Camden National (CAC) 8-KResults of Operations and Financial Condition

Filed: 31 Oct 07, 12:00am

Exhibit 99.1

Dear Shareholders:

I am pleased to report to you that in the face of continued economic uncertainty and in the midst of financial markets that seemingly bring us more bad news than good news these days, your Company is performing at a highly satisfactory level and actively pursuing its strategic growth agenda.

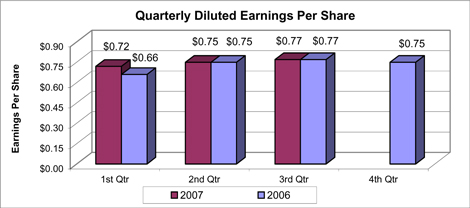

Through the first nine months of 2007, earnings per diluted share of $2.24 represented an increase of 2.8%, compared to $2.18 for the same three quarters in 2006, reflecting the Company's common stock repurchase activity. Net income of $14.7 million for the nine-month period ended September 30, 2007 was down 4.0% from the $15.3 million reported for the nine-month period ended September 30, 2006. These results translated into a return on average equity of 18.08% and a return on average assets of 1.13% for the nine-month period ended September 30, 2007, which compared to 18.23% and 1.19%, respectively, for the same period a year ago.

For the quarter ended September 30, 2007, earnings per diluted share of $0.77 was equal to the $0.77 per diluted share earned during the third quarter of 2006. Net income for the recently completed quarter was $5.0 million, which was $138,000, or 2.7%, lower than that earned in the same quarter a year ago.

At September 30, 2007, total assets of $1.7 billion were flat compared to where the Company ended the third quarter of 2006. Total loans of $1.2 billion at September 30, 2007 declined $69.8 million, or 5.61%, year-on-year. This decline is almost exclusively centered in our commercial real estate portfolio and reflects a continued conservative posture in the Company’s loan underwriting practices given the earlier-mentioned uncertainty surrounding the economy.

Year-to-date, the quality of the Company’s loan portfolio continues to demonstrate soundness and improvement, as evidenced by the level of non-performing loans to total loans, which at 0.50% at September 30, 2007 was down from 0.68% and 1.12% at September 30, 2006 and December 31, 2006, respectively. In addition, net charge-offs to total loans for the nine-month period ended September 30, 2007 was 0.09%. The allowance for loan and lease losses, at $13.9 million, was more than double the outstanding balances of our non-performing loans at September 30, 2007, and as a percentage of total loans stands at 1.19%. Once again, by any of the aforementioned measures of performance, your Company is considered better than average among its peers.

At September 30, 2007, total core deposits (total deposits excluding brokered certificates of deposit), at $1.1 billion, were up 3.2% over balances reported at September 30, 2006. The most significant deposit category for growth was money market accounts, up $30.9 million, or 11.8%, year-on-year. These results reflect the emphasis on the business development efforts of the Company’s commercial banking and cash management teams, who are laser-focused on deposit growth in the current environment. This effort is featured in the side panels of this report.

Positive momentum continued in the area of non-interest income, which at $9.4 million for the nine months ended September 30, 2007, was up $706,000, or 8.1%, versus the same period a year ago. Primary contributors to this success continue to be fiduciary services, brokerage and insurance commissions, and debit card activities with year-on-year revenue increases of 11.5%, 59.7% and 18.2%, respectively. At the same time, the Company maintained its commitment to controlling overhead as total non-interest expenses for the first nine months of 2007 were $25.5 million, which was $190,000, or 0.7%, lower than year-to-date at September 30, 2006. This resulted in an efficiency ratio of 54.92%, up from 51.73% reported at the same time last year, yet worthy of our recognition in the industry as a ‘low-cost producer.’

Undoubtedly the most significant event of the third quarter was our announced intention to acquire Union Bankshares Company, parent company of Union Trust Company, a $565.1 million community bank headquartered in Ellsworth, Maine. Our high regard for this 120-year old company dates back many years, which ostensibly kept them on our list of desirable acquisition targets. Prominent among their appealing characteristics is the coastal nature of the branch franchise, which makes for a natural geographic extension to our existing footprint. In addition, their well-developed wealth management and financial advisory business models will provide added scale to Camden National Corporation’s existing capabilities resident within Acadia Trust, N.A. and Acadia Financial Consultants. We anticipate closing on the transaction in early 2008 at which time the combined enterprises will result in the creation of the largest community banking organization headquartered in Maine.

