 2006)

Divestiture of deposits of $65

million and 3 branches

12/10/04

Migration to common pricing

begins (anticipate $25MM

incremental revenue by

2006)

Mitigation plans developed

for all customer and

employee impacts

Network connectivity and

infrastructure

Sequenced

Systems

Conversions

Begins

Completed Systems

Conversions:

Fixed Assets

Treasury

PCS Brokerage &

Insurance

Payroll/Benefits

Accounts Payable

Officer Knowledge

General Ledger

Non-Systems

Conversion

Begins

NCF ATM/Debit

Card Release

Buddy Bankers

Onsite

Store signage

installation

Complete Core

conversion

Trust Conversion

Bank Operations

Standard

Operational

Authorities

implementation

Branch consolidations

begin 4/22/05

Data center consolidation

3Q04

4Q04

1Q05

2Q05

3Q05

Ongoing Employee

Communications

FOCUSED ON RETAINING CUSTOMERS

Three-phase customer analysis

identifying effects of integration

on the customer so mitigation

activities can be planned to

promote retention and client

satisfaction

Phase I complete – over

one million households

analyzed with 80%

showing minimal or no

impact.

Phases II and III include

additional analysis, action

plan development and

special analysis in support

of conversion weekend

Comprehensive

communications program

designed to inform customers

of merger-related events or

changes.

Recent customer mailings:

Over one million

welcome letters

Securities letters and

other early conversion

communications

Upcoming major mailings

include:

Branch consolidations

Product/pricing letters

in March

Customer remediation plans

include phone follow-up,

employee communication,

training, and scripting.

Retention teams in all LOBs

are developing programs based

on results of the customers

profile analysis.

A Service Quality Excellence

Scorecard is produced monthly

that monitors 49 key service

measures across all lines of

business and major corporate

functions.

Activities scheduled in

planned waves

Special promotions

Sales opportunities

Client retention tracking

underway; will continue for

12-month period

Examples of key measures:

Telephone banking

average speed of

answer (ASA)

ATM availability

Mortgage client

satisfaction survey

scores

Action plans are in place to

ensure service quality is

maintained in all critical

areas

Customer Impact

Assessment

Communications

Retention

Implementation

Measurement and

Monitoring

BUILDING WITH PROVEN TALENT

Key Accomplishments

Key NCF Managers named in combined organization:

Bill Reed, former CEO of NCF, named vice chairman and head of Geographic

Banking(Florida, Central, Mid Atlantic, and the Carolinas) and Sales Administration.

Richard Furr, former chief operating officer at NCF, was named chairman, president and

CEO of the Carolinas Group.

Scott Edwards, former NCF chief administrative officer, was named Carolinas Group

credit officer

David Popwell, former executive vice president for Financial Enterprises at NCF, was

named chairman and CEO of the Memphis Region and Executive for specialty

businesses.

Integrated NCF organizational structure, major business lines and support functions into the

overall SunTrust organization.

Placed more than 160 NCF managers within in a geography, a business line or a support area

Mapped all NCF revenue producers to SunTrust position (over 3,200 positions)

Guaranteed positions to all branch personnel.

Created an Employee Experience team comprised of NCF and STI employees across lines of

business, functions and geographies focused on employee communications, retention, morale,

and merger readiness.

TRANSLATING POTENTIAL INTO PERFORMANCE

Potential

Revenue and earnings momentum

Industry-leading credit quality

Strong LOB & sales results

Performance

High growth geographic footprint

Distinctive operating model

Sales and revenue focus

Investments for the future

APPENDIX

SunTrust presents a return on average assets and return on average realized equity which exclude realized and unrealized securities gains/losses and dividends from The Coca-

Cola Company. The foregoing numbers reflect primarily adjustments to remove the effects of the Company's securities portfolio which includes the ownership by the Company of

48.3 million shares of The Coca-Cola Company. The Company uses this information internally to gauge its actual performance in the industry. The Company believes that the

return on average assets less the net unrealized securities gains is more indicative of the Company's return on assets because it more accurately reflects the return on the assets

that are related to the Company's core businesses which are primarily customer relationship and customer transaction driven. The Company also believes that the return on

average realized equity is more indicative of the Company's return on equity because the excluded equity relates primarily to a long term holding of a specific security

Annualized

SunTrust presents selected financial data on an operating basis that excludes merger charges. The Company believes the exclusion of the merger charges, which represent

incremental costs to integrate NCF’s operations, is more reflective of normalized operations

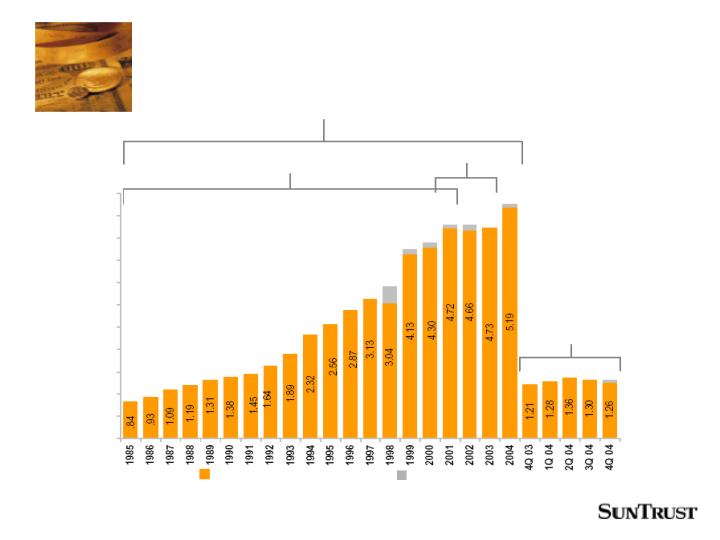

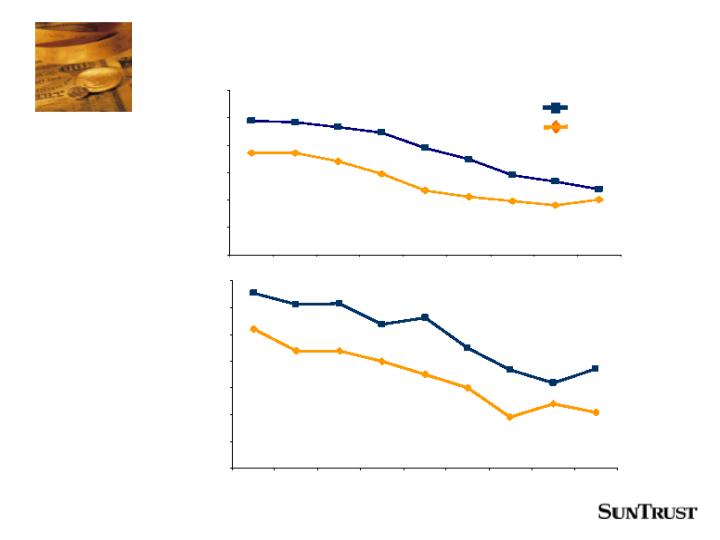

EARNINGS MOMENTUM

(442) b.p.

(348) b.p.

16.02

16.96

12.54

Return on Avg.

Realized Equity(1)

(275) b.p.

(247) b.p.

(322)b.p.

(294) b.p.

