Exhibit 99.1

| | | | | |

| | PRESS RELEASE |

1004 N. Big Spring, Suite 400 | | Contact: | | Cindy Thomason |

Midland, TX 79701 (432) 684-3727 | | | | Manager of Investor Relations |

http://www.plll.com | | | | cindyt@plll.com |

PARALLEL PETROLEUM ANNOUNCES INCREASED PRODUCTION,

WORK-IN-PROGRESS, AND FIELD OPERATIONS UPDATE

MIDLAND, Texas, (BUSINESS WIRE), May 5, 2008— Parallel Petroleum Corporation (NASDAQ: PLLL) today announced its first quarter 2008 average net daily production, work-in-progress, and field operations update. In a separate press release issued today, Parallel announced its financial results for the first quarter ended March 31, 2008. The Company’s financial and field operations conference call and webcast will be held Tuesday, May 6, 2008 at 2:00 p.m. Eastern time (1:00 p.m. Central time). Details for the conference call and webcast are disclosed at the end of this press release.

Net Daily Production — First Quarter 2008 Average

The Company’s net daily production for the first quarter ended March 31, 2008 averaged 7,592 equivalent barrels of oil per day (BOEPD), an increase of 13% when compared to an average of 6,707 BOEPD during the fourth quarter ended December 31, 2007. During the first quarter 2008, production from the Company’s Barnett Shale gas project increased 50%, from 1,678 to 2,520 BOEPD, due to the completion of new wells and increased take-away capacity related to pipeline expansion and additional compression. Production from the New Mexico Wolfcamp gas project increased 16%, from 1,551 to 1,795 BOEPD, during the first quarter 2008 due to better, and more consistent, well results and timing of completions. The first quarter 2008 increases were partially offset by a 3% decrease in the Company’s long-life Permian Basin oil projects, from 2,995 to 2,897 BOEPD, due to development timing and normal decline on base production, and a 21% decrease in its South Texas short-life gas properties from 483 to 380 BOEPD due to normal decline.

Please refer to Table 1 at the end of this press release for quarterly comparison information pertaining to daily production by area/property for the first quarter of 2008, the fourth quarter of 2007 and the first quarter of 2007.

Work-in-Progress Well Operations

As of March 31, 2008, the Company had 38 gross (11.96 net) wells in progress. Of the 38 gross wells, 31 gross (9.51 net) wells were shut-in awaiting pipeline, completing or awaiting completion, and 7 gross (2.45 net) wells were drilling. Of the 31 wells that were shut-in awaiting pipeline, completing or awaiting completion, 27 gross (6.20 net) wells were in the Barnett Shale, 2 gross (2.00 net) wells were in the Wolfcamp, and 2 gross (1.31 net) wells were in the Permian Basin. Of the 7 wells that were drilling, 4 gross (0.82 net) wells were drilling in the Barnett Shale, 2 gross (0.97 net) wells were drilling in the Wolfcamp, and 1 gross (0.66 net) well was drilling in the Permian Basin. Please refer to Table 2 at the end of this press release for a summary of work-in-progress on certain of Parallel’s properties as of March 31, 2008.

Management Comments

Larry C. Oldham, Parallel’s President, commented, “As evidenced by our 13% increase in first quarter 2008 production compared to fourth quarter 2007, we are achieving one of our stated goals of increasing our production during 2008. Along with this production growth, we are also anticipating a net increase in proved developed producing (PDP) reserves when we report our mid-year 2008 reserves update.”

In a final comment, Oldham stated, “The increases in production and PDP reserves are expected to continue as drilling continues and take-away capacity is increased in the Barnett Shale gas project; development drilling continues in our New Mexico Wolfcamp gas project; and infill development and waterflood implementation continues on the majority of our West Texas Permian Basin oil projects.”

