Dear Fellow Shareholders:

Technology has fueled a new evolution that empowers our customers, employees, community and shareholders more today than ever before. While we have been focused on these trends for several years, we recognize that today’s rapidly changing environment is swiftly evolving consumer interactions-from communicating to managing their financial services. We are uniquely positioned to garner customer feedback, and we have assembled the capacity, talent and resources to deliver new products and services that compete with large competitors. This critical balance of being small enough to listen and large enough to act differentiates us from our competitors and delivers an exceptional banking experience.

Innovation. We continue to provide new services and capabilities which improve and simplify the customer banking experience, reinforced by our focus on genuine personal interactions. We recently introduced “Live Chat” as part of our online and mobile banking offerings so we can securely communicate with our customers. This new customer-service platform complements our previous investment in 24/7 call center capabilities. We also introduced a new, seamless retail deposit account opening platform. We can proudly share that we now have one of the most comprehensive customer service programs among community banks.

Products. Our product and service offerings continue to evolve. In the third quarter, we enhanced our treasury management online platform, “TreasuryLink”, to expand the depth of our product capabilities for corporate customers. This powerful tool has been instrumental as we onboard several new large deposit relationships-they now have simple, secure and customizable access to all their business banking needs. Additionally, Camden National Wealth Management expanded its wealth management investment offerings to add to its proprietary investment capabilities. This provides our wealth management clients with a broader array of investment options, still personally delivered by a team of investment professionals.

Performance. Our hallmark is to invest in our organization while providing a strong return to our shareholders. During the third quarter of 2017, we reported net income of $11.3 million or $0.72 per diluted share, resulting in year-to-date income of $31.6 million or $2.02 per diluted share, an increase of 9% and 7%, respectively, compared to the same periods last year. Our strong year-to-date financial performance is also highlighted by our return on average assets of 1.07% compared to 1.02% for the same period a year ago and a return on average equity of 10.49% compared to 10.29% for the same period last year.

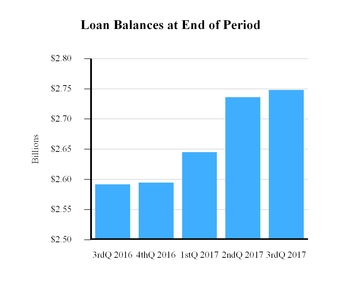

For several years we have prioritized the importance of our deposit base which is critical to supporting our lending capabilities. In addition to executing on several strategic initiatives to increase deposits from our existing customer base, we also added deposits from key strategic acquisitions

including 14 Bank of America branches in 2012 and The Bank of Maine acquisition in 2015. Based on the most recent deposit market share report, provided by the Federal Deposit Insurance Corporation, or FDIC, we have the highest deposit market share of any Maine-based organization and are now ranked number two in the state.

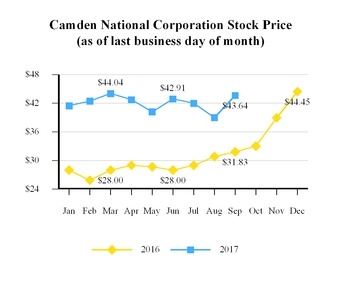

Our focus on creating shareholder value has resulted in solid returns for our shareholders. As of September 30, 2017, our tangible book value per share increased 7% from a year ago. Total shareholder return, which combines the changes in our stock price with dividends, was 40.28% for the 12 month period compared to the NASDAQ Market Index of 22.29%.

Leadership. During the quarter we had several important changes to our leadership. Patricia “Trish” Rose joined us as Executive Vice President of Retail and Mortgage Banking. Trish has extensive experience in retail banking administration, as well as significant accomplishments in developing sales and service cultures. Jennifer Mirabile was promoted to Managing Director of Camden National Wealth Management. With over 25 years of wealth management experience, Jennifer will further our efforts and establish a wealth management office in the Mid-Coast Maine area.

Lawrence “Larry” Sterrs was named Chair of the Board of Directors of Camden National Corporation and Camden National Bank after Karen Stanley reached the Board’s mandatory retirement age. Larry serves as Chair of Unitel, Inc. a high speed internet and phone service company and the Unity Foundation. Karen retired after 10 years of exemplary service as a director and was named the Company’s first female Chair in 2010. During Karen’s tenure, the Company evolved from having $2.3 billion in assets to over $4.0 billion today, maintained our strong performance during the financial crisis, completed two major acquisitions and implemented numerous other critical strategies. She served as a strong advisor and mentor to management as well as her fellow directors.

Your continuous support of Camden National is greatly appreciated.

Sincerely,

Gregory A. Dufour

President and Chief Executive Officer

Third Quarter Report - 2017

Third Quarter Report - 2017