14.40

14.68

11.46

Return on Avg. Equity

flat

14 b.p.

1.04

1.18

1.18

Return on Avg. Assets less net

realized securities gains(1)

5 b.p.

11 b.p.

1 b.p.

7 b.p.

1.09

1.15

1.16

Return on Avg. Assets

3%(2)

8%

(12)%(2)

4%

1.21

1.30

1.26

Earnings per Share

114%(2)

38%

94%(2)

33%

$342.5

$368.8

$455.7

Net Income

4Q04 : 3Q04

Sequential

Change(3)

4Q04 : 4Q03

Change(3)

4Q04 : 3Q04

Sequential

Change

4Q04 : 4Q03

Change

4Q 2003

3Q 2004

4Q 2004

($ in millions except per share data)

(1)

(3)

(2)

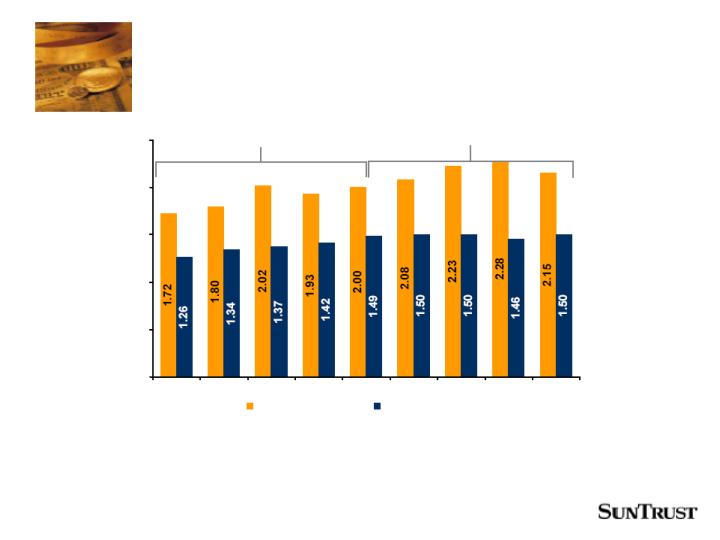

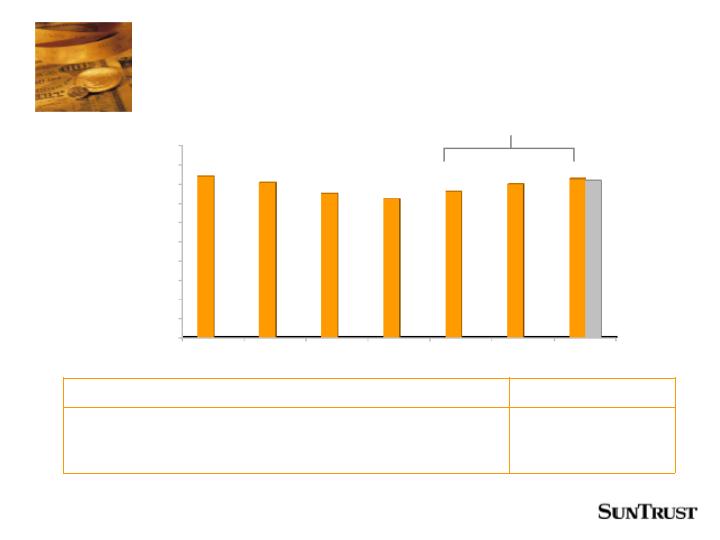

FEE INCOME GROWTH

Estimated Historical

Combined(1)

4%

10%

78%

30%

273.6

298.3

356.8

Deposits and Other Fees

79%

12%

161%

32%

120.1

113.3

159.9

Broker Dealer Revenue

(12)%

10%

29%

24%

$129.6

$149.7

$160.5

Trust and Investment Mgmt.

4Q04:3Q04

(Annualized)

4Q2004:

4Q2003

4Q04:3Q04

(Annualized)

4Q2004:

4Q2003

4Q 2003

3Q 2004

4Q 2004

($ in millions)

Fee income growth momentum continuing

(1) See appendix for reconciliations

LOAN GROWTH

Driven by targeted sales initiatives

($ in millions)

8%

8%

78%

26/30%

79,370.1

83,753.2

100,137.5

Total Loans

28%

32%

135%

63%

6,740.7

8,238.6

11,016.4

Real Estate Equity

(3)%

4%

90%

28%

12,035.0

12,549.7

15,368.5

Consumer

(10)%

3%

8,435.0

8,882.9

8,661.6

Indirect

332%

86%

3,600.0

3,666.8

6,706.9

Direct

10%

24%

34%

31%

17,117.4

20,722.7

22,461.0

Mortgages

11%

7%

125%

36%

13,650.9

14,169.7

18,601.8

RE Comm. &Const

366%

108%

4,364.4

4,727.8

9,054.6

RE Construction

5%

3%

9,286.5

9,441.9

9,547.2

RE Commercial

5%

(3)%

66%

10/19%

$29,289.1

$27,630.5

$32,223.1

Commercial

4Q04:3Q04

(Annualized)

4Q2004:

4Q2003

4Q04:3Q04

(Annualized)

4Q2004:

4Q2003

4Q 2003

3Q 2004

4Q 2004

(1)

See appendix for reconciliations

(2)

The addition of direct and indirect

(3)

Higher growth rate adjusted for consolidation of Three Pillars

(3)

(2)

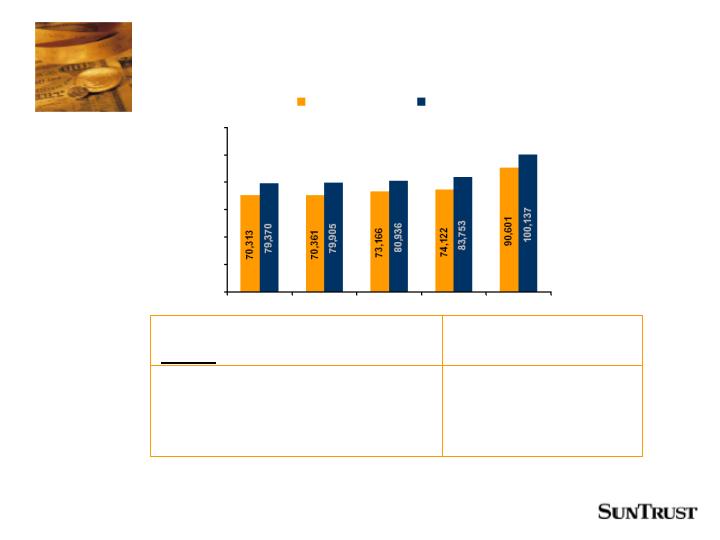

CUSTOMER DEPOSIT GROWTH

($ in millions)

13%

14%

82%

33%

36,937.3

40,914.4

49,261.7

Total low cost

deposits(2)

12%

8%

89%

29%

70,312.6

74,121.8

90,601.4

TOTAL(1)

21%

4%

225%

52%

11,101.5

10,773.0

16,832.7

CDs

(42)%

2%

39%

30%

6,248.9

7,424.7

8,139.3

SAV

5%

1%

37%

10%

22,273.8

22,434.4

24,507.0

MMA

42%

20%

121%

40%

12,102.3

12,999.5

16,940.7

NOW

16%

14%

72%

30%

$18,586.1

$20,490.2

$24,181.7

DDA

4Q04:3Q04

(Annualized)

