| Proxy Statement April 19, 2010 |

| P.O. Box 9005 Quakertown, PA 18951-9005 TEL (215)538-5600 FAX (215)538-5765 |

April 19, 2010

Dear Fellow Shareholder:

You are invited to attend QNB Corp.’s 2010 Annual Meeting of Shareholders on Tuesday, May 18, 2010. The meeting will be held at the offices of QNB Bank, 320 West Broad Street, Quakertown, Pennsylvania at 11:00 a.m., Eastern time. Enclosed are the notice of the annual meeting, proxy statement and proxy card for the annual meeting. Our 2009 Annual Report on Form 10-K accompanies these enclosures.

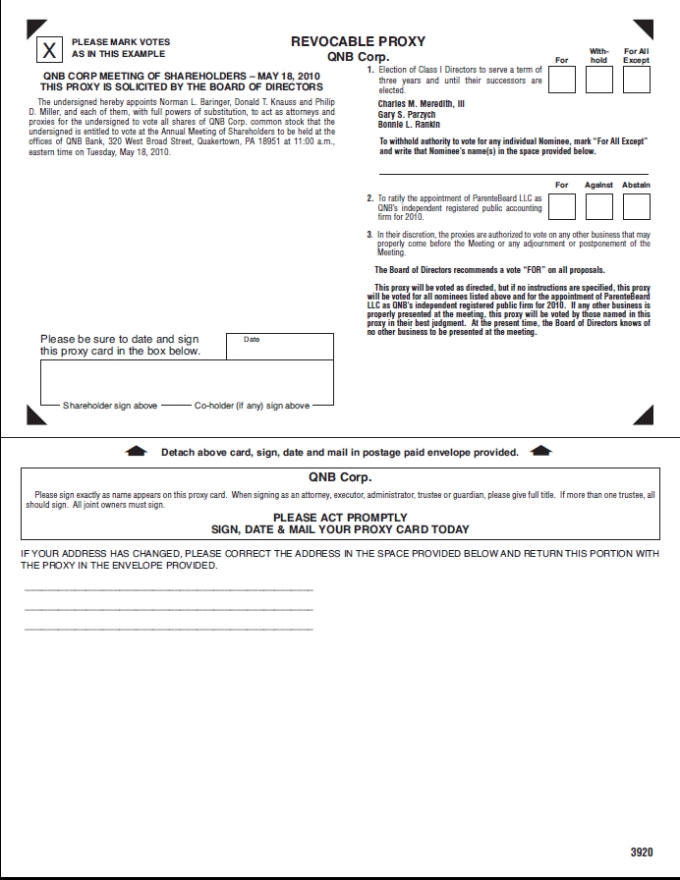

At this year's annual meeting, you are being asked to elect the three Class I director nominees of the Board of Directors and to ratify the Audit Committee’s appointment of ParenteBeard LLC as QNB Corp’s independent registered public accounting firm for 2010. These proposals are fully described in the accompanying proxy statement, which you are urged to read carefully.

YOUR BOARD OF DIRECTORS HAS UNANIMOUSLY ENDORSED THE NOMINEES FOR ELECTION. WE RECOMMEND THAT YOU VOTE "FOR" ALL THREE NOMINEES AND “FOR” THE RATIFICATION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2010.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend, you can ensure that your shares are represented at the meeting by promptly voting and submitting your proxy by completing, signing, dating and returning your proxy card in the enclosed envelope.

If you have any questions with regard to the annual meeting, please contact Jean Scholl at (215) 538-5600, extension 5719.

Thank you for your cooperation and continuing support.

Sincerely,

Thomas J. Bisko

President and

Chief Executive Officer

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

QNB CORP.

TO BE HELD ON MAY 18, 2010

TO OUR SHAREHOLDERS:

The 2010 annual meeting of the shareholders of QNB Corp. will be held at the offices of QNB Bank, 320 West Broad Street, Quakertown, Pennsylvania on Tuesday, May 18, 2010, beginning at 11:00 a.m., Eastern time, for the purpose of considering and acting upon the following matters:

| | (1) | election of the three Class I director nominees of the Board of Directors; |

| | (2) | ratification of the appointment of ParenteBeard LLC as QNB’s independent registered public accounting firm for 2010; and |

| | (3) | such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors fixed the close of business on April 5, 2010 as the record date for the purpose of determining those shareholders entitled to notice of, and to vote at, the annual meeting, either in person or by proxy.

All shareholders are cordially invited to attend the annual meeting. Whether or not you plan to attend the annual meeting, you are requested to complete, date and sign the proxy card, and return it promptly in the enclosed envelope provided. At any time prior to the proxy being voted, it is revocable by written notice to QNB in accordance with the instructions set forth in the enclosed proxy statement, including by voting at the meeting in person.

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 18, 2010: Under Securities and Exchange Commission rules, you are receiving this notice that the proxy materials for the 2010 Annual Meeting of Shareholders are available on the Internet. The proxy statement, the proxy card and the 2009 Annual Report to Shareholders on Form 10-K are available at www.qnb.com under the “Investor Relations” link.

If you plan to attend the annual meeting, please bring photo identification. If your shares are held in the name of a broker or other nominee, please bring with you a letter (and a legal proxy if you wish to vote your shares) from the broker or nominee confirming your ownership as of the record date.

By Order of the Board of Directors,

Charles M. Meredith, III

Secretary

Quakertown, Pennsylvania

April 19, 2010

QNB Corp.

15 North Third Street

P.O. Box 9005

Quakertown, Pennsylvania 18951

(215) 538-5600

2010 ANNUAL MEETING OF SHAREHOLDERS – MAY 18, 2010

This proxy statement is being furnished to holders of the common stock, par value $0.625 per share, of QNB Corp. (herein referred to as QNB or the Corporation) in connection with the solicitation of proxies by the Board of Directors for use at the 2010 Annual Meeting of Shareholders.

As of the date of this proxy statement, the Board of Directors knows of no business that will be presented for consideration at the annual meeting other than that referred to in the accompanying Notice of Annual Meeting and described in this proxy statement. As to other business, if any, properly presented at the annual meeting, executed proxies will be voted in accordance with the judgment of the person or persons voting the proxy or the recommendation of the Board of Directors.

The cost of solicitation of proxies will be paid by QNB. QNB will reimburse brokerage firms and other custodians, nominees, and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of QNB’s common stock. In addition to solicitations by mail, directors, officers, and employees of QNB and the Bank may solicit proxies personally, by telephone or other electronic means without additional compensation.

These proxy materials are first being mailed to shareholders on or about April 19, 2010.

Date, Time and Place of Meeting

QNB Corp.’s annual shareholders’ meeting will be held on Tuesday, May 18, 2010, beginning at 11:00 a.m., Eastern time. The meeting will be held at QNB Bank’s (the Bank) offices at 320 West Broad Street, Quakertown, Pennsylvania.

Outstanding Securities; Quorum; Voting Rights; and Record Date

The close of business on April 5, 2010 was fixed as the record date for the purpose of determining those shareholders entitled to notice of, and to vote at, the annual meeting and any adjournments or postponements of the meeting. As of the close of business on the record date, QNB had 3,098,805 shares of common stock issued and outstanding.

Shareholders are entitled to one vote for each share of common stock held of record on the record date with respect to each matter to be voted on at the annual meeting.

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of the common stock on the record date is necessary to constitute a quorum at the annual meeting. We intend to count as present shares present in person but not voting and shares for which we have received proxies but for which the holders of such shares have withheld votes or abstained. We also intend to count as present shares represented by proxies returned by a broker holding shares for a beneficial owner in nominee or street name even if the shares are not entitled to be voted on a particular proposal because the nominee does not have discretionary voting authority with respect to that proposal and has not received instructions from the beneficial owner (commonly referred to as “broker non-votes”).

QNB’s Bylaws and Pennsylvania law govern the vote needed to elect directors and approve the proposal to ratify the appointment of ParenteBeard LLC as QNB’s independent registered public accounting firm for 2010. In the case of the election of the Class I directors, assuming the presence of a quorum, the three candidates receiving the highest number of votes will be elected to the Board of Directors. With respect to the ratification of the appointment of ParenteBeard LLC, assuming the presence of a quorum, the affirmative vote of a majority of the votes cast is required for approval. Because they are not considered votes cast, abstentions and broker non-votes have no effect on the proposal to ratify the appointment of ParenteBeard LLC as QNB’s independent registered public accounting firm for 2010.