-more-

Parallel Petroleum Announces Increased Production,

Work-in-Progress, and Field Operations Update

May 5, 2008

Page 2

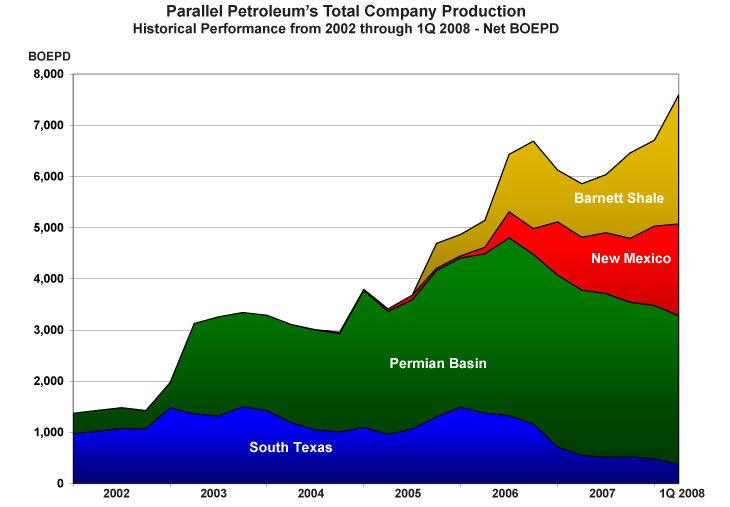

Total Company Historical Performance — Net BOEPD

The following graph shows individual volumetric contributions and growth from Parallel’s core oil and gas projects from 2002 through the first quarter of 2008. The graph also illustrates the evolution of the portfolio since 2002 and the growing importance of the Barnett Shale and New Mexico Wolfcamp components.

Operations by Area/Property

Summarized below are Parallel’s more significant current projects, including its planned operations and capital investment budget for these projects in 2008.

Resource Gas Projects

Parallel has two resource gas projects in varying stages of development, which are the Barnett Shale gas project in the Fort Worth Basin of North Texas and the Wolfcamp gas project in the Permian Basin of New Mexico.

Fort Worth Basin of North Texas

Barnett Shale Gas Project, Tarrant County, Texas

Leasehold acreage in Parallel’s Barnett Shale gas project consists of approximately 30,000 gross (8,900 net) acres located in and around the Trinity River flood plain, east and west of downtown Fort Worth. At present, the project controls approximately 75 multi-well pad sites. Based on current industry practices, Parallel anticipates development drilling on 40-acre spacing.

As of March 31, 2008, Parallel’s Barnett Shale gas project had 58 gross (16.43 net) producing wells. For the first quarter ended March 31, 2008, daily production in this project averaged approximately 74,000 gross (15,120 net) Mcf of gas, or 2,520 net BOE. This increase in production volumes was due to the completion of new wells and increased take-away capacity related to pipeline expansion and additional compression. As of March 31, 2008, the Company had 31 gross (7.02 net) wells in progress in the Barnett Shale. Of the 31 gross wells, 15 wells were being completed, 10 wells were awaiting completion, 2 wells were shut-in awaiting pipeline, and 4 wells were drilling. Based on information currently available, Parallel expects the operator, Chesapeake Energy Corporation (NYSE: CHK), to maintain a 4-rig drilling program for the foreseeable future. Chesapeake continues to install additional compression and pipeline in order to provide sufficient take-away capacity as new wells are drilled and completed and production volumes continue to increase.

-more-

Parallel Petroleum Announces Increased Production,

Work-in-Progress, and Field Operations Update

May 5, 2008

Page 3

Parallel’s 2008 budget for its Barnett Shale project is approximately $60.0 million. The amount budgeted will be used to fund the drilling and completion of an estimated 53 gross (20.0 net) wells, pipeline construction and leasehold acquisition.

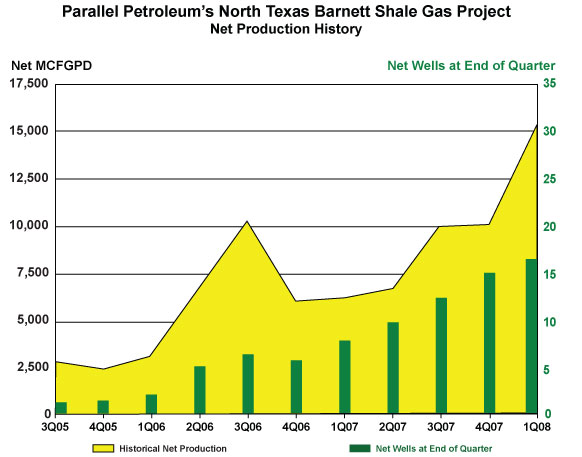

The following graph depicts net production history, including the associated net producing wells at the end of each quarter in Parallel’s North Texas Barnett Shale gas project. Parallel cannot project future production due to timing of completions and other normal operating variables.

