EXHIBIT 99.1

| | |

| | | |

| | PRESS RELEASE |

| | | | | | | |

| | | 1004 N. Big Spring, Suite 400 | | Contact: | | Cindy Thomason |

| | | Midland, TX 79701 (432) 684-3727 | | | | Manager of Investor Relations |

| | | http://www.plll.com | | | | cindyt@plll.com |

PARALLEL PETROLEUM ANNOUNCES INCREASED PRODUCTION, WORK-IN-PROGRESS,

2008 CAPEX BUDGET, INCREASED PDP RESERVES AND FIELD OPERATIONS UPDATE

MIDLAND, Texas, (BUSINESS WIRE), February 20, 2008— Parallel Petroleum Corporation (NASDAQ: PLLL) today announced its fourth quarter 2007 average and February 1, 2008 estimated net daily production, work-in-progress, 2008 capital investment budget, 2007 reserves and field operations update. In a separate press release issued today, Parallel announced its financial results for the fourth quarter and year ended December 31, 2007. The Company’s financial and field operations conference call and webcast will be held Thursday, February 21, 2008 at 2:00 p.m. Eastern time (1:00 p.m. Central time). Details for the conference call and webcast are disclosed at the end of this press release.

Net Daily Production — Fourth Quarter 2007 Average and February 1, 2008 Estimates

The Company’s net daily production for the fourth quarter ended December 31, 2007 averaged 6,707 equivalent barrels of oil per day (BOEPD), an increase of 4% when compared to an average of 6,460 BOEPD during the third quarter ended September 30, 2007. Based on information available at the time of this press release, Parallel estimates that its net daily production was approximately 7,400 BOEPD as of February 1, 2008, which is a 10% increase over fourth quarter 2007 average net daily production. During the fourth quarter 2007, production from the Company’s New Mexico Wolfcamp gas project increased 24% from 1,251 to 1,551 BOEPD, due to better, and more consistent, well results and timing of completions, and as of February 1, 2008, the Company estimates that its Wolfcamp production has increased an additional 10% to approximately 1,700 BOE per day due to new wells. Production from the Barnett Shale gas project increased only 1%, from 1,669 to 1,678 BOEPD, during the fourth quarter 2007 due to limited take-away capacity; however, as of February 1, 2008, the Company estimates that its Barnett Shale production has increased an additional 37% to approximately 2,300 BOE per day due to the completion of new wells and increased take-away capacity related to pipeline expansion and additional compression. The fourth quarter 2007 increases were partially offset by a 1% decrease in the Company’s long-life Permian Basin oil projects, from 3,014 to 2,995 BOEPD, due to normal decline on base production, and an 8% decrease in its South Texas gas properties from 526 to 483 BOEPD due to normal decline.Due to uncertainties associated with initial decline rates of new wells and uncertainties associated with timing of take-away capacity and related pipeline expansion and compression, management cautions investors not to place undue reliance on February 1, 2008 estimated net daily production for the purpose of estimating the Company’s future net daily production.

Please refer to Table 1 at the end of this press release for quarterly comparison information pertaining to daily production by area/property for the fourth quarter of 2007, the third quarter of 2007 and the fourth quarter of 2006.

Work-in-Progress Well Operations

As of February 1, 2008, the Company had 22 gross (8.74 net) wells in progress. Of the 22 gross wells, 18 gross (7.27 net) wells were shut-in awaiting pipeline, completing or awaiting completion, and 4 gross (1.47 net) wells were drilling. Of the 18 wells that were shut-in awaiting pipeline, completing or awaiting completion, 15 gross (4.56 net) wells were in the Barnett Shale and 3.0 gross (2.71 net) wells were in the Wolfcamp. Of the 4 wells that were drilling, 3 gross (0.54 net) wells were drilling in the Barnett Shale and 1 gross (0.93 net) well was drilling in the Wolfcamp. Please refer to Table 2 at the end of this press release for a summary of work-in-progress on certain of Parallel’s properties as of February 1, 2008.

2008 Capital Investment Budget

Parallel’s 2008 capital investment budget is approximately $127.2 million, which includes approximately $108.8 million for the drilling and completion of approximately 108 gross (63.6 net) new wells and the workover or conversion-to-injection of 67 gross (49.4 net) existing wells and approximately $18.4 million for the purchase of leasehold and seismic data. On a project basis, approximately $100.0 million, or 79%, of the 2008 capital investment budget is expected to be invested in the Company’s two horizontal drilling gas projects. Parallel has budgeted

-more-

Parallel Petroleum Announces Increased Production, Work-in-Progress,

2008 CAPEX Budget, Increased PDP Reserves and Field Operations Update

February 20, 2008

Page 2

approximately $60.0 million for its Barnett Shale Gas project and approximately $40.0 million for its New Mexico Wolfcamp Gas project. Additionally, the Company expects to invest approximately $24.5 million, or 19%, of the 2008 budget in its long-life, shallow oil properties located in the Permian Basin of West Texas. The remainder of the 2008 budget will be allocated to the Company’s other projects. Parallel anticipates that the $127.2 million 2008 capital investment budget will be funded from its operating cash flow and revolving credit facility. At December 31, 2007, approximately $140.0 million was available under the Company’s revolving credit facility. Please refer to Table 3 at the end of this press release for further information pertaining to the capital investment budget.

Proved Reserves as of December 31, 2007

As estimated by its independent engineers as of December 31, 2007, Parallel’s proved developed producing (PDP) reserves were approximately 20.5 million equivalent barrels of oil (MMBOE). This is a 12% increase of approximately 2.2 MMBOE when compared to PDP reserves as of December 31, 2006, and includes PDP reserve additions of approximately 4.5 MMBOE, less production run-off of approximately 2.3 MMBOE. Proved developed non-producing (PDNP) reserves decreased approximately 0.6 MMBOE to approximately 0.8 MMBOE during 2007 primarily due to transfers to PDP reserves. Proved undeveloped (PUD) reserves decreased approximately 2.1 MMBOE to approximately 16.7 MMBOE during 2007.