You may not vote your shares held by a broker in nominee or “street” name at the annual meeting unless you obtain a legal proxy from your broker or holder of record.

Solicitation of Proxies

The Board of Directors is soliciting proxies for use at QNB’s 2010 Annual Meeting of Shareholders.

Voting and Revocability of Proxies

Shares of common stock represented by properly executed proxies will, unless the proxies have previously been revoked, be voted in accordance with the instructions indicated on the proxies. If no instructions are indicated on the proxies, the shares will be voted FOR the election of QNB’s nominees to the Board of Directors and FOR the appointment of ParenteBeard LLC as QNB’s independent registered public accounting firm for 2010. The Board of Directors does not anticipate that any matters will be presented at the annual meeting other than as set forth in the accompanying Notice of Annual Meeting. In the event that any other matters are properly presented at the annual meeting, proxies will be voted at the discretion of the proxy holders as to such matters upon the recommendation of the Board of Directors.

A shareholder of record who executes and returns a proxy has the power to revoke it at any time before it is voted by delivering to Mr. Charles M. Meredith, III, Secretary of QNB, at the offices of QNB, at 320 West Broad Street, P.O. Box 9005 Quakertown, Pennsylvania, 18951, either a written notice of the revocation or a duly executed later-dated proxy, or by attending the annual meeting and voting in person after giving notice of the revocation.

PROPOSAL 1

ELECTION OF THE THREE CLASS I DIRECTOR NOMINEES

The Board of Directors

QNB’s Articles of Incorporation and Bylaws provide that the Board of Directors consists of ten members divided into three classes, Class I, Class II, and Class III, as nearly equal in number as possible. The three directors currently constituting Class I have been nominated for re-election at the annual meeting. Directors in Class II and Class III will hold office until the 2011 and 2012 annual meetings, respectively.

The Class I Director Nominees of the Board of Directors

At the annual meeting, three Class I directors will be elected. Each director so elected will hold office until the 2013 Annual Meeting of Shareholders and until his or her successor in office is duly qualified and elected.

To the extent given discretion, the persons named in the accompanying proxy intend to vote FOR each of the nominees listed below. Each nominee has consented to being nominated as a director and, as far as the Board of Directors and management of QNB are aware, will serve as a director if elected. In the event that any nominee should decline to serve or be unable to serve, the persons named in the accompanying proxy may vote for the election of such person or persons as the Board of Directors recommends.

Set forth on the following pages, we include the following information with respect to each director and director nominee:

| | · | the years they first became directors of QNB and the Bank; |

| | · | their principal occupations and other directorships over the past five years; and |

| | · | a brief discussion of the specific experience, qualifications, attributes or skills that led to our Board’s conclusion that the person should serve as a director. |

Voting Requirements

The three director candidates are required to be elected by a plurality of the total votes cast. Thus, the three persons receiving the highest number of votes will be elected. Votes may be cast in favor or withheld for any or all of the nominees.

RECOMMENDATION

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT EACH OF THESE

NOMINEES BE ELECTED AS A CLASS I DIRECTOR.

CURRENT CLASS I DIRECTORS AND NOMINEES FOR THREE YEAR TERM EXPIRING IN 2013

Charles M. Meredith, III

Director of QNB since 1984

Director of the Bank since 1968

Secretary of QNB and the Bank since 1994

Age 74

Mr. Meredith is a newspaper columnist as well as the Owner of Franklin & Meredith Inc., a commercial publisher. Over the years Mr. Meredith has served as a Director and Trustee for various local organizations including the Upper Bucks YMCA, the American Automobile Association (AAA), the Lehigh Valley Community Foundation and the Quakertown Rotary. Mr. Meredith was also an elected Bucks County Commissioner (1966 through 1972). Mr. Meredith’s educational background includes a Bachelor’s Degree from the Wharton School of Business at the University of Pennsylvania. The Board believes that Mr. Meredith’s business and public service experience along with his years of service as a director of QNB and the Bank give him the qualifications and skills to serve as a QNB director.

Gary S. Parzych

Director of QNB and the Bank since 1995

Age 54

Mr. Parzych is the President of Eugene T. Parzych, Inc., a construction company (1980 to present), President of Finland Leasing Company, Inc., a real estate holding company (1986 to present), a Partner in G & T Properties, a real estate holding company (1999 to present) and President of Gargen Incorporated a sporting goods dealer (2008 to present). Mr. Parzych was a Quakertown School Board director from 1987 to 2004 and is currently a Trustee for the Upper Bucks YMCA. Mr. Parzych is also involved in other service organizations. Mr. Parzych’s business experience and his knowledge of the construction industry along with his years of service as a director provide the Board with valuable industry experience and knowledge of QNB.

Bonnie L. Rankin

Director of QNB and the Bank since 2007

Age 56

Ms. Rankin retired from Harleysville Group Inc. after serving as the Senior Vice President/Vice President-Strategic Planning, from 2003 to 2008. Prior to this position Ms. Rankin served as the Chief Service Officer/Senior Vice President- Business Process Consulting from 2000 to 2003, and President & Chief Operating Officer of Harleysville Insurance of New York from 1996 to 2000. Ms. Rankin held officer-level responsibility with the Harleysville Insurance organization for 23 years prior to retirement. Ms. Rankin holds a Master of Science degree from the University of Pennsylvania and a Bachelor of Arts degree from Millersville University. In addition Ms. Rankin has earned Chartered Property Casualty Underwriter (CPCU) and Certified Insurance Counselor (CIC) designations; completed Insurance Executive Development program at the University of Pennsylvania’s Wharton School and the Strategic Planning & Implementation Program at University of Michigan’s Ross School of Business. Ms. Rankin’s senior level experience with a public company as well as her knowledge of strategic planning gives her the qualifications and skills to serve as a director of QNB.

Continuing Directors Serving Until 2011 (Class II Directors)

Kenneth F. Brown, Jr.

Director of QNB and the Bank since 1993

Age 54

Mr. Brown is the President of McAdoo & Allen, Inc., a manufacturer of pigment dispersions and high performance coatings (September 1989 to present). Mr. Brown also serves as a Director and Trustee for various local nonprofit organizations including the Upper Bucks YMCA and St. Luke’s Quakertown Hospital. Mr. Brown’s success in building and managing McAdoo and Allen, Inc. along with his prominent role in the community and years of service as a director of QNB give Mr. Brown the qualifications and skills to serve as a director of QNB.

Anna Mae Papso

Director of QNB and the Bank since 2004

Age 66

Ms. Papso retired from West Pharmaceutical Services, Inc., a manufacturer of specialized pharmaceutical packaging & medical device components in 2001. Ms. Papso served as a Corporate Vice President and Chief Financial Officer from 2000 to 2001 and prior thereto as Vice President & Corporate Controller from 1989 to 2000. Ms. Papso’s educational background includes a Bachelor of Science degree in business administration and a Masters of Business Administration, both from Drexel University. The Board believes that Ms. Papso’s financial, business and accounting experience at publicly traded companies as well as her background in public accounting give her the qualifications and skills to serve as a QNB director.

Henry L. Rosenberger

Director of QNB and the Bank since 1984

Age 64

Mr. Rosenberger owns and operates Tussock Sedge Farms and is a Director of Wood Composite Technologies, Inc. (2000 to present). Mr. Rosenberger was the President of Rosenberger Companies, Ltd., a cold storage company from 1998 to 2006. Mr. Rosenberger is very active in the local community and served as President of Dock Woods Community, Inc., a retirement community, from 1992 to 2002 and was a Director of Dock Woods Community, Inc. from 1978 to December 2002. The Board believes that Mr. Rosenberger’s business experience combined with his years of service on the board and his prominence in the community give him the qualifications to serve as a director of QNB.

