First Quarter 2022�Earnings Conference Call 4/19/2022 HANCOCK WHITNEY Exhibit 99.2

This presentation contains forward-looking statements within the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements that we may make include statements regarding our expectations of our performance and financial condition, balance sheet and revenue growth, the provision for credit losses, loan growth expectations, management’s predictions about charge-offs for loans, the impact of the COVID-19 pandemic on the economy and our operations, the impacts related to Russia’s military action in Ukraine, the adequacy of our enterprise risk management framework, potential claims, damages, penalties, fines and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions; the ongoing impact of future business combinations on our performance and financial condition, including our ability to successfully integrate the businesses, success of revenue-generating and cost reduction initiatives, the effectiveness of derivative financial instruments and hedging activities to manage risks, projected tax rates, increased cybersecurity risks, including potential business disruptions or financial losses, the adequacy of our internal controls over financial reporting, the financial impact of regulatory requirements and tax reform legislation, the impact of the change in the referenced rate reform, deposit trends, credit quality trends, the impact of natural or man-made disasters, the impact of PPP loans and forgiveness on our results, changes in interest rates, inflation, net interest margin trends, future expense levels, future profitability, improvements in expense to revenue (efficiency) ratio, purchase accounting impacts, accretion levels and expected returns. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “forecast,” “goals,” “targets,” “initiatives,” “focus,” “potentially,” “probably,” “projects,” “outlook," or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements are based upon the current beliefs and expectations of management and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. Forward-looking statements are subject to significant risks and uncertainties. Any forward-looking statement made in this release is subject to the safe harbor protections set forth in the Private Securities Litigation Reform Act of 1995. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Additional factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021 and in other periodic reports that we file with the SEC. Important cautionary statement about forward-looking statements HNCOCK WHITNEY 2

Non-GAAP Reconciliations & Glossary of Terms Throughout this presentation we may use non-GAAP numbers to supplement the evaluation of our performance. The items noted below with an asterisk, "*", are considered non-GAAP. These non-GAAP financial measures should not be considered alternatives to GAAP-basis financial statements, and other bank holding companies may define or calculate these non-GAAP measures or similar measures differently. Reconciliations of those non-GAAP measures to the comparable GAAP measure are included in the appendix to this presentation. The earnings release, financial tables and supporting slide presentation can be found on the company’s Investor Relations website at investors.hancockwhitney.com. AFS – Available for sale securities ACL – Allowance for credit losses Annualized – Calculated to reflect a rate based on a�full year AOCI – Accumulated other comprehensive income B – Dollars in billions bps – basis points CARES Act – Coronavirus Aid Relief, and Economic Security Act CCB – Capital Conservation Buffer C&D – Construction and land development loans C&I – Commercial and industrial loans CDI – Core Deposit Intangible CECL – Current Expected Credit Losses �(accounting standard effective 1/1/2020) CET1 – Common Equity Tier 1 Ratio Core Loans - Loans excluding PPP activity COVID-19 – Pandemic related virus CRE – Commercial real estate DDA – Noninterest-bearing demand deposit accounts DP – Data processing (e) – estimated *Efficiency ratio – noninterest expense to total net interest (TE) and noninterest income, excluding amortization of purchased intangibles and nonoperating items EOP – End of period EPS – Earnings per share Excess liquidity - deposits held at the Fed plus investment in the bond portfolio above normal levels Fed - Federal Reserve Bank FF – Federal Funds FTE – Full time equivalent FV – Fair Value HFS – Held for sale HTM – Held to maturity securities ICRE – Income-producing commercial real estate IRR – Interest rate risk LIBOR – London Inter-Bank Offered Rate Line Utilization - represents the used portion of a revolving line resulting in a funded balance for a given portfolio; credit cards, construction loans (commercial and residential), and consumer lines of credit are excluded from the calculation Linked-quarter (LQ) – current quarter compared to previous quarter LOB – Line of Business LQA – Linked-quarter annualized M&A – Mergers and acquisitions MM – Dollars in millions MMDDYY – Month Day Year NII – Net interest income *NIM – Net interest margin (TE) NPA – Nonperforming assets NPL – Nonperforming loans OCI – Other comprehensive income OFA – Other foreclosed assets *Operating – Financial measure excluding nonoperating items *Operating Leverage – Operating revenue (TE) less operating expense; also known as PPNR ORE – Other real estate PAA – Purchase accounting accretion from business combinations *PPNR – Pre-provision net revenue (operating); also known as operating leverage PPP – SBA’s Paycheck Protection Program related to COVID-19 PY – Prior year ROA – Return on average assets ROTCE – Return on tangible common equity SBA – Small Business Administration S1 – Stronger Near-term Growth S2 – Slower Near-term Growth TCE – Tangible common equity ratio (common shareholders’ equity less intangible assets divided by total assets less intangible assets) TDR – Troubled Debt Restructuring *TE – Taxable equivalent (calculated using the current statutory federal tax rate) VERP – Voluntary Early Retirement Program XHYY – Half Year XQYY – Quarter Year Y-o-Y – Year over year HNCOCK WHITNEY 3

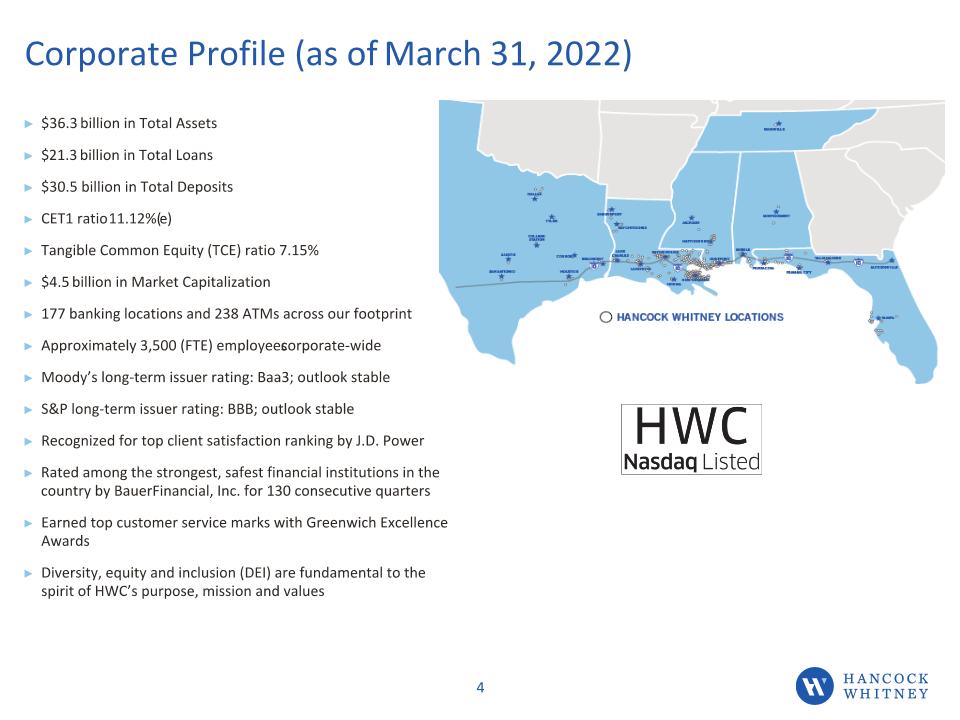

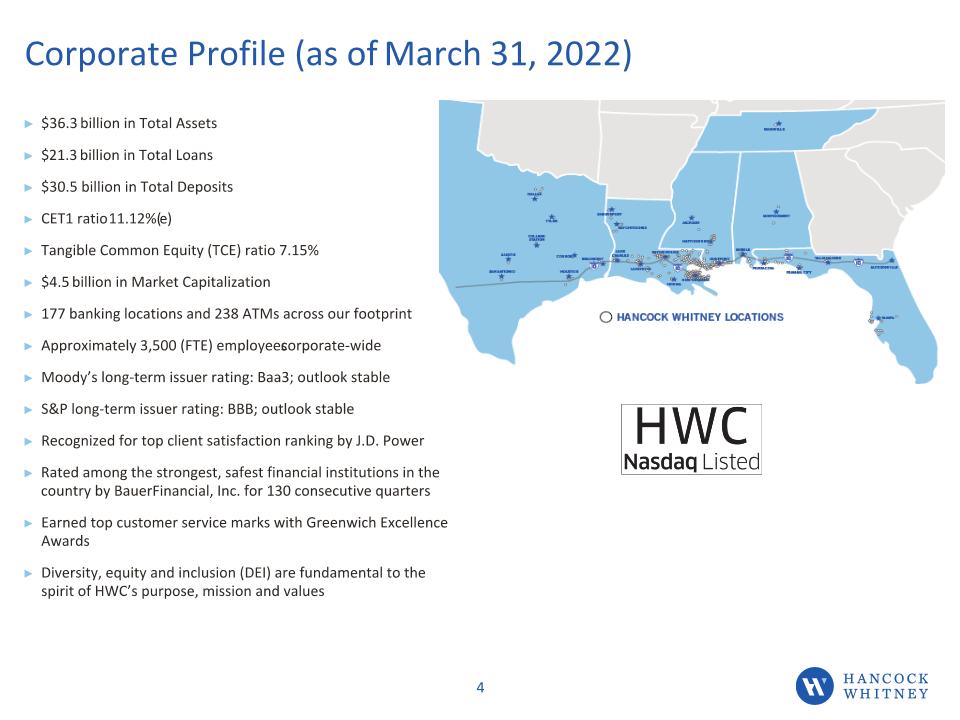

Corporate Profile (as of March 31, 2022) $36.3 billion in Total Assets $21.3 billion in Total Loans $30.5 billion in Total Deposits CET1 ratio 11.12%(e) Tangible Common Equity (TCE) ratio 7.15% $4.5 billion in Market Capitalization 177 banking locations and 238 ATMs across our footprint Approximately 3,500 (FTE) employees corporate-wide Moody’s long-term issuer rating: Baa3; outlook stable S&P long-term issuer rating: BBB; outlook stable Recognized for top client satisfaction ranking by J.D. Power Rated among the strongest, safest financial institutions in the country by BauerFinancial, Inc. for 130 consecutive quarters Earned top customer service marks with Greenwich Excellence Awards Diversity, equity and inclusion (DEI) are fundamental to the spirit of HWC’s purpose, mission and values HWC Nasdaq Listed HNCOCK WHITNEY 4

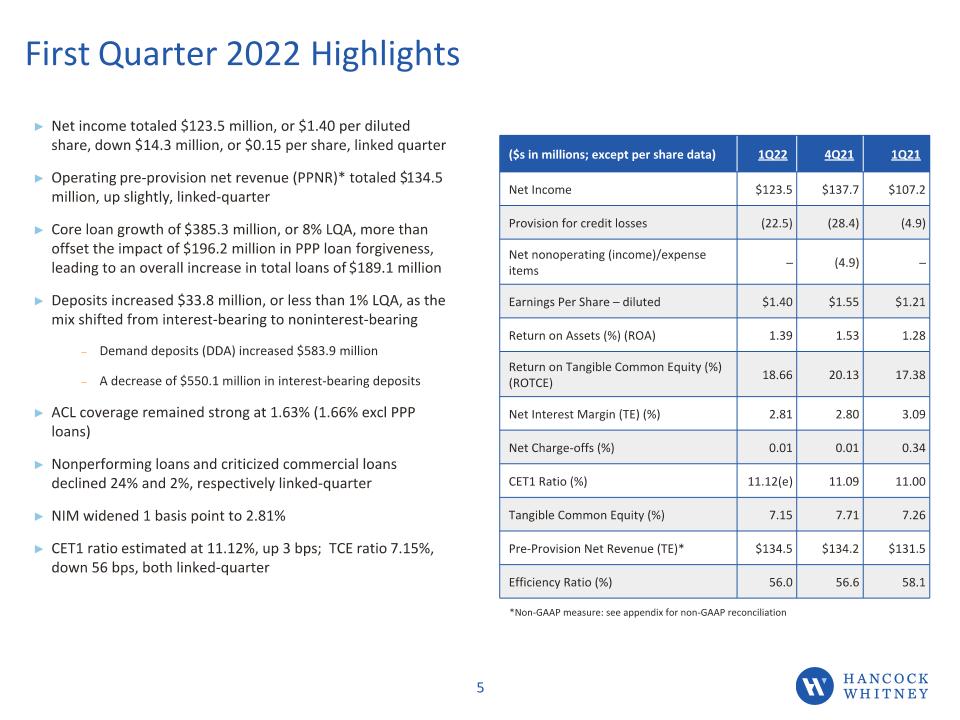

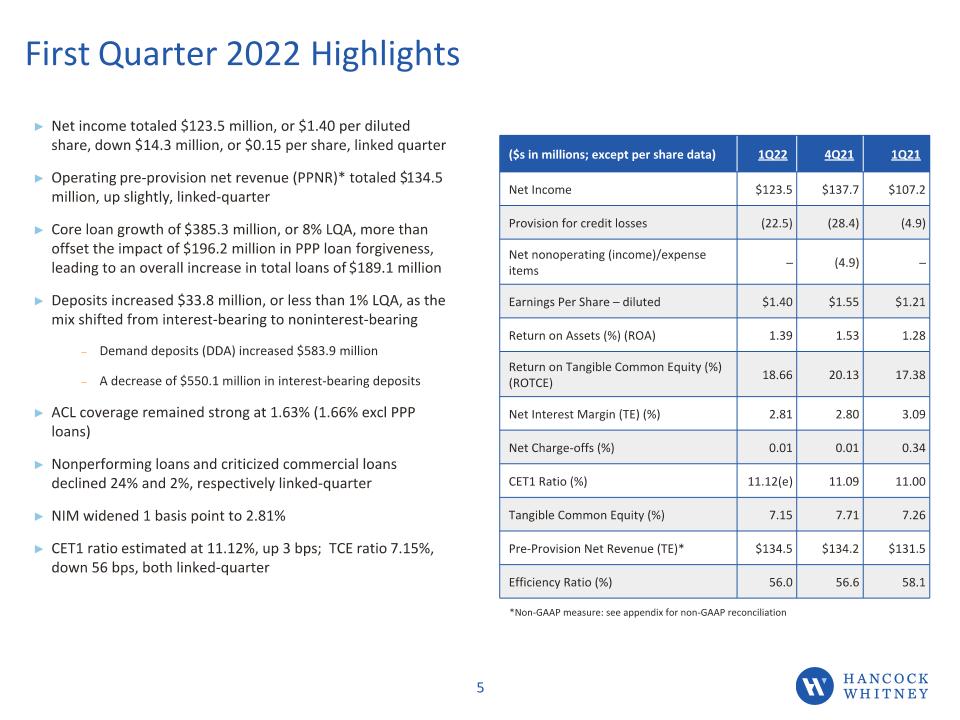

First Quarter 2022 Highlights Net income totaled $123.5 million, or $1.40 per diluted share, down $14.3 million, or $0.15 per share, linked quarter Operating pre-provision net revenue (PPNR)* totaled $134.5 million, up slightly, linked-quarter Core loan growth of $385.3 million, or 8% LQA, more than offset the impact of $196.2 million in PPP loan forgiveness, leading to an overall increase in total loans of $189.1 million Deposits increased $33.8 million, or less than 1% LQA, as the mix shifted from interest-bearing to noninterest-bearing Demand deposits (DDA) increased $583.9 million A decrease of $550.1 million in interest-bearing deposits ACL coverage remained strong at 1.63% (1.66% excl PPP loans) Nonperforming loans and criticized commercial loans declined 24% and 2%, respectively linked-quarter NIM widened 1 basis point to 2.81% CET1 ratio estimated at 11.12%, up 3 bps; TCE ratio 7.15%, down 56 bps, both linked-quarter ($s in millions; except per share data) 1Q22 4Q21 1Q21 Net Income $123.5 $137.7 $107.2 Provision for credit losses (22.5) (28.4) (4.9) Net nonoperating (income)/expense items ─ (4.9) ─ Earnings Per Share – diluted $1.40 $1.55 $1.21 Return on Assets (%) (ROA) 1.39 1.53 1.28 Return on Tangible Common Equity (%) (ROTCE) 18.66 20.13 17.38 Net Interest Margin (TE) (%) 2.81 2.80 3.09 Net Charge-offs (%) 0.01 0.01 0.34 CET1 Ratio (%) 11.12(e) 11.09 11.00 Tangible Common Equity (%) 7.15 7.71 7.26 Pre-Provision Net Revenue (TE)* $134.5 $134.2 $131.5 Efficiency Ratio (%) 56.0 56.6 58.1 *Non-GAAP measure: see appendix for non-GAAP reconciliation