The 11% decrease in PUD reserves was due to three factors: 1) transfers to PDP reserves due to development during 2007; 2) PUD reserves revisions resulting primarily from the Company’s change in its method of recognizing proved undeveloped reserves related to its horizontal drilling gas projects, as was announced in its July 18, 2007 press release; and 3) a decrease in new PUD bookings because of the horizontal PUD methodology adopted by the Company at mid-year 2007. As of December 31, 2007, PUD reserves consisted of 198 locations, of which 5 were Barnett Shale locations, 11 were New Mexico Wolfcamp locations, and 182 were West Texas Permian Basin locations. Comparatively, as of December 31, 2006, PUD reserves consisted of 213 locations, of which 15 were Barnett Shale locations, 31 were New Mexico Wolfcamp locations, and 167 were West Texas Permian Basin locations. Parallel anticipates that development of these PUD reserves will require, over the next three years, approximately $111.4 million of capital investment.

The Company’s total proved reserves as of December 31, 2007 decreased 1% to 38.0 MMBOE, as compared to 38.5 MMBOE as of December 31, 2006. The 2007 year-end proved reserves were 54% PDP, 2% PDNP, and 44% PUD, compared to 2006 year-end proved reserves, which were 47% PDP, 4% PDNP, and 49% PUD. The 2007 year-end proved reserves by volume were 75% oil and 25% natural gas. Please refer to Table 4 at the end of this press release for information pertaining to total proved reserves by category as of December 31, 2006 and December 31, 2007.

Parallel’s Standardized Measure of Discounted Future Net Cash Flows as of December 31, 2007 increased 89% to approximately $634.4 million, compared to year-end 2006. This increase was primarily the result of pricing. The NYMEX price per barrel of oil increased from $61.06 to $96.01, and the NYMEX price per Mcf of natural gas increased from $5.47 to $7.46, when comparing December 31, 2006 to December 31, 2007. The Company’s Permian Basin long-life oil projects represented approximately 87% of its proved reserves value, and its two emerging resource gas projects represented approximately 11% of the value. Please refer to Table 5 at the end of this press release for detail of proved reserves on a property basis and the estimated Standardized Measure of Future Net Cash Flows as of December 31, 2007.

Management Comments

Larry C. Oldham, Parallel’s President, commented, “Our bank lenders increased our borrowing base to $200.0 million in December 2007 as a result of our increase in proved developed producing (PDP) reserves. This borrowing base increase, combined with our $150.0 million senior notes and $52.5 million equity offerings during 2007, positions the Company with a strong balance sheet.”

Oldham further commented, “Because of our strong balance sheet and increased borrowing base, we can accelerate the exploitation of our drilling inventory based on sustained performance. Given our extensive drilling inventory in the Barnett Shale, New Mexico Wolfcamp and our long-life Permian Basin properties, our primary focus for 2008 is to increase our daily production volumes and PDP reserves.”

-more-

Parallel Petroleum Announces Increased Production, Work-in-Progress,

2008 CAPEX Budget, Increased PDP Reserves and Field Operations Update

February 20, 2008

Page 3

In a final comment, Oldham stated, “We are excited to have already realized an increase in production volumes in the Barnett Shale as of February 1, 2008 due to the completion of new wells and increased take-away capacity related to pipeline expansion and additional compression. We anticipate future Barnett Shale production increases for the same reasons. We had 18 Barnett Shale wells in progress as of February 1, 2008 and expect to drill 53 gross (20.0 net) wells in the project this year. Additionally, we have improved our New Mexico Wolfcamp results by focusing in the Northern Area, where we are realizing better and more consistent well results and are experiencing lower drilling and completion costs directly related to improved operating efficiencies. To complement the growth in our two resource gas projects, we began the 2008 development drilling program on our Diamond M Canyon Reef oil project during the first week of February and by the end of May 2008, we expect to have drilled the first 6 of the budgeted twelve-well program.”

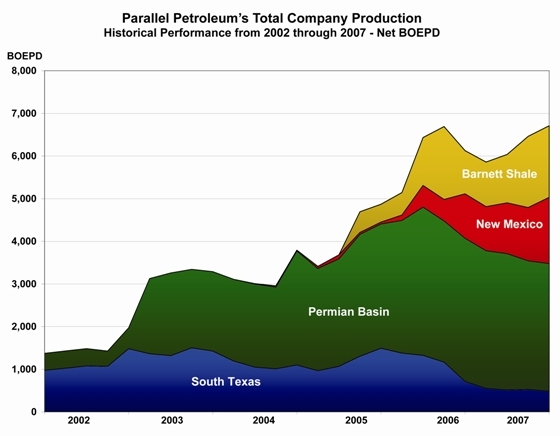

Total Company Historical Performance — Net BOEPD

The following graph shows individual volumetric contributions and growth from Parallel’s core oil and gas projects from 2002 through 2007. The South Texas short-life gas component represented approximately 70% of the Company’s production when it shifted its focus to long-lived reserves in June 2002, and, consequently, represented only 7% of the Company’s production as of the fourth quarter ended December 31, 2007. The Company’s Permian Basin oil projects, which have been added to the portfolio since December 2002, provide added cash flow to help fund development of the resource gas plays in the North Texas Barnett Shale and the New Mexico Wolfcamp, which are in early stages of development.

Operations by Area/Property

Summarized below are Parallel’s more significant current projects, including its planned operations and capital investment budget for these projects in 2008.