Permian Basin of New Mexico

Wolfcamp Gas Project, Eddy and Chaves Counties, New Mexico

The New Mexico Wolfcamp horizontal resource gas play, as defined by Parallel, encompasses approximately 300,000 gross acres in portions of Eddy and Chaves Counties in southeastern New Mexico. Parallel currently owns an interest in approximately 106,000 gross (77,000 net) acres acquired specifically for the Wolfcamp, with the majority of the acreage being in the Northern and Southern Areas of the project. Parallel’s operations in its Wolfcamp project currently consist of a 1-rig development drilling program in the Northern and Central Areas and the acquisition of a 3-D seismic survey in the Southern Area.

As of March 31, 2008, Parallel operated 45 gross (33.27 net) producing gas wells in the New Mexico Wolfcamp gas project. In addition, the Company had ownership in another 30 gross (3.67 net) wells operated by other companies, primarily EOG Resources, Inc. (NYSE: EOG). For the first quarter ended March 31, 2008, daily production in this project averaged approximately 27,500 gross (10,770 net) Mcfe, or 1,795 net BOE. As of March 31, 2008, the Company had 1 well completing, 1 well awaiting completion, and 2 wells drilling in the project.

Northern Area— As of March 31, 2008, 27 gross (21.91 net) wells had been drilled and completed in the Company’s Forego/County Line and Racehorse projects in the Northern Area. For the first quarter ended March 31, 2008, daily production in the Northern Area averaged approximately 13,000 gross (7,836 net) Mcf of gas, or 1,306 net BOE. As of March 31, 2008, the Company had 1 well drilling, 1 well completing and 1 well awaiting completion in the Forego/County Line area. Parallel anticipates that the Forego/County Line area will be its most active Wolfcamp development area for the foreseeable future.

Parallel’s Racehorse project is located approximately four miles east, northeast of its Forego/County Line area and has 6 gross (5.4 net) wells producing at low rates, which were the initial wells drilled in the Northern Area. There is currently no drilling activity planned for the Racehorse area.

-more-

Parallel Petroleum Announces Increased Production,

Work-in-Progress, and Field Operations Update

May 5, 2008

Page 4

Central Area— As of March 31, 2008, Parallel had an interest in 27 gross (2.91 net) EOG-operated horizontal wells. For the first quarter ended March 31, 2008, daily production from the EOG-operated wells averaged approximately 8,600 gross (318 net) Mcf of gas, or 53 net BOE. Parallel had one operated well producing at an average daily rate of 500 gross (336 net) Mcf of gas, or 56 net BOE, during the first quarter 2008. As of March 31, 2008, Parallel had 1 well drilling in the Central Area.

Southern Area— As of March 31, 2008, Parallel’s Southern Area had 21 gross (12.12 net) producing wells. For the first quarter ended March 31, 2008, daily production in the Company’s Southern Area averaged approximately 5,400 gross (2,280 net) Mcf of gas, or 380 net BOE. Parallel, in conjunction with a third party pipeline company, continues to modify the field gas gathering system to enhance individual well performance and overall production volumes from the field. The Company began data acquisition of a 3-D seismic survey in late October 2007 and anticipates the completion of data processing and interpretation during 2008.

Parallel’s 2008 New Mexico Wolfcamp budget is approximately $40.0 million. The amount budgeted will be used to fund the drilling and completion of an estimated 18 gross (15.3 net) operated wells in the Northern and Central Areas, the installation of pipelines and related infrastructure, the acquisition of additional leasehold, and the acquisition of 3-D seismic data in the Southern Area.

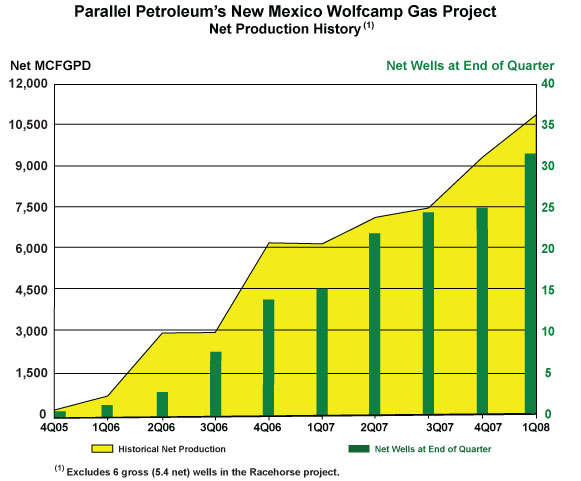

The following graph depicts net production history, including the associated net producing wells at the end of each quarter in Parallel’s New Mexico Wolfcamp gas project. Parallel cannot project future production due to timing of completions and other normal operating variables.

