| | PRESS RELEASE |

1004 N. Big Spring, Suite 400 | | Contact: | Cindy Thomason |

| | | Manager of Investor Relations |

http://www.plll.com | | | cindyt@plll.com |

| |

PARALLEL PETROLEUM ANNOUNCES OPERATIONS UPDATE

AND SECOND QUARTER 2006 PRODUCTION AND PROVED RESERVES

MIDLAND, Texas, (BUSINESS WIRE), August 9, 2006 - Parallel Petroleum Corporation (NASDAQ: PLLL) today announced its operations update and second quarter 2006 production and proved reserves.

Second Quarter 2006 Production

Parallel’s net daily production for the second quarter ended June 30, 2006 averaged 6,432 equivalent barrels of oil (BOE) per day, an increase of 75% when compared to an average of 3,681 BOE per day during the second quarter ended June 30, 2005, and an increase of 25% when compared to an average of 5,146 BOE per day during the first quarter ended March 31, 2006. Since its May 10, 2006 operations update press release, the Company has completed an additional 22 gross (11.87 net) wells for the aggregate of initial daily test rates of approximately 2,689 BOE per day, net to Parallel. Due to the unstable nature of initial test data, and the natural decline rates associated with the Company’s second quarter base production, management cautions investors not to combine initial test data with actual quarterly production for the purpose of estimating the Company’s current net daily production or place undue reliance on this production data.

Management estimates that the Company’s production exit rate at the end of the second quarter 2006 was approximately 6,500 BOE per day.

As of today, the Company has 35 gross (18.36 net) wells in progress. Please refer to Tables 1, 2 and 3 below for quarterly comparison information pertaining to daily production and summary information related to “completed” and “work-in-progress” well operations since January 1, 2006.

Proved Reserves as of June 30, 2006

Beginning with the first quarter of 2006, Parallel’s management decided to have its independent engineers update the Company’s proved reserves quarterly. For the six months ended June 30, 2006, Parallel’s proved reserves, as estimated by its independent engineers, increased approximately 19% to 30.1 million BOE (MMBOE), as compared to 25.4 MMBOE as of December 31, 2005. For the six months ended June 30, 2006, reserve additions were an estimated 5.75 MMBOE, which represented approximately 548% of production of 1.05 MMBOE. Therefore, for each BOE produced during the six months ended June 30, 2006, the Company added approximately 5.48 BOE of proved reserves.

The Company’s Standardized Measure of Discounted Future Net Cash Flows increased approximately 29% to $466 million as of June 30, 2006, compared to $361 million as of December 31, 2005. The price per barrel of oil increased 21% from $61.04 to $73.98, and the price per Mcf of natural gas decreased 38% from $9.43 to $5.80, when comparing December 31, 2005 to June 30, 2006.

Please refer to Tables 4 and 5 below for proved reserves information and detail of proved reserves by area/property as of June 30, 2006.

Revised 2006 Capital Investment Budget

Parallel's capital investments through June 30, 2006 were approximately $114.0 million, which includes $29.5 million of acquisitions made during the first quarter of 2006. Parallel has revised its 2006 capital investment budget to approximately $159.8 million, a 54% increase over its original 2006 budget of approximately $103.7 million. Excluding the $29.5 million of acquisitions, this is an increase of $26.6 million, or 26%, to $130.3 million budgeted for operations. Budgeted well operations have been increased 16% from 147 wells to 171 wells. Approximately $23.0 million, or 86%, of the $26.6 million increase is associated with increased activity on the Company’s two resource gas

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 2

projects, the Barnett Shale and the New Mexico Wolfcamp. Table 6 below shows the Company’s revised 2006 capital investment budget compared to second quarter 2006 average daily production and proved reserve value by property as of June 30, 2006. Table 7 below shows the Company’s revised 2006 capital investment budget compared to the original 2006 capital investment budget.

Operations by Area/Property

Resource Gas Projects

Parallel has two resource gas projects in early stages of development, including the Wolfcamp gas project in the Permian Basin of New Mexico and the Barnett Shale gas project in the Fort Worth Basin of North Texas. These resource gas projects generated approximately 25% of Parallel’s second quarter 2006 daily production (1,632 BOE per day) and represented approximately 5% of its reserve value as of June 30, 2006.

The Company has revised its 2006 budget for these two resource gas projects to approximately $95.4 million, which is an increase of 43% over the original budget of approximately $66.6 million, and includes $6.1 million for the additional interests acquired in the Barnett Shale project in March 2006.

Permian Basin of New Mexico

Wolfcamp Gas Project, Eddy and Chaves Counties, New Mexico

Background Information

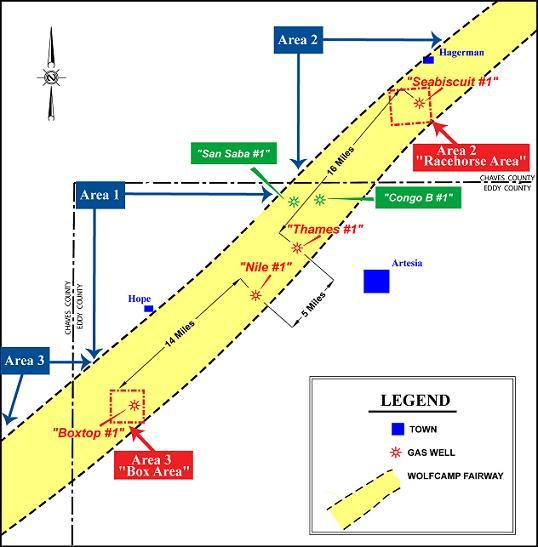

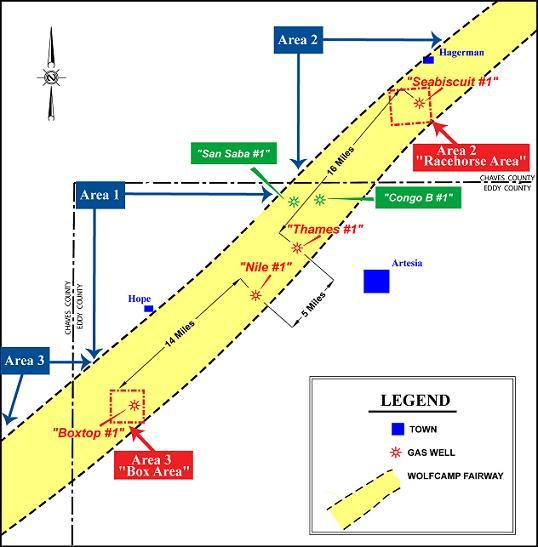

The New Mexico Wolfcamp horizontal resource gas play, as defined by Parallel Petroleum, encompasses approximately 300,000 gross acres in portions of Eddy and Chaves Counties in southeastern New Mexico. Map 1 represents an overview of the “Wolfcamp fairway” showing the three areas discussed in this press release. Also shown are certain key wells in the gas play, including the wells’ proximity to each other and the designated towns.

