UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04087

Manning & Napier Fund, Inc.

(Exact name of registrant as specified in charter)

290 Woodcliff Drive, Fairport, NY 14450

(Address of principal executive offices)(Zip Code)

Paul J. Battaglia 290 Woodcliff Drive, Fairport, NY 14450

(Name and address of agent for service)

Registrant’s telephone number, including area code: 585-325-6880

Date of fiscal year end: October 31

Date of reporting period: November 1, 2023 through October 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1: | Reports to Stockholders. |

Manning & Napier Equity Series Tailored Shareholder Report MNEQY-S-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

annual shareholder report Equity Series ticker: EXEYX | |

This annual shareholder report contains important information about Equity Series Class S, a series of Manning & Napier Fund Inc. (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.manning-napier.com/products/mutual-funds. You can also request this information by contacting us at (800) 466-3863. Shareholders who own the Fund through a third-party advisor or intermediary platform should contact their financial advisor directly for additional information.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class S | $121 | 1.05% |

Expenses are equal to each Class's annualized expense ratio (for the twelve-month period) multiplied by the average account value over the period. The Class's expenses would have been higher if certain expenses had not been waived or reimbursed during the period.

Management's Discussion of Fund Performance

How did the fund perform last year?

The Series delivered meaningfully positive returns but underperformed its benchmark, the Russell 3000 Index, for the 12-month period ending 10/31/2024.

What factors influenced performance?

The Series' positive return benefited from its focus within the U.S. equity market. Stocks rallied on the back of positive investor sentiment driven by a resilient U.S. economy. Returns were also more broadly distributed across the market than the previous year. Although the Series largely participated in the strong period for stock returns, underperformance relative to the benchmark was primarily driven by individual stock outcomes, mostly concentrated within the Consumer, Health Care, and Industrials sectors.

Positioning

Despite risks appearing broadly balanced to the upside and downside, we expect a degree of volatility in markets moving forward. We have positioned the Series with a generally defensive tilt through a primary focus on less economically sensitive businesses and those that can benefit from long-term secular trends, while also selectively identifying pockets of opportunity in more cyclical industries.

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years. The graph assumes a $10,000 initial investment in the Fund and two appropriate broad-based securities market indices that reflects the market sector in which the Fund invests for the same period.

Initial Investment of $10,000

Date | Equity Series - S | MSCI USA IMI | Russell 3000® |

10/31/2014 | 10000.0 | 10000.0 | 10000.0 |

10/31/2015 | 9854.0 | 10390.0 | 10449.0 |

10/31/2016 | 10461.0 | 10778.0 | 10892.0 |

10/31/2017 | 12834.0 | 13281.0 | 13504.0 |

10/31/2018 | 13818.0 | 14090.0 | 14395.0 |

10/31/2019 | 16151.0 | 15907.0 | 16337.0 |

10/31/2020 | 18411.0 | 17464.0 | 17995.0 |

10/31/2021 | 26090.0 | 25079.0 | 25895.0 |

10/31/2022 | 21451.0 | 20852.0 | 21617.0 |

10/31/2023 | 23132.0 | 22534.0 | 23429.0 |

10/31/2024 | 30280.0 | 30962.0 | 32299.0 |

The returns are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to net asset values in accordance with accounting principles generally accepted in the United States of America.

The MSCI USA Investable Market Index (IMI) is designed to measure large, mid, and small-cap representation across the US market. The Russell 3000® Index is an unmanaged index that consists of 3,000 of the largest U.S. companies based on total market capitalization. The Index returns do not reflect any fees or expenses. Index returns provided by Bloomberg.

Average Annual Total Returns

(As of October 31, 2024)

| 1 Year | 5 Year | 10 Year |

|---|

Equity Series - S | 30.90% | 13.39% | 11.72% |

MSCI USA IMI | 37.40% | 14.25% | 11.97% |

Russell 3000® | 37.86% | 14.60% | 12.44% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Index data referenced herein is the property of each index sponsor (London Stock Exchange Group plc and its group undertakings (Russell and MSCI), their affiliates, and/or their third-party suppliers and has been licensed for use by Manning & Napier. For additional disclosure information, please see: https://go.manning-napier.com/benchmark-provisions.

Manning & Napier Equity Series Tailored Shareholder Report MNEQY-S-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Equity Series Tailored Shareholder Report MNEQY-S-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Key Fund Statistics (as of October 31, 2024)

| |

|---|

Fund Size | $70,600,223 |

Number of Holdings | 46 |

Annual Portfolio Turnover | 57% |

Total Advisory Fees Paid (net of reimbursements) | $351,700 |

The total advisory fee represents management fees at fund level in aggregate dollar amount including waivers and reimbursements.

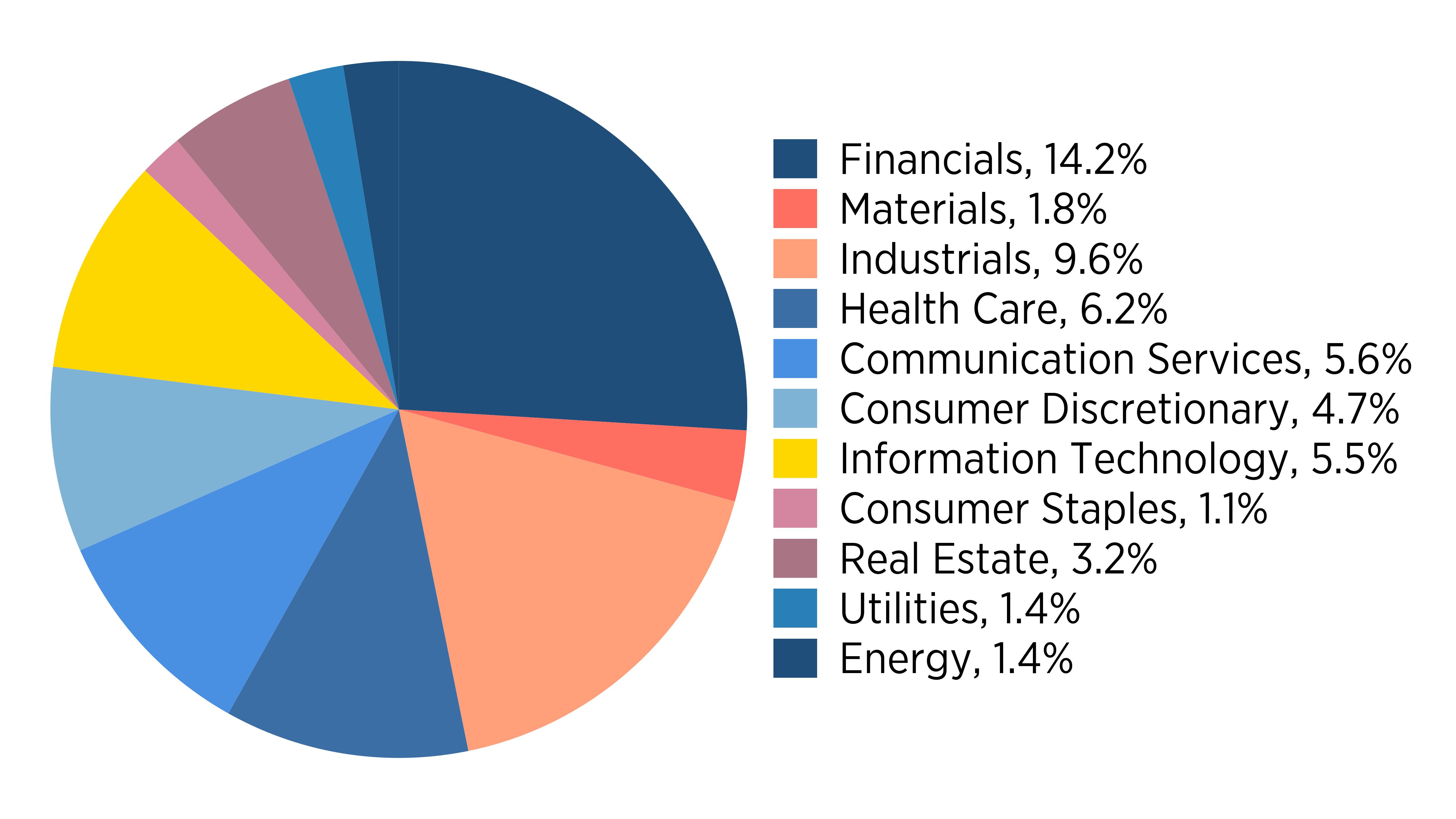

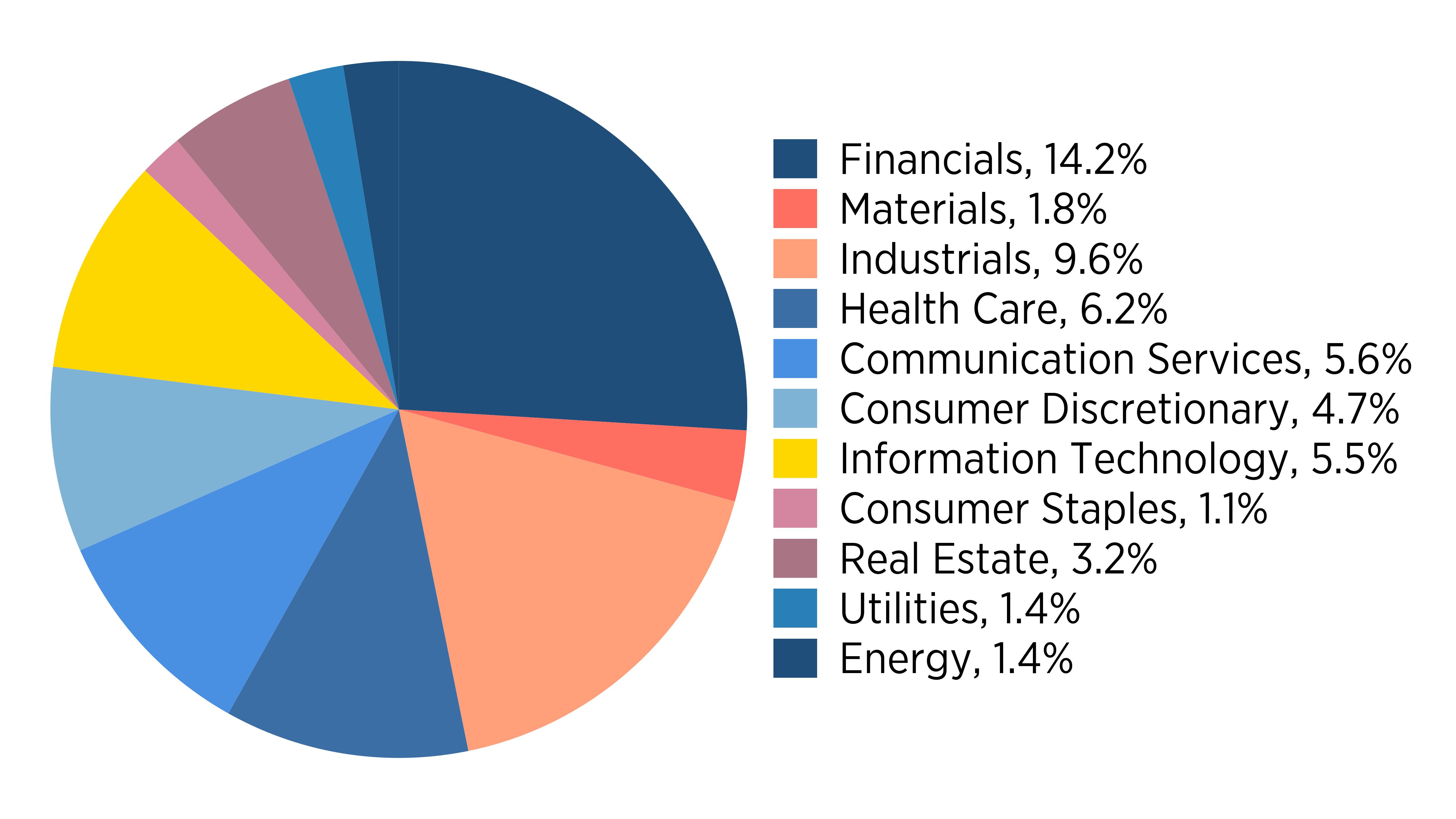

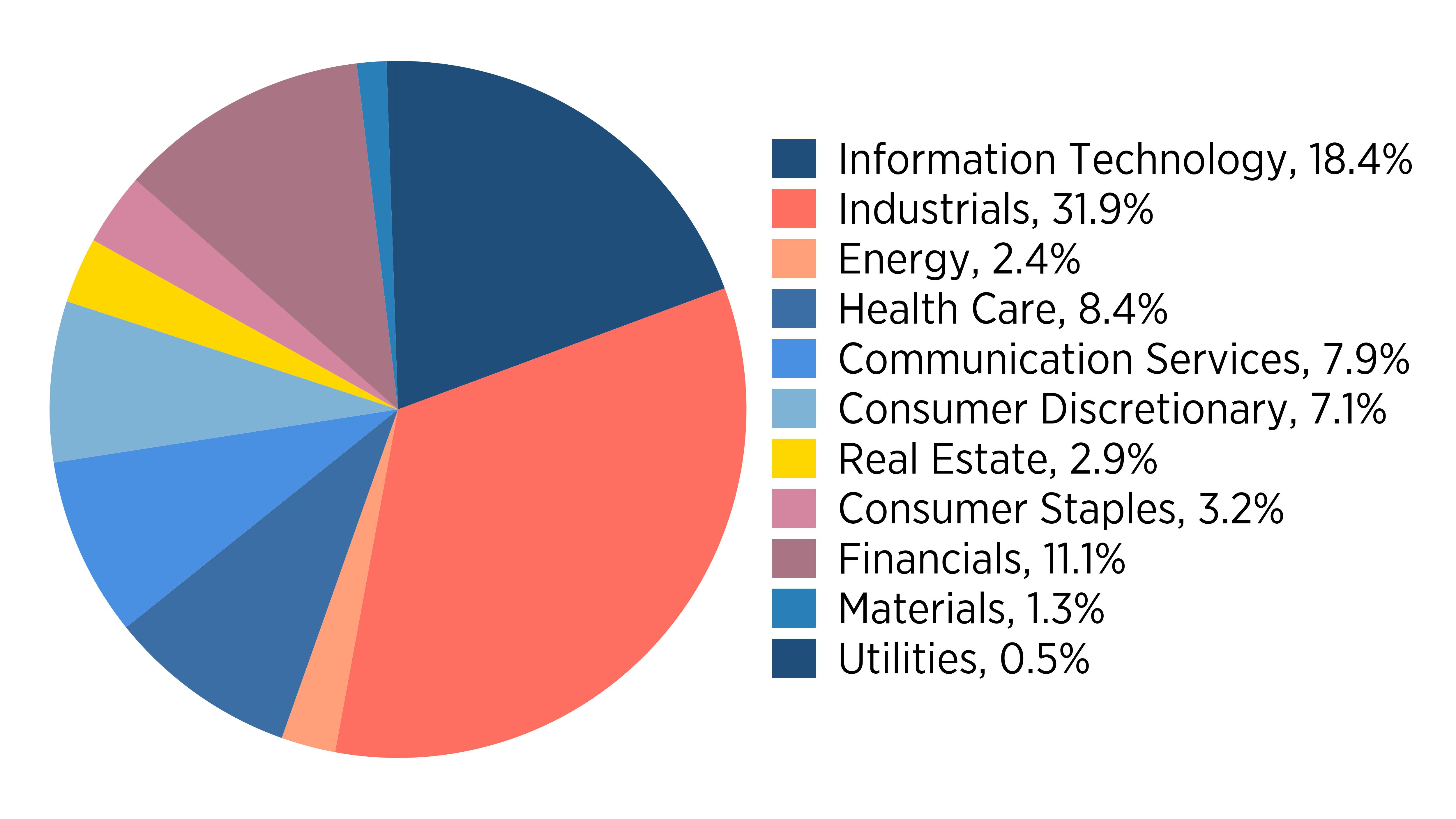

Sector Allocation (% of net assets)

Sector | Allocation |

Materials | 0.022 |

Communication Services | 0.129 |

Consumer Discretionary | 0.054 |

Information Technology | 0.190 |

Financials | 0.202 |

Real Estate | 0.041 |

Industrials | 0.210 |

Utilities | 0.016 |

Health Care | 0.095 |

Consumer Staples | 0.020 |

The Global Industry Classification Standard (GICS) was developed by and is exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor's a division of S&P Global Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom.

What did the Fund invest in?

(as of October 31, 2024)

Top Investment Types | % |

|---|

Cash, Short-Term Investment, and Liabilities, Less Other Assets | 2.1 |

Common Stocks | 97.9 |

Expressed as a percentage of net assets.

Householding

The Fund may send only one copy of the Series' prospectus and annual and semi-annual reports to certain shareholders residing at the same "household" for shareholders who have elected this option. This reduces Fund expenses, which benefits you and other shareholders. If you wish to change your "householding" option, please call (800) 466-3863 or contact your financial advisor.