Permian Basin of West Texas

Parallel’s Permian Basin of West Texas oil properties currently consist of four major project areas. The Diamond M Canyon Reef and Shallow, Carm-Ann San Andres/N. Means Queen, Harris San Andres and Fullerton San Andres projects comprise approximately 18,400 gross (15,000 net) acres, combined. Most of these properties have been added to Parallel’s portfolio since June 2002. As of March 31, 2008, Parallel estimates that daily production from its west Texas Permian Basin oil properties averaged approximately 2,897 net BOE per day.

-more-

Parallel Petroleum Announces Increased Production,

Work-in-Progress, and Field Operations Update

May 5, 2008

Page 5

Diamond M Canyon Reef Unit, Scurry County, Texas

As of March 31, 2008, 2 wells were being completed and 1 well was drilling in Parallel’s Diamond M Canyon Reef project. The Company has budgeted approximately $9.6 million for the drilling and completion of approximately 12 gross (7.9 net) new wells and the workover or deepening of approximately 18 gross (11.8 net) existing wells during 2008. Parallel is the operator of this project with an average working interest of approximately 66%.

Diamond M Shallow Leases, Scurry County, Texas

The Company’s 2008 budget for the Diamond M Shallow project is approximately $1.3 million for the installation of dual injection strings in approximately 25 gross (16.5 net) existing wells. Parallel is the operator of this project with an average working interest of approximately 66%.

Carm-Ann San Andres Field/N. Means Queen Unit, Andrews & Gaines Counties, Texas

The Company’s 2008 budget for the Carm-Ann/N. Means project is approximately $3.3 million for the drilling and completion of 5 gross (4.3 net) wells and the conversion to injection of 6 gross (5.1 net) existing wells. The Company is currently involved in the unitization process prior to waterflood implementation and anticipates unit approval within the next six months. In the interim, the Company will focus on activities which are prerequisite to waterflooding. Parallel is the operator of these properties with an average working interest of approximately 77%.

Harris San Andres Field, Andrews & Gaines Counties, Texas

The Company’s 2008 budget for the Harris San Andres project is approximately $5.3 million for the drilling of an estimated 7 gross (6.3 net) wells and the re-frac workover or conversion to injection of 16 gross (14.4 net) existing wells. Also, as with Carm-Ann, Parallel has initiated unitization proceedings prior to waterflood implementation, which it expects to commence during the second half of 2008. Parallel is the operator of these properties with an average working interest of approximately 90%.

Fullerton San Andres Field, Andrews County, Texas

The Company’s 2008 budget for the Fullerton project is approximately $4.0 million for the drilling of an estimated 7 gross (6.2 net) new wells and the conversion to injection of 2 gross (1.6 net) existing wells.Parallel owns an 85% average working interest in these properties.

Onshore Gulf Coast of South Texas

Yegua/Frio/Wilcox and Cook Mountain Gas Projects, Jackson, Wharton and Liberty Counties, Texas

The Company’s 2008 budget for the South Texas projects is approximately $0.7 million for the drilling of 2 gross (0.5 net) wells. As of March 31, 2008, Parallel estimates that daily production from its south Texas gas properties averaged approximately 380 net BOE per day.

Other Projects

Utah/Colorado Conventional Oil & Gas and Heavy Oil Sand Projects, Uinta Basin

Parallel’s Utah/Colorado project consists of approximately 163,000 gross (155,000 net) acres. The primary objective is the Weber oil sand, with secondary objectives of conventional gas and heavy oil sands. The Company is currently awaiting drilling permit approval on three conventional oil and gas exploratory prospects, with anticipated spud dates before the fourth quarter of 2008.

Approximately 10,000 gross acres of the Company’s leasehold is located on the geologic feature known as Asphalt Ridge. The Company is continuing to evaluate development options for these heavy oil sand deposits.

The Company’s 2008 budget for its Utah/Colorado project is approximately $1.5 million for the drilling of 3 gross (2.9 net) wells and the acquisition of additional leasehold. Parallel owns and operates 97.5% of this project.

-more-

Parallel Petroleum Announces Increased Production,

Work-in-Progress, and Field Operations Update

May 5, 2008

Page 6

Daily Production — First Quarter 2008, Compared to Fourth Quarter 2007 and First Quarter 2007

The following Table 1 represents a comparison of Parallel’s daily production by area/property for the first quarter of 2008, the fourth quarter of 2007 and the first quarter of 2007. Detailed information on certain properties listed in this table is provided within the text of this press release.

