Exhibit 99.2

Fourth Quarter/Fiscal 2008

Earnings Conference Call

March 2, 2009

Forward Looking Statements

This presentation contains forward-looking statements regarding the Company's

prospects, including the outlook for tanker and articulated tug barge markets, the

outcome of negotiations with Aker and Bender, changing oil trading patterns,

anticipated levels of newbuilding and scrapping, prospects for certain strategic

alliances and investments, prospects for the growth of the OSG Gas transport

business, estimated TCE rates and synthetic TCE rates achieved for 2009,

projected drydock and repair schedule, timely delivery of newbuildings in

accordance with contractual terms, credit risks of counterparties including

charterers, suppliers and shipyards and the impact this may have on OSG and

prospects of OSG’s strategy of being a market leader in the segments in which it

competes. Factors, risks and uncertainties that could cause actual results to differ

from the expectations reflected in these forward-looking statements are described in

the Company’s Annual Report for 2008 on Form 10-K.

Extraordinary Times OSG

A balanced growth strategy has positioned OSG to handle the

extraordinary difficult economic times we are operating in

Today and beyond, we can focus on running our ships flawlessly, optimizing our

commercial management and servicing our customers

Balance sheet strength, liability management and healthy liquidity

means OSG can manage a prolonged downturn in the markets

OSG’s portfolio – a combination of time charters, FFA coverage, COA

business and cargo systems – will enable us to remain cash flow

positive and profitable

Well-positioned for an expected weak 2009 tanker market

The U.S. Flag unit’s performance has been disappointing

Decisive actions underway to turn it around

Extraordinary Times The Market

Single hull phase-out

Scrapping 98 remaining single hull VLCCs will spark a recovery in tanker rates in

2010

The lack of available bank financing will profoundly impact the tanker

orderbook

The orderbook is not static. A much healthier market could result

Banking system problems will create enormous opportunities for

strong shipping companies in the next few years

Patience and discipline will be key

When the global economy recovers, OSG will emerge as one of the

clear winners in the tanker trades

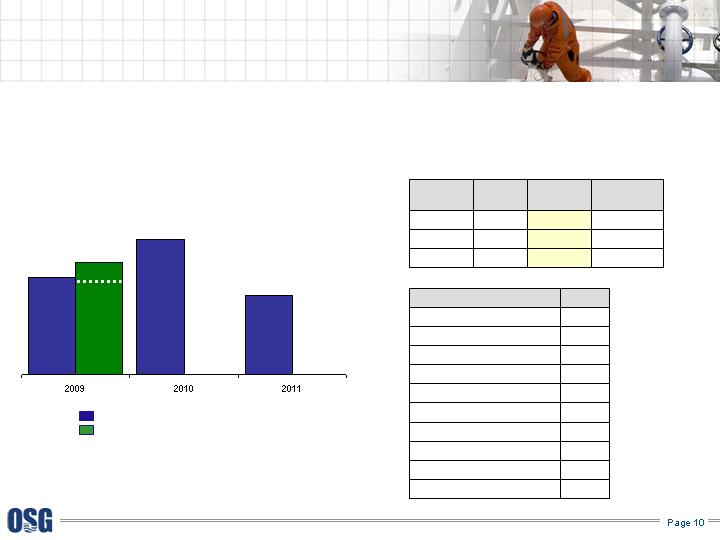

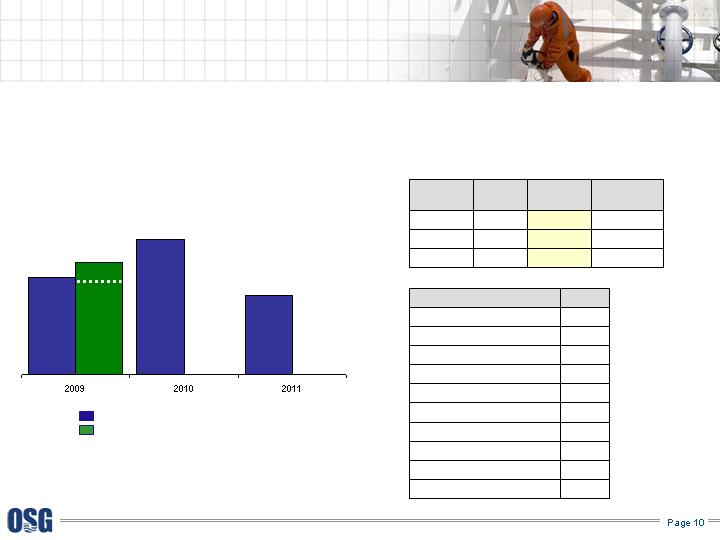

Strong Financial Performance

TCE revenues up 49% to $1.5B

$318M net income includes noncash

goodwill and asset impairment charges

on 4 ATBs of $168M

Net income and EPS more than doubled

Adjusted net income $449M1

Adjusted EPS $13.831

Cash generated from operations $367M

4.5 million shares repurchased

14.4%, for $259M

$45M dividends paid

$1.5B total liquidity

Cash as of Feb-27 $500M

36.8% liquidity-adjusted debt to cap

1See reconciling items on page 22.