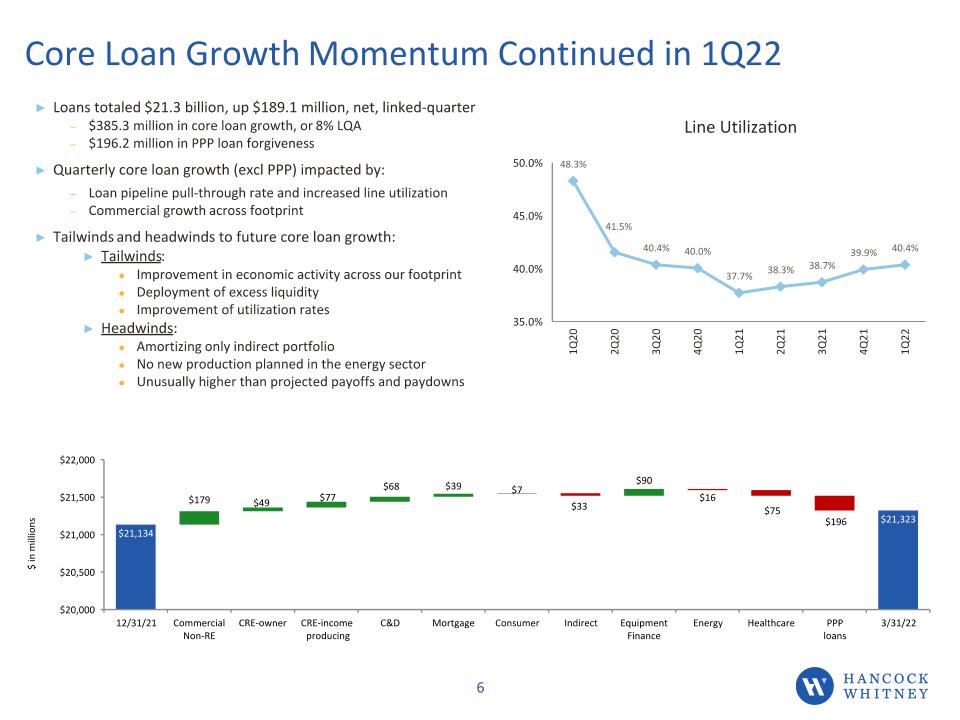

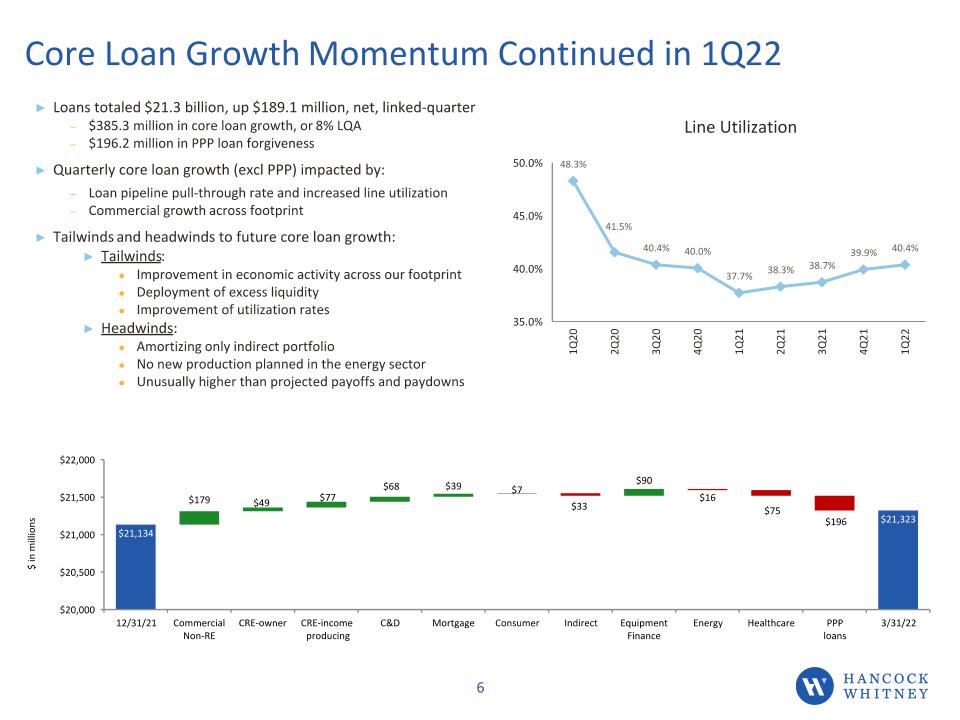

Loans totaled $21.3 billion, up $189.1 million, net, linked-quarter $385.3 million in core loan growth, or 8% LQA $196.2 million in PPP loan forgiveness Quarterly core loan growth (excl PPP) impacted by: Loan pipeline pull-through rate and increased line utilization Commercial growth across footprint Tailwinds and headwinds to future core loan growth: Tailwinds: Improvement in economic activity across our footprint Deployment of excess liquidity Improvement of utilization rates Headwinds: Amortizing only indirect portfolio No new production planned in the energy sector Unusually higher than projected payoffs and paydowns Core Loan Growth Momentum Continued in 1Q22 Bar Chart

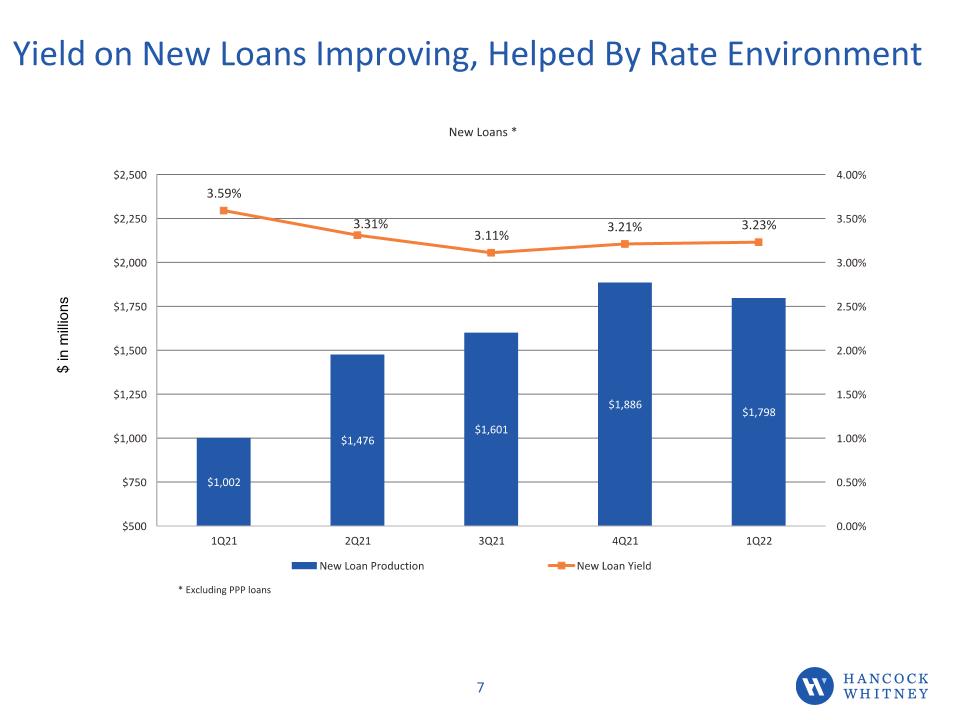

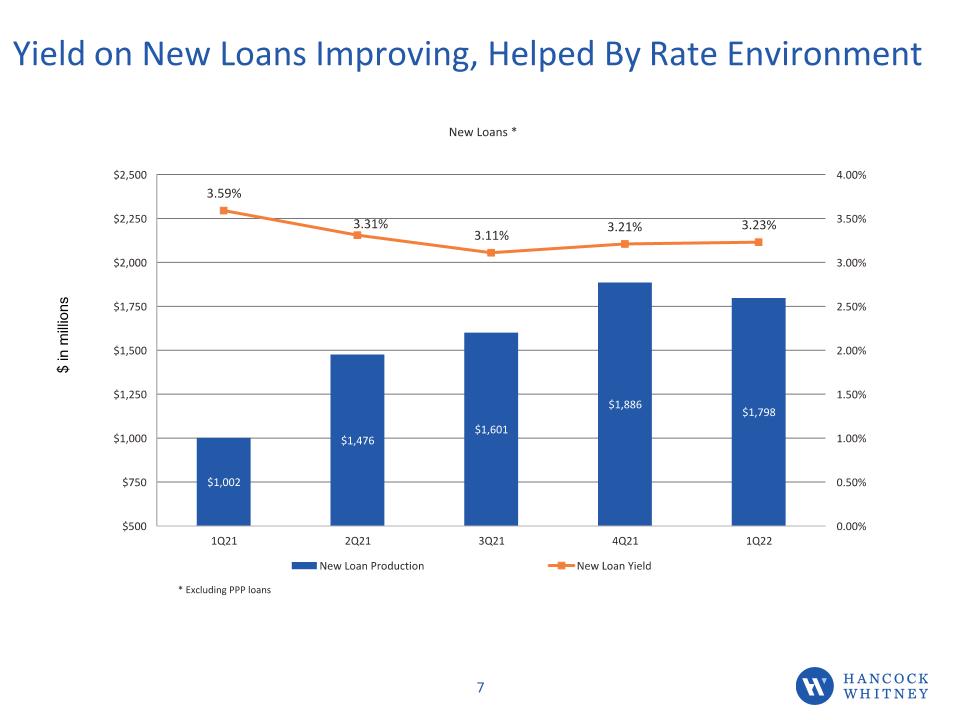

Yield on New Loans Improving, Helped By Rate Environment $ in millions * Excluding PPP loans

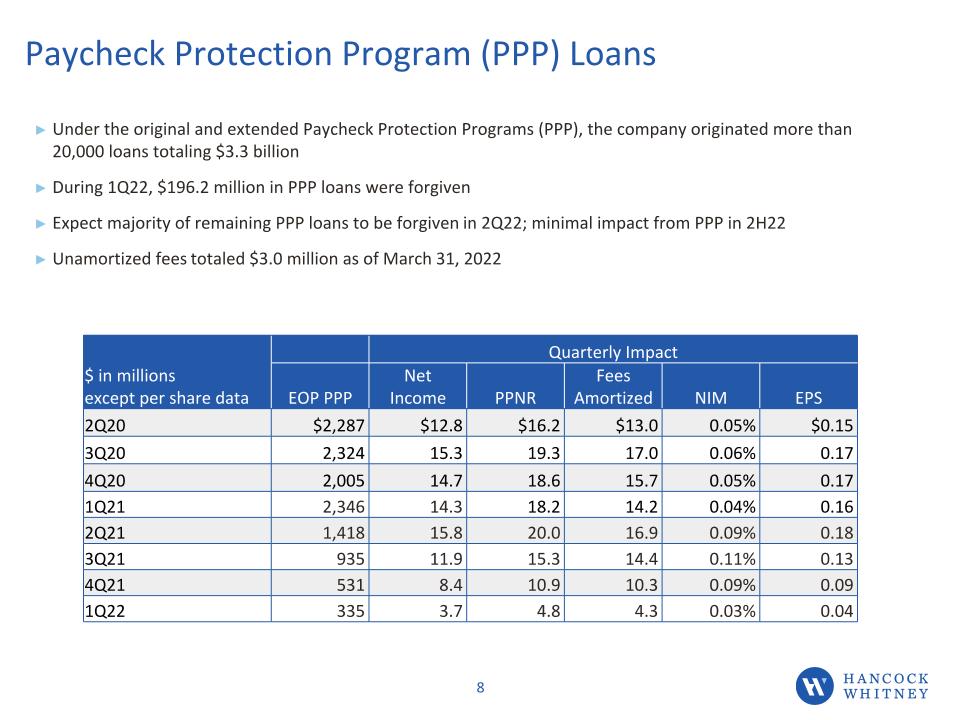

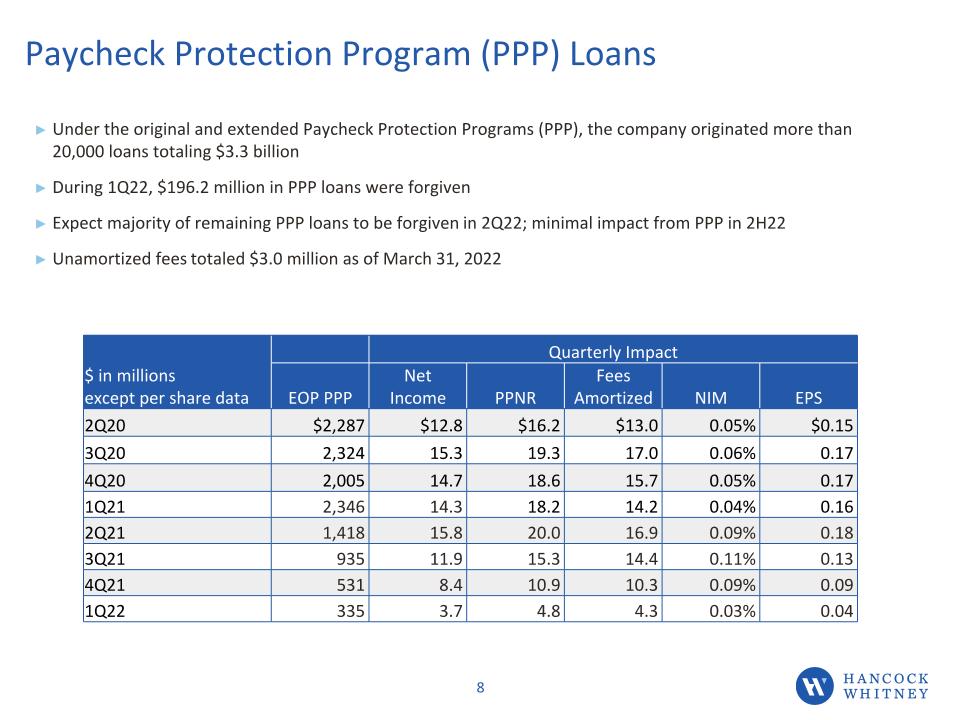

Paycheck Protection Program (PPP) Loans Under the original and extended Paycheck Protection Programs (PPP), the company originated more than 20,000 loans totaling $3.3 billion During 1Q22, $196.2 million in PPP loans were forgiven Expect majority of remaining PPP loans to be forgiven in 2Q22; minimal impact from PPP in 2H22 Unamortized fees totaled $3.0 million as of March 31, 2022 Quarterly Impact $ in millions�except per share data EOP PPP Net �Income PPNR Fees Amortized NIM EPS 2Q20 $2,287 $12.8 $16.2 $13.0 0.05% $0.15 3Q20 2,324 15.3 19.3 17.0 0.06% 0.17 4Q20 2,005 14.7 18.6 15.7 0.05% 0.17 1Q21 2,346 14.3 18.2 14.2 0.04% 0.16 2Q21 1,418 15.8 20.0 16.9 0.09% 0.18 3Q21 935 11.9 15.3 14.4 0.11% 0.13 4Q21 531 8.4 10.9 10.3 0.09% 0.09 1Q22 335 3.7 4.8 4.3 0.03% 0.04 West 25% Central 39% East 36% HNCOCK WHITNEY 7

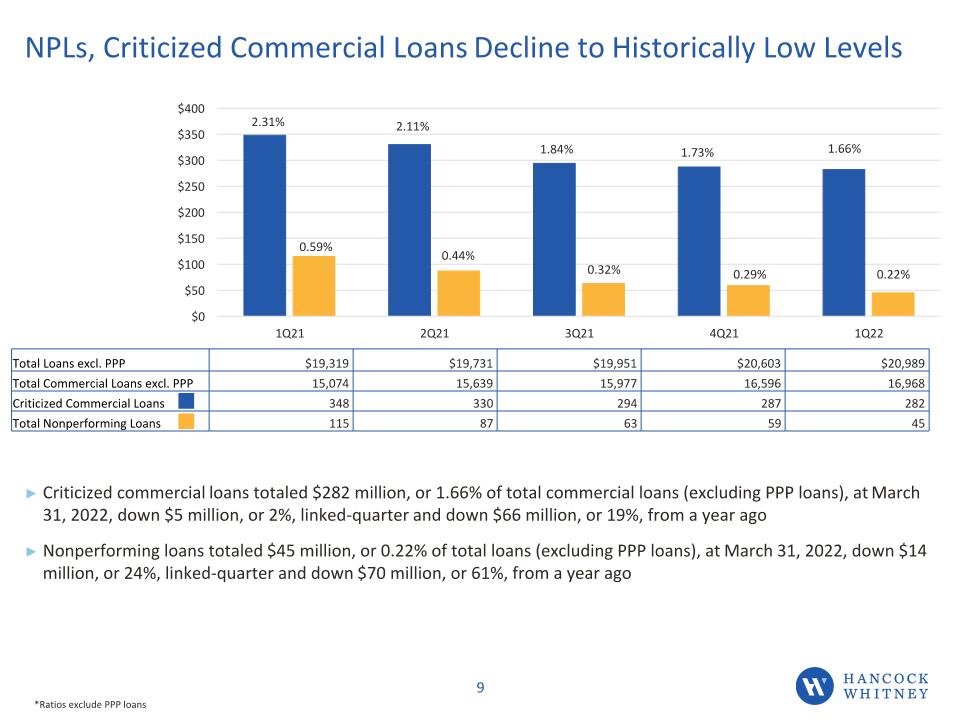

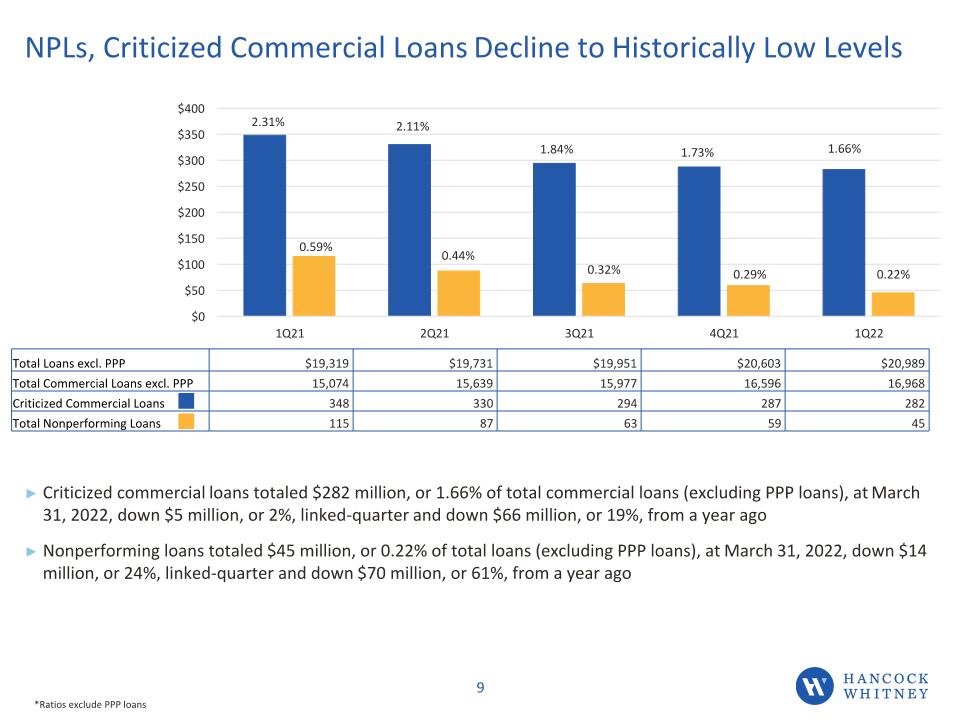

NPLs, Criticized Commercial Loans Decline to Historically Low Levels Criticized commercial loans totaled $282 million, or 1.66% of total commercial loans (excluding PPP loans), at March 31, 2022, down $5 million, or 2%, linked-quarter and down $66 million, or 19%, from a year ago Nonperforming loans totaled $45 million, or 0.22% of total loans (excluding PPP loans), at March 31, 2022, down $14 million, or 24%, linked-quarter and down $70 million, or 61%, from a year ago *Ratios exclude PPP loans 2.31% 0.59% 1.73% Total Loans excl. PPP $19,319 $19,731 $19,951 $20,603 $20,989 Total Commercial Loans excl. PPP 15,074 15,639 15,977 16,596 16,968 Criticized Commercial Loans 348 330 294 287 282 Total Nonperforming Loans 115 87 63 59 45 2.11% 0.44% 1.84% 0.32% 0.29% 1.66% 0.22% $700 $600 $500 $400 $300 $200 $100 $0 3Q20 4Q20 1Q21 2Q21 3Q21 HNCOCK WHITNEY 12