Edgar L. Stauffer

Director of QNB since 1984

Director of the Bank since 1983

Age 72

Prior to his retirement, Mr. Stauffer was Co-Owner, President, Vice President and Secretary of Stauffer Manufacturing Corporation, a manufacturer and importer of industrial work gloves and safety equipment and Co-Owner and President of H. Texier Glove Corporation. Mr. Stauffer serves on the Boards of various nonprofit organizations. Mr. Stauffer’s educational background includes a Bachelor of Science degree in Commerce and Finance from Bucknell University. Mr. Stauffer’s business experience combined with his years of service on the board and his prominence in the community give him the qualifications to serve as a director of QNB.

Continuing Directors Serving Until 2012 (Class III Directors)

Thomas J. Bisko

Director of QNB since 1986

Director of the Bank since 1985

Age 62

Mr. Bisko has been the Chief Executive Officer of QNB and the Bank from March 1988 to present. Mr. Bisko also serves as the President of QNB since 1986 and the President of the Bank since 1985. Mr. Bisko has also held the position of Treasurer of QNB since February 1986. Prior to joining QNB, Mr. Bisko was an examiner for the Office of the Comptroller of the Currency and a consultant with a firm specializing in the banking industry. Mr. Bisko serves on many local Boards including St. Luke’s Quakertown Hospital and the Upper Bucks YMCA. Mr. Bisko’s educational background includes a Bachelor of Science degree from Kings College. The Board believes Mr. Bisko’s career in banking gives him the qualifications and skills to serve as a QNB director.

Dennis Helf

Chairman of the Board since 2002

Director of QNB since 1997

Director of the Bank since 1996

Age 63

Mr. Helf has been a Registered Investment Advisor since 1995 and has over 30 years of experience investing in community bank stocks. Prior to 1995 Mr. Helf was the managing partner in a law firm and spent 22 years representing five financial institutions in all facets of the law affecting financial institutions with a particular concentration in commercial lending and workouts. Mr. Helf served on the Board of Sellersville Savings & Loan and has long-term involvement with many nonprofit organizations in QNB’s market area. Mr. Helf’s educational background includes a Bachelor of Arts degree from Muhlenberg College, a Juris Doctorate from Villanova School of Law and a Masters in Tax Law from Temple University Law School. The Board believes that Mr. Helf’s extensive legal and business experience in the financial services industry gives him the qualifications and skills to serve as a QNB director.

G. Arden Link

Director of QNB since 2001

Director of the Bank since 1997

Age 70

Mr. Link is the owner of Link Beverages, Inc., a beverage distributor in Coopersburg PA. Mr. Link is actively involved in various service organizations in the Southern Lehigh area. Mr. Link’s business experience combined with his years of service on the board and his prominence in the community give him the qualifications to serve as a director of QNB.

EXECUTIVE OFFICERS OF QNB AND/OR THE BANK

The following list sets forth the names of the executive officers of QNB, and other significant employees of the Bank, their respective ages, positions held, recent business experience with QNB and the Bank, and the period they have served in their respective capacities.

Thomas J. Bisko

Age 62; Chief Executive Officer of QNB and the Bank from March 1988 to present; President of QNB from May 1986 to present; Treasurer of QNB from February 1986 to present; President of the Bank from September 1985 to present.

Bret H. Krevolin

Age 47; Chief Financial Officer of QNB from May 2003 to present; Chief Accounting Officer of QNB from January 1992 to present; Executive Vice President/Chief Financial Officer of the Bank from January 2000 to present; Senior Vice President/Chief Financial Officer of the Bank from January 1995 to December 1999; Vice President/Controller of the Bank from August 1989 to December 1994.

Scott G. Orzehoski

Age 44; Senior Vice President/Chief Lending Officer of the Bank from January 2002 to present; Vice President/Commercial Lending Officer of the Bank from August 1997 to December 2001; Assistant Vice President/Commercial Lending Officer of the Bank from February 1996 to July 1997.

Mary Ann Smith

Age 56; Senior Vice President/Chief Information Officer of the Bank from January 1999 to present; Senior Vice President/Operations of the Bank from January 1995 to December 1998; Vice President/Operations of the Bank from January 1988 to December 1994.

Dale A. Wentz

Age 54; Senior Vice President/Retail Banking of the Bank from October 2008 to present; Vice President, Fairmont Quality Service & Sales Development, Frederick, PA from March 1999 to September 2008.

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2010

Independent Registered Public Accounting Firm

Our Board’s Audit Committee is comprised entirely of directors who are independent pursuant to the rules adopted by the Securities and Exchange Commission (SEC) and the corporate governance standards promulgated by the NASDAQ Stock Market. Among other things, the Board has determined that each member has a general understanding of finance and accounting practices. The Board made these determinations in its business judgment, based on its interpretation of the Nasdaq Stock Market’s requirements for audit committee members.

Under the Audit Committee’s charter, the Committee is responsible for selecting QNB’s independent registered public accounting firm. The Committee evaluates and monitors the auditors’ qualifications, performance and independence. You can learn more about the committee’s responsibilities with respect to the independent registered public accounting firm in the Committee’s charter, which is available on QNB’s website at www.qnb.com under “Governance Documents”.

Based on the recommendation of the Audit Committee, the Board unanimously recommends that shareholders vote to ratify the Audit Committee’s selection of ParenteBeard LLC as QNB’s independent registered public accounting firm for 2010.

Representatives of ParenteBeard LLC will be present at the Annual Meeting and will have an opportunity to make a statement if they so desire. They will also be available to respond to appropriate questions presented at the Annual Meeting.

Voting Requirements

The affirmative vote of a majority of the votes cast at the meeting, assuming the presence of a quorum, is required for the adoption of this Proposal.

In the event that the shareholders do not ratify the selection of ParenteBeard LLC, the selection of QNB’s independent registered public accounting firm will be reconsidered by the Audit Committee. The Committee will be under no obligation, however, to select a new independent registered public accounting firm. If the Committee does select a new independent registered public accounting firm for 2010, we will not seek shareholder ratification of the new independent registered public accounting firm selected by the Committee.

RECOMMENDATION

THE BOARD OF DIRECTORS AND MANAGEMENT RECOMMEND THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF PARENTEBEARD LLC AS THE QNB’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2010.

BENEFICIAL OWNERSHIP OF DIRECTORS AND OFFICERS

The following table sets forth, as of April 5, 2010, the number of shares of common stock, par value $0.625 per share, beneficially owned by each current director and nominee for director, by each named executive officer, and by all directors, nominees and executive officers of QNB and the Bank, as a group. Unless otherwise indicated, shares are held individually and not pledged as security. The address for each person is 320 West Broad Street, P.O. Box 9005, Quakertown, Pennsylvania 18951.

| Name of Beneficial Owner | | Amount and Nature of Beneficial Ownership (1) | | | Percentage of Class (2) | |

| | | | | | | |

| Thomas J. Bisko | | | 50,143 | (3) | | | 1.54 | % |

| Kenneth F. Brown, Jr. | | | 150,100 | (4) | | | 4.61 | % |

| Dennis Helf | | | 31,172 | (5) | | | * | |

| Bret H. Krevolin | | | 30,664 | (6) | | | * | |

| G. Arden Link | | | 7,600 | (7) | | | * | |

| Charles M. Meredith III | | | 57,789 | (8) | | | 1.78 | % |

| Scott G. Orzehoski | | | 20,516 | (9) | | | * | |

| Anna Mae Papso | | | 2,825 | | | | * | |

| Gary S. Parzych | | | 9,039 | (10) | | | * | |

| Bonnie L. Rankin | | | 2,000 | | | | * | |

| Henry L. Rosenberger | | | 38,872 | (11) | | | 1.19 | % |

| Mary Ann Smith | | | 35,631 | (12) | | | 1.09 | % |

| Edgar L. Stauffer | | | 100,814 | (13) | | | 3.10 | % |

| Dale A. Wentz | | | 590 | | | | * | |

Current Directors, Nominees & Executive Officers

as a Group (14 persons) | | | 537,755 | (14) | | | 16.52 | % |

| (1) | The securities "beneficially owned" by an individual are determined in accordance with the definitions of "beneficial ownership" set forth in the General Rules and Regulations of the SEC and may include securities owned by or for the individual's spouse and minor children and any other relative who has the same home, as well as securities as to which the individual has, or shares, voting or investment power or has the right to acquire beneficial ownership within 60 days after April 5, 2010. Beneficial ownership may be disclaimed as to certain of the securities. |

