EXPERTS IN POWER AND MOTION CONTROL December 2013

This presentation contains “forward-looking statements,” as defined in the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties which, in many cases, are beyond the control of the company. These risks and uncertainties include, but are not limited to, economic conditions in general, business conditions in material handling, elevator, and mining markets, operating conditions, competitive factors such as pricing and technology, risks associated with acquisitions and divestitures, legal proceedings, the risk that the company’s ultimate costs of doing business exceed present estimates, and those described in Item 1A of our most recent annual report on Form 10-K. Further information regarding factors that could affect Magnetek’s results can be found in the company’s filings with the Securities and Exchange Commission. The forward-looking statements in this presentation relate to developments, results, conditions, or other events we expect or anticipate will occur in the future. Words such as “believes,” “anticipates,” “estimate,” “may,” “should,” “could,” “plans,” “expects” and similar expressions identify forward-looking statements. Those statements may relate to future equity value, pension expenses, pension obligations and funding amounts, revenues, margins, earnings, cash flows, market conditions, new strategies, and the competitive environment, and include the statements on the slides entitled “Today’s Business,” “Continuing Operations P&L,” “Balance Sheet Comparison,” “Future Growth Drivers in Our Served Markets,” “FY 2013-2015 Top Level Objectives,” “Current Status of Pension,” and “Why Invest in Magnetek?” We undertake no obligation to update or revise any forward-looking statements. Actual results could differ materially from those anticipated in the forward- looking statements and from any projections or illustrations included in this presentation. We may, in the course of our financial presentations, earnings releases, earnings conference calls, and otherwise, publicly disclose certain numerical measures which are or may be considered "non-GAAP financial measures” under SEC Regulation G. As used herein, "GAAP" refers to generally accepted accounting principles in the United States. Non-GAAP financial measures disclosed by management are provided as additional information to investors in order to provide them with an alternative method for assessing our financial condition and operating results. These measures are not in accordance with, or a substitute for, GAAP, and may be different from or inconsistent with non-GAAP financial measures used by other companies. This presentation includes non-GAAP measures such as EBITDA and adjusted EBITDA. EBITDA represents our GAAP results adjusted to exclude interest, taxes, depreciation and amortization. Adjusted EBITDA represents EBITDA adjusted to exclude non-cash pension and stock compensation expenses. Forward-Looking Statements 2

Magnetek, Inc. (NASDAQ: MAG) 3 Magnetek is a leading provider of energy-efficient digital power and motion control systems used in overhead material handling, elevator, and mining applications. Our power control systems enable customers to improve operational efficiency and save energy.

What is Digital Power Control? 4 Digital power control is being applied to an increasing number of industries and applications Digital power control is achieved through the application of variable frequency drives (VFDs) VFDs control motor speed, torque, and direction by varying motor input frequency and voltage VFDs are common across all of Magnetek’s served markets About one third of the world’s energy is consumed by electric motors running at a fixed speed Benefits of the application of VFDs: o Allows for changes in speed and torque of the motor o More precise motion control o Reduced energy consumption

