UNITED STATES

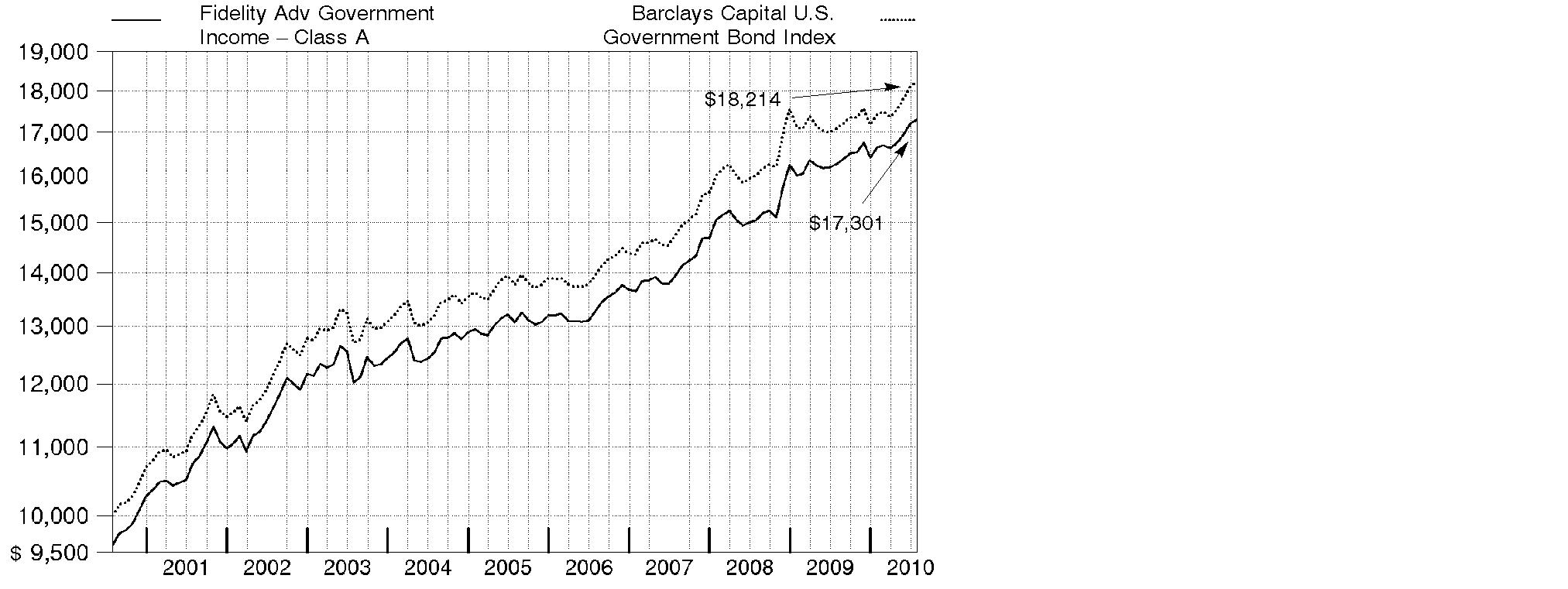

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4085

Fidelity Income Fund

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | July 31 |

| |

Date of reporting period: | July 31, 2010 |

Item 1. Reports to Stockholders

Fidelity® GNMA Fund

(formerly Fidelity Ginnie Mae Fund)

Fidelity Intermediate

Government Income Fund

Annual Report

July 31, 2010

(2_fidelity_logos) (Registered_Trademark)

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com or http://www.advisor.fidelity.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

(photo_of_Abigail_P_Johnson)

Dear Shareholder:

A yearlong uptrend in global equity markets reversed course in late April 2010 when investor sentiment turned bearish due in great measure to concern that Europe's debt crisis would expand and slow or derail economic recovery. However, a bounceback in July helped to recover some of the ground that was lost. Financial markets are always unpredictable, of course, but there also are several time-tested investment principles that can help put the odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There can be tax advantages and cost benefits to consider as well. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or by phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

(The chairman's signature appears here.)

Abigail P. Johnson

Annual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (February 1, 2010 to July 31, 2010).

Actual Expenses

The first line of the accompanying table for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each fund provides information about hypothetical account values and hypothetical expenses based on a fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Annual Report

| Annualized Expense Ratio | Beginning

Account Value

February 1, 2010 | Ending

Account Value

July 31, 2010 | Expenses Paid

During Period*

February 1, 2010

to July 31, 2010 |

GNMA Fund | .45% | | | |

Actual | | $ 1,000.00 | $ 1,051.30 | $ 2.29 |

HypotheticalA | | $ 1,000.00 | $ 1,022.56 | $ 2.26 |

Intermediate Government Income Fund | .45% | | | |

Actual | | $ 1,000.00 | $ 1,037.20 | $ 2.27 |

HypotheticalA | | $ 1,000.00 | $ 1,022.56 | $ 2.26 |

A 5% return per year before expenses

* Expenses are equal to each Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Annual Report

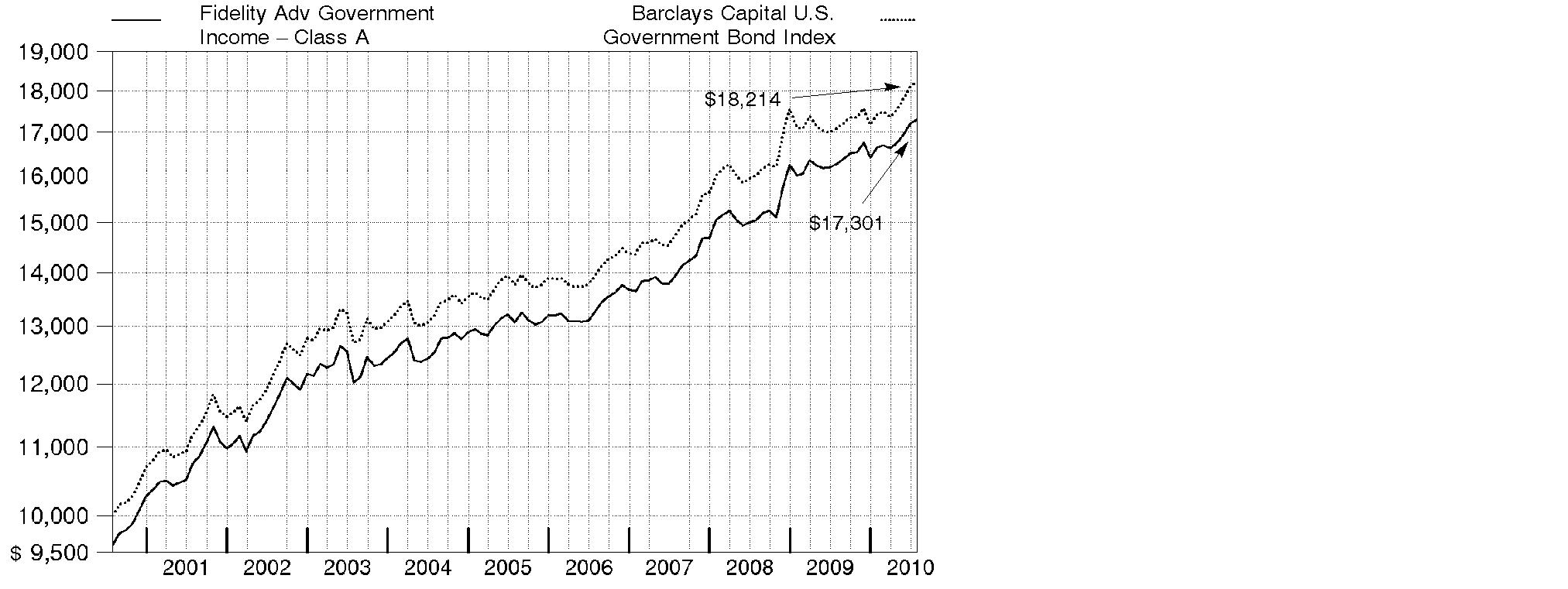

Fidelity GNMA Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended July 31, 2010 | Past 1

