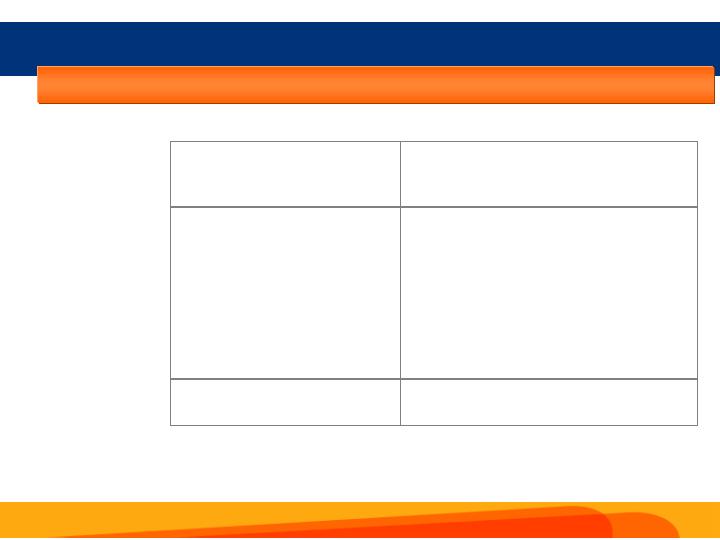

2005 LOB Accomplishments

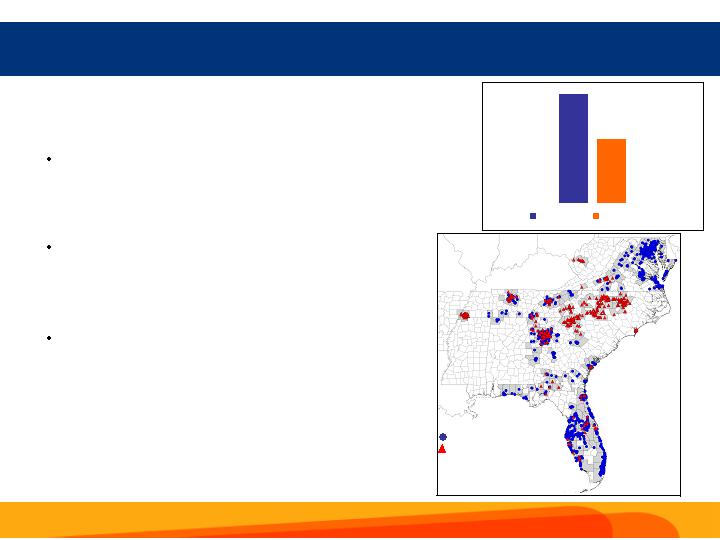

Increased product specialists

Debt Capital Markets Revenue = $229MM, up

$52MM or30%

Corporate Banking’s twelve month trailingRAROC

has increased 1.7%

Corporate and Investment Banking

Results1

Key Initiatives

1 Includes only legacy SunTrust data for the first nine months of 2005 as compared to the first nine months of 2004

Drive the cross-sell of Capital

Markets products to the Commercial

and Wealth & Investment

Management LOBs

Invest in Debt Capital Markets

product capabilities, both new and

existing

Focused initiative to enhance risk

adjusted returnsof corporate

clients

Deliver‘best in class’ credit

performance

Capital Markets Revenue cross-sold to the

Commercial and Wealth & Investment Management

LOB’s = $60MM, up $27MM or84%

Corporate Banking total new business revenue up

19%

Criticized loans = $205.3MM,down $93.8MM or

31%. Represents 1.3% of total loans

Non-accrual loans = $31.1MM,down $32.2MM or

51%. Represents 0.2% of total loans

8

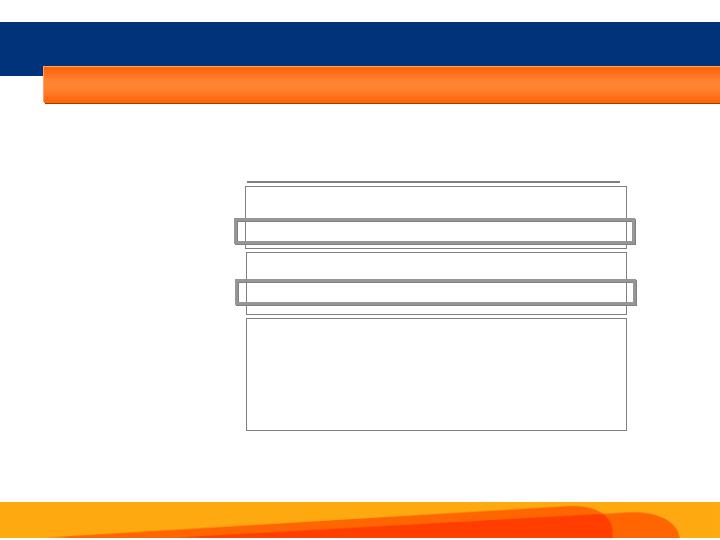

2005 LOB Accomplishments

Results1

Wealth and Investment Management

Key Initiatives

1 Includes only legacy SunTrust data for the first nine months of 2005 as compared to the first nine months of 2004

Rolled out and implemented new client

management operating model in Private

Wealth Management

Continue to ensure ourofferings of

products and services exceeds those of

ourcompetitors

Implemented initiatives whichincreased

penetration into existing STI client base

Integrated NCF and First Mercantile into

business units,expanding opportunities

for cross selling

Loans up13%

Deposits up18%

Institutional new trust business up56%

Capital Markets referral $ up175%

Discretionary assets under management

increased12%9/30/05 over 9/30/04

Brokerage assets increased20%9/30/05

over 9/30/04

Personal Trust retention improved by14%

9

2005 LOB Accomplishments

Key Initiatives

Results1

Total booked products up69%, an

increase of 28,000 products sold over

the same period in 2004

Mortgage

1 Includes only legacy SunTrust data for the first nine months of 2005 as compared to the first nine months of 2004

Grow Market Share

Grow purchase originations faster

than peer average

Increasedthe size of the mortgage

sales force

Opened 30 new offices toexpand

national footprint to 157 total

Retail offices and 17 total

Wholesale offices

Strongemphasis on Mortgage

cross-sell program

Focused on home equity,

deposit, credit/debit card and

other consumer products

Over $51 billion in total applications, up

44% over the same period in 2004

Nearly $31 billion in purchase

applications, up49%

Over $32 billion in total closings, up46%

Over $19 billion in purchase closings,

up51%

10

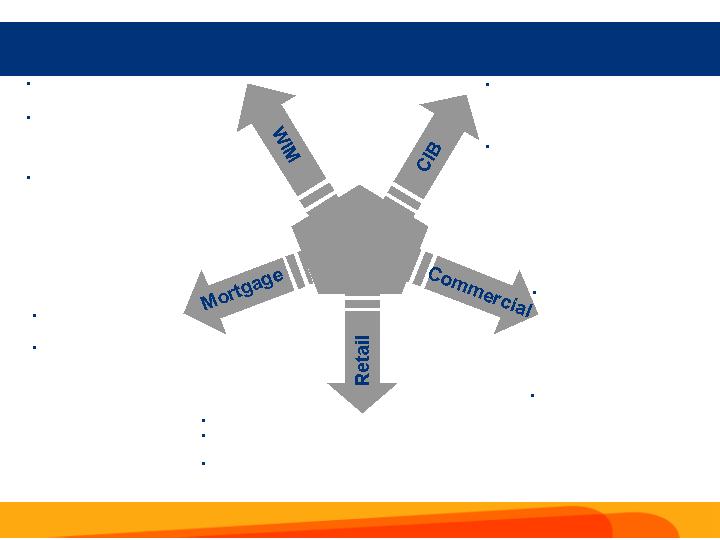

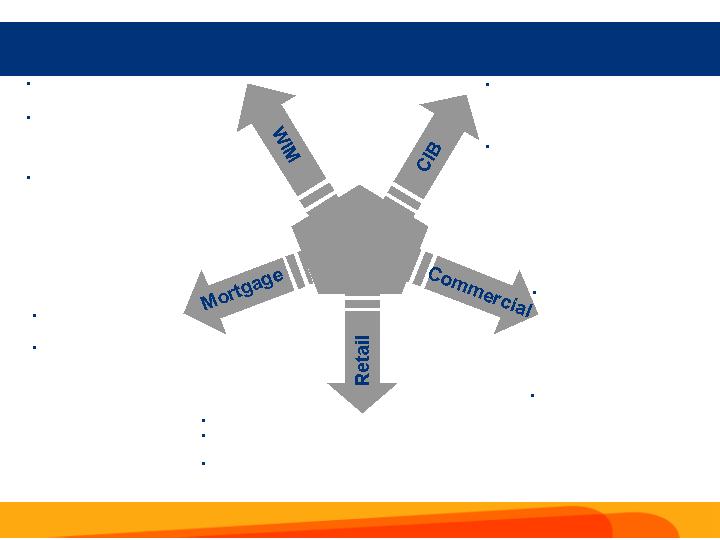

360o Relationship Focus

Cross-LOB Referrals Driving Revenue Growth

1STI legacy only vs September YTD last year

2 Includes NCF

Commercialgenerated$46 million in Capital Markets fees – up 74%2

CIB

Wlth

and

Invest.

Man.