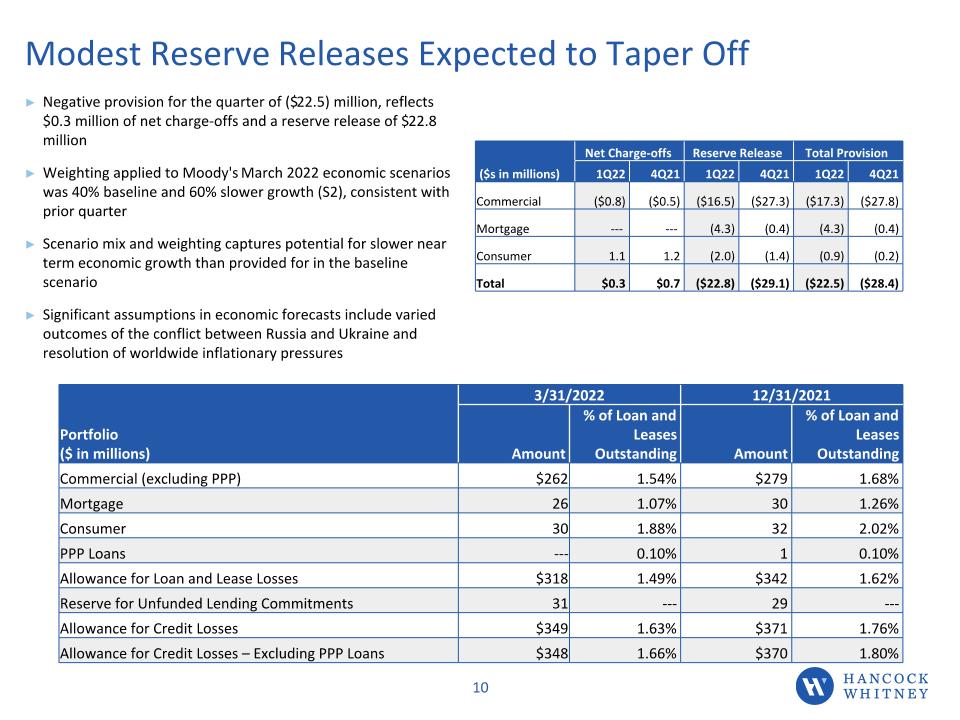

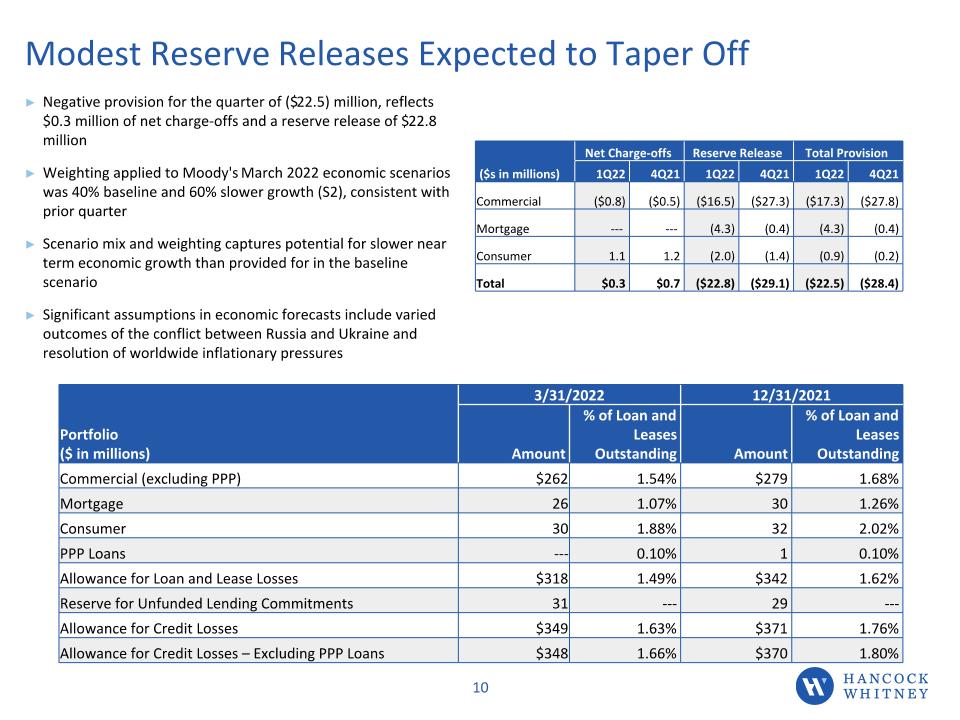

Modest Reserve Releases Expected to Taper Off Negative provision for the quarter of ($22.5) million, reflects $0.3 million of net charge-offs and a reserve release of $22.8 million Weighting applied to Moody's March 2022 economic scenarios was 40% baseline and 60% slower growth (S2), consistent with prior quarter Scenario mix and weighting captures potential for slower near term economic growth than provided for in the baseline scenario Significant assumptions in economic forecasts include varied outcomes of the conflict between Russia and Ukraine and resolution of worldwide inflationary pressures Net Charge-offs Reserve Release Total Provision ($s in millions) 1Q22 4Q21 1Q22 4Q21 1Q22 4Q21 Commercial ($0.8) ($0.5) ($16.5) ($27.3) ($17.3) ($27.8) Mortgage --- --- (4.3) (0.4) (4.3) (0.4) Consumer 1.1 1.2 (2.0) (1.4) (0.9) (0.2) Total $0.3 $0.7 ($22.8) ($29.1) ($22.5) ($28.4) 3/31/2022 12/31/2021 Portfolio ($ in millions) Amount % of Loan and Leases Outstanding Amount % of Loan and Leases Outstanding Commercial (excluding PPP) $262 1.54% $279 1.68% Mortgage 26 1.07% 30 1.26% Consumer 30 1.88% 32 2.02% PPP Loans --- 0.10% 1 0.10% Allowance for Loan and Lease Losses $318 1.49% $342 1.62% Reserve for Unfunded Lending Commitments 31 --- 29 --- Allowance for Credit Losses $349 1.63% $371 1.76% Allowance for Credit Losses – Excluding PPP Loans $348 1.66% $370 1.80%

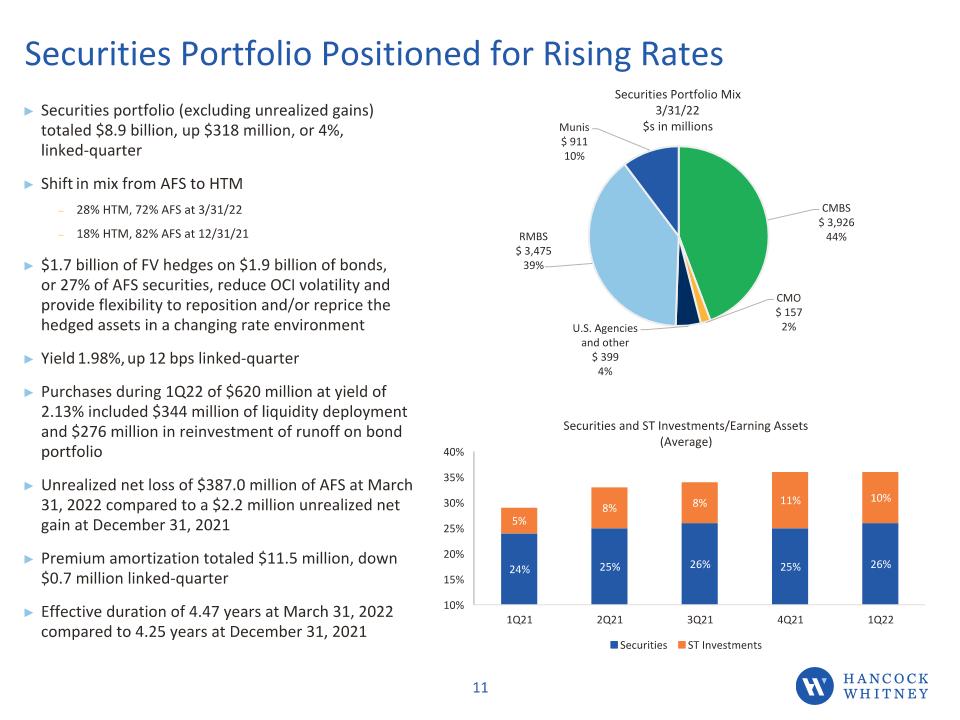

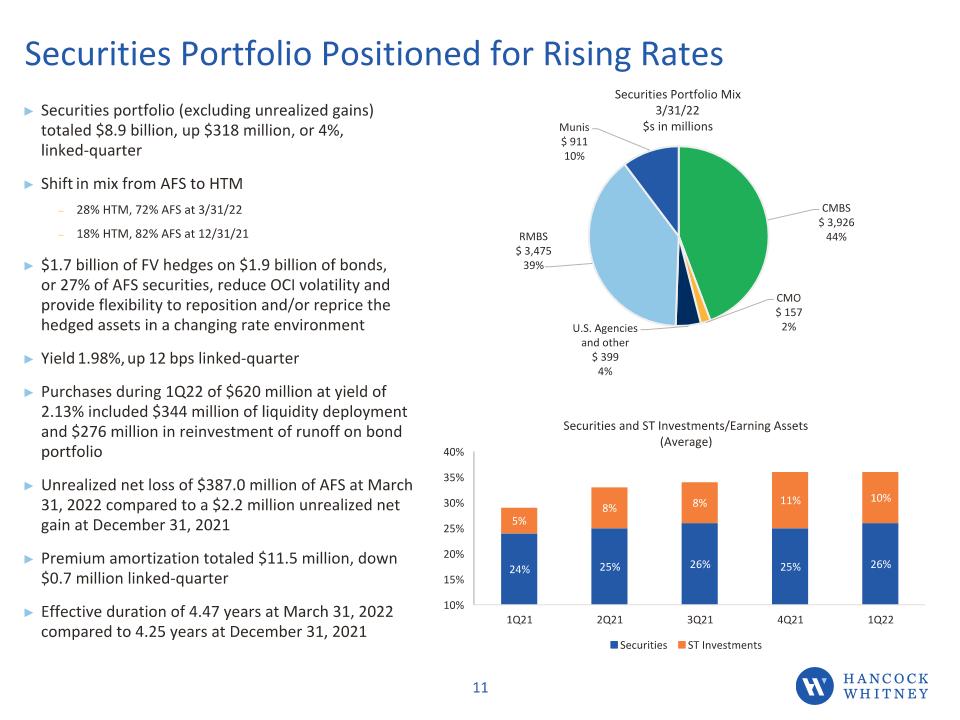

Securities Portfolio Positioned for Rising Rates Securities portfolio (excluding unrealized gains) totaled $8.9 billion, up $318 million, or 4%, �linked-quarter Shift in mix from AFS to HTM 28% HTM, 72% AFS at 3/31/22 18% HTM, 82% AFS at 12/31/21 $1.7 billion of FV hedges on $1.9 billion of bonds, �or 27% of AFS securities, reduce OCI volatility and provide flexibility to reposition and/or reprice the hedged assets in a changing rate environment Yield 1.98%, up 12 bps linked-quarter Purchases during 1Q22 of $620 million at yield of 2.13% included $344 million of liquidity deployment and $276 million in reinvestment of runoff on bond portfolio Unrealized net loss of $387.0 million of AFS at March 31, 2022 compared to a $2.2 million unrealized net gain at December 31, 2021 Premium amortization totaled $11.5 million, down $0.7 million linked-quarter Effective duration of 4.47 years at March 31, 2022 compared to 4.25 years at December 31, 2021 Securities Portfolio Mix 12/31/20 $s in millions CMBS $2,873 41% CMO $513 7% U.S. Agencies and other $219 3% RMBS $2,582 36% Munis $936 13% HNCOCK WHITNEY 15 Bar chart,pie chart

Deposits Virtually Unchanged, Mix Shift to Almost Half DDA Total deposits of $30.5 billion, up $33.8 million, or less than 1%, linked-quarter Noninterest-bearing demand deposits (DDAs) increased $583.9 million due to hurricane recovery proceeds and seasonal deposit inflows Interest-bearing transaction and savings deposits decreased $188.9 million Interest-bearing public fund deposits decreased $280.3 million primarily related to expected runoff in the first quarter of each year Time deposits decreased $80.9 million, with a portion moving to transaction accounts in light of the low rate environment DDAs comprised 49% of total period-end deposits March cost of deposits 5 bps, down 1 bp from December 2021 Total Deposits 12/31/20 $s in millions Time Deposits (retail) $1,835 7% Time Deposits (brokered) $14 ― Interest-bearing public funds $3,235 12% Interest-bearing transaction & savings $10,414 37% Noninterest bearing $12,200 44% $s in billions Avg Qtrly Deposits LQA EOP growth $28.0 $26.0 $24.0 $22.0 $20.0 $18.0 $16.0 1Q20 $24.3 20% 2Q20 $26.7 37% 3Q20 $26.8 -4% 4Q20 $27.0 10% 1Q21 $27.0 10% HNCOCK WHITNEY 15 Bar chart,pie chart

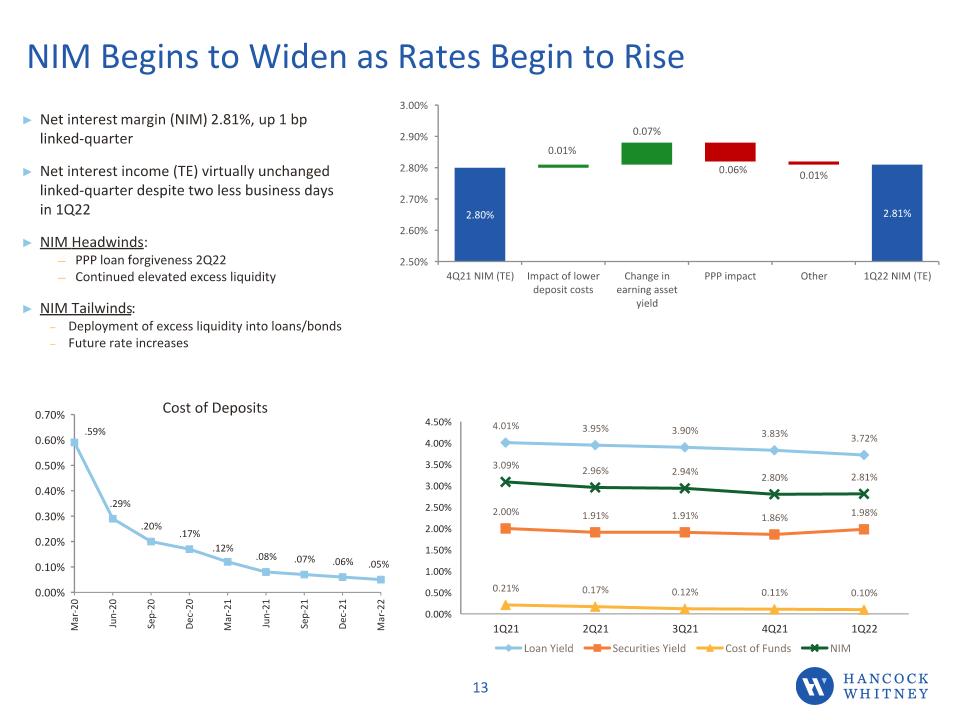

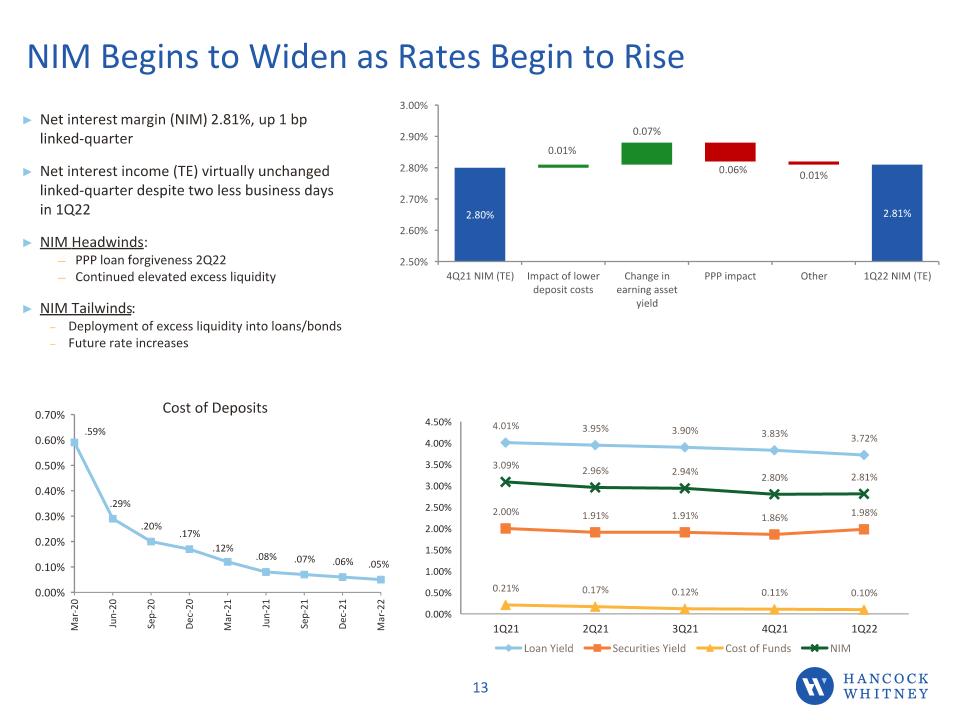

Net interest margin (NIM) 2.81%, up 1 bp �linked-quarter Net interest income (TE) virtually unchanged �linked-quarter despite two less business days �in 1Q22 NIM Headwinds: PPP loan forgiveness 2Q22 Continued elevated excess liquidity NIM Tailwinds: Deployment of excess liquidity into loans/bonds Future rate increases NIM Begins to Widen as Rates Begin to Rise Cost of Deposits 0.60% 0.50% 0.40% 0.30% 0.20% 0.10% Mar-20 Apr-20 May-20 Jun 20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Mar-21e .59% .41% .33% .29% .25% .21% .20% .19% .17% .17% .13% 3.40% 3.30% 3.20% 3.10% 3.00% 2.90% 2.80% 3Q20 NIM (TE) Impact of Securities Portfolio Purchase/Premium amortization Impact of change in earnings asset mix Lower cost of deposits Net impact of interest reversals and recoveries/loan fees accretion 4Q20 NIM (TE) 0.02% 0.06% 0.05% 0.02% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% 4Q19 1Q20 2Q20 3Q20 4Q20 4.69% 3.43% 2.56% 0.76% 4.56% 3.41% 2.53% 0.67% 4.04% 3.23% 2.47% 0.38% 3.95% 3.23% 2.31% 0.30% 3.99% 3.22% 2.23% 0.25% Loan Yield Securities Yield Cost of Fund NIM HNCOCK WHITNEY 18 Line chart

