| UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-CSR CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES Investment Company Act file number 811- 4079 John Hancock Equity Trust (Exact name of registrant as specified in charter) 601 Congress Street, Boston, Massachusetts 02210 (Address of principal executive offices) (Zip code) Alfred P. Ouellette Senior Attorney and Assistant Secretary 601 Congress Street Boston, Massachusetts 02210 (Name and address of agent for service) Registrant's telephone number, including area code: 617-663-4324 Date of fiscal year end: October 31 Date of reporting period: October 31, 2005 ITEM 1. REPORT TO SHAREHOLDERS. |

| Table of contents |

| Your fund at a glance |

| page 1 |

| Manager’s report |

| page 2 |

| A look at performance |

| page 6 |

| Growth of $10,000 |

| page 7 |

| Your expenses |

| page 8 |

| Fund’s investments |

| page 10 |

| Financial statements |

| page 13 |

| Trustees & officers |

| page 31 |

| For more information |

| page 37 |

To Our Shareholders,

I am pleased to be writing to you as the new President and Chief Executive Officer of John Hancock Funds, LLC, following the departure of James A. Shepherdson to pursue other opportunities. In addition, on July 25, 2005, your fund’s Board of Trustees appointed me to the roles of President and Chief Executive Officer of your fund.

As a means of introduction, I have been involved in the mutual fund industry since 1985. I have been with John Hancock Funds for the last 15 years, most recently as executive vice president of retail sales and marketing and a member of the company’s executive and investment committees. In my former capacity, I was responsible for all aspects of the distribution and marketing of John Hancock Funds’ open-end and closed-end funds. Outside of John Hancock, I have served as Chairman of the Investment Company Institute (ICI) Sales Force Marketing Committee since September 2003.

It is an exciting time to be at John Hancock Funds, and I am grateful for the opportunity to lead and shape its future growth. With the acquisition of John Hancock by Manulife Financial Corporation in April 2004, we are receiving broad support toward the goal of providing our shareholders with excellent investment opportunities and a more complete lineup of choices for the discerning investor.

For one example, we have recently added five “Lifestyle Portfolio” funds-of-funds that blend multiple fund offerings from internal and external money managers to create a broadly diversified asset allocation portfolio. Look for more information about these exciting additions to the John Hancock family of funds in the near future.

Although there has been a change in executive-level management, rest assured that the one thing that never wavers is John Hancock Funds’ commitment to placing the needs of shareholders above all else. We are all dedicated to the task of working with you and your financial advisors to help you reach your long-term financial goals.

Sincerely,

Keith F. Hartstein,

President and Chief Executive Officer

This commentary reflects the CEO’s views as of October 31, 2005. They are subject to change at any time.

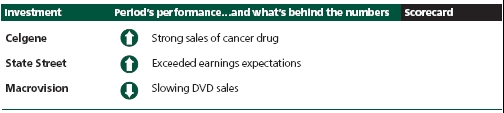

| YOUR FUND AT A GLANCE |

| The Fund seeks capi- tal appreciation by normally investing at least 80% of its assets in companies that the manager believes are, or have the potential to be technology leaders. |

| Over the last five months | |

| * | Technology stocks posted decent gains, although they lagged the |

| better-performing energy- and utility-driven broader market averages. | |

| * | The Fund performed in line with the NASDAQ-100 Index, but trailed |

| its Lipper peer group average primarily due to its focus on large-cap | |

| stocks as small-cap stocks outperformed. | |

| * | The Fund’s best performers were a diverse group, although hardware |

| holdings generally lagged. | |

| Total returns for the Fund are at net asset value with all distributions reinvested. These returns do not reflect the deduction of the maximum sales charge, which would reduce the performance shown above. | |

| * | From inception June 20, 2005 through October 31, 2005. |

| Top 10 holdings | |

| 4.0% | Apple Computer, Inc. |

| 3.6% | SanDisk Corp. |

| 3.0% | Google, Inc. |

| 2.9% | Lucent Technologies, Inc. |

| 2.9% | Corning, Inc. |

| 2.6% | Adobe Systems, Inc. |

| 2.5% | Pixar, Inc. |

| 2.5% | Yahoo! Inc. |

| 2.5% | Nokia Corp. |

| 2.4% | QUALCOMM, Inc. |

| As a percentage of net assets on October 31, 2005. | |

1

BY ANURAG PANDIT, CFA, PORTFOLIO MANAGER

| MANAGER’S REPORT |

| JOHN HANCOCK Technology Leaders Fund |

Effective June 20, 2005, the Light Revolution Fund was merged into the newly formed John Hancock Technology Leaders Fund.

Given all the economic and interest rate worries that weighed on them during the 12 months ended October 31, 2005, technology stocks posted decent gains, although they lagged the better-performing energy- and utility-driven broader market averages. In the final two months of 2004, tech stocks rallied strongly in concert with the broader stock market, fueled by expectations that economic growth would accelerate in 2005. But in the early months of 2005, the environment turned decidedly more negative. High oil prices, rising interest rates and worries over a potentially weak economy prompted nervous investors to pull back from tech stocks for fear that American consumers and business would rein in their spending on technology products and services. Valuation concerns also weighed on tech-company stocks given their strong prior advances during 2004. The spring and summer were much kinder to the tech group, thanks to receding worries about the impact on technology companies of higher energy prices and higher interest rates. And, contrary to expectations at the beginning of 2005, tech companies posted surprisingly solid earnings for the period.

| “...technology stocks posted decent gains, although they lagged the better-performing energy- and utility-driven broader market averages.” |

Performance

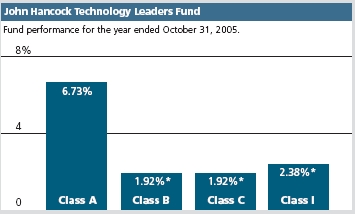

For the 12 months ended October 31, 2005, John Hancock Technology Leaders Fund’s Class A shares posted a total return of 6.73% at net asset value. During the same 12-month period, the NASDAQ 100 Index returned 6.63% and the average science and technology fund had a total return of 8.47%, according to Lipper, Inc.,1 while the Standard & Poor’s 500 Index returned 8.72% . From their inception on June 20, 2005, through October 31, 2005, the Fund’s Class B, Class C and Class I shares returned 1.92%, 1.92% and 2.38%, respectively, at net asset value. Keep in mind that your net asset value return will be different from the Fund’s performance if you were not invested in the Fund for the entire

2

period and did not reinvest all distributions. See pages six and seven for historical performance results.

Although we performed in line with our benchmark index, our lag behind the Lipper peer group stemmed, in our view, from our focus on high-quality large-cap stocks in a period when smaller-company issuers performed better.

Best performers

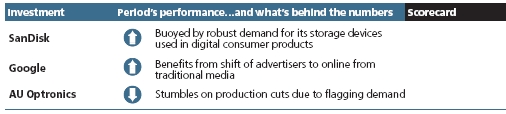

One of our best performers and biggest contributors to performance over the past 12 months was SanDisk Corp., the leading maker of storage devices for digital consumer products, including cell phones, digital cameras, Apple’s iPod line of products and others. The company’s dominant position with many of its partners, coupled with the success of many end products, such as the iPod, attracted considerable investor interest in the stock. Apple Computer, Inc. was also a big winner for us, as the iconic company successfully reinvented itself as a design innovator of technology products. Its iPod initiatives with music opened up a new avenue of growth and profitability for the company, while strong sales of MAC personal computers also helped. We enjoyed excellent gains from web-search company Google, Inc., which blew past investors’ expectations for profits and revenues, sending its shares soaring. The company continued to reap the benefits of advertisers’ moves toward spending online and away from traditional media.