year | Past 5

years | Past 10

years |

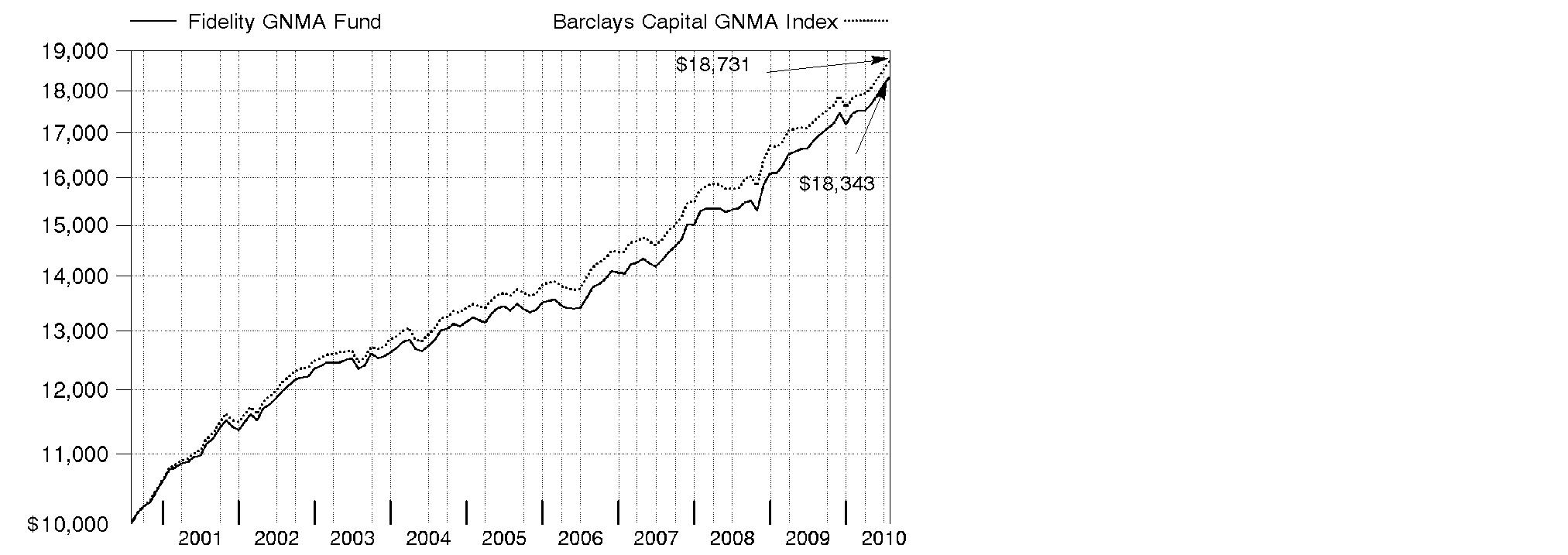

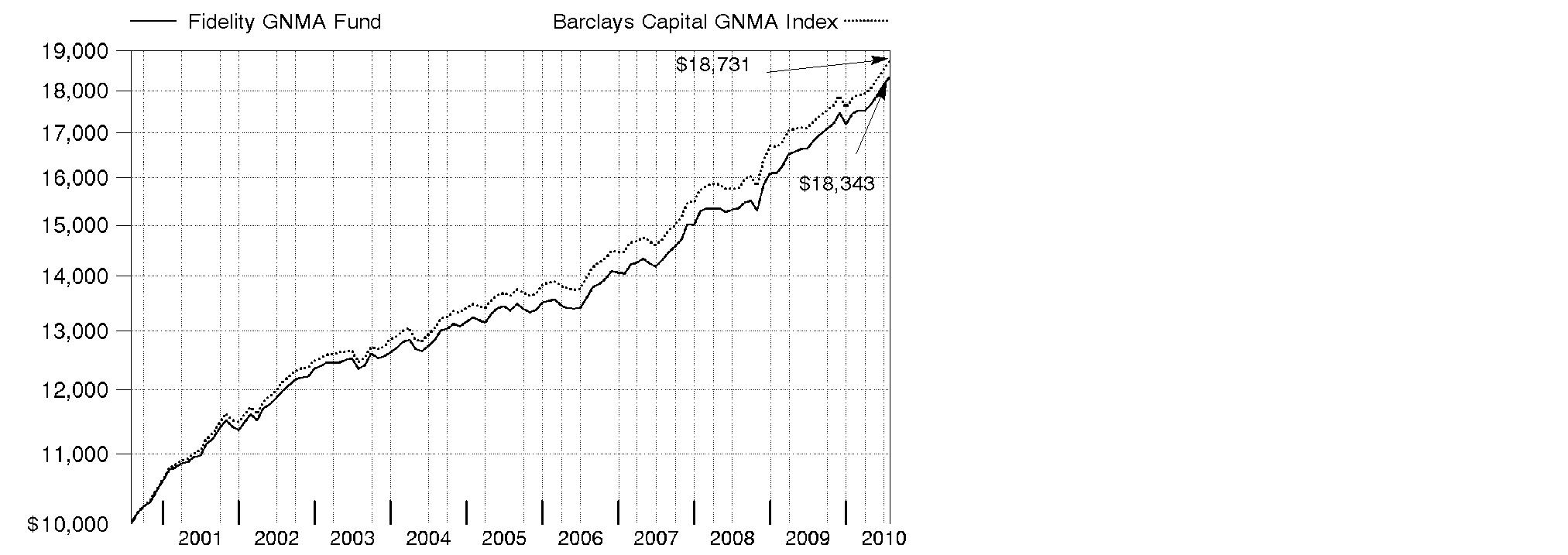

Fidelity® GNMA Fund | 8.97% | 6.54% | 6.25% |

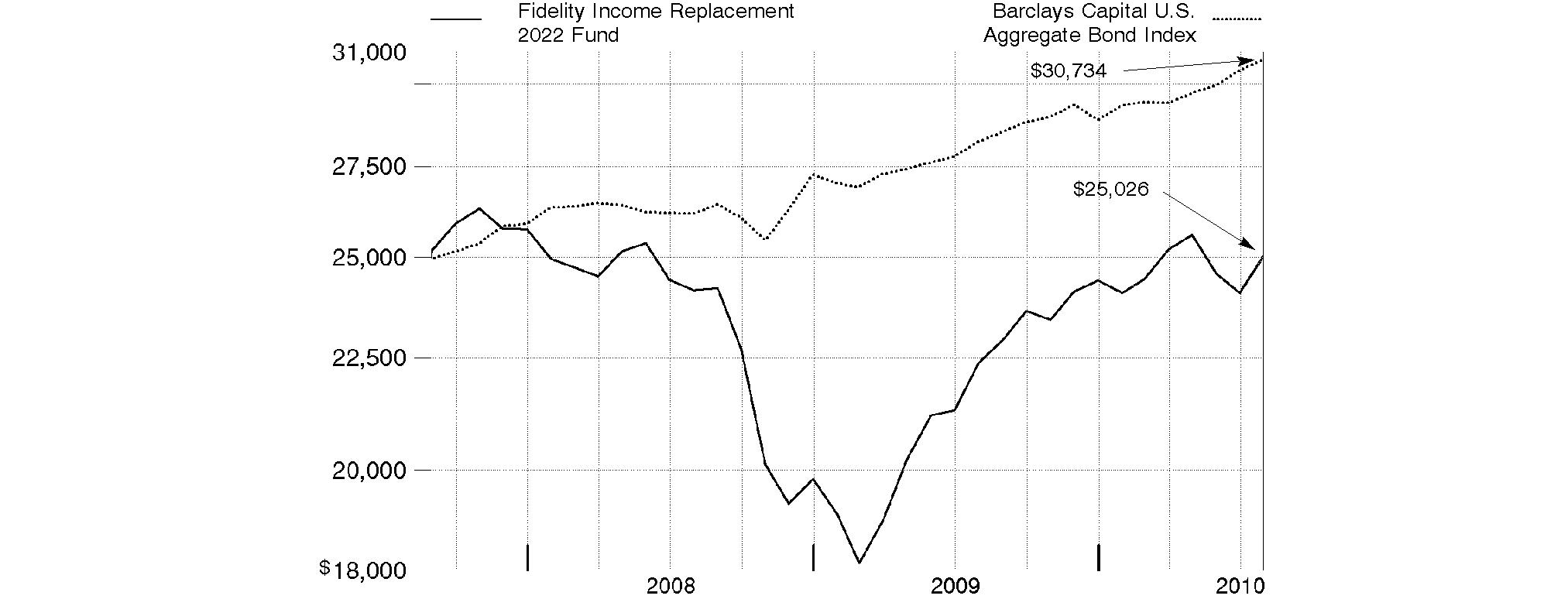

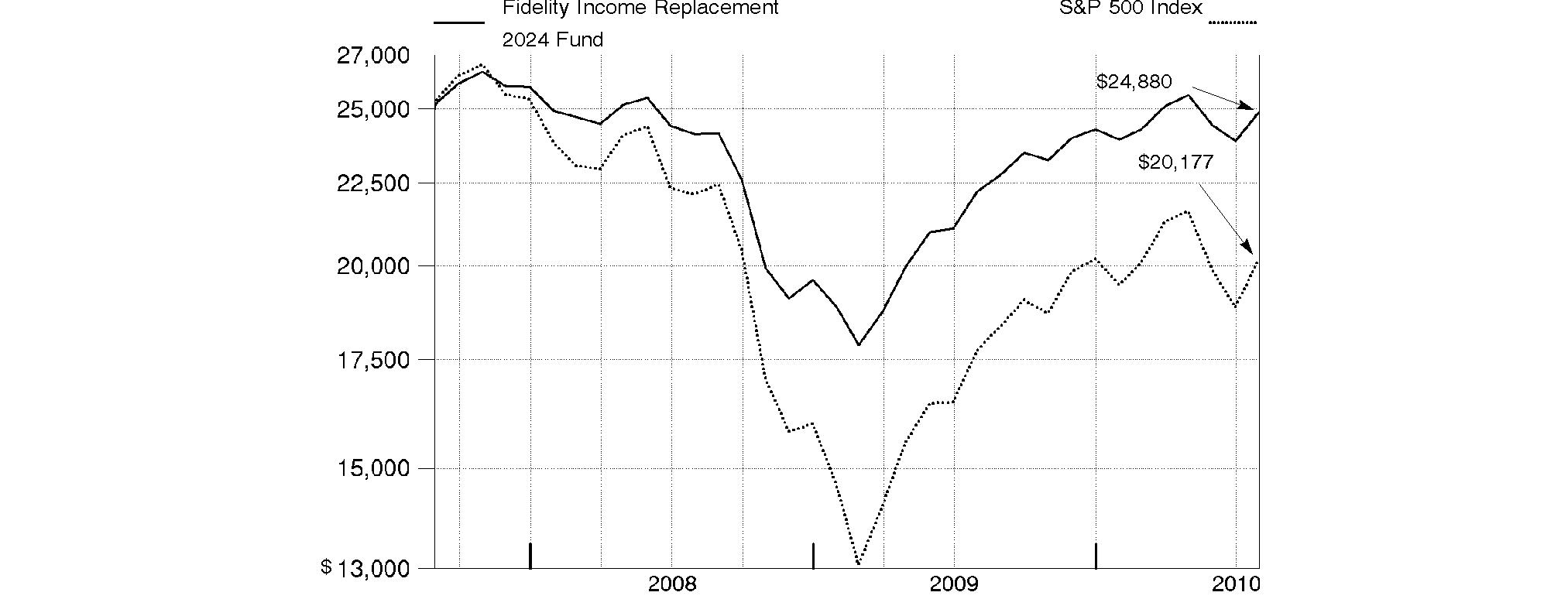

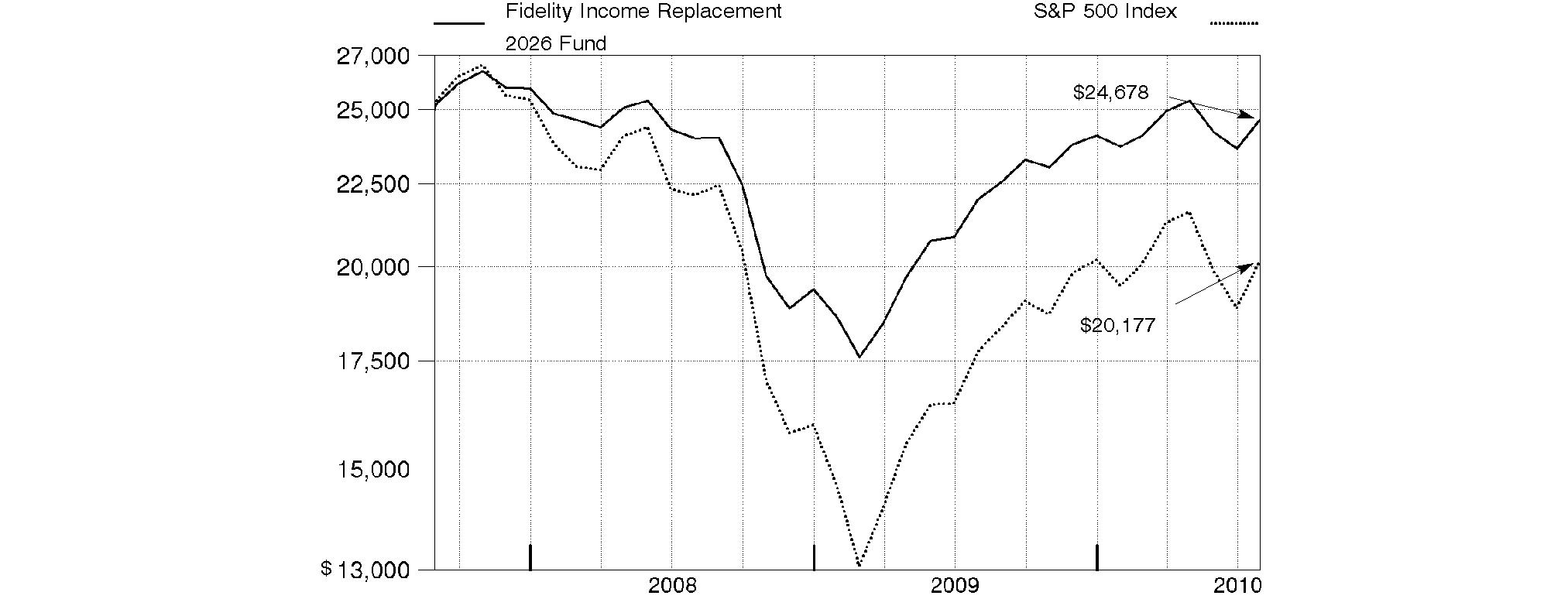

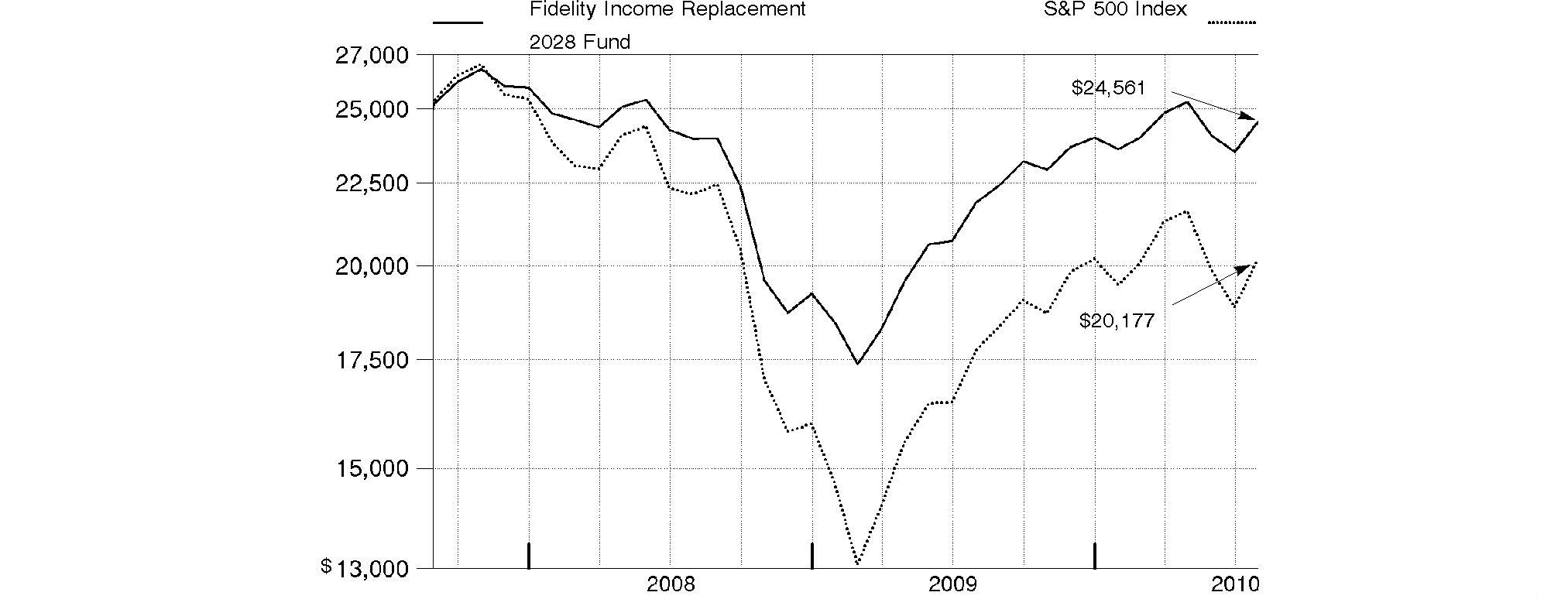

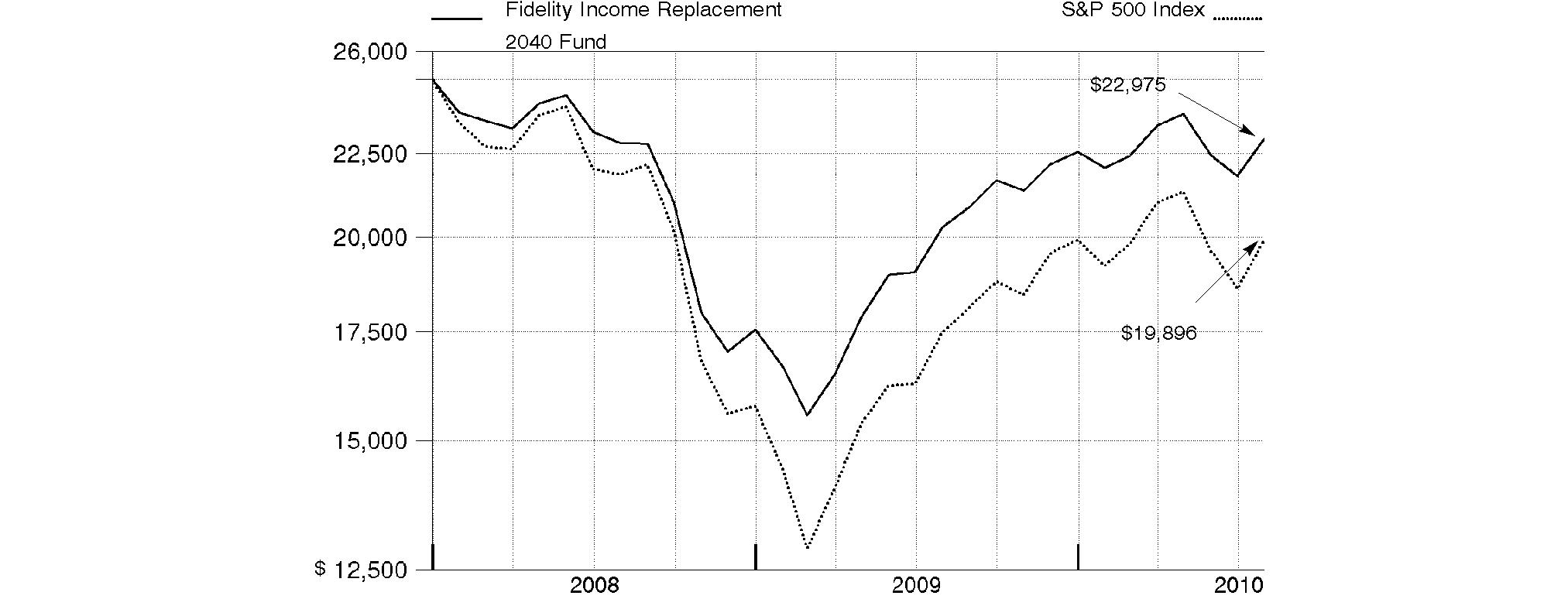

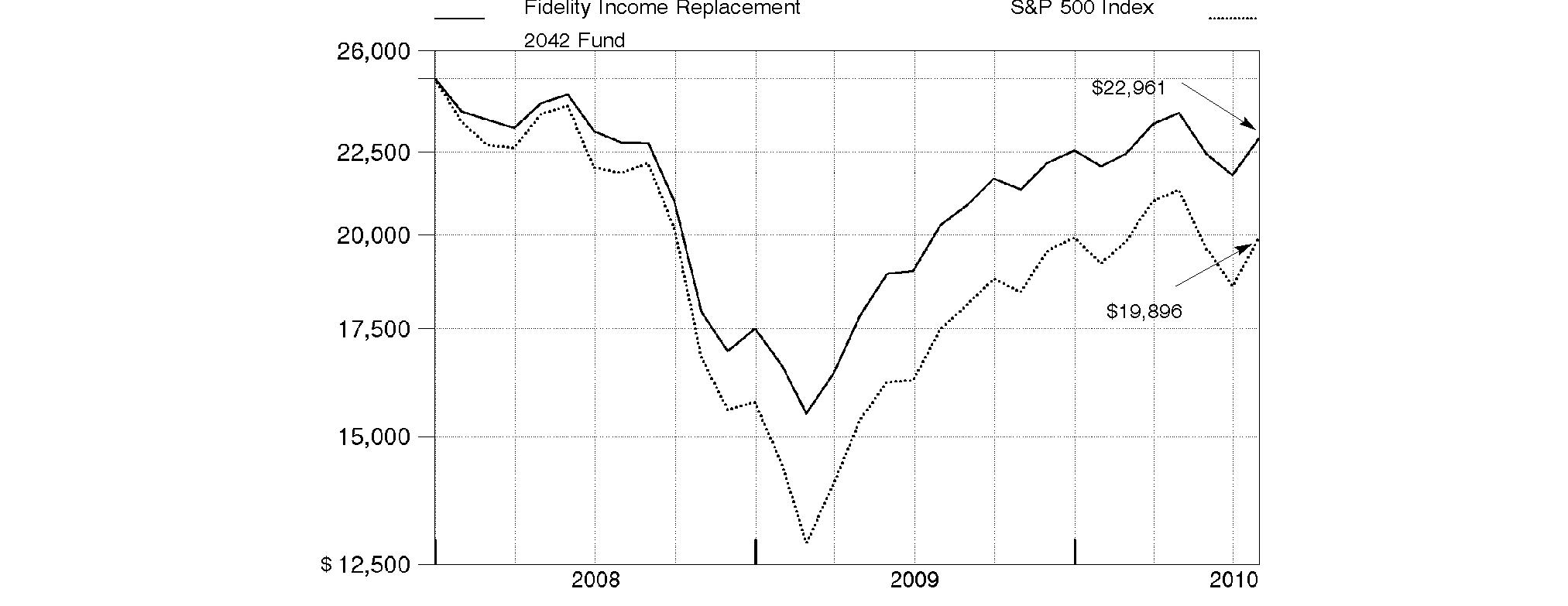

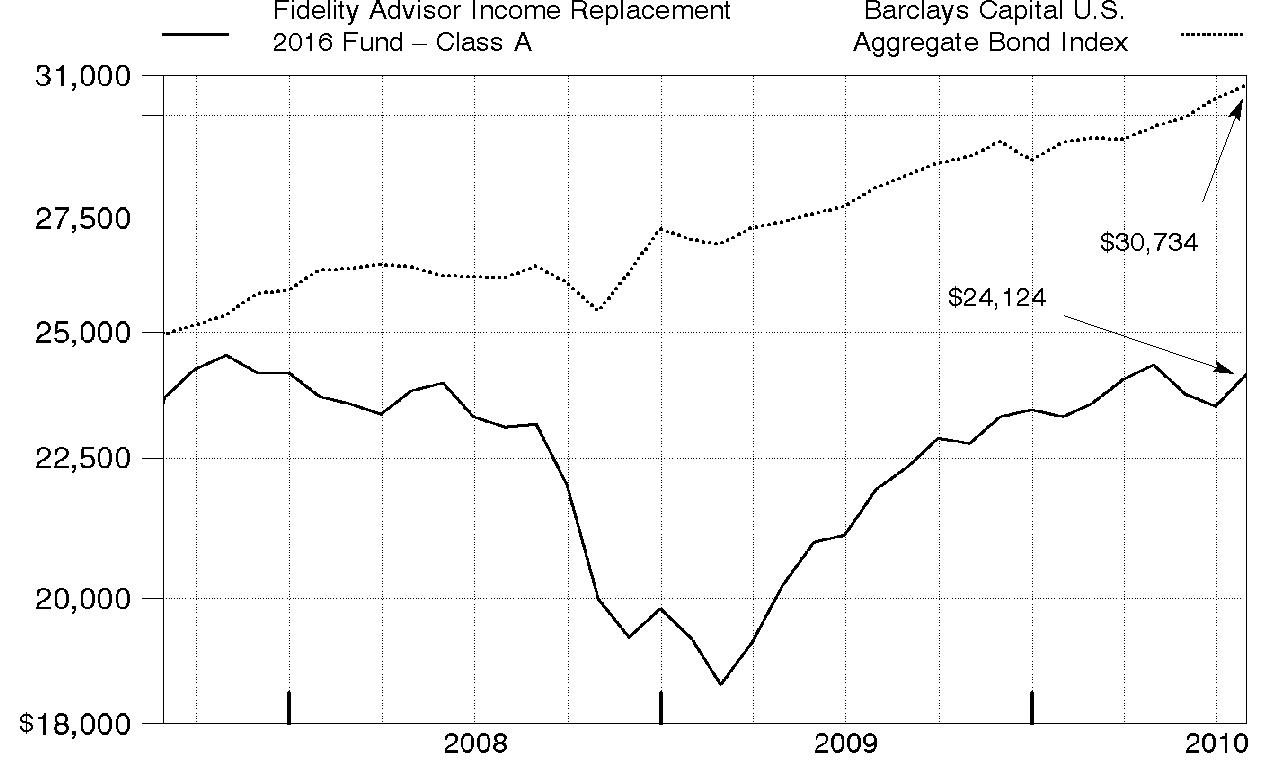

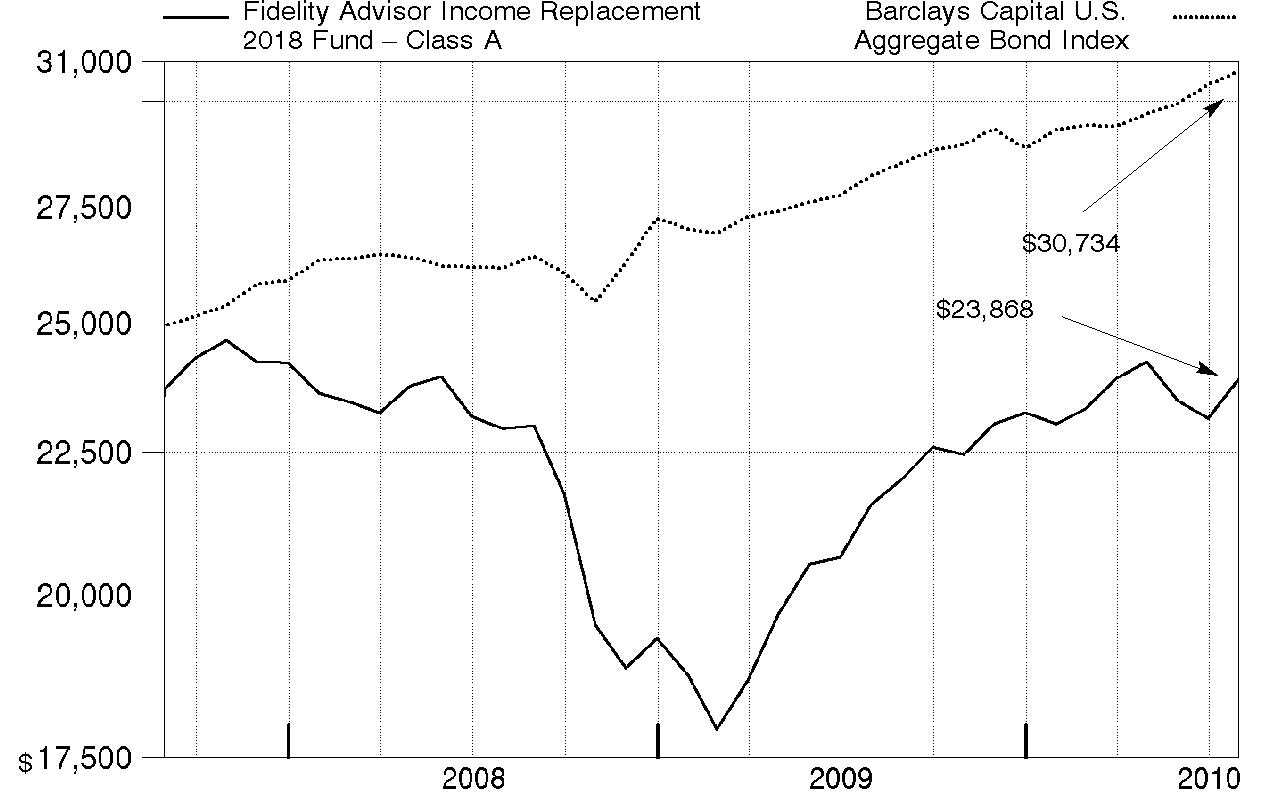

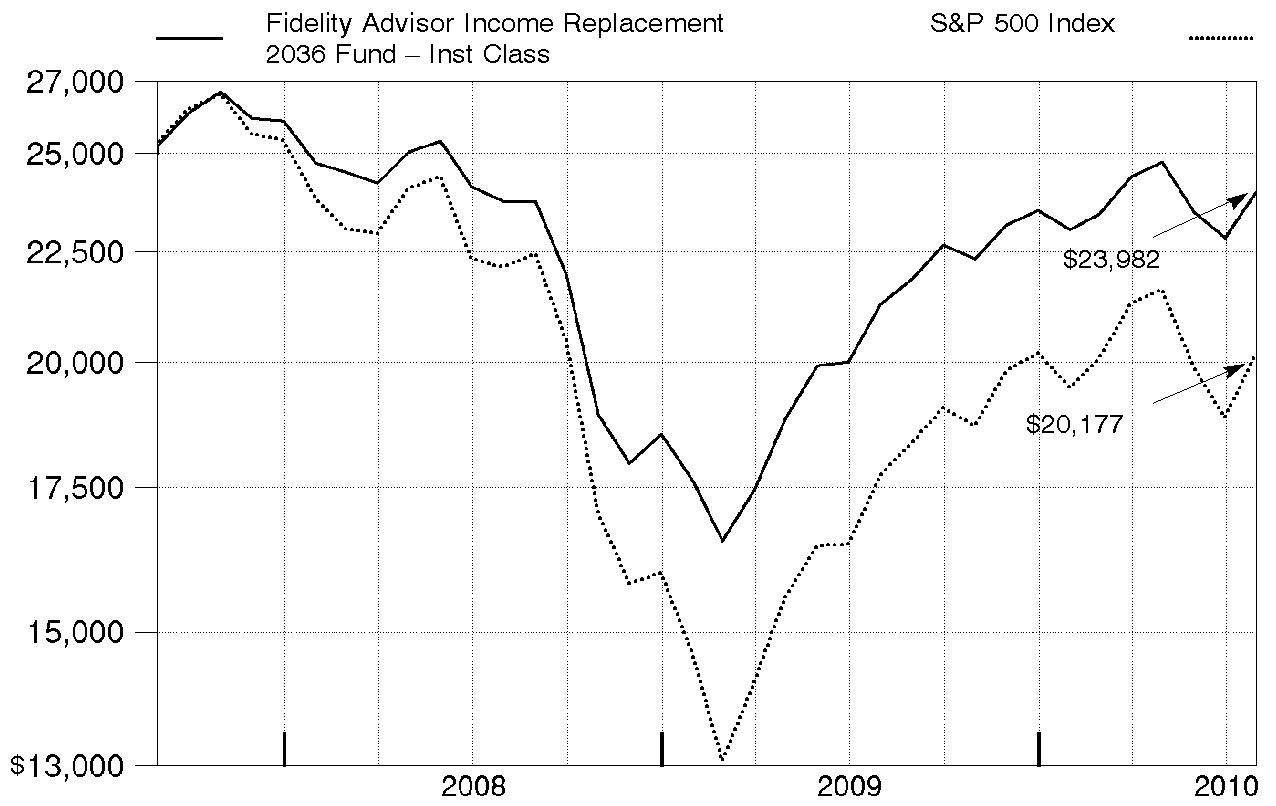

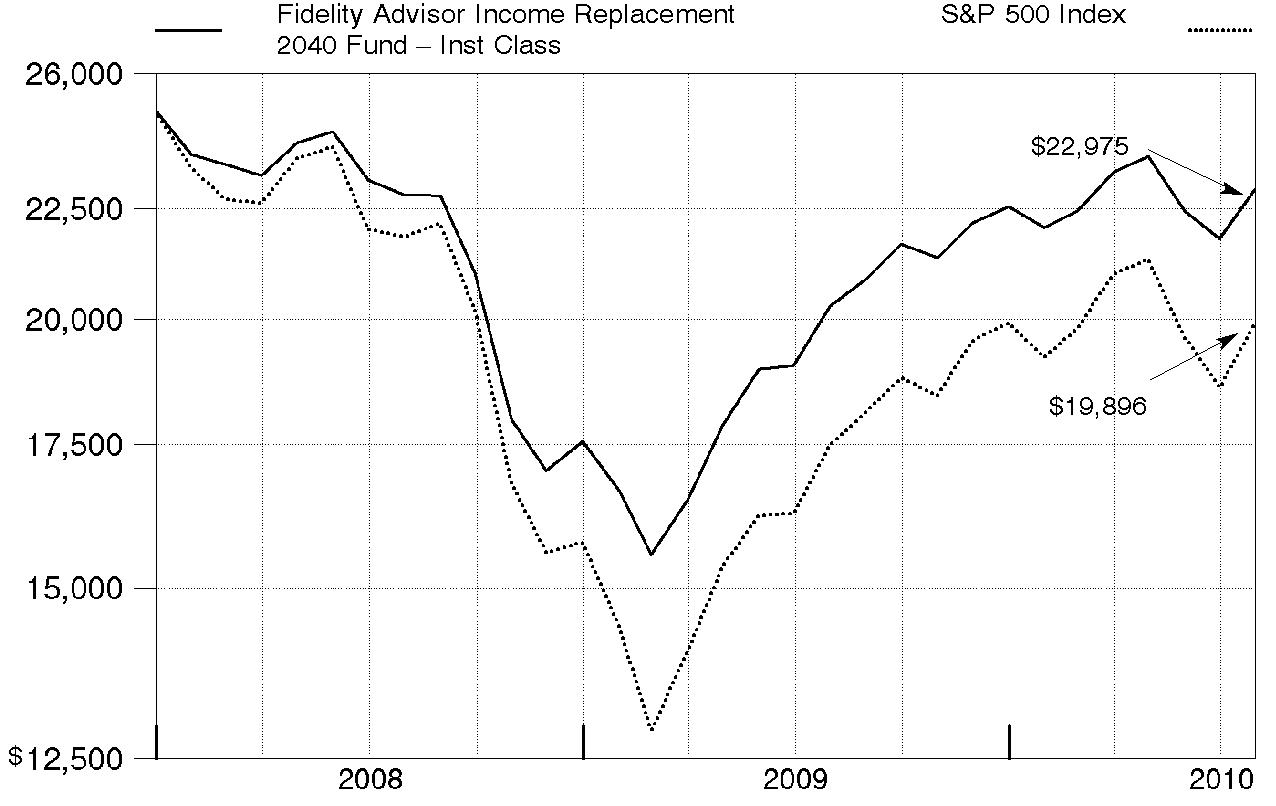

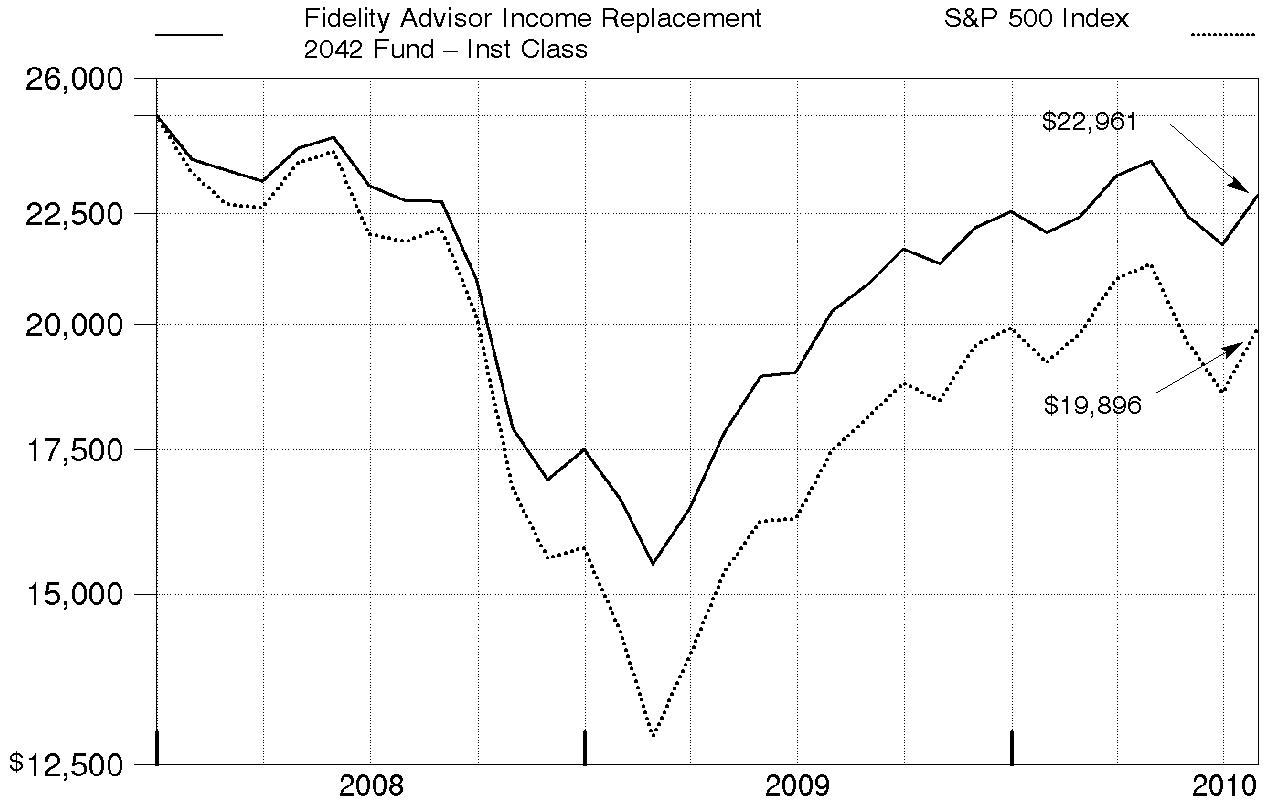

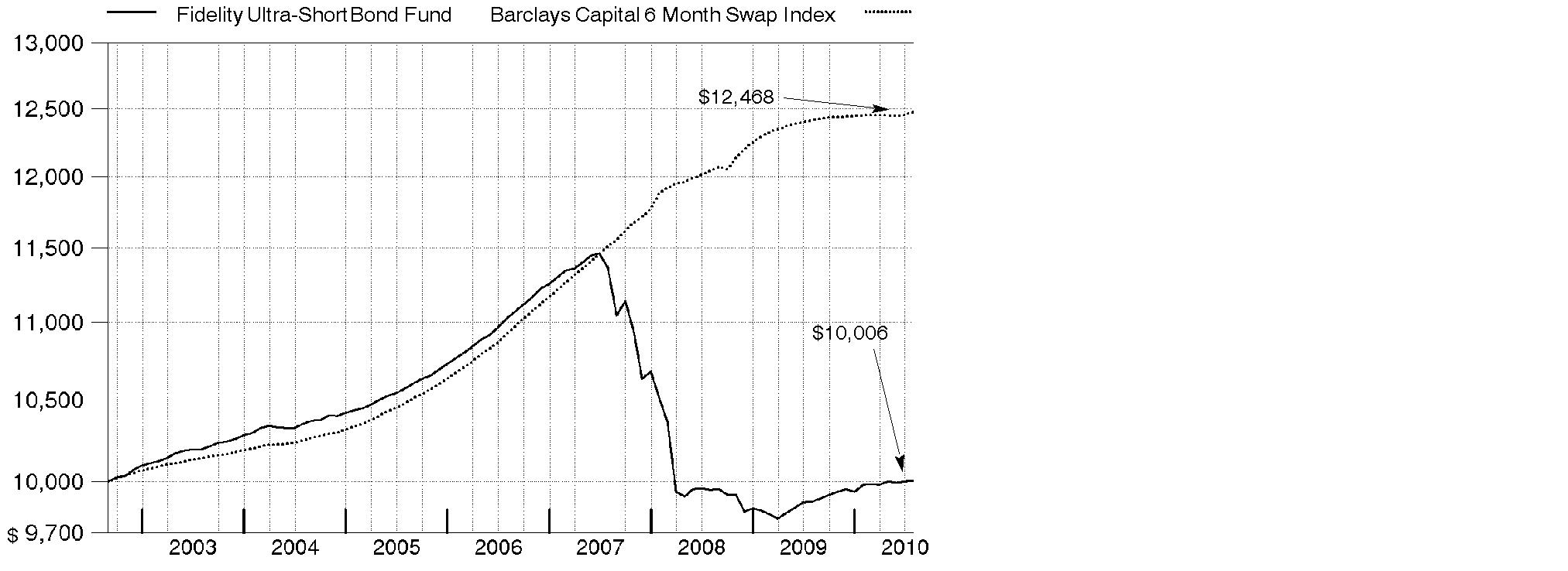

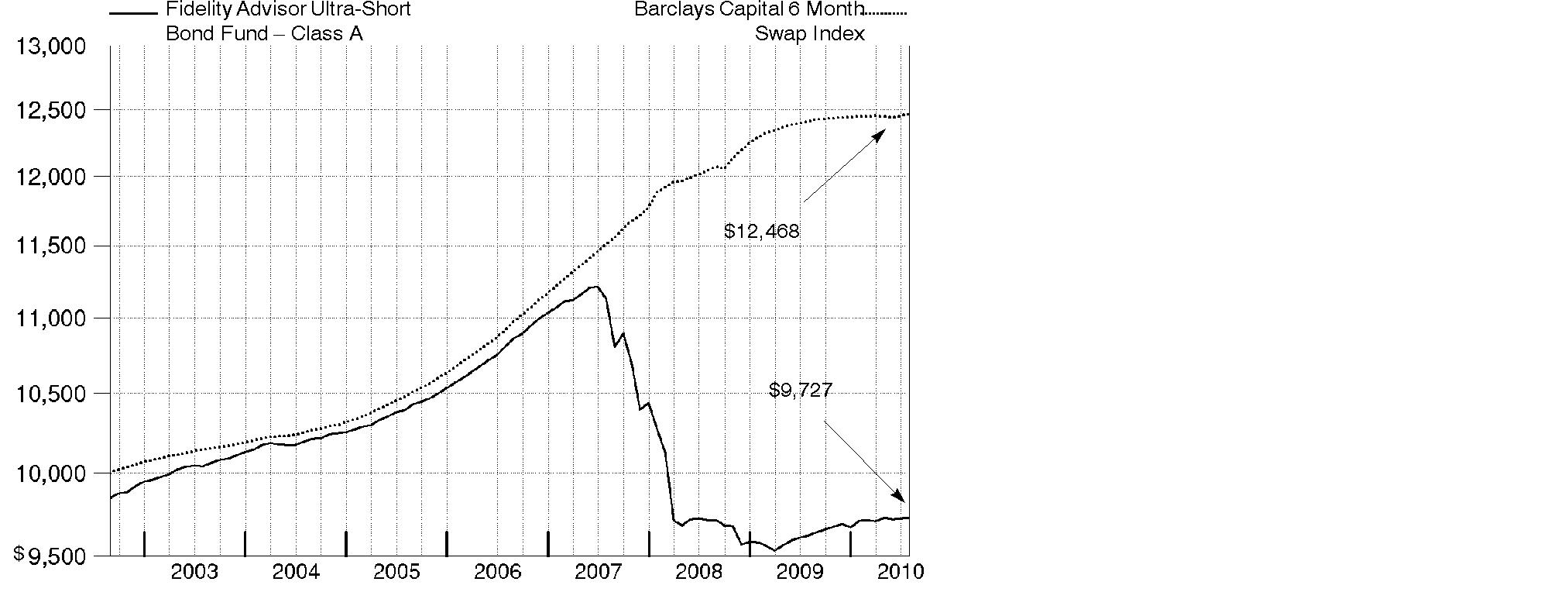

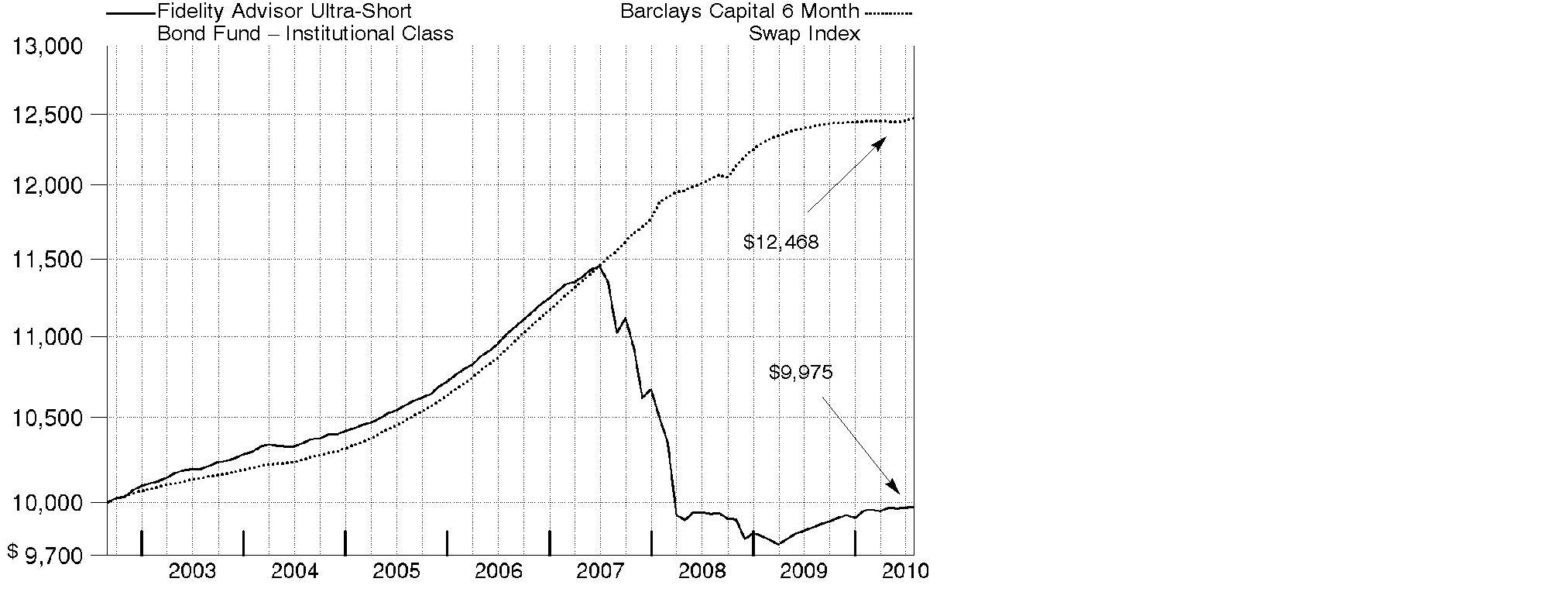

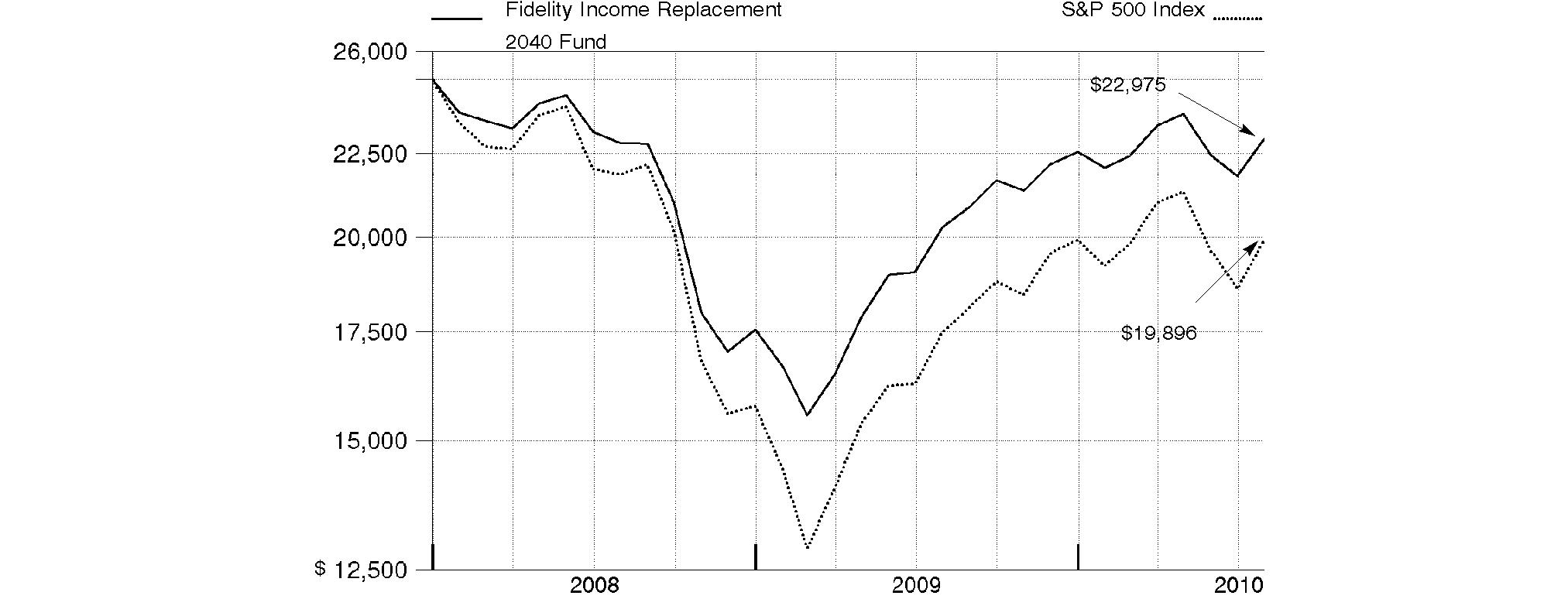

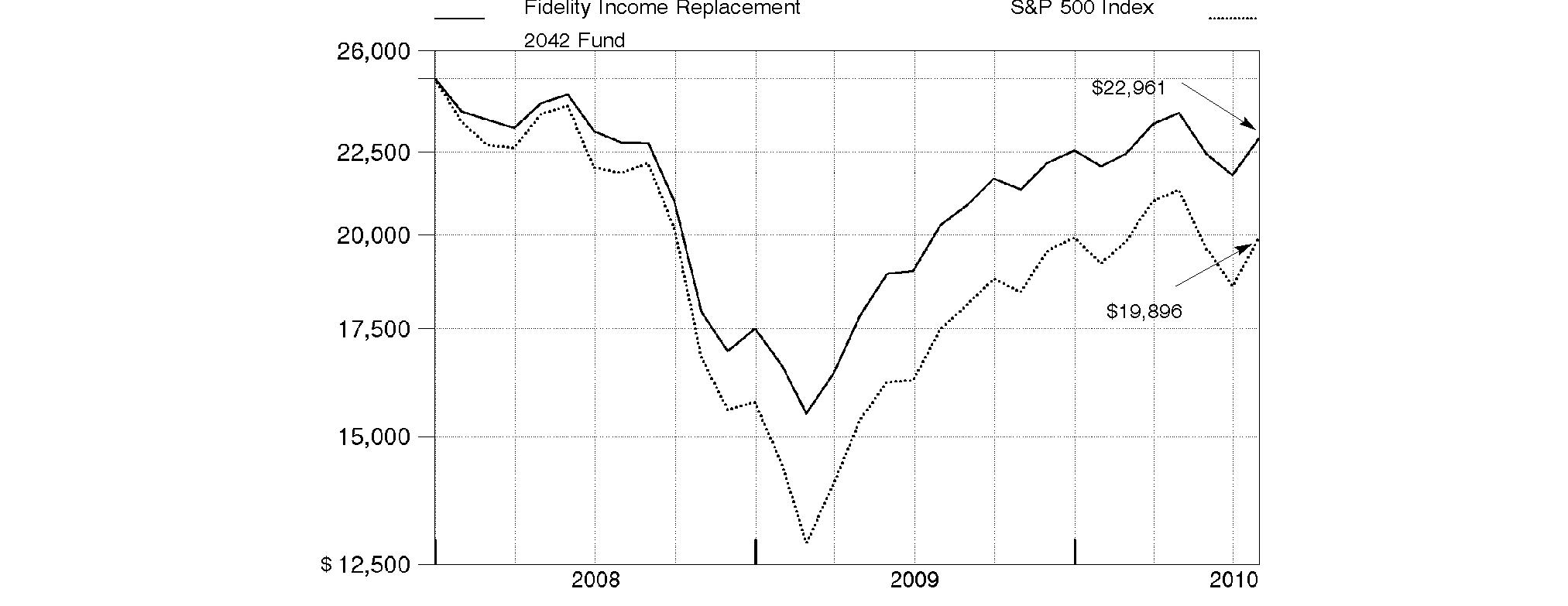

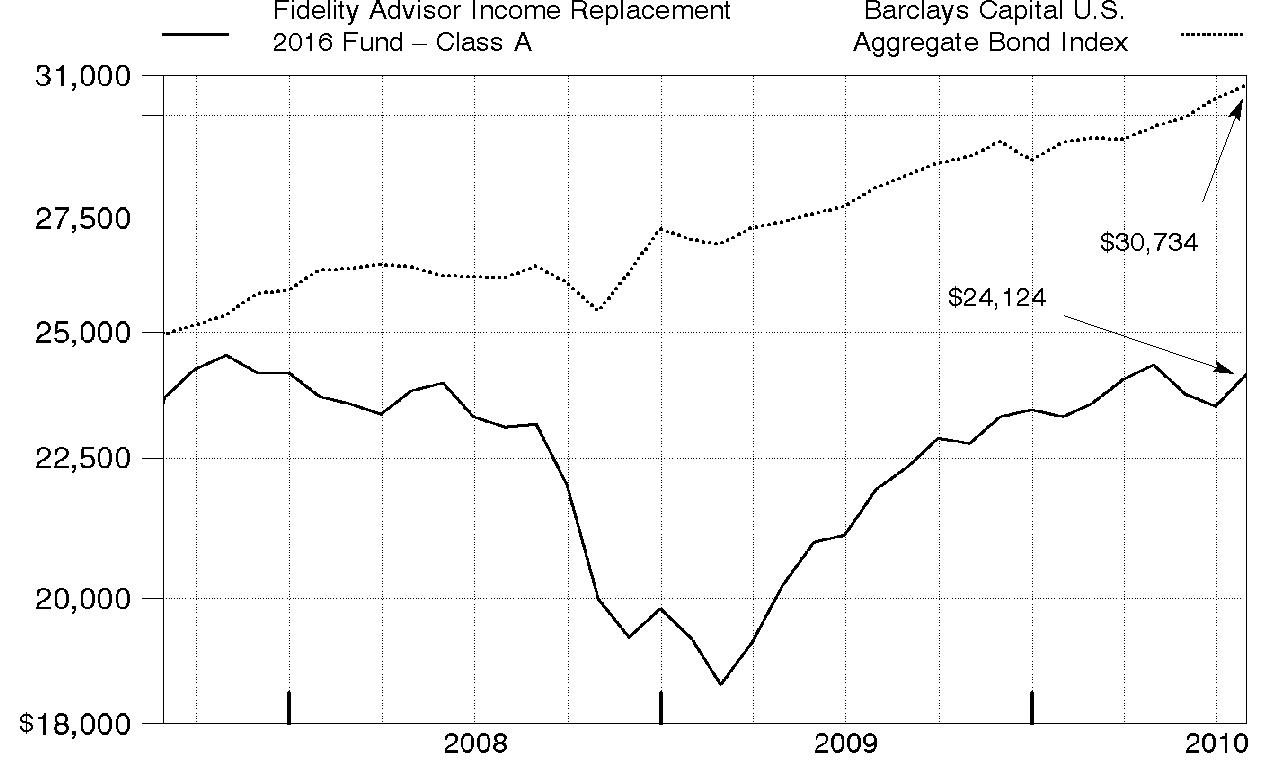

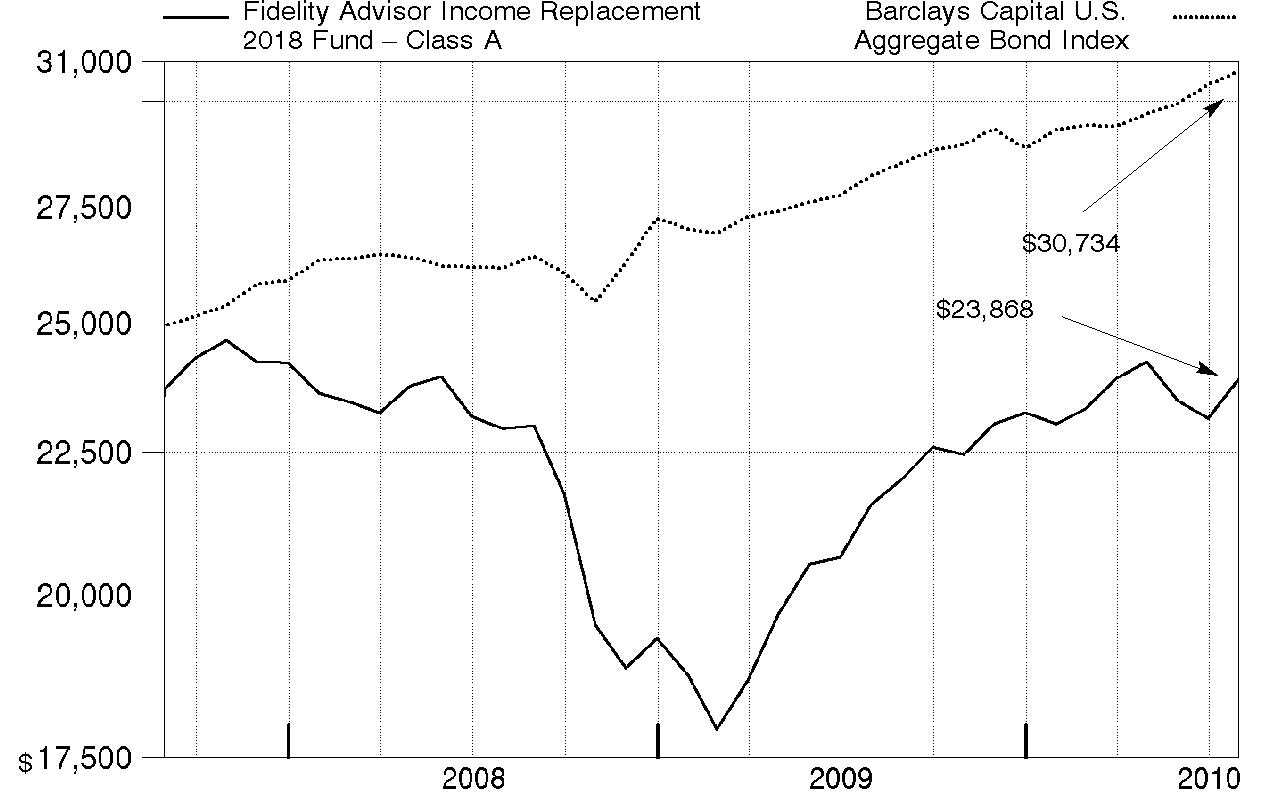

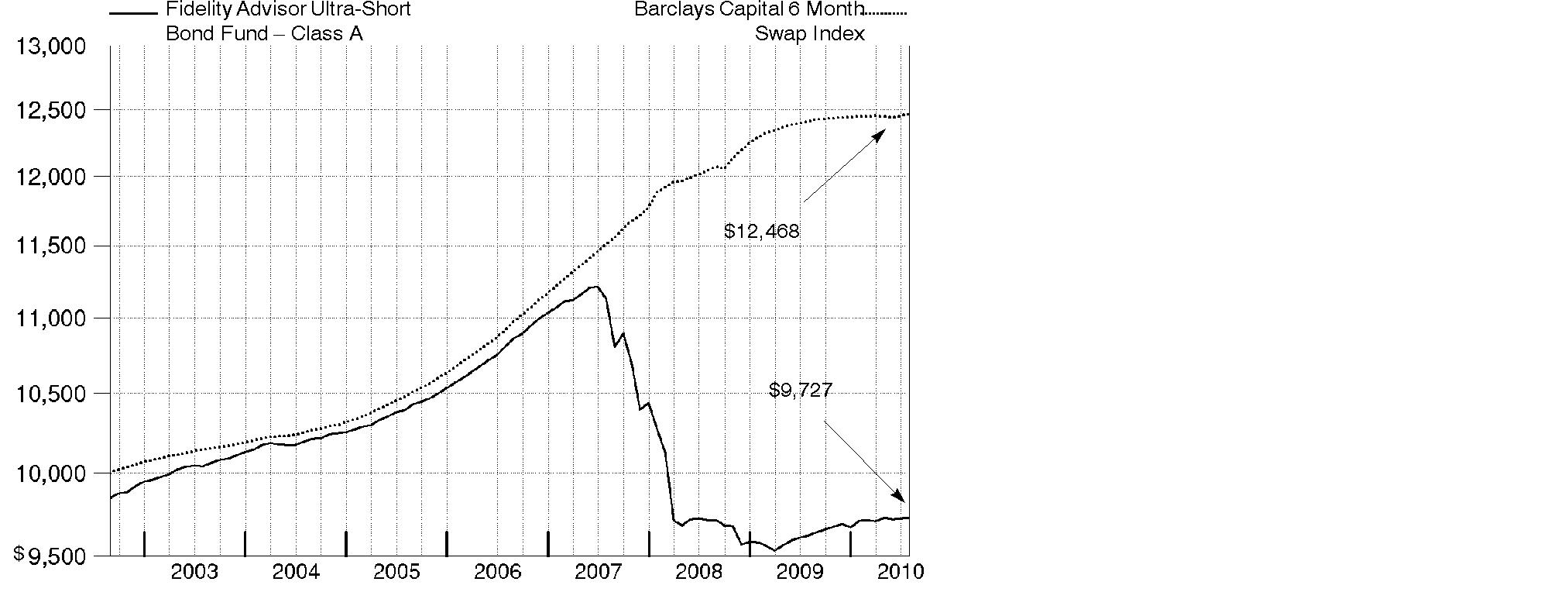

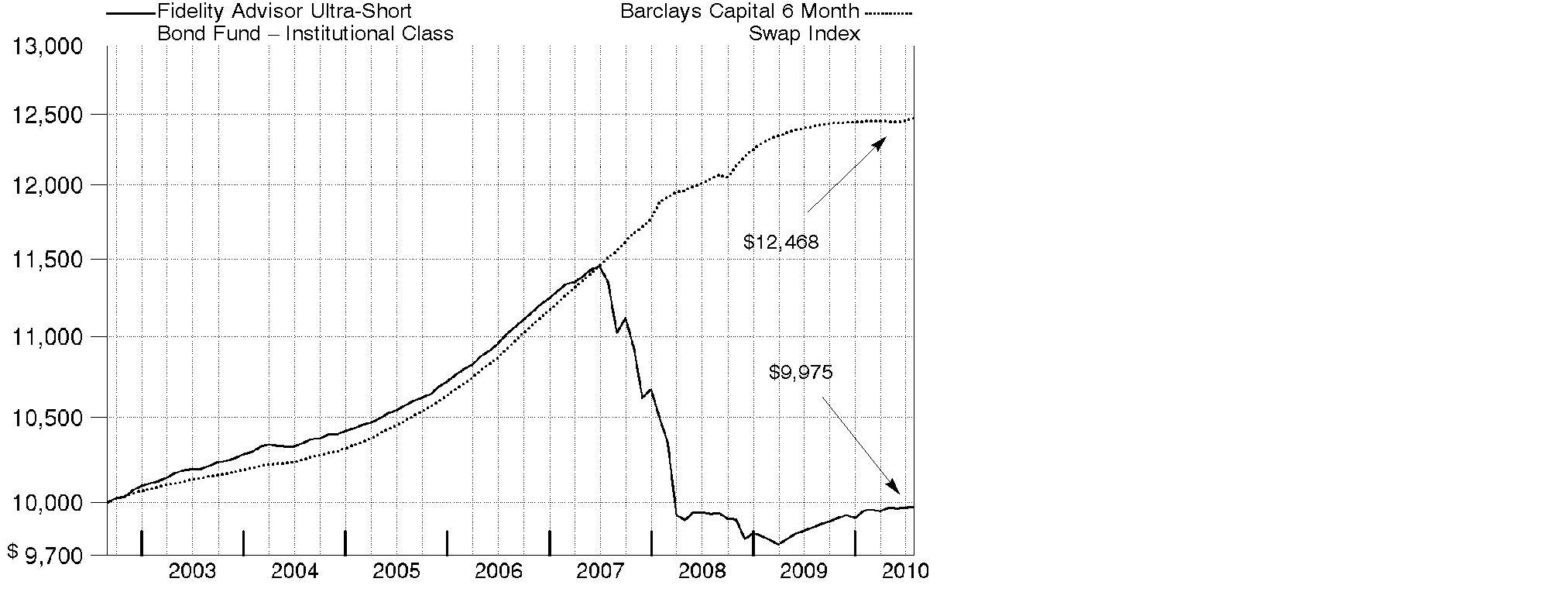

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® GNMA Fund on July 31, 2000. The chart shows how the value of your investment would have changed, and also shows how the Barclays Capital GNMA Index performed over the same period.

Annual Report

Fidelity GNMA Fund

Market Recap: U.S. taxable bonds generated solid gains during the 12-month period ending July 31, 2010, as evidenced by the 8.91% advance of the Barclays Capital U.S. Aggregate Bond Index, a broad measure of the domestic investment-grade debt universe. Riskier segments of the market fared best overall, beneficiaries of strong demand for higher-yielding investments. The Barclays Capital U.S. Credit Bond Index rose 12.60% and the Barclays Capital U.S. Fixed-Rate ABS Index returned 12.14%. The Barclays Capital U.S. Treasury Bond Index advanced 6.95%, with most of the gain coming in the second half of the period. That's when investors began to favor the relative safety of U.S. government bonds, as the economic outlook became less certain and deflation fears resurfaced. Mortgage-backed securities (MBS), bolstered largely by government purchase programs, increased 7.52%, as measured by the Barclays Capital U.S. MBS Index. Government-backed agency securities lagged the broader MBS market, with the Barclays Capital U.S. Agency Bond Index gaining 5.53%. Agency securities initially were constrained by investors' diminished appetite for bonds with lower perceived credit risk, but later were helped by the Federal Reserve's purchases of agency debt.