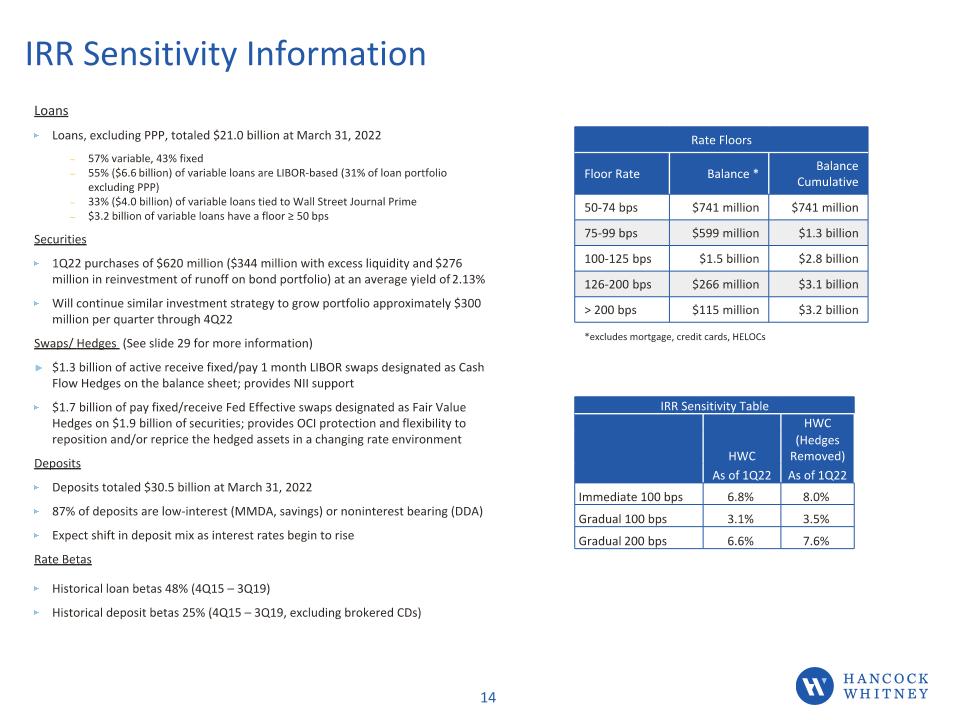

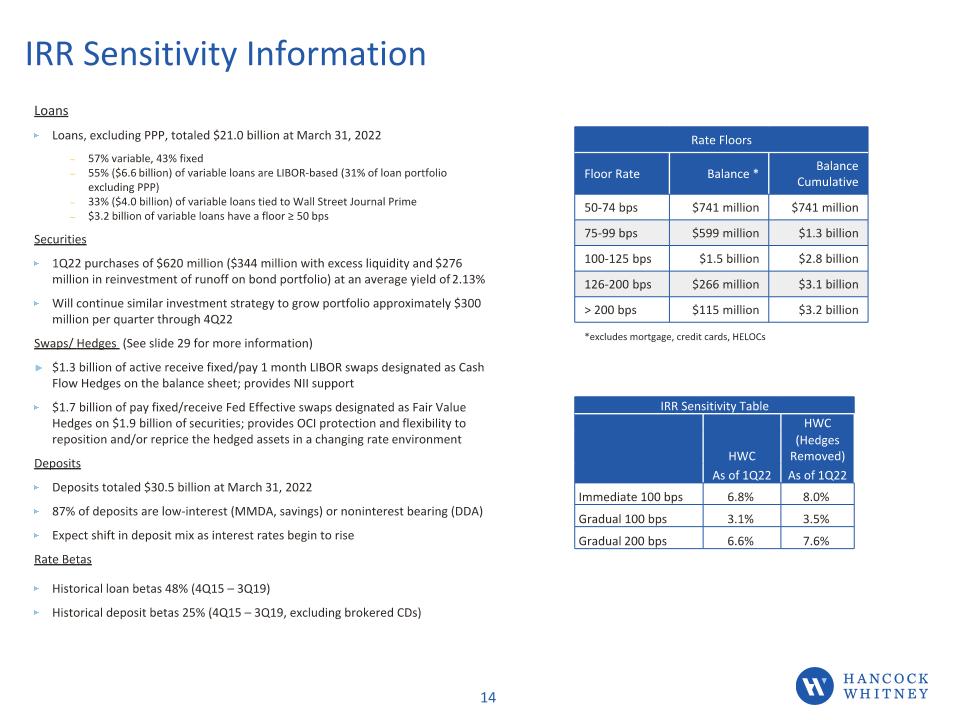

Loans Loans, excluding PPP, totaled $21.0 billion at March 31, 2022 57% variable, 43% fixed 55% ($6.6 billion) of variable loans are LIBOR-based (31% of loan portfolio excluding PPP) 33% ($4.0 billion) of variable loans tied to Wall Street Journal Prime $3.2 billion of variable loans have a floor ≥ 50 bps Securities 1Q22 purchases of $620 million ($344 million with excess liquidity and $276 million in reinvestment of runoff on bond portfolio) at an average yield of 2.13% Will continue similar investment strategy to grow portfolio approximately $300 million per quarter through 4Q22 Swaps/ Hedges (See slide 29 for more information) $1.3 billion of active receive fixed/pay 1 month LIBOR swaps designated as Cash Flow Hedges on the balance sheet; provides NII support $1.7 billion of pay fixed/receive Fed Effective swaps designated as Fair Value Hedges on $1.9 billion of securities; provides OCI protection and flexibility to reposition and/or reprice the hedged assets in a changing rate environment Deposits Deposits totaled $30.5 billion at March 31, 2022 87% of deposits are low-interest (MMDA, savings) or noninterest bearing (DDA) Expect shift in deposit mix as interest rates begin to rise Rate Betas Historical loan betas 48% (4Q15 – 3Q19) Historical deposit betas 25% (4Q15 – 3Q19, excluding brokered CDs) Rate Floors Floor Rate Balance * Balance Cumulative 25-49 bps $670 million $670 million 50-74 bps $804 million $1.5 billion 75-99 bps $546 million $2.0 billion 100-150 bps $1.8 billion $3.8 billion > 150 bps $172 million $4.0 billion IRR Sensitivity Table HWC (Hedges Removed) As of 4Q21 As of 4Q21 Peers * Immediate 100 bps 7.3% 8.4% 7.3% Gradual 100 bps 3.2% 3.6% 4.3% Deposits $ in millions Time Deposits $1,129 4% Interest-bearing public funds $3,295 11% Interest-bearing transaction & savings $11,650 38% Noninterest bearing $14,393 47% IRR Sensitivity Information Rate Floors Floor Rate Balance * Balance Cumulative 50-74 bps $741 million $741 million 75-99 bps $599 million $1.3 billion 100-125 bps $1.5 billion $2.8 billion 126-200 bps $266 million $3.1 billion > 200 bps $115 million $3.2 billion *excludes mortgage, credit cards, HELOCs IRR Sensitivity Table HWC HWC (Hedges Removed) As of 1Q22 As of 1Q22 Immediate 100 bps 6.8% 8.0% Gradual 100 bps 3.1% 3.5% Gradual 200 bps 6.6% 7.6%

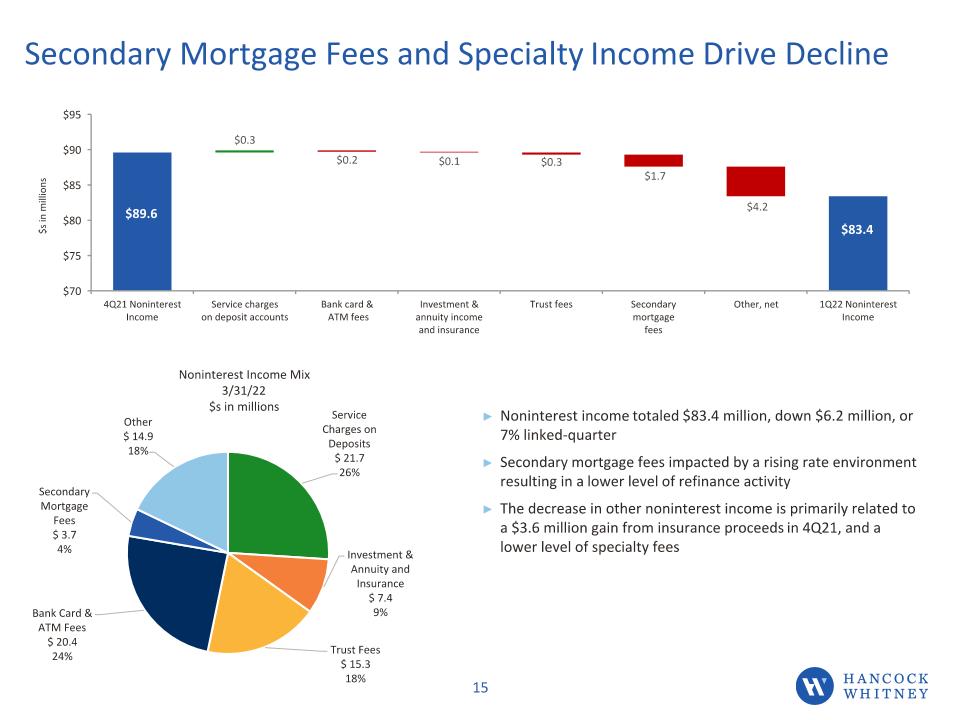

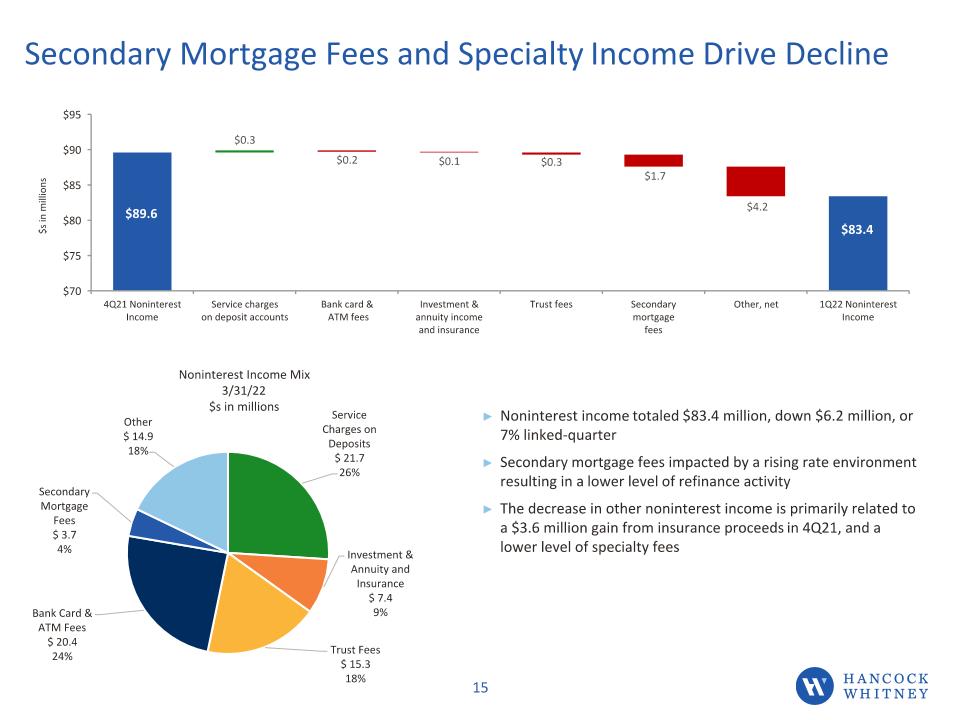

Secondary Mortgage Fees and Specialty Income Drive Decline Noninterest income totaled $83.4 million, down $6.2 million, or 7% linked-quarter Secondary mortgage fees impacted by a rising rate environment resulting in a lower level of refinance activity The decrease in other noninterest income is primarily related to a $3.6 million gain from insurance proceeds in 4Q21, and a lower level of specialty fees Noninterest Income Mix 3/31/22 $s in millions Lower Mortgage, Specialty Income Partly Offset by Higher Service Fees Noninterest income totaled $82.4 million, down $1.3 million, or 2% linked-quarter Service charges and bank card & ATM fees up primarily due to increased activity, although lower than pre-pandemic levels Secondary mortgage fees continue to be impacted by the favorable rate environment, albeit a lower level of refinance activity compared to previous quarters Other income decrease related to lower levels of specialty income (BOLI) in 4Q20 partially offset by higher derivative income Expect 1Q21 fee income to be down related to anticipated lower levels of specialty income and secondary mortgage fees Secondary Mortgage Fees $11.5 14%Other $12.8 16% Noninterest Income Mix 12/31/20 $s in millions Service Charges on Deposit $19.9 24% Investment & Annuity and Insurance $5.8 7% Trust Fees $14.8 18% Bank Card & ATM Fees $17.6 21% 3Q20 NON INTEREST INCOME SERVICE CHARGES ON DEPOSIT accounts bank card & atm fees investment & annuity income and insurance trust fees secondary mortgage fees other 4q20 Non interest income Pie chart

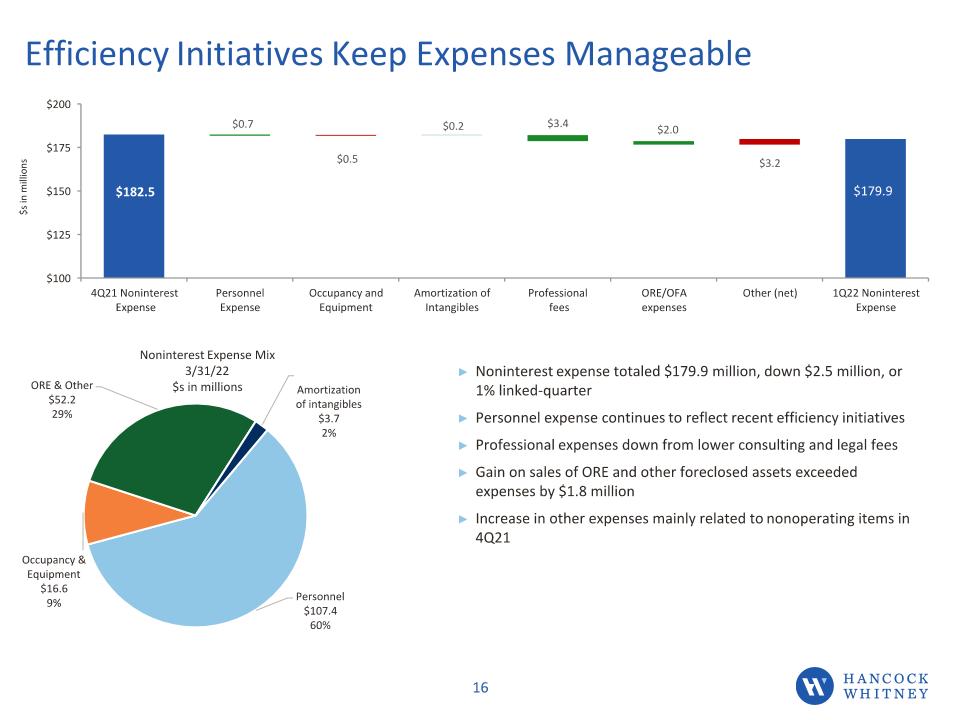

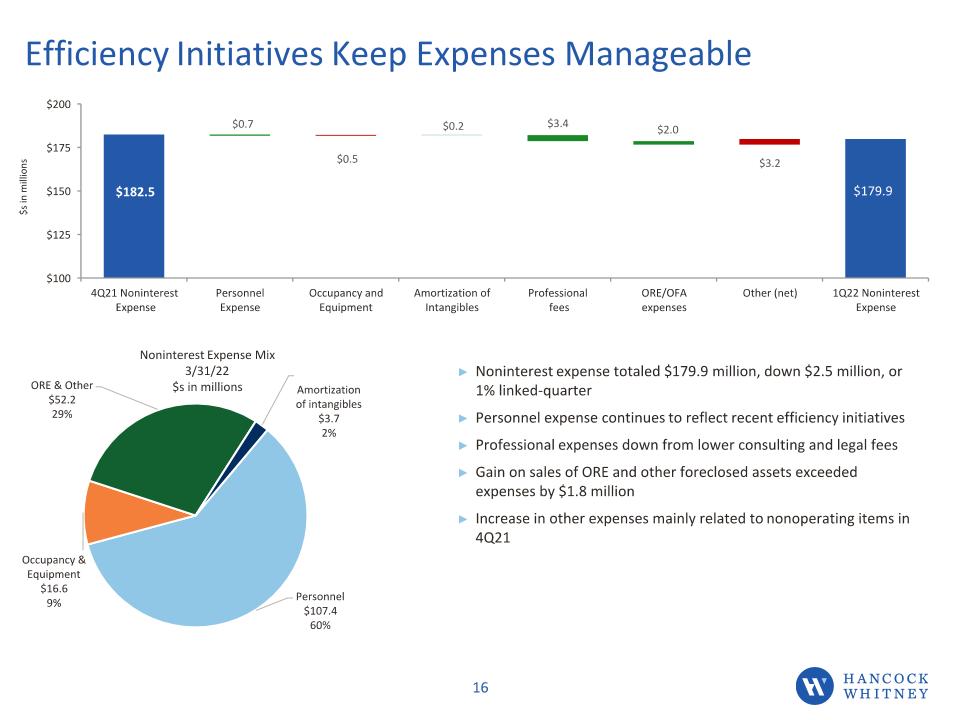

Efficiency Initiatives Keep Expenses Manageable Noninterest expense totaled $179.9 million, down $2.5 million, or 1% linked-quarter Personnel expense continues to reflect recent efficiency initiatives Professional expenses down from lower consulting and legal fees Gain on sales of ORE and other foreclosed assets exceeded expenses by $1.8 million Increase in other expenses mainly related to nonoperating items in 4Q21 Noninterest Expense Mix 3/31/22 $s in millions A Focus on Expense Control; More Initiatives Underway Noninterest expense totaled $193.1 million, down $2.7 million, or 1% LQ Decline in personnel expense related to savings from efficiency measures taken to-date, including staff attrition and recent financial center closures Increase in other expenses mainly related to nonrecurring hurricane expense and branch closures Expense reduction initiatives to-date Closed 12 financial centers in 4Q20 8 additional financial centers closures announced in 1Q21 Ongoing branch rationalization reviews Closed Wealth Management trust offices in the NE corridor FTE down 210 compared to June 30, 2020 through staff attrition and other initiatives Early retirement package offered to select employees in 1Q21 Expect 1Q21 expenses to be flat as efficiency initiatives continue and offset typical beginning of the year increases; does not include nonrecurring charges for certain initiatives (i.e. early retirement)