Resource Gas Projects

Parallel has two resource gas projects in varying stages of development, which are the Barnett Shale gas project in the Fort Worth Basin of North Texas and the Wolfcamp gas project in the Permian Basin of New Mexico.

Fort Worth Basin of North Texas

Barnett Shale Gas Project, Tarrant County, Texas

Leasehold acreage in Parallel’s Barnett Shale gas project consists of approximately 28,700 gross (8,500 net) acres located in and around the Trinity River flood plain, east and west of downtown Fort Worth. At present, the project controls approximately 75 multi-well pad sites. Based on current industry practices, Parallel anticipates development drilling on 40-acre spacing.

-more-

Parallel Petroleum Announces Increased Production, Work-in-Progress,

2008 CAPEX Budget, Increased PDP Reserves and Field Operations Update

February 20, 2008

Page 4

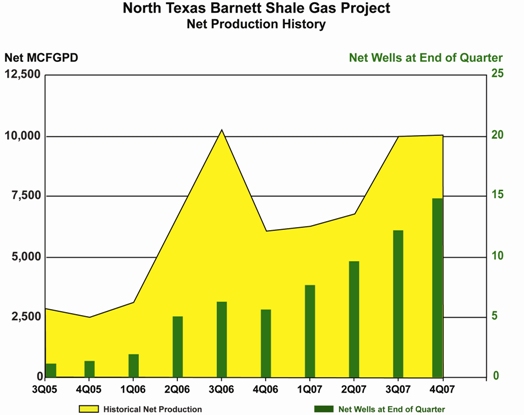

As of February 1, 2008, Parallel’s Barnett Shale gas project had 57 gross (16.09 net) producing wells. Parallel estimates that daily production from these 57 wells was approximately 70,000 gross (14,000 net) Mcf of gas, or 2,300 net BOE, per day. As of February 1, 2008, production volumes have increased approximately 37% when compared to fourth quarter 2007 daily production, due to the completion of new wells and increased take-away capacity related to pipeline expansion and additional compression. In addition to the producing wells, as of February 1, 2008, 8 wells were being completed, 5 wells were awaiting completion, 2 wells were shut-in awaiting pipeline, and 3 wells were drilling. Based on information currently available, Parallel expects the operator, Chesapeake Energy Corporation (NYSE: CHK), to maintain a 4-rig drilling program for the foreseeable future.

As of February 1, 2008, Chesapeake was continuing to install additional compression and pipeline in order to provide sufficient take-away capacity as new wells are drilled and completed and production volumes continue to increase.

Parallel’s 2008 budget for its Barnett Shale project is approximately $60.0 million. The amount budgeted will be used to fund the drilling and completion of an estimated 53 gross (20.0 net) wells, pipeline construction and leasehold acquisition.

The following graph depicts net production history, including the associated net producing wells at the end of each quarter in Parallel’s North Texas Barnett Shale gas project. Parallel cannot project future production due to timing of completions and other normal operating variables.

Permian Basin of New Mexico

Wolfcamp Gas Project, Eddy and Chaves Counties, New Mexico

The New Mexico Wolfcamp horizontal resource gas play, as defined by Parallel, encompasses approximately 300,000 gross acres in portions of Eddy and Chaves Counties in southeastern New Mexico. Parallel currently owns an interest in approximately 106,000 gross (77,000 net) acres acquired specifically for the Wolfcamp, with the majority of the acreage being in the Northern and Southern Areas of the project. Parallel’s operations in its Wolfcamp project currently consist of a 1-rig development drilling program in the Northern Area and the acquisition of a 3-D seismic survey in the Southern Area.

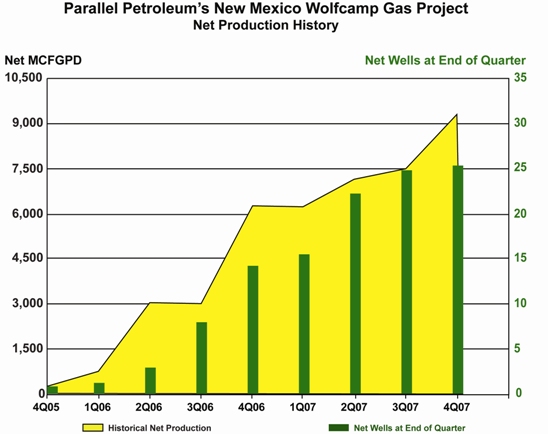

As of February 1, 2008, Parallel operated 42 gross (30.37 net) producing gas wells in the New Mexico Wolfcamp gas project. In addition, the Company had ownership in another 28 gross (2.97 net) wells operated by other companies, primarily EOG Resources, Inc. (NYSE: EOG). On a combined basis, these 70 gross (33.34 net) wells were producing at a combined rate of approximately 28,800 gross (10,200 net) Mcfe, or 1,700 net BOE, per day,

-more-

Parallel Petroleum Announces Increased Production, Work-in-Progress,

2008 CAPEX Budget, Increased PDP Reserves and Field Operations Update

February 20, 2008

Page 5

which represents an approximate 10% increase over fourth quarter 2007 average net daily production. In addition to the producing wells, as of February 1, 2008, the Company had 2 wells completing, 1 well awaiting completion, and 1 well was drilling.

Northern Area— As of February 1, 2008, 16 gross (12.87 net) wells had been drilled and completed in the Company’s Forego/County Line project. Parallel estimates that daily production from these 16 wells as of February 1, 2008, was approximately 13,100 gross (6,800 net) Mcf of gas, or 1,133 net BOE, per day. In addition to the producing wells, as of February 1, 2008, the Company had 1 well drilling, 2 wells completing and 1 well awaiting completion. Parallel anticipates that the Forego/County Line area will be its most active Wolfcamp development area for the foreseeable future.

