UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-4103

Seligman High Income Fund Series

(Exact name of Registrant as specified in charter)

50606 Ameriprise Financial Center

Minneapolis, Minnesota 55474

(Address of principal executive offices) (Zip code)

Scott R. Plummer

5228 Ameriprise Financial Center

Minneapolis, MN 55474

Lawrence P. Vogel

100 Park Avenue

New York, New York 10017

(Name and address of agent for service)

| |

Registrant’s telephone number, including area code: | (212) 850-1864 |

| |

Date of fiscal year end: | 12/31 |

| |

Date of reporting period: | 6/30/09 |

| |

ITEM 1. | REPORTS TO STOCKHOLDERS. |

Seligman

High-Yield Fund*

* The Fund is expected to merge into RiverSource High Yield Bond Fund

in the third quarter of 2009.

Mid-Year Report

June 30, 2009

Seeking a High Level of

Current Income and the

Potential for Capital

Appreciation by Investing

in a Diversified Portfolio

of High-Yield Securities

Performance and Portfolio Overview

This section of the report is intended to help you understand the performance of Seligman High-Yield Fund and to provide a summary of the Fund’s portfolio characteristics.

Performance data quoted in this report represents past performance and does not guarantee or indicate future investment results. The rates of return will vary and the principal value of an investment will fluctuate. Shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Total returns of the Fund (except for Class R2 and R5 shares) as of the most recent month-end will be available at www.seligman.com1 by the seventh business day following that month-end. Calculations assume reinvestment of distributions, if any. Performance data quoted does not reflect the deduction of taxes that an investor may pay on distributions or the redemption of shares.

Returns for Class A shares are calculated with and without the effect of the initial 4.75% maximum sales charge. Returns for Class B shares are calculated with and without the effect of the maximum 5% CDSC, charged on redemptions made within one year of the date of purchase, declining to 1% in the sixth year and 0% thereafter. Returns for Class C shares are calculated with and without the effect of the 1% CDSC, charged on redemptions made within one year of purchase. Returns for Class C shares would have been lower for periods prior to June 4, 2007 if the 1% initial sales charge then in effect was incurred. Class R2 (formerly Class R prior to June 13, 2009) and Class R5 (formerly Class I prior to June 13, 2009) shares do not have sales charges, and returns are calculated accordingly. Effective June 13, 2009, there is no longer a 1% CDSC for Class R2 shares.

An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

| |

1 | The website reference is an inactive textual reference and information contained in or otherwise accessible through the website does not form a part of this report or the Fund’s prospectuses or statement of additional information. |

|

Performance and Portfolio Overview |

|

Investment Results |

|

Total Returns |

For Periods Ended June 30, 2009 |

| |

| | | | | | | | | | | | | | | | | | | |

| | | | | Average Annual | |

| | | | | | |

| |

| | Six

Months* | | One

Year | | Five

Years | | Ten

Years | | Class R2

Since

Inception

4/30/03 | | Class R5

Since

Inception

11/30/01 | |

| | | | | | | | | | | | | | |

| |

Class A | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| |

With Sales Charge | | 18.53 | % | | (16.67 | )% | | (0.57 | )% | | (1.72 | )% | | n/a | | | n/a | | |

| | | | | | | | | | | | | | | | | | | | |

| |

Without Sales Charge | | 24.64 | | | (12.39 | ) | | 0.41 | | | (1.24 | ) | | n/a | | | n/a | | |

| | | | | | | | | | | | | | | | | | | | |

| |

Class B | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| |

With CDSC† | | 19.16 | | | (17.00 | ) | | (0.61 | ) | | n/a | | | n/a | | | n/a | | |

| | | | | | | | | | | | | | | | | | | | |

| |

Without CDSC | | 24.16 | | | (13.09 | ) | | (0.34 | ) | | (1.86 | )†† | | n/a | | | n/a | | |

| | | | | | | | | | | | | | | | | | | | |

| |

Class C | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| |

With 1% CDSC | | 23.69 | | | (13.81 | ) | | n/a | | | n/a | | | n/a | | | n/a | | |

| | | | | | | | | | | | | | | | | | | | |

| |

Without CDSC | | 24.69 | | | (13.03 | ) | | (0.33 | ) | | (1.99 | ) | | n/a | | | n/a | | |

| | | | | | | | | | | | | | | | | | | | |

| |

Class R2 (formerly Class R) | | 24.52 | | | (12.90 | ) | | 0.16 | | | n/a | | | 1.73 | % | | n/a | | |

| | | | | | | | | | | | | | | | | | | | |

| |

Class R5 (formerly Class I) | | 24.83 | | | (12.37 | ) | | 0.81 | | | n/a | | | n/a | | | 2.39 | % | |

| | | | | | | | | | | | | | | | | | | | |

| |

Benchmarks** | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| |

JP Morgan Global High Yield Index | | 29.91 | | | (3.90 | ) | | 4.15 | | | 4.99 | | | 5.94 | # | | 0.49 | ## | |

| | | | | | | | | | | | | | | | | | | | |

| |

Lipper High Current Yield Funds Average | | 22.49 | | | (7.64 | ) | | 2.42 | | | 2.99 | | | 4.09 | # | | 4.49 | ## | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Net Asset Value Per Share | | | | | | | | | | |

| |

| | 6/30/09 | | 12/31/08 | | 6/30/08 | |

| | | | | | | | | | | |

| |

|

Class A | | $2.28 | | | $1.94 | | | $2.92 | | |

| | | | | | | | | | | |

| |

Class B | | 2.28 | | | 1.94 | | | 2.92 | | |

| | | | | | | | | | | |

| |

Class C | | 2.29 | | | 1.94 | | | 2.93 | | |

| | | | | | | | | | | |

| |

Class R2 | | 2.28 | | | 1.94 | | | 2.93 | | |

| | | | | | | | | | | |

| |

Class R5 | | 2.28 | | | 1.94 | | | 2.93 | | |

| | | | | | | | | | | |

| | | | | |

Dividend Per Share and Yield Information | |

| |

For Periods Ended June 30, 2009 | |

| | |

DividendØ | | SEC 30-Day YieldØØ | |

| | | | | | |

| |

$0.1251 | | | 8.71 | % | |

| | | | | | |

| |

0.1171 | | | 8.37 | | |

| | | | | | |

| |

0.1171 | | | 8.38 | | |

| | | | | | |

| |

0.1233 | | | 8.93 | | |

| | | | | | |

| |

0.1287 | | | 10.12 | | |

| | | | | | |

Performance and Portfolio Overview

| | | |

| | |

* | | Returns for periods of less than one year are not annualized. |

** | | The JPMorgan Global High Yield Index (“JP Morgan Index”) and the Lipper High Current Yield Funds Average (“Lipper Average”) are unmanaged benchmarks that assume reinvestment of all distributions. The Lipper Average excludes the effect of fees, taxes and sales charges. The JP Morgan Index also excludes the effect of expenses. The JP Morgan Index is used to mirror the investable universe of the U.S. dollar global high yield corporate debt market of both developed and emerging markets. The Lipper Average is an average of funds that aim at high (relative) current yield from fixed income securities, have no quality or maturity restrictions, and tend to invest in lower-grade debt instruments. Investors cannot invest directly in an average or an index. |

Ø | | Represents per share amount paid or declared for the six months ended June 30, 2009. |

ØØ | | Current yield, representing the annualized yield for the 30-day period ended June 30, 2009, has been computed in accordance with SEC regulations and will vary. |

† | | The CDSC is 5% if you sell your shares within one year of purchase and 2% for the five-year period. |

†† | | Ten-year return of Class B shares reflects automatic conversion to Class A shares approximately eight years after their date of purchase. |

# | | From May 1, 2003. |

## | | From December 1, 2001. |

Performance and Portfolio Overview

|

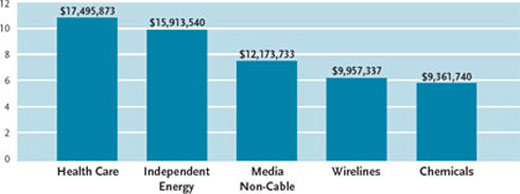

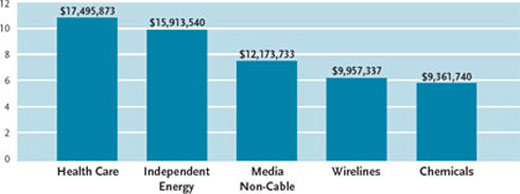

Largest Industries |

June 30, 2009 |

| |

| |

Percent of

Net Assets

|

Largest Portfolio Changes |

January 1 to June 30, 2009 |

| |

| |

| | |

Largest Purchases | | Largest Sales |

| | | |

| |

Texas Competitive Electric Holdings 10.25%, 11/1/2015* | | Lamar Media 6.625%, 8/15/2015** |

| | | |

| |

CC Holdings GS V LLC/Crown Castle GS III 7.75%, 5/1/2017* | | AES 9.375%, 9/15/2010** |

| | | |

| |

Level 3 Financing 8.75%, 2/15/2017* | | Felcor Lodging 9%, 6/1/2011** |

| | | |

| |

Lamar Media 9.75%, 4/1/2014* | | Cott Beverages USA 8%, 12/15/2011** |

| | | |

| |

Terex 10.875%, 6/1/2016* | | Allegheny Energy Supply 7.8%, 3/15/2011** |

| | | |

| |

Range Resources 8%, 5/15/2019* | | Level 3 Financing 12.25%, 3/15/2013** |

| | | |

| |

WMG Acquisition 9.5%, 6/15/2016* | | Owens-Brockway Glass Container 8.25%, 5/15/2013** |

| | | |

| |

Williams Partners 7.25%, 2/1/2017* | | Flextronics International 6.25%, 11/15/2014** |

| | | |

| |

United Rentals North America 10.875%, 6/15/2016* | | Communications & Power Industries 8%, 2/1/2012** |

| | | |

| |

Cricket Communications 7.75%, 5/15/2016* | | El Paso 7%, 6/15/2017** |

| | | |

Largest portfolio changes from the previous period to the current period are based on cost of purchases and proceeds from sales of securities, listed in descending order.