Additional information about the Series, including its prospectus, financial information, holdings, and proxy information can be obtained at www.manning-napier.com/products/mutual-funds or by calling (800) 466-3863. Shareholders can also elect to receive certain documents via e-delivery. For more information or to sign up for e-delivery, please visit the Fund's website.

Manning & Napier Equity Series Tailored Shareholder Report MNEQY-S-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Equity Series Tailored Shareholder Report MNEQY-W-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

annual shareholder report Equity Series ticker: MEYWX | |

This annual shareholder report contains important information about Equity Series Class W, a series of Manning & Napier Fund Inc. (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.manning-napier.com/products/mutual-funds. You can also request this information by contacting us at (800) 466-3863. Shareholders who own the Fund through a third-party advisor or intermediary platform should contact their financial advisor directly for additional information.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class W | $6 | 0.05% |

Expenses are equal to each Class's annualized expense ratio (for the twelve-month period) multiplied by the average account value over the period. The Advisor has contractually agreed to waive the management fee for the Class W shares. The Class's expenses would have been higher if certain expenses had not been waived or reimbursed during the period.

Management's Discussion of Fund Performance

How did the fund perform last year?

The Series delivered meaningfully positive returns but underperformed its benchmark, the Russell 3000 Index, for the 12-month period ending 10/31/2024.

What factors influenced performance?

The Series' positive return benefited from its focus within the U.S. equity market. Stocks rallied on the back of positive investor sentiment driven by a resilient U.S. economy. Returns were also more broadly distributed across the market than the previous year. Although the Series largely participated in the strong period for stock returns, underperformance relative to the benchmark was primarily driven by individual stock outcomes, mostly concentrated within the Consumer, Health Care, and Industrials sectors.

Positioning

Despite risks appearing broadly balanced to the upside and downside, we expect a degree of volatility in markets moving forward. We have positioned the Series with a generally defensive tilt through a primary focus on less economically sensitive businesses and those that can benefit from long-term secular trends, while also selectively identifying pockets of opportunity in more cyclical industries.

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years. The graph assumes a $10,000 initial investment in the Fund and two appropriate broad-based securities market indices that reflects the market sector in which the Fund invests for the same period.

Initial Investment of $10,000

Date | Equity Series - W | MSCI USA IMI | Russell 3000® |

10/31/2014 | 10000.0 | 10000.0 | 10000.0 |

10/31/2015 | 9854.0 | 10390.0 | 10449.0 |

10/31/2016 | 10461.0 | 10778.0 | 10892.0 |

10/31/2017 | 12834.0 | 13281.0 | 13504.0 |

10/31/2018 | 13818.0 | 14090.0 | 14395.0 |

10/31/2019 | 16255.0 | 15907.0 | 16337.0 |

10/31/2020 | 18718.0 | 17464.0 | 17995.0 |

10/31/2021 | 26799.0 | 25079.0 | 25895.0 |

10/31/2022 | 22243.0 | 20852.0 | 21617.0 |

10/31/2023 | 24240.0 | 22534.0 | 23429.0 |

10/31/2024 | 32048.0 | 30962.0 | 32299.0 |

The returns are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to net asset values in accordance with accounting principles generally accepted in the United States of America.

For periods through March 1, 2019 (the inception date of the Class W shares), performance for the Class W shares is based on the historical performance of the Class S shares. Because the Class W shares invest in the same portfolio of securities as the Class S shares, performance will be different only to the extent that the Class S shares have a higher expense ratio.

The MSCI USA Investable Market Index (IMI) is designed to measure large, mid, and small-cap representation across the US market. The Russell 3000® Index is an unmanaged index that consists of 3,000 of the largest U.S. companies based on total market capitalization. The Index returns do not reflect any fees or expenses. Index returns provided by Bloomberg.

Average Annual Total Returns

(As of October 31, 2024)

| 1 Year | 5 Year | 10 Year |

|---|

Equity Series - W | 32.21% | 14.54% | 12.35% |

MSCI USA IMI | 37.40% | 14.25% | 11.97% |

Russell 3000® | 37.86% | 14.60% | 12.44% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Index data referenced herein is the property of each index sponsor (London Stock Exchange Group plc and its group undertakings (Russell and MSCI), their affiliates, and/or their third-party suppliers and has been licensed for use by Manning & Napier. For additional disclosure information, please see: https://go.manning-napier.com/benchmark-provisions.

Manning & Napier Equity Series Tailored Shareholder Report MNEQY-W-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Equity Series Tailored Shareholder Report MNEQY-W-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Key Fund Statistics (as of October 31, 2024)

| |

|---|

Fund Size | $70,600,223 |

Number of Holdings | 46 |

Annual Portfolio Turnover | 57% |

Total Advisory Fees Paid (net of reimbursements) | $351,700 |

The total advisory fee represents management fees at fund level in aggregate dollar amount including waivers and reimbursements.

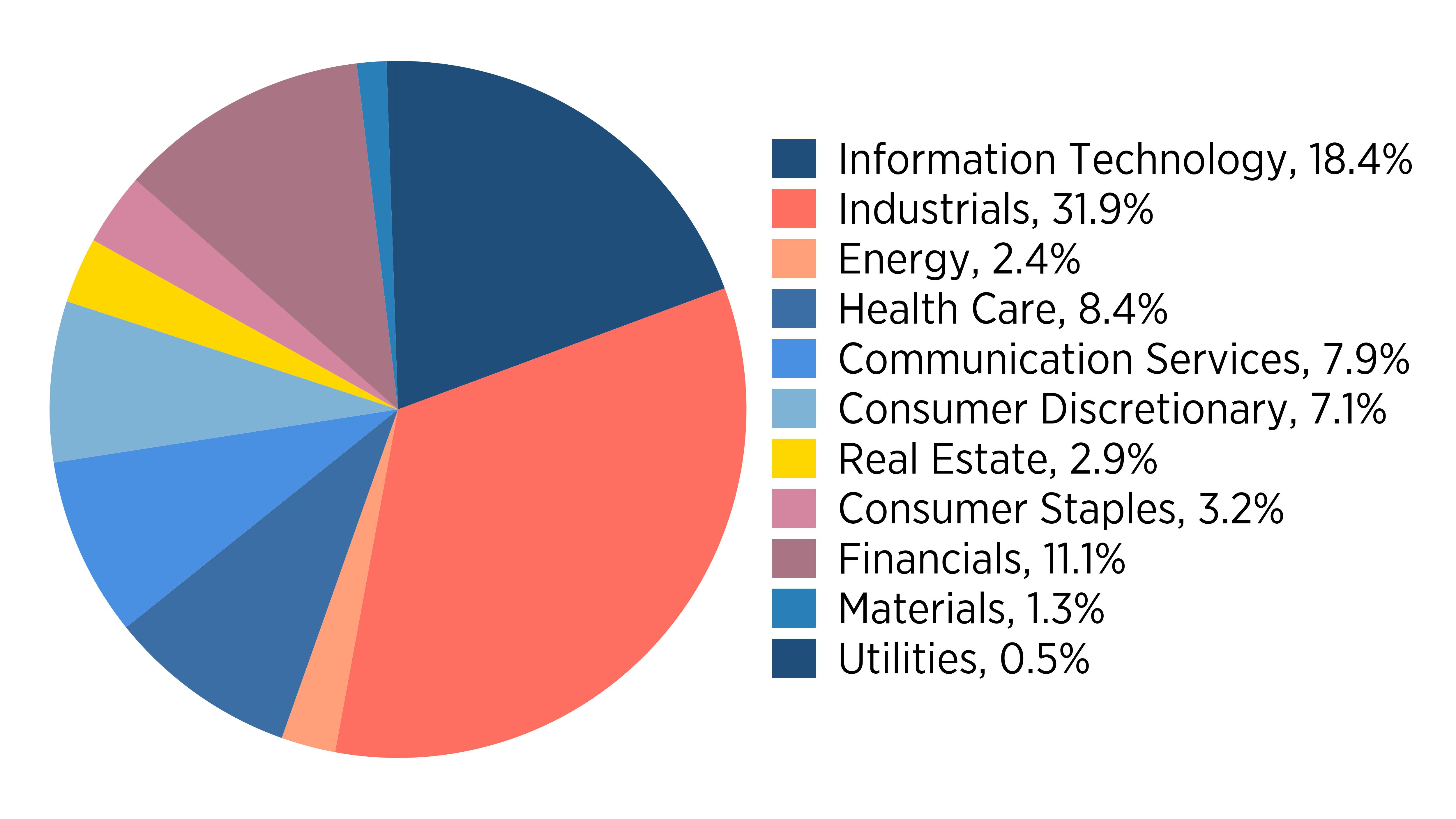

Sector Allocation (% of net assets)

Sector | Allocation |

Materials | 0.022 |

Communication Services | 0.129 |

Consumer Discretionary | 0.054 |

Information Technology | 0.190 |

Financials | 0.202 |

Real Estate | 0.041 |

Industrials | 0.210 |

Utilities | 0.016 |

Health Care | 0.095 |

Consumer Staples | 0.020 |

The Global Industry Classification Standard (GICS) was developed by and is exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor's a division of S&P Global Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom.

What did the Fund invest in?

(as of October 31, 2024)

Top Investment Types | % |

|---|

Cash, Short-Term Investment, and Liabilities, Less Other Assets | 2.1 |

Common Stocks | 97.9 |

Expressed as a percentage of net assets.

Householding

The Fund may send only one copy of the Series' prospectus and annual and semi-annual reports to certain shareholders residing at the same "household" for shareholders who have elected this option. This reduces Fund expenses, which benefits you and other shareholders. If you wish to change your "householding" option, please call (800) 466-3863 or contact your financial advisor.

Additional information about the Series, including its prospectus, financial information, holdings, and proxy information can be obtained at www.manning-napier.com/products/mutual-funds or by calling (800) 466-3863. Shareholders can also elect to receive certain documents via e-delivery. For more information or to sign up for e-delivery, please visit the Fund's website.

Manning & Napier Equity Series Tailored Shareholder Report MNEQY-W-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-I-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

annual shareholder report Overseas Series ticker: EXOSX | |

This annual shareholder report contains important information about Overseas Series Class I, a series of Manning & Napier Fund Inc. (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.manning-napier.com/products/mutual-funds. You can also request this information by contacting us at (800) 466-3863. Shareholders who own the Fund through a third-party advisor or intermediary platform should contact their financial advisor directly for additional information.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $84 | 0.75% |

Expenses are equal to each Class's annualized expense ratio (for the twelve-month period) multiplied by the average account value over the period. The Class's expenses would have been higher if certain expenses had not been waived or reimbursed during the period.

Management's Discussion of Fund Performance

How did the fund perform last year?

The Series delivered positive returns for the 12-month period ended 10/31/2024 but modestly underperformed its benchmark, the MSCI ACWI ex USA Index.

What factors influenced performance?

The Series' positive return was driven primarily by its exposure to foreign stocks. Equity markets were meaningfully positive over the past twelve months, not only in the U.S. but around the globe. Investor sentiment was buoyed by a resilient U.S. economy and moderating inflation, while foreign markets benefited from attractive valuations and a broadening-out of equity market returns away from previous return concentration in large U.S. growth companies. While country and sector positioning decisions were largely positive over the period, the Series' relative underperformance was primarily driven by individual stock results, most notably within the Industrials, Information Technology, and Financials sectors.

Positioning

While the U.S. economy has been surprisingly resilient, we continue to believe that risks to markets remain in place with a cooling job market, rising geopolitical conflict around the world, and elevated security valuations. However, non-U.S. markets may present more attractive opportunities than domestically as some regions are earlier in their economic cycles with runways for growth lying ahead. As a function of these more early-cycle opportunities in foreign markets, we are seeking to take advantage of a wider variety of opportunities between both high-quality long-term positions and more economically sensitive exposures.

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years. The graph assumes a $10,000 initial investment in the Fund and one appropriate broad-based securities market index that reflects the market sector in which the Fund invests for the same period.

Initial Investment of $10,000

Date | Overseas Series - I | MSCI ACWI ex USA |

10/31/2014 | 10000.0 | 10000.0 |

10/31/2015 | 9694.0 | 9532.0 |

10/31/2016 | 9660.0 | 9553.0 |

10/31/2017 | 11640.0 | 11811.0 |

10/31/2018 | 10624.0 | 10838.0 |

10/31/2019 | 11711.0 | 12059.0 |

10/31/2020 | 13470.0 | 11745.0 |

10/31/2021 | 18474.0 | 15228.0 |

10/31/2022 | 12605.0 | 11462.0 |

10/31/2023 | 13974.0 | 12846.0 |

10/31/2024 | 17197.0 | 15971.0 |

The returns are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to net asset values in accordance with accounting principles generally accepted in the United States of America.

The MSCI ACWI ex USA Index (ACWIxUS) is designed to measure large and mid-cap representation across 22 of 23 Developed Markets countries (excluding the U.S.) and 24 Emerging Markets countries. The Index returns do not reflect any fees or expenses. Index returns provided by Bloomberg.

Average Annual Total Returns

(As of October 31, 2024)

| 1 Year | 5 Year | 10 Year |

|---|

Overseas Series - I | 23.06% | 7.99% | 5.57% |

MSCI ACWI ex USA | 24.33% | 5.78% | 4.79% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Index data referenced herein is the property of MSCI, its affiliates ("MSCI") and/or its third-party suppliers and has been licensed for use by Manning & Napier. For additional disclosure information, please see: https://go.manning-napier.com/benchmark-provisions.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-I-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-I-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Key Fund Statistics (as of October 31, 2024)

| |

|---|

Fund Size | $623,925,803 |

Number of Holdings | 39 |

Annual Portfolio Turnover | 57% |

Total Advisory Fees Paid (net of reimbursements) | $1,937,795 |

The total advisory fee represents management fees at fund level in aggregate dollar amount including waivers and reimbursements.

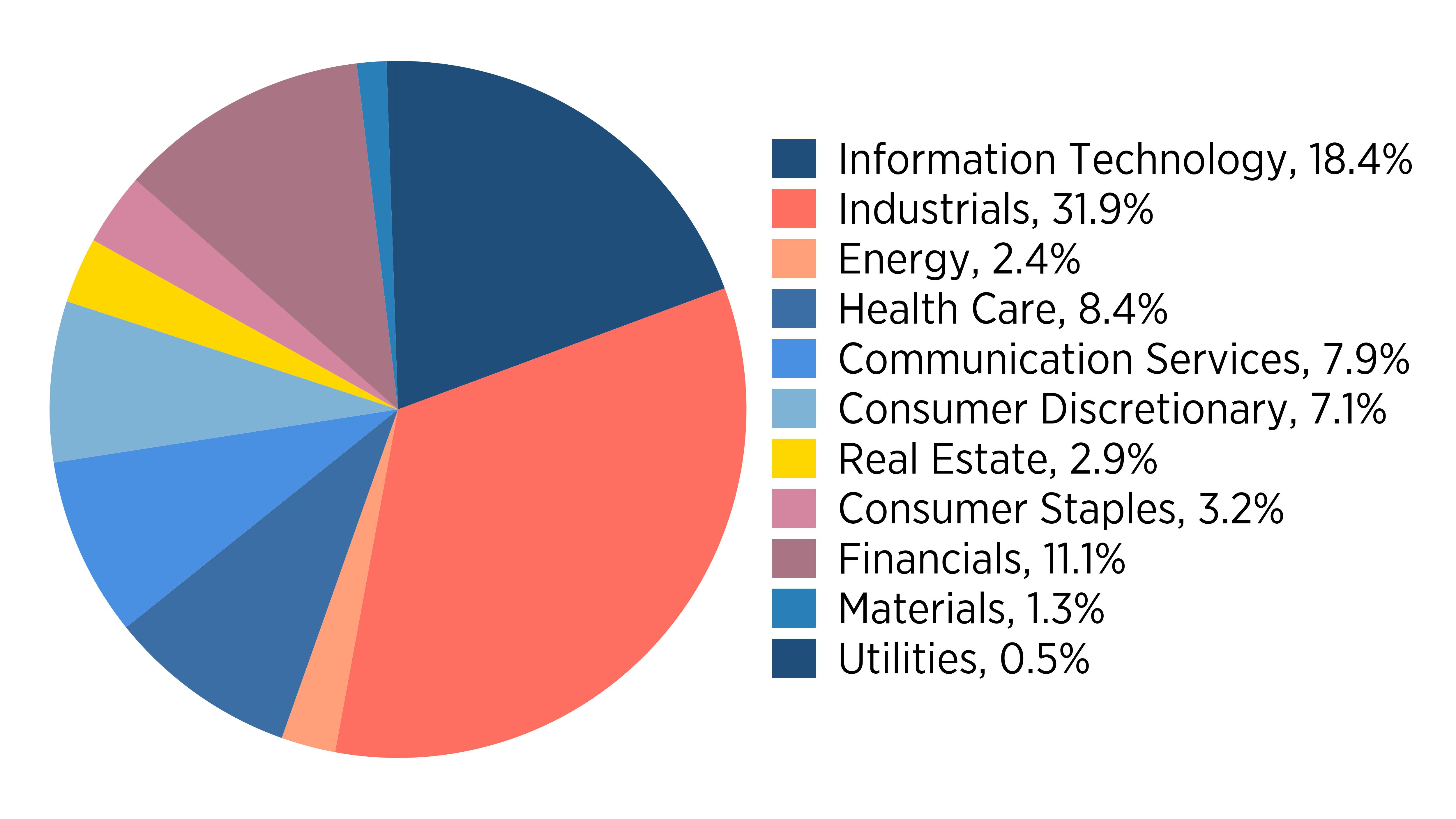

Sector Allocation (% of net assets)

Sector | Allocation |

Financials | 0.138 |

Materials | 0.071 |

Industrials | 0.278 |

Health Care | 0.113 |

Information Technology | 0.184 |

Communication Services | 0.067 |

Consumer Staples | 0.020 |

Consumer Discretionary | 0.086 |

The Global Industry Classification Standard (GICS) was developed by and is exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor's a division of S&P Global Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom.