4Q2004:

4Q2003

4Q04:3Q04

(Annualized)

4Q2004:

4Q2003

4Q 2003

3Q 2004

4Q 2004

Estimated Historical Combined(3)

(1)

Average quarterly Consumer and Commercial Deposits (excludes Broker & Foreign Deposits)

(2)

Total of DDA, NOW, Savings

(3)

See appendix for reconciliations

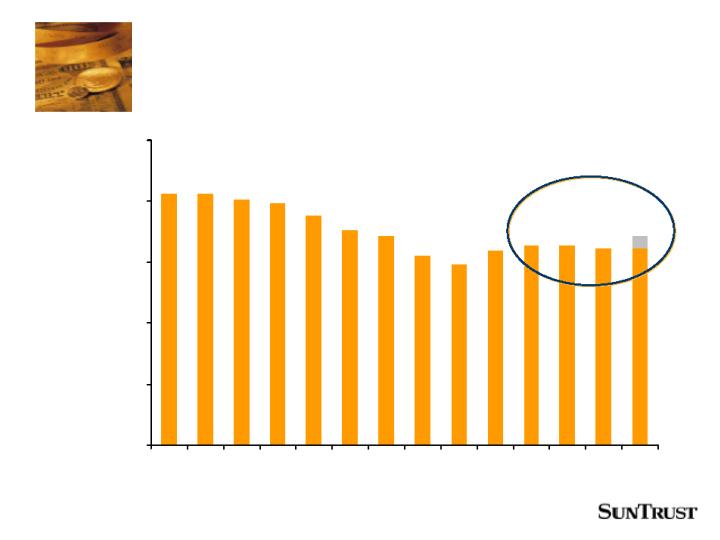

STRONG CREDIT QUALITY

3.4

4.0

6.0

4.4

4.9

Allowance to Charge-

offs (Years Coverage)

268.1%

309.7%

299.7%

315.7%

281.3%

Allowance to Non-

performing loans

$941,922

$936,972

$902,243

$892,974

$1,050,024

Allowance for loan

losses

0.47%

0.42%

0.39%

0.36%

0.40%

NPAs to

Loans/OREO/Other repo

$378,097

$331,912

$324,420

$304,216

$410,658

NPAs

0.35%

0.30%

0.19%

0.24%

0.21%

Net Charge-offs to Avg.

Loans

$69,787

$58,787

$37,556

$51,043

$53,893

Net Charge-offs

4Q2003

1Q2004

2Q2004

3Q2004

4Q2004

($ in thousands)

Average Diluted Shares

Outstanding

Fee Income excluding securities

gains and losses

Fee Income excluding securities

RECONCILIATIONS APPENDIX

1,879,268

1,539,580

1,516,779

1,454,063

1,442,072

1,387,768

1,375,969

1,338,633

1,325,518

Core Revenue*

19,377

18,193

9,048

(4,927)

(19,501)

(31,098)

(31,238)

(42,039)

(39,547)

Securities losses/(gains)

1,859,891

1,521,387

1,507,731

1,458,990

1,461,573

1,418,866

1,407,207

1,380,672

1,365,065

Total Revenue

1,100,888

893,695

885,066

863,904

877,501

844,388

810,415

833,013

837,341

Net Interest Income-FTE

16,684

16,821

12,637

12,256

11,981

11,588

10,902

10,543

10,240

FTE adjustment

778,380

645,885

631,713

590,159

564,571

543,380

565,554

505,620

488,177

19,377

18,193

9,048

(4,927)

(19,501)

(31,098)

(31,238)

(42,039)

(39,547)

Securities losses/(gains)

759,003

627,692

622,665

595,086

584,072

574,478

596,792

547,659

527,724

Fee Income

1,084,204

876,874

872,429

851,648

865,520

832,800

799,513

822,470

827,101

Net Interest Income

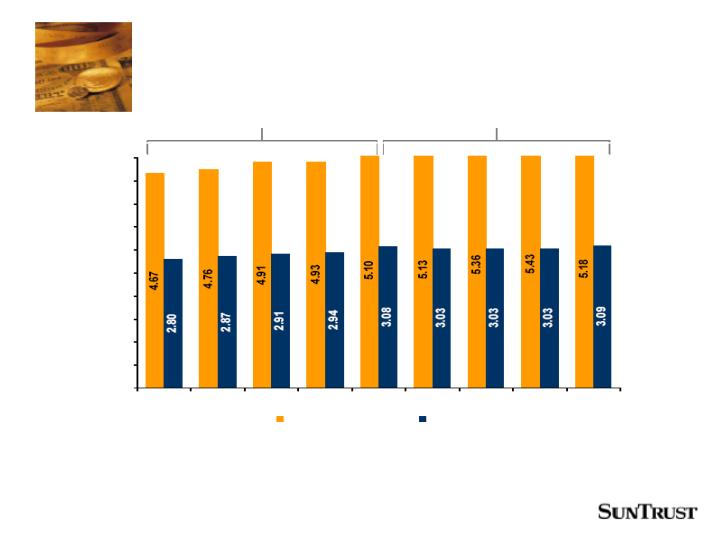

5.18

5.43

5.36

5.13

5.10

4.93

4.91

4.76

4.67

Core Revenue Per Share

362,661

283,502

283,116

283,523

282,537

281,567

280,287

281,330

283,595

1,879,268

1,539,580

1,516,779

1,454,063

1,442,072

1,387,768

1,375,969

1,338,633

1,325,518

Core Revenue*

1,100,888

893,695

885,066

863,904

877,501

844,388

810,415

833,013

837,341

Net Interest Income-FTE

$778,380

$645,885

$631,713

$590,159

$564,571

$543,380

$565,554

$505,620

$488,177

4Q 04

3Q 04

2Q 04

1Q 04

4Q 03

3Q 03

2Q 03

1Q 03

4Q 02

(Dollars and shares in thousands except per share amounts)

* Also known as total revenue excluding securities gains and losses

gains and losses

RECONCILIATIONS APPENDIX

* Also known as total revenue excluding securities gains and losses

6,389.7

5,544.4

5,347.5

5,192.2

4,915.4

4,923.0

4,619.2

Core Revenue*

6,389.7

5,544.4

5,347.5

5,192.2

4,915.4

4,923.0

4,619.2

Core Revenue*

41.7

(123.9)

(204.5)

(153.1)

(6.6)

109.1

(8.2)

Securities losses/(gains)

6,348.0

5,668.3

5,552.0

5,345.3

4,922.0

4,813.9

4,627.4

Total Revenue

58.4

45.0

39.5

40.8

39.9

42.5

44.4

FTE Adjustment

3,685.2

3,320.3

3,243.7

3,252.6

3,108.5

3,145.5

2,929.1

Net Interest Income

41.7

(123.9)

(204.5)

(153.1)

(6.6)

109.1

(8.2)

Securities losses/(gains)

$2,604.4

$2,303.0

$2,268.8

$2,051.9

$1,773.6

$1,625.9

$1,653.9

Fee Income

2004

2003

2002

2001

2000

1999

1998

(Dollars in millions)