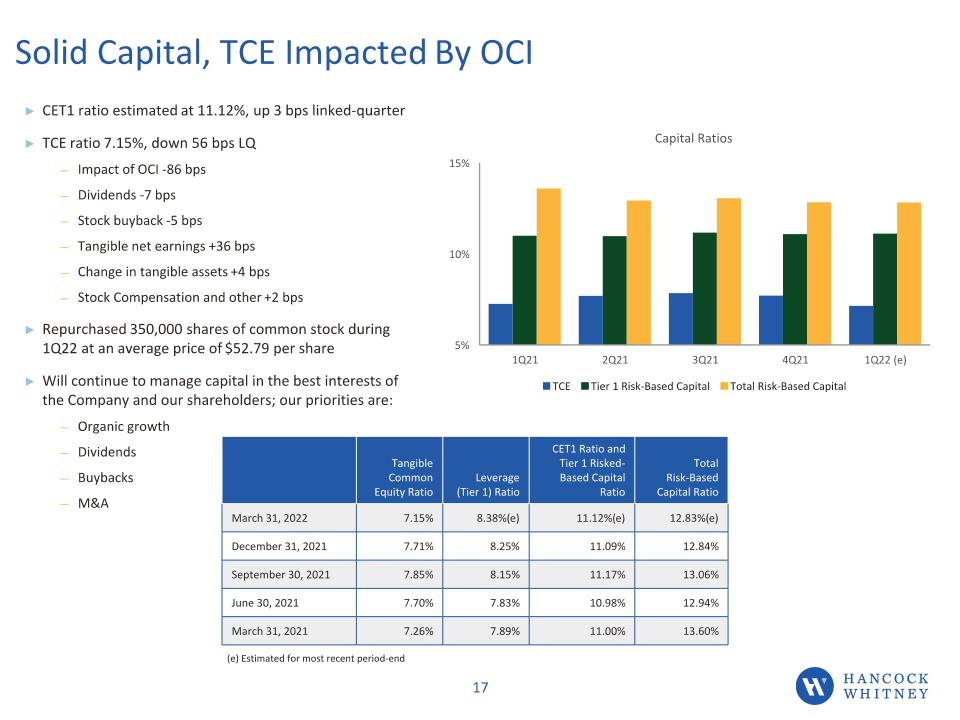

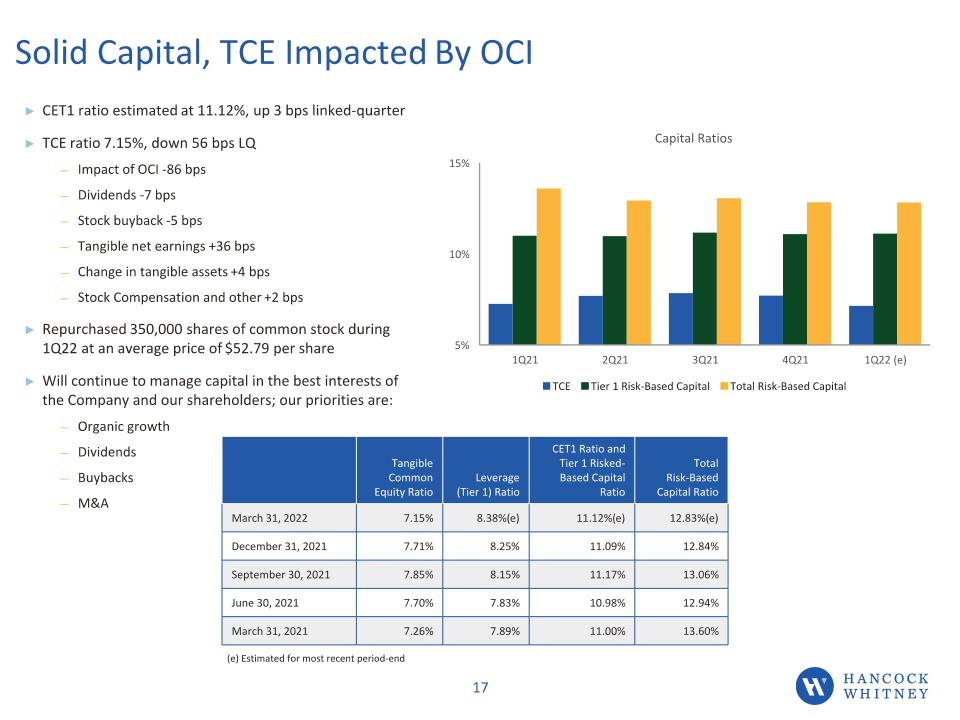

Solid Capital, TCE Impacted By OCI CET1 ratio estimated at 11.12%, up 3 bps linked-quarter TCE ratio 7.15%, down 56 bps LQ Impact of OCI -86 bps Dividends -7 bps Stock buyback -5 bps Tangible net earnings +36 bps Change in tangible assets +4 bps Stock Compensation and other +2 bps Repurchased 350,000 shares of common stock during 1Q22 at an average price of $52.79 per share Will continue to manage capital in the best interests of the Company and our shareholders; our priorities are: Organic growth Dividends Buybacks M&A Tangible Common Equity Ratio Leverage (Tier 1) Ratio CET1 Ratio and �Tier 1 Risked-Based Capital Ratio Total �Risk-Based Capital Ratio March 31, 2022 7.15% 8.38%(e) 11.12%(e) 12.83%(e) December 31, 2021 7.71% 8.25% 11.09% 12.84% September 30, 2021 7.85% 8.15% 11.17% 13.06% June 30, 2021 7.70% 7.83% 10.98% 12.94% March 31, 2021 7.26% 7.89% 11.00% 13.60% (e) Estimated for most recent period-end Capital Rebuild Continues After 1H20 De-Risking Activities TCE ratio 7.64%, up 11 bps LQ (7.99% excluding PPP loans) Tangible net earnings +34 bps Change in tangible assets/additional excess liquidity -10 bps Dividends -7 bps Change in OCI & other -6 bps CET1 ratio 10.70%, up 40 bps linked-quarter Intend to pay quarterly dividend in consultation with examiners; board reviews dividend policy quarterly Buybacks on hold Tangible Common Equity Ratio Leverage (Tier 1) Ratio CET1 Ratio and Tier 1 Risked-Based Capital Ratio Total Risk-Based Capital Ratio December 31, 2020 7.64% 7.87%(e) 10.70%(e) 13.31%(e) September 30, 2020 7.53% 7.70% 10.30% 12.92% June 30, 2020 7.33% 7.37% 9.78% 12.36% March 31, 2020 8.00% 8.40% 10.02% 11.87% December 31, 2019 8.45% 8.76% 10.50% 11.90% (e) Estimated for most recent period-end; effective March 31, 2020 regulatory capital ratios reflect the election to use the five-year CECL transition rules

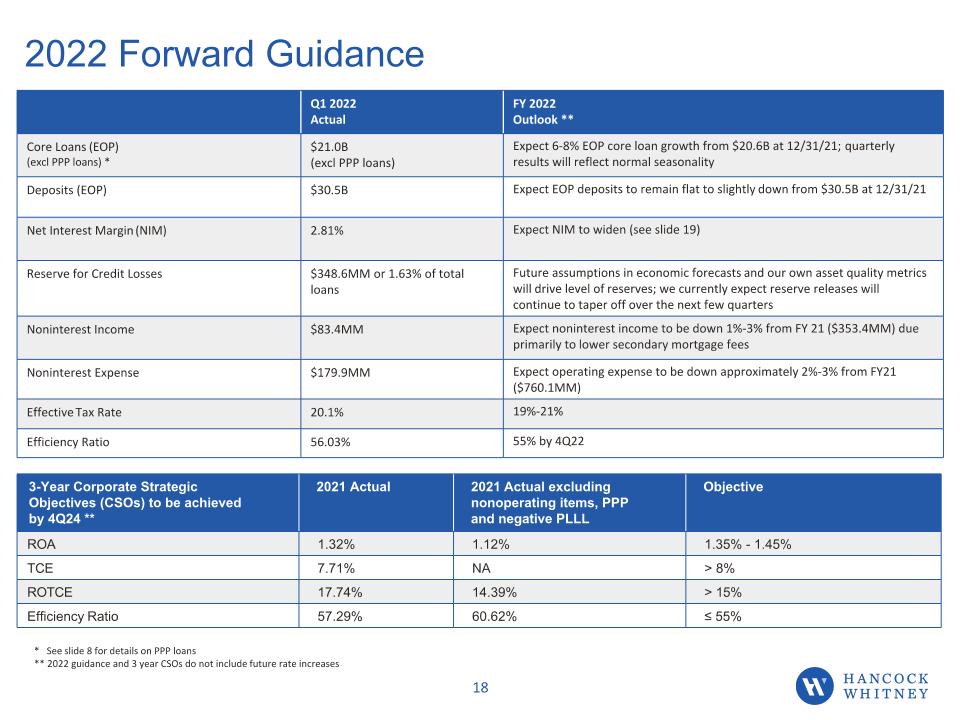

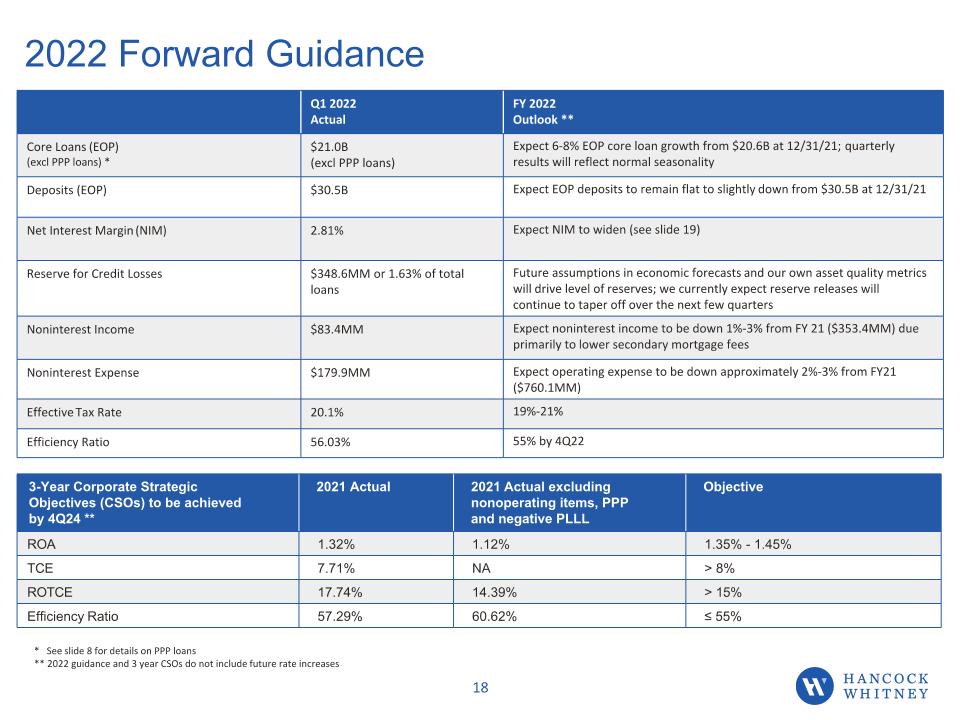

2022 Forward Guidance Q1 2022 �Actual FY 2022 �Outlook ** Core Loans (EOP) (excl PPP loans) * $21.0B �(excl PPP loans) Expect 6-8% EOP core loan growth from $20.6B at 12/31/21; quarterly results will reflect normal seasonality Deposits (EOP) $30.5B Expect EOP deposits to remain flat to slightly down from $30.5B at 12/31/21 Net Interest Margin (NIM) 2.81% Expect NIM to widen (see slide 19) Reserve for Credit Losses $348.6MM or 1.63% of total loans Future assumptions in economic forecasts and our own asset quality metrics will drive level of reserves; we currently expect reserve releases will continue to taper off over the next few quarters Noninterest Income $83.4MM Expect noninterest income to be down 1%-3% from FY 21 ($353.4MM) due primarily to lower secondary mortgage fees Noninterest Expense $179.9MM Expect operating expense to be down approximately 2%-3% from FY21 ($760.1MM) Effective Tax Rate 20.1% 19%-21% Efficiency Ratio 56.03% 55% by 4Q22 3-Year Corporate Strategic Objectives (CSOs) to be achieved by 4Q24 ** 2021 Actual 2021 Actual excluding nonoperating items, PPP and negative PLLL Objective ROA 1.32% 1.12% 1.35% - 1.45% TCE 7.71% NA > 8% ROTCE 17.74% 14.39% > 15% Efficiency Ratio 57.29% 60.62% ≤ 55% * See slide 8 for details on PPP loans ** 2022 guidance and 3 year CSOs do not include future rate increases

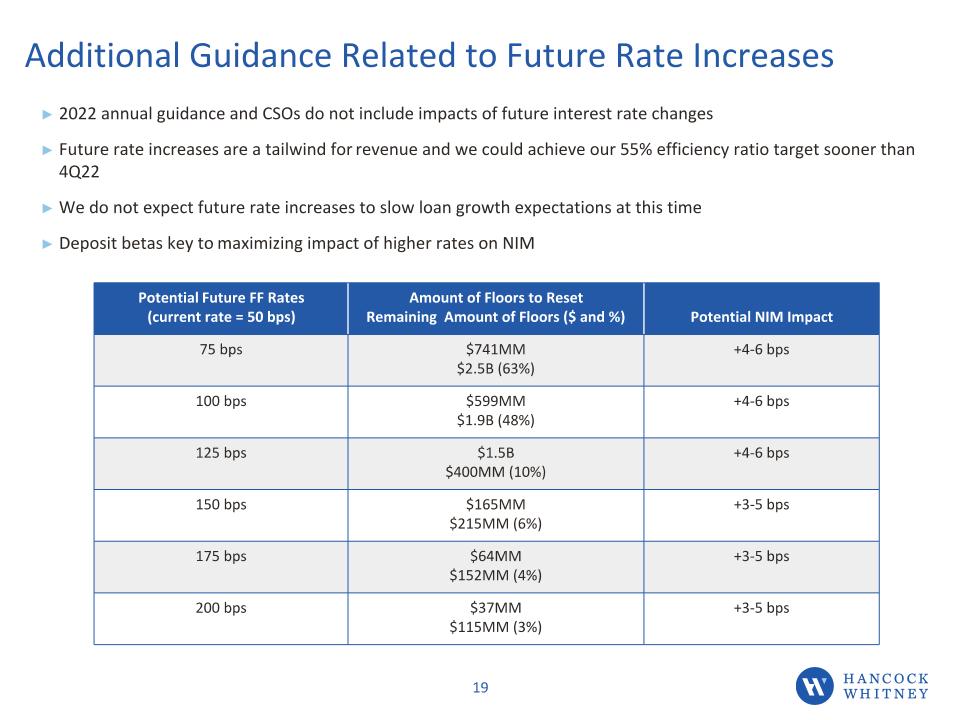

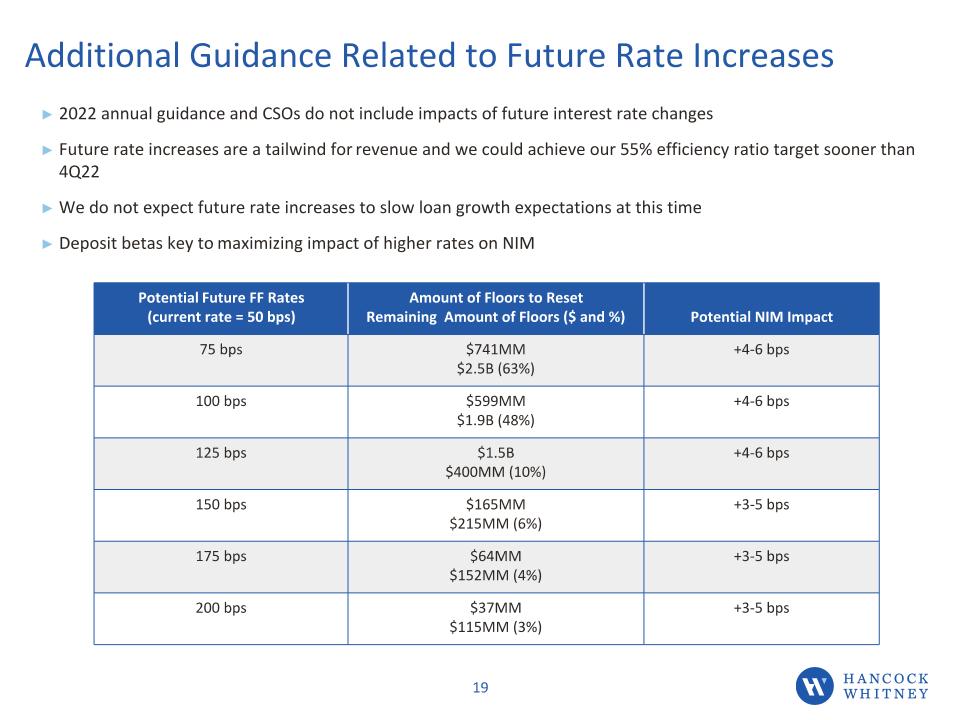

Additional Guidance Related to Future Rate Increases 2022 annual guidance and CSOs do not include impacts of future interest rate changes Future rate increases are a tailwind for revenue and we could achieve our 55% efficiency ratio target sooner than 4Q22 We do not expect future rate increases to slow loan growth expectations at this time Deposit betas key to maximizing impact of higher rates on NIM Potential Future FF Rates�(current rate = 50 bps) Amount of Floors to Reset Remaining Amount of Floors ($ and %) Potential NIM Impact 75 bps $741MM $2.5B (63%) +4-6 bps 100 bps $599MM $1.9B (48%) +4-6 bps 125 bps $1.5B $400MM (10%) +4-6 bps 150 bps $165MM $215MM (6%) +3-5 bps 175 bps $64MM $152MM (4%) +3-5 bps 200 bps $37MM $115MM (3%) +3-5 bps