Retail

Cmml

Mortgage

SunTrust

Customer

September 2005 YTD

Retail referred$2.7 billion in closed

Mortgages – up over 51%1

Retail made 59,000 qualified referrals to

Wealth and Investment Management1

Wealth and Investment Management

made 21,000 referrals to Retail2

Commercialproduced$3.1 million in

fees to Institutional Wealth and

Investment Management - up 41%2

Over 67,000 total products sold byMortgage – up 69%1

11

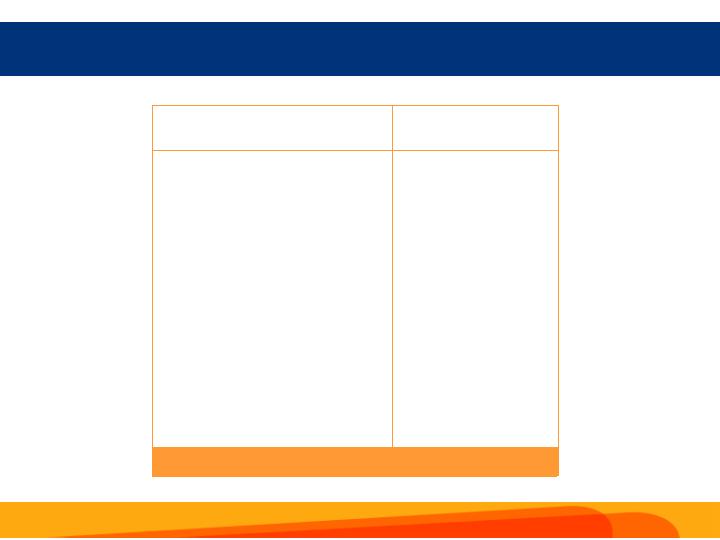

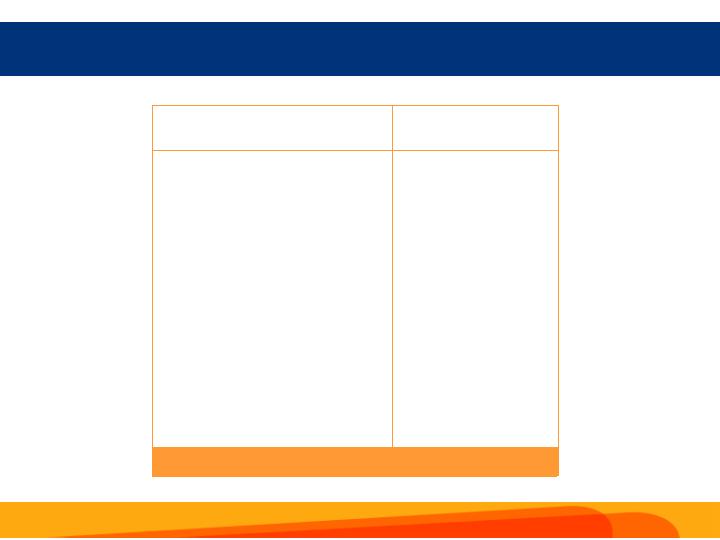

New Personal Checking Sales

New Business Checking Sales

New Direct Home Equity Production

New Business Banking Loan Production

Deposit Outstandings

Loan Outstandings

Capital Market Fees

Debt Capital Markets Revenue

CIB New Business Revenue

Institutional New Trust Business

Deposit Outstandings

Loan Outstandings

Purchase Mortgage Closings

# of Total Products Cross-Sold

New Check Cards

New Deposit Accounts

% Increase

Retail

SunTrust Call

Center

Wealth &

Investment

Management

CIB

Mortgage

2005 YTD Sales Results1

Commercial

15%

55%

29%

33%

11%

9%

79%

30%

19%

56%

18%

13%

51%

62%

44%

61%

1 Includes only legacy SunTrust data for the first nine months of 2005 as compared to the first nine months of 2004 (checking sales include both STI and NCF)