| (2) | Numbers are rounded-off to the nearest one-hundredth percent. |

| (3) | Includes 17,738 shares owned jointly by Mr. Bisko with his wife, Barbara, 325 shares held in her individual capacity, and 27,160 options. |

| (4) | Includes 148,336 shares owned jointly by Mr. Brown with his wife, Pamela. |

| (5) | Includes 22,043 shares owned jointly by Mr. Helf with his wife, Mary. |

| (6) | Includes 5,554 shares owned jointly by Mr. Krevolin with his wife, Susan, and 25,110 options. |

| (7) | Includes 1,800 shares owned jointly by Mr. Link with his wife, Dorothy. |

| (8) | Includes 13,527 shares owned jointly by Mr. Meredith with his wife, Elizabeth, 5,030 shares held in her individual capacity, and 3,738 shares held of record by Franklin & Meredith, Inc, a commercial publishing company owned by Mr. Meredith. |

| (9) | Includes 17,580 options. |

| (10) | Includes 2,589 shares owned by Mr. Parzych’s wife, Karen, and 2,595 shares held of record by Eugene T. Parzych, Inc., a construction company owned by Mr. Parzych. |

| (11) | Includes 8,796 shares owned by Mr. Rosenberger’s wife, Charlotte. |

| (12) | Includes 1,788 shares owned jointly by Ms. Smith with her husband, Randall, and 24,660 options. |

| (13) | Includes 65,034 shares owned jointly by Mr. Stauffer with his wife, Mary Blake, and 10,664 shares held in her individual capacity. |

| (14) | Includes 155,464 options, in the aggregate which are exercisable within 60 days of the record date; thus, the percentage ownership calculation is based upon an aggregate of 3,254,269 shares outstanding. |

GOVERNANCE OF THE CORPORATION

Our Board of Directors believes that the purpose of corporate governance is to ensure that we maximize shareholder value in a manner consistent with legal requirements and the highest standards of integrity. The Board has adopted and adheres to corporate governance practices which the Board and senior management believe promote this purpose, are sound and represent best practices. We continually review these governance practices, Pennsylvania law (the state in which we are incorporated), the rules and listing standards of the Nasdaq Stock Market and SEC regulations, as well as best practices suggested by recognized governance authorities.

The structure of the Corporation’s Board leadership consists of an independent non-employee Chairman, Mr. Helf, a non-independent President and Principal Executive Officer, Thomas Bisko, and eight other independent non-employee directors. The independent directors of the Board meet separately twice a year without management present. Additionally, the Corporation has an active Board Committee structure in which members of the Board of Directors attend and actively participate in the following Committees: Asset & Liability Management Committee, Audit Committee, Compensation Committee, Executive Committee, Investment Committee, Loan Committee, Nominating and Governance Committee and Wealth Management Committee. The active participation in these Committees in addition to the monthly Board of Directors’ meetings provides the independent members of the Board the necessary insight into the daily operations of the Corporation. The Board believes that this Board leadership structure most effectively represents the best interests of shareholders in maximizing value.

Currently, our Board of Directors has 10 members. Under the rules adopted by the Securities and Exchange Commission and Nasdaq Stock Market for independence, Kenneth F. Brown, Jr., Dennis Helf, G. Arden Link, Charles M. Meredith, III, Anna Mae Papso, Gary S. Parzych, Bonnie L. Rankin, Henry L. Rosenberger and Edgar L. Stauffer meet the standards for independence. These directors represent more than a majority of our Board of Directors.

Our Board of Directors determined that the following director was not independent within the meaning of the rules and listing standards of the Nasdaq Stock Market: Thomas J. Bisko, President and Chief Executive Officer of QNB.

Our Board of Directors has determined that a lending relationship resulting from a loan made by the Bank to a director would not affect the determination of independence if the loan complies with Regulation O under the federal banking laws. Our Board of Directors also determined that maintaining with the Bank a deposit, savings or similar account by a director or any of the director’s affiliates would not affect the determination of independence if the account is maintained on the same terms and conditions as those available to similarly situated customers. Additional categories or types of transactions or relationships considered by our Board of Directors regarding director independence include, but are not limited to, vendor or contractual relationships with directors or their affiliates.

Risk Management

The management of risk is fundamental to the business of banking and integral to the daily operations of the Corporation. The Board of Directors oversees the Risk Management functions of the Corporation through policies which are reviewed at least on an annual basis and by representation on Loan Committee, Investment Committee and the Asset & Liability Committee. The minutes from these Committees are reported into the full Board of Directors. Currently, QNB does not have a Chief Risk Officer or an Enterprise Risk Management Committee.

Code of Ethics

We have adopted a Code of Ethics for directors, officers and employees of QNB and the Bank. It is intended to promote honest and ethical conduct, full and accurate reporting and compliance with laws as well as other matters. A copy of the Code of Ethics is posted on our website at http://www.qnb.com.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS OF QNB AND THE BANK

Set forth below is a list of each of our current board members and our current Board committee members. The respective chairperson of each of the Board committees is also noted below. Each current director of QNB is also a current member of the Bank’s Board of Directors.

| Board Member | | Board | | | Audit | | | Compensation | | | Executive | | | Nominating | |

| Thomas J. Bisko | | X | | | | | | | | | X | | | | |

| Kenneth F. Brown, Jr. | | X | | | | | | | | | X | | | C | |

| Dennis Helf | | C | | | | | | X | | | C | | | | |

| G. Arden Link | | X | | | | | | | | | | | | X | |

| Charles M. Meredith, III | | X | | | X | | | X | | | X | | | | |

| Anna Mae Papso | | X | | | C | | | | | | | | | | |

| Gary S. Parzych | | X | | | | | | | | | | | | | |

| Bonnie L. Rankin | | X | | | | | | X | | | | | | | |

| Henry L. Rosenberger | | X | | | X | | | X | | | | | | X | |

| Edgar L. Stauffer | | X | | | X | | | C | | | X | | | X | |

| | | | | | | | | | | | | | | | |

| Meetings Held in 2009 | | 13 | | | 5 | | | 1 | | | 2 | | | 1 | |

C – Chairperson

All current directors attended at least 75% of the aggregate of the total number of meetings of the Board of Directors (held for the period for which he or she has been a director) and the total number of meetings held by all committees of the Board of Directors on which he or she served (during the periods that he or she served).

QNB has no specific policy requiring directors to attend the Annual Meeting of Shareholders; however, director attendance is strongly encouraged. All current members of the Board of Directors were present at the 2009 Annual Meeting of Shareholders. It is anticipated that all members of the Board of Directors will be attending the 2010 Annual Meeting of Shareholders.

QNB’s Board of Directors established and maintains the following committees, among others:

Audit Committee. The Audit Committee recommends the engagement and dismissal of the independent registered public accounting firm, reviews their annual audit plan and the results of their auditing activities, and considers the range of audit and non-audit fees. It also reviews the general audit plan, scope and results of QNB's procedures for internal auditing. The reports of examination of QNB and its subsidiary by bank regulatory examiners are also reviewed by the Audit Committee. The Audit Committee also reviews all SEC filings and earnings press releases. The Audit Committee meets with management and the auditors prior to the filing of officers’ certifications with the SEC to receive information concerning, among other things, the adequacy of the design and operation of internal controls, including significant deficiencies identified, if any.

All members of the Audit Committee are non-executives and are independent directors pursuant to the rules adopted by the SEC and the corporate governance standards promulgated by the Nasdaq Stock Market. In determining whether a director is independent for purposes of each of the above stated guidelines, the Board of Directors must affirmatively determine that the directors on the Audit Committee do not, among other things, accept any consulting, advisory, or other compensatory fee from QNB. Applying these standards, the Board of Directors has determined that all of the directors on the Audit Committee are independent. The members of QNB’s Audit Committee are Directors Meredith, Papso, Rosenberger and Stauffer.

