|

| AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON May 25, 2017 |

| |

| FILE NO. |

| |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| FORM N-14 |

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

| |

| Pre-Effective Amendment No. 2 |

| Post-Effective Amendment No. |

| |

| VANGUARD CHESTER FUNDS |

| (Exact Name of Registrant as Specified in Declaration of Trust) |

| |

| 100 VANGUARD BLVD., MALVERN, PA 19355 |

| (Address of Principal Executive Office) |

| |

| Registrant’s Telephone Number (610) 669-1000 |

| |

| ANNE E. ROBINSON |

| 100 VANGUARD BLVD., MALVERN, PA 19355 |

| (Name and Address of Agent for Service) |

| |

| |

| |

| Approximate Date of Proposed Public Offering: As soon as practicable after this registration |

| statement becomes effective. |

| It is proposed that this filing will become effective on May 30, 2017, pursuant to Rule 488 under |

| the Securities Act of 1933. |

| The title of securities being registered are Vanguard Institutional Target Retirement Income |

| Fund Institutional Shares. |

| No filing fee is due in reliance on Section 24(f) under the Investment Company Act of 1940. |

IMPORTANT NEWS FOR SHAREHOLDERS

Vanguard Institutional Target Retirement 2010 Fund

The Vanguard Institutional Target Retirement 2010 Fund is to be reorganized into the Vanguard Institutional Target Retirement Income Fund on or about July 21, 2017. The first few pages of this booklet highlight key points about this reorganization.

The reorganization does not require shareholder approval, and you are not being asked to vote.

We do, however, ask that you review the enclosed information statement/prospectus, which contains information about the combined fund, outlines the differences between your fund and the combined fund, and provides details about the terms and conditions of the reorganization.

KEY POINTS ABOUT THE REORGANIZATION

Purpose of the Reorganization

The purpose of the reorganization is to combine the Vanguard Institutional Target Retirement 2010 Fund (the “2010 Fund”) with and into Vanguard Institutional Target Retirement Income Fund (the “Income Fund”) (each, a “Fund” and collectively, the “Funds”). The Target Retirement Funds were originally launched in 2006. It was anticipated that approximately seven years after the target retirement date as specified in a fund’s name, such fund’s allocation would become substantially similar to the Income Fund’s allocation, and the Dated Fund would be merged into the Income Fund. This intention is disclosed in the Target Retirement Funds’ prospectuses. In mid-2017, the 2010 Fund will have allocations substantially similar to the Income Fund.

At the time of the reorganization, the 2010 Fund and the Income Fund will have the same minimum initial investment amount and the same expense ratio. They have substantially similar investment objectives, and identical fundamental investment policies, share class structures, boards of trustees, investment advisors, and fiscal year ends. They have had similar performance records, and the target allocation of the Funds will be substantially similar at the time of the proposed reorganization.

Similar Costs for Shareholders

For the fiscal year ended September 30, 2016, each of the Funds had total annual fund operating expenses of 0.09%. Although their asset sizes differ, the 2010 Fund and the Income Fund are funds of funds, therefore their expense ratios are a function of their underlying funds. As a result, the Income Fund’s expense ratio is not expected to change due to the reorganization.

Investment Objectives, Index, Investment Strategies, Risks, and Investment Advisory Arrangement

At the time of the reorganization, the 2010 Fund and the Income Fund will have the same minimum initial investment amount and the same expense ratio. They also have substantially similar investment objectives, and identical fundamental investment policies, share class structures, boards of trustees, investment advisors, and fiscal year ends. They have had similar performance records, and the target allocation of the two Funds will be substantially similar at the time of the proposed reorganization (as seen in the tables on the next page). Although their asset size differs, the Income Fund’s expense ratio is not expected to change as a result of the reorganization. Both Funds also have identical risks and substantially similar investment strategies. The Funds operate as diversified open-end management companies within the meaning of the Investment Company Act of 1940 (the “1940 Act”).

The Vanguard Group, Inc. (“Vanguard”) serves as investment advisor to both Funds through its Equity Index Group. The Funds also have the same portfolio managers, which are primarily responsible for each Fund’s day-to-day management. Vanguard provides investment advisory services to the Funds on an at-cost basis, subject to the supervision and oversight of the Boards of Trustees and officers of the Funds.

Comparison of Investment Performance

The following table shows the average annual total returns of the 2010 Fund, along with the Income Fund. Also shown are the returns of the Funds’ current benchmarks, the Target 2010 Composite Index and the Target Income Composite Index.

Average Annual Total Returns¹ for Periods Ended December 31, 2016²

| | |

| | | Since Inception |

| | 12-Month | (6/26/2015) |

| Institutional Target Retirement | | |

| 2010 Fund | 5.31% | 2.37% |

| Institutional Target Retirement | | |

| Income Fund | 5.29% | 2.61% |

| Target 2010 Composite Index³ | 5.44% | 2.57% |

| Target Income Composite Index³ | 5.35% | 2.78% |

| 1 | Returns shown are before taxes and net of fees. |

| 2 | Keep in mind that the Funds’ past performance does not indicate how they will perform in the future. Actual performance may be higher or lower than the performance shown. |

| 3 | This reflects no deduction for fees, expenses, or taxes. |

Service Arrangements

According to an agreement applicable to the Target Retirement Funds and Vanguard, the Funds’ direct expenses will be offset by Vanguard for (1) the Funds’ contributions to the costs of operating the underlying Vanguard funds in which the Target Retirement Funds invest and (2) certain savings in administrative and marketing costs that Vanguard expects to derive from the Funds’ operation. The Funds’ trustees believe that the offsets should be sufficient to cover most, if not all, of the direct expenses incurred by the Funds. As a result, each Fund is expected to operate at a very low or zero direct expense ratio. Since their inceptions, the Funds, in fact, have incurred no direct net expenses. Although the Target Retirement Funds are not expected to incur any net expenses directly, the Funds’ shareholders indirectly bear the expenses of the underlying Vanguard Funds.

How the Reorganization Will Occur and How It Will Affect Your Account

The Board of Trustees for each Fund approved the reorganization of the 2010 Fund into the Income Fund on December 16, 2016. There is no action required by the Funds’ shareholders to implement the reorganization. No vote is required by either the 2010 Fund or the Income Fund shareholders to approve the reorganization.

The Declaration of Trust for the Funds, along with applicable state and federal law, do not require shareholder approval for fund mergers such as the reorganization. Because applicable legal requirements do not require shareholder approval under these circumstances and the Board of Trustees has determined that the reorganization is in the best interests of each Fund and its shareholders, shareholders are not being asked to vote on the reorganization.

In the reorganization, shares of 2010 Fund will be exchanged, on a tax-free basis, for an equivalent dollar amount of shares in the Income Fund. Your account registration and account options will be the same, unless you alter them. In addition, your aggregate tax basis in your shares will remain the same.

The 2010 Fund is closed for investments by new accounts, and it will stop accepting purchase requests from existing accounts shortly before the reorganization is scheduled to occur. If you place a purchase order directly or through an investment program during this period before the closing, it will be rejected.

Tax-Free Nature of the Reorganization

The proposed exchange of shares is expected to be accomplished on a tax-free basis. Accordingly, we anticipate that 2010 Fund shareholders will not realize any capital gains or losses from the reorganization. However, you should pay close attention to these points.

- Final distribution. Prior to the reorganization, the 2010 Fund will distribute any remaining undistributed net income and/or realized capital gains. These distributions generally will be taxable to you.

- Payments of distributions. Following the reorganization, Income Fund shareholders (including former shareholders of the 2010 Fund) will participate fully in any distributions made for the shares of the Income Fund. These distributions generally will be taxable to you.

- Cost basis. Following the reorganization, your aggregate cost basis and your holding period in your shares will remain the same. However, your nominal per-share cost basis will change as a result of differences in the share prices of the 2010 Fund and the Income Fund. Vanguard will provide to you certain cost basis information in connection with the reorganization on its “Report of Organizational Actions Affecting Basis of Securities,” which will be available on vanguard.com shortly after the reorganization.

If you choose to redeem your shares before the reorganization takes place, then the redemption will be treated as a normal sale of shares and, generally, will be a taxable transaction.