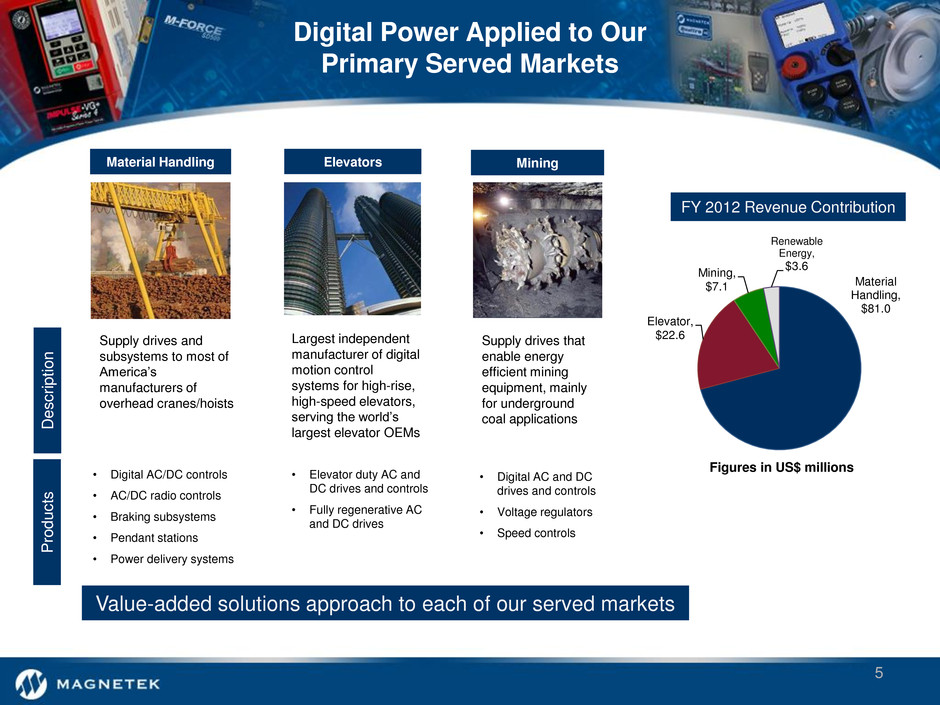

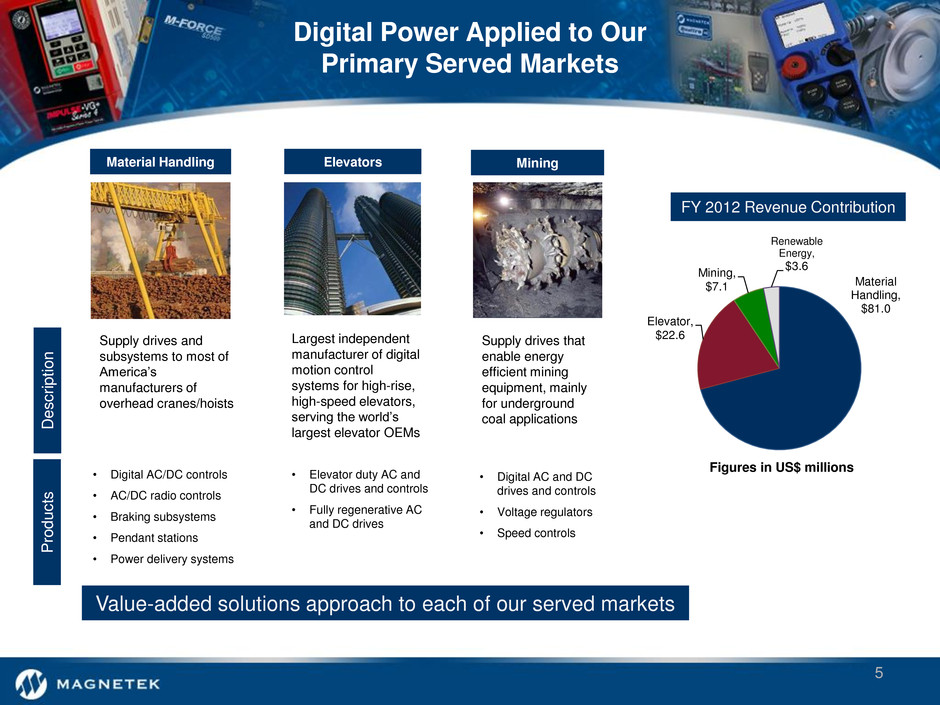

Digital Power Applied to Our Primary Served Markets 5 FY 2012 Revenue Contribution Material Handling Mining Elevators D escr ip tio n Supply drives and subsystems to most of America’s manufacturers of overhead cranes/hoists Supply drives that enable energy efficient mining equipment, mainly for underground coal applications Largest independent manufacturer of digital motion control systems for high-rise, high-speed elevators, serving the world’s largest elevator OEMs Value-added solutions approach to each of our served markets P ro d u ct s • Digital AC/DC controls • AC/DC radio controls • Braking subsystems • Pendant stations • Power delivery systems • Elevator duty AC and DC drives and controls • Fully regenerative AC and DC drives • Digital AC and DC drives and controls • Voltage regulators • Speed controls Material Handling, $81.0 Elevator, $22.6 Mining, $7.1 Renewable Energy, $3.6 Figures in US$ millions

Overhead cranes have lives of 50 years or more Technology advancements provide opportunities for improved performance and safety, cost savings, and higher efficiency Our products comprise the “intelligence” of the crane system Digital Power Bundled in a Crane System 6 MONDEL® Brake-by-Wire Braking Subsystems BLACK MAX® & BLUE MAX® Inverter-Duty Motors ELECTROMOTIVE® Festoon Electrification Systems LASERGUARD® Distance-Detection & Collision Avoidance Sensors ELECTROBAR® Conductor Bar Electrification Products TELEMOTIVE® Radio Remote Crane and Hoist Controls IMPULSE® & OMNIPULSE™ Digital Drive Subsystems SCS® Load Swing-Control Hardware and Software