Comments from William Irving, Lead Portfolio Manager of Fidelity® GNMA Fund, and Franco Castagliuolo, who became Co-Portfolio Manager on December 1, 2009: For the year, the fund returned 8.97% and the Barclays Capital GNMA Index returned 8.34%. Security selection was the main contributor to the fund's outperformance of the index, particularly a focus on prepayment-resistant securities. Even though prepayment activity was slower than might have been expected, it still occurred. Furthermore, worries that prepayments would accelerate, given that mortgage rates had hit a near-50-year low, helped fuel demand for bonds less likely to prepay. In particular, the fund's overweighting in securities backed by loans with low remaining balances helped because they prepaid at comparatively slow speeds. Our bias toward GNMA securities backed by loans made in certain geographic regions where prepayments lagged also worked to our advantage. An out-of-index stake in securities backed by reverse mortgages was a plus. They were helped by the combination of their higher yields and their more-predictable levels of prepayment. Our use of dollar rolls also proved beneficial. These transactions allowed us to buy mortgage-backed securities and then settle them on a later date, usually at a profit to the fund. In terms of decisions detracting from the fund's relative performance, we're happy to say there weren't any major disappointments.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Fidelity GNMA Fund

Investment Changes (Unaudited)

Coupon Distribution as of July 31, 2010 |

| % of fund's investments | % of fund's investments

6 months ago |

Less than 4% | 4.4 | 2.1 |

4 - 4.99% | 25.4 | 17.2 |

5 - 5.99% | 34.6 | 40.0 |

6 - 6.99% | 10.7 | 17.6 |

7% and over | 1.5 | 1.9 |

Coupon distribution shows the range of stated interest rates on the fund's investments, excluding short-term investments. |

Weighted Average Maturity as of July 31, 2010 |

| | 6 months ago |

Years | 3.10 | 3.2 |

Weighted Average Maturity (WAM) is a weighted average of all the maturities of the securities held in a fund. The weighted average maturity is based on the dollar-weighted average length of time until principal payments are expected or until securities reach maturity, taking into account any maturity shortening feature such as a call, refunding or redemption provision if it is probable that the issuer of the instrument will take advantage of such features. |

Duration as of July 31, 2010 |

| | 6 months ago |

Years | 0.5 | 2.9 |

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five-year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund's performance and share price. Accordingly, a bond fund's actual performance may differ from this example. |