Parallel’s Racehorse project is located approximately four miles east, northeast of its Forego/County Line area and has 6 gross (5.4 net) wells producing at low rates, which were the initial wells drilled in the Northern Area. There is currently no drilling activity planned for the Racehorse area.

Southern Area— As of February 1, 2008, Parallel’s Southern Area had 22 gross (12.1 net) producing wells. The Company estimates that daily production from these 22 wells was approximately 5,900 gross (2,600 net) Mcf of gas, or 433 net BOE, per day. Parallel, in conjunction with a third party pipeline company, continues to modify the field gas gathering system to enhance individual well performance and overall production volumes from the field. The Company began data acquisition of a 3-D seismic survey in late October 2007 and anticipates the completion of data processing and interpretation during 2008.

Central Area— As of February 1, 2008, Parallel had an interest in 25 gross (2.12 net) EOG-operated horizontal wells. As of February 1, 2008, the wells were producing at a combined rate of approximately 9,200 gross (400 net) Mcf of gas, or 67 net BOE, per day. Parallel has one operated well producing at an estimated 600 gross (400 net) Mcf of gas, or 67 net BOE, per day.

Parallel’s 2008 New Mexico Wolfcamp budget is approximately $40.0 million. The amount budgeted will be used to fund the drilling and completion of an estimated 18 gross (15.3 net) operated wells in the Northern Area, the installation of pipelines and related infrastructure, the acquisition of additional leasehold, and the acquisition of 3-D seismic data in the Southern Area.

The following graph depicts net production history, including the associated net producing wells at the end of each quarter in Parallel’s New Mexico Wolfcamp gas project. Parallel cannot project future production due to timing of completions and other normal operating variables.

-more-

Parallel Petroleum Announces Increased Production, Work-in-Progress,

2008 CAPEX Budget, Increased PDP Reserves and Field Operations Update

February 20, 2008

Page 6

Permian Basin of West Texas

Parallel’s Permian Basin of West Texas oil properties currently consist of four major project areas. The Diamond M Canyon Reef and Shallow, Carm-Ann San Andres/N. Means Queen, Harris San Andres and Fullerton San Andres projects comprise approximately 18,400 gross (15,000 net) acres, combined. Most of these properties have been added to Parallel’s portfolio since June 2002. As of February 1, 2008, Parallel estimates that daily production from its west Texas Permian Basin oil properties was approximately 3,000 net BOE per day.

Diamond M Canyon Reef Unit, Scurry County, Texas

As the Company discussed in previous operations update press releases, interpreted 3-D seismic data has been incorporated with geologic and reservoir engineering data to high-grade the selection of development drilling opportunities in its Diamond M Canyon Reef project. The Company has budgeted approximately $9.6 million for the drilling and completion of approximately 12 gross (7.9 net) new wells and the workover or deepening of approximately 18 gross (11.8 net) existing wells during 2008. Parallel is the operator of this project with an average working interest of approximately 66%.

Diamond M Shallow Leases, Scurry County, Texas

The Company’s 2008 budget for the Diamond M Shallow project is approximately $1.3 million for the installation of dual injection strings in approximately 25 gross (16.5 net) existing wells. Parallel is the operator of this project with an average working interest of approximately 66%.

Carm-Ann San Andres Field/N. Means Queen Unit, Andrews & Gaines Counties, Texas

The Company’s 2008 budget for the Carm-Ann/N. Means project is approximately $3.3 million for the drilling and completion of 5 gross (4.3 net) wells and the conversion to injection of 6 gross (5.1 net) existing wells. The Company is currently involved in the unitization process prior to waterflood implementation and anticipates unit approval within the next six months. In the interim, the Company will focus on activities which are prerequisite to waterflooding. Parallel is the operator of these properties with an average working interest of approximately 77%.

Harris San Andres Field, Andrews & Gaines Counties, Texas

The Company’s 2008 budget for the Harris San Andres project is approximately $5.3 million for the drilling of an estimated 7 gross (6.3 net) wells and the re-frac workover or conversion to injection of 16 gross (14.4 net) existing wells. Also as with Carm-Ann, Parallel has initiated unitization proceedings, prior to waterflood implementation, and anticipates unit operations to commence during the second quarter of 2008. Parallel is the operator of these properties with an average working interest of approximately 90%.

Fullerton San Andres Field, Andrews County, Texas

The Company’s 2008 budget for the Fullerton project is approximately $4.0 million for the drilling of an estimated 7 gross (6.2 net) new wells and the conversion to injection of 2 gross (1.6 net) existing wells.Parallel owns an 85% average working interest in these properties.

Onshore Gulf Coast of South Texas

Yegua/Frio/Wilcox and Cook Mountain Gas Projects, Jackson, Wharton and Liberty Counties, Texas

The Company’s 2008 budget for the South Texas projects is approximately $0.7 million for the drilling of 2 gross (0.5 net) wells. As of February 1, 2008, Parallel estimates that daily production from its south Texas gas properties was approximately 400 net BOE per day.

Other Projects

Utah/Colorado Conventional Oil & Gas and Heavy Oil Sand Projects, Uinta Basin

Parallel’s Utah/Colorado project consists of approximately 163,000 gross (155,000 net) acres. The primary objective is the Weber oil sand, with secondary objectives of conventional gas and heavy oil sands. The

-more-

Parallel Petroleum Announces Increased Production, Work-in-Progress,

2008 CAPEX Budget, Increased PDP Reserves and Field Operations Update

February 20, 2008

Page 7

Company is currently awaiting drilling permit approval on three conventional oil and gas exploratory prospects, with anticipated spud dates before the fourth quarter of 2008.

Approximately 10,000 gross acres of the Company’s leasehold is located on the geologic feature known as Asphalt Ridge. The Company is continuing to evaluate development options for these heavy oil sand deposits.

