As filed with the Securities and Exchange Commission on February 14, 2022

Securities Act File No. 333-XX

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ________________________ FORM N-14 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 Pre-Effective Amendment No. ☐ Post-Effective Amendment No. ☐ VANGUARD CHESTER FUNDS (Exact Name of Registrant as Specified in Declaration of Trust) ________________________ P.O. Box 2600, Valley Forge, PA 19482 (Address of Principal Executive Office) Registrant’s Telephone Number (610) 669-1000 ________________________ Anne E. Robinson, Esquire P.O. Box 876 Valley Forge, PA 19482 (Name and Address of Agent for Service) Approximate Date of Proposed Public Offering: As soon as practicable after this registration statement becomes effective. Title of securities being registered: Vanguard Target Retirement Income Fund Investor Shares Calculation of Registration Fee under the Securities Act of 1933: No filing fee is due in reliance on Section 24(f) and Rule 24f-2 under the Investment Company Act of 1940. It is proposed this filing will become effective on March 16, 2022, pursuant to Rule 488 under the Securities Act of 1933. |

IMPORTANT NEWS FOR SHAREHOLDERS

Vanguard Target Retirement 2015 Fund is to be reorganized into Vanguard Target Retirement Income Fund on or about July 8, 2022. The first few pages of this booklet highlight key points about this reorganization.

The reorganization does not require shareholder approval, and you are not being asked to vote.

We do, however, ask that you review the enclosed combined information statement/prospectus, which contains information about the combined fund, outlines the differences between your fund and the combined fund, and provides details about the terms and conditions of the reorganization.

1

KEY POINTS ABOUT THE REORGANIZATION

Purpose of the Reorganization

The purpose of the reorganization is to combine Vanguard Target Retirement 2015 Fund (the “Acquired Fund”) with and into Vanguard Target Retirement Income Fund (the “Acquiring Fund,” and together with the Acquired Fund, the “Funds”). The Target Retirement Funds were originally launched in 2003 and invest in other Vanguard mutual funds (underlying funds). It was anticipated that approximately seven years after the target retirement date as specified in a fund’s name, such fund’s allocation would become substantially similar to the income fund’s allocation, and the target date fund would be merged into the income fund. This intention is disclosed in the Target Retirement Funds’ prospectuses. In mid-2022, the Acquired Fund will have substantially similar allocations as the Acquiring Fund.

At the time of the reorganization, the Acquired Fund and the Acquiring Fund will have the same minimum initial investment amount and the same expense ratio. They also have substantially similar investment objectives, and identical fundamental investment policies, risks, share class structures, boards of trustees, investment advisors, and fiscal year-ends. They have had similar performance records, and the target allocation of the Funds will be substantially similar at the time of the reorganization.

Similar Costs for Shareholders

For the fiscal year ended September 30, 2021, each of the Funds had total annual fund operating expenses of .12%. In addition, on or about February 11, 2022, Vanguard Institutional Target Retirement 2015 Fund was reorganized into the Acquired Fund and Vanguard Institutional Target Retirement Income Fund was reorganized into the Acquiring Fund. The total annual fund operating expense ratio of each combined fund at the time of the forthcoming reorganization is expected to be .08%. To achieve the lower expense ratios, the combined funds will invest in lower-cost share classes of the underlying funds.

Investment Objectives, Investment Strategies, and Risks

The Funds have substantially similar investment objectives and strategies, and identical fundamental investment policies and risks. They also have identical share class structures (i.e., Investor Shares only), boards of directors, investment advisors, and fiscal year-ends. The Funds operate as diversified open-end management companies within the meaning of the Investment Company Act of 1940.

Comparison of Investment Performance

The following table shows the average annual total returns of the Funds. Also shown are the returns of the Funds’ current benchmarks, the Target Retirement 2015 Composite Index and the Target Retirement Income Composite Index.

Average Annual Total Returns¹ for Periods Ended December 31, 2021²

| 1 Year | 5 Years | 10 Years | |

| Target Retirement 2015 Fund | 5.78% | 7.71% | 7.46% |

| Target Retirement Income Fund | 5.25% | 6.85% | 5.88% |

| Target Retirement 2015 Composite Index³ | 5.96% | 7.97% | 7.70% |

| Target Retirement Income Composite Index³ | 5.44% | 7.12% | 6.10% |

1 | Returns shown are before taxes and net of fees. |

2 | Keep in mind that the Funds’ past performance does not indicate how they will perform in the future. Actual performance may be higher of lower than the performance shown. |

3 | This reflects no deduction for fees, expenses, or taxes. |

2

Investment Advisory and Service Arrangements

The Vanguard Group, Inc. (“Vanguard”), a subsidiary jointly owned by the Vanguard funds, serves as advisor to the Funds through its Equity Index Group. Vanguard also serves as investment advisor for each of the underlying funds.

Each Fund is part of the Vanguard group of investment companies, which consists of over 200 funds. The Funds obtain virtually all of their corporate management, administrative, and distribution services through Vanguard. Vanguard may contract with certain third-party service providers to assist Vanguard in providing certain administrative and/or accounting services with respect to the Funds, subject to Vanguard’s oversight.

All of these services are provided at Vanguard’s total cost of operations pursuant to the Fifth Amended and Restated Funds’ Service Agreement (the “Funds’ Service Agreement”). Vanguard was established and operates under the Funds’ Service Agreement. Vanguard employs a supporting staff of management and administrative personnel needed to provide the requisite services to the Funds and also furnishes the Funds with necessary office space, furnishings, and equipment.

The Funds’ Service Agreement provides that the Funds will not contribute to Vanguard’s capitalization or pay for corporate management, administrative, and distribution services provided by Vanguard. In addition, the Funds’ Service Agreement further provides that the Funds’ direct expenses, such as legal, auditing, and custodial fees, may be offset, in whole or in part, by (1) the Funds’ contributions to the cost of operating the underlying funds in which the Funds invest and (2) certain savings in administrative and marketing costs that Vanguard expects to derive from the Funds’ operations. Accordingly, all expenses for services provided by Vanguard to the Funds and all other expenses incurred by the Funds are expected to be borne by the underlying funds. The Funds’ shareholders bear the fees and expenses associated with the Funds’ investments in the underlying funds.

How the Reorganization Will Occur and How It Will Affect Your Account

The Board of Trustees of each Fund approved the reorganization on December 17, 2021. No vote or action is required by either the Acquired Fund’s shareholders or the Acquiring Fund’s shareholders to approve or implement the reorganization.

Because applicable legal requirements do not require shareholder approval and the Board of Trustees has determined that the reorganization is in the best interests of each Fund and its shareholders, shareholders are not being asked to vote on the reorganization.

In the reorganization, Investor Shares of the Acquired Fund will be exchanged, on a tax-free basis, for an equivalent dollar amount of Investor Shares of the Acquiring Fund. Your account registration and account options will be the same unless you alter them. In addition, your aggregate tax basis in your shares will remain the same. The Acquired Fund will stop accepting purchase requests approximately two business days before the reorganization is scheduled to occur. If you place a purchase order directly or through an intermediary during this period before the closing, then it will be rejected.

Tax-Free Nature of the Reorganization

The proposed exchange of shares is expected to be accomplished on a tax-free basis. Accordingly, we anticipate that Acquired Fund shareholders will not realize any capital gains or losses directly from this exchange. However, you should pay close attention to these points:

| • | Final distribution(s). Prior to the reorganization, the Acquired Fund will distribute to its shareholders any remaining undistributed net income and/or realized capital gains. This distribution(s) will be taxable to Acquired Fund shareholders as ordinary income or capital gains, as applicable. |

3

| • | Payments of distributions. Following the reorganization, Acquiring Fund shareholders (including former shareholders of the Acquired Fund) will participate fully in the distributions, if any, made for the Acquiring Fund. |

| • | Cost basis. Following the reorganization, your aggregate cost basis and your holding period in your shares will remain the same. However, your nominal per-share cost basis will change as a result of differences in the share prices of the Acquired Fund and the Acquiring Fund. Vanguard will provide certain cost basis information in connection with the reorganization on its “Report of Organizational Actions Affecting Basis of Securities,” which will be available on vanguard.com shortly after the reorganization. |

If you choose to redeem your shares before the reorganization takes place, then the redemption will be treated as a normal sale of shares and, generally, will be a taxable transaction.