The Board of Directors has determined that Anna Mae Papso meets the requirements adopted by the SEC and Nasdaq Stock Market for qualification as an Audit Committee financial expert. Ms. Papso has past employment experience as a Corporate Vice President, Chief Accounting Officer and Chief Financial Officer providing her with diverse and progressive financial management experience, as well as expertise in internal controls and U.S. accounting rules and SEC reporting. An Audit Committee financial expert is defined as a person who has the following attributes: (i) an understanding of generally accepted accounting principles and financial statements; (ii) the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves; (iii) experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity or accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the registrant’s financial statements, or experience actively supervising one or more persons engaged in such activities; (iv) an understanding of internal controls and procedures for financial reporting; and (v) an understanding of audit committee functions.

The identification of a person as an audit committee financial expert does not impose on such person any duties, obligations or liability that are greater than those that are imposed on such person as a member of the Audit Committee and the Board of Directors in the absence of such identification. Moreover, the identification of a person as an audit committee financial expert for purposes of the regulations of the SEC does not affect the duties, obligations or liability of any other member of the Audit Committee or the Board of Directors. Additionally, a person who is determined to be an Audit Committee financial expert will not be deemed an “expert” for purposes of Section 11 of the Securities Act of 1933.

The Audit Committee operates under a formal charter that governs its duties and conduct. The Audit Committee Charter is available on our website at www.qnb.com.

The Audit Committee has also adopted a Whistleblower Policy to enable confidential and anonymous reporting of questionable accounting or auditing matters, fraudulent activities, or misconduct to the Audit Committee. The policy also is available on our website at www.qnb.com.

Compensation Committee. The Compensation Committee's primary functions are to review and approve key executive salaries and salary policy, determine the salary of the Chief Executive Officer and to administer equity compensation plans. In formulating its recommendations for the other executive officers, the Compensation Committee will consider information provided by Mr. Bisko related to subordinate executives. In addition, the Committee reviews the general guidelines on compensation for all employees. The Board of Directors has determined that all of the directors serving on the Compensation Committee are independent for the purposes of the rules adopted by the SEC and the corporate governance standards promulgated by the Nasdaq Stock Market. The Compensation Committee has a formal charter which is available on our website at www.qnb.com. The members of the Compensation Committee are Directors Helf, Meredith, Rankin, Rosenberger and Stauffer.

Executive Committee. The Executive Committee is authorized to exercise all of the authority of the Board of Directors in the management of QNB between Board meetings, unless otherwise provided in QNB’s Bylaws. The members of the Executive Committee are Directors Bisko, Brown, Helf, Meredith and Stauffer.

Nominating Committee. The Board of Directors has determined that all of the directors serving on the Nominating Committee are independent for the purposes of the rules adopted by the SEC and the corporate governance standards promulgated by the Nasdaq Stock Market. The principal duties of the Nominating Committee include developing and recommending to the Board criteria for selecting qualified director candidates, identifying individuals qualified to become Board members, evaluating and selecting, or recommending to the Board, director nominees for each election of directors, considering committee member qualifications, appointment and removal, recommending codes of conduct and codes of ethics applicable to the Corporation and providing oversight in the evaluation of the Board and each committee. The Nominating Committee has no formal process for considering director candidates recommended by shareholders, but the Nominating Committee will consider such candidates and its policy is to give due consideration to all candidates. If a shareholder wishes to recommend a director candidate as a possible nominee for the 2011 annual meeting of shareholders, the shareholder should mail the name, background and contact information for the candidate to the Nominating Committee at the Corporation's offices at P.O. Box 9005, Quakertown, PA 18951 no later than April 3, 2011. The Nominating Committee has a formal charter which is available on our website at www.qnb.com. Members of the Nominating Committee include Directors Brown, Link, Rosenberger and Stauffer.

In considering individual director candidates, the Nominating Committee considers individuals who, in the judgment of the Committee, would be best qualified to serve on the Board. The Nominating Committee does not specifically consider diversity of gender or ethnicity in fulfilling its responsibilities to select qualified and appropriate director candidates. Instead, the Committee will seek to balance the existing skill sets of current Board members with the need for other diverse skills and qualities that will complement the Corporation’s strategic vision. All director candidates are evaluated based on general characteristics and specific talents and skills needed to increase the Board’s effectiveness. Additionally, all candidates must possess an unquestionable commitment to high ethical standards and have a demonstrated reputation for integrity.

AUDIT COMMITTEE REPORT

Pursuant to rules adopted by the SEC designed to improve disclosures related to the functioning of corporate audit committees and to enhance the reliability and credibility of financial statements of public companies, QNB’s Audit Committee submits the following report:

Audit Committee Report to Board of Directors

The Board of Directors has formally adopted an Audit Committee Charter setting forth the Committee's duties. The Charter delegates to the Committee responsibility for overseeing QNB's financial reporting process. In that connection, the Committee has discussed and reviewed the Corporation's audited financial statements for 2009 with management and ParenteBeard LLC, QNB's independent registered public accounting firm.

Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal control. ParenteBeard LLC is responsible for expressing an opinion on the conformity of the QNB's audited financial statements with generally accepted accounting principles.

In discharging its responsibilities, the Committee's review of the Corporation's financial statements for 2009 included discussion of the quality, not just the acceptability, of the accounting principles used, the reasonableness of significant judgments made, and the clarity, consistency and completeness of disclosures in such financial statements with management and ParenteBeard LLC, as required by U.S. Auditing Standards Section AU380, Communication with Audit Committees.

The Audit Committee has considered the compatibility of non-audit services provided by ParenteBeard LLC with the maintenance of QNB's registered public accounting firm's independence. ParenteBeard LLC has provided written disclosures and a letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding its firm's communications with the Audit Committee concerning independence. These disclosures have been reviewed by the Audit Committee and discussed with management and ParenteBeard LLC.

The Committee discussed with QNB's internal auditors and ParenteBeard LLC the overall scope and plans for their respective audits, and met with both firms, with and without management present, to discuss the results of their examinations, their evaluations of QNB's internal controls and the overall quality of QNB's financial reporting process.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2009, for filing with the SEC.

| | Respectfully submitted, |

| | THE AUDIT COMMITTEE |

| | |

| | Anna Mae Papso, Chairperson |

| | Charles M. Meredith, III |

| | Henry L. Rosenberger |

| | Edgar L. Stauffer |

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of the Independent Registered Public Accounting Firm

The Audit Committee has a policy for the pre-approval of services provided by the independent registered public accounting firm. The policy requires the Audit Committee to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit related services, tax services, and other services. Under the policy, pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is subject to a specific budget. In addition, the Audit Committee may also pre-approve particular services on a case by case basis. The Audit Committee has delegated to the Chairperson of the Audit Committee authority to pre-approve services not prohibited by law to be performed by our independent registered public accounting firm and associated fees up to a maximum for any one service of $5,000. All of the services related to the Audit Related Fees, Tax Fees, and All Other Fees described below were approved by the Audit Committee pursuant to the pre-approval provisions set forth in applicable rules issued by the SEC and the Audit Committee’s pre-approval policy.

Appointment of ParenteBeard LLC During 2009

On October 1, 2009, QNB was notified that the audit practice of Beard Miller Company LLP (“Beard”), an independent registered public accounting firm, was combined with ParenteBeard LLC (“ParenteBeard”) in a transaction pursuant to which Beard combined its operations with ParenteBeard and certain of the professional staff and partners of Beard joined ParenteBeard either as employees or partners of ParenteBeard. On October 1, 2009, Beard resigned as the auditors of QNB and with the approval of the Audit Committee of QNB’s Board of Directors, ParenteBeard was engaged as its independent registered public accounting firm.

Prior to engaging ParenteBeard, QNB did not consult with ParenteBeard regarding the application of accounting principles to a specific completed or contemplated transaction or regarding the type of audit opinions that might be rendered by ParenteBeard on QNB’s financial statements, and ParenteBeard did not provide any written or oral advice that was an important factor considered by QNB in reaching a decision as to any such accounting, auditing or financial reporting issue.

