Exhibit 99.1

Dear Shareholders:

The events of the past quarter continue to present evidence of the resiliency, resourcefulness and sense of history and responsibility that exists within your Company, all at a time when unprecedented interest rate conditions are stressing the net interest margin, when fierce competition is giving rise to irrational loan pricing and structure, and the effects of rising energy costs on Maine’s economy, particularly tourism, are uncertain, at best.

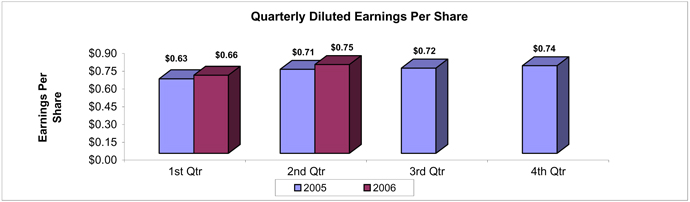

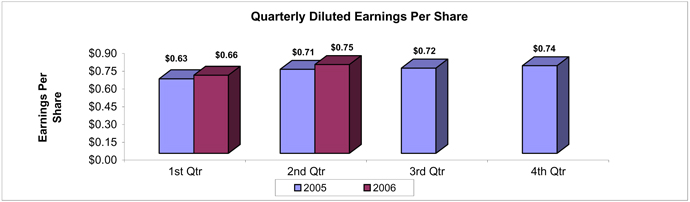

For the quarter ended June 30, 2006, earnings per diluted share increased 5.63% to $0.75 compared to $0.71 per diluted share for the second quarter of 2005. Net income for the recently completed quarter was $5.3 million, down slightly from $5.5 million for the same quarter a year ago.

For the six months ended June 30, 2006, earnings per diluted share of $1.41 were up 5.22%, compared to $1.34 for the first half of 2005. Net income for the first six months of 2006 decreased 0.98% to $10.2 million, down from $10.3 million reported at mid-year in 2005. These results translated into return on average equity of 17.19% and a return of average assets of 1.20% at June 30, 2006, compared to 16.73% and 1.35%, respectively, for the same six-month period a year ago.

Reflected in the mid-year results for 2006 are the impact of a charge to earnings of $645,000 resulting from the Steamship Navigation et al litigation involving Camden National Bank, $106,000 in expenses incurred as part of the consolidation of our two banks, which is scheduled for the beginning of the fourth quarter this year, and interest costs of $437,000 associated with the issuance of Trust Preferred securities to fund the “Dutch Auction” tender offer. Without the one-time expenses associated with the litigation and bank consolidation, and the introduction of the Trust Preferred interest expense, the Company’s net income would have been up 2.37% and 6.94%, respectively, over the second quarter and six-month period in 2005.

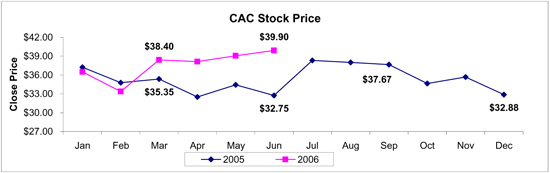

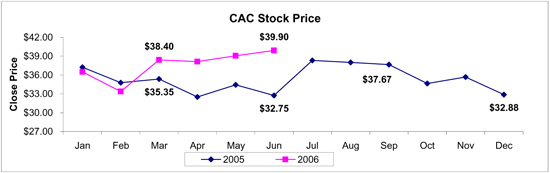

The successful execution of our “Dutch Auction” tender offer resulted in the Company repurchasing 880,827, or 11.7% of its outstanding shares at a price of $39.00 per share, which represented a 12.3% premium above the closing price on the day prior to the announcement. It is fair to say this transaction generated considerable attention from shareholders and non-shareholders alike regarding the Company’s strategic intent. As we noted previously, this innovative strategy provided liquidity, at a premium to market, for those shareholders wishing to sell their shares and the potential for long-term improvement in earnings per share for those who wished to remain owners.

We believe the performance of the stock, since the completion of the tender offer, supports the latter assumption.