Map 1 (New Mexico Trend Map - Areas 1-3)

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 3

Geologically, the play is described as a broad area of gas-saturated, low permeability Wolfcamp dolomite, which historically has responded relatively poorly to conventional drilling and completion techniques. The introduction of horizontal drilling and multi-stage fracture completion techniques since mid-2004 has improved production response from the rock, thereby increasing industry interest in the play. To date, approximately 100 horizontal permits have been approved by state and federal regulatory agencies on behalf of thirteen operators. Current New Mexico Oil Conservation Division regulations allow for minimum 160-acre horizontal spacing, which appears to be validated by early results from recent 160-acre horizontal wells drilled and completed by EOG Resources Inc. (NYSE: EOG).

Parallel’s current performance “type curve” anticipates the typical horizontal Wolfcamp well will exhibit an initial gross gas rate of approximately 2,000 Mcf of gas per day and a hyperbolic curve shape which yields approximately 2 Bcf of gross gas reserves over a 17-year period. This “type curve”, along with an assumed drill-and-complete cost of $2.2 million, a royalty burden of 20%, and a realized wellhead price of $7.00 per Mcf of natural gas, yields a “typical well” undiscounted payout, undiscounted net income-to-investment ratio and rate-of-return of 0.95 years, 4.47:1 and 100%, respectively.

Project Status

Parallel has revised its 2006 New Mexico Wolfcamp budget from approximately $45.5 million to approximately $55.7 million. This increased budget will be used to fund the Company’s accelerated drilling and completion of an estimated 30 Company operated wells in Areas 2 and 3 and 34 non-operated wells primarily in Area 1, the installation of pipelines and related infrastructure, and the acquisition of additional leasehold. Parallel’s leasehold position in its entire New Mexico Wolfcamp gas project is approximately 166,000 gross (56,000 net) acres, with the majority of acreage being in Areas 2 and 3.

Other Information

Parallel’s New Mexico Wolfcamp gas project generated approximately 8% of the Company’s second quarter 2006 daily production (507 BOE per day) and represented approximately 2% of its reserve value as of June 30, 2006.

Area 1 - Parallel currently holds approximately 63,000 gross (4,600 net) acres in this portion of the project, which is operated by third parties, primarily by LCX Energy, LLC. Due to Parallel’s acreage position, the Company has the opportunity to participate with other operators through periodic acreage contributions into pooled units. As of this press release, Parallel has ownership in 23 active producing wells, of which 17 are operated by LCX Energy, 5 are operated by EOG Resources, and one well is operated by Devon Energy Corporation (NYSE: DVN). The Company also has interests in five LCX Energy wells and two EOG Resources wells that are either awaiting completion or have completions in progress. Two LCX Energy wells are currently drilling. Parallel’s proportionate base working interest in Area 1 is 8.5%.

Recent Highlights

Two non-operated wells have recently been completed in Parallel’s Wolfcamp Area 1. The San Saba #1 flowed at an estimated initial rate of 4,000 gross Mcf of gas per day, and the Congo B #1 flowed at an estimated initial rate of 6,000 gross Mcf of gas per day. It is the Company’s opinion that these improved initial rates are the result of ongoing improvements to completion procedures. Although Parallel owns a small interest in these two wells, the drilling and completion information is beneficial to Parallel’s future operations in its Wolfcamp project.

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 4

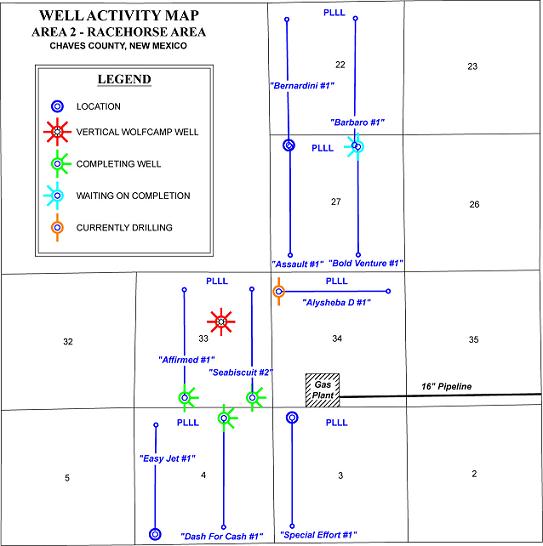

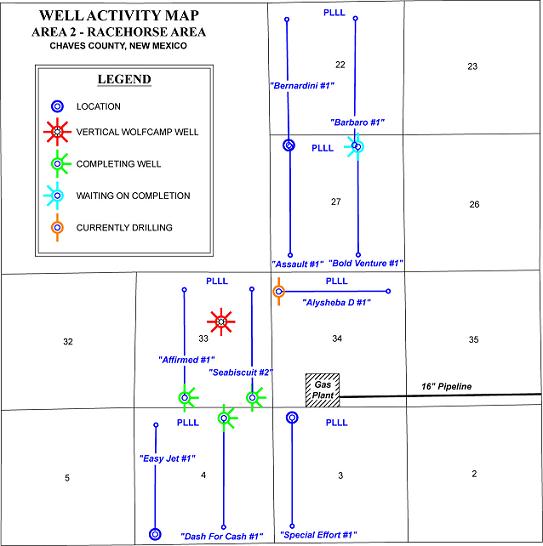

Area 2 “Racehorse Area” - Parallel currently holds approximately 77,000 gross (35,000 net) acres in this Company operated area, with a proportionate base working interest of approximately 85.0%. Currently, the Company has three horizontal wells that are being completed, one horizontal well awaiting completion and one horizontal well drilling. Parallel also has one vertical Wolfcamp well that has been completed and is shut-in. This well is being used to monitor frac jobs on offsetting horizontal completions.

The Company is in the process of staking and permitting more than 50 wells in its “Racehorse Area”.

Due to the lack of existing infrastructure in the area, Parallel has installed a treating plant and has built approximately nine miles of 16-inch pipeline, with initial capacity of approximately 10,000 Mcf of gas per day. The capacity could ultimately be expanded to approximately 100,000 Mcf of gas per day, with additional compression and plant expansion. The current schedule calls for commencement of gas sales this month.

Map 2 represents an overview of a portion of Parallel’s New Mexico Area 2 ”Racehorse Area” and shows the current well activity there.

Map 2 (New Mexico Area 2 "Racehorse Area")