| | |

| | |

* | Position added during the period. |

** | Position eliminated during the period. |

Performance and Portfolio Overview

|

Top Ten Companies† |

June 30, 2009 |

| |

| |

| | | | | | |

Security | | Value | | Percent

of Net

Assets |

| |

| |

HCA | | $ | 5,139,180 | | | 3.2 |

| | | | | | | |

| |

Qwest | | | 3,785,875 | | | 2.3 |

| | | | | | | |

| |

Charter Communications | | | 3,083,150 | | | 1.9 |

| | | | | | | |

| |

L-3 Communications | | | 2,787,525 | | | 1.7 |

| | | | | | | |

| |

Windstream | | | 2,722,763 | | | 1.7 |

| | | | | | | |

| |

NRG Energy | | | 2,713,600 | | | 1.7 |

| | | | | | | |

| |

Select Medical | | | 2,603,375 | | | 1.6 |

| | | | | | | |

| |

Georgia-Pacific | | | 2,521,500 | | | 1.6 |

| | | | | | | |

| |

Forest Oil | | | 2,482,663 | | | 1.5 |

| | | | | | | |

| |

CSC Holdings | | | 2,429,534 | | | 1.5 |

| | | | | | | |

The amounts shown for the top ten companies represent the aggregate value of the Fund’s investments in securities issued by the companies or their affiliates.

There can be no assurance that the securities presented have remained or will remain in the Fund’s portfolio. Information regarding the Fund’s portfolio holdings should not be construed as a recommendation to buy or sell any security or as an indication that any security is suitable for a particular investor.

| | | | | |

Ratings§ | | | | Duration* | |

| |

June 30, 2009 | | | | June 30, 2009 | 4.0 years |

| | | |

| |

| | | |

| | Moody’s |

| |

| |

Baa | | 3.3 | % |

| | | | |

| |

Ba | | 34.1 | |

| | | | |

| |

B | | 40.2 | |

| | | | |

| |

Caa | | 17.5 | |

| | | | |

| |

Below Caa | | 1.4 | |

| | | | |

| |

Non-rated | | 3.5 | |

| | | | |

| | |

| | |

† | Excludes short-term holdings. |

§ | Credit ratings are those issued by Moody’s Investors Services, Inc. Percentages are based on the market values of long-term corporate bond holdings. |

* | Duration is the average amount of time that it takes to receive the interest and principal of a bond or portfolio of bonds. The duration formula is based on a formula that calculates the weighted average of the cash flows (interest and principal payments) of the bond, discounted to present time. |

Understanding and Comparing

Your Fund’s Expenses

As a shareholder of the Fund, you incur ongoing expenses, such as management fees, distribution and/or service (12b-1) fees (as applicable), and other Fund expenses. The information below is intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to compare them with the ongoing expenses of investing in other mutual funds. Please note that the expenses shown in the table are meant to highlight your ongoing expenses only and do not reflect any transactional costs, such as sales charges (also known as loads) on certain purchases or redemptions. Therefore, the table is useful in comparing ongoing expenses only, and will not help you to determine the relative total expenses of owning different funds. In addition, if transactional costs were included, your total expenses would have been higher.

The table is based on an investment of $1,000 invested at the beginning of January 1, 2009 and held for the entire six-month period ended June 30, 2009.

Actual Expenses

The table below provides information about actual expenses and actual account values. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value at the beginning of the period by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” for the Fund’s share class that you own to estimate the expenses that you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical expenses and hypothetical account values based on the actual expense ratio of each class and an assumed rate of return of 5% per year before expenses, which is not the actual return of any class of the Fund. The hypothetical expenses and account values may not be used to estimate the ending account value or the actual expenses you paid for the period. You may use this information to compare the ongoing expenses of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Actual | | Hypothetical | |

| | | | | | | | | |

| | Beginning

Account

Value

1/1/09 | | Annualized

Expense

Ratio* | | Ending

Account

Value

6/30/09 | | Expenses Paid

During Period

1/1/09 to

6/30/09** | | Ending

Account

Value

6/30/09 | | Expenses Paid

During Period

1/1/09 to

6/30/09** | |

| | | | | | | | | | | | | | |

| |

Class A | | | $ | 1,000.00 | | | 1.73 | % | | $ | 1,246.40 | | | $ | 9.64 | | | $ | 1,016.22 | | | $ | 8.65 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Class B | | | | 1,000.00 | | | 2.49 | | | | 1,241.60 | | | | 13.84 | | | | 1,012.45 | | | | 12.42 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Class C | | | | 1,000.00 | | | 2.48 | | | | 1,246.90 | | | | 13.82 | | | | 1,012.50 | | | | 12.37 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Class R2 | | | | 1,000.00 | | | 1.98 | | | | 1,245.20 | | | | 11.02 | | | | 1,014.98 | | | | 9.89 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Class R5 | | | | 1,000.00 | | | 1.30 | | | | 1,248.30 | | | | 7.25 | | | | 1,018.35 | | | | 6.51 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | |

* | Expenses of Class B, Class C, Class R2 (formerly Class R prior to June 13, 2009) and Class R5 (formerly Class I prior to June 13, 2009) shares differ from the expenses of Class A shares due to the differences in 12b-1 fees and other class-specific expenses paid by each share class. See the Fund’s prospectuses for a description of each share class and its fees, expenses and sales charges. Certain one-time non-recurring charges (see Note 4c of the Financial Statements) are not annualized. |

** | Expenses are equal to the annualized expense ratio based on actual expenses for the period January 1, 2009 to June 30, 2009, multiplied by the average account value over the period, multiplied by 181/365 (number of days in the period). |

Portfolio of Investments (unaudited)

June 30, 2009

| | | | | | | |

| | Principal

Amount | | Value | |

Corporate Bonds 92.7% | | | | | | | |

| | | | | | | | |

| |

Aerospace and Defense 1.7% | | | | | | | |

| | | | | | | | |

| |

L-3 Communications: | | | | | | | |

| | | | | | | | |

| |

7.625%, 6/15/2012 | | $ | 1,010,000 | | $ | 1,012,525 | |

| | | | | | | | |

| |

5.875%, 1/15/2015 | | | 2,000,000 | | | 1,775,000 | |

| | | | | | | | |

| |

| | | | | | 2,787,525 | |

| | | | | | | | |

| |

Building Materials 0.8% | | | | | | | |

| | | | | | | | |

| |

Gibraltar Industries 8%, 12/1/2015 | | | 1,815,000 | | | 1,361,250 | |

| | | | | | | | |

| |

Chemicals 5.8% | | | | | | | |

| | | | | | | | |

| |

Ashland 9.125%, 6/1/2017 | | | 445,000 | | | 462,800 | |

| | | | | | | | |

| |

Chemtura 6.875%, 6/1/2016†† | | | 2,789,000 | | | 2,022,025 | |

| | | | | | | | |

| |

Compass Minerals International 8%, 6/1/2019* | | | 335,000 | | | 333,325 | |

| | | | | | | | |

| |

Dow Chemical 8.55%, 5/15/2019 | | | 1,200,000 | | | 1,202,136 | |

| | | | | | | | |

| |

Invista 9.25%, 5/1/2012* | | | 2,490,000 | | | 2,346,825 | |

| | | | | | | | |

| |

MacDermid 9.5%, 4/15/2017 | | | 1,210,000 | | | 883,300 | |

| | | | | | | | |

| |

Momentive Performance Materials 10.125%, 12/1/2014 | | | 129 | | | 49 | |

| | | | | | | | |

| |

Nalco: | | | | | | | |

| | | | | | | | |

| |

8.875%, 11/15/2013 | | | 780,000 | | | 795,600 | |

| | | | | | | | |

| |

8.25%, 5/15/2017* | | | 410,000 | | | 412,050 | |

| | | | | | | | |

| |

Nova Chemicals 4.538%, 11/15/2013# | | | 1,092,000 | | | 903,630 | |

| | | | | | | | |

| |

| | | | | | 9,361,740 | |

| | | | | | | | |

| |

Construction Machinery 2.4% | | | | | | | |

| | | | | | | | |

| |

RSC Equipment Rental 10%, 7/15/2017* | | | 465,000 | | | 452,538 | |

| | | | | | | | |

| |

Terex: | | | | | | | |

| | | | | | | | |

| |

10.875%, 6/1/2016 | | | 1,375,000 | | | 1,375,000 | |

| | | | | | | | |

| |

8%, 11/15/2017 | | | 995,000 | | | 764,906 | |

| | | | | | | | |

| |

United Rentals North America 10.875%, 6/15/2016* | | | 1,260,000 | | | 1,209,600 | |

| | | | | | | | |

| |

| | | | | | 3,802,044 | |

| | | | | | | | |

| |

Consumer Cyclical Services 0.5% | | | | | | | |

| | | | | | | | |

| |

West 11%, 10/15/2016 | | | 1,041,000 | | | 869,235 | |

| | | | | | | | |

| |

Consumer Products 2.6% | | | | | | | |

| | | | | | | | |

| |

American Achievement 8.25%, 4/1/2012* | | | 1,115,000 | | | 1,042,525 | |

| | | | | | | | |

| |

Jarden: | | | | | | | |

| | | | | | | | |

| |

8%, 5/1/2016 | | | 710,000 | | | 678,050 | |

| | | | | | | | |

| |

7.5%, 5/1/2017 | | | 545,000 | | | 476,875 | |

| | | | | | | | |

| |

Sealy Mattress 10.875%, 4/15/2016* | | | 350,000 | | | 366,625 | |

| | | | | | | | |

| |

Visant 0% (10.25%†), 12/1/2013 | | | 1,675,000 | | | 1,662,438 | |

| | | | | | | | |

| |

| | | | | | 4,226,513 | |

| | | | | | | | |

| |

| | |

See footnotes on page 14. |

Portfolio of Investments (unaudited)