On June 30, 2006, the price of Camden National Corporation (AMEX: CAC) stock closed at $39.90, $7.15, or 21.8%, higher than the closing price at June 30, 2005. The Board of Directors of the Company approved a dividend of $0.22 per share, payable July 31, 2006, for shareholders of record on July 17, 2006. This represents a 10.0% increase over the dividend

declared for the same period a year ago. Additionally, on June 30, 2006, Camden National Corporation had its listing on the Russell 3000® Index and the Russell 2000® Index reaffirmed. Inclusion in the Russell Indexes broadens the exposure of Camden National Corporation’s stock to the wide range of investors who base buying decisions upon a company’s inclusion in these important indexes.

Your Company continues to demonstrate an ability not only to perform well financially, but also to carry out its responsibilities as a community banking organization as several distinctions were accorded individuals and an affiliate during the second quarter. Eric Y. Boucher, Assistant Controller, was named “Community Banker of the Year” by the Maine Bankers Association, for his record of outstanding community service. This marks the third time in six years that a representative of our Company has been chosen to be the industry’s honoree. Also, at a Statehouse ceremony during Bankers Day at the Legislature, Governor John E. Baldacci recognized Vera E. Rand, Camden National Bank, and Richard L. Fournier II, UnitedKingfield Bank, as America’s Promise volunteers, who have dedicated themselves to “Making a Difference for Kids and Communities.” For the third year in a row, Camden National Bank was voted “Best of the Best” in a readers’ poll conducted throughout Knox County. The bank also received a rating of “Outstanding” by its primary regulator in fulfillment of its Community Re-investment Act (CRA) responsibilities, a designation earned by less than 5% of the banks in the country. You can learn more by going towww.camdennational.com and clicking on Community, followed by CRA Public File.

In June, William H. Bolinder announced his retirement as President and CEO of Acadia Trust, N.A. Bill provided valuable leadership during a period of expansion for the Company’s wealth management and financial advisory group. Lawrence J. Blaisdell was appointed as the new leader of this affiliate. Larry has been with the organization for seven years and in the industry for over twenty years. Larry’s familiarity with our Company and the Acadia Trust, N.A. client base will allow for an orderly leadership transition, and for growth momentum to be sustained.

With half a year under our belt, the obvious question is, “what can we expect for the balance of 2006?” ‘Cautious optimism’ would best describe how we view our prospects. A 17th consecutive 0.25% increase in the Fed Funds rate in June, and continued uncertainty about the Federal Reserve Bank’s future action on interest rates, have resulted in a protracted period where the yield curve has been flat and, on occasion, even inverted. This has continued to squeeze our net interest margin, thus slowing the growth of net interest income.

To combat this effect, we have placed added emphasis on fee income generation, which for the first six months of 2006 is up 12.12% versus the same period a year ago. This positive trend has been bolstered by an 18.53% increase in fee income derived from our debit card program, featured in this quarter’s sidebar. In addition, our effort to reduce the Company’s reliance on pricier, and more volatile, wholesale funding through the establishment of an internal Deposit Group is paying dividends as core deposits at June 30, 2006 are up 11.54% versus June 30, 2005. These are but a few steps being taken to combat slower asset growth and offset the increased spending needed for all-important investments in our workforce, facilities and technology infrastructure. These expenditures are necessary to position ourselves to be ready when the opportunities for strategic acquisitions and/or geographic expansion present themselves.

One thing is certain, we will not be drawn into irresponsible pricing and structuring of credit facilities, which is evident today as demand for loan volume seems to be outstripping supply. This Company has always strived to maintain a conservative approach to underwriting and, as a result, has experienced fewer delinquencies and charge-offs. We will fight our battles to retain and attract profitable Customer relationships through prudent portfolio management, innovation and a service experience second to none because, at Camden National Corporation, we’re in it for the long haul.

Thank you for your continued loyalty and support.

