Exhibit 99.1

December 2015 Investor Presentation Confidential and Proprietary

1 Disclaimer and Industry Information Forward - Looking Statements During the course of this presentation, the Company ( Overseas Shipholding Group, Inc.) may make forward - looking statements or provide forward - looking information. All statements other than statements of historical facts should be considered forward - looking statements. Some of these statements i nclude words such as ‘‘outlook,’’ ‘‘believe,’’ ‘‘expect,’’ ‘‘potential,’’ ‘‘continue,’’ ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘could,’’ ‘‘seek,’’ ‘‘predict,’’ ‘‘inte nd, ’’ ‘‘plan,’’ ‘‘estimate,’’ ‘‘anticipate,’’ ‘‘target,’’ ‘‘project,’’ ‘‘forecast,’’ ‘‘shall,’’ ‘‘contemplate’’ or the negative version of those words or other comparable words. Although they reflect OSG’s cur ren t expectations, these statements are not guarantees of future performance, but involve a number of risks, uncertainties, and assumptions which are difficult to predic t. Some of the factors that may cause actual outcomes and results to differ materially from those expressed in, or implied by, the forward - looking statements include, but ar e not necessarily limited to, general economic conditions, competitive pressures, the nature of the C ompany’s services and their price movements, and the ability to retain key employees. The Company does not undertake to update any forward - looking statements as a result of future developments, new information or otherwise . Non - GAAP Financial Measures Included in this presentation are certain non - GAAP financial measures, including Time Charter Equivalent (“TCE”) revenue , EBITDA, Adjusted EBITDA , and total leverage ratios, designed to complement the financial information presented in accordance with generally accepted accounting principles in the United S tat es of America because management believes such measures are useful to investors. TCE revenues, which represents shipping revenues less voyage expen ses , is a measure to compare revenue generated from a voyage charter to revenue generated from a time charter. EBITDA represents net (loss)/income before int erest expense, income taxes and depreciation and amortization expense. Adjusted EBITDA consists of EBITDA adjusted for the impact of certain items that we do no t consider indicative of our ongoing operating performance . Total leverage ratios are calculated as total debt divided by Adjusted EBITDA. We present non - GAAP measures when we believe that the additional information is useful and meaningful to investors. Non - GAAP financial measures do not have any standardized meaning a nd are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non - GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. See Appendix for a reconciliation of c ert ain non - GAAP measures to the comparable GAAP measures . This presentation also contains estimates and other information concerning our industry that are based on industry publicatio ns, surveys and forecasts. This information involves a number of assumptions and limitations, and we have not independently verified the accuracy or completeness of the inf ormation . Additional Information Before you participate in the tender offers and/or consent solicitations, you should read the offer to purchase relating to the relevant tender offer and consent solicitation and the documents the Company has filed with the SEC for more complete information. You may obtain these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov . Private & Confidential

2 I. Transaction Overview II. Financial Summary III. Appendix i. Company Overview ii. Supplemental Financials Page Table of Contents Private & Confidential 3 10 14 15 19

Transaction Overview

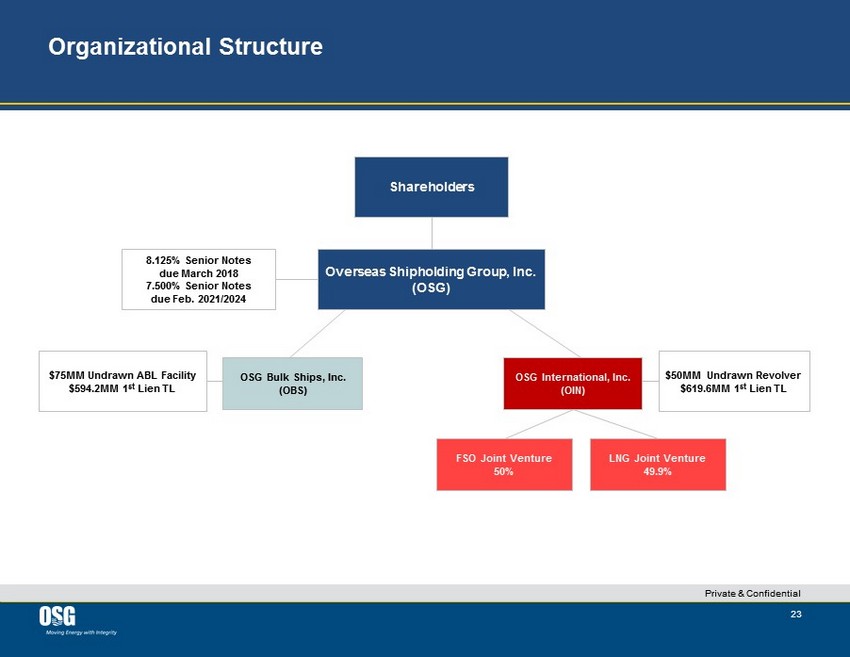

4 Executive Summary Private & Confidential x Overseas Shipholding Group, Inc. (“OSG” or the “Company”) owns and/or operates 79 vessels around the world, enabling the safe and efficient transport of oil and refined products x OSG is the only major tanker company with both a significant U.S. Flag fleet and International Flag fleet – OSG Bulk Ships, Inc. (“OBS”), OSG’s U.S. Flag business with a fleet of 24 vessels, remains a Jones Act market leader with 22 Jones Act vessels – OSG International, Inc. (“OIN”), with a fleet of 55 vessels (7 of which are chartered - in and 6 of which are owned through JVs), maintains one of the largest global footprints in the market through its international transportation of crude oil and refined products x For the last twelve months (“LTM”) ending September 30, 2015, OSG’s time charter equivalent (“TCE”) revenue and Adjusted EBITDA were $889 million and $459 million, respectively – As of September 30, 2015, OSG’s Total and Net Leverage Ratios were 3.4x and 2.0x, respectively