June 30, 2009

| | | | | | | |

| | Principal

Amount | | Value | |

| |

Electric 5.4% | | | | | | | |

| | | | | | | | |

| |

CMS Energy: | | | | | | | |

| | | | | | | | |

| |

6.55%, 7/17/2017 | | $ | 850,000 | | $ | 765,356 | |

| | | | | | | | |

| |

8.75%, 6/15/2019 | | | 205,000 | | | 206,025 | |

| | | | | | | | |

| |

Dynergy 8.75%, 2/15/2012 | | | 1,246,000 | | | 1,055,985 | |

| | | | | | | | |

| |

Edison Mission Energy: | | | | | | | |

| | | | | | | | |

| |

7.75%, 6/15/2016 | | | 255,000 | | | 207,825 | |

| | | | | | | | |

| |

7%, 5/15/2017 | | | 1,705,000 | | | 1,308,588 | |

| | | | | | | | |

| |

Nisource Finance: | | | | | | | |

| | | | | | | | |

| |

6.8%, 1/15/2019 | | | 740,000 | | | 693,449 | |

| | | | | | | | |

| |

5.45%, 9/15/2020 | | | 240,000 | | | 201,860 | |

| | | | | | | | |

| |

NRG Energy: | | | | | | | |

| | | | | | | | |

| |

7.375%, 2/1/2016 | | | 2,300,000 | | | 2,176,375 | |

| | | | | | | | |

| |

7.375%, 1/15/2017 | | | 570,000 | | | 537,225 | |

| | | | | | | | |

| |

Texas Competitive Electric Holdings 10.25%, 11/1/2015 | | | 2,575,000 | | | 1,602,938 | |

| | | | | | | | |

| |

| | | | | | 8,755,626 | |

| | | | | | | | |

| |

Entertainment 2.2% | | | | | | | |

| | | | | | | | |

| |

AMC Entertainment: | | | | | | | |

| | | | | | | | |

| |

11%, 2/1/2016 | | | 907,000 | | | 877,523 | |

| | | | | | | | |

| |

8.75%, 6/1/2019* | | | 513,000 | | | 482,220 | |

| | | | | | | | |

| |

Cinemark USA 8.625%, 6/15/2019 | | | 227,000 | | | 224,162 | |

| | | | | | | | |

| |

Speedway Motorsports 8.75%, 6/1/2016* | | | 655,000 | | | 663,187 | |

| | | | | | | | |

| |

WMG Acquisition 9.5%, 6/15/2016* | | | 1,376,000 | | | 1,376,000 | |

| | | | | | | | |

| |

| | | | | | 3,623,092 | |

| | | | | | | | |

| |

Environmental 0.9% | | | | | | | |

| | | | | | | | |

| |

Browning-Ferris Industries 7.4%, 9/15/2035 | | | 1,500,000 | | | 1,404,608 | |

| | | | | | | | |

| |

Food and Beverage 1.7% | | | | | | | |

| | | | | | | | |

| |

ASG Consolidated/ASG Finance 11.5%, 11/1/2011 | | | 1,446,000 | | | 1,323,090 | |

| | | | | | | | |

| |

Pinnacle Foods Finance 9.25%, 4/1/2015 | | | 1,515,000 | | | 1,371,075 | |

| | | | | | | | |

| |

| | | | | | 2,694,165 | |

| | | | | | | | |

| |

Gaming 4.9% | | | | | | | |

| | | | | | | | |

| |

Ameristar Casinos 9.25%, 6/1/2014* | | | 395,000 | | | 402,900 | |

| | | | | | | | |

| |

Boyd Gaming 7.125%, 2/1/2016 | | | 1,885,000 | | | 1,397,256 | |

| | | | | | | | |

| |

FireKeepers Development Authority 13.875%, 5/1/2015* | | | 1,000,000 | | | 922,500 | |

| | | | | | | | |

| |

Indianapolis Downs LLC & Capital 11%, 11/1/2012* | | | 1,204,000 | | | 933,100 | |

| | | | | | | | |

| |

MGM Mirage 11.125%, 11/15/2017* | | | 430,000 | | | 455,800 | |

| | | | | | | | |

| |

Pokagon Gaming Authority 10.375%, 6/15/2014* | | | 1,335,000 | | | 1,308,300 | |

| | | | | | | | |

| |

Seneca Gaming 7.25%, 5/1/2012 | | | 955,000 | | | 826,075 | |

| | | | | | | | |

| |

Shingle Springs Tribal Gaming Authority 9.375%, 6/15/2015* | | | 2,700,000 | | | 1,620,000 | |

| | | | | | | | |

| |

| | | | | | 7,865,931 | |

| | | | | | | | |

| |

Gas Distributors 0.8% | | | | | | | |

| | | | | | | | |

| |

Southwestern Energy 7.5%, 2/1/2018* | | | 1,260,000 | | | 1,209,600 | |

| | | | | | | | |

| |

| | |

See footnotes on page 14. |

Portfolio of Investments (unaudited)

June 30, 2009

| | | | | | | |

| | Principal

Amount | | Value | |

| |

Gas Pipelines 1.7% | | | | | | | |

| | | | | | | | |

| |

El Paso: | | | | | | | |

| | | | | | | | |

| |

12%, 12/12/2013 | | $ | 400,000 | | $ | 440,000 | |

| | | | | | | | |

| |

6.875%, 6/15/2014 | | | 130,000 | | | 121,322 | |

| | | | | | | | |

| |

8.25% 2/15/2016 | | | 490,000 | | | 476,525 | |

| | | | | | | | |

| |

Williams Companies 8.75%, 1/15/2020 | | | 415,000 | | | 432,637 | |

| | | | | | | | |

| |

Williams Partners 7.25%, 2/1/2017 | | | 1,455,000 | | | 1,327,688 | |

| | | | | | | | |

| |

| | | | | | 2,798,172 | |

| | | | | | | | |

| |

Health Care 10.8% | | | | | | | |

| | | | | | | | |

| |

Apria Healthcare Group 11.25%, 11/1/2014* | | | 795,000 | | | 767,175 | |

| | | | | | | | |

| |

Biomet 10.375%, 10/15/2017 | | | 558,000 | | | 539,865 | |

| | | | | | | | |

| |

CHS Community Health System 8.875%, 7/15/2015 | | | 1,133,000 | | | 1,110,340 | |

| | | | | | | | |

| |

DaVita: | | | | | | | |

| | | | | | | | |

| |

6.625%, 3/15/2013 | | | 790,000 | | | 744,575 | |

| | | | | | | | |

| |

7.25%, 3/15/2015 | | | 1,500,000 | | | 1,410,000 | |

| | | | | | | | |

| |

HCA: | | | | | | | |

| | | | | | | | |

| |

9.125%, 11/15/2014* | | | 500,000 | | | 495,000 | |

| | | | | | | | |

| |

6.5%, 2/15/2016 | | | 2,000,000 | | | 1,615,000 | |

| | | | | | | | |

| |

9.625%,11/15/2016 | | | 1,772,000 | | | 1,754,280 | |

| | | | | | | | |

| |

9.875%, 2/15/2017 | | | 190,000 | | | 191,900 | |

| | | | | | | | |

| |

7.5%, 11/6/2033 | | | 1,900,000 | | | 1,083,000 | |

| | | | | | | | |

| |

IASIS Healthcare/IASIS Capital 8.75%, 6/15/2014 | | | 1,800,000 | | | 1,764,000 | |

| | | | | | | | |

| |

Omnicare: | | | | | | | |

| | | | | | | | |

| |

6.75%, 12/15/2013 | | | 135,000 | | | 121,500 | |

| | | | | | | | |

| |

6.875%, 12/15/2015 | | | 2,130,000 | | | 1,922,325 | |

| | | | | | | | |

| |

Select Medical: | | | | | | | |

| | | | | | | | |

| |

7.625%, 2/1/2015 | | | 670,000 | | | 544,375 | |

| | | | | | | | |

| |

7.654%, 9/15/2015# | | | 2,900,000 | | | 2,059,000 | |

| | | | | | | | |

| |

Tenet Healthcare 8.875%, 7/1/2019* | | | 415,000 | | | 416,038 | |

| | | | | | | | |

| |

Vanguard Health Holding 9%, 10/1/2014 | | | 1,000,000 | | | 957,500 | |

| | | | | | | | |

| |

| | | | | | 17,495,873 | |

| | | | | | | | |

| |

Health Care Insurance 0.8% | | | | | | | |

| | | | | | | | |

| |

Coventry Health Care: | | | | | | | |

| | | | | | | | |

| |

6.3%, 8/15/2014 | | | 380,000 | | | 335,122 | |

| | | | | | | | |

| |

5.95%, 3/15/2017 | | | 1,140,000 | | | 893,745 | |

| | | | | | | | |

| |

| | | | | | 1,228,867 | |

| | | | | | | | |

| |

Home Construction 0.7% | | | | | | | |

| | | | | | | | |

| |

K Hovnanian Enterprises 11.5%, 5/1/2013 | | | 1,245,000 | | | 1,076,925 | |

| | | | | | | | |

| |

| | |

See footnotes on page 14. |

Portfolio of Investments (unaudited)