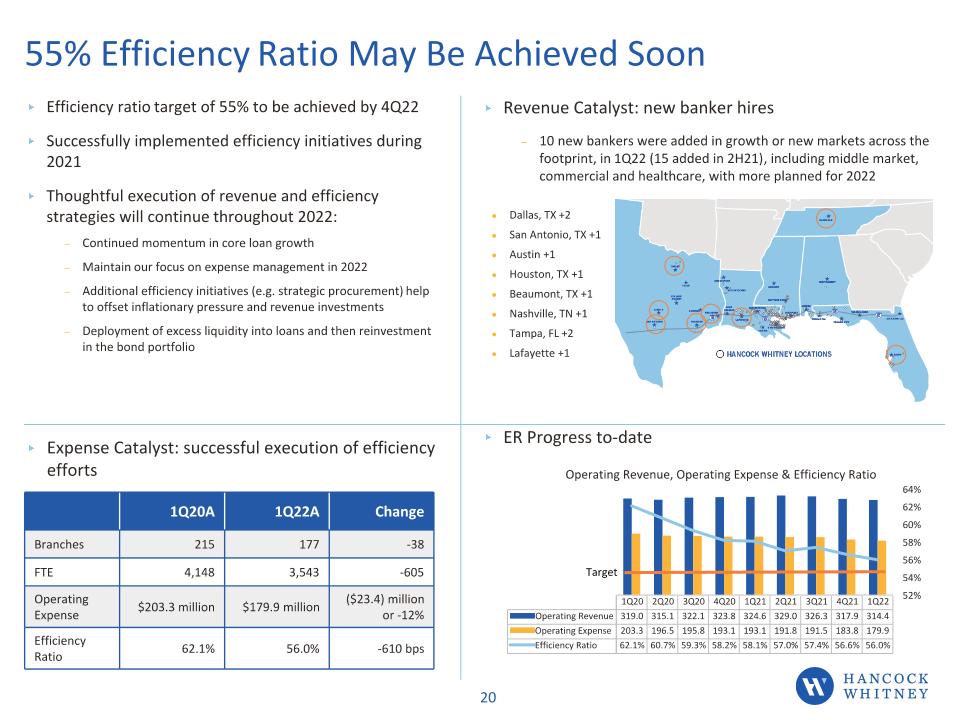

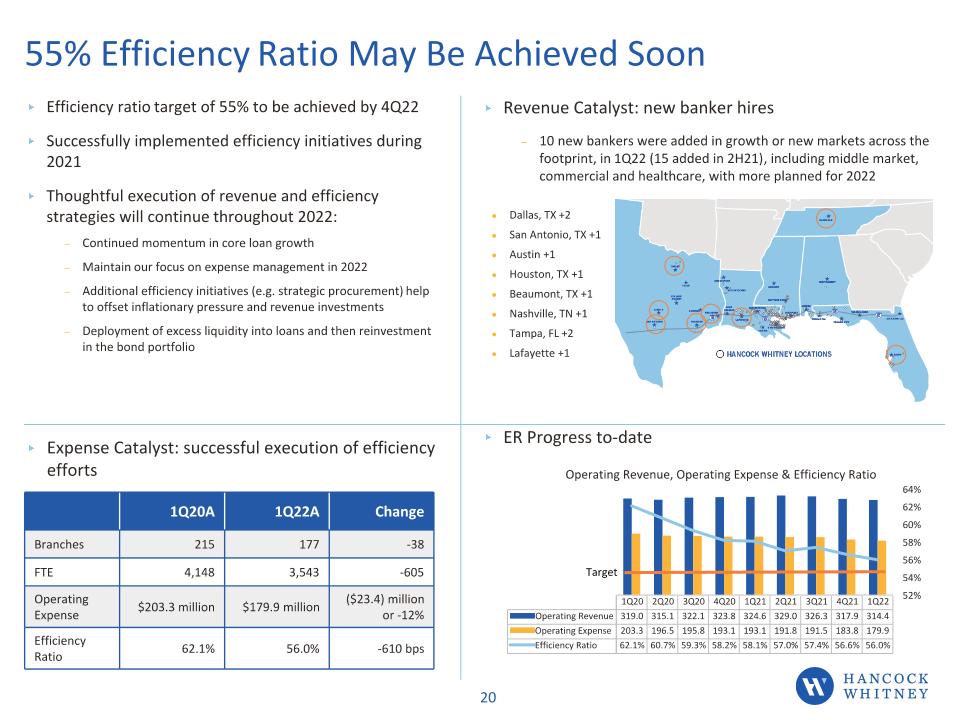

Efficiency ratio target of 55% to be achieved by 4Q22 Successfully implemented efficiency initiatives during 2021 Thoughtful execution of revenue and efficiency strategies will continue throughout 2022: Continued momentum in core loan growth Maintain our focus on expense management in 2022 Additional efficiency initiatives (e.g. strategic procurement) help to offset inflationary pressure and revenue investments Deployment of excess liquidity into loans and then reinvestment in the bond portfolio Expense Catalyst: successful execution of efficiency efforts 55% Efficiency Ratio May Be Achieved Soon Revenue Catalyst: new banker hires 10 new bankers were added in growth or new markets across the footprint, in 1Q22 (15 added in 2H21), including middle market, commercial and healthcare, with more planned for 2022 ER Progress to-date 1Q20A 1Q22A Change Branches 215 177 -38 FTE 4,148 3,543 -605 Operating Expense $203.3 million $179.9 million ($23.4) million or -12% Efficiency Ratio 62.1% 56.0% -610 bps Dallas, TX +2 San Antonio, TX +1 Austin +1 Houston, TX +1 Beaumont, TX +1 Nashville, TN +1 Tampa, FL +2 Lafayette +1 Target

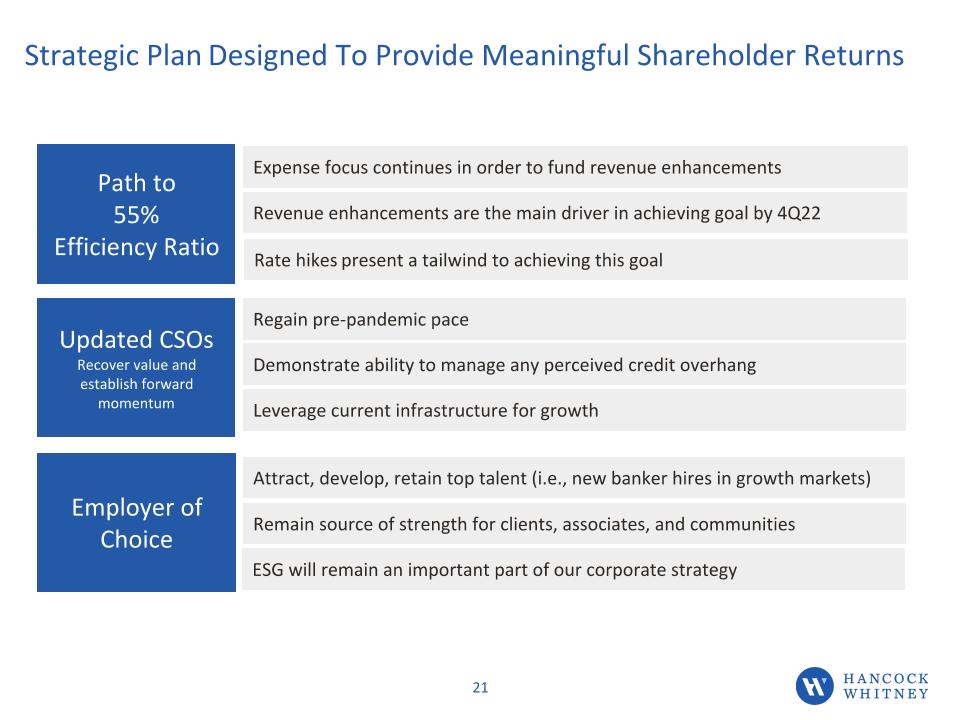

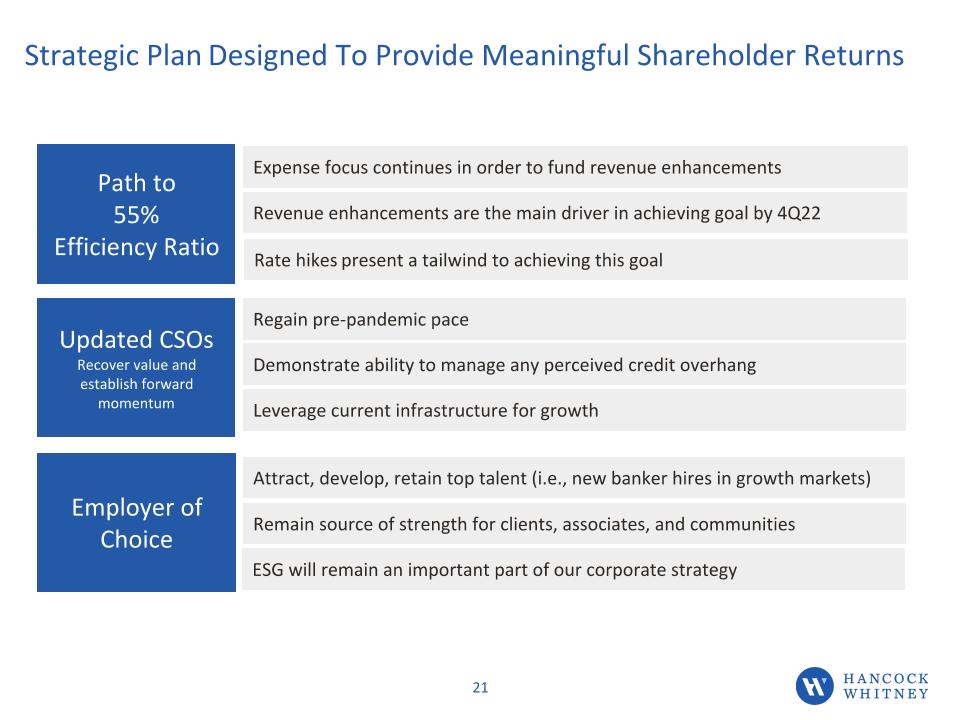

Strategic Plan Designed To Provide Meaningful Shareholder Returns Updated CSOs Recover value and establish forward momentum Employer of Choice Path to 55% �Efficiency Ratio Expense focus continues in order to fund revenue enhancements Revenue enhancements are the main driver in achieving goal by 4Q22 Leverage current infrastructure for growth Regain pre-pandemic pace Demonstrate ability to manage any perceived credit overhang Attract, develop, retain top talent (i.e., new banker hires in growth markets) Remain source of strength for clients, associates, and communities ESG will remain an important part of our corporate strategy Rate hikes present a tailwind to achieving this goal

Appendix and Non-GAAP Reconciliations Appendix and Non-GAAP Reconciliations CHANCOCK WHITNEY

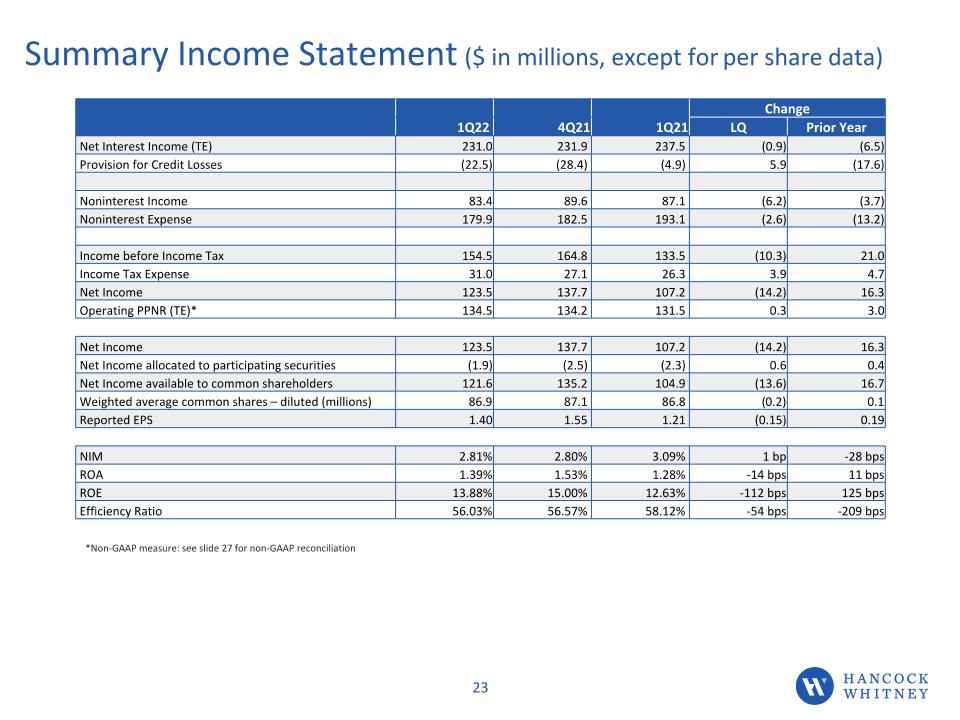

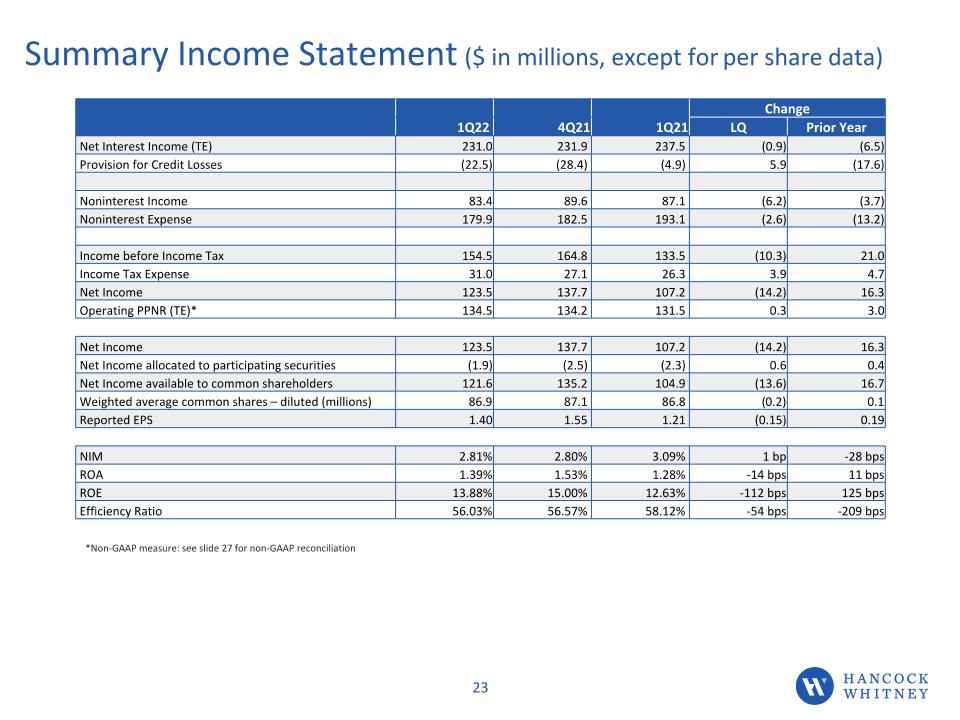

Summary Income Statement ($ in millions, except for per share data) *Non-GAAP measure: see slide 27 for non-GAAP reconciliation Change 1Q22 4Q21 1Q21 LQ Prior Year Net Interest Income (TE) 231.0 231.9 237.5 (0.9) (6.5) Provision for Credit Losses (22.5) (28.4) (4.9) 5.9 (17.6) Noninterest Income 83.4 89.6 87.1 (6.2) (3.7) Noninterest Expense 179.9 182.5 193.1 (2.6) (13.2) Income before Income Tax 154.5 164.8 133.5 (10.3) 21.0 Income Tax Expense 31.0 27.1 26.3 3.9 4.7 Net Income 123.5 137.7 107.2 (14.2) 16.3 Operating PPNR (TE)* 134.5 134.2 131.5 0.3 3.0 Net Income 123.5 137.7 107.2 (14.2) 16.3 Net Income allocated to participating securities (1.9) (2.5) (2.3) 0.6 0.4 Net Income available to common shareholders 121.6 135.2 104.9 (13.6) 16.7 Weighted average common shares – diluted (millions) 86.9 87.1 86.8 (0.2) 0.1 Reported EPS 1.40 1.55 1.21 (0.15) 0.19 NIM 2.81% 2.80% 3.09% 1 bp -28 bps ROA 1.39% 1.53% 1.28% -14 bps 11 bps ROE 13.88% 15.00% 12.63% -112 bps 125 bps Efficiency Ratio 56.03% 56.57% 58.12% -54 bps -209 bps