Whom Can You Call If You Have Any Questions

Please call Vanguard toll-free at 800-662-7447 if you have any questions about the reorganization.

COMBINED INFORMATION STATEMENT/PROSPECTUS

VANGUARD INSTITUTIONAL TARGET RETIREMENT 2010 FUND, A SERIES OF VANGUARD CHESTER FUNDS

TO BE REORGANIZED INTO AND WITH

VANGUARD INSTITUTIONAL TARGET RETIREMENT INCOME FUND, A SERIES OF VANGUARD CHESTER FUNDS

INTRODUCTION

Proposal Summary. This combined information statement/prospectus describes the reorganization to combine the Vanguard Institutional Target Retirement 2010 Fund (the “2010 Fund”) with and into the Vanguard Institutional Target Retirement Income Fund (the “Income Fund”) (each, a “Fund” and collectively, the “Funds”). The 2010 Fund’s investment objective is to provide capital appreciation and current income consistent with its current asset allocation. The Income Fund’s investment objective is to provide current income and some capital appreciation. The purpose of the reorganization is to combine the 2010 Fund with and into the Income Fund. The Target Retirement Funds were originally launched in 2006. It was anticipated that approximately seven years after the target retirement date as specified in a fund’s name, such fund’s allocation would become substantially similar to the Income Fund’s allocation, and the Dated Fund would be merged into the Income Fund.

The reorganization involves a few basic steps. First, the 2010 Fund will transfer substantially all of its assets and all of its liabilities to the Income Fund. Second, and simultaneously with step one, the Income Fund will open an account for each 2010 Fund shareholder, crediting it with an amount of shares of the Income Fund equal in value to the shares of the 2010 Fund owned by such holder at the time of the reorganization. Thereafter, the 2010 Fund will be liquidated and dissolved. These steps together are referred to in this information statement/prospectus as the “Reorganization.”

The address for the 2010 Fund and the Income Fund is P.O. Box 2600, Valley Forge, PA 19482, and the telephone number is 610-669-1000 or 800-662-7447. The 2010 Fund and the Income Fund are each a series of Vanguard Chester Funds, which is a Delaware statutory trust.

Read and Keep These Documents. Please read this entire information statement/prospectus along with the enclosed Income Fund prospectus, dated January 27, 2017, as supplemented. The prospectus sets forth concisely the information about the Income Fund that a prospective investor ought to know before investing. These documents contain information that is important to you, and you should keep them for future reference.

Additional Information is Available. The Income Fund’s Statement of Additional Information (dated January 27, 2017), as supplemented, contains important information about the Income Fund. It has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and is incorporated into this information statement/prospectus by reference. In addition, the 2010 Fund’s prospectus and Statement of Additional Information (dated January 27, 2017), as supplemented, are incorporated by reference into and are considered part of this information statement/prospectus. The Statement of Additional Information relating to the Reorganization dated January 27, 2017, also is incorporated by reference into this information statement/prospectus. The audited financial statements and related independent registered public accounting firm’s report for the 2010 Fund is contained in its annual report for the fiscal year ended September 30, 2016, and for the Income Fund is contained in its annual report for the fiscal year ended September 30, 2016, also incorporated by reference. The most recent unaudited semiannual report for each Fund is contained in the respective shareholder report for the fiscal period ended March 31, 2017. You can obtain copies of these documents without charge by calling Vanguard at 800-662-7447, by writing to us at P.O. Box 2600, Valley Forge, PA 19482-2600, or by visiting the EDGAR database on the SEC’s website (www.sec.gov).

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND

EXCHANGE COMMISSION, NOR HAS THE SEC PASSED UPON THE ACCURACY OR ADEQUACY

OF THIS INFORMATION STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE

CONTRARY IS A CRIMINAL OFFENSE.

OVERVIEW

This section summarizes key information concerning the proposed Reorganization. Keep in mind that more detailed information appears throughout the information statement/prospectus. Please be sure to read everything.

The Proposed Reorganization. At a meeting on December 16, 2016, the Board of Trustees for each Fund approved a plan to combine the 2010 Fund with and into the Income Fund. The plan calls for the 2010 Fund to transfer substantially all of its assets and all of its liabilities to the Income Fund in exchange for shares of the Income Fund. Shareholders of the 2010 Fund will receive shares of the Income Fund equivalent in value to their investments at the time of the Reorganization. The closing of the Reorganization is currently expected to occur on or about July 21, 2017. The 2010 Fund will then be liquidated and dissolved. The Reorganization will result in an exchange of your shares in the 2010 Fund for new shares of the Income Fund, and it is expected to occur on a tax-free basis. The Boards of Trustees of the Funds have concluded that the proposed Reorganization is in the best interests of the Funds and will not dilute the interests of the Funds’ shareholders.

Investment Objectives, Strategies, and Risks of Each Fund. The investment objective of the 2010 Fund is substantially similar to the investment objective of the Income Fund. The Funds have similar investment strategies and the risks of the Funds are identical.

The 2010 Fund’s investment objective is to provide capital appreciation and current income consistent with its current asset allocation. The Income Fund’s investment objective is to provide current income and some capital appreciation.

The Funds have similar investment strategies.

The Income Fund invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors currently in retirement. The 2010 Fund invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of 2010 (the target year). The Fund is designed for an investor who plans to withdraw the value of an account in the Fund over a period of many years after the target year. The Fund’s asset allocation will become more conservative over time, meaning that the percentage of assets allocated to stocks will decrease while the percentage of assets allocated to bonds and other fixed income investments will increase. Within seven years after 2010, the Fund’s asset allocation should become similar to that of the Income Fund.

The Funds have identical risks, which are as follows: interest rate risk, income risk, credit risk, call risk, country/regional risk, currency hedging risk, stock market risk, currency risk, and asset allocation risk.

These investment objectives, strategies, and risks are discussed in detail under “Investment Practices and Risk Considerations.” The investment objectives may be changed without a shareholder vote. Complete descriptions of the investment objectives, policies, strategies, and risks of the 2010 Fund and the Income Fund are contained in each Fund’s prospectus, along with any accompanying prospectus supplements, and Statement of Additional Information.

Investment Advisory Arrangements. The Vanguard Group, Inc. (“Vanguard”) serves as investment advisor to the Funds through its Equity Index Group. Vanguard provides investment advisory services to the Funds on an at-cost basis, subject to the supervision and oversight of the Boards of Trustees and officers of the Funds. Further details about the advisory arrangements for the Funds are provided in this Overview and under the section titled “Additional Information About the Funds.”

Service Arrangements. According to an agreement applicable to the Target Retirement Funds and Vanguard, the Funds’ direct expenses will be offset by Vanguard for (1) the Funds’ contributions to the costs of operating the underlying Vanguard funds in which the Target Retirement Funds invest and (2) certain savings in administrative and marketing costs that Vanguard expects to derive from the Funds’ operation. The Funds’ trustees believe that the offsets should be sufficient to cover most, if not all, of the direct expenses incurred by the Funds. As a result, each Fund is expected to operate at a very low or zero direct expense ratio. Since their inceptions, the Funds, in fact, have

incurred no direct net expenses. Although the Target Retirement Funds are not expected to incur any net expenses directly, the Funds’ shareholders indirectly bear the expenses of the underlying Vanguard Funds.

Additional information about the service arrangements for each Fund appears under “Additional Information About the Funds.”

Purchase, Redemption, Exchange, and Conversion Information. The purchase, redemption, exchange, and conversion features of the Funds are identical.

Distribution Schedules. Income dividends for the Income Fund generally are distributed quarterly in March, June, September, and December. Capital gains distributions, if any, generally occur annually in December for both Funds. In addition, each Fund may occasionally make a supplemental distribution at some other time during the year.

Tax-Free Reorganization. It is expected that the proposed Reorganization will constitute a tax-free reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (or the “Code”). As a condition to closing the Reorganization, the Funds will receive a favorable opinion from legal counsel as to the foregoing income tax consequences of the Reorganization. Please see “Investment Practices and Risk Considerations: Information About the Reorganization: Tax-Free Reorganization” for additional information.

