RBC Capital Markets Financial Institutions Conference September 26, 2007 Presenter Robert W. Daigle President and Chief Executive Officer Exhibit 99.2 |

2 Safe Harbor Statement This report contains statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward- looking statements can be identified by the use of the words "believe," "expect," "anticipate," "intend," "estimate," "assume," "will," "should," and other expressions which predict or indicate future events or trends and which do not relate to historical matters. Forward-looking statements should not be relied on, because they involve known and unknown risks, uncertainties and other factors, some of which are beyond the control of Camden National Corporation ("Camden"). These risks, uncertainties and other factors may cause the actual results, performance or achievements of Camden to be materially different from the anticipated future results, performance or achievements expressed or implied by the forward-looking statements. Some of the factors that might cause these differences include the following: (i) failure of the parties to satisfy the closing conditions in the Merger Agreement in a timely manner or at all; (ii) failure of the shareholders of Union Bankshares Company ("Union Bankshares") to approve the Merger Agreement; (iii) failure to obtain governmental approvals of the Merger, or imposition of adverse regulatory conditions in connection with such approvals; (iv) disruptions in the businesses of the parties as a result of the pendency of the Merger; (v) integration costs following the merger, (vi) changes in general, national or regional economic conditions; (vii) changes in loan default and charge-off rates; (viii) reductions in deposit levels necessitating increased borrowing to fund loans and investments; (ix) changes in interest rates; (x) changes in laws and regulations; (xi) changes in the size and nature of the Camden's competition; and (xii) changes in the assumptions used in making such forward-looking statements. Other factors could also cause these differences. For more information about these factors please see Camden’s and Union Bankshares’ filings with the SEC, including their Annual Report on Form 10-K on file with the Securities and Exchange Commission ("SEC"). All of these factors should be carefully reviewed, and readers should not place undue reliance on these forward-looking statements. These forward- looking statements were based on information, plans and estimates at the date of this report, and the Company does not promise to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes. |

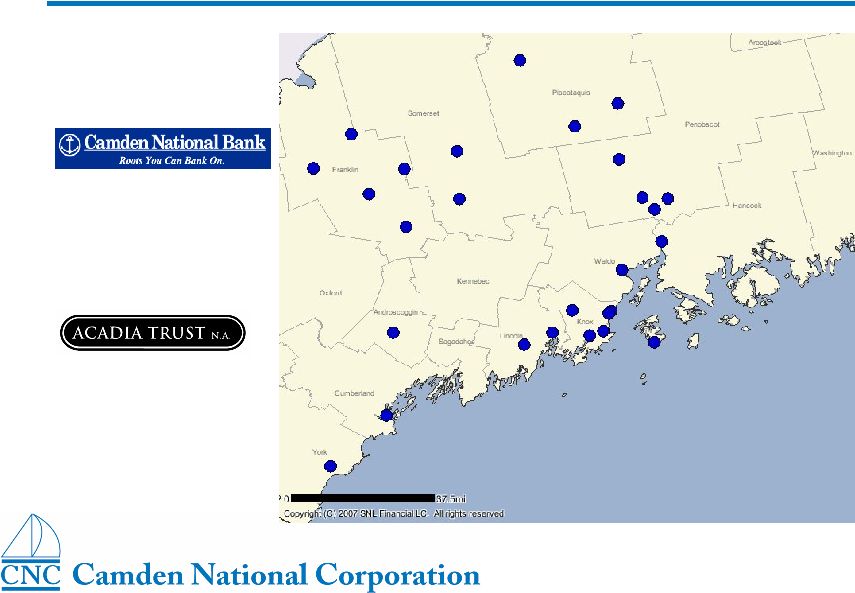

3 Overview • Founded 1875 in Camden, Maine • Common Stock CAC trades on AMEX • Profile – Total Assets - $1.8 billion – Assets under Administration - $925 million – Total Households - 45,600 – Employees – 324 – Banking Centers - 27 |