June 30, 2009

| | | | | | | |

| | Principal

Amount | | Value | |

| |

Independent Energy 9.9% | | | | | | | |

| | | | | | | | |

| |

Berry Petroleum 10.25%, 6/1/2014 | | $ | 505,000 | | $ | 510,050 | |

| | | | | | | | |

| |

Chesapeake Energy 7.625%, 7/15/2013 | | | 2,465,000 | | | 2,070,600 | |

| | | | | | | | |

| |

Connacher Oil and Gas: | | | | | | | |

| | | | | | | | |

| |

11.75%, 7/15/2014* | | | 355,000 | | | 341,688 | |

| | | | | | | | |

| |

10.25%, 12/15/2015* | | | 450,000 | | | 272,250 | |

| | | | | | | | |

| |

Denbury Resources: | | | | | | | |

| | | | | | | | |

| |

7.5%, 4/1/2013 | | | 118,000 | | | 112,690 | |

| | | | | | | | |

| |

7.5%, 12/15/2015 | | | 42,000 | | | 39,900 | |

| | | | | | | | |

| |

9.75%, 3/1/2016 | | | 610,000 | | | 626,775 | |

| | | | | | | | |

| |

EXCO Resources 7.25%, 1/15/2011 | | | 1,300,000 | | | 1,261,000 | |

| | | | | | | | |

| |

Forest Oil: | | | | | | | |

| | | | | | | | |

| |

8.5%, 2/15/2014 | | | 705,000 | | | 692,662 | |

| | | | | | | | |

| |

7.25%, 6/15/2019 | | | 2,000,000 | | | 1,790,000 | |

| | | | | | | | |

| |

Hilcorp Energy I LP/Hilcorp Finance 7.75%, 11/1/2015* | | | 1,560,000 | | | 1,318,200 | |

| | | | | | | | |

| |

PetroHawk Energy: | | | | | | | |

| | | | | | | | |

| |

9.125%, 7/15/2013 | | | 300,000 | | | 298,500 | |

| | | | | | | | |

| |

10.5%, 8/1/2014* | | | 770,000 | | | 787,325 | |

| | | | | | | | |

| |

7.875%, 6/1/2015 | | | 365,000 | | | 337,625 | |

| | | | | | | | |

| |

Quicksilver Resources: | | | | | | | |

| | | | | | | | |

| |

11.75%, 1/1/2016 | | | 355,000 | | | 367,425 | |

| | | | | | | | |

| |

7.125%, 4/1/2016 | | | 1,700,000 | | | 1,326,000 | |

| | | | | | | | |

| |

Range Resources: | | | | | | | |

| | | | | | | | |

| |

7.25%, 5/1/2018 | | | 1,000,000 | | | 935,000 | |

| | | | | | | | |

| |

8%, 5/15/2019 | | | 1,390,000 | | | 1,367,413 | |

| | | | | | | | |

| |

SandRidge Energy 8.625%, 4/1/2015## | | | 1,625,000 | | | 1,458,437 | |

| | | | | | | | |

| |

| | | | | | 15,913,540 | |

| | | | | | | | |

| |

Lodging 1.3% | | | | | | | |

| | | | | | | | |

| |

Starwood Hotels & Resorts Worldwide 7.875%, 10/15/2014 | | | 925,000 | | | 869,500 | |

| | | | | | | | |

| |

Wyndham Worldwide 9.875%, 5/1/2014 | | | 1,250,000 | | | 1,245,843 | |

| | | | | | | | |

| |

| | | | | | 2,115,343 | |

| | | | | | | | |

| |

Media 0.4% | | | | | | | |

| | | | | | | | |

| |

Interpublic Group 10%, 7/15/2017* | | | 670,000 | | | 680,050 | |

| | | | | | | | |

| |

Media Cable 4.6% | | | | | | | |

| | | | | | | | |

| |

Charter Communications Operating Capital 8.375%, 4/30/2014* | | | 3,220,000 | | | 3,083,150 | |

| | | | | | | | |

| |

CSC Holdings: | | | | | | | |

| | | | | | | | |

| |

8.5%, 4/15/2014 | | | 1,189,000 | | | 1,178,596 | |

| | | | | | | | |

| |

8.5%, 6/15/2015* | | | 1,100,000 | | | 1,080,750 | |

| | | | | | | | |

| |

8.625%, 2/15/2019 | | | 175,000 | | | 170,188 | |

| | | | | | | | |

| |

Mediacom Broadband 8.5%, 10/15/2015 | | | 1,400,000 | | | 1,260,000 | |

| | | | | | | | |

| |

Videotron 9.125%, 4/15/2018 | | | 210,000 | | | 213,413 | |

| | | | | | | | |

| |

Virgin Media Finance 8.75%, 4/15/2014 | | | 535,000 | | | 521,625 | |

| | | | | | | | |

| |

| | | | | | 7,507,722 | |

| | | | | | | | |

| |

| | |

See footnotes on page 14. |

Portfolio of Investments (unaudited)

June 30, 2009

| | | | | | | |

| | Principal

Amount | | Value | |

| |

Media Non-Cable 7.5% | | | | | | | |

| | | | | | | | |

| |

DirecTV Holdings/DirecTV Financing 6.375%, 6/15/2015 | | $ | 1,975,000 | | $ | 1,826,875 | |

| | | | | | | | |

| |

RR Donnelley 6.125%, 1/15/2017 | | | 325,000 | | | 285,873 | |

| | | | | | | | |

| |

Echostar 6.625%, 10/1/2014 | | | 2,550,000 | | | 2,352,375 | |

| | | | | | | | |

| |

Intelsat Jackson Holdings 11.25%, 6/15/2016 | | | 895,000 | | | 912,900 | |

| | | | | | | | |

| |

Intelsat Subsidiary Holding 8.875%, 1/15/2015 | | | 850,000 | | | 826,149 | |

| | | | | | | | |

| |

Lamar Media 9.75%, 4/1/2014* | | | 1,540,000 | | | 1,591,975 | |

| | | | | | | | |

| |

Liberty Media 5.7%, 5/15/2013 | | | 2,647,000 | | | 2,289,655 | |

| | | | | | | | |

| |

Nielsen Finance 10%, 8/1/2014 | | | 1,335,000 | | | 1,263,244 | |

| | | | | | | | |

| |

Quebecor Media 7.75%, 3/15/2016 | | | 910,000 | | | 824,687 | |

| | | | | | | | |

| |

| | | | | | 12,173,733 | |

| | | | | | | | |

| |

Metals 2.3% | | | | | | | |

| | | | | | | | |

| |

Freeport-McMoRan Copper & Gold 8.375%, 4/1/2017 | | | 1,580,000 | | | 1,591,850 | |

| | | | | | | | |

| |

Noranda Aluminium Acquisition 6.595%, 5/15/2015# | | | 3,799,597 | | | 2,094,528 | |

| | | | | | | | |

| |

| | | | | | 3,686,378 | |

| | | | | | | | |

| |

Non Captive Diversified 1.7% | | | | | | | |

| | | | | | | | |

| |

Ford Motor Credit 10.25%, 9/15/2010 | | | 1,500,000 | | | 1,436,844 | |

| | | | | | | | |

| |

GMAC 6.75%, 12/1/2014 | | | 1,615,000 | | | 1,267,775 | |

| | | | | | | | |

| |

| | | | | | 2,704,619 | |

| | | | | | | | |

| |

Oil Field Services 0.3% | | | | | | | |

| | | | | | | | |

| |

Helix Energy Solutions 9.5%, 1/15/2016* | | | 550,000 | | | 501,875 | |

| | | | | | | | |

| |

Other Financial Institutions 0.9% | | | | | | | |

| | | | | | | | |

| |

Cardtronics 9.25%, 8/15/2013 | | | 1,675,000 | | | 1,499,125 | |

| | | | | | | | |

| |

Packaging 1.5% | | | | | | | |

| | | | | | | | |

| |

Crown Americas Capital 7.625%, 5/15/2017* | | | 545,000 | | | 525,925 | |

| | | | | | | | |

| |

Owens-Brockway Glass Container 7.375%, 5/15/2016* | | | 775,000 | | | 751,750 | |

| | | | | | | | |

| |

Silgan Holdings 7.25%, 8/15/2016* | | | 940,000 | | | 902,400 | |

| | | | | | | | |

| |

Solo Cup 10.5%, 11/1/2013* | | | 175,000 | | | 175,438 | |

| | | | | | | | |

| |

| | | | | | 2,355,513 | |

| | | | | | | | |

| |

Paper 3.3% | | | | | | | |

| | | | | | | | |

| |

Boise Cascade 7.125%, 10/15/2014 | | | 255,000 | | | 134,512 | |

| | | | | | | | |

| |

Cascades 7.25%, 2/15/2013 | | | 500,000 | | | 436,250 | |

| | | | | | | | |

| |

Georgia-Pacific: | | | | | | | |

| | | | | | | | |

| |

8.25%, 5/1/2016* | | | 490,000 | | | 475,300 | |

| | | | | | | | |

| |

7.125%, 1/15/2017# | | | 340,000 | | | 316,200 | |

| | | | | | | | |

| |

8.875%, 5/15/2031 | | | 2,000,000 | | | 1,730,000 | |

| | | | | | | | |

| |

Newpage 10%, 5/1/2012 | | | 2,280,000 | | | 1,094,400 | |

| | | | | | | | |

| |

Norampac Industries 6.75%, 6/1/2013 | | | 95,000 | | | 81,225 | |

| | | | | | | | |

| |

Smurfit-Stone Container 8%, 3/15/2017†† | | | 1,000,000 | | | 370,000 | |

| | | | | | | | |

| |

Verso Paper Holdings 11.5%, 7/1/2014* | | | 745,000 | | | 677,950 | |

| | | | | | | | |

| |

| | | | | | 5,315,837 | |

| | | | | | | | |

| |

| | |

See footnotes on page 14. |

Portfolio of Investments (unaudited)