RECONCILIATIONS APPENDIX

Quarter - to - Quarter Comparison | | | YTD Comparison | | |

| | 4th Quarter

2004 | | | 3rd Quarter

2004 | | | 2nd Quarter

2004 | | | 1st Quarter

2004 | | | 4th Quarter

2003 | | | | December 31 | | |

2004 | | | | 2003 |

NON-GAAP MEASURES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Dollars in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 455,729 | | | $ | 368,766 | | | $ | 386,571 | | | $ | 361,835 | | | $ | 342,507 | | | $ | 1,572,901 | | | $ | 1,332,297 | | |

Securities losses/(gains), net of tax | | | 12,595 | | | | 11,825 | | | | 5,881 | | | | (3,203 | ) | | | (12,676 | ) | | | 27,099 | | | | (80,519 | ) | |

Net income excluding securities gains and losses | | | 468,324 | | | | 380,591 | | | | 392,452 | | | | 358,632 | | | | 329,831 | | | | 1,600,000 | | | | 1,251,778 | | |

The Coca-Cola Company dividend, net of tax | | | (10,739 | ) | | | (10,740 | ) | | | (10,739 | ) | | | (10,740 | ) | | | (9,451 | ) | | | (42,957 | ) | | | (37,803 | ) | |

Net income excluding securities gains and losses and The Coca-Cola Company dividend | | $ | 457,585 | | | $ | 369,851 | | | $ | 381,713 | | | $ | 347,892 | | | $ | 320,380 | | | $ | 1,557,043 | | | $ | 1,213,975 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total average assets | | $ | 156,570,092 | | | $ | 127,127,968 | | | $ | 127,287,458 | | | $ | 123,853,747 | | | $ | 124,756,099 | | | $ | 133,754,293 | | | $ | 122,325,361 | | |

Average net unrealized securities gains | | | (2,056,737 | ) | | | (2,054,978 | ) | | | (2,803,917 | ) | | | (2,580,304 | ) | | | (2,363,948 | ) | | | (2,372,246 | ) | | | (2,343,015 | ) | |

Average assets less net unrealized securities gains | | $ | 154,513,355 | | | $ | 125,072,990 | | | $ | 124,483,541 | | | $ | 121,273,443 | | | $ | 122,392,151 | | | $ | 131,382,047 | | | $ | 119,982,346 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total average equity | | $ | 15,818,968 | | | $ | 9,992,905 | | | $ | 10,194,201 | | | $ | 9,840,282 | | | $ | 9,435,794 | | | $ | 11,469,482 | | | $ | 9,083,026 | | |

Average other comprehensive income | | | (1,304,553 | ) | | | (1,318,332 | ) | | | (1,804,833 | ) | | | (1,645,712 | ) | | | (1,503,355 | ) | | | (1,517,227 | ) | | | (1,486,125 | ) | |

Total average realized equity | | $ | 14,514,415 | | | $ | 8,674,573 | | | $ | 8,389,368 | | | $ | 8,194,570 | | | $ | 7,932,439 | | | $ | 9,952,255 | | | $ | 7,596,901 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Return on average total assets | | | 1.16 | | % | | 1.15 | | % | | 1.22 | | % | | 1.18 | | % | | 1.09 | | % | | 1.18 | | % | | 1.09 | | % |

Impact of excluding net realized and unrealized securities gains/losses and The Coca-Cola Company dividend | | | 0.02 | | | | 0.03 | | | | 0.01 | | | | (0.03 | ) | | | (0.05 | ) | | | 0.01 | | | | (0.08 | ) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Return on average total assets less net realized and unrealized securities gains/losses and The Coca-Cola Company dividend1 | | | 1.18 | | % | | 1.18 | | % | | 1.23 | | % | | 1.15 | | % | | 1.04 | | % | | 1.19 | | % | | 1.01 | | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Return on average total shareholders’ equity | | | 11.46 | | % | | 14.68 | | % | | 15.25 | | % | | 14.79 | | % | | 14.40 | | % | | 13.71 | | % | | 14.67 | | % |

Impact of excluding net unrealized securities gains | | | 1.08 | | | | 2.28 | | | | 3.05 | | | | 2.28 | | | | 1.62 | | | | 1.94 | | | | 1.31 | | |

Return on average realized shareholders’ equity2 | | | 12.54 | | % | | 16.96 | | % | | 18.30 | | % | | 17.07 | | % | | 16.02 | | % | | 15.65 | | % | | 15.98 | | % |

Net interest income | | $ | 1,084,204 | | | $ | 876,874 | | | $ | 872,429 | | | $ | 851,648 | | | $ | 865,520 | | | $ | 3,685,155 | | | $ | 3,320,303 | | |

FTE adjustment | | | 16,684 | | | | 16,821 | | | | 12,637 | | | | 12,256 | | | | 11,981 | | | | 58,398 | | | | 45,014 | | |

Net interest income - FTE | | | 1,100,888 | | | | 893,695 | | | | 885,066 | | | | 863,904 | | | | 877,501 | | | | 3,743,553 | | | | 3,365,317 | | |

Noninterest income | | | 759,003 | | | | 627,692 | | | | 622,665 | | | | 595,086 | | | | 584,072 | | | | 2,604,446 | | | | 2,303,001 | | |

Total revenue | | | 1,859,891 | | | | 1,521,387 | | | | 1,507,731 | | | | 1,458,990 | | | | 1,461,573 | | | | 6,347,999 | | | | 5,668,318 | | |

Securities losses/(gains) | | | 19,377 | | | | 18,193 | | | | 9,048 | | | | (4,927 | ) | | | (19,501 | ) | | | 41,691 | | | | (123,876 | ) | |

Total revenue excluding securities gains and losses | | $ | 1,879,268 | | | $ | 1,539,580 | | | $ | 1,516,779 | | | $ | 1,454,063 | | | $ | 1,442,072 | | | $ | 6,389,690 | | | $ | 5,544,442 | | |

1 | Computed by dividing annualized net income, excluding securities gains/losses and The Coca-Cola Company dividend, by average assets less net unrealized securities gains. |

2 | Computed by dividing annualized net income, excluding securities gains/losses and The Coca-Cola Company dividend, by average realized shareholders’ equity. |

RECONCILIATIONS APPENDIX

| | 4th Quarter

2004 | | | | YTD

December 31

2004 | | |

SELECTED NON-GAAP OPERATING MEASURES3 | | | | | | | | | | | | |

(Dollars in thousands) | | | | | | | | | | | | |

| | | | | | | | | | | | |

Net income | | | $ | 455,729 | | | | | $ | 1,572,901 | | |

Merger expense, net of tax | | | | 18,461 | | | | | | 18,461 | | |

Operating net income | | | | 474,190 | | | | | | 1,591,362 | | |

Securities losses/(gains), net of tax | | | | 12,595 | | | | | | 27,099 | | |

The Coca-Cola Company dividend, net of tax | | | | (10,739 | ) | | | | | (42,957 | ) | |