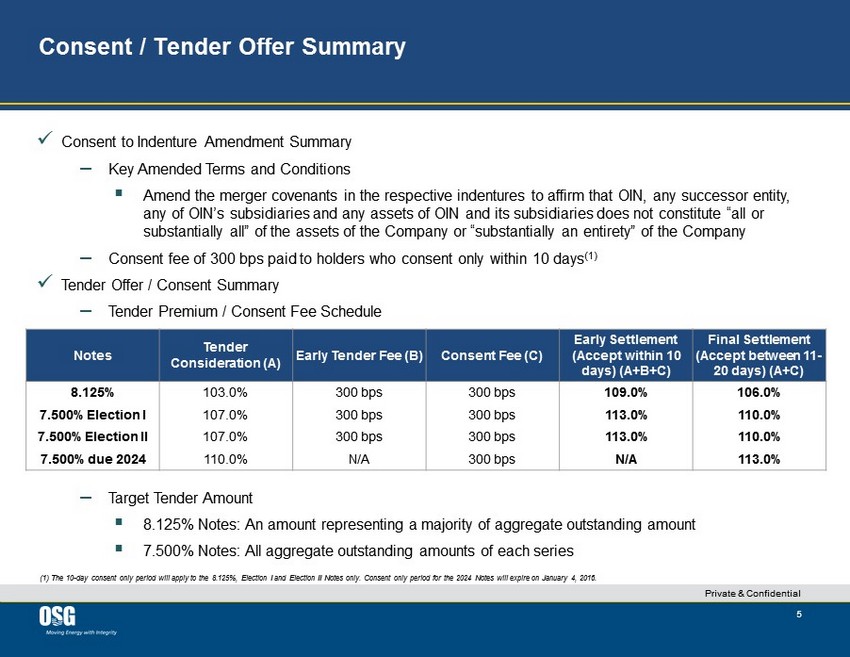

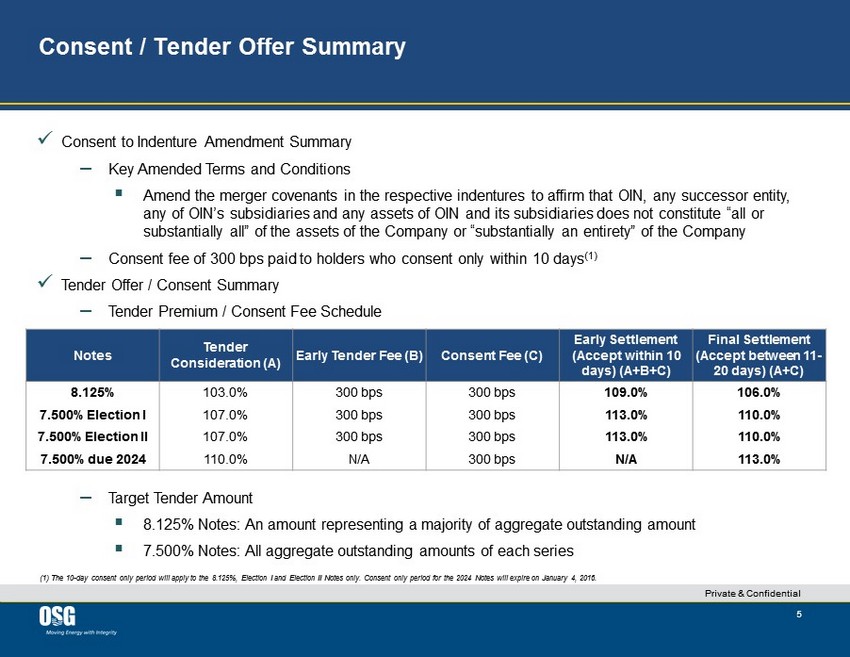

5 Consent / Tender Offer Summary Private & Confidential x Consent to Indenture Amendment Summary – Key Amended Terms and Conditions ▪ Amend the merger covenants in the respective indentures to affirm that OIN, any successor entity, any of OIN’s subsidiaries and any assets of OIN and its subsidiaries does not constitute “all or substantially all” of the assets of the Company or “substantially an entirety” of the Company – Consent fee of 300 bps paid to holders who consent only within 10 days (1) x Tender Offer / Consent Summary – Tender Premium / Consent Fee Schedule – Target Tender Amount ▪ 8.125% Notes: An amount representing a majority of aggregate outstanding amount ▪ 7.500% Notes: All aggregate outstanding amounts of each series Notes Tender Consideration (A) Early Tender Fee (B) Consent Fee (C) Early Settlement (Accept within 10 days) (A+B+C) Final Settlement (Accept between 11 - 20 days) (A+C) 8.125% 103.0% 300 bps 300 bps 109.0% 106.0% 7.500% Election I 107.0% 300 bps 300 bps 113.0% 110.0% 7.500% Election II 107.0% 300 bps 300 bps 113.0% 110.0% 7.500% due 2024 110.0% N/A 300 bps N/A 113.0% (1) The 10 - day consent only period will apply to the 8.125 %, Election I and Election II Notes only. Consent only period for the 2024 Notes will expire on January 4, 2016.

6 Consent / Tender Offer Summary (Cont’d) Private & Confidential x Holders participating in the tender offer and consent will receive both the early tender payment and consent fee, while holders only participating in the consent solicitation will receive the consent fee only – The consent fee will be paid to all consenting holders of the 8.125% Notes and each series of the 7.500% Notes – Consent / tender payments will only be made if requisite consents / tenders are received to effect the amendment and other conditions are satisfied

7 Transaction Rationale Private & Confidential x OSG is seeking to amend the merger covenant to provide the Company with maximum flexibility as OSG continues to evaluate strategic alternatives with respect to OIN x There are no immediate plans for a separation of the business segments x Combining the consent with a tender for a majority of the 8.125% Notes and all of each series of the 7.500% Notes provides an attractive de - leveraging opportunity for OSG and an opportunity for Noteholders to obtain liquidity at a significant premium – The Company is limiting the tender offers to the above respective percentages as this will utilize substantially all of the existing unrestricted cash at OSG HoldCo

8 Sources & Uses and Pro Forma Capitalization Private & Confidential Source: Company filings Note: Cash & Cash Equivalents excludes $26.6 million of Restricted Cash; $9.0 million of legally restricted cash relating to OIN Facilities at OIN and $17.6 million for certain unsecured bankruptcy related clai ms at OSG HoldCo . (1) OSG HoldCo received a $54.9 million tax refund from the IRS in November 2015. (2) Assumes transaction closing as of 12/15/15 and cash settlement on accrued interest for tendered notes. (3) Leverage based on OBS LTM 9/30/15 Adj. EBITDA of $182.2 million, OIN LTM 9/30/15 Adj. EBITDA of $274.9 million and Consolidat ed LTM 9/30/15 Adj. EBITDA of $459.1 million. (4) ‘Pro Forma (Consolidated)’ and ‘Pro Forma (excluding OIN)’ OSG HoldCo Cash & Cash Equivalents are unadjusted for remaining in ter est payments on the OSG HoldCo Notes through maturity of $24.1 million. (US$ in mm) Sources and Uses Sources Uses Sources and Uses Cash from HoldCo Balance Sheet 182.3$ Repurchase 8.125% Notes 119.1$ Cash from OBS Balance Sheet 25.0 Repurchase 7.500% Notes 106.8 Tax Refund (1) 54.9 Early Tender Payment 17.8 Consent Fees 10.3 Accrued Interest (2) 4.7 Transaction Fees and Expenses 3.5 Total Sources 262.2$ Total Uses 262.2$ Capitalization Current Pro Forma (Consolidated) Pro Forma (excl. OIN) 9/30/15 Leverage (3) 9/30/15 Leverage (3) 9/30/15 Leverage (3) OSG HoldCo: OSG HoldCo Cash & Cash Equivalents (4) 190.9$ 8.6$ 8.6$ 8.125% Senior Notes 238.2 119.1 119.1 7.5% Senior Notes 106.8 - - Total OSG HoldCo Debt 344.9 119.1 119.1 Total OSG HoldCo Net Debt 154.0 110.5 110.5 OBS: OBS Cash & Cash Equivalents 186.8 161.8 161.8 $75.0 million ABL Revolver - - - OBS Senior Secured TL 594.2 594.2 594.2 Total OBS Debt 594.2 3.3x 594.2 3.3x 594.2 3.3x OIN: OIN Cash & Cash Equivalents 250.3 250.3 $50.0 million Revolver - - OIN Senior Secured TL 619.6 619.6 Total OIN Debt 619.6 2.3x 619.6 2.3x Consolidated: Consolidated Cash & Cash Equivalents 628.0 420.7 170.4 Total Consolidated Debt 1,558.7$ 3.4x 1,332.9$ 2.9x 713.3$ 3.9x Net Consolidated Debt 930.7 2.0x 912.2 2.0x 542.9 3.0x Net Consolidated Debt (Excl. HoldCo Cash) 1,121.6 2.4x 920.7 2.0x 551.5 3.0x Total Book Equity (9/30/15) 1,562.4 Total Capitalization 2,895.3$

