- NNN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

National Retail Properties (NNN) 8-KResults of Operations and Financial Condition

Filed: 11 Feb 25, 8:30am

Exhibit 99.2

ANNUAL SUPPLEMENTAL DATA

|

As of December 31, 2024

TABLE OF CONTENTS

| PAGE |

Financial Summary |

|

4 | |

5 | |

6 | |

7 | |

8 | |

8 | |

9 | |

10 | |

11 | |

11 | |

12 | |

Transaction Summary |

|

13 | |

13 | |

Property Portfolio |

|

14 | |

15 | |

15 | |

16 | |

17 | |

18 | |

18 | |

19 | |

19 |

2

Statements in this annual supplemental data that are not strictly historical are “forward-looking” statements. These statements generally are characterized by the use of terms such as "believe," "expect," "intend," "may," "estimated," or other similar words or expressions. Forward-looking statements involve known and unknown risks, which may cause the company’s actual future results to differ materially from expected results. These risks include, among others, general economic conditions, including inflation, local real estate conditions, changes in interest rates, increases in operating costs, the preferences and financial condition of the company's tenants, the availability of capital, risks related to the company's status as a real estate investment trust ("REIT") and the potential impacts of an epidemic or pandemic on the company's business operations, financial results and financial position and on the world economy. Additional information concerning these and other factors that could cause actual results to differ materially from these forward-looking statements is contained from time to time in the company’s Securities and Exchange Commission (the “Commission”) filings, including, but not limited to, the company’s Annual Report on Form 10-K for the year ended December 31, 2024.

Copies of each filing may be obtained from the company or the Commission. Such forward-looking statements should be regarded solely as reflections of the company’s current operating plans and estimates. Actual operating results may differ materially from what is expressed or forecast in this press release. NNN REIT, Inc. undertakes no obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date these statements were made.

3

INCOME STATEMENT SUMMARY |

(dollars in thousands, except per share data)

(unaudited)

|

| Quarter Ended |

|

| Year Ended |

|

| ||||||||||

|

| December 31, |

|

| December 31, |

|

| ||||||||||

|

| 2024 |

|

| 2023 |

|

| 2024 |

|

| 2023 |

|

| ||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Rental income |

| $ | 218,348 |

|

| $ | 215,178 |

|

| $ | 867,468 |

|

| $ | 826,090 |

|

|

Interest and other income from real estate transactions |

|

| 134 |

|

|

| 1,053 |

|

|

| 1,798 |

|

|

| 2,021 |

|

|

|

| 218,482 |

|

|

| 216,231 |

|

|

| 869,266 |

|

|

| 828,111 |

|

| |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

General and administrative |

|

| 8,705 |

|

|

| 10,530 |

|

|

| 44,287 |

|

|

| 43,746 |

|

|

Real estate |

|

| 11,142 |

|

|

| 8,237 |

|

|

| 32,317 |

|

|

| 28,378 |

|

|

Depreciation and amortization |

|

| 63,194 |

|

|

| 60,079 |

|

|

| 249,681 |

|

|

| 238,625 |

|

|

Leasing transaction costs |

|

| 24 |

|

|

| 76 |

|

|

| 99 |

|

|

| 299 |

|

|

Impairment losses – real estate, net of recoveries |

|

| 3,724 |

|

|

| 2,315 |

|

|

| 6,632 |

|

|

| 5,990 |

|

|

Executive retirement costs |

|

| 42 |

|

|

| 2,569 |

|

|

| 668 |

|

|

| 3,454 |

|

|

|

| 86,831 |

|

|

| 83,806 |

|

|

| 333,684 |

|

|

| 320,492 |

|

| |

Gain on disposition of real estate |

|

| 12,083 |

|

|

| 7,263 |

|

|

| 42,290 |

|

|

| 47,485 |

|

|

Earnings from operations |

|

| 143,734 |

|

|

| 139,688 |

|

|

| 577,872 |

|

|

| 555,104 |

|

|

Other expenses (revenues): |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Interest and other income |

|

| (1,040 | ) |

|

| (383 | ) |

|

| (2,980 | ) |

|

| (1,134 | ) |

|

Interest expense |

|

| 46,880 |

|

|

| 43,389 |

|

|

| 184,017 |

|

|

| 163,898 |

|

|

|

| 45,840 |

|

|

| 43,006 |

|

|

| 181,037 |

|

|

| 162,764 |

|

| |

Net earnings |

| $ | 97,894 |

|

| $ | 96,682 |

|

| $ | 396,835 |

|

| $ | 392,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Basic |

|

| 186,449,345 |

|

|

| 181,425,202 |

|

|

| 183,688,562 |

|

|

| 181,200,040 |

|

|

Diluted |

|

| 186,833,150 |

|

|

| 181,932,133 |

|

|

| 184,043,841 |

|

|

| 181,689,723 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Net earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Basic |

| $ | 0.52 |

|

| $ | 0.53 |

|

| $ | 2.16 |

|

| $ | 2.16 |

|

|

Diluted |

| $ | 0.52 |

|

| $ | 0.53 |

| (1) | $ | 2.15 |

|

| $ | 2.16 |

| (1) |

(1) | During the quarter ended December 31, 2023, one tenant was reclassified to accrual basis for accounting purposes due to their improved qualitative and quantitative credit factors, which resulted in an increase of accrued rent in the amount of $5,573. Excluding such, net earnings per common share would have been $0.50 and $2.13 for the quarter and year ended December 31, 2023, respectively. |

4

FUNDS FROM OPERATIONS ("FFO")(1) |

(dollars in thousands, except per share data)