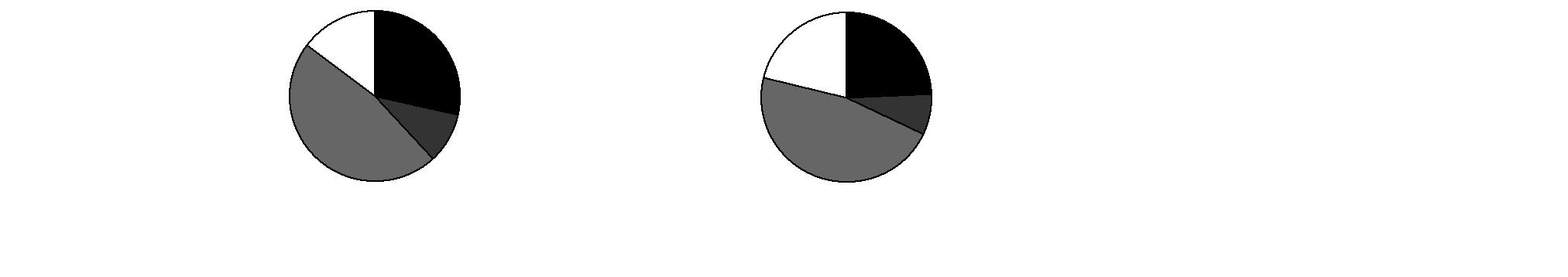

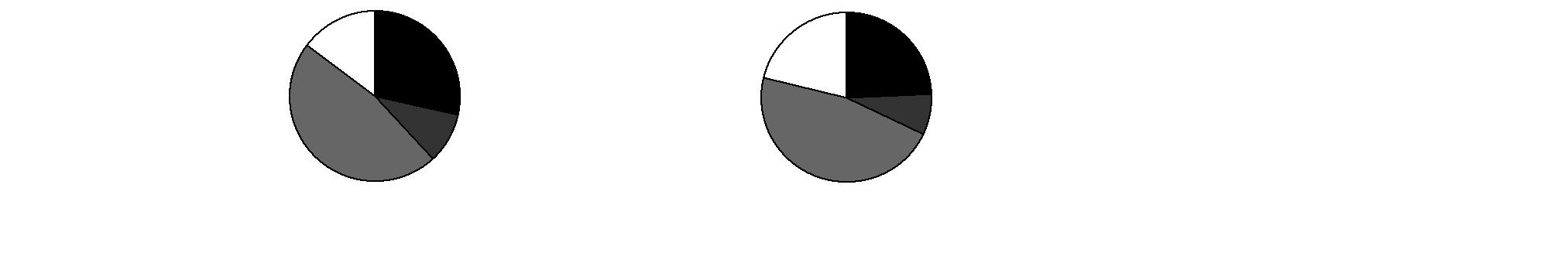

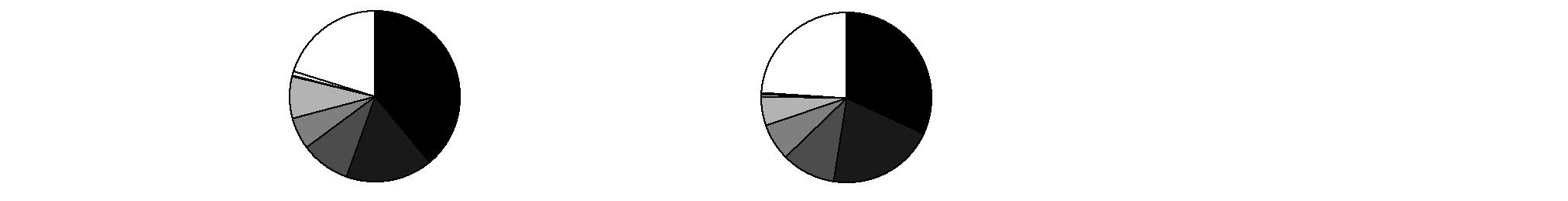

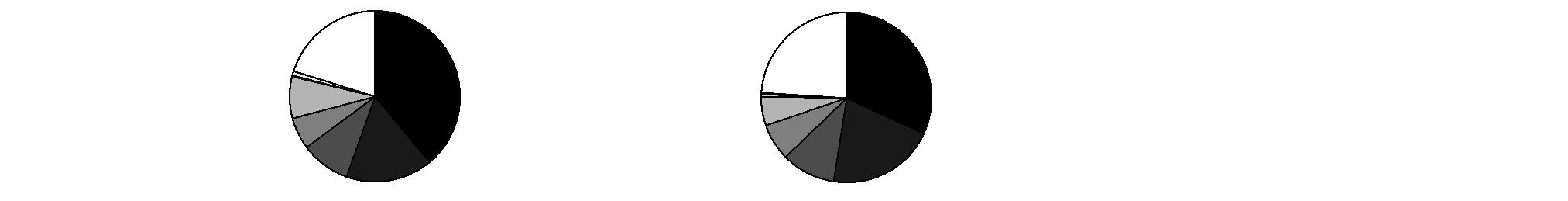

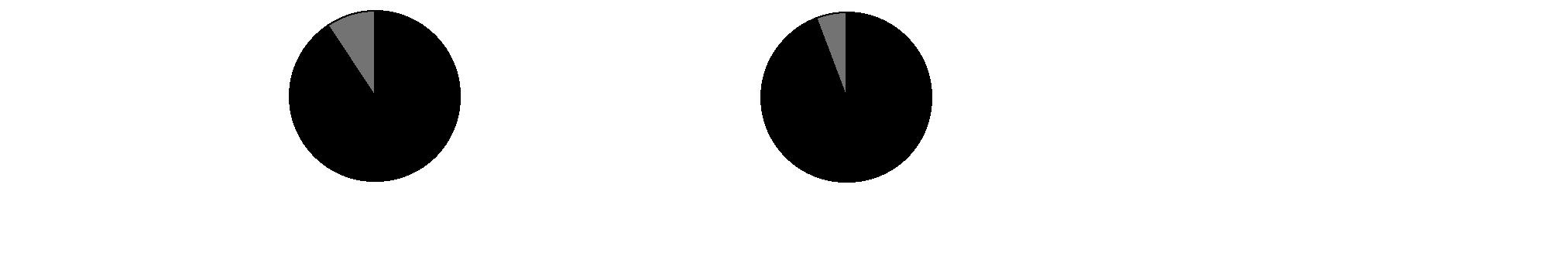

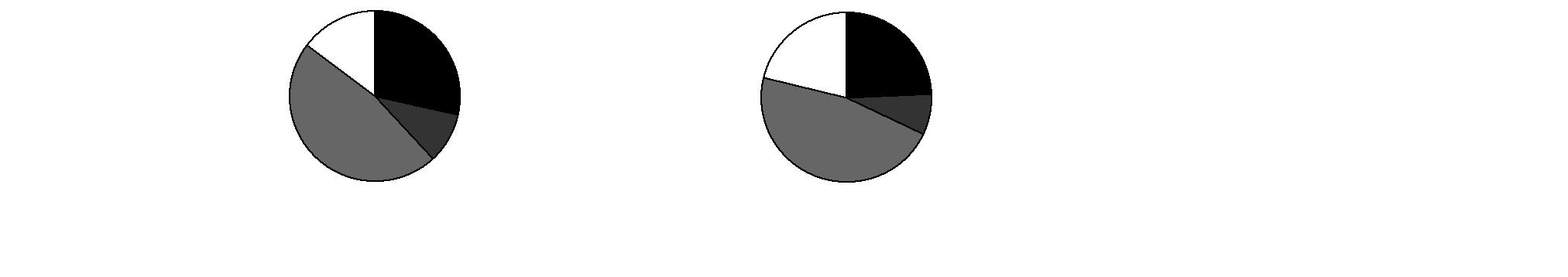

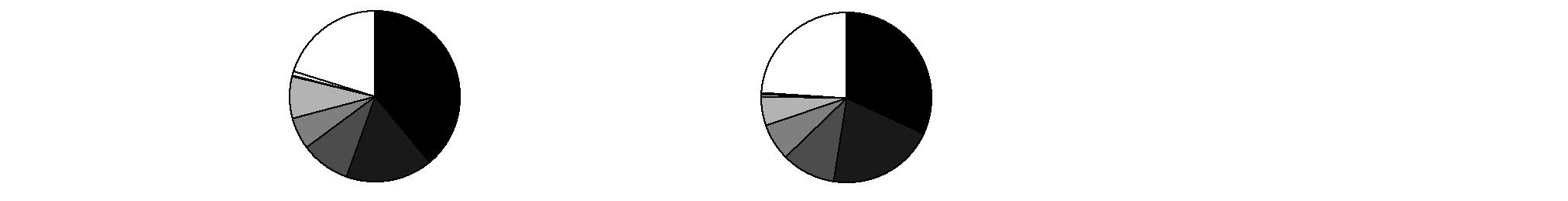

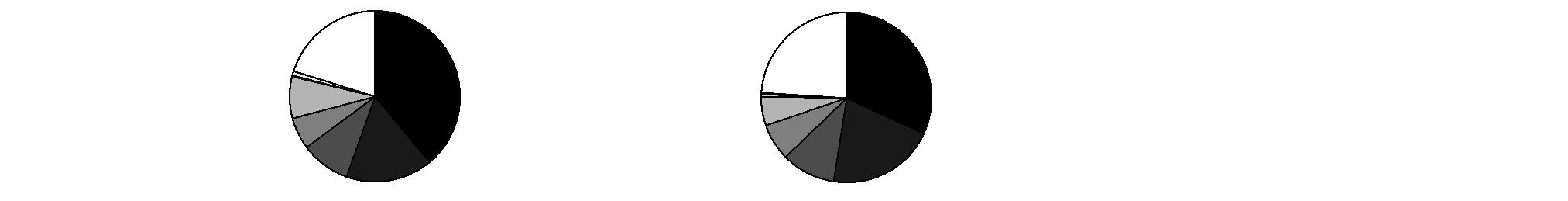

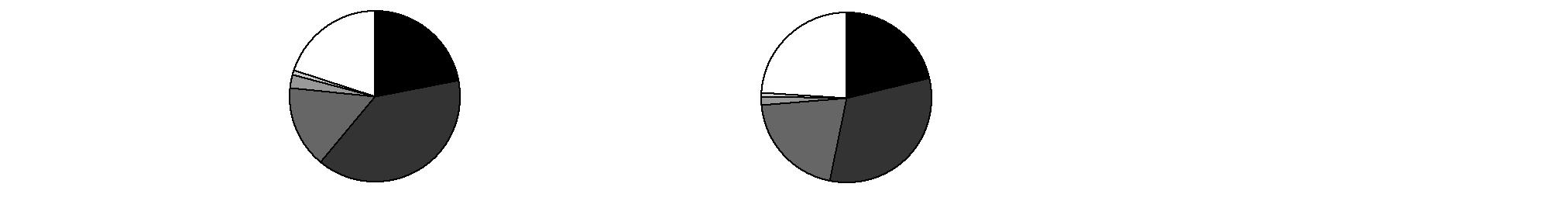

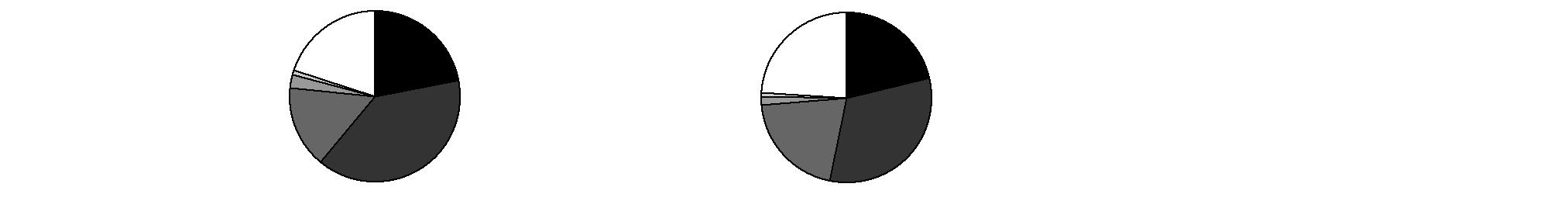

Asset Allocation (% of fund's net assets) |

As of July 31, 2010 * A | As of January 31, 2010 ** B |

| Mortgage

Securities 100.8% | |  | Mortgage

Securities 103.4% | |

| CMOs and

Other Mortgage

Related Securities 10.2% | |  | CMOs and

Other Mortgage

Related Securities 6.3% | |

| Short-Term

Investments and

Net Other Assets † (11.0)% | |  | Short-Term

Investments and

Net Other Assets † (9.7)% | |

* GNMA Securities | 101.4% | | ** GNMA Securities | 104.9% | |

A Futures and Swaps | (0.5)% | | B Futures and Swaps | (0.6)% | |

† Short-Term Investments and Net Other Assets are not included in the pie chart. |

Annual Report

Fidelity GNMA Fund

Investments July 31, 2010

Showing Percentage of Net Assets

U.S. Government Agency - Mortgage Securities - 100.8% |

| Principal Amount (000s) | | Value (000s) |

Fannie Mae - 6.1% |

1.742% 10/1/33 (c) | | $ 1,542 | | $ 1,575 |

1.942% 10/1/33 (c) | | 86 | | 89 |

1.953% 9/1/33 (c) | | 1,660 | | 1,706 |

1.965% 3/1/35 (c) | | 8,638 | | 8,902 |

1.969% 4/1/36 (c) | | 1,132 | | 1,164 |

1.975% 12/1/34 (c) | | 203 | | 208 |

1.989% 2/1/33 (c) | | 181 | | 186 |

1.99% 3/1/35 (c) | | 162 | | 167 |

2.031% 10/1/34 (c) | | 2,397 | | 2,474 |

2.06% 2/1/35 (c) | | 11,286 | | 11,614 |

2.125% 7/1/35 (c) | | 87 | | 90 |

2.136% 3/1/35 (c) | | 32 | | 33 |

2.47% 5/1/34 (c) | | 1,620 | | 1,691 |

2.693% 7/1/36 (c) | | 479 | | 499 |

2.799% 10/1/33 (c) | | 182 | | 190 |

2.805% 7/1/35 (c) | | 12,492 | | 13,028 |

2.817% 11/1/34 (c) | | 30,713 | | 32,234 |

2.838% 11/1/36 (c) | | 3,601 | | 3,769 |

2.905% 11/1/34 (c) | | 5,347 | | 5,593 |

2.942% 9/1/35 (c) | | 6,167 | | 6,493 |

2.962% 3/1/33 (c) | | 480 | | 502 |

2.99% 11/1/36 (c) | | 861 | | 904 |

3.01% 7/1/34 (c) | | 1,744 | | 1,835 |

3.018% 1/1/35 (c) | | 820 | | 855 |

3.037% 7/1/35 (c) | | 4,818 | | 5,073 |

3.042% 2/1/34 (c) | | 60 | | 63 |

3.093% 10/1/35 (c) | | 3,480 | | 3,616 |

3.131% 8/1/35 (c) | | 1,072 | | 1,122 |

3.213% 7/1/35 (c) | | 922 | | 963 |

3.26% 9/1/34 (c) | | 454 | | 471 |

3.308% 8/1/35 (c) | | 2,446 | | 2,587 |

3.326% 5/1/35 (c) | | 1,423 | | 1,484 |

3.358% 7/1/34 (c) | | 98 | | 102 |

3.391% 4/1/35 (c) | | 3,013 | | 3,153 |

3.407% 10/1/37 (c) | | 74 | | 77 |

3.436% 9/1/36 (c) | | 1,357 | | 1,417 |

3.488% 2/1/36 (c) | | 2,281 | | 2,384 |

3.5% 8/1/25 (a) | | 12,000 | | 12,343 |

3.633% 6/1/47 (c) | | 493 | | 516 |

3.639% 9/1/35 (c) | | 967 | | 1,010 |

4% 8/1/25 (a) | | 13,000 | | 13,595 |

4% 8/1/25 (a) | | 80,000 | | 83,663 |

U.S. Government Agency - Mortgage Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Fannie Mae - continued |

4% 8/1/40 (a)(b) | | $ 120,000 | | $ 122,989 |

4% 8/1/40 (a)(b) | | 120,000 | | 122,989 |

5.482% 9/1/34 (c) | | 1,136 | | 1,202 |

5.5% 12/1/16 to 3/1/20 | | 6,197 | | 6,731 |

5.725% 3/1/36 (c) | | 1,527 | | 1,630 |

6.5% 10/1/17 to 12/1/24 | | 2,087 | | 2,308 |

6.5% 8/1/40 (a) | | 16,000 | | 17,544 |

7% 11/1/16 to 3/1/17 | | 1,162 | | 1,271 |

7.5% 9/1/10 to 4/1/17 | | 512 | | 552 |

8.5% 12/1/27 | | 156 | | 181 |

9.5% 9/1/30 | | 15 | | 19 |

10.25% 10/1/18 | | 6 | | 7 |

11.5% 11/1/14 to 7/1/15 | | 11 | | 13 |

12.5% 10/1/15 to 7/1/16 | | 22 | | 25 |

13.25% 9/1/11 | | 7 | | 8 |

| | 506,909 |

Freddie Mac - 0.7% |

2.266% 7/1/36 (c) | | 5,457 | | 5,668 |

2.415% 6/1/33 (c) | | 1,078 | | 1,118 |

2.617% 5/1/35 (c) | | 1,701 | | 1,783 |

2.625% 5/1/35 (c) | | 1,989 | | 2,078 |

2.653% 6/1/33 (c) | | 3,020 | | 3,158 |

2.738% 10/1/35 (c) | | 1,419 | | 1,477 |

2.865% 11/1/35 (c) | | 1,218 | | 1,272 |

3.093% 1/1/36 (c) | | 3,233 | | 3,401 |

3.165% 1/1/35 (c) | | 2,762 | | 2,894 |

3.221% 6/1/33 (c) | | 2,632 | | 2,775 |

3.221% 3/1/35 (c) | | 4,356 | | 4,560 |

3.32% 10/1/33 (c) | | 1,865 | | 1,955 |

3.392% 3/1/37 (c) | | 417 | | 431 |

3.396% 7/1/35 (c) | | 1,193 | | 1,246 |

3.499% 10/1/36 (c) | | 1,366 | | 1,418 |

3.538% 3/1/33 (c) | | 31 | | 32 |

3.578% 8/1/34 (c) | | 409 | | 429 |

3.682% 5/1/37 (c) | | 317 | | 331 |

5.022% 12/1/35 (c) | | 8,254 | | 8,617 |

5.264% 12/1/35 (c) | | 876 | | 905 |

5.5% 11/1/17 to 1/1/25 | | 6,823 | | 7,371 |

5.581% 4/1/36 (c) | | 1,269 | | 1,334 |

8.5% 5/1/17 to 6/1/25 | | 35 | | 39 |

9% 1/1/17 to 3/1/20 | | 12 | | 14 |

U.S. Government Agency - Mortgage Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Freddie Mac - continued |

9.5% 7/1/30 | | $ 66 | | $ 78 |

10% 12/1/10 to 7/1/19 | | 111 | | 126 |

10.25% 11/1/16 | | 6 | | 7 |

12% 2/1/13 to 6/1/15 | | 23 | | 25 |

12.5% 11/1/12 to 5/1/15 | | 21 | | 23 |

13% 5/1/14 to 11/1/14 | | 4 | | 4 |

13.5% 9/1/14 to 12/1/14 | | 2 | | 3 |

| | 54,572 |

Ginnie Mae - 94.0% |

3.5% 3/20/34 | | 882 | | 899 |

4% 11/20/33 to 10/15/39 (a) | | 3,648 | | 3,780 |

4% 8/1/40 (a) | | 21,000 | | 21,669 |

4% 8/1/40 (a) | | 50,000 | | 51,593 |

4% 8/1/40 (a) | | 68,300 | | 70,476 |

4% 8/1/40 (a)(b) | | 120,000 | | 123,824 |

4% 8/1/40 (a) | | 7,000 | | 7,223 |

4.5% 7/15/33 to 6/20/40 (g) | | 845,879 | | 893,861 |

4.5% 8/1/40 (a) | | 195,000 | | 205,207 |

4.5% 8/1/40 (a) | | 196,000 | | 206,259 |

4.5% 8/1/40 (a) | | 182,000 | | 191,527 |

4.5% 8/1/40 (a) | | 260,500 | | 274,136 |

4.5% 8/1/40 (a) | | 162,000 | | 170,791 |

4.5% 8/1/40 (a) | | 262,000 | | 276,218 |

4.5% 8/1/40 (a) | | 12,000 | | 12,651 |

4.5% 8/1/40 (a) | | 5,000 | | 5,271 |

4.5% 8/1/40 (a) | | 157,000 | | 165,520 |

4.5% 8/1/40 (a) | | 14,000 | | 14,760 |

5% 8/15/18 to 6/15/40 (a) | | 1,113,809 | | 1,203,370 |

5% 8/1/40 (a) | | 364,200 | | 391,145 |

5% 8/1/40 (a) | | 3,000 | | 3,222 |

5% 8/1/40 (a) | | 77,000 | | 82,697 |

5% 8/1/40 (a) | | 95,000 | | 102,029 |

5% 8/1/40 (a) | | 55,000 | | 59,069 |

5% 8/1/40 (a) | | 110,000 | | 118,138 |

5% 8/1/40 (a)(b) | | 120,000 | | 129,076 |

5% 8/1/40 (a) | | 122,000 | | 131,227 |

5% 8/1/40 (a) | | 7,000 | | 7,529 |

5% 8/1/40 (a) | | 7,000 | | 7,529 |

5% 8/1/40 (a) | | 13,000 | | 13,983 |

5% 8/1/40 (a) | | 9,000 | | 9,681 |

5% 8/1/40 (a) | | 6,000 | | 6,454 |

U.S. Government Agency - Mortgage Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Ginnie Mae - continued |

5% 8/1/40 (a) | | $ 8,000 | | $ 8,605 |

5% 8/1/40 (a) | | 7,000 | | 7,529 |

5.251% 7/1/60 (f) | | 46,650 | | 51,435 |

5.39% to 5.391% 11/20/59 to 12/20/59 (f) | | 114,236 | | 126,753 |

5.46% 12/20/59 (f) | | 30,726 | | 33,953 |

5.5% 12/20/18 to 9/15/39 | | 839,309 | | 917,271 |

5.5% 8/1/40 (a) | | 55,000 | | 59,692 |

5.5% 8/1/40 (a) | | 92,000 | | 99,976 |

5.5% 8/1/40 (a) | | 137,000 | | 148,877 |

5.5% 8/1/40 (a) | | 22,000 | | 23,907 |

5.5% 8/1/40 (a) | | 30,000 | | 32,601 |

5.5% 8/1/40 (a) | | 6,000 | | 6,520 |

5.5% 8/1/40 (a) | | 8,500 | | 9,237 |

5.5% 12/20/59 (f) | | 26,269 | | 29,247 |

6% 8/15/17 to 11/15/39 | | 655,002 | | 724,162 |

6% 6/1/40 (a)(b) | | 2,000 | | 2,186 |

6% 7/1/40 (a)(b) | | 10,000 | | 10,962 |

6% 8/1/40 (a) | | 3,600 | | 3,939 |

6% 8/1/40 (a) | | 4,000 | | 4,374 |

6.45% 10/15/31 to 11/15/32 | | 1,435 | | 1,609 |

6.5% 12/15/24 to 12/20/39 | | 340,604 | | 377,176 |

7% 10/20/16 to 9/20/34 | | 65,324 | | 73,045 |

7.25% 9/15/27 | | 119 | | 135 |

7.395% 6/20/25 to 11/20/27 | | 1,361 | | 1,538 |

7.5% 5/15/17 to 9/20/32 | | 26,956 | | 30,828 |

8% 8/15/18 to 7/15/32 | | 7,090 | | 8,140 |

8.5% 5/15/16 to 2/15/31 | | 1,873 | | 2,103 |

9% 5/15/14 to 5/15/30 | | 967 | | 1,119 |

9.5% 12/20/15 to 4/20/17 | | 299 | | 337 |

10.5% 1/15/14 to 10/15/18 | | 378 | | 433 |

13% 2/15/11 to 1/15/15 | | 47 | | 53 |

13.5% 1/15/15 | | 3 | | 4 |

| | 7,758,560 |

TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $8,048,771) | 8,320,041 |

Collateralized Mortgage Obligations - 10.1% |

| Principal Amount (000s) | | Value (000s) |

U.S. Government Agency - 10.1% |

Fannie Mae: | | | | |

floater Series 2006-56 Class PF, 0.6788% 7/25/36 (c) | | $ 23,824 | | $ 23,709 |

sequential payer Series 2010-50 Class FA, 0.6788% 1/25/24 (c) | | 8,098 | | 8,120 |

Series 2003-39 Class IA, 5.5% 10/25/22 (c)(d) | | 2,001 | | 152 |

target amortization class Series G94-2 Class D, 6.45% 1/25/24 | | 1,175 | | 1,199 |

Fannie Mae Stripped Mortgage-Backed Securities: | | | | |

Series 331 Class 12, 6.5% 2/1/33 (d) | | 1,551 | | 312 |

Series 339 Class 5, 5.5% 8/1/33 (d) | | 2,455 | | 451 |

Series 343 Class 16, 5.5% 5/1/34 (d) | | 1,854 | | 361 |

Fannie Mae subordinate REMIC pass-thru certificates: | | | | |

floater Series 2006-93 Class FN, 0.7288% 10/25/36 (c) | | 21,188 | | 21,094 |

Series 2008-76 Class EF, 0.8288% 9/25/23 (c) | | 10,202 | | 10,198 |

Freddie Mac Multi-class participation certificates guaranteed: | | | | |

floater: | | | | |

Series 2861 Class JF, 0.6409% 4/15/17 (c) | | 869 | | 870 |

Series 3094 Class UF, 0% 9/15/34 (c) | | 73 | | 73 |

Series 3247 Class F, 0.6909% 8/15/36 (c) | | 25,487 | | 25,277 |

Series 3279 Class FB, 0.6609% 2/15/37 (c) | | 8,119 | | 8,096 |

Series 3346 Class FA, 0.5709% 2/15/19 (c) | | 83,390 | | 83,359 |

planned amortization class: | | | | |

Series 2220 Class PD, 8% 3/15/30 | | 2,221 | | 2,602 |

Series 40 Class K, 6.5% 8/17/24 | | 1,008 | | 1,131 |

sequential payer: | | | | |

Series 2204 Class N, 7.5% 12/20/29 | | 4,596 | | 5,309 |

Series 2601 Class TI, 5.5% 10/15/22 (d) | | 7,678 | | 572 |

Series 3427 Class FX, 0.4909% 8/15/18 (c) | | 49,726 | | 49,548 |

Ginnie Mae guaranteed Multi-family REMIC pass-thru securities sequential payer Series 2002-71 Class Z, 5.5% 10/20/32 | | 34,489 | | 37,596 |

Ginnie Mae guaranteed REMIC pass-thru securities: | | | | |

floater: | | | | |

Series 2001-22 Class FM, 0.6881% 5/20/31 (c) | | 427 | | 427 |

Series 2002-41 Class HF, 0.7409% 6/16/32 (c) | | 490 | | 492 |

Series 2010-H03 Class FA, 0.8881% 3/20/60 (c)(f) | | 23,947 | | 24,291 |

floater 0.6381% 1/20/31 (c) | | 11,500 | | 11,507 |

Collateralized Mortgage Obligations - continued |

| Principal Amount (000s) | | Value (000s) |

U.S. Government Agency - continued |

Ginnie Mae guaranteed REMIC pass-thru securities: - continued | | | | |

planned amortization class: | | | | |

Series 1993-13 Class PD, 6% 5/20/29 | | $ 10,517 | | $ 11,646 |

Series 1994-4 Class KQ, 7.9875% 7/16/24 | | 687 | | 810 |

Series 2000-26 Class PK, 7.5% 9/20/30 | | 1,828 | | 2,157 |

Series 2002-50 Class PE, 6% 7/20/32 | | 13,624 | | 15,134 |

Series 2003-70 Class LE, 5% 7/20/32 | | 44,000 | | 48,163 |

Series 2004-19: | | | | |

Class DJ, 4.5% 3/20/34 | | 874 | | 900 |

Class DP, 5.5% 3/20/34 | | 3,895 | | 4,292 |

Series 2004-64 Class KE, 5.5% 12/20/33 | | 22,978 | | 25,092 |

Series 2004-98 Class IG, 5.5% 2/20/30 (d) | | 556 | | 2 |

Series 2005-17 Class IA, 5.5% 8/20/33 (d) | | 2,794 | | 90 |

Series 2005-24 Class TC, 5.5% 3/20/35 | | 5,403 | | 6,022 |

Series 2005-54 Class BM, 5% 7/20/35 | | 9,658 | | 10,530 |

Series 2005-57 Class PB, 5.5% 7/20/35 | | 5,673 | | 6,355 |

Series 2006-50 Class JC, 5% 6/20/36 | | 11,780 | | 12,981 |

Series 2008-28 Class PC, 5.5% 4/20/34 | | 18,652 | | 21,169 |

sequential payer: | | | | |

Series 1995-4 Class CQ, 8% 6/20/25 | | 507 | | 575 |

Series 1998-23 Class ZB, 6.5% 6/20/28 | | 7,660 | | 8,555 |

Series 2001-40 Class Z, 6% 8/20/31 | | 4,966 | | 5,495 |

Series 2001-49 Class Z, 7% 10/16/31 | | 2,175 | | 2,491 |

Series 2002-18 Class ZB, 6% 3/20/32 | | 4,992 | | 5,526 |

Series 2002-29: | | | | |

Class SK, 8.25% 5/20/32 (c)(e) | | 222 | | 250 |

Class Z, 6.5% 5/16/32 | | 6,970 | | 7,869 |

Series 2002-33 Class ZJ, 6.5% 5/20/32 | | 4,155 | | 4,592 |

Series 2002-42 Class ZA, 6% 6/20/32 | | 3,201 | | 3,539 |

Series 2002-43 Class Z, 6.5% 6/20/32 | | 7,604 | | 8,561 |

Series 2002-45 Class Z, 6% 6/20/32 | | 1,803 | | 2,002 |

Series 2002-49 Class ZA, 6.5% 7/20/32 | | 26,920 | | 30,330 |

Series 2003-75 Class ZA, 5.5% 9/20/33 | | 12,405 | | 13,549 |

Series 2004-46 Class BZ, 6% 6/20/34 | | 14,392 | | 16,064 |

Series 2004-65 Class VE, 5.5% 7/20/15 | | 3,149 | | 3,439 |

Series 2004-86 Class G, 6% 10/20/34 | | 6,273 | | 7,219 |

Series 2005-28 Class AJ, 5.5% 4/20/35 | | 26,841 | | 30,255 |

Series 2005-47 Class ZY, 6% 6/20/35 | | 5,422 | | 6,543 |

Series 2005-6 Class EX, 5.5% 11/20/34 | | 1,001 | | 1,100 |

Series 2005-82 Class JV, 5% 6/20/35 | | 3,500 | | 3,820 |

Collateralized Mortgage Obligations - continued |

| Principal Amount (000s) | | Value (000s) |

U.S. Government Agency - continued |

Ginnie Mae guaranteed REMIC pass-thru securities: - continued | | | | |

Series 1995-6 Class Z, 7% 9/20/25 | | $ 1,407 | | $ 1,433 |

Series 2003-42 Class FH, 0.7881% 5/20/33 (c) | | 4,793 | | 4,808 |

Series 2003-92 Class SN, 6.0891% 10/16/33 (c)(d)(e) | | 18,246 | | 2,058 |

Series 2004-32 Class GS, 6.1591% 5/16/34 (c)(d)(e) | | 1,731 | | 300 |

Series 2004-59 Class FC, 0.6409% 8/16/34 (c) | | 9,458 | | 9,425 |

Series 2005-41 Class F, 0.6381% 5/20/35 (c) | | 24,281 | | 24,137 |

Series 2005-6 Class EY, 5.5% 11/20/33 | | 1,016 | | 1,203 |

Series 2006-13 Class DS, 10.5928% 3/20/36 (c)(e) | | 32,322 | | 37,473 |

Series 2007-35 Class SC, 38.1544% 6/16/37 (c)(e) | | 9,861 | | 16,845 |

Series 2008-88 Class BZ, 5.5% 5/20/33 | | 49,024 | | 53,199 |

Series 2010-H010 Class FA, 0.6681% 5/20/60 (c)(f) | | 16,978 | | 17,052 |

0.6416% 8/1/60 (a)(c)(f) | | 19,937 | | 20,024 |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $781,156) | 831,820 |