12

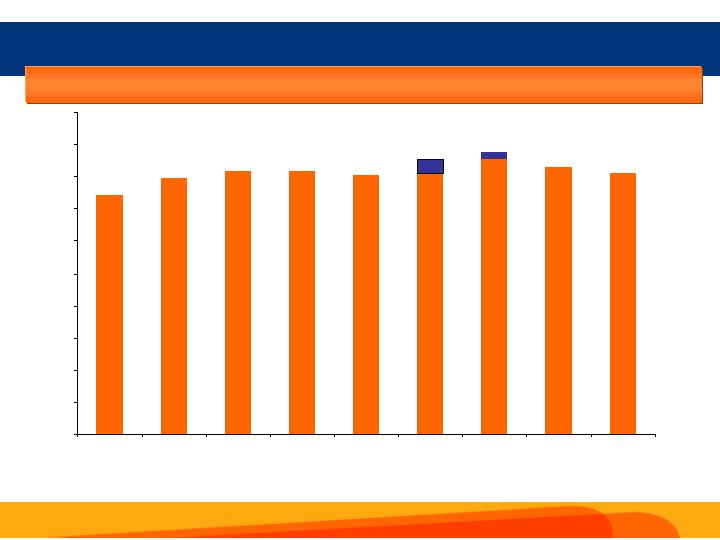

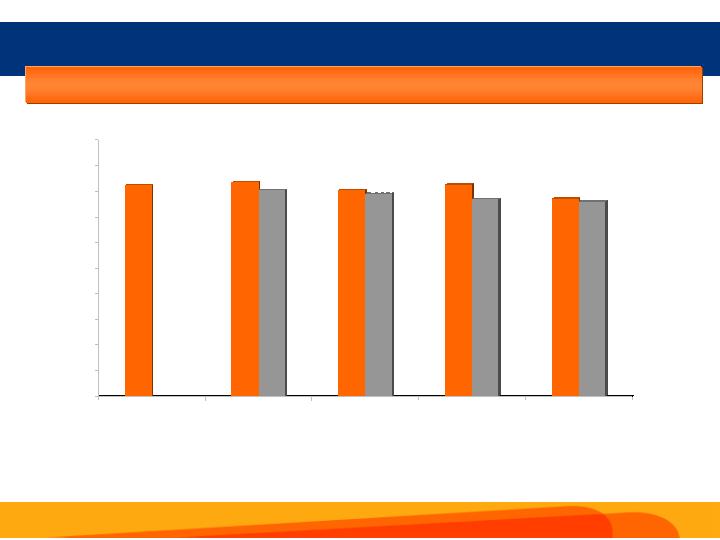

98,085

100,137

103,216

106,967

110,818

87,878

90,601

90,968

93,065

94,076

$0

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

3Q 04

4Q 04

1Q 05

2Q 05

3Q 05

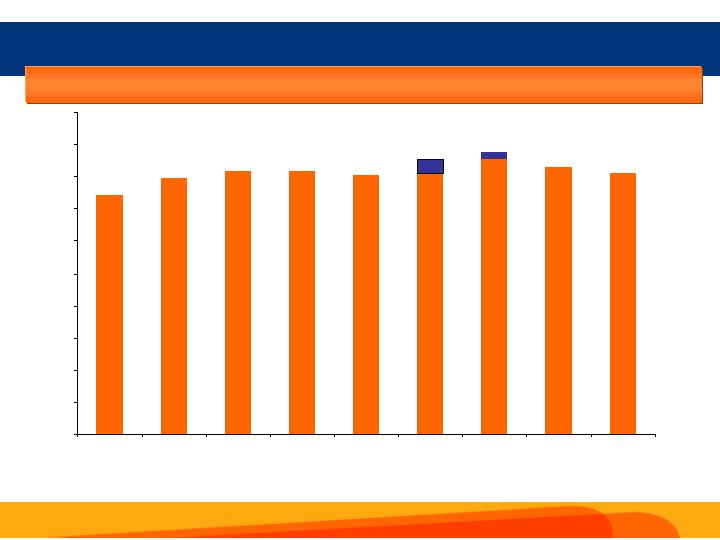

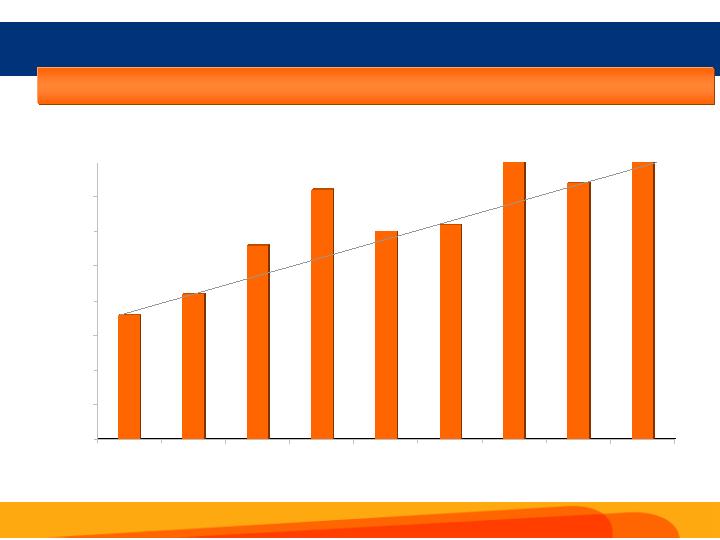

Average Loans: 13% YOY Growth

Average Deposits: 7% YOY Growth

1 Deposits = Consumer and Commercial Deposits

2 3Q 04 is reported on an estimated historical combined basis

Loan and Deposit Growth1

($ in millions)

2

13

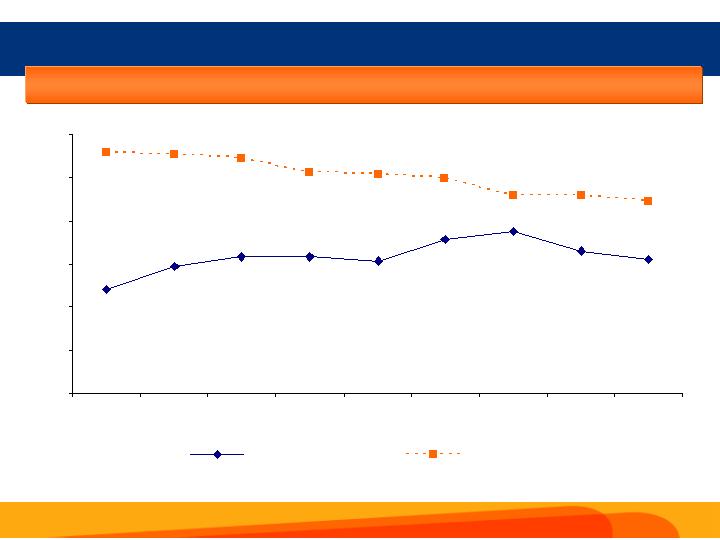

3.12%

2.98%

3.09%

3.13%

3.13%

3.11%