(unaudited)

|

| Quarter Ended |

|

| Year Ended |

|

| ||||||||||

|

| December 31, |

|

| December 31, |

|

| ||||||||||

|

| 2024 |

|

| 2023 |

|

| 2024 |

|

| 2023 |

|

| ||||

Net earnings |

| $ | 97,894 |

|

| $ | 96,682 |

|

| $ | 396,835 |

|

| $ | 392,340 |

|

|

Real estate depreciation and amortization |

|

| 63,154 |

|

|

| 59,978 |

|

|

| 249,324 |

|

|

| 238,229 |

|

|

Gain on disposition of real estate |

|

| (12,083 | ) |

|

| (7,263 | ) |

|

| (42,290 | ) |

|

| (47,485 | ) |

|

Impairment losses – depreciable real estate, net of recoveries |

|

| 3,724 |

|

|

| 2,315 |

|

|

| 6,632 |

|

|

| 5,990 |

|

|

Total FFO adjustments |

|

| 54,795 |

|

|

| 55,030 |

|

|

| 213,666 |

|

|

| 196,734 |

|

|

FFO |

| $ | 152,689 |

|

| $ | 151,712 |

|

| $ | 610,501 |

|

| $ | 589,074 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

FFO per share: |

|

|

|

|

|

|

|

|

| ||||||||

Basic |

| $ | 0.82 |

|

| $ | 0.84 |

|

| $ | 3.32 |

|

| $ | 3.25 |

|

|

Diluted |

| $ | 0.82 |

|

| $ | 0.83 |

| (2) | $ | 3.32 |

|

| $ | 3.24 |

| (2) |

(1) | FFO is a non-GAAP financial measure. Please reference the Earnings Release for the quarter and year ended December 31, 2024 for the company's definition and explanation of how the company utilizes this metric. |

(2) | During the quarter ended December 31, 2023, one tenant was reclassified to accrual basis for accounting purposes due to their improved qualitative and quantitative credit factors, which resulted in an increase of accrued rent in the amount of $5,573. Excluding such, FFO per common share would have been $0.80 and $3.21 for the quarter and year ended December 31, 2023, respectively. |

5

CORE FUNDS FROM OPERATIONS ("Core FFO")(1) |

(dollars in thousands, except per share data)

(unaudited)

|

| Quarter Ended |

|

| Year Ended |

|

| ||||||||||

|

| December 31, |

|

| December 31, |

|

| ||||||||||

|

| 2024 |

|

| 2023 |

|

| 2024 |

|

| 2023 |

|

| ||||

Net earnings |

| $ | 97,894 |

|

| $ | 96,682 |

|

| $ | 396,835 |

|

| $ | 392,340 |

|

|

Total FFO adjustments |

|

| 54,795 |

|

|

| 55,030 |

|

|

| 213,666 |

|

|

| 196,734 |

|

|

FFO |

|

| 152,689 |

|

|

| 151,712 |

|

|

| 610,501 |

|

|

| 589,074 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Executive retirement costs |

|

| 42 |

|

|

| 2,569 |

|

|

| 668 |

|

|

| 3,454 |

|

|

Total Core FFO adjustments |

|

| 42 |

|

|

| 2,569 |

|

|

| 668 |

|

|

| 3,454 |

|

|

Core FFO |

| $ | 152,731 |

|

| $ | 154,281 |

|

| $ | 611,169 |

|

| $ | 592,528 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Core FFO per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Basic |

| $ | 0.82 |

|

| $ | 0.85 |

|

| $ | 3.33 |

|

| $ | 3.27 |

|

|

Diluted |

| $ | 0.82 |

|

| $ | 0.85 |

| (2) | $ | 3.32 |

|

| $ | 3.26 |

| (2) |

(1) | Core FFO is a non-GAAP financial measure. Please reference the Earnings Release for the quarter and year ended December 31, 2024 for the company's definition and explanation of how the company utilizes this metric. |

(2) | During the quarter ended December 31, 2023, one tenant was reclassified to accrual basis for accounting purposes due to their improved qualitative and quantitative credit factors, which resulted in an increase of accrued rent in the amount of $5,573. Excluding such, Core FFO would have been $0.82 and $3.23 for the quarter and year ended December 31, 2023, respectively. |

6

ADJUSTED FUNDS FROM OPERATIONS ("AFFO")(1) |

(dollars in thousands, except per share data)

(unaudited)

|

| Quarter Ended |

|

| Year Ended |

|

| ||||||||||

|

| December 31, |

|

| December 31, |

|

| ||||||||||

|

| 2024 |

|

| 2023 |

|

| 2024 |

|

| 2023 |

|

| ||||

Net earnings |

| $ | 97,894 |

|

| $ | 96,682 |

|

| $ | 396,835 |

|

| $ | 392,340 |

|

|

Total FFO adjustments |

|

| 54,795 |

|

|

| 55,030 |

|

|

| 213,666 |

|

|

| 196,734 |

|

|

Total Core FFO adjustments |

|

| 42 |

|

|

| 2,569 |

|

|

| 668 |

|

|

| 3,454 |

|

|

Core FFO |

|

| 152,731 |

|

|

| 154,281 |

|

|

| 611,169 |

|

|

| 592,528 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Straight-line accrued rent, net of reserves |

|

| (302 | ) |

|

| (5,957 | ) |

|

| (294 | ) |

|

| (7,453 | ) |

|

Net capital lease rent adjustment |

|

| 58 |

|

|

| 75 |

|

|

| 222 |

|

|

| 319 |

|

|

Below-market rent amortization |

|

| (144 | ) |

|

| (82 | ) |

|

| (495 | ) |

|

| (431 | ) |

|

Stock based compensation expense |

|

| 2,775 |

|

|

| 2,592 |

|

|

| 11,816 |

|

|

| 10,846 |

|

|

Capitalized interest expense |

|

| (1,061 | ) |

|

| (1,912 | ) |

|

| (5,805 | ) |

|

| (4,286 | ) |

|

Total AFFO adjustments |

|

| 1,326 |

|

|

| (5,284 | ) |

|

| 5,444 |

|

|

| (1,005 | ) |

|

AFFO |

| $ | 154,057 |

|

| $ | 148,997 |

|

| $ | 616,613 |

|

| $ | 591,523 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

AFFO per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Basic |

| $ | 0.83 |

|

| $ | 0.82 |

|

| $ | 3.36 |

|

| $ | 3.26 |

|

|

Diluted |

| $ | 0.82 |

|

| $ | 0.82 |

|

| $ | 3.35 |

|

| $ | 3.26 |

|

|

(1) | AFFO is a non-GAAP financial measure. Please reference the Earnings Release for the quarter and year ended December 31, 2024 for the company's definition and explanation of how the company utilizes this metric. |

7

OTHER INFORMATION |

(dollars in thousands)

