UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

As filed with the Securities and Exchange Commission on April 12, 2005

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

AUBURN NATIONAL BANCORPORATION, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

April 12, 2005

TO OUR SHAREHOLDERS:

You are cordially invited to attend the 99th Annual Meeting of Shareholders of Auburn National Bancorporation, Inc., to be held at the AuburnBank Center, 132 North Gay Street, Auburn, Alabama, on Tuesday, May 10, 2005, at 3:00 p.m., Local Time (the “Meeting”).

The Notice of Meeting, Proxy Statement, Proxy, and our 2004 Annual Report to Shareholders are enclosed. We hope you can attend and vote your shares in person. In any case, please complete the enclosed Proxy and return it to us. This action will ensure that your preferences will be expressed on the matters that are being considered. If you attend the Meeting, you may vote your shares in person even if you have previously returned your Proxy.

Prior to the meeting, a reception will be held from 2:30 p.m. until 3:00 p.m. in the AuburnBank Center. We hope you can join us!

We thank you for your support this past year, and encourage you to review our Annual Report. If you have any questions about the Proxy Statement or the Annual Report, please call or write us.

|

Sincerely, |

|

/s/ E. L. Spencer, Jr. |

E. L. Spencer, Jr. |

Chairman of the Board and Chief Executive Officer |

AUBURN NATIONAL BANCORPORATION, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 10, 2005

Notice is hereby given that the 2005 Annual Meeting of Shareholders of Auburn National Bancorporation, Inc. (the “Company”) will be held at the AuburnBank Center, 132 North Gay Street, Auburn, Alabama, on Tuesday, May 10, 2005, at 3:00 p.m., Local Time (collectively, with any adjournments or postponements thereof, the “Meeting”), for the following purposes:

| 1. | Elect Directors.To elect 10 directors to the Board of Directors; and |

| 2. | Other Business.To transact such other business as may properly come before the Meeting. |

Only shareholders of record at the close of business on March 11, 2005, are entitled to notice of and to vote at the Meeting. All shareholders, whether or not they expect to attend the Meeting in person, are requested to complete, date, sign and return the enclosed Proxy in the accompanying envelope.

Also enclosed is a copy of the Company’s 2004 Annual Report.

|

By Order of the Board of Directors |

|

/s/ C. Wayne Alderman |

C. Wayne Alderman |

| Secretary |

April 12, 2005

PLEASE COMPLETE, DATE, AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY TO THE TRANSFER AGENT IN THE ENVELOPE PROVIDED. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON BY WRITTEN BALLOT IF YOU WISH, EVEN IF YOU HAVE PREVIOUSLY RETURNED YOUR PROXY.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

OF

AUBURN NATIONAL BANCORPORATION, INC.

To Be Held May 10, 2005

INTRODUCTION

General

This Proxy Statement is being furnished to the shareholders of Auburn National Bancorporation, Inc. (the “Company”), a Delaware corporation registered as a bank holding company under the Bank Holding Company Act of 1956, as amended (the “BHC Act”), in connection with the solicitation of proxies by the Company’s Board of Directors from holders of the outstanding shares of the Company’s $.01 par value Common Stock (“Common Stock”) for the 2005 Annual Meeting of Shareholders of the Company (collectively, with any adjournments or postponements, the “Meeting”). Unless the context otherwise requires, the term “Company” includes the Company’s subsidiary, AuburnBank (the “Bank”). The Company’s Common Stock is listed on the Nasdaq SmallCap Market under the symbol “AUBN.”

The Meeting is being held to consider and vote upon: (i) the election of 10 directors to the Board of Directors and (ii) such other matters as may properly come before the Meeting.

The Company’s Board of Directors knows of no business that will be presented for consideration at the Meeting other than the matters described in this Proxy Statement.

The Proxy Statement and Proxy are first being mailed on or about April 12, 2005, to Company shareholders of record as of the close of business on March 11, 2005 (the “Record Date”). The Company’s 2004 Annual Report (the “Annual Report”), including financial statements for the fiscal year ended December 31, 2004, accompanies this Proxy Statement.

Each shareholder is entitled to one vote on each proposal per share of Common Stock held as of the Record Date. In determining whether a quorum exists at the Meeting for purposes of all matters to be voted on, all votes “for” or “against,” as well as all abstentions (including votes to withhold authority to vote in certain cases), with respect to the proposal receiving the most such votes, will be counted as shares voted. Under Delaware law, the vote required for the election of directors is a plurality of the votes cast by the shares present in person or represented by proxy at the Meeting and entitled to vote for the election, provided a quorum is present. Consequently, with respect to the election of directors, abstentions and broker non-votes will not be counted in the base number of votes to be used in determining whether the proposal has received the requisite number of votes for approval.

The Company’s principal executive offices are located at 100 N. Gay Street, Auburn, Alabama 36830, and its telephone number is (334) 821-9200.

Record Date, Solicitation and Revocability of Proxies

The Record Date for the Meeting has been set as the close of business on March 11, 2005. Accordingly, only holders of record of shares of Common Stock on the Record Date will be entitled to vote at the Meeting. At the close of business on such date, there were approximately 3,843,911 shares of Common Stock issued and outstanding, which were held by approximately 450 shareholders of record.

Shares of Common Stock represented by a properly executed Proxy, if such Proxy is received in time and is not revoked, will be voted at the Meeting in accordance with the instructions indicated in such Proxy.If no instructions are indicated, such shares of Common Stock will be voted “FOR” the election of all nominees for director named in the Proxy, and in the discretion of the proxy holder with respect to any other proper matters that may come before the Meeting.

1

A shareholder who has given a Proxy may revoke it at any time prior to its exercise at the Meeting by either (i) giving written notice of revocation to the Company’s Secretary, (ii) properly submitting to the Company a duly executed Proxy bearing a later date, or (iii) appearing in person at the Meeting and voting in person by written ballot. All written notices of revocation or other communications with respect to revocation of Proxies should be addressed as follows: Auburn National Bancorporation, Inc., P.O. Box 3110, Auburn, Alabama 36831-3110, Attention: C. Wayne Alderman, Secretary.

PROPOSAL ONE

ELECTION OF DIRECTORS

General

The Meeting is being held to elect 10 directors to serve on the Company’s Board of Directors for one-year terms of office expiring at the Company’s next scheduled annual meeting of shareholders and until their successors have been elected and qualified. All of the nominees for director are presently directors of the Company.