3.12%

3.21%

3.16%

1.5%

1.7%

1.9%

2.1%

2.3%

2.5%

2.7%

2.9%

3.1%

3.3%

3.5%

3Q 03

4Q 03

1Q 04

2Q 04

3Q 04

4Q 04

1Q 05

2Q 05

3Q 05

3.25%

1

1NCF added 9 b.p., organic margin improved 1 b.p. from 3Q 04.

2

3.21%

2 Day count added 4 b.p., organic margin was flat from 4Q 04.

14.

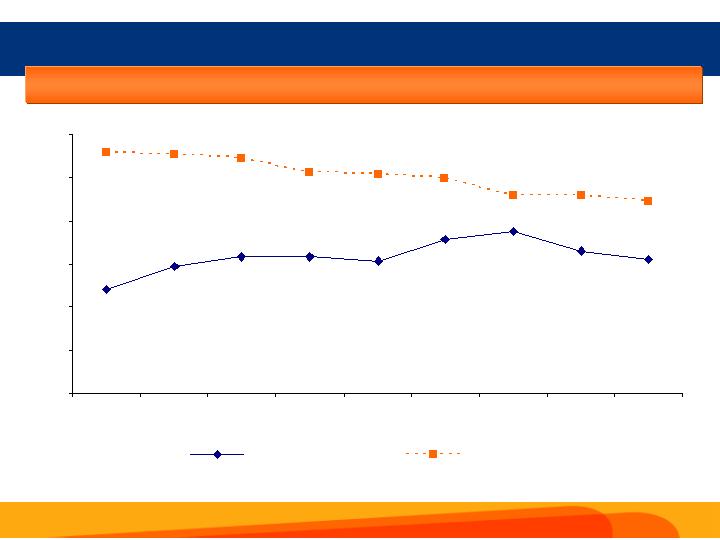

Net Interest Margin Trend

Net interest margin has been relatively stable to improving over a two-year horizon

14

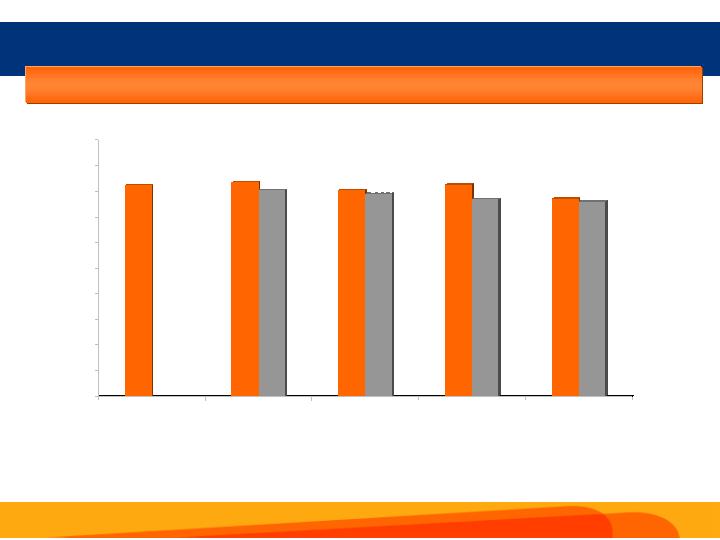

Net Interest Margin Compared to Peers

*

Source: SNL Financial

Stable to improving NIM over the two-year horizon has brought SunTrust closer to the peer group