Whom to Call If You Have Any Questions

Please call Vanguard toll-free at 877-662-7447 if you have any questions about the reorganization.

4

COMBINED INFORMATION STATEMENT/PROSPECTUS

VANGUARD TARGET RETIREMENT 2015 FUND,

A SERIES OF VANGUARD CHESTER FUNDS

TO BE REORGANIZED WITH AND INTO

VANGUARD TARGET RETIREMENT INCOME FUND,

A SERIES OF VANGUARD CHESTER FUNDS

INTRODUCTION

Proposal Summary. This combined information statement/prospectus describes the reorganization of Vanguard Target Retirement 2015 Fund (the “Acquired Fund”) with and into Vanguard Target Retirement Income Fund (the “Acquiring Fund,” and together with the Acquired Fund, the “Funds”). The Target Retirement Funds were originally launched in 2003. It was anticipated that approximately seven years after the target retirement date as specified in a fund’s name, such fund’s allocation would become substantially similar to the income fund’s allocation, and the target date fund would be merged into the corresponding income fund. This intention is disclosed in the Target Retirement Funds’ prospectuses. In mid-2022, the Acquired Fund will have substantially similar allocations as the Acquiring Fund.

At the time of the reorganization, the Acquired Fund and the Acquiring Fund will have the same minimum initial investment amount and the same expense ratio. They also have substantially similar investment objectives, and identical fundamental investment policies, risks, share class structures, boards of trustees, investment advisors, and fiscal year-ends. They have had similar performance records, and the target allocation of the Funds will be substantially similar at the time of the reorganization.

The reorganization involves a few basic steps. First, the Acquired Fund will transfer substantially all of its assets and all of its liabilities to the Acquiring Fund in exchange for shares of beneficial interest of the Acquiring Fund. Simultaneously, the Acquired Fund will distribute such shares to its shareholders and the Acquiring Fund will open an account for each shareholder, crediting it with an amount of the Acquiring Fund’s Investor Shares equal in value to the Investor Shares of the Acquired Fund owned by each shareholder at the time of the reorganization. These steps together are referred to in this combined information statement/prospectus as the “Reorganization.” Thereafter, the Acquired Fund will be dissolved, wound up, and terminated in accordance with its Declaration of Trust and applicable law. The Acquiring Fund will be the surviving fund for accounting purposes.

NO ACTION ON YOUR PART IS REQUIRED TO EFFECT THE REORGANIZATION. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The address for each Fund is P.O. Box 2600, Valley Forge, PA 19482, and the telephone number is 610-669-1000 or 800-662-7447. Each Fund is a series of Vanguard Chester Funds (the “Trust”), which is a Delaware statutory trust.

Read and Keep These Documents. Please read this entire combined information statement/prospectus along with the enclosed prospectus of the Acquiring Fund, dated January 31, 2022, as supplemented. The prospectus sets forth concisely the information about the Acquiring Fund that a prospective investor ought to know before investing. These documents contain information that is important to you, and you should keep them for future reference.

Additional Information Is Available. The Funds’ Statement of Additional Information dated January 31, 2022, as supplemented (the “SAI”), contains important information about the Funds. It has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and is incorporated into this combined information statement/prospectus by reference. In addition, the Acquired Fund’s prospectus dated January 31, 2022, as supplemented, is incorporated by reference into and is considered part of this combined information statement/prospectus. The Statement of Additional Information relating to the Reorganization dated [March 16], 2022, also is incorporated by reference into this combined information statement/prospectus. Each Fund’s annual report for the fiscal year ended September 30, 2021, is incorporated by reference into this combined information statement/prospectus. You can obtain copies of these documents without charge by calling Vanguard at 800-662-7447, by writing to us at P.O. Box 2600, Valley Forge, PA 19482-2600, or by visiting the EDGAR database on the SEC’s website (www.sec.gov).

5

This combined information statement/prospectus is first expected to be sent to shareholders on or about [April 13], 2022.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC, NOR HAS THE SEC PASSED UPON THE ACCURACY OR ADEQUACY OF THIS COMBINED INFORMATION STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this combined information statement/prospectus is [March 16], 2022.

6

TABLE OF CONTENTS

SUMMARY | 8 |

MORE ON THE FUNDS | 15 |

FINANCIAL HIGHLIGHTS | 25 |

INVESTING WITH VANGUARD | 26 |

INFORMATION ABOUT THE REORGANIZATION | 38 |

ADDITIONAL INFORMATION ABOUT THE FUNDS | 40 |

GENERAL INFORMATION | 42 |

APPENDIX A | A-1 |

APPENDIX B | B-1 |

7

SUMMARY

The section summarizes key features and consequences of the Reorganization. This summary is qualified in its entirety by reference to the information contained elsewhere in this combined information statement/prospectus, in each Fund’s prospectus, in each Fund’s financial statements contained in its annual report, in each Fund’s SAI, and in the related Agreement and Plan of Reorganization (the “Agreement and Plan”), a form of which is attached as Appendix A hereto.

The Reorganization. At a meeting on December 17, 2021, the Board of Trustees of the Trust approved an Agreement and Plan to combine the Acquired Fund with and into the Acquiring Fund. The Agreement and Plan calls for the Acquired Fund to transfer substantially all of its assets and all of its liabilities to the Acquiring Fund in exchange for Investor Shares of the Acquiring Fund. Shareholders of the Acquired Fund will receive distributions from the Acquiring Fund of Investor Shares equivalent in value to their investments at the time of the Reorganization. The closing of the Reorganization is currently expected to occur on or about July 8, 2022. The Acquired Fund will then be dissolved, wound up, and terminated. The Reorganization will result in an exchange of Investor Shares in the Acquired Fund for new Investor Shares of the Acquiring Fund, and it is expected to occur on a tax-free basis. The Board of Trustees of the Trust has concluded that the Reorganization is in the best interests of the Funds and will not dilute the interests of the Funds’ shareholders.

Reasons for the Reorganization and Board of Trustees Approval. The Target Retirement Funds were originally launched in 2003. It was anticipated that approximately seven years after the target retirement date as specified in a fund’s name, such fund’s allocation would become substantially similar to the income fund’s allocation, and the target date fund would be merged into the corresponding income fund. This intention is disclosed in the Target Retirement Funds’ prospectuses. In mid-2022, the Acquired Fund will have substantially similar allocations as the Acquiring Fund.

At the time of the Reorganization, the Acquired Fund and the Acquiring Fund will have the same minimum initial investment amount and the same expense ratio. They also have substantially similar investment objectives, and identical fundamental investment policies, risks, share class structures, boards of trustees, investment advisors, and fiscal year-ends. They have had similar performance records, and the target allocation of the Funds will be substantially similar at the time of the Reorganization.

Tax-Free Reorganization. It is expected that the Reorganization will constitute a tax-free reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and the Funds will receive a favorable opinion from legal counsel to that effect. Please see “Information About the Reorganization - Tax-Free Reorganization” for additional information.

Overview of the Reorganization. Below is a comparison of the investment objectives, principal investment strategies, investment risks, other investment policies and risks, performance history, fees and expenses, and management of the Funds, among other things. The information below is only a summary; for more detailed information, please see the rest of this combined information statement/prospectus and each Fund’s prospectus and SAI. References to “we” generally refer to Vanguard.

Comparison of Investment Objectives

The Funds have substantially similar investment objectives. The Acquired Fund seeks to provide capital appreciation and current income consistent with its current asset allocation. The Acquiring Fund seeks to provide current income and some capital appreciation.

