February 11, 2015 NASDAQ: CAC 1

Safe Harbor Statement The information presented may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based upon current beliefs and expectations and are subject to significant risks and uncertainties some of which are beyond Camden National Corporation’s control. Actual results may differ materially from the results discussed in these forward-looking statements. Certain factors that could cause Camden National Corporation’s results to differ materially can be found in the risk factors set forth in Camden National Corporation’s Annual Report on Form 10-K for the year ended December 31, 2013, as updated by Camden National Corporation’s Quarterly Reports on Form 10-Q and other filings with the SEC. Camden National Corporation does not have any obligation to update forward-looking statements. 2

Camden National Corporation Camden National Corporation is a Maine-based community bank focused on delivering long- term shareholder value through banking, brokerage and wealth management services in Maine, New Hampshire and select markets of Northern New England. 3

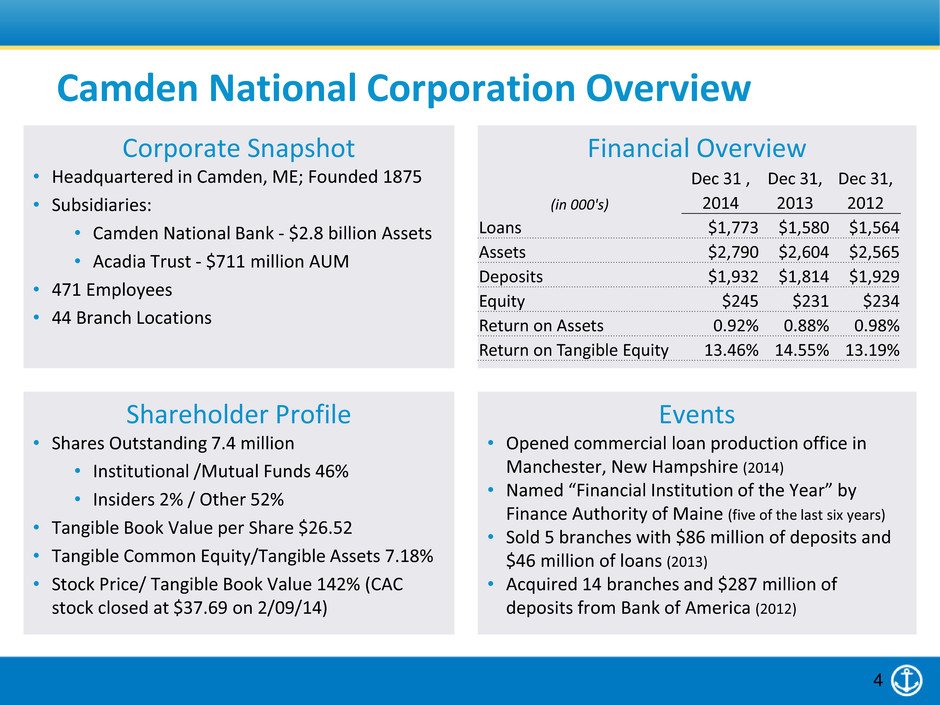

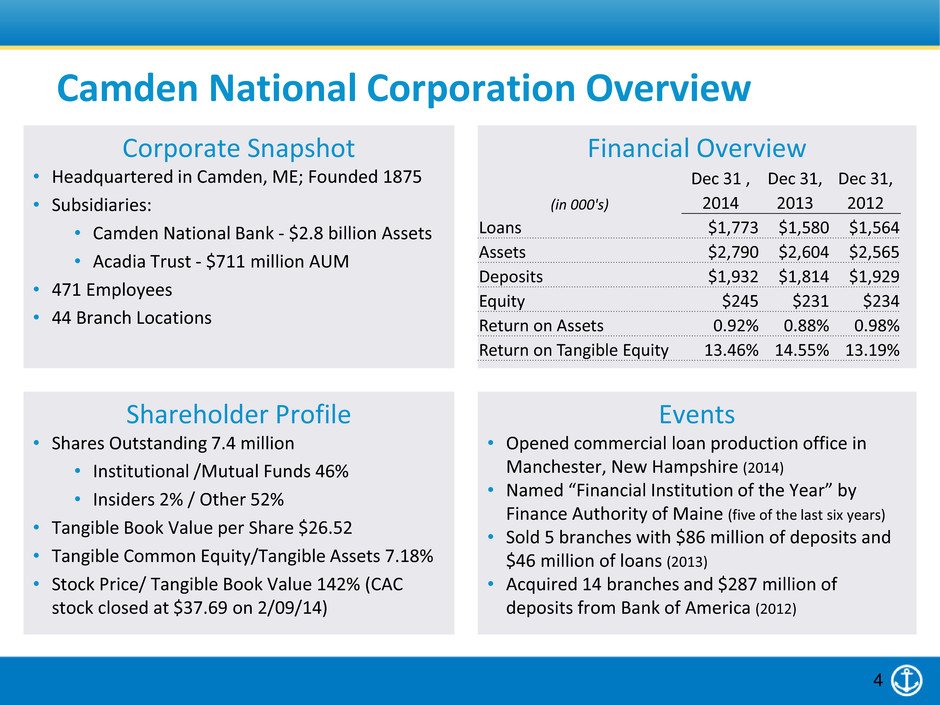

Camden National Corporation Overview Corporate Snapshot • Headquartered in Camden, ME; Founded 1875 • Subsidiaries: • Camden National Bank - $2.8 billion Assets • Acadia Trust - $711 million AUM • 471 Employees • 44 Branch Locations Financial Overview Shareholder Profile • Shares Outstanding 7.4 million • Institutional /Mutual Funds 46% • Insiders 2% / Other 52% • Tangible Book Value per Share $26.52 • Tangible Common Equity/Tangible Assets 7.18% • Stock Price/ Tangible Book Value 142% (CAC stock closed at $37.69 on 2/09/14) Events • Opened commercial loan production office in Manchester, New Hampshire (2014) • Named “Financial Institution of the Year” by Finance Authority of Maine (five of the last six years) • Sold 5 branches with $86 million of deposits and $46 million of loans (2013) • Acquired 14 branches and $287 million of deposits from Bank of America (2012) Dec 31 , Dec 31, Dec 31, (in 000's) 2014 2013 2012 Loans $1,773 $1,580 $1,564 Assets $2,790 $2,604 $2,565 Deposits $1,932 $1,814 $1,929 Equity $245 $231 $234 Return on Assets 0.92% 0.88% 0.98% Return on Tangible Equity 13.46% 14.55% 13.19% 4

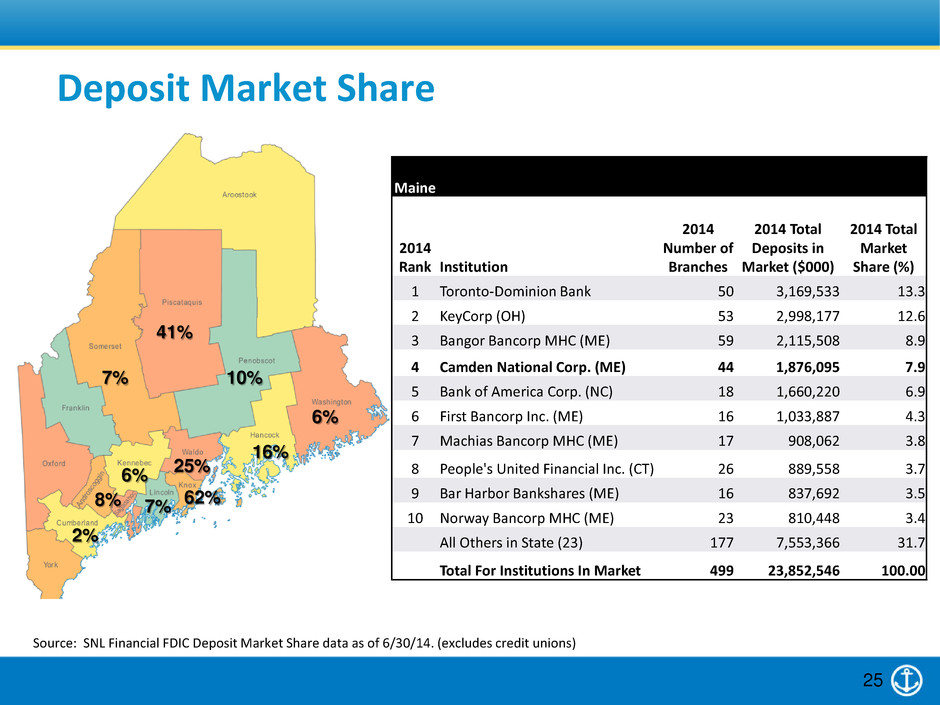

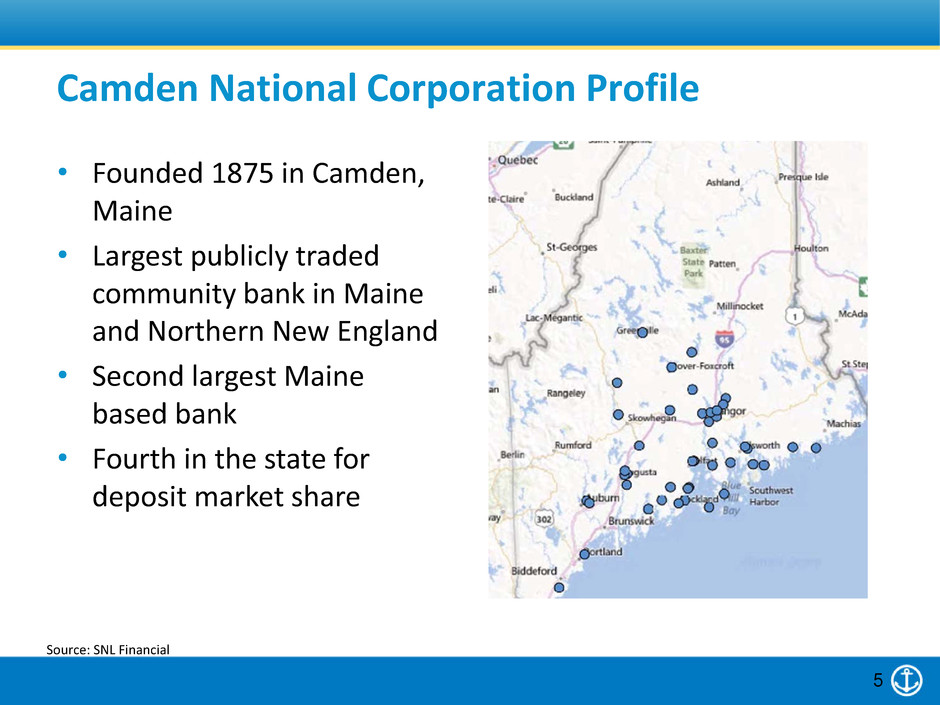

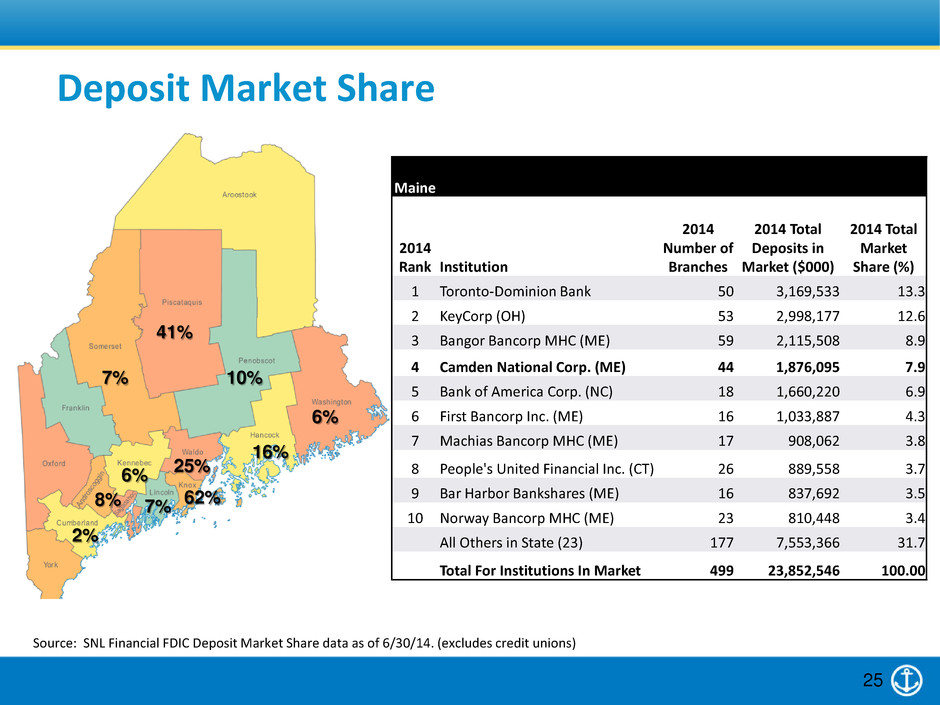

Camden National Corporation Profile • Founded 1875 in Camden, Maine • Largest publicly traded community bank in Maine and Northern New England • Second largest Maine based bank • Fourth in the state for deposit market share Source: SNL Financial 5