average

2.50

2.70

2.90

3.10

3.30

3.50

3.70

3Q 03

4Q 03

1Q 04

2Q 04

3Q 04

4Q 04

1Q 05

2Q 05

3Q 05

SunTrust

Peer Average*

Peers include Amsouth, Bank of America, BB&T, Comerica, Fifth Third, First Horizon, Keycorp, M&T Bank, Mellon, National City, Northern Trust, PNC,

Regions, US Bancorp, Wachovia and Wells Fargo. Numbers presented for peers are averages

15

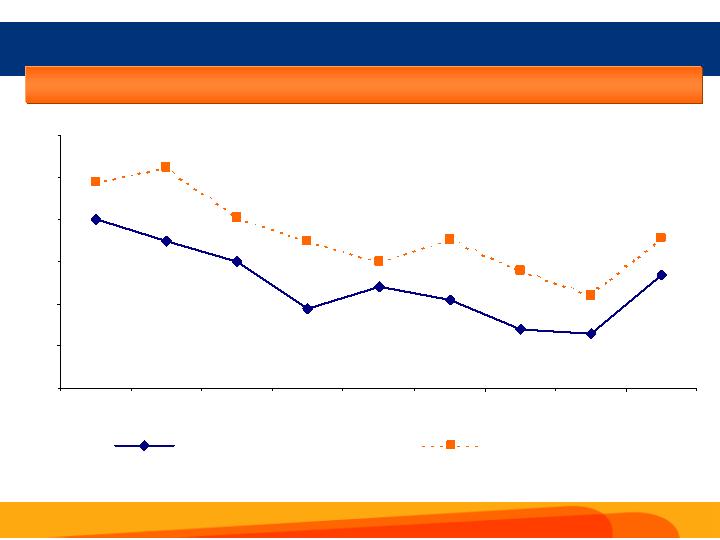

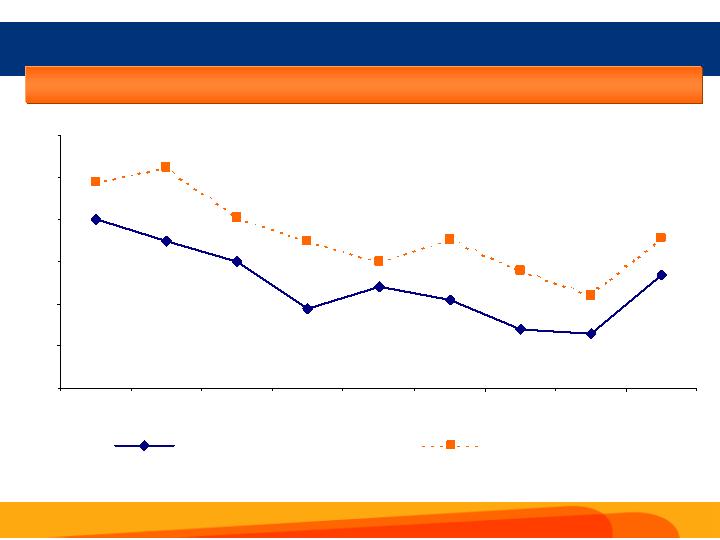

NCOs/Average Loans Compared to Peers

*

Source: SNL Financial

Net charge-offs continue to compare favorably vs. peer group average

3Q 03

4Q 03

1Q 04

2Q 04

3Q 04

4Q 04

1Q 05

2Q 05

3Q 05

0.00

0.10

0.20

0.30

0.40

0.50

0.60

SunTrust Banks, Inc.

Peer Average*

Peers include AmSouth, Bank of America, BB&T, Comerica, Fifth Third, First Horizon, Keycorp, M&T Bank, Mellon, National City, Northern Trust, PNC,

Regions, US Bancorp, Wachovia and Wells Fargo. Numbers presented for peers are averages

16

Trust and Investment Mgmt.

Broker Dealer Revenue

Deposits and Other Fees

Other Noninterest Income

Noninterest Income

($ in millions)

$168,802

147,184

368,613

146,360

$830,959

$167,503

138,149

357,545

107,739

$770,936

$1,299

9,035

11,068

38,621

$60,023

3.1%

26.2%

12.4%

143.2%

31.1%

3Q 2005

Growth

2Q 2005

Sequential

Annualized

Growth Rate

0.8%

6.5%

3.1%

35.8%

7.8%

Growth

Rate

Noninterest Income excludes securities (losses)/gains and net gain on sale of RCM assets.

1

2

Increase in other noninterest income mainly attributable to mortgage production income.