Fees and Expenses

The tables below compare the fees and expenses of the shares of the 2010 Fund and the shares of the Income Fund as of September 30, 2016. The tables also show the estimated fees and expenses of the Institutional Shares of the combined Fund, on a pro forma basis, as of September 30, 2016, and do not include the estimated costs of the Reorganization (for information about the costs of the Reorganization, please see “Expenses of the Reorganization”). The actual fees and expenses of the Funds and the combined Fund as of the closing date may differ from those reflected in the tables below.

| | | |

| Shareholder Fees (fees paid directly from your investment) | | |

| |

| | 2010 Fund | Income Fund | Income Fund |

| | | | Pro Forma |

| | | | Combined Fund |

| |

| Sales Charge (Load) | None | None | None |

| Imposed on Purchases | | | |

| |

| Purchase Fee | None | None | None |

| |

| Sales Charge (Load) | None | None | None |

| Imposed on | | | |

| Reinvested Dividends | | | |

| |

| Redemption Fee | None | None | None |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | |

| | 2010 Fund | Income Fund | Income Fund |

| | | | Pro Forma |

| | | | Combined Fund |

| |

| Management Fees | None | None | None |

| |

| 12b-1 Distribution Fee | None | None | None |

| |

| Other Expenses | None | None | None |

| |

| Acquired Fund Fees | 0.09% | 0.09% | 0.09% |

| and Expenses | | | |

| Total Annual Fund | 0.09% | 0.09% | 0.09% |

| Operating Expenses | | | |

Examples

The following examples are intended to help you compare the cost of investing in the 2010 Fund, the Income Fund, and the combined Fund (based on the fees and expenses of the acquired funds) with the cost of investing in other mutual funds. They illustrate the hypothetical expenses that you would incur over various periods if you invest $10,000 in each Fund’s shares. These examples assume that the Shares provide a return of 5% a year and that total annual fund operating expenses remain as stated in the preceding table. You would incur these hypothetical expenses whether or not you redeem your investment at the end of the given period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | |

| | 1 Year | 3 Years | 5 Years | 10 Years |

| 2010 Fund | $9 | $29 | $51 | $115 |

| |

| Income Fund | $9 | $29 | $51 | $115 |

| |

| Income Fund | $9 | $29 | $51 | $115 |

| Pro Forma | | | | |

| Combined Fund | | | | |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in more taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the previous expense examples, reduce each Fund’s performance. During the most recent fiscal year ended September 30, 2016, the 2010 Fund’s portfolio turnover rate was 8%. During the most recent fiscal year ended September 30, 2016, the Income Fund’s portfolio turnover rate was 7%.

INVESTMENT PRACTICES AND RISK CONSIDERATIONS

Following is a brief discussion of the investment objectives, strategies, and risks of the Funds. More detailed information is available in each Fund’s prospectus and any accompanying prospectus supplements, and Statement of Additional Information. Please see the Income Fund’s prospectus attached as Appendix B to this information statement/prospectus.

| |

| Investment Objective | |

| The investment objective for the Funds are as follows: | |

| Fund | Investment Objective |

| 2010 Fund | The Fund seeks to provide capital appreciation and |

| | current income consistent with its current asset |

| | allocation. |

| |

| Income Fund | The Fund seeks to provide current income and some |

| | capital appreciation. |

Primary Investment Strategies

The primary investment strategies for the Funds are as follows:

| |

| Fund | Primary Investment Strategies |

| |

| 2010 Fund | The 2010 Fund invests in other Vanguard mutual funds |

| | according to an asset allocation strategy designed for |

| | investors planning to retire and leave the workforce in |

| | or within a few years of 2010 (the target year). The 2010 |

| | Fund is designed for an investor who plans to withdraw |

| | the value of an account in the Fund over a period of |

| | many years after the target year. The Fund’s asset |

| | allocation will become more conservative over time, |

| | meaning that the percentage of assets allocated to stocks |

| | will decrease while the percentage of assets allocated to |

| | bonds and other fixed income investments will increase. |

| | Within seven years after 2010, the 2010 Fund’s asset |

| | allocation should become similar to that of the Income |

| | Fund. |

| |

| | As of September 30, 2016, the stocks in the underlying |

| | domestic equity fund had an asset-weighted median |

| | market capitalization exceeding $53.2 billion. The |

| | stocks in the underlying international equity fund had |

| | an asset-weighted median market capitalization |

| | exceeding $22 billion. |

| |

| Income Fund | The Income Fund invests in other Vanguard mutual |

| | funds according to an asset allocation strategy designed |

| | for investors currently in retirement. |

|

| As of September 30, 2016, the stocks in the underlying |

| domestic equity fund had an asset-weighted median |

| market capitalization exceeding $53.2 billion. The |

| stocks in the underlying international equity fund had |

| an asset-weighted median market capitalization |

| exceeding $22 billion. |

Primary Risks

An investment in a Fund could lose money over short or even long periods. You should expect a Fund’s share price and total return to fluctuate within a wide range, like the fluctuations of the overall stock market.

Both Funds are subject to the following risks, which could affect the Funds’ performance:

- Interest rate risk, which is the chance that bond prices will decline because of rising interest rates.

- Income risk, which is the chance that an underlying fund’s income will decline because of falling interest rates.

- Credit risk, which is the chance that a bond issuer will fail to pay interest or principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline, thus reducing the underlying fund’s return.

- Call risk, which is the chance that during periods of falling interest rates, issuers of callable bonds may call (redeem) securities with higher coupon rates or interest rates before their maturity dates. An underlying fund would then lose any price appreciation above the bond’s call price and would be forced to reinvest the unanticipated proceeds at lower interest rates, resulting in a decline in the underlying fund’s income.

- Country/regional risk, which is the chance that world events—such as political upheaval, financial troubles, or natural disasters—will adversely affect the value of companies in any one country or region, as well as the value and/or liquidity of securities issued by foreign governments, government agencies, or companies.

- Currency hedging risk, which is the chance that the currency hedging transactions entered into by the underlying international bond fund may not perfectly offset the fund’s foreign currency exposure.

- Stock market risk, which is the chance that stock prices overall will decline. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices.

- Currency risk, which is the chance that the value of a foreign investment, measured in U.S. dollars, will decrease because of unfavorable changes in currency exchange rates. Country/regional risk and currency risk are especially high in emerging markets.

- Asset allocation risk, which is the chance that the selection of underlying funds, and the allocation of assets to them, will cause the Fund to underperform other funds with a similar investment objective.

Other Investment Policies and Risks

Each underlying fund may invest, to a limited extent, in derivatives. Generally speaking, a derivative is a financial contract whose value is based on the value of a financial asset (such as a stock, a bond, or a currency), a physical asset (such as gold, oil, or wheat), a market index (such as the S&P 500 Index), or a reference rate (such as LIBOR). Investments in derivatives may subject the funds to risks different from, and possibly greater than, those of investments directly in the underlying securities or assets. The funds will not use derivatives for speculation or for the purpose of leveraging (magnifying) investment returns.

Cash Management. Each Fund‘s daily cash balance may be invested in one or more Vanguard CMT Funds, which are very low-cost money market funds. When investing in a Vanguard CMT Fund, each Fund bears its proportionate share of the expenses of the CMT Fund in which it invests. Vanguard receives no additional revenue from Fund assets invested in a Vanguard CMT Fund.

To put cash flow to work as soon as possible, and thereby capture as much of the market’s return as possible, each Fund reserves the right to invest in shares of Vanguard Total Stock Market ETF, Vanguard Total International Stock ETF, Vanguard Total Bond Market ETF, Vanguard Short-Term Inflation-Protected Securities ETF, and Vanguard Total International Bond ETF, as applicable (each provides returns similar to the returns of its corresponding market segment). The Funds’ advisor may purchase ETF Shares when large cash inflows come into a Fund too late in the day to invest the cash, on a same-day basis, in shares of the underlying Vanguard funds that serve as the Fund’s primary investments. These cash-flow situations will arise infrequently, and the period of holding the ETF Shares will be short—in most cases, one day. (Vanguard does not receive duplicate management fees when Fund assets are invested in ETF Shares.)