Commercial Mortgage Securities - 0.1% |

|

Fannie Mae subordinate REMIC pass-thru certificates: | | | | |

Series 1998-M3 Class IB, 0.9079% 1/17/38 (c)(d) | | 6,634 | | 105 |

Series 1998-M4 Class N, 1.0118% 2/25/35 (c)(d) | | 1,599 | | 6 |

Ginnie Mae guaranteed Multi-family REMIC pass-thru securities: | | | | |

sequential payer Series 2001-58 Class X, 0.8587% 9/16/41 (c)(d) | | 87,999 | | 1,693 |

Series 2001-12 Class X, 0.6748% 7/16/40 (c)(d) | | 28,038 | | 519 |

Ginnie Mae guaranteed REMIC pass-thru securities: | | | | |

sequential payer Series 2002-81 Class IO, 1.5829% 9/16/42 (c)(d) | | 92,990 | | 3,000 |

Series 2002-62 Class IO, 1.2434% 8/16/42 (c)(d) | | 57,075 | | 1,901 |

Series 2002-85 Class X, 1.624% 3/16/42 (c)(d) | | 59,937 | | 2,917 |

TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $19,965) | 10,141 |

Cash Equivalents - 33.8% |

| Maturity Amount (000s) | | Value (000s) |

Investments in repurchase agreements in a joint trading account at 0.21%, dated 7/30/10 due 8/2/10 (Collateralized by U.S. Government Obligations) #

(Cost $2,788,212) | $ 2,788,262 | | $ 2,788,212 |

TOTAL INVESTMENT PORTFOLIO - 144.8% (Cost $11,638,104) | | 11,950,214 |

NET OTHER ASSETS (LIABILITIES) - (44.8)% | | (3,698,023) |

NET ASSETS - 100% | $ 8,252,191 |

Swap Agreements |

| Expiration Date | | Notional Amount (000s) | | |

Interest Rate Swaps |

Receive quarterly a floating rate based on 3-month LIBOR and pay semi-annually a fixed rate equal to 3.8225% with Credit Suisse First Boston | April 2020 | | $ 43,200 | | $ (4,137) |

Legend |

(a) Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

(b) A portion of the security is subject to a forward commitment to sell. |

(c) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

(d) Security represents right to receive monthly interest payments on an underlying pool of mortgages or assets. Principal shown is the outstanding par amount of the pool held as of the end of the period. |

(e) Coupon is inversely indexed to a floating interest rate multiplied by a specified factor. The price may be considerably more volatile than the price of a comparable fixed rate security. |

(f) Represents an investment in an underlying pool of reverse mortgages which typically do not require regular principal and interest payments as repayment is deferred until a maturity event. |

(g) Security or a portion of the security has been segregated as collateral for open swap agreements. At the period end, the value of securities pledged amounted to $3,882,000. |

# Additional information on each counterparty to the repurchase agreement is as follows: |

Repurchase Agreement / Counterparty | Value

(Amounts in thousands) |

$2,788,212,000 due 8/02/10 at 0.21% |

Banc of America Securities LLC | $ 189,829 |

Bank of America NA | 94,969 |

Deutsche Bank Securities, Inc. | 712,269 |

Goldman, Sachs & Co. | 189,938 |

ING Financial Markets LLC | 498,817 |

J.P. Morgan Securities, Inc. | 29,236 |

Merrill Lynch Government Securities, Inc. | 170,945 |

Mizuho Securities USA, Inc. | 759,755 |

Morgan Stanley & Co., Inc. | 94,969 |

RBC Capital Markets Corp. | 47,485 |

| $ 2,788,212 |

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the tables below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value: |

(Amounts in thousands) | |

Investments in Securities: | |

Beginning Balance | $ 13,930 |

Total Realized Gain (Loss) | - |

Total Unrealized Gain (Loss) | 1,144 |

Cost of Purchases | - |

Proceeds of Sales | (15,074) |

Amortization/Accretion | - |

Transfers in to Level 3 | - |

Transfers out of Level 3 | - |

Ending Balance | $ - |

The change in unrealized gain (loss) for the period attributable to Level 3 securities held at July 31, 2010 | $ - |

The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations. |

Value of Derivative Instruments |

The following table is a summary of the Fund's value of derivative instruments by risk exposure as of July 31, 2010. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements. |

Risk Exposure /

Derivative Type | Value |

(Amounts in thousands) | Asset | Liability |

Interest Rate Risk | | |

Swap Agreements (a) | $ - | $ (4,137) |

Total Value of Derivatives | $ - | $ (4,137) |

(a) Value is disclosed on the Statement of Assets and Liabilities in the Unrealized Appreciation and Unrealized Depreciation on Swap Agreements line-items. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity GNMA Fund

Statement of Assets and Liabilities

Amounts in thousands (except per-share amount) | July 31, 2010 |

| | |

Assets | | |

Investment in securities, at value (including repurchase agreements of $2,788,212) - See accompanying schedule: Unaffiliated issuers (cost $11,638,104) | | $ 11,950,214 |

Commitment to sell securities on a delayed delivery basis | $ (449,639) | |

Receivable for securities sold on a delayed delivery basis | 446,331 | (3,308) |

Receivable for investments sold, regular delivery | | 14,296 |

Receivable for fund shares sold | | 21,084 |

Interest receivable | | 28,694 |

Other receivables | | 1,299 |

Total assets | | 12,012,279 |

| | |

Liabilities | | |

Payable to custodian bank | $ 70 | |

Payable for investments purchased

Regular delivery | 28,627 | |

Delayed delivery | 3,714,882 | |

Payable for fund shares redeemed | 6,010 | |

Distributions payable | 2,030 | |

Unrealized depreciation on swap agreements | 4,137 | |

Accrued management fee | 2,136 | |

Other affiliated payables | 897 | |

Other payables and accrued expenses | 1,299 | |

Total liabilities | | 3,760,088 |

| | |

Net Assets | | $ 8,252,191 |

Net Assets consist of: | | |

Paid in capital | | $ 7,799,697 |

Distributions in excess of net investment income | | (22,383) |

Accumulated undistributed net realized gain (loss) on investments | | 170,212 |

Net unrealized appreciation (depreciation) on investments | | 304,665 |

Net Assets, for 692,980 shares outstanding | | $ 8,252,191 |

Net Asset Value, offering price and redemption price per share ($8,252,191 ÷ 692,980 shares) | | $ 11.91 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

Amounts in thousands | Year ended July 31, 2010 |

| | |

Investment Income | | |

Interest | | $ 248,449 |

| | |

Expenses | | |

Management fee | $ 23,315 | |

Transfer agent fees | 7,369 | |

Fund wide operations fee | 2,449 | |

Independent trustees' compensation | 26 | |

Miscellaneous | 28 | |

Total expenses | | 33,187 |

Net investment income | | 215,262 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 272,978 | |

Futures contracts | (618) | |

Swap agreements | (2,409) | |

Total net realized gain (loss) | | 269,951 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 145,420 | |

Futures contracts | (6) | |

Swap agreements | (3,393) | |

Delayed delivery commitments | 3,809 | |

Total change in net unrealized appreciation (depreciation) | | 145,830 |

Net gain (loss) | | 415,781 |

Net increase (decrease) in net assets resulting from operations | | $ 631,043 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity GNMA Fund

Financial Statements - continued

Statement of Changes in Net Assets

Amounts in thousands | Year ended

July 31,

2010 | Year ended

July 31,

2009 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income | $ 215,262 | $ 215,485 |

Net realized gain (loss) | 269,951 | 37,749 |

Change in net unrealized appreciation (depreciation) | 145,830 | 177,641 |

Net increase (decrease) in net assets resulting

from operations | 631,043 | 430,875 |

Distributions to shareholders from net investment income | (217,763) | (222,729) |

Distributions to shareholders from net realized gain | (74,582) | - |

Total distributions | (292,345) | (222,729) |

Share transactions

Proceeds from sales of shares | 3,765,037 | 4,570,675 |

Reinvestment of distributions | 260,696 | 196,614 |

Cost of shares redeemed | (2,693,893) | (1,874,230) |

Net increase (decrease) in net assets resulting from share transactions | 1,331,840 | 2,893,059 |

Total increase (decrease) in net assets | 1,670,538 | 3,101,205 |

| | |

Net Assets | | |

Beginning of period | 6,581,653 | 3,480,448 |

End of period (including distributions in excess of net investment income of $22,383 and distributions in excess of net investment income of $26,121, respectively) | $ 8,252,191 | $ 6,581,653 |

Other Information Shares | | |

Sold | 325,929 | 408,345 |

Issued in reinvestment of distributions | 22,566 | 17,617 |

Redeemed | (234,206) | (167,834) |

Net increase (decrease) | 114,289 | 258,128 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

Years ended July 31, | 2010 | 2009 | 2008 | 2007 | 2006 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 11.37 | $ 10.86 | $ 10.64 | $ 10.62 | $ 11.00 |

Income from Investment Operations | | | | | |

Net investment income B | .337 | .497 | .534 | .537 | .497 |

Net realized and unrealized gain (loss) | .660 | .533 | .230 | .017 | (.315) |

Total from investment operations | .997 | 1.030 | .764 | .554 | .182 |

Distributions from net investment income | (.342) | (.520) | (.544) | (.534) | (.542) |

Distributions from net realized gain | (.115) | - | - | - | (.020) |

Total distributions | (.457) | (.520) | (.544) | (.534) | (.562) |

Net asset value, end of period | $ 11.91 | $ 11.37 | $ 10.86 | $ 10.64 | $ 10.62 |

Total Return A | 8.97% | 9.69% | 7.27% | 5.29% | 1.70% |

Ratios to Average Net Assets C | | | | | |

Expenses before reductions | .45% | .45% | .45% | .45% | .45% |

Expenses net of fee waivers,

if any | .45% | .45% | .45% | .45% | .45% |

Expenses net of all reductions | .45% | .45% | .45% | .45% | .45% |

Net investment income | 2.92% | 4.47% | 4.90% | 5.01% | 4.61% |

Supplemental Data | | | | | |

Net assets, end of period

(in millions) | $ 8,252 | $ 6,582 | $ 3,480 | $ 3,172 | $ 3,365 |

Portfolio turnover rate | 540% | 464% | 227% | 165% | 183% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Calculated based on average shares outstanding during the period.

C Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

See accompanying notes which are an integral part of the financial statements.