Total noninterest income increased 31% on a sequential annualized basis

Fee Income Growth

1

2

17

Based on estimated historical combined numbers

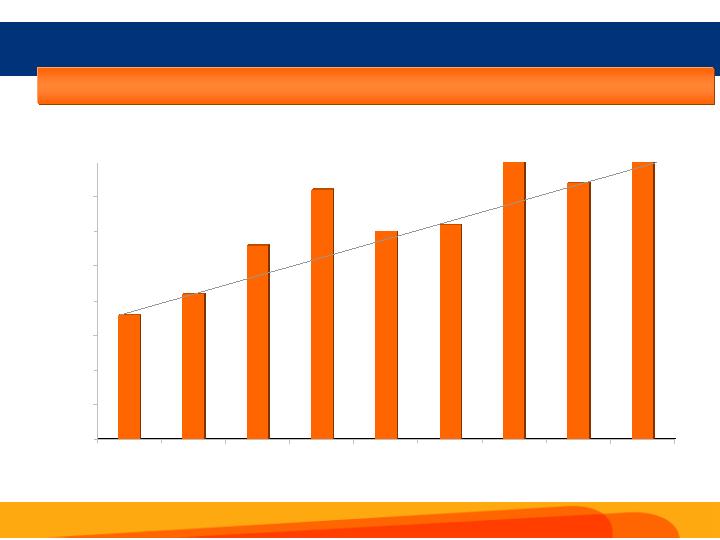

Improvement in Operating Leverage

Expense Growth

Revenue Growth

Core Revenue Growth

6%

flat

7

2

Sequential Annualized Growth Trends

5%

(4)

(2)

3

Concerted effort to improve operating leverage is paying off

1Q 05

4Q 04

6%

4

10

2Q 05

1

20%

8

20

3Q 05

SunTrust presents total revenue excluding realized securities gains/losses (and the net gain on sale of RCM assets for 1Q 05); the Company

believes total revenue without securities gains/losses and without the net gain on sale of RCM assets is more indicative of the Company’s

performance because this isolates income that is primarily customer relationship and customer transaction driven

Expense growth excludes merger related expenses and amortization of intangibles (and impairment charge on Affordable Housing Properties in

3Q 05)

1

2

3

18

1 Excluding merger related expenses (and the impact of net gain on sale of RCM assets for 1Q 05.

1

1

1

1

Focus on Efficiency

Positive operating leverage driving operating efficiency ratio improvement

61.12

61.78

60.25

60.22

59.48

61.30

58.46

58.62

58.01

20

25

30

35

40

45

50

55

60

65

70

3Q 04

4Q 04

1Q 05

2Q 05

3Q 05

19

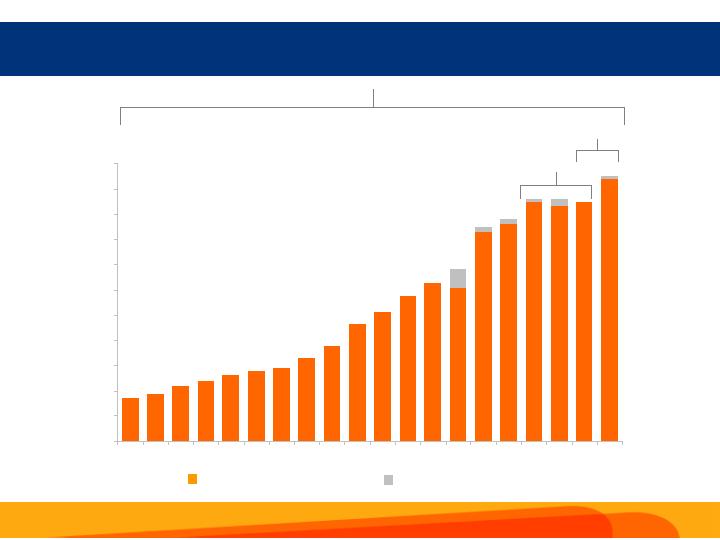

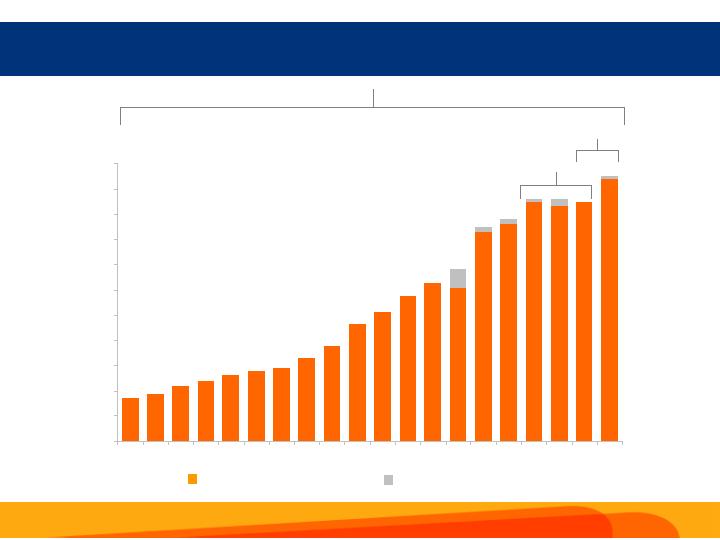

EPS Growth Back on Track in 2004

4.73

5.19

0.06

4.66

4.72

4.30

4.13

3.04

3.13

2.87

2.56

2.32

1.89

1.64

1.45

1.38

1.31

1.19

1.09

.93

.84

0.09

0.10

0.37

0.14

0.07

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.00

$4.50

$5.00

$5.50

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

EPS1

1EPS as originally reported and adjusted for stock splits. There are no adjustments for merger pooling

2 CAGR and growth based on GAAP EPS excluding merger-related charges

GAAP EPS

Reduction in EPS due to merger-related charges

CAGR2 = 10.1%

CAGR2 = (0.6)%

Growth2 = 11.0%

20

Improving Operating EPS Trends1

Strong operating trends translating into quarterly EPS growth despite fluctuating provision

expense trends

1 Operating EPS excludes the after-tax impact of merger expenses. Reconcilement of reported EPS to operating EPS is contained in the appendix