Proxies cannot be voted for a greater number of persons than the number of nominees specified herein. Cumulative voting for directors is not permitted. All shares represented by valid Proxies received and not revoked before they are exercised will be voted in the manner specified therein. If no specification is made, the Proxies will be voted for the election of the 10 nominees listed below. In the unanticipated event that any nominee is unable to serve, the persons designated as Proxies will cast votes for the remaining nominees and for such other replacements as may be nominated by the Company’s Board of Directors.

The nominees have been nominated by the Company’s Board of Directors based on the recommendation of the Nominating and Corporate Governance Committee, and the Board unanimously recommends a vote “FOR” the election of all ten nominees listed below.

Information about Nominees for Director and Executive Officers

The following table sets forth the name and age of each nominee for director, as well as each executive officer of the Company who is not a director or nominee, the year in which he or she was first elected a director or executive officer, as the case may be, a description of his or her position and offices with the Company, a brief description of his or her principal occupation and business experience, directorships in other companies and Common Stock owned beneficially as of March 11, 2005. Executive officers are appointed annually at a meeting of the respective Boards of Directors of the Company and the Bank in January to serve for one-year terms and until successors are chosen and qualified. Except as otherwise indicated, each nominee has been or was engaged in his or her present or last principal employment, in the same or a similar position, for more than five years.

| | | | | |

Name, Age and Year First Elected or Appointed as a Director or Executive Officer

| | Information About Nominees for Director

| | Shares of Common Stock Beneficially Owned and Percentage of Outstanding (1)

| |

C. Wayne Alderman (54) Elected to Bank Board: 1993 Elected to Company Board: 2004 | | Director of the Company and the Bank; Director of Financial Operations of the Bank since 2000; Professor and former Dean, College of Business, Auburn University; employed by Auburn University since 1979. | | 8,279

0.22 |

% |

| | |

Terry W. Andrus (53) Elected to Bank Board: 1991 Elected to Company Board: 1998 | | Director of the Company and the Bank; President and Chief Executive Officer of the East Alabama Medical Center since 1984; Director of Blue Cross/Blue Shield of Alabama. | | 1,270

0.03 |

% |

2

| | | | | |

Name, Age and Year First Elected or Appointed as a Director or Executive Officer

| | Information About Nominees for Director

| | Shares of Common Stock Beneficially Owned and Percentage of Outstanding (1)

| |

Robert W. Dumas (51) Elected to Bank Board: 1997 Elected to Company Board: 2001 | | Director of the Company and the Bank; Chief Executive Officer and President of the Bank since 2001; President and Chief Lending Officer of the Bank from 1998 to 2001; employed by the Bank since 1984. | | 31,581

0.82 | (2)

% |

| | |

J.E. Evans (63) Elected to Bank Board: 1986 Elected to Company Board: 1997 | | Director of the Company and the Bank; Owner of Evans Realty since 1970; President of J&L Contractors, Inc. since 1976. | | 18,000

0.47 |

% |

| | |

William F. Ham, Jr. (51) Elected to Bank Board: 1993 Elected to Company Board: 2004 | | Director of the Company and the Bank; Mayor of City of Auburn since 1998; owner of Varsity Enterprises since 1977. | | 2,329

0.06 | (3)

% |

| | |

David E. Housel (58) Elected to Bank Board: 1997 Elected to Company Board: 2004 | | Director of the Company and the Bank; Director of Athletics Emeritus at Auburn University since January 2005; Director of Athletics at Auburn University from 1994 to January 2005; employed by Auburn University since 1970. | | 2,247

0.06 |

% |

| | |

Anne M. May (54) Elected to Bank Board: 1982 Elected to Company Board: 1990 | | Director of the Company and the Bank; Partner, Machen, McChesney & Chastain, Certified Public Accountants, since 1973. | | 29,872

0.78 | (4)

% |

| | |

E. L. Spencer, Jr. (74) Elected to Bank Board: 1975 Elected to Company Board: 1984 | | Director of the Company and the Bank; Chairman of the Company’s and Bank’s Board of Directors since 1984 and 1980, respectively; Chief Executive Officer and President of the Company since 1990; formerly Chief Executive Officer and President of the Bank from 1990-2000; President of Spencer Lumber Company since 1970; Director of East Alabama Medical Center; father of Edward Lee Spencer, III. | | 707,595

18.41 | (5)

% |

| | |

Edward Lee Spencer, III (49) Elected to Bank Board: 1991 Elected to Company Board: 2004 | | Director of the Company and the Bank; Vice President, Spencer Lumber Company; employed by Spencer Lumber Company since 1973; son of E.L. Spencer, Jr. | | 7,889

0.21 | (6)

% |

| | |

Emil F. Wright, Jr. (68) Elected to Bank Board: 1973 Elected to Company Board: 1984 | | Director of the Company and the Bank; Vice Chairman of the Company and the Bank since 1991; former attorney practicing with Samford, Denson, Horsley, & Pettey; former ophthalmologist practicing with the Medical Arts Eye Clinic 1971-1997. | | 416,046

10.82 | (7)

% |

3

| | | | | |

Name, Age and Year First Elected or Appointed as a Director or Executive Officer

| | Information About Executive Officers

| | Shares of Common Stock Beneficially Owned and Percentage of Outstanding (1)

| |

| Terrell E. Bishop (68) | | Senior Vice President and Senior Mortgage Lending Officer of the Bank since 1991. | | 41,000

1.07 |

% |

| | |

| Jo Ann Hall (55) | | Senior Vice President and Chief Operations Officer of the Bank since 1994; various other positions with the Bank since 1974. | | 18,252

0.47 | (8)

% |

| | |

| W. Thomas Johnson (57) | | Senior Vice President (Commercial and Consumer Lending) and Senior Lending Officer of the Bank since 2001; formerly Vice President (Commercial and Consumer Lending) of the Bank since 1999. | | 3,589

0.09 |

% |

| | |

| James E. Dulaney (46) | | Senior Vice President (Business Development/Marketing) since 2004; formerly Senior Vice President (Commercial and Consumer Lending) of the Bank since 1998; formerly Vice President (Commercial and Consumer Lending) of the Bank since 1993. | | 3,520

0.09 | (8)

% |

| | |

| C. Eddie Smith, Jr. (47) | | City President, Opelika Branch and Senior Vice President since 2003; Senior Vice President (Commercial and Consumer Lending) of the Bank since 2001; formerly Vice President (Commercial and Consumer Lending) of the Bank since 1999. | | 921