Operating net income excluding securities gains/ | | | | | | | | | | | | |

losses and The Coca-Cola Company dividend | | | $ | 476,046 | | | | | $ | 1,575,504 | | |

| | | | | | | | | | | | |

Noninterest expense | | | $ | 1,148,992 | | | | | $ | 3,897,038 | | |

Merger expense | | | | (28,401 | ) | | | | | (28,401 | ) | |

Noninterest expense excluding merger expense | | | $ | 1,120,591 | | | | | $ | 3,868,637 | | |

| | | | | | | | | | | | |

Return on average total assets | | | | 1.16 | | % | | | | 1.18 | | % |

Impact of excluding merger expense | | | | 0.04 | | | | | | 0.01 | | |

Operating return on average total assets4 | | | | 1.20 | | % | | | | 1.19 | | % |

| | | | | | | | | | | | |

Return on average total shareholders’ equity | | | | 11.46 | | % | | | | 13.71 | | % |

Impact of excluding merger expense | | | | 0.47 | | | | | | 0.16 | | |

Operating return on average total shareholders’ equity5 | | | | 11.93 | | % | | | | 13.87 | | % |

| | | | | | | | | | | | |

Efficiency ratio | | | | 61.78 | | % | | | | 61.39 | | % |

Impact of excluding merger expense | | | | (1.53 | ) | | | | | (0.45 | ) | |

Operating efficiency ratio | | | | 60.25 | | % | | | | 60.94 | | % |

| | | | | | | | | | | | |

Diluted earnings per share | | | $ | 1.26 | | | | | $ | 5.19 | | |

Impact of excluding merger expense | | | | 0.05 | | | | | | 0.06 | | |

Operating diluted earnings per share | | | $ | 1.31 | | | | | $ | 5.25 | | |

| 3 | SunTrust presents selected financial data on an operating basis that excludes merger charges. The Company believes the exclusion of the merger charges, which represent incremental costs to integrate NCF's operations, is more reflective of normalized operations. |

| 4 | Computed by dividing annualized operating net income by average total assets. |

| 5 | Computed by dividing annualized operating net income by average total shareholders' equity. |

RECONCILIATIONS APPENDIX

Quarter - to - Quarter Comparison |

| | | 4th Quarter

2004 | | | | 4th Quarter

2003 | | | Change

% | |

| NON-GAAP DISCLOSURES FOR IMPACTS OF THREE | | | | | | | | | | | | |

| PILLARS1 | | | | | | | | | | | | |

| (Dollars in millions) | | | | | | | | | | | | |

| Average loans - reported | | $ | 100,137 | | | | $ | 79,370 | | | 26.2 | |

| Impact of Three Pillars | | | - | | | | | (2,243 | ) | | | |

| Average loans excluding Three Pillars | | $ | 100,137 | | | | $ | 77,127 | | | 29.8 | |

| Average earning assets - reported | | $ | 136,450 | | | | $ | 112,730 | | | 21.0 | |

| Impact of Three Pillars | | | - | | | | | (2,699 | ) | | | |

| Average earning assets excluding Three Pillars | | $ | 136,450 | | | | $ | 110,031 | | | 24.0 | |

| Average commercial loans - reported | | $ | 32,223 | | | | $ | 29,289 | | | 10.0 | |

| Impact of Three Pillars | | | - | | | | | (2,243 | ) | | | |

| Average commercial loans excluding Three Pillars | | $ | 32,223 | | | | $ | 27,046 | | | 19.1 | |

| Average commercial loan yield - reported | | | 4.45 | | % | | | 3.58 | | % | 24.3 | |

| Impact of Three Pillars | | | - | | | | | 0.11 | | | | |

| Average commercial loan yield excluding Three Pillars | | | 4.45 | | % | | | 3.69 | | % | 20.6 | |

| Net interest margin - reported | | | 3.21 | | % | | | 3.09 | | % | 3.9 | |

| Impact of Three Pillars | | | - | | | | | 0.06 | | | | |

| Net interest margin excluding Three Pillars | | | 3.21 | | % | | | 3.15 | | % | 1.9 | |

Quarter - to - Quarter Comparison |

| | 4th Quarter

2004 | | 3rd Quarter

2004 | | Change %2 | | | 4th Quarter

2004 | | | 4th Quarter

2004 | | Change % |

REVENUE GROWTH RATE | | | | | | | | | | | | | | | | |

(Dollars in thousands) | | | | | | | | | | | | | | | | |

Total revenue excluding securities gains and losses | | $ | 1,879,268 | | $ | 1,539,580 | | 22.1 | | $ | 1,879,268 | | $ | 1,442,072 | | 30.3 |

AVERAGE LOW COST CONSUMER AND COMMERCIAL DEPOSIT RECONCILEMENT | | | | | | | | | | | | | |

(Dollars in thousands) | | | | | | | | | | | | | | | | |

Demand deposits | | $ | 24,181,729 | | $ | 20,490,191 | | 18.0 | | $ | 24,181,729 | | $ | 18,586,159 | | 30.1 |

NOW accounts | | | 16,940,751 | | | 12,999,444 | | 30.3 | | | 16,940,751 | | | 12,102,292 | | 40.0 |

Savings | | | 8,139,263 | | | 7,424,698 | | 9.6 | | | 8,139,263 | | | 6,248,917 | | 30.3 |

Total average low cost consumer and commercial deposits | | $ | 49,261,743 | | $ | 40,914,333 | | 20.4 | | $ | 49,261,743 | | $ | 36,937,368 | | 33.4 |

| 1 | Under the provisions of FASB Interpretation No. 46, SunTrust consolidated its commercial paper conduit, Three Pillars, effective July 1, 2003.

As of March 1, 2004, Three Pillars was restructured and deconsolidated. Adjustments were made to reported figures for comparability purposes. |

| 2 | Multiply by 4 to calculate sequential annualized growth or reductions discussed in the earnings call. |

RECONCILIATIONS APPENDIX

| | Quarter - to - Quarter Comparison | | Quarter - to - Quarter Comparison | |

| | 4th Quarter

2004 | | 3rd Quarter

2004 | | Increase/(Decrease) | | 4th Quarter

2004 | | 4th Quarter

2003 | | Increase/(Decrease) | |

| | | | Amount | | % | | | Amount | | % | |

| | | | | | | | | | | | | | | | | | | | | | | |

STATEMENTS OF INCOME (Dollars in thousands) | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

NET INTEREST INCOME | | $ | 1,084,204 | | $ | 1,071,689 | | $ | 12,515 | | 1.2 | %4 | $ | 1,084,204 | | $ | 1,060,948 | | $ | 23,256 | | 2.2 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Provision for loan losses | | | 37,099 | | | 60,818 | | | (23,719) | | (39.0 | ) | | 37,099 | | | 82,668 | | | (45,569) | | (55.1 | ) |

NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES | | | 1,047,105 | | | 1,010,871 | | | 36,234 | | 3.6 | | | 1,047,105 | | | 978,280 | | | 68,825 | | 7.0 | |

| | | | | | | | | | | | | | | | | | | | | | | |

NONINTEREST INCOME | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Deposit and other fees1 | | | 356,777 | | | 353,573 | | | 3,204 | | 0.9 | | | 356,777 | | | 323,081 | | | 33,696 | | 10.4 | |

Trust and investment management income | | | 160,526 | | | 165,603 | | | (5,077) | | (3.1 | ) | | 160,526 | | | 145,856 | | | 14,670 | | 10.1 | |

Broker / dealer revenue2 | | | 158,888 | | | 132,650 | | | 26,238 | | 19.8 | | | 158,888 | | | 141,677 | | | 17,211 | | 12.1 | |

