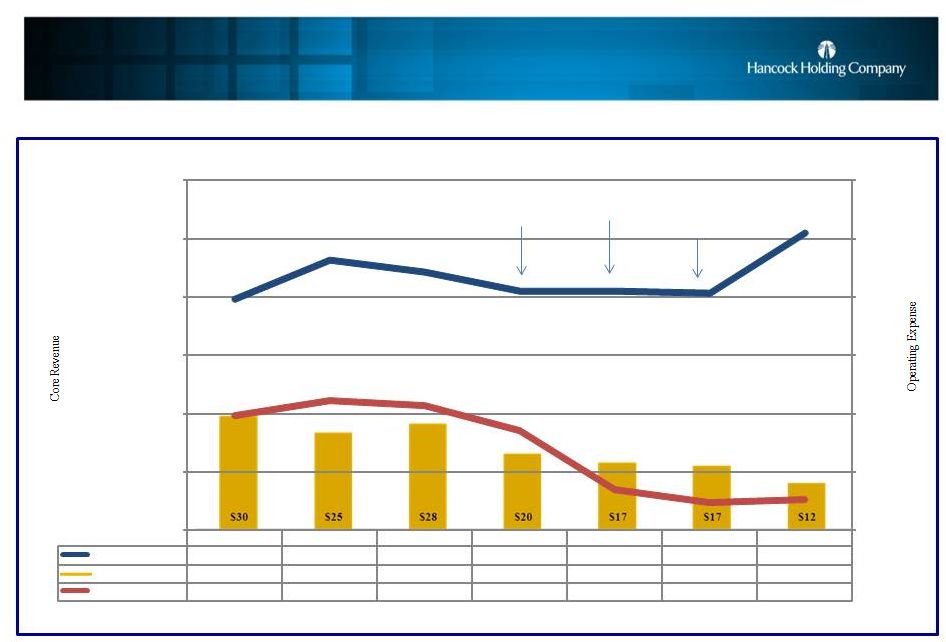

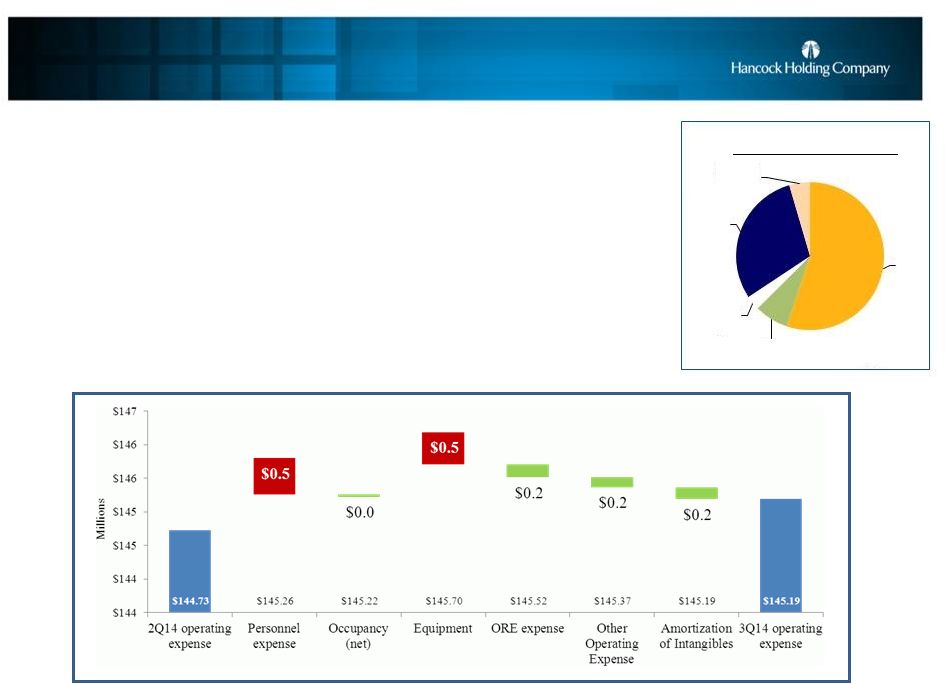

Third Quarter 2014 Highlights • Operating income $49.1 million or $.59 per diluted common share, flat linked-quarter • Core income $41.2 million or $.49 per diluted common share, up 6.5% linked-quarter • Net loan growth of $488 million, or 16%, linked-quarter annualized; approximately $1.7 billion, or 15%, year-over- year loan growth (each excluding the FDIC-covered portfolio) • Net deposit growth of $491 million, or 13% linked-quarter annualized; completely funding the loan growth in the third quarter • An increase of $5 million in core revenue offset a $5 million decline in purchase accounting revenue • Operating expenses remained relatively stable and below the targeted expense goal for 4Q14 • Solid capital levels with a tangible common equity (TCE) ratio of 9.10%; approximately $10 million of capital used to repurchase stock during the quarter • Return on average assets (ROA) (operating) 1.00% down 4bps; core ROA up 2bps; total assets grew to $20 billion from 2Q14 Operating income is defined as net income excluding tax-effected securities transactions gains or losses and nonoperating expense items. * Core is defined as operating results less purchase accounting adjustments. See table on slide 24. ** Noninterest expense to total revenue (TE) excluding amortization of purchased intangibles, nonoperating expense items, and securities transactions. ($s in millions; except per share data) 3Q14 2Q14 LQ change Operating Income $49.1 $49.6 -1% Earnings Per Share (diluted) - operating $.59 $.59 --- Net Income $46.6 $40.0 +16.5% Earnings Per Share (diluted) $.56 $.48 +16.7% Nonoperating expense items $3.9 $12.1 n/m Return on Assets (operating) (%) 1.00 1.04 -4bps Return on Tangible Common Equity (operating) (%) 11.28 11.75 -47bps Total Loans (excluding covered loans) $13,068 $12,580 +4% Net Interest Margin (%) 3.81 3.99 -18bps Net Interest Margin (%) (core)* 3.32 3.35 -3bps Net Charge-offs (%) (non-covered) 0.19 0.13 +6bps Tangible Common Equity (%) 9.10 9.29 -19bps Efficiency Ratio** (%) 61.84 61.67 +17bps 4 |