0.02 | (8)

% |

| | |

| All Directors and Executive Officers as a Group | | | | 1,292,390

33.62 | (9)

% |

| (1) | Information relating to beneficial ownership of Common Stock by directors is based upon information furnished by each person using “beneficial ownership” concepts set forth in rules of the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Under such rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under such rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may disclaim any beneficial ownership. Accordingly, nominees are named as beneficial owners of shares as to which they may disclaim any beneficial interest. Except as indicated in other notes to this table describing special relationships with other persons and specifying shared voting or investment power, directors possess sole voting and investment power with respect to all shares of Common Stock set forth opposite their names. |

| (2) | Includes 2,570 shares held by Mr. Dumas’ mother, as to which Mr. Dumas may be deemed to have shared voting and investment power. Also includes 400 shares subject to stock options exercisable currently or within 60 days. |

| (3) | Includes 300 shares held by Mr. Ham’s wife, as to which Mr. Ham may be deemed to have shared voting and investment power. |

4

| (4) | Includes 525 shares held by Ms. May’s daughter, as to which Ms. May may be deemed to have shared voting and investment power. |

| (5) | Includes 15,000 shares held by Mr. Spencer’s wife, as to which Mr. Spencer may be deemed to have shared voting and investment power and 1,100 shared held by Spencer Companies Profit Sharing Plan, of which Mr. Spencer is a co-trustee, as to which Mr. Spencer may be deemed to have shared voting and investment power. |

| (6) | Includes 3,960 shares held by Spencer LLC, a company in which Mr. Spencer is a partner, as to which Mr. Spencer may be deemed to have shared voting and investment power, and as to which Mr. Spencer disclaims beneficial ownership of 2,640 shares. |

| (7) | Includes 19,816 shares held by DTS, a company in which Dr. Wright is a partner, as to which Dr. Wright may be deemed to have shared voting and investment power, and as to which Dr. Wright disclaims beneficial ownership of 19,816 shares. Also includes 48,654 shares held by Dr. Wright’s wife, as to which Dr. Wright may be deemed to have shared voting and investment power. |

| (8) | Includes 200 shares subject to stock options exercisable currently or within 60 days. |

| (9) | Includes Directors and Executive Officers of the Company and the Bank. |

ADDITIONAL INFORMATION CONCERNING THE COMPANY’S

BOARD OF DIRECTORS AND COMMITTEES

Director Nominating Process

The Nominating and Corporate Governance Committee, in consultation with the Chairman of the Board, periodically examines the composition of the Company’s Board of Directors and determines whether the Board of Directors would better serve its purposes with the addition of one or more directors. This assessment includes, among other relevant factors, in the context of the perceived needs of the Board at that time, issues of experience, reputation, judgment, diversity and skills.

If the Nominating and Corporate Governance Committee determines that adding a new director is advisable, the Nominating and Corporate Governance Committee initiates the search, working with other directors, management and, if it deems appropriate or necessary, a search firm retained to assist in the search. The Nominating and Corporate Governance Committee will consider all appropriate candidates proposed by management, directors and shareholders. Information regarding potential candidates is presented to the Nominating and Corporate Governance Committee, which then evaluates the candidates based on the needs of the Board of Directors at that time and the criteria listed above. Potential candidates are evaluated according to the same criteria, regardless of whether the candidate was recommended by the Nominating and Corporate Governance Committee, a shareholder, another director, management or another third party. The Nominating and Corporate Governance Committee then meets to consider the selected candidate(s) and submits the approved candidate(s) to the full Board of Directors for approval and recommendation to the shareholders.

Subject to the requirements of the Company’s Certificate of Incorporation and Amended and Restated Bylaws, as well as any requirements of law or regulation, any Shareholder entitled to vote for the election of directors may recommend a director nominee. Advance notice of such proposed nomination must be received by the Secretary of the Company not less than 21 days nor more than 60 days prior to any meeting of the shareholders called for the election of directors. Nominations should be submitted in writing to the Secretary of the Company specifying the nominee’s name and other required information set forth in the Company’s Bylaws.

Shareholder Communications

Shareholders who wish to communicate with the Board may do so by sending written communications addressed to: Board of Directors of Auburn National Bancorporation, Inc., c/o C. Wayne Alderman, Secretary, Auburn National Bancorporation, Inc., 100 N. Gay Street, P.O. Box 3110, Auburn, Alabama, 36831-3110. All information will be compiled by the Secretary of the Company and submitted to the Board of Directors at the next regular Board meeting.

5

Meetings of the Board of Directors

The Company’s and the Bank’s Board of Directors held twelve meetings during 2004. Starting in April 2004, the Company and the Bank held joint meetings. All directors attended at least 75% of all Company and Bank Board meetings and at least 75% of all meetings of each committee on which they served. All of the Company’s directors are encouraged to attend the Company’s Annual Meeting of Shareholders. All of the Company’s directors attended the 2004 Annual Meeting of Shareholders.

Committees of the Board of Directors

The Company’s Board of Directors has seven standing committees: the Executive Committee, the Proxy Committee, the Compensation Committee, the Strategic Planning Committee, the Audit and Compliance Committee, the Nominating and Corporate Governance Committee and the Independent Director Committee.

Executive Committee.The Company’s Executive Committee is authorized to act in the absence of the Board of Directors on certain matters that require Board approval. E. L. Spencer, Jr., Robert W. Dumas, Anne M. May, and Emil F. Wright, Jr. constitute the current members of this committee. This committee held three meetings during 2004.

Proxy Committee.The Proxy Committee is authorized to act on behalf of Company shareholders when authorized by Proxy. E.L. Spencer, Jr., Emil F. Wright, Jr., and Terry W. Andrus constitute the current members of this committee. This committee met once in 2004.

Compensation Committee.The Compensation Committee is authorized to review, recommend and approve the compensation of the CEO, other executive officers and other key employees of the Company and the Bank; to evaluate the Company’s incentive compensation plans, including any equity compensation plans; and to select, interview and make hiring recommendations to the Board for the CEO position. In addition, the Committee approves changes to any Company personnel policy manuals or handbooks, and annually evaluates director compensation. Anne M. May, Emil F. Wright, Jr. and Terry W. Andrus, all of whom are independent Directors as defined in Nasdaq Rule 4200(a)(15), constitute the current members of this committee. This committee met three times during 2004.