Annual Report

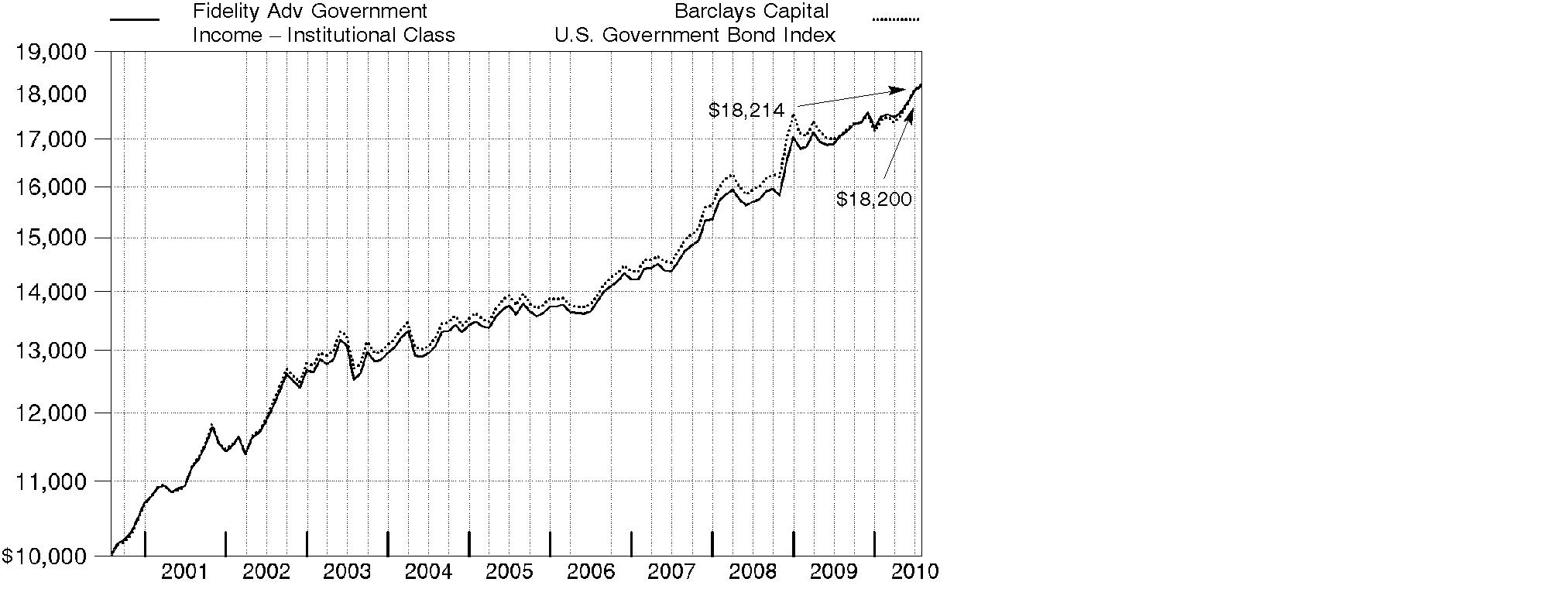

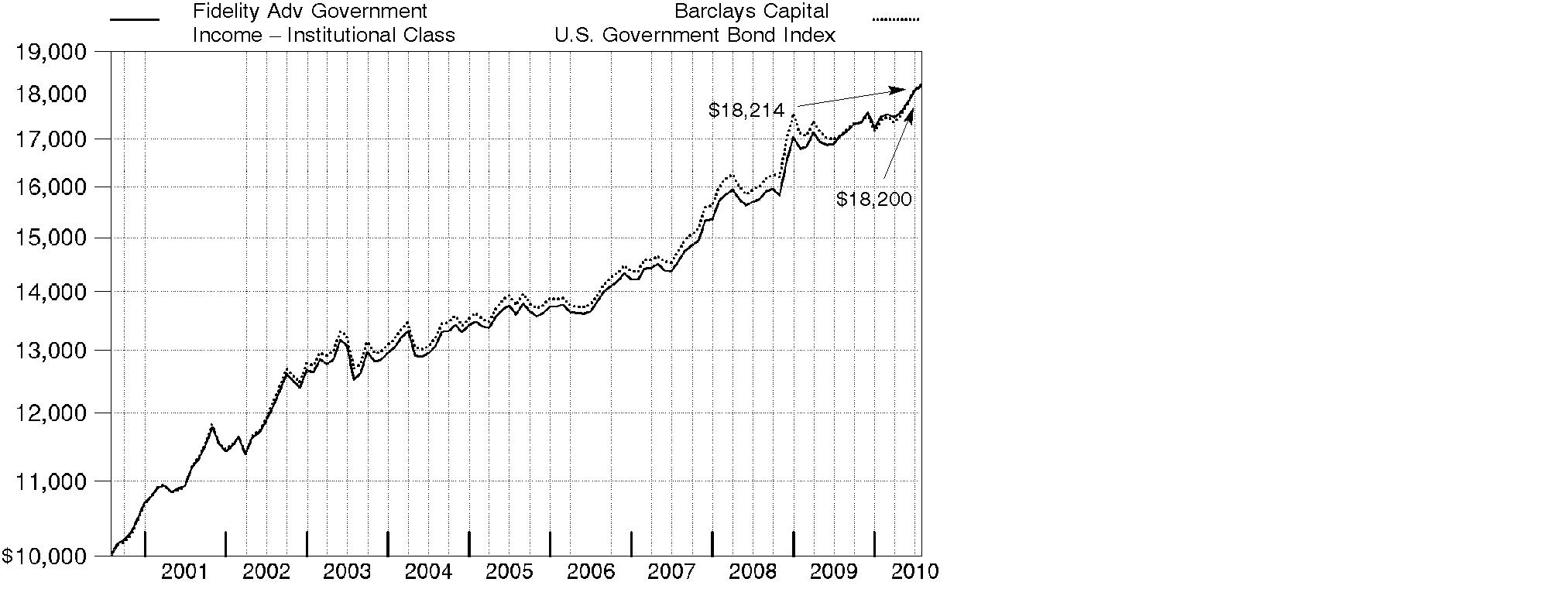

Fidelity Intermediate Government Income Fund

Performance: The Bottom Line

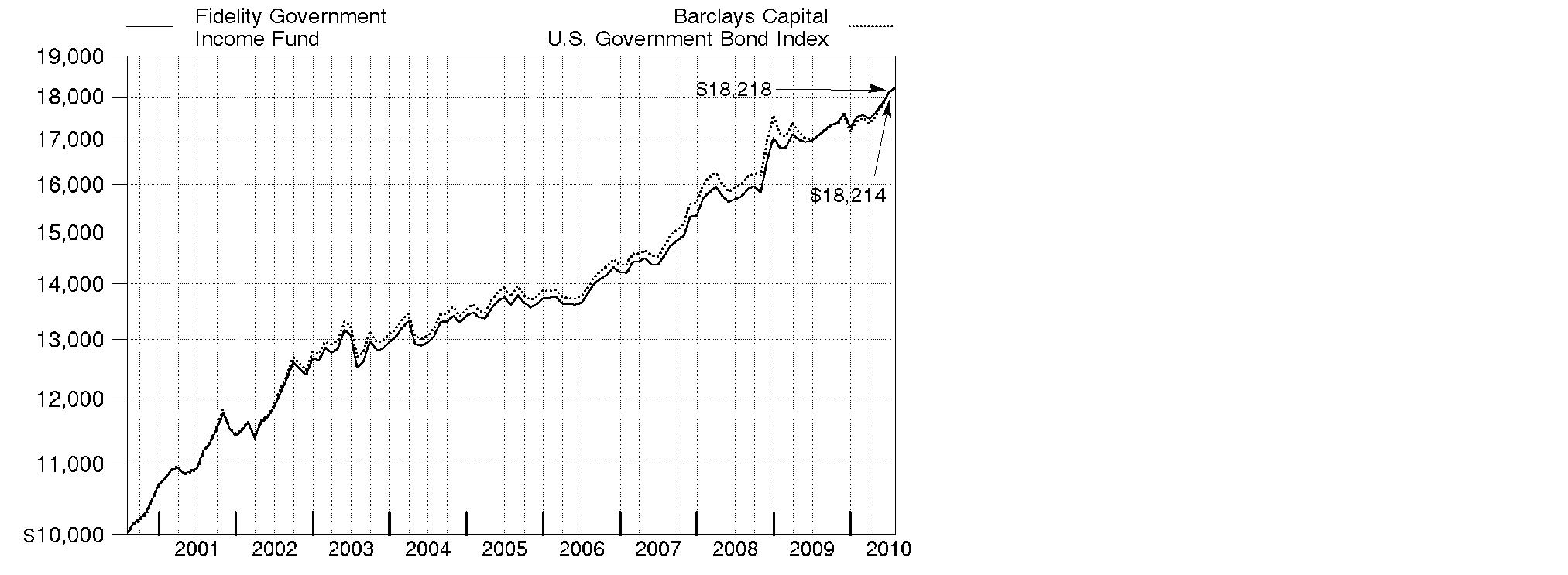

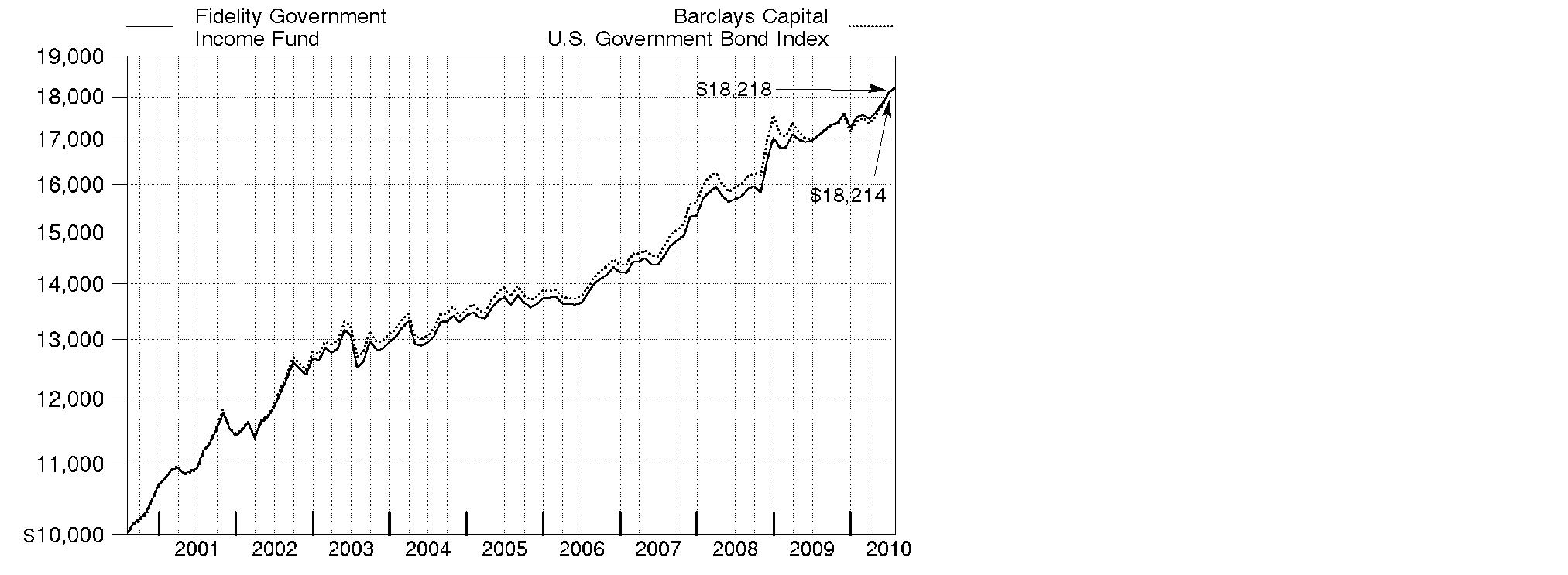

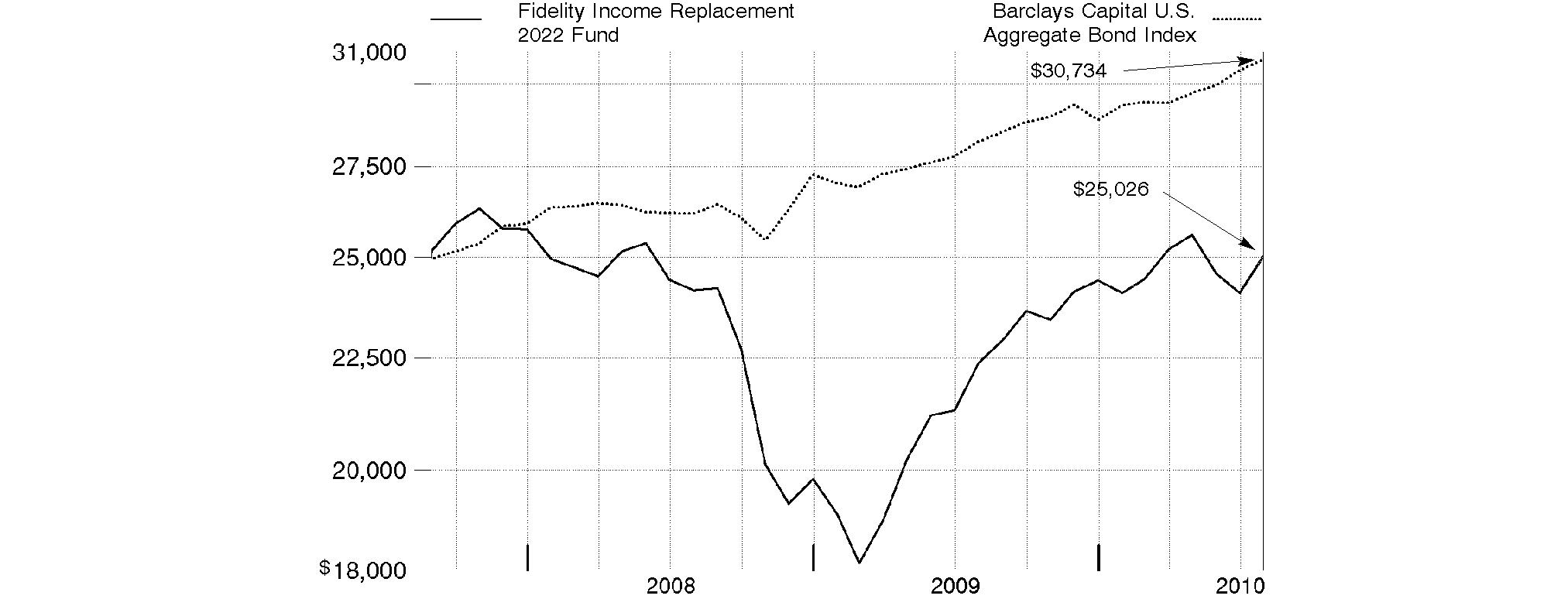

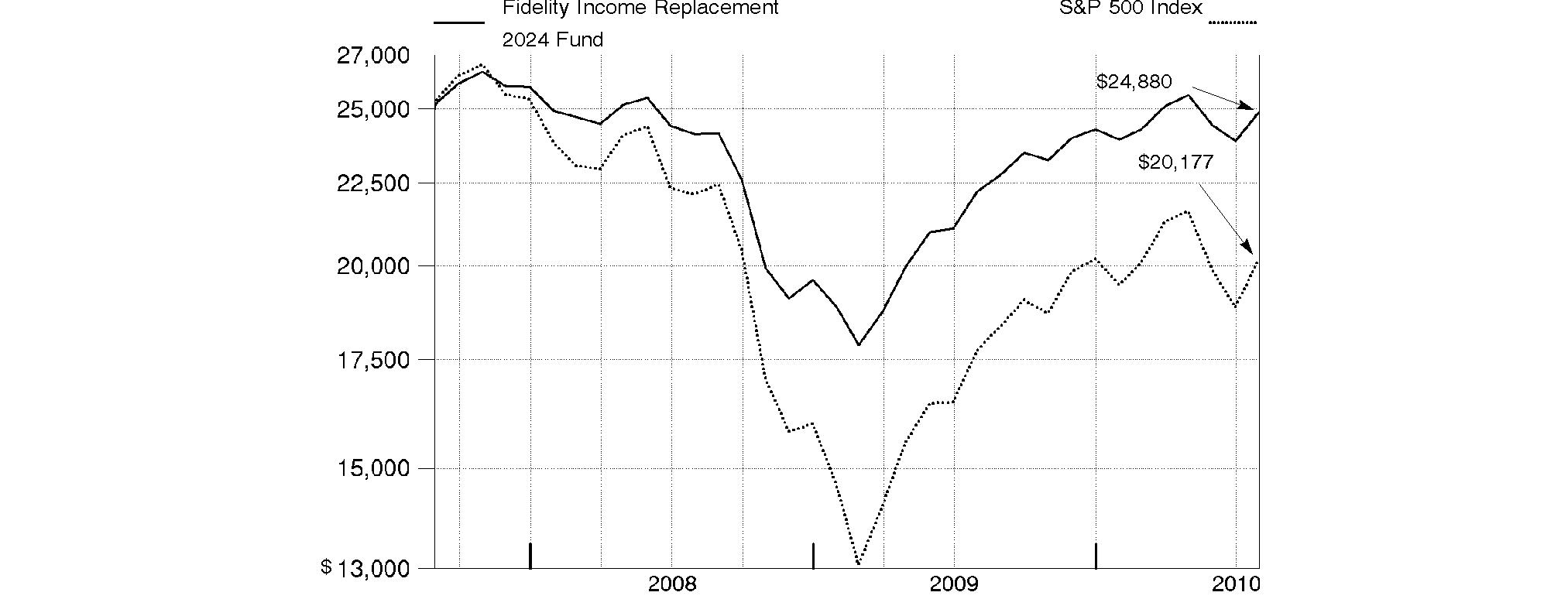

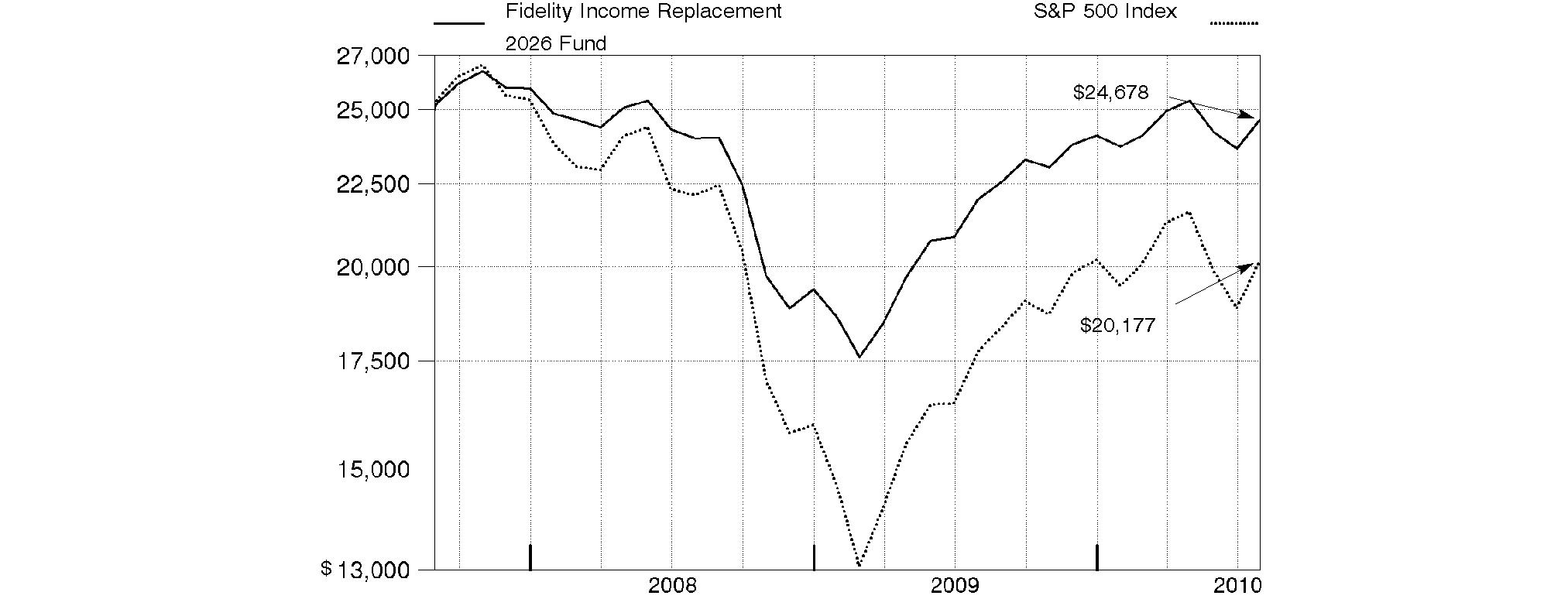

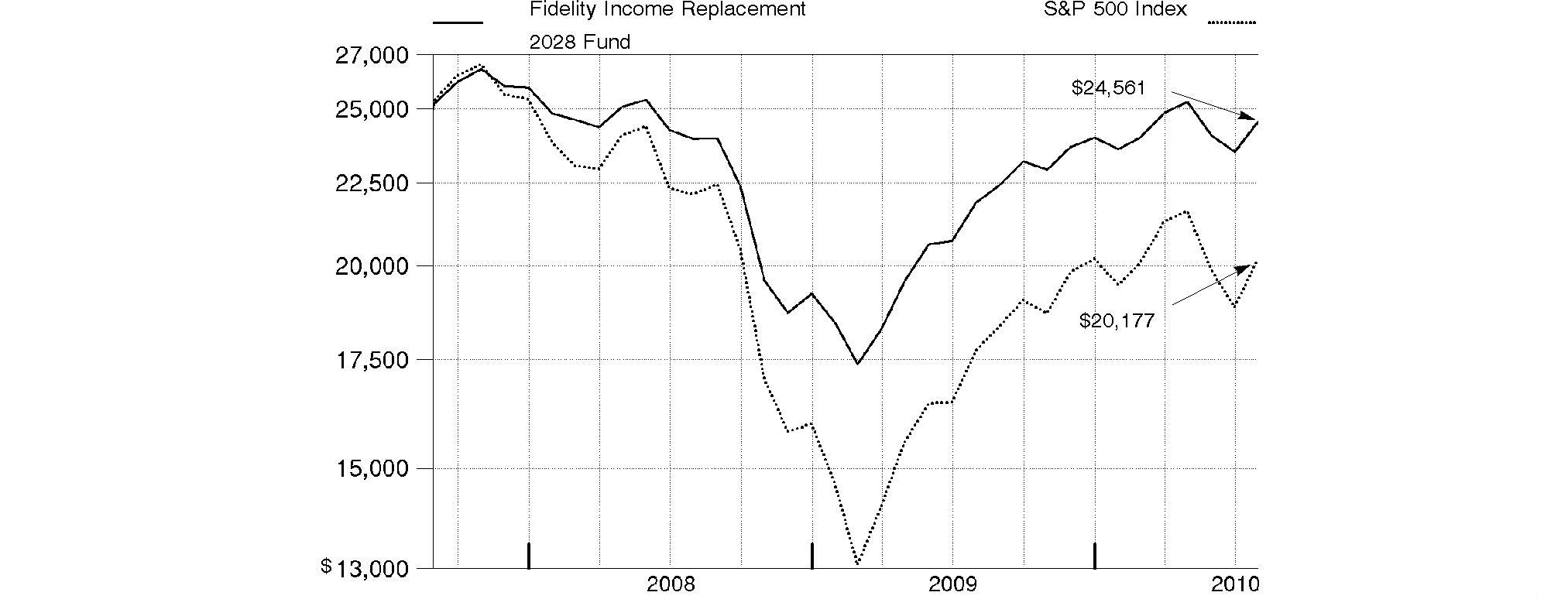

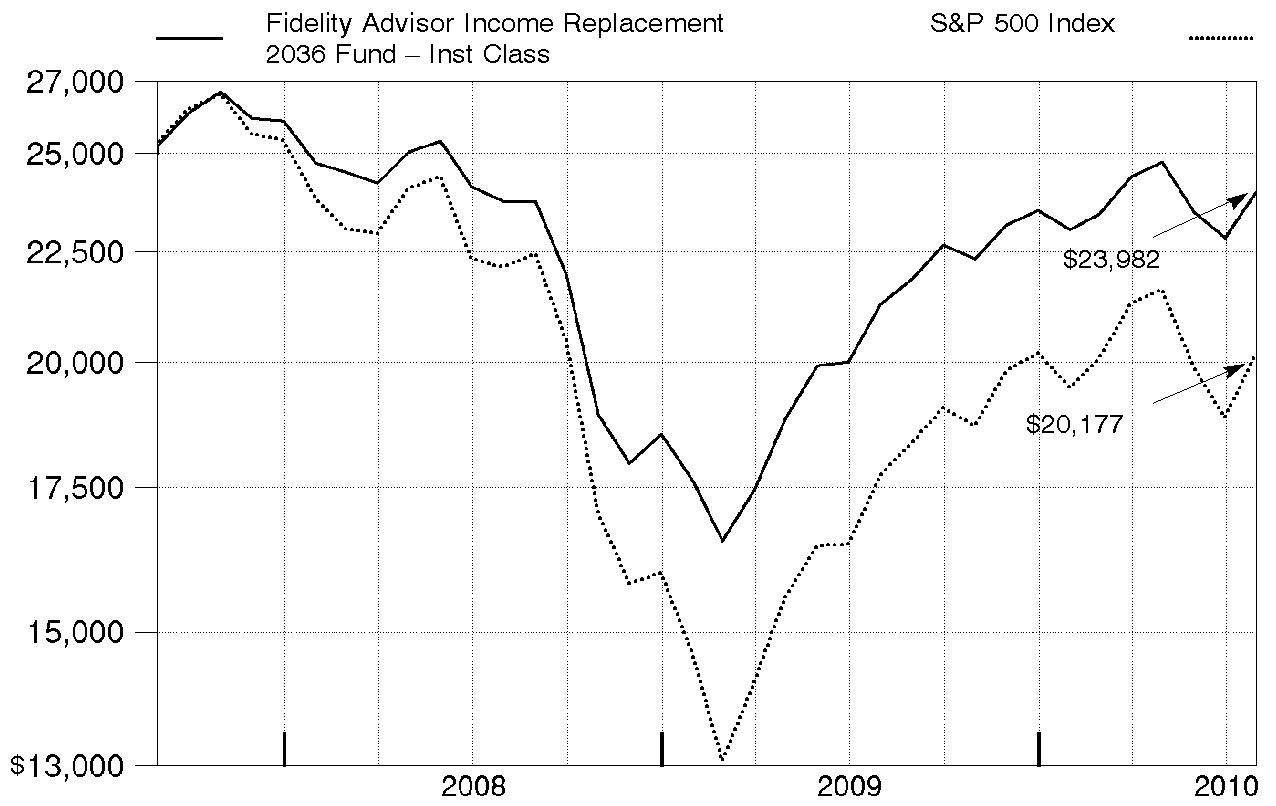

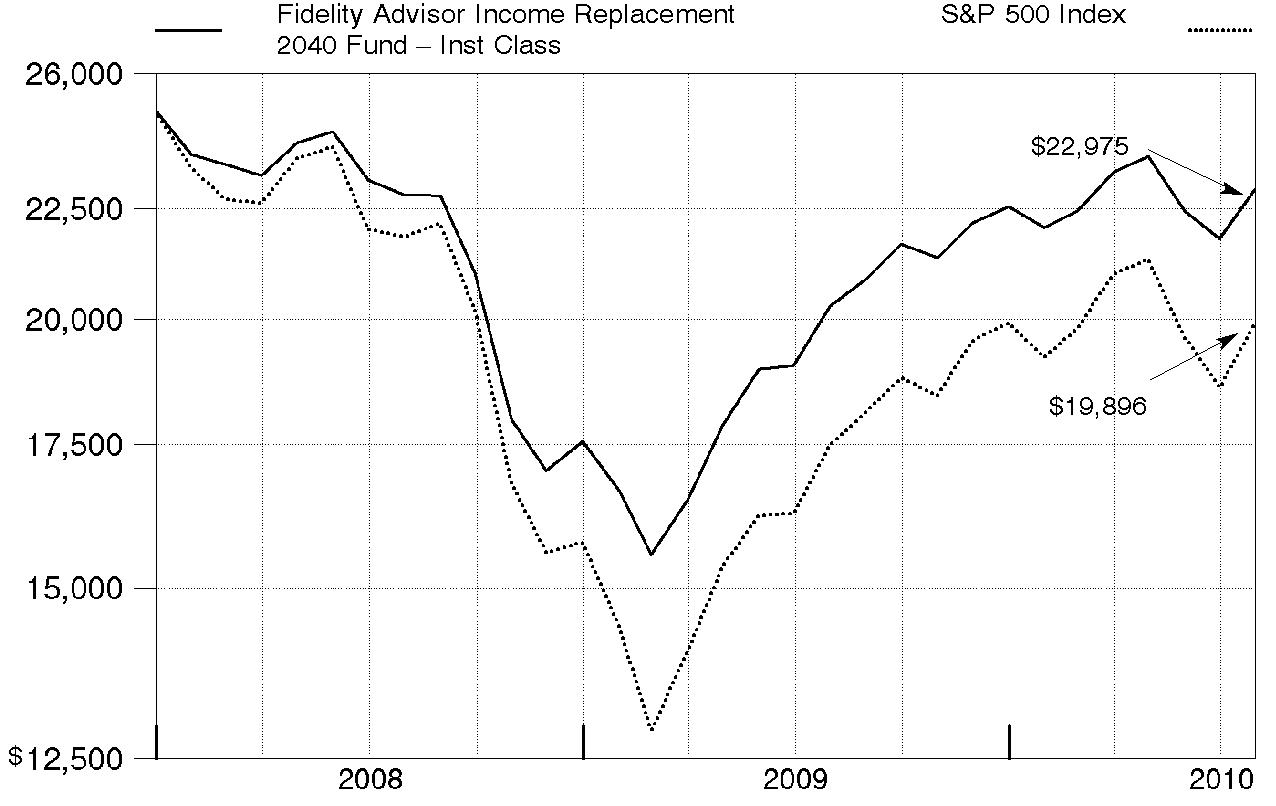

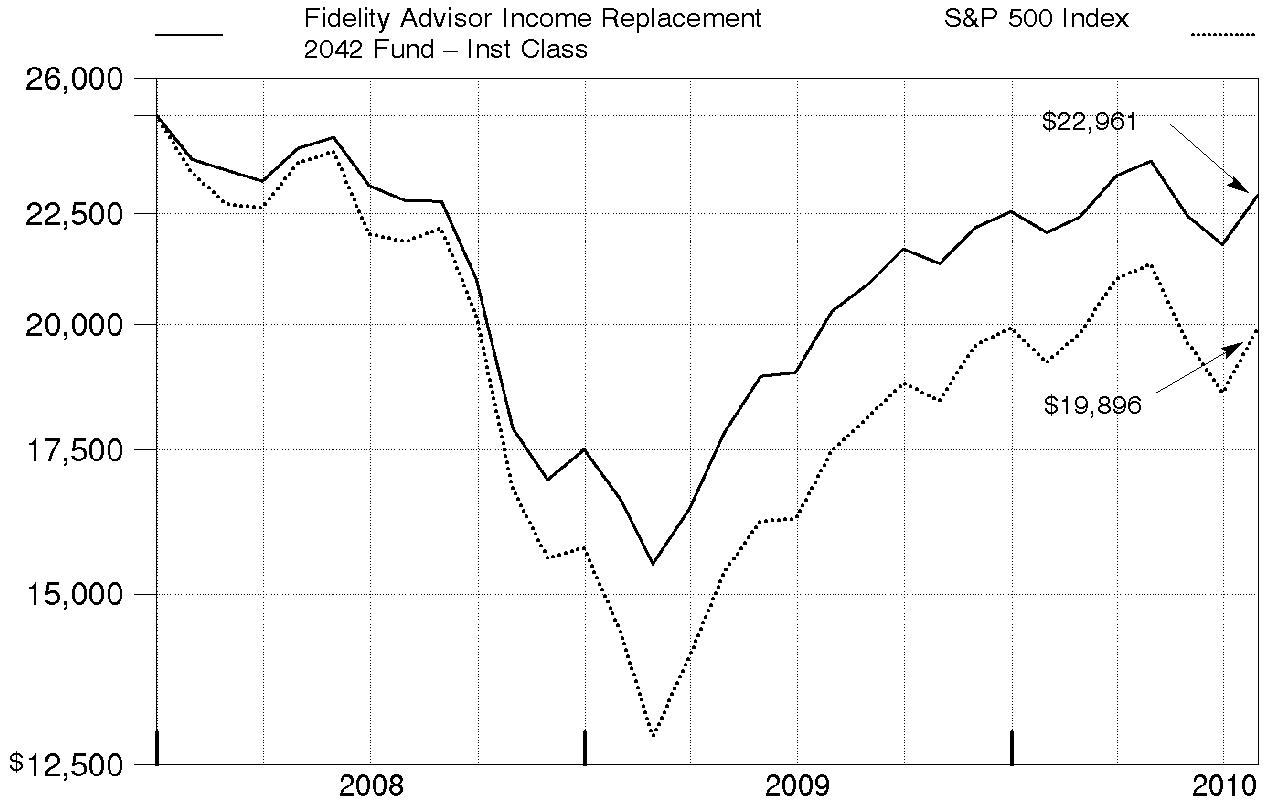

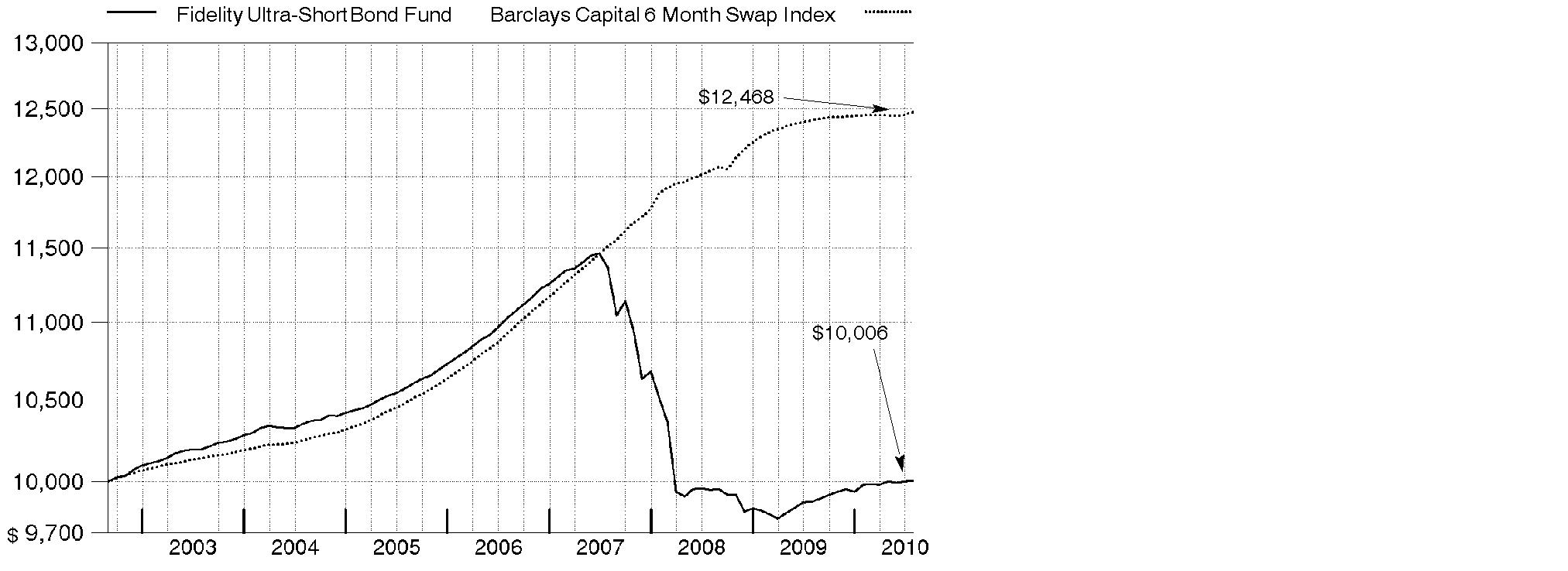

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended July 31, 2010 | Past 1

year | Past 5

years | Past 10

years |

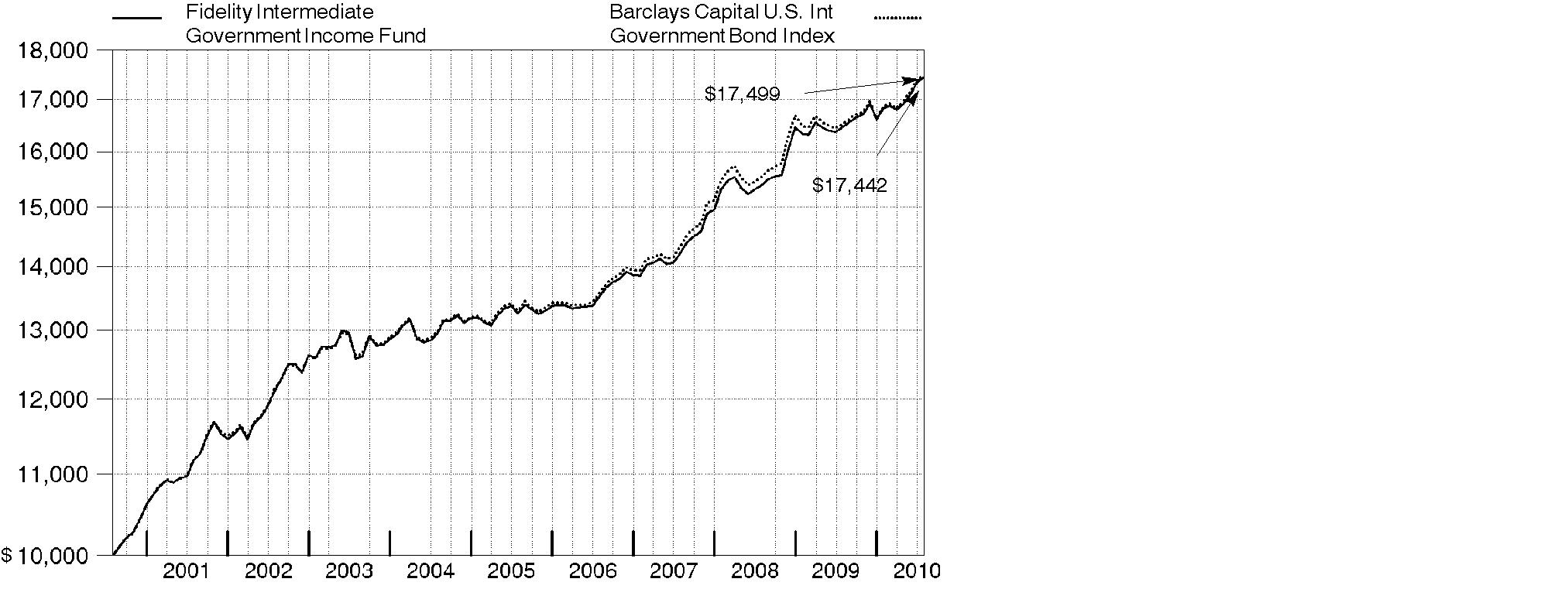

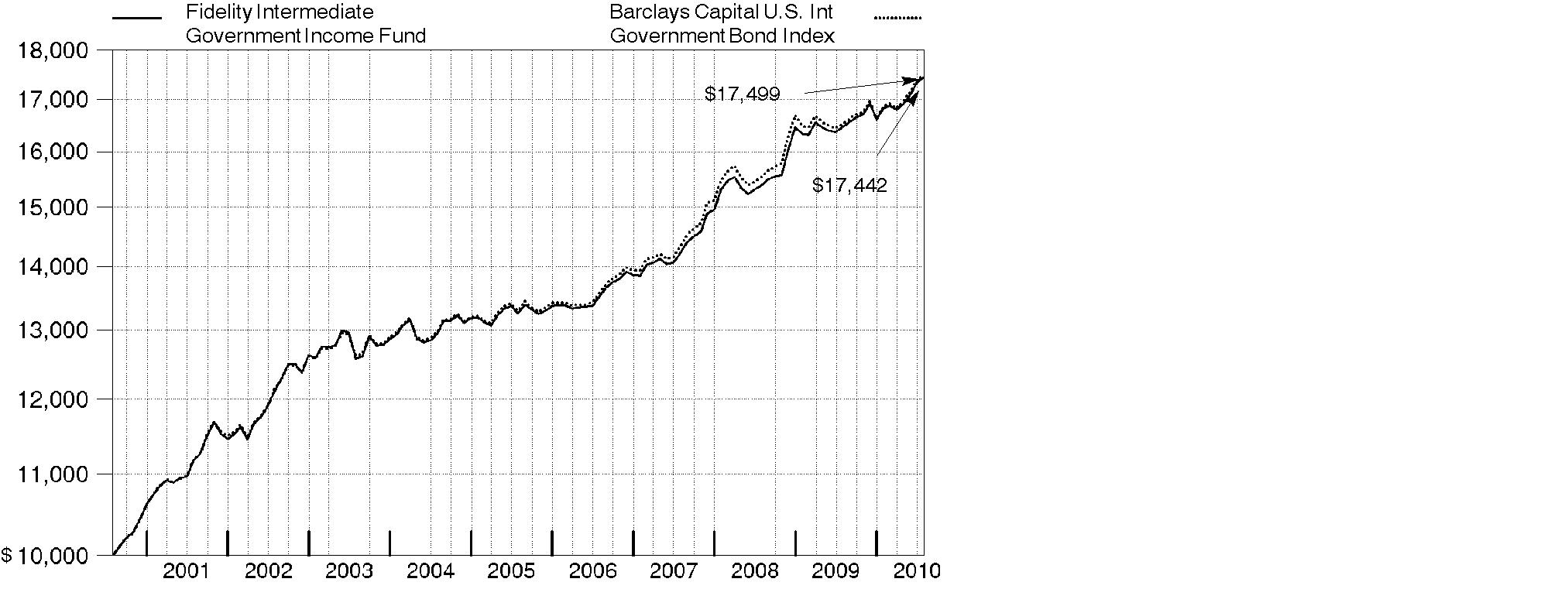

Fidelity Intermediate Government Income Fund | 6.02% | 5.65% | 5.72% |

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Intermediate Government Income Fund on July 31, 2000. The chart shows how the value of your investment would have changed, and also shows how the Barclays Capital U.S. Intermediate Government Bond Index performed over the same period.

Annual Report

Fidelity Intermediate Government Income Fund

Market Recap: U.S. taxable bonds generated solid gains during the 12-month period ending July 31, 2010, as evidenced by the 8.91% advance of the Barclays Capital U.S. Aggregate Bond Index, a broad measure of the domestic investment-grade debt universe. Riskier segments of the market fared best overall, beneficiaries of strong demand for higher-yielding investments. The Barclays Capital U.S. Credit Bond Index rose 12.60% and the Barclays Capital U.S. Fixed-Rate ABS Index returned 12.14%. The Barclays Capital U.S. Treasury Bond Index advanced 6.95%, with most of the gain coming in the second half of the period. That's when investors began to favor the relative safety of U.S. government bonds, as the economic outlook became less certain and deflation fears resurfaced. Mortgage-backed securities (MBS), bolstered largely by government purchase programs, increased 7.52%, as measured by the Barclays Capital U.S. MBS Index. Government-backed agency securities lagged the broader MBS market, with the Barclays Capital U.S. Agency Bond Index gaining 5.53%. Agency securities initially were constrained by investors' diminished appetite for bonds with lower perceived credit risk, but later were helped by the Federal Reserve's purchases of agency debt.