Comparison of Principal Investment Strategies

The Funds have substantially similar principal investment strategies. Each Fund’s principal investment strategies are set out below:

The Acquired Fund invests in a mix of Vanguard mutual funds (underlying funds) according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of 2015 (the target year). The Acquired Fund is designed for an investor who plans to withdraw the value of an account in the Acquired

8

Fund over a period of many years after the target year. The Acquired Fund’s asset allocation will become more conservative over time, meaning that the percentage of assets allocated to stocks will decrease while the percentage of assets allocated to bonds and other fixed income investments will increase. Within seven years after 2015, the Acquired Fund’s asset allocation should become similar to that of the Acquiring Fund. As of September 30, 2021, the Acquired Fund’s asset allocation among the underlying asset classes was as follows:

• | U.S. fixed-income securities | 36.5% |

• | U.S. stocks | 18.7% |

• | Inflation-indexed securities | 16.2% |

• | Foreign fixed-income securities | 15.8% |

• | Foreign stocks | 12.8% |

The Acquiring Fund invests in a mix of Vanguard mutual funds (underlying funds) according to an asset allocation strategy designed for investors currently in retirement. As of September 30, 2021, the Acquiring Fund’s allocation among the underlying asset classes was as follows:

• | U.S. fixed-income securities | 37.4% |

• | U.S. stocks | 17.3% |

• | Inflation-indexed securities | 17.1% |

• | Foreign fixed-income securities | 16.3% |

• | Foreign stocks | 11.9% |

Allocations may not total to 100% due to rounding. At any given time, each Fund’s asset allocation may be affected by a variety of factors, such as whether the underlying funds are accepting additional investments. Vanguard may change the selection of underlying share classes or underlying funds or the allocation of assets to the underlying funds at any time without prior notice to shareholders.

Each Fund’s indirect bond holdings are a diversified mix of short-, intermediate-, and long-term U.S. government, U.S. agency, and investment-grade U.S. corporate bonds; inflation-protected public obligations issued by the U.S. Treasury; mortgage-backed and asset-backed securities; and government, agency, corporate, and securitized investment-grade foreign bonds issued in currencies other than the U.S. dollar (but hedged by Vanguard to minimize foreign currency exposure).

Each Fund’s indirect stock holdings are a diversified mix of U.S. and foreign large-, mid-, and small-capitalization stocks.

Comparison of Principal Risks

The principal risks of the Acquired Fund are identical to those of the Acquiring Fund due to the Funds having substantially similar investment objectives and principal investment strategies, as noted above. Each Fund’s principal risks are described below:

Each Fund is subject to the risks associated with the stock and bond markets, any of which could cause an investor to lose money, and the level of risk may vary based on market conditions. An investment in each Fund is not guaranteed. An investor may experience losses. There is no guarantee that each Fund will provide adequate income through retirement. Because fixed-income securities such as bonds and short-term investments are typically less volatile than stocks and because each Fund invests most of its assets in fixed-income securities and short-term investments, each Fund’s overall level of risk is expected to be low to moderate.

| • | With approximately 70% of its assets allocated to fixed-income securities, each Fund is proportionately subject to the following bond risks: interest rate risk, which is the chance that bond prices overall will |

9

decline because of rising interest rates; income risk, which is the chance that an underlying fund’s income will decline because of falling interest rates; credit risk, which is the chance that a bond issuer will fail to pay interest or principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline, thus reducing the underlying fund’s return; and call risk, which is the chance that during periods of falling interest rates, issuers of callable bonds may call (redeem) securities with higher coupon rates or interest rates before their maturity dates. An underlying fund would then lose any price appreciation above the bond’s call price and would be forced to reinvest the unanticipated proceeds at lower interest rates, resulting in a decline in the underlying fund’s income. Each Fund is also subject to the following risks associated with investments in currency-hedged foreign bonds: country/regional risk, which is the chance that world events—such as political upheaval, financial troubles, or natural disasters—will adversely affect the value and/or liquidity of securities issued by foreign governments, government agencies, or companies; and currency hedging risk, which is the chance that the currency hedging transactions entered into by the underlying international bond fund may not perfectly offset the fund’s foreign currency exposure. |

| • | With approximately 30% of its assets allocated to stocks, each Fund is proportionately subject to stock market risk, which is the chance that stock prices overall will decline. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. Each Fund is also subject to the following risks associated with investments in foreign stocks: country/regional risk, which is the chance that world events—such as political upheaval, financial troubles, or natural disasters—will adversely affect the value of securities issued by companies in foreign countries or regions; and currency risk, which is the chance that the value of a foreign investment, measured in U.S. dollars, will decrease because of unfavorable changes in currency exchange rates. Country/regional risk and currency risk are especially high in emerging markets. |

| • | Each Fund is also subject to asset allocation risk, which is the chance that the selection of underlying funds, and the allocation of assets to them, will cause the Fund to underperform other funds with a similar investment objective. |

Comparison of Fundamental Investment Policies and Other Investment Policies and Risks

The Funds have fundamental investment policies and other investment policies, practices, and restrictions, which, together with their related risks, are set forth in the Funds’ prospectuses and SAI. The Acquired Fund’s fundamental investment policies and other investment policies and risks are identical to the Acquiring Fund’s fundamental investment policies and other investment policies and risks.

Comparison of Fund Performance

The following bar charts and tables are intended to help you understand the risks of investing in each Fund. The bar charts show how the performance of each Fund has varied from one calendar year to another over the periods shown. The tables show how the average annual total returns of each Fund compare with those of relevant market indexes and composite stock/bond indexes, which have investment characteristics similar to those of the Funds. The Target Retirement 2015 Composite Index is a custom blended index developed by Vanguard based on the Acquired Fund’s asset allocation glide schedule, which becomes more conservative as time elapses. As of September 30, 2021, the composite was derived using the following portion allocations: 12.7% FTSE Global All Cap ex US Index; 36.6% Bloomberg U.S. Aggregate Float Adjusted Index; 16.1% Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 0-5 Year Index; 15.7% Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged); and 19% CRSP US Total Market Index. The Target Retirement Income Composite Index is a custom blended index developed by Vanguard based on the Acquiring Fund’s asset allocation glide schedule, which becomes more conservative as time elapses. As of September 30, 2021, the composite was derived using the following portion allocations: 12% FTSE Global All Cap ex US Index; 37.2% Bloomberg U.S. Aggregate Float Adjusted Index; 16.8% Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 0-5 Year Index; 16% Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged); and 18% CRSP US Total Market Index. International stock benchmark returns are adjusted for withholding taxes. The components that make up the composite indexes may vary over time. Percentages listed may not total to 100% due to rounding. Keep in mind that each Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance

10

information for each Fund is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447.

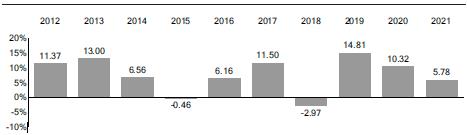

Annual Total Returns — Vanguard Target Retirement 2015 Fund Investor Shares

During the periods shown in the bar chart, the highest and lowest returns for a calendar quarter were:

| Total Return | Quarter | |

| Highest | 8.90% | June 30, 2020 |

| Lowest | -7.44% | March 31, 2020 |

Average Annual Total Returns for Periods Ended December 31, 2021 — Vanguard Target Retirement 2015 Fund

| 1 Year | 5 Years | 10 Years | |

| Vanguard Target Retirement 2015 Fund Investor Shares | |||

| Return Before Taxes | 5.78% | 7.71% | 7.46% |

| Return After Taxes on Distributions | 2.40 | 5.64 | 5.89 |

| Return After Taxes on Distributions and Sale of Fund Shares | 5.30 | 5.63 | 5.62 |

Target Retirement 2015 Composite Index (reflects no deduction for fees, expenses, or taxes) | 5.96% | 7.97% | 7.70% |

Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | -1.54 | 3.57 | 2.90 |

MSCI US Broad Market Index (reflects no deduction for fees, expenses, or taxes) | 26.10 | 18.09 | 16.39 |