The Company’s 2008 budget for its Utah/Colorado project is approximately $1.5 million for the drilling of 3 gross (2.9 net) wells and the acquisition of additional leasehold. Parallel owns and operates 97.5% of this project.

Daily Production — Fourth Quarter 2007, Compared to Third Quarter 2007 and Fourth Quarter 2006

The following Table 1 represents a comparison of Parallel’s daily production by area/property for the fourth quarter of 2007, the third quarter of 2007 and the fourth quarter of 2006. Detailed information on certain properties listed in this table is provided within the text of this press release.

TABLE 1

AVERAGE DAILY PRODUCTION — 4Q 2007, COMPARED TO 3Q 2007 AND 4Q 2006

| | | | | | | | | | | | | | | | | | | | | |

| | | 4Q 2007 | | | 3Q 2007 | | | 4Q 2006 | | | 4Q 2007 | | | 4Q 2007 | |

| | | Average | | | Average | | | Average | | | Compared to | | | Compared to | |

| | | BOE | | | BOE | | | BOE | | | 3Q 2007 | | | 4Q 2006 | |

| AREA/PROPERTY | | per day | | | per day | | | per day | | | % Change | | | % Change | |

Resource Projects | | | | | | | | | | | | | | | | | | | | |

Barnett Shale(1) | | | 1,678 | | | | 1,669 | | | | 1,013 | | | | 1 | % | | | 66 | % |

New Mexico Wolfcamp(2) | | | 1,551 | | | | 1,251 | | | | 1,042 | | | | 24 | % | | | 49 | % |

| | | | | | | | | | | | | | | | | | |

Total Resource Projects | | | 3,229 | | | | 2,920 | | | | 2,055 | | | | 11 | % | | | 57 | % |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Permian Basin of West Texas | | | | | | | | | | | | | | | | | | | | |

| Fullerton San Andres | | | 1,520 | | | | 1,492 | | | | 1,544 | | | | 2 | % | | | (2 | )% |

Carm-Ann San Andres / N. MeansQueen(3) | | | 452 | | | | 513 | | | | 560 | | | | (12 | )% | | | (19 | )% |

Harris San Andres(4) | | | 554 | | | | 509 | | | | 608 | | | | 9 | % | | | (9 | )% |

| Diamond M Shallow | | | 42 | | | | 52 | | | | 56 | | | | (19 | )% | | | (25 | )% |

Diamond M Canyon Reef(5) | | | 176 | | | | 202 | | | | 301 | | | | (13 | )% | | | (42 | )% |

| Other Permian Basin | | | 251 | | | | 246 | | | | 289 | | | | 2 | % | | | (13 | )% |

| | | | | | | | | | | | | | | | | | |

Total Permian Basin | | | 2,995 | | | | 3,014 | | | | 3,358 | | | | (1 | )% | | | (11 | )% |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Onshore Gulf Coast of South Texas | | | | | | | | | | | | | | | | | | | | |

| Yegua/Frio | | | 239 | | | | 242 | | | | 253 | | | | (1 | )% | | | (6 | )% |

| Wilcox | | | 193 | | | | 221 | | | | 376 | | | | (13 | )% | | | (49 | )% |

| Cook Mountain | | | 51 | | | | 63 | | | | 82 | | | | (19 | )% | | | (38 | )% |

| | | | | | | | | | | | | | | | | | |

Total Gulf Coast | | | 483 | | | | 526 | | | | 711 | | | | (8 | )% | | | (32 | )% |

| | | | | | | | | | | | | | | | | | |

GRAND TOTAL | | | 6,707 | | | | 6,460 | | | | 6,124 | | | | 4 | % | | | 10 | % |

| | | | | | | | | | | | | | | | | | |

| | |

| (1) | | Dec. 2006 — Drilling activity resumed after Chesapeake purchased Dale Resources’ interest and assumed operations. 3Q 2007 & 4Q 2007 — Production restricted due to limited take-away capacity. |

| |

| (2) | | 2Q 2007 — Delineation and exploitation of Northern Area. 3Q 2007 — Drilling deferred pending results of 3-D seismic in Southern Area. |

| |

| (3) | | Expect implementation of waterflood to start in 3Q 2008. |

| |

| (4) | | Expect implementation of waterflood to start in 2Q 2008. |

| |

| (5) | | Drilling activity began in early February 2008. |

-more-

Parallel Petroleum Announces Increased Production, Work-in-Progress,

2008 CAPEX Budget, Increased PDP Reserves and Field Operations Update

February 20, 2008

Page 8

Work-in-Progress Well Operations

The following Table 2 is a summary of work-in-progress oil and gas well operations on certain of Parallel’s properties as of February 1, 2008. Detailed information on the well operations in this table is provided within the text of this press release.

TABLE 2

WORK-IN-PROGRESS WELL OPERATIONS

AS OF FEBRUARY 1, 2008

| | | | | | | | | |

| | | Number of Wells | |

| Work-in-Progress Well Operations | | Gross | | | Net | |

North Texas Barnett Shale | | | | | | | | |

| Drilling | | | 3 | | | | 0.54 | |

| Completing | | | 8 | | | | 2.98 | |

| Awaiting completion | | | 5 | | | | 0.92 | |

| Shut-in, awaiting pipeline | | | 2 | | | | 0.66 | |

| | | | | | | |

Total Barnett Shale | | | 18 | | | | 5.10 | |

| | | | | | | |

New Mexico Wolfcamp | | | | | | | | |

| Drilling | | | 1 | | | | 0.93 | |

| Completing | | | 2 | | | | 1.71 | |

| Awaiting completion | | | 1 | | | | 1.00 | |

| | | | | | | |

Total Wolfcamp | | | 4 | | | | 3.64 | |

| | | | | | | |

| | | | | | | | | |

TOTAL | | | 22 | | | | 8.74 | |

| | | | | | | |

-more-

Parallel Petroleum Announces Increased Production, Work-in-Progress,

2008 CAPEX Budget, Increased PDP Reserves and Field Operations Update

February 20, 2008

Page 9

2008 CAPEX Budget — Compared to Average Daily Production and Proved Reserves Value by Property

The following Table 3 represents Parallel’s 2008 capital investment budget, compared to fourth quarter 2007 average daily production and percent of total proved reserves value as of December 31, 2007, on a property basis. Detailed information on certain properties listed in this table is provided within the text of this press release.