TABLE 1

AVERAGE DAILY PRODUCTION — 1Q 2008, COMPARED TO 4Q 2007 AND 1Q 2007

| | | | | | | | | | | | | | | | | | | | | |

| | | 1Q 2008 | | | 4Q 2007 | | | 1Q 2007 | | | 1Q 2008 | | | 1Q 2008 | |

| | | Average | | | Average | | | Average | | | Compared to | | | Compared to | |

| | | BOE | | | BOE | | | BOE | | | 4Q 2007 | | | 1Q 2007 | |

| AREA/PROPERTY | | per day | | | per day | | | per day | | | % Change | | | % Change | |

| | | | | | | | | | | | | | | | | | | | | |

Resource Projects | | | | | | | | | | | | | | | | | | | | |

Barnett Shale(1) | | | 2,520 | | | | 1,678 | | | | 1,044 | | | | 50 | % | | | 141 | % |

New Mexico Wolfcamp(2) | | | 1,795 | | | | 1,551 | | | | 1,035 | | | | 16 | % | | | 73 | % |

| | | | | | | | | | | | | | | | | | |

Total Resource Projects | | | 4,315 | | | | 3,229 | | | | 2,079 | | | | 34 | % | | | 108 | % |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Permian Basin of West Texas | | | | | | | | | | | | | | | | | | | | |

| Fullerton San Andres | | | 1,486 | | | | 1,520 | | | | 1,493 | | | | (2 | )% | | | (0 | )% |

Carm-Ann San Andres / N. Means Queen(3) | | | 413 | | | | 452 | | | | 551 | | | | (9 | )% | | | (25 | )% |

Harris San Andres(4) | | | 554 | | | | 554 | | | | 563 | | | | 0 | % | | | (2 | )% |

| Diamond M Shallow | | | 48 | | | | 42 | | | | 54 | | | | 14 | % | | | (11 | )% |

| Diamond M Canyon Reef | | | 183 | | | | 176 | | | | 273 | | | | 4 | % | | | (33 | )% |

| Other Permian Basin | | | 213 | | | | 251 | | | | 294 | | | | (15 | )% | | | (28 | )% |

| | | | | | | | | | | | | | | | | | |

Total Permian Basin | | | 2,897 | | | | 2,995 | | | | 3,228 | | | | (3 | )% | | | (10 | )% |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Onshore Gulf Coast of South Texas | | | | | | | | | | | | | | | | | | | | |

| Yegua/Frio | | | 181 | | | | 239 | | | | 196 | | | | (24 | )% | | | (8 | )% |

| Wilcox | | | 154 | | | | 193 | | | | 283 | | | | (20 | )% | | | (46 | )% |

| Cook Mountain | | | 45 | | | | 51 | | | | 73 | | | | (12 | )% | | | (38 | )% |

| | | | | | | | | | | | | | | | | | |

Total Gulf Coast | | | 380 | | | | 483 | | | | 552 | | | | (21 | )% | | | (31 | )% |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

GRAND TOTAL | | | 7,592 | | | | 6,707 | | | | 5,859 | | | | 13 | % | | | 30 | % |

| | | | | | | | | | | | | | | | | | |

| | | |

| (1) | | Dec. 2006 — Drilling activity resumed after Chesapeake purchased Dale Resources’ interest and assumed operations. 3Q 2007 & 4Q 2007 — Production restricted due to limited take-away capacity. |

| |

| (2) | | 2Q 2007 — Delineation and exploitation of Northern Area.

3Q 2007 — Drilling deferred pending results of 3-D seismic in Southern Area. |

| |

| (3) | | Expect implementation of waterflood to start in 4Q 2008. |

| |

| (4) | | Expect implementation of waterflood to start in 3Q 2008. |

-more-

Parallel Petroleum Announces Increased Production,

Work-in-Progress, and Field Operations Update

May 5, 2008

Page 7

Work-in-Progress Well Operations

The following Table 2 is a summary of work-in-progress oil and gas well operations on certain of Parallel’s properties as of March 31, 2008. Detailed information on the well operations in this table is provided within the text of this press release.