Comparison of Investment Objectives, Investment Strategies, and Risks

The 2010 Fund and the Income Fund currently have substantially similar investment objectives. The 2010 Fund seeks to provide capital appreciation and current income consistent with its current asset allocation. The Income Fund seeks to provide current income and some capital appreciation. The combined Fund will maintain the investment objective of the Income Fund. There is no guarantee that each Fund will achieve its stated objective.

The Funds have similar investment strategies. The 2010 Fund invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of 2010 (the target year). The 2010 Fund is designed for an investor who plans to withdraw the value of an account in the Fund over a period of many years after the target year. The 2010 Fund’s asset allocation will become more conservative over time, meaning that the percentage of assets allocated to stocks will decrease while the percentage of assets allocated to bonds and other fixed income investments will increase. Within seven years after 2010, the 2010 Fund’s asset allocation should become similar to that of the Income Fund. The Income Fund invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors currently in retirement. The combined Fund will continue to utilize the investment strategies of the Income Fund.

The Funds have identical risks and the combined Fund will continue to have these risks.

Investment Advisor and Portfolio Managers

The Funds have the same investment advisor, Vanguard, and are overseen by the same group within Vanguard, the Equity Index Group.

The managers primarily responsible for the day-to-day management of the Funds are the same. The Funds are overseen by:

William Coleman, CFA, Portfolio Manager at Vanguard. He has worked in investment management since joining Vanguard in 2006 and has co-managed the Funds since their inceptions in 2015. Education: B.S., King’s College; M.S., Saint Joseph’s University.

Walter Nejman, Portfolio Manager at Vanguard. He has been with Vanguard since 2005, has worked in investment management since 2008, and has co-managed the Funds since their inceptions in 2015. Education: B.A., Arcadia University; M.B.A., Villanova University.

The Statement of Additional Information provides information about each portfolio manager’s compensation, other accounts under management, and ownership of shares of the Funds.

INVESTMENT PERFORMANCE OF THE FUNDS

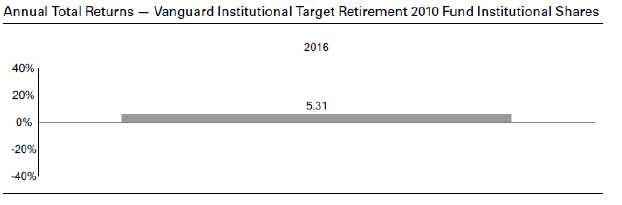

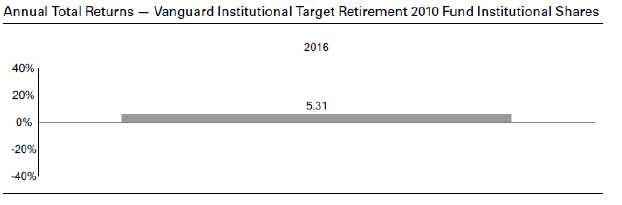

Investment Performance of the 2010 Fund

The following bar chart and table are intended to help you understand the risks of investing in the 2010 Fund. The bar chart shows how the performance of the 2010 Fund has varied from one calendar year to another over the periods shown. The table shows how the average annual total returns of the 2010 Fund compare with those of relevant market indexes and a composite bond/stock index, which have investment characteristics similar to those of the Fund. Keep in mind that the 2010 Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447.

During the periods shown in the bar chart, the highest return for a calendar quarter was 2.20% (quarter ended March 31, 2016), and the lowest return for a quarter was –0.98% (quarter ended December 31, 2016).

| | |

| Average Annual Total Returns for Periods Ended December 31, 2016 | |

| | 1 Year | Since Inception |

| | | (6/26/2015) |

| Vanguard Institutional Target Retirement 2010 Fund | | |

| Return Before Taxes | 5.31% | 2.37% |

| Return After Taxes on Distributions | 4.63 | 1.77 |

| Return After Taxes on Distributions and Sale of FundShares | 3.14 | 1.60 |

| |

| Target 2010 Composite Index | 5.44 | 2.57 |

Actual after-tax returns depend on your tax situation and may differ from those shown in the preceding table. When after-tax returns are calculated, it is assumed that the shareholder was in the highest individual federal marginal income tax bracket at the time of each distribution of income or capital gains or upon redemption. State and local income taxes are not reflected in the calculations. Please note that after-tax returns are not relevant for a shareholder who holds fund shares in a tax-deferred account, such as an individual retirement account or a 401(k) plan. Also, figures captioned Return After Taxes on Distributions and Sale of Fund Shares may be higher than other figures for the same period if a capital loss occurs upon redemption and results in an assumed tax deduction for the shareholder.

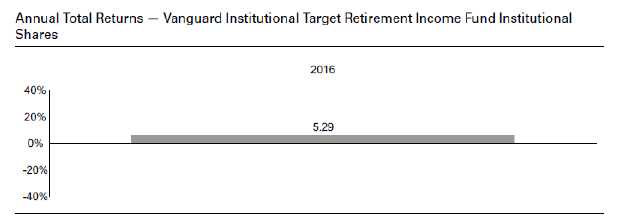

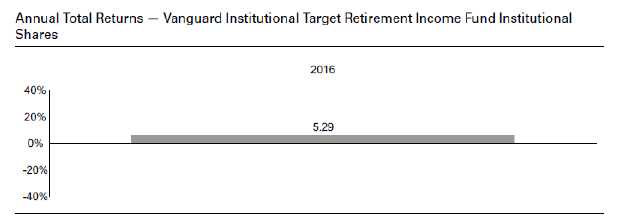

Investment Performance of the Income Fund

The following bar chart and table are intended to help you understand the risks of investing in the Income Fund. The bar chart shows how the performance of the Income Fund has varied from one calendar year to another over the periods shown. The table shows how the average annual total returns of the Income Fund compare with those of relevant market indexes and a composite bond/stock index, which have investment characteristics similar to those of the Fund. Keep in mind that the Income Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447.

During the periods shown in the bar chart, the highest return for a calendar quarter was 2.28% (quarter ended March 31, 2016), and the lowest return for a quarter was –1.00% (quarter ended December 31, 2016).

| | |

| Average Annual Total Returns for Periods Ended December 31, 2016 | |

| | 1 Year | Since Inception |

| | | (6/26/2015) |

| Vanguard Institutional Target Retirement Income Fund | | |

| Return Before Taxes | 5.29% | 2.61% |

| Return After Taxes on Distributions | 4.52 | 1.93 |

| Return After Taxes on Distributions and Sale of FundShares | 3.12 | 1.75 |

| |

| Target Income Composite Index | 5.35 | 2.78 |

Actual after-tax returns depend on your tax situation and may differ from those shown in the preceding table. When after-tax returns are calculated, it is assumed that the shareholder was in the highest individual federal marginal income tax bracket at the time of each distribution of income or capital gains or upon redemption. State and local income taxes are not reflected in the calculations. Please note that after-tax returns are not relevant for a shareholder who holds fund shares in a tax-deferred account, such as an individual retirement account or a 401(k) plan. Also, figures captioned Return After Taxes on Distributions and Sale of Fund Shares may be higher than other figures for the same period if a capital loss occurs upon redemption and results in an assumed tax deduction for the shareholder.

Share Price

Share price, also known as net asset value (NAV), is calculated each business day as of the close of regular trading on the New York Stock Exchange (NYSE), generally 4 p.m., Eastern time. The NAV per share is computed by

dividing the total assets, minus liabilities, of each Fund by the number of Fund shares outstanding. On U.S. holidays or other days when the NYSE is closed, the NAV is not calculated, and the Funds do not sell or redeem shares. The underlying Vanguard funds in which the Funds invest also do not calculate their NAV on days when the NYSE is closed, but the value of their assets may be affected to the extent that they hold securities that change in value on those days (such as foreign securities that trade on foreign markets that are open).

Each Fund’s NAV is calculated based upon the values of the underlying mutual funds in which the Fund invests. The values of the mutual fund shares held by a Fund are based on the NAVs of the shares. The values of any ETF shares or institutional money market fund shares held by a Fund are based on the market value of the shares. The prospectuses for the underlying funds explain the circumstances under which those funds will use fair-value pricing and the effects of doing so.

Vanguard fund share prices are published daily on our website at vanguard.com/prices.