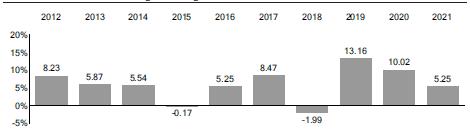

Annual Total Returns — Vanguard Target Retirement Income Fund Investor Shares

During the periods shown in the bar chart, the highest and lowest returns for a calendar quarter were:

11

| Total Return | Quarter | |

| Highest | 7.84% | June 30, 2020 |

| Lowest | -5.91% | March 31, 2020 |

Average Annual Total Returns for Periods Ended December 31, 2021 — Vanguard Target Retirement Income Fund

| 1 Year | 5 Years | 10 Years | |

| Vanguard Target Retirement Income Fund Investor Shares | |||

| Return Before Taxes | 5.25% | 6.85% | 5.88% |

| Return After Taxes on Distributions | 2.89 | 5.48 | 4.74 |

| Return After Taxes on Distributions and Sale of Fund Shares | 4.19 | 4.96 | 4.30 |

Target Retirement Income Composite Index (reflects no deduction for fees, expenses, or taxes) | 5.44% | 7.12% | 6.10% |

Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | -1.54 | 3.57 | 2.90 |

MSCI US Broad Market Index (reflects no deduction for fees, expenses, or taxes) | 26.10 | 18.09 | 16.39 |

Both Funds

Actual after-tax returns depend on your tax situation and may differ from those shown in the preceding tables. When after-tax returns are calculated, it is assumed that the shareholder was in the highest individual federal marginal income tax bracket at the time of each distribution of income or capital gains or upon redemption. State and local income taxes are not reflected in the calculations. Please note that after-tax returns are not relevant for a shareholder who holds fund shares in a tax-deferred account, such as an individual retirement account or a 401(k) plan. Also, figures captioned Return After Taxes on Distributions and Sale of Fund Shares may be higher than other figures for the same period if a capital loss occurs upon redemption and results in an assumed tax deduction for the shareholder.

Comparison of Fees and Expenses

In this Reorganization, Investor Shares of the Acquired Fund will be exchanged, on a tax-free basis, for an equivalent dollar amount of Investor Shares of the Acquiring Fund. The tables below compare the fees and annualized expenses of Investor Shares of the Acquired Fund as of September 30, 2021, and Investor Shares of the Acquiring Fund as of September 30, 2021. The tables also show the estimated fees and expenses of Investor Shares of the combined fund (the “Combined Fund”), on a pro forma basis, as of September 30, 2021 (unless otherwise noted), and do not include the estimated costs of the Reorganization (for information about the costs of the Reorganization please see “Information About the Reorganization – Expenses of the Reorganization”). The actual fees and expenses of the Funds and the Combined Fund as of the closing date may differ from those reflected in the tables below.

Shareholder Fees (Fees paid directly from your investment)

| Vanguard Target Retirement 2015 Fund | Vanguard Target Retirement Income Fund | Vanguard Target Retirement Income Fund | |

| Investor Shares | Investor Shares | Pro Forma Combined Fund Investor Shares | |

| Sales Charge (Load) Imposed on Purchases | None | None | None |

| Purchase Fee | None | None | None |

| Sales Charge (Load) Imposed on Reinvested Dividends | None | None | None |

| Redemption Fee | None | None | None |

12

| Account Service Fee Per Year (for certain fund account balances below $10,000) | $20 | $20 | $20 |

Annual Fund Operating Expenses (Expenses that you pay each year as a percentage of the value of your investment)

| Vanguard Target Retirement 2015 Fund Investor Shares | Vanguard Target Retirement Income Fund Investor Shares | Vanguard Target Retirement Income Fund Pro Forma Combined Fund Investor Shares | |

| Management Fees | 0.00% | 0.00% | 0.00% |

| 12b-1 Distribution Fee | None | None | None |

| Other Expenses | 0.00% | 0.00% | 0.00% |

| Acquired Fund Fees and Expenses | 0.12% | 0.12% | 0.08%* |

| Total Annual Fund Operating Expenses | 0.12% | 0.12% | 0.08%* |

*Acquired Fund Fees and Expenses have been restated to reflect Acquired Fund Fees and Expenses anticipated at the time of the closing of the Reorganization.

Examples

The following examples are intended to help you compare the cost of investing in Investor Shares of the Acquired Fund, Investor Shares of the Acquiring Fund, and Investor Shares of the Combined Fund with the cost of investing in other mutual funds. They illustrate the hypothetical expenses that you would incur over various periods if you were to invest $10,000 in each Fund’s shares. These examples assume that the shares provide a return of 5% each year and that total annual fund operating expenses remain as stated in the preceding table. You would incur these hypothetical expenses whether or not you redeem your investment at the end of the given period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Vanguard Target Retirement 2015 Fund Investor Shares | $12 | $39 | $68 | $154 |

| Vanguard Target Retirement Income Fund Investor Shares | $12 | $39 | $68 | $154 |

| Vanguard Target Retirement Income Fund Pro Forma Combined Fund Investor Shares | $8 | $26 | $45 | $103 |

These examples should not be considered to represent actual expenses or performance from the past or for the future. Actual future expenses may be higher or lower than those shown.

Comparison of Portfolio Turnover

Each Fund may pay transaction costs, such as purchase fees, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in more taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the previous expense example, reduce each Fund’s performance. During the most recent fiscal year ended September 30, 2021, the Acquired Fund’s portfolio turnover rate was 4%. During the most recent fiscal year ended September 30, 2021, the Acquiring Fund’s portfolio turnover rate was 6%.

13

Comparison of Investment Advisor and Portfolio Managers

The Acquired Fund and the Acquiring Fund have the same investment advisor, The Vanguard Group, Inc. The Acquired Fund and the Acquiring Fund also have the same portfolio managers. The Funds are both co-managed by William A. Coleman, CFA, and Walter Nejman, who have co-managed both Funds since 2013.

The Combined Fund is expected to retain The Vanguard Group, Inc., as investment advisor and Mr. Coleman and Mr. Nejman as co-portfolio managers.

Investment Advisor

The Vanguard Group, Inc., P.O. Box 2600, Valley Forge, PA 19482, which began operations in 1975, serves as advisor to the Funds through its Equity Index Group. Vanguard also serves as investment advisor for each of the underlying funds. As of September 30, 2021, Vanguard served as advisor for approximately $6.5 trillion in assets. Vanguard provides investment advisory services to the Funds pursuant to the Fifth Amended and Restated Funds’ Service Agreement (the “Funds’ Service Agreement”) and is subject to the supervision and oversight of the trustees and officers of the Funds.

For a discussion of why the Board of Trustees approved each Fund’s investment advisory arrangement, see the most recent semiannual reports to shareholders covering the fiscal period ended March 31.

Portfolio Managers

The managers primarily responsible for the day-to-day management of the Funds are:

William A. Coleman, CFA, Portfolio Manager at Vanguard. He has worked in investment management since joining Vanguard in 2006, has co-managed the Target Retirement 2065 Fund since its inception in 2017, and has co-managed the rest of the Target Retirement Funds since 2013. Education: B.S., King’s College; M.S., Saint Joseph’s University.

Walter Nejman, Portfolio Manager at Vanguard. He has been with Vanguard since 2005, has worked in investment management since 2008, has co-managed the Target Retirement 2065 since its inception in 2017, and has co-managed the rest of the Target Retirement Funds since 2013. Education: B.A., Arcadia University; M.B.A., Villanova University.

The Funds’ SAI provides information about each portfolio manager’s compensation, other accounts under management, and ownership of shares of the Funds.

Comparison of Purchase, Redemption, and Exchange Information

The purchase, redemption, and exchange features of the Funds are identical. Shareholders may purchase, redeem, or exchange shares of the Funds online, by mail, or by telephone. For Investor shares of each Fund, the minimum investment amount required to open and maintain a Fund account is $1,000, and the minimum investment amount required to add to an existing Fund account is generally $1. Financial intermediaries, institutional clients, and Vanguard-advised clients should contact Vanguard for information on special eligibility rules that may apply to them regarding Investor Shares.