In the software area, two companies were standouts. Cadence Design Systems, Inc., provider of software to design and verify advanced semiconductors, circuit boards and systems used in consumer electronics, networking and telecommunications equipment, was our biggest winner in the software segment. Autodesk, Inc. which is a leading design software and digital-content company used by customers in the building, manufacturing, infrastructure, digital media and wireless data services industries, was another strong performer due to its successful new products. Texas Instruments, Inc., the leading provider of cellular handset integrated circuit solutions, outperformed due to strong end-market demand that was driven by robust world-wide sales of cell phones. The result was better-than-expected financial performance for the company.

| “It was a tough period for some of our holdings that make technology hardware...” |

3

| Industry |

| distribution2 |

| Communications |

| equipment -- 12% |

| Semiconductors -- |

| 11% |

| Internet software & |

| services -- 8% |

| Systems |

| software -- 8% |

| Computer |

| hardware -- 8% |

| Application |

| software -- 6% |

| Computer storage & |

| peripherals -- 6% |

| Internet retail -- 4% |

| Movies & |

| entertainment -- 4% |

| Integrated |

| telecommunication |

| services -- 4% |

| All others -- 25% |

Hardware companies sag

It was a tough period for some of our holdings that make technology hardware, with AU Optronics Corp. our biggest disappointment during the period. The company, which is a leading supplier of flat panel and plasma displays, cut production forecasts substantially in the summer because mobile phone manufacturers delayed orders. Expectations for Dell, Inc., the leading personal computer maker, also were reduced amid worse-than-expected sales of its computers amid pricing pressure from resurgent rivals such as Hewlett-Packard.

Outlook

Overall, we’re bullish on the outlook for technology stocks in the coming year. From a macroeconomic standpoint, we believe we’re in the late stages of interest rate hikes, which should bode well for stocks overall. Furthermore, we’re on the cusp of an important product cycle that could drive better demand for tech products and services. The introduction of Microsoft’s Vista, an updated version of its Windows operating system, is likely to prompt consumers and businesses alike to make all types of software and hardware

upgrades. The debut of Vista, coupled with strong adoption of various consumer digital technologies and such home entertainment products as gaming and high definition television, could provide the underpinnings for good performance for a number of tech stocks. We also believe that several longer-term secular trends will continue to favor the tech-stock group, including the rapidly expanding need for data storage, the move toward Voice

4

over Internet Protocol (VoIP) and the explosive growth in the use of cell phones, to name a few. Lastly, we’re hopeful that 2006 could be the year that corporations, flush with cash, finally increase their spending on technology.

| “...we’re on the cusp of an important product cycle that should drive better demand for tech products and services.” |

This commentary reflects the views of the portfolio manager through the end of the Fund’s period discussed in this report. The manager’s statements reflect his own opinions. As such, they are in no way guarantees of future events, and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Sector investing is subject to greater risks than the market as a whole.

1 Figures from Lipper, Inc. include reinvested dividends and do not take into account sales charges. Actual load-adjusted performance is lower.

2 As a percentage of net assets on October 31, 2005.

5

| A LOOK AT PERFORMANCE For the period ended October 31, 2005 |

| Class A | Class B | Class C | Class I1 | |

| Inception date | 6-29-99 | 6-20-05 | 6-20-05 | 6-20-05 |

| Average annual returns with maximum sales charge (POP) | ||||

| One year | 1.39% | -- | -- | -- |

| Five years | -10.44 | -- | -- | -- |

| Since inception | -2.01 | -- | -- | -- |

| Cumulative total returns with maximum sales charge (POP) | ||||

| One year | 1.39 | -- | -- | -- |

| Five years | -42.39 | -- | -- | -- |

| Since inception | -12.09 | -3.08 | 0.92 | 2.38 |

Performance figures assume all distributions are reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class I shares.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month-end, please call 1-800-225-5291 or visit the Fund’s Web site at www.jhfunds.com. The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

1For certain types of investors as described in the Fund’s Class I share prospectus.

6

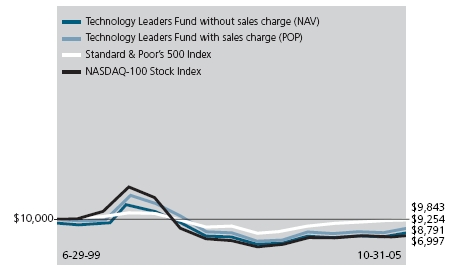

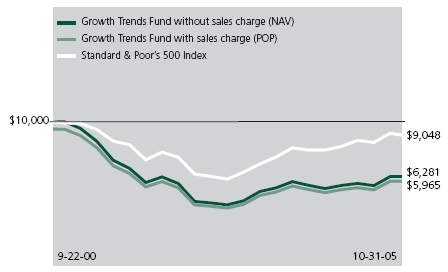

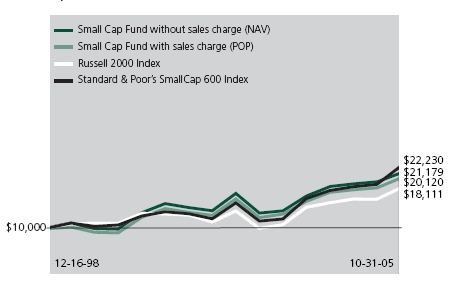

| GROWTH OF $10,000 |

This chart shows what happened to a hypothetical $10,000 investment in Class A shares for the period indicated. For comparison, we’ve shown the same investment in two separate indexes.

| 0 | |||

| Class B1 | Class C1 | Class I1,2 | |

| Period beginning | 6-20-05 | 6-20-05 | 6-20-05 |

| Without sales charge | $10,192 | $10,192 | $10,238 |

| With maximum sales charge | 9,692 | 10,092 | 10,238 |

| Index 1 | 9,986 | 9,986 | 9,986 |

| Index 2 | 10,584 | 10,584 | 10,584 |

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B, Class C and Class I shares, respectively, as of October 31, 2005. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Standard & Poor’s 500 Index -- Index 1 -- is an unmanaged index that includes 500 widely traded common stocks.

NASDAQ-100 Index -- Index 2 -- is an unmanaged index that includes 100 of the largest domestic and international non-financial companies listed on the NASDAQ Stock Market based on market capitalization.

It is not possible to invest directly in an index. Index figures do not reflect sales charges and would be lower if they did.

1 Index 2 figure as of June 30, 2005.

2 For certain types of investors as described in the Fund’s Class I share prospectus.

7

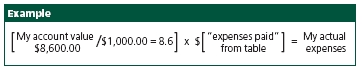

| YOUR EXPENSES |

These examples are intended to help you understand your ongoing

operating expenses.

| Understanding fund expenses | |

| As a shareholder of the Fund, you incur two types of costs: | |

| * | Transaction costs which include sales charges (loads) on |

| purchases or redemptions (varies by share class), minimum | |

| account fee charge, etc. | |

| * | Ongoing operating expenses including management |

| fees, distribution and service fees (if applicable) and other | |

| fund expenses. | |

| We are going to present only your ongoing operating | |

| expenses here. |

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on April 30, 2005, with the same investment held until October 31, 2005.

| Account value | Expenses paid | |

| $1,000.00 | Ending value | during period |

| on 4-30-05 | on 10-31-05 | ended 10-31-051 |

| Class A | $1,094.40 | $22.13 |

| Class B2 | 1,019.20 | 9.19 |

| Class C2 | 1,019.20 | 9.19 |

| Class I2 | 1,023.80 | 4.76 |

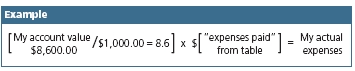

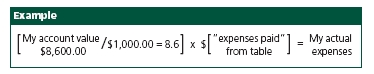

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at October 31, 2005 by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

8

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annual return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on April 30, 2005, with the same investment held until October 31, 2005. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| Account value | Expenses paid | |

| $1,000.00 | Ending value | during period |

| on 4-30-05 | on 10-31-05 | ended 10-31-051 |

| Class A | $1,004.07 | $21.18 |

| Class B2 | 1,009.12 | 9.14 |

| Class C2 | 1,009.11 | 9.15 |

| Class I2 | 1,013.51 | 4.74 |

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

| 1 | Expenses are equal to the Fund's annualized expense ratio of 4.19%, 2.50%, 2.50% and 1.29% for Class A, Class B, Class C and Class I, respectively, multiplied by the average account value over the period, multiplied by number of days in most recent fiscal half-year/365 or 366 (to reflect the one-half year period). |

| 2 | Class B, Class C and Class I shares began operations on 6-20-05. Ending values and expenses paid during the period are calculated for the period from 6-20-05 through 10-31-05. |

9

F I N A N C I A L S TAT E M E N T S

| FUND’S INVESTMENTS |

| Securities owned by the Fund on October 31, 2005 |

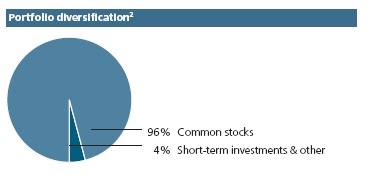

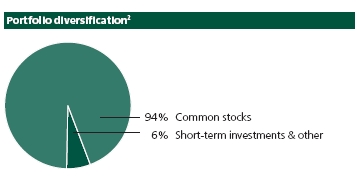

This schedule is divided into two main categories: common stocks, and short-term investments. Common stocks are further broken down by industry group. Short-term investments, which represent the Fund’s cash position, are listed last.