Purchases, Redemptions, and Exchanges of Fund Shares; Other Shareholder Information

| | |

| Purchase, Redemption, and | 2010 Fund | Income Fund |

| Exchange Features | | |

| |

| Minimum initial purchase | $100 million | $100 million |

| amount | | |

| |

| Additional investment | | |

| purchase amount | $1 | $1 |

| | (other than by Automatic | |

| | Investment Plan, which | (other than by Automatic |

| | has no established | Investment Plan, which has |

| | minimum) | no established minimum) |

| |

| |

| Purchases | Through Vanguard’s | |

| | | Through |

| | website, mobile | Vanguard’s website, |

| | application, by telephone, | mobile application, by |

| | or by mail | telephone, or by mail |

| |

| Redemptions | Through Vanguard’s | |

| | | Through |

| | website, mobile | Vanguard’s website, |

| | application, by telephone, | mobile application, by |

| | or by mail | telephone, or by mail |

| |

| Free Exchange Privileges | Yes, through Vanguard’s | |

| | | Yes, through |

| | website, mobile | Vanguard’s website, |

| | application, by telephone, | mobile application, by |

| | or by mail | telephone, or by mail |

Purchasing Shares

Trade Date

The trade date for any purchase request received in good order will depend on the day and time Vanguard receives your request, the manner in which you are paying, and the type of fund you are purchasing. Your purchase will be executed using the net asset value (NAV) as calculated on the trade date. NAVs are calculated only on days that the New York Stock Exchange (NYSE) is open for trading (a business day).

For purchases by check into all funds other than money market funds and for purchases by exchange, wire, or electronic bank transfer (not using an Automatic Investment Plan) into all funds: If the purchase request is received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the trade date for the purchase will be the same day. If the purchase request is received on a business day after the close of regular trading on the NYSE, or on a nonbusiness day, the trade date for the purchase will be the next business day.

For purchases by check into money market funds: If the purchase request is received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the trade date for the purchase will be the next business day. If the purchase request is received on a business day after the close of regular trading on the NYSE, or on a nonbusiness day, the trade date for the purchase will be the second business day following the day Vanguard receives the purchase request. Because money market instruments must be purchased with federal funds and it takes a money market mutual fund one business day to convert check proceeds into federal funds, the trade date for the purchase will be one business day later than for other funds.

For purchases by electronic bank transfer using an Automatic Investment Plan: Your trade date generally will be the date you selected for withdrawal of funds from your bank account. Your bank account generally will be debited on the business day after your trade date. If the date you selected for withdrawal of funds from your bank account falls on a weekend, holiday, or other nonbusiness day, your trade date generally will be the previous business day.

If your purchase request is not accurate and complete, it may be rejected.

Vanguard reserves the right, without notice, to increase or decrease the minimum amount required to open, convert shares to, or maintain a fund account or to add to an existing fund account.

Investment minimums may differ for certain categories of investors.

Account minimum to open and maintain an account—$100 million

Certain Vanguard institutional clients may meet the minimum investment amount by aggregating separate accounts within the same Fund. This aggregation policy does not apply to financial intermediaries.

Vanguard may charge additional recordkeeping fees for institutional clients whose accounts are recordkept by Vanguard. Please contact your Vanguard representative to determine whether additional recordkeeping fees apply to your account.

Other Purchase Rules You Should Know

Check purchases. All purchase checks must be written in U.S. dollars and must be drawn on a U.S. bank. Vanguard does not accept cash, traveler’s checks, or money orders. In addition, Vanguard may refuse “starter checks” and checks that are not made payable to Vanguard.

New accounts. We are required by law to obtain from you certain personal information that we will use to verify your identity. If you do not provide the information, we may not be able to open your account. If we are unable to verify your identity, Vanguard reserves the right, without notice, to close your account or take such other steps as we deem reasonable. Certain types of accounts may require additional documentation.

Refused or rejected purchase requests. Vanguard reserves the right to stop selling fund shares or to reject any purchase request at any time and without notice, including, but not limited to, purchases requested by exchange from another Vanguard fund. This also includes the right to reject any purchase request because the investor has a history of frequent trading or because the purchase may negatively affect a fund’s operation or performance.

Large purchases. Call Vanguard before attempting to invest a large dollar amount.

No cancellations. Vanguard will not accept your request to cancel any purchase request once processing has begun. Please be careful when placing a purchase request.

Redeeming Shares

Trade Date

The trade date for any redemption request received in good order will depend on the day and time Vanguard receives your request and the manner in which you are redeeming. Your redemption will be executed using the NAV as calculated on the trade date. NAVs are calculated only on days that the NYSE is open for trading (a business day).

For redemptions by check, exchange, or wire: If the redemption request is received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the trade date will be the same day. If the redemption request is received on a business day after the close of regular trading on the NYSE, or on a nonbusiness day, the trade date will be the next business day.

- For requests received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the redemption proceeds generally will leave Vanguard by the close of business on the next business day. For requests received by Vanguard on a business day after the close of regular trading on the NYSE, or on a nonbusiness day, the redemption proceeds generally will leave Vanguard by the close of business on the second business day after Vanguard receives the request.

For redemptions by electronic bank transfer using an Automatic Withdrawal Plan: Your trade date generally will be the date you designated for withdrawal of funds (redemption of shares) from your Vanguard account. Proceeds of redeemed shares generally will be credited to your designated bank account two business days after your trade date. If the date you designated for withdrawal of funds from your Vanguard account falls on a weekend, holiday, or other nonbusiness day, your trade date generally will be the previous business day.

For redemptions by electronic bank transfer not using an Automatic Withdrawal Plan: If the redemption request is received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the trade date will be the same day. If the redemption request is received on a business day after the close of regular trading on the NYSE, or on a nonbusiness day, the trade date will be the next business day.

If your redemption request is not accurate and complete, it may be rejected. If we are unable to send your redemption proceeds by wire or electronic bank transfer because the receiving institution rejects the transfer, Vanguard will make additional efforts to complete your transaction. If Vanguard is still unable to complete the transaction, we may send the proceeds of the redemption to you by check, generally payable to all registered account owners, or use your proceeds to purchase new shares of the fund from which you sold shares for the purpose of the wire or electronic bank transfer transaction.

Other Redemption Rules You Should Know

Documentation for certain accounts. Special documentation may be required to redeem from certain types of accounts, such as trust, corporate, nonprofit, or retirement accounts. Please call us before attempting to redeem from these types of accounts.

Potentially disruptive redemptions. Vanguard reserves the right to pay all or part of a redemption in kind—that is, in the form of securities—if we reasonably believe that a cash redemption would negatively affect a Fund’s operation or performance or that the shareholder may be engaged in market-timing or frequent trading. Under these circumstances, Vanguard also reserves the right to delay payment of the redemption proceeds for up to seven calendar days. By calling us before you attempt to redeem a large dollar amount, you may avoid in-kind or delayed payment of your redemption.

Recently purchased shares. Although you can redeem shares at any time, proceeds may not be made available to you until the fund collects payment for your purchase. This may take up to seven calendar days for shares purchased by check or by electronic bank transfer. If you have written a check on a fund with checkwriting privileges, that check may be rejected if your fund account does not have a sufficient available balance.

Share certificates. Share certificates are no longer issued for Vanguard funds. Shares currently held in certificates cannot be redeemed, exchanged, converted, or transferred (reregistered) until you return the certificates (unsigned) to Vanguard by registered mail.

Address change. If you change your address online or by telephone, there may be up to a 14-day restriction on your ability to request check redemptions online and by telephone. You can request a redemption in writing at any time. Confirmations of address changes are sent to both the old and new addresses.

Payment to a different person or address. At your request, we can make your redemption check payable, or wire your redemption proceeds, to a different person or send it to a different address. However, this generally requires the written consent of all registered account owners and may require a signature guarantee or a notarized signature. You may obtain a signature guarantee from some commercial or savings banks, credit unions, trust companies, or member firms of a U.S. stock exchange.

No cancellations. Vanguard will not accept your request to cancel any redemption request once processing has begun. Please be careful when placing a redemption request.