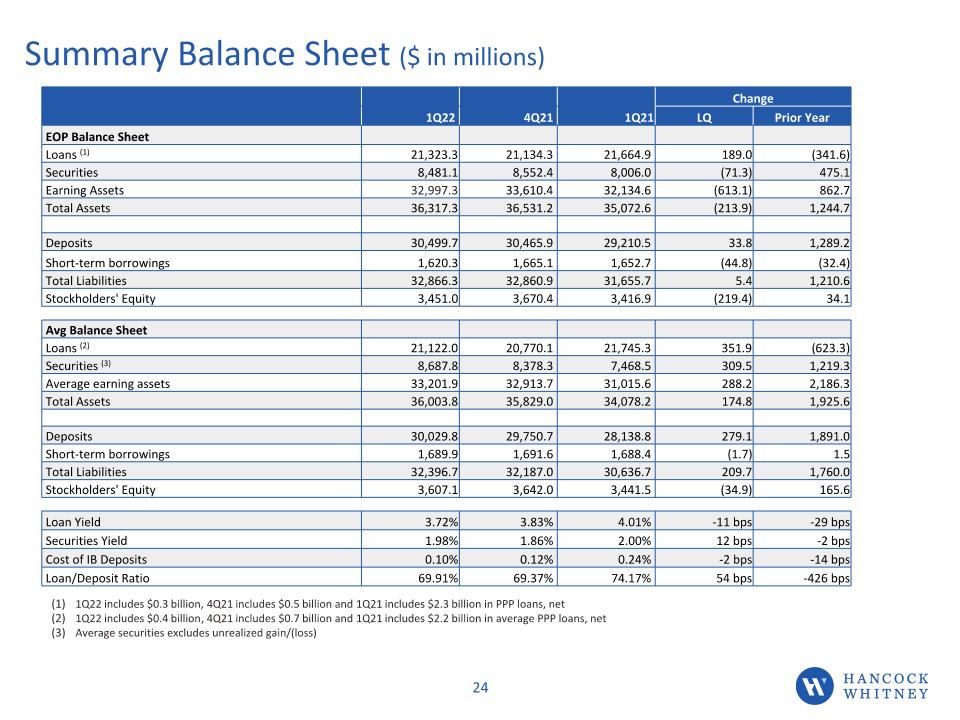

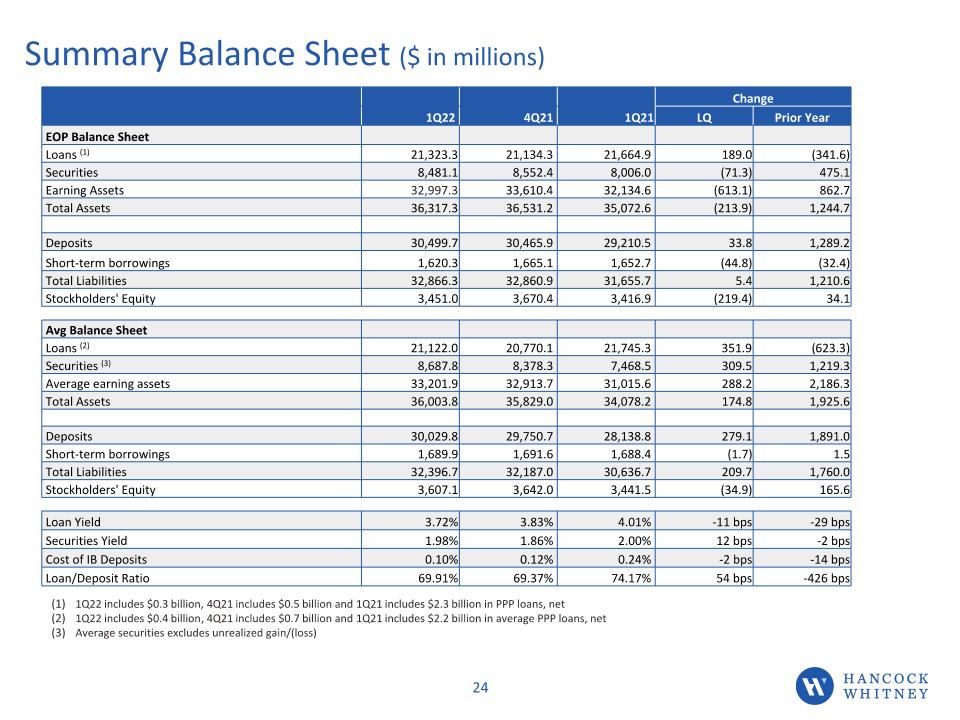

Summary Balance Sheet ($ in millions) 1Q22 includes $0.3 billion, 4Q21 includes $0.5 billion and 1Q21 includes $2.3 billion in PPP loans, net 1Q22 includes $0.4 billion, 4Q21 includes $0.7 billion and 1Q21 includes $2.2 billion in average PPP loans, net Average securities excludes unrealized gain/(loss) Summary Balance Sheet ($ in millions) 4Q20 and YTD 2020 include $2.0 billion and 3Q20 included $2.3 billion in PPP loans, net Average securities excludes unrealized gain /(loss) Change 4Q20 3Q20 4Q19 LQ PY Line Item YTD 2020 YTD 2019 Y-o-Y EOP Balance Sheet $21,789.9 $22,240.2 $21,212.8 ($450.3) $577.1 Loans (1) $21,789.9 $21,212.8 $577.1 7,356.5 7,056.3 6,243.3 300.2 1,113.2 Securities 7,356.5 6,243.3 1,113.2 30,616.3 30,179.1 27,622.2 437.2 2,994.1 Earning Assets 30,616.3 27,622.2 2,994.1 33,638.6 33,193.3 30,600.8 445.3 3,037.8 Total assets 33,638.6 30,600.8 3,037.8 $27,698.0 $27,030.7 $23,803.6 $667.3 $3,894.4 Deposits $27,698.0 $23,803.6 $3,894.4 1,667.5 1,906.9 2,714.9 (239.4) (1,047.4) Short-term borrowings 1,667.5 2,714.9 (1,047.4) 30,199.6 29,817.7 27,133.1 381.9 3,066.5 Total Liabilities 30,199.6 27,133.1 3,066.5 3,439.0 3,375.6 3,467.7 63.4 (28.7) Stockholders' Equity 3,439.0 3,467.7 (28.7) Avg Balance Sheet $22,065.7 $22,407.8 $21,037.9 ($342.1) $1,027.8 Loans $22,166.5 $20,380.0 $1,786.5 6,921.1 6,389.2 6,201.6 531.9 719.5 Securities (2) 6,398.7 5,864.2 534.5 29,875.5 29,412.3 27,441.5 463.2 2,434.0 Average earning assets 29,235.3 26,476.9 2,758.4 33,067.5 32,685.4 30,343.3 382.1 2,724.2 Total assets 32,391.0 29,125.4 3,265.6 $27,040.4 $26,763.8 $23,848.4 $276.6 $3,192.0 Deposits $26,212.3 $23,299.3 $2,913.0 1,779.5 1,733.3 2,393.4 46.2 (613.9) Short-term borrowings 1,978.2 1,942.1 36.1 29,660.8 29,333.8 26,869.6 327.0 2,791.2 Total Liabilities 28,957.9 25,822.8 3,135.1 3,406.6 3,351.6 3,473.7 55.0 (67.1) Stockholders' Equity 3,433.1 3,302.7 130.4 3.99% 3.95% 4.69% 4 bps -70 bps Loan Yield 4.13% 4.81% -68 bps 2.23% 2.31% 2.56% -8 bps -33 bps Securities Yield 2.38% 2.62% -24 bps 0.31% 0.39% 1.11% -8 bps -80 bps Cost of IB Deposits 0.57% 1.25% -68 bps 79% 82% 89% -361 bps -1045 bps Loan/Deposit Ratio (Period End) 79% 89% -1045 bps CHANCOCK WHITNEY 26 Change 1Q22 4Q21 1Q21 LQ Prior Year EOP Balance Sheet Loans (1) 21,323.3 21,134.3 21,664.9 189.0 (341.6) Securities 8,481.1 8,552.4 8,006.0 (71.3) 475.1 Earning Assets 32,997.3 33,610.4 32,134.6 (613.1) 862.7 Total Assets 36,317.3 36,531.2 35,072.6 (213.9) 1,244.7 Deposits 30,499.7 30,465.9 29,210.5 33.8 1,289.2 Short-term borrowings 1,620.3 1,665.1 1,652.7 (44.8) (32.4) Total Liabilities 32,866.3 32,860.9 31,655.7 5.4 1,210.6 Stockholders' Equity 3,451.0 3,670.4 3,416.9 (219.4) 34.1 Avg Balance Sheet Loans (2) 21,122.0 20,770.1 21,745.3 351.9 (623.3) Securities (3) 8,687.8 8,378.3 7,468.5 309.5 1,219.3 Average earning assets 33,201.9 32,913.7 31,015.6 288.2 2,186.3 Total Assets 36,003.8 35,829.0 34,078.2 174.8 1,925.6 Deposits 30,029.8 29,750.7 28,138.8 279.1 1,891.0 Short-term borrowings 1,689.9 1,691.6 1,688.4 (1.7) 1.5 Total Liabilities 32,396.7 32,187.0 30,636.7 209.7 1,760.0 Stockholders' Equity 3,607.1 3,642.0 3,441.5 (34.9) 165.6 Loan Yield 3.72% 3.83% 4.01% -11 bps -29 bps Securities Yield 1.98% 1.86% 2.00% 12 bps -2 bps Cost of IB Deposits 0.10% 0.12% 0.24% -2 bps -14 bps Loan/Deposit Ratio 69.91% 69.37% 74.17% 54 bps -426 bps

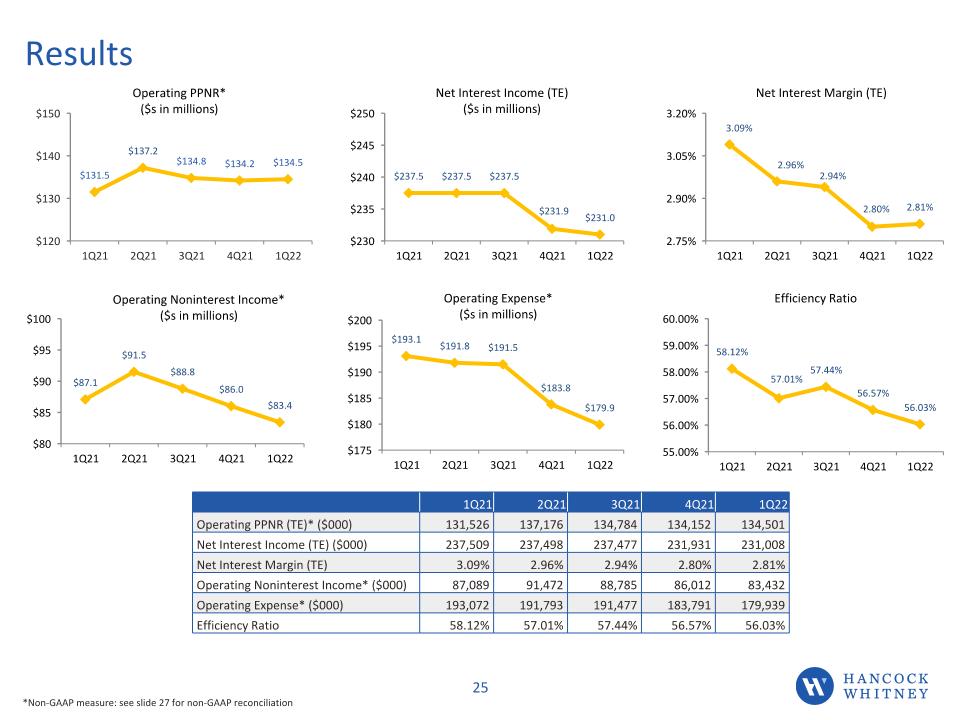

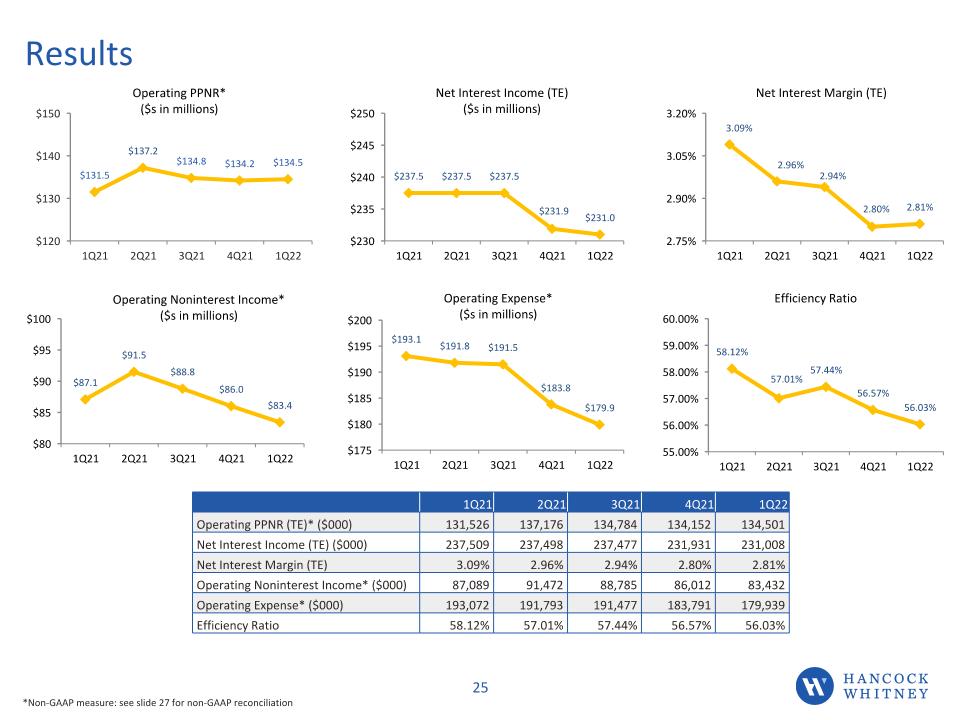

Results *Non-GAAP measure: see slide 27 for non-GAAP reconciliation 1Q21 2Q21 3Q21 4Q21 1Q22 Operating PPNR (TE)* ($000) 131,526 137,176 134,784 134,152 134,501 Net Interest Income (TE) ($000) 237,509 237,498 237,477 231,931 231,008 Net Interest Margin (TE) 3.09% 2.96% 2.94% 2.80% 2.81% Operating Noninterest Income* ($000) 87,089 91,472 88,785 86,012 83,432 Operating Expense* ($000) 193,072 191,793 191,477 183,791 179,939 Efficiency Ratio 58.12% 57.01% 57.44% 56.57% 56.03% Results *Non-GAAP measures. See slides 29-31 for non-GAAP reconciliations 4Q19 1Q20 2Q20 3Q20 4Q20 Operating PPNR (TE)* ($000) 125,660 115,688 118,518 126,346 130,607 Net Interest Income (TE)* ($000) 236,736 234,636 241,114 238,372 241,401 Net Interest Margin (TE)* 3.43% 3.41% 3.23% 3.23% 3.22% Noninterest Income ($000) 82,924 84,387 73,943 83,748 82,350 Operating Expense* ($000) 194,000 203,335 196,539 195,774 193,144 Efficiency Ratio* 58.88% 62.06% 60.74% 59.29% 58.23% CHANCOCK WHITNEY 27

