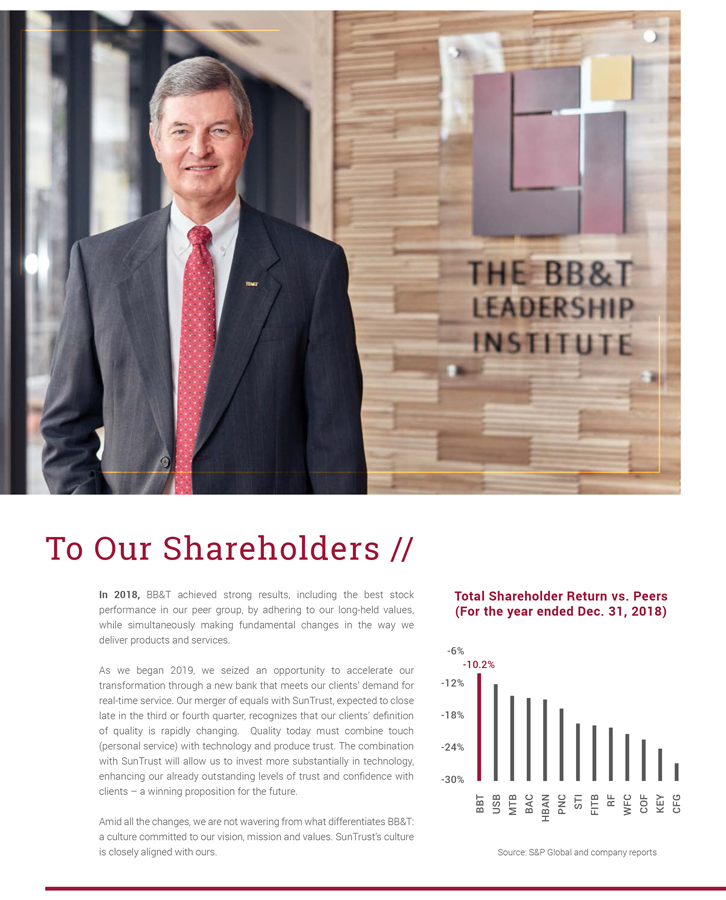

Forward Looking Statements This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of BB&T and SunTrust. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on BB&T’s and SunTrust’s current expectations and assumptions regarding BB&T’s and SunTrust’s businesses, the economy and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Many possible events or factors could affect BB&T’s or SunTrust’s future financial results and performance and could cause actual results or performance to differ materially from anticipated results or performance. Such risks and uncertainties include, among others: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between BB&T and SunTrust, the outcome of any legal proceedings that may be instituted against BB&T or SunTrust, delays in completing the transaction, the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction) and shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all, the possibility that the anticipated benefits of thetransaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where BB&T and SunTrust do business, the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, diversion of management’s attention from ongoing business operations and opportunities, potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction, the ability to complete the transaction and integration of BB&T and SunTrust successfully and the dilution caused by BB&T’s issuance of additional shares of its capital stock in connection with the transaction. Except to the extent required by applicable law or regulation, each of BB&T and SunTrust disclaim any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Further information regarding BB&T, SunTrust and factors that could affect the forward-looking statements contained herein can be found in BB&T’s Annual Report on Form10-K for the fiscal year ended Dec. 31, 2018, and its other filings with the Securities and Exchange Commission (“SEC”), and in SunTrust’s Annual Report on Form10-K for the fiscal year ended December 31, 2018, and its other filings with the SEC. About the Report This 2018 Annual Report contains financial information and performance measures determined by methods other than in accordance with accounting principles generally accepted in the United States of America (GAAP). BB&T’s management uses these“non-GAAP” measures in their analysis of the corporation’s performance and the efficiency of its operations. Management believes thesenon-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results with prior periods and demonstrate the effects of significant gains and losses. The company believes a meaningful analysis of its financial performance requires an understanding of the factors underlying that performance. BB&T’s management believes investors may use thesenon-GAAP financial measures to analyze financial performance without the impact of unusual items that may obscure trends in the company’s underlying performance. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable tonon-GAAP performance measures that may be presented by other companies. Below is a listing of the types ofnon-GAAP measures used in this 2018 Annual Report: The adjusted diluted earnings per share isnon-GAAP in that it excludes merger-related and restructuring charges and other selected items, net of tax. BB&T’s management uses this measure in their analysis of the corporation’s performance. BB&T’s management believes this measure provides a greater understanding of ongoing operations, enhances comparability of results with prior periods and demonstrates the effects of significant gains and charges. Tangible common equity and related measures arenon-GAAP measures that exclude the impact of intangible assets and their related amortization. These measures are useful for evaluating the performance of a business consistently, whether acquired or developed internally. The adjusted efficiency ratio isnon-GAAP in that it excludes securities gains (losses), amortization of intangible assets, merger-related and restructuring charges and other selected items. BB&T’s management uses this measure in their analysis of the corporation’s performance. BB&T’s management believes this measure provides a greater understanding of ongoing operations, enhances comparability of results with prior periods and demonstrates the effects of significant gains and charges. Where applicable, the most directly comparable GAAP measure is included in the Form10-K for the year ended Dec. 31, 2018, as well as in BB&T’s Fourth Quarter 2018 Quarterly Performance Summary, which are available at BBT.com or included herein. Reconciliations ofnon-GAAP measures, where applicable, are available at BBT.com. Corporate Profile Founded in 1872, BB&T Corporation continues to build on a strong foundation of excellence. Headquartered in Winston-Salem, North Carolina, BB&T had consolidated assets on Dec. 31, 2018, totaling $225.7 billion, and ranks as the eighth-largest financial institution based on deposits in the United States. As of Dec. 31, 2018, BB&T operated 1,879 financial centers in 15 states and Washington, D.C. BB&T is a values-driven, highly profitable growth organization. A Fortune 500 company, BB&T offers a full range of consumer and commercial banking, securities brokerage, asset management, mortgage and insurance products and services. We are consistently recognized for outstanding client satisfaction by the U.S. Small Business Administration, Greenwich Associates and others. Our fundamental strategy is to deliver the best value proposition in our markets. Recognizing that value is a function of quality to price, our focus is on delivering high-quality client service, resulting in the Perfect Client Experience. Our overarching purpose is to achieve our vision and mission, consistent with our values, with the ultimate goal of maximizing shareholder returns. At BB&T, we’ve spent 147 years sharing our knowledge with our clients. By offering sound advice and personal attention, we help our clients make informed choices as they manage theirday-to-day finances and set a course to reach their long-term financial goals. More information about BB&T and our full line of products and services is available at BBT.com. Annual Meeting You are cordially invited to attend the annual meeting of shareholders of BB&T Corporation at 11 a.m. (EDT) on Tuesday, April 30, 2019, at Hibernian Hall, 105 Meeting St., Charleston, South Carolina. Get the report online at bbt.com/annual-report-2018 2 0 / / T H E D E T A I L S