page 8

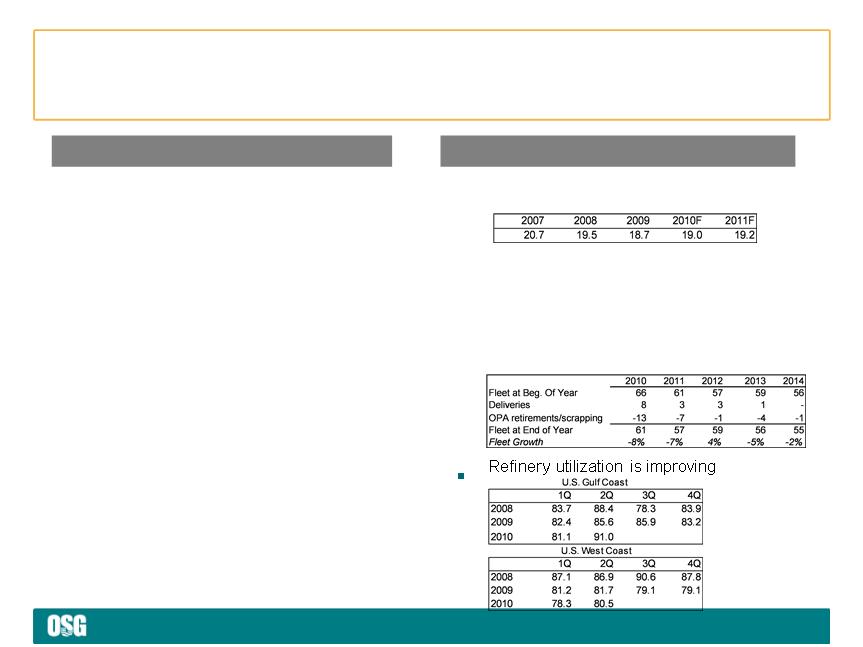

Products Segment Development / Outlook

< Products expected to benefit from short- and long-term market developments

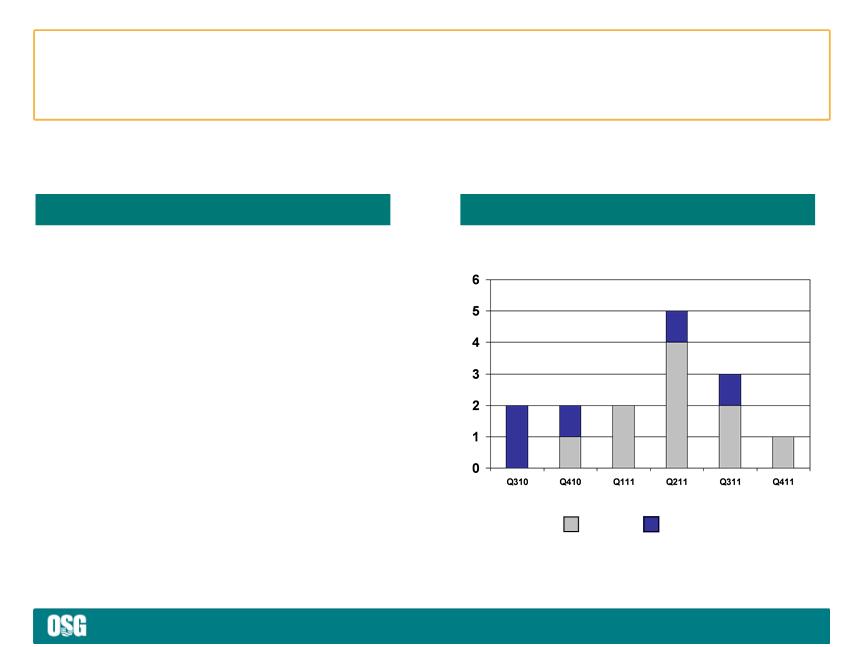

< Peaks and valleys of the orderbook: what a difference a year makes

• 2009: witnessed excess tonnage delivered vs. contracting demand

• 2010: reversal expected due to positive demand, fleet contraction and increased ton-miles

- Deliveries: less than 50 MRs have delivered YTD, well below Clarksons projections for 2010

- Storage: 25 vessels storing clean products down from 118 at year-end 2009

< Worldwide demand for refined products has increased significantly in 2010

• 1H 2010 demand grew 2.6%

• 2010 demand levels now forecast to be slightly over 2007 levels

- Slight growth in oil demand forecast in OECD countries; 4.1% increase in demand in non-OECD

< Summer 2010

• Late start to the summer “driving season” has led to a rally into the third quarter

< 2H 2010 expected to improve from 1H 2010

• Arbitrage-driven trades have returned on the back of economic recovery; moving more

than just contracted barrels

• Trans-Atlantic arbitrage opportunities between NW Europe and U.S. open in both

directions

- Gasoline imports to the USAC and US Gulf diesel exports back increase vessel utilization and ton-

miles

• Indian exports expanding into the Western markets: LRs put cargo into storage in

Bahamas with MRs distributing cargo