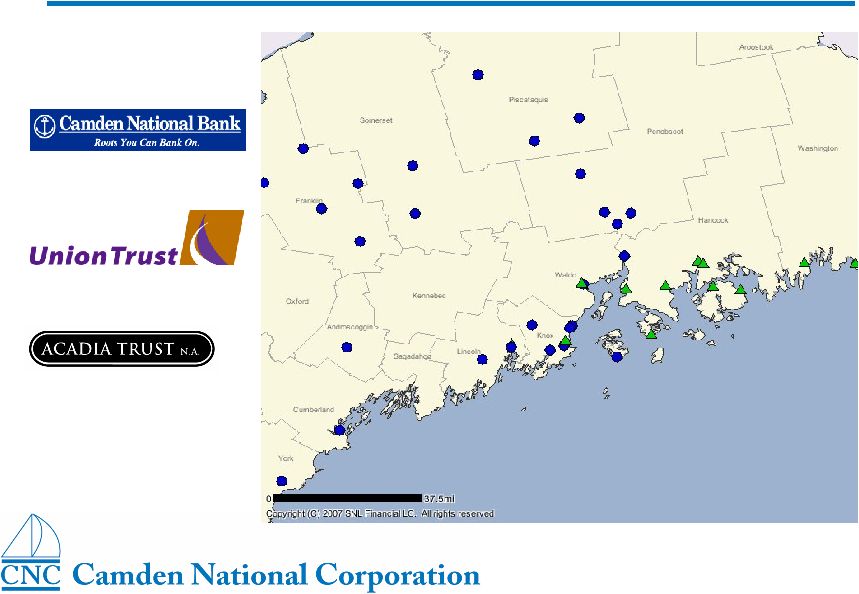

4 Franchise Geography |

5 Franchise Ranking Source: SNL Financial; Bank of America and KeyBank do not provide total Maine-based assets Top Fifteen Banks in Maine by Asset Size Total Assets (000's) Institution Name As of June 30, 2007 TD Banknorth, National Association $43,027,878 Bangor Bancorp, MHC $2,078,791 Camden National Corporation $1,761,103 First National Lincoln Corporation $1,161,274 Gardiner Savings Institution, FSB $976,444 Norway Bancorp, MHC $835,076 Bar Harbor Bankshares $833,450 Machias Bancorp, MHC $795,958 Gorham Bancorp, MHC $739,323 Kennebunk Savings Bank $719,275 Saco & Biddeford Savings Institution $674,339 Kennebec Savings Bank $610,407 Union Bankshares Company $565,426 Androscoggin Bancorp, MHC $564,767 Northeast Bancorp $556,866 |

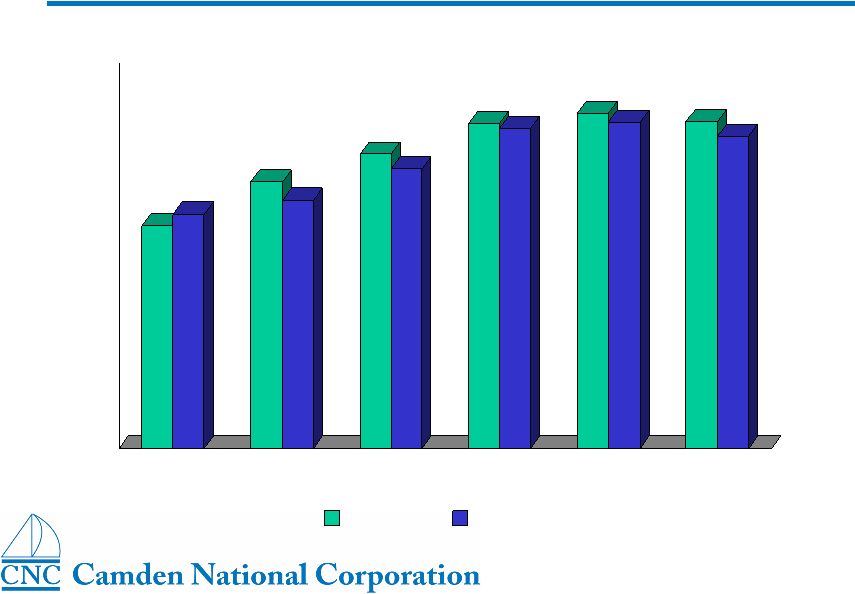

6 Loan and Deposit Growth $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 2002 2003 2004 2005 2006 Q2-07 Loans Deposits ($ in millions) |

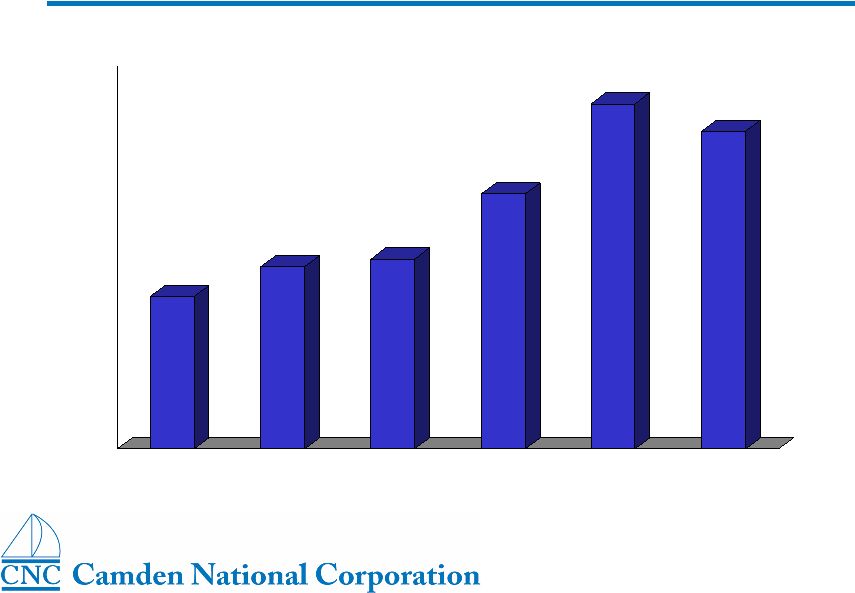

7 Return On Equity 15.38% 15.85% 15.97% 16.99% 18.40% 17.97% 13.0% 14.0% 15.0% 16.0% 17.0% 18.0% 19.0% 2002 2003 2004 2005 2006 Q2-07 * * Q2-07 year to date results annualized |