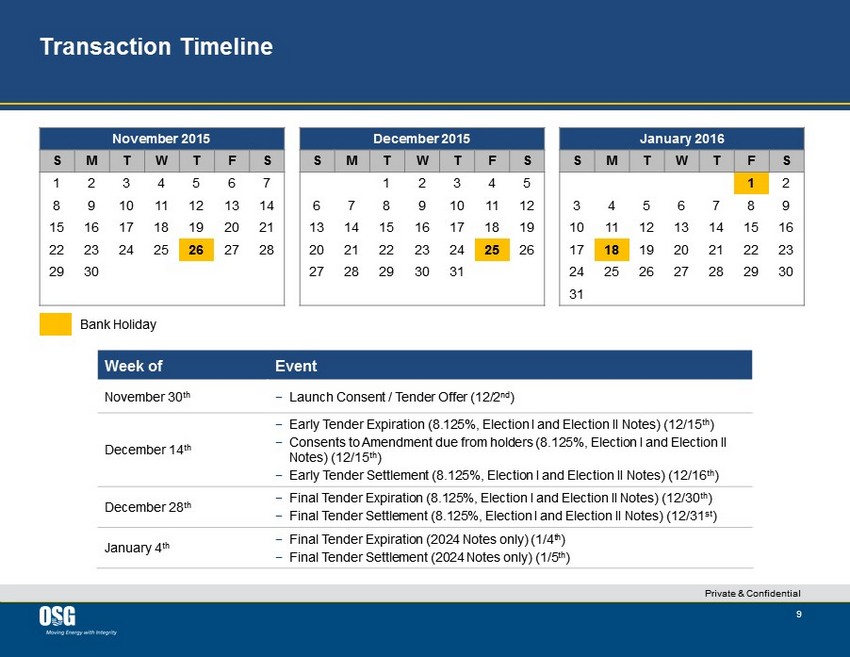

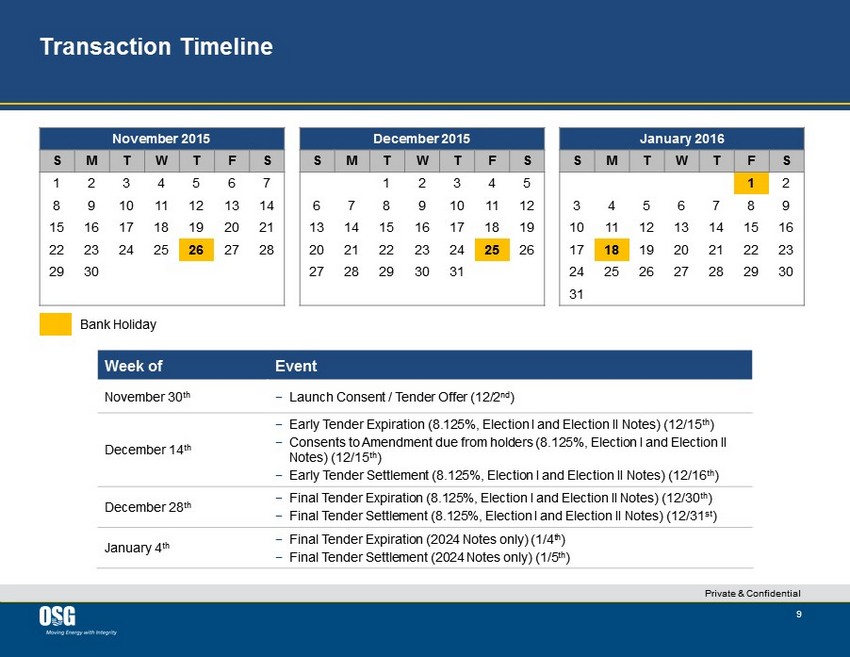

9 Transaction Timeline Private & Confidential Week of Event November 30 th − Launch Consent / Tender Offer (12/2 nd ) December 14 th − Early Tender Expiration (8.125%, Election I and Election II Notes) (12/15 th ) − Consents to Amendment due from holders (8.125%, Election I and Election II Notes) (12/15 th ) − Early Tender Settlement (8.125%, Election I and Election II Notes) (12/16 th ) December 28 th − Final Tender Expiration (8.125%, Election I and Election II Notes) (12/30 th ) − Final Tender Settlement (8.125%, Election I and Election II Notes) (12/31 st ) January 4 th − Final Tender Expiration (2024 Notes only) (1/4 th ) − Final Tender Settlement (2024 Notes only) (1/5 th ) November 2015 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Bank Holiday December 2015 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 January 2016 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