Comments from William Irving, Lead Portfolio Manager of Fidelity® Intermediate Government Income Fund, and Franco Castagliuolo, who became Co-Portfolio Manager on December 1, 2009: For the year, the fund returned 6.02%, in line with the 6.01% advance of the Barclays Capital U.S. Intermediate Government Bond Index. Sector selection was the main driver of the fund's relative performance. Out-of-index holdings in government-agency-backed mortgage pass-through securities (MBS), collateralized mortgage obligations (CMOs) and Treasury Inflation-Protected Securities (TIPS) helped offset the negative impact of being significantly underweighted in plain-vanilla U.S. Treasury securities. MBS generally outpaced the index, stoked by investors' appetite for higher-yielding alternatives to Treasuries, the federal government's MBS repurchase program and relatively muted prepayment activity. CMO holdings - which are mortgages carved into different classes of bonds, each with its own expected maturity and cash flow pattern - outpaced the index largely due to their higher yields. Tactical positions in TIPS worked in the fund's favor in the first half of the period amid concerns about the potential for higher inflation. Security selection among MBS was another plus, particularly an emphasis on prepayment-resistant hybrid adjustable-rate mortgages (ARMs) and "seasoned" securities.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Fidelity Intermediate Government Income Fund

Investment Changes (Unaudited)

Coupon Distribution as of July 31, 2010 |

| % of fund's investments | % of fund's investments

6 months ago |

0.01 - 0.99% | 6.5 | 7.0 |

1 - 1.99% | 20.9 | 15.8 |

2 - 2.99% | 16.8 | 20.1 |

3 - 3.99% | 38.4 | 34.2 |

4 - 4.99% | 8.6 | 10.4 |

5 - 5.99% | 5.7 | 3.9 |

6% and over | 2.9 | 2.9 |

Coupon distribution shows the range of stated interest rates on the fund's investments, excluding short-term investments. |

Weighted Average Maturity as of July 31, 2010 |

| | 6 months ago |

Years | 4.7 | 4.2 |

Weighted Average Maturity (WAM) is a weighted average of all the maturities of the securities held in a fund. The weighted average maturity is based on the dollar-weighted average length of time until principal payments are expected or until securities reach maturity, taking into account any maturity shortening feature such as a call, refunding or redemption provision if it is probable that the issuer of the instrument will take advantage of such features. |

Duration as of July 31, 2010 |

| | 6 months ago |

Years | 3.6 | 3.6 |

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five-year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund's performance and share price. Accordingly, a bond fund's actual performance may differ from this example. |

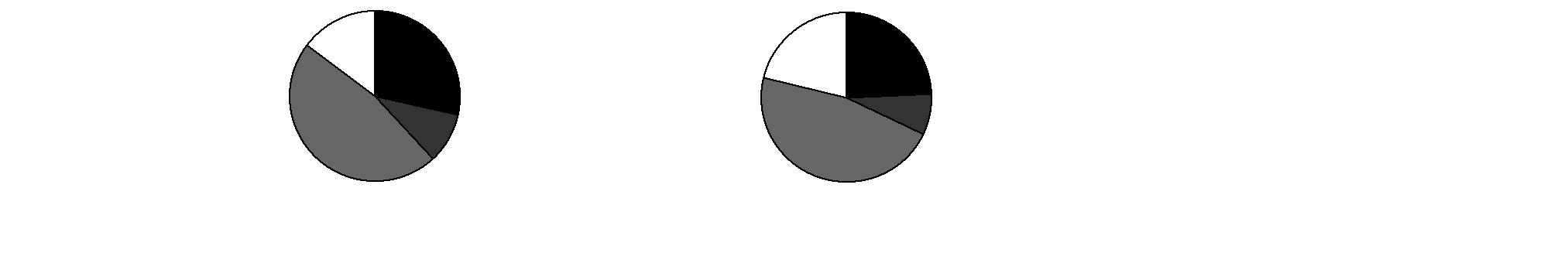

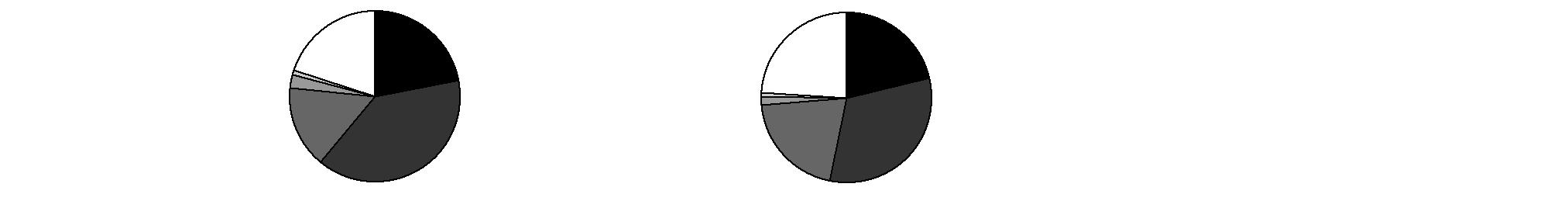

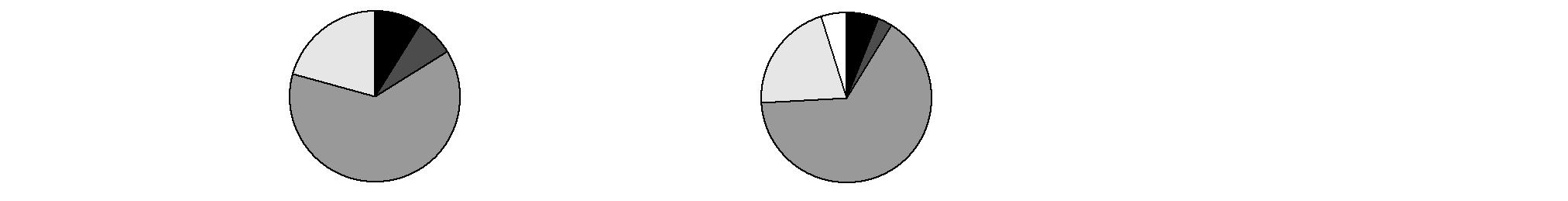

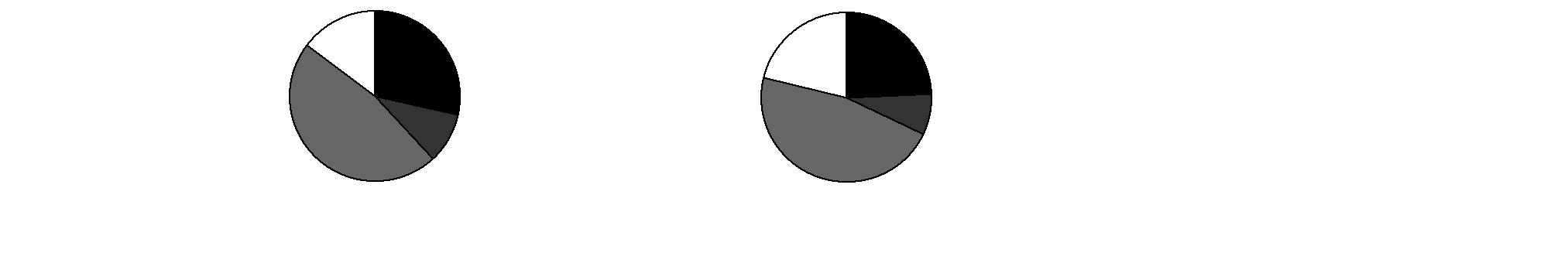

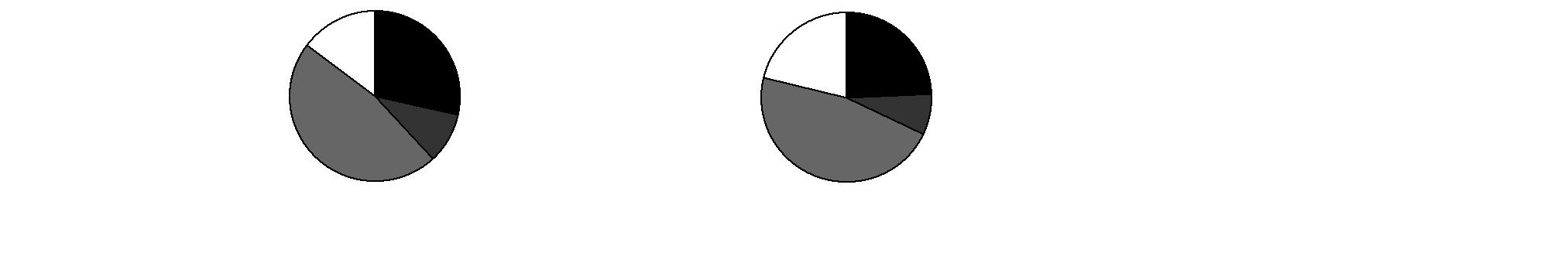

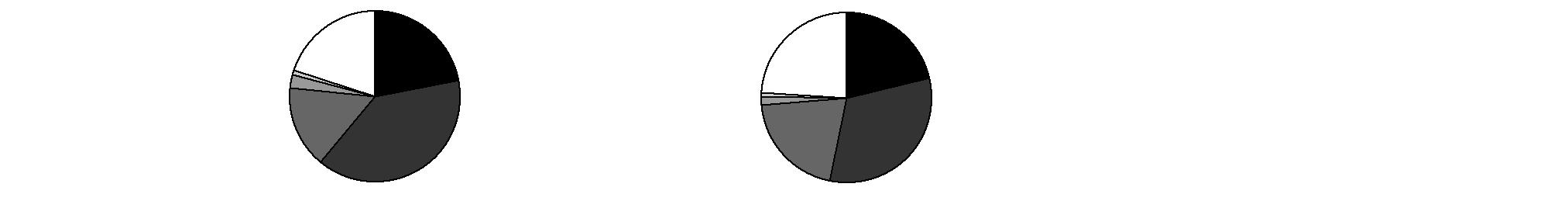

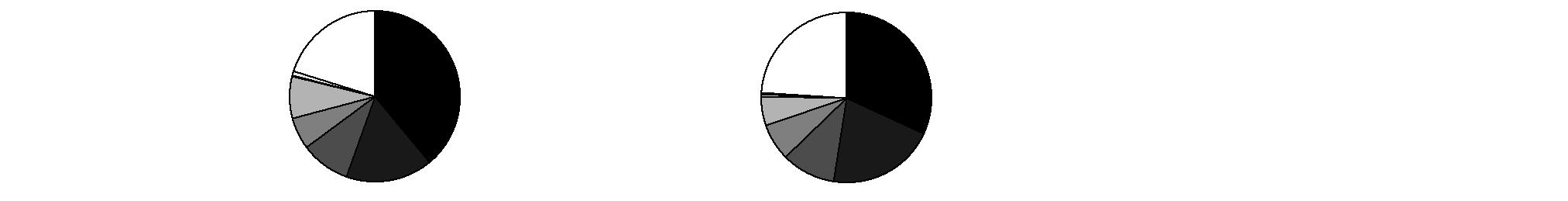

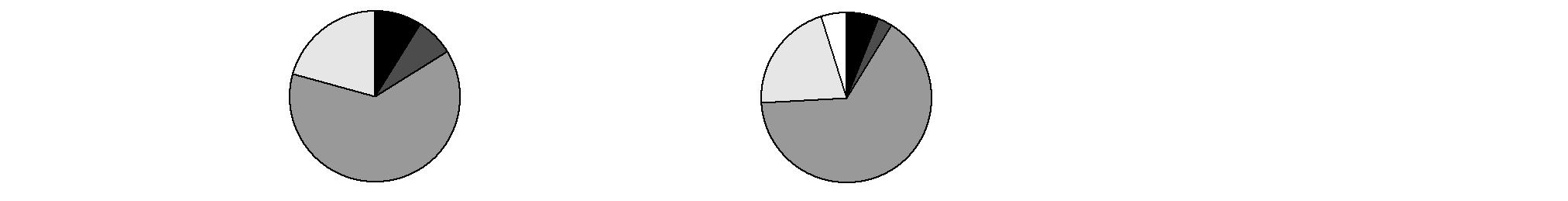

Asset Allocation (% of fund's net assets) |

As of July 31, 2010 * | As of January 31, 2010 ** |

| Mortgage Securities 9.0% | |  | Mortgage Securities 6.0% | |

| CMOs and

Other Mortgage

Related Securities 7.4% | |  | CMOs and Other Mortgage Related Securities 2.8% | |

| U.S. Treasury

Obligations 63.6% | |  | U.S. Treasury

Obligations 65.3% | |

| U.S. Government

Agency Obligations † 20.9% | |  | U.S. Government

Agency Obligations † 21.0% | |

| Short-Term

Investments and

Net Other Assets†† (0.9)% | |  | Short-Term

Investments and

Net Other Assets 4.9% | |

* Futures and Swaps | 0.0% | | ** Futures and Swaps | 1.0% | |

† Includes FDIC Guaranteed Corporate Securities. †† Short-Term Investments and Net Other Assets are not included in pie chart. |

Annual Report

Fidelity Intermediate Government Income Fund

Investments July 31, 2010

Showing Percentage of Net Assets

U.S. Government and Government Agency Obligations - 84.5% |

| Principal Amount (000s) | | Value (000s) |

U.S. Government Agency Obligations - 10.2% |

Fannie Mae: | | | | |

1.125% 7/30/12 | | $ 37,060 | | $ 37,393 |

1.25% 8/20/13 | | 6,900 | | 6,944 |

Federal Home Loan Bank: | | | | |

0.875% 8/22/12 | | 2,100 | | 2,107 |

1.5% 1/16/13 | | 5,055 | | 5,134 |

1.875% 6/21/13 | | 12,060 | | 12,372 |

3.625% 10/18/13 | | 8,395 | | 9,082 |

Freddie Mac: | | | | |

1.625% 4/15/13 | | 5,100 | | 5,198 |

1.75% 6/15/12 | | 41,361 | | 42,212 |

Israeli State (guaranteed by U.S. Government through Agency for International Development) 6.8% 2/15/12 | | 4,000 | | 4,126 |

Private Export Funding Corp. secured: | | | | |

4.974% 8/15/13 | | 3,435 | | 3,826 |

5.66% 9/15/11 (a) | | 9,000 | | 9,492 |

5.685% 5/15/12 | | 3,915 | | 4,267 |

Small Business Administration guaranteed development participation certificates Series 2004-20H Class 1, 5.17% 8/1/24 | | 544 | | 589 |

U.S. Department of Housing and Urban Development Government guaranteed participation certificates Series 1999-A, 6.06% 8/1/10 | | 1,480 | | 1,480 |

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS | | 144,222 |

U.S. Treasury Inflation Protected Obligations - 7.4% |

U.S. Treasury Inflation-Indexed Notes 3% 7/15/12 | | 99,258 | | 105,653 |

U.S. Treasury Obligations - 56.2% |

U.S. Treasury Bonds 8.75% 5/15/17 | | 14,750 | | 20,844 |

U.S. Treasury Notes: | | | | |

0.625% 6/30/12 | | 8,638 | | 8,653 |

0.625% 7/31/12 | | 15,000 | | 15,021 |

1% 12/31/11 | | 3,011 | | 3,036 |

1% 4/30/12 | | 1,026 | | 1,035 |

1% 7/15/13 | | 1,514 | | 1,522 |

1.375% 2/15/12 | | 5,637 | | 5,718 |

1.375% 10/15/12 | | 2,075 | | 2,109 |

1.375% 11/15/12 | | 5,078 | | 5,164 |

1.375% 2/15/13 | | 9,255 | | 9,410 |

1.5% 10/31/10 | | 80 | | 80 |

1.5% 12/31/13 | | 4,659 | | 4,741 |

U.S. Government and Government Agency Obligations - continued |

| Principal Amount (000s) | | Value (000s) |

U.S. Treasury Obligations - continued |

U.S. Treasury Notes: - continued | | | | |

1.75% 4/15/13 | | $ 38,535 | | $ 39,571 |

1.875% 4/30/14 | | 1,550 | | 1,593 |

1.875% 6/30/15 | | 35,554 | | 36,076 |

2.375% 8/31/14 | | 9,290 | | 9,705 |

2.375% 9/30/14 | | 13,422 | | 14,019 |

2.375% 10/31/14 | | 16,136 | | 16,836 |

2.375% 7/31/17 | | 12,000 | | 12,053 |

2.5% 3/31/15 | | 42,900 | | 44,901 |

2.5% 4/30/15 | | 1,940 | | 2,030 |

2.5% 6/30/17 | | 1,800 | | 1,825 |

2.625% 4/30/16 | | 29,640 | | 30,770 |

2.75% 10/31/13 | | 55,000 | | 58,248 |

2.75% 2/15/19 | | 2,505 | | 2,522 |

3% 9/30/16 | | 32,641 | | 34,378 |

3% 2/28/17 | | 30,674 | | 32,131 |

3.125% 8/31/13 | | 19,105 | | 20,430 |

3.125% 9/30/13 | | 47,650 | | 50,993 |

3.125% 10/31/16 | | 33,540 | | 35,521 |

3.125% 1/31/17 | | 27,081 | | 28,598 |

3.125% 5/15/19 | | 26,941 | | 27,756 |

3.375% 6/30/13 | | 26,378 | | 28,358 |

3.5% 2/15/18 | | 20,117 | | 21,715 |

3.5% 5/15/20 | | 14,175 | | 14,884 |

3.625% 8/15/19 | | 17,290 | | 18,429 |

3.625% 2/15/20 | | 11,372 | | 12,070 |

3.75% 11/15/18 | | 15,261 | | 16,617 |

3.875% 2/15/13 | | 5,752 | | 6,227 |

3.875% 5/15/18 | | 2,578 | | 2,848 |

4% 8/15/18 | | 22,133 | | 24,583 |

4.25% 11/15/17 | | 6,260 | | 7,091 |

4.5% 5/15/17 | | 19,369 | | 22,190 |

4.625% 2/15/17 | | 14,625 | | 16,829 |

4.75% 8/15/17 | | 23,339 | | 27,188 |

TOTAL U.S. TREASURY OBLIGATIONS | | 796,318 |

Other Government Related - 10.7% |

Bank of America Corp.: | | | | |

2.1% 4/30/12 (FDIC Guaranteed) (b) | | 1,493 | | 1,530 |

3.125% 6/15/12 (FDIC Guaranteed) (b) | | 305 | | 319 |

Citibank NA 1.875% 5/7/12 (FDIC Guaranteed) (b) | | 22,000 | | 22,468 |

U.S. Government and Government Agency Obligations - continued |

| Principal Amount (000s) | | Value (000s) |

Other Government Related - continued |

Citigroup Funding, Inc.: | | | | |

1.875% 10/22/12 (FDIC Guaranteed) (b) | | $ 20,600 | | $ 21,079 |

1.875% 11/15/12 (FDIC Guaranteed) (b) | | 3,800 | | 3,888 |

2% 3/30/12 (FDIC Guaranteed) (b) | | 10,000 | | 10,212 |

2.125% 7/12/12 (FDIC Guaranteed) (b) | | 2,384 | | 2,449 |

General Electric Capital Corp.: | | | | |

1.8% 3/11/11 (FDIC Guaranteed) (b) | | 15,000 | | 15,143 |

2% 9/28/12 (FDIC Guaranteed) (b) | | 13,000 | | 13,327 |

2.625% 12/28/12 (FDIC Guaranteed) (b) | | 4,364 | | 4,549 |

3% 12/9/11 (FDIC Guaranteed) (b) | | 1,030 | | 1,065 |

GMAC, Inc. 1.75% 10/30/12 (FDIC Guaranteed) (b) | | 15,000 | | 15,320 |

Goldman Sachs Group, Inc. 3.25% 6/15/12 (FDIC Guaranteed) (b) | | 306 | | 321 |

JPMorgan Chase & Co.: | | | | |

2.2% 6/15/12 (FDIC Guaranteed) (b) | | 2,260 | | 2,326 |

3.125% 12/1/11 (FDIC Guaranteed) (b) | | 170 | | 176 |

Morgan Stanley 3.25% 12/1/11 (FDIC Guaranteed) (b) | | 36,180 | | 37,469 |

TOTAL OTHER GOVERNMENT RELATED | | 151,641 |

TOTAL U.S. GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS (Cost $1,160,728) | 1,197,834 |

U.S. Government Agency - Mortgage Securities - 9.0% |

|

Fannie Mae - 4.2% |

1.942% 10/1/33 (e) | | 19 | | 19 |

1.969% 4/1/36 (e) | | 464 | | 477 |

1.975% 12/1/34 (e) | | 41 | | 42 |

1.985% 4/1/36 (e) | | 95 | | 98 |

1.989% 2/1/33 (e) | | 38 | | 39 |

1.99% 3/1/35 (e) | | 36 | | 37 |

2.02% 7/1/35 (e) | | 544 | | 565 |

2.125% 7/1/35 (e) | | 19 | | 20 |

2.136% 3/1/35 (e) | | 7 | | 7 |

2.411% 7/1/35 (e) | | 234 | | 241 |

2.47% 5/1/34 (e) | | 352 | | 368 |

2.582% 3/1/35 (e) | | 25 | | 26 |

2.693% 7/1/36 (e) | | 170 | | 177 |

2.73% 11/1/33 (e) | | 118 | | 123 |

2.785% 8/1/35 (e) | | 1,095 | | 1,148 |

U.S. Government Agency - Mortgage Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Fannie Mae - continued |

2.799% 10/1/33 (e) | | $ 37 | | $ 39 |

2.805% 7/1/35 (e) | | 1,184 | | 1,235 |

2.889% 2/1/35 (e) | | 2,069 | | 2,160 |

2.962% 3/1/33 (e) | | 110 | | 115 |

2.989% 10/1/35 (e) | | 57 | | 59 |

2.99% 11/1/36 (e) | | 237 | | 249 |

3.018% 1/1/35 (e) | | 187 | | 195 |

3.042% 2/1/34 (e) | | 14 | | 14 |

3.079% 7/1/35 (e) | | 50 | | 53 |

3.093% 10/1/35 (e) | | 820 | | 852 |

3.213% 7/1/35 (e) | | 192 | | 200 |

3.213% 4/1/36 (e) | | 300 | | 315 |

3.221% 7/1/35 (e) | | 748 | | 783 |

3.26% 9/1/34 (e) | | 323 | | 335 |

3.308% 8/1/35 (e) | | 555 | | 587 |

3.358% 7/1/34 (e) | | 22 | | 22 |

3.359% 1/1/40 (e) | | 14,032 | | 14,598 |

3.391% 4/1/35 (e) | | 525 | | 550 |

3.407% 10/1/37 (e) | | 331 | | 346 |

3.488% 2/1/36 (e) | | 523 | | 547 |

3.5% 8/1/25 (c) | | 21,000 | | 21,600 |

3.564% 11/1/36 (e) | | 243 | | 254 |

3.619% 2/1/37 (e) | | 432 | | 451 |

3.633% 6/1/47 (e) | | 108 | | 113 |

3.639% 9/1/35 (e) | | 292 | | 305 |

3.697% 6/1/36 (e) | | 29 | | 30 |

3.875% 9/1/36 (e) | | 139 | | 146 |

4% 9/1/13 | | 191 | | 197 |

4.162% 10/1/35 (e) | | 270 | | 280 |

4.783% 7/1/35 (e) | | 229 | | 239 |

5% 2/1/16 to 4/1/22 | | 275 | | 293 |

5.032% 2/1/34 (e) | | 342 | | 358 |

5.495% 2/1/36 (e) | | 72 | | 74 |

5.587% 4/1/36 (e) | | 481 | | 503 |

5.738% 5/1/36 (e) | | 100 | | 105 |

5.883% 4/1/36 (e) | | 1,270 | | 1,315 |

6% 6/1/16 to 3/1/34 | | 2,095 | | 2,302 |

6% 8/1/40 (c)(d) | | 2,000 | | 2,173 |

6.074% 3/1/37 (e) | | 91 | | 97 |

6.5% 6/1/16 to 7/1/32 | | 1,111 | | 1,217 |

7% 3/1/12 to 9/1/14 | | 90 | | 94 |

9% 2/1/13 | | 12 | | 12 |

U.S. Government Agency - Mortgage Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Fannie Mae - continued |

10.25% 10/1/18 | | $ 3 | | $ 3 |

11% 9/1/14 to 1/1/16 | | 14 | | 16 |

11.25% 5/1/14 to 1/1/16 | | 25 | | 29 |

11.5% 1/1/13 to 6/15/19 | | 49 | | 54 |

12.25% 8/1/13 | | 2 | | 2 |

12.5% 9/1/12 to 7/1/16 | | 78 | | 90 |

12.75% 10/1/11 to 4/1/12 | | 8 | | 8 |

13% 7/1/13 to 10/1/14 | | 30 | | 34 |

13.25% 9/1/11 | | 12 | | 12 |

13.5% 11/1/14 to 12/1/14 | | 9 | | 10 |

15% 4/1/12 | | 1 | | 1 |

| | 59,058 |

Freddie Mac - 0.8% |

1.791% 3/1/37 (e) | | 481 | | 493 |

1.866% 5/1/37 (e) | | 83 | | 85 |

1.903% 3/1/35 (e) | | 139 | | 143 |

2.394% 5/1/37 (e) | | 498 | | 520 |

2.396% 7/1/35 (e) | | 1,023 | | 1,056 |

2.409% 5/1/37 (e) | | 759 | | 794 |

2.415% 6/1/33 (e) | | 236 | | 244 |

2.605% 4/1/34 (e) | | 852 | | 890 |

2.613% 12/1/33 (e) | | 497 | | 519 |

2.625% 5/1/35 (e) | | 441 | | 461 |

2.698% 6/1/35 (e) | | 80 | | 84 |

2.738% 10/1/35 (e) | | 311 | | 323 |

2.865% 11/1/35 (e) | | 265 | | 277 |

3.086% 4/1/37 (e) | | 80 | | 84 |

3.165% 1/1/35 (e) | | 602 | | 630 |

3.392% 3/1/37 (e) | | 92 | | 96 |

3.396% 7/1/35 (e) | | 264 | | 276 |

3.499% 10/1/36 (e) | | 311 | | 323 |

3.538% 3/1/33 (e) | | 7 | | 7 |

3.682% 5/1/37 (e) | | 69 | | 73 |

3.95% 12/1/36 (e) | | 1,122 | | 1,172 |

4.431% 2/1/36 (e) | | 58 | | 61 |

4.695% 7/1/35 (e) | | 199 | | 210 |

5.253% 2/1/36 (e) | | 24 | | 25 |

5.403% 1/1/36 (e) | | 265 | | 275 |

5.462% 6/1/37 (e) | | 201 | | 211 |

5.515% 1/1/36 (e) | | 233 | | 244 |

5.551% 3/1/36 (e) | | 799 | | 831 |

U.S. Government Agency - Mortgage Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Freddie Mac - continued |