June 30, 2009

| | | | | | | |

| | Principal

Amount | | Value | |

| |

Pharmaceuticals 0.8% | | | | | | | |

| | | | | | | | |

| |

Valeant Pharmaceuticals International 8.375%, 6/15/2016* | | $ | 345,000 | | $ | 342,412 | |

| | | | | | | | |

| |

Warner Chilcott 8.75%, 2/1/2015 | | | 1,000,000 | | | 995,000 | |

| | | | | | | | |

| |

| | | | | | 1,337,412 | |

| | | | | | | | |

| |

Retail 0.1% | | | | | | | |

| | | | | | | | |

| |

Rite Aid 9.75%, 6/12/2016* | | | 185,000 | | | 185,000 | |

| | | | | | | | |

| |

Technology 1.2% | | | | | | | |

| | | | | | | | |

| |

SS&C Technologies 11.75%, 12/1/2013 | | | 1,070,000 | | | 1,048,600 | |

| | | | | | | | |

| |

Sungard Data System 9.125%, 8/15/2013 | | | 1,000,000 | | | 945,000 | |

| | | | | | | | |

| |

| | | | | | 1,993,600 | |

| | | | | | | | |

| |

Transportation Services 1.5% | | | | | | | |

| | | | | | | | |

| |

Erac USA Finance 6.375%, 10/15/2017* | | | 835,000 | | | 753,927 | |

| | | | | | | | |

| |

Hertz 8.875%, 1/1/2014 | | | 1,775,000 | | | 1,633,000 | |

| | | | | | | | |

| |

| | | | | | 2,386,927 | |

| | | | | | | | |

| |

Wireless 4.9% | | | | | | | |

| | | | | | | | |

| |

CC Holdings GS V LLC/Crown Castle GS III 7.75%, 5/1/2017* | | | 1,745,000 | | | 1,701,375 | |

| | | | | | | | |

| |

Cricket Communications: | | | | | | | |

| | | | | | | | |

| |

9.375%, 11/1/2014 | | | 20,000 | | | 19,700 | |

| | | | | | | | |

| |

10%, 7/15/2015* | | | 800,000 | | | 794,000 | |

| | | | | | | | |

| |

7.75%, 5/15/2016* | | | 1,265,000 | | | 1,217,562 | |

| | | | | | | | |

| |

MetroPCS Wireless: | | | | | | | |

| | | | | | | | |

| |

9.25%, 11/1/2014 | | | 1,282,000 | | | 1,273,987 | |

| | | | | | | | |

| |

9.25%, 11/1/2014* | | | 295,000 | | | 292,050 | |

| | | | | | | | |

| |

Nextel Communications 7.375%, 8/1/2015 | | | 1,670,000 | | | 1,331,825 | |

| | | | | | | | |

| |

Sprint Capital: | | | | | | | |

| | | | | | | | |

| |

7.625%, 1/30/2011 | | | 611,000 | | | 604,126 | |

| | | | | | | | |

| |

8.375%, 3/15/2012 | | | 610,000 | | | 600,850 | |

| | | | | | | | |

| |

| | | | | | 7,835,475 | |

| | | | | | | | |

| |

Wirelines 6.7% | | | | | | | |

| | | | | | | | |

| |

Citizens Communications 6.625%, 3/15/2015 | | | 650,000 | | | 572,000 | |

| | | | | | | | |

| |

Frontier Communications: | | | | | | | |

| | | | | | | | |

| |

8.25%, 5/1/2014 | | | 330,000 | | | 311,850 | |

| | | | | | | | |

| |

7.125%, 3/15/2019 | | | 900,000 | | | 767,250 | |

| | | | | | | | |

| |

Level 3 Financing 8.75%, 2/15/2017 | | | 2,050,000 | | | 1,558,000 | |

| | | | | | | | |

| |

Qwest: | | | | | | | |

| | | | | | | | |

| |

7.875%, 9/1/2011 | | | 840,000 | | | 840,000 | |

| | | | | | | | |

| |

7.625%, 6/15/2015 | | | 2,000,000 | | | 1,880,000 | |

| | | | | | | | |

| |

8.375%, 5/1/2016* | | | 375,000 | | | 361,875 | |

| | | | | | | | |

| |

6.5%, 6/1/2017 | | | 800,000 | | | 704,000 | |

| | | | | | | | |

| |

| | |

See footnotes on page 14. |

Portfolio of Investments (unaudited)

June 30, 2009

| | | | | | | |

| | Principal

Amount

or Shares | | Value | |

| |

Wirelines (continued) | | | | | | | |

| | | | | | | | |

| |

Time Warner Telecom Holdings 9.25%, 2/15/2014 | | $ | 720,000 | | $ | 714,600 | |

| | | | | | | | |

| |

US West Communications 6.875%, 9/15/2033 | | | 500,000 | | | 365,000 | |

| | | | | | | | |

| |

Windstream: | | | | | | | |

| | | | | | | | |

| |

8.625%, 8/1/2016 | | | 1,935,000 | | | 1,852,762 | |

| | | | | | | | |

| |

7%, 3/15/2019 | | | 1,000,000 | | | 870,000 | |

| | | | | | | | |

| |

| | | | | | 10,797,337 | |

| | | | | | | | |

| |

Other 0.1% | | | | | | | |

| | | | | | | | |

| |

Chart Industries 9.125%, 10/15/2015 | | | 180,000 | | | 167,400 | |

| | | | | | | | |

| |

Total Corporate Bonds (Cost $143,452,756) | | | | | | 149,718,052 | |

| | | | | | | | |

| |

Money Market Fund 1.2% | | | | | | | |

| | | | | | | | |

| |

SSgA U.S. Treasury Money Market Fund | | | | | | | |

| |

(Cost $2,000,000) | | | 2,000,000 | shs. | | 2,000,000 | |

| | | | | | | | |

| |

Total Investments (Cost $145,452,756) 93.9% | | | | | | 151,718,052 | |

| | | | | | | | |

| |

Other Assets Less Liabilities 6.1% | | | | | | 9,845,637 | |

| | | | | | | | |

| |

Net Assets 100.0% | | | | | $ | 161,563,689 | |

| | | | | | | | |

| | | |

| | |

| |

* | | The security may be offered and sold only to “qualified institutional buyer” under Rule 144A of the Security Act of 1933. |

| |

# | | Floating rate security, the interest rate is reset periodically. The interest rate disclosed reflects the rate in effect at June 30, 2009. |

| |

## | | Pay-in-kind bond. |

| |

† | | Deferred-interest debentures pay no interest for a stipulated number of years, after which they pay the indicated coupon rate. |

| |

†† | | Security in default and non-income producing. |

| |

See Notes to Financial Statements. |

|

Statement of Assets and Liabilities (unaudited) |

June 30, 2009 |

| | | | |

Assets: | | | | |

| | | | | |

Investments, at value: | | | | |

| | | | | |

Corporate bonds (cost $143,452,756) | | $ | 149,718,052 | |

| | | | | |

Money market fund (cost $2,000,000) | | | 2,000,000 | |

| | | | | |

Total investments (cost $145,452,756) | | | 151,718,052 | |

| | | | | |

Cash | | | 3,979,613 | |

| | | | | |

Receivable for securities sold | | | 4,664,588 | |

| | | | | |

Interest and dividends receivable | | | 3,015,220 | |

| | | | | |

Receivable for shares of Beneficial Interest sold | | | 828,177 | |

| | | | | |

Other | | | 15,506 | |

| | | | | |

Total Assets | | | 164,221,156 | |

| | | | | |

| | | | |

Liabilities: | | | | |

| | | | | |

Payable for securities purchased | | | 1,034,719 | |

| | | | | |

Payable for shares of Beneficial Interest repurchased | | | 919,926 | |

| | | | | |

Dividends payable | | | 289,288 | |

| | | | | |

Accrued transfer agency fees | | | 206,788 | |

| | | | | |

Management fee payable | | | 89,141 | |

| | | | | |

Distribution and service (12b-1) fees payable | | | 64,400 | |

| | | | | |

Accrued expenses and other | | | 53,205 | |

| | | | | |

Total Liabilities | | | 2,657,467 | |

| | | | | |

Net Assets | | $ | 161,563,689 | |

| | | | | |

| | | | |

Composition of Net Assets: | | | | |

| | | | | |

Shares of Beneficial Interest, at par (unlimited shares authorized; $0.001 par value; 70,727,082 shares outstanding): | | | | |