Financial Summary

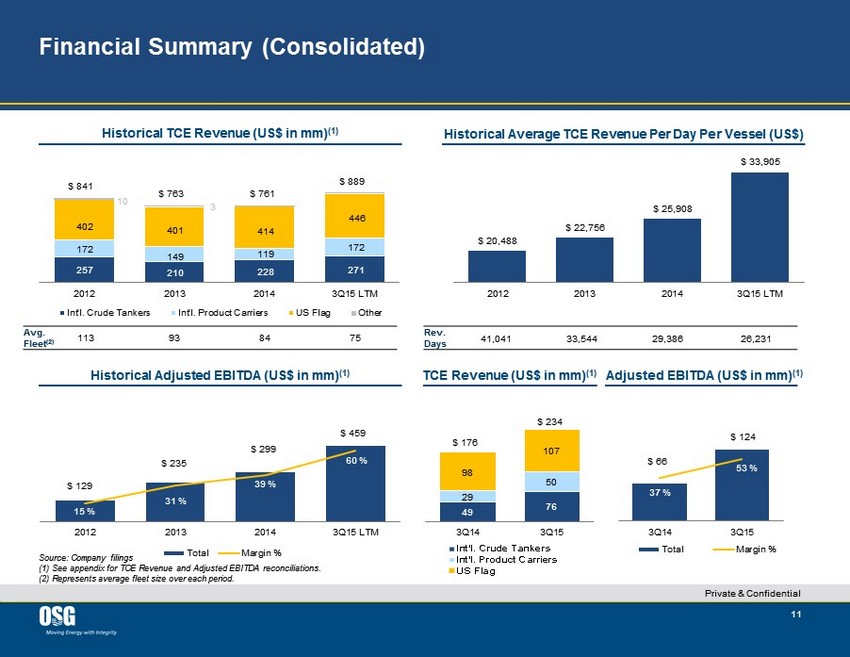

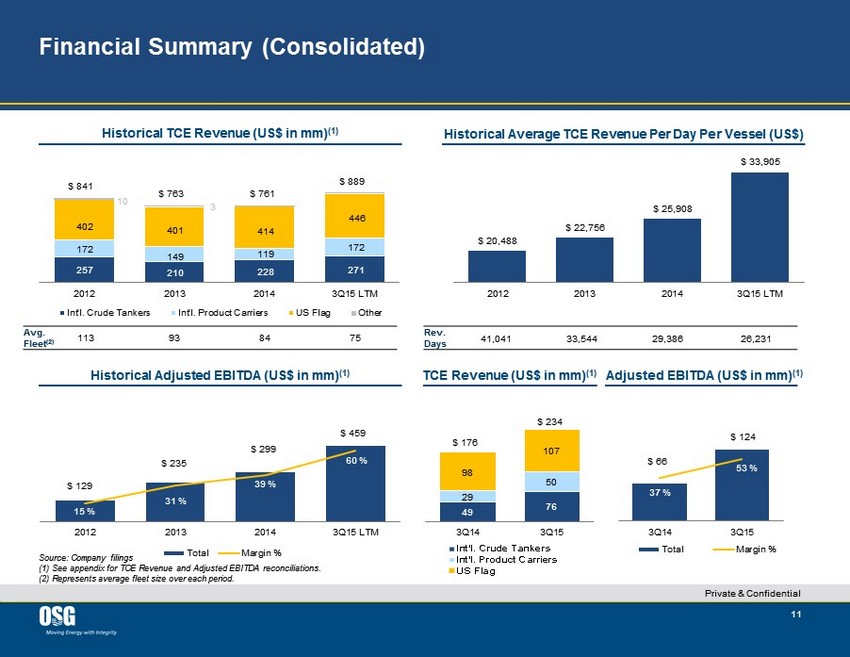

11 83 67 31 44 101 111 $ 215 $ 222 1Q14 1Q15 Int'l. Crude Tankers Int'l. Product Carriers US Flag $ 129 $ 235 $ 299 $ 459 15 % 31 % 39 % 60 % 2012 2013 2014 3Q15 LTM Total Margin % 257 210 228 271 172 149 119 172 402 401 414 446 10 3 $ 841 $ 763 $ 761 $ 889 2012 2013 2014 3Q15 LTM Int'l. Crude Tankers Int'l. Product Carriers US Flag Other Historical TCE Revenue (US$ in mm) (1) Historical Average TCE Revenue P er Day Per Vessel (US$) Historical Adjusted EBITDA (US$ in mm) (1) Avg. Fleet (2) 113 93 84 75 Rev. Days 41,041 33,544 29,386 26,231 Private & Confidential TCE Revenue (US$ in mm) (1) Adjusted EBITDA (US$ in mm) (1) Financial Summary (Consolidated) Source: Company filings (1) See appendix for TCE Revenue and Adjusted EBITDA reconciliations. (2) Represents average fleet size over each period . $ 66 $ 124 37 % 53 % 3Q14 3Q15 Total Margin % 49 76 29 50 98 107 3Q14 3Q15 $ 234 $ 176 $ 20,488 $ 22,756 $ 25,908 $ 33,905 2012 2013 2014 3Q15 LTM

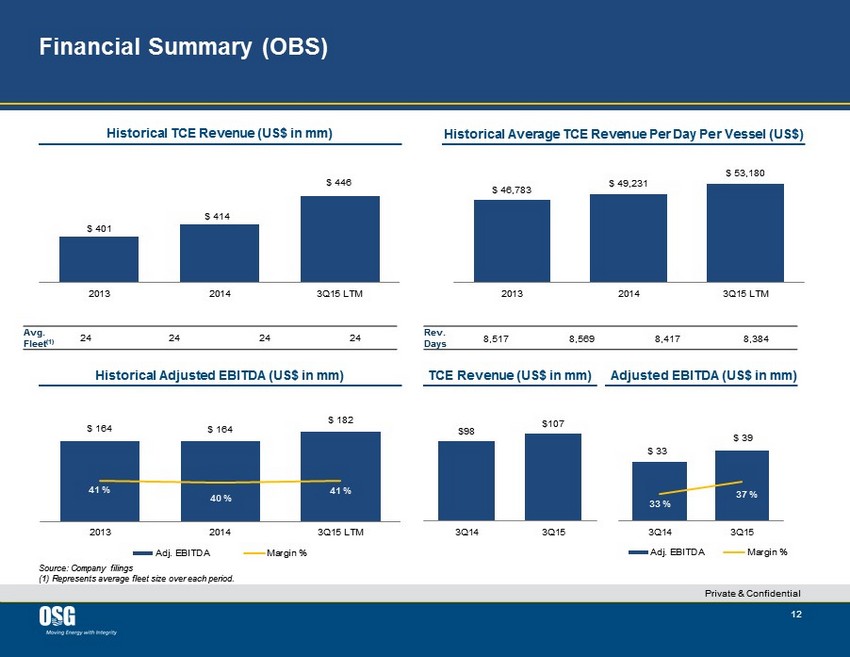

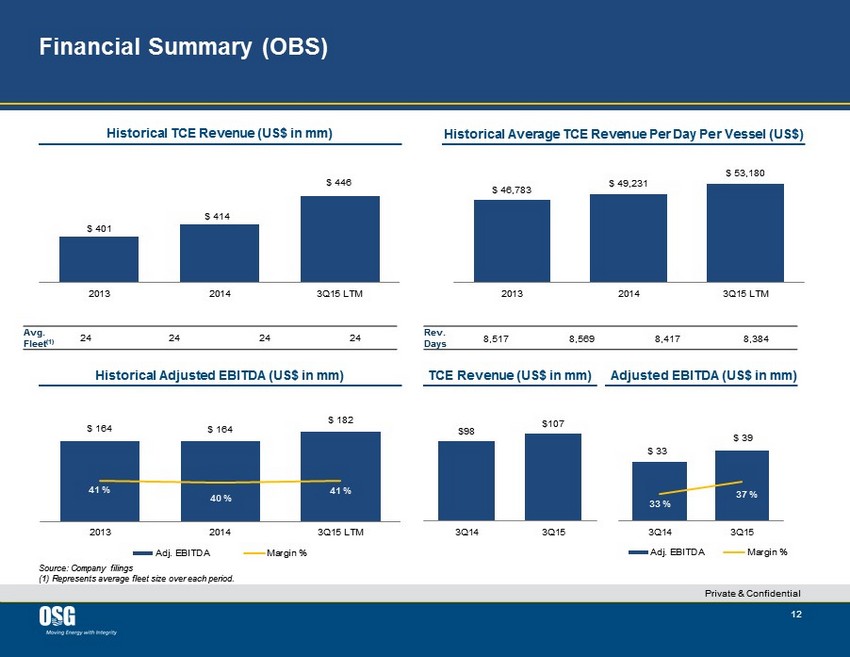

12 $ 164 $ 164 $ 182 41 % 40 % 41 % 2013 2014 3Q15 LTM Adj. EBITDA Margin % $ 401 $ 414 $ 446 2013 2014 3Q15 LTM Historical TCE Revenue (US$ in mm) Historical Average TCE Revenue P er Day Per Vessel (US$) Historical Adjusted EBITDA (US$ in mm) Avg. Fleet (1) 24 24 24 24 Rev. Days 8,517 8,569 8,417 8,384 Private & Confidential TCE Revenue (US$ in mm) Adjusted EBITDA (US$ in mm) Financial Summary (OBS) Source: Company filings (1) Represents average fleet size over each period . $ 33 $ 39 33 % 37 % 3Q14 3Q15 Adj. EBITDA Margin % $ 46,783 $ 49,231 $ 53,180 2013 2014 3Q15 LTM $98 $107 3Q14 3Q15