Emergency circumstances. Vanguard funds can postpone payment of redemption proceeds for up to seven calendar days. In addition, Vanguard funds can suspend redemptions and/or postpone payments of redemption proceeds beyond seven calendar days at times when the NYSE is closed or during emergency circumstances, as determined by the SEC.

Exchanging Shares

An exchange occurs when you use the proceeds from the redemption of shares of one Vanguard fund to simultaneously purchase shares of a different Vanguard fund. You can make exchange requests online (if you are registered for online access), by telephone, or by written request.

If the NYSE is open for regular trading (generally until 4 p.m., Eastern time, on a business day) at the time an exchange request is received in good order, the trade date generally will be the same day.

Vanguard will not accept your request to cancel any exchange request once processing has begun. Please be careful when placing an exchange request.

Please note that Vanguard reserves the right, without notice, to revise or terminate the exchange privilege, limit the amount of any exchange, or reject an exchange, at any time, for any reason. See Frequent-Trading Limitations for additional restrictions on exchanges.

Payments to Financial Intermediaries

The Funds and their investment advisor do not pay financial intermediaries for sales of their shares.

Advisory Arrangements

The Vanguard Group, Inc., P.O. Box 2600, Valley Forge, PA 19482, which began operations in 1975, serves as advisor to the Funds through its Equity Index Group. As of September 30, 2016, Vanguard served as advisor for approximately $2.9 trillion in assets. Vanguard also serves as investment advisor for each of the underlying funds.

Vanguard, through its Equity Index Group, provides investment advisory services to the Vanguard Target Retirement Funds and the Vanguard Institutional Target Retirement Funds. Each Fund is a fund of funds and invests in other Vanguard mutual funds (underlying funds). Vanguard also serves as investment advisor for each of the underlying funds. The Funds benefit from the investment advisory services provided to the underlying funds and, as shareholders of those funds, indirectly bear a proportionate share of those funds’ at-cost advisory expenses.

Vanguard provides at-cost investment advisory services to the Vanguard Target Retirement Funds and the Vanguard Institutional Target Retirement Funds pursuant to the terms of the Fifth Amended and Restated Funds’ Service Agreement. The agreement will continue in full force and effect until terminated or amended by mutual agreement of the Vanguard funds and Vanguard. For more information about the investment advisory services provided to the underlying funds, please refer to each fund’s Statement of Additional Information.

Dividends, Capital Gains, and Taxes

Basic Tax Points

Vanguard will send you a statement each year showing the tax status of all your distributions. In addition, investors in taxable accounts should be aware of the following basic federal income tax points:

- Distributions are taxable to you whether or not you reinvest these amounts in additional Fund shares.

- Distributions declared in December—if paid to you by the end of January—are taxable as if received in December.

- Any dividend distribution or short-term capital gains distribution that you receive is taxable to you as ordinary income. If you are an individual and meet certain holding- period requirements with respect to your Fund shares, you may be eligible for reduced tax rates on “qualified dividend income,” if any, distributed by the Fund.

- Any distribution of net long-term capital gains is taxable to you as long-term capital gains, no matter how long you have owned shares in the Fund.

- Capital gains distributions may vary considerably from year to year as a result of the Funds’ normal investment activities and cash flows.

- A sale or exchange of Fund shares is a taxable event. This means that you may have a capital gain to report as income, or a capital loss to report as a deduction, when you complete your tax return.

Vanguard (or your intermediary) will send you a statement each year showing the tax status of all of your distributions. Individuals, trusts, and estates whose income exceeds certain threshold amounts are subject to a 3.8% Medicare contribution tax on “net investment income.” Net investment income takes into account distributions paid by the Fund and capital gains from any sale or exchange of Fund shares.

Dividend and capital gains distributions that you receive, as well as your gains or losses from any sale or exchange of Fund shares, may be subject to state and local income taxes.

This information statement/prospectus provides general tax information only. If you are investing through a tax-advantaged account, such as an IRA or an employer-sponsored retirement or savings plan, special tax rules apply. Please consult your tax advisor for detailed information about any tax consequences for you.

General Information

Backup withholding. By law, Vanguard must withhold 28% of any taxable distributions or redemptions from your account if you do not:

- Provide us with your correct taxpayer identification number.

- Certify that the taxpayer identification number is correct.

- Confirm that you are not subject to backup withholding.

Similarly, Vanguard must withhold taxes from your account if the IRS instructs us to do so.

Foreign investors. Vanguard funds offered for sale in the United States (Vanguard U.S. funds), including the Funds, generally are not sold outside the United States, except to certain qualified investors. Non-U.S. investors should be aware that U.S. withholding and estate taxes and certain U.S. tax reporting requirements may apply to any investments in Vanguard U.S. funds.

Invalid addresses. If a dividend or capital gains distribution check mailed to your address of record is returned as undeliverable, Vanguard will automatically reinvest the distribution and all future distributions until you provide us with a valid mailing address. Reinvestments will receive the net asset value calculated on the date of the reinvestment.

Frequent-Trading Limitations

Because excessive transactions can disrupt management of a fund and increase the fund’s costs for all shareholders, the Board of Trustees of each Vanguard fund places certain limits on frequent trading in the funds. Each Vanguard fund (other than money market funds and short-term bond funds, but including Vanguard Short-Term Inflation- Protected Securities Index Fund) limits an investor’s purchases or exchanges into a fund account for 30 calendar days after the investor has redeemed or exchanged out of that fund account. ETF Shares are not subject to these frequent-trading limits.

For Vanguard Retirement Investment Program pooled plans, the limitations apply to exchanges made online or by telephone.

These frequent-trading limitations do not apply to the following:

• Purchases of shares with reinvested dividend or capital gains distributions.

• Transactions through Vanguard’s Automatic Investment Plan, Automatic Exchange Service, Direct Deposit Service, Automatic Withdrawal Plan, Required Minimum Distribution Service, and Vanguard Small Business Online®.

• Redemptions of shares to pay fund or account fees.

• Redemptions of shares to remove excess shareholder contributions to certain types of retirement accounts (including, but not limited to, IRAs, certain Individual 403(b)(7) Custodial Accounts, and Vanguard Individual 401(k) Plans).

• Transaction requests submitted by mail to Vanguard from shareholders who hold their accounts directly with Vanguard or through a Vanguard brokerage account. (Transaction requests submitted by fax, if otherwise permitted, are subject to the limitations.) • Transfers and reregistrations of shares within the same fund.

• Purchases of shares by asset transfer or direct rollover.

• Conversions of shares from one share class to another in the same fund.

• Checkwriting redemptions.

• Section 529 college savings plans.

• Certain approved institutional portfolios and asset allocation programs, as well as trades made by Vanguard funds that invest in other Vanguard funds. (Please note that shareholders of Vanguard’s funds of funds are subject to the limitations.)

For participants in employer-sponsored defined contribution plans,* the frequent-trading limitations do not apply to: • Purchases of shares with participant payroll or employer contributions or loan repayments.

• Purchases of shares with reinvested dividend or capital gains distributions. • Distributions, loans, and in-service withdrawals from a plan.

• Redemptions of shares as part of a plan termination or at the direction of the plan.

• Automated transactions executed during the first six months of a participant’s enrollment in the Vanguard Managed Account Program.

• Redemptions of shares to pay fund or account fees. • Share or asset transfers or rollovers.

• Reregistrations of shares.

• Conversions of shares from one share class to another in the same fund.

• Exchange requests submitted by written request to Vanguard. (Exchange requests submitted by fax, if otherwise permitted, are subject to the limitations.)

* The following Vanguard fund accounts are subject to the frequent-trading limitations: SEP-IRAs, SIMPLE IRAs, certain Individual 403(b)(7) Custodial Accounts, and Vanguard Individual 401(k) Plans.

Accounts Held by Institutions (Other Than Defined Contribution Plans)

Vanguard will systematically monitor for frequent trading in institutional clients’ accounts. If we detect suspicious trading activity, we will investigate and take appropriate action, which may include applying to a client’s accounts the 30-day policy previously described, prohibiting a client’s purchases of fund shares, and/or revoking the client’s exchange privilege.