1.18

1.21

1.28

1.36

1.30

1.31

1.40

1.37

1.42

1.00

1.05

1.10

1.15

1.20

1.25

1.30

1.35

1.40

3Q 03

4Q 03

1Q 04

2Q 04

3Q 04

4Q 04

1Q 05

2Q 05

3Q 05

21

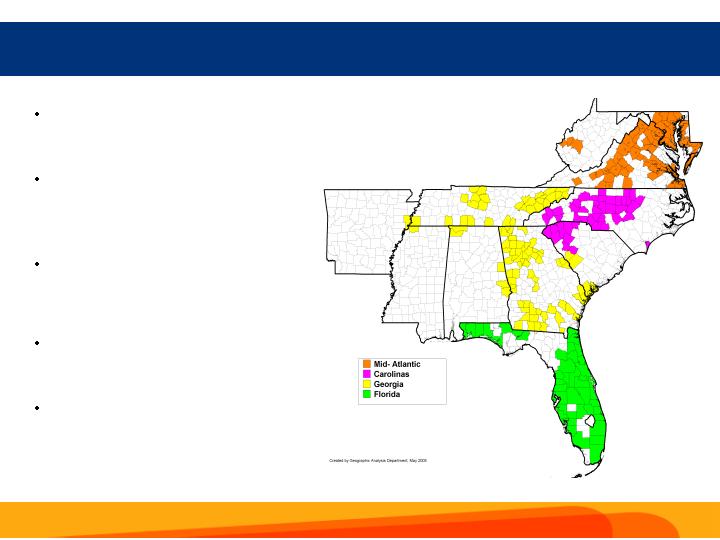

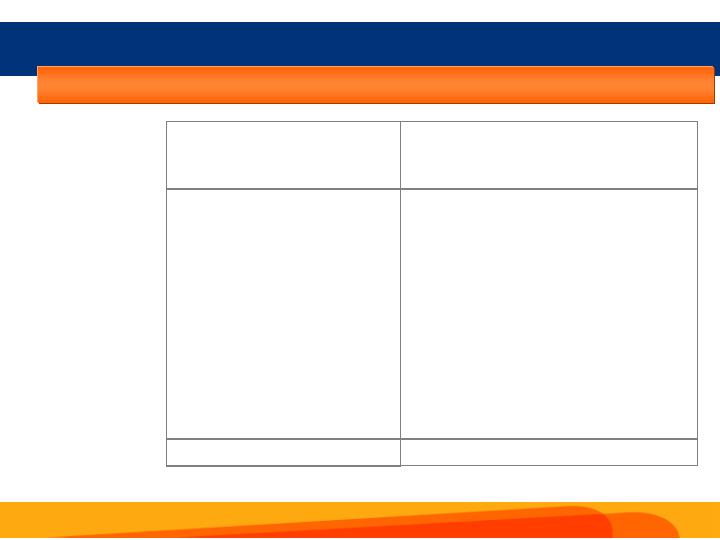

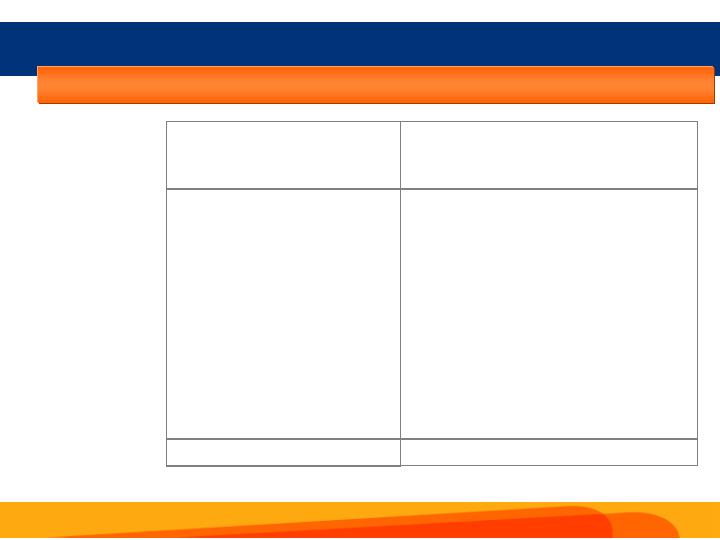

Line of Business Goals

GOALS

Aggressivelyexpand and retain

share of emerging wealth segments

Integrate successful private

banking units into private

wealth management for a more

comprehensive approach

Integrate Alexander Key and SunTrust

Securities into SunTrust Investment

Services to leverage broker

platformand achieve efficiencies

Partner with Retail to

improve penetration

Continue tostrengthen

product offeringsand

distribution

capabilities

Leverage merger tocapture market share

Grow branch network,emphasis on in-store

opportunities

Improvepartnership between business banking and other

LOBs to ensure proper client segmentation, enhance

service and improve retention

Continue toenhance capital

markets sales into Commercial

and Wealth & Investment

Management client base

Invest indeveloping new and

existing Debt Capital Market

product capabilities

Make significant investments

in Treasury Management

products, sales and

service tocapture

emerging opportunities

in the payments

business

Capitalize on opportunities in

legacy NCF footprint to

grow diversified

commercial, auto dealer,

middle market and

institutional/government

segments

22

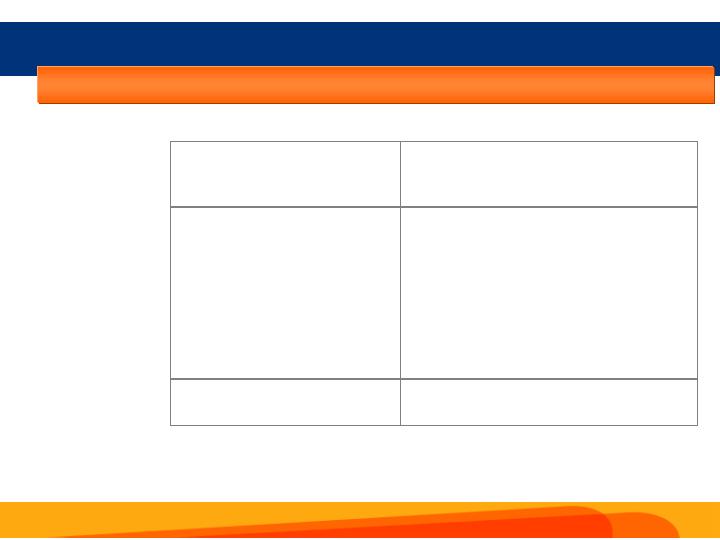

Long Term Growth Initiatives

8

-

10%

SunTrust

8

-

10%

8

-

10%

9

-

11%

12

-

14%

8

-

10%

Retail

Commercial

Corporate and Investment

Banking

Wealth & Investment

Management

Mortgage

Long Term Growth

Rate Target

Business Line

8

-

10%

SunTrust

8

-

10%

8

-

10%

9

-

11%

12

-

14%

8

-

10%

Retail

Commercial

Corporate and Investment

Banking

Wealth & Investment

Management

Mortgage

Long Term Growth

Rate Target

Business Line

23

NCF Merger on Track

SunTrust announced theNational Commerce Financial merger in May 2004, the transaction

was completed on Oct. 1, 2004 - systems successfully converted and enhanced product

capabilities in place

Cost saves are ahead of the original estimateof $76MM; now projecting $97MM for 2005,

one-time merger expensesare on trackto be $121MM, $4 MM better than the original

estimate

Key components of our sales organization are in place – sales leadership model, weekly

sales meetings, sales training, sales and referral goals, incentives and recognition

Customer retention remains atop priority

115,000 client calls completed by relationship managers across the footprint

Reached100% of key customers – Retail, Wealth & Investment Management,

Commercial and Treasury Management

Companywide retention metricsare being tracked monthly

Based on third party research, retention results to date indicate the Company isexceeding

prior average industry merger experience

24

SunTrust Today

Ourfoundation is firmlyin place:

Fully functioning operating model with clear allocation of responsibilities

Key components of sales organization in place: weekly sales meetings,

sales and referral goals and linked incentives