$790

$962

$993

$1,039

$1,546

TCE Revenues

EBITDA

$211

$401

$465

$393

$318

Net Income

$655

$706

$595

$476

$530

$ in millions

$ in millions

$ in millions

A Platform of Commercial Excellence

$38K

$47K

Suezmax

4Q07

4Q08

$21K

$26K

Handysize

$30K

$36K

Panamax

$30K

$45K

LR1

$25K

$34K

Aframax

$35K

$57K

VLCC

4Q08 Average TCE Spot Rates/Day

$38K

$50K

Suezmax

FY07

FY08

$28K

$27K

Handysize

$32K

$36K

Panamax

$28K

$39K

LR1

$30K

$44K

Aframax

$43K

$92K

VLCC

2008 Average TCE Spot Rates/Day

Cargo is king, especially in weak markets

OSG has more COA business than any competitor through the 5 pools

we operate

Scale matters

Commercial pools

Improved laden to ballast ratios

Beating the competition on results

Scale makes us more important to clients and brokers giving us an

information advantage

Scale enables us to build cargo systems

New business derived from partners / customers

Unipec (China), Flopec (Ecuador), SONAP (Chile), PDV and Citgo

(Venezuela)

Korea Line from TI is also a partner in CPI

Ultragas from PI is also a partner in CPI

Seaarland from AI is also a partner in SI

Best-in-class platform leads to higher margin projects /

business

Superior commercial operations =

outperforming the competition

A Platform of Technical Excellence

OSG remains strongly committed to best-

in-class in-house technical management

Weaker markets will benefit the better

operators

Vetted and approved by all the oil majors

Tenacious focus yields results

Crew retention: U.S. mariners 90%, Int’l 97%

Improved training programs: dedicated facilities

in Manila and Tampa

Long-term commitment to sea staff and clients

is paying off

The cost of regulatory compliance will

continue to escalate: those that fail to plan

for this can plan to fail

2009 Key Events

Sale of Donna generated $77M gain in Q109

FSO project on schedule and very healthy

returns

Lightering is contract-oriented business and

a good hedge in weaker markets

Tight control and emphasis on daily running

costs

MR expansion 2009-2011

9 vessels total, 2 already delivered and entered CPI

Pool.

CPI Pool Expansion 2009

2 additional vessels: Ya-Sa (Jan); Ultragas (May)

Total 12 vessels in pool

LR1 Expansion 2009-2011

3 currently trading in PI pool to take advantage of pool’s

strong earnings

1 delivers in March and will enter PI pool

Ongoing evaluation of clean and dirty markets in 2010-

2011 to determine best trades to obtain the highest

returns

Bottom line: Fleet replacement program improves profit on

11 vessels redelivering in 2009 by approx. $4,500 per day, or

$1.6M per year per vessel adding $18M to the bottom line.

Crude

Products

U.S. Flag

6 Aker ships trading

Higher-yielding Aker vessels deliver through Q1 2011,

including 2 shuttle tankers

TI Africa and TI Asia in Dubai

Liquidity / Bank Commitments

299%

$2.4B

36%

23%

$965M debt on

$1.4B of vessels

$1.2B in losses or

shareholder

distributions

$963M

add’l debt

$279M

add’l secured debt

Minimum Net Worth

Tangible net worth $1.2B

Minimum Unencumbered Assets

Tangible assets to unsecured debt

150%

Maximum Leverage

Funded indebtedness to total

capitalization <60%

Limit on Secured Debt

Maximum 30%

Well-positioned to capitalize on opportunities

without going to the equity or debt markets

for funding

Unsecured revolving facilities $794

Public debt 220

Secured term loans 408

Total 1,422

Less current debt

Long-term debt outstanding $1,396

Debt Obligations

Debt Amortization per Annum

2009 2010 2011

$26.2$29.7$33.3

Covenants on $1.8B facility

$ in millions

Capacity

Predominantly unsecured borrower

Back-end liability structure

Low level of capital commitments in 2009

No loan to collateral maintenance clauses

Uniform covenants on facilities

(26)