Strategic Planning Committee.The Strategic Planning Committee evaluates potential acquisitions and the Company’s long range goals and oversees the process for the officers’ and directors’ strategic planning sessions. E.L. Spencer, Jr., Anne M. May, Robert W. Dumas, Terry W. Andrus, C. Wayne Alderman and David E. Housel constitute the current members of this committee. This committee met two times during 2004.

Audit and Compliance Committee.The Audit and Compliance Committee (“Audit Committee”) is composed of Terry W. Andrus, David E. Housel and William F. Ham, Jr., all of whom are “independent directors,” as defined in Nasdaq Rule 4200(a)(15), and meet the independence criteria set forth in SEC Rule 10A-3(b)(1). All members of the Audit Committee meet the financial literacy requirements of Nasdaq and the SEC. The Audit Committee has the responsibilities set forth in the Audit Committee Charter (as filed with our proxy statement issued in conjunction with our 2004 Annual Meeting of Shareholders), including reviewing the Company’s financial statements, evaluating internal accounting controls, reviewing reports of regulatory authorities and determining that all audits and examinations required by law are performed. It appoints independent auditors, reviews and approves their audit plan and reviews with the independent auditors the results of the audit and management’s response thereto. The Audit Committee also reviews the adequacy of the internal audit budget and personnel, the internal audit plan and schedule, and results of audits performed by the internal audit staff. The Audit Committee is responsible for overseeing the entire audit function and appraising the effectiveness of internal and external audit efforts. This Committee met 15 times in 2004. The Board of Directors has determined that Terry W. Andrus, a member of the Audit Committee, meets the requirements adopted by the SEC for qualification as an “audit committee financial expert.”

Nominating and Corporate Governance Committee.The Nominating and Corporate Governance Committee is composed of Anne M. May, Emil F. Wright, Jr., J.E. Evans and Terry W. Andrus, all of whom are independent directors as defined in Nasdaq Rule 4200(a)(15). The purpose of the Nominating and Corporate Governance Committee is to identify individuals qualified to become members of the Company’s Board of Directors and recommend to the Board the director nominees for the next annual meeting of shareholders. This Committee also takes a leadership role in shaping corporate governance policies and practices of the Company. The responsibilities and duties of the Nominating and

6

Corporate Governance Committee are more fully set out in the Nominating and Corporate Governance Committee Charter as filed with our proxy statement issued in conjunction with our 2004 Annual Meeting of Shareholders. The Nominating and Corporate Governance Committee held one meeting during 2004.

Independent Directors Committee.The Independent Directors Committee was formed to comply with the Nasdaq Rule 4200(a)(15) which requires that the Company’s independent directors will meet separately from the other directors in regularly scheduled executive sessions at least twice annually, and at such other times as may be deemed appropriate by the Company’s independent directors. Nasdaq Rule 4200(a)(15) also requires that a majority of the Company’s directors be “independent directors.” The Board has affirmatively determined that the following directors, constituting a majority of the Company’s Board of Directors, are independent directors: William F. Ham, Jr., David E. Housel, J. E. Evans, Anne M. May, Emil F. Wright, Jr. and Terry W. Andrus. The Company’s Board of Directors has appointed Anne M. May to serve as the Board’s presiding independent director. This committee was formed mid 2004 and held its first meeting in 2004.

Board Compensation

Each director of the Company and the Bank currently receives $600 for each Company and Bank board meeting attended. In addition, for his services as such, the Chairman of the Company’s and the Bank’s Board of Directors receives $1,200 for each meeting attended. Members of the Audit Committee and Compensation Committee of the Company which also serve as the Audit Committee and Compensation Committee of the Bank, receive an additional fee of $100 for each committee meeting attended, while each Chairman of these committees receives $200 per meeting. Members of the Bank’s Loan Committee, Asset/Liability Committee and IT/IS Steering Committee receive $100 per meeting attended. The Company’s and the Bank’s directors may receive year-end bonuses based upon the Company’s financial performance. In 2004, total fees and bonuses paid to Company and Bank Directors equaled $116,900. The compensation of directors may be changed from time to time by the Board of Directors upon recommendation of the Compensation Committee without shareholder approval.

Audit Committee Report

Management is responsible for the Company’s internal controls and the financial reporting process. The independent accountants are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and to issue a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes. In this context, we have met and held discussions with management and the independent accountants. We have reviewed and discussed the consolidated financial statements with management and the independent accountants. We discussed with the independent accountants matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees.

The Company’s independent accountants also provided to us the written disclosures required by Independent Standards Board Standard No. 1,Independent Discussions with Audit Committees, and we discussed with the independent accountants that firm’s independence.

Based upon our discussions with management and the independent accountants and our review of the representation of management and the report of the independent accountants to the Audit Committee, we recommended that the Board of Directors include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004.

Terry W. Andrus

William F. Ham, Jr.

David E. Housel

PRINCIPAL SHAREHOLDERS

Other than as set forth above, no “persons” (as that term is defined by the SEC) other than E.L. Spencer, Jr. and Emil F. Wright, Jr. are known by the Company to be the beneficial owners of more than 5% of the Common Stock, the Company’s only class of voting securities, as of the Record Date.

7

EXECUTIVE OFFICERS

Summary Compensation of Executive Officers

The following table sets forth certain information regarding compensation paid or to be paid by the Company or the Bank to its Chief Executive Officer and its four other most highly compensated executive officers (the “Named Executive Officers”) for 2004, 2003, and 2002. The Company granted stock options during 2003 and 2002, and no options were granted in 2004. The Company has not granted any restricted stock or stock appreciation rights and has not made any payouts under any long-term incentive plan. Certain 2003 and 2002 amounts have been reclassified to conform to the 2004 presentation.