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 5

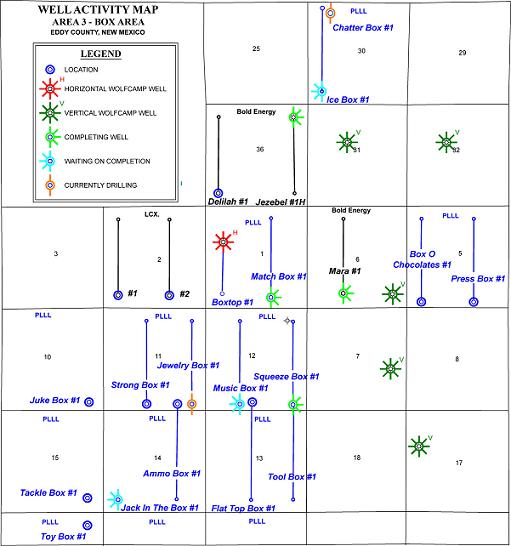

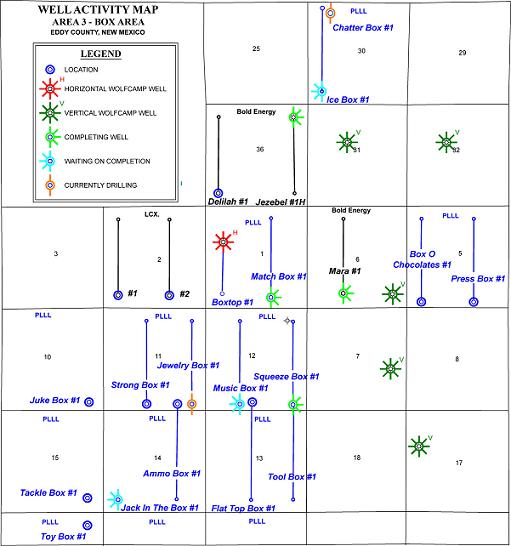

Area 3 “Box Area” - Parallel’s leasehold position in Area 3 is approximately 26,000 gross (17,000 net) acres. The Company’s proportionate base working interest in this operated area is approximately 85.0%. Currently, the Company has three horizontal Wolfcamp wells that are being completed, two horizontal Wolfcamp wells awaiting completion and two horizontal Wolfcamp wells drilling. The first producing well in this area, the Box Top 1921-1 Federal No. 1, has been on production since early April 2006. Through July 31, 2006, the well had cumulative gross production of 465,000 Mcf of gas. The well is currently producing at a rate of approximately 2,500 Mcf of gas per day, and its performance has exceeded Parallel's “type curve”. Parallel owns working and net revenue interests in the Boxtop 1921-1 Federal No. 1 well of approximately 47% and 36%, respectively.

As Parallel announced in its press release dated May 10, 2006, due to pipeline restrictions, the gas pipeline company is making modifications to increase the capacity of its pipeline to approximately 50,000 Mcf of gas per day.

In addition to the Wolfcamp activity, the Company has recently made a Morrow field discovery. The Jack in the Box No. 1 well was drilled as an obligatory Morrow formation test under the terms of a farmout agreement. The well has been completed and is currently flowing to sales at 1,050 gross Mcf of gas per day after acid stimulation. Well performance will be monitored for 30-60 days to evaluate the potential for additional stimulation and offset development. Parallel’s working and net revenue interests in this well are approximately 50% and 38%, respectively.

The nearest significant Morrow production is located approximately eight miles south in the Little Box Canyon field. Public data indicates that in excess of 76 Bcf of gas has been recovered from 28 wells in the Little Box Canyon field since 1977. Parallel owns no interest in the Little Box Canyon field.

Map 3 represents an overview of a portion of Parallel’s New Mexico Area 3 ”Box Area” and shows the current well activity there.

Map 3 (New Mexico Area 3 "Box Area")

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 6

Fort Worth Basin of North Texas

Barnett Shale Gas Project, Tarrant County, Texas

Current Operations

The Company’s Barnett Shale gas project now has 15 wells on production. Four wells operated by Chesapeake Energy Corp (NYSE: CHK), which recently acquired Four Sevens, and 11 wells operated by Dale Resources, LLC, are now producing at a combined rate of approximately 45,900 gross Mcf of gas per day, or 7,650 gross BOE per day (2,075 BOE per day, net to Parallel). The current average daily producing rate from each of these fifteen wells ranges from a low of 900 gross Mcf to a high of 6,300 gross Mcf of gas per day.

The Company’s Barnett Shale gas project currently has 5 wells operated by Dale Resources, LLC in various stages of pre-production operations. Four wells are currently flowing back frac-load, and one well is currently awaiting completion and pipeline connection. Parallel estimates that it currently takes less than 30 days to drill and case a Barnett Shale well and have it ready to be frac’d into sales.

Parallel’s working interest in each of the 4 wells operated by Chesapeake Energy Corp is approximately 25.0% before payout and approximately 18.0% after payout. Parallel’s working interest in each of the 16 wells operated by Dale Resources, LLC varies from a low of approximately 18.5% to a high of approximately 50.0% before payout, and varies from a low of approximately 18.5% to a high of approximately 37.0% after payout.

Recent Completions

On June 30, 2006, the Company announced the completion of two additional wells utilizing the “simo frac” method. Currently, these two wells are selling gas at a combined rate of approximately 11,400 gross Mcf of gas per day, or 1,900 gross BOE per day (600 BOE per day, net to Parallel). On March 14, 2006, the Company announced the completion of two wells utilizing for the first time the “simo frac” method. Currently, these two wells are selling gas at a combined rate of approximately 7,300 gross Mcf of gas per day, or 1,217 gross BOE per day (373 BOE per day, net to Parallel).

The “simo frac” method of stimulation is accomplished by drilling the two wells with horizontal laterals of approximately 4,000 feet in length, with the laterals situated approximately 1,200 feet apart and running parallel to each other. These two adjacent wells are then fracture stimulated simultaneously, each sequentially, with a total of four frac stages per well. These frac stages utilize approximately 5.0 million gallons of frac-load and 1.6 million pounds of sand per well.

Other Information

Parallel’s Barnett Shale gas project generated approximately 17% of the Company’s second quarter 2006 daily production (1,125 BOE per day) and represented approximately 3% of its reserve value as of June 30, 2006.

Parallel’s current leasehold position in the Barnett Shale gas project is approximately 13,400 gross (4,900 net) acres. The Company has revised its 2006 budget for the Barnett Shale project from approximately $21.1 million to approximately $39.7 million, which includes $6.1 million for the additional interests acquired in the project in March 2006. This budget will be used to fund the drilling and completion of 20 new wells, pipeline construction and leasehold acquisition.

Permian Basin of West Texas

The Permian Basin of West Texas generated approximately 54% of Parallel’s second quarter 2006 daily production (3,474 BOE per day) and represented approximately 91% of its reserve value as of June 30, 2006.

The Company has revised its 2006 budget for the Permian Basin of West Texas from approximately $28.6 million to approximately $57.5 million, which includes $23.4 million associated with the “Harris San Andres” properties that were acquired during January 2006. This budget will be used to fund the drilling and completion of 44 wells, 30 workovers, equipment, pipeline construction, seismic and leasehold acquisition.

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 7

Carm-Ann San Andres Field/N. Means Queen Unit, Andrews & Gaines Counties, Texas

Current Operations

2006 drilling activity in Parallel’s Carm-Ann field began on December 28, 2005. Since that time, the Company has drilled 11 wells, averaging approximately eight days from spud to rig release on each well. The eleven new wells, and one carry-over well from 2005, were all completed and placed on production during the second quarter of 2006 with a combined initial test rate of 880 gross BOE per day (574 BOE per day, net to Parallel). Gross daily field production peaked at 1,278 BOE as a result of the 11-well drilling program.

Background Information

Parallel acquired the Carm-Ann/N. Means properties for a combined net purchase price of approximately $18.7 million through multiple transactions in the fourth quarter of 2004 and the first quarter of 2005. This acquisition established a new core operating area that is located within 50 miles of the Company’s Midland,

Texas, headquarters. Initial development on these properties began in March 2005 with the drilling of 16 in-fill San Andres wells and one Queen well. The success of the 2005 drilling program prompted the Company to budget additional activity for 2006 and to acquire the adjacent Harris field.

Other Information

The Carm-Ann/N. Means properties generated approximately 11% of the Company’s second quarter 2006 daily production (733 BOE per day) and represented approximately 12% of its reserve value as of June 30, 2006.