The report of Beard regarding QNB’s financial statements for the fiscal years ended December 31, 2008 and 2007 did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the years ended December 31, 2008 and 2007, and during the interim period from the end of the most recently completed fiscal year through October 1, 2009, the date of resignation, there were no disagreements with Beard on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of Beard would have caused it to make reference to such disagreement in its reports.

Audit Fees, Audit Related Fees, Tax Fees, and All Other Fees

ParenteBeard was QNB’s independent registered public accounting firm from October 1, 2009 through December 31, 2009 while Beard Miller Company LLP was QNB’s independent registered public accounting firm for 2008 and during the interim period from January 1, 2009 through October 1, 2009. Aggregate fees billed to QNB by them for services rendered are presented below.

| | | 2009 | | | 2008 | |

| Audit fees | | $ | 93,155 | | | $ | 90,000 | |

| Audit related fees | | | 10,900 | | | | 7,500 | |

| Audit and audit related fees | | | 104,055 | | | | 97,500 | |

| Tax fees | | | 1,775 | | | | - | |

| All other fees | | | - | | | | - | |

| Total fees | | $ | 105,830 | | | $ | 97,500 | |

Audit Fees include professional services rendered for the audit of QNB’s annual financial statements and review of financial statements included in Forms 10-Q, including out-of-pocket expenses.

Audit Related Fees include assurance and related services reasonably related to the performance of the audit or review of the financial statements including the following: employee benefit plan audits for 2009 and 2008 and consent procedures in regards to From S-3 registration statement filing for 2009.

Tax Fees include fees billed for tax consultation and tax compliance services.

All Other Fees would include fees billed for products and services other than the services reported under the Audit Fees, Audit Related Fees, or Tax Fees sections of the table above.

A representative of ParenteBeard LLP is expected to be present at the Annual Meeting. The representative will have an opportunity to make a statement and be available to respond to appropriate questions.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee makes recommendation to the Board of Directors concerning general guidelines on compensation of employees and specific recommendations for Mr. Bisko. The Compensation Committee is composed entirely of the following five independent outside directors: Stauffer, Rosenberger, Rankin, Meredith, and Helf. No member of the Compensation Committee during fiscal year 2009 was an officer or employee of the Corporation or its subsidiary or was formerly an officer of the Corporation or its subsidiary. No member of the Compensation Committee had any relationship or transaction with the Corporation requiring disclosure under applicable SEC rules.

EXECUTIVE COMPENSATION

The following table is a summary of the compensation for the past two years earned by the principal executive officer and two other named executive officers:

Summary Compensation Table

Name and Position | | Year | | Salary ($)(6) | | | Bonus ($) | | | Stock Awards ($) | | | Option Awards ($)(1) | | | Non-Equity Incentive Plan Compensation ($) | | | All Other Compensation ($) | | | Total ($) | |

| Thomas J. Bisko | | 2009 | | | 275,000 | | | | 0 | | | | 0 | | | | 7,053 | | | | N/A | | | | 29,514 | (2) | | | 311,567 | |

| President and | | 2008 | | | 265,685 | | | | 13,284 | | | | 0 | | | | 7,890 | | | | N/A | | | | 28,251 | (2) | | | 315,110 | |

| Principal Executive Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Robert C. Werner | | 2009 | | | 193,982 | | | | 0 | | | | 0 | | | | 6,510 | | | | N/A | | | | 123,708 | (3) | | | 324,200 | |

| Former Executive Vice President | | 2008 | | | 188,918 | | | | 9,446 | | | | 0 | | | | 7,233 | | | | N/A | | | | 20,304 | (3) | | | 225,901 | |

| and Chief Operating Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bret H. Krevolin | | 2009 | | | 177,488 | | | | 0 | | | | 0 | | | | 6,510 | | | | N/A | | | | 15,314 | (4) | | | 199,312 | |

| Executive Vice President and | | 2008 | | | 170,252 | | | | 8,513 | | | | 0 | | | | 7,233 | | | | N/A | | | | 13,620 | (4) | | | 199,618 | |

| Principal Financial Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mary Ann Smith | | 2009 | | | 143,700 | | | | 0 | | | | 0 | | | | 6,185 | | | | N/A | | | | 11,496 | (5) | | | 161,381 | |

| Senior Vice President and | | 2008 | | | 137,842 | | | | 6,892 | | | | 0 | | | | 6,838 | | | | N/A | | | | 11,027 | (5) | | | 163,847 | |

| Chief Information Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | The amounts reported in the column reflect the aggregate fair value computed in accordance with FASB ASC Topic 718. This method of reporting using the aggregate grant date fair value differs from the method used in previous years of reporting the amount recognized each year for financial statement reporting purposes, and is the result of a recent rule change promulgated by the SEC. All of the option awards vest ratably over a three-year period. The assumptions used to arrive at the estimated fair value using the Black-Scholes option pricing model are disclosed in Note 1 to our consolidated financial statements included in our 2009 Annual Report on Form 10-K. |

| (2) | Includes the Bank's contributions on behalf of Mr. Bisko to the Retirement Savings Plan of $19,600 and $18,400; country club membership dues of $8,898 and $8,756; and reimbursement of spousal travel expense of $1,016 and $1,095 for 2009 and 2008, respectively. |

| (3) | Includes the Bank's contributions on behalf of Mr. Werner to the Retirement Savings Plan of $15,323 and $15,113; country club membership dues of $5,547 and $5,191; reimbursement of spousal travel expense of $1,294 and $0 for 2009 and 2008, respectively and a severance payment of $101,544. In connection with Mr. Werner’s termination of employment on November 23, 2009, the Corporation, the Bank, and Mr. Werner entered into a separation agreement (the “Agreement”) dated as of December 21, 2009. Under the Agreement, the Corporation agreed to pay Mr. Werner a total severance amount of $101,543.52, in three installments of $16,923.92 on each of January 1, 2010, January 23, 2010, and February 23, 2010, and a final installment of $50,771.76 on or by March 12, 2010, and maintain Mr. Werner’s coverage under the Corporation’s medical benefit plan for a period of six months. The Agreement contains a non-solicitation provision relating to customers or employees of the Corporation or the Bank for a period of one year, and includes a mutual release of claims. |

| (4) | Includes the Bank's contributions on behalf of Mr. Krevolin to the Retirement Savings Plan of $14,199 and $13,620 for 2009 and 2008, respectively. |

| (5) | Includes the Bank’s contributions on behalf of Ms. Smith to the Retirement Savings Plan of $11,496 and $11,027 for 2009 and 2008 respectively. |

| (6) | “Salary” is the actual base pay compensation paid through December 31, 2009. The annual base salaries for 2010 for the named executive officers are: Mr. Bisko $300,000, Mr. Krevolin $195,000 and Ms. Smith $148,730. |

Stock Option Grants for 2009

On January 20, 2009, the Corporation granted 3,250, 3,000, 3,000 and 2,850 stock options to Messrs. Bisko, Krevolin, Werner and Ms. Smith, respectively, under the Corporation’s existing stock option program. The stock options are all subject to a ten-year term, are exercisable at $17.15 per share, and vest ratably over a three-year period from the grant date. The 3,000 options granted to Mr. Werner were forfeited in connection with his termination of employment on November 23, 2009.

