Dear Fellow Shareholders:

We are pleased to report record net income for the third quarter of 2018 of $14.1 million and strong earnings per diluted share of $0.90. Our continued financial success is built on expanding our customer relationships through robust products and services delivered by talented and engaged employees. We continue to invest in our employees’ professional growth and financial training so that each customer interaction, whether in-person, on the phone or digital, is tailored to the customer’s specific needs.

Our focus on achieving a strong financial performance, delivering a simplified customer experience, and contributing to the communities in which we live and work, is guided by our Core Values:

| |

| • | Honesty and Integrity above all else |

| |

| • | Service creating remarkable experiences |

| |

| • | Responsibility to use resources for the greater good |

| |

| • | Excellence through hard work and lifelong learning |

We believe that being grounded by ethics and integrity, investing in our employees, and strategically managing Camden National for long-term performance, are the hallmarks of our success.

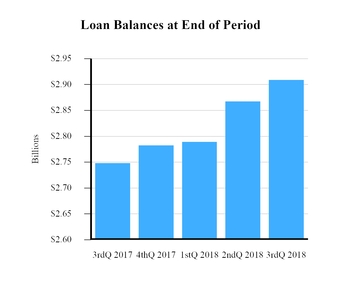

Record Financial Performance. Net income for the third quarter of 2018 reached a record level of $14.1 million, an increase of 24% over the third quarter of 2017. Net income and earnings per diluted share for the nine months ended September 30, 2018 of $39.1 million and $2.50, respectively, increased 24% over the same period last year. The combination of lower federal corporate income taxes and our consistent efforts to build our customer base has strengthened our financial performance and fueled our earnings growth. We have successfully executed on retail, business and treasury management initiatives, which have led to an increase in total deposits of $264.3 million, or 9%, and an increase in total loans of $160.6 million, or 6%, compared to a year ago.

Based on the most recent deposit market share report provided by the Federal Deposit Insurance Corporation, or FDIC, as of June 30, 2018, we had the highest deposit market share of any Maine-based financial institution (and the second highest deposit market share of any financial institution) with 10.5% of Maine’s total deposits, maintaining our number two overall ranking in the state.

Our strong year-to-date financial performance is also highlighted by our return on average assets of 1.27% compared to 1.07% for the same period a year ago and a return on average equity of 12.83% compared to 10.49% for the same period last year.

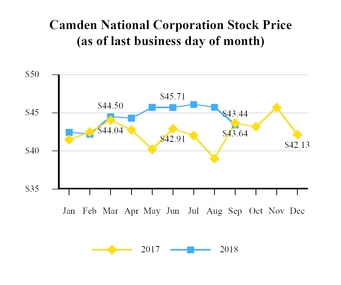

We are focused on driving shareholder value through strong operating results and by returning capital to our shareholders through dividends. Our quarterly dividend rate is $0.30 per share which represents a $0.07 per share, or a 30% increase over the same period last year. Camden National’s dividend yield is 2.76% as of quarter end.

Strong Asset Quality. We remain fully committed to high credit standards. We have experienced lending and credit risk teams and robust operating systems to manage and monitor our credit portfolio. Our overall credit quality across our portfolio remains strong with low levels of non-performing assets of $19.1 million at September 30, 2018, which represented 0.46% of total assets. Our allowance for loan loss reserve at September 30, 2018 was $23.5 million, or 0.81% percent of the total loans outstanding.

Leadership Continues to Expand. Our Board of Directors continues to grow as we welcomed Marie McCarthy as an independent director of the company. Ms. McCarthy currently serves as Chief Operations and People Officer of L.L.Bean, where she’s worked since 1993. Ms. McCarthy’s experience and insight into a wide variety of areas, including human resources development, will be instrumental as we continue to deepen customer satisfaction, recruit and retain top employee talent, and build long-term value for our shareholders. With the addition of Ms. McCarthy, we now have an 11-member Board, consisting of 10 independent outside directors, of which four are women.

We believe the future is bright for our shareholders, customers, communities and employees. We greatly appreciate your continued support.

Sincerely,

Gregory A. Dufour

President and Chief Executive Officer

Third Quarter Report - 2018

Third Quarter Report - 2018