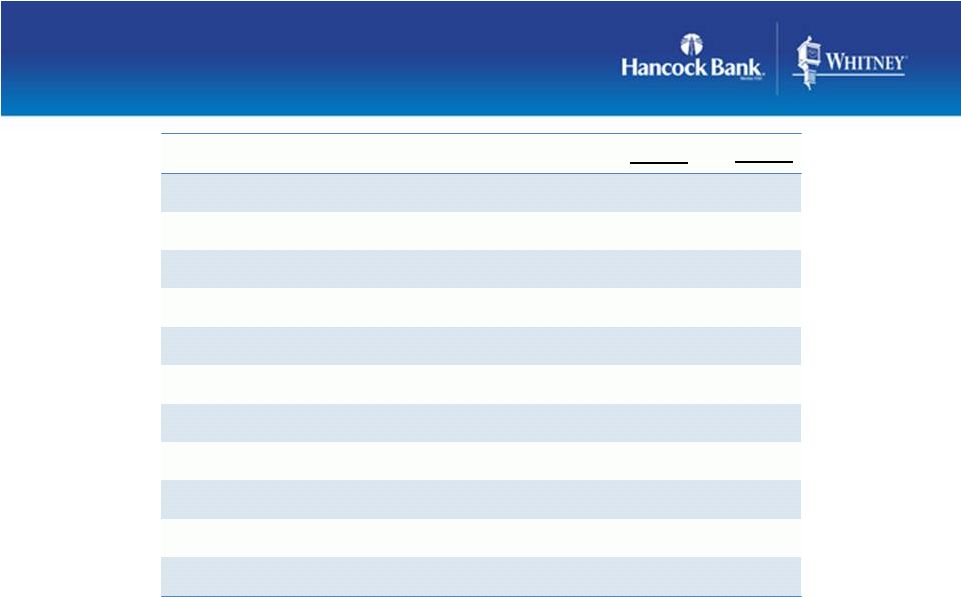

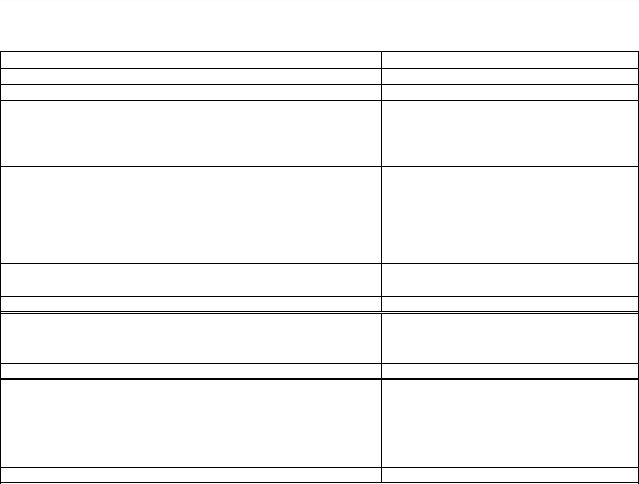

Non-GAAP Reconciliation Non-GAAP Non-GAAP Reconciliation Reconciliation (amounts in thousands) (unaudited) 3/31/2012 12/31/2011 3/31/2011 Income Statement Interest income $191,716 $196,500 $82,533 Interest income (TE) 194,665 199,453 85,405 Interest expense 15,428 18,131 15,769 Net interest income (TE) 179,237 181,322 69,636 Provision for loan losses 10,015 11,512 8,822 Noninterest income excluding securities transactions 61,494 60,592 34,183 Securities transactions gains/(losses) 12 (20) (51) Noninterest expense 205,463 205,610 73,019 Income before income taxes 22,316 21,819 19,055 Income tax expense 3,821 2,854 3,727 Net income $18,495 $18,965 $15,328 Merger-related expenses 33,913 40,202 1,588 Securities transactions gains/(losses) 12 (20) (51) Taxes on adjustments 11,865 14,078 574 Operating income (a) $40,531 $45,109 $16,393 Difference between interest income and interest income (TE) $2,949 $2,953 $2,872 Provision for loan losses 10,015 11,512 8,822 Merger-related expenses 33,913 40,202 1,588 Less securities transactions gains/(losses) 12 (20) (51) Income tax expense 3,821 2,854 3,727 Pre-tax, pre-provision profit (PTPP) (b) $69,181 $76,506 $32,388 Three Months Ended (a) Net income less tax-effected merger costs and securities gains/losses. Management believes that this is a useful financial measure because it enables investors to assess ongoing operations. (b) Pre-tax pre-provision profit (PTPP) is total revenue less noninterest expense, merger items, and securities transactions. Management believes that PTPP profit is a useful financial measure because it enables investors and others to assess the Company’s ability to generate capital to cover credit losses through a credit cycle. 24 |