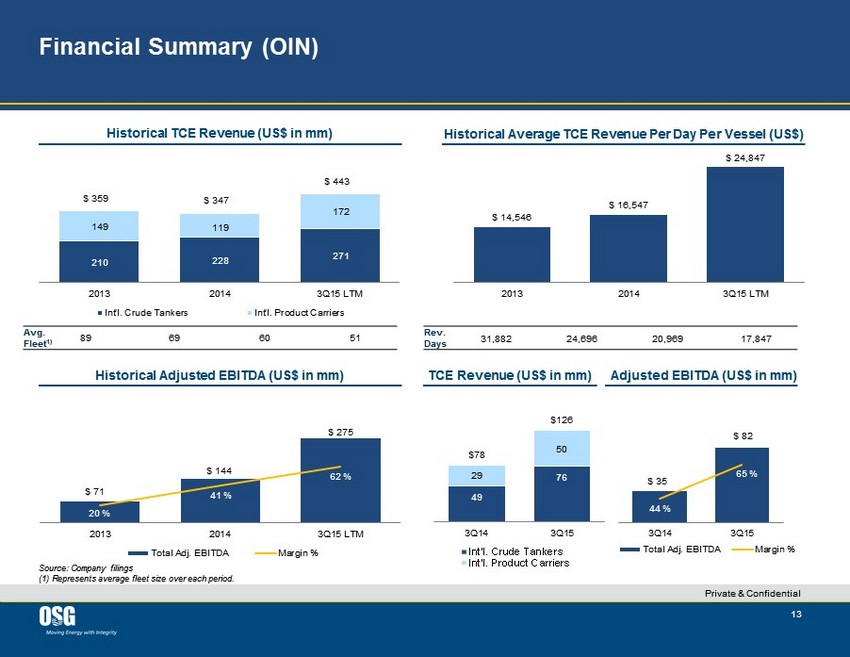

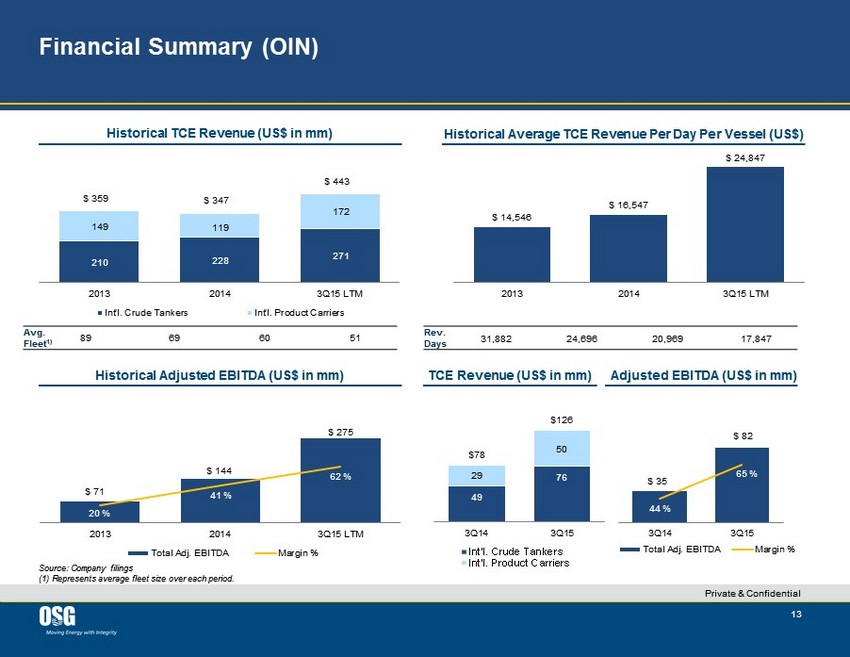

13 $ 71 $ 144 $ 275 20 % 41 % 62 % 2013 2014 3Q15 LTM Total Adj. EBITDA Margin % 210 228 271 149 119 172 $ 359 $ 347 $ 443 2013 2014 3Q15 LTM Int'l. Crude Tankers Int'l. Product Carriers Historical TCE Revenue (US$ in mm) Historical Average TCE Revenue P er Day Per Vessel (US$) Historical Adjusted EBITDA (US$ in mm) Avg. Fleet 1) 89 69 60 51 Rev. Days 31,882 24,696 20,969 17,847 Private & Confidential TCE Revenue (US$ in mm) Adjusted EBITDA (US$ in mm) Financial Summary (OIN) Source: Company filings (1) Represents average fleet size over each period . $ 35 $ 82 44 % 65 % 3Q14 3Q15 Total Adj. EBITDA Margin % $ 14,546 $ 16,547 $ 24,847 2013 2014 3Q15 LTM 49 76 29 50 $78 $126 3Q14 3Q15 83 67 31 44 101 111 $ 215 $ 222 1Q14 1Q15 Int'l. Crude Tankers Int'l. Product Carriers US Flag

Appendix

Company Overview

16 Company Overview ; Overseas Shipholding Group, Inc. (“OSG” or the “Company”) is a leading provider of ocean transportation services for crude oil and refined petroleum products ; Owns and/or operates 79 vessels ; OSG is one of the largest tanker companies worldwide and is the only major tanker company with both a significant US Flag fleet (“OBS”) and International Flag fleet (“OIN”) ; OBS benefits from medium - term customer contracts while OIN primarily operates in the spot market ; OIN also has interests in two Joint Ventures in LNG carriers and FSOs ; OBS is primarily a Jones Act business with 22 vessels operating within Jones Act regulated trades and 2 non - Jones Act US Flag vessels trading internationally and participating in the US Maritime Security Program (“MSP”) ; The Company has a strong presence in all US coastal regions, enabling it to take advantage of the surge in domestic crude as a result of shale oil developments ; The Company maintains one of the largest global footprints in the market through its international transportation of crude oil and refined products and is well positioned to benefit from the rate recovery in those markets given spot exposure Company Description 18% 14% 16% 41% 8% 2% VLCC/ULCC Aframax Panamax MR LR1 LR2 International Flag Fleet (1) Business Segments 38% 13% 8% 33% 8% Tanker Shuttle Tanker Lightering ATB ATB MSP Tanker US Flag Fleet (1) US Flag Business (OBS): International Flag Business (OIN): Source: Company filings. (1) Based on vessel count as of September 30, 2015. Private & Confidential