| Issuer | Shares | Value |

| Common stocks 95.81% | $3,408,144 | |

| (Cost $2,956,287) | ||

Application Software 5.49% | 195,093 | |

| Autodesk, Inc. | 750 | 33,847 |

| Cadence Design Systems, Inc. (I) | 4,400 | 70,312 |

| Intuit, Inc. (I) | 1,253 | 57,550 |

| Quest Software, Inc. (I) | 2,400 | 33,384 |

Broadcasting & Cable TV 2.62% | 93,175 | |

| Comcast Corp. (Special Class A) (I) | 1,679 | 46,021 |

| DIRECTV Group, Inc. (The) (I) | 3,316 | 47,154 |

Communications Equipment 12.04% | 428,428 | |

| Cisco Systems, Inc. (I) | 2,900 | 50,605 |

| Corning, Inc. (I) | 5,100 | 102,459 |

| Lucent Technologies, Inc. (I) | 36,250 | 103,312 |

| Nokia Corp., American Depositary Receipt (ADR) (Finland) | 5,246 | 88,238 |

| QUALCOMM, Inc. | 2,108 | 83,814 |

Computer Hardware 7.94% | 282,300 | |

| Apple Computer, Inc. (I) | 2,480 | 142,823 |

| Dell, Inc. (I) | 2,156 | 68,733 |

| International Business Machines Corp. | 864 | 70,744 |

Computer Storage & Peripherals 6.44% | 228,987 | |

| EMC Corp. (I) | 3,750 | 52,350 |

| SanDisk Corp. (I) | 2,185 | 128,675 |

| Seagate Technology (Cayman Islands) (I) | 3,310 | 47,962 |

Data Processing & Outsourced Services 3.32% | 118,242 | |

| First Data Corp. | 1,298 | 52,504 |

| Fiserv, Inc. (I) | 1,505 | 65,738 |

Diversified Banks 1.51% | 53,698 | |

| Wells Fargo & Co. | 892 | 53,698 |

| See notes to financial statements. |

10

F I N A N C I A L S TAT E M E N T S

| Issuer | Shares | Value | |

Electrical Components & Equipment 1.22% | $43,465 | ||

| AU Optronics Corp. (ADR) (Taiwan) | 3,409 | 43,465 | |

Electronic Equipment Manufacturers 1.76% | 62,615 | ||

| Garmin Ltd. (Cayman Islands) | 1,040 | 59,727 | |

| Symbol Technologies, Inc. | 348 | 2,888 | |

Home Entertainment Software 2.29% | 81,566 | ||

| Electronic Arts, Inc. (I) | 1,434 | 81,566 | |

Household Audio & Video Equipment 0.98% | 34,932 | ||

| Sony Corp. (ADR) (Japan) | 1,065 | 34,932 | |

Integrated Telecommunication Services 3.79% | 134,788 | ||

| BT Group Plc (ADR) (United Kingdom) (L) | 892 | 33,727 | |

| Telefonos de Mexico S.A. de CV (ADR) (Mexico) | 2,900 | 58,522 | |

| Verizon Communications, Inc. | 1,350 | 42,539 | |

Internet Retail 4.29% | 152,703 | ||

| Amazon.com, Inc. (I) | 1,650 | 65,802 | |

| eBay, Inc. (I) | 1,548 | 61,301 | |

| IAC/InterActiveCorp (I) | 1,000 | 25,600 | |

Internet Software & Services 8.37% | 297,807 | ||

| Digital River, Inc. (I) | 2,050 | 57,421 | |

| Google, Inc. (I) | 285 | 106,060 | |

| Infosys Technologies Ltd. (ADR) (India) | 676 | 45,968 | |

| Yahoo! Inc. (I) | 2,390 | 88,358 | |

Leisure Products 0.95% | 33,822 | ||

| Expedia, Inc. (I) | 1,800 | 33,822 | |

Movies & Entertainment 3.88% | 138,041 | ||

| Disney (Walt) Co. (The) | 2,009 | 48,959 | |

| Pixar, Inc. (I) | 1,756 | 89,082 | |

Photographic Equipment & Supplies 1.94% | 69,150 | ||

| Canon, Inc. (ADR) (Japan) | 1,303 | 69,150 | |

Semiconductor Equipment 3.03% | 107,964 | ||

| Applied Materials, Inc. | 3,200 | 52,416 | |

| KLA-Tencor Corp. | 1,200 | 55,548 | |

Semiconductors 10.74% | 381,802 | ||

| Advanced Micro Devices, Inc. (I) | 3,000 | 69,660 | |

| Analog Devices, Inc. | 1,500 | 52,170 | |

| Intel Corp. | 2,981 | 70,054 | |

| Maxim Integrated Products, Inc. | 2,050 | 71,094 | |

| See notes to financial statements. |

11

F I N A N C I A L S TAT E M E N T S

| Issuer | Shares | Value | |

Semiconductors (continued) | |||

| Texas Instruments, Inc. | 2,610 | $74,516 | |

| Xilinx, Inc. | 1,850 | 44,308 | |

Systems Software 8.33% | 296,189 | ||

| Adobe Systems, Inc. | 2,864 | 92,364 | |

| Microsoft Corp. | 3,068 | 78,848 | |

| SAP A.G., (ADR) (Germany) | 1,232 | 52,902 | |

| Symantec Corp. (I) | 3,022 | 72,075 | |

Technology Distributors 1.30% | 46,207 | ||

| CDW Corp. | 820 | 46,207 | |

Wireless Telecommunication Services 3.58% | 127,170 | ||

| China Mobile (Hong Kong) Ltd. (ADR) (Hong Kong) | 3,236 | 72,648 | |

| Sprint Nextel Corp. | 2,339 | 54,522 | |

| Interest | Par value | ||

| Issuer, description, maturity date | rate | (000) | Value |

Short-term investments 4.34% | $154,542 | ||

| (Cost $154,542) | |||

Joint Repurchase Agreement 4.13% | 147,000 | ||

| Investment in a joint repurchase agreement | |||

| transaction with Barclays Capital, Inc. -- | |||

| Dated 10-31-05 due 11-1-05 (secured by | |||

| U.S. Treasury Inflation Indexed Notes 0.875% | |||

| due 4-15-10 and 1.875% due 7-15-13) | 3.94% | $147 | 147,000 |

| Shares | |||

| Cash Equivalents 0.21% | 7,542 | ||

| AIM Cash Investment Trust (T) | 7,542 | 7,542 | |

Total investments 100.15% | $3,562,686 | ||

Other assets and liabilities, net (0.15%) | ($5,382) | ||

| Total net assets 100.00% | $3,557,304 | ||

| (I) | Non-income-producing security. |

| (L) | All or a portion of this security is on loan as of October 31, 2005. |

| (T) | Represents investment of securities lending collateral. |

| Parenthetical disclosure of a foreign country in the security description represents country of a foreign issuer. The percentage shown for each investment category is the total value of that category as a percentage of the net assets of the Fund. | |

| See notes to financial statements. |

12

| ASSETS AND LIABILITIES October 31, 2005 This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share. |