Digital Power in an Elevator - Quattro® Energy Saving Drive 7 Under load, an elevator motor consumes electricity as the elevator car is lifted — but actually generates energy as the car descends Magnetek’s QUATTRO® elevator motion control system captures the energy generated by the elevator drive and motor and returns it to the utility power grid QUATTRO® also minimizes power line “noise”, which can interfere with building electronics, such as data processing, lighting, and security systems With Magnetek’s QUATTRO®, maximum electric power is regenerated to the utility grid, saving building owners thousands of dollars in electricity bills each year

Magnetek has built a long-standing relationship-driven, diversified blue-chip customer base that includes many of the most recognized names in its served markets We Touch Many Blue-Chip Customers Strong customer and end-user loyalty over years of proven innovation, expertise and service 8

Industry & Application Expertise Drive Higher Margins 9 Multi-disciplined team consisting of more than 100 engineers, designers, and technicians Leveraging our knowledge in a variety of disciplines and applications to add value We believe that our value-add proposition has been vital to our growth and profitability 28.0% 29.0% 30.0% 31.0% 32.0% 33.0% 34.0% 35.0% CY 2007 CY 2008 CY 2009 CY 2010 CY 2011 CY 2012 Gross Margin % of Sales - 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 CY 2007 CY 2008 CY 2009 CY 2010 CY 2011 CY 2012 Adjusted EBITDA in US$ Millions Gross margins approaching 35% Adjusted EBITDA increased from $8MM to $18MM in the last four years

History of Magnetek 10 Founding and acquisition period – rapid growth phase – 1984 to 1995 • Founded in 1984, Magnetek grew very quickly by acquisition through the mid-1990s • Focus on electro-mechanical technologies - ballasts, motors, generators – financed with debt • Grew to $1.5 billion in sales and nearly 15,000 employees in 1994 Divestiture period – downsizing phase with retention of certain liabilities – 1996 to 2001 • Acquisition period resulted in significant debt balances • Electro-mechanical businesses became increasingly “commoditized” (pricing & margin pressure) • Prior management executed a plan to divest electro-mechanical businesses to repay debt ‒ Retained power electronic solutions with competitive advantages and better growth prospects • Terms of these divestiture agreements resulted in retention of a number of liabilities from previously owned businesses ‒ Primarily pension obligations, and to a lesser extent, certain various environmental & other liabilities ‒ Pension was considered fully funded in 2001, but is now underfunded due mainly to interest rate reductions

Today’s Business 11 Today’s business – built through acquisitions in the early 2000s timeframe • Relocated from CA to WI in 2007, cut costs, focused on power control systems solutions • We have no debt but a large legacy pension issue as interest rates have declined ‒ The pension liability comprises most of enterprise value today • Current management is committed to growing the business while resolving legacy issues • As legacy liabilities decline, the equity value of the Company could increase substantially Our value proposition – continue to grow profitably while reducing our liabilities • Current business has a history of consistently strong cash flow and EBITDA growth ‒ Adjusted EBITDA has averaged $15MM per year from 2010 through 2012 ‒ Continuing operations generated $15MM in cash in FY 2012 prior to pension contributions ‒ Continuing operations will likely generate $12MM in cash in FY 2013 prior to pension contributions • We have $21MM in cash (as of Sep-2013) & our business fundamentals remain solid ‒ Pension funding amounts are estimated at $24MM over the next 5 quarters, then drop to $7MM in 2015 • We believe interest rates bottomed in 2012 and could likely continue to edge higher ‒ Higher rates reduce our pension liability – 100 basis points = approximately $20 million in liability • We believe we have a high probability of substantial gains in equity value over the next 3-5 years ‒ Based on growth in our business, and continuing strong EBITDA and cash generation ‒ Based on our belief that interest rates will not decrease and we reduce our pension with contributions

Material Handling Overview Our customers include the majority of America’s manufacturers of overhead cranes & hoists Wide variety of served industries – aerospace, automotive, steel, aluminum, paper, logging, mining, shipping Proven ROI to customers – increased through-put, labor and energy savings, lower operating cost, safer workplace Growth opportunities – market share gains, wireless applications, mobile hydraulic, automation, waste to energy 12 Percent of FY 2012 Total Revenue Material Handling =71% Material handling business bundles products with engineered services to provide customer-specific solutions (drives, radios, brakes, electrification, other features, etc.)