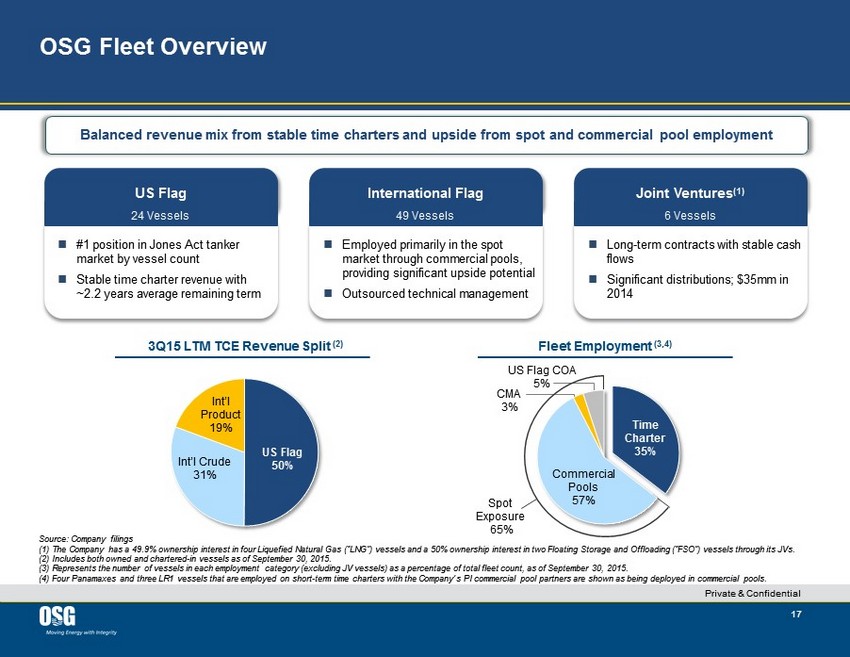

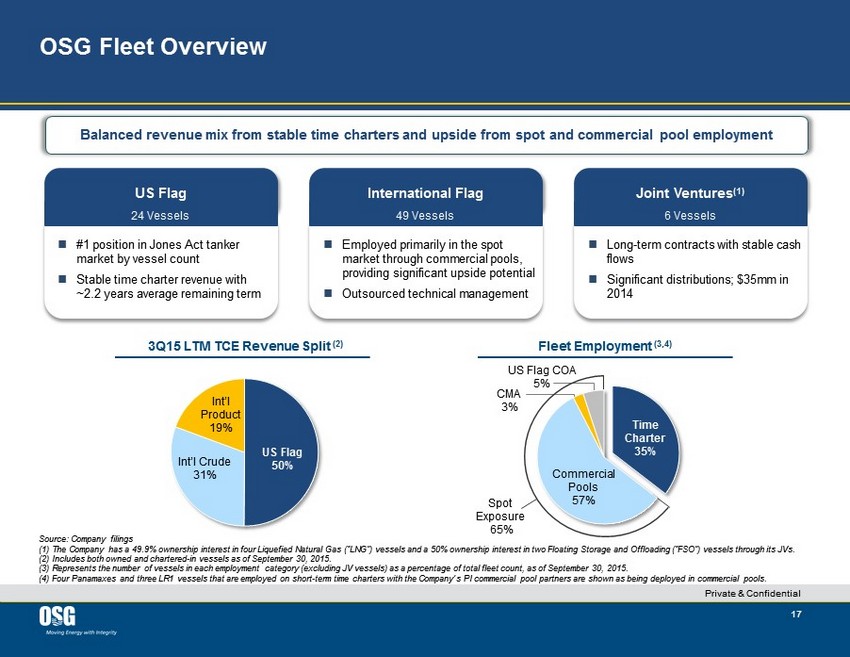

17 ; #1 position in Jones Act tanker market by vessel count ; Stable time charter revenue with ~2.2 years average remaining term US Flag 24 Vessels Source: Company filings (1) The Company has a 49.9% ownership interest in four Liquefied Natural Gas (“LNG”) vessels and a 50% ownership interest in two Floa tin g Storage and Offloading (“FSO”) vessels through its JVs . (2) Includes both owned and chartered - in vessels as of September 30, 2015 . (3) Represents the number of vessels in each employment category (excluding JV vessels) as a percentage of total fleet count, as of September 30, 2015. (4) Four Panamaxes and three LR1 vessels that are employed on short - term time charters with the Company’s PI commercial pool partners are shown as being deployed in commercial pools. OSG Fleet Overview Private & Confidential Time Charter 35% Commercial Pools 57% US Flag 50% Int’l Crude 31% Int’l Product 19% CMA 3% US Flag COA 5% Spot Exposure 65% Balanced revenue mix from stable time charters and upside from spot and commercial pool employment 3Q15 LTM TCE Revenue Split (2) Fleet Employment (3,4) International Flag ; Employed primarily in the spot market through commercial pools, providing significant upside potential ; Outsourced technical management 49 Vessels Joint Ventures (1) ; Long - term contracts with stable cash flows ; Significant distributions; $35mm in 2014 6 Vessels

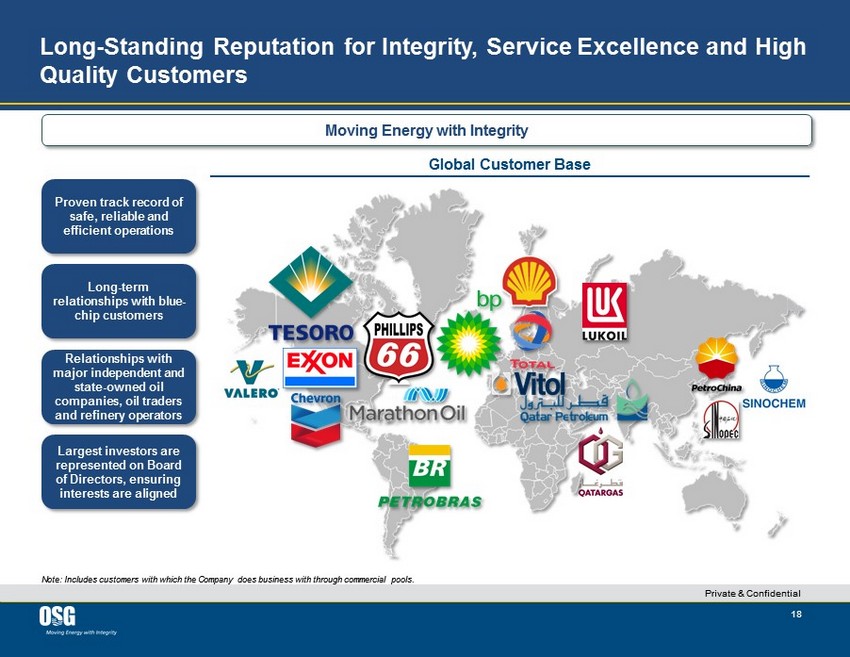

18 Global Customer Base Note: Includes customers with which the Company does business with through commercial pools. Private & Confidential Long - Standing Reputation for Integrity, Service Excellence and High Quality Customers Moving Energy with Integrity Proven track record of safe, reliable and efficient operations Relationships with major independent and state - owned oil companies, oil traders and refinery operators Long - term relationships with blue - chip customers Largest investors are represented on Board of Directors, ensuring interests are aligned