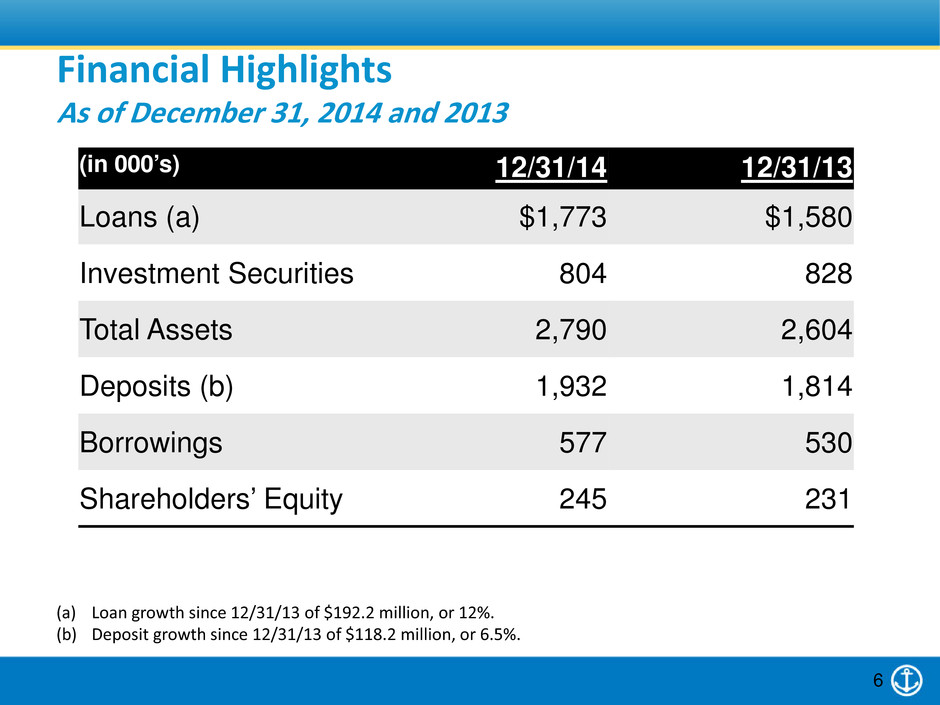

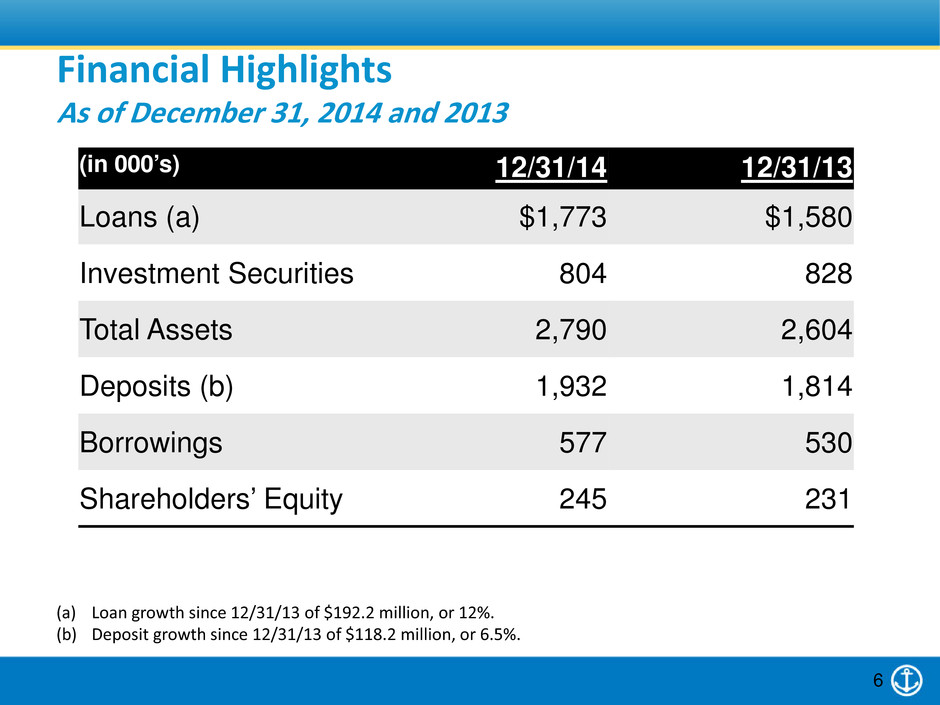

(in 000’s) 12/31/14 12/31/13 Loans (a) $1,773 $1,580 Investment Securities 804 828 Total Assets 2,790 2,604 Deposits (b) 1,932 1,814 Borrowings 577 530 Shareholders’ Equity 245 231 (a) Loan growth since 12/31/13 of $192.2 million, or 12%. (b) Deposit growth since 12/31/13 of $118.2 million, or 6.5%. Financial Highlights As of December 31, 2014 and 2013 6

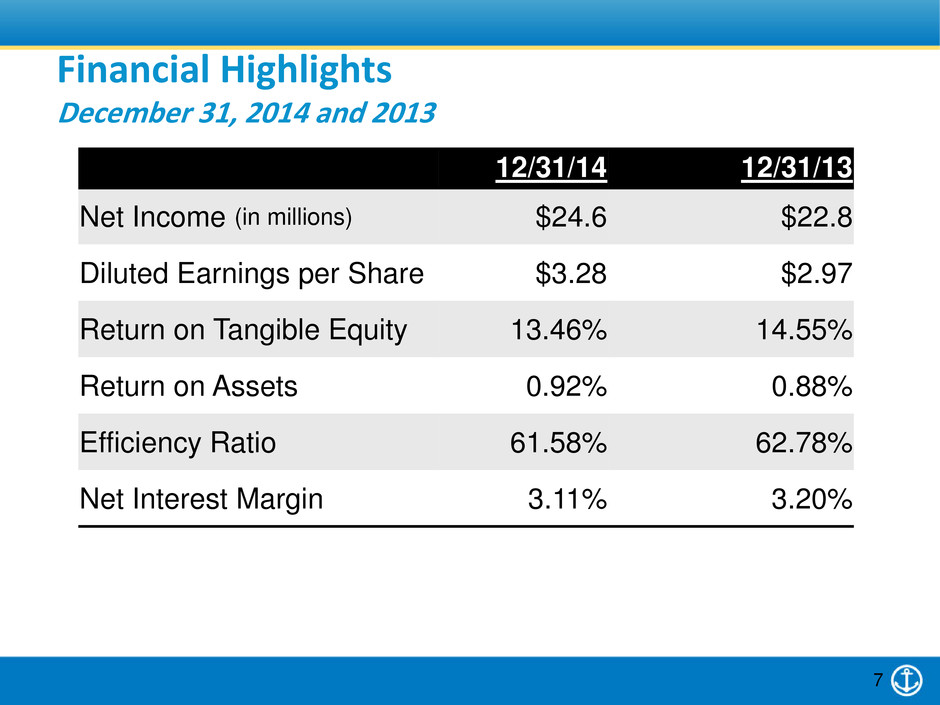

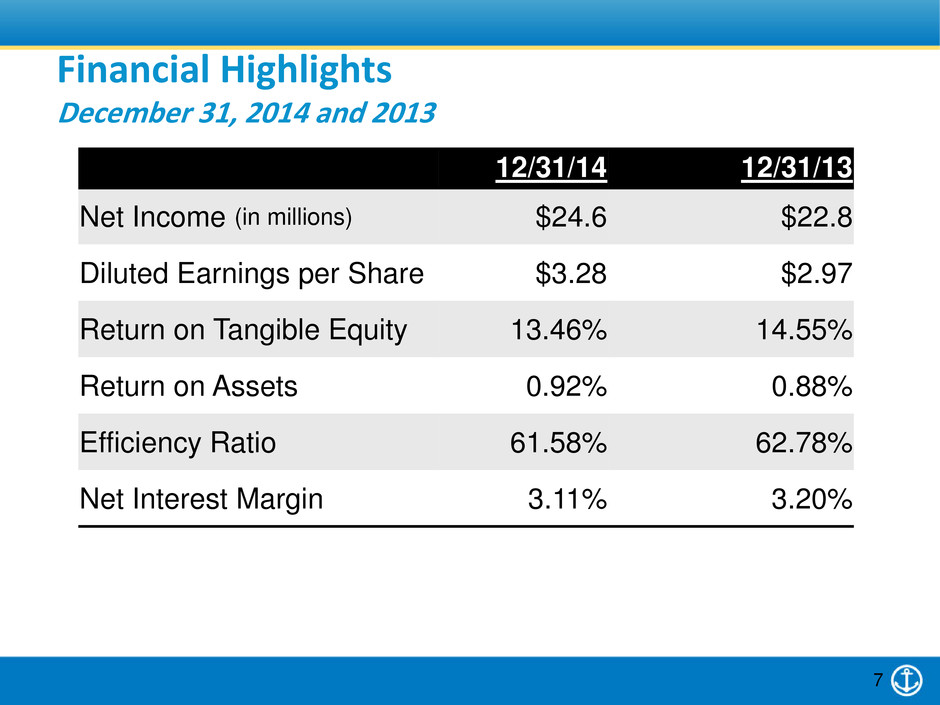

12/31/14 12/31/13 Net Income (in millions) $24.6 $22.8 Diluted Earnings per Share $3.28 $2.97 Return on Tangible Equity 13.46% 14.55% Return on Assets 0.92% 0.88% Efficiency Ratio 61.58% 62.78% Net Interest Margin 3.11% 3.20% Financial Highlights December 31, 2014 and 2013 7