Sincerely,

Robert W. Daigle

President & Chief Executive Officer

Consolidated Statements of Condition(unaudited)

| | | | | | | | | | | | |

| | | June 30, | | | December 31, 2005 | |

(In thousands, except number of shares & per share data) | | 2006 | | | 2005 | | |

Assets | | | | | | | | | | | | |

Cash and due from banks | | $ | 33,838 | | | $ | 27,271 | | | $ | 30,321 | |

Federal funds sold | | | — | | | | — | | | | 1,110 | |

Securities available for sale, at market value | | | 371,486 | | | | 346,715 | | | | 350,502 | |

Securities held to maturity | | | 34,124 | | | | 13,932 | | | | 17,127 | |

Loans, less allowance for loan and lease losses of $15,256 $14,040 and $14,167 at June 30, 2006 and 2005 and December 31, 2005, respectively | | | 1,229,358 | | | | 1,116,443 | | | | 1,168,008 | |

Premises and equipment, net | | | 16,062 | | | | 16,506 | | | | 15,967 | |

Goodwill | | | 3,991 | | | | 3,991 | | | | 3,991 | |

Other assets | | | 66,815 | | | | 62,126 | | | | 66,231 | |

| | | | | | | | | | | | |

Total assets | | $ | 1,755,674 | | | $ | 1,586,984 | | | $ | 1,653,257 | |

| | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | |

Deposits: | | | | | | | | | | | | |

Demand | | $ | 142,943 | | | $ | 136,487 | | | $ | 150,953 | |

NOW | | | 116,797 | | | | 124,026 | | | | 118,247 | |

Money market | | | 272,512 | | | | 221,271 | | | | 240,958 | |

Savings | | | 96,254 | | | | 103,837 | | | | 101,010 | |

Certificates of deposit | | | 608,482 | | | | 492,426 | | | | 552,737 | |

| | | | | | | | | | | | |

Total deposits | | | 1,236,988 | | | | 1,078,047 | | | | 1,163,905 | |

Borrowings from Federal Home Loan Bank | | | 312,088 | | | | 310,409 | | | | 287,501 | |

Other borrowed funds | | | 60,595 | | | | 60,818 | | | | 59,538 | |

Long-term debt | | | 36,083 | | | | — | | | | — | |

Accrued interest and other liabilities | | | 13,709 | | | | 11,135 | | | | 12,775 | |

| | | | | | | | | | | | |

Total liabilities | | | 1,659,463 | | | | 1,460,409 | | | | 1,523,719 | |

| | | | | | | | | | | | |

Shareholders’ Equity | | | | | | | | | | | | |

Common stock, no par value; authorized 20,000,000 shares, issued and outstanding 6,608,505, 7,588,461 and 7,529,073 shares on June 30, 2006 and 2005 and December 31, 2005, respectively | | | 2,450 | | | | 2,450 | | | | 2,450 | |

Surplus | | | 2,392 | | | | 4,158 | | | | 4,098 | |

Retained earnings | | | 98,544 | | | | 120,542 | | | | 126,687 | |

Accumulated other comprehensive loss | | | | | | | | | | | | |

Net unrealized losses on securities available for sale, net of tax | | | (6,958 | ) | | | (575 | ) | | | (3,584 | ) |

Net unrealized losses on derivative instruments marked to market, net of tax | | | (217 | ) | | | — | | | | (113 | ) |

| | | | | | | | | | | | |

Total accumulated other comprehensive loss | | | (7,175 | ) | | | (575 | ) | | | (3,697 | ) |

| | | | | | | | | | | | |

Total shareholders’ equity | | | 96,211 | | | | 126,575 | | | | 129,538 | |

| | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 1,755,674 | | | $ | 1,586,984 | | | $ | 1,653,257 | |

| | | | | | | | | | | | |

Camden National Corporation stock is listed on the American Stock Exchange under the ticker symbol “CAC.” Stock prices shown in chart are as of close of trading on the last business day of the month.