Other noninterest income | | | 102,189 | | | 106,550 | | | (4,361) | | (4.1 | ) | | 102,189 | | | 62,324 | | | 39,865 | | 64.0 | |

Noninterest income before securities (losses)/gains | | | 778,380 | | | 758,376 | | | 20,004 | | 2.6 | | | 778,380 | | | 672,938 | | | 105,442 | | 15.7 | |

Securities (losses)/gains | | | (19,377) | | | (16,565) | | | (2,812) | | (17.0 | ) | | (19,377) | | | 22,839 | | | (42,216) | | (184.8 | ) |

Total noninterest income | | | 759,003 | | | 741,811 | | | 17,192 | | 2.3 | | | 759,003 | | | 695,777 | | | 63,226 | | 9.1 | |

| | | | | | | | | | | | | | | | | | | | | | | |

NONINTEREST EXPENSE | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Personnel expense | | | 612,861 | | | 605,325 | | | 7,536 | | 1.2 | | | 612,861 | | | 591,575 | | | 21,286 | | 3.6 | |

Net occupancy expense | | | 78,218 | | | 79,875 | | | (1,657) | | (2.1 | ) | | 78,218 | | | 73,766 | | | 4,452 | | 6.0 | |

Outside processing and software | | | 81,368 | | | 75,449 | | | 5,919 | | 7.8 | | | 81,368 | | | 69,871 | | | 11,497 | | 16.5 | |

Equipment expense | | | 50,765 | | | 50,904 | | | (139) | | (0.3 | ) | | 50,765 | | | 52,926 | | | (2,161) | | (4.1 | ) |

Marketing and customer development | | | 34,389 | | | 34,975 | | | (586) | | (1.7 | ) | | 34,389 | | | 27,574 | | | 6,815 | | 24.7 | |

Other noninterest expense | | | 231,231 | | | 242,693 | | | (11,462) | | (4.7 | ) | | 231,231 | | | 200,602 | | | 30,629 | | 15.3 | |

Noninterest expense before amortization of intangible assets and merger expense | | | 1,088,832 | | | 1,089,221 | | | (389) | | (0.0 | ) | | 1,088,832 | | | 1,016,314 | | | 72,518 | | 7.1 | |

Amortization of intangible assets | | | 31,759 | | | 28,132 | | | 3,627 | | 12.9 | | | 31,759 | | | 30,716 | | | 1,043 | | 3.4 | |

Merger expense | | | 28,401 | | | - | | | 28,401 | | 100.0 | | | 28,401 | | | - | | | 28,401 | | 100.0 | |

Total noninterest expense | | | 1,148,992 | | | 1,117,353 | | | 31,639 | | 2.8 | | | 1,148,992 | | | 1,047,030 | | | 101,962 | | 9.7 | |

| | | | | | | | | | | | | | | | | | | | | | | |

INCOME BEFORE INCOME TAXES | | | 657,116 | | | 635,329 | | | 21,787 | | 3.4 | | | 657,116 | | | 627,027 | | | 30,089 | | 4.8 | |

Provision for income taxes | | | 201,387 | | | 198,926 | | | 2,461 | | 1.2 | | | 201,387 | | | 195,019 | | | 6,368 | | 3.3 | |

NET INCOME FROM CONTINUING OPERATIONS | | | 455,729 | | | 436,403 | | | 19,326 | | 4.4 | | | 455,729 | | | 432,008 | | | 23,721 | | 5.5 | |

Income from discontinued operations, net of tax | | | - | | | - | | | - | | - | | | - | | | 767 | | | (767) | | (100.0 | ) |

NET INCOME | | | 455,729 | | | 436,403 | | | 19,326 | | 4.4 | | | 455,729 | | | 432,775 | | | 22,954 | | 5.3 | |

Merger expense, net of tax | | | 18,461 | | | - | | | 18,461 | | 100.0 | | | 18,461 | | | - | | | 18,461 | | 100.0 | |

OPERATING NET INCOME | | $ | 474,190 | | $ | 436,403 | | $ | 37,787 | | 8.7 | % | $ | 474,190 | | $ | 432,775 | | $ | 41,415 | | 9.6 | |

| | | | | | | | | | | | | | | | | | | | | | | |

REVENUE (Dollars in thousands) | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | $ | 1,084,204 | | $ | 1,071,689 | | $ | 12,515 | | 1.2 | % | $ | 1,084,204 | | $ | 1,060,948 | | $ | 23,256 | | 2.2 | |

FTE adjustment3 | | | 16,684 | | | 19,063 | | | (2,379) | | (12.5 | ) | | 16,684 | | | 14,027 | | | 2,657 | | 18.9 | |

Net interest income – FTE | | | 1,100,888 | | | 1,090,752 | | | 10,136 | | 0.9 | | | 1,100,888 | | | 1,074,975 | | | 25,913 | | 2.4 | |

Noninterest income | | | 759,003 | | | 741,811 | | | 17,192 | | 2.3 | | | 759,003 | | | 695,777 | | | 63,226 | | 9.1 | |

Total revenue | | | 1,859,891 | | | 1,832,563 | | | 27,328 | | 1.5 | | | 1,859,891 | | | 1,770,752 | | | 89,139 | | 5.0 | |

Securities losses/(gains) | | | 19,377 | | | 16,565 | | | 2,812 | | 17.0 | | | 19,377 | | | (22,839) | | | 42,216 | | 184.8 | |

Total revenue excluding securities gains and losses | | $ | 1,879,268 | | $ | 1,849,128 | | $ | 30,140 | | 1.6 | % | $ | 1,879,268 | | $ | 1,747,913 | | $ | 131,355 | | 7.5 | |

1 | Includes service charges on deposit, cards and other charges and fees. |

| 2 | Includes retail investment services, investment banking income and trading account profits and commissions. |

| 3 | NCF's FTE adjustments where reduced $4,001 from the third quarter 2004 and $4,917 from the fourth quarter of 2003 to confirm to SunTrust's methodology. |

| 4 | Multiply by 4 to calculate sequential annualized growth or reductions |

RECONCILIATIONS APPENDIX

| | Quarter - to - Quarter Comparison | | Quarter - to - Quarter Comparison | |

| | 4th Quarter

2004 | | 3rd Quarter

2004 | | Increase/(Decrease) | | 4th Quarter

2004 | | 4th Quarter

2003 | | Increase/(Decrease) | |

| | | Amount | | % | | | | Amount | | % | |

SELECTED AVERAGE BALANCES (Dollars in millions) | | | | | | | | | | | | | | | | | | | | | | | |

Average Loans4 | | | | | | | | | | | | | | | | | | | | | | | |

Commercial5 | | $ | 32,343 | | $ | 31,977 | | $ | 366 | | 1.1 | %7 | $ | 32,343 | | $ | 33,344 | | $ | (1,001 | ) | (3.0) | % |

Real estate 1-4 family | | | 22,535 | | | 21,963 | | | 572 | | 2.6 | | | 22,535 | | | 18,213 | | | 4,322 | | 23.7 | |

Real estate commercial and construction | | | 18,660 | | | 18,155 | | | 505 | | 2.8 | | | 18,660 | | | 17,489 | | | 1,171 | | 6.7 | |