(unaudited)

|

| Quarter Ended |

|

| Year Ended |

|

| ||||||||||

|

| December 31, |

|

| December 31, |

|

| ||||||||||

|

| 2024 |

|

| 2023 |

|

| 2024 |

|

| 2023 |

|

| ||||

Rental income from operating leases(1) |

| $ | 212,565 |

|

| $ | 209,037 |

|

| $ | 846,653 |

|

| $ | 805,136 |

|

|

Earned income from direct financing leases(1) |

| $ | 115 |

|

| $ | 133 |

|

| $ | 468 |

|

| $ | 560 |

|

|

Percentage rent(1) |

| $ | 189 |

|

| $ | 241 |

|

| $ | 1,536 |

|

| $ | 1,631 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Real estate expenses reimbursed from tenants(1) |

| $ | 5,479 |

|

| $ | 5,767 |

|

| $ | 18,811 |

|

| $ | 18,763 |

|

|

Real estate expenses |

|

| (11,142 | ) |

|

| (8,237 | ) |

|

| (32,317 | ) |

|

| (28,378 | ) |

|

Real estate expenses, net of tenant reimbursements |

| $ | (5,663 | ) |

| $ | (2,470 | ) |

| $ | (13,506 | ) |

| $ | (9,615 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Amortization of debt costs |

| $ | 1,455 |

|

| $ | 1,295 |

|

| $ | 5,993 |

|

| $ | 4,943 |

|

|

Scheduled debt principal amortization (excluding maturities) |

| $ | — |

|

| $ | — |

|

| $ | — |

|

| $ | 173 |

| (2) |

Non-real estate depreciation expense |

| $ | 43 |

|

| $ | 105 |

|

| $ | 370 |

|

| $ | 409 |

|

|

(1) | For the quarters ended December 31, 2024 and 2023, the aggregate of such amounts is $218,348 and $215,178, respectively, and $867,468 and $826,090, for the year ended December 31, 2024 and 2023, respectively, and is classified as rental income on the income statement summary. |

(2) | In April 2023, NNN repaid the remaining mortgages payable principal balance of $9,774. |

EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION FOR REAL ESTATE ("EBITDA")(1) |

(dollars in thousands)

(unaudited)

|

| Quarter Ended |

|

| Year Ended |

| ||||||||||

|

| December 31, |

|

| December 31, |

| ||||||||||

|

| 2024 |

|

| 2023 |

|

| 2024 |

|

| 2023 |

| ||||

Net earnings |

| $ | 97,894 |

|

| $ | 96,682 |

|

| $ | 396,835 |

|

| $ | 392,340 |

|

Interest expense |

|

| 46,880 |

|

|

| 43,389 |

|

|

| 184,017 |

|

|

| 163,898 |

|

Depreciation and amortization |

|

| 63,194 |

|

|

| 60,079 |

|

|

| 249,681 |

|

|

| 238,625 |

|

Gain on disposition of real estate |

|

| (12,083 | ) |

|

| (7,263 | ) |

|

| (42,290 | ) |

|

| (47,485 | ) |

Impairment losses – real estate, net of recoveries |

|

| 3,724 |

|

|

| 2,315 |

|

|

| 6,632 |

|

|

| 5,990 |

|

EBITDA |

| $ | 199,609 |

|

| $ | 195,202 |

|

| $ | 794,875 |

|

| $ | 753,368 |

|

(1) | EBITDA is non-GAAP financial measure. Please reference the Earnings Release for the quarter and year ended December 31, 2024 for the company's definition and explanation of how the company utilizes this metric. |

8

BALANCE SHEET SUMMARY |

(dollars in thousands)

(unaudited)

|

| December 31, |

|

| December 31, |

| ||

Assets: |

|

|

|

|

|

| ||

Real estate portfolio, net of accumulated depreciation and amortization |

| $ | 8,746,168 |

|

| $ | 8,535,851 |

|

Cash and cash equivalents |

|

| 8,731 |

|

|

| 1,189 |

|

Restricted cash and cash held in escrow |

|

| 331 |

|

|

| 3,966 |

|

Receivables, net of allowance of $617 and $669, respectively |

|

| 2,975 |

|

|

| 3,649 |

|

Accrued rental income, net of allowance of $4,156 and $4,168, respectively |

|

| 34,005 |

|

|

| 34,611 |

|

Debt costs, net of accumulated amortization of $27,002 and $23,952, respectively |

|

| 8,958 |

|

|

| 3,243 |

|

Other assets |

|

| 71,560 |

|

|

| 79,459 |

|

Total assets |

| $ | 8,872,728 |

|

| $ | 8,661,968 |

|

|

|

|

|

|

|

| ||

Liabilities: |

|

|

|

|

|

| ||

Line of credit payable |

| $ | — |

|

| $ | 132,000 |

|

Notes payable, net of unamortized discount and unamortized debt costs |

|

| 4,373,803 |

|

|

| 4,228,544 |

|

Accrued interest payable |

|

| 29,699 |

|

|

| 34,374 |

|

Other liabilities |

|

| 106,951 |

|

|

| 109,593 |

|

Total liabilities |

|

| 4,510,453 |

|

|

| 4,504,511 |

|

|

|

|

|

|

|

| ||

Total equity |

|

| 4,362,275 |

|

|

| 4,157,457 |

|

|

|

|

|

|

|

| ||

Total liabilities and equity |

| $ | 8,872,728 |

|

| $ | 8,661,968 |

|

|

|

|

|

|

|

| ||

Common shares outstanding |

|

| 187,540,929 |

|

|

| 182,474,770 |

|

|

|

|

|

|

|

| ||

Gross leasable area, Property Portfolio (square feet) |

|

| 36,557,000 |

|

|

| 35,966,000 |

|

9

DEBT SUMMARY |

As of December 31, 2024

(dollars in thousands)

(unaudited)

Unsecured Debt |

| Principal |

|

| Principal, |

|

| Stated |

|

| Effective |

|

| Maturity | ||||

Line of credit payable |

| $ | — |

|

| $ | — |

|

| SOFR + 87.5bps |

|

|

| — |

|

| April 2028 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Unsecured notes payable: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