Outstanding Equity Awards at Fiscal Year End

The following table sets forth information concerning exercisable and unexercisable stock options held by each named executive officer as of December 31, 2009.

| | | OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END |

| | | Option Awards |

Name | | Option Grant Date | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | | | Option Exercise Price ($) | | Option Expiration Date (1) |

| Thomas J. Bisko | | 1/16/2001 | | | 3,360 | | | | | | | 0 | | | | 13.30 | | 1/16/2011 |

| | | 1/15/2002 | | | 6,000 | | | | | | | 0 | | | | 16.13 | | 1/15/2012 |

| | | 1/21/2003 | | | 6,000 | | | | | | | 0 | | | | 20.00 | | 1/21/2013 |

| | | 4/27/2004 | | | 2,800 | | | | | | | 0 | | | | 33.25 | | 4/27/2014 |

| | | 1/18/2005 | | | 3,000 | | | | | | | 0 | | | | 32.35 | | 1/18/2015 |

| | | 1/17/2006 | | | 3,000 | | | | | | | 0 | | | | 26.00 | | 1/17/2011 |

| | | 1/16/2007 | | | | | | | 3,000 | | | | 0 | | | | 25.15 | | 1/16/2012 |

| | | 1/15/2008 | | | | | | | 3,000 | | | | 0 | | | | 21.00 | | 1/15/2013 |

| | | 1/20/2009 | | | | | | | 3,250 | | | | 0 | | | | 17.15 | | 1/20/2014 |

| | | | | | | | | | | | | | | | | | | | |

| Robert C. Werner | | 1/16/2001 | | | 3,360 | | | | | | | | 0 | | | | 13.30 | | 1/16/2011 |

| | | 1/15/2002 | | | 5,500 | | | | | | | | 0 | | | | 16.13 | | 1/15/2012 |

| | | 1/21/2003 | | | 5,500 | | | | | | | | 0 | | | | 20.00 | | 1/21/2013 |

| | | 4/27/2004 | | | 2,500 | | | | | | | | 0 | | | | 33.25 | | 4/27/2014 |

| | | 1/18/2005 | | | 2,750 | | | | | | | | 0 | | | | 32.35 | | 1/18/2015 |

| | | 1/17/2006 | | | 2,750 | | | | | | | | 0 | | | | 26.00 | | 1/17/2011 |

| | | | | | | | | | | | | | | | | | | | |

| Bret H. Krevolin | | 1/18/2000 | | | 3,528 | | | | | | | | 0 | | | | 13.09 | | 1/18/2010 |

| | | 1/16/2001 | | | 3,360 | | | | | | | | 0 | | | | 13.30 | | 1/16/2011 |

| | | 1/15/2002 | | | 5,500 | | | | | | | | 0 | | | | 16.13 | | 1/15/2012 |

| | | 1/21/2003 | | | 5,500 | | | | | | | | 0 | | | | 20.00 | | 1/21/2013 |

| | | 4/27/2004 | | | 2,500 | | | | | | | | 0 | | | | 33.25 | | 4/27/2014 |

| | | 1/18/2005 | | | 2,750 | | | | | | | | 0 | | | | 32.35 | | 1/18/2015 |

| | | 1/17/2006 | | | 2,750 | | | | | | | | 0 | | | | 26.00 | | 1/17/2011 |

| | | 1/16/2007 | | | | | | | 2,750 | | | | 0 | | | | 25.15 | | 1/16/2012 |

| | | 1/15/2008 | | | | | | | 2,750 | | | | 0 | | | | 21.00 | | 1/15/2013 |

| | | 1/20/2009 | | | | | | | 3,000 | | | | 0 | | | | 17.15 | | 1/20/2014 |

| | | | | | | | | | | | | | | | | | | | |

| Mary Ann Smith | | 1/16/2001 | | | 3,360 | | | | | | | | 0 | | | | 13.30 | | 1/16/2011 |

| | | 1/15/2002 | | | 5,500 | | | | | | | | 0 | | | | 16.13 | | 1/15/2012 |

| | | 1/21/2003 | | | 5,500 | | | | | | | | 0 | | | | 20.00 | | 1/21/2013 |

| | | 4/27/2004 | | | 2,500 | | | | | | | | 0 | | | | 33.25 | | 4/27/2014 |

| | | 1/18/2005 | | | 2,600 | | | | | | | | 0 | | | | 32.35 | | 1/18/2015 |

| | | 1/17/2006 | | | 2,600 | | | | | | | | 0 | | | | 26.00 | | 1/17/2011 |

| | | 1/16/2007 | | | | | | | 2,600 | | | | 0 | | | | 25.15 | | 1/16/2012 |

| | | 1/15/2008 | | | | | | | 2,600 | | | | 0 | | | | 21.00 | | 1/15/2013 |

| | | 1/20/2009 | | | | | | | 2,850 | | | | 0 | | | | 17.15 | | 1/20/2014 |

(1) Options vest after a 3 year period, commencing upon the date of grant.

In connection with Mr. Werner’s termination of employment on November 23, 2009, the Corporation agreed that all outstanding stock options granted to him pursuant to the Corporation’s equity incentive plan which were vested and outstanding on such date will remain exercisable until the expiration of the term of such stock options.

Employment Agreements

QNB and Mr. Bisko are parties to an employment agreement that terminates on December 31, 2013; provided however, that the employment agreement may be terminated by either party upon three years' prior written notice. Under the terms of the employment agreement, Mr. Bisko is to be employed as the President of the Bank and to render services as may be reasonably required of him from time to time by the Board of Directors. Mr. Bisko may be discharged at any time for just and proper cause, which includes:

| | (1) | his failure to properly perform his duties; |

| | (2) | his violation of any covenants or commitments set forth in the Agreement; |

| | (3) | his failure or refusal to comply with the proper and reasonable written policies or directives of the Board which do not violate any of the provisions in the Agreement; |

| | (4) | conduct on his part, which violates any applicable state or Federal law; or |

| | (5) | conduct on his part, which, in the reasonable discretion of the Board, would make his continued employment prejudicial to the best interest of QNB. |

Following a change of control of QNB (which is defined as any one person or group obtaining voting control of 25% or more of QNB’s outstanding common stock) Mr. Bisko's employment may only be terminated if he materially breaches his obligations under the employment agreement, fails or refuses to comply with the proper and reasonable written policies of the Board of Directors, or is convicted of a felony. If Mr. Bisko's employment is terminated for reasons other than, among others, discharge for cause, a change in control of QNB, or death or disability, Mr. Bisko is entitled to receive a lump sum severance payment equal to 2.99 times his then current base salary. If Mr. Bisko were terminated at the minimum base salary of $300,000 as of January 1, 2010, he would be entitled to receive a maximum lump sum payment equal to $897,000. Such a provision may be deemed to be "anti-takeover" in nature inasmuch as it may discourage a potential acquirer who may desire to replace Mr. Bisko with a new president. In the event of Mr. Bisko's death or disability, QNB shall pay either to Mr. Bisko, his estate, or his designated beneficiary, an amount equal to his then current base salary in twelve equal monthly installments, which amounts may be reduced based upon the receipt of any life or disability insurance proceeds from policies maintained by and at the expense of QNB. Under Section 280G of the Internal Revenue Code, payments to an executive made upon a change of control (“parachute payments”) which exceed three times the executive’s five year average annualized compensation will be subject to the following tax consequences: (i) the paying corporation is denied any deduction for employee compensation on the excess payment and (ii) the recipient is subject to a nondeductible 20% excise tax on such excess payment (in addition to income taxes). If 280G were to be applicable to payments made to Mr. Bisko upon a change of control, Mr. Bisko would be responsible for any taxes on benefits in excess of amounts that are considered parachute payments under the Internal Revenue Code, and QNB would not be entitled to take a deduction for the amounts paid with respect to the parachute payment.

The Bank provides Mr. Bisko, for the benefit of his named beneficiary, with a salary continuation agreement. In the event of Mr. Bisko's death, the agreement provides his beneficiary with monthly income for 180 consecutive months. The agreement is enforceable only while Mr. Bisko remains employed by the Bank. If Mr. Bisko's employment is terminated for any reason other than death all rights under the agreement will be terminated. The benefits are funded through an insurance policy with the cost limited to the annual premium on the policy. Mr. Bisko is also reimbursed for all reasonable and necessary expenses related to his duties.

Change of Control Agreement

On July 18, 2000, QNB and the Bank entered into a change of control agreement with Bret H. Krevolin, Executive Vice President and Chief Financial Officer of the Bank. This agreement provides certain benefits to Mr. Krevolin in the event of a change of control of QNB or the Bank. The agreement becomes operative only if (i) Mr. Krevolin is an employee of QNB and the Bank upon a change in control and (ii) he is not offered substantially equivalent position following the change in control. Under the Agreement, a change in control includes, among other things, a merger, consolidation, division or disposition of substantially all of the assets of QNB or the Bank, or a purchase by QNB or the Bank of substantially all of the assets of another entity, unless, in either case, the transaction is approved in advance by 70% or more of the members of the Board of QNB or the Bank who are not interested in the transaction and a majority of the members of the Board of the surviving entity and of the Board of Directors of such entity’s parent corporation, if any, are former members of the Board of QNB or Bank. A change of control also includes the acquisition by a person or group of beneficial ownership of 25% of more of the voting securities of QNB or the Bank. It also includes a situation where, during any period of two consecutive years, individuals who at the beginning of such period constitute the Board of QNB or the Bank cease for any reason to constitute at least a majority thereof, unless the election of each director who was not a director at the beginning of such period has been approved in advance by directors representing at least two-thirds of the directors then in office who were directors at the beginning of the period.