Comparison of Distribution Schedules

For the Acquired Fund, income dividends generally are distributed annually in December. For the Acquiring Fund, income dividends generally are distributed quarterly in March, June, September, and December. For both Funds, capital gains distributions, if any, generally occur annually in December. From time to time, the Funds may also make distributions that are treated as a return of capital. In addition, both Funds may occasionally make a supplemental distribution at some other time during the year.

14

MORE ON THE FUNDS

This combined information statement/prospectus describes the principal risks you would face as a Fund shareholder. It is important to keep in mind one of the main principles of investing: generally, the higher the risk of losing money, the higher the potential reward. The reverse, also, is generally true: the lower the risk, the lower the potential reward. As you consider an investment in any mutual fund, you should take into account your personal tolerance for fluctuations in the securities markets. Look for this  symbol throughout this section. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way.

symbol throughout this section. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way.

Plain Talk About Costs of Investing |

Costs are an important consideration in choosing a mutual fund. That is because you, as a shareholder, pay a proportionate share of the costs of operating a fund and any transaction costs incurred when the fund buys or sells securities. These costs can erode a substantial portion of the gross income or the capital appreciation a fund achieves. Even seemingly small differences in expenses can, over time, have a dramatic effect on a fund’s performance. |

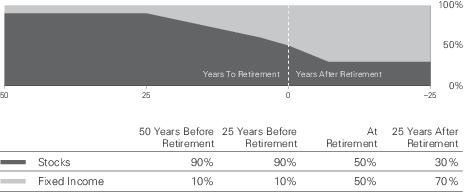

The following sections explain the principal investment strategies and policies that each Fund uses in pursuit of its investment objective. The Funds’ Board of Trustees, which oversees each Fund’s management, may change investment strategies or policies in the interest of shareholders without a shareholder vote, unless those strategies or policies are designated as fundamental. As funds of funds, the Funds achieve their investment objectives by investing in other Vanguard mutual funds. Through its investments in the underlying funds, each Fund indirectly owns a diversified portfolio of stocks and bonds.

Asset Allocation Framework

Asset allocation—that is, dividing your investment among stocks, fixed income securities, and short-term investments—is one of the most critical decisions you can make as an investor. It is also important to recognize that the asset allocation strategy you use today may not be appropriate as you move closer to retirement. The Funds are designed to provide you with a single Fund with an asset allocation that changes over time and becomes more conservative as you approach retirement, meaning that the percentage of assets allocated to stock will decrease while the percentage of assets allocated to bonds and other fixed income investments will increase.

The following table shows the targeted asset allocation for each Fund, as well as the other Vanguard Target Retirement Funds, as of September 30, 2021.

| Target Retirement Fund | ||||||

| Underlying Asset Class | Income | 2015 | 2020 | 2025 | 2030 | 2035 |

| U.S. stocks | 18% | 19.3% | 27.9% | 34.5% | 39.4% | 43.9% |

| Foreign stocks | 12.0 | 12.9 | 18.6 | 23.0 | 26.2 | 29.2 |

| U.S. fixed-income securities | 37.2 | 36.4 | 30.8 | 28.3 | 24.1 | 18.8 |

| Foreign fixed-income securities | 16.0 | 15.6 | 13.2 | 12.2 | 10.3 | 8.1 |

| Inflation-indexed securities | 16.8 | 15.9 | 9.6 | 2.0 | 0.0 | 0.0 |

15

| Target Retirement Fund | ||||||

| Underlying Asset Class | 2040 | 2045 | 2050 | 2055 | 2060 | 2065 |

| U.S. stocks | 48.4% | 52.9% | 54.0% | 54.0% | 54.0% | 54.0% |

| Foreign stocks | 32.3 | 35.3 | 36.0 | 36.0 | 36.0 | 36.0 |

| U.S. fixed-income securities | 13.6 | 8.3 | 7.0 | 7.0 | 7.0 | 7.0 |

| Foreign fixed-income securities | 5.8 | 3.6 | 3.0 | 3.0 | 3.0 | 3.0 |

| Inflation-indexed securities | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

The Funds’ advisor allocates each Fund’s assets among the underlying funds based on its investment objective and policies. The asset allocation for each Target Retirement Fund (other than the Acquiring Fund) will change over time as the date indicated in the Target Retirement Fund’s name draws closer. Once a Target Retirement Fund’s asset allocation is similar to that of the Acquiring Fund, the Target Retirement Fund’s board of trustees may approve combining the Target Retirement Fund with the Acquiring Fund. The board will grant such approval if it determines the combination to be in the best interest of Target Retirement Fund shareholders. Once such a combination occurs, shareholders will own shares of the Acquiring Fund. Shareholders will be notified prior to such a combination. We expect these combinations to occur within seven years after the year indicated in the Target Retirement Fund’s name.

The following chart shows how we expect the asset allocations for the Funds to change over time. The actual asset allocations may differ from this chart.

An example of how fund asset allocations change over time

The Funds’ investments in the underlying funds may be affected by a variety of factors. For example, an underlying fund may stop accepting or may limit additional investments, forcing the Funds to invest in a different underlying fund.

Stocks

By owning shares of underlying funds that hold U.S. stocks, each Fund indirectly invests, to varying degrees, in U.S. stocks, with an emphasis on large-cap stocks. To a lesser extent, each Fund also invests in funds that own mid- and small-cap U.S. stocks, as well as foreign stocks, including emerging markets.

Historically, mid- and small-cap stocks have been more volatile than—and at times have performed quite differently from—large-cap stocks. This volatility is due to several factors, including the fact that smaller companies often have fewer customers and financial resources than larger firms. These characteristics can make mid-size and small companies more sensitive to changing economic conditions, leading to less certain growth and dividend prospects.

16

As of September 30, 2021, the stocks in the underlying domestic equity fund had an asset-weighted median market capitalization of $127.5 billion and the stocks in the underlying international equity fund had an asset-weighted median market capitalization of $33 billion.

By owning shares of underlying funds that hold foreign stocks, each Fund is subject to country/regional risk and currency risk.

Plain Talk About International Investing |

U.S. investors who invest in foreign securities will encounter risks not typically associated with U.S. companies because foreign stock and bond markets operate differently from the U.S. markets. For instance, foreign companies and governments may not be subject to the same or similar accounting, auditing, legal, tax, and financial reporting standards and practices as U.S. companies and the U.S. government, and their stocks and bonds may not be as liquid as those of similar U.S. entities. In addition, foreign stock exchanges, brokers, companies, bond markets, and dealers may be subject to less government supervision and regulation than their counterparts in the United States. These factors, among others, could negatively affect the returns U.S. investors receive from foreign investments. |

Fixed-Income Securities

By owning shares of underlying funds that hold U.S. fixed-income securities, each Fund indirectly invests, to varying degrees, in government and corporate bonds, as well as in mortgage-backed and asset-backed securities. Through their investments in Vanguard Short-Term Inflation-Protected Securities Index Fund, the Funds also invest in inflation-protected bonds.

Plain Talk About Inflation-Indexed Securities |

Unlike a conventional bond, whose issuer makes regular fixed interest payments and repays the face value of the bond at maturity, an inflation-indexed security (IIS) provides principal and interest payments that are adjusted over time to reflect a rise (inflation) or a drop (deflation) in the general price level for goods and services. This adjustment is a key feature of an IIS. Even though historically the general price level for goods and services has risen each year, there have been periods when the general price level for goods and services has dropped (as measured by the Consumer Price Index (CPI). Importantly, for shareholders of U.S. government issued inflation-indexed securities, during such a period of deflation, the U.S. Treasury has guaranteed that it will repay at least the face value of the securities. However, if an IIS is purchased by a fund at a premium, a deflationary period could cause the fund to experience a loss. |

17

Inflation measurement and adjustment for an IIS have two important features. There is a two-month lag between the time that inflation occurs in the economy and when it is factored into IIS valuations. This is due to the time required to measure and calculate the CPI and for the U.S. Treasury to adjust the inflation accrual schedules for an IIS. For example, inflation that occurs in January is calculated and announced during February and affects IIS valuations throughout the month of March. In addition, the inflation index used is the nonseasonally adjusted index. It differs from the CPI that is reported by most news organizations, which is statistically smoothed to overcome highs and lows observed at different points each year. The use of the nonseasonally adjusted index can cause a fund’s income level to fluctuate. |

Although fixed income securities (commonly referred to as bonds) are often thought to be less risky than stocks, there have been periods when bond prices have fallen significantly because of rising interest rates.