We haveclear strategy andfocused initiatives to drive performance:

Deliver “Big Bank” capabilities with local decision making and

responsiveness

Focus on customer acquisition and retention

Drive cross-LOB referrals

Keyinitiatives are generatingtangible results

Capitalizing on opportunitiesprovided by theNational Commerce

Financial merger

25

APPENDIX

26

Average Loan Growth

Mortgages

RE Construction

RE Equity

RE Commercial

Commercial

Business Credit Card

Consumer - Direct

Consumer - Indirect

Nonaccrual

Total Loans

2Q 2005

As Adjusted

($ in millions)

$1,497.6

553.3

618.3

(170.3)

971.0

10.4

236.0

121.3

14.1

$3,851.7

$26,752.9

8,962.4

12,030.3

13,042.3

31,630.7

213.1

4,937.0

9,058.5

339.5

$106,966.7

$28,250.5

9,515.7

12,648.6

12,872.0

32,601.7

223.5

5,173.0

9,179.8

353.6

$110,818.4

3Q 2005

22.4%

24.7%

20.6%

(5.2)%

12.3%

19.5%

19.1%

5.4%

16.6%

14.4%

1 As a result of the NCF systems conversion on April 22, 2005, SunTrust presents consolidated average balances on an adjusted basis for both loans and deposits.

The Company believes these adjusted measures provide a better comparison between reporting periods and are more indicative of true loan and deposit

fluctuations. The adjustments represent reclassifications due to account mapping changes resulting from the systems conversion.

Adjusted

Growth

Adjusted

Sequential

Annualized

Growth Rate

5.6%

6.2%

5.1%

(1.3)%

3.1%

4.9%

4.8%

1.3%

4.2%

3.6%

Adjusted

Growth Rate

1

Driven by targeted sales initiatives

27

Average Consumer and Commercial Deposit Growth

DDA

NOW

MMA

Savings

Consumer Time

Other Time

Total Consumer and

Commercial Deposits

2Q 2005

As Adjusted

($ in millions)

$196.7

(661.9)

621.4

(381.5)

862.8

373.7

$1,011.2

$24,324.7

17,515.0

25,678.3

6,246.6

11,556.5

7,743.4

$93,064.5

$24,521.4

16,853.1

26,299.7

5,865.1

12,419.3

8,117.1

$94,075.7

3Q 2005

3.2%

(15.1)%

9.7%

(24.4)%

29.9%

19.3%

4.3%

1As a result of the NCF systems conversion on April 22, 2005, SunTrust presents consolidated average balances on an adjusted basis for both loans and deposits.

The Company believes these adjusted measures provide a better comparison between reporting periods and are more indicative of true loan and deposit

fluctuations. The adjustments represent reclassifications due to account mapping changes resulting from the systems conversion.

Adjusted

Growth

Adjusted

Sequential

Annualized

Growth Rate

0.8%

(3.8)%

2.4%

(6.1)%

7.5%

4.8%

1.1%

Adjusted

Growth Rate

1

Driven by targeted sales initiatives

28

Strong Credit Quality

Net Charge-offs

Net Charge-offs to Avg.

Loans

NPAs

NPAs to

Loans/OREO/Other repo

Allowance for loan

losses

Allowance to Non-

performing loans

Allowance to Charge-

offs (Years Coverage)

3Q 2004

4Q 2004

3Q 2005

$76,711

0.27%

$362,737

0.32%

$1,029,855

312.4%

3.4

$51,043

0.24%

$304,216

0.36%

$892,974

315.7%

4.4

$53,893

0.21%

$410,658

0.40%

$1,050,024

281.3%

4.9

$35,384

0.13%

$380,303

0.35%

$1,036,173

296.7%

7.4

2Q 2005

($ in thousands)

1Q 2005

$36,834

0.14%

$392,345

0.37%

$1,023,746

286.7%

7.0

Excluding the effect of the Delta Airlines charge-off, credit quality trends continue to be better

than historical average

29