As of Dec. 31 2008

2009 Liquidity Position Expected to be Similar to 2008

Note: minimum unencumbered asset capacity assumes 70% advance rate

10

9

10

Total

4

6

2009

Chartered-

in

Owned

Vessel

Deliveries

4

6

2011

4

5

2010

Fleet Development / Commitments

Cash from operations, asset sales and debt capacity

provide ample newbuild funding coverage

$256M

$357M

$209M

Newbuild Commitments / Funding

As of Feb. 20, 2009

$296M

Newbuilding capital requirements

Proceeds from asset sales + CCF

121

As of 12/31/11

10

Deliveries

(6)

Redeliveries

10

Deliveries

112

As of 12/31/09

(4)

Redeliveries

120

Operating Fleet as of 2/20/09

(18)

Redeliveries

9

Deliveries

117

Total

Fleet Development

As of 12/31/10

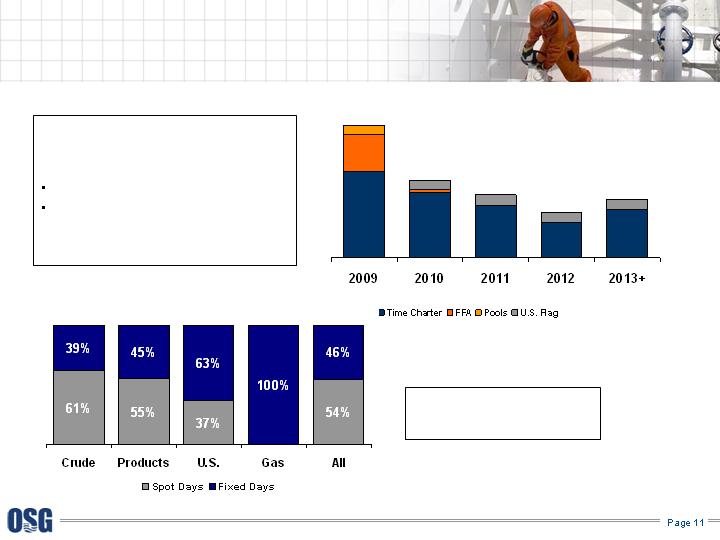

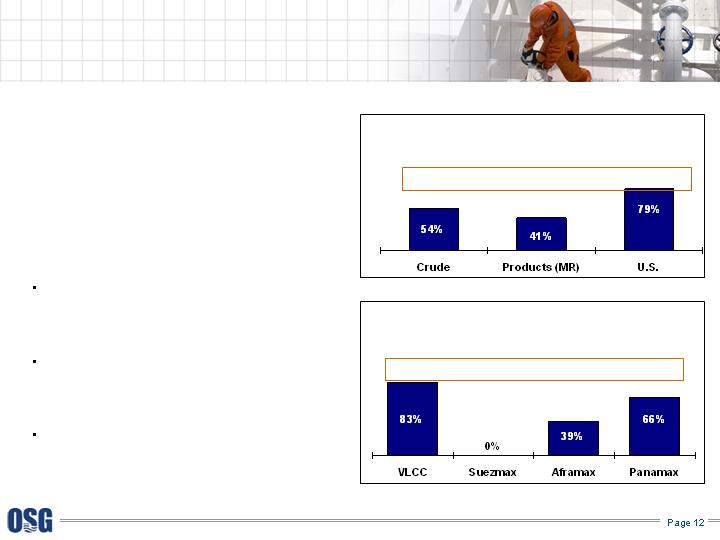

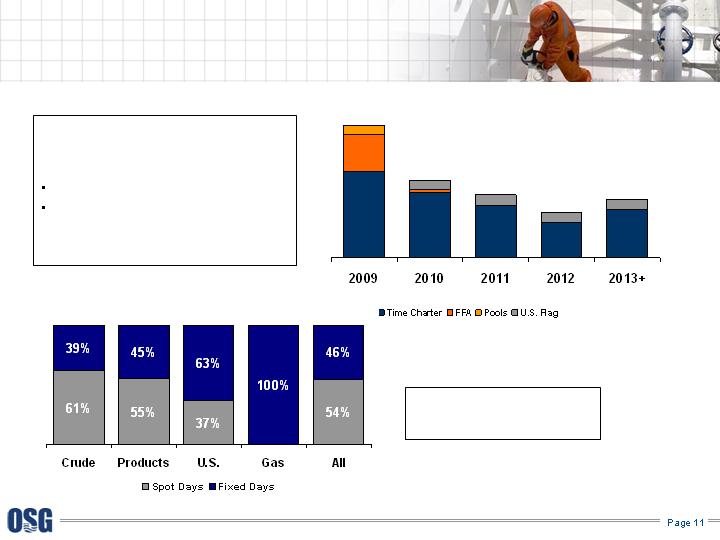

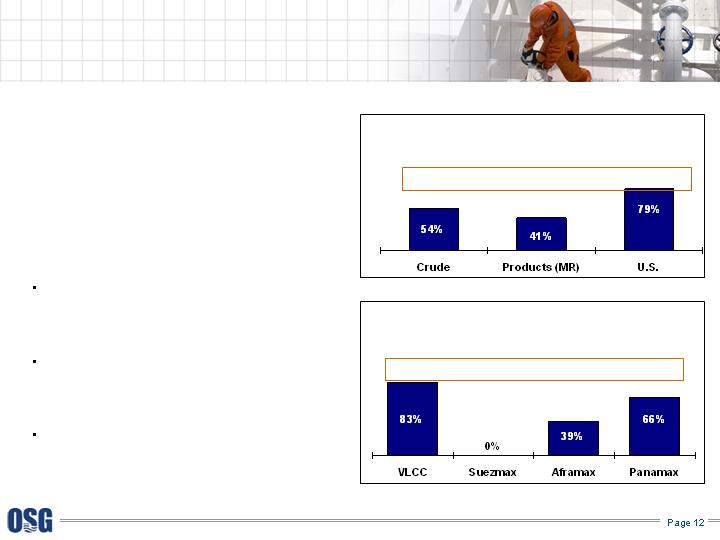

Contract Portfolio

2009 Portfolio Mix

(in revenue days)

$507M

$299M

$242M

$174M

$479

Portfolio of

Contractual Business

$507M1 fixed revenue in 2009

LNG and FSO joint venture projects

to generate $77M in fixed revenues

in 2009

1Excludes gas revenue days as gas revenue is reported in Equity in Income of Affiliated Companies.

Fixed Revenue / Cash Expense Coverage

2009 contracted revenue provides

stable cash flow covering a significant

portion of cash expenditures

54% of Crude cash expenditures are

covered by fixed revenue requiring

$20K/day to be earned on open days to

cover balance of cash expenditures

41% of Product (MR) cash expenditures

arecovered by fixed revenue requiring

$20K/day to be earned on open days to

cover balance of cash expenditures

79% of U.S. Flag cash expenditures are

covered by fixed revenue

$12K/day $45K/day $22K/day $9K/day

$20K/day $20K/day $17K/day

Rates required per day to cover cash expenditures are net of fixed revenue earned and include vessel operating expenses, charter-in expenses

(cash basis), drydock cost, allocated G&A, debt amortization and interest expense.