What did the Fund invest in?

(as of October 31, 2024)

Top Investment Types | % |

|---|

Cash, Short-Term Investment, and Other Assets, Less Liabilities | 4.3 |

Common Stocks | 95.7 |

Expressed as a percentage of net assets.

Householding

The Fund may send only one copy of the Series' prospectus and annual and semi-annual reports to certain shareholders residing at the same "household" for shareholders who have elected this option. This reduces Fund expenses, which benefits you and other shareholders. If you wish to change your "householding" option, please call (800) 466-3863 or contact your financial advisor.

Additional information about the Series, including its prospectus, financial information, holdings, and proxy information can be obtained at www.manning-napier.com/products/mutual-funds or by calling (800) 466-3863. Shareholders can also elect to receive certain documents via e-delivery. For more information or to sign up for e-delivery, please visit the Fund's website.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-I-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-S-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

annual shareholder report Overseas Series ticker: MNOSX | |

This annual shareholder report contains important information about Overseas Series Class S, a series of Manning & Napier Fund Inc. (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.manning-napier.com/products/mutual-funds. You can also request this information by contacting us at (800) 466-3863. Shareholders who own the Fund through a third-party advisor or intermediary platform should contact their financial advisor directly for additional information.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class S | $117 | 1.05% |

Expenses are equal to each Class's annualized expense ratio (for the twelve-month period) multiplied by the average account value over the period. The Class's expenses would have been higher if certain expenses had not been waived or reimbursed during the period.

Management's Discussion of Fund Performance

How did the fund perform last year?

The Series delivered positive returns for the 12-month period ended 10/31/2024 but modestly underperformed its benchmark, the MSCI ACWI ex USA Index.

What factors influenced performance?

The Series' positive return was driven primarily by its exposure to foreign stocks. Equity markets were meaningfully positive over the past twelve months, not only in the U.S. but around the globe. Investor sentiment was buoyed by a resilient U.S. economy and moderating inflation, while foreign markets benefited from attractive valuations and a broadening-out of equity market returns away from previous return concentration in large U.S. growth companies. While country and sector positioning decisions were largely positive over the period, the Series' relative underperformance was primarily driven by individual stock results, most notably within the Industrials, Information Technology, and Financials sectors.

Positioning

While the U.S. economy has been surprisingly resilient, we continue to believe that risks to markets remain in place with a cooling job market, rising geopolitical conflict around the world, and elevated security valuations. However, non-U.S. markets may present more attractive opportunities than domestically as some regions are earlier in their economic cycles with runways for growth lying ahead. As a function of these more early-cycle opportunities in foreign markets, we are seeking to take advantage of a wider variety of opportunities between both high-quality long-term positions and more economically sensitive exposures.

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years. The graph assumes a $10,000 initial investment in the Fund and one appropriate broad-based securities market index that reflects the market sector in which the Fund invests for the same period.

Initial Investment of $10,000

Date | Overseas Series - S | MSCI ACWI ex USA |

10/31/2014 | 10000.0 | 10000.0 |

10/31/2015 | 9665.0 | 9532.0 |

10/31/2016 | 9603.0 | 9553.0 |

10/31/2017 | 11537.0 | 11811.0 |

10/31/2018 | 10503.0 | 10838.0 |

10/31/2019 | 11541.0 | 12059.0 |

10/31/2020 | 13238.0 | 11745.0 |

10/31/2021 | 18098.0 | 15228.0 |

10/31/2022 | 12312.0 | 11462.0 |

10/31/2023 | 13609.0 | 12846.0 |

10/31/2024 | 16696.0 | 15971.0 |

The returns are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to net asset values in accordance with accounting principles generally accepted in the United States of America.

For periods through September 21, 2018 (the inception date of the Class S shares), performance for the Class S shares is hypothetical and is based on the historical performance of the Class I shares adjusted for the Class S shares' charges and expenses.

The MSCI ACWI ex USA Index (ACWIxUS) is designed to measure large and mid-cap representation across 22 of 23 Developed Markets countries (excluding the U.S.) and 24 Emerging Markets countries. The Index returns do not reflect any fees or expenses. Index returns provided by Bloomberg.

Average Annual Total Returns

(As of October 31, 2024)

| 1 Year | 5 Year | 10 Year |

|---|

Overseas Series - S | 22.68% | 7.66% | 5.26% |

MSCI ACWI ex USA | 24.33% | 5.78% | 4.79% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Index data referenced herein is the property of MSCI, its affiliates ("MSCI") and/or its third-party suppliers and has been licensed for use by Manning & Napier. For additional disclosure information, please see: https://go.manning-napier.com/benchmark-provisions.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-S-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-S-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Key Fund Statistics (as of October 31, 2024)

| |

|---|

Fund Size | $623,925,803 |

Number of Holdings | 39 |

Annual Portfolio Turnover | 57% |

Total Advisory Fees Paid (net of reimbursements) | $1,937,795 |

The total advisory fee represents management fees at fund level in aggregate dollar amount including waivers and reimbursements.

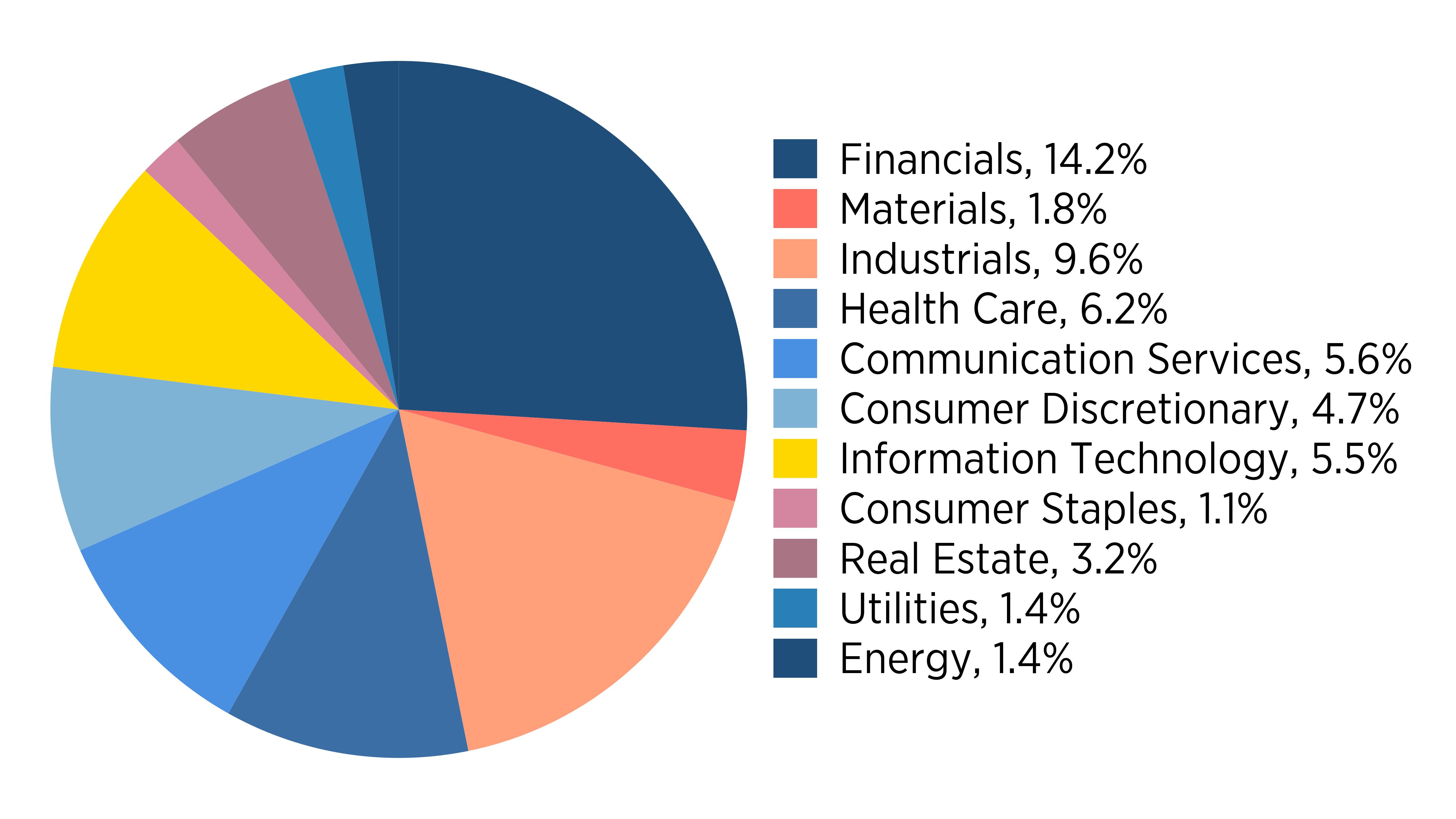

Sector Allocation (% of net assets)

Sector | Allocation |

Financials | 0.138 |

Materials | 0.071 |

Industrials | 0.278 |

Health Care | 0.113 |

Information Technology | 0.184 |

Communication Services | 0.067 |

Consumer Staples | 0.020 |

Consumer Discretionary | 0.086 |

The Global Industry Classification Standard (GICS) was developed by and is exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor's a division of S&P Global Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom.

What did the Fund invest in?

(as of October 31, 2024)

Top Investment Types | % |

|---|

Cash, Short-Term Investment, and Other Assets, Less Liabilities | 4.3 |

Common Stocks | 95.7 |

Expressed as a percentage of net assets.

Householding

The Fund may send only one copy of the Series' prospectus and annual and semi-annual reports to certain shareholders residing at the same "household" for shareholders who have elected this option. This reduces Fund expenses, which benefits you and other shareholders. If you wish to change your "householding" option, please call (800) 466-3863 or contact your financial advisor.

Additional information about the Series, including its prospectus, financial information, holdings, and proxy information can be obtained at www.manning-napier.com/products/mutual-funds or by calling (800) 466-3863. Shareholders can also elect to receive certain documents via e-delivery. For more information or to sign up for e-delivery, please visit the Fund's website.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-S-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-Z-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

annual shareholder report Overseas Series ticker: MNOZX | |

This annual shareholder report contains important information about Overseas Series Class Z, a series of Manning & Napier Fund Inc. (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.manning-napier.com/products/mutual-funds. You can also request this information by contacting us at (800) 466-3863. Shareholders who own the Fund through a third-party advisor or intermediary platform should contact their financial advisor directly for additional information.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class Z | $73 | 0.65% |

Expenses are equal to each Class's annualized expense ratio (for the twelve-month period) multiplied by the average account value over the period. The Class's expenses would have been higher if certain expenses had not been waived or reimbursed during the period.

Management's Discussion of Fund Performance

How did the fund perform last year?

The Series delivered positive returns for the 12-month period ended 10/31/2024 but modestly underperformed its benchmark, the MSCI ACWI ex USA Index.

What factors influenced performance?

The Series' positive return was driven primarily by its exposure to foreign stocks. Equity markets were meaningfully positive over the past twelve months, not only in the U.S. but around the globe. Investor sentiment was buoyed by a resilient U.S. economy and moderating inflation, while foreign markets benefited from attractive valuations and a broadening-out of equity market returns away from previous return concentration in large U.S. growth companies. While country and sector positioning decisions were largely positive over the period, the Series' relative underperformance was primarily driven by individual stock results, most notably within the Industrials, Information Technology, and Financials sectors.

Positioning

While the U.S. economy has been surprisingly resilient, we continue to believe that risks to markets remain in place with a cooling job market, rising geopolitical conflict around the world, and elevated security valuations. However, non-U.S. markets may present more attractive opportunities than domestically as some regions are earlier in their economic cycles with runways for growth lying ahead. As a function of these more early-cycle opportunities in foreign markets, we are seeking to take advantage of a wider variety of opportunities between both high-quality long-term positions and more economically sensitive exposures.

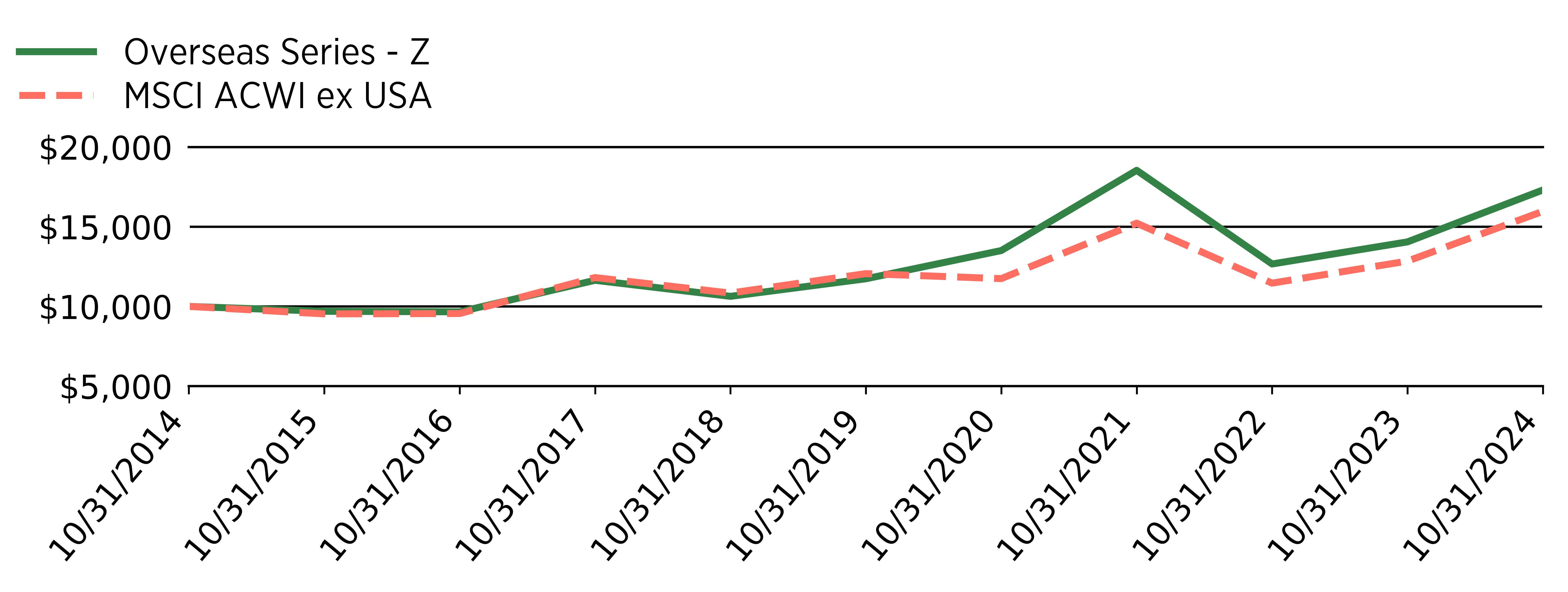

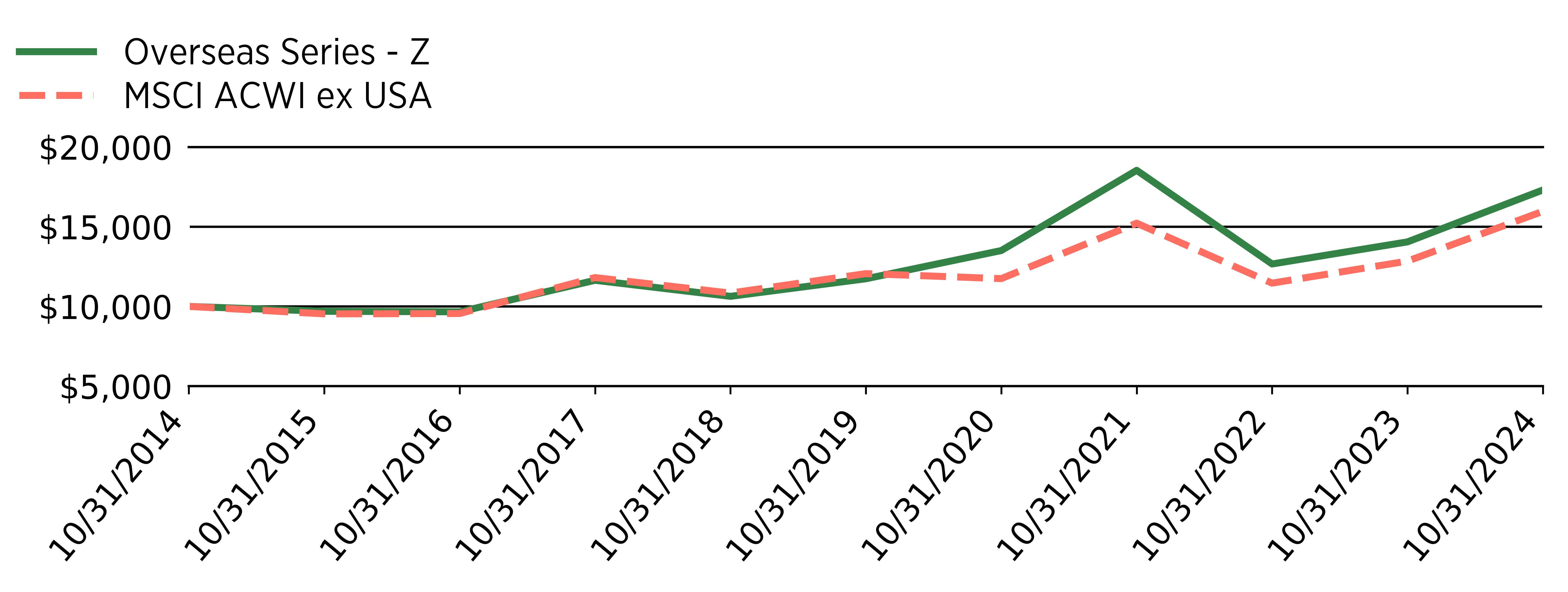

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years. The graph assumes a $10,000 initial investment in the Fund and one appropriate broad-based securities market index that reflects the market sector in which the Fund invests for the same period.