TABLE 2

WORK-IN-PROGRESS WELL OPERATIONS

AS OF MARCH 31, 2008

| | | | | | | | | |

| | | Number of Wells | |

| Work-in-Progress Well Operations | | Gross | | | Net | |

| | | | | | | | | |

North Texas Barnett Shale | | | | | | | | |

| Drilling | | | 4 | | | | 0.82 | |

| Completing | | | 15 | | | | 4.27 | |

| Awaiting completion | | | 10 | | | | 1.36 | |

| Shut-in, awaiting pipeline | | | 2 | | | | 0.57 | |

| | | | | | | |

Total Barnett Shale | | | 31 | | | | 7.02 | |

| | | | | | | |

| | | | | | | | | |

New Mexico Wolfcamp | | | | | | | | |

| Drilling | | | 2 | | | | 0.97 | |

| Completing | | | 1 | | | | 1.00 | |

| Awaiting completion | | | 1 | | | | 1.00 | |

| | | | | | | |

Total Wolfcamp | | | 4 | | | | 2.97 | |

| | | | | | | |

| | | | | | | | | |

West Texas Permian Basin | | | | | | | | |

| Drilling | | | 1 | | | | 0.66 | |

| Completing | | | 2 | | | | 1.31 | |

| | | | | | | |

Total Permian Basin | | | 3 | | | | 1.97 | |

| | | | | | | |

| | | | | | | | | |

TOTAL | | | 38 | | | | 11.96 | |

| | | | | | | |

-more-

Parallel Petroleum Announces Increased Production,

Work-in-Progress, and Field Operations Update

May 5, 2008

Page 8

Conference Call and Webcast Information

Parallel’s management will host a conference call to discuss first quarter 2008 financial results, production, work-in-progress, and field operations. In addition to this press release, please refer to Parallel’s first quarter 2008 earnings release also dated May 5, 2008 and its Form 10-Q Report for the quarter ended March 31, 2008 that was filed with the Securities and Exchange Commission on May 5, 2008.

The conference call will be held on Tuesday, May 6, 2008, at 2:00 p.m. Eastern time (1:00 p.m. Central time). To participate in the call, dial 888-679-8018 or 617-213-4845, Participant Passcode 29180963, at least ten minutes before the scheduled start time. The conference call will also be webcast with slides, and can be accessed live at Parallel’s web site,http://www.plll.com. A replay of the conference call will be available at the Company’s web site or by calling 888-286-8010 or 617-801-6888, Passcode 30061674.

Participants may pre-register for the call at Parallel’s web site on the Event Details page for the webcast or athttps://www.theconferencingservice.com/prereg/key.process?key=PHRFRTTUM. Pre-registrants will be issued a pin number to use when dialing into the live call which will provide quick access to the conference by bypassing the operator upon connection.

The Company

Parallel Petroleum is an independent energy company headquartered in Midland, Texas, engaged in the exploitation, development, acquisition and production of oil and gas using 3-D seismic technology and advanced drilling, completion and recovery techniques. Parallel’s primary areas of operation are the Permian Basin of West Texas and New Mexico, North Texas Barnett Shale, Onshore Gulf Coast of South Texas, East Texas and Utah/Colorado. Additional information on Parallel is available via the internet athttp://www.plll.com.

This release contains forward-looking statements subject to various risks and uncertainties that could cause the Company’s future plans, objectives and performance to differ materially from those in the forward-looking statements. Forward-looking statements can be identified by the use of forward-looking terminology such as “initial daily test rates,” “may,” “will,” “expect,” “intend,” “plan,” “subject to,” “anticipate,” “estimate,” “continue,” “present value,” “future,” “reserves”, “appears,” “prospective,” or other variations thereof or comparable terminology. Factors that could cause or contribute to such differences could include, but are not limited to, those relating to:

| | • | | the results of exploratory drilling activity; |

| |

| | • | | the Company’s growth strategy; |

| |

| | • | | changes in oil and natural gas prices; |

| |

| | • | | operating risks, availability of drilling equipment; |

| |

| | • | | outstanding indebtedness; |

| |

| | • | | weaknesses in our internal controls; |

| |

| | • | | the inherent variability in early production tests; |

| |

| | • | | uncertainties inherent in estimating production rates; |

| |

| | • | | the availability and capacity of natural gas gathering and transportation facilities; |

| |

| | • | | the period of time that our oil and natural gas wells have been producing; |

| |

| | • | | changes in interest rates; |

| |

| | • | | dependence on weather conditions; |

| |

| | • | | seasonality; |

| |

| | • | | expansion and other activities of competitors; |

| |

| | • | | changes in federal or state environmental laws and the administration of such laws; and |

| |

| | • | | the general condition of the economy and its effect on the securities market. |

While we believe our forward-looking statements are based upon reasonable assumptions, these are factors that are difficult to predict and that are influenced by economic and other conditions beyond our control. Investors are directed to consider such risks and other uncertainties discussed in documents filed by the Company with the Securities and Exchange Commission.

###