| Assets | |

| Investments at value (cost $3,110,829) including | |

| $7,394 of securities loaned | $3,562,686 |

| Cash | 993 |

| Receivable for shares sold | 6,089 |

| Dividends and interest receivable | 887 |

| Receivable from affiliates | 28,454 |

| Total assets | 3,599,109 |

| Liabilities | |

| Payable upon return of securities loaned | 7,542 |

| Payable to affiliates | |

| Management fees | 5,807 |

| Distribution and service fees | 163 |

| Other | 298 |

| Other payables and accrued expenses | 27,995 |

| Total liabilities | 41,805 |

| Net assets | |

| Capital paid-in | 7,851,848 |

| Accumulated net realized loss on investments | (4,746,401) |

| Net unrealized appreciation of investments | 451,857 |

| Net assets | $3,557,304 |

| Net asset value per share | |

| Based on net asset values and shares outstanding -- | |

| the Fund has an unlimited number of shares | |

| authorized with no par value | |

| Class A ($3,347,329 ÷ 370,356 shares) | $9.04 |

| Class B ($173,059 ÷ 19,205 shares) | $9.01 |

| Class C ($35,893 ÷ 3,983 shares) | $9.01 |

| Class I ($1,023 ÷ 113 shares) | $9.05 |

| Maximum offering price per share | |

| Class A1 ($9.04 ÷ 95%) | $9.52 |

| 1 | On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced. |

| See notes to financial statements. |

13

F I N A N C I A L S TAT E M E N T S

| OPERATIONS |

| For the year ended October 31, 2005 |

| This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated. |

| Investment income | |

| Dividends (net of foreign withholding taxes of $303) | $27,076 |

| Interest | 2,672 |

| Total investment income | 29,748 |

| Expenses | |

| Investment management fees | 33,831 |

| Class A distribution and service fees | 9,079 |

| Class B distribution and service fees | 211 |

| Class C distribution and service fees | 46 |

| Class A, B and C transfer agent fees | 23,223 |

| Professional fees | 66,950 |

| Registration and filing fees | 62,541 |

| Miscellaneous | 13,850 |

| Custodian fees | 10,182 |

| Printing | 7,772 |

| Accounting and legal services fees | 310 |

| Trustees’ fees | 47 |

| Total expenses | 228,042 |

| Less expense reductions | (71,975) |

| Net expenses | 156,067 |

| Net investment loss | (126,319) |

| Realized and unrealized gain (loss) | |

| Net realized gain on investments | 549,414 |

| Change in net unrealized appreciation | |

| (depreciation) of investments | (207,725) |

| Net realized and unrealized gain | 341,689 |

| Increase in net assets from operations | $215,370 |

| See notes to financial statements. |

14

F I N A N C I A L S TAT E M E N T S

| CHANGES IN NET ASSETS |

| These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions. |

| Year | Year | |

| ended | ended | |

| 10-31-04 | 10-31-05 | |

| Increase (decrease) in net assets | ||

| From operations | ||

| Net investment loss | ($126,037) | ($126,319) |

| Net realized gain | 267,392 | 549,414 |

| Change in net unrealized | ||

| appreciation (depreciation) | (125,364) | (207,725) |

| Increase in net assets | ||

| resulting from operations | 15,991 | 215,370 |

| From Fund share transactions | (585,538) | (15,338) |

| Net assets | ||

| Beginning of period | 3,926,819 | 3,357,272 |

| End of period | $3,357,272 | $3,557,304 |

| See notes to financial statements. |

15

F I N A N C I A L H I G H L I G H T S

| FINANCIAL HIGHLIGHTS |

| CLASS A SHARES The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period. |

| Period ended | 10-31-011 | 10-31-021 | 10-31-031 | 10-31-041 | 10-31-052 |

| Per share operating performance | |||||

| Net asset value, | |||||

| beginning of period | $15.25 | $8.46 | $6.32 | $8.42 | $8.47 |

| Net investment loss3 | (0.14) | (0.21) | (0.19) | (0.30) | (0.33) |

| Net realized and unrealized | |||||

| gain (loss) on investments | (6.35) | (1.93) | 2.29 | 0.35 | 0.90 |

| Total from | |||||

| investment operations | (6.49) | (2.14) | 2.10 | 0.05 | 0.57 |

| Less distributions | |||||

| From net investment income | (0.19) | -- | -- | -- | -- |

| From net realized gain | (0.11) | -- | -- | -- | -- |

| (0.30) | -- | -- | -- | -- | |

| Net asset value, end of period | $8.46 | $6.32 | $8.42 | $8.47 | $9.04 |

| Total return4,5 (%) | (43.25)6 | (25.30) | 33.23 | 0.59 | 6.73 |

| Ratios and supplemental data | |||||

| Net assets, end of period | |||||

| (in millions) | $6 | $3 | $4 | $3 | $3 |

| Ratio of expenses | |||||

| to average net assets (%) | 2.00 | 3.27 | 3.19 | 4.13 | 4.62 |

| Ratio of adjusted expenses | |||||

| to average net assets7 (%) | 3.98 | 4.38 | 4.02 | 4.13 | 6.71 |

| Ratio of net investment loss | |||||

| to average net assets (%) | (1.37) | (2.66) | (2.63) | (3.56) | (3.74) |

| Portfolio turnover (%) | 51 | 73 | 109 | 54 | 59 |

| See notes to financial statements. |

16

F I N A N C I A L H I G H L I G H T S

CLASS B SHARES

| Period ended | 10-31-058 |

| Per share operating performance | |

| Net asset value, | |

| beginning of period | $8.84 |

| Net investment loss3 | (0.06) |

| Net realized and unrealized | |

| gain on investments | 0.23 |

| Total from | |

| investment operations | 0.17 |

| Net asset value, end of period | $9.01 |

| Total return4,5 (%) | 1.929 |

| Ratios and supplemental data | |

| Net assets, end of period | |

| (in millions) | --10 |

| Ratio of expenses | |

| to average net assets (%) | 2.5011 |

| Ratio of adjusted expenses | |

| to average net assets7 (%) | 8.3111 |

| Ratio of net investment loss | |

| to average net assets (%) | (1.81)11 |

| Portfolio turnover (%) | 59 |

| See notes to financial statements. |

17

F I N A N C I A L H I G H L I G H T S

CLASS C SHARES

| Period ended | 10-31-058 |

| Per share operating performance | |

| Net asset value, | |

| beginning of period | $8.84 |

| Net investment loss3 | (0.06) |

| Net realized and unrealized | |

| gain on investments | 0.23 |

| Total from | |

| investment operations | 0.17 |

| Net asset value, end of period | $9.01 |

| Total return4,5 (%) | 1.929 |

| Ratios and supplemental data | |

| Net assets, end of period | |

| (in millions) | --10 |

| Ratio of expenses | |

| to average net assets (%) | 2.5011 |

| Ratio of adjusted expenses | |

| to average net assets7 (%) | 8.3111 |

| Ratio of net investment loss | |

| to average net assets (%) | (2.02)11 |

| Portfolio turnover (%) | 59 |

| See notes to financial statements. |

18

F I N A N C I A L H I G H L I G H T S

CLASS I SHARES

| Period ended | 10-31-058 |

| Per share operating performance | |

| Net asset value, | |

| beginning of period | $8.84 |

| Net investment loss3 | (0.01) |

| Net realized and unrealized | |

| gain on investments | 0.22 |

| Total from | |

| investment operations | 0.21 |

| Net asset value, end of period | $9.05 |

| Total return4,5 (%) | 2.389 |

| Ratios and supplemental data | |

| Net assets, end of period | |

| (in millions) | --10 |

| Ratio of expenses | |

| to average net assets (%) | 1.2911 |

| Ratio of adjusted expenses | |

| to average net assets7 (%) | 7.1011 |

| Ratio of net investment loss | |

| to average net assets (%) | (0.46)11 |

| Portfolio turnover (%) | 59 |

| 1 | Audited by previous Auditor. |

| 2 | Effective 6-18-05, shareholders of the former Light Revolution Fund became owners of an equal number of full and fractional Class A shares of the John Hancock Technology Leaders Fund. Additionally, the accounting and performance history of the Light Revolution Fund was redesignated as that of Class A of John Hancock Technology Leaders Fund. |

| 3 | Based on the average of the shares outstanding. |

| 4 | Assumes dividend reinvestment and does not reflect the effect of sales charges. |

| 5 | Total returns would have been lower had certain expenses not been reduced during the periods shown. |

| 6 | The total return calculation does not reflect the maximum sales charge discounted 2-08-02 of 4.75%. |

| 7 | Does not take into consideration expense reductions during the periods shown. |

| 8 | Class B, Class C and Class I shares began operations on 6-20-05. |

| 9 | Not annualized. |

| 10 | Less than $500,000. |

| 11 | Annualized. |

| See notes to financial statements. |

19

| NOTES TO STATEMENTS |

Note A

Accounting policies

John Hancock Technology Leaders Fund (the “Fund”) is a diversified series of John Hancock Equity Trust, an open-end management investment company registered under the Investment Company Act of 1940. The investment objective of the Fund is to achieve long-term growth of capital.

The Trustees have authorized the issuance of multiple classes of shares of the Fund, designated as Class A, Class B, Class C and Class I shares. The shares of each class represent an interest in the same portfolio of investments of the Fund and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Trustees, may be applied differently to each class of shares in accordance with current regulations of the Securities and Exchange Commission and the Internal Revenue Service. Shareholders of a class that bears distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan.