The agreement specifies payment to Mr. Krevolin upon his termination on or before the three year anniversary of the date of the change of control in an amount equal to the product of the average aggregate annual compensation paid by QNB and the Bank which is includable in his gross income for Federal income tax purposes during the five calendar years preceding the taxable year in which the date of the termination occurs, multiplied by two. The agreement further provides that, if this lump sum payment, when added to all other amounts or benefits provided to or on behalf of Mr. Krevolin in connection with his termination of employment, would result in the imposition of an excise tax under Section 4999 of the Internal Revenue Code of 1986, as amended (the Code), such payment would be reduced to the extent necessary to avoid such excise tax imposition. In addition, if any portion of the amount payable to Mr. Krevolin is determined to be non-deductible pursuant to the regulations promulgated under Section 280G of the Code, QNB is required only to pay to him the amount determined to be deductible under Section 280G. The determination of any reduction in the lump sum payment pursuant to the foregoing provisions will be made by QNB’s independent registered public accounting firm.

DIRECTOR COMPENSATION

The following table illustrates compensation earned by non-employee directors for the year ended December 31, 2009. Each director of QNB is also a member of the Bank’s Board of Directors.

| Name and Position | | Fees Earned or Paid in Cash ($) | |

| | | | |

| Kenneth F. Brown, Jr. | | | 26,683 | |

| Dennis Helf | | | 43,500 | |

| G. Arden Link | | | 21,158 | |

| Charles M. Meredith, III | | | 27,442 | |

| Anna Mae Papso | | | 27,683 | |

| Gary S. Parzych | | | 24,233 | |

| Bonnie L. Rankin | | | 18,558 | |

| Henry L. Rosenberger | | | 17,958 | |

| Edgar L. Stauffer | | | 19,408 | |

During 2010, directors, with the exception of Mr. Bisko, will receive an annual fee of $7,500. The Chairman of the Board, Dennis Helf, will receive additional compensation of $10,000 and the Corporate Secretary, Charles Meredith, will receive an additional $2,000. In addition, each director will receive a fee of $600 for each Bank Board meeting attended. Directors are not reimbursed for QNB Board meetings. Members of the committees of the Board of Directors will receive $325 for each committee meeting attended, provided the committee meeting was not held as part of a scheduled Board meeting. The Chairperson of the Audit Committee, Anna Mae Papso, will receive additional compensation of $2,000. In addition, the Chairman of the Compensation Committee, Edgar Stauffer, will receive additional compensation of $750 and the Chairman of the Building Committee, Gary Parzych, will receive additional compensation of $750.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

QNB and the Bank have not entered into any material transactions, proposed or consummated, with any director or executive officer, or any 5% security holder, of QNB or the Bank, or any associate of the foregoing persons, with the exception of that disclosed below. QNB and the Bank have engaged in and intend to continue to engage in banking and financial transactions in the ordinary course of business with directors and officers of QNB and the Bank and their associates on comparable terms with similar interest rates as those prevailing from time to time for other bank customers. The Bank makes loans to its officers and directors, as well as their immediate families and companies, in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons not related to the Bank, and these loans did not involve more than the normal risk of collection or present other unfavorable features. The aggregate amount of indebtedness outstanding as of the latest practicable date, February 28, 2010, to the above described group was $5,404,000.

SHAREHOLDER COMMUNICATIONS

The Board of Directors does not have a formal process for shareholders to send communications to the Board. Due to the infrequency of shareholder communications to the Board of Directors, the Board does not believe that a formal process is necessary. Written communications received by QNB from shareholders are shared with the full Board no later than the next regularly scheduled Board meeting. Written communication should be mailed to the President/CEO at the Corporation's offices at P.O. Box 9005, Quakertown, PA 18951.

NOMINATIONS AND SHAREHOLDER PROPOSALS

Nominations of individuals for election to the Board of Directors may be made by any shareholder if made in writing and delivered or mailed to the President of QNB, not less than 45 days or more than 60 days prior to any shareholder meeting called for the election of directors; provided, however, that if less than 21 days notice of the meeting is given to shareholders, the nomination shall be mailed or delivered to the President of QNB not later than the close of business on the 7th day following the day on which the notice of the meeting was mailed. The notification must contain the following information to the extent known to the notifying shareholder:

| (a) | the name and address of each proposed nominee; |

| (b) | the principal occupation of each proposed nominee; |

| (c) | the total number of shares of QNB common stock that will be voted for each proposed nominee; |

| (d) | the name and residential address of the notifying shareholder; and |

| (e) | the number of shares of QNB common stock owned by the notifying shareholder. |

Nominations not made in accordance with these provisions may be disregarded by the Chairman at the annual meeting.

If you wish to include a proposal in the Proxy Statement for the 2011 Annual Meeting of Shareholders, your written proposal must be received by the Corporation no later than December 20, 2010. The proposal should be mailed by certified mail, return receipt requested, and must comply in all respects with applicable rules and regulations of the SEC, the laws of the State of Pennsylvania, and the Corporation’s Bylaws. Shareholder proposals may be mailed to the Secretary of QNB, QNB Corp., P.O. Box 9005, Quakertown, PA 18951-9005.

The rules of the SEC provide that, if the Corporation does not receive notice of a shareholder proposal at least 45 days prior to the first anniversary of the date of mailing of the prior year’s proxy statement, then the Corporation will be permitted to use its discretionary voting authority when the proposal is raised at the annual meeting. The deadline for these proposals for the year 2011 annual meeting is March 5, 2011. If a shareholder gives notice of such a proposal after this deadline, the Corporation’s proxy holders will be allowed to use their discretionary authority to vote against the shareholder proposal when and if the proposal is raised at our 2011 Annual Meeting.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires QNB's officers and directors and persons who own more than 10% of QNB's common stock to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than 10% owners are required by SEC regulations to furnish QNB with copies of all Section 16(a) forms they file.

To the Board of Directors’ knowledge, based solely on review of the copies of such reports furnished to QNB during fiscal year ended December 31, 2009, no director, officer or beneficial owner of more than 10% of the Corporation’s common stock failed to file on a timely basis any report required by Section 16(a) of the Exchange Act.

OTHER MATTERS

Management is not aware of any business to come before the annual meeting other than those matters described in the proxy statement and the accompanying notice of annual meeting. However, if any other matters should properly come before the annual meeting, it is intended that the proxies hereby solicited will be voted with respect to those other matters in accordance with the judgment of the persons voting the proxies or the recommendation of the Board of Directors.

If there are not sufficient votes for approval of any of the matters to be acted upon at the annual meeting, the annual meeting may be adjourned to permit the further solicitation of proxies.

MISCELLANEOUS

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of the QNB’s Proxy Statement may have been sent to multiple shareholders in your household. QNB will promptly deliver a separate copy of the document to you if you request one by writing or calling as follows: Jean Scholl at QNB Corp., P.O. Box 9005, Quakertown, PA 18951-9005, telephone (215) 538-5600. If you want to receive separate copies of the proxy statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker or other nominee record holder, or you may contact us at the above address and phone number.

UPON REQUEST OF ANY SHAREHOLDER, A COPY OF THE CORPORATION’S ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009, INCLUDING A LIST OF THE EXHIBITS THERETO, REQUIRED TO BE FILED WITH THE SEC PURSUANT TO RULE 13a-1 UNDER THE EXCHANGE ACT MAY BE OBTAINED, WITHOUT CHARGE, BY WRITING TO THE CORPORATION’S ASSISTANT SECRETARY AT QNB CORP., P.O. BOX 9005, QUAKERTOWN, PA 18951-9005.