Exhibit 99.2

Columbus McKinnon to Acquire Magnetek

Advancing Productivity and Safety for Our Customers

July 27, 2015

Call Participants

Timothy T. Tevens

President and Chief Executive Officer, Columbus McKinnon Corporation

Gregory P. Rustowicz

Vice President – Finance and CFO, Columbus McKinnon Corporation

Peter M. McCormick

President and Chief Executive Officer, Magnetek, Inc.

Marty J. Schwenner

Vice President and CFO, Magnetek, Inc.

2

© 2015 Columbus McKinnon Corporation

Safe Harbor Statement

Any statements made concerning the proposed transaction between the Company and Magnetek, the expected timetable for completing the transaction, the successful integration of the business, the benefits of the transaction, future revenue and earnings and any other statements that are not purely historical fact are forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed or implied by such statements, including general economic and business conditions, conditions affecting the industries served by the Company or Magnetek and their respective subsidiaries, conditions affecting the Company’s or Magnetek’s customers and suppliers, competitor responses to the Company’s or Magnetek’s products and services, the overall market acceptance of such products and services, the integration of the businesses and other factors disclosed in the Company’s and Magnetek’s periodic reports filed with the SEC. Consequently, such forward looking statements should be regarded as the Company’s and Magnetek’s current plans, estimates and beliefs. Neither the Company nor Magnetek assume any obligation to update the forward-looking information contained in this report, except as expressly required by law.

3

© 2015 Columbus McKinnon Corporation

Additional Information

Additional Information and Where to Find it

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities. The tender offer for the outstanding shares of Magnetek’s common stock described in this communication has not commenced. At the time the tender offer is commenced, the Company will file or cause to be filed a Tender Offer Statement on Schedule TO with the SEC and Magnetek will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC related to the tender offer. The Tender Offer Statement (including an Offer to Purchase, a related Letter of Transmittal and other tender offer documents) and the Solicitation/Recommendation Statement will contain important information that should be read carefully before any decision is made with respect to the tender offer. Those materials will be made available to Magnetek’s stockholders at no expense to them by the information agent to the tender offer, which will be announced. In addition, all of those materials (and any other documents filed with the SEC) will be available at no charge on the SEC’s website at www.sec.gov.

4

© 2015 Columbus McKinnon Corporation

Strategic Imperatives

Superior Customer Satisfaction

Grow Profitably

Geographic Market Expansion

Acquisitions and

Strategic Alliances

Global Product Development and Key Vertical Markets

Operational Excellence

5

© 2015 Columbus McKinnon Corporation

Productivity

Safety

Acquisition Aligned with Growth Strategy

Combination of America’s largest supplier of digital power control systems for industrial cranes and hoists with leading global hoist manufacturer

Acquisition accelerates plan to achieve $1B in revenue

Complementary adjacencies: Brain and brawn

“Smart power” with mechanical lifting and positioning

New product lines and markets

Strong strategic and cultural fit

Commitment to quality, service and superior customer satisfaction

Customer intimacy as strategic advantage

6

© 2015 Columbus McKinnon Corporation

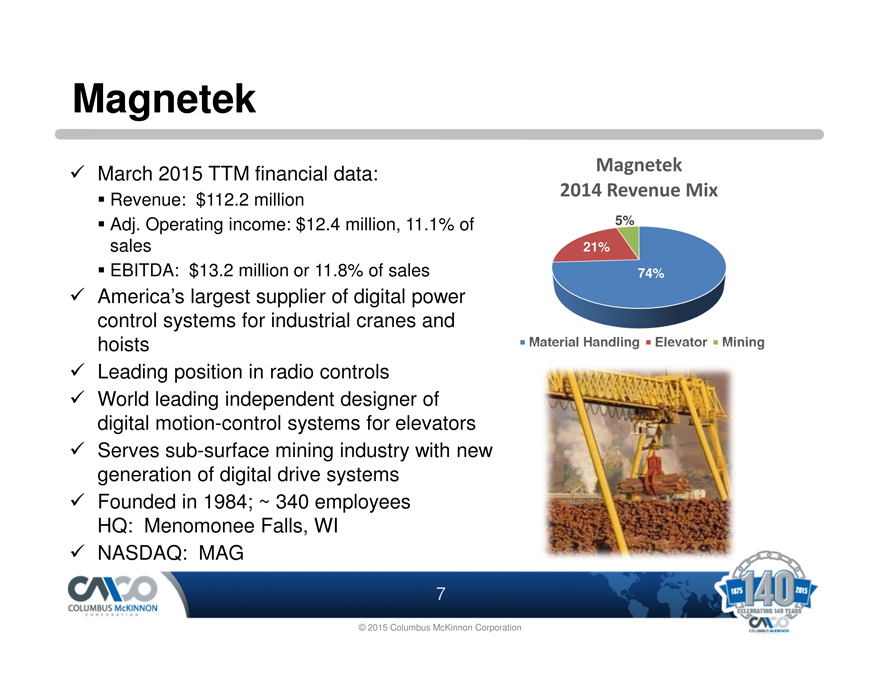

Magnetek

March 2015 TTM financial data:

Revenue: $112.2 million

Adj. Operating income: $12.4 million, 11.1% of sales

EBITDA: $13.2 million or 11.8% of sales

America’s largest supplier of digital power control systems for industrial cranes and hoists

Leading position in radio controls

World leading independent designer of digital motion-control systems for elevators

Serves sub-surface mining industry with new generation of digital drive systems

Founded in 1984; ~ 340 employees HQ: Menomonee Falls, WI

NASDAQ: MAG

Magnetek 2014 Revenue Mix

5% 21% 74%

Material Handling Elevator Mining

7

© 2015 Columbus McKinnon Corporation

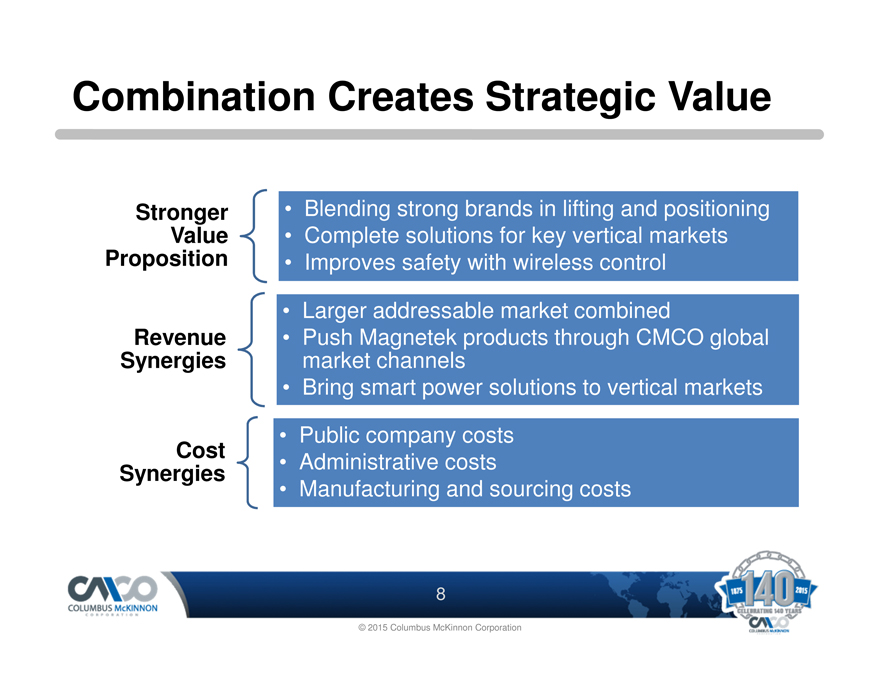

Combination Creates Strategic Value

Stronger

Value

Proposition

Revenue

Synergies

Cost

Synergies

Blending strong brands in lifting and positioning

Complete solutions for key vertical markets

Improves safety with wireless control

Larger addressable market combined

Push Magnetek products through CMCO global market channels

Bring smart power solutions to vertical markets

Public company costs

Administrative costs

Manufacturing and sourcing costs

8

© 2015 Columbus McKinnon Corporation

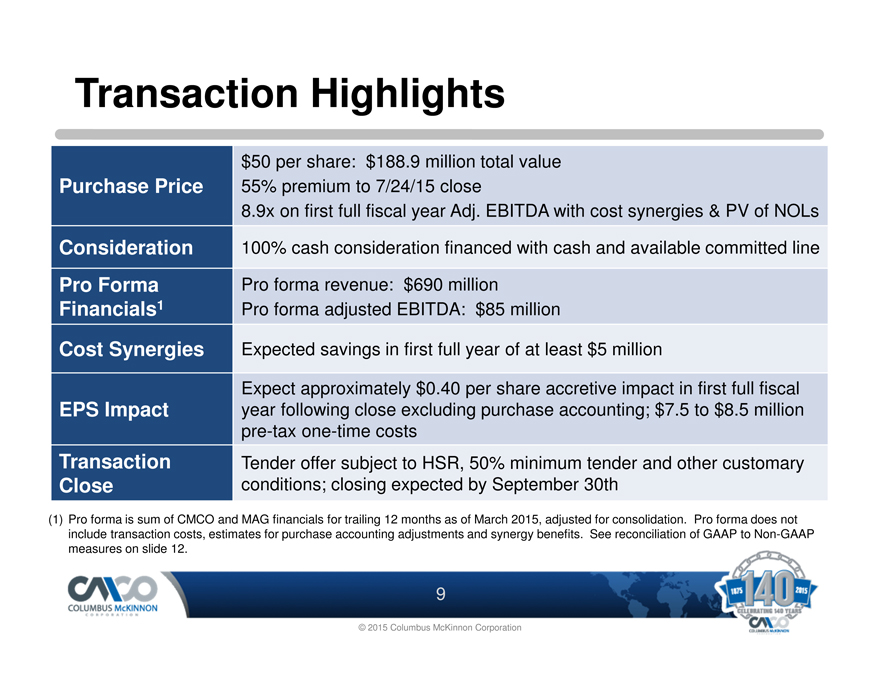

Transaction Highlights

Purchase Price

Consideration

Pro Forma Financials1

Cost Synergies

EPS Impact

Transaction Close

$50 per share: $188.9 million total value 55% premium to 7/24/15 close