The Fund is the accounting and performance successor to Light Revolution Fund (the “Predecessor Fund”), a diversified open-end management investment company organized as a Maryland corporation. On June 17, 2005, the Fund acquired substantially all the assets and assumed the liabilities of the Predecessor Fund pursuant to an agreement and plan of reorganization, in exchange for Class A shares of the Fund.

Significant accounting policies

of the Fund are as follows:

Valuation of investments

Securities in the Fund’s portfolio are valued on the basis of market quotations, valuations provided by independent pricing services or if quotations are not readily available, or the value has been materially affected by events occurring after the closing of a foreign market, at fair value as determined in good faith in accordance with procedures approved by the Trustees. Short-term debt investments which have a remaining maturity of 60 days or less may be valued at amortized cost, which approximates market value. Investments in AIM Cash Investment Trust are valued at their net asset value each business day. All portfolio transactions initially expressed in terms of foreign currencies have been translated into U.S. dollars as described in “Foreign currency translation” below.

Joint repurchase agreement

Pursuant to an exemptive order issued by the Securities and Exchange Commission, the Fund, along with other registered investment companies having a management contract with John Hancock Advisers, LLC (the “Adviser”), a wholly owned subsidiary of John Hancock Financial Services, Inc., may

20

participate in a joint repurchase agreement transaction. Aggregate cash balances are invested in one or more large repurchase agreements, whose underlying securities are obligations of the U.S. government and/or its agencies. The Fund’s custodian bank receives delivery of the underlying securities for the joint account on the Fund’s behalf. The Adviser is responsible for ensuring that the agreement is fully collateralized at all times.

Foreign currency

translation

All assets or liabilities initially expressed in terms of foreign currencies are translated into U.S. dollars based on London currency exchange quotations as of 4:00 P.M., London time, on the date of any determination of the net asset value of the Fund. Transactions affecting statement of operations accounts and net realized gain (loss) on investments are translated at the rates prevailing at the dates of the transactions.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctua-tions are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign currency exchange gains or losses arise from sales of foreign currency, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency exchange gains and losses arise from changes in the value of assets and liabilities, other than investments in securities, resulting from changes in the exchange rates.

Investment transactions

Investment transactions are recorded as of the date of purchase, sale or maturity. Net realized gains and losses on sales of investments are determined on the identified cost basis. Capital gains realized on some foreign securities are subject to foreign taxes, which are accrued as applicable.

Class allocations

Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the appropriate net asset value of the respective classes. Distribution and service fees, if any, and transfer agent fees for Class I shares, are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rate(s) applicable to each class.

Expenses

The majority of expenses are directly identifiable to an individual fund. Expenses that are not readily identifi-able to a specific fund are allocated in such a manner as deemed equitable, taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

Bank borrowings

The Fund is permitted to have bank borrowings for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The Fund has entered into a syndicated line of credit agreement with various banks. This agreement enables the Fund to participate, with other funds managed by the Adviser, in an unsecured line of credit with banks, which permits borrowings of up to $250 million, collectively. Interest is charged to each fund based on its borrowing. In addition, a commitment fee is charged to each fund based on the average daily unused portion of the line of credit, and is allocated among the participating funds. The Fund had no borrowing activity under the line of credit during the year ended October 31, 2005.

21

Securities lending

The Fund may lend securities to certain qualified brokers who pay the Fund negotiated lender fees. The loans are collateralized at all times with cash or securities with a market value at least equal to the market value of the securities on loan. As with other extensions of credit, the Fund may bear the risk of delay of the loaned securities in recovery or even loss of rights in the collateral, should the borrower of the securities fail financially. At October 31, 2005, the Fund loaned securities having a market value of $7,394 collateralized by cash in the amount of $7,542. The cash collateral was invested in a short-term instrument. Securities lending expenses, if any, are paid by the Fund to the Adviser.

Federal income taxes

The Fund qualifies as a “regulated investment company” by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required. For federal income tax purposes, the Fund has $4,641,491 of a capital loss carryforward available, to the extent provided by regulations, to offset future net realized capital gains. To the extent that such carryforward is used by the Fund, no capital gain distributions will be made. The loss carryforward expires as follows: October 31, 2009 -- $925,651, October 31, 2010 --$3,278,640 and October 31, 2011 -- $437,200.

Dividends, interest

and distributions

Dividend income on investment securities is recorded on the ex-dividend date or, in the case of some foreign securities, on the date thereafter when the Fund identifies the dividend. Interest income on investment securities is recorded on the accrual basis. Foreign income may be subject to foreign withholding taxes, which are accrued as applicable.

The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. There were no distributions during the years ended October 31, 2004 and October 31, 2005. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class.

As of October 31, 2005 there were no distributable earnings on a tax basis.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Use of estimates

The preparation of these financial statements, in accordance with accounting principles generally accepted in the United States of America, incorporates estimates made by management in determining the reported amount of assets, liabilities, revenues and expenses of the Fund. Actual results could differ from these estimates.

Note B

Management fee and

transactions with

affiliates and others

The Fund has an investment management contract with the Adviser. Under the investment management contract, the Fund pays a daily management fee to the Adviser, at an annual rate of 1.00% of the Fund’s average daily net asset value. Prior to June 18, 2005, the Predecessor Fund paid a monthly management fee to its investment adviser, Light Index Investment Company, at an annual rate of 1.00% of the Predecessor Fund’s average daily net assets.

The Adviser has agreed to limit the Fund’s total expenses, excluding distribution and service fees and transfer agent fees, to 1.25%

22

of the Fund’s average daily net asset value, on an annual basis, and total operating expenses of Class A, Class B, Class C and Class I shares to 1.80%, 2.50%, 2.50% and 1.30% of each respective class’s average daily net asset value, at least until June 19, 2006. This limitation became effective on June 20, 2005. Accordingly, the expense reductions related to this total expense limitation amounted to $71,975 for the year ended October 31, 2005. The Adviser reserves the right to terminate these limitations in the future.

The Fund has Distribution Plans with John Hancock Funds, LLC (“JH Funds”), a wholly owned subsidiary of the Adviser. The Fund has adopted Distribution Plans with respect to Class A, Class B and Class C, pursuant to Rule 12b-1 under the Investment Company Act of 1940, to reimburse JH Funds for the services it provides as distributor of shares of the Fund. Accordingly, the Fund makes monthly payments to JH Funds at an annual rate not to exceed 0.30% of Class A average daily net asset value and 1.00% of Class B and Class C average daily net asset value. A maximum of 0.25% of such payments may be service fees, as defined by the Conduct Rules of the National Association of Securities Dealers. Under the Conduct Rules, curtailment of a portion of the Fund’s 12b-1 payments could occur under certain circumstances. Prior to June 17, 2005, Quasar Distributors, LLC, served as the Predecessor Fund’s principal underwriter and was compensated at an annual rate of 0.25% of the Predecessor Fund’s average daily net asset value.

Class A shares are assessed up-front sales charges. During the year ended October 31, 2005, JH Funds received net up-front sales charges of $702 with regard to sales of Class A shares. Of this amount, $106 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $596 was paid as sales commissions to unrelated broker-dealers and none paid as sales commissions to sales personnel of Signator Investors, Inc. (“Signator Investors”), a related broker-dealer. The Adviser’s indirect parent, John Hancock Life Insurance Company (“JHLICo”), is the indirect sole shareholder of Signator Investors.

Class B shares that are redeemed within six years of purchase are subject to a contingent deferred sales charge (“CDSC”) at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a CDSC at a rate of 1.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from the CDSCs are paid to JH Funds and are used, in whole or in part, to defray its expenses for providing distribution-related services to the Fund in connection with the sale of Class B and Class C shares. During the year ended October 31, 2005, JH Funds received no CDSCs with regard to Class B shares and Class C shares.

The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (“Signature Services”), an indirect subsidiary of JHLICo. For Class A, Class B and Class C shares, the Fund pays a monthly transfer agent fee at an annual rate of 0.05% of each class’s average daily net asset value, plus a fee based on the number of shareholder accounts and reimbursement for certain out-of-pocket expenses, aggregated and allocated to each class on the basis of its relative net asset value. For Class I shares the Fund pays a monthly transfer agent fee at a total annual rate of 0.05% of Class I average daily net asset value. The Adviser has agreed to limit transfer agent fees on Class A, Class B and Class C shares to 0.25% of each class’s average daily net asset value, at least until June 19, 2006.