By Operating Segment

By Crude Vessel Class

In 2009, 57% of cash opex is

covered by fixed revenue

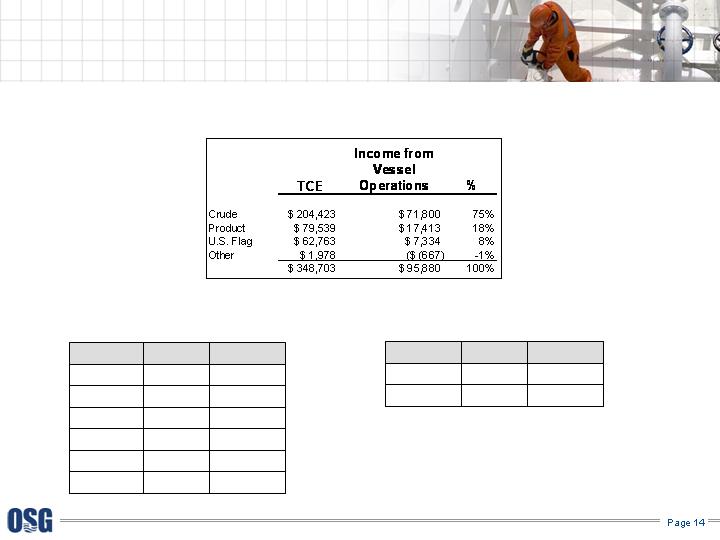

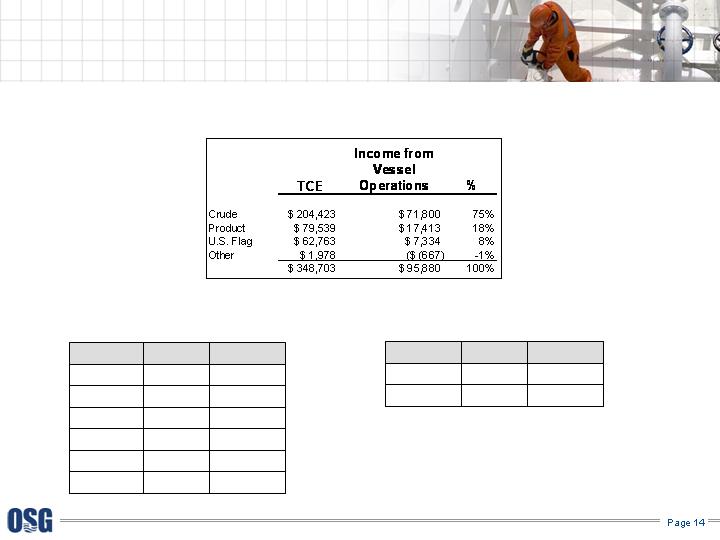

Financial Review

Myles R. Itkin

Chief Financial Officer

Rate Performance

TCE Revenues / Income from Vessel Ops

$38K

$47K

Suezmax

4Q07

4Q08

$21K

$26K

Handysize

$30K

$36K

Panamax

$30K

$45K

LR1

$25K

$34K

Aframax

$35K

$57K

VLCC

4Q08 Average TCE Spot Rates/Day

4,473

6,054

Days

Fixed

Spot

39%

61%

%

Spot/Fixed Mix

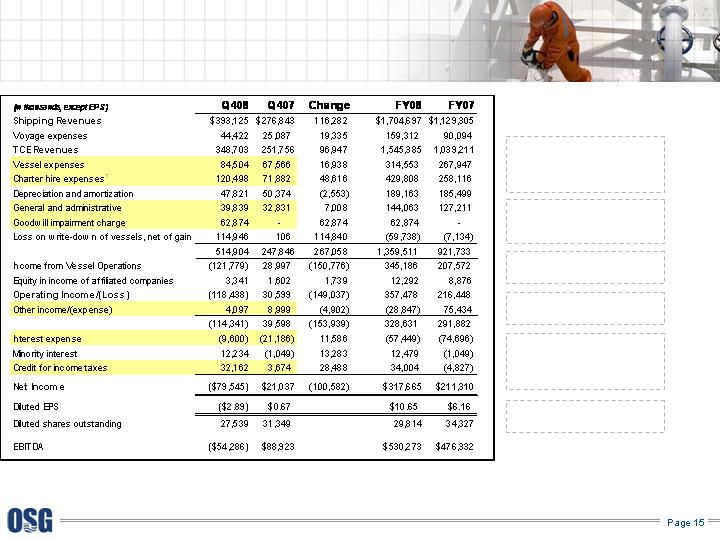

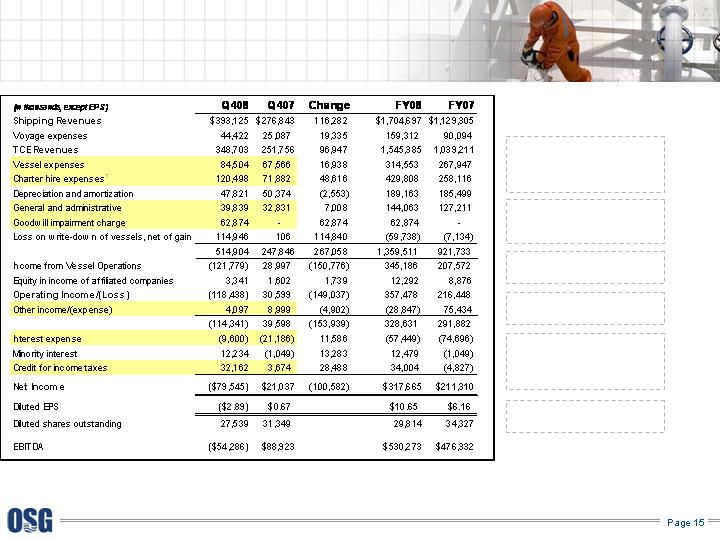

Financial Review – Income Statement

39% increase due to spot rates

increases VLCCs (+60%) and

Aframaxes (+38%); 1,240

increase in revenue days

10 additional chartered-in ships

and $9M increase in profit share

expense

Goodwill impairment on U.S.

Flag operations

$105M write-down on 4 ATBs;

Q109 write-down $20 to $35M

$6.5M in lower interest income

offset by $2.7M favorable gains

on derivatives that do not qualify

for hedge accounting

$33M tax benefit resulting from

write-down on vessels

Supplemental information detailing specific items affecting net income for fourth quarters and

fiscal years 2008 and 2007 is available in the Appendix (page 22) and on the Investor Relations

Webcasts and Presentations section of www.osg.com.

1For detail of charter-hire expense, see Appendix “Charter Hire Expense by Segment.”