Plain Talk About Bonds and Interest Rates |

As a rule, when interest rates rise, bond prices fall. The opposite is also true: Bond prices go up when interest rates fall. Why do bond prices and interest rates move in opposite directions? Let’s assume that you hold a bond offering a 4% yield. A year later, interest rates are on the rise and bonds of comparable quality and maturity are offered with a 5% yield. With higher-yielding bonds available, you would have trouble selling your 4% bond for the price you paid—you would probably have to lower your asking price. On the other hand, if interest rates were falling and 3% bonds were being offered, you should be able to sell your 4% bond for more than you paid. |

How mortgage-backed securities are different: In general, declining interest rates will not lift the prices of mortgage-backed securities—such as those guaranteed by the Government National Mortgage Association—as much as the prices of comparable bonds. Why? Because when interest rates fall, the bond market tends to discount the prices of mortgage-backed securities for prepayment risk—the possibility that homeowners will refinance their mortgages at lower rates and cause the bonds to be paid off prior to maturity. In part to compensate for this prepayment possibility, mortgage-backed securities tend to offer higher yields than other bonds of comparable credit quality and maturity. In contrast, when interest rates rise, prepayments tend to slow down, subjecting mortgage-backed securities to extension risk—the possibility that homeowners will repay their mortgages at slower rates. This will lengthen the duration or average life of mortgage-backed securities held by a fund and delay the fund’s ability to reinvest proceeds at higher interest rates, making the fund more sensitive to changes in interest rates. |

Plain Talk About Inflation-Indexed Securities and Interest Rates |

18

Interest rates on conventional bonds have two primary components: a “real” yield and an increment that reflects investor expectations of future inflation. By contrast, interest rates on an IIS are adjusted for inflation and, therefore, are not affected meaningfully by inflation expectations. This leaves only real interest rates to influence the price of an IIS. A rise in real interest rates will cause the price of an IIS to fall, while a decline in real interest rates will boost the price of an IIS. |

Changes in interest rates can affect bond income as well as bond prices.

The Funds are also subject to income fluctuations through their investments in Vanguard Short-Term Inflation-Protected Securities Index Fund. The quarterly income distributions of Vanguard Short-Term Inflation-Protected Securities Index Fund are likely to fluctuate considerably more than income distributions of a typical bond fund because of changes in inflation.

For mortgage-backed securities, the risk that borrowers (e.g., homeowners) may refinance their mortgages at lower interest rates is known as prepayment risk.

Because the underlying funds invest only a portion of their assets in callable bonds and mortgage-backed securities, call/prepayment risk for each Fund should be low to moderate.

The credit quality of the fixed-income securities held by the underlying funds is expected to be very high, and thus credit risk for each Fund should be low.

To a limited extent, the Funds are also indirectly subject to event risk, which is the chance that corporate fixed income securities held by the underlying funds may suffer a substantial decline in credit quality and market value because of a corporate restructuring.

By owning shares of underlying funds that hold foreign fixed-income securities, each Fund is subject to risks associated with investments in currency-hedged foreign bonds.

Market disruptions can adversely affect local and global markets as well as normal market conditions and operations. Any such disruptions could have an adverse impact on the value of a Fund’s investments and Fund performance.

19

Security Selection

Each Fund seeks to achieve its investment objective by investing in a mix of underlying Vanguard funds to pursue a target allocation of stocks and fixed-income securities, which are briefly described in the following paragraphs.

| • | Vanguard Total Stock Market Index Fund seeks to track the performance of the CRSP US Total Market Index, which represents approximately 100% of the investable U.S. stock market and includes large-, mid-, small-, and micro-cap stocks regularly traded on the New York Stock Exchange and Nasdaq. The fund invests by sampling the Index, meaning that it holds a broadly diversified collection of securities that, in the aggregate, approximates the full Index in terms of key characteristics. |

| • | Vanguard Total International Stock Index Fund seeks to track the performance of the FTSE Global All Cap ex US Index, a float-adjusted market-capitalization-weighted index designed to measure equity market performance of companies located in developed and emerging markets, excluding the United States. The Index is most heavily weighted in Japan, China, the United Kingdom, Canada, Switzerland, and France. |

| • | Vanguard Total Bond Market II Index Fund seeks to track the performance of the Bloomberg U.S. Aggregate Float Adjusted Index by investing in a representative sample of bonds included in the Index. The Index measures the performance of a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States—including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities—all with maturities of more than 1 year. The fund maintains a dollar-weighted average maturity consistent with that of the Index, which generally ranges between 5 and 10 years. |

| • | Vanguard Total International Bond Index Fund and Vanguard Total International Bond II Index Fund seek to track the performance of the Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged) by investing in a representative sample of securities included in the Index. The Index provides a broad-based measure of the global, investment-grade, fixed-rate debt markets. The Index includes government, government agency, corporate, and securitized non-U.S. investment-grade fixed income investments, all issued in currencies other than the U.S. dollar and with maturities of more than 1 year. Each fund maintains a dollar-weighted average maturity consistent with that of the Index, which generally ranges between 5 and 10 years. To minimize the currency risk associated with investment in bonds denominated in currencies other than the U.S. dollar, each fund will attempt to hedge its foreign currency exposure. |

| • | Vanguard Short-Term Inflation-Protected Securities Index Fund seeks to track the performance of the Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 0–5 Year Index, a market-capitalization-weighted index that includes all inflation-protected public obligations issued by the U.S. Treasury with remaining maturities of less than 5 years. The fund maintains a dollar-weighted average maturity consistent with that of the Index, which generally does not exceed 3 years. |

Other Investment Policies and Risks

Each underlying fund may invest, to a limited extent, in derivatives. In addition, each Fund may invest, to a limited extent, in stock and bond futures, which are types of derivatives. Each Fund will use futures to both facilitate the periodic rebalancing of the Fund’s portfolio to maintain its target asset allocation and to allow the Fund to remain fully invested in accordance with its investment strategies. Generally speaking, a derivative is a financial contract whose value is based on the value of a financial asset (such as a stock, a bond, or a currency), a physical asset (such as gold, oil, or wheat), a market index, or a reference rate. Investments in derivatives may subject the funds to risks different from, and possibly greater than, those of investments directly in the underlying securities or assets. The Funds and the underlying funds will not use derivatives for speculation or for the purpose of leveraging (magnifying) investment returns.

Cash Management

20

Each Fund’s daily cash balance may be invested in Vanguard Market Liquidity Fund and/or Vanguard Municipal Cash Management Fund (each, a CMT Fund), which are low-cost money market funds. When investing in a CMT Fund, each Fund bears its proportionate share of the expenses of the CMT Fund in which it invests. Vanguard receives no additional revenue from Fund assets invested in a CMT Fund.

To put cash flow to work as soon as possible, and thereby capture as much of the market’s return as possible, each Fund reserves the right to invest in shares of Vanguard Total Stock Market ETF, Vanguard Total International Stock ETF, Vanguard Total Bond Market ETF, Vanguard Short-Term Inflation-Protected Securities ETF, and Vanguard Total International Bond ETF, as applicable (each provides returns similar to the returns of its corresponding market segment). The Funds’ advisor may purchase ETF Shares when large cash inflows come into a Fund too late in the day to invest the cash, on a same-day basis, in shares of the underlying Vanguard funds that serve as the Fund’s primary investments. These cash-flow situations will arise infrequently, and the period of holding the ETF Shares will be short—in most cases, one day. (Vanguard does not receive duplicate management fees when Fund assets are invested in ETF Shares.)