23

Signature Services has also agreed to voluntarily reduce the Fund’s asset-based portion of the transfer agent fee if the total transfer agent fee exceeds the Lipper, Inc. median transfer agency fee for comparable mutual funds by 0.05% . There were no transfer agent fee reductions during the year ended October 31, 2005. Signature Services reserves the right to terminate this limitation at any time. Prior to June 17, 2005, Mutual Shareholder Services served as the Predecessor Fund’s transfer agent and fund accountant.

The Fund has an agreement with the Adviser to perform necessary tax, accounting and legal services for the Fund. The compensation for the year amounted to $310. The Fund also paid the Adviser the amount of $747 for certain publishing services, included in the printing fees. The Fund also paid the amount of $50 to JHLICo for certain compliance costs, included in the miscellaneous expenses.

The Adviser and other subsidiaries of JHLICo owned 113 Class I shares of benefi-cial interest of the Fund on October 31, 2005.

Mr. James R. Boyle is an officer of certain affiliates of the Adviser, as well as affili-ated Trustee of the Fund, and is compensated by the Adviser and/or its affiliates. The compensation of other unaffiliated Trustees is borne by the Fund. The unaffiliated Trustees may elect to defer, for tax purposes, their receipt of this compensation under the John Hancock Group of Funds Deferred Compensation Plan. The Fund makes investments into other John Hancock funds, as applicable, to cover its liability for the deferred compensation. Investments to cover the Fund’s deferred compensation liability are recorded on the Fund’s books as an other asset. The deferred compensation liability and the related other asset are always equal and are marked to market on a periodic basis to reflect any income earned by the investments, as well as any unrealized gains or losses. The Deferred Compensation Plan investments had no impact on the operations of the Fund.

24

Note C

Fund share transactions

This listing illustrates the number of Fund shares sold and repurchased during the last two years, along with the corresponding dollar value.

| Year ended 10-31-04 | Year ended 10-31-05 | |||

| Shares | Amount | Shares | Amount | |

| Class A shares | ||||

| Sold | 4,058 | $32,893 | 21,880 | $197,339 |

| Repurchased | (74,253) | (618,431) | (47,794) | (424,498) |

| Net decrease | (70,195) | ($585,538) | (25,914) | ($227,159) |

| Class B shares1 | ||||

| Sold | -- | -- | 24,986 | $226,995 |

| Repurchased | -- | -- | (5,781) | (52,223) |

| Net increase | -- | -- | 19,205 | $174,772 |

| Class C shares1 | ||||

| Sold | -- | -- | 3,983 | $36,049 |

| Repurchased | -- | -- | -- | -- |

| Net increase | -- | -- | 3,983 | $36,049 |

| Class I shares1 | ||||

| Sold | -- | -- | 113 | $1,000 |

| Repurchased | -- | -- | -- | -- |

| Net increase | -- | -- | 113 | $1,000 |

| Net decrease | (2,613) | ($15,338) | ||

| 1 | Class B, Class C and Class I shares began operations on 6-20-05. |

Note D

Investment

transactions

Purchases and proceeds from sales or maturities of securities, other than short-term securities and obligations of the U.S. government, during the year ended October 31, 2005, aggregated $1,916,633 and $2,126,633, respectively.

The cost of investments owned on October 31, 2005, including short-term investments, for federal income tax purposes, was $3,215,739. Gross unrealized appreciation and depreciation of investments aggregated $530,514 and $183,567, respectively, resulting in net unrealized appreciation of $346,947. The difference between book basis and tax basis net unrealized appreciation of investments is attributable primarily to the tax deferral of losses on certain sales of securities.

Note E

Reclassification

of accounts

During the year ended October 31, 2005, the Fund reclassified amounts to reflect a decrease in accumulated net investment loss of $126,319 and a decrease in capital paid-in of $126,319. This represents the amount necessary to report these balances on a tax basis, excluding certain temporary differences, as of October 31, 2005. Additional adjustments may be needed in subsequent reporting periods. These reclassifications, which have no impact on the net asset value of the Fund, are primarily attributable to certain differences in the computation of distributable income and capital gains under federal tax rules versus

25

accounting principles generally accepted in the United States of America, book and tax differences in accounting for net operating losses. The calculation of net investment loss per share in the Fund’s Financial Highlights excludes these adjustments.

Note F

Acquisition

On June 17, 2005, the Fund acquired substantially all of the assets and liabilities of the Predecessor Fund in exchange solely for Class A shares of the Fund. The acquisition was accounted for as tax-free exchange of 368,620 Class A shares of the Fund for the net assets of the Predecessor Fund, which amounted to $3,257,918, including $412,456 of unrealized appreciation, after the close of business on June 17, 2005. Accounting and performance history of the Predecessor Fund was redesignated as that of Class A of John Hancock Technology Leaders Fund.

26

| AUDITORS’ REPORT |

| Report of Independent Registered Public Accounting Firm |

| To the Board of Trustees and Shareholders of John Hancock Technology Leaders Fund, |

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of John Hancock Technology Leaders Fund (the “Fund”) at October 31, 2005, the results of its operations, the changes in its net assets and the financial highlights for the periods, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these finan-cial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and sig-nificant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at October 31, 2005 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.The statement of changes in net assets of the Fund for the year ended October 31, 2004, and the financial highlights for each of the four years ended on or before October 31, 2004 were audited by other independent registered public accounting firms, whose report dated December 23, 2004 expressed an unqualified opinion thereon.

| PricewaterhouseCoopers LLP Boston, Massachusetts December 14, 2005 |

27

| TAX INFORMATION |

Unaudited

For federal income tax purposes, the following information is furnished with respect to the distributions of the Fund, if any, paid during its taxable year ended October 31, 2005.

The Fund hereby designates the maximum amount allowable of its net taxable income as qualified dividend income as provided in the Jobs and Growth Tax Relief Reconciliation Act of 2003. This amount will be reflected on Form 1099-DIV for the calendar year 2005.

Shareholders will be mailed a 2005 U.S. Treasury Department Form 1099-DIV in January 2006. This will reflect the total of all distributions that are taxable for calendar year 2005.

28

Board Consideration

of Investment

Advisory Agreement:

John Hancock

Technology Leaders

Fund

Section 15(c) of the Investment Company Act of 1940 (the “1940 Act”) requires the Board of Trustees (the “Board”) of John Hancock Equity Trust (the “Trust”), including a majority of the Trustees who have no direct or indirect interest in the investment advisory agreement and are not “interested persons” of the Trust, as defined in the 1940 Act (the “Independent Trustees”), initially to review and approve the investment advisory agreement (the “Advisory Agreement”) with John Hancock Advisers, LLC (the “Adviser”) for the John Hancock Technology Leaders Fund (the “Fund”).

At meetings held on March 8, 2005, the Board, including the Independent Trustees, considered the factors and reached the conclusions described below relating to the selection of the Adviser and the approval of the Advisory Agreement. During such meeting, the Board’s Contracts/Operations Committee and the Independent Trustees also met in executive sessions with their independent legal counsel. In evaluating the Advisory Agreement, the Board, including the Contracts/Operations Committee and the Independent Trustees, reviewed a broad range of information requested for this purpose by the Independent Trustees, including but not limited to the following: (i) advisory and other fees incurred by, and the expense ratios of, a group of comparable funds selected by the Adviser and the proposed fee and estimated expense ratio of the Fund and (ii) the advisory fees of comparable portfolios of other clients of the Adviser. The Independent Trustees also consider information that was provided in connection with the Trustees annual review of the advisory agreement for other funds managed by the Adviser including (i) the Adviser’s financial results and condition, (ii) the background and experience of senior management and investment professionals, (iii) the nature, cost and character of advisory and non-investment management services provided by the Adviser and its affiliates to other series of the Trust and (iv) the Adviser’s record of compliance with applicable laws and regulations, with the Fund’s investment policies and restrictions, and with the Fund’s Code of Ethics and the structure and responsibilities of the Adviser’s compliance department.

Nature, extent and quality

of services

The Board considered the ability of the Adviser, based on its resources, reputation and other attributes, to attract and retain qualified investment professionals, including research, advisory, and supervisory personnel. The Board further considered the compliance programs and compliance records of the Adviser. In addition, the Board took into account the administrative services to be provided to the Fund by the Adviser and its affiliates.

Based on the above factors, together with those references below, the Board concluded that, within the context of its full deliberations, the nature, extent and quality of the investment advisory services provided to the Fund by the Adviser were sufficient to support approval of the Advisory Agreement.