TABLE 3

2008 CAPEX BUDGET COMPARED TO AVERAGE DAILY PRODUCTION

AND PERCENT OF TOTAL PROVED RESERVES VALUE BY PROPERTY

| | | | | | | | | | | | | | | | | | | | | |

| | | 2008 | | | 4Q 2007 | | | 12/31/2007 | |

| | | CAPEX Budget | | | Avg Daily Production | | | % of Total Proved | |

| AREA/PROPERTY | | $MM | | | % | | | BOE | | | % | | | Reserves Value(1) | |

| | | | | | | | | | | | | | | | | | | | | |

Resource Projects | | | | | | | | | | | | | | | | | | | | |

| Barnett Shale | | $ | 60.0 | | | | 47 | % | | | 1,678 | | | | 25 | % | | | 5 | % |

| New Mexico Wolfcamp | | | 40.0 | | | | 31 | % | | | 1,551 | | | | 23 | % | | | 6 | % |

| | | | | | | | | | | | | | | | |

Total Resource Projects | | $ | 100.0 | | | | 78 | % | | | 3,229 | | | | 48 | % | | | 11 | % |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Permian Basin of West Texas | | | | | | | | | | | | | | | | | | | | |

| Fullerton San Andres | | $ | 4.0 | | | | 3 | % | | | 1,520 | | | | 23 | % | | | 31 | % |

| Carm-Ann San Andres/N. Means Queen | | | 3.3 | | | | 3 | % | | | 452 | | | | 7 | % | | | 16 | % |

| Harris San Andres | | | 5.3 | | | | 4 | % | | | 554 | | | | 8 | % | | | 23 | % |

| Diamond M Shallow | | | 1.3 | | | | 1 | % | | | 42 | | | | 1 | % | | | 6 | % |

| Diamond M Canyon Reef | | | 9.6 | | | | 7 | % | | | 176 | | | | 3 | % | | | 9 | % |

| Other Permian Basin | | | 1.0 | | | | 1 | % | | | 251 | | | | 4 | % | | | 2 | % |

| | | | | | | | | | | | | | | | |

Total Permian Basin | | $ | 24.5 | | | | 19 | % | | | 2,995 | | | | 45 | % | | | 87 | % |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Onshore Gulf Coast of South Texas | | $ | 0.7 | | | | 1 | % | | | 483 | | | | 7 | % | | | 2 | % |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Other Projects | | | | | | | | | | | | | | | | | | | | |

| Cotton Valley Reef | | $ | 0.5 | | | | 0 | % | | | — | | | | 0 | % | | | 0 | % |

| Utah/Colorado | | | 1.5 | | | | 2 | % | | | — | | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | |

Total Other Projects | | $ | 2.0 | | | | 2 | % | | | — | | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

GRAND TOTAL | | $ | 127.2 | | | | 100 | % | | | 6,707 | | | | 100 | % | | | 100 | % |

| | | | | | | | | | | | | | | | |

| | |

| (1) | | Based on independent reserve study by Cawley, Gillespie & Associates, Inc. utilizing NYMEX prices of $96.01 per barrel of oil and $7.46 per Mcf of natural gas, and realized average prices of $89.93 per barrel of oil and $6.77 per Mcf of natural gas, as of December 31, 2007. |

-more-

Parallel Petroleum Announces Increased Production, Work-in-Progress,

2008 CAPEX Budget, Increased PDP Reserves and Field Operations Update

February 20, 2008

Page 10

Proved Reserves as of December 31, 2006 and December 31, 2007

The following Table 4 represents Parallel’s total proved reserves by category and the Standardized Measure of Discounted Future Net Cash Flows as of December 31, 2006 and December 31, 2007.

TABLE 4

PROVED RESERVES AS OF DECEMBER 31, 2006 AND DECEMBER 31, 2007

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Percent | |

| | | December 31, | | | December 31, | | | Increase | | | Increase | |

| | | 2006(1) | | | 2007(1) | | | (Decrease) | | | (Decrease) | |

Total Proved Reserves: | | | | | | | | | | | | | | | | |

| Oil (MMBbls) | | | 28.7 | | | | 28.4 | | | | (0.3 | ) | | | (1 | )% |

| Gas (Bcfg) | | | 58.9 | | | | 57.2 | | | | (1.7 | ) | | | (3 | )% |

| MMBOE | | | 38.5 | | | | 38.0 | | | | (0.5 | ) | | | (1 | )% |

| | | | | | | | | | | | | | | | | |

SEC Reserve Categories: | | | | | | | | | | | | | | | | |

PDP (MMBOE)(2) | | | 18.3 | | | | 20.5 | | | | 2.2 | | | | 12 | % |

PDNP (MMBOE)(3) | | | 1.4 | | | | 0.8 | | | | (0.6 | ) | | | (43 | )% |

PUD (MMBOE)(4) | | | 18.8 | | | | 16.7 | | | | (2.1 | ) | | | (11 | )% |

| | | | | | | | | | | | | | |

| Total Proved Reserves (MMBOE) | | | 38.5 | | | | 38.0 | | | | (0.5 | ) | | | (1 | )% |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Standardized Measure of Discounted Future Net Cash Flows ($MM)(5) | | $ | 336 | | | $ | 634 | | | $ | 298 | | | | 89 | % |