| | | | | |

Class A | | $ | 47,904 | |

| | | | | |

Class B | | | 3,361 | |

| | | | | |

Class C | | | 17,174 | |

| | | | | |

Class R2 (Note 1) | | | 1,911 | |

| | | | | |

Class R5 (Note 1) | | | 377 | |

| | | | | |

Additional paid-in capital | | | 1,353,917,616 | |

| | | | | |

Dividends in excess of net investment income | | | (1,529,442 | ) |

| | | | | |

Accumulated net realized loss | | | (1,197,160,508 | ) |

| | | | | |

Net unrealized appreciation of investments | | | 6,265,296 | |

| | | | | |

Net Assets | | $ | 161,563,689 | |

| | | | | |

| | | | |

Net Asset Value Per Share: | | | | |

| | | | | |

Class A ($109,301,431 ÷ 47,903,815 shares) | | | $ 2.28 | |

| | | | | |

Class B ($7,675,625 ÷ 3,361,415 shares) | | | $ 2.28 | |

| | | | | |

Class C ($39,360,848 ÷ 17,173,418 shares) | | | $ 2.29 | |

| | | | | |

Class R2 ($4,366,905 ÷ 1,911,600 shares) | | | $ 2.28 | |

| | | | | |

Class R5 ($858,880 ÷ 376,834 shares) | | | $ 2.28 | |

| | | | | |

| |

| | |

See Notes to Financial Statements. |

|

Statement of Operations (unaudited) |

For the Six Months Ended June 30, 2009 |

| | | | |

Investment Income: | | | | |

| | | | | |

Interest | | $ | 9,232,105 | |

| | | | | |

Dividends | | | 135 | |

| | | | | |

Other income | | | 1,080 | |

| | | | | |

Total Investment Income | | | 9,233,320 | |

| | | | | |

| | | | |

Expenses: | | | | |

| | | | | |

Transfer agency fees (Note 4c) | | | 575,967 | |

| | | | | |

Management fee | | | 482,798 | |

| | | | | |

Distribution and service (12b-1) fees | | | 342,679 | |

| | | | | |

Registration | | | 77,331 | |

| | | | | |

Custody and related services | | | 38,284 | |

| | | | | |

Shareholder reports and communications | | | 21,980 | |

| | | | | |

Auditing and legal fees | | | 8,282 | |

| | | | | |

Trustees’ fees and expenses | | | 4,655 | |

| | | | | |

Plan administration services fees – Class R2 | | | 534 | |

| | | | | |

Miscellaneous | | | 5,438 | |

| | | | | |

Total Expenses | | | 1,557,948 | |

| | | | | |

Net Investment Income | | | 7,675,372 | |

| | | | | |

| | | | |

Net Realized and Unrealized Gain (Loss) on Investments: | | | | |

| | | | | |

Net realized loss on investments | | | (8,002,246 | ) |

| | | | | |

Net change in unrealized depreciation of investments | | | 33,894,532 | |

| | | | | |

Net Gain on Investments | | | 25,892,286 | |

| | | | | |

Increase in Net Assets from Operations | | $ | 33,567,658 | |

| | | | | |

| |

| | |

See Notes to Financial Statements. |

|

Statements of Changes In Net Assets |

(unaudited) |

| | | | | | | | | | | |

| | Six Months Ended

June 30, 2009 | | Year Ended

December 31, 2008 | |

| | | | | | |

| | | | | | | |

Operations: | | | | | | | |

| | | | | | | | |

Net investment income | | | $ | 7,675,372 | | | | $ | 16,106,705 | | |

| | | | | | | | | | | | |

Net realized loss on investments | | | | (8,002,246 | ) | | | | (70,475,177 | ) | |

| | | | | | | | | | | | |

Net change in unrealized depreciation of investments | | | | 33,894,532 | | | | | (16,697,310 | ) | |

| | | | | | | | | | | | |

Increase (Decrease) in Net Assets from Operations | | | | 33,567,658 | | | | | (71,065,782 | ) | |

| | | | | | | | | | | | |

| | | | | | | | | | | |

Distributions to Shareholders: | | | | | | | | | | | |

| | | | | | | | | | | | |

Dividends from net investment income: | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | | | (5,039,320 | ) | | | | (10,333,616 | ) | |

| | | | | | | | | | | | |

Class B | | | | (369,023 | ) | | | | (1,121,649 | ) | |

| | | | | | | | | | | | |

Class C | | | | (1,761,259 | ) | | | | (2,600,952 | ) | |

| | | | | | | | | | | | |

Class D | | | | — | | | | | (1,111,332 | ) | |

| | | | | | | | | | | | |

Class R2 | | | | (203,832 | ) | | | | (348,560 | ) | |

| | | | | | | | | | | | |

Class R5 | | | | (301,938 | ) | | | | (590,596 | ) | |

| | | | | | | | | | | | |

Total | | | | (7,675,372 | ) | | | | (16,106,705 | ) | |

| | | | | | | | | | | | |

Dividends in excess of net investment income: | | | | | | | | | | | |

| | | | | | | | | | | | |

Class A | | | | (693,219 | ) | | | | (2,259,499 | ) | |

| | | | | | | | | | | | |

Class B | | | | (50,764 | ) | | | | (245,255 | ) | |

| | | | | | | | | | | | |

Class C | | | | (242,282 | ) | | | | (568,712 | ) | |

| | | | | | | | | | | | |

Class D | | | | — | | | | | (242,998 | ) | |

| | | | | | | | | | | | |

Class R2 | | | | (28,039 | ) | | | | (76,214 | ) | |

| | | | | | | | | | | | |

Class R5 | | | | (41,535 | ) | | | | (129,137 | ) | |

| | | | | | | | | | | | |

Total | | | | (1,055,839 | ) | | | | (3,521,815 | ) | |

| | | | | | | | | | | | |

Decrease in Net Assets from Distributions | | | | (8,731,211 | ) | | | | (19,628,520 | ) | |

| | | | | | | | | | | | |

| | | | | | | | | | | |

Transactions in Shares of Beneficial Interest: | | | | | | | | | | | |

| | | | | | | | | | | | |

Net proceeds from sales of shares | | | | 17,842,968 | | | | | 15,054,643 | | |

| | | | | | | | | | | | |

Investment of dividends | | | | 5,420,928 | | | | | 11,836,659 | | |

| | | | | | | | | | | | |

Exchanged from associated funds | | | | 7,821,726 | | | | | 6,671,692 | | |

| | | | | | | | | | | | |

Total | | | | 31,085,622 | | | | | 33,562,994 | | |

| | | | | | | | | | | | |

Cost of shares repurchased | | | | (24,635,059 | ) | | | | (56,761,719 | ) | |

| | | | | | | | | | | | |

Exchanged into associated funds | | | | (4,139,726 | ) | | | | (8,444,420 | ) | |

| | | | | | | | | | | | |

Total | | | | (28,774,785 | ) | | | | (65,206,139 | ) | |

| | | | | | | | | | | | |

Increase (Decrease) in Net Assets from Transactions in Shares of Beneficial Interest | | | | 2,310,837 | | | | | (31,643,145 | ) | |

| | | | | | | | | | | | |

Increase (Decrease) in Net Assets | | | | 27,147,284 | | | | | (122,337,447 | ) | |

| | | | | | | | | | | | |

| | | | | | | | | | | |

Net Assets: | | | | | | | | | | | |

| | | | | | | | | | | | |

Beginning of period | | | | 134,416,405 | | | | | 256,753,852 | | |

| | | | | | | | | | | | |

End of Period (net of dividends in excess of net investment income of $1,529,442 and $485,137, respectively) | | | $ | 161,563,689 | | | | $ | 134,416,405 | | |

| | | | | | | | | | | | |

| |

| | |

See Notes to Financial Statements. |

Notes to Financial Statements (unaudited)

| | |

1. | Organization and Multiple Classes of Shares — Seligman High-Yield Fund (the “Fund”) is a series of Seligman High Income Fund Series (the “Series”) which is registered with the Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end diversified management investment company (Note 10). The Fund offers the following five classes of shares: |

| | |

| Class A shares are sold with an initial sales charge of up to 4.75% and are subject to a continuing service fee of up to 0.25% on an annual basis. Class A shares purchased in an amount of $1,000,000 or more are sold without an initial sales charge but are subject to a contingent deferred sales charge (“CDSC”) of 1% on redemptions within 18 months of purchase. Eligible employee benefit plans that have at least $2,000,000 in Plan assets may purchase Class A shares at net asset value, but in the event of a plan termination, will be subject to a CDSC of 1% on redemption of shares purchased within 18 months prior to plan termination. |

| | |

| Class B shares are sold without an initial sales charge but are subject to a distribution fee of 0.75% and a service fee of up to 0.25% on an annual basis, and a CDSC, if applicable, of 5% on redemptions in the first year of purchase, declining to 1% in the sixth year and 0% thereafter. Class B shares will automatically convert to Class A shares approximately eight years after their date of purchase. If Class B shares of the Fund are exchanged for Class B shares of another Seligman or RiverSource mutual fund, the holding period of the shares exchanged will be added to the holding period of the shares acquired, both for determining the applicable CDSC and the conversion of Class B shares to Class A shares. |

| | |

| Class C shares are sold without an initial sales charge but are subject to a distribution fee of up to 0.75% and a service fee of up to 0.25% on an annual basis, and a CDSC, if applicable, of 1% imposed on redemptions made within one year of purchase. |

| | |

| The Board of Trustees of the Series (the “Trustees”) approved the automatic conversion of all of the Fund’s outstanding Class D shares to Class C shares at their relative net asset values. The conversion was implemented on May 16, 2008. Effective at the close of business on May 16, 2008, the Fund no longer offers Class D shares. The conversion did not affect individual shareholder account values. |