Supplemental Financials

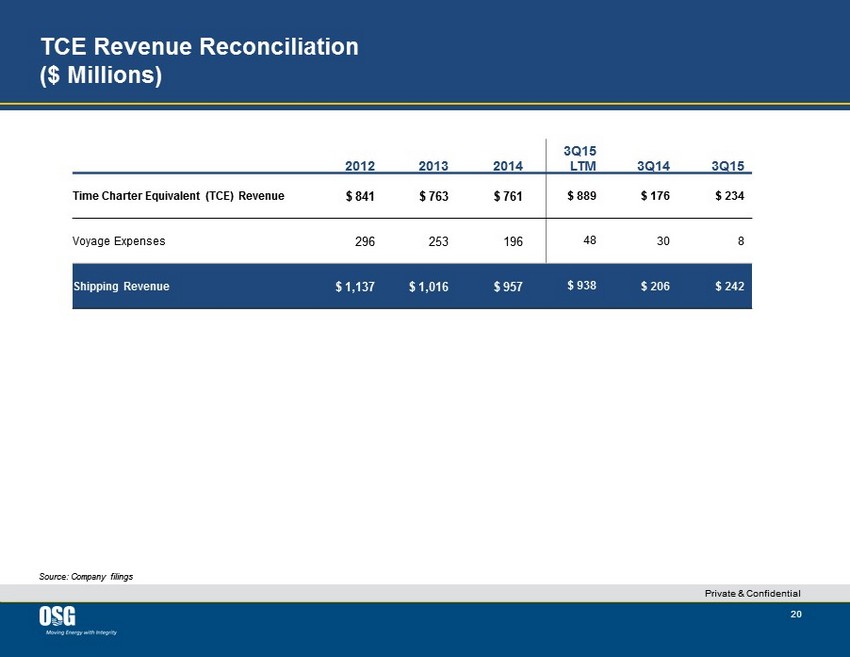

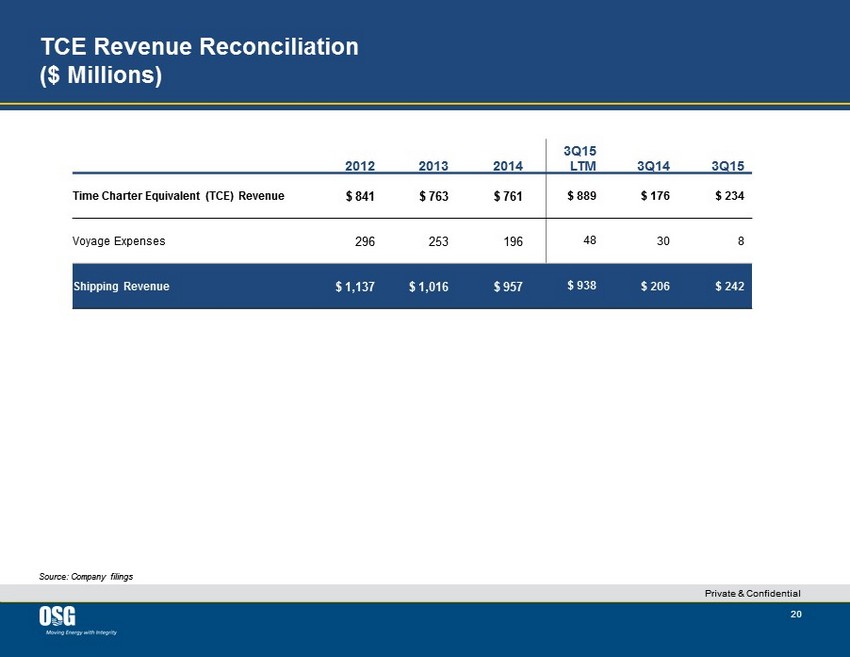

20 TCE Revenue Reconciliation ($ Millions) Source : Company filings 2012 2013 2014 3Q15 LTM 3Q14 3Q15 Time Charter Equivalent (TCE) Revenue $ 841 $ 763 $ 761 $ 889 $ 176 $ 234 Voyage Expenses 296 253 196 48 30 8 Shipping Revenue $ 1,137 $ 1,016 $ 957 $ 938 $ 206 $ 242 Private & Confidential

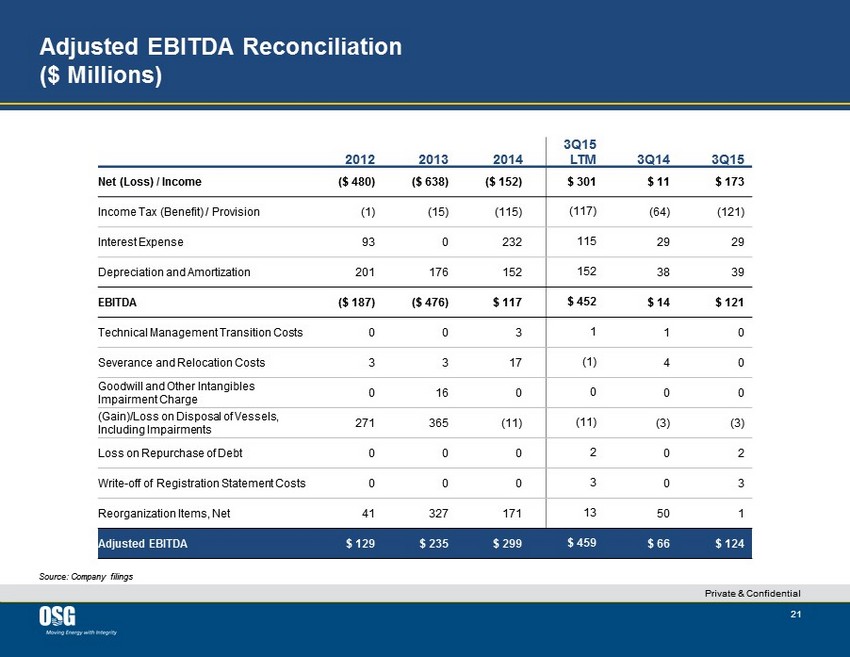

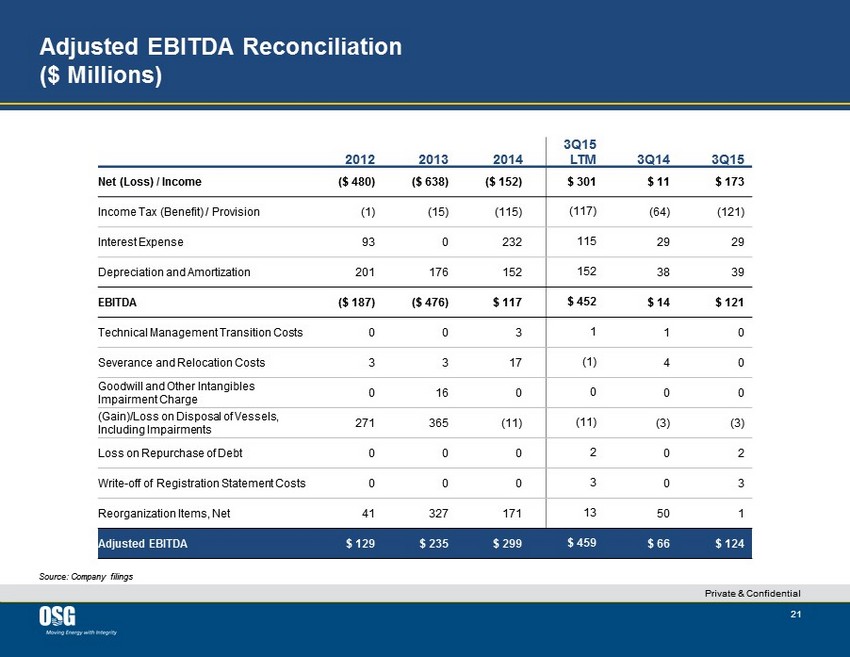

21 Adjusted EBITDA Reconciliation ($ Millions ) Source : Company filings 2012 2013 2014 3Q15 LTM 3Q14 3Q15 Net (Loss) / Income ($ 480 ) ($ 638 ) ($ 152 ) $ 301 $ 11 $ 173 Income Tax (Benefit) / Provision (1) (15) (115) (117) (64) (121) Interest Expense 93 0 232 115 29 29 Depreciation and Amortization 201 176 152 152 38 39 EBITDA ($ 187 ) ($ 476 ) $ 117 $ 452 $ 14 $ 121 Technical Management Transition Costs 0 0 3 1 1 0 Severance and Relocation Costs 3 3 17 (1) 4 0 Goodwill and Other Intangibles Impairment Charge 0 16 0 0 0 0 (Gain)/Loss on Disposal of Vessels, Including Impairments 271 365 (11) (11) (3) (3) Loss on Repurchase of Debt 0 0 0 2 0 2 Write - off of Registration Statement Costs 0 0 0 3 0 3 Reorganization Items, Net 41 327 171 13 50 1 Adjusted EBITDA $ 129 $ 235 $ 299 $ 459 $ 66 $ 124 Private & Confidential