8.9x on first full fiscal year Adj. EBITDA with cost synergies & PV of NOLs 100% cash consideration financed with cash and available committed line

Pro forma revenue: $690 million

Pro forma adjusted EBITDA: $85 million

Expected savings in first full year of at least $5 million

Expect approximately $0.40 per share accretive impact in first full fiscal year following close excluding purchase accounting; $7.5 to $8.5 million pre-tax one-time costs

Tender offer subject to HSR, 50% minimum tender and other customary conditions; closing expected by September 30th

(1) Pro forma is sum of CMCO and MAG financials for trailing 12 months as of March 2015, adjusted for consolidation. Pro forma does not include transaction costs, estimates for purchase accounting adjustments and synergy benefits. See reconciliation of GAAP to Non-GAAP measures on slide 12.

9

© 2015 Columbus McKinnon Corporation

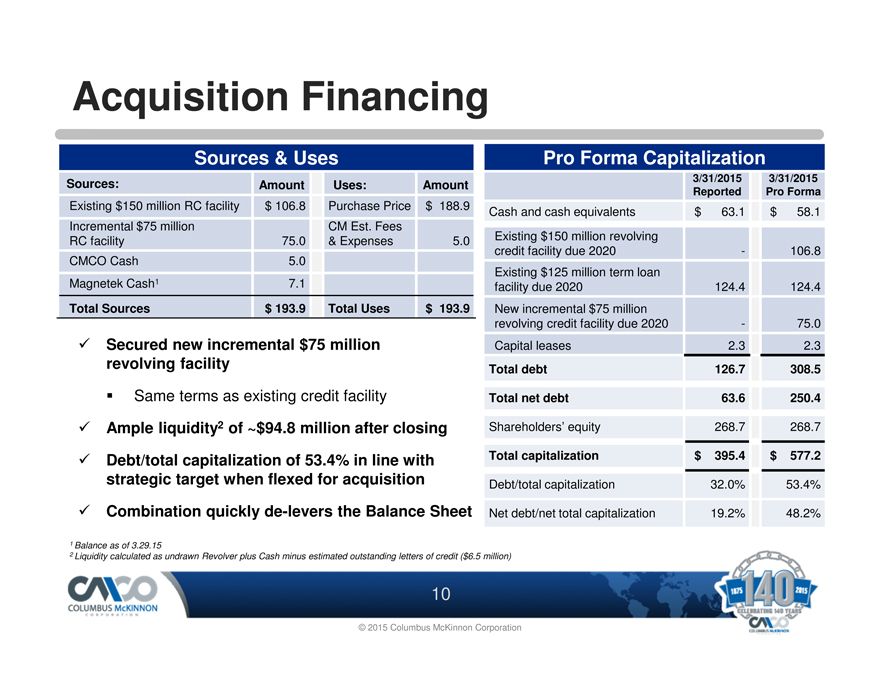

Acquisition Financing

Sources & Uses

Sources: Amount Uses: Amount

Existing $150 million RC facility $ 106.8 Purchase Price $ 188.9

Incremental $75 million CM Est. Fees

RC facility 75.0 & Expenses 5.0

CMCO Cash 5.0

Magnetek Cash1 7.1

Total Sources $ 193.9 Total Uses $ 193.9

_ Secured new incremental $75 million revolving facility

_ Same terms as existing credit facility

_ Ample liquidity2 of ~$94.8 million after closing

_ Debt/total capitalization of 53.4% in line with strategic target when flexed for acquisition