| | |

| Class R2 (formerly Class R prior to June 13, 2009) shares are offered to certain employee benefit plans and are not available to all investors. They are sold without an initial sales charge, but are subject to a distribution fee of up to 0.25% and a service fee of up to 0.25% on an annual basis. There is no longer a 1% CDSC for Class R2 shares. |

| |

| Class R5 (formerly Class I prior to June 13, 2009) shares are offered to certain institutional clients and other investors, as described in the Fund’s Class R5 shares prospectus. Class R5 shares are sold without any sales charges and are not subject to distribution or service fees. |

| |

| All classes of shares represent interests in the same portfolio of investments, have the same rights and are generally identical in all respects except that each class bears its own class-specific expenses, and has exclusive voting rights with respect to any matter on which a separate vote of any class is required. |

| |

2. | Significant Accounting Policies — The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America which require management to make certain estimates and assumptions at the date of the financial statements. Actual results may differ from these estimates. These unaudited interim financial statements reflect all adjustments which are, in the opinion of management, necessary to a fair statement of the results for the interim period presented. All such adjustments are of a normal recurring nature. The following summarizes the significant accounting policies of the Fund: |

| | |

| a. | Security Valuation and Risk — Securities traded on an exchange are valued at the last sales price on the primary exchange or market on which they are traded. Fixed income securities not listed on an exchange or security market are valued by independent pricing services based on bid prices, which consider such factors as coupons, maturities, credit ratings, liquidity, specific terms and features, and |

| | |

| | |

Notes to Financial Statements (unaudited) |

|

| | the US Treasury yield curve. Equity securities not listed on an exchange or security market, or equity securities for which there is no last sales price, are valued at the mean of the most recent bid and asked prices. Securities for which market quotations are not readily available (or are otherwise no longer valid or reliable) are valued at fair value determined in accordance with procedures approved by the Trustees. This can occur in the event of, among other things, natural disasters, acts of terrorism, market disruptions, intra-day trading halts, and extreme market volatility in the US markets. The determination of fair value involves subjective judgments. As a result, using fair value to price a security may result in a price materially different from the prices used by other mutual funds to determine net asset value or the price that may be realized upon the actual sale of the security. |

| |

| | Short-term holdings maturing in 60 days or less are valued at current market quotations or may be valued at amortized cost if it approximates fair value. Short-term holdings that mature in more than 60 days are valued at current market quotations until the 60th day prior to maturity and are then valued as described above for securities maturing in 60 days or less. Investments in money market funds are valued at net asset value. |

| |

| | Statement of Financial Accounting Standards No. 157 (“SFAS 157”), “Fair Value Measurements,” establishes a three-tier hierarchy to classify the assumptions, referred to as inputs, used in valuation techniques (as described above) to measure fair value of the Fund’s investments. These inputs are summarized in three broad levels: Level 1 – quoted prices in active markets for identical investments; Level 2 – other significant observable inputs (including quoted prices in inactive markets or for similar investments, interest rates, prepayment speeds, credit risk, etc.); and Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value) (Note 3). Observable inputs are those based on market data obtained from sources independent of the Fund, and unobservable inputs reflect the Fund’s own assumptions based on the best information available. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. |

| |

| | Statement of Financial Accounting Standards No. 161 (“SFAS 161”), “Disclosures about Derivative Instruments and Hedging Activities — an amendment of FASB Statement No. 133 (“SFAS 133”),” requires enhanced disclosures about a fund’s derivative and hedging activities. Funds are required to provide enhanced disclosures about (a) how and why a fund uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for under SFAS 133 and its related interpretations, and (c) how derivative instruments and related hedged items affect a fund’s financial position, financial performance, and cash flows. The Fund has determined that SFAS 161 did not have a material impact on the Fund’s financial statements for the six months ended June 30, 2009. |

| |

| | Fixed income securities are subject to interest rate risk, credit risk, prepayment risk and market risk. High-yield securities are subject to higher volatility in yield and market value and a greater risk of loss of principal and interest than higher-rated, investment grade fixed income securities. |

| |

| b. | Multiple Class Allocations — All income, expenses (other than class-specific expenses), and realized and unrealized gains or losses are allocated daily to each class of shares based upon the relative value of shares of each class. Class-specific expenses, which include distribution and service (12b-1) fees and any other items that are specifically attributable to a particular class, are charged directly to such class. For the six months ended June 30, 2009, distribution and service (12b-1) fees, transfer agency fees, plan administration services fee and registration expenses were class-specific expenses. |

| | |

| c. | Security Transactions and Related Investment Income — Investment transactions are recorded on trade dates. Identified cost of investments sold is used for both financial reporting and federal income tax purposes. Dividends receivable are recorded on ex-dividend dates. Interest income is recorded on an accrual basis. The Fund amortizes discount and premium on portfolio securities for financial reporting purposes. |

| | |

| d. | Distributions to Shareholders — Dividends are declared daily and paid monthly. Other distributions paid by the Fund are recorded on ex-dividend dates. |

| | |

Notes to Financial Statements (unaudited) |

| | |

| e. | Taxes — There is no provision for federal income tax. The Fund has elected to be taxed as a regulated investment company and intends to distribute substantially all taxable net income and net gain realized. |

| | |

| | Financial Accounting Standards Board (“FASB”) Interpretation No. 48 (“FIN 48”), “Accounting for Uncertainty in Income Taxes – an interpretation of FASB Statement No. 109,” requires the Fund to measure and recognize in its financial statements the benefit of a tax position taken (or expected to be taken) on an income tax return if such position will more likely than not be sustained upon examination based on the technical merits of the position. Based upon its review of tax positions, the Fund has determined that FIN 48 did not have a material impact on the Fund’s financial statements for the six months ended June 30, 2009. |

| | |

3. | Fair Value Measurements — A summary of the value of the Fund’s investments as of June 30, 2009, based on the level of inputs used in accordance with SFAS 157 (Note 2a) and FASB Staff Position FAS 157-4, “Determining Fair Value When the Volume and Level of Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly” is as follows: |

| | | | | | | |

| | Investment | | | | |

| | | | | | |

Valuation Inputs | | Category | | Value | |

| |

Level 1 – | Quoted Prices in Active Markets for Identical Investments | | Money Market Fund | | $ | 2,000,000 | |

| | | | | | | | |

Level 2 – | Other Significant Observable Inputs | | Corporate Bonds | | | 149,718,052 | |

| | | | | | | | |

Level 3 – | Significant Unobservable Inputs | | | | | — | |

| |

Total | | | | | $ | 151,718,052 | |

| |

| | |

4. | Management and Distribution Services, and Other Related Party Transactions |

| |

| a. | Management and Administrative Services — RiverSource Investments, LLC (“RiverSource” or the “Manager”) receives a fee, calculated daily and payable monthly, equal to 0.65% per annum of the first $1 billion of the Fund’s average daily net assets and 0.55% per annum of the Fund’s average daily net assets in excess of $1 billion. The management fee reflected in the Statement of Operations represents 0.65% per annum of the Fund’s average daily net assets. |

| | |

| | Under an Administrative Services Agreement, Ameriprise Financial, Inc. (“Ameriprise”), the parent company of the Manager, administers certain aspects of the Fund’s business and other affairs at no cost. Ameriprise provides the Fund with office space, and certain administrative and other services and executive and other personnel as are necessary for Fund operations. Ameriprise pays all of the compensation of Trustees of the Fund who are employees or consultants of RiverSource and of the officers and other personnel of the Fund. Ameriprise reserves the right to seek approval of the Trustees to increase the fees payable by the Fund under the Administrative Services Agreement. However, Ameriprise anticipates that any such increase in fees would be offset by decreases in advisory fees under the Investment and Management Services Agreement and in certain other Fund expenses. If an increase in fees under the Administrative Services Agreement would not be offset by decreases in advisory fees and other expenses, the Fund will inform shareholders prior to the effectiveness of such increase. |

| | |

| b. | Distribution Services — The Fund has an Administration, Shareholder Services and Distribution Plan (the “Plan”) with respect to distribution of its shares. Under the Plan, with respect to Class A shares, service organizations can enter into agreements with RiverSource Fund Distributors, Inc. (the “Distributor”) and receive a continuing fee of up to 0.25% on an annual basis, of the average daily net assets of the Class A shares attributable to the particular service organizations for providing personal services and/or the maintenance of shareholder accounts. The Distributor charges such fees to the Fund pursuant to the Plan. For the six months ended June 30, 2009, fees incurred under the Plan aggregated $116,687 or 0.24% per annum of the average daily net assets of Class A shares. |

| | |

| | Under the Plan, with respect to Class B shares, Class C shares, and Class R2 (formerly Class R) shares, service organizations can enter into agreements with the Distributor and receive a continuing fee for |

| | |

Notes to Financial Statements (unaudited) |

|

| | providing personal services and/or the maintenance of shareholder accounts of up to 0.25% on an annual basis of the average daily net assets of the Class B, Class C, and Class R2 shares for which the organizations are responsible; and, for Class C and Class R2 shares, fees for providing other distribution assistance of up to 0.75% and 0.25%, respectively, on an annual basis of such average daily net assets. Such fees are paid monthly by the Fund to the Distributor pursuant to the Plan.