The Company has revised its budget to approximately $9.6 million for the Carm-Ann/N. Means project in 2006 for the drilling and completion of 14 wells and the workover of 9 existing wells. Eleven of the wells are San Andres wells situated on injection well locations and will be converted from oil producers to injection services at the appropriate time. The other three wells will be Queen formation “step-out” producers. Parallel is the operator of these properties with an average working interest of approximately 77%.

Harris San Andres Field, Andrews & Gaines Counties, Texas

Current Operations

A drilling rig is currently active in the Harris field and has drilled sixteen wells to date. The first nine of the sixteen wells have had a combined initial test rate of approximately 750 gross BOE per day (506 BOE per day, net to Parallel). Currently, three wells are being completed, three wells are awaiting completion and one well is drilling.

Background Information

Parallel acquired the Harris San Andres properties for a combined net purchase price of approximately $44.2 million through two transactions in the fourth quarter of 2005 and the first quarter of 2006. The leases include approximately 6,100 gross (5,490 net) acres, are approximately one mile from the Company’s Carm-Ann assets, and will be integrated into the Carm-Ann base of operations. Approximately 1,300 gross (1,170 net) acres of the total leasehold have been developed through the prior operator’s drilling of thirty-five wells on 40-acre spacing. Parallel anticipates the 1,300 acres will be further developed through 20-acre infill drilling and waterflood implementation. The Company expects the remaining 4,800 gross (4,320 net) acres to be field extension and lower risk exploration acreage.

Other Information

The Harris San Andres properties generated approximately 6% of the Company’s second quarter 2006 daily production (393 BOE per day) and represented approximately 21% of its reserve value as of June 30, 2006.

The Company has revised its budget to approximately $33.2 million for the Harris San Andres project in 2006 for the drilling of 26 wells and 4 workovers, and including approximately $23.4 million associated with the properties that were acquired during January 2006. The originally budgeted 23 wells are all infill locations. The additional three wells will be drilled as “step-out” producers, intended to prove-up additional acreage. Parallel is the operator of these properties with an average working interest of approximately 90%.

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 8

Diamond M Canyon Reef Unit, Scurry County, Texas

Current Operations

2006 activity to date in Parallel’s Diamond M Canyon Reef project has revolved primarily around the acquisition of a new 3-D seismic survey. The survey is designed to acquire both pressure-wave (P-wave) and shear-wave (S-wave) data, and the Company anticipates that it will provide more detail and better compartmental imaging than a “typical” 3-D seismic survey. As of this press release, the P-wave acquisition and the S-wave acquisition are complete and the data is currently being processed.

Parallel has drilled the first two of the six new wells budgeted for 2006. Both wells are now on pump. The initial combined test rate was 364 gross BOE per day (213 BOE per day, net to Parallel). The Company anticipates that the remaining four new wells will be drilled later in the year after processing and interpretation of the 3-D seismic survey is completed.

In addition, workover operations have been completed on four workover wells. Early test results for these four wells averaged approximately 122 gross BOE per day per well (70 BOE per day per well, net to Parallel), as fluid levels continue to pull down and oil cuts continue to improve. Currently, the Company has one workover rig in the field for completion and workover activity.

Other Information

The Diamond M Canyon Reef property generated approximately 7% of the Company’s second quarter 2006 daily production (415 BOE per day) and represented approximately 10% of its reserve value as of June 30, 2006.

The Company has revised its budget to approximately $8.2 million for the project in 2006 for the acquisition of a new 3-D seismic survey, the drilling of 6 new wells, and the continuation of the deepening program with 12 additional workovers. Parallel is the operator of these properties with an average working interest of approximately 66% above the contractual base volumes associated with the Company’s work-to-earn arrangement with Southwestern Energy Company (NYSE: SWN).

Diamond M Shallow Leases, Scurry County, Texas

Current Operations

The Company is currently monitoring flood response on its Diamond M Shallow property and will resume development once satisfactory response is observed. During 2004, the Company drilled 12 producing well locations and 18 water injection well locations in the project. Parallel’s typical practice is to produce the injection well locations for a period of time to condition the formation for injection and to improve economic return. All but two of the 18 wells were converted to injection service during 2005.

Other Information

The Diamond M Shallow property generated approximately 1% of the Company’s second quarter 2006 daily production (52 BOE per day) and represented approximately 9% of its reserve value as of June 30, 2006.

The Company has revised its budget to approximately $100,000 for the project in 2006 for general maintenance and workovers, pending waterflood response. Parallel is the operator of these properties with an average working interest of approximately 66% above the contractual base volumes associated with the Company’s work-to-earn arrangement with Southwestern Energy Company.

Fullerton San Andres Field, Andrews County, Texas

Current Operations

Year-to-date activity in Parallel’s Fullerton Field has consisted primarily of the re-fracture stimulation of six active producing wells, with three additional similar workovers currently scheduled. Though the wells are currently pumping fluid levels down, and therefore have no currently available test data, the Company’s experience with approximately 90 such jobs performed in the field since February 2003 indicates that initial rates of approximately 12 bopd per well can be expected.

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 9

Other Information

The Fullerton property generated approximately 25% of the Company’s second quarter 2006 daily production (1,628 BOE per day) and represented approximately 36% of its reserve value as of June 30, 2006.

The Company has revised its budget to approximately $1.3 million for the Fullerton project in 2006 for the drilling and completion of 4 new wells and 5 workovers. Parallel owns an 82% average working interest in these properties.

Other Permian Basin Projects

Other Permian Basin projects generated approximately 4% of the Company’s second quarter 2006 daily production (253 BOE per day) and represented approximately 3% of its reserve value as of June 30, 2006.

The Company revised its budget to approximately $5.1 million for other Permian Basin properties in 2006, primarily for lease and well equipment and well maintenance. This budget also includes capitalized overhead and other miscellaneous capital costs.

Onshore Gulf Coast of South Texas

Yegua/Frio/Wilcox and Cook Mountain Gas Projects, Jackson, Wharton and Liberty Counties, Texas

Current Operations

The Company has 5 Wilcox gas wells currently producing at a combined rate of approximately 24,280 gross Mcf of gas per day and 340 gross barrels of oil per day, or 4,387 gross BOE per day (611 BOE per day, net to Parallel). The current average daily producing rate from each of these five wells ranges from a low of 2,000 gross Mcf to a high of 5,920 gross Mcf of gas per day. Parallel’s working interest in this project, which is operated by Tri-C Resources, is approximately 15.9% before payout and approximately 23.8% after payout.

Parallel also participated in the drilling of one deep Frio well during the second quarter of 2006. The well was unsuccessful and has been plugged.

Other Information

The Onshore Gulf Coast of South Texas gas projects generated approximately 21% of Parallel’s second quarter 2006 daily production (1,326 BOE per day) and represented approximately 4% of its reserve value as of June 30, 2006.

The Company has revised its budget to approximately $1.9 million for the South Texas projects in 2006 for the drilling and completion of 1 Wilcox well and 4 Yegua/Frio/Cook Mountain wells.