2025 |

|

| 400,000 |

|

|

| 399,900 |

|

|

| 4.000 | % |

|

| 4.029 | % |

| November 2025 |

2026 |

|

| 350,000 |

|

|

| 349,128 |

|

|

| 3.600 | % |

|

| 3.733 | % |

| December 2026 |

2027 |

|

| 400,000 |

|

|

| 399,490 |

|

|

| 3.500 | % |

|

| 3.548 | % |

| October 2027 |

2028 |

|

| 400,000 |

|

|

| 398,778 |

|

|

| 4.300 | % |

|

| 4.388 | % |

| October 2028 |

2030 |

|

| 400,000 |

|

|

| 399,286 |

|

|

| 2.500 | % |

|

| 2.536 | % |

| April 2030 |

2033 |

|

| 500,000 |

|

|

| 489,579 |

|

|

| 5.600 | % |

|

| 5.905 | % |

| October 2033 |

2034 |

|

| 500,000 |

|

|

| 494,112 |

|

|

| 5.500 | % |

|

| 5.662 | % |

| June 2034 |

2048 |

|

| 300,000 |

|

|

| 296,219 |

|

|

| 4.800 | % |

|

| 4.890 | % |

| October 2048 |

2050 |

|

| 300,000 |

|

|

| 294,561 |

|

|

| 3.100 | % |

|

| 3.205 | % |

| April 2050 |

2051 |

|

| 450,000 |

|

|

| 442,228 |

|

|

| 3.500 | % |

|

| 3.602 | % |

| April 2051 |

2052 |

|

| 450,000 |

|

|

| 440,282 |

|

|

| 3.000 | % |

|

| 3.118 | % |

| April 2052 |

Total |

|

| 4,450,000 |

|

|

| 4,403,563 |

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Total unsecured debt(1) |

| $ | 4,450,000 |

|

| $ | 4,403,563 |

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Debt costs |

|

|

|

| $ | (43,820 | ) |

|

|

|

|

|

|

|

| |||

Accumulated amortization |

|

|

| 14,060 |

|

|

|

|

|

|

|

|

| |||||

Debt costs, net of accumulated amortization |

|

|

| (29,760 | ) |

|

|

|

|

|

|

|

| |||||

Notes payable, net of unamortized discount and |

|

| $ | 4,373,803 |

|

|

|

|

|

|

|

|

| |||||

(1) Unsecured debt has a weighted average interest rate of 4.1% and a weighted average maturity of 12.1 years.

10

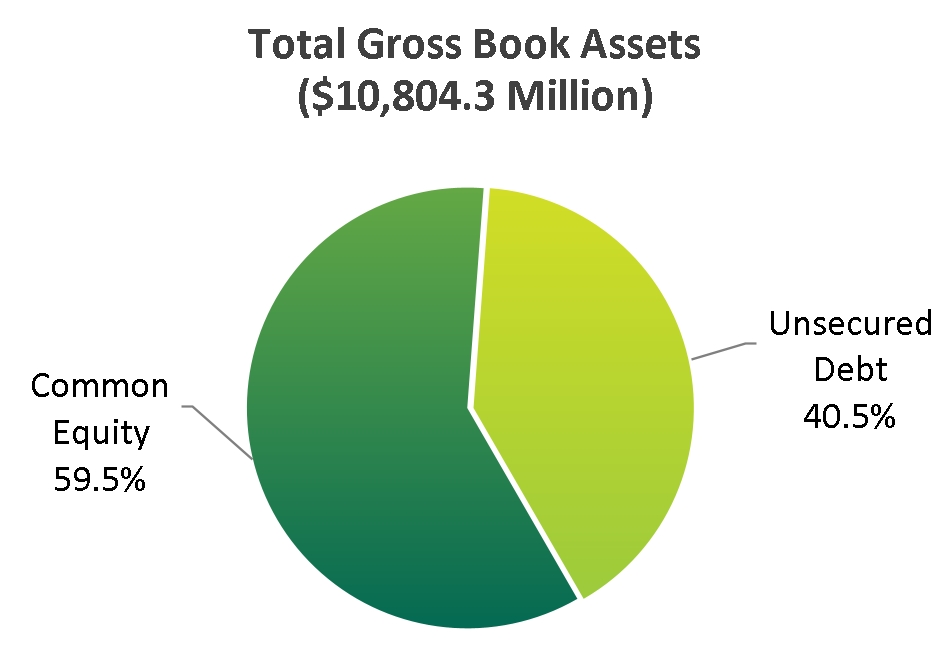

CREDIT METRICS (1) |

Ratings: Moody's Baa1; S&P BBB+

| 2020 |

|

| 2021 |

|

| 2022 |

|

| 2023 |

|

| 2024 |

| ||||||

Debt / Total assets (gross book) |

|

| 34.4 | % |

|

| 39.9 | % |

|

| 40.4 | % |

|

| 42.0 | % |

|

| 40.5 | % |

Debt + preferred / Total assets (gross book) |

|

| 38.4 | % |

|

| 39.9 | % |

|

| 40.4 | % |

|

| 42.0 | % |

|

| 40.5 | % |

Debt / EBITDA (last quarter annualized) |

|

| 5.0 |

|

|

| 5.2 |

|

|

| 5.4 |

|

|

| 5.5 |

|

|

| 5.5 |

|

Debt + preferred / EBITDA (last quarter annualized) |

|

| 5.6 |

|

|

| 5.2 |

|

|

| 5.4 |

|

|

| 5.5 |

|

|

| 5.5 |

|

EBITDA / Interest expense (cash) |

|

| 4.6 |

|

|

| 4.7 |

|

|

| 4.7 |

|

|

| 4.5 |

|

|

| 4.2 |

|

EBITDA / Fixed charges (cash) |

|

| 4.0 |

|

|

| 4.3 |

|

|

| 4.7 |

|

|

| 4.5 |

|

|

| 4.2 |

|

(1) Debt amounts used in calculations are net of cash balances.

CREDIT FACILITY AND NOTES COVENANTS |

The following is a summary of key financial covenants for the company's unsecured credit facility and notes, as defined and calculated per the terms of the facility's credit agreement and the notes' governing documents, respectively, which are included in the company's filings with the Commission. These calculations, which are not based on U.S. GAAP measurements, are presented to investors to show that as of December 31, 2024, the company believes it is in compliance with the covenants.