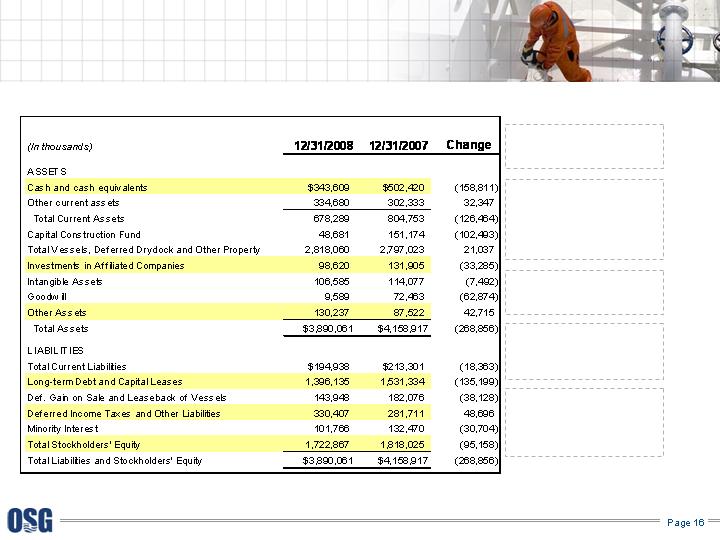

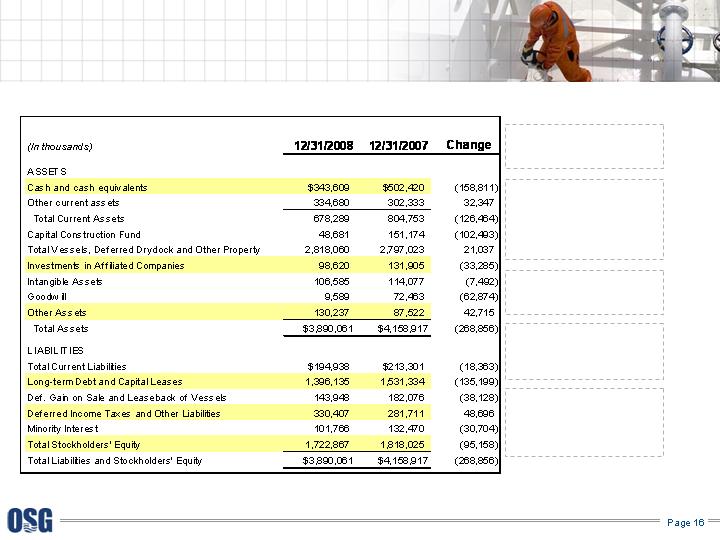

Financial Review – Balance Sheet

$545 repatriation of foreign cash

used to pay down debt and

purchase treasury stock

Investment in JVs reflects

decrease of $94M due to mark-

to-market losses on interest rate

swaps; offset by an increase of

$88M related to FSO JV

investment

Other assets in 2008 includes

$69M related to margin call on

derivatives positions

$545M repatriation of foreign

cash used to pay down debt;

offset by funding of share

repurchases

Equity reflects $318M net

income; offset by $259M stock

repurchases, $45M dividends

and $118M in losses on

interest rate swaps

2009 Guidance

Estimated vessel expenses

$300M to $320M

Time and bareboat charter hire expenses

$415M to $435M

Depreciation and Amortization

$175M to $195M

G&A

$125M to $130M

Equity income of affiliated companies

$12 to $16M

Other income, net of interest expense

Interest expense approx. $55M to $65M

Other income, net of derivative transactions, $8M to $10M

Taxes

Approx. <$5M

Capital Expenditures

$35M in drydock costs (Q1 $7M; Q2 $17M Q3 $7M and Q4 $4M)

$286M newbuild progress payments, vessel improvements and capitalized interest in

2009 (Q1 $80M; Q2 $52M Q3 $62M and Q4 $92M)

Morten Arntzen – Wrap up

Built for the Positive Momentum in 2010

Our balance sheet strength, strong liquidity and superior liability management means that we

can focus on running the business well, taking advantage of opportunities and reducing

costs, not on meeting with our banks for covenant or maturity relief

Product tanker segment redelivers 9 old double sided problem tankers by July 6, 2009 and

eliminates the drag on earnings they represent

In 2010 we will get a full year contribution from the FSOs stationed in Qatar

By the middle of 2010, we will have 6 more of the Aker ships deliver, all with terms and all

higher rates than the first 5

Our U.S. Gulf lightering business, which we acquired to provide stable contract revenues in

weaker markets, should do just that in 2009 and with greater market share is well-positioned

for 2010.

The crude tanker fleet will benefit from the single-hull phase out in 2010

The banking crisis will both winnow down the newbuilding orderbook and create

opportunities for the strong companies with liquidity and real operating platforms

We have already identified $15M of G&A cuts in 2009 and intend to make further progress in

the coming two years

OSG will be a winner in this difficult environment

An invitation to investors to join OSG

management at the Company’s

Annual Investor Event

New York

May 21, 2009

Contact: Jennifer Schlueter

Appendix

Reconciliation and Supplemental Information

EBITDA

EBITDA represents operating earnings, which is before interest expense and

income taxes, plus other income and depreciation and amortization expense.