Initial Investment of $10,000

Date | Overseas Series - Z | MSCI ACWI ex USA |

10/31/2014 | 10000.0 | 10000.0 |

10/31/2015 | 9694.0 | 9532.0 |

10/31/2016 | 9660.0 | 9553.0 |

10/31/2017 | 11640.0 | 11811.0 |

10/31/2018 | 10633.0 | 10838.0 |

10/31/2019 | 11735.0 | 12059.0 |

10/31/2020 | 13508.0 | 11745.0 |

10/31/2021 | 18548.0 | 15228.0 |

10/31/2022 | 12665.0 | 11462.0 |

10/31/2023 | 14053.0 | 12846.0 |

10/31/2024 | 17313.0 | 15971.0 |

The returns are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to net asset values in accordance with accounting principles generally accepted in the United States of America.

For periods through May 1, 2018 (the inception date of the Class Z shares), performance for the Class Z shares is based on the historical performance of the Class I shares. Because the Class Z shares invest in the same portfolio of securities as the Class I shares, performance will be different only to the extent that the Class I shares have a higher expense ratio.

The MSCI ACWI ex USA Index (ACWIxUS) is designed to measure large and mid-cap representation across 22 of 23 Developed Markets countries (excluding the U.S.) and 24 Emerging Markets countries. The Index returns do not reflect any fees or expenses. Index returns provided by Bloomberg.

Average Annual Total Returns

(As of October 31, 2024)

| 1 Year | 5 Year | 10 Year |

|---|

Overseas Series - Z | 23.20% | 8.09% | 5.64% |

MSCI ACWI ex USA | 24.33% | 5.78% | 4.79% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Index data referenced herein is the property of MSCI, its affiliates ("MSCI") and/or its third-party suppliers and has been licensed for use by Manning & Napier. For additional disclosure information, please see: https://go.manning-napier.com/benchmark-provisions.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-Z-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-Z-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

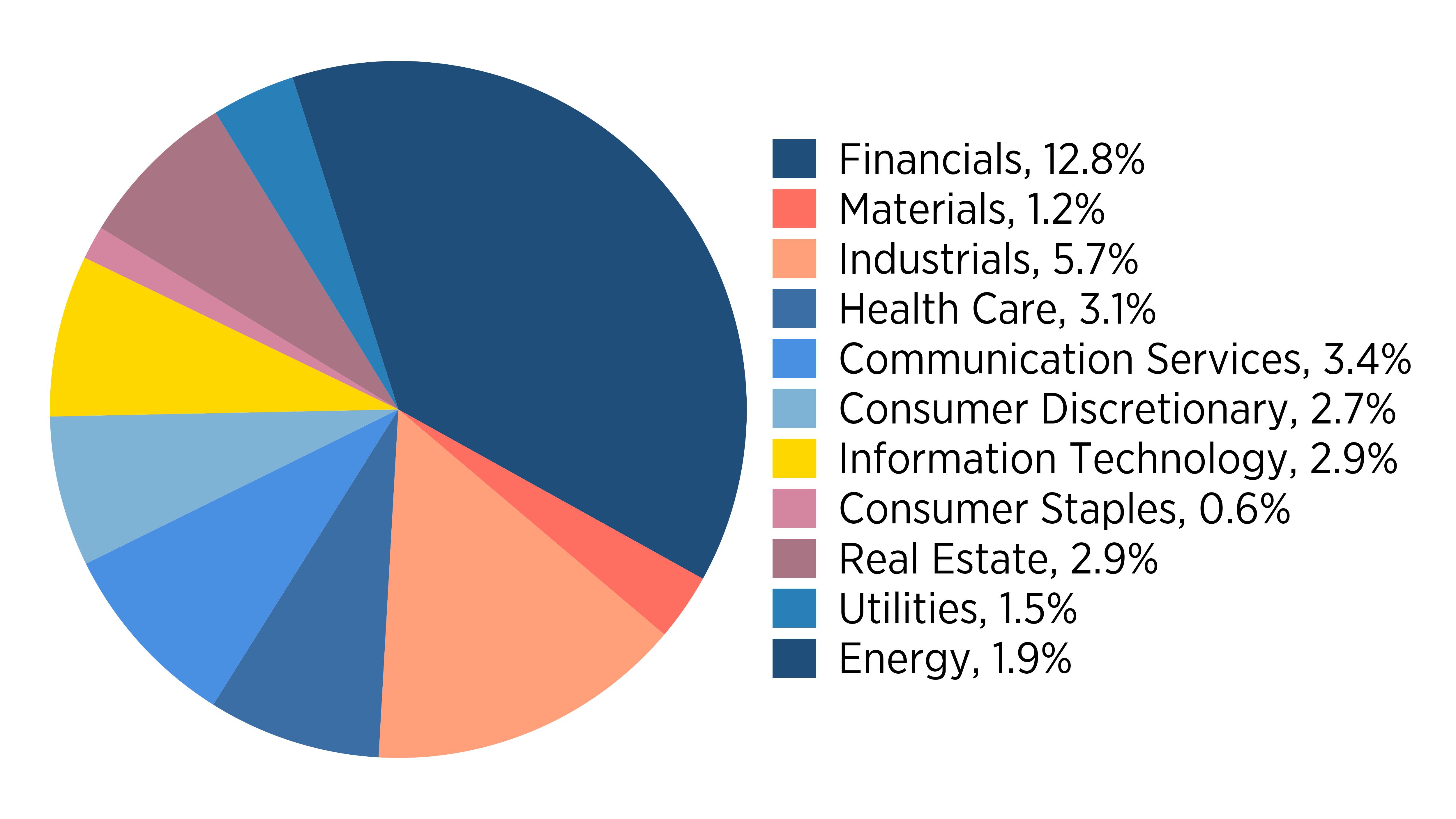

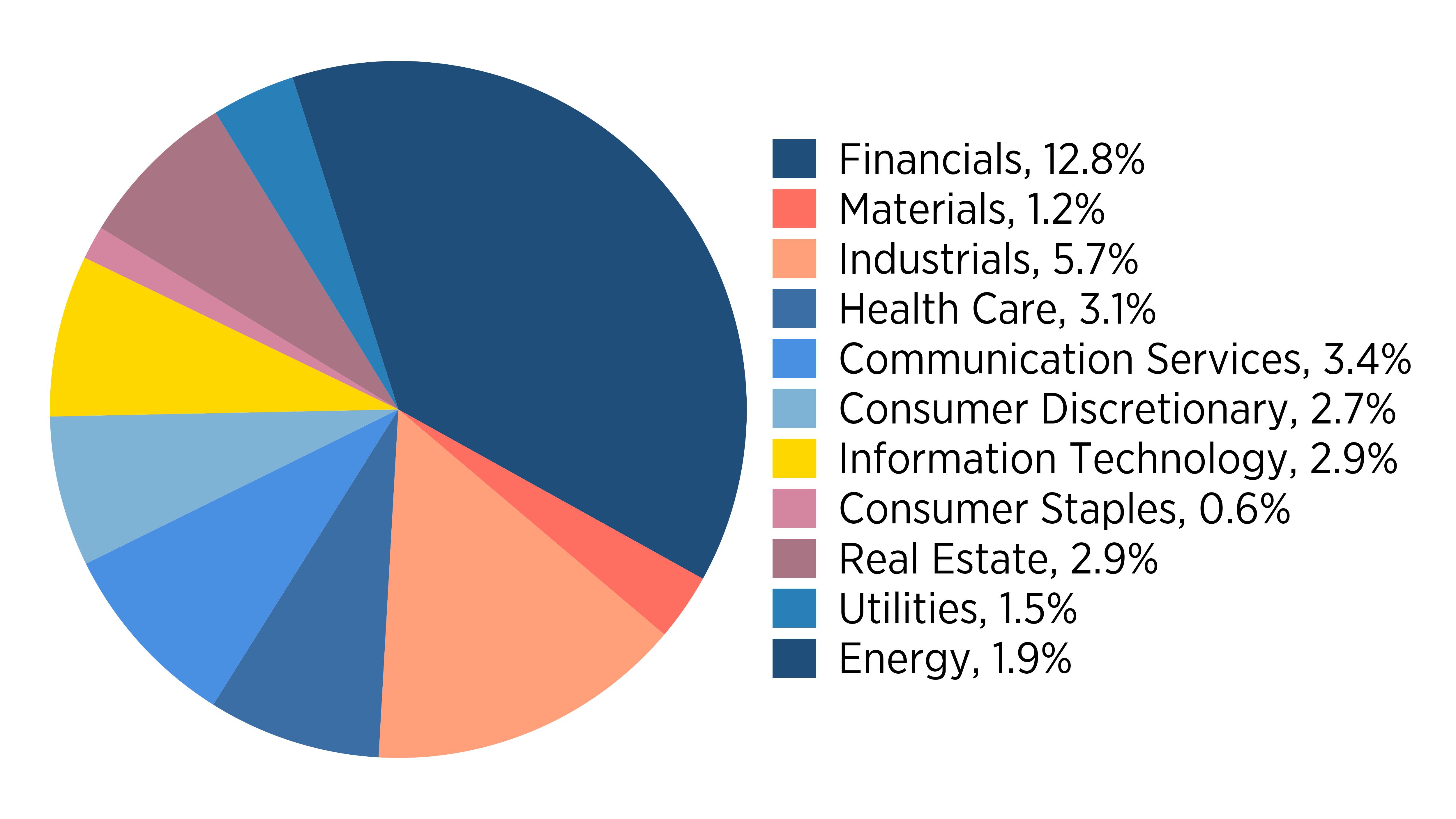

Key Fund Statistics (as of October 31, 2024)

| |

|---|

Fund Size | $623,925,803 |

Number of Holdings | 39 |

Annual Portfolio Turnover | 57% |

Total Advisory Fees Paid (net of reimbursements) | $1,937,795 |

The total advisory fee represents management fees at fund level in aggregate dollar amount including waivers and reimbursements.

Sector Allocation (% of net assets)

Sector | Allocation |

Financials | 0.138 |

Materials | 0.071 |

Industrials | 0.278 |

Health Care | 0.113 |

Information Technology | 0.184 |

Communication Services | 0.067 |

Consumer Staples | 0.020 |

Consumer Discretionary | 0.086 |

The Global Industry Classification Standard (GICS) was developed by and is exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor's a division of S&P Global Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom.

What did the Fund invest in?

(as of October 31, 2024)

Top Investment Types | % |

|---|

Cash, Short-Term Investment, and Other Assets, Less Liabilities | 4.3 |

Common Stocks | 95.7 |

Expressed as a percentage of net assets.

Householding

The Fund may send only one copy of the Series' prospectus and annual and semi-annual reports to certain shareholders residing at the same "household" for shareholders who have elected this option. This reduces Fund expenses, which benefits you and other shareholders. If you wish to change your "householding" option, please call (800) 466-3863 or contact your financial advisor.

Additional information about the Series, including its prospectus, financial information, holdings, and proxy information can be obtained at www.manning-napier.com/products/mutual-funds or by calling (800) 466-3863. Shareholders can also elect to receive certain documents via e-delivery. For more information or to sign up for e-delivery, please visit the Fund's website.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-Z-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-W-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

annual shareholder report Overseas Series ticker: MNOWX | |

This annual shareholder report contains important information about Overseas Series Class W, a series of Manning & Napier Fund Inc. (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.manning-napier.com/products/mutual-funds. You can also request this information by contacting us at (800) 466-3863. Shareholders who own the Fund through a third-party advisor or intermediary platform should contact their financial advisor directly for additional information.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class W | $6 | 0.05% |

Expenses are equal to each Class's annualized expense ratio (for the twelve-month period) multiplied by the average account value over the period. The Advisor has contractually agreed to waive the management fee for the Class W shares. The Class's expenses would have been higher if certain expenses had not been waived or reimbursed during the period.

Management's Discussion of Fund Performance

How did the fund perform last year?

The Series delivered positive returns for the 12-month period ended 10/31/2024 but modestly underperformed its benchmark, the MSCI ACWI ex USA Index.

What factors influenced performance?

The Series' positive return was driven primarily by its exposure to foreign stocks. Equity markets were meaningfully positive over the past twelve months, not only in the U.S. but around the globe. Investor sentiment was buoyed by a resilient U.S. economy and moderating inflation, while foreign markets benefited from attractive valuations and a broadening-out of equity market returns away from previous return concentration in large U.S. growth companies. While country and sector positioning decisions were largely positive over the period, the Series' relative underperformance was primarily driven by individual stock results, most notably within the Industrials, Information Technology, and Financials sectors.

Positioning

While the U.S. economy has been surprisingly resilient, we continue to believe that risks to markets remain in place with a cooling job market, rising geopolitical conflict around the world, and elevated security valuations. However, non-U.S. markets may present more attractive opportunities than domestically as some regions are earlier in their economic cycles with runways for growth lying ahead. As a function of these more early-cycle opportunities in foreign markets, we are seeking to take advantage of a wider variety of opportunities between both high-quality long-term positions and more economically sensitive exposures.

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years. The graph assumes a $10,000 initial investment in the Fund and one appropriate broad-based securities market index that reflects the market sector in which the Fund invests for the same period.

Initial Investment of $10,000

Date | Overseas Series - W | MSCI ACWI ex USA |

10/31/2014 | 10000.0 | 10000.0 |

10/31/2015 | 9694.0 | 9532.0 |

10/31/2016 | 9660.0 | 9553.0 |

10/31/2017 | 11640.0 | 11811.0 |

10/31/2018 | 10624.0 | 10838.0 |

10/31/2019 | 11770.0 | 12059.0 |

10/31/2020 | 13629.0 | 11745.0 |

10/31/2021 | 18826.0 | 15228.0 |

10/31/2022 | 12936.0 | 11462.0 |

10/31/2023 | 14438.0 | 12846.0 |

10/31/2024 | 17897.0 | 15971.0 |

The returns are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to net asset values in accordance with accounting principles generally accepted in the United States of America.

For periods through March 1, 2019 (the inception date of the Class W shares), performance for the Class W shares is based on the historical performance of the Class I shares. Because the Class W shares invest in the same portfolio of securities as the Class I shares, performance will be different only to the extent that the Class I shares have a higher expense ratio.

The MSCI ACWI ex USA Index (ACWIxUS) is designed to measure large and mid-cap representation across 22 of 23 Developed Markets countries (excluding the U.S.) and 24 Emerging Markets countries. The Index returns do not reflect any fees or expenses. Index returns provided by Bloomberg.

Average Annual Total Returns

(As of October 31, 2024)

| 1 Year | 5 Year | 10 Year |

|---|

Overseas Series - W | 23.95% | 8.74% | 5.99% |

MSCI ACWI ex USA | 24.33% | 5.78% | 4.79% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Index data referenced herein is the property of MSCI, its affiliates ("MSCI") and/or its third-party suppliers and has been licensed for use by Manning & Napier. For additional disclosure information, please see: https://go.manning-napier.com/benchmark-provisions.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-W-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-W-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Key Fund Statistics (as of October 31, 2024)

| |

|---|

Fund Size | $623,925,803 |

Number of Holdings | 39 |

Annual Portfolio Turnover | 57% |

Total Advisory Fees Paid (net of reimbursements) | $1,937,795 |

The total advisory fee represents management fees at fund level in aggregate dollar amount including waivers and reimbursements.