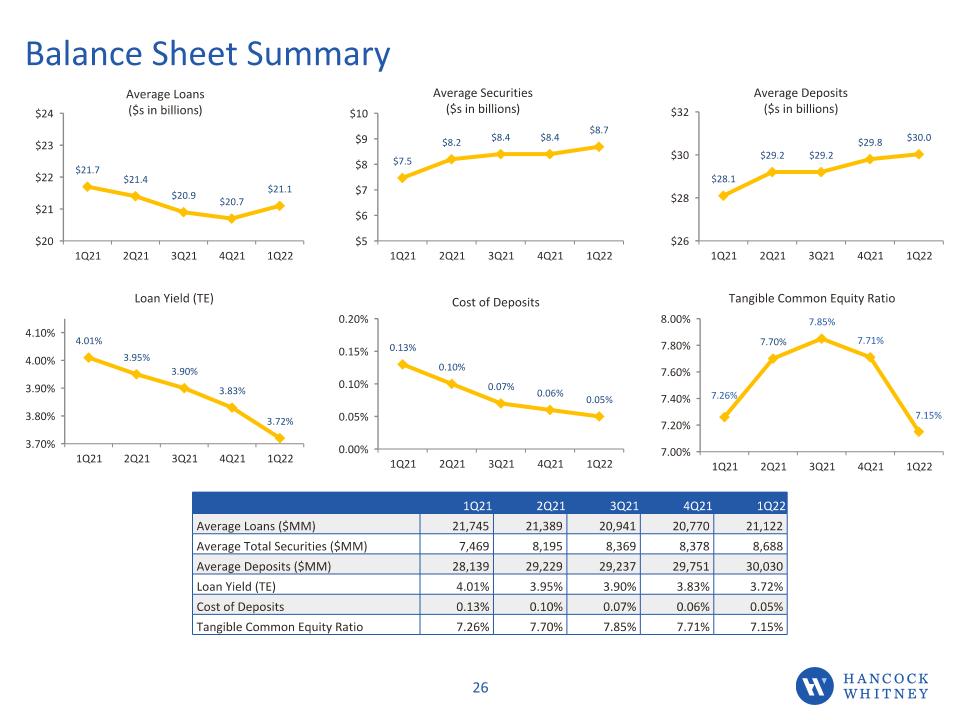

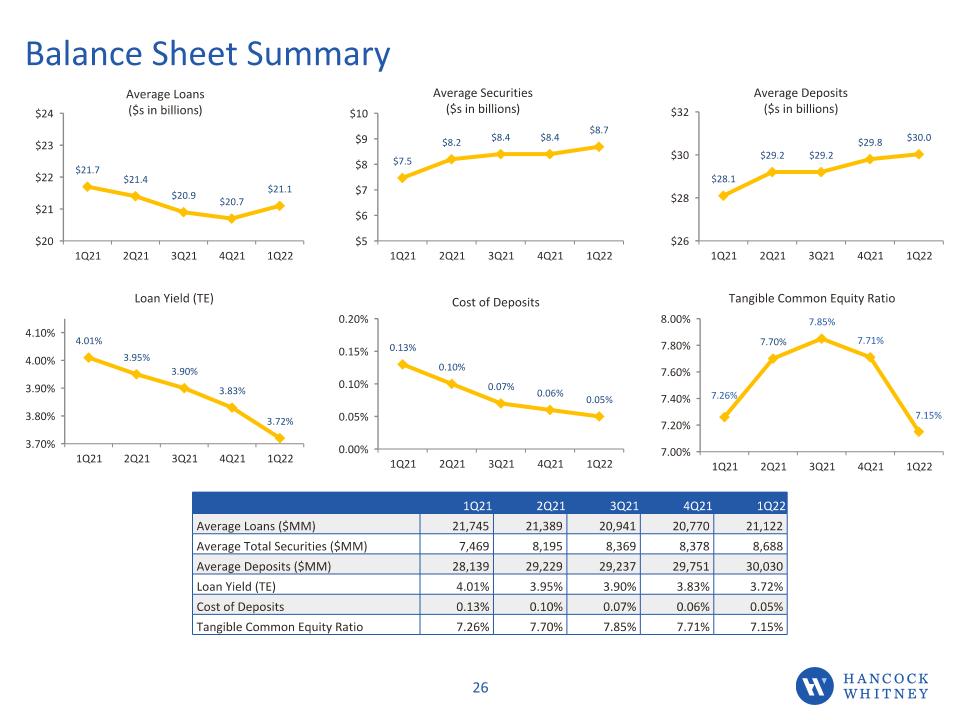

Balance Sheet Summary 1Q21 2Q21 3Q21 4Q21 1Q22 Average Loans ($MM) 21,745 21,389 20,941 20,770 21,122 Average Total Securities ($MM) 7,469 8,195 8,369 8,378 8,688 Average Deposits ($MM) 28,139 29,229 29,237 29,751 30,030 Loan Yield (TE) 4.01% 3.95% 3.90% 3.83% 3.72% Cost of Deposits 0.13% 0.10% 0.07% 0.06% 0.05% Tangible Common Equity Ratio 7.26% 7.70% 7.85% 7.71% 7.15% Balance Sheet Summary 4Q19 1Q20 2Q20 3Q20 4Q20 Average Loans ($MM) 21,038 21,234 22,957 22,408 22,066 Average Total Securities ($MM) 6,202 6,149 6,130 6,389 6,921 Average Deposits ($MM) 23,848 24,327 26,703 26,764 27,040 Loan Yield (TE) 4.69% 4.56% 4.04% 3.95% 3.99% Cost of Interest Bearing Deposits 1.11% 1.01% 0.58% 0.39% 0.31% Tangible Common Equity Ratio 8.45% 8.00% 7.33% 7.53% 7.64% CHANCOCK WHITNEY 28

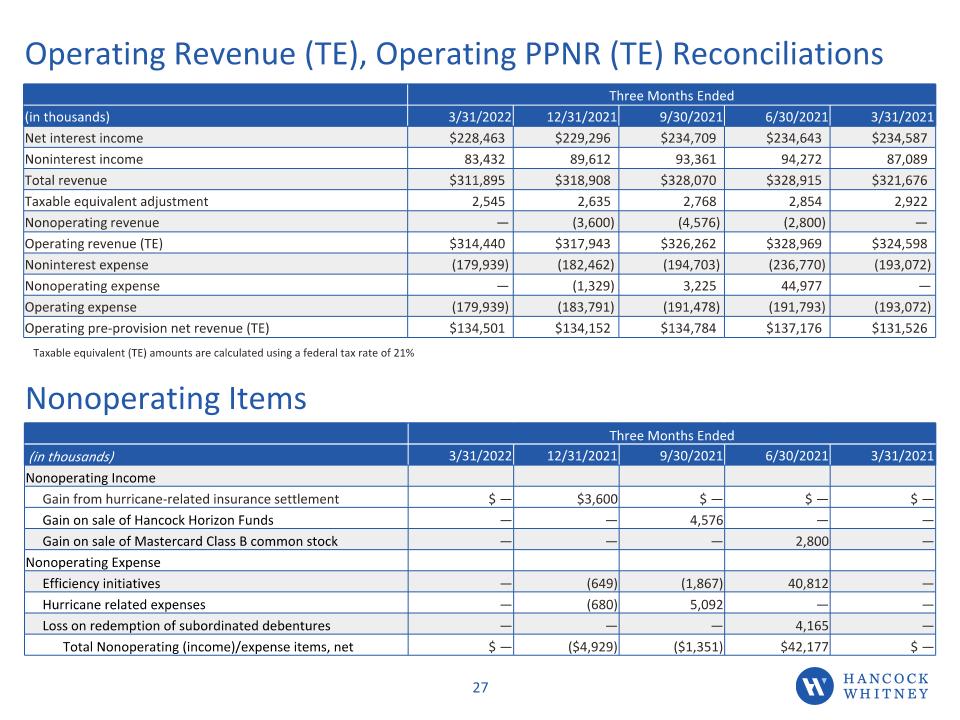

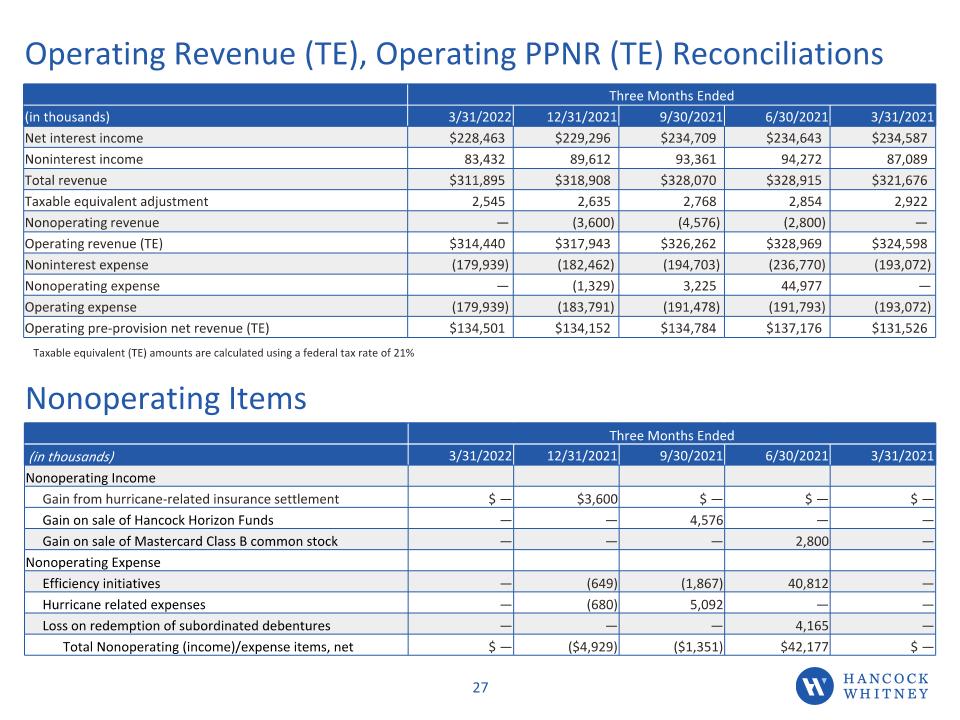

Operating Revenue (TE), Operating PPNR (TE) Reconciliations Three Months Ended (in thousands) 3/31/2022 12/31/2021 9/30/2021 6/30/2021 3/31/2021 Net interest income $228,463 $229,296 $234,709 $234,643 $234,587 Noninterest income 83,432 89,612 93,361 94,272 87,089 Total revenue $311,895 $318,908 $328,070 $328,915 $321,676 Taxable equivalent adjustment 2,545 2,635 2,768 2,854 2,922 Nonoperating revenue — (3,600) (4,576) (2,800) — Operating revenue (TE) $314,440 $317,943 $326,262 $328,969 $324,598 Noninterest expense (179,939) (182,462) (194,703) (236,770) (193,072) Nonoperating expense — (1,329) 3,225 44,977 — Operating expense (179,939) (183,791) (191,478) (191,793) (193,072) Operating pre-provision net revenue (TE) $134,501 $134,152 $134,784 $137,176 $131,526 Total Revenue (TE), Operating PPNR (TE) Reconciliations Taxable equivalent (TE) amounts are calculated using a federal income tax rate of 21%. Three Months Ended (in thousands) 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Net interest income $238,286 $235,183 $237,866 $231,188 $233,156 Noninterest income 82,350 83,748 73,943 84,387 82,924 Total revenue $320,636 $318,931 $311,809 $315,575 $316,080 Taxable equivalent adjustment 3,115 3,189 3,248 3,448 3,580 Total revenue (TE) $323,751 $322,120 $315,057 $319,023 $319,660 Noninterest expense (193,144) (195,774) (196,539) (203,335) (197,856) Nonoperating expense — — — — 3,856 Operating pre-provision net revenue $130,607 $126,346 $118,518 $115,688 $125,660 CHANCOCK WHITNEY 31 Taxable equivalent (TE) amounts are calculated using a federal tax rate of 21% Three Months Ended (in thousands) 3/31/2022 12/31/2021 9/30/2021 6/30/2021 3/31/2021 Nonoperating Income Gain from hurricane-related insurance settlement $ — $3,600 $ — $ — $ — Gain on sale of Hancock Horizon Funds — — 4,576 — — Gain on sale of Mastercard Class B common stock — — — 2,800 — Nonoperating Expense Efficiency initiatives — (649) (1,867) 40,812 — Hurricane related expenses — (680) 5,092 — — Loss on redemption of subordinated debentures — — — 4,165 — Total Nonoperating (income)/expense items, net $ — ($4,929) ($1,351) $42,177 $ — Nonoperating Items

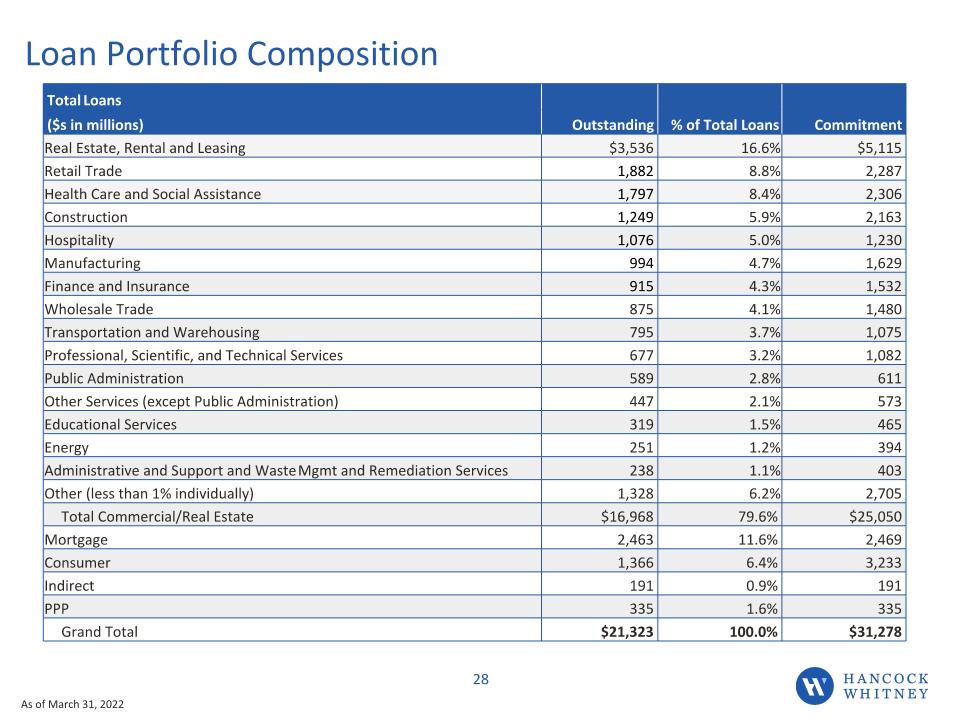

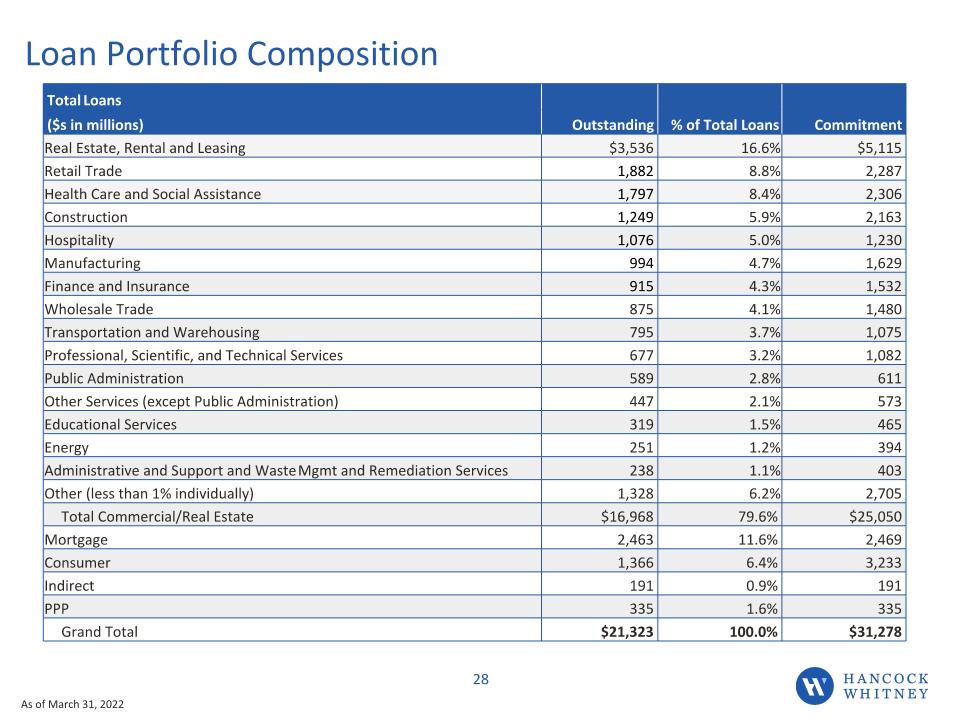

Loan Portfolio Composition As of March 31, 2022 HNCOCK WHITNEY 10 Total Loans Outstanding % of Total Loans Commitment ($s in millions) Real Estate, Rental and Leasing $3,536 16.6% $5,115 Retail Trade 1,882 8.8% 2,287 Health Care and Social Assistance 1,797 8.4% 2,306 Construction 1,249 5.9% 2,163 Hospitality 1,076 5.0% 1,230 Manufacturing 994 4.7% 1,629 Finance and Insurance 915 4.3% 1,532 Wholesale Trade 875 4.1% 1,480 Transportation and Warehousing 795 3.7% 1,075 Professional, Scientific, and Technical Services 677 3.2% 1,082 Public Administration 589 2.8% 611 Other Services (except Public Administration) 447 2.1% 573 Educational Services 319 1.5% 465 Energy 251 1.2% 394 Administrative and Support and Waste Mgmt and Remediation Services 238 1.1% 403 Other (less than 1% individually) 1,328 6.2% 2,705 Total Commercial/Real Estate $16,968 79.6% $25,050 Mortgage 2,463 11.6% 2,469 Consumer 1,366 6.4% 3,233 Indirect 191 0.9% 191 PPP 335 1.6% 335 Grand Total $21,323 100.0% $31,278

Current Hedge Positions Cash Flow (CF) Hedges Receive 152 bps/pay 1 month LIBOR on $1.3 billion $500 million of CF hedges terminated in 3Q21 will provide NII support of $16.7 million in 2022 and 2023 collectively No additional CF hedges were terminated in 1Q22 Total Termination Value on remaining active CF Hedges is approximately ($34.3) million as of 3/31/22 $425 million of existing CF hedges will mature over the course of 2022 Fair Value (FV) Hedges $1.9 billion in securities are hedged with $1.7 billion of FV hedges Duration (Market Price Risk) reduced from approximately 7.5 to 3.3 on hedged securities Current Termination Value of FV hedges is approximately $60.7 million at 3/31/2022 FV hedges become fully effective beginning October 2023 through July 2026; at that point we pay fixed 1.32% and receive the fed fund effective rate (resulting in these bonds being a variable rate of FF plus 34 bps) When FV hedges are terminated, the value of each hedge is an adjustment to the book value of the underlying security; thereby changing its current book yield and extending its duration

First Quarter 2022�Earnings Conference Call 4/19/2022 HANCOCK WHITNEY