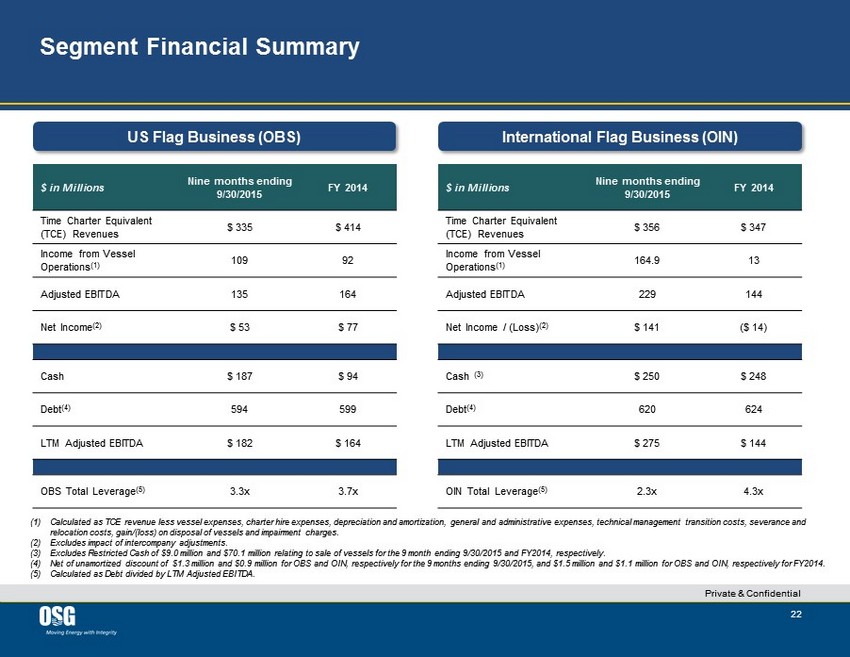

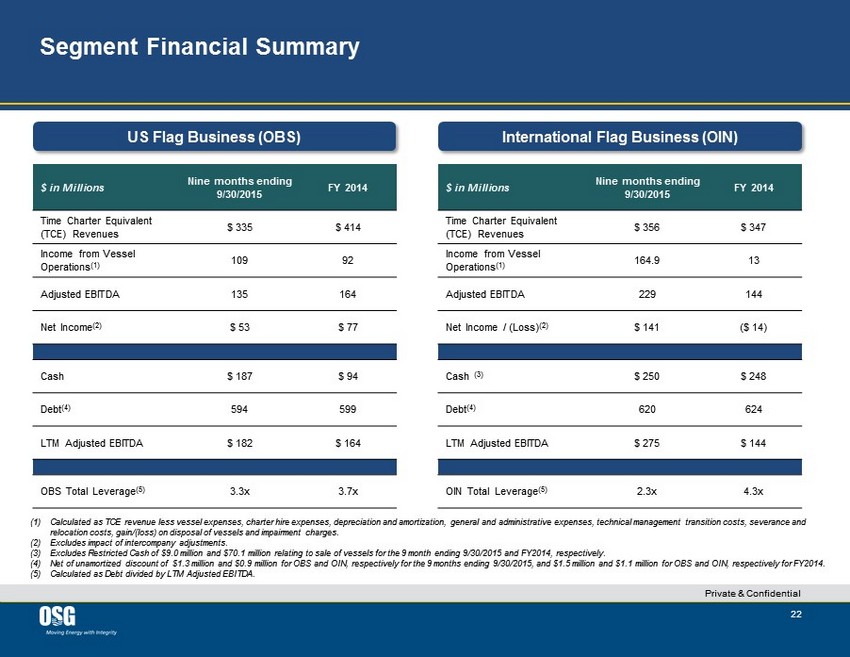

22 Segment Financial Summary $ in Millions Nine months ending 9/30/2015 FY 2014 Time Charter Equivalent (TCE) Revenues $ 356 $ 347 Income from Vessel Operations (1) 164.9 13 Adjusted EBITDA 229 144 Net Income / (Loss) (2) $ 141 ($ 14) Cash (3) $ 250 $ 248 Debt (4) 620 624 LTM Adjusted EBITDA $ 275 $ 144 OIN Total Leverage (5) 2.3x 4.3x International Flag Business (OIN) US Flag Business (OBS) $ in Millions Nine months ending 9/30/2015 FY 2014 Time Charter Equivalent (TCE) Revenues $ 335 $ 414 Income from Vessel Operations (1) 109 92 Adjusted EBITDA 135 164 Net Income (2) $ 53 $ 77 Cash $ 187 $ 94 Debt (4) 594 599 LTM Adjusted EBITDA $ 182 $ 164 OBS Total Leverage (5) 3.3x 3.7x (1) Calculated as TCE r evenue less vessel expenses, charter hire expenses, depreciation and amortization, general and administrative expenses, technical management transition costs, severance and relocation costs, gain/(loss) on disposal of vessels and impairment charges. (2) Excludes impact of intercompany adjustments . (3) Excludes Restricted Cash of $9.0 million and $70.1 million relating to sale of vessels for the 9 month ending 9/30/2015 and F Y20 14, respectively. (4) Net of unamortized discount of $1.3 million and $0.9 million for OBS and OIN, respectively for the 9 months ending 9/30/2015 , a nd $1.5 million and $1.1 million for OBS and OIN, respectively for FY2014. (5) Calculated as Debt divided by LTM Adjusted EBITDA. Private & Confidential

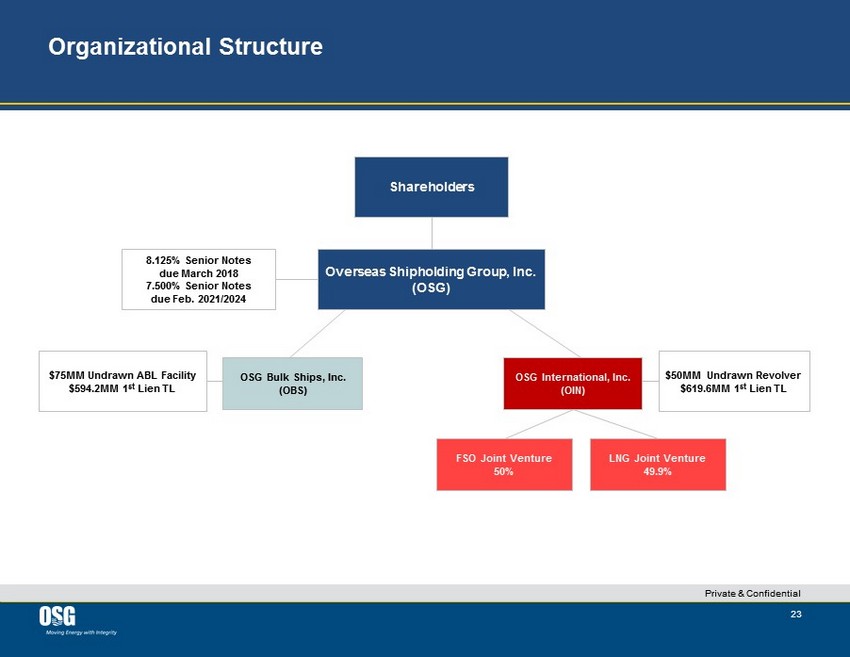

23 Private & Confidential Organizational Structure OSG International, Inc. ( OIN) OSG Bulk Ships, Inc. (OBS) FSO Joint Venture 50% LNG Joint Venture 49.9% 8.125% Senior Notes due March 2018 7.500% Senior Notes due Feb. 2021/2024 $75MM Undrawn ABL Facility $594.2MM 1 st Lien TL $50MM Undrawn Revolver $619.6MM 1 st Lien TL Overseas Shipholding Group, Inc. (OSG) Shareholders