Elevator = 20% Elevator Overview 13 Magnetek Elevator drives are found in many of the world’s most recognizable buildings: Percent of FY 2012 Revenue Elevator business provides highly integrated digital motion control subsystems and drives used primarily in mid/high-rise, high-speed elevator applications Magnetek’s top OEM customers comprise over 80% of the world market share ‒ More than 70,000 DC drives in operation worldwide Installed base, brand-name recognition, expertise, proven technology Growth opportunities – regenerative drives, AC market share, geographic expansion

Mining Overview 14 Systems are used in coal hauling vehicles, shuttle cars, scoops, and other heavy equipment Largest installed base of DC drives in mining industry – provides repair & upgrade opportunities—10,000 drives in the field valued at $55 million Global demand for coal is projected to continue to grow although coal’s share of the total energy mix is declining Growth opportunities - AC drives, radios, surface mining, coal outside US Percent of FY 2012 Revenue Magnetek is the leading independent supplier of AC and DC digital motion control systems to underground coal mining equipment manufacturers in North America Mining = 6%

Continuing Operations P&L - in US$ millions except per share amounts Estimate Actual Calendar (Amounts in US$ millions) FY 2013 FY 2012 Change 2011 Net sales Material handling 78.4$ 81.0$ (2.6)$ 70.7$ Elevator 22.3 22.6 (0.3) 23.5 Energy delivery (Mining and RE) 4.3 10.7 (6.4) 23.4 Total net sales 105.0$ 114.3$ (9.3)$ 117.6$ Cost of sales 69.0 74.5 (5.5) 78.1 Gross profit 36.0$ 39.8$ (3.8)$ 39.5$ Gross margin % 34.3% 34.9% -0.6% 33.6% Research & development 3.4 3.8 (0.4) 4.4 Pension expense 6.4 6.9 (0.5) 5.9 Selling, G & A 20.9 21.1 (0.2) 21.2 Total operating expenses 30.7 31.8 (1.1) 31.5 Income from operations 5.3$ 8.0$ (2.7)$ 8.0$ Add: pension expense 6.4 6.9 (0.5) 5.9 Adjusted operating income (non-GAAP) 11.7$ 14.9$ (3.2)$ 13.9$ Adjusted operating income % 11.1% 13.0% -1.9% 11.8% Total sales down from prior year; MH reached near-term peak in 2012, difficult Mining conditions, withdrawal from RE markets. GM% approaching 35% despite year-over-year sales reduction of 9% in 2013 – well-positioned to exceed 35% on volume increase. Operating income adjusted for non-cash pension expense exceeds 10% for the past three years. Business performing quite well, particularly in traditional served markets 15

Balance Sheet Comparison 16 Increase (Amounts in US$ Millions) Sep-13 Dec-12 (Decrease) Dec-11 Cash 21.1$ 29.0$ (7.9)$ 20.9$ Accounts receivable 15.2 15.8 (0.6) 16.7 Inventories 13.4 14.9 (1.5) 13.7 Fixed assets, net 2.7 2.9 (0.2) 4.0 Goodwill & other assets 35.6 36.2 (0.6) 36.7 Total Assets 88.0$ 98.8$ (10.8)$ 92.0$ Accounts payable & other 14.7$ 18.1$ (3.4)$ 20.9$ Long term debt - - - - Pension benefit obligation 84.5 102.3 (17.8) 98.1 Other long term obligations 1.0 1.1 (0.1) 1.5 Deferred taxes 8.9 8.2 0.7 7.2 Stockholders' equity (deficit) (21.1) (30.9) 9.8 (35.7) Total Liabilities & Equity 88.0$ 98.8$ (10.8)$ 92.0$ Improvements in pension obligation in 2013 not yet reflected in balance sheet – will be measured in Dec-2013. Cash balances flat with 2011 ending balance after contributing $28MM to pension plan assets in 2012 and 2013. AR days in low 50s; inventory turnover near 5 turns. Pension funding requirements beyond 2013 are estimated at $48MM. Simple business model, healthy cash levels, and strong asset management