Other Projects

Utah/Colorado Conventional Oil & Gas and Heavy Oil Sand Projects, Uinta Basin

Current Operations

Parallel recently drilled the first test well in its Utah/Colorado project. The Sunshine Bench No. 2 well was drilled by the Company based on historical 2-D seismic and geological information. The well spudded on February 18, 2006, was drilled to a total depth of approximately 5,200 feet, open-hole logged, selectively side-wall cored, and plugged and abandoned. The well information will be incorporated into the 3-D seismic interpretation. The seismic shoot has been completed, and the data has been processed and is currently being interpreted.

Other Information

The Utah/Colorado project does not yet contribute to the Company’s current daily production or reserve value.

Parallel has increased its leasehold acreage position in this project to approximately 160,000 net acres. It is a multiple zone project consisting of both oil and gas targets at depths of less than 6,000 feet. Seismic and geologic data evaluation continues.

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 10

Approximately 3,000 acres of the Company’s leasehold is located on the geologic feature known as Asphalt Ridge. The Company is currently investigating development options for these heavy oil sand deposits.

The Company has revised its budget from approximately $4.2 million to approximately $3.7 million for this project in 2006 for the drilling and completion of the 1 well mentioned above and the acquisition of a 3-D seismic survey and additional leasehold. Parallel owns and operates 100% of this project.

East Texas Cotton Valley Reef Gas Project, Leon and Freestone Counties

The East Texas Cotton Valley Reef gas project contributes minimally to the Company’s current daily production and reserve value.

This 3-D seismic gas project has a higher risk profile than the Company’s other projects. The objective is the Cotton Valley barrier reef facies found between depths of approximately 16,000 and 18,000 feet. The project consists of approximately 5,000 gross (650 net) acres.

Parallel has revised its budget to approximately $1.3 million for the Cotton Valley Reef gas project in 2006 for additional leasehold and the drilling of one well, which is currently drilling below 17,000 feet. Parallel owns an approximate 13.125% working interest in this project.

Management Comments

Larry C. Oldham, Parallel’s President, commented, “As we announced on March 14 and May 10, 2006, we had an earlier-than-expected start on our 2006 drilling activity in our Carm-Ann, Harris, and Diamond M projects. On all projects combined, we currently have about 28 wells ‘stacked up’ in pre-production operations and 7 wells drilling. Since our May 10, 2006 press release, we have completed 22 gross (11.87 net) wells representing aggregate net initial test volumes of approximately 2,689 BOE per day. ”

Oldham further stated, “Our aggressive 2006 capital investment budget has resulted in strong second quarter production results and related production exit rate, as well as increased proved reserves. We believe future quarters will continue to show improved results as we continue the development of our projects through our revised capital investment budget of $159.8 million, which includes approximately $29.5 million of acquisitions during the first quarter of 2006. We plan to invest $95.4 million, or 60%, of the revised 2006 capital investment budget in our New Mexico Wolfcamp and Fort Worth Basin Barnett Shale gas projects. Production from these two resource gas projects was up 149% over the first quarter 2006 and 1565% over the second quarter 2005.”

In a final comment, Oldham stated, “Over the past four years, we have grown production at a compounded annual growth rate of 22%. Production over the last year is up 75%. We intend to maintain a very aggressive growth pace.”

Conference Call and Webcast Information

The Company’s management will host a conference call to discuss current operations, production, reserves and financial results for the second quarter ended June 30, 2006. In addition to this press release, please refer to the Company’s second quarter 2006 earnings release also dated August 9, 2006 and its Form 10-Q for the quarterly period ended June 30, 2006 that was filed with the Securities and Exchange Commission on August 9, 2006.

The conference call will be held on Thursday, August 10, 2006, at 10:00 a.m. Eastern time (9:00 a.m. Central time). To participate in the call, dial 866-202-3109 or 617-213-8844, Participant Passcode 75055721, at least five minutes before the scheduled start time. The conference call will also be webcast with slides, and can be accessed live at Parallel’s web site, http://www.plll.com. A replay of the conference call will be available at the Company’s web site or by calling 888-286-8010 or 617-801-6888, Passcode 39330854.

TABLES FOLLOW

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 11

Daily Production - Second Quarter 2006, Compared to First Quarter 2006 and Second Quarter 2005

The following Table 1 represents a comparison of Parallel’s daily production by area/property for the second quarter of 2006, the first quarter of 2006 and the second quarter of 2005. Detailed information on each property listed in this table is provided within the text of this press release.

TABLE 1

AVERAGE DAILY PRODUCTION - 2Q 2006, COMPARED TO 1Q 2006 AND 2Q 2005 | |

| | | | | | | | | | | | |

| | | 2Q 2006 | | 1Q 2006 | | 2Q 2005 | | 2Q 2006 | | 2Q 2006 | |

AREA/PROPERTY | | Average BOE per day | | Average BOE per day | | Average BOE per day | | Compared to 1Q 2006 % Change | | Compared to 2Q 2005 % Change | |

Resource Projects | | | | | | | | | | | |

Barnett Shale (1) | | | 1,125 | | | 527 | | | — | | | 113 | % | | N/A | |

New Mexico (2) | | | 507 | | | 129 | | | 98 | | | 293 | % | | 417 | % |

Total Resource Projects | | | 1,632 | | | 656 | | | 98 | | | 149 | % | | 1565 | % |

Permian Basin of West Texas | | | | | | | | | | | | | | | | |

| Fullerton San Andres | | | 1,628 | | | 1,544 | | | 1,545 | | | 5 | % | | 5 | % |

Carm-Ann San Andres / N. Means Queen (3) | | | 733 | | | 545 | | | 351 | | | 34 | % | | 109 | % |

Harris San Andres (4) | | | 393 | | | 296 | | | — | | | 33 | % | | N/A | |

Diamond M Shallow (5) | | | 52 | | | 56 | | | 77 | | | (7 | )% | | (32 | )% |

Diamond M Canyon Reef (6) | | | 415 | | | 398 | | | 203 | | | 4 | % | | 104 | % |

| Other Permian Basin | | | 253 | | | 271 | | | 340 | | | (7 | )% | | (26 | )% |

Total Permian Basin | | | 3,474 | | | 3,110 | | | 2,516 | | | 12 | % | | 38 | % |

Onshore Gulf Coast of South Texas | | | | | | | | | | | | | | | | |

| Yegua/Frio | | | 390 | | | 419 | | | 650 | | | (7 | )% | | (40 | )% |

Wilcox (7) | | | 808 | | | 854 | | | 230 | | | (5 | )% | | N/A | |

| Cook Mountain | | | 128 | | | 107 | | | 187 | | | 20 | % | | (32 | )% |

Total Gulf Coast | | | 1,326 | | | 1,380 | | | 1,067 | | | (4 | )% | | 24 | % |

GRAND TOTAL | | | 6,432 | | | 5,146 | | | 3,681 | | | 25 | % | | 75 | % |

| | | | | | | | | | | | | | | | | |

(1) 11 gross (3.47 net) new wells added since 1/1/06 | | | | | | | | | | | | | | | | |

(2) 15 gross (2.9 net) new wells added since 1/1/06; only 1 gross (.46 net) operated | | | | | | | | | | | | | | | | |

(3) 12 gross (9.9 net) wells added since 1/1/06 | | | | | | | | | | | | | | | | |

(4) 9 gross (8.10 net) wells added since 1/1/06 | | | | | | | | | | | | | | | | |

(5) 1Q 2005 - initiated conversion of producing wells to injection wells. Currently awaiting waterflood response. | | | | | | | | | | | | | | | | |

(6) 6 gross (3.96 net) wells added since 1/1/06 | | | | | | | | | | | | | | | | |

(7) 5 gross (1.20 net) wells added since 3Q 2005 | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 12

Summary of Completed Well Operations Since January 1, 2006

The following Table 2 is a summary of completed well operations since January 1, 2006 on certain of Parallel’s properties. Detailed information pertaining to the completed well operations in this table for the time period from January 1, 2006 to May 10, 2006 is provided in the Company’s previous operations update press releases dated March 14, 2006 and May 10, 2006, and the completed well operations information for the time period from May 10, 2006 to August 1, 2006 is provided within the text of this press release.