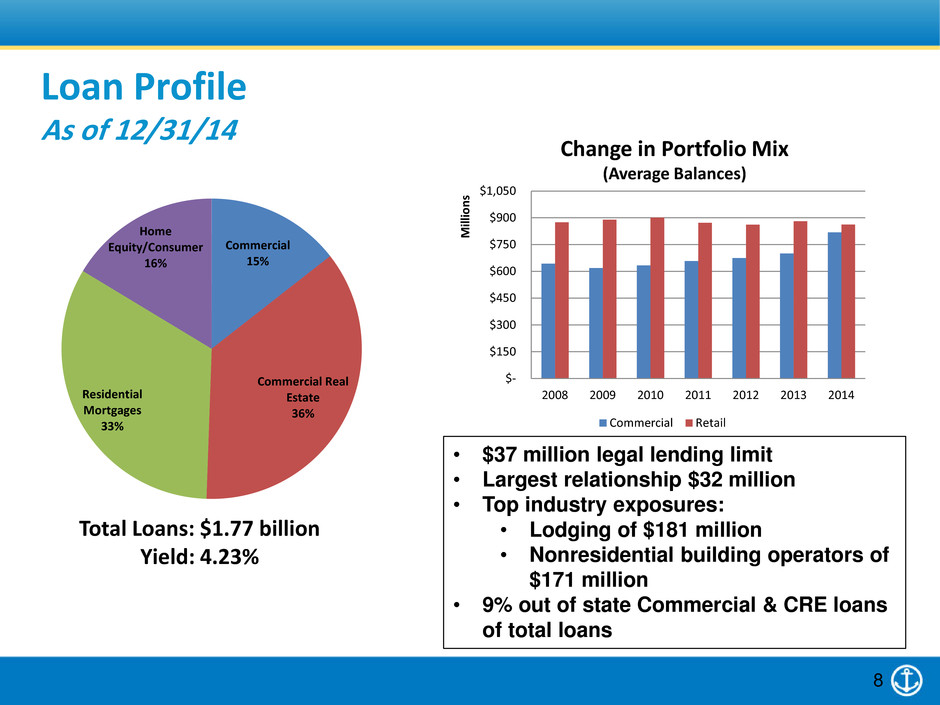

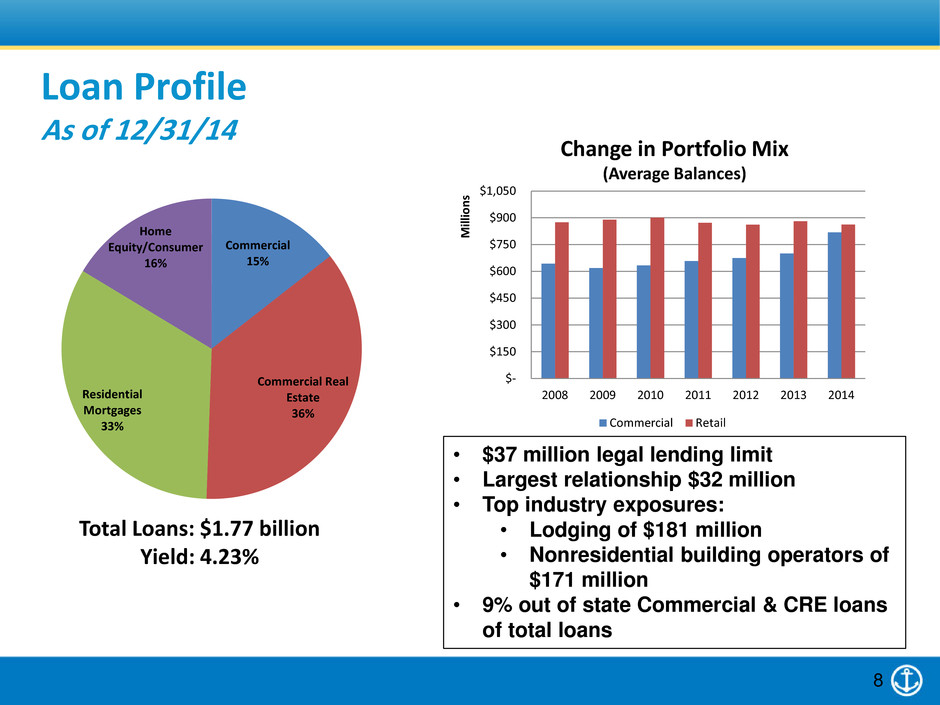

Total Loans: $1.77 billion Yield: 4.23% Loan Profile As of 12/31/14 • $37 million legal lending limit • Largest relationship $32 million • Top industry exposures: • Lodging of $181 million • Nonresidential building operators of $171 million • 9% out of state Commercial & CRE loans of total loans Change in Portfolio Mix (Average Balances) 8 Commercial 15% Commercial Real Estate 36% Residential Mortgages 33% Home Equity/Consumer 16% $- $150 $300 $450 $600 $750 $900 $1,050 2008 2009 2010 2011 2012 2013 2014 M ill io ns Commercial Retail

Portfolio Stats Market Value $783 Million Average Yield 2.25% Duration 3.52 Years Premium $8.9 Million Premium as % of Portfolio 1.14% Investment Portfolio As of 12/31/14 Excludes FRB/FHLB stock of $20 million 9 MBS 48% Agency CMO 45% Municipals 6% Non-Agency 1% Book Value - $784 Million

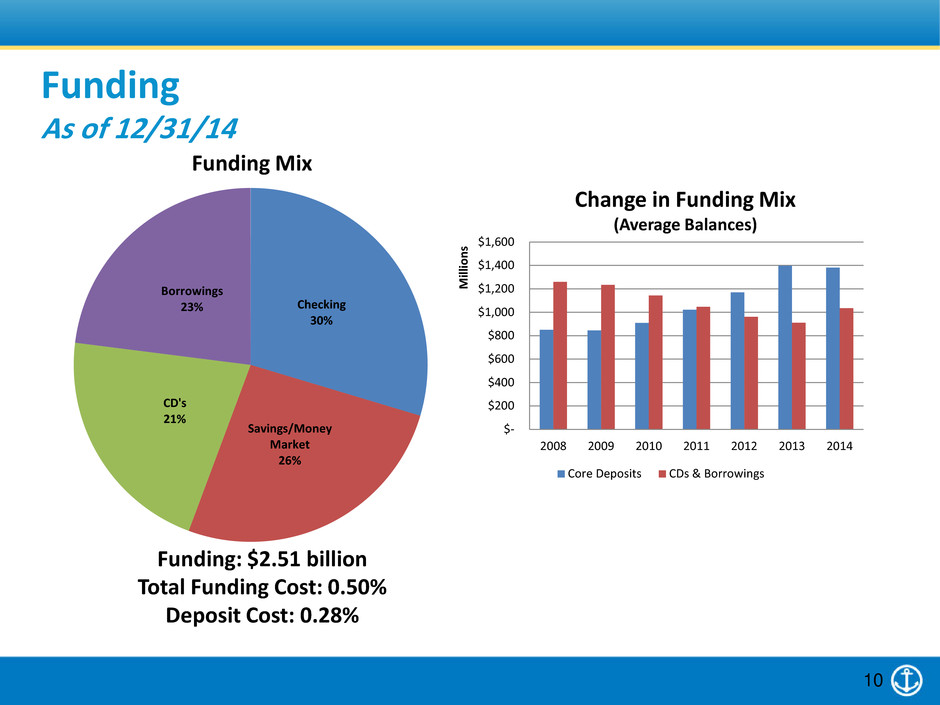

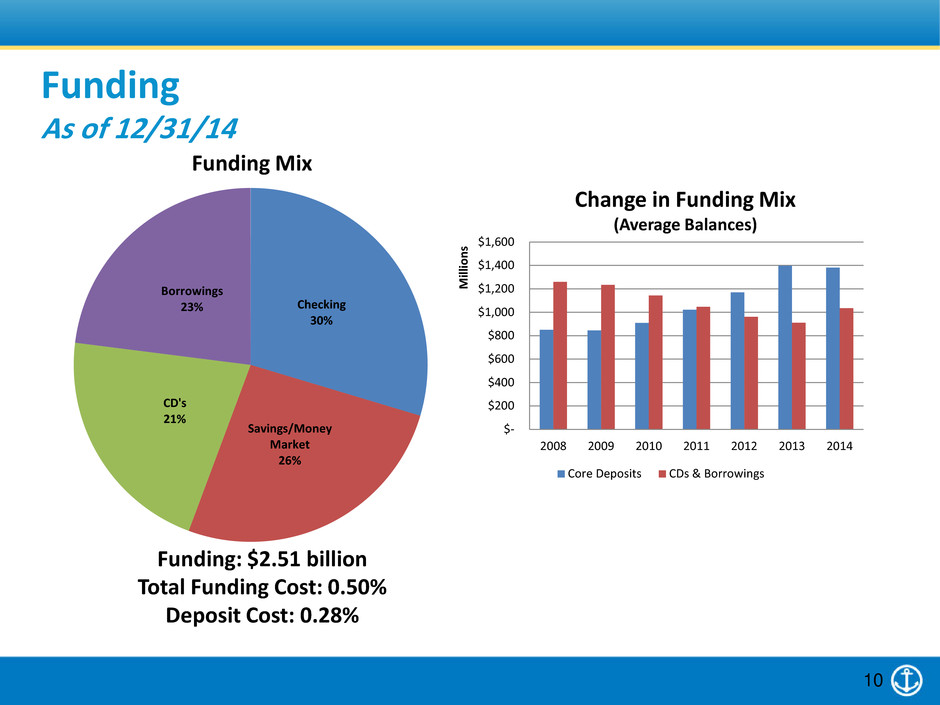

Funding: $2.51 billion Total Funding Cost: 0.50% Deposit Cost: 0.28% Funding As of 12/31/14 Change in Funding Mix (Average Balances) 10 Checking 30% Savings/Money Market 26% CD's 21% Borrowings 23% Funding Mix $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2008 2009 2010 2011 2012 2013 2014 M ill io ns Core Deposits CDs & Borrowings

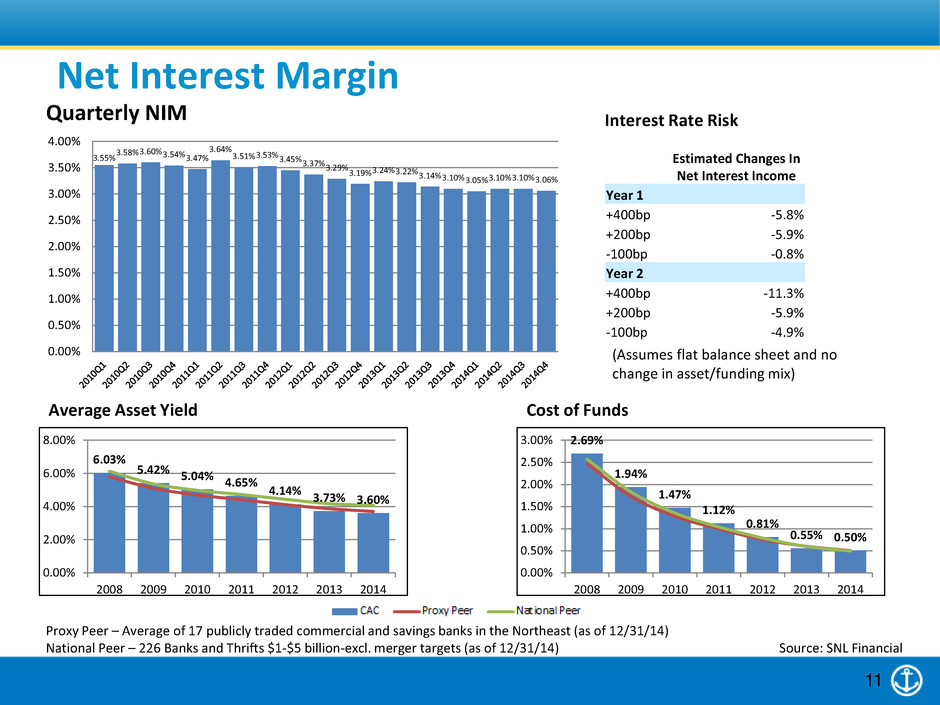

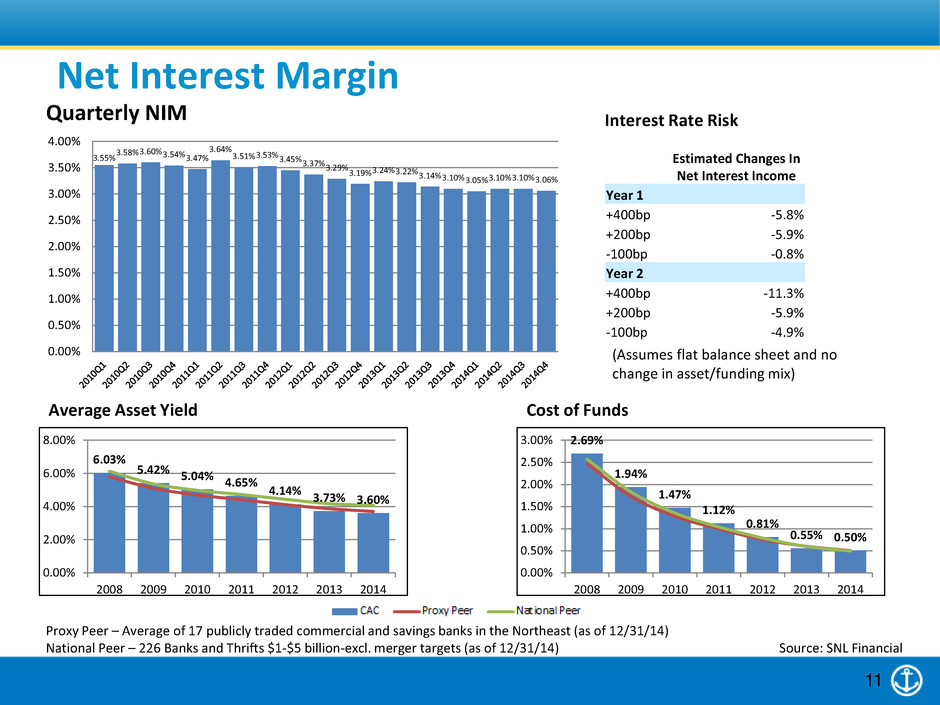

Net Interest Margin Cost of Funds Average Asset Yield Proxy Peer – Average of 17 publicly traded commercial and savings banks in the Northeast (as of 12/31/14) National Peer – 226 Banks and Thrifts $1-$5 billion-excl. merger targets (as of 12/31/14) Source: SNL Financial Interest Rate Risk (Assumes flat balance sheet and no change in asset/funding mix) 11 3.55% 3.58% 3.60% 3.54% 3.47% 3.64% 3.51% 3.53% 3.45% 3.37% 3.29% 3.19% 3.24% 3.22% 3.14% 3.10% 3.05% 3.10% 3.10% 3.06% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% Quarterly NIM 6.03% 5.42% 5.04% 4.65% 4.14% 3.73% 3.60% 0.00% 2.00% 4.00% 6.00% 8.00% 2008 2009 2010 2011 2012 2013 2014 2.69% 1.94% 1.47% 1.12% 0.81% 0.55% 0.50% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 2008 2009 2010 2011 2012 2013 2014 Estimated Changes In Net Interest Income Year 1 +400bp -5.8% +200bp -5.9% -100bp -0.8% Year 2 +400bp -11.3% +200bp -5.9% -100bp -4.9%

Why Camden National? • Earnings power and capital generation to fund growth • Successful record of acquired and organic growth • Disciplined risk management • Strategic repositioning for future shareholder value • Long-term value and return to shareholders 12