Methods Used to Meet Redemption Requests

Under normal circumstances, each Fund typically expects to meet redemptions with positive cash flows. When this is not an option, each Fund seeks to maintain its risk exposure by selling a cross section of the Fund’s holdings to meet redemptions, while also factoring in transaction costs. Additionally, a Fund may work with larger clients to implement their redemptions in a manner that is least disruptive to the portfolio; see “Potentially disruptive redemptions” under Redeeming Shares in the Investing With Vanguard section.

Under certain circumstances, including under stressed market conditions, there are additional tools that each Fund may use in order to meet redemptions, including advancing the settlement of market trades with counterparties to match investor redemption payments or delaying settlement of an investor’s transaction to match trade settlement within regulatory requirements. A Fund may also suspend payment of redemption proceeds for up to seven days; see “Emergency circumstances” under Redeeming Shares in the Investing With Vanguard section. Additionally under these unusual circumstances, a Fund may borrow money (subject to certain regulatory conditions and if available under board-approved procedures) through an interfund lending facility; through a bank line-of-credit, including a joint committed credit facility; or through an uncommitted line-of-credit from Vanguard in order to meet redemption requests.

Frequent Trading or Market-Timing

Background. Some investors try to profit from strategies involving frequent trading of mutual fund shares, such as market-timing. For funds holding foreign securities, investors may try to take advantage of an anticipated difference between the price of the fund’s shares and price movements in overseas markets, a practice also known as time-zone arbitrage. Investors also may try to engage in frequent trading of funds holding investments such as small-cap stocks and high-yield bonds. As money is shifted into and out of a fund by a shareholder engaging in frequent trading, the fund incurs costs for buying and selling securities, resulting in increased brokerage and administrative costs. These costs are borne by all fund shareholders, including the long-term investors who do not generate the costs. In addition, frequent trading may interfere with an advisor’s ability to efficiently manage the fund.

Policies to address frequent trading. The Vanguard funds (other than money market funds and short-term bond funds, but including Vanguard Short-Term Inflation-Protected Securities Index Fund) do not knowingly accommodate frequent trading. The board of trustees of each Vanguard fund (other than money market funds and short-term bond funds, but including Vanguard Short-Term Inflation-Protected Securities Index Fund) has adopted policies and procedures reasonably designed to detect and discourage frequent trading and, in some cases, to compensate the fund for the costs associated with it. These policies and procedures do not apply to ETF Shares because frequent trading in ETF Shares generally does not disrupt portfolio management or otherwise harm fund shareholders. Although there is no assurance that Vanguard will be able to detect or prevent frequent trading or market-timing in all circumstances, the following policies have been adopted to address these issues:

21

| • | Each Vanguard fund reserves the right to reject any purchase request—including exchanges from other Vanguard funds—without notice and regardless of size. For example, a purchase request could be rejected because the investor has a history of frequent trading or if Vanguard determines that such purchase may negatively affect a fund’s operation or performance. |

| • | Each Vanguard fund (other than money market funds and short-term bond funds, but including Vanguard Short-Term Inflation-Protected Securities Index Fund) generally prohibits, except as otherwise noted in the Investing With Vanguard section, an investor’s purchases or exchanges into a fund account for 30 calendar days after the investor has redeemed or exchanged out of that fund account. |

| • | Certain Vanguard funds charge shareholders purchase and/or redemption fees on transactions. |

See the Investing With Vanguard section of this combined information statement/prospectus for further details on Vanguard’s transaction policies.

Each Vanguard fund (other than retail and government money market funds), in determining its net asset value, will use fair-value pricing when appropriate, as described in the Share Price section. Fair-value pricing may reduce or eliminate the profitability of certain frequent-trading strategies.

Do not invest with Vanguard if you are a market-timer.

Turnover Rate

Although each Fund generally seeks to invest for the long term, a Fund may sell shares of the underlying funds regardless of how long they have been held. The Financial Highlights section of this combined information statement/prospectus shows historical turnover rates for the Acquiring Fund. A turnover rate of 100%, for example, would mean that a Fund had sold and replaced shares of the underlying funds valued at 100% of its net assets within a one-year period. In general, the greater the turnover rate, the greater the impact transaction costs will have on a fund’s return. Also, funds with high turnover rates may be more likely to generate capital gains, including short-term capital, gains that must be distributed to shareholders and will be taxable to shareholders investing through a taxable account.

Dividends, Capital Gains, and Taxes

Fund Distributions

Each Fund distributes to shareholders virtually all of its net income as well as any net short-term or long-term capital gains realized from the sale of its holdings or received as capital gains distributions from the underlying funds. From time to time, each Fund may also make distributions that are treated as a return of capital. Income dividends for the Acquiring Fund generally are distributed quarterly in March, June, September, and December; income dividends for the Acquired Fund generally are distributed annually in December. Capital gains distributions, if any, generally occur annually in December. In addition, each Fund may occasionally make a supplemental distribution at some other time during the year.

You can receive distributions of income or capital gains in cash, or you can have them automatically reinvested in more shares of the Fund. However, if you are investing through an employer-sponsored retirement or savings plan, your distributions will be automatically reinvested in additional Fund shares.

Basic Tax Points

Investors in taxable accounts should be aware of the following basic federal income tax points:

| • | Distributions are taxable to you whether or not you reinvest these amounts in additional Fund shares. |

| • | Distributions declared in December—if paid to you by the end of January—are taxable as if received in December. |

22

| • | Any dividend distribution or short-term capital gains distribution that you receive is taxable to you as ordinary income. If you are an individual and meet certain holding-period requirements with respect to your Fund shares, you may be eligible for reduced tax rates on “qualified dividend income,” if any, or a special tax deduction on “qualified REIT dividends,” if any, distributed by the Fund. |

| • | Any distribution of net long-term capital gains is taxable to you as long-term capital gains, no matter how long you have owned shares in the Fund. |

| • | Capital gains distributions may vary considerably from year to year as a result of the Funds’ normal investment activities and cash flows. |

| • | Your cost basis in the Fund will be decreased by the amount of any return of capital that you receive. This, in turn, will affect the amount of any capital gain or loss that you realize when selling or exchanging your Fund shares. |

| • | Return of capital distributions generally are not taxable to you until your cost basis has been reduced to zero. If your cost basis is at zero, return of capital distributions will be treated as capital gains. |

| • | A sale or exchange of Fund shares is a taxable event. This means that you may have a capital gain to report as income, or a capital loss to report as a deduction, when you complete your tax return. |

| • | Vanguard (or your intermediary) will send you a statement each year showing the tax status of all of your distributions. |

Individuals, trusts, and estates whose income exceeds certain threshold amounts are subject to a 3.8% Medicare contribution tax on “net investment income.” Net investment income takes into account distributions paid by the Fund and capital gains from any sale or exchange of Fund shares.

Dividend distributions and capital gains distributions that you receive, as well as your gains or losses from any sale or exchange of Fund shares, may be subject to state and local income taxes.

This combined information statement/prospectus provides general tax information only. If you are investing through a tax-advantaged account, such as an IRA or an employer-sponsored retirement or savings plan, special tax rules apply. Please consult your tax advisor for detailed information about any tax consequences for you.

Plain Talk About Buying a Dividend |

Unless you are a tax-exempt investor or investing through a tax-advantaged account (such as an IRA or an employer-sponsored retirement or savings plan), you should consider avoiding a purchase of fund shares shortly before the fund makes a distribution, because doing so can cost you money in taxes. This is known as “buying a dividend.” For example: On December 15, you invest $5,000, buying 250 shares for $20 each. If the fund pays a distribution of $1 per share on December 16, its share price will drop to $19 (not counting market change). You still have only $5,000 (250 shares x $19 = $4,750 in share value, plus 250 shares x $1 = $250 in distributions), but you owe tax on the $250 distribution you received—even if you reinvest it in more shares. To avoid buying a dividend, check a fund’s distribution schedule before you invest. |

General Information

Backup withholding. By law, Vanguard must withhold 24% of any taxable distributions or redemptions from your account if you do not:

23

| • | Provide your correct taxpayer identification number. |

| • | Certify that the taxpayer identification number is correct. |

| • | Confirm that you are not subject to backup withholding. |

Similarly, Vanguard (or your intermediary) must withhold taxes from your account if the IRS instructs us to do so.