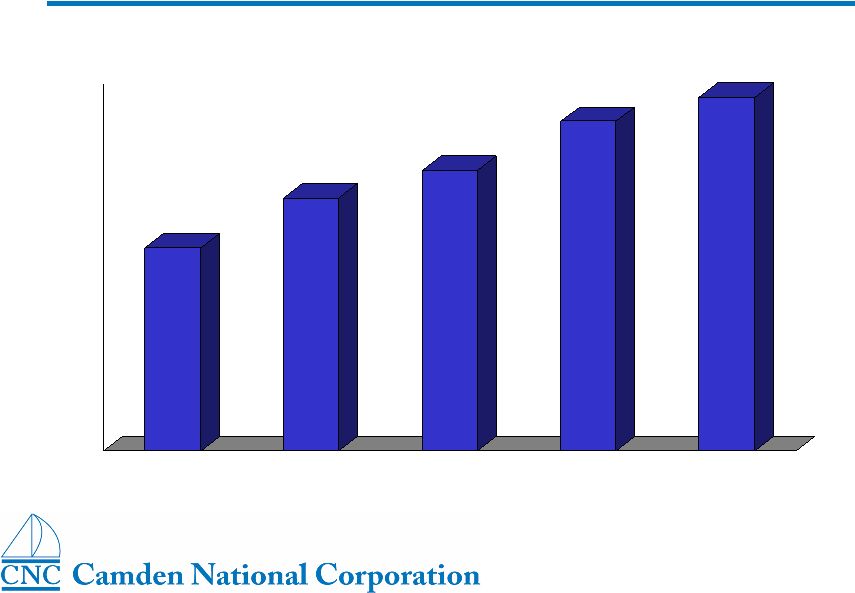

8 Diluted EPS growth $2.11 $2.38 $2.53 $2.80 $2.93 $1.00 $1.50 $2.00 $2.50 $3.00 2002 2003 2004 2005 2006 |

9 Strategic Focus • Maximizing Shareholder Value • Optimizing Capital • “Block and Tackle” Banking • Investing in the Business • Merger of banking subsidiaries • Technology infrastructure • Deposit Group |

10 Key Initiatives • Tender Offer / Trust Preferred Issuance – 2006 • Merger of banking subsidiaries – 2006 • Merger Agreement: Union Bankshares – 2007 |

11 Union Bankshares Overview Ticker UNBH Headquarters Ellsworth, Maine Founded 1887 Branches 13 Total Assets $565 Million (1) Total Loans $373 Million (1) Total Deposits $318 Million (1) Reserves to Loans 1.14% (1) Efficiency Ratio (LTM) 71.49% (2) (1) At June 30, 2007 (2) Last twelve months, as of June 30, 2007 |

12 Acquisition – Pro Forma Map |

13 Acquisition – Terms Purchase Price per share $68.00 (1) Consideration 60% stock / 40% cash Fixed Exchange Ratio 1.9106 Aggregate Purchase Price $72.5 Million (1) Premium to Market 33% (2) Price to Book/Tangible Book 174% / 205% (3) Price to LTM Earnings 18.6x (3) Anticipated Closing January 2008 (1) The actual purchase price at closing will vary with changes in CAC’s stock price. The purchase price reflects a CAC stock price of $35.59 (2) Based on the August 13, 2007 closing price of UNBH (3) Financial data as of June 30, 2007 |

14 Acquisition – Compatibility • Two 100+ year old Maine-based institutions • Contiguous geography • Comparable corporate culture • Focus on the customer experience • Conservative credit approach • Operational similarities |

15 Acquisition – Execution • Experienced senior management team • Merger of banking subsidiaries: operational template • Achievable cost savings and growth assumptions • Compatible cultures Manageable Execution Risk |

16 Acquisition – Financial Impact 2008 2009 EPS Accretion < 1% 4% - 5% Cost Savings (1) 16% 25% (1) Cost Savings are expressed as a percentage of UNBH’s 2007 annualized non-interest expense • The legal transaction is expected to be completed in January 2008 • Operational integration is expected to be completed by the end of the first quarter in 2008 • Full cost savings are expected to be realized in 2009. |

17 Visit our website for a wide range of products and latest financial reports: www.camdennational.com |