On the governance front, Theodore C. Johanson, a Director of the Company and its affiliate, Camden National Bank, attained the mandatory age of retirement following 11 years of loyal service. Ted was an enlightened presence in our midst, always mindful of his fiduciary duty to you, the shareholders. We shall miss his valuable insight and good humor, and we will always be grateful for his many contributions to each of the Company’s constituencies.

Finally, the Board of Directors approved a dividend of $0.24 per share, payable on October 31, 2007, to shareholders of record on October 15, 2007. This represents a $0.02, or 9.1%, increase over the dividend paid for the same period a year ago.

It goes without saying that these are fairly challenging times for our industry. The investment community appears unimpressed, even with those who, like us, continue to produce results worthy of notice. Rest assured, however, that your Company and its workforce are undaunted by the effects of that which we cannot control. Rather, we remain collectively focused on doing what comes naturally – delivering remarkable experiences, each day, every day – confident that when economic conditions improve, we will be among those ready to seize the opportunities before us.

Sincerely,

Robert W. Daigle

President & CEO

Consolidated Statements of Condition (unaudited)

| September 30, | December 31, | |||||||||||

(In thousands, except number of shares & per share data) | 2007 | 2006 | 2006 | |||||||||

Assets | ||||||||||||

Cash and due from banks | $ | 35,833 | $ | 34,069 | $ | 33,358 | ||||||

Federal funds sold | 30,965 | 2,125 | — | |||||||||

Securities available for sale, at market value | 393,193 | 361,257 | 409,926 | |||||||||

Securities held to maturity | 34,277 | 34,169 | 34,167 | |||||||||

Loans, less allowance for loan losses of $13,925 $14,472 and $14,933 at September 30, 2007 and 2006 and December 31, 2006, respectively | 1,160,386 | 1,229,670 | 1,203,196 | |||||||||

Premises and equipment, net | 19,728 | 16,758 | 17,595 | |||||||||

Other real estate owned | 110 | — | 125 | |||||||||

Goodwill | 3,991 | 3,991 | 3,991 | |||||||||

Other assets | 69,343 | 67,149 | 67,528 | |||||||||

Total assets | $ | 1,747,826 | $ | 1,749,188 | $ | 1,769,886 | ||||||

Liabilities | ||||||||||||

Deposits: | ||||||||||||

Demand | $ | 160,516 | $ | 157,816 | $ | 146,458 | ||||||

NOW | 131,254 | 126,429 | 125,809 | |||||||||

Money market | 293,700 | 262,817 | 261,585 | |||||||||

Savings | 89,512 | 95,060 | 96,661 | |||||||||

Certificates of deposit | 502,434 | 577,999 | 555,288 | |||||||||

Total deposits | 1,177,416 | 1,220,121 | 1,185,801 | |||||||||

Borrowings from Federal Home Loan Bank | 263,084 | 307,227 | 340,499 | |||||||||

Other borrowed funds | 140,278 | 67,723 | 60,782 | |||||||||

Junior subordinated debentures | 36,083 | 36,083 | 36,083 | |||||||||

Due to broker | 556 | — | 24,354 | |||||||||

Accrued interest and other liabilities | 16,300 | 15,308 | 15,315 | |||||||||

Total liabilities | 1,633,717 | 1,646,462 | 1,662,834 | |||||||||

Shareholders' Equity | ||||||||||||

Common stock, no par value; authorized 20,000,000 shares, issued and outstanding 6,513,000, 6,615,480 and 6,616,780 shares on September 30, 2007 and 2006 and December 31, 2006, respectively | 2,531 | 2,450 | 2,450 | |||||||||

Surplus | 2,538 | 2,278 | 2,584 | |||||||||

Retained earnings | 111,861 | 102,434 | 105,959 | |||||||||

Accumulated other comprehensive loss | ||||||||||||

Net unrealized losses on securities available for sale, net of tax | (2,056 | ) | (4,266 | ) | (2,985 | ) | ||||||

Net unrealized losses on derivative instruments marked to market, net of tax | — | (170 | ) | (198 | ) | |||||||

Adjustment for unfunded post-retirement plans, net of tax | (765 | ) | — | (758 | ) | |||||||

Total accumulated other comprehensive loss | (2,821 | ) | (4,436 | ) | (3,941 | ) | ||||||