Summary Compensation Table

Annual Compensation

| | | | | | | | | | | | | | | | | | | |

Name and Principal Position

| | Year

| | Base Salary

| | Bonus

| | | Other Annual Compensation

(1)

| | Securities Underlying Options

| | All Other Compensation

| |

E.L. Spencer, Jr., Chairman, CEO and President of the Company and Chairman and Director of the Bank | | 2004

2003

2002 | | $

| 195,672

189,973

184,440 | | $

| 65,500

28,750

-0- | (2)

(2)

| | $

| -0-

-0-

-0- | | $

| -0-

-0-

-0- | | $

| 27,317

25,819

23,738 | (3)

(3)

(3) |

| | | | | | |

Robert W. Dumas, President and CEO of the Bank and Director of the Bank and the Company | | 2004

2003

2002 | |

| 161,705

155,486

148,082 | |

| 76,000

30,000

-0- | (4)

(4)

| |

| -0-

-0-

-0- | |

| -0-

200

200 | |

| 17,771

17,156

16,917 | (5)

(5)

(5) |

| | | | | | |

Terrell E. Bishop, Senior Vice President of the Bank | | 2004

2003

2002 | |

| 117,766

113,237

107,845 | |

| 22,000

22,000

19,000 |

| |

| 3,752

-0-

-0- | |

| -0-

200

200 | |

| 4,579

4,229

4,019 | (6)

(6)

(6) |

| | | | | | |

Jo Ann Hall, Senior Vice President of the Bank | | 2004

2003

2002 | |

| 117,809

113,278

107,884 | |

| 20,000

20,000

19,000 |

| |

| 1,718

-0-

-0- | |

| -0-

200

200 | |

| 4,483

4,239

4,036 | (7)

(7)

(7) |

| | | | | | |

W. Thomas Johnson, Senior Vice President of the Bank | | 2004

2003

2002 | |

| 106,676

102,573

98,628 | |

| 18,500

18,500

18,000 |

| |

| -0-

1,564

-0- | |

| -0-

200

-0- | |

| 4,020

3,909

3,371 | (8)

(8)

(8) |

| (1) | Includes amounts reimbursed for payment of taxes upon the exercise of stock options. Excludes certain personal benefits, the total value of which did not exceed the lesser of $50,000 or 10% of the total annual salary and bonus for the reporting persons. |

| (2) | Includes a bonus of $30,500 paid to Mr. Spencer in August 2004 as a result of the Bank’s performance in 2003 and the first quarter results of 2004 and a bonus of $35,000 paid to Mr. Spencer in February 2005 which was accrued as of December 31, 2004 as a result of the Bank’s performance in 2004. The 2003 bonus was paid to Mr. Spencer as a result of the Bank’s performance in 2002. |

| (3) | Includes Company contributions to the 401(k) Plan of $6,500, $6,000 and $5,500; Board of Directors and Board committee fees of $20,675, $19,750 and $18,175; and life insurance premiums paid by the Company on behalf of Mr. Spencer of $142, $69 and $63, respectively, for the years 2004, 2003 and 2002. |

| (4) | Includes a bonus of $36,000 paid to Mr. Dumas in August 2004 as a result of the Bank’s performance in 2003 and the first quarter results of 2004 and a bonus of $40,000 paid to Mr. Dumas in February 2005 which was accrued as of December 31, 2004 as a result of the Bank’s performance in 2004. The 2003 bonus was paid to Mr. Dumas as a result of the Bank’s performance in 2002. |

| (5) | Includes Company contributions to the 401(k) Plan of $5,931, $5,565 and $5,192; Board of Directors and Board committee fees of $11,500, $11,300 and $11,450; and life insurance premiums paid by the Company on behalf of Mr. Dumas of $340, $291 and $275, respectively, for the years 2004, 2003 and 2002. |

8

| (6) | Represents Company contributions to the 401(k) Plan of $4,306, $3,967 and $3,775; and life insurance premiums paid by the Company on behalf of Mr. Bishop of $273, $262 and $244, respectively, for the years 2004, 2003 and 2002. |

| (7) | Represents Company contributions to the 401(k) Plan of $4,210, $3,976 and $3,784; and life insurance premiums paid by the Company on behalf of Ms. Hall of $273, $263 and $252, respectively, for the years 2004, 2003 and 2002. |

| (8) | Represents Company contributions to the 401(k) Plan of $3,774, $3,671 and $3,150; and life insurance premiums paid buy the Company on behalf of Mr. Johnson of $246, $238 and $221, respectively, for the years 2004, 2003 and 2002. |

Option Grants in Last Fiscal Year

No options were granted in 2004.

Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table shows stock options exercised by the Named Executive Officers in 2004. In addition, the table below shows the number of shares of the Company’s common stock covered by both exercisable and unexercisable stock options held by the Named Executive Officers as of December 31, 2004. The table also reflects the values for in-the-money options based on the positive spread between the exercise price of such options and the last reported sale price of the common stock as of December 31, 2004.

| | | | | | | | | | | | | | | |

Name

| | Shares Acquired on Exercise (#)

| | Value Realized (1)

| | Number of Securities

Underlying Unexercised

Options at December 31, 2004

| | Value of Unexercised In-The-Money Options at December 31, 2004 (2)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

E.L. Spencer, Jr. | | -0- | | $ | 0 | | -0- | | -0- | | $ | 0 | | $ | 0 |

Robert W. Dumas | | -0- | | $ | 0 | | 400 | | -0- | | $ | 3,324 | | $ | 0 |

Terrell E. Bishop | | 400 | | $ | 3,396 | | -0- | | -0- | | $ | 0 | | $ | 0 |

Jo Ann Hall | | 200 | | $ | 1,718 | | 200 | | -0- | | $ | 1,458 | | $ | 0 |

W. Thomas Johnson | | -0- | | $ | 0 | | -0- | | -0- | | $ | 0 | | $ | 0 |

| (1) | The value realized was calculated using the fair market value of the underlying common stock based on the sales price of the common stock as quoted on the Nasdaq at the time of the exercise and the exercise price of the option. |

| (2) | The value of the unexercised in-the-money options as of December 31, 2004 was calculated using a market price of $20.68 per share and the exercise price of the option. |

Retirement Plan

The Company has established the Company’s 401(k) Plan which covers substantially all employees. Participants become 20% vested in their accounts after two years of service with an additional 20% vesting each year until the participant is 100% vested after six years of service. Contributions by the Company to the 401(k) Plan are determined by the Board of Directors based principally on the Company’s earnings. Company contributions to the 401(k) Plan amounted to $112,319 and $97,372 in 2004 and 2003, respectively.

COMPENSATION COMMITTEE REPORT

Overview

The Company has a Compensation Committee, which is composed entirely of independent directors, as defined by Nasdaq Rule 4200(a)(15), and which functions as a joint committee of the Company and Bank Board of Directors. We fully support the Company’s philosophy that the relationship between pay and performance is fundamental to a compensation program. Executive officer compensation is composed of base salary and annual cash bonuses.