Key Covenants |

| Required |

| December 31, 2024 |

Unsecured Bank Credit Facility: |

|

|

|

|

Maximum leverage ratio |

| < 0.60 |

| 0.37 |

Minimum fixed charge coverage ratio |

| > 1.50 |

| 4.28 |

Maximum secured indebtedness ratio |

| < 0.40 |

| — |

Unencumbered asset value ratio |

| > 1.67 |

| 2.70 |

Unencumbered interest ratio |

| > 1.75 |

| 4.23 |

Unsecured Notes: |

|

|

|

|

Limitation on incurrence of total debt |

| ≤ 60% |

| 40.0% |

Limitation on incurrence of secured debt |

| ≤ 40% |

| — |

Debt service coverage ratio |

| ≥ 1.50 |

| 4.2 |

Maintenance of total unencumbered assets |

| ≥ 150% |

| 250% |

11

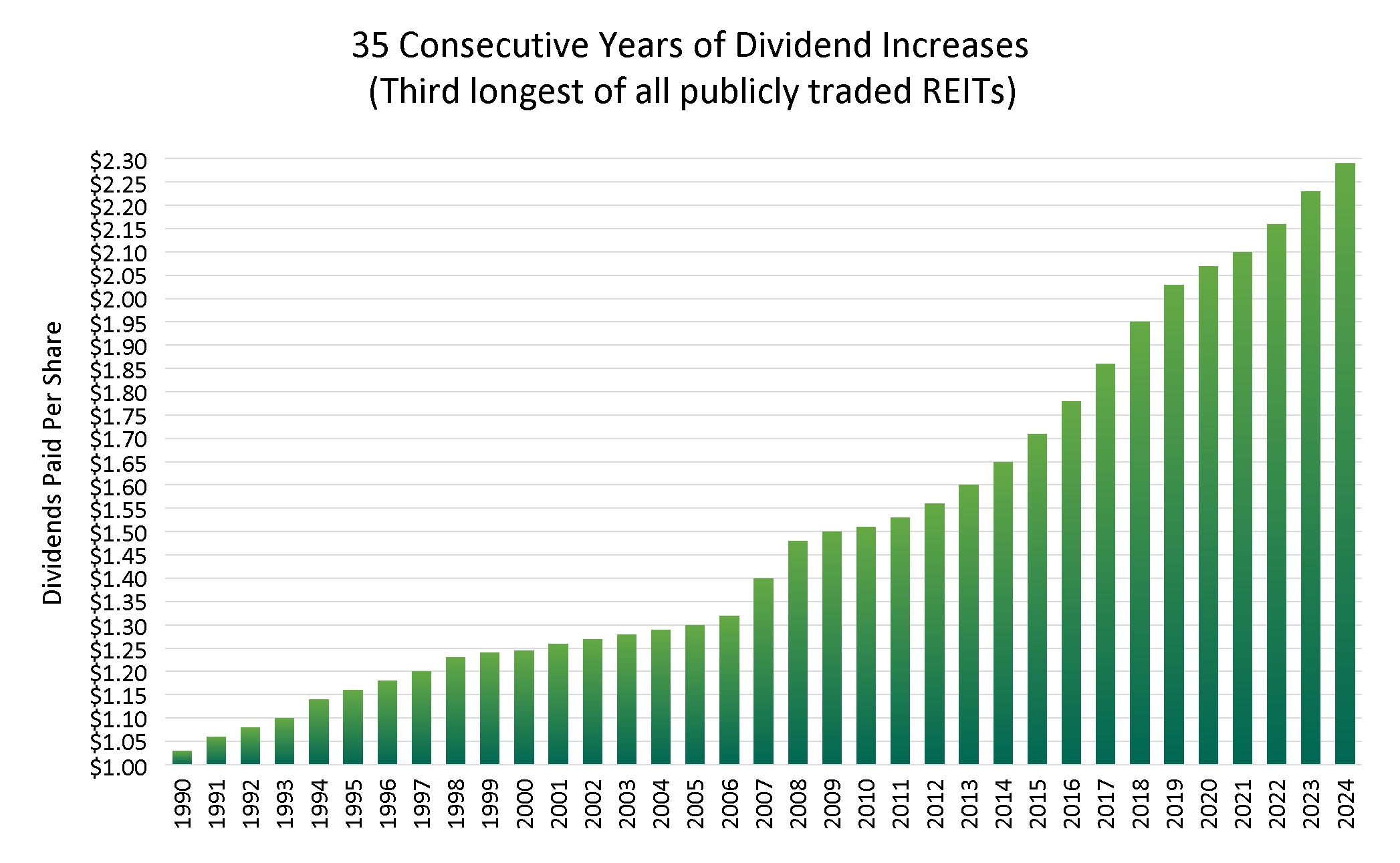

LONG-TERM DIVIDEND HISTORY |

12

PROPERTY ACQUISITIONS |

(dollars in thousands)

|

| Year Ended December 31, |

| |||||

|

| 2024 |

|

| 2023 |

| ||

Total dollars invested(1) |

| $ | 565,416 |

|

| $ | 819,710 |

|

Number of Properties |

|

| 75 |

|

|

| 165 |

|

Gross leasable area (square feet)(2) |

|

| 1,486,000 |

|

|

| 1,281,000 |

|

Cap rate (3) |

|

| 7.7 | % |

|

| 7.3 | % |

Weighted average lease term |

|

| 18.5 |

|

|

| 18.8 |

|

(1) | Includes dollars invested in projects under construction or tenant improvements for each respective year. |

(2) | Includes additional square footage from completed construction on existing Properties. |

(3) | The cap rate is a weighted average, calculated as the initial cash annual base rent divided by the total purchase price of the Properties. |