Sector Allocation (% of net assets)

Sector | Allocation |

Financials | 0.138 |

Materials | 0.071 |

Industrials | 0.278 |

Health Care | 0.113 |

Information Technology | 0.184 |

Communication Services | 0.067 |

Consumer Staples | 0.020 |

Consumer Discretionary | 0.086 |

The Global Industry Classification Standard (GICS) was developed by and is exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor's a division of S&P Global Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom.

What did the Fund invest in?

(as of October 31, 2024)

Top Investment Types | % |

|---|

Cash, Short-Term Investment, and Other Assets, Less Liabilities | 4.3 |

Common Stocks | 95.7 |

Expressed as a percentage of net assets.

Householding

The Fund may send only one copy of the Series' prospectus and annual and semi-annual reports to certain shareholders residing at the same "household" for shareholders who have elected this option. This reduces Fund expenses, which benefits you and other shareholders. If you wish to change your "householding" option, please call (800) 466-3863 or contact your financial advisor.

Additional information about the Series, including its prospectus, financial information, holdings, and proxy information can be obtained at www.manning-napier.com/products/mutual-funds or by calling (800) 466-3863. Shareholders can also elect to receive certain documents via e-delivery. For more information or to sign up for e-delivery, please visit the Fund's website.

Manning & Napier Overseas Series Tailored Shareholder Report MNOVS-W-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Pro-Blend® Conservative Term Series Tailored Shareholder Report MNPBCO-L-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

annual shareholder report Pro-Blend® Conservative Term Series ticker: MNCCX | |

This annual shareholder report contains important information about Pro-Blend® Conservative Term Series Class L, a series of Manning & Napier Fund Inc. (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.manning-napier.com/products/mutual-funds. You can also request this information by contacting us at (800) 466-3863. Shareholders who own the Fund through a third-party advisor or intermediary platform should contact their financial advisor directly for additional information.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class L | $170 | 1.61% |

Expenses are equal to each Class's annualized expense ratio (for the twelve-month period) multiplied by the average account value over the period. The Class's expenses would have been higher if certain expenses had not been waived or reimbursed during the period.

Management's Discussion of Fund Performance

How did the fund perform last year?

The Series delivered positive double-digit returns but underperformed its blended benchmark for the 12-month period ending 10/31/2024.

What factors influenced performance?

The Series' positive return benefited from exposure to both equities and fixed income securities with each asset class delivering double-digit returns. Equity markets rallied on the back of a resilient U.S. economy while bond markets benefited from the onset of the Federal Reserve's rate cut cycle contributing to interest rates falling across the yield curve. The Series' underperformance relative to the blended benchmark was primarily driven by an underweight to equities in comparison to the benchmark. Selection within equities was a relative contributor, as was fixed income positioning.

Positioning

Despite risks appearing broadly balanced to the upside and downside, we expect a degree of volatility in markets moving forward. We have positioned the Series with a generally defensive tilt through a primary focus on less economically sensitive businesses and those that can benefit from long-term secular, while also selectively identifying pockets of opportunity in more cyclical industries. Within fixed income, we continue to view securitized debt as relatively attractive and focus on securities with seniority in the capital structure that are backed by asset classes with high-quality fundamentals and low credit risk. Alternatively, we are more cautious on corporate credit as valuations remain elevated.

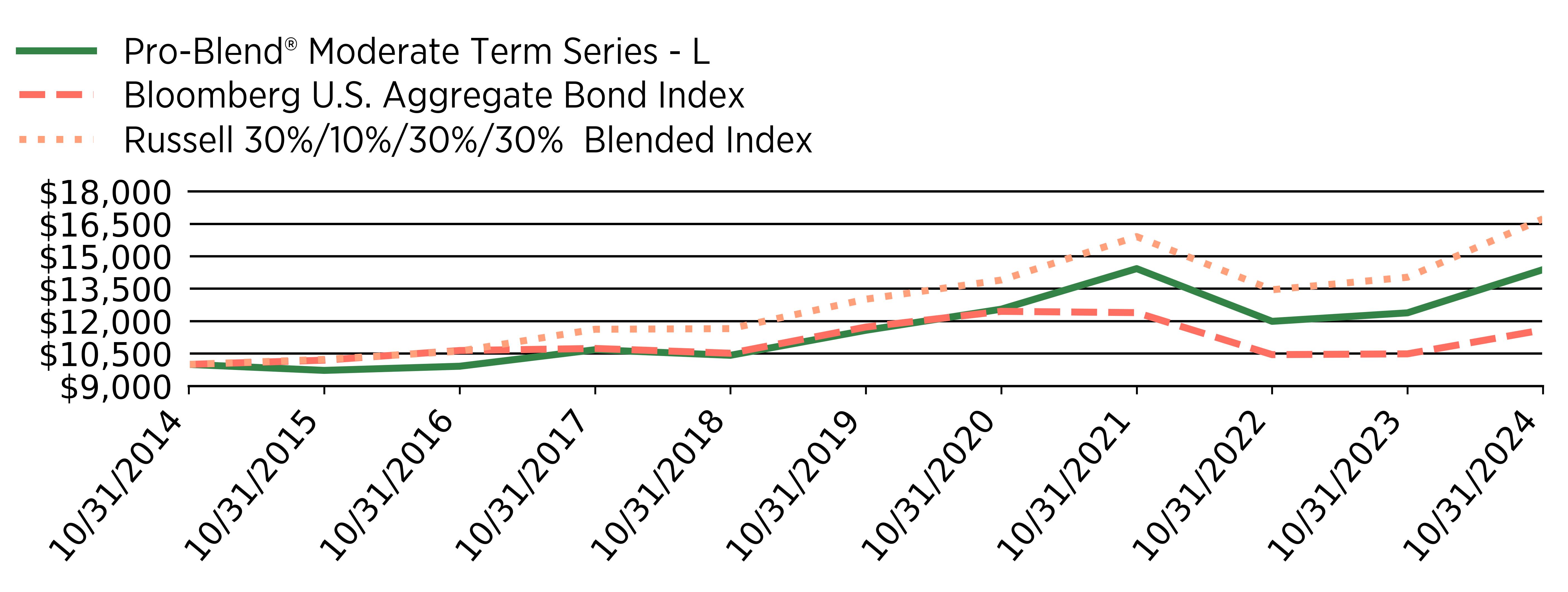

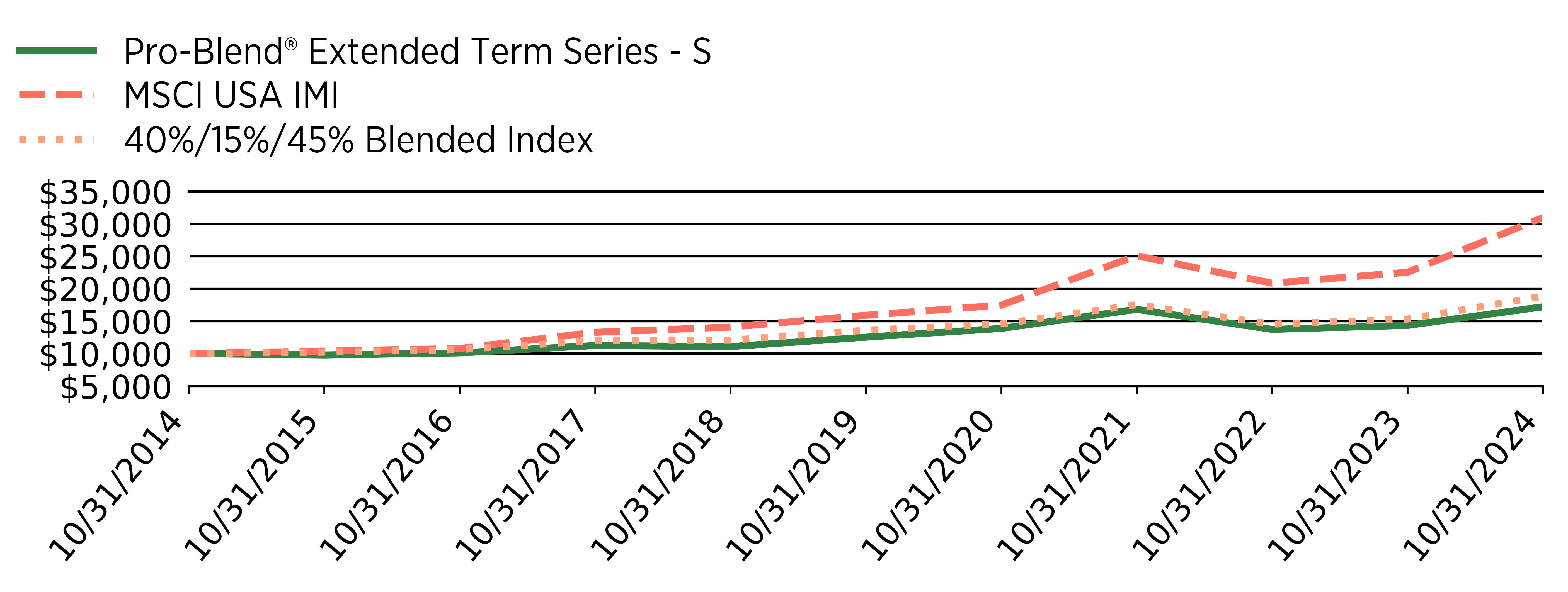

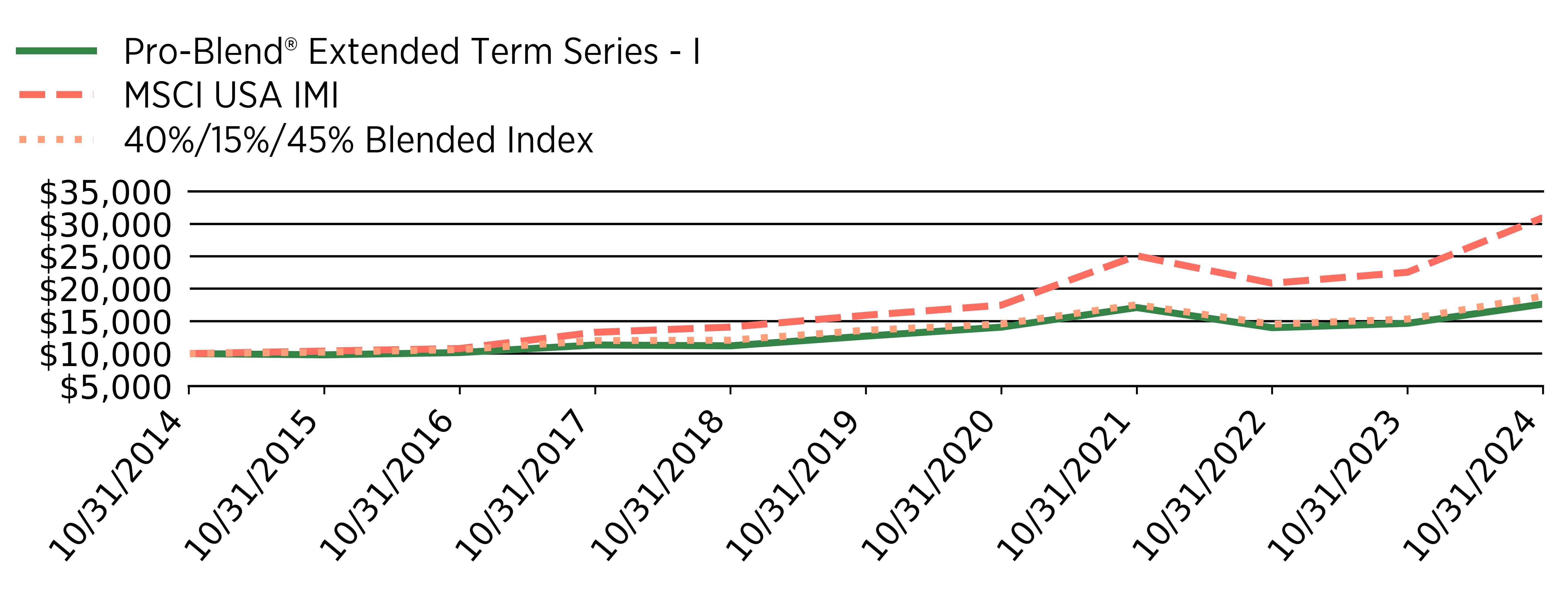

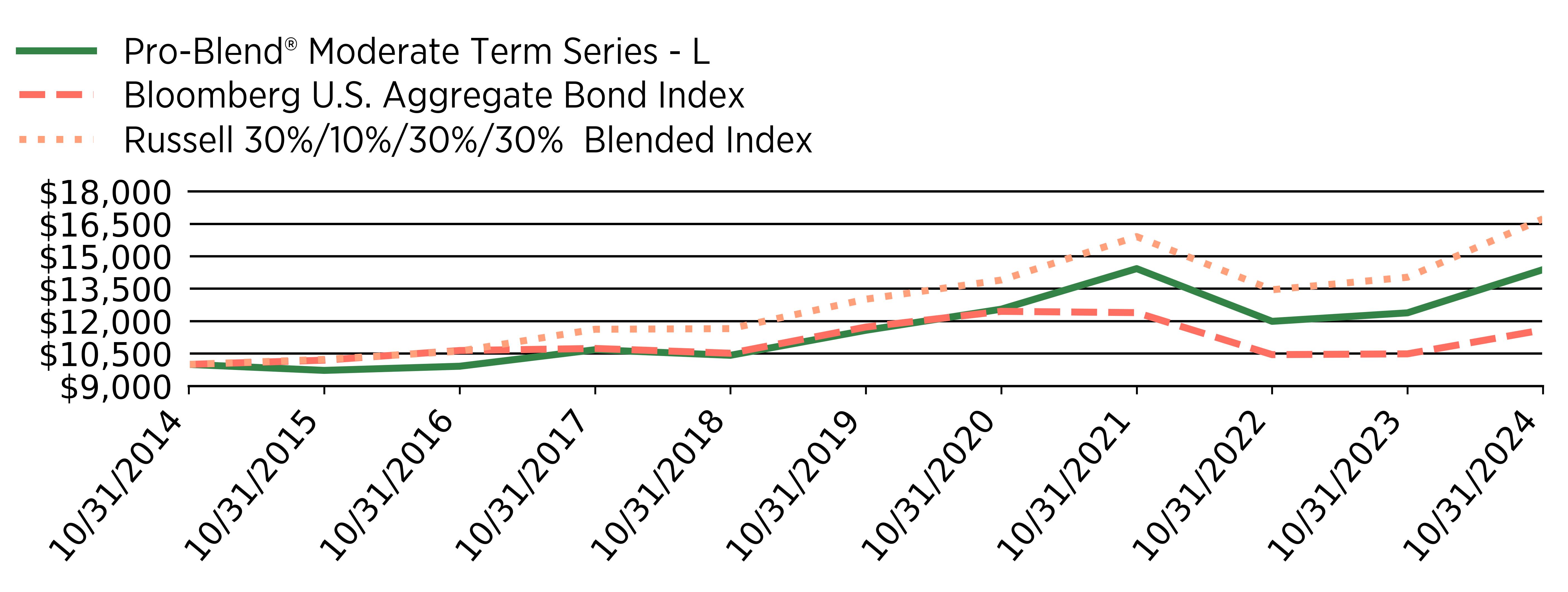

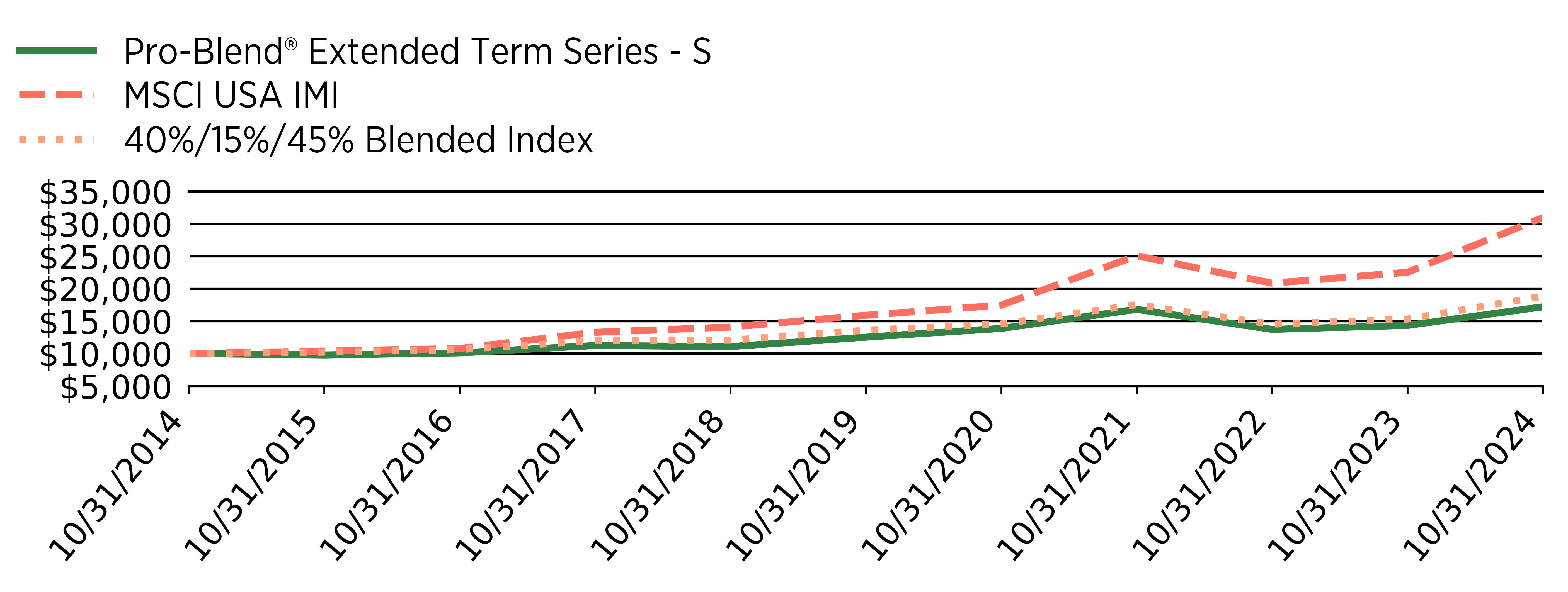

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years. The graph assumes a $10,000 initial investment in the Fund and an appropriate broad-based securities market index and a blended index that reflects the market sector in which the Fund invests for the same period.