TABLE 2

SUMMARY OF COMPLETED WELL OPERATIONS SINCE JANUARY 1, 2006 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TIME PERIOD | | | JANUARY 1, 2006 to MARCH 14, 2006 (1) | | | MARCH 14, 2006 to MAY 10, 2006 (1) | | | MAY 10, 2006 to AUGUST 1, 2006 (2) | |

| | | | Number of Wells | | | Estimated Initial | | | Number of Wells | | | Estimated Initial | | | Number of Wells | | | Estimated Initial | |

Completed Well Operations | | | Gross | | | Net | | | Net BOEPD (3) (4) | | | Gross | | | Net | | | Net BOEPD (3) (4) | | | Gross | | | Net | | | Net BOEPD (3) (4) | |

| Producing | | | 12 | | | 4.97 | | | 1,326 | | | 19 | | | 9.89 | | | 1,135 | | | 22 | | | 10.72 | | | 2,471 | |

| Workovers - Producing | | | 3 | | | 2.32 | | | 110 | | | — | | | — | | | — | | | 2 | | | 1.32 | | | 218 | |

| Shut-in | | | 3 | | | 1.02 | | | 64 | | | — | | | — | | | — | | | (2 | ) | | (0.17 | ) | | — | |

Total | | | 18 | | | 8.31 | | | 1,500 | | | 19 | | | 9.89 | | | 1,135 | | | 22 | | | 11.87 | | | 2,689 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Please refer to the Company's operations update press releases dated March 14, 2006 and May 10, 2006 for detailed information pertaining to well operations on certain properties that contributed to the summary of completed well operations data included in this portion of the table for the time period from January 1, 2006 to May 10, 2006. |

(2) Please refer to this press release for detailed information pertaining to well operations on certain properties that contributed to the summary of completed well operations data included in this portion of the table for the time period from May 10, 2006 to August 1, 2006. |

(3) The net equivalent barrels of oil per day (BOEPD) represents an initial producing rate, or an initial test rate, of the well or wells and is not intended to represent a sustained or stabilized producing rate. |

(4) The estimated net BOEPD is calculated based upon the conversion of 6 Mcf of natural gas being equal to 1 barrel of oil. |

Current “Work-in-Progress” Well Operations

The following Table 3 is a summary of current “work-in-progress” well operations on certain of Parallel’s properties. Detailed information of the well operations in this table is provided within the text of this press release.

TABLE 3

"WORK-IN-PROGRESS" WELL OPERATIONS AS OF AUGUST 1, 2006 | |

| | | Number of Wells | |

"Work-in-Progress" Well Operations | | Gross | | Net | |

| Completing | | | 15 | | | 8.17 | |

| Workovers - Completing | | | 1 | | | 0.66 | |

| Awaiting Completion | | | 12 | | | 6.18 | |

| Drilling | | | 7 | | | 3.35 | |

Total | | | 35 | | | 18.36 | |

| | | | | | | | |

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 13

Proved Reserves as of December 31, 2005 and June 30, 2006

The following Table 4 represents Parallel’s total proved reserves by category and the Standardized Measure of Discounted Future Net Cash Flows as of December 31, 2005, and June 30, 2006.

TABLE 4

PROVED RESERVES AS OF DECEMBER 31, 2005 AND JUNE 30, 2006 | |

| | | | | | | | |

| | | December 31, 2005 (1) | | June 30, 2006 (1) | | Percentage Change | |

Total Proved Reserves: | | | | | | | |

| Oil (MMBbls) | | | 21.2 | | | 24.2 | | | 14 | % |

| Gas (Bcfg) | | | 25.2 | | | 35.2 | | | 40 | % |

| MMBOE | | | 25.4 | | | 30.1 | | | 19 | % |

SEC Reserve Categories: | | | | | | | | | | |

PDP (MMBOE) (2) | | | 16.0 | | | 17.9 | | | 12 | % |

PDNP (MMBOE) (3) | | | 0.5 | | | 0.6 | | | 20 | % |

PUD (MMBOE) (4) | | | 8.9 | | | 11.6 | | | 30 | % |

| Total Proved Reserves (MMBOE) | | | 25.4 | | | 30.1 | | | 19 | % |

Standardized Measure of | | | | | | | | | | |

Discounted Future Net Cash Flows ($MM) | | $ | 361 | | $ | 466 | (5) | | 29 | % |

NYMEX prices: | | | | | | | | | | |

| Per Bbl of oil | | $ | 61.04 | | $ | 73.98 | | | 21 | % |

| Per Mcf of natural gas | | $ | 9.43 | | $ | 5.80 | | | (38 | )% |

Realized prices: | | | | | | | | | | |

| Per Bbl of oil | | $ | 56.09 | | $ | 68.48 | | | 22 | % |

| Per Mcf of natural gas | | $ | 8.68 | | $ | 4.75 | | | (45 | )% |

| | | | | | | | | | | |

(1) Based on independent reserve studies prepared by Cawley, Gillespie & Associates, Inc., our independent petroleum engineers. | | | | | | | | | | |

(2) PDP is proved developed producing reserves. | | | | | | | | | | |

(3) PDNP is proved developed non-producing reserves. | | | | | | | | | | |

(4) PUD is proved undeveloped reserves. | | | | | | | | | | |

(5) The Standardized Measure of Discounted Future Net Cash Flows as of June 30, 2006 has been estimated utilizing the same tax rate applicable to the Standardized Measure of Discounted Future Net Cash Flows as of December 31, 2005. | | | | | | | | | | |

| | | | | | | | | | | |

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 14

Proved Reserves by Area/Property as of June 30, 2006

The following Table 5 represents Parallel’s proved reserves, on a property basis, and the estimated Standardized Measure of Discounted Future Net Cash Flows as of June 30, 2006. Detailed information on each property listed in this table is provided within the text of this press release.