Real estate equity | | | 11,016 | | | 10,295 | | | 721 | | 7.0 | | | 11,016 | | | 8,350 | | | 2,666 | | 31.9 | |

Consumer6 | | | 15,390 | | | 15,520 | | | (130 | ) | (0.8 | ) | | 15,390 | | | 14,812 | | | 578 | | 3.9 | |

Credit cards | | | 193 | | | 175 | | | 18 | | 10.3 | | | 193 | | | 155 | | | 38 | | 24.5 | |

Total loans | | $ | 100,137 | | $ | 98,085 | | $ | 2,052 | | 2.1 | % | $ | 100,137 | | $ | 92,363 | | $ | 7,774 | | 8.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Average deposits | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest bearing deposits | | $ | 24,182 | | $ | 23,239 | | $ | 943 | | 4.1 | % | $ | 24,182 | | $ | 21,141 | | $ | 3,041 | | 14.4 | % |

NOW accounts | | | 16,941 | | | 15,335 | | | 1,606 | | 10.5 | | | 16,941 | | | 14,139 | | | 2,802 | | 19.8 | |

Money market accounts | | | 24,507 | | | 24,211 | | | 296 | | 1.2 | | | 24,507 | | | 24,304 | | | 203 | | 0.8 | |

Savings | | | 8,139 | | | 9,099 | | | (960 | ) | (10.6 | ) | | 8,139 | | | 7,982 | | | 157 | | 2.0 | |

Consumer time | | | 12,084 | | | 11,882 | | | 202 | | 1.7 | | | 12,084 | | | 12,390 | | | (306 | ) | (2.5 | ) |

Other time | | | 4,748 | | | 4,112 | | | 636 | | 15.5 | | | 4,748 | | | 3,833 | | | 915 | | 23.9 | |

Total consumer and commercial deposits | | | 90,601 | | | 87,878 | | | 2,723 | | 3.1 | | | 90,601 | | | 83,789 | | | 6,812 | | 8.1 | |

Brokered and foreign deposits | | | 10,671 | | | 11,496 | | | (825 | ) | (7.2 | ) | | 10,671 | | | 12,645 | | | (1,974 | ) | (15.6 | ) |

Total deposits | | $ | 101,272 | | $ | 99,374 | | $ | 1,898 | | 1.9 | % | $ | 101,272 | | $ | 96,434 | | $ | 4,838 | | 5.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

SELECTED CREDIT DATA (Dollars in thousands) | | | | | | | | | | | | | | | | | | | | | | | |

Nonaccrual loans | | $ | 354,241 | | $ | 329,340 | | $ | 24,901 | | 7.6 | % | $ | 354,241 | | $ | 367,276 | | $ | (13,035 | ) | (3.5) | % |

Restructured loans | | | 19,049 | | | 19,724 | | | (675 | ) | (3.4 | ) | | 19,049 | | | 14,782 | | | 4,267 | | 28.9 | |

Total nonperforming loans | | | 373,290 | | | 349,064 | | | 24,226 | | 6.9 | | | 373,290 | | | 382,058 | | | (8,768 | ) | (2.3 | ) |

Other real estate owned (OREO) | | | 28,619 | | | 27,126 | | | 1,493 | | 5.5 | | | 28,619 | | | 44,654 | | | (16,035 | ) | (35.9 | ) |

Other repossessed assets | | | 8,749 | | | 15,082 | | | (6,333 | ) | (42.0 | ) | | 8,749 | | | 14,908 | | | (6,159 | ) | (41.3 | ) |

Total nonperforming assets | | $ | 410,658 | | $ | 391,272 | | $ | 19,386 | | 5.0 | % | $ | 410,658 | | $ | 441,620 | | $ | (30,962 | ) | (7.0) | % |

| 4 | SunTrust's average nonaccrual and restructured loans are included in the respective categories to conform to the NCF presentation. |

| 5 | The historical combined 4th quarter 2003 includes $2,243 related to the consolidation of SunTrust's commercial paper conduit, Three Pillars. |

| 6 | Includes consumer direct and consumer indirect loans. |

| 7 | Multiply by 4 to calculate sequential annualized growth or reductions |

RECONCILIATIONS APPENDIX

| | 3rd Quarter

2004 | | | 4th Quarter

2003 |

| | SunTrust | | | NCF | | | Historical

Combined | | | SunTrust | | | NCF | | | Historical

Combined |

STATEMENTS OF INCOME (Dollars in thousands) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

NET INTEREST INCOME | | $ | 876,874 | | | $ | 194,815 | | | $ | 1,071,689 | | | $ | 865,520 | | | $ | 195,428 | | | $ | 1,060,948 | |

Provision for loan losses | | | 41,774 | | | | 19,044 | | | | 60,818 | | | | 70,286 | | | | 12,382 | | | | 82,668 | |

NET INTEREST INCOME AFTER PROVISION

FOR LOAN LOSSES | | | 835,100 | | | | 175,771 | | | | 1,010,871 | | | | 795,234 | | | | 183,046 | | | | 978,280 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

NONINTEREST INCOME | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Deposit and other fees1 | | | 298,328 | | | | 55,245 | | | | 353,573 | | | | 273,567 | | | | 49,514 | | | | 323,081 | |

Trust and investment management income | | | 149,673 | | | | 15,930 | | | | 165,603 | | | | 129,622 | | | | 16,234 | | | | 145,856 | |

Broker / dealer revenue2 | | | 113,308 | | | | 19,342 | | | | 132,650 | | | | 120,117 | | | | 21,560 | | | | 141,677 | |

Other noninterest income | | | 84,576 | | | | 21,974 | | | | 106,550 | | | | 41,265 | | | | 21,059 | | | | 62,324 | |

Noninterest income before securities (losses)/gains | | | 645,885 | | | | 112,491 | | | | 758,376 | | | | 564,571 | | | | 108,367 | | | | 672,938 | |

Securities (losses)/gains | | | (18,193 | ) | | | 1,628 | | | | (16,565 | ) | | | 19,501 | | | | 3,338 | | | | 22,839 | |

Total noninterest income | | | 627,692 | | | | 114,119 | | | | 741,811 | | | | 584,072 | | | | 111,705 | | | | 695,777 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

NONINTEREST EXPENSE | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Personnel expense | | | 527,734 | | | | 77,591 | | | | 605,325 | | | | 516,171 | | | | 75,404 | | | | 591,575 | |

Net occupancy expense | | | 66,542 | | | | 13,333 | | | | 79,875 | | | | 60,522 | | | | 13,244 | | | | 73,766 | |

Outside processing and software | | | 68,657 | | | | 6,792 | | | | 75,449 | | | | 63,176 | | | | 6,695 | | | | 69,871 | |

Equipment expense | | | 43,275 | | | | 7,629 | | | | 50,904 | | | | 45,527 | | | | 7,399 | | | | 52,926 | |

Marketing and customer development | | | 32,028 | | | | 2,947 | | | | 34,975 | | | | 24,830 | | | | 2,744 | | | | 27,574 | |

Other noninterest expense | | | 176,020 | | | | 66,673 | | | | 242,693 | | | | 158,189 | | | | 42,413 | | | | 200,602 | |

Noninterest expense before amortization of | | | | | | | | | | | | | | | | | | | | | | | | |

intangible assets | | | 914,256 | | | | 174,965 | | | | 1,089,221 | | | | 868,415 | | | | 147,899 | | | | 1,016,314 | |