Consolidated Statements of Income(unaudited)

| | | | | | | | | | | | |

| | | Six Months Ended June 30, | | Three Months Ended

June 30, |

(In thousands, except number of shares & per share data) | | 2006 | | 2005 | | 2006 | | 2005 |

Interest Income | | | | | | | | | | | | |

Interest and fees on loans | | $ | 42,354 | | $ | 33,790 | | $ | 21,671 | | $ | 17,519 |

Interest on securities | | | 9,176 | | | 7,398 | | | 4,754 | | | 3,873 |

Interest on interest rate swap agreements | | | — | | | 173 | | | — | | | — |

Other interest income | | | 565 | | | 404 | | | 274 | | | 220 |

| | | | | | | | | | | | |

Total interest income | | | 52,095 | | | 41,765 | | | 26,699 | | | 21,612 |

| | | | |

Interest Expense | | | | | | | | | | | | |

Interest on deposits | | | 16,303 | | | 9,318 | | | 8,811 | | | 4,956 |

Interest on borrowed funds | | | 8,073 | | | 5,939 | | | 4,371 | | | 3,250 |

Interest on interest rate swap agreements | | | — | | | 142 | | | — | | | — |

| | | | | | | | | | | | |

Total interest expense | | | 24,376 | | | 15,399 | | | 13,182 | | | 8,206 |

| | | | | | | | | | | | |

Net interest income | | | 27,719 | | | 26,366 | | | 13,517 | | | 13,406 |

| | | | |

Provision for Loan and Lease Losses | | | 1,104 | | | 575 | | | 552 | | | 345 |

| | | | | | | | | | | | |

Net interest income after provision for loan and lease losses | | | 26,615 | | | 25,791 | | | 12,965 | | | 13,061 |

| | | | |

Non-interest Income | | | | | | | | | | | | |

Service charges on deposit accounts | | | 1,678 | | | 1,702 | | | 883 | | | 884 |

Other service charges and fees | | | 855 | | | 618 | | | 381 | | | 347 |

Income from fiduciary services | | | 2,151 | | | 1,971 | | | 1,074 | | | 1,024 |

Life insurance earnings | | | 400 | | | 322 | | | 200 | | | 161 |

Other income | | | 623 | | | 477 | | | 390 | | | 248 |

| | | | | | | | | | | | |

Total non-interest income | | | 5,707 | | | 5,090 | | | 2,928 | | | 2,664 |

| | | | |

Non-interest Expenses | | | | | | | | | | | | |

Salaries and employee benefits | | | 9,208 | | | 8,933 | | | 4,472 | | | 4,709 |

Premises and fixed assets | | | 2,346 | | | 2,109 | | | 1,158 | | | 1,012 |

Amortization of core deposit intangible | | | 437 | | | 443 | | | 216 | | | 221 |

Other expenses | | | 5,485 | | | 4,260 | | | 2,418 | | | 1,915 |

| | | | | | | | | | | | |

Total non-interest expenses | | | 17,476 | | | 15,745 | | | 8,264 | | | 7,857 |

| | | | | | | | | | | | |

Income before income taxes | | | 14,846 | | | 15,136 | | | 7,629 | | | 7,868 |

Income Taxes | | | 4,650 | | | 4,839 | | | 2,370 | | | 2,412 |

| | | | | | | | | | | | |

Net Income | | $ | 10,196 | | $ | 10,297 | | $ | 5,259 | | $ | 5,456 |

| | | | | | | | | | | | |

Per Share Data | | | | | | | | | | | | |

Basic earnings per share | | $ | 1.41 | | $ | 1.35 | | $ | 0.75 | | $ | 0.72 |

Diluted earnings per share | | | 1.41 | | | 1.34 | | | 0.75 | | | 0.71 |

Cash dividends per share | | $ | 0.44 | | $ | 0.90 | | $ | 0.22 | | $ | 0.20 |

Weighted average number of shares outstanding | | | 7,229,407 | | | 7,629,786 | | | 6,938,024 | | | 7,615,464 |

Tangible book value per share | | $ | 13.71 | | $ | 15.84 | | | | | | |

A complete set of financial statements for Camden National Corporation may be obtained upon written request to Sean G. Daly, Chief Financial Officer, Camden National Corporation, P.O. Box 310, Camden, Maine 04843.