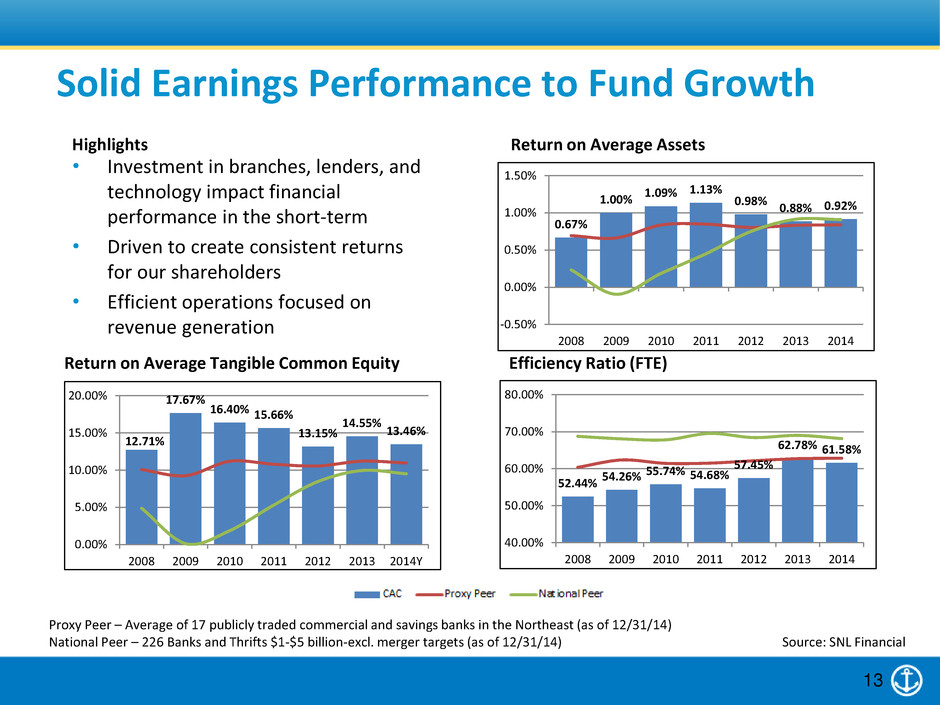

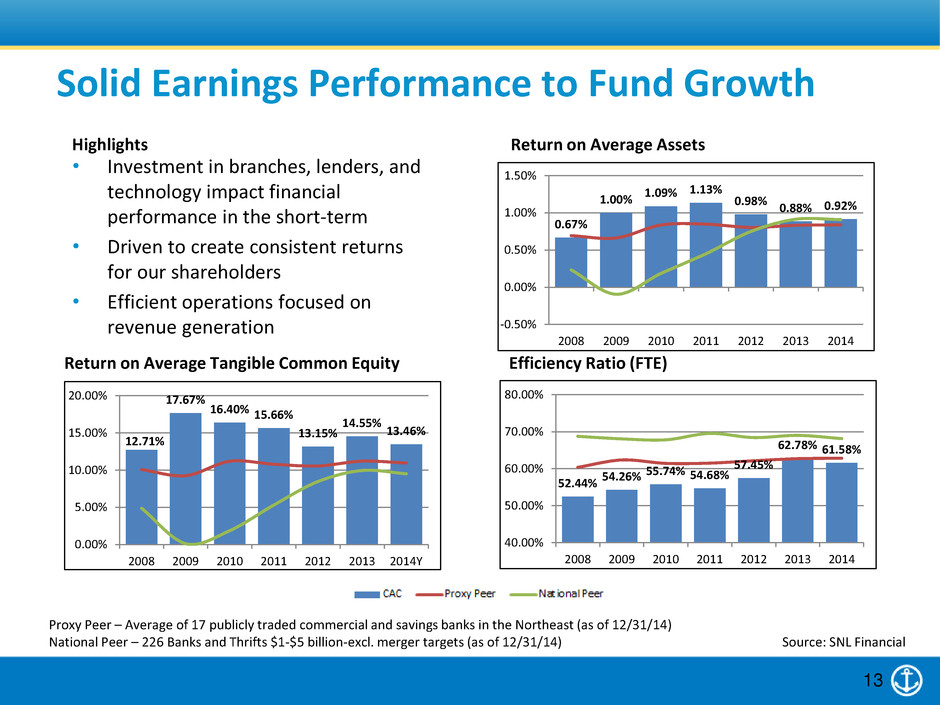

Solid Earnings Performance to Fund Growth • Investment in branches, lenders, and technology impact financial performance in the short-term • Driven to create consistent returns for our shareholders • Efficient operations focused on revenue generation Proxy Peer – Average of 17 publicly traded commercial and savings banks in the Northeast (as of 12/31/14) National Peer – 226 Banks and Thrifts $1-$5 billion-excl. merger targets (as of 12/31/14) Source: SNL Financial Highlights Return on Average Assets Return on Average Tangible Common Equity Efficiency Ratio (FTE) 13 0.67% 1.00% 1.09% 1.13% 0.98% 0.88% 0.92% -0.50% 0.00% 0.50% 1.00% 1.50% 2008 2009 2010 2011 2012 2013 2014 52.44% 54.26% 55.74% 54.68% 57.45% 62.78% 61.58% 40.00% 50.00% 60.00% 70.00% 80.00% 2008 2009 2010 2011 2012 2013 2014 12.71% 17.67% 16.40% 15.66% 13.15% 14.55% 13.46% 0.00% 5.00% 10.00% 15.00% 20.00% 2008 2009 2010 2011 2012 2013 2014Y

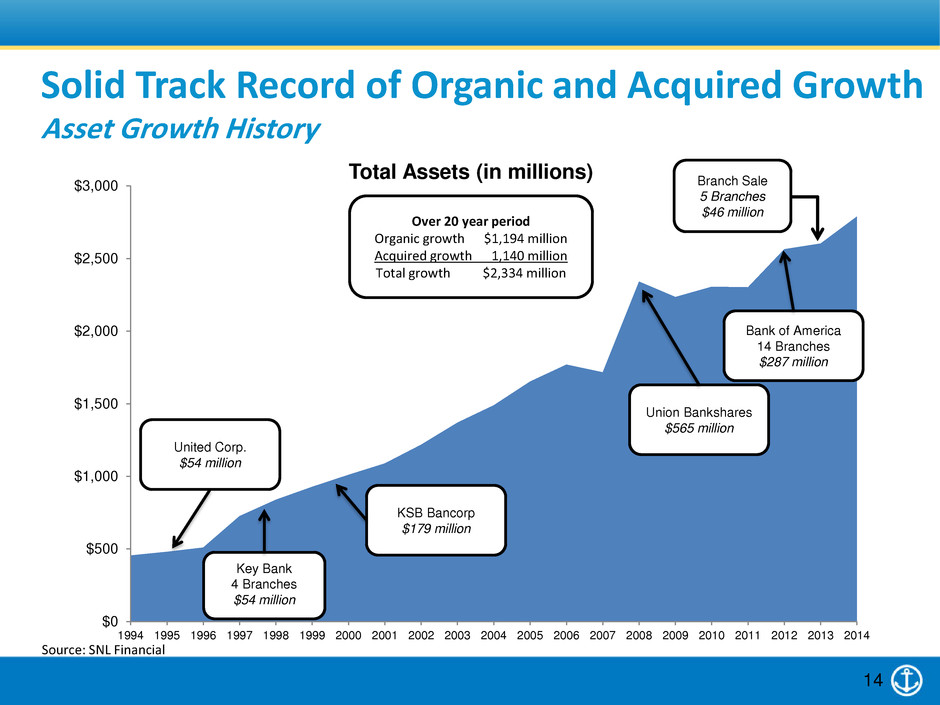

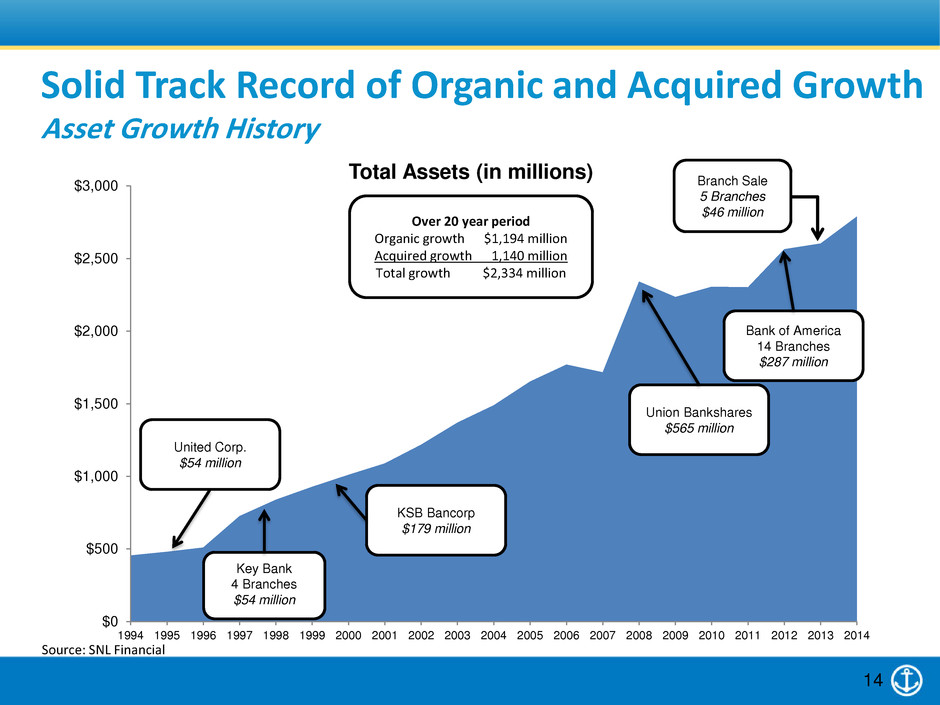

Solid Track Record of Organic and Acquired Growth Asset Growth History Source: SNL Financial 14 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Total Assets (in millions) United Corp. $54 million KSB Bancorp $179 million Union Bankshares $565 million Bank of America 14 Branches $287 million Branch Sale 5 Branches $46 million Over 20 year period Organic growth $1,194 million Acquired growth 1,140 million Total growth $2,334 million Key Bank 4 Branches $54 million