| | | | | | | | | | | | | | | | | |

NYMEX prices: | | | | | | | | | | | | | | | | |

| Per Bbl of oil | | $ | 61.06 | | | $ | 96.01 | | | $ | 34.95 | | | | 57 | % |

| Per Mcf of natural gas | | $ | 5.47 | | | $ | 7.46 | | | $ | 1.99 | | | | 36 | % |

| | | | | | | | | | | | | | | | | |

Realized prices: | | | | | | | | | | | | | | | | |

| Per Bbl of oil | | $ | 54.67 | | | $ | 89.93 | | | $ | 35.26 | | | | 64 | % |

| Per Mcf of natural gas | | $ | 5.00 | | | $ | 6.77 | | | $ | 1.77 | | | | 35 | % |

| | |

| (1) | | Based on independent reserve studies prepared by Cawley, Gillespie & Associates, Inc. |

| |

| (2) | | PDP is proved developed producing reserves. |

| |

| (3) | | PDNP is proved developed non-producing reserves. |

| |

| (4) | | PUD is proved undeveloped reserves. |

| |

| (5) | | The Standardized Measure of Discounted Future Net Cash Flows have been calculated utilizing the estimated future income tax rates as of December 31, 2006 and December 31, 2007, respectively. |

-more-

Parallel Petroleum Announces Increased Production, Work-in-Progress,

2008 CAPEX Budget, Increased PDP Reserves and Field Operations Update

February 20, 2008

Page 11

Proved Reserves by Area/Property as of December 31, 2007

The following Table 5 represents Parallel’s total proved reserves, on a property basis, and the estimated Standardized Measure of Discounted Future Net Cash Flows as of December 31, 2007.

TABLE 5

PROVED RESERVES BY AREA/PROPERTY AS OF DECEMBER 31, 2007

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Proved Reserves as of 12-31-07 (1) (2) | |

| | | PDP(3) | | | PDNP(4) | | | PUD(5) (6) | | | Total Proved | | | | |

| | | | | | | PV-10% | | | | | | | PV-10% | | | | | | | PV-10% | | | | | | | PV-10% | | | % of | |

| AREA/PROPERTY | | MMBOE | | | ($MM)(7) | | | MMBOE | | | ($MM)(7) | | | MMBOE | | | ($MM)(7) | | | MMBOE | | | ($MM)(7) | | | PV-10% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Resource Projects | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Barnett Shale | | | 2.42 | | | $ | 36.3 | | | | — | | | $ | — | | | | 0.53 | | | $ | 4.6 | | | | 2.95 | | | $ | 41.0 | | | | 5 | % |

| New Mexico Wolfcamp | | | 2.86 | | | | 43.1 | | | | — | | | | — | | | | 1.19 | | | | 5.8 | | | | 4.05 | | | | 48.9 | | | | 6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Resource Projects | | | 5.28 | | | $ | 79.4 | | | | — | | | $ | — | | | | 1.72 | | | $ | 10.5 | | | | 7.00 | | | $ | 89.9 | | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Permian Basin of West Texas | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fullerton San Andres | | | 9.17 | | | $ | 254.3 | | | | 0.05 | | | $ | 2.6 | | | | 0.43 | | | $ | 10.9 | | | | 9.65 | | | $ | 267.8 | | | | 31 | % |

| Carm-Ann San Andres/N. Means Queen | | | 1.60 | | | | 45.1 | | | | 0.28 | | | | 12.5 | | | | 5.36 | | | | 85.1 | | | | 7.25 | | | | 142.7 | | | | 16 | % |

| Harris San Andres | | | 2.14 | | | | 67.8 | | | | 0.29 | | | | 12.5 | | | | 5.83 | | | | 125.5 | | | | 8.27 | | | | 205.8 | | | | 23 | % |

| Diamond M Shallow | | | 0.26 | | | | 4.2 | | | | 0.17 | | | | 8.2 | | | | 1.43 | | | | 43.7 | | | | 1.86 | | | | 56.0 | | | | 6 | % |

| Diamond M Canyon Reef | | | 0.45 | | | | 12.0 | | | | — | | | | — | | | | 1.91 | | | | 70.8 | | | | 2.36 | | | | 82.8 | | | | 9 | % |

| Other Permian Basin | | | 1.00 | | | | 22.0 | | | | — | | | | — | | | | — | | | | — | | | | 1.00 | | | | 22.0 | | | | 2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Permian Basin | | | 14.63 | | | $ | 405.3 | | | | 0.80 | | | $ | 35.7 | | | | 14.95 | | | $ | 336.1 | | | | 30.38 | | | $ | 777.2 | | | | 87 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Onshore Gulf Coast of South Texas | | | 0.55 | | | $ | 15.0 | | | | 0.03 | | | $ | 0.9 | | | | — | | | $ | — | | | | 0.58 | | | $ | 15.9 | | | | 2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

GRAND TOTAL | | | 20.46 | | | $ | 499.8 | | | | 0.84 | | | $ | 36.7 | | | | 16.67 | | | $ | 346.6 | | | | 37.96 | | | $ | 883.0 | | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Estimated Future Income Taxes (8) | | | | | | | (142.7 | ) | | | | | | | (10.7 | ) | | | | | | | (96.2 | ) | | | | | | | (249.5 | ) | | | | |