Future Growth Drivers in Our Served Markets 17 Focus on increasing efficiency and productivity – Our products improve operational efficiency by increasing output while reducing labor and maintenance costs, resulting in significant returns on investment Growing energy needs should result in growth opportunities in our served markets Shift from electro-mechanical control to digital power control – Technology improvements allow for downsizing of power platforms and inclusion of high-performance features valued by the marketplace Conversion to wireless applications – Many industries are rapidly adopting wireless control solutions Modernization and upgrade of existing but outdated equipment Systems solutions – customers seeking increasingly integrated solutions Communication and diagnostic features – smart devices, performance monitoring Safer workplace environments We Believe Future Demand for Our Products Will be Aided by the Following Trends:

FY 2013-2015 Top Level Objectives Consistent revenue growth over 3 years – FY 2013 growth rate impacted by softness in MH market, mining downturn and renewable energy exit Expand geographically outside US and Canada – Grow export sales from 12% to 15% Achieve and maintain gross margins of 35% – Manage sales prices and material costs – Use product modifications, enhanced features, and product bundling to add value Achieve operating profit margins of 10% of sales – Effectively manage R&D and SG&A costs while growing the business Maximize cash flow through effective asset management – Fund most of our pension contributions of $27MM from 2014 to 2015 with cash generated from operations Assure adequate financial resources are available to fund growth, meet obligations, and reduce our pension through contributions 18

Current Status of Pension Our pension obligation was $100MM at Dec-12, estimated using historically low interest rates Our near-term strategy is to reduce the obligation through contributions Longer-term, we intend to terminate the plan when economically feasible Recent interest rate movements have reduced our liability by about $18MM as of Sep-2013 – 100 basis points change in interest rates = approximately $20MM change in our pension obligation – We believe the period of interest rate declines is behind us and the current bias is toward higher rates Our assets have increased by about $27MM since Dec-12 – Due partially to our contributions and partially due to better than expected asset returns We’ve seen a $45MM improvement in our pension situation from Dec-2012 to Sep-2013 – Not yet reflected in our balance sheet, as we measure our pension annually at the end of December – If we re-measured our pension at Sep-13, our balance sheet figure would likely be around $55MM Our pension liability represents a significant discount in our share price, and as it decreases over time, the value of our equity should increase proportionally 19

Why Invest in Magnetek? We know we are a thinly traded, micro-cap stock requiring a longer investment horizon We have an established history of consistently strong cash generation Our legacy liabilities, mainly our pension, comprise a fair amount of enterprise value (EV) today Over the next several years, we should continue to see a reduction in liabilities, which could translate into substantial equity appreciation, providing outsized returns ‒ By reducing our pension through contributions ‒ We could also benefit substantially from higher interest rates – we have benefitted from higher rates to-date in 2013 Our EV at Sep-13 is approximately $100MM, or approximately $31 on a per share basis (about 65% market cap, 35% pension net of cash) The lower pension could result in a higher EV to EBITDA multiple than our current multiple ‒ A multiple of 8-9 times EBITDA results in EV of $105-120MM, or EV of $33-37 per share We further believe EV could increase, as we believe adjusted EBITDA could increase over time to $20MM - 5 years out if economic conditions remain stable and mining recovers ‒ Under this scenario, EV could increase to $160-180MM, or approximately $50-55 per share With a lower pension, most, or perhaps all, of our EV per share could be equity value 20 We Believe There is Opportunity for Substantial Returns for Shareholders

Appendix

Relationship Between Share Price and Pension Obligation 22 • Projected figures for Dec-2013 are based on actuarial projections as of Oct-2013 • Share prices and pension liability are as of fiscal period end – not charted throughout the year Strong correlation between increasing pension and decreasing share price Pension increased in 4 of 6 periods; share price declined each of those 4 periods - 10.00 20.00 30.00 40.00 50.00 60.00 70.00 80.00 90.00 MAG Share Price versus Net Pension Liability (GAAP liability less cash on hand; point in time share prices) MAG price Net pension

Historical Pension Plan Figures From an accounting perspective, as of June 2001, the plan was “fully funded” – pension plan assets were equal to the projected pension liability (PBO) – Past 10 years characterized by interest rate reductions, less than expected returns on assets, and accelerated funding requirements (Pension Protection Act of 2006) Contributions to assets, rate increases, and better than expected asset returns in 2013 have resulted in an estimated reduction in the liability of $50MM since Jan-2013 – not yet reflected in our balance sheet Our objective is to terminate the plan as we approach fully funded status 23

Primary IR Contact: Marty Schwenner Chief Financial Officer 262.703.4282