Initial Investment of $10,000

Date | Pro-Blend® Conservative Term Series - L | Bloomberg U.S. Aggregate Bond | Conservative Term Composite Benchmark |

10/31/2014 | 10000.0 | 10000.0 | 10000.0 |

10/31/2015 | 9791.0 | 10196.0 | 10226.0 |

10/31/2016 | 10009.0 | 10642.0 | 10570.0 |

10/31/2017 | 10623.0 | 10737.0 | 11328.0 |

10/31/2018 | 10455.0 | 10517.0 | 11330.0 |

10/31/2019 | 11460.0 | 11728.0 | 12506.0 |

10/31/2020 | 12052.0 | 12454.0 | 13275.0 |

10/31/2021 | 13288.0 | 12394.0 | 14659.0 |

10/31/2022 | 11502.0 | 10451.0 | 12773.0 |

10/31/2023 | 11821.0 | 10488.0 | 13146.0 |

10/31/2024 | 13187.0 | 11595.0 | 14983.0 |

The returns are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to net asset values in accordance with accounting principles generally accepted in the United States of America.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged, market-value weighted index of U.S. domestic investment-grade debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of one year or more. Index returns provided by Intercontinental Exchange (ICE). The Conservative Term Composite Benchmark is a blend of the Russell 3000® Index (Russell 3000), MSCI ACWI ex USA Index (ACWIxUS), and Bloomberg U.S. Intermediate Aggregate Bond Index (BIAB) in the following weightings: 22% Russell 3000, 8% ACWIxUS, and 70% BIAB through 12/31/2021; and 15% Russell 3000, 5% ACWIxUS, and 80% BIAB beginning 01/01/2022. Russell 3000 is an unmanaged index that consists of 3,000 of the largest U.S. companies based on total market capitalization. Index returns provided by Bloomberg. ACWIxUS is designed to measure large and mid-cap representation across 22 of 23 Developed Markets countries (excluding the U.S.) and 24 Emerging Markets countries. Index returns provided by Bloomberg. BIAB is an unmanaged, market value-weighted index of U.S. domestic investment-grade debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of greater than one year but less than 10 years. Index returns provided by ICE. Index returns do not reflect any fees or expenses. Returns provided are calculated monthly using a blended allocation. Because the fund's asset allocation will vary over time, the composition of the fund's portfolio may not match the composition of the comparative Indices.

Average Annual Total Returns

(As of October 31, 2024)

| 1 Year | 5 Year | 10 Year |

|---|

Pro-Blend® Conservative Term Series - L | 11.55% | 2.85% | 2.80% |

Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

Conservative Term Composite Benchmark | 13.98% | 3.68% | 4.12% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Index data referenced herein is the property of each index sponsor (London Stock Exchange Group plc and its group undertakings (Russell, MSCI, and Bloomberg), their affiliates, and/or their third-party suppliers and has been licensed for use by Manning & Napier. For additional disclosure information, please see: https://go.manning-napier.com/benchmark-provisions.

Manning & Napier Pro-Blend® Conservative Term Series Tailored Shareholder Report MNPBCO-L-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Pro-Blend® Conservative Term Series Tailored Shareholder Report MNPBCO-L-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

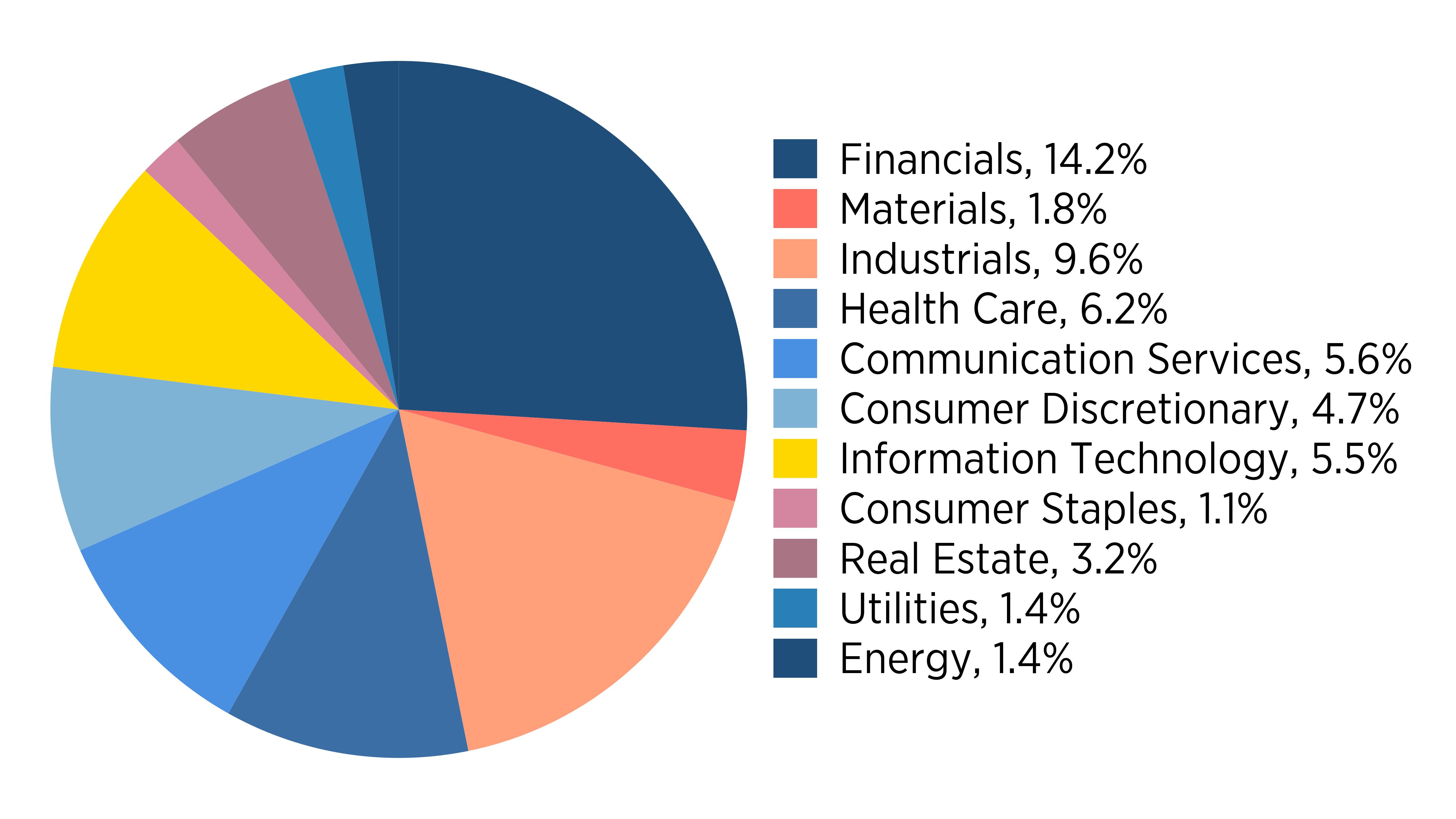

Key Fund Statistics (as of October 31, 2024)

| |

|---|

Fund Size | $332,785,669 |

Number of Holdings | 256 |

Annual Portfolio Turnover | 59% |

Total Advisory Fees Paid (net of reimbursements) | $1,409,977 |

The total advisory fee represents management fees at fund level in aggregate dollar amount including waivers and reimbursements for the period and recoupments of waivers and/or reimbursements previously recorded by the Series.

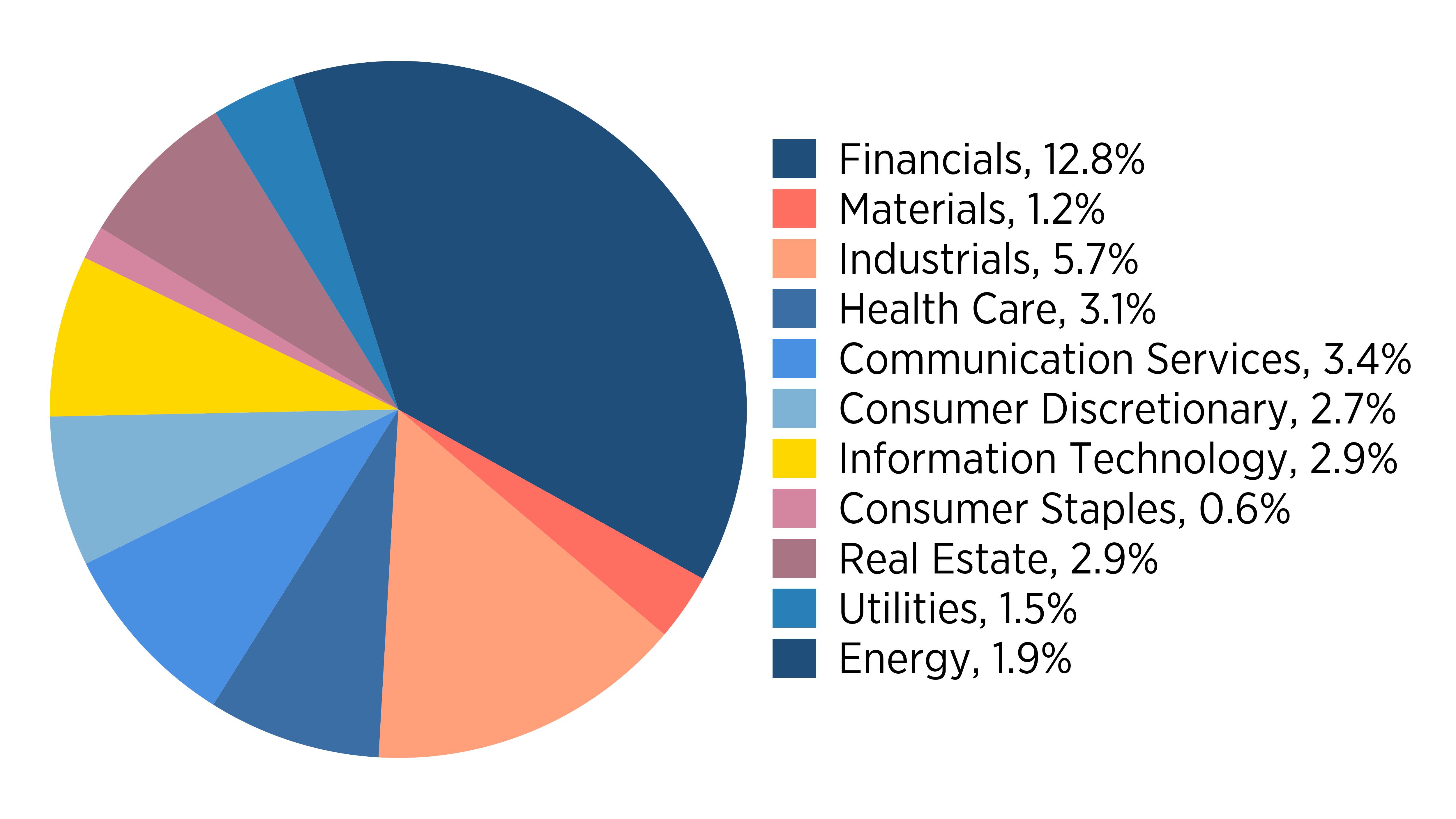

Sector Allocation (% of net assets)

Sector | Allocation |

Financials | 0.128 |

Materials | 0.012 |

Industrials | 0.057 |

Health Care | 0.031 |

Communication Services | 0.034 |

Consumer Discretionary | 0.027 |

Information Technology | 0.029 |

Consumer Staples | 0.006 |

Real Estate | 0.029 |

Utilities | 0.015 |

Energy | 0.019 |

The Global Industry Classification Standard (GICS) was developed by and is exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor's a division of S&P Global Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom.

What did the Fund invest in?

(as of October 31, 2024)

Top Investment Types | % |

|---|

Cash, Short-Term Investment and Assets, Less Liabilities/Liabilities, Less Assets | 2.8 |

Commercial Mortgage-Backed Securities | 9.2 |

Common Stocks | 20.5 |

Asset-Backed Securities | 7.2 |

U.S. Government Agencies | 13.8 |

Foreign Government Bonds | 0.4 |

Municipal Bonds | 1.6 |

Corporate Bonds | 18.0 |

U.S. Treasury Note | 26.5 |

Expressed as a percentage of net assets.

Householding

The Fund may send only one copy of the Series' prospectus and annual and semi-annual reports to certain shareholders residing at the same "household" for shareholders who have elected this option. This reduces Fund expenses, which benefits you and other shareholders. If you wish to change your "householding" option, please call (800) 466-3863 or contact your financial advisor.

Additional information about the Series, including its prospectus, financial information, holdings, and proxy information can be obtained at www.manning-napier.com/products/mutual-funds or by calling (800) 466-3863. Shareholders can also elect to receive certain documents via e-delivery. For more information or to sign up for e-delivery, please visit the Fund's website.

Manning & Napier Pro-Blend® Conservative Term Series Tailored Shareholder Report MNPBCO-L-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Pro-Blend® Conservative Term Series Tailored Shareholder Report MNPBCO-R-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

annual shareholder report Pro-Blend® Conservative Term Series ticker: MNCRX | |

This annual shareholder report contains important information about Pro-Blend® Conservative Term Series Class R, a series of Manning & Napier Fund Inc. (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.manning-napier.com/products/mutual-funds. You can also request this information by contacting us at (800) 466-3863. Shareholders who own the Fund through a third-party advisor or intermediary platform should contact their financial advisor directly for additional information.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class R | $117 | 1.10% |

Expenses are equal to each Class's annualized expense ratio (for the twelve-month period) multiplied by the average account value over the period. The Class's expenses would have been higher if certain expenses had not been waived or reimbursed during the period.

Management's Discussion of Fund Performance

How did the fund perform last year?

The Series delivered positive double-digit returns but underperformed its blended benchmark for the 12-month period ending 10/31/2024.

What factors influenced performance?

The Series' positive return benefited from exposure to both equities and fixed income securities with each asset class delivering double-digit returns. Equity markets rallied on the back of a resilient U.S. economy while bond markets benefited from the onset of the Federal Reserve's rate cut cycle contributing to interest rates falling across the yield curve. The Series' underperformance relative to the blended benchmark was primarily driven by an underweight to equities in comparison to the benchmark. Selection within equities was a relative contributor, as was fixed income positioning.

Positioning

Despite risks appearing broadly balanced to the upside and downside, we expect a degree of volatility in markets moving forward. We have positioned the Series with a generally defensive tilt through a primary focus on less economically sensitive businesses and those that can benefit from long-term secular, while also selectively identifying pockets of opportunity in more cyclical industries. Within fixed income, we continue to view securitized debt as relatively attractive and focus on securities with seniority in the capital structure that are backed by asset classes with high-quality fundamentals and low credit risk. Alternatively, we are more cautious on corporate credit as valuations remain elevated.