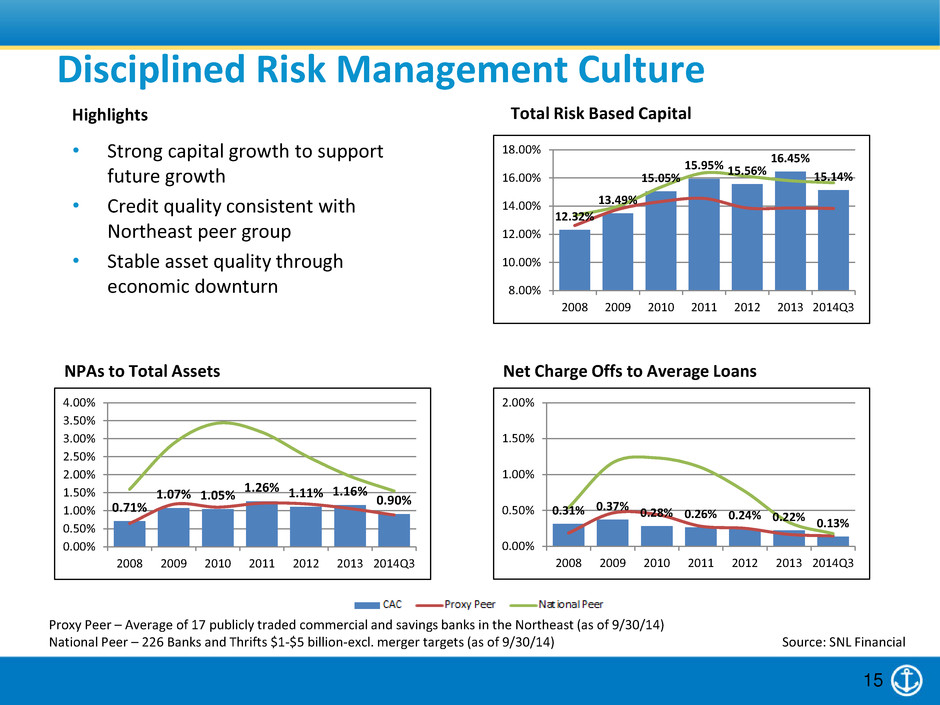

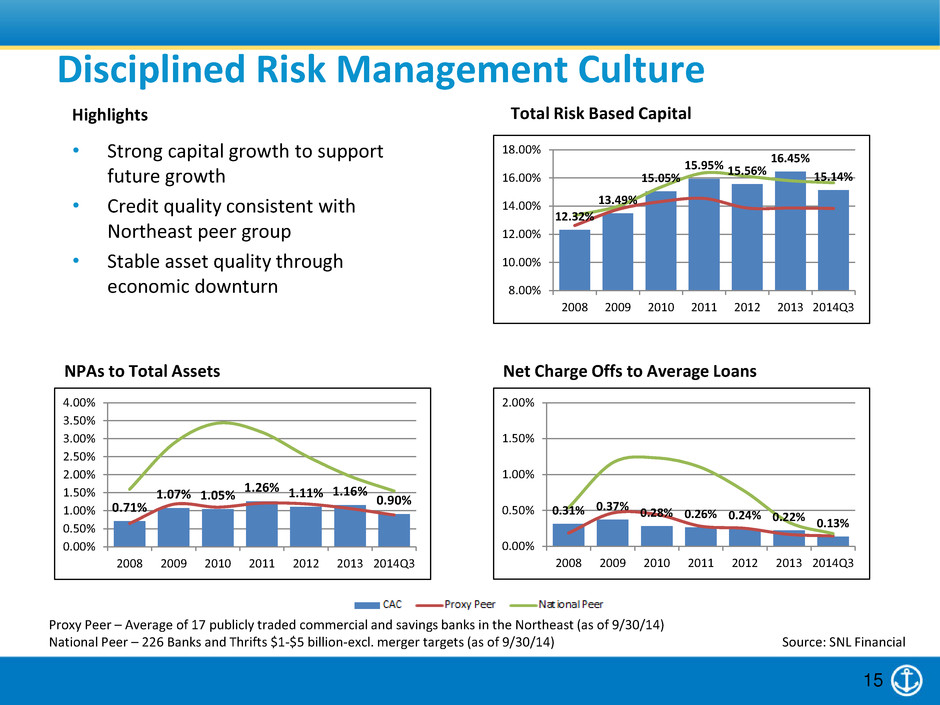

Disciplined Risk Management Culture • Strong capital growth to support future growth • Credit quality consistent with Northeast peer group • Stable asset quality through economic downturn NPAs to Total Assets Net Charge Offs to Average Loans Total Risk Based Capital Highlights Proxy Peer – Average of 17 publicly traded commercial and savings banks in the Northeast (as of 9/30/14) National Peer – 226 Banks and Thrifts $1-$5 billion-excl. merger targets (as of 9/30/14) Source: SNL Financial 15 12.32% 13.49% 15.05% 15.95% 15.56% 16.45% 15.14% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 2008 2009 2010 2011 2012 2013 2014Q3 0.71% 1.07% 1.05% 1.26% 1.11% 1.16% 0.90% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 2008 2009 2010 2011 2012 2013 2014Q3 0.31% 0.37% 0.28% 0.26% 0.24% 0.22% 0.13% 0.00% 0.50% 1.00% 1.50% 2.00% 2008 2009 2010 2011 2012 2013 2014Q3

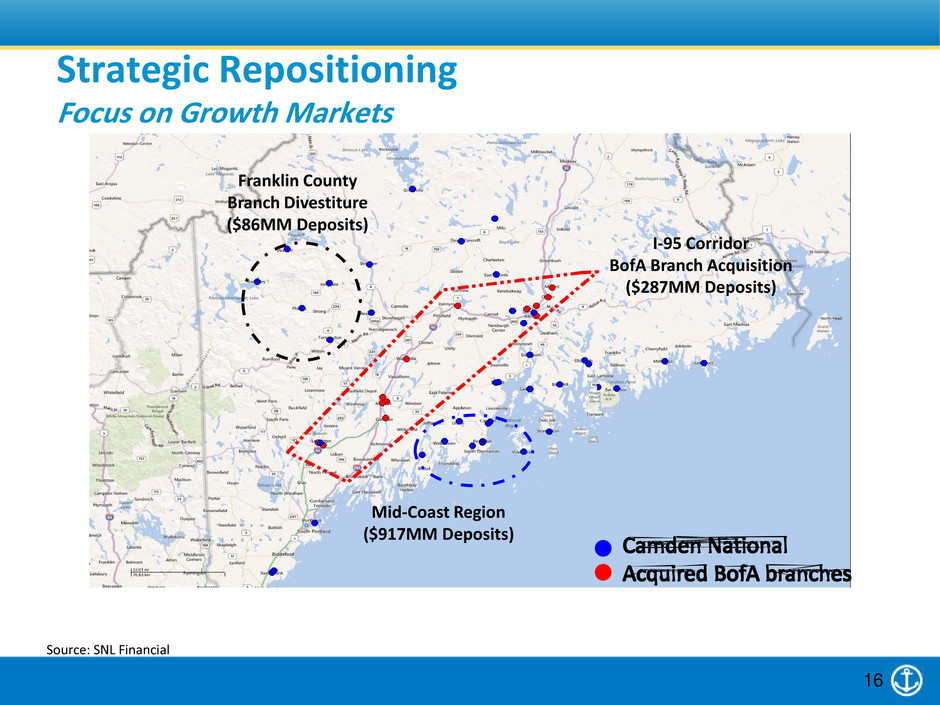

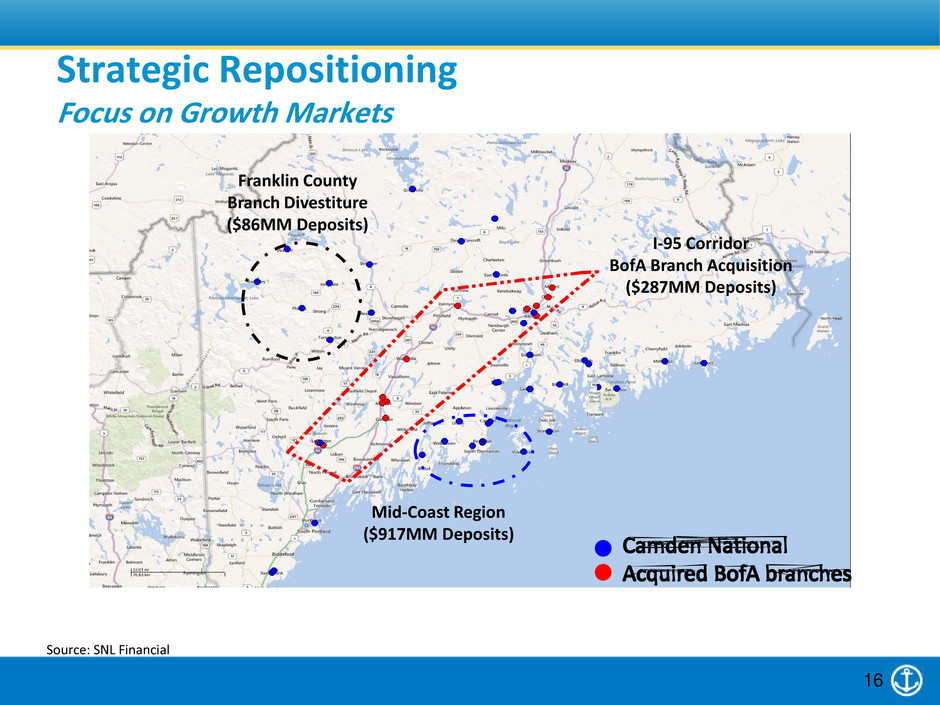

Source: SNL Financial Strategic Repositioning Focus on Growth Markets Franklin County Branch Divestiture ($86MM Deposits) I-95 Corridor BofA Branch Acquisition ($287MM Deposits) Mid-Coast Region ($917MM Deposits) 16

• Branch Acquisitions • Acquisition of 14 branches from Bank of America resulted in $287 million in core deposits • Increased our market share in Maine and improved presence in growth markets • Earn back of Tangible Book Value within four years • Branch Divestitures/Consolidation • Sold five branches in Franklin County in 2013 • $86 million of deposits and $46 million of loans at deposit premium of 3.5% • 2014 EPS dilution of 3% mitigated by stock repurchases of 181,355 shares. • Combined two Kennebunk branches during 2nd quarter 2013 Strategic Repositioning Preparing for the Future 17

• Talent Acquisition and Development • Hired 10 commercial bankers and mortgage originators • Improved credit administration • Internal management programs • New Markets – Manchester, New Hampshire • Experienced commercial real estate lender with 25 years • Loan production office based delivery platform • Technology Investments • Web, mobile, phone banking – Q2 • Outsource core processing – Jack Henry Outlink • Mortgage loan platform – Encompass 360 • AML/BSA system – Verafin Strategic Repositioning Preparing for the Future 18

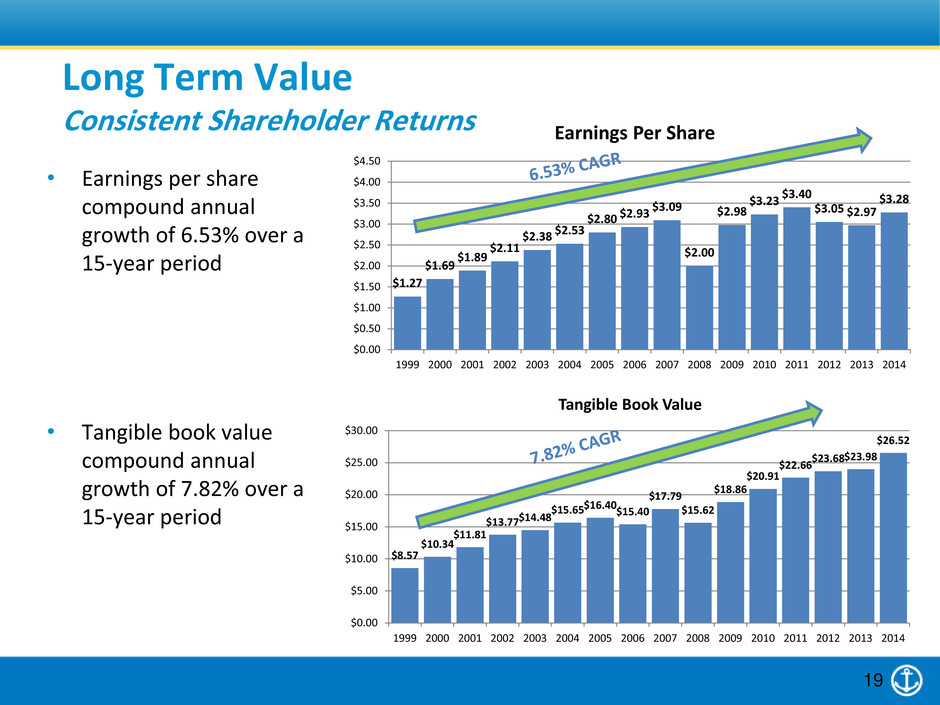

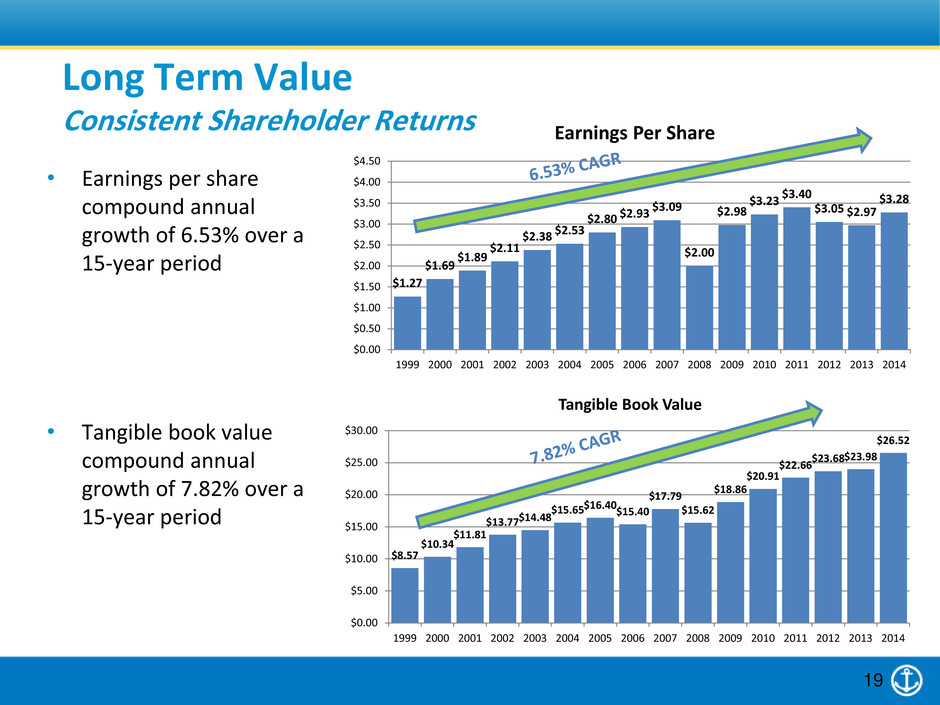

$8.57 $10.34 $11.81 $13.77 $14.48 $15.65 $16.40 $15.40 $17.79 $15.62 $18.86 $20.91 $22.66 $23.68 $23.98 $26.52 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Tangible Book Value Long Term Value Consistent Shareholder Returns • Earnings per share compound annual growth of 6.53% over a 15-year period • Tangible book value compound annual growth of 7.82% over a 15-year period $1.27 $1.69 $1.89 $2.11 $2.38 $2.53 $2.80 $2.93 $3.09 $2.00 $2.98 $3.23 $3.40 $3.05 $2.97 $3.28 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Earnings Per Share 19