Accounts Held by Intermediaries

When intermediaries establish accounts in Vanguard funds for the benefit of their clients, we cannot always monitor the trading activity of the individual clients. However, we review trading activity at the intermediary (omnibus) level, and if we detect suspicious activity, we will investigate and take appropriate action. If necessary, Vanguard may prohibit additional purchases of fund shares by an intermediary, including for the benefit of certain of the intermediary’s clients. Intermediaries also may monitor their clients’ trading activities with respect to Vanguard funds.

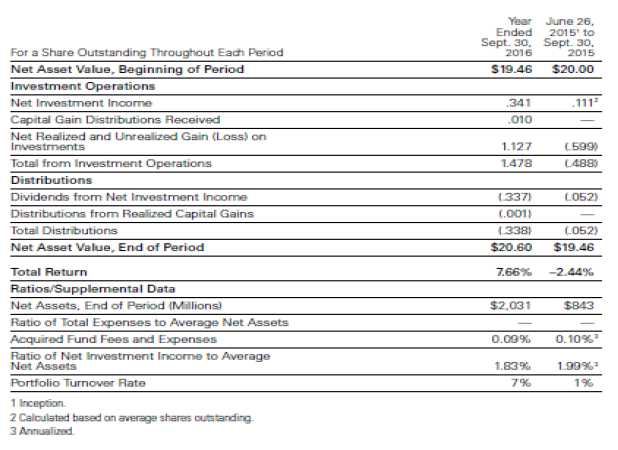

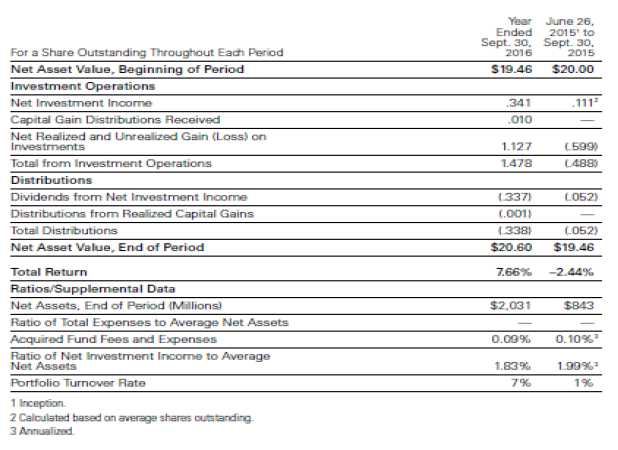

Financial Highlights

The following financial highlights tables are intended to help you understand the Income Fund’s financial performance for the periods shown, and certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that an investor would have earned or lost each period on an investment in the Fund (assuming reinvestment of all distributions). The information for all periods in the table through September 30, 2016, has been obtained from the financial statements audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, whose report—along with the Income Fund’s financial statements—is included in the Income Fund’s most recent annual report to shareholders. You may obtain a free copy of the latest annual or semiannual report by visiting vanguard.com or by contacting Vanguard by telephone or mail.

Information About the Reorganization

At a meeting on December 16, 2016, the Boards of Trustees for the Funds discussed and approved the proposed Reorganization and the Agreement and Plan of Reorganization (the “Agreement and Plan”). The Vanguard Chester Funds (the “Trust”), the legal entity to which the 2010 Fund and the Income Fund belong, and have entered into an Agreement and Plan, by and between the 2010 Fund and the Income Fund.

Agreement and Plan of Reorganization. The Agreement and Plan sets out the terms and conditions that will apply to the Reorganization.

Three Steps to Reorganize. The Reorganization will be accomplished in a three-step process:

- First, the 2010 Fund will transfer substantially all of its assets and liabilities to the Income Fund.

- Second, and simultaneously with step one, the Income Fund will open an account for each 2010 Fund shareholder, crediting it with an amount of the Income Fund equal in value to that of the 2010 Fund owned by such holder at the time of the Reorganization.

- Third, the 2010 Fund will be liquidated promptly and terminated as a series of Vanguard Chester Funds.

Until the closing date of the Reorganization, shareholders of the 2010 Fund will be able to redeem their shares of the Fund. Redemption requests received after the Reorganization will be treated as requests for redemption of shares of the Income Fund received by the shareholder in the Reorganization. It is also anticipated that shortly before the Reorganization is scheduled to occur, the 2010 Fund will be closed for any investment, which will assist in the processing of the Reorganization. If you place a purchase order directly or through an investment program during this period before the closing, it will be rejected.

The obligations of the Funds under the Agreement and Plan are subject to various conditions. Among other things, the Agreement and Plan requires that all filings be made with, and all consents be received from federal, state, and local regulatory authorities as may be necessary to carry out the transactions contemplated by the Agreement and Plan. The Agreement and Plan may be terminated at any time by the actions of the trustees of either Fund, and may be amended, modified, or supplemented as may be mutually agreed upon by authorized officers for the Funds. For a complete description of the terms and conditions that will apply to the Reorganization, please see the form of Agreement and Plan attached as Appendix A to this information statement/prospectus.

Effective as Soon as Practicable. The Reorganization will take place as soon as practicable after all necessary regulatory approvals and legal opinions are received. It is currently anticipated that the Reorganization will be accomplished on or about the close of business on July 21, 2017.

Tax-Free Reorganization. It is expected that the proposed Reorganization will constitute a tax-free reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended. This means that generally none of the parties involved – the 2010 Fund, the Income Fund, or their respective shareholders – will recognize a gain or loss directly as a result of the Reorganization. There is additional information about the federal income tax consequences of the Reorganization in the Agreement and Plan.

• Final distribution. Prior to the Reorganization, the 2010 Fund will distribute any remaining undistributed net income and/or realized capital gains. These distributions generally will be taxable to you.

• Payments of distributions. Following the Reorganization, Income Fund shareholders (including former shareholders of the 2010 Fund) will participate fully in any distributions made for the Income Fund. These distributions generally will be taxable to you.

• Cost basis. Following the Reorganization, your aggregate cost basis and your holding period in your shares will remain the same. However, your nominal per-share cost basis will change as a result of differences in the share prices of the 2010 Fund and the Income Fund. Vanguard will provide to you certain cost basis information in connection with the Reorganization on its “Report of Organizational Actions Affecting Basis of Securities,” which will be available on vanguard.com a short time after the Reorganization.

Each Fund’s capital gains and losses for tax purposes are determined only at the end of each fiscal year.

For tax purposes, as of December 31, 2016, neither the Income Fund nor the 2010 Fund had capital loss carryforwards or net unrealized losses available to offset future net capital gains. However, the Income Fund’s and/or the 2010 Fund’s capital loss carryforwards and net unrealized loss positions may change significantly between now and the Reorganization Closing Date, expected to be approximately July 21, 2017. Should the Income Fund or the 2010 Fund have available capital loss carryforwards and/or net unrealized losses in their respective portfolios in amounts exceeding certain thresholds at the time of the Reorganization, the Reorganization could restrict the use of the Income Fund’s and/or the 2010 Fund’s capital loss carryforwards and net unrealized losses, if any. Further, the ability of each Fund to use these losses (even in the absence of the Reorganization) depends on factors other than loss limitations, such as the future realization of capital gains or losses. The combination of these factors may result in some or all of the loss carryforwards or net unrealized losses of either or both of the Funds being significantly restricted.

Each Fund will continue its operations pursuant to its investment objective and policies through the Reorganization.

Expenses of the Reorganization. The 2010 Fund will bear the expenses incurred in the Reorganization, which are expected to be approximately $29,000. These expenses include the cost of the printing and mailing of this information statement/prospectus, and audit fees. According to an agreement applicable to the Target Retirement Funds and Vanguard, the Funds’ direct expenses will be offset by Vanguard for (1) the Funds’ contributions to the costs of operating the underlying Vanguard funds in which the Target Retirement Funds invest and (2) certain savings in administrative and marketing costs that Vanguard expects to derive from the Funds’ operation.

Why We Want to Reorganize Your Funds.