Investment advisory fee

rates and expenses

The Board reviewed and considered the contractual investment advisory rate to be payable by the Fund to the Adviser for investment advisory services (the “Advisory Agreement Rate”). The Board received and considered information comparing the Advisory Agreement Rate with the average fee paid by a group of similar funds selected by the Adviser. The Board noted that the Advisory Agreement Rate was consistent with the average advisory fee rate for these similar funds. The Board concluded that the Advisory Agreement Rate was reasonable in relation to the services to be provided.

29

The Board received and considered information regarding the Fund’s estimated total operating expense ratio and its various components, including contractual advisory fees, actual advisory fees, non-management fees, Rule 12b-1 and non-Rule 12b-1 service fees. The Board also considered comparisons of these expenses to the expenses information for the similar funds. The Board noted that the total operating expense ratio of the Fund was projected to be lower than that of the peer group of funds. Based on the above-referenced considerations and other factors, the Board concluded that the Fund’s projected overall expense ratio supported the approval of the Advisory Agreement.

Information about

services to other clients

The Board also received information about the nature, extent and quality of services and fee rates offered by the Adviser to its other clients, including other registered investment companies, institutional investors and separate accounts. The Board concluded that the Advisory Agreement Rate was not unreasonable, taking into account fee rates offered to others by the Adviser and giving effect to differences in services covered by such fee rates.

Other benefits to

the Adviser

The Board received information regarding potential “fall-out” or ancillary bene-fits received by the Adviser and its affiliates as a result of the Adviser’s relationship with the Fund. Such benefits could include, among others, benefits directly attributable to the relationship of the Adviser with the Fund and benefits potentially derived from an increase in the business of the Adviser as a result of its relationship with the Fund (such as the ability to market to shareholders other finan-cial products offered by the Adviser and its affiliates).

The Board also considered the effectiveness of the Adviser’s and the Fund’s policies and procedures for complying with the requirements of the federal securities laws, including those relating to best execution of portfolio transactions and brokerage allocation.

Factors not considered

relevant at this time

In light of the fact that the Fund has not yet commenced normal operations, the Trustees noted that certain factors, such as investment performance, economics of scale and profitability, that will be relevant when the Trustee considers continuing the Advisory Agreement, are not germane to its initial approval.

Other factors and

broader review

The Board regularly reviews and assesses the quality of the services that the other funds managed by the Adviser receive throughout the year. In this regard, the Board reviews reports of the Adviser at least quarterly, which include, among other things, a detailed portfolio review, detailed fund performance reports and compliance reports. In addition, the Board meets with portfolio managers and senior investment offi-cers at various times throughout the year.

After considering the above-described factors and based on its deliberations and its evaluation of the information described above, the Board concluded that approval of the Advisory Agreement for the Fund was in the best interest of the Fund and its shareholders. Accordingly, the Board unanimously approved the Advisory Agreement.

30

| TRUSTEES & OFFICERS |

This chart provides information about the Trustees and Officers who oversee your John Hancock fund. Officers elected by the Trustees manage the day-to-day operations of the Fund and execute policies formulated by the Trustees.

Independent Trustees

| Name, age | Number of | |

| Position(s) held with Fund | Trustee | John Hancock |

| Principal occupation(s) and other | of Fund | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

| Ronald R. Dion, Born: 1946 | 2005 | 53 |

| Independent Chairman (since 2005); Chairman and Chief Executive Officer, | ||

| R.M. Bradley & Co., Inc.; Director, The New England Council and Massachusetts | ||

| Roundtable; Trustee, North Shore Medical Center; Director, Boston Stock | ||

| Exchange; Director, BJ’s Wholesale Club, Inc. and a corporator of the Eastern | ||

| Bank; Trustee, Emmanuel College; Director, Boston Municipal Research Bureau; | ||

| Member of the Advisory Board, Carroll Graduate School of Management at | ||

| Boston College. | ||

| James F. Carlin, Born: 1940 | 2005 | 53 |

| Director and Treasurer, Alpha Analytical Inc. (analytical laboratory) (since 1985); | ||

| Part Owner and Treasurer, Lawrence Carlin Insurance Agency, Inc. (since 1995); | ||

| Part Owner and Vice President, Mone Lawrence Carlin Insurance Agency, Inc. | ||

| (since 1996); Director and Treasurer, Rizzo Associates (engineering) (until 2000); | ||

| Chairman and CEO, Carlin Consolidated, Inc. (management/investments) (since | ||

| 1987); Director and Partner, Proctor Carlin & Co., Inc. (until 1999); Trustee, | ||

| Massachusetts Health and Education Tax Exempt Trust (since 1993); Director of | ||

| the following: Uno Restaurant Corp. (until 2001), Arbella Mutual (insurance) | ||

| (until 2000), HealthPlan Services, Inc. (until 1999), Flagship Healthcare, Inc. (until | ||

| 1999), Carlin Insurance Agency, Inc. (until 1999); Chairman, Massachusetts | ||

| Board of Higher Education (until 1999). | ||

| Richard P. Chapman, Jr.,2 Born: 1935 | 2005 | 53 |

| President and Chief Executive Officer, Brookline Bancorp Inc. (lending) | ||

| (since 1972); Director, Lumber Insurance Co. (insurance) (until 2000); | ||

| Chairman and Director, Northeast Retirement Services, Inc. (retirement | ||

| administration) (since 1998). | ||

| William H. Cunningham, Born: 1944 | 2005 | 143 |

| Former Chancellor, University of Texas System and former President of the | ||

| University of Texas, Austin, Texas; Chairman and CEO, IBT Technologies | ||

| (until 2001); Director of the following: The University of Texas Investment | ||

| Management Company (until 2000), Hire.com (until 2004), STC Broadcasting, | ||

| Inc. and Sunrise Television Corp. (electronic manufacturing) (until 2001), | ||

| Symtx, Inc. (electronic manufacturing) (since 2001), Adorno/Rogers Technology, | ||

| Inc. (until 2004), Pinnacle Foods Corporation (until 2003), rateGenius (Internet | ||

31

Independent Trustees (continued)

| Name, age | Number of | |

| Position(s) held with Fund | Trustee | John Hancock |

| Principal occupation(s) and other | of Fund | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

| William H. Cunningham, Born: 1944 (continued) | 2005 | 143 |

| service) (until 2003), Jefferson-Pilot Corporation (diversified life insurance | ||

| company) (since 1985), New Century Equity Holdings (formerly Billing Concepts) | ||

| (until 2001), eCertain (until 2001), ClassMap.com (until 2001), Agile Ventures | ||

| (until 2001), LBJ Foundation (until 2000), Golfsmith International, Inc. | ||

| (until 2000), Metamor Worldwide (until 2000), AskRed.com (until 2001), | ||

| Southwest Airlines (since 2000) and Introgen (since 2000); Advisory Director, | ||

| Q Investments (until 2003); Advisory Director, Chase Bank (formerly Texas | ||

| Commerce Bank - Austin) (since 1988), LIN Television (since 2002), WilTel | ||

| Communications (until 2003) and Hayes Lemmerz International, Inc. | ||

| (diversified automotive parts supply company) (since 2003). | ||

| Charles L. Ladner,2 Born: 1938 | 2005 | 143 |

| Chairman and Trustee, Dunwoody Village, Inc. (retirement services) (until 2003); | ||

| Senior Vice President and Chief Financial Officer, UGI Corporation (public utility | ||

| holding company) (retired 1998); Vice President and Director for AmeriGas, Inc. | ||

| (retired 1998); Director of AmeriGas Partners, L.P. (until 1997) (gas distribution); | ||

| Director, EnergyNorth, Inc. (until 1995); Director, Parks and History Association | ||

| (since 2001). | ||

| John A. Moore,2 Born: 1939 | 2005 | 53 |

| President and Chief Executive Officer, Institute for Evaluating Health Risks, | ||

| (nonprofit institution) (until 2001); Chief Scientist, Sciences International (health | ||

| research) (until 2003); Principal, Hollyhouse (consulting) (since 2000); Director, | ||

| CIIT (nonprofit research) (since 2002). | ||

| Patti McGill Peterson,2 Born: 1943 | 2005 | 53 |

| Executive Director, Council for International Exchange of Scholars and Vice | ||

| President, Institute of International Education (since 1998); Senior Fellow, Cornell | ||

| Institute of Public Affairs, Cornell University (until 1998); Former President of | ||

| Wells College and St. Lawrence University; Director, Niagara Mohawk Power | ||

| Corporation (until 2003); Director, Ford Foundation, International Fellowships | ||

| Program (since 2002); Director, Lois Roth Endowment (since 2002); Director, | ||

| Council for International Educational Exchange (since 2003). | ||

| Steven R. Pruchansky, Born: 1944 | 2005 | 53 |

| Chairman and Chief Executive Officer, Greenscapes of Southwest Florida, Inc. | ||

| (since 2000); Director and President, Greenscapes of Southwest Florida, Inc. | ||

| (until 2000); Managing Director, JonJames, LLC (real estate) (since 2001); | ||

| Director, First Signature Bank & Trust Company (until 1991); Director, Mast | ||

| Realty Trust (until 1994); President, Maxwell Building Corp. (until 1991). | ||