5.554% 10/1/35 (e) | | $ 39 | | $ 41 |

6.009% 6/1/37 (e) | | 27 | | 28 |

6.122% 7/1/36 (e) | | 107 | | 113 |

6.23% 8/1/37 (e) | | 168 | | 178 |

6.458% 2/1/37 (e) | | 60 | | 63 |

6.5% 12/1/21 | | 475 | | 516 |

7.22% 4/1/37 (e) | | 4 | | 4 |

9% 7/1/16 | | 19 | | 21 |

9.5% 7/1/16 to 8/1/21 | | 141 | | 159 |

10% 4/1/15 to 3/1/21 | | 264 | | 302 |

10.5% 1/1/21 | | 3 | | 3 |

11% 9/1/20 | | 11 | | 13 |

11.25% 6/1/14 | | 32 | | 36 |

11.5% 10/1/15 to 1/1/16 | | 22 | | 25 |

12% 2/1/13 to 11/1/19 | | 25 | | 27 |

12.25% 11/1/13 to 8/1/15 | | 22 | | 24 |

12.5% 2/1/11 to 6/1/19 | | 203 | | 229 |

13% 11/1/12 to 5/1/17 | | 31 | | 34 |

13.5% 8/1/11 | | 3 | | 3 |

14% 11/1/12 to 4/1/16 | | 3 | | 3 |

| | 12,229 |

Ginnie Mae - 4.0% |

5.5% 1/20/60 to 3/20/60 (f) | | 50,202 | | 55,944 |

8% 12/15/23 | | 248 | | 284 |

8.5% 6/15/16 to 2/15/17 | | 3 | | 4 |

10.5% 9/15/15 to 10/15/21 | | 395 | | 470 |

11% 5/20/16 to 1/20/21 | | 31 | | 37 |

13% 1/15/11 to 10/15/13 | | 11 | | 12 |

13.25% 8/15/14 | | 6 | | 7 |

13.5% 12/15/14 | | 1 | | 2 |

14% 6/15/11 | | 2 | | 2 |

| | 56,762 |

TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $124,453) | 128,049 |

Collateralized Mortgage Obligations - 7.4% |

| Principal Amount (000s) | | Value (000s) |

U.S. Government Agency - 7.4% |

Fannie Mae: | | | | |

floater: | | | | |

Series 1994-42 Class FK, 2.67% 4/25/24 (e) | | $ 2,078 | | $ 2,059 |

Series 2006-56 Class PF, 0.6788% 7/25/36 (e) | | 4,462 | | 4,441 |

planned amortization class: | | | | |

Series 1988-21 Class G, 9.5% 8/25/18 | | 48 | | 55 |

Series 2003-28 Class KG, 5.5% 4/25/23 | | 725 | | 805 |

Series 2006-127 Class FD, 0.6088% 7/25/36 (e) | | 4,043 | | 4,020 |

Series 2006-44 Class FK, 0.7588% 6/25/36 (e) | | 1,534 | | 1,532 |

Fannie Mae subordinate REMIC pass-thru certificates: | | | | |

floater: | | | | |

Series 2001-38 Class QF, 1.3088% 8/25/31 (e) | | 385 | | 392 |

Series 2002-60 Class FV, 1.3288% 4/25/32 (e) | | 131 | | 134 |

Series 2002-74 Class FV, 0.7788% 11/25/32 (e) | | 2,194 | | 2,196 |

Series 2002-75 Class FA, 1.3288% 11/25/32 (e) | | 269 | | 274 |

Series 2005-56 Class F, 0.6188% 7/25/35 (e) | | 5,914 | | 5,861 |

Series 2006-50 Class BF, 0.7288% 6/25/36 (e) | | 4,658 | | 4,647 |

Series 2006-79 Class PF, 0.7288% 8/25/36 (e) | | 3,060 | | 3,045 |

planned amortization class: | | | | |

Series 2002-16 Class PG, 6% 4/25/17 | | 687 | | 744 |

Series 2002-9 Class PC, 6% 3/25/17 | | 50 | | 54 |

Series 2004-80 Class LD, 4% 1/25/19 | | 980 | | 1,034 |

Series 2004-81 Class KD, 4.5% 7/25/18 | | 1,315 | | 1,406 |

Series 2005-52 Class PB, 6.5% 12/25/34 | | 669 | | 730 |

sequential payer: | | | | |

Series 2002-56 Class MC, 5.5% 9/25/17 | | 197 | | 214 |

Series 2002-57 Class BD, 5.5% 9/25/17 | | 175 | | 192 |

Series 2004-72 Class CB, 4% 9/25/19 | | 5,000 | | 5,390 |

Series 2003-79 Class FC, 0.7788% 8/25/33 (e) | | 3,205 | | 3,206 |

Series 2008-76 Class EF, 0.8288% 9/25/23 (e) | | 1,798 | | 1,797 |

Freddie Mac floater Series 237 Class F16, 0.8409% 5/15/36 (e) | | 3,196 | | 3,193 |

Freddie Mac Multi-class participation certificates guaranteed: | | | | |

floater: | | | | |

Series 2526 Class FC, 0.7409% 11/15/32 (e) | | 468 | | 467 |

Series 2630 Class FL, 0.8409% 6/15/18 (e) | | 58 | | 59 |

Series 2925 Class CQ, 0% 1/15/35 (e) | | 46 | | 44 |

Series 3247 Class F, 0.6909% 8/15/36 (e) | | 4,438 | | 4,401 |

Series 3255 Class FC, 0.6409% 12/15/36 (e) | | 4,981 | | 4,937 |

Series 3279 Class FB, 0.6609% 2/15/37 (e) | | 1,414 | | 1,409 |

Collateralized Mortgage Obligations - continued |

| Principal Amount (000s) | | Value (000s) |

U.S. Government Agency - continued |

Freddie Mac Multi-class participation certificates guaranteed: - continued | | | | |

floater: | | | | |

Series 3346 Class FA, 0.5709% 2/15/19 (e) | | $ 9,001 | | $ 8,997 |

planned amortization class: | | | | |

Series 2356 Class GD, 6% 9/15/16 | | 204 | | 220 |

Series 2376 Class JE, 5.5% 11/15/16 | | 187 | | 204 |

Series 2381 Class OG, 5.5% 11/15/16 | | 135 | | 147 |

Series 2425 Class JH, 6% 3/15/17 | | 243 | | 266 |

Series 2628 Class OE, 4.5% 6/15/18 | | 705 | | 770 |

Series 2640 Class GE, 4.5% 7/15/18 | | 3,690 | | 4,018 |

Series 2695 Class DG, 4% 10/15/18 | | 1,635 | | 1,754 |

Series 2802 Class OB, 6% 5/15/34 | | 1,355 | | 1,551 |

Series 2810 Class PD, 6% 6/15/33 | | 1,080 | | 1,147 |

Series 2831 Class PB, 5% 7/15/19 | | 1,975 | | 2,186 |

Series 2866 Class XE, 4% 12/15/18 | | 2,895 | | 3,056 |

Series 3122 Class FE, 0.6409% 3/15/36 (e) | | 4,019 | | 4,003 |

Series 3147 Class PF, 0.6409% 4/15/36 (e) | | 3,382 | | 3,364 |

sequential payer: | | | | |

Series 1929 Class EZ, 7.5% 2/17/27 | | 1,493 | | 1,630 |

Series 2570 Class CU, 4.5% 7/15/17 | | 76 | | 79 |

Series 2572 Class HK, 4% 2/15/17 | | 86 | | 88 |

Series 2668 Class AZ, 4% 9/15/18 | | 1,984 | | 2,146 |

Series 2729 Class GB, 5% 1/15/19 | | 974 | | 1,044 |

Series 2860 Class CP, 4% 10/15/17 | | 55 | | 56 |

Series 2998 Class LY, 5.5% 7/15/25 | | 295 | | 331 |

Series 3007 Class EW, 5.5% 7/15/25 | | 1,125 | | 1,265 |

Series 3013 Class VJ, 5% 1/15/14 | | 1,149 | | 1,218 |

Series 2715 Class NG, 4.5% 12/15/18 | | 890 | | 978 |

Series 2769 Class BU, 5% 3/15/34 | | 142 | | 143 |

Ginnie Mae guaranteed REMIC pass-thru securities: | | | | |

floater 0.6381% 1/20/31 (e) | | 2,131 | | 2,132 |

0.6416% 8/1/60 (c)(e)(f) | | 3,481 | | 3,496 |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $102,324) | 105,027 |

Cash Equivalents - 0.1% |

| Maturity Amount (000s) | | Value (000s) |

Investments in repurchase agreements in a joint trading account at 0.21%, dated 7/30/10 due 8/2/10 (Collateralized by U.S. Government Obligations) #

(Cost $761) | $ 761 | | $ 761 |

TOTAL INVESTMENT PORTFOLIO - 101.0% (Cost $1,388,266) | | 1,431,671 |

NET OTHER ASSETS (LIABILITIES) - (1.0)% | | (14,201) |

NET ASSETS - 100% | $ 1,417,470 |

Legend |

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $9,492,000 or 0.7% of net assets. |

(b) Under the Temporary Liquidity Guarantee Program, the Federal Deposit Insurance Corporation guarantees principal and interest in the event of payment default or bankruptcy until the earlier of maturity date of the debt or until June 30, 2012. At the end of the period these securities amounted to $151,641,000 or 10.7% of net assets. |

(c) Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

(d) A portion of the security is subject to a forward commitment to sell. |

(e) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

(f) Represents an investment in an underlying pool of reverse mortgages which typically do not require regular principal and interest payments as repayment is deferred until a maturity event. |

# Additional information on each counterparty to the repurchase agreement is as follows: |

Repurchase Agreement / Counterparty | Value

(Amounts in thousands) |

$761,000 due 8/02/10 at 0.21% |

Banc of America Securities LLC | $ 52 |

Bank of America NA | 26 |

Deutsche Bank Securities, Inc. | 194 |

Goldman, Sachs & Co. | 52 |

ING Financial Markets LLC | 136 |

J.P. Morgan Securities, Inc. | 8 |

Merrill Lynch Government Securities, Inc. | 47 |

Mizuho Securities USA, Inc. | 207 |

Morgan Stanley & Co., Inc. | 26 |

RBC Capital Markets Corp. | 13 |

| $ 761 |

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the tables below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value: |

(Amounts in thousands) | |

Investments in Securities: | |

Beginning Balance | $ 696 |

Total Realized Gain (Loss) | - |

Total Unrealized Gain (Loss) | 58 |

Cost of Purchases | - |

Proceeds of Sales | (754) |

Amortization/Accretion | - |

Transfers in to Level 3 | - |

Transfers out of Level 3 | - |

Ending Balance | $ - |

The change in unrealized gain (loss) for the period attributable to Level 3 securities held at July 31, 2010 | $ - |

The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Intermediate Government Income Fund

Statement of Assets and Liabilities

Amounts in thousands (except per-share amount) | July 31, 2010 |

| | |

Assets | | |

Investment in securities, at value (including repurchase agreements of $761) - See accompanying schedule: Unaffiliated issuers (cost $1,388,266) | | $ 1,431,671 |

Commitment to sell securities on a delayed delivery basis | $ (2,173) | |

Receivable for securities sold on a delayed delivery basis | 2,174 | 1 |

Receivable for investments sold, regular delivery | | 37,033 |

Receivable for fund shares sold | | 1,136 |

Interest receivable | | 9,151 |

Total assets | | 1,478,992 |

| | |

Liabilities | | |

Payable for investments purchased

Regular delivery | $ 32,778 | |

Delayed delivery | 27,012 | |

Payable for fund shares redeemed | 1,019 | |

Distributions payable | 184 | |

Accrued management fee | 372 | |

Other affiliated payables | 157 | |

Total liabilities | | 61,522 |

| | |

Net Assets | | $ 1,417,470 |

Net Assets consist of: | | |

Paid in capital | | $ 1,355,479 |

Undistributed net investment income | | 676 |

Accumulated undistributed net realized gain (loss) on investments | | 17,909 |

Net unrealized appreciation (depreciation) on investments | | 43,406 |

Net Assets, for 127,663 shares outstanding | | $ 1,417,470 |

Net Asset Value, offering price and redemption price per share ($1,417,470 ÷ 127,663 shares) | | $ 11.10 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Intermediate Government Income Fund

Financial Statements - continued

Statement of Operations

Amounts in thousands | Year ended July 31, 2010 |

| | |

Investment Income | | |

Interest | | $ 35,754 |

| | |

Expenses | | |

Management fee | $ 4,656 | |

Transfer agent fees | 1,472 | |

Fund wide operations fee | 489 | |

Independent trustees' compensation | 5 | |

Miscellaneous | 6 | |

Total expenses | | 6,628 |

Net investment income | | 29,126 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 25,665 | |

Swap agreements | 683 | |

Total net realized gain (loss) | | 26,348 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 30,294 | |

Swap agreements | (401) | |

Delayed delivery commitments | 74 | |

Total change in net unrealized appreciation (depreciation) | | 29,967 |

Net gain (loss) | | 56,315 |

Net increase (decrease) in net assets resulting from operations | | $ 85,441 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

Amounts in thousands | Year ended

July 31,

2010 | Year ended

July 31,

2009 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income | $ 29,126 | $ 37,729 |

Net realized gain (loss) | 26,348 | 39,073 |

Change in net unrealized appreciation (depreciation) | 29,967 | 12,798 |

Net increase (decrease) in net assets resulting

from operations | 85,441 | 89,600 |

Distributions to shareholders from net investment income | (28,870) | (37,002) |

Distributions to shareholders from net realized gain | (17,774) | - |

Total distributions | (46,644) | (37,002) |

Share transactions

Proceeds from sales of shares | 356,483 | 1,251,369 |

Reinvestment of distributions | 43,213 | 33,859 |

Cost of shares redeemed | (583,721) | (749,256) |

Net increase (decrease) in net assets resulting from share transactions | (184,025) | 535,972 |

Total increase (decrease) in net assets | (145,228) | 588,570 |

| | |

Net Assets | | |

Beginning of period | 1,562,698 | 974,128 |

End of period (including undistributed net investment income of $676 and undistributed net investment income of $697, respectively) | $ 1,417,470 | $ 1,562,698 |

Other Information Shares | | |

Sold | 32,895 | 117,192 |

Issued in reinvestment of distributions | 3,989 | 3,156 |

Redeemed | (53,973) | (69,652) |

Net increase (decrease) | (17,089) | 50,696 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

Years ended July 31, | 2010 | 2009 | 2008 | 2007 | 2006 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 10.80 | $ 10.36 | $ 9.97 | $ 9.92 | $ 10.11 |

Income from Investment Operations | | | | | |

Net investment income B | .214 | .278 | .398 | .435 | .414 |

Net realized and unrealized gain (loss) | .423 | .439 | .413 | .067 | (.219) |

Total from investment operations | .637 | .717 | .811 | .502 | .195 |

Distributions from net investment income | (.212) | (.277) | (.421) | (.452) | (.385) |

Distributions from net realized gain | (.125) | - | - | - | - |

Total distributions | (.337) | (.277) | (.421) | (.452) | (.385) |

Net asset value, end of period | $ 11.10 | $ 10.80 | $ 10.36 | $ 9.97 | $ 9.92 |

Total Return A | 6.02% | 6.98% | 8.24% | 5.14% | 1.97% |

Ratios to Average Net Assets C | | | | | |

Expenses before reductions | .45% | .45% | .45% | .45% | .45% |

Expenses net of fee waivers,

if any | .45% | .45% | .45% | .45% | .45% |

Expenses net of all reductions | .45% | .45% | .45% | .45% | .45% |

Net investment income | 1.98% | 2.59% | 3.86% | 4.36% | 4.14% |

Supplemental Data | | | | | |

Net assets, end of period

(in millions) | $ 1,417 | $ 1,563 | $ 974 | $ 700 | $ 759 |

Portfolio turnover rate | 227% | 305% | 318% | 121% | 97% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Calculated based on average shares outstanding during the period.

C Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

See accompanying notes which are an integral part of the financial statements.

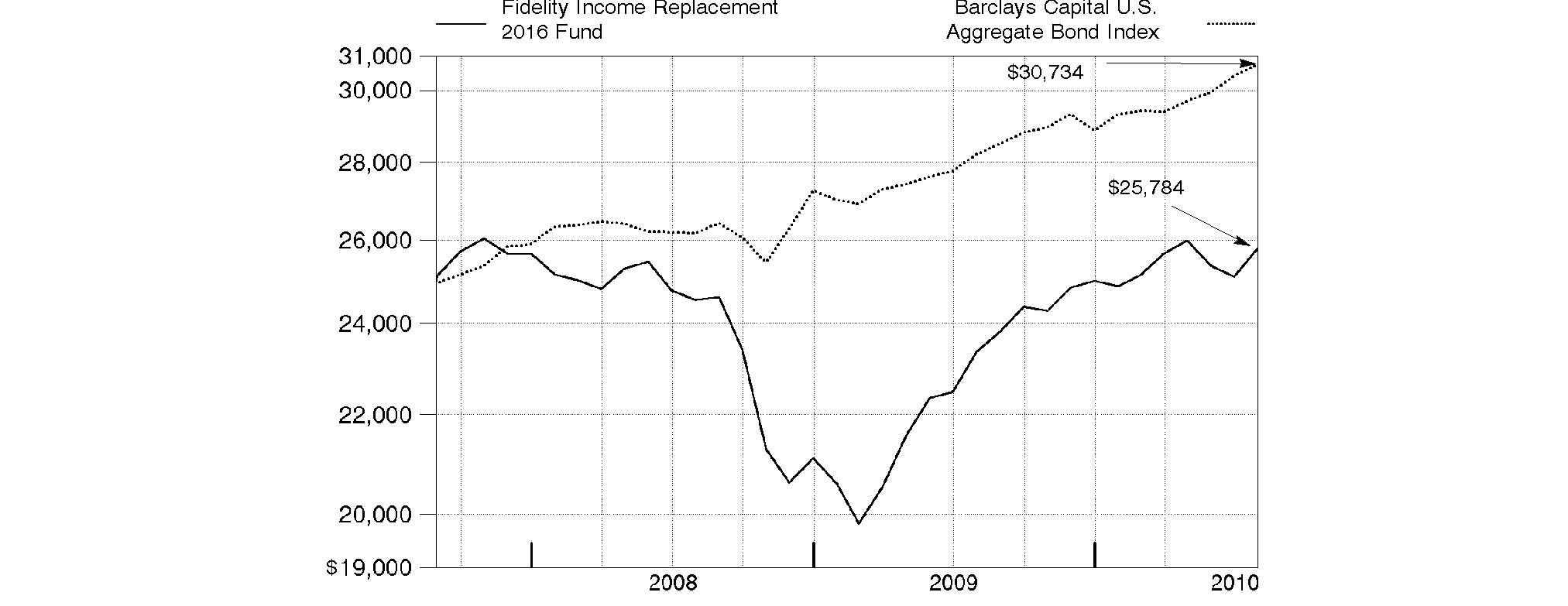

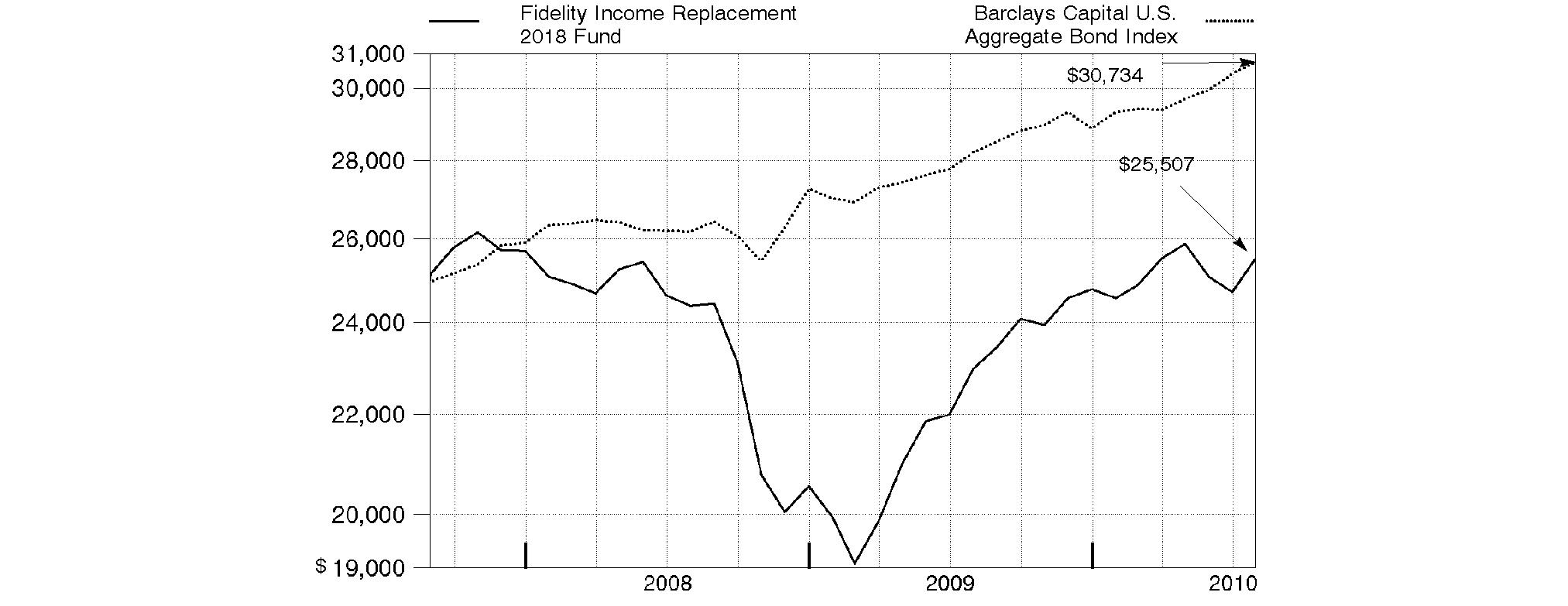

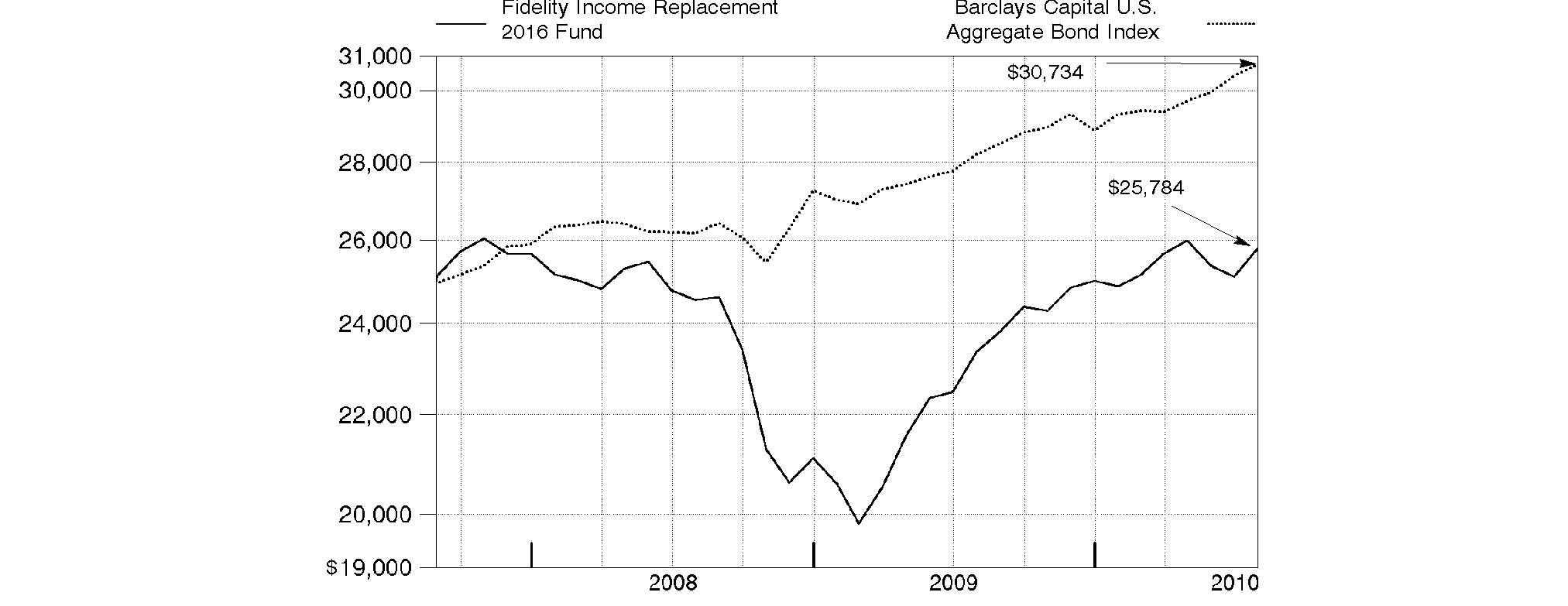

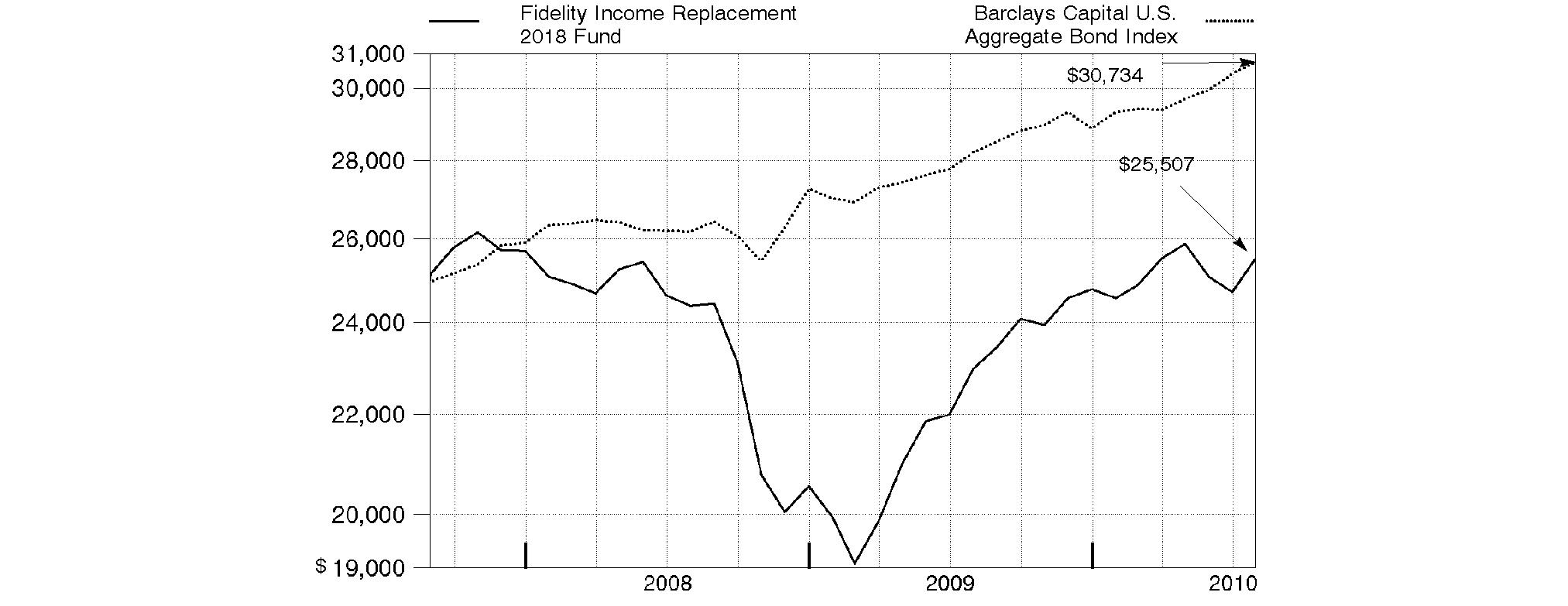

Annual Report

Notes to Financial Statements

For the period ended July 31, 2010

(Amounts in thousands except ratios)

1. Organization.

Fidelity GNMA Fund (formerly Fidelity Ginnie Mae Fund) and Fidelity Intermediate Government Income Fund (the Funds) are funds of Fidelity Income Fund (the Trust). The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Each Fund is authorized to issue an unlimited number of shares.

2. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Funds:

Security Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. Each Fund uses independent pricing services approved by the Board of Trustees to value their investments. When current market prices or quotations are not readily available or reliable, valuations may be determined in good faith in accordance with procedures adopted by the Board of Trustees. Factors used in determining value may include market or security specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The value used for net asset value (NAV) calculation under these procedures may differ from published prices for the same securities.

Each Fund categorizes the inputs to valuation techniques used to value their investments into a disclosure hierarchy consisting of three levels as shown below.

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the fund's own assumptions based on the best information available)