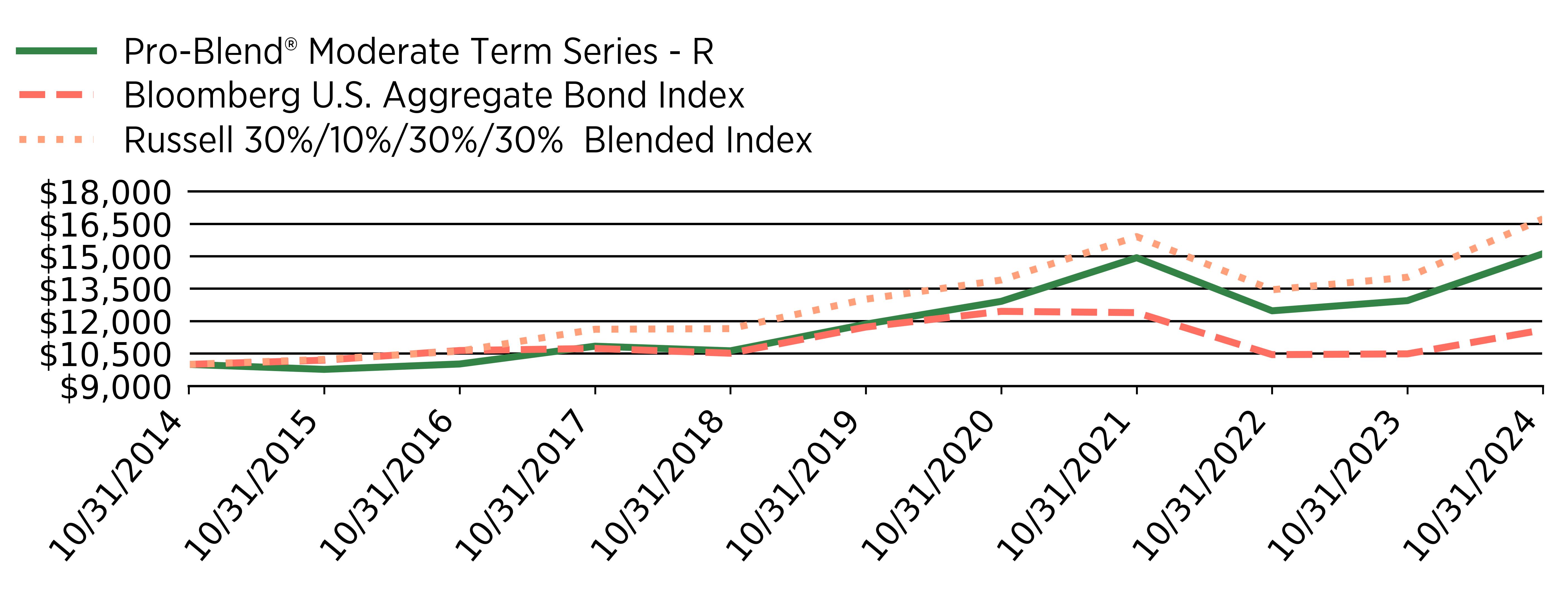

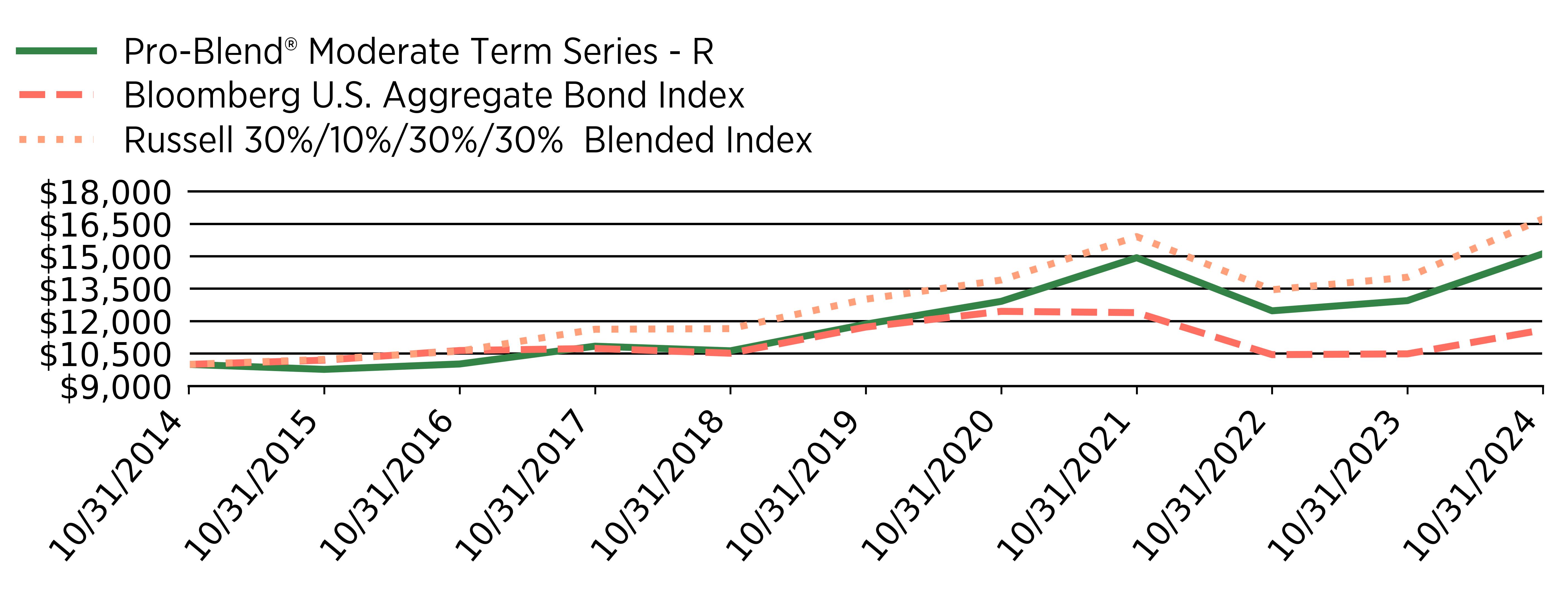

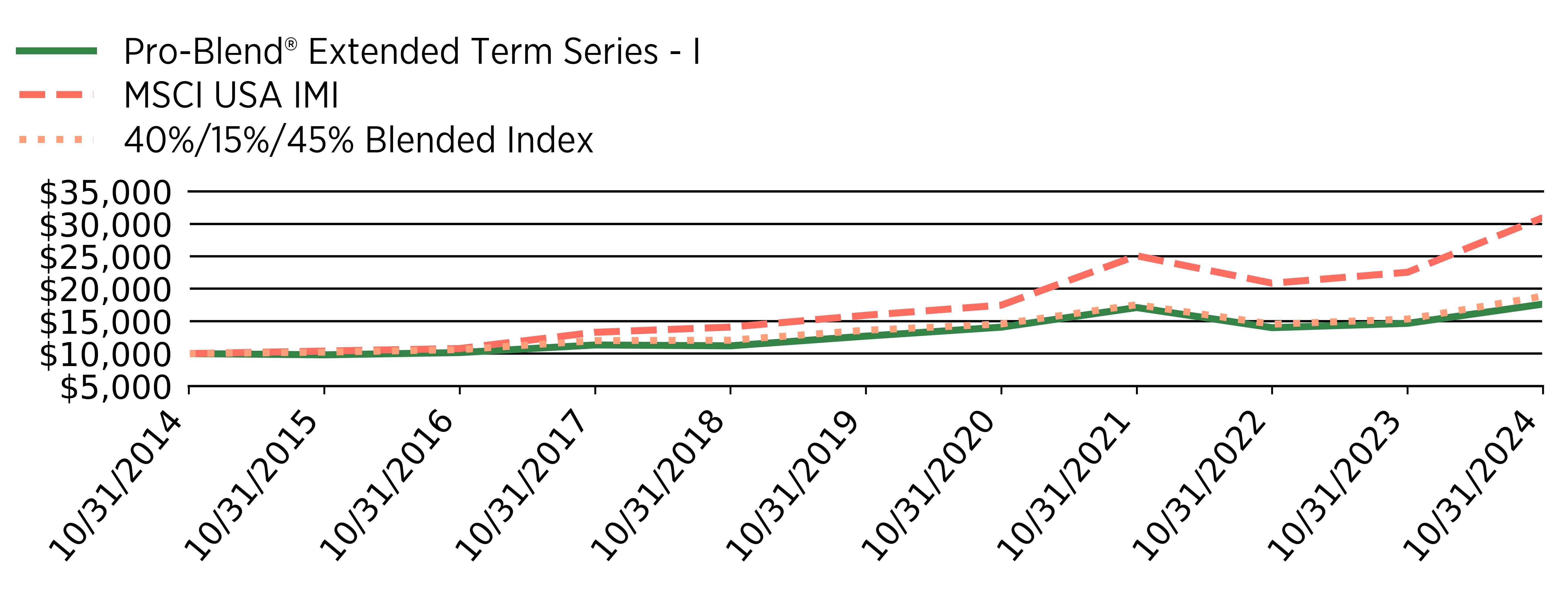

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years. The graph assumes a $10,000 initial investment in the Fund and an appropriate broad-based securities market index and a blended index that reflects the market sector in which the Fund invests for the same period.

Initial Investment of $10,000

Date | Pro-Blend® Conservative Term Series - R | Bloomberg U.S. Aggregate Bond | Conservative Term Composite Benchmark |

10/31/2014 | 10000.0 | 10000.0 | 10000.0 |

10/31/2015 | 9840.0 | 10196.0 | 10226.0 |

10/31/2016 | 10115.0 | 10642.0 | 10570.0 |

10/31/2017 | 10794.0 | 10737.0 | 11328.0 |

10/31/2018 | 10678.0 | 10517.0 | 11330.0 |

10/31/2019 | 11759.0 | 11728.0 | 12506.0 |

10/31/2020 | 12428.0 | 12454.0 | 13275.0 |

10/31/2021 | 13772.0 | 12394.0 | 14659.0 |

10/31/2022 | 11990.0 | 10451.0 | 12773.0 |

10/31/2023 | 12371.0 | 10488.0 | 13146.0 |

10/31/2024 | 13885.0 | 11595.0 | 14983.0 |

The returns are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to net asset values in accordance with accounting principles generally accepted in the United States of America.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged, market-value weighted index of U.S. domestic investment-grade debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of one year or more. Index returns provided by Intercontinental Exchange (ICE). The Conservative Term Composite Benchmark is a blend of the Russell 3000® Index (Russell 3000), MSCI ACWI ex USA Index (ACWIxUS), and Bloomberg U.S. Intermediate Aggregate Bond Index (BIAB) in the following weightings: 22% Russell 3000, 8% ACWIxUS, and 70% BIAB through 12/31/2021; and 15% Russell 3000, 5% ACWIxUS, and 80% BIAB beginning 01/01/2022. Russell 3000 is an unmanaged index that consists of 3,000 of the largest U.S. companies based on total market capitalization. Index returns provided by Bloomberg. ACWIxUS is designed to measure large and mid-cap representation across 22 of 23 Developed Markets countries (excluding the U.S.) and 24 Emerging Markets countries. Index returns provided by Bloomberg. BIAB is an unmanaged, market value-weighted index of U.S. domestic investment-grade debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of greater than one year but less than 10 years. Index returns provided by ICE. Index returns do not reflect any fees or expenses. Returns provided are calculated monthly using a blended allocation. Because the fund's asset allocation will vary over time, the composition of the fund's portfolio may not match the composition of the comparative Indices.

Average Annual Total Returns

(As of October 31, 2024)

| 1 Year | 5 Year | 10 Year |

|---|

Pro-Blend® Conservative Term Series - R | 12.25% | 3.38% | 3.34% |

Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

Conservative Term Composite Benchmark | 13.98% | 3.68% | 4.12% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Index data referenced herein is the property of each index sponsor (London Stock Exchange Group plc and its group undertakings (Russell, MSCI, and Bloomberg), their affiliates, and/or their third-party suppliers and has been licensed for use by Manning & Napier. For additional disclosure information, please see: https://go.manning-napier.com/benchmark-provisions.

Manning & Napier Pro-Blend® Conservative Term Series Tailored Shareholder Report MNPBCO-R-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Pro-Blend® Conservative Term Series Tailored Shareholder Report MNPBCO-R-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Key Fund Statistics (as of October 31, 2024)

| |

|---|

Fund Size | $332,785,669 |

Number of Holdings | 256 |

Annual Portfolio Turnover | 59% |

Total Advisory Fees Paid (net of reimbursements) | $1,409,977 |

The total advisory fee represents management fees at fund level in aggregate dollar amount including waivers and reimbursements for the period and recoupments of waivers and/or reimbursements previously recorded by the Series.