9

Executive officer compensation is based not only on individual performance and contributions, but also total Company performance relative to profitability measures and shareholder interests. We periodically review and revise salary ranges and total compensation programs for officers and employees and uses salary survey and other outside sources to develop salary ranges based upon current surveys of peer group market salaries for specific positions. The peer group that the Company analyzes in determining officer and employee compensation consists of similarly situated banking organizations in the Southeast of comparable asset size and other banks that are direct competitors with the Company in its markets. We intend that executive officer compensation be fair and competitive in order to recruit and retain quality personnel.

Base Salary

The Company’s general philosophy is to provide base pay that is competitive with other banks and bank holding companies of similar size in the Southeast. In establishing executive officer salaries and increases, we consider individual performance, the relationship of base pay to the existing salary market and responsibility and duties. Changes in base pay are recommended by the Chief Executive Officer of the Bank and are evaluated and approved by us, and ratified by the full Board of Directors. We formally review the base compensation paid to executive officers in January of each year.

Annual Cash Bonuses

The Company utilizes cash bonuses to better align compensation with individual and Company performance. Cash bonuses are based on overall financial performance and profitability of the Company and the performance of the individual. The Company’s performance objectives are intended to promote a group effort by all officers and employees. We consider and approve awards, based in part upon recommendations of the Chief Executive Officer of the Bank, and the full Board of Directors approves the awards recommended by us. This philosophy assists in overall better control of expenses associated with salary increases by reducing the need for significant annual base salary increases as a reward for past performance, and places more emphasis on annual profitability and the potential rewards associated with future performance. Market information is used to establish competitive rewards that are adequate to motivate strong individual performance during the year.

Long-Term Incentives

The Company’s Long-Term Incentive Plan expired in May 2004. The Company has not adopted a new plan.

Chief Executive Officer Compensation

E.L. Spencer, Jr. is the current Chief Executive Officer of the Company. Mr. Spencer’s compensation awards in 2004 were based upon the Compensation Committee’s assessment of the Company’s financial performance as compared to the Company’s financial performance objectives and non-financial performance and Mr. Spencer’s individual performance. In 2004, the Company exceeded its profitability goals and continued to excel in non-financial performance areas, successfully achieving its policy objectives relating to customers, employees and communities. We have determined Mr. Spencer’s total compensation is reasonable and accurate.

Policy Relative to Code Section 162(m)

The Omnibus Budget Reconciliation of 1993 disallows the deduction for certain annual compensation in excess of $1 million paid to certain executive officers of the Company, unless the compensation qualifies as “performance-based” under Section 162(m) of the Internal Revenue Code. It is our intent to maximize the deductibility of executive compensation while retaining the discretion necessary to compensate executive officers in a manner commensurate with performance and the competitive market of executive talent. At this time, based upon executive compensation levels, the Company does not appear to be at risk of losing deductions under the $1 million deduction limit. As a result, we have not yet established a formal policy regarding this limit.

Terry W. Andrus

Anne M. May

Emil F. Wright

10

PERFORMANCE GRAPH

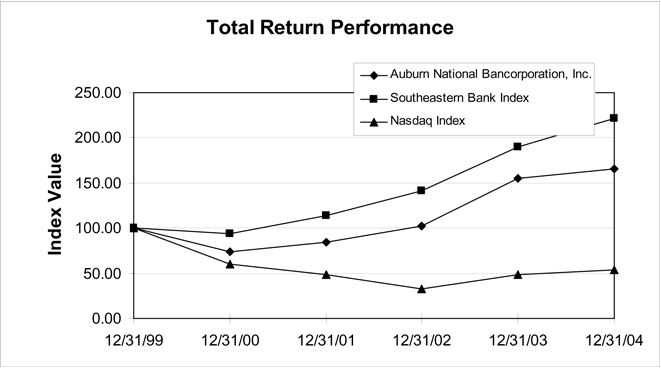

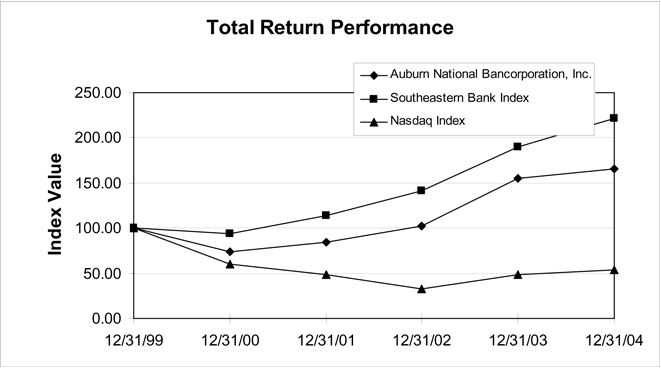

The following line-graph compares the cumulative, total return on the Company’s Class A Common Stock from December 31, 1999 to December 31, 2004, with that of the Nasdaq Index and Southeastern Bank Index (assuming a $100 investment on December 31, 1999). The Southeastern Bank Index is an independent bank index of Southern banks prepared by The Carson Medlin Company. Cumulative total return represents the change in stock price and the amount of dividends received over the indicated period, assuming the reinvestment of dividends.

Comparison of Five Year Cumulative Total Return

| | | | | | | | | | | | |

| | | 1999

| | 2000

| | 2001

| | 2002

| | 2003

| | 2004

|

Auburn National Bancorporation, Inc. | | 100 | | 74 | | 84 | | 102 | | 155 | | 166 |

Southeastern Bank Index | | 100 | | 94 | | 114 | | 141 | | 190 | | 221 |

Nasdaq Index | | 100 | | 60 | | 48 | | 33 | | 49 | | 54 |

CERTAIN TRANSACTIONS AND BUSINESS RELATIONSHIPS

Various Company and Bank directors, officers, and their affiliates, including corporations and firms of which they are directors or officers or in which they and/or their families have an ownership interest, are customers of the Company and the Bank. These persons, corporations, and firms have had transactions in the ordinary course of business with the Company and the Bank, including borrowings, all of which, in the opinion of management, were on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with unaffiliated persons and did not involve more than the normal risk of collectability or present other unfavorable features. The Company and the Bank expect to have such transactions, on similar terms, with its directors, officers, and their affiliates in the future. The aggregate amount of loans outstanding by the Bank to directors, executive officers, and related parties of the Company or the Bank as of December 31, 2004 was approximately $5,628,000, which represented approximately 12.6% of the Company’s consolidated shareholders’ equity on that date.