32

Non-Independent Trustee3

| Name, age | Number of | |

| Position(s) held with Fund | Trustee | John Hancock |

| Principal occupation(s) and other | of Fund | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

| James R. Boyle, Born: 1959 | 2005 | 237 |

| President, John Hancock Annuities; Executive Vice President, John Hancock | ||

| Life Insurance Company (since June, 2004); Chairman and Director, John | ||

| Hancock Advisers, LLC (the “Adviser”); John Hancock Funds, LLC (“John | ||

| Hancock Funds”) and The Berkeley Financial Group, LLC (“The Berkeley | ||

| Group”) (holding company) (since 2005); President U.S. Annuities; Senior | ||

| Vice President, The Manufacturers Life Insurance Company (U.S.A.) (prior | ||

| to 2004). | ||

Principal officers who are not Trustees

| Name, age | |

| Position(s) held with Fund | Officer |

| Principal occupation(s) and | of Fund |

| directorships during past 5 years | since |

| Keith F. Hartstein, Born: 1956 | 2005 |

| President and Chief Executive Officer | |

| Senior Vice President, Manulife Financial Corporation (since 2004); Director, | |

| President and Chief Executive Officer, the Adviser and The Berkeley Group; | |

| Director, President and Chief Executive Officer, John Hancock Funds; Director, | |

| President and Chief Executive Officer, Sovereign Asset Management LLC | |

| (“Sovereign”); Director, John Hancock Signature Services, Inc.; President, John | |

| Hancock Trust; Chairman and President, NM Capital Management, Inc. (NM | |

| Capital) (since 2005); Chairman, Investment Company Institute Sales Force | |

| Marketing Committee (since 2003); Executive Vice President, John Hancock | |

| Funds (until 2005). | |

| William H. King, Born: 1952 | 2005 |

| Vice President and Treasurer | |

| Vice President and Assistant Treasurer, the Adviser; Vice President and Treasurer | |

| of each of the John Hancock funds advised by the Adviser; Assistant Treasurer | |

| of each of the John Hancock funds (until 2001). | |

| Francis V. Knox, Jr., Born: 1947 | 2005 |

| Vice President and Chief Compliance Officer | |

| Vice President and Chief Compliance Officer for John Hancock Investment | |

| Company, John Hancock Life Insurance Company (U.S.A.), John Hancock Life | |

| Insurance Company and John Hancock Funds (since 2005); Fidelity Investments - | |

| Vice President and Assistant Treasurer, Fidelity Group of Funds (until 2004); | |

| Fidelity Investments - Vice President and Ethics & Compliance Officer (until 2001). | |

| John G. Vrysen, Born: 1955 | 2005 |

| Executive Vice President and Chief Financial Officer; Director, the Adviser, | |

| The Berkeley Group and John Hancock Funds. | |

| Executive Vice President and Chief Financial Officer, the Adviser, Sovereign, | |

| The Berkeley Group and John Hancock Funds (since 2005); Vice President and | |

| General Manager, Fixed Annuities, U.S. Wealth Management (until 2005); Vice | |

| President, Operations, Manulife Wood Logan (July 2000 thru September 2004). | |

33

Notes to Trustees and Officers pages

| The business address for all Trustees and Officers is 601 Congress Street, Boston, Massachusetts 02210-2805. | |

| The Statement of Additional Information of the Fund includes additional information about members of the | |

| Board of Trustees of the Fund and is available, without charge, upon request, by calling 1-800-225-5291. | |

| 1 | Each Trustee serves until resignation, retirement age or until his or her successor is elected. |

| 2 | Member of Audit Committee. |

| 3 | Non-independent Trustees hold positions with the Fund’s investment adviser, underwriter and certain other affiliates. |

34

| OUR FAMILY OF FUNDS |

| Equity | Balanced Fund |

| Classic Value Fund | |

| Core Equity Fund | |

| Focused Equity Fund | |

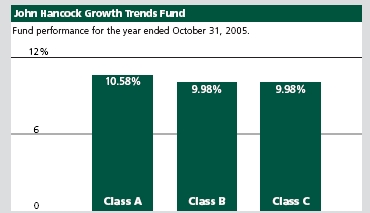

| Growth Trends Fund | |

| International Fund | |

| Large Cap Equity Fund | |

| Large Cap Growth Fund | |

| Large Cap Select Fund | |

| Mid Cap Growth Fund | |

| Multi Cap Growth Fund | |

| Small Cap Equity Fund | |

| Small Cap Growth Fund | |

| Sovereign Investors Fund | |

| U.S. Global Leaders Growth Fund | |

| Asset Allocation and | Allocation Growth + Value Portfolio |

| Lifestyle Portfolios | Allocation Core Portfolio |

| Lifestyle Aggressive Portfolio | |

| Lifestyle Growth Portfolio | |

| Lifestyle Balanced Portfolio | |

| Lifestyle Moderate Portfolio | |

| Lifestyle Conservative Portfolio | |

| Sector | Biotechnology Fund |

| Financial Industries Fund | |

| Health Sciences Fund | |

| Real Estate Fund | |

| Regional Bank Fund | |

| Technology Fund | |

| Income | Bond Fund |

| Government Income Fund | |

| High Yield Fund | |

| Investment Grade Bond Fund | |

| Strategic Income Fund | |

| Tax-Free Income | California Tax-Free Income Fund |

| High Yield Municipal Bond Fund | |

| Massachusetts Tax-Free Income Fund | |

| New York Tax-Free Income Fund | |

| Tax-Free Bond Fund | |

| Money Market | Money Market Fund |

| U.S. Government Cash Reserve | |

For more complete information on any John Hancock Fund and a prospectus, which includes charges and expenses, call your financial professional, or John Hancock Funds at 1-800-225-5291. Please read the prospectus carefully before investing or sending money.

35

| ELECTRONIC DELIVERY |

| Now available from John Hancock Funds |

Instead of sending annual and semiannual reports and prospectuses through the U.S. mail, we’ll notify you by e-mail when these documents are available for online viewing.

How does electronic delivery benefit you?

| * | No more waiting for the mail to arrive; you’ll receive an |

| e-mail notification as soon as the document is ready for | |

| online viewing. | |

| * | Reduces the amount of paper mail you receive from |

| John Hancock Funds. | |

| * | Reduces costs associated with printing and mailing. |

| Sign up for electronic delivery today at www.jhfunds.com/edelivery |

36

For more information

The Fund’s proxy voting policies, procedures and records are available without charge, upon request:

| By phone | On the Fund’s Web site | On the SEC’s Web site |

| 1-800-225-5291 | www.jhfunds.com/proxy | www.sec.gov |

| Investment adviser | Custodian | Legal counsel |

| John Hancock Advisers, LLC | The Bank of New York | Wilmer Cutler Pickering |

| 601 Congress Street | One Wall Street | Hale and Dorr LLP |

| Boston, MA 02210-2805 | New York, NY 10286 | 60 State Street |

| Boston, MA 02109-1803 | ||

| Principal distributor | Transfer agent | |

| John Hancock Funds, LLC | John Hancock Signature | Independent registered |

| 601 Congress Street | Services, Inc. | public accounting firm |

| Boston, MA 02210-2805 | 1 John Hancock Way, | PricewaterhouseCoopers LLP |

| Suite 1000 | 125 High Street | |

| Boston, MA 02217-1000 | Boston, MA 02110 | |

The Fund’s investment objective, risks, charges and expenses are included in the prospectus and should be considered carefully before investing. For a prospectus, call your financial professional, call John Hancock Funds at 1-800-225-5291, or visit the Fund’s Web site at www.jhfunds.com. Please read the prospectus carefully before investing or sending money.

| How to contact us | ||

| Internet | www.jhfunds.com | |