TABLE 5

| | | PROVED RESERVES BY AREA/PROPERTY AS OF JUNE 30, 2006 | | |

| | | | | |

| | | Proved Reserves as of 06-30-06 (1) (2) (3) | | |

| | | PDP (4) | | PDNP (5) | | PUD (6) | | Total Proved | | | |

AREA/PROPERTY | | MMBOE | | PV-10% ($MM) | | MMBOE | | PV-10% ($MM) | | MMBOE | | PV-10% ($MM) | | MMBOE | | PV-10% ($MM) | | % of PV-10% | |

| | | | | | | | | | | | | | | | | | | | |

Resource Projects | | | | | | | | | | | | | | | | | | | |

Barnett Shale (2) | | | 1.11 | | $ | 14.6 | | | 0.30 | | $ | 2.6 | | | 1.02 | | $ | 2.1 | | | 2.43 | | $ | 19.3 | | | 3.3 | % |

| New Mexico Wolfcamp | | | 0.34 | | | 5.7 | | | - | | | - | | | 0.40 | | | 2.9 | | | 0.74 | | | 8.6 | | | 1.5 | % |

Total Resource Projects | | | 1.45 | | $ | 20.3 | | | 0.30 | | $ | 2.6 | | | 1.42 | | $ | 5.0 | | | 3.17 | | $ | 27.9 | | | 4.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Permian Basin of West Texas | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fullerton San Andres | | | 8.95 | | $ | 180.5 | | | 0.05 | | $ | 2.0 | | | 1.52 | | $ | 29.3 | | | 10.52 | | $ | 211.8 | | | 36.0 | % |

| Carm-Ann San Andres/N. Means Queen | | | 1.72 | | | 41.5 | | | - | | | - | | | 1.57 | | | 30.3 | | | 3.29 | | | 71.8 | | | 12.2 | % |

Harris San Andres (3) | | | 1.50 | | | 32.8 | | | - | | | - | | | 4.57 | | | 87.9 | | | 6.07 | | | 120.7 | | | 20.5 | % |

| Diamond M Shallow | | | 0.63 | | | 8.8 | | | 0.20 | | | 7.4 | | | 1.68 | | | 39.6 | | | 2.51 | | | 55.8 | | | 9.5 | % |

| Diamond M Canyon Reef | | | 1.36 | | | 28.7 | | | - | | | - | | | 0.82 | | | 28.8 | | | 2.18 | | | 57.5 | | | 9.8 | % |

| Other Permian Basin | | | 1.16 | | | 16.9 | | | - | | | - | | | - | | | - | | | 1.16 | | | 16.9 | | | 2.9 | % |

Total Permian Basin | | | 15.32 | | $ | 309.2 | | | 0.25 | | $ | 9.4 | | | 10.16 | | $ | 215.9 | | | 25.73 | | $ | 534.5 | | | 90.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Onshore Gulf Coast of South Texas | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Yegua/Frio | | | 0.55 | | $ | 11.5 | | | 0.04 | | $ | 0.9 | | | - | | $ | - | | | 0.59 | | $ | 12.4 | | | 2.0 | % |

| Wilcox | | | 0.47 | | | 11.4 | | | - | | | - | | | - | | | - | | | 0.47 | | | 11.4 | | | 1.9 | % |

| Cook Mountain | | | 0.10 | | | 2.6 | | | - | | | - | | | - | | | - | | | 0.10 | | | 2.6 | | | 0.5 | % |

Total Gulf Coast | | | 1.12 | | $ | 25.5 | | | 0.04 | | $ | 0.9 | | | - | | $ | - | | | 1.16 | | $ | 26.4 | | | 4.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

GRAND TOTAL | | | 17.89 | | $ | 355.0 | | | 0.59 | | $ | 12.9 | | | 11.58 | | $ | 220.9 | | | 30.06 | | $ | 588.8 | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Estimated Future Income Taxes (7) | | | | | | (57.3 | ) | | | | | (3.7 | ) | | | | | (62.1 | ) | | | | | (123.1 | ) | | | |

Estimated Standardized Measure of | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Discounted Future Net Cash Flows | | | | | $ | 297.7 | | | | | $ | 9.2 | | | | | $ | 158.8 | | | | | $ | 465.7 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Based on independent reserve study by Cawley, Gillespie & Associates, Inc. utilizing NYMEX prices of $73.98 per barrel of oil and $5.80 per Mcf of natural gas, and realized average prices of $68.48 per barrel of oil and $4.75 per Mcf of natural gas. | | | | | | | | | |

(2) Includes approximately 3.7 BCF (.62 million BOE) of reserves associated with the additional interests acquired in the Barnett Shale project during March 2006. | | | | | | | | | |

(3) Includes approximately 3.5 million BOE of reserves associated with the "Harris San Andres" properties that were acquired during January 2006. | | | | | | | | | |

(4) PDP is proved developed producing reserves. | | | | | | | | | |

(5) PDNP is proved developed non-producing reserves. | | | | | | | | | |

(6) PUD is proved undeveloped reserves. | | | | | | | | | |

(7) Future income taxes have been estimated utilizing the same tax rate applicable to the Standardized Measure of Discounted Future Net Cash Flows as of December 31,2005. | |

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 15

Revised 2006 CAPEX Budget - Compared to Average Daily Production and Proved Reserve Value by Property

The following Table 6 represents Parallel’s revised 2006 capital investment budget compared to second quarter 2006 average daily production and total proved reserve value as of June 30, 2006, on a property basis, and includes the estimated Standardized Measure of Discounted Future Net Cash Flows as of June 30, 2006. Detailed information on each property listed in this table is provided within the text of this press release.

TABLE 6

REVISED 2006 CAPEX BUDGET COMPARED TO AVERAGE DAILY PRODUCTION AND PROVED RESERVE VALUE BY PROPERTY | |

| | | | | | | | | | | | | | | | | | | | |

| | | | Revised 2006 | | | 2Q 2006 Average | | | 06-30-06 Total Proved Reserve | |

| | | | CAPEX Budget | | | Daily Production (2) (3) | | | Value (PV-10%) (1) (2) (3) | |

AREA/PROPERTY | | | $MM | | | % | | | BOE | | | % | | | $MM | | | % | |

Resource Projects | | | | | | | | | | | | | | | | | | | |

Barnett Shale (2) | | $ | 39.7 | | | 25 | % | | 1,125 | | | 17 | % | $ | 19.3 | | | 3.3 | % |

| New Mexico Wolfcamp | | | 55.7 | | | 35 | % | | 507 | | | 8 | % | | 8.6 | | | 1.5 | % |

Total Resource Projects | | $ | 95.4 | | | 60 | % | | 1,632 | | | 25 | % | $ | 27.9 | | | 4.8 | % |

| | | | | | | | | | | | | | | | | | | | |

Permian Basin of West Texas | | | | | | | | | | �� | | | | | | | | | |

| Fullerton San Andres | | $ | 1.3 | | | 1 | % | | 1,628 | | | 25 | % | $ | 211.8 | | | 36.0 | % |

| Carm-Ann San Andres/N. Means Queen | | | 9.6 | | | 6 | % | | 733 | | | 11 | % | | 71.8 | | | 12.2 | % |

Harris San Andres (3) | | | 33.2 | | | 21 | % | | 393 | | | 6 | % | | 120.7 | | | 20.5 | % |

| Diamond M Shallow | | | 0.1 | | | 0 | % | | 52 | | | 1 | % | | 55.8 | | | 9.5 | % |

| Diamond M Canyon Reef | | | 8.2 | | | 5 | % | | 415 | | | 7 | % | | 57.5 | | | 9.8 | % |

| Other Permian Basin | | | 5.1 | | | 3 | % | | 253 | | | 4 | % | | 16.9 | | | 2.9 | % |