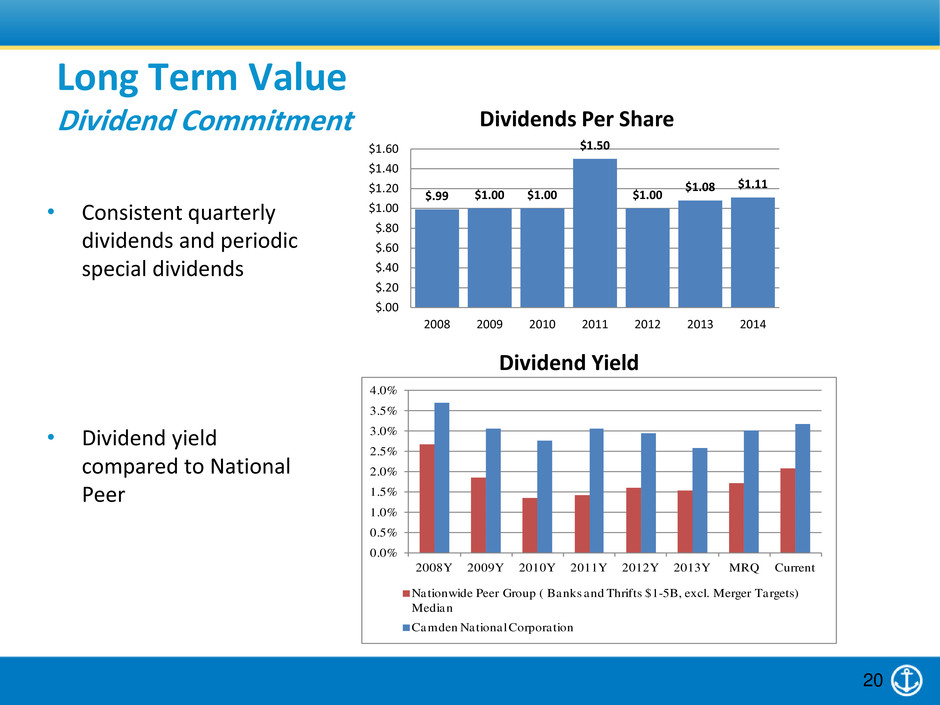

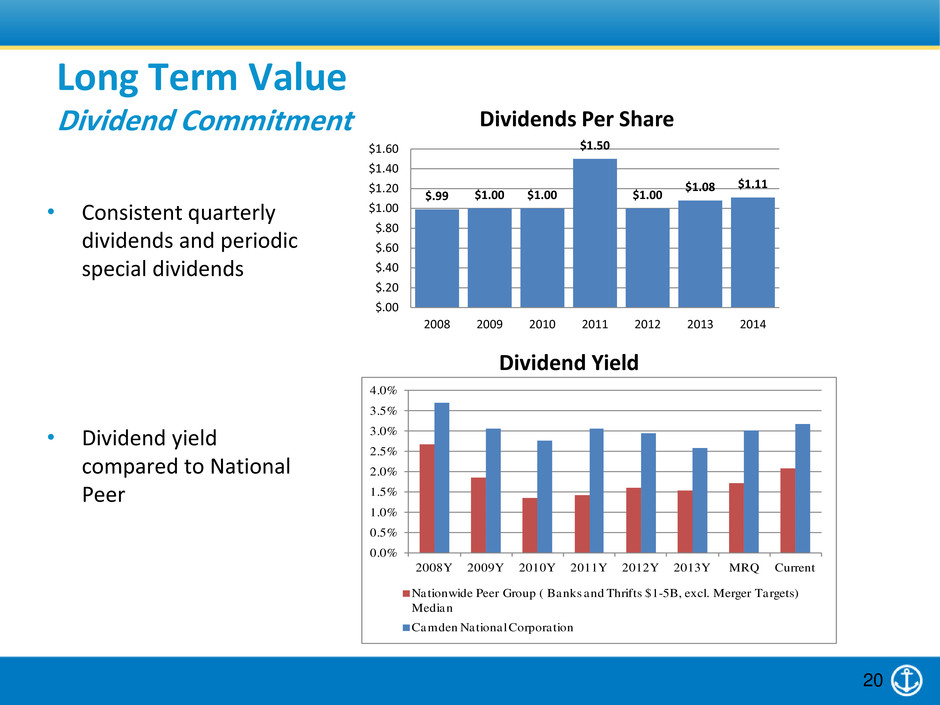

• Consistent quarterly dividends and periodic special dividends • Dividend yield compared to National Peer Long Term Value Dividend Commitment Dividend Yield 20 $.99 $1.00 $1.00 $1.50 $1.00 $1.08 $1.11 $.00 $.20 $.40 $.60 $.80 $1.00 $1.20 $1.40 $1.60 2008 2009 2010 2011 2012 2013 2014 Dividends Per Share 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 2008Y 2009Y 2010Y 2011Y 2012Y 2013Y MRQ Current Nationwide Peer Group ( Banks and Thrifts $1-5B, excl. Merger Targets) Median Camden National Corporation

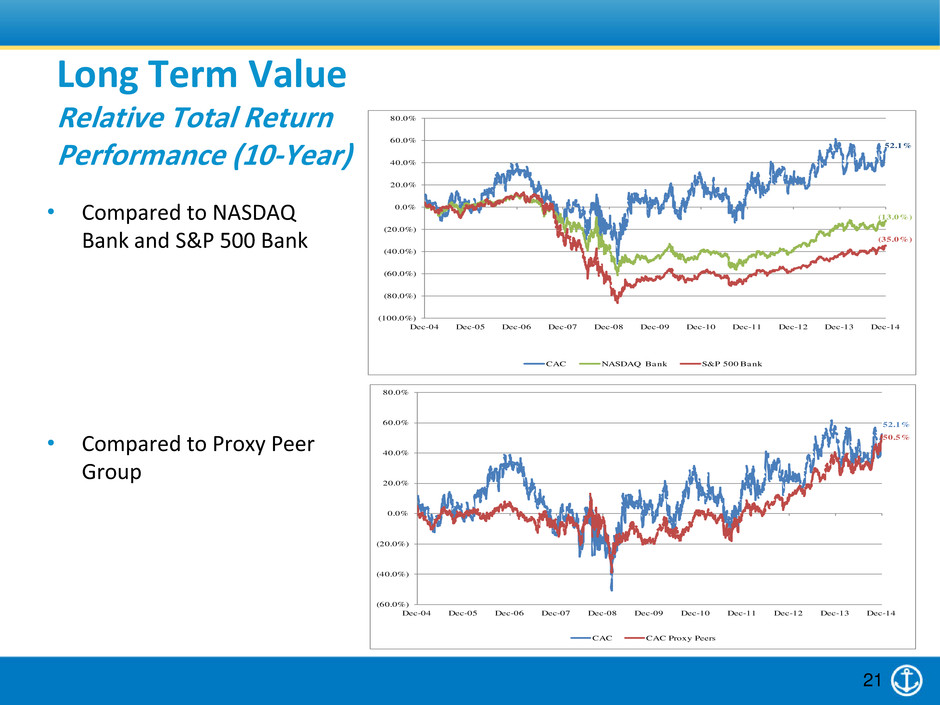

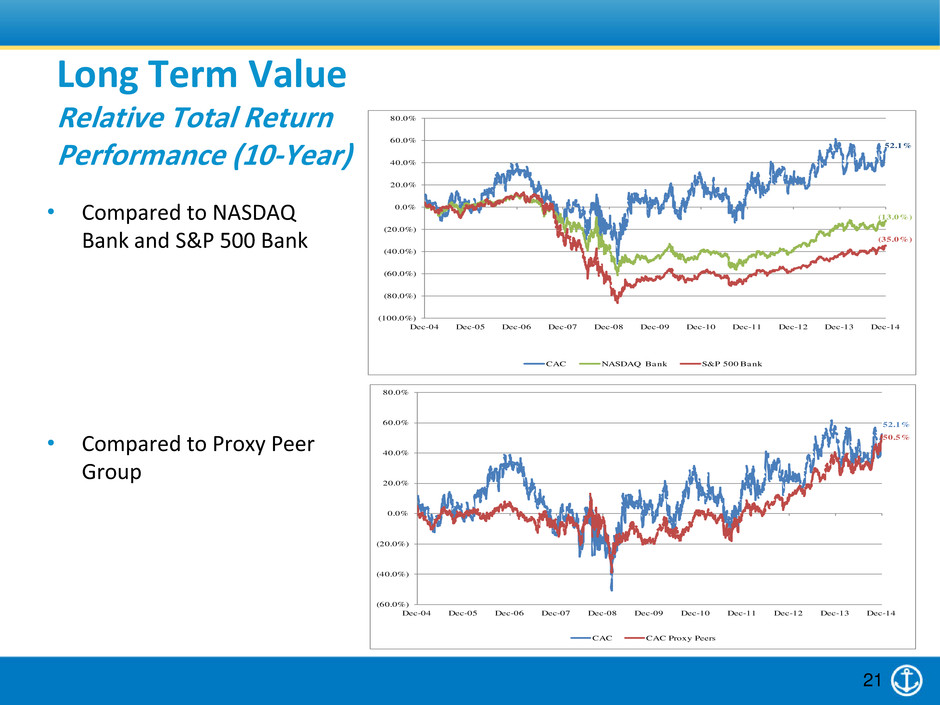

• Compared to NASDAQ Bank and S&P 500 Bank • Compared to Proxy Peer Group Long Term Value Relative Total Return Performance (10-Year) 21 52.1% (13.0%) (35.0%) (100.0%) (80.0%) (60.0%) (40.0%) (20.0%) 0.0% 20.0% 40.0% 60.0% 80.0% Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 CAC NASDAQ Bank S&P 500 Bank (60.0%) (40.0%) (20.0%) 0.0% 20.0% 40.0% 60.0% 80.0% Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 CAC CAC Proxy Peers 52.1% 50.5%

