| Registrant’s telephone number, including area code: | (212) 850-1864 |

| Date of fiscal year end: | 12/31 |

| Date of reporting period: | 6/30/03 |

Seligman |

|

High-Yield Bond Series |

|

| |

| Mid-Year Report |

| June 30, 2003 |

|

|

| Seeking to Maximize |

| Current Income by |

| Investing in a Diversified |

| Portfolio of High-Yielding |

| Corporate Bonds |

| |

Table of Contents | |

To The Shareholders | 1 |

Performance Overview | 2 |

Portfolio Overview | 5 |

Portfolio of Investments | 7 |

Statement of Assets and Liabilities | 15 |

Statement of Operations | 17 |

Statements of Changes in Net Assets | 18 |

Notes to Financial Statements | 20 |

Financial Highlights | 26 |

Report of Independent Auditors | 31 |

Trustees and Executive Officers | 32 |

For More Information | Back cover |

To The Shareholders

William C. Morris

Chairman

Brian T. Zino

President

August 15, 2003

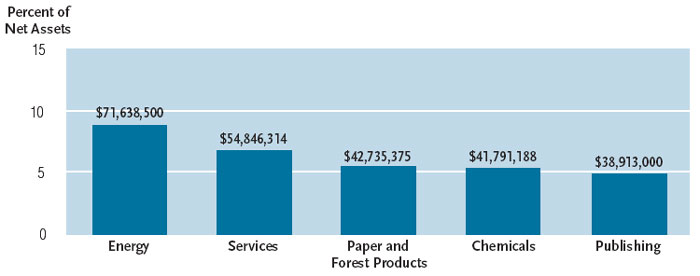

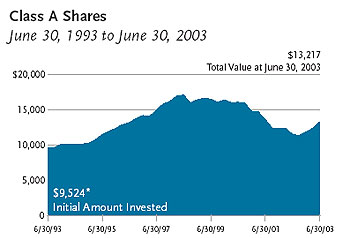

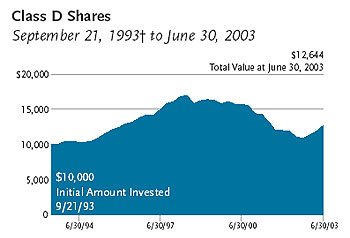

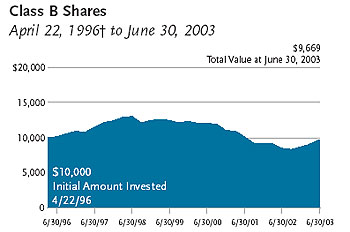

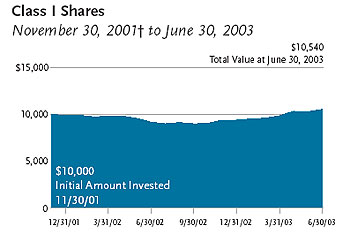

Growth of an Assumed $10,000 Investment

|  |

|  |

|  |

These charts reflect the growth of a hypothetical $10,000 investment for a 10-year period for Class A shares and since inception for Class B, Class C, Class D, Class I, and Class R shares, assuming that all applicable initial sales charges are imposed and all distributions within the periods are reinvested in additional shares. These charts do not reflect the deduction of taxes that an investor may pay on Fund distributions or on the redemption of Fund shares.

Since the measured periods vary, the charts are plotted using different scales and are not comparable. An investment in the Fund is subject to certain risks, including the possible loss of interest. Past performance in not indicative of future investment results. The rates of return will vary and the principal value