Total Permian Basin | | $ | 57.5 | | | 36 | % | | 3,474 | | | 54 | % | $ | 534.5 | | | 90.8 | % |

| | | | | | | | | | | | | | | | | | | | |

Onshore Gulf Coast of South Texas | | | | | | | | | | | | | | | | | | | |

| Yegua/Frio | | $ | 1.5 | | | 1 | % | | 390 | | | 6 | % | $ | 12.4 | | | 2.1 | % |

| Wilcox | | | 0.3 | | | 0 | % | | 808 | | | 13 | % | | 11.4 | | | 1.9 | % |

| Cook Mountain | | | 0.1 | | | 0 | % | | 128 | | | 2 | % | | 2.6 | | | 0.4 | % |

Total Gulf Coast | | $ | 1.9 | | | 1 | % | | 1,326 | | | 21 | % | $ | 26.4 | | | 4.4 | % |

| | | | | | | | | | | | | | | | | | | | |

Other Projects | | | | | | | | | | | | | | | | | | | |

| Cotton Valley Reef | | $ | 1.3 | | | 1 | % | | - | | | 0 | % | $ | - | | | 0.0 | % |

| Utah/Colorado | | | 3.7 | | | 2 | % | | - | | | 0 | % | | - | | | 0.0 | % |

Total Other Projects | | $ | 5.0 | | | 3 | % | | - | | | 0 | % | $ | - | | | 0.0 | % |

| | | | | | | | | | | | | | | | | | | | |

GRAND TOTAL | | $ | 159.8 | | | 100 | % | | 6,432 | | | 100 | % | $ | 588.8 | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | |

Estimated Future Income Taxes (4) | | | | | | | | | | | | | | | (123.1 | ) | | | |

Estimated Standardized Measure of | | | | | | | | | | | | | | | | | | | |

Discounted Future Net Cash Flows | | | | | | | | | | | | | | $ | 465.7 | | | | |

| | | | | | | | | | | | | |

(1) Based on independent reserve study by Cawley, Gillespie & Associates, Inc. utilizing NYMEX prices of $73.98 per barrel of oil and $5.80 per Mcf of natural gas, and realized average prices of $68.48 per barrel of oil and $4.75 per Mcf of natural gas. | | | | |

(2) Includes approximately $6.1 million of CAPEX and approximately 3.7 BCF (.62 million BOE) of reserves associated with the additional interests acquired in the Barnett Shale project during March 2006. | | | | |

(3) Includes approximately $23.4 million of CAPEX and approximately 3.5 million BOE of reserves associated with the "Harris San Andres" properties that were acquired during January 2006. | | | | |

(4) Future income taxes have been estimated utilizing the same tax rate applicable to the Standardized Measure of Discounted Future Net Cash Flows as of December 31, 2005. | | | | |

| | | | | | | | | | | | | |

Parallel Petroleum Announces Operations Update and

Second Quarter 2006 Production and Proved Reserves

August 9, 2006

Page 16

Revised 2006 CAPEX Budget compared to Original 2006 CAPEX Budget

The following Table 7 represents Parallel’s revised 2006 capital investment budget compared to its original 2006 capital investment budget. Detailed information on each property listed in this table is provided within the text of this press release.

TABLE 7

REVISED 2006 CAPEX BUDGET COMPARED TO ORIGINAL 2006 CAPEX BUDGET | |

| | | | | | | | | | |

| | | Revised 2006 CAPEX Budget | | Original 2006 CAPEX Budget | | Net Change | |

Area/Property | | $MM | | $MM | | $MM | | % | |

Resource Projects | | | | | | | | | |

Barnett Shale (1) (2) | | $ | 39.7 | | $ | 21.1 | | $ | 18.6 | | | 88 | % |

New Mexico Wolfcamp (1) | | | 55.7 | | | 45.5 | | | 10.2 | | | 22 | % |

Total | | $ | 95.4 | | $ | 66.6 | | $ | 28.8 | | | 43 | % |

| | | | | | | | | | | | | | |

Permian Basin of West Texas | | | | | | | | | | | | | |

| Fullerton San Andres | | $ | 1.3 | | $ | 1.8 | | $ | (0.5 | ) | | (28 | )% |

| Carm-Ann San Andres/N. Means Queen | | | 9.6 | | | 5.0 | | | 4.6 | | | 92 | % |

Harris San Andres (3) | | | 33.2 | | | 11.1 | | | 22.1 | | | N/A | |

| Diamond M Shallow | | | 0.1 | | | 0.2 | | | (0.1 | ) | | (50 | )% |

| Diamond M Canyon Reef | | | 8.2 | | | 8.3 | | | (0.1 | ) | | (1 | )% |

| Other Permian Basin | | | 5.1 | | | 2.2 | | | 2.9 | | | 132 | % |

Total Permian Basin | | $ | 57.5 | | $ | 28.6 | | $ | 28.9 | | | 101 | % |

| | | | | | | | | | | | | | |

Onshore Gulf Coast | | $ | 1.9 | | $ | 2.8 | | $ | (0.9 | ) | | (32 | )% |

| Other Projects | | | | | | | | | | | | | |

| Cotton Valley Reef | | $ | 1.3 | | $ | 1.5 | | $ | (0.2 | ) | | (13 | )% |

| Utah/Colorado | | | 3.7 | | | 4.2 | | | (0.5 | ) | | (12 | )% |

Total Other Projects | | $ | 5.0 | | $ | 5.7 | | $ | (0.7 | ) | | (12 | )% |

| | | | | | | | | | | | | | |

Grand Total | | $ | 159.8 | | $ | 103.7 | | $ | 56.1 | | | 54 | % |

| | | | | | | | | | | | | | |

(1) Emerging resource gas project | | | | | |

(2) Includes approximately $6.1 million of CAPEX associated with the additional interests acquired in the Barnett Shale project during March 2006. | | | | | |

(3) Includes approximately $23.4 million of CAPEX associated with the "Harris San Andres" properties that were acquired during January 2006. | | | | | |

| | | | | | | | | | | | | |

The Company

Parallel Petroleum is an independent energy company headquartered in Midland, Texas, engaged in the acquisition, exploration, development and production of oil and gas using 3-D seismic technology and advanced drilling, completion and recovery techniques. Parallel’s primary areas of operation are the Permian Basin of West Texas and New Mexico, North Texas Barnett Shale, Onshore Gulf Coast of South Texas, East Texas and Utah/Colorado. Additional information on Parallel Petroleum Corporation is available at http://www.plll.com.

This release contains forward-looking statements subject to various risks and uncertainties that could cause the Company’s future plans, objectives and performance to differ materially from those in the forward-looking statements. Forward-looking statements can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “plan,” “subject to,” “anticipate,” “estimate,” “continue,” “present value,” “future,” “reserves”, “appears,” “prospective,” or other variations thereof or comparable terminology. Factors that could cause or contribute to such differences could include, but are not limited to, those relating to the results of exploratory drilling activity, the Company’s growth strategy, changes in oil and natural gas prices, operating risks, availability of drilling equipment, outstanding indebtedness, weaknesses in our internal controls, the inherent variability in early production tests, changes in interest rates, dependence on weather conditions, seasonality, expansion and other activities of competitors, changes in federal or state environmental laws and the administration of such laws, and the general condition of the economy and its effect on the securities market. While we believe our forward-looking statements are based upon reasonable assumptions, these are factors that are difficult to predict and that are influenced by economic and other conditions beyond our control. Investors are directed to consider such risks and other uncertainties discussed in documents filed by the Company with the Securities and Exchange Commission.

###