Amortization of intangible assets | | | 15,593 | | | | 12,539 | | | | 28,132 | | | | 16,379 | | | | 14,337 | | | | 30,716 | |

Total noninterest expense | | | 929,849 | | | | 187,504 | | | | 1,117,353 | | | | 884,794 | | | | 162,236 | | | | 1,047,030 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

INCOME BEFORE INCOME TAXES | | | 532,943 | | | | 102,386 | | | | 635,329 | | | | 494,512 | | | | 132,515 | | | | 627,027 | |

Provision for income taxes | | | 164,177 | | | | 34,749 | | | | 198,926 | | | | 152,005 | | | | 43,014 | | | | 195,019 | |

NET INCOME FROM CONTINUING OPERATIONS | | | 368,766 | | | | 67,637 | | | | 436,403 | | | | 342,507 | | | | 89,501 | | | | 432,008 | |

Income from discontinued operations, net of tax | | | - | | | | - | | | | - | | | | - | | | | 767 | | | | 767 | |

NET INCOME | | $ | 368,766 | | | $ | 67,637 | | | $ | 436,403 | | | $ | 342,507 | | | $ | 90,268 | | | $ | 432,775 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

REVENUE (Dollars in thousands) | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | $ | 876,874 | | | $ | 194,815 | | | $ | 1,071,689 | | | $ | 865,520 | | | $ | 195,428 | | | $ | 1,060,948 | |

FTE adjustment3 | | | 16,821 | | | | 2,242 | | | | 19,063 | | | | 11,981 | | | | 2,046 | | | | 14,027 | |

Net interest income – FTE | | | 893,695 | | | | 197,057 | | | | 1,090,752 | | | | 877,501 | | | | 197,474 | | | | 1,074,975 | |

Noninterest income | | | 627,692 | | | | 114,119 | | | | 741,811 | | | | 584,072 | | | | 111,705 | | | | 695,777 | |

Total revenue | | | 1,521,387 | | | | 311,176 | | | | 1,832,563 | | | | 1,461,573 | | | | 309,179 | | | | 1,770,752 | |

Securities losses/(gains) | | | 18,193 | | | | (1,628 | ) | | | 16,565 | | | | (19,501 | ) | | | (3,338 | ) | | | (22,839 | ) |

Total revenue excluding securities gains and losses | | $ | 1,539,580 | | | $ | 309,548 | | | $ | 1,849,128 | | | $ | 1,442,072 | | | $ | 305,841 | | | $ | 1,747,913 | |

| 1 | Includes service charges on deposits, card and other charges and fees. |

| 2 | Includes retail investment services, investment banking income and trading account profits and commissions. |

| 3 | NCF’s FTE adjustments were reduced $4,001 from the third quarter 2004 and $4,917 from the fourth quarter of 2003 to conform to SunTrust’s methodology. |

RECONCILIATIONS APPENDIX

| | 3rd Quarter

2004 | | 4th Quarter

2003 | |

| | SunTrust | | NCF | | Historical

Combined | | SunTrust | | NCF | | Historical

Combined | |

SELECTED AVERAGE BALANCES (Dollars in millions) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Average Loans4 | | | | | | | | | | | | | | | | | | | |

Commercial5 | | $ | 27,753 | | $ | 4,224 | | $ | 31,977 | | $ | 29,484 | | $ | 3,860 | | $ | 33,344 | |

Real estate 1-4 family | | | 20,798 | | | 1,165 | | | 21,963 | | | 17,218 | | | 995 | | | 18,213 | |

Real estate commercial and construction | | | 14,231 | | | 3,924 | | | 18,155 | | | 13,713 | | | 3,776 | | | 17,489 | |

Real estate equity | | | 8,239 | | | 2,056 | | | 10,295 | | | 6,741 | | | 1,609 | | | 8,350 | |

Consumer6 | | | 12,574 | | | 2,946 | | | 15,520 | | | 12,074 | | | 2,738 | | | 14,812 | |

Credit cards | | | 158 | | | 17 | | | 175 | | | 140 | | | 15 | | | 155 | |

Total loans | | $ | 83,753 | | $ | 14,332 | | $ | 98,085 | | $ | 79,370 | | $ | 12,993 | | $ | 92,363 | |

| | | | | | | | | | | | | | | | | | | |

Average deposits | | | | | | | | | | | | | | | | | | | |

Noninterest bearing deposits | | $ | 20,490 | | $ | 2,749 | | $ | 23,239 | | $ | 18,586 | | $ | 2,555 | | $ | 21,141 | |

NOW accounts | | | 13,000 | | | 2,335 | | | 15,335 | | | 12,102 | | | 2,037 | �� | | 14,139 | |

Money market accounts | | | 22,434 | | | 1,777 | | | 24,211 | | | 22,274 | | | 2,030 | | | 24,304 | |

Savings | | | 7,425 | | | 1,674 | | | 9,099 | | | 6,249 | | | 1,733 | | | 7,982 | |

Consumer time | | | 6,967 | | | 4,915 | | | 11,882 | | | 7,601 | | | 4,789 | | | 12,390 | |

Other time | | | 3,806 | | | 306 | | | 4,112 | | | 3,501 | | | 332 | | | 3,833 | |

Total consumer and commercial deposits | | | 74,122 | | | 13,756 | | | 87,878 | | | 70,313 | | | 13,476 | | | 83,789 | |

Brokered and foreign deposits | | | 9,341 | | | 2,155 | | | 11,496 | | | 10,769 | | | 1,876 | | | 12,645 | |

Total deposits | | $ | 83,463 | | $ | 15,911 | | $ | 99,374 | | $ | 81,082 | | $ | 15,352 | | $ | 96,434 | |

| | | | | | | | | | | | | | | | | | | |

SELECTED CREDIT DATA (Dollars in thousands) | | | | | | | | | | | | | | | | | | | |

Nonaccrual loans | | $ | 263,127 | | $ | 66,213 | | $ | 329,340 | | $ | 336,587 | | $ | 30,689 | | $ | 367,276 | |

Restructured loans | | | 19,724 | | | - | | | 19,724 | | | 14,782 | | | - | | | 14,782 | |

Total nonperforming loans | | | 282,851 | | | 66,213 | | | 349,064 | | | 351,369 | | | 30,689 | | | 382,058 | |

Other real estate owned (OREO) | | | 10,934 | | | 16,192 | | | 27,126 | | | 16,458 | | | 28,196 | | | 44,654 | |

Other repossessed assets | | | 10,431 | | | 4,651 | | | 15,082 | | | 10,270 | | | 4,638 | | | 14,908 | |

Total nonperforming assets | | $ | 304,216 | | $ | 87,056 | | $ | 391,272 | | $ | 378,097 | | $ | 63,523 | | $ | 441,620 | |

| 4 | SunTrust's average nonaccrual and restructured loans are included in the respective categories to conform to the NCF presentation. |

| 5 | SunTrust's 4th quarter 2003 includes $2,243 related to the consolidation of its commercial paper conduit, Three Pillars. |

| 6 | Includes consumer direct and consumer indirect loans. |

L. Phillip Humann

Chairman and CEO

Smith Barney Citigroup

Financial Services Conference

January 2005