Net Salvage(9) | | | | | | | 0.7 | | | | | | | | — | | | | | | | | 0.2 | | | | | | | | 0.9 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Estimated Standardized Measure of Discounted Future Net Cash Flows | | | | | | $ | 357.8 | | | | | | | $ | 26.0 | | | | | | | $ | 250.6 | | | | | | | $ | 634.4 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (1) | | Variances in certain column totals are due to rounding. |

| |

| (2) | | Based on independent reserve study by Cawley, Gillespie & Associates, Inc. utilizing NYMEX prices of $96.01 per barrel of oil and $7.46 per Mcf of natural gas, and realized average prices of $89.93 per barrel of oil and $6.77 per Mcf of natural gas, as of December 31, 2007. |

| |

| (3) | | PDP is proved developed producing reserves. |

| |

| (4) | | PDNP is proved developed non-producing reserves. |

| |

| (5) | | PUD is proved undeveloped reserves. |

| |

| (6) | | The development of these PUD reserves will require, over the next three years, approximately $111.4 million of capital investment, which has already been deducted from the reserves PV-10% estimate. |

| |

| (7) | | The PV-10 Value is derived from the standardized measure of discounted future net cash flows which is the most directly comparable GAAP financial measure. PV-10 Value is equal to the standardized measure of discounted future net cash flows at the relevant date before deducting future income taxes, discounted at 10%. Parallel believes that the presentation of the PV-10 Value is relevant and useful to investors because it presents the discounted future net cash flows attributable to Parallel’s proved reserves prior to taking into account corporate future income taxes and it is a useful measure for evaluating the relative monetary significance of Parallel’s oil and natural gas properties. Further, investors may utilize the measure as a basis for comparison of the relative size and value of Parallel’s reserves to other companies. Parallel uses this measure when assessing the potential return on investment related to its oil and natural gas properties. However, PV-10 Value is not a substitute for the standardized measure of discounted future net cash flows. Parallel’s PV-10 Value measure and the standardized measure of discounted future net cash flows do not purport to present the fair value of Parallel’s oil and natural gas reserves. |

| |

| (8) | | Future income taxes have been estimated utilizing the tax rate applicable to the Standardized Measure of Discounted Future Net Cash Flows as of December 31, 2007. |

| |

| (9) | | Net salvage is the estimated future value of the plugging costs, less the value received for the equipment, once a well has been plugged and abandoned. |

-more-

Parallel Petroleum Announces Increased Production, Work-in-Progress,

2008 CAPEX Budget, Increased PDP Reserves and Field Operations Update

February 20, 2008

Page 12

Conference Call and Webcast Information

Parallel’s management will host a conference call to discuss fourth quarter and year end 2007 financial results, production, work-in-progress, 2008 capital investment budget, 2007 reserves and field operations. In addition to this press release, please refer to Parallel’s fourth quarter and year end 2007 earnings release also dated February 20, 2008 and its Form 10-K Report for the year ended December 31, 2007 that was filed with the Securities and Exchange Commission on February 20, 2008.

The conference call will be held on Thursday, February 21, 2008, at 2:00 p.m. Eastern time (1:00 p.m. Central time). To participate in the call, dial 888-713-4214 or 617-213-4866, Participant Passcode 75665568, at least five minutes before the scheduled start time. The conference call will also be webcast with slides, and can be accessed live at Parallel’s web site,http://www.plll.com. Participants may pre-register for the call at Parallel’s web site on the Event Details page for the webcast or atwww.theconferencingservice.com/prereg/key.process?key=PU697WYER. Pre-registrants will be issued a pin number to use when dialing into the live call which will provide quick access to the conference by bypassing the operator upon connection. A replay of the conference call will be available at the Company’s web site or by calling 888-286-8010 or 617-801-6888, Passcode 90030622.

The Company

Parallel Petroleum is an independent energy company headquartered in Midland, Texas, engaged in the acquisition, exploration, development and production of oil and gas using 3-D seismic technology and advanced drilling, completion and recovery techniques. Parallel’s primary areas of operation are the Permian Basin of West Texas and New Mexico, North Texas Barnett Shale, Onshore Gulf Coast of South Texas, East Texas and Utah/Colorado. Additional information on Parallel Petroleum Corporation is available athttp://www.plll.com.

This release contains forward-looking statements subject to various risks and uncertainties that could cause the Company’s future plans, objectives and performance to differ materially from those in the forward-looking statements. Forward-looking statements can be identified by the use of forward-looking terminology such as “initial daily test rates,” “may,” “will,” “expect,” “intend,” “plan,” “subject to,” “anticipate,” “estimate,” “continue,” “present value,” “future,” “reserves”, “appears,” “prospective,” or other variations thereof or comparable terminology. Factors that could cause or contribute to such differences could include, but are not limited to, those relating to:

| | • | | the results of exploratory drilling activity; |

| |

| | • | | the Company’s growth strategy; |

| |

| | • | | changes in oil and natural gas prices; |

| |

| | • | | operating risks, availability of drilling equipment; |

| |

| | • | | outstanding indebtedness; |

| |

| | • | | weaknesses in our internal controls; |

| |

| | • | | the inherent variability in early production tests; |

| |

| | • | | uncertainties inherent in estimating production rates; |

| |

| | • | | the availability and capacity of natural gas gathering and transportation facilities; |

| |

| | • | | the period of time that our oil and natural gas wells have been producing; |

| |

| | • | | changes in interest rates; |

| |

| | • | | dependence on weather conditions; |

| |

| | • | | seasonality; |

| |

| | • | | expansion and other activities of competitors; |

| |

| | • | | changes in federal or state environmental laws and the administration of such laws; and |

| |

| | • | | the general condition of the economy and its effect on the securities market. |

While we believe our forward-looking statements are based upon reasonable assumptions, these are factors that are difficult to predict and that are influenced by economic and other conditions beyond our control. Investors are directed to consider such risks and other uncertainties discussed in documents filed by the Company with the Securities and Exchange Commission.

###