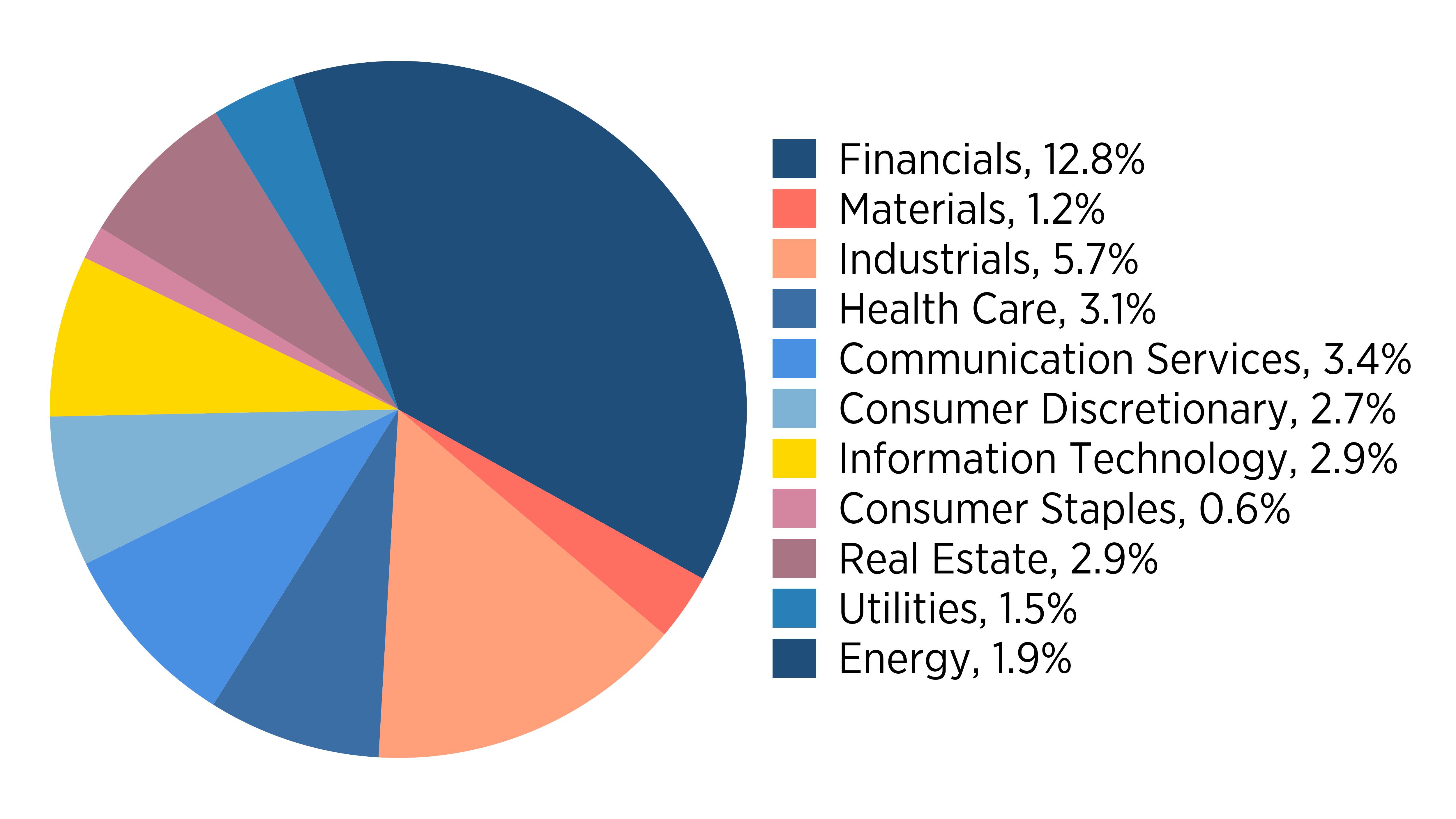

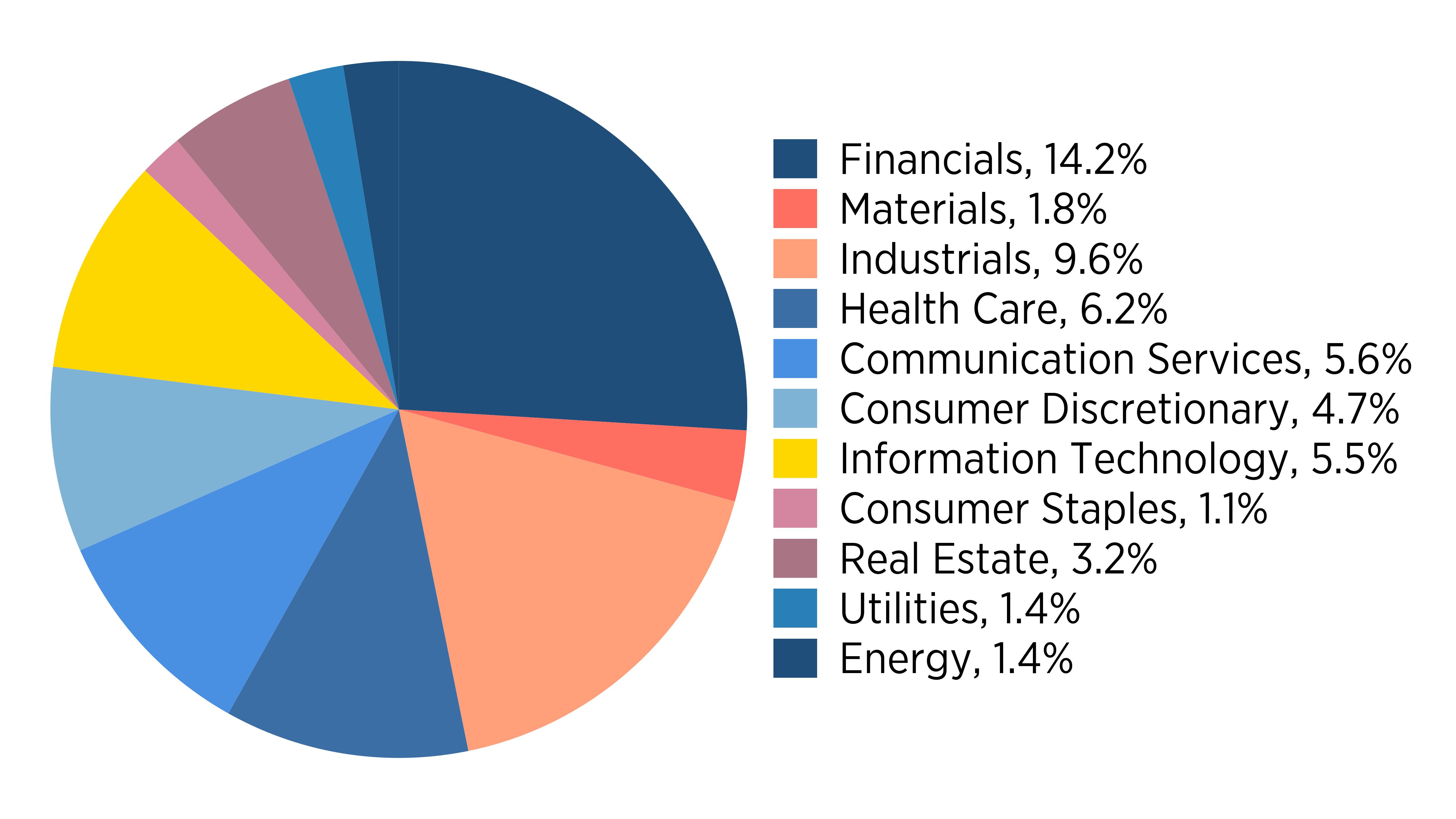

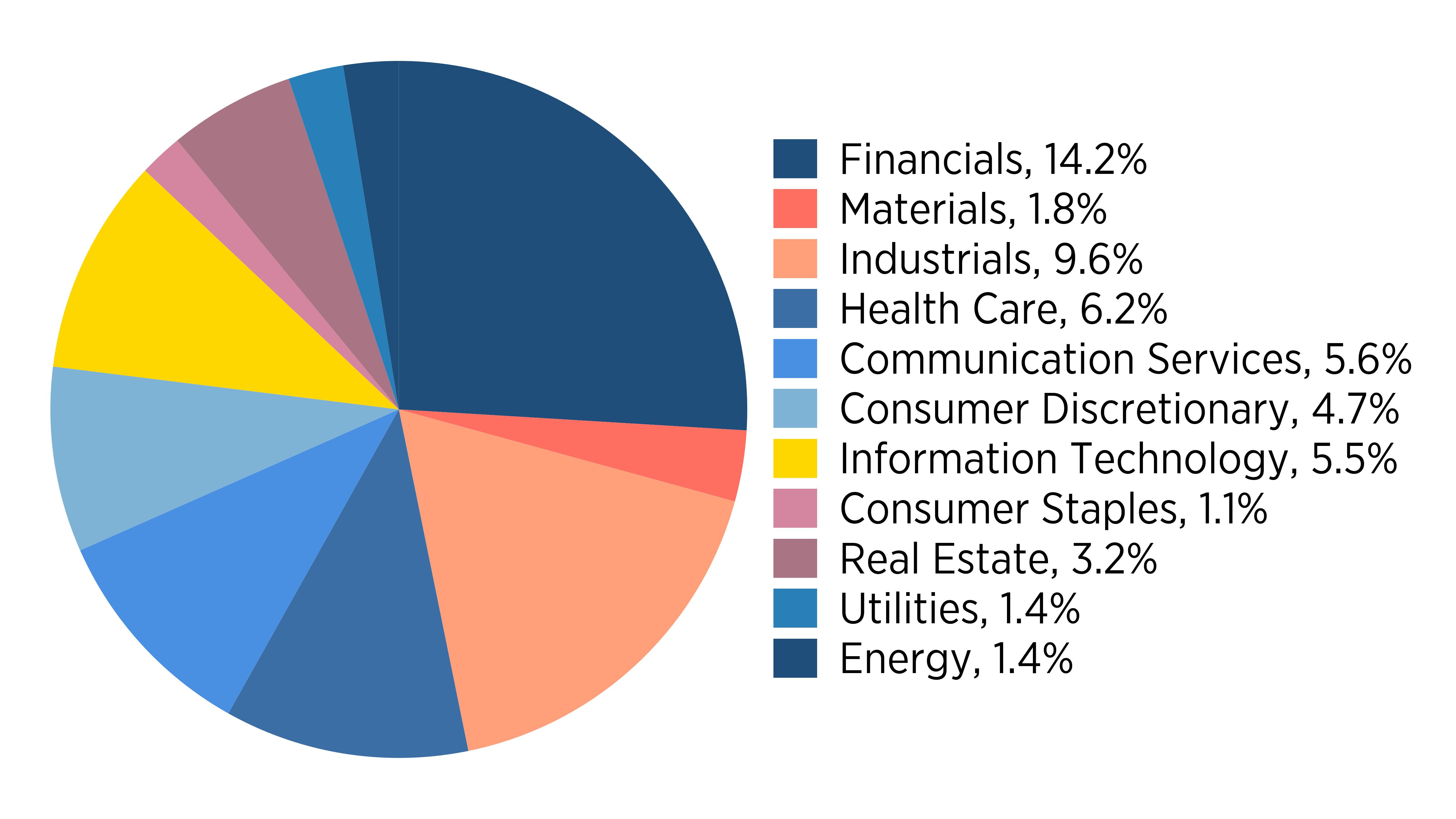

Sector Allocation (% of net assets)

Sector | Allocation |

Financials | 0.128 |

Materials | 0.012 |

Industrials | 0.057 |

Health Care | 0.031 |

Communication Services | 0.034 |

Consumer Discretionary | 0.027 |

Information Technology | 0.029 |

Consumer Staples | 0.006 |

Real Estate | 0.029 |

Utilities | 0.015 |

Energy | 0.019 |

The Global Industry Classification Standard (GICS) was developed by and is exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor's a division of S&P Global Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom.

What did the Fund invest in?

(as of October 31, 2024)

Top Investment Types | % |

|---|

Cash, Short-Term Investment and Assets, Less Liabilities/Liabilities, Less Assets | 2.8 |

Commercial Mortgage-Backed Securities | 9.2 |

Common Stocks | 20.5 |

Asset-Backed Securities | 7.2 |

U.S. Government Agencies | 13.8 |

Foreign Government Bonds | 0.4 |

Municipal Bonds | 1.6 |

Corporate Bonds | 18.0 |

U.S. Treasury Note | 26.5 |

Expressed as a percentage of net assets.

Householding

The Fund may send only one copy of the Series' prospectus and annual and semi-annual reports to certain shareholders residing at the same "household" for shareholders who have elected this option. This reduces Fund expenses, which benefits you and other shareholders. If you wish to change your "householding" option, please call (800) 466-3863 or contact your financial advisor.

Additional information about the Series, including its prospectus, financial information, holdings, and proxy information can be obtained at www.manning-napier.com/products/mutual-funds or by calling (800) 466-3863. Shareholders can also elect to receive certain documents via e-delivery. For more information or to sign up for e-delivery, please visit the Fund's website.

Manning & Napier Pro-Blend® Conservative Term Series Tailored Shareholder Report MNPBCO-R-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

Manning & Napier Pro-Blend® Conservative Term Series Tailored Shareholder Report MNPBCO-S-10/24-AR

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

annual shareholder report Pro-Blend® Conservative Term Series ticker: EXDAX | |

This annual shareholder report contains important information about Pro-Blend® Conservative Term Series Class S, a series of Manning & Napier Fund Inc. (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.manning-napier.com/products/mutual-funds. You can also request this information by contacting us at (800) 466-3863. Shareholders who own the Fund through a third-party advisor or intermediary platform should contact their financial advisor directly for additional information.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class S | $96 | 0.90% |

Expenses are equal to each Class's annualized expense ratio (for the twelve-month period) multiplied by the average account value over the period. The Class's expenses would have been higher if certain expenses had not been waived or reimbursed during the period.

Management's Discussion of Fund Performance

How did the fund perform last year?

The Series delivered positive double-digit returns but underperformed its blended benchmark for the 12-month period ending 10/31/2024.

What factors influenced performance?

The Series' positive return benefited from exposure to both equities and fixed income securities with each asset class delivering double-digit returns. Equity markets rallied on the back of a resilient U.S. economy while bond markets benefited from the onset of the Federal Reserve's rate cut cycle contributing to interest rates falling across the yield curve. The Series' underperformance relative to the blended benchmark was primarily driven by an underweight to equities in comparison to the benchmark. Selection within equities was a relative contributor, as was fixed income positioning.

Positioning

Despite risks appearing broadly balanced to the upside and downside, we expect a degree of volatility in markets moving forward. We have positioned the Series with a generally defensive tilt through a primary focus on less economically sensitive businesses and those that can benefit from long-term secular, while also selectively identifying pockets of opportunity in more cyclical industries. Within fixed income, we continue to view securitized debt as relatively attractive and focus on securities with seniority in the capital structure that are backed by asset classes with high-quality fundamentals and low credit risk. Alternatively, we are more cautious on corporate credit as valuations remain elevated.

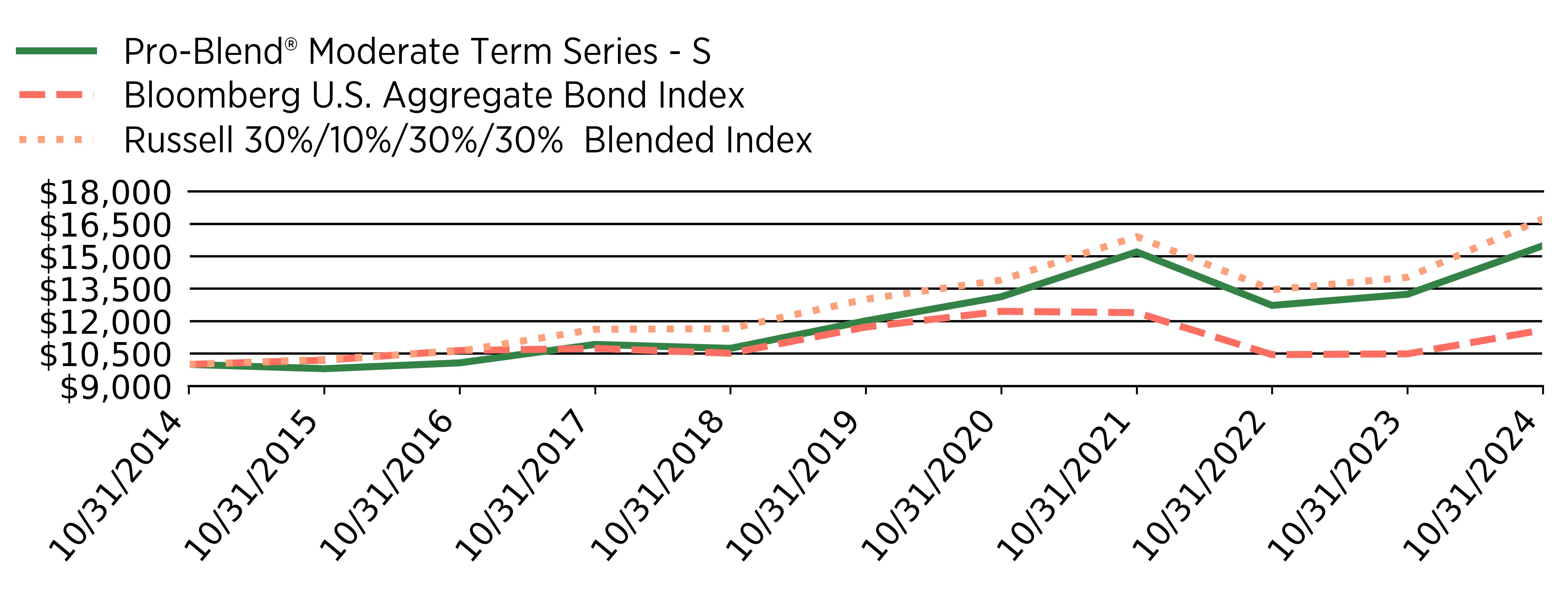

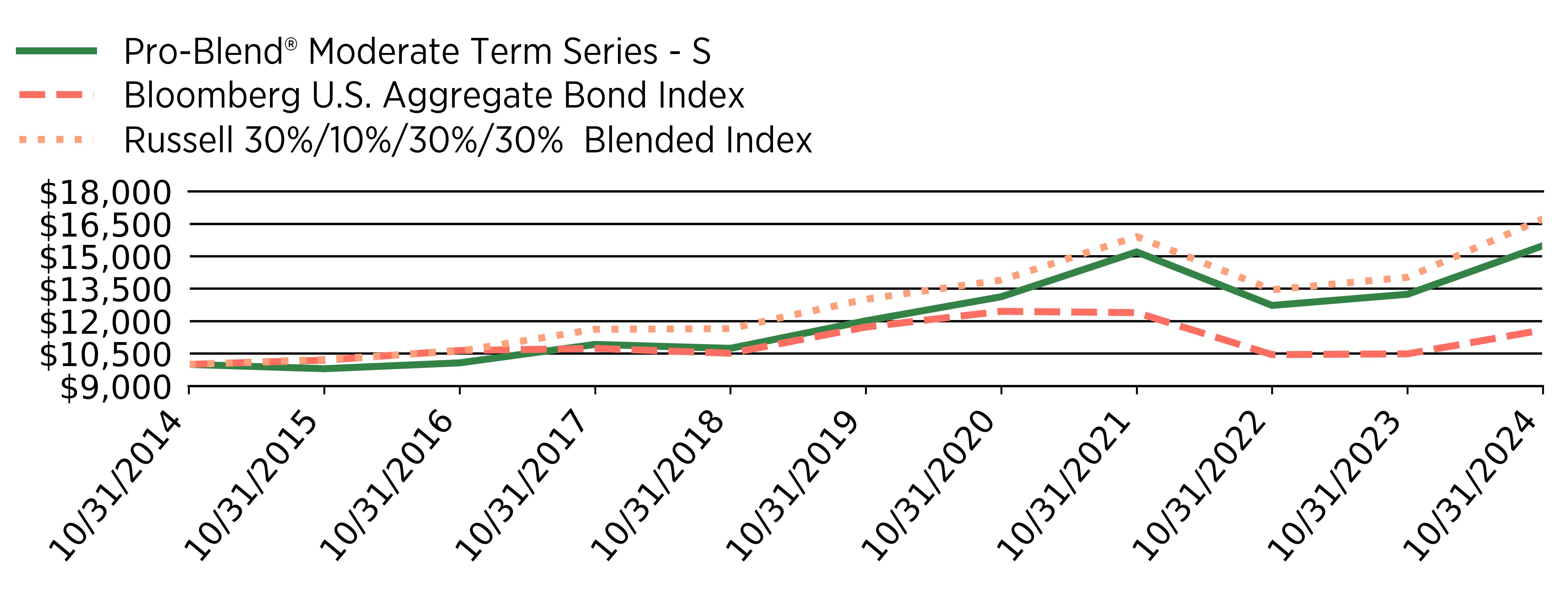

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years. The graph assumes a $10,000 initial investment in the Fund and an appropriate broad-based securities market index and a blended index that reflects the market sector in which the Fund invests for the same period.

Initial Investment of $10,000

Date | Pro-Blend® Conservative Term Series - S | Bloomberg U.S. Aggregate Bond | Conservative Term Composite Benchmark |

10/31/2014 | 10000.0 | 10000.0 | 10000.0 |

10/31/2015 | 9867.0 | 10196.0 | 10226.0 |

10/31/2016 | 10171.0 | 10642.0 | 10570.0 |

10/31/2017 | 10885.0 | 10737.0 | 11328.0 |

10/31/2018 | 10803.0 | 10517.0 | 11330.0 |

10/31/2019 | 11926.0 | 11728.0 | 12506.0 |

10/31/2020 | 12625.0 | 12454.0 | 13275.0 |

10/31/2021 | 14011.0 | 12394.0 | 14659.0 |

10/31/2022 | 12222.0 | 10451.0 | 12773.0 |

10/31/2023 | 12648.0 | 10488.0 | 13146.0 |

10/31/2024 | 14216.0 | 11595.0 | 14983.0 |