_ Combination quickly de-levers the Balance Sheet

1 Balance as of 3.29.15

2 Liquidity calculated as undrawn Revolver plus Cash minus estimated outstanding letters of credit ($6.5 million)

Pro Forma Capitalization

3/31/2015 3/31/2015

Reported Pro Forma

Cash and cash equivalents $ 63.1 $ 58.1

Existing $150 million revolving

credit facility due 2020 - 106.8

Existing $125 million term loan

facility due 2020 124.4 124.4

New incremental $75 million

revolving credit facility due 2020 - 75.0

Capital leases 2.3 2.3

Total debt 126.7 308.5

Total net debt 63.6 250.4

Shareholders’ equity 268.7 268.7

Total capitalization $ 395.4 $ 577.2

Debt/total capitalization 32.0% 53.4%

Net debt/net total capitalization 19.2% 48.2%

10

© 2015 Columbus McKinnon Corporation

Appendix

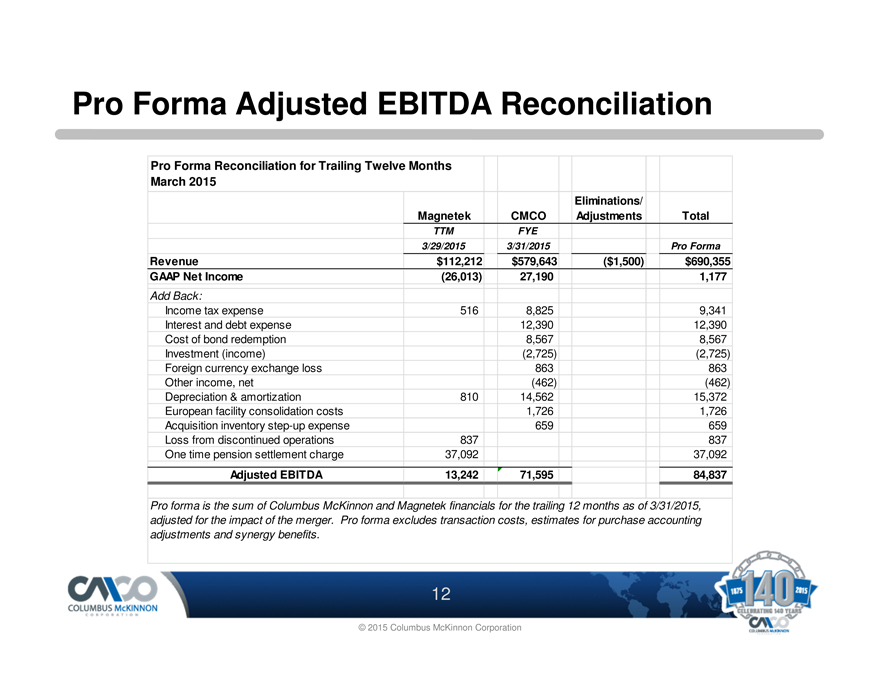

Pro Forma Adjusted EBITDA Reconciliation

Pro Forma Reconciliation for Trailing Twelve Months March 2015

Eliminations/

Magnetek CMCO Adjustments Total

TTM FYE

3/29/2015 3/31/2015 Pro Forma

Revenue $112,212 $579,643 ($1,500) $690,355

GAAP Net Income (26,013) 27,190 1,177

Add Back:

Income tax expense 516 8,825 9,341

Interest and debt expense 12,390 12,390

Cost of bond redemption 8,567 8,567

Investment (income) (2,725) (2,725)

Foreign currency exchange loss 863 863

Other income, net (462) (462)

Depreciation & amortization 810 14,562 15,372

European facility consolidation costs 1,726 1,726

Acquisition inventory step-up expense 659 659

Loss from discontinued operations 837 837

One time pension settlement charge 37,092 37,092

Adjusted EBITDA 13,242 71,595 84,837

Pro forma is the sum of Columbus McKinnon and Magnetek financials for the trailing 12 months as of 3/31/2015, adjusted for the impact of the merger. Pro forma excludes transaction costs, estimates for purchase accounting adjustments and synergy benefits.

12

© 2015 Columbus McKinnon Corporation