None of the directors of the Company serves as an executive officer of, or owns, or during 2004 owned, of record or beneficially in excess of 10% equity interest in, any business or professional entity that has made or received during 2004, or proposes to make or receive in 2005, payments to or from the Company or the Bank for property or services

11

in excess of 5% of the Company’s consolidated gross revenues for 2004, or in excess of 5% of such other business or professional entity’s consolidated gross revenues for 2004.

SECTION 16(a) BENEFICIAL OWNERSHIP

REPORTING COMPLIANCE

The Company is subject to Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which requires the Company’s officers and Directors, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Officers, Directors and greater-than-10% shareholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of the copies of Forms 3, 4 and 5 furnished to the Company during and with respect to 2004, or written representations that no Forms 5 were required, the Company believes that all Section 16(a) filing requirements applicable to the Company’s and the Bank’s officers, directors and greater-than-10% beneficial owners were complied with during 2004 except that, Terrell E. Bishop filed one transaction late on Form 4 and Emil F. Wright, Jr. filed an amended Form 3 in 2005 to report shares beneficially owned that were not reported on the original Form 3.

INDEPENDENT PUBLIC ACCOUNTANTS

A representative of KPMG LLP will be present at the Meeting and will be given the opportunity to make a statement on behalf of the firm, and will also be available to respond to appropriate questions from shareholders.

Independent Public Accountants’ Fees

The following table presents fees for professional audit services rendered by KPMG LLP for the audit of the Company’s annual financial statements for the years ended December 31, 2004, and December 31, 2003, and fees billed for other services rendered by KPMG LLP during those periods.

| | | | | | |

| | | 2004

| | 2003

|

Audit Fees (1) | | $ | 144,588 | | $ | 112,706 |

Audit-Related Fees (2) | | | — | | | — |

Tax Fees (3) | | $ | 20,750 | | $ | 15,500 |

All Other Fees (4) | | | — | | | — |

| | |

|

| |

|

|

Total | | $ | 165,338 | | $ | 128,206 |

| (1) | Includes the aggregate fees billed by KPMG LLP for professional services rendered for the audit of the Company’s annual financial statements and review of financial statements included in the Company’s Forms 10-Q filed during fiscal years 2004 and 2003. |

| (2) | No Audit-Related Fees were billed by KPMG LLP in the fiscal years ended December 31, 2004 and December 31, 2003. |

| (3) | Includes the aggregate fees billed by KPMG LLP for professional services rendered for tax compliance, tax advice and tax planning for the Company. |

| (4) | No fees were billed by KPMG LLP in the fiscal years ended December 31, 2004 and December 31, 2003 other than as stated above under the captions “Audit Fees” and “Tax Fees.” |

Audit Committee Review

The Company’s Audit Committee has reviewed the services rendered and the fees billed by KPMG LLP for the fiscal year ended December 31, 2004. The Audit Committee has determined that the services rendered and the fees billed last year that were not related to the audit of the Company’s financial statements are compatible with the independence of KPMG LLP as the Company’s independent accountants.

12

Audit Committee Pre-Approval Policy

Under the Audit Committee’s Charter and Pre-Approval Policy, the Audit Committee is required to approve in advance the terms of all audit services provided to the Company as well as all permissible audit related and non-audit services to be provided by the independent public accountants. Unless a service to be provided by the independent public accountants has received approval under the Pre-Approval Policy, it will require specific approval by the Audit Committee. The Pre-Approval Policy is detailed as to the particular services to be provided, and the Audit Committee is to be informed about each service provided. The approval of non-audit services may be performed by the Chairman of the Committee and reported to the full Audit Committee at its next meeting, but may not be performed by the Company’s management. The term of any pre-approval is twelve months, unless the Audit Committee specifically provides for a different period.

The Audit Committee will approve the annual audit engagement terms and fees prior to the commencement of any audit work other than that necessary for the independent public accountant to prepare the proposed audit approach, scope and fee estimates. In addition to the annual audit work, the independent public accountants may perform certain other audit related or non-audit services that are pre-approved by the Audit Committee and are not prohibited by regulatory or other professional requirements. Engagements for the annual audit and recurring tax return preparation engagements shall be reviewed and approved annually by the Audit Committee based on the agreed upon engagement terms, conditions and fees. The nature and dollar value of services provided under these engagements shall be reviewed by the Audit Committee to approve changes in terms, conditions and fees resulting from changes in audit scope, Company structure, exchange rates or other items, if any.

In the event audit-related or non-audit services that are pre-approved under the Pre-Approval Policy have an estimated cost in excess of certain dollar thresholds, these services will require specific approval by the Audit Committee or by the Chairman of the Audit Committee. Any proposed engagement must be approved in advance by the Audit Committee or by the Chairman of the Audit Committee applying the principles set forth in the Pre-Approval Policy, prior to the commencement of the engagement.In determining the approval of services by the independent public accountants, the Audit Committee evaluates each service to determine whether the performance of such service would: (a) impair the public accountant’s independence; (b) create a mutual or conflicting interest between the public accountant and the Company; (c) place the public accountant in the position of auditing his or her own work; (d) result in the public accountant acting as management or an employee of the Company; or (e) place the public accountant in a position of being an advocate for the Company. In no event are monetary limits the only basis for the pre-approval of services.

All of the services provided by KPMG LLP during 2004 and described above under the captions “Audit-Related Fees” and “Tax Fees” were pre-approved by the Company’s Audit Committee pursuant to SEC Regulation S-X, Rule 2-01(c)(7)(i).

OTHER MATTERS

The Company knows of no other matters to be brought before the Meeting. However, if any other proper matter is presented, the persons named in the enclosed form of Proxy intend to vote the Proxy in accordance with their judgment of what is in the best interest of the Company.

AVAILABILITY OF ANNUAL REPORT

Copies of the Company’s 2004 Annual Report to Shareholders have been provided to each shareholder. Upon the written request of any person whose Proxy is solicited by this Proxy Statement, the Company will furnish to such person without charge (other than for exhibits) a copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004, including financial statements and schedules thereto, as filed with the SEC. Such requests should be directed to Joyce Aderholdt, Shareholder Relations, Auburn National Bancorporation, Inc., P.O. Box 3110, Auburn, Alabama, 36831-3110.

13

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

The Securities and Exchange Commission permits the Company, to send a single set of these reports to any household at which two or more shareholders reside if we believe that they are members of the same family. Each shareholder will continue to receive a separate proxy card. This procedure, known as “Householding,” reduces the volume of duplicate information you receive and helps to reduce our expenses. In order to take advantage of this opportunity, we have delivered only one proxy statement and annual report to multiple shareholders who share an address, unless we received contrary instructions from the impacted shareholders prior to the mailing date. We will deliver a separate copy of the proxy statement or annual report, as requested, to any shareholder at a shared address to which a single copy of those documents was delivered.