For the six months ended June 30, 2009, fees incurred under the Plan, equivalent to 1% per annum of the average daily net assets of Class B and Class C shares, and 0.50% per annum of average daily net assets of Class R2 shares, amounted to $37,319, $178,862, and $9,811, respectively. |

| |

| | Sales charges received by the Distributor for distributing Fund shares were $60,818 for Class A, $3,738 for Class B and $1,809 for Class C for the six months ended June 30, 2009. |

| | |

| c. | Transfer Agency Services — Under a Transfer Agency Agreement, RiverSource Service Corporation (“RSC”), an affiliate of the Manager, maintains Fund shareholder accounts and records and provides Fund shareholder services. Effective June 15, 2009, the Fund pays RSC an annual account-based fee at a rate equal to $20.50 for Class A, $21.50 for Class B and $21.00 for Class C for this service. RSC also charges an annual fee of $3 per account serviced directly by the Fund or its designated agent. The Fund also pays RSC an annual asset-based fee at a rate of 0.05% of the Fund’s average daily net assets attributable to Class R2 (formerly Class R) and Class R5 (formerly Class I) shares. RSC charges an annual fee of $5 per inactive account, charged on a pro-rata basis for the 12-month period from the date the account becomes inactive. |

| | |

| | RSC also charges an annual plan administration services fee at a rate of 0.25% of the average daily net assets of the Fund’s Class R2 shares for the provision of various administrative, recordkeeping, communications and educational services. For the period from June 15, 2009 to June 30, 2009, the total RSC charges for transfer agency and shareholder services and for plan administration services fees were $26,262 and $534, respectively. |

| | |

| | Prior to June 15, 2009, Seligman Data Corp. (“SDC”), owned by certain associated investment companies, provided shareholder servicing and transfer agency services to the Fund, as well as certain other Seligman funds. In January 2009, the Trustees approved the Fund’s termination of the shareholder servicing and transfer agency relationship with SDC and the engagement of RSC to provide shareholder servicing and transfer agency services. As a result of the Trustees’ termination of the shareholder servicing and transfer agency relationship with SDC (which was SDC’s sole business), SDC has exited the transfer agent business, effective June 15, 2009. |

| | |

| | For the period from January 1, 2009 to June 15, 2009, SDC charged the Fund $322,642 for shareholder account and transfer agency services in accordance with a methodology approved by the Series’ Trustees. Class R5 shares (formerly designated as Class I shares prior to June 13, 2009) received more limited shareholder services than the Fund’s other classes of shares. SDC did not allocate to Class R5 the costs of any of its departments that did not provide services to the Class R5 shareholders. Costs of SDC directly attributable to the other classes of the Fund were charged to those classes in proportion to their relative net asset values. Costs directly attributable to Class R5 shares were charged to Class R5. The remaining charges were allocated to Class R5 and the other classes by SDC pursuant to a formula based on their net assets, shareholder transaction volumes and number of shareholder accounts. |

| | |

| | In connection with the termination of the Seligman funds’ relationship with SDC, the Fund incurred certain non-recurring charges including charges relating to the remaining periods of SDC’s leases (the “Non-Recurring Charges”). These Non-Recurring Charges were incurred over a period from January 28, 2009 to June 12, 2009, and amounted to $227,063, or 0.15% of the Fund’s average daily net assets for the six months ended June 30, 2009 (not annualized). These Non-Recurring Charges are reported as transfer agency fees on the Statement of Operations. The liability remaining at June 30, 2009 for Non-Recurring Charges amounted to $180,526 and is included in accrued transfer agency fees on the Statement of Assets and Liabilities. |

| | |

| | The Series and certain other associated investment companies (together, the “Guarantors”) have severally but not jointly guaranteed the performance and observance of all the terms and conditions of |

| | |

Notes to Financial Statements (unaudited) |

|

| | a lease entered into by SDC, including the payment of rent by SDC (the “Guaranty”). The lease and the related Guaranty expire in January 2019. The obligation of the Series to pay any amount due under the Guaranty is limited to a specified percentage of the full amount, which generally is based on the Series’ percentage of the expenses billed by SDC to all Guarantors in the preceding calendar quarter. As of June 30, 2009, the Series’ total potential future obligation under the Guaranty over the life of the Guaranty is $498,900. The Fund would bear a portion of any payments made by the Series under the Guaranty. The Fund’s portion of the net present value of this obligation as of June 12, 2009 has been expensed as part of the aforementioned Non-Recurring Charges. |

| | |

| d. | Trustees’ Fees and Expenses — Trustees’ fees and expenses includes the compensation of Board members who are not employees of RiverSource and the Fund’s proportionate share of certain expenses of a company providing limited administrative services to the Fund and the other Seligman and RiverSource Funds. These expenses include boardroom and office expense, employee compensation, employee health and retirement benefits and certain other expenses. For the six months ended June 30, 2009, the Fund paid $3,515 to this company for such services. |

| | |

| | The Series has a compensation arrangement under which trustees who receive fees may elect to defer receiving such fees. Trustees may elect to have their deferred fees accrue interest or earn a return based on the performance of the Fund or other funds in the Seligman and RiverSource Groups of Investment Companies. The cost of such fees and earnings/losses accrued thereon is included in trustees’ fees and expenses, and the accumulated balance thereof at June 30, 2009, of $3,331 is included in accrued expenses and other liabilities. Deferred fees and related accrued earnings are not deductible by the Fund for federal income tax purposes until such amounts are paid. |

| | |

| Certain officers and trustees of the Series are officers or directors of the Manager, Ameriprise, the Distributor, RSC, and/or Seligman Data Corp. |

| | |

5. | Committed Line of Credit — Effective June 17, 2009, the Fund became an additional borrower in a revolving credit facility with a syndicate of banks led by JPMorgan Chase Bank, N.A. (the Administrative Agent”), whereby the Fund may borrow up to 10% of its net assets for the temporary funding of shareholder redemptions or for other temporary or emergency purposes. The credit facility agreement, which is a collective agreement between the Fund and certain other Seligman and RiverSource funds, severally and not jointly, permits collective borrowings up to $475 million. The borrowers shall have the right, upon written notice to the Administrative Agent to request an increase of up to $175 million in the aggregate amount of the credit facility from new or existing lenders, provided that the aggregate amount of the credit facility shall at no time exceed $650 million. Participation in such increase by any existing lender shall be at such lender’s sole discretion. Interest is charged to the Fund based on its borrowings at a rate equal to the federal funds rate plus 0.75%. Each borrowing under the credit facility matures no later than 60 days after the date of borrowing. The Fund also pays a commitment fee equal to its pro rata share of the amount of the credit facility at a rate of 0.06% per annum. |

| | |

| Until June 17, 2009, the Fund was a participant in a committed line of credit with a syndicate of banks, whereby the Fund was permitted to borrow up to 10% of its net assets for the temporary funding of shareholder redemptions or for other temporary or emergency purposes. The credit facility agreement, which was a collective agreement between the Fund and certain other Seligman funds, severally and not jointly, permitted collective borrowings up to $200 million. Interest was charged to the Fund based on its borrowings at a rate equal to the federal funds rate plus 0.50%. Each borrowing under the credit facility matured no later than 60 days after the date of borrowing. The Fund also paid a commitment fee equal to its pro rata share of the amount of the credit facility at a rate of 0.12% per annum. The Fund had no borrowings during the six months ended June 30, 2009. |

| |

6. | Purchases and Sales of Securities — Purchases and sales of portfolio securities, excluding short-term investments, for the six months ended June 30, 2009, amounted to $77,122,859 and $82,374,759, respectively. |

| |

7. | Federal Tax Information — Certain components of income, expense and realized capital gain and loss are recognized at different times or have a different character for federal income tax purposes and for financial |

| | |

Notes to Financial Statements (unaudited) |

| | |

| reporting purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value per share of the Fund. As a result of the differences described above, the treatment for financial reporting purposes of distributions made during the year from net investment income or net realized gains may differ from their treatment for federal income tax purposes. Further, the cost of investments also can differ for federal income tax purposes. |

| | |

| The tax basis information presented below is based on operating results for the six months ended June 30, 2009, and will vary from the final tax information as of the Fund’s year end. |

| | |

| At June 30, 2009, the cost of investments for federal income tax purposes was $146,372,356. The tax basis cost was greater than the cost for financial reporting purposes primarily due to the tax deferral of losses on wash sales in the amount of $7,054 and the amortization of premium for financial reporting purposes of $912,546. |

| | |

| At June 30, 2009, the tax basis components of accumulated losses were as follows: |

| | | | |

Gross unrealized appreciation of portfolio securities | | $ | 10,963,103 | |

| |

Gross unrealized depreciation of portfolio securities | | | (5,617,407 | ) |

| | | | | |

Net unrealized appreciation of portfolio securities | | | 5,345,696 | |

| |

Capital loss carryforwards | | | (1,128,589,445 | ) |

| | | | | |

Undistributed ordinary income | | | 352,353 | |

| | | | | |

Current period net realized loss* | | | (69,545,043 | ) |

| |

Total accumulated losses | | $ | (1,192,436,439 | ) |

| | | | | |

| | | |

| | | |

* | Includes post-October losses of $60,572,379 from prior year. |

| | |

| At December 31, 2008, the Fund had net capital loss carryforwards for federal income tax purposes of $1,128,589,445, which are available for offset against future taxable net capital gains, with $668,622,539 expiring in 2009, $444,283,739 expiring in 2010, $1,544,248 expiring in 2012, and $14,138,919 expiring in 2016. The amount was determined after adjustments for certain differences between financial reporting and tax purposes, such as wash sale losses. Accordingly, no capital gain distributions are expected to be paid to shareholders until net capital gains have been realized in excess of the available capital loss carryforwards. There can be no assurance that the Fund will be able to utilize all of these capital loss carryforwards before they expire. |

| | |