EBITDA is presented to provide investors with meaningful additional

information that management uses to monitor ongoing operating results and

evaluate trends over comparative periods. EBITDA should not be considered

a substitute for net income or cash flow from operating activities prepared in

accordance with accounting principles generally accepted in the United States

or as a measure of profitability or liquidity. While EBITDA is frequently used as

a measure of operating results and performance, it is not necessarily

comparable to other similarly titled captions of other companies due to

differences in methods of calculation.

TCE Revenues

Consistent with general practice in the shipping industry, the Company uses time charter

equivalent revenues, which represents shipping revenues less voyage expenses, as a

measure to compare revenue generated from a voyage charter to revenue generated

from a time charter. Time charter equivalent revenues, a non-GAAP measure, provides

additional meaningful information in conjunction with shipping revenues, the most

directly comparable GAAP measure, because it assists Company management in

making decisions regarding the deployment and use of its vessels and in evaluating their

financial performance.

Specific Items Affecting Net Income

Set forth below are significant items of income and expense that affected the Company’s net income for the three and twelve months ended December 31, 2008 and 2007, all of which

items are typically excluded by securities analysts in their published estimates of the Company’s financial results

Fiscal Year Ended Dec. 31,

Three Months Ended Dec. 31,

$1,129,305

$1,704,697

$276,843

$393,125

Shipping Revenues

90,094

159,313

25,087

44,422

Add: Voyage expenses

$1,039,211

$1,545,384

$251,756

$348,703

Time charter equivalent revenues

2007

2008

2007

2008

$ in thousands

(in thousands, except EPS)

$

$ Per Share

$

$ Per Share

$

$ Per Share

$

$ Per Share

(Gain)/loss on sales of vessels

$1,081

$0.04

$ -

-

($77,970)

($2.62)

($7,134)

($0.21)

Write-down on vessels held for sale

8,754

0.20

(1)

-

-

32,597

0.60

Asset impairment

105,111

3.18

-

-

105,111

2.93

-

-

(Gain)/loss on sale of securities

1,087

0.03

-

-

1,269

0.03

(41,173)

(0.78)

Goodwill impairment

62,874

2.28

-

-

62,874

2.11

-

-

Unrealized derivative activity

(8,289)

(0.30)

-

-

(2,137)

(0.07)

-

-

Redemption of 8.25% Senior Notes

-

-

9,415

0.20

-

-

Total

$170,618

$5.42

(2)

$ -

$0.00

$131,159

$3.18

($48,307)

($0.99)

Reported Net Income / EPS

($79,545)

($2.89)

$21,037

$0.67

317,665

$

$10.65

$211,310

$6.16

Adjusted Net Income / EPS

$91,073

(3)

$2.53

(3)

$21,037

$0.67

448,824

$

$13.83

$163,003

$5.17

(1) The $8.7 million vessel writedown is made up of $1.8M on the Integrity and $6.9M on the OSG 300. The calculation deducts 22.9% minority interest on the Integrity and is tax effected ($6.9M+$1.8*.771)*.65

(2) Rounding effect

(3) 4Q08 net income includes a $32.2M tax benefit, which includes $21.1M related to the vessel write-downs and write-down on asset held for sale