The purpose of the Reorganization is to combine the 2010 Fund with and into the Income Fund. At the time of the Reorganization, the 2010 Fund and the Income Fund would have the same minimum initial investment amount and the same expense ratio. They also have substantially similar investment objectives, and the same fundamental investment policies, share class structure, board of trustees, investment advisor, and fiscal year end. They have had similar performance records, and the target allocation of the two Funds will be substantially similar at the time of the Reorganization. Although their asset size differs, the Income Fund’s expense ratio is not expected to change as a result of the Reorganization. The Reorganization has been proposed to consolidate the assets of the Funds for the following reasons:

When the Target Retirement Funds were launched, we anticipated that approximately seven years after the target retirement date as specified in a fund’s name, such fund’s allocation would become substantially similar to the Income Fund’s allocation, and the Dated Fund would be merged into the Income Fund. This intention is disclosed in the Target Retirement Funds’ prospectus. In mid-2017, the 2010 Fund will have an allocation substantially similar to the Income Fund and can be merged without a shareholder vote into the Income Fund.

As a result of this Reorganization, there is expected to be no gain or loss recognized by shareholders for U.S. federal income tax purposes, since the Reorganization is expected to be a tax-free transaction.

The Boards of Trustees believe that it is in shareholders’ best interests to reorganize the 2010 Fund with and into the Income Fund, which will issue shares of the Income Fund to shareholders of the 2010 Fund. After the

Reorganization, you will be a shareholder of the Income Fund, and the 2010 Fund, which will have no remaining assets, will be dissolved.

ADDITIONAL INFORMATION ABOUT THE FUNDS

Form of Organization. Vanguard Chester Funds are organized as a Delaware statutory trust (the “Trust”). The Funds are series of the Trust, which are each an open-end management investment company registered under the 1940 Act.

Trustees. The business and affairs of each Fund are managed under the direction of a Board of Trustees. The respective Board of Trustees of each Fund have the same members.

Voting Rights. Shareholders of the Funds are entitled to one vote for each dollar of net asset value and a fractional vote for each fractional dollar of net assets owned unless otherwise required by applicable law. Separate votes are required by each series or class of shares on matters affecting an individual series or class. Shares have noncumulative voting rights and no preemptive or subscription rights. The Funds are not required to hold shareholder meetings annually, although shareholder meetings may be called from time to time for purposes such as electing or removing trustees, changing fundamental policies, or approving a significant transaction.

Independent Auditor. PricewaterhouseCoopers LLP serves as the independent registered public accounting firm for the Funds.

Service Agreements.

Each Fund is a member of The Vanguard Group, a family of more than 190 mutual

Funds. As of September 30, 2016, Vanguard served as advisor for approximately $2.9 trillion. All of the funds that are members of The Vanguard Group (other than funds of funds) share in the expenses associated with administrative services and business operations, such as personnel, office space, and equipment.

The following is a description of the material terms of the current arrangements for the Funds with Vanguard.

Fees

According to an agreement applicable to the Target Retirement Funds and Vanguard, the Funds’ direct expenses will be offset by Vanguard for (1) the Funds’ contributions to the costs of operating the underlying Vanguard funds in which the Target Retirement Funds invest and (2) certain savings in administrative and marketing costs that Vanguard expects to derive from the Funds’ operation. The Funds’ trustees believe that the offsets should be sufficient to cover most, if not all, of the direct expenses incurred by the Funds. As a result, each Fund is expected to operate at a very low or zero direct expense ratio. Since their inceptions, the Funds, in fact, have incurred no direct net expenses. Although the Target Retirement Funds are not expected to incur any net expenses directly, the Funds’ shareholders indirectly bear the expenses of the underlying Vanguard Funds.

Capitalization of Vanguard

The Funds’ Service Agreement provides that the Funds will not contribute to Vanguard’s capitalization or pay for corporate management, administrative, and distribution services provided by Vanguard. However, each Fund will bear

its own direct expenses, such as legal, auditing, and custodial fees. In addition, the Agreement further provides that the Funds’ direct expenses will be offset, in whole or in part, by a reimbursement from Vanguard for (1) the Funds’ contributions to the cost of operating the underlying Vanguard funds in which the Funds invest and (2) certain savings in administrative and marketing costs that Vanguard expects to derive from the Funds’ operations. The Funds expect that the reimbursements should be sufficient to offset most or all of the direct expenses incurred by each Fund. Therefore, the Funds are expected to operate at a very low—or zero—direct expense ratio. Of course, there is no guarantee that this will always be the case.

Capitalization. The following table shows, on an unaudited basis, the capitalization of each Fund as of September 30, 2016, and the capitalization of the Income Fund on a pro forma basis as of that date, after giving effect to the proposed acquisition of assets at net asset value. The following are examples of the number of shares of the 2010 Fund that would be exchanged for the shares of the Income Fund if the Reorganization had been consummated on September 30, 2016. The examples do not reflect the number of such shares or the value of such shares that would actually be received when the Reorganization occurs.

Capitalization Table

(unaudited)

| | | | |

| | 2010 Fund | Income Fund | Total | Pro Forma Combined |

| | | | Pro Forma | Income Fund |

| | | | Adjustments(a) | |

| |

| Total Net Assets | $1,837,824,324 | $2,030,499,755 | (29,000) | $3,868,295,079 |

| |

| Total Number of | | | | |

| Shares | 88,426,935 | 98,546,255 | 786,430 | 187,759,620 |

| Outstanding | | | | |

| |

| NAV Per Share | $20.78 | $20.60 | N/A | $20.60 |

| |

| (a) Pro forma adjustments represent the dollar amount of reorganization expenses incurred by Vanguard Institutional |

| Target Retirement 2010 Fund and the net change in shares outstanding pursuant to the Reorganization. |

GENERAL INFORMATION

This section provides information on a number of topics relating to the information statement/prospectus.

Annual/Semiannual Reports. The most recent annual and semiannual reports to shareholders for the 2010 Fund and the Income Fund are available at no cost. To request a report, please call Vanguard toll-free at 800-662-7447, or write to us at P.O. Box 2600, Valley Forge, PA 19482-2600. The reports are also available at our website, vanguard.com. Participants in a company-sponsored 401(k) or other retirement plan administered by Vanguard may call us toll-free at 800-523-1188.

Principal Shareholders. As of September 30, 2016, the 2010 Fund had approximately $1,837,824,324 in net assets and 88,426,935 outstanding shares. As of the same date, the officers and trustees of Vanguard Chester Funds, as a group, owned less than 1% of the outstanding shares of the 2010 Fund.

As of December 31, 2016, the following were known to be the record or beneficial owner of more than 5% of the outstanding shares of the 2010 Fund:

| |

| | Percentage of Outstanding Shares |

| Record Owner | Owned |

| Fidelity Investments Institutional Operations Co. | |

| Covington, Kentucky | 34.01% |

| Vanguard Fiduciary Trust Company, Valley Forge, | |

| PA | 23.96% |

| TIAA-CREF Trust Company, Saint Louis, MO | 11.53% |

| State Street Bank Trust, Harrison, NY | 7.10% |

As of September 30, 2016, the Income Fund had approximately $2,030,499,755 in net assets and 98,546,255 outstanding shares. As of the same date, the officers and trustees of Vanguard Chester Funds, as a group, owned less than 1% of the outstanding shares of the Income Fund.

As of December 31, 2016, the following were known to be the record or beneficial owner of more than 5% of the outstanding shares of the Income Fund:

| |

| | Percentage of Outstanding Shares |

| Record Owner | Owned |

| Vanguard Fiduciary Trust Company, Valley Forge, | |

| PA | 28.21% |

| State Street Bank Trust, Harrison, NY | 6.19% |

| TIAA-CREF Trust Company, Saint Louis, MO | 5.34% |

The percentage of the shares of the 2010 Fund that would be owned by the above named shareholders upon completion of the Reorganization is expected to be lower, as would the aggregate percentage of the Income Fund, due to the combination of the Funds.

For purposes of the 1940 Act, any person who owns either directly or through one or more controlled companies, more than 25% of the voting securities of a company is presumed to “control” such company. Accordingly, to the extent that a shareholder identified in the preceding tables is identified as the beneficial holder of more than 25% of a class, or is identified as the holder of record of more than 25% of a class and has voting and/or investment power, that shareholder may be presumed to control such class. The Funds generally believe that most of the shares

referred to in the above tables were held by the above persons in accounts for their fiduciary, agency, or custodial customers.