22

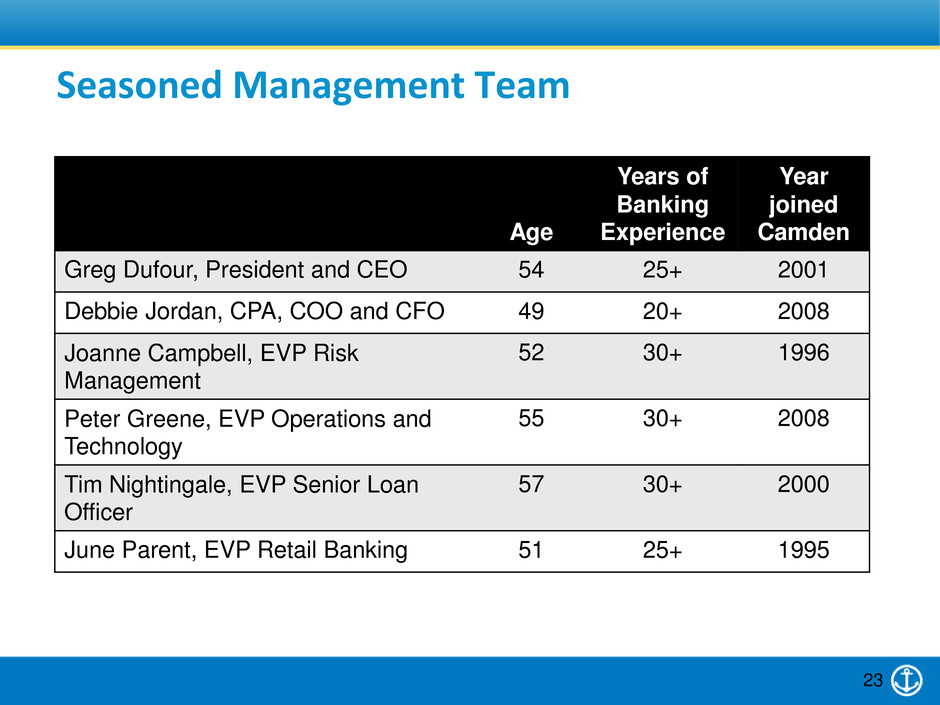

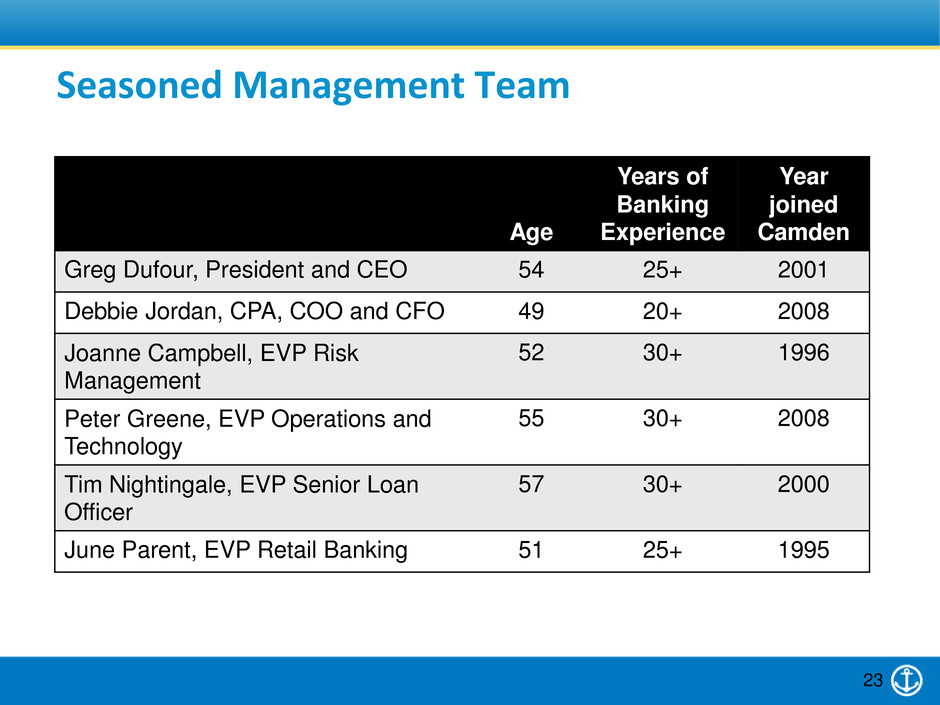

Seasoned Management Team Age Years of Banking Experience Year joined Camden Greg Dufour, President and CEO 54 25+ 2001 Debbie Jordan, CPA, COO and CFO 49 20+ 2008 Joanne Campbell, EVP Risk Management 52 30+ 1996 Peter Greene, EVP Operations and Technology 55 30+ 2008 Tim Nightingale, EVP Senior Loan Officer 57 30+ 2000 June Parent, EVP Retail Banking 51 25+ 1995 23

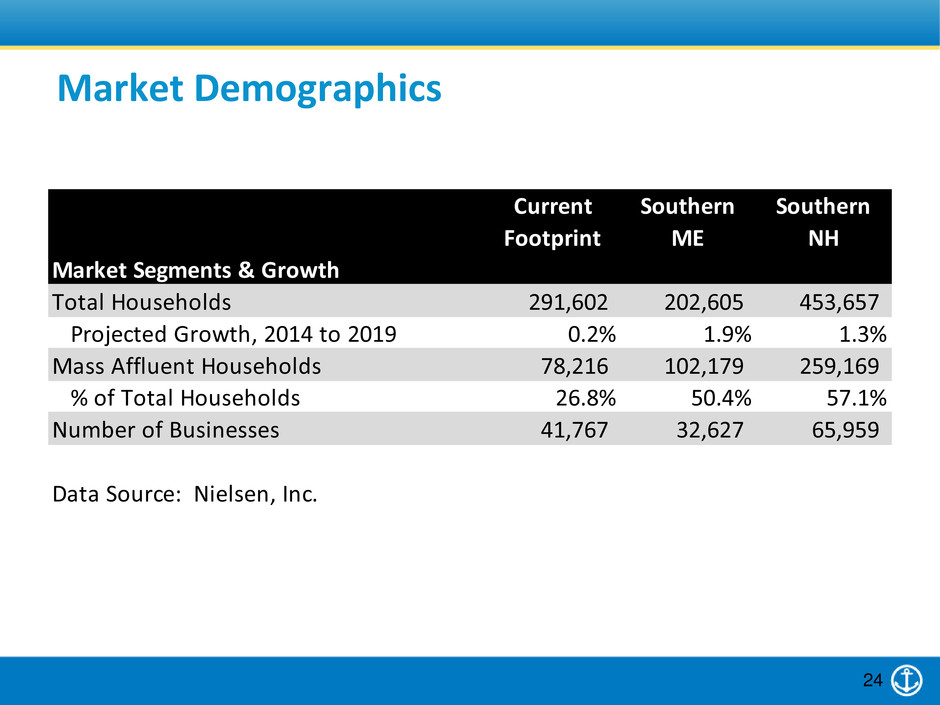

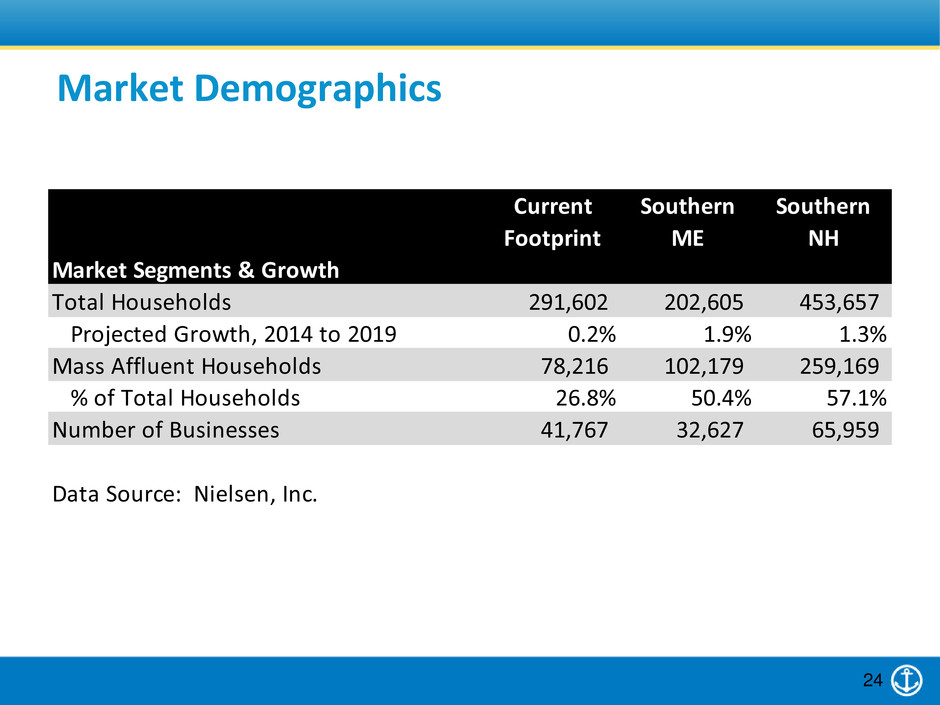

Market Demographics Current Southern Southern Footprint ME NH Market Segments & Growth Total Households 291,602 202,605 453,657 Projected Growth, 2014 to 2019 0.2% 1.9% 1.3% Mass Affluent Households 78,216 102,179 259,169 % of Total Households 26.8% 50.4% 57.1% Number of Businesses 41,767 32,627 65,959 Data Source: Nielsen, Inc. 24

Deposit Market Share 62% 6% 16% 10% 8% 25% 7% 2% 6% 41% 7% Source: SNL Financial FDIC Deposit Market Share data as of 6/30/14. (excludes credit unions) Maine 2014 Rank Institution 2014 Number of Branches 2014 Total Deposits in Market ($000) 2014 Total Market Share (%) 1 Toronto-Dominion Bank 50 3,169,533 13.3 2 KeyCorp (OH) 53 2,998,177 12.6 3 Bangor Bancorp MHC (ME) 59 2,115,508 8.9 4 Camden National Corp. (ME) 44 1,876,095 7.9 5 Bank of America Corp. (NC) 18 1,660,220 6.9 6 First Bancorp Inc. (ME) 16 1,033,887 4.3 7 Machias Bancorp MHC (ME) 17 908,062 3.8 8 People's United Financial Inc. (CT) 26 889,558 3.7 9 Bar Harbor Bankshares (ME) 16 837,692 3.5 10 Norway Bancorp MHC (ME) 23 810,448 3.4 All Others in State (23) 177 7,553,366 31.7 Total For Institutions In Market 499 23,852,546 100.00 25

Proxy Peer Group Arrow Financial Corporation - NY Bar Harbor Bankshares - ME Berkshire Hills Bancorp, Inc. - MA Brookline Bancorp, Inc. - MA Century Bancorp, Inc. - MA Chemung Financial Corporation - NY Enterprise Bancorp, Inc. - MA Financial Institutions, Inc. - NY First Bancorp, Inc. – ME Independent Bank Corp. - MA Merchants Bancshares, Inc. - VT NH Thrift Bancshares, Inc. - NH Tompkins Financial Corporation - NY TrustCo Bank Corp NY - NY United Financial Bancorp, Inc. - MA Washington Trust Bancorp, Inc. - RI Westfield Financial, Inc. – MA 26