Fiscal Year Ended

Dec. 31, 2008

Twelve Months Ended

Dec. 31, 2007

Three Months Ended

Dec. 31, 2008

Three Months Ended

Dec. 31, 2007

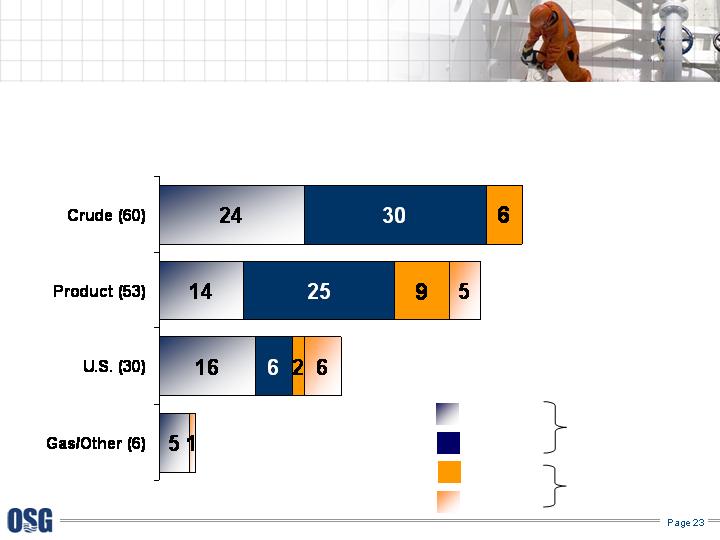

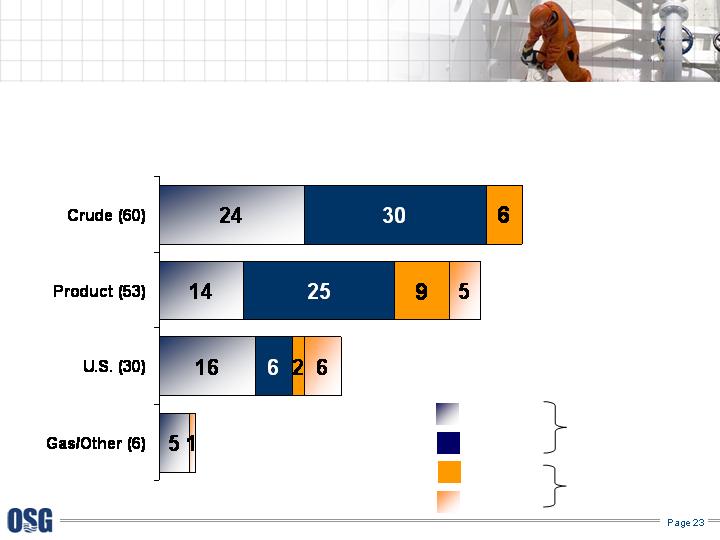

114,946

Owned

Chartered-in

Owned

Chartered-in

120 OPERATING

29 NEWBUILD/

CONVERSIONS

59

61

17

12

As of February 20, 2009

Fleet Snapshot

1

1Includes 2 ships in layup

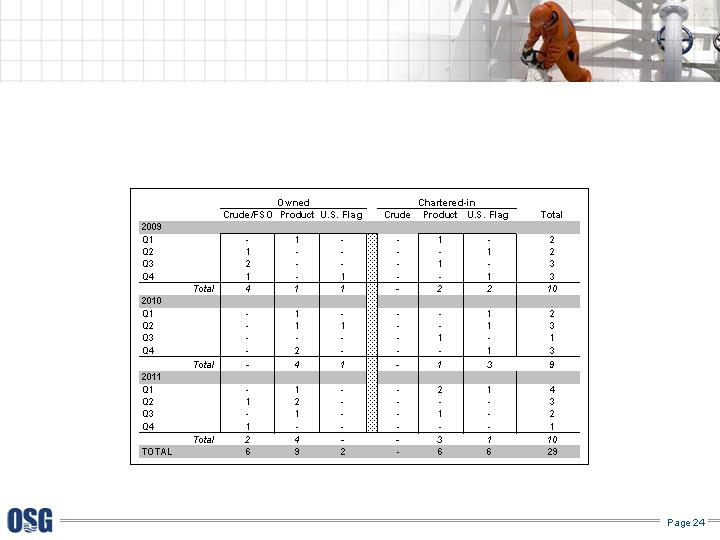

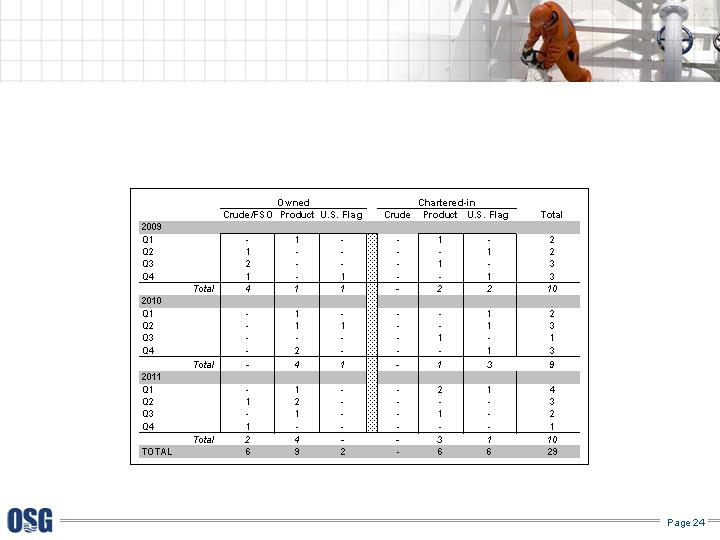

Vessel Delivery Schedule

As of February 20, 2009

An excel spreadsheet of OSG’s full fleet, including delivery date information, can be found on www.osg.com.

Charter Hire Expense by Segment

For the Quarter Ended December 31, 2008

Charter Hire Expense by Segment

For the Fiscal Ended December 31, 2008

Future Revenue $/Days by Segment

Locked-in Time Charter

Days by Segment

Locked-in Time Charter

Revenue by Segment

Locked-in

Charter Revenue

www.osg.com