Total shareholders' equity | 114,109 | 102,726 | 107,052 | |||||||||

Total liabilities and shareholders' equity | $ | 1,747,826 | $ | 1,749,188 | $ | 1,769,886 | ||||||

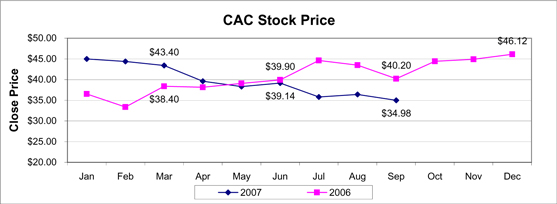

| Camden National Corporation stock is listed on the American Stock Exchange under the ticker symbol "CAC." Stock prices shown in chart are as of close of trading on the last business day of the month. |

Consolidated Statements of Income (unaudited)

| Nine Months Ended September 30, | Three Months Ended September 30, | |||||||||||

(In thousands, except number of shares & per share data) | 2007 | 2006 | 2007 | 2006 | ||||||||

Interest Income | ||||||||||||

Interest and fees on loans | $ | 64,162 | $ | 64,795 | $ | 21,105 | $ | 22,441 | ||||

Interest on securities | 15,380 | 13,815 | 5,085 | 4,639 | ||||||||

Other interest income | 1,455 | 906 | 637 | 341 | ||||||||

Total interest income | 80,997 | 79,516 | 26,827 | 27,421 | ||||||||

Interest Expense | ||||||||||||

Interest on deposits | 27,849 | 25,708 | 9,197 | 9,405 | ||||||||

Interest on other borrowings | 14,417 | 11,889 | 4,854 | 4,253 | ||||||||

Interest on junior subordinated debentures | 1,781 | 1,037 | 600 | 600 | ||||||||

Total interest expense | 44,047 | 38,634 | 14,651 | 14,258 | ||||||||

Net interest income | 36,950 | 40,882 | 12,176 | 13,163 | ||||||||

Provision for Loan and Lease Losses | 100 | 1,656 | — | 552 | ||||||||

Net interest income after provision for loan and lease losses | 36,850 | 39,226 | 12,176 | 12,611 | ||||||||

Non-interest Income | ||||||||||||

Service charges on deposit accounts | 2,582 | 2,570 | 838 | 892 | ||||||||

Other service charges and fees | 1,380 | 1,271 | 502 | 416 | ||||||||

Income from fiduciary services | 3,668 | 3,290 | 1,240 | 1,139 | ||||||||

Life insurance earnings | 603 | 600 | 218 | 200 | ||||||||

Other income | 1,183 | 979 | 367 | 356 | ||||||||

Total non-interest income | 9,416 | 8,710 | 3,165 | 3,003 | ||||||||

Non-interest Expenses | ||||||||||||

Salaries and employee benefits | 13,894 | 13,663 | 4,609 | 4,455 | ||||||||

Premises and fixed assets | 3,730 | 3,466 | 1,235 | 1,120 | ||||||||

Amortization of core deposit intangible | 642 | 650 | 214 | 213 | ||||||||

Other expenses | 7,200 | 7,877 | 2,344 | 2,392 | ||||||||

Total non-interest expenses | 25,466 | 25,656 | 8,402 | 8,180 | ||||||||

Income before income taxes | 20,800 | 22,280 | 6,939 | 7,434 | ||||||||

Income Taxes | 6,077 | 6,948 | 1,941 | 2,298 | ||||||||

Net Income | $ | 14,723 | $ | 15,332 | $ | 4,998 | $ | 5,136 | ||||

Per Share Data | ||||||||||||

Basic earnings per share | $ | 2.24 | $ | 2.18 | $ | 0.77 | $ | 0.77 | ||||

Diluted earnings per share | 2.24 | 2.18 | 0.77 | 0.77 | ||||||||

Cash dividends per share | $ | 0.72 | $ | 0.66 | $ | 0.24 | $ | 0.22 | ||||

Weighted average number of shares outstanding | 6,571,836 | 7,021,808 | 6,513,000 | 6,613,379 | ||||||||

Tangible book value per share(1) | $ | 16.83 | $ | 14.71 | ||||||||

| (1) | Computed by dividing total shareholders’ equity less goodwill and core deposit intangible by the number of common shares outstanding. |

| A complete set of financial statements for Camden National Corporation may be obtained upon written request to Suzanne Brightbill, Public Relations Officer, Camden National Corporation, P.O. Box 310, Camden, Maine 04843. |