Foreign investors. Vanguard funds offered for sale in the United States (Vanguard U.S. funds), including the Funds, are not widely available outside the United States. Non-U.S. investors should be aware that U.S. withholding and estate taxes and certain U.S. tax reporting requirements may apply to any investments in Vanguard U.S. funds. Foreign investors should visit the non-U.S. investors page on our website at vanguard.com for information on Vanguard’s non-U.S. products.

Invalid addresses. If a dividend distribution or capital gains distribution check mailed to your address of record is returned as undeliverable, Vanguard will automatically reinvest the distribution and all future distributions until you provide us with a valid mailing address. Reinvestments will receive the net asset value calculated on the date of the reinvestment.

Share Price

Share price, also known as net asset value (NAV), is calculated as of the close of regular trading on the New York Stock Exchange (NYSE), generally 4 p.m., Eastern time, on each day that the NYSE is open for business (a business day). In the rare event the NYSE experiences unanticipated disruptions and is unavailable at the close of the trading day, NAVs will be calculated as of the close of regular trading on the Nasdaq (or another alternate exchange if the Nasdaq is unavailable, as determined at Vanguard’s discretion), generally 4 p.m., Eastern time. The NAV per share is computed by dividing the total assets, minus liabilities, of each Fund by the number of Fund shares outstanding. On U.S. holidays or other days when the NYSE is closed, the NAV is not calculated, and the Funds do not sell or redeem shares. The underlying Vanguard funds in which the Funds invest also do not calculate their NAV on days when the NYSE is closed, but the value of their assets may be affected to the extent that they hold securities that change in value on those days (such as foreign securities that trade on foreign markets that are open).

Each Fund’s NAV is calculated based upon the values of the underlying mutual funds in which the Fund invests. The values of any mutual fund shares, including institutional money market fund shares, held by a fund are based on the NAVs of the shares. The values of any ETF shares held by a fund are based on the market value of the shares. The prospectuses for the underlying funds explain the circumstances under which those funds will use fair-value pricing and the effects of doing so.

Vanguard fund share prices are published daily on our website at vanguard.com/prices.

Vanguard fund share prices are published daily on our website at vanguard.com/prices.

24

FINANCIAL HIGHLIGHTS

Financial highlights information is intended to help you understand a fund's performance for the past five years (or, if shorter, its period of operations). Certain information reflects financial results for a single fund share. Total return represents the rate that an investor would have earned or lost each period on an investment in a fund or share class (assuming reinvestment of all distributions). This information has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, whose report, along with each Fund’s audited financial statements for the fiscal year ended September 30, 2021, is included in the Fund’s most recent annual report, which is available upon request.

| Vanguard Target Retirement Income Fund Investor Shares | |||||||||

| For a Share Outstanding | Year Ended September 30, | ||||||||

| Throughout Each Period | 2021 | 2020 | 2019 | 2018 | 2017 | ||||

| Net Asset Value, Beginning of Period | $14.54 | $13.85 | $13.52 | $13.46 | $13.08 | ||||

| Investment Operations | |||||||||

Net Investment Income1 | .278 | .308 | .341 | .334 | .250 | ||||

Capital Gain Distributions Received1 | .056 | — | — | .001 | .004 | ||||

| Net Realized and Unrealized Gain (Loss) on Investments | .887 | .696 | .533 | .107 | .422 | ||||

| Total from Investment Operations | 1.221 | 1.004 | .874 | .442 | .676 | ||||

| Distributions | |||||||||

| Dividends from Net Investment Income | (.256) | (.297) | (.352) | (.327) | (.254) | ||||

| Distributions from Realized Capital Gains | (.265) | (.017) | (.192) | (.055) | (.042) | ||||

| Total Distributions | (.521) | (.314) | (.544) | (.382) | (.296) | ||||

| Net Asset Value, End of Period | $15.24 | $14.54 | $13.85 | $13.52 | $13.46 | ||||

Total Return2 | 8.48% | 7.35% | 6.75% | 3.31% | 5.26% | ||||

| Ratios/Supplemental Data | |||||||||

| Net Assets, End of Period (Millions) | $16,322 | $17,576 | $16,984 | $16,613 | $16,645 | ||||

Ratio of Total Expenses to Average Net Assets | — | — | — | — | — | ||||

| Acquired Fund Fees and Expenses | 0.12% | 0.12% | 0.12% | 0.12% | 0.13% | ||||

Ratio of Net Investment Income to Average Net Assets | 1.84% | 2.19% | 2.54% | 2.47% | 1.90% | ||||

| Portfolio Turnover Rate | 6% | 17% | 10% | 6% | 8% | ||||

1 Calculated based on average shares outstanding.

2 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

25

INVESTING WITH VANGUARD

This section of the combined information statement/prospectus explains the basics of doing business with Vanguard as a shareholder of the Acquiring Fund. Vanguard fund shares can be held directly with Vanguard or indirectly through an intermediary, such as a bank, a broker, or an investment advisor. If you hold Vanguard fund shares directly with Vanguard, you should carefully read each topic within this section that pertains to your relationship with Vanguard. If you hold Vanguard fund shares indirectly through an intermediary (including shares held in a brokerage account through Vanguard Brokerage Services®), please see Investing With Vanguard Through Other Firms, and also refer to your account agreement with the intermediary for information about transacting in that account. If you hold Vanguard fund shares through an employer-sponsored retirement or savings plan, please see Employer-Sponsored Plans. Vanguard reserves the right to change the following policies without notice. Please call or check online for current information. See Contacting Vanguard.

For Vanguard fund shares held directly with Vanguard, each fund you hold in an account is a separate “fund account.” For example, if you hold three funds in a nonretirement account titled in your own name, two funds in a nonretirement account titled jointly with your spouse, and one fund in an individual retirement account, you have six fund accounts—and this is true even if you hold the same fund in multiple accounts. Note that each reference to “you” in this combined information statement/prospectus applies to any one or more registered account owners or persons authorized to transact on your account.

Purchasing Shares

Vanguard reserves the right, without notice, to increase or decrease the minimum amount required to open or maintain a fund account or to add to an existing fund account.

Investment minimums may differ for certain categories of investors.

Account Minimums

To open and maintain an account. $1,000. Financial intermediaries, institutional clients, and Vanguard-advised clients should contact Vanguard for information on special eligibility rules that may apply to them regarding Investor Shares. If you are investing through an intermediary, please contact that firm directly for more information regarding your eligibility.

To add to an existing account. Generally $1.

How to Initiate a Purchase Request

Be sure to check Exchanging Shares, Frequent-Trading Limitations, and Other Rules You Should Know before placing your purchase request.

Online. You may open certain types of accounts, request a purchase of shares, and request an exchange through our website or our mobile application if your account is eligible and you are registered for online access.

By telephone. You may call Vanguard to begin the account registration process or request that the account-opening forms be sent to you. You may also call Vanguard to request a purchase of shares in your account or to request an exchange. See Contacting Vanguard.

By mail. You may send Vanguard your account registration form and check to open a new fund account. To add to an existing fund account, you may send your check with an Invest-by-Mail form (from a transaction confirmation or your account statement) or with a deposit slip (available online).

How to Pay for a Purchase

By electronic bank transfer. You may purchase shares of a Vanguard fund through an electronic transfer of money from a bank account. To establish the electronic bank transfer service on an account, you must designate the bank account online, complete a form, or fill out the appropriate section of your account registration form. After the service is set up on your account, you can purchase shares by electronic bank transfer on a regular schedule (Automatic

26

Investment Plan), if eligible, or upon request. Your purchase request can be initiated online (if you are registered for online access), by telephone, or by mail.

By wire. Wiring instructions vary for different types of purchases. Please call Vanguard for instructions and policies on purchasing shares by wire. See Contacting Vanguard.