A majority of brokerage firms have instituted Householding. If your family has multiple holdings in the Company, you may have received a Householding notification directly from your broker. Please contact your broker directly if you have any questions, if you require additional copies of the annual report or proxy statement, if you are currently receiving multiple copies of the annual report and proxy statement and wish to receive only a single copy, or if you wish to revoke your decision to household, and thereby receive multiple statements and reports.

If you do not have a broker, you may make any of the above requests by writing to Joyce Aderholdt, Shareholder Relations, Auburn National Bancorporation, Inc., P.O. Box 3110, Auburn, Alabama, 36831-3110, or by calling the Company at (334) 821-9200.

SHAREHOLDER PROPOSALS FOR 2005 ANNUAL MEETING

Proposals of shareholders intended to be presented at the Company’s 2006 Annual Meeting must be received by the Company on or before December 13, 2005, in order to be eligible for inclusion in the Company’s proxy statement and form of proxy for that meeting. In addition, regarding any shareholder proposal that is not submitted for inclusion in the proxy statement and form of proxy relating to the 2006 Annual Meeting of Shareholders, but is instead sought to be presented directly to the shareholders at the 2006 Annual Meeting, management will be able to vote proxies in its discretion if either (i) the Company does not receive notice of the proposal before the close of business on February 26, 2006, or (ii) the Company receives notice of the proposal before the close of business on February 26, 2006, and advises shareholders in the proxy statement for the 2006 Annual Meeting about the nature of the proposal and how management intends to vote on the proposal, unless the shareholder notifies the Company by February 26, 2006 that it intends to deliver a proxy statement with respect to such proposal and thereafter takes the necessary steps to do so.

OTHER INFORMATION

Proxy Solicitation Costs

The cost of soliciting Proxies for the Meeting will be paid by the Company. In addition to the solicitation of shareholders of record by mail, telephone, facsimile, or personal contact, the Company will contact brokers, dealers, banks, or voting trustees or their nominees who can be identified as record holders of Common Stock; such holders, after inquiry by the Company, will provide information concerning quantities of proxy materials and 2004 Annual Reports needed to supply such information to beneficial owners, and the Company will reimburse such persons for the reasonable expenses of mailing proxy materials and 2004 Annual Reports to such persons.

|

| By Order of the Board of Directors |

|

/s/ E.L. Spencer, Jr. |

E.L. Spencer, Jr. |

| Chairman |

April 12, 2005

14

| | | | | | | | | | | | | | |

x | | PLEASE MARK VOTES AS IN THIS EXAMPLE | | REVOCABLE PROXY AUBURN NATIONAL BANCORPORATION, INC. | | | | | | | | |

| | | 2005 ANNUAL MEETING OF SHAREHOLDERS MAY 10, 2005 | | | | | | For | | With- hold | | For All Except |

| | | | | | | 1. To elect ten directors for one-year terms (Proposal 1) | | ¨ | | ¨ | | ¨ |

| | | |

| KNOW BY ALL MEN BY THESE PRESENTS, that the undersigned shareholder of Auburn National Bancorporation, Inc., Auburn, Alabama (the “Company”), hereby revoking any proxy heretofore given, does hereby nominate, constitute, and appoint E.L. Spencer, Jr., Emil F. Wright, Jr., and Terry W. Andrus or either one of them, the true and lawful attorneys and proxies of the undersigned, with full power of substitution, for the undersigned and in the undersigned’s name, place, and stead, to vote all of the shares of common stock of the Company standing in the undersigned’s name, on its books on March 11, 2005, and that the undersigned may be entitled to vote at the Annual Meeting of Shareholders to be held at the AuburnBank Center, 132 N Gay Street, Auburn, Alabama at 3:00 p.m. local time, on Tuesday, May 10, 2005, and at any adjournments thereof (the “Meeting”), with all the powers the undersigned would possess if personally present as follows: | | Nominees: E.L. Spencer, Jr. J.E. Evans Emil F. Wright, Jr. Edward Lee Spencer, III | | Terry W. Andrus Anne M. May Robert W. Dumas | | C. Wayne Alderman William F. Ham, Jr. David E. Housel |

| | | | | INSTRUCTION: To withhold authority to vote for any individual nominee(s), mark “For All Except” and write the name of the nominee(s) in the space provided below. |

| | | | |

2. The Proxies are authorized to vote upon such other business as may properly come before the Annual Meeting, or any adjournments of the meeting, in accordance with the determination of a majority of the Corporation’s Board of Directors. |

| | | | |

| | | | | Please check box if you plan to attend the May 10, 2005 Annual Stockholders Meeting. | | ð | | ¨ |

| | |

| | | | | The proxy will be voted as directed by the undersigned shareholder.Unless contrary direction is given, this proxy will be voted FOR the election of the nominees listed in Proposal 1, and in accordance with the determination of a majority of the Board of Directors as to any other matters.The undersigned shareholder may revoke this proxy at any time before it is voted by delivering to the Secretary of the Corporation either a written revocation of the proxy or a duly executed proxy bearing a later date, or by appearing at the Annual Meeting and voting in person. The undersigned shareholder hereby acknowledges receipt of the Notice of Annual Meeting and Proxy Statement. |

| | | | | | | | | | | | | | | | |

Please be sure to sign and date this Proxy in the box below. | | Date | | | | | | | | | | |

Shareholder sign above——— Co-holder (if any) sign above——— | | | | |

Ù Detach above card, sign, date and mail in postage paid envelope provided.Ù

AUBURN NATIONAL BANCORPORATION, INC.

Please date and sign exactly as your name(s) appear(s) hereon. Each executor, administrator, trustee, guardian, attorney-in-fact, and any other fiduciary should sign and indicate his or her full title. When stock has been issued in the name of two or more persons, all should sign.

If you receive more than one proxy card, please sign and return all cards in the accompanying envelope.

PLEASE ACT PROMPTLY

SIGN, DATE & MAIL YOUR PROXY CARD TODAY

IF YOUR ADDRESS HAS CHANGED, PLEASE CORRECT THE ADDRESS IN THE SPACE PROVIDED BELOW AND RETURN THIS PORTION WITH THE PROXY IN THE ENVELOPE PROVIDED.