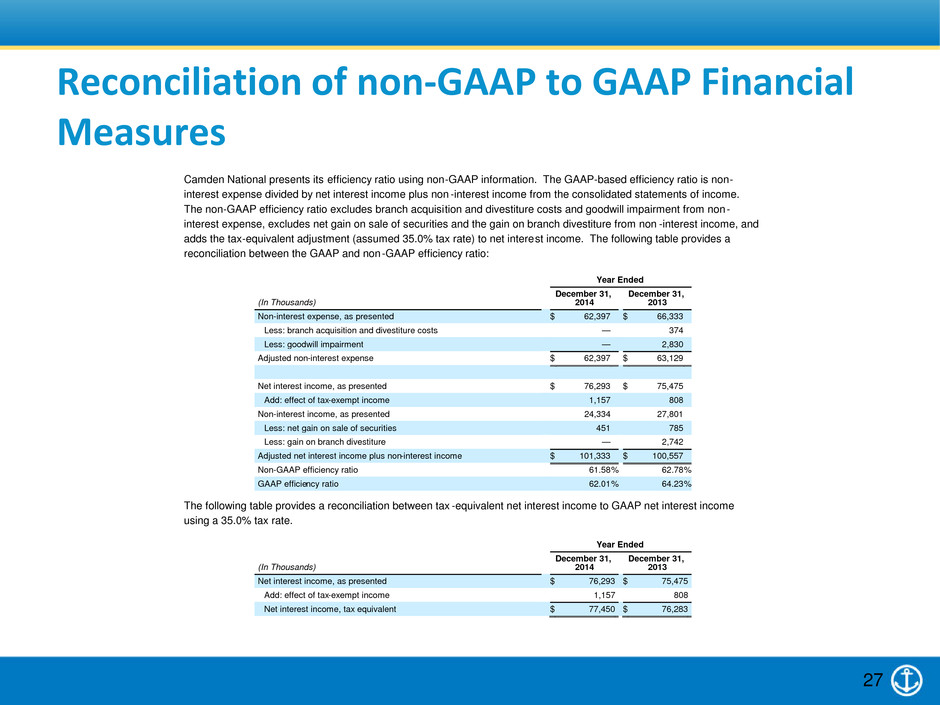

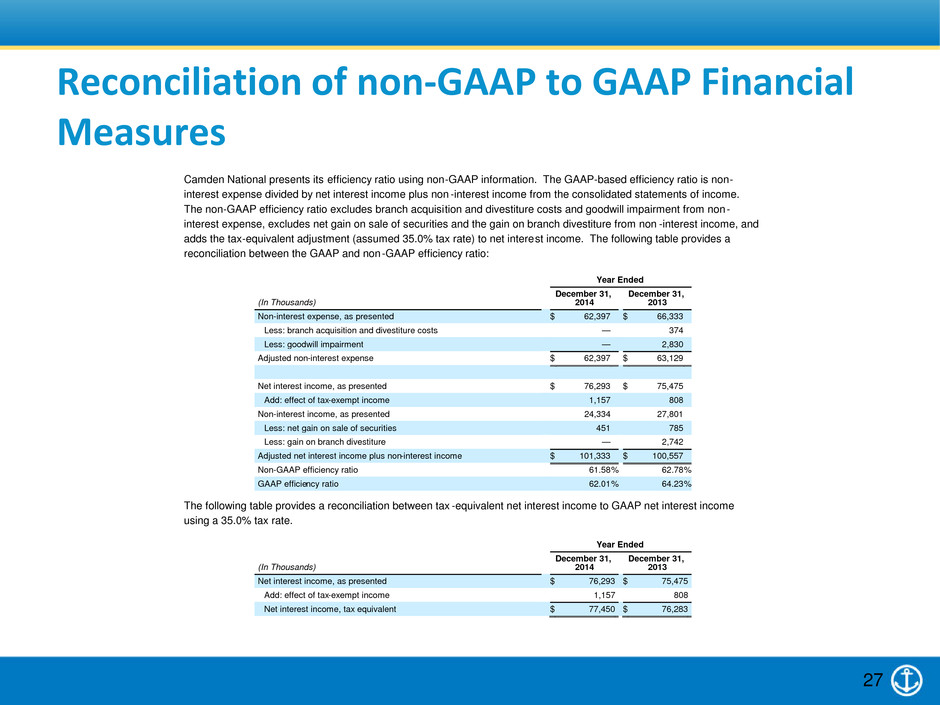

Reconciliation of non-GAAP to GAAP Financial Measures 27 Camden National presents its efficiency ratio using non-GAAP information. The GAAP-based efficiency ratio is non- interest expense divided by net interest income plus non -interest income from the consolidated statements of income. The non-GAAP efficiency ratio excludes branch acquisition and divestiture costs and goodwill impairment from non- interest expense, excludes net gain on sale of securities and the gain on branch divestiture from non -interest income, and adds the tax-equivalent adjustment (assumed 35.0% tax rate) to net interest income. The following table provides a reconciliation between the GAAP and non-GAAP efficiency ratio: Year Ended (In Thousands) December 31, 2014 December 31, 2013 Non-interest expense, as presented $ 62,397 $ 66,333 Less: branch acquisition and divestiture costs — 374 Less: goodwill impairment — 2,830 Adjusted non-interest expense $ 62,397 $ 63,129 Net interest income, as presented $ 76,293 $ 75,475 Add: effect of tax-exempt income 1,157 808 Non-interest income, as presented 24,334 27,801 Less: net gain on sale of securities 451 785 Less: gain on branch divestiture — 2,742 Adjusted net interest income plus non-interest income $ 101,333 $ 100,557 Non-GAAP efficiency ratio 61.58 % 62.78 % GAAP efficiency ratio 62.01 % 64.23 % The following table provides a reconciliation between tax -equivalent net interest income to GAAP net interest income using a 35.0% tax rate. Year Ended (In Thousands) December 31, 2014 December 31, 2013 Net interest income, as presented $ 76,293 $ 75,475 Add: effect of tax-exempt income 1,157 808 Net interest income, tax equivalent $ 77,450 $ 76,283

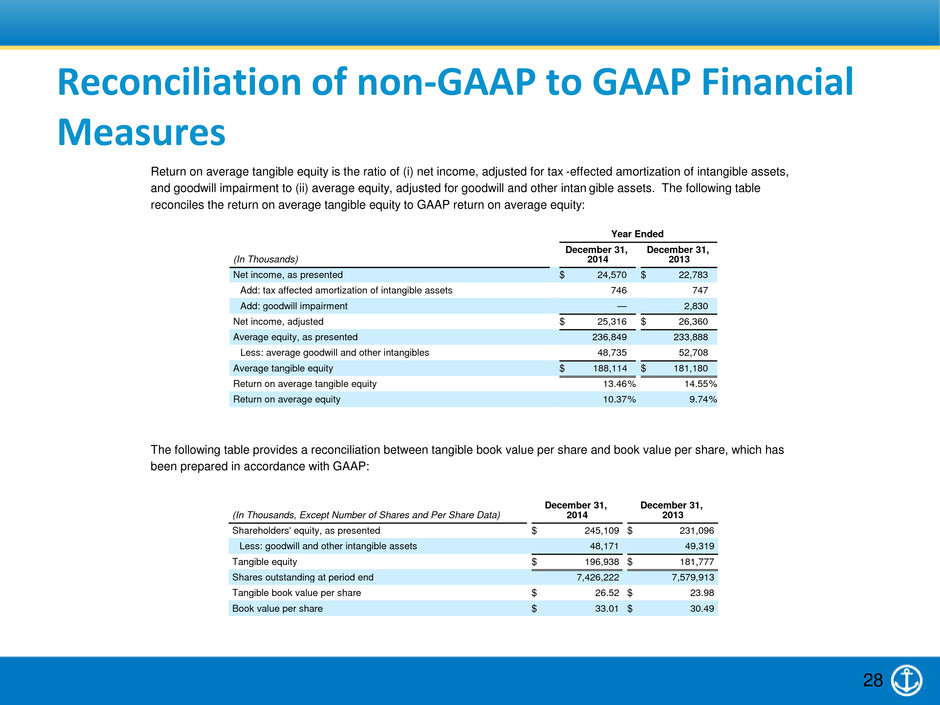

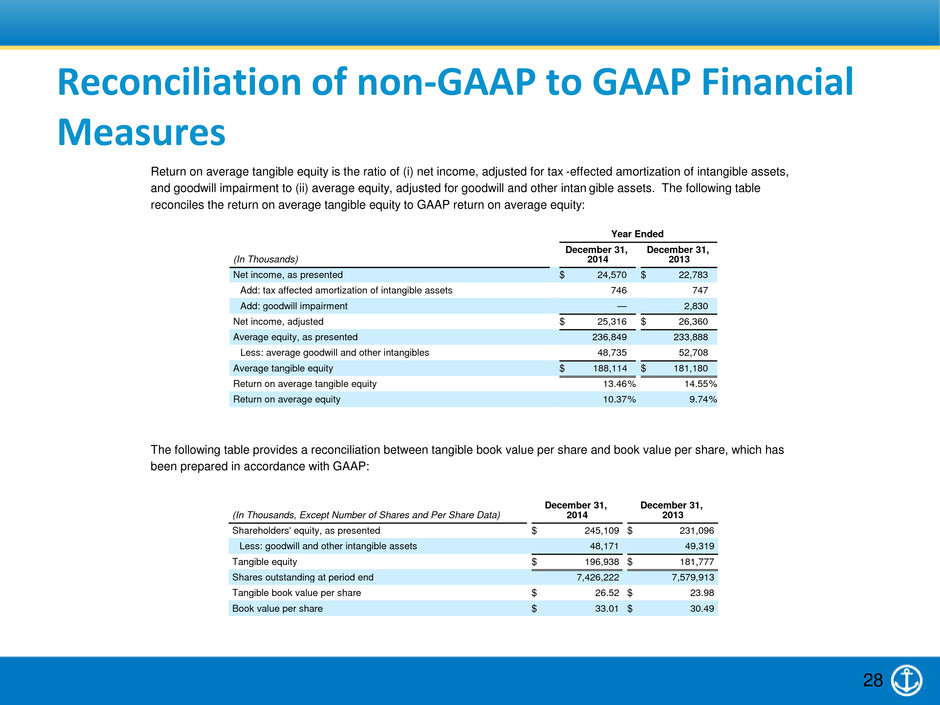

Reconciliation of non-GAAP to GAAP Financial Measures 28 Return on average tangible equity is the ratio of (i) net income, adjusted for tax -effected amortization of intangible assets, and goodwill impairment to (ii) average equity, adjusted for goodwill and other intan gible assets. The following table reconciles the return on average tangible equity to GAAP return on average equity: Year Ended (In Thousands) December 31, 2014 December 31, 2013 Net income, as presented $ 24,570 $ 22,783 Add: tax affected amortization of intangible assets 746 747 Add: goodwill impairment — 2,830 Net income, adjusted $ 25,316 $ 26,360 Average equity, as presented 236,849 233,888 Less: average goodwill and other intangibles 48,735 52,708 Average tangible equity $ 188,114 $ 181,180 Return on average tangible equity 13.46 % 14.55 % Return on average equity 10.37 % 9.74 % The following table provides a reconciliation between tangible book value per share and book value per share, which has been prepared in accordance with GAAP: (In Thousands, Except Number of Shares and Per Share Data) December 31, 2014 December 31, 2013 Shareholders' equity, as presented $ 245,109 $ 231,096 Less: goodwill and other intangible assets 48,171 49,319 Tangible equity $ 196,938 $ 181,777 Shares outstanding at period end 7,426,222 7,579,913 Tangible book value per share $ 26.52 $ 23.98 Book value per share $ 33.01 $ 30.49

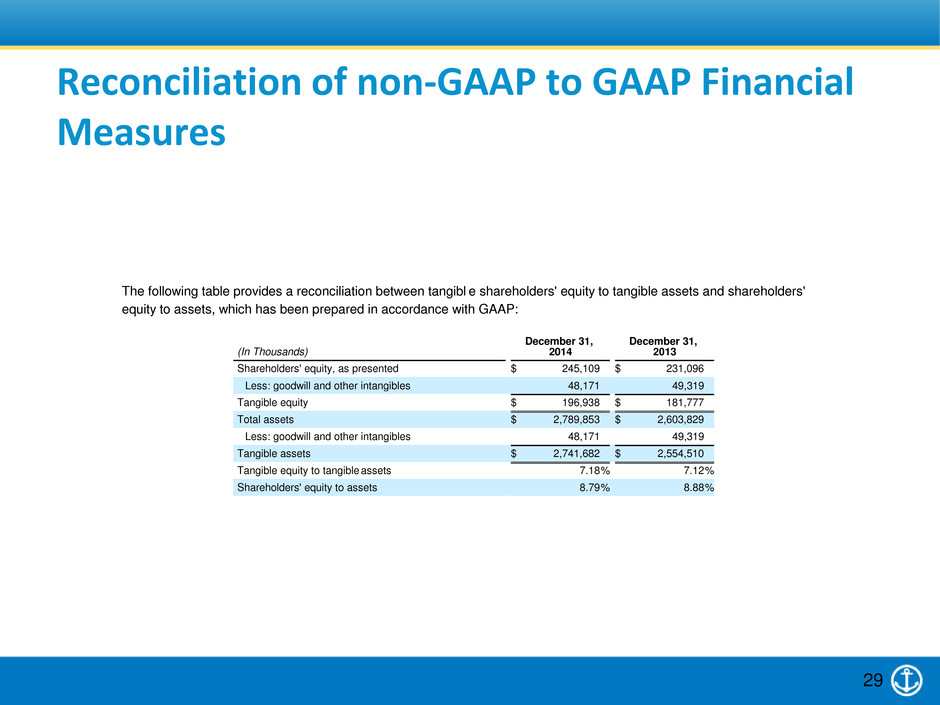

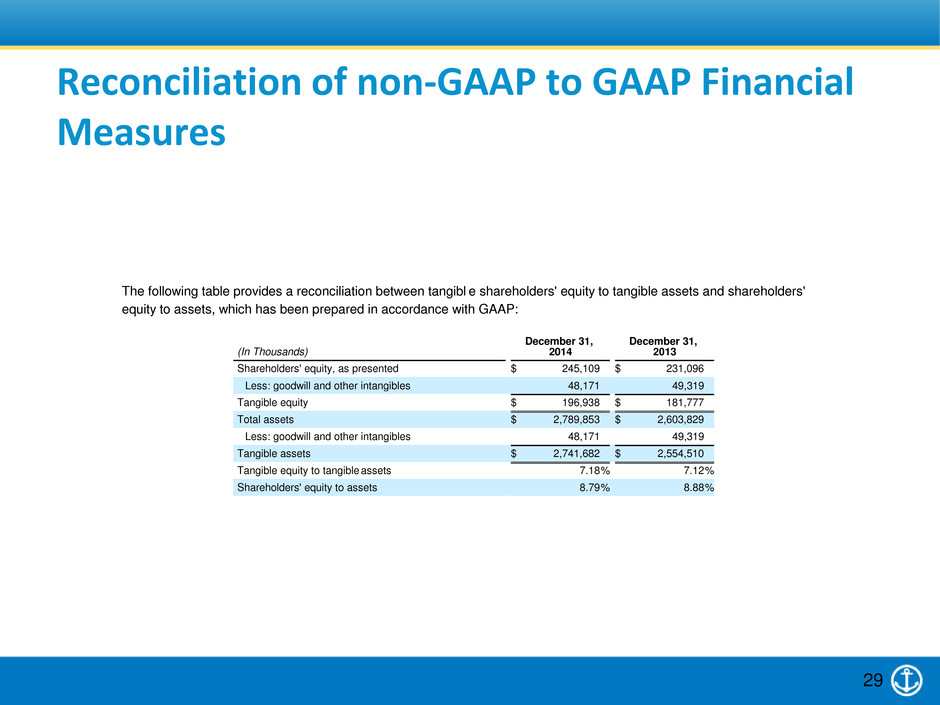

Reconciliation of non-GAAP to GAAP Financial Measures 29 The following table provides a reconciliation between tangibl e shareholders' equity to tangible assets and shareholders' equity to assets, which has been prepared in accordance with GAAP: (In Thousands) December 31, 2014 December 31, 2013 Shareholders' equity, as presented $ 245,109 $ 231,096 Less: goodwill and other intangibles 48,171 49,319 Tangible equity $ 196,938 $ 181,777 Total assets $ 2,789,853 $ 2,603,829 Less: goodwill and other intangibles 48,171 49,319 Tangible assets $ 2,741,682 $ 2,554,510 Tangible equity to tangible assets 7.18 % 7.12 % Shareholders' equity to assets 8.79 % 8.88 %