PROPERTY DISPOSITIONS |

(dollars in thousands)

|

| Year Ended December 31, |

| |||||||||||||||||||||

|

| 2024 |

|

| 2023 |

| ||||||||||||||||||

|

| Occupied |

|

| Vacant |

|

| Total |

|

| Occupied |

|

| Vacant |

|

| Total |

| ||||||

Number of properties |

|

| 27 |

|

|

| 14 |

|

|

| 41 |

|

|

| 24 |

|

|

| 21 |

|

|

| 45 |

|

Gross leasable area (square feet) |

|

| 640,000 |

|

|

| 209,000 |

|

|

| 849,000 |

|

|

| 177,000 |

|

|

| 116,000 |

|

|

| 293,000 |

|

Acquisition costs |

| $ | 117,556 |

|

| $ | 30,276 |

|

| $ | 147,832 |

|

| $ | 69,790 |

|

| $ | 25,036 |

|

| $ | 94,826 |

|

Net book value |

| $ | 84,212 |

|

| $ | 22,294 |

|

| $ | 106,506 |

|

| $ | 55,098 |

|

| $ | 13,133 |

|

| $ | 68,231 |

|

Net sale proceeds |

| $ | 115,923 |

|

| $ | 32,735 |

|

| $ | 148,658 |

|

| $ | 97,822 |

|

| $ | 17,894 |

|

| $ | 115,716 |

|

Cap rate(1) |

|

| 7.3 | % |

|

| — |

|

|

| 7.3 | % |

|

| 5.9 | % |

|

| — |

|

|

| 5.9 | % |

(1) | The cap rate is a weighted average, calculated as the cash annual base rent divided by the total gross proceeds received for the properties. |

13

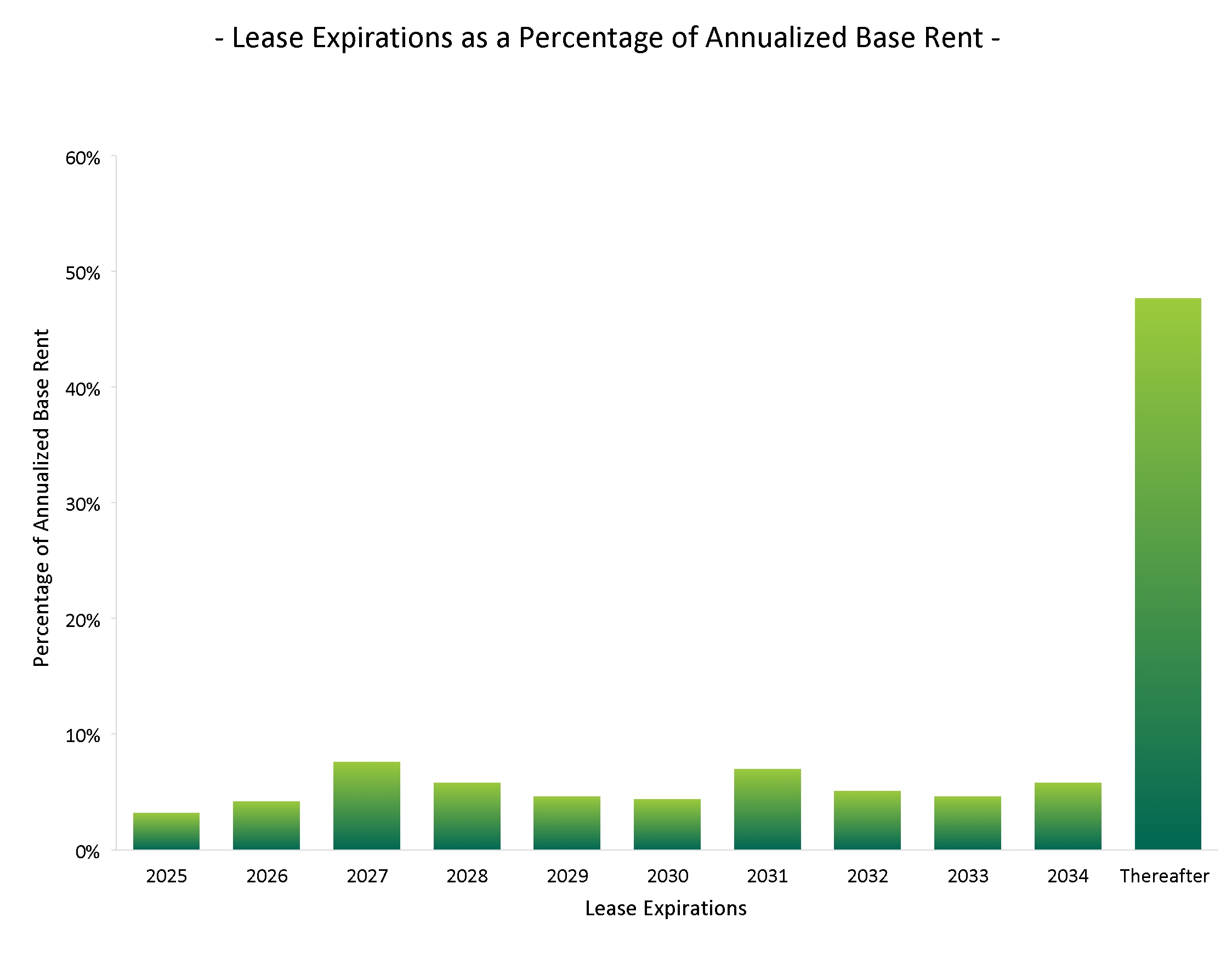

LEASE EXPIRATIONS(1) |

|

| % of |

| # of |

|

| Gross Leasable |

|

|

|

| % of |

| # of |

|

| Gross Leasable |

| ||||

2025 |

| 3.2% |

|

| 132 |

|

|

| 874,000 |

|

| 2031 |

| 7.0% |

|

| 184 |

|

|

| 2,655,000 |

|

2026 |

| 4.2% |

|

| 204 |

|

|

| 1,981,000 |

|

| 2032 |

| 5.1% |

|

| 183 |

|

|

| 1,804,000 |

|

2027 |

| 7.6% |

|

| 231 |

|

|

| 3,401,000 |

|

| 2033 |

| 4.6% |

|

| 134 |

|

|

| 1,398,000 |

|

2028 |

| 5.8% |

|

| 255 |

|

|

| 2,306,000 |

|

| 2034 |

| 5.8% |

|

| 182 |

|

|

| 2,398,000 |

|

2029 |

| 4.6% |

|

| 143 |

|

|

| 2,083,000 |

|

| Thereafter |

| 47.7% |

|

| 1,711 |

|

|

| 14,840,000 |

|

2030 |

| 4.4% |

|

| 154 |

|

|

| 2,086,000 |

|

|

|

|

|

|

|

|

|

|

| ||

(1) | As of December 31, 2024, the weighted average remaining lease term is 9.9 years. |

(2) | Based on the annual base rent of $860,562,000, which is the annualized base rent for all leases in place as of December 31, 2024. |

(3) | Square feet. |

14

TOP 20 LINES OF TRADE |

|

|

|

| As of December 31, 2024 |

| As of December 31, 2023 | ||||

|

| Lines of Trade |

| % of Total(1) |

| # of Properties |

| % of Total(2) |

| # of Properties |

1. |

| Convenience stores |

| 17.0% |

| 678 |

| 16.4% |

| 661 |

2. |

| Automotive service |

| 16.9% |

| 641 |

| 15.6% |

| 629 |

3. |

| Restaurants – limited service |

| 8.4% |

| 618 |

| 8.5% |

| 610 |

4. |

| Restaurants – full service |

| 7.8% |

| 399 |

| 8.7% |

| 417 |

5. |

| Family entertainment centers |

| 7.2% |

| 98 |

| 6.4% |

| 94 |

6. |

| Recreational vehicle dealers, parts and accessories |

| 5.1% |

| 70 |

| 4.6% |

| 62 |

7. |

| Theaters |

| 4.0% |

| 33 |

| 4.1% |

| 33 |

8. |

| Health and fitness |

| 3.9% |

| 31 |

| 4.5% |

| 33 |

9. |

| Equipment rental |

| 3.2% |

| 105 |

| 3.0% |

| 99 |

10. |

| Wholesale clubs |

| 2.4% |

| 13 |

| 2.5% |

| 13 |

11. |

| Automotive parts |

| 2.4% |

| 139 |

| 2.5% |

| 144 |

12. |

| Drug stores |

| 2.2% |

| 61 |

| 2.4% |

| 66 |

13. |

| Home improvement |

| 2.1% |

| 48 |

| 2.2% |

| 50 |

14. |

| Medical service providers |

| 1.7% |

| 82 |

| 1.7% |

| 79 |

15. |

| General merchandise |

| 1.4% |

| 71 |

| 1.4% |

| 72 |

16. |

| Furniture |

| 1.3% |

| 45 |

| 2.0% |

| 75 |

17. |

| Pet supplies and services |

| 1.3% |

| 52 |

| 1.1% |

| 51 |

18. |

| Consumer electronics |

| 1.3% |

| 16 |

| 1.4% |

| 17 |

19. |

| Travel plazas |

| 1.2% |

| 24 |

| 1.3% |

| 24 |

20. |

| Home furnishings |

| 1.1% |

| 12 |

| 1.3% |

| 13 |

| Other |

| 8.1% |

| 332 |

| 8.4% |

| 290 | |

|

| Total |

| 100.0% |

| 3,568 |

| 100.0% |

| 3,532 |

As a percentage of annual base rent, which is the annualized base rent for all leases in place. | ||

| (1) | $860,562,000 as of December 31, 2024. |

| (2) | $818,749,000 as of December 31, 2023. |

TOP 10 STATES |

|

| State |

| % of Total(1) |

|

|

| State |

| % of Total(1) |

1. |

| Texas |

| 18.8% |

| 6. |

| Tennessee |

| 3.8% |

2. |

| Florida |

| 8.7% |

| 7. |

| North Carolina |

| 3.7% |

3. |

| Illinois |

| 5.1% |

| 8. |

| Indiana |

| 3.6% |

4. |

| Georgia |

| 4.5% |

| 9. |

| Arizona |

| 3.2% |

5. |

| Ohio |

| 4.2% |

| 10. |

| Virginia |

| 3.2% |

As a percentage of annual base rent, which is the annualized base rent for all leases in place. | ||

| (1) | $860,562,000 as of December 31, 2024. |

15

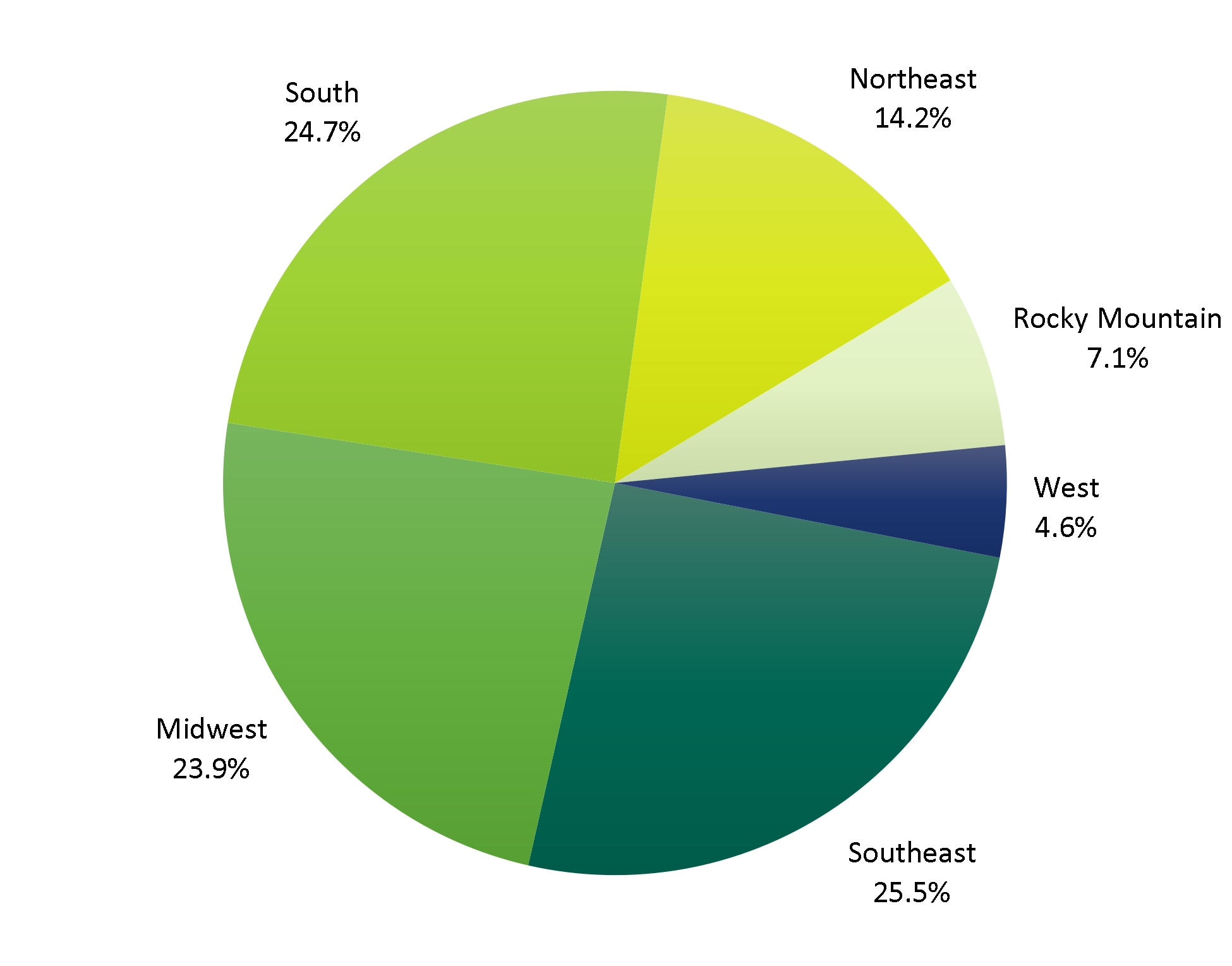

PORTFOLIO BY REGION |

As a percentage of annual base rent - December 31, 2024

| Based on the annual base rent of $860,562,000, which is the annualized base rent for all leases in place as of December 31, 2024. |

16

TOP TENANTS |

Creditworthy Retailers

Top 20 Tenants

|

| Tenant |

| # of |

| % of |

1. |

| 7-Eleven |

| 146 |

| 4.5% |

2. |

| Mister Car Wash |

| 121 |

| 4.1% |

3. |

| Dave & Buster's |

| 34 |

| 3.8% |

4. |

| Camping World |

| 48 |

| 3.8% |

5. |

| GPM Investments (convenience stores) |

| 148 |

| 2.8% |

6. |

| Flynn Restaurant Group (Taco Bell/Arby's) |

| 204 |

| 2.7% |

7. |

| AMC Theatres |

| 20 |

| 2.6% |

8. |

| LA Fitness |

| 26 |

| 2.5% |

9. |

| BJ's Wholesale Club |

| 13 |

| 2.4% |

10. |

| Mavis Tire Express Services |

| 140 |

| 2.2% |

11. |

| Couche Tard (Pantry) |

| 91 |

| 2.2% |

12. |

| Kent Distributors (convenience stores) |

| 38 |

| 2.1% |

13. |

| Chuck E. Cheese |

| 53 |

| 1.8% |

14. |

| Walgreens |

| 49 |

| 1.8% |

15. |

| Sunoco |

| 53 |

| 1.8% |

16. |

| Casey's General Stores (convenience stores) |

| 62 |

| 1.7% |

17. |

| United Rentals |

| 49 |

| 1.6% |

18. |

| Tidal Wave Auto Spa |

| 35 |

| 1.3% |

19. |

| Super Star Car Wash |

| 33 |

| 1.3% |

20. |

| Lifetime Fitness |

| 3 |

| 1.3% |

(1) | Based on the annual base rent of $860,562,000, which is the annualized base rent for all leases in place as of December 31, 2024. |

17

SAME STORE RENTAL INCOME |

(dollars in thousands)

Properties (Cash Basis) (1) |

|

|

| |

Number of properties |

|

| 3,327 |

|

Year ended December 31, 2024 (2) |

| $ | 758,489 |

|

Year ended December 31, 2023 (2) |

| $ | 759,119 |

|

Change (in dollars) |

| $ | (630 | ) |

Change (percent) (3) |

|

| (0.1 | )% |

(1) | Includes all properties owned for current and prior year period excluding any properties under development or re-development. |

(2) | Excludes any rent deferral payments from the COVID-19 rent deferral lease amendments. |

(3) | Excluding impact of Frisch's Restaurants and Badcock Furniture bankruptcy, change would have been 0.8% |

LEASING DATA |

(dollars in thousands)

Year Ended December 31, 2024 |

| Renewals With |

|

| Vacancy Re-Lease |

|

| Releasing |

|

| |||

Number of leases |

|

| 94 |

|

|

| 57 |

|

|

| 151 |

|

|

New cash rents |

| $ | 25,400 |

|

| $ | 8,216 |

|

| $ | 33,616 |

|

|

Prior cash rents |

| $ | 25,924 |

|

| $ | 11,868 |

|

| $ | 37,792 |

| (2) |

Recovery rate |

|

| 98.0 | % |

|

| 69.2 | % |

|

| 89.0 | % |

|

Tenant improvements |

| $ | 2,900 |

|

| $ | 5,897 |

|

| $ | 8,797 |

|

|

(1) | Long-term renewal rate for the period of 2010 through 2024 was 83.2%. |

(2) | Represents 4.4% of total annualized base rent as of December 31, 2024. |

18

OTHER PROPERTY PORTFOLIO DATA |

As of December 31, 2024

Tenant Financials

|

| # of |

| % of Annual |

Property level financial information |

| 2,982 |

| 82% |

Tenant corporate financials |

| 2,773 |

| 79% |

Rent Increases |

| % of Annual Base Rent (1) | ||||||

| Annual |

| Five Year |

| Other |

| Total | |

CPI |

| 37% |

| 44% |

| 1% |

| 82% |

Fixed |

| 2% |

| 11% |

| 1% |

| 14% |

No increases |

| — |

| — |

| 4% |

| 4% |

| 39% |

| 55% |

| 6% |

| 100% | |

Lease Structure - as a percentage of the company's annual base rent(1)

(1) | Based on the annual base rent of $860,562,000, which is the annualized base rent for all leases in place as of December 31, 2024. |

EARNINGS GUIDANCE |

Guidance is based on current plans and assumptions and subject to risks and uncertainties more fully described in this press release and the company's reports filed with the Commission.

|

| 2025 Guidance |

Net earnings per share excluding any gains on disposition of real |

| $1.97 - $2.02 per share |

Real estate depreciation and amortization per share |

| $1.36 per share |

Core FFO per share |

| $3.33 - $3.38 per share |

AFFO per share |

| $3.39 - $3.44 per share |

General and administrative expenses |

| $47 - $48 Million |

Real estate expenses, net of tenant reimbursements |

| $15 - $16 Million |

Acquisition volume |

| $500 - $600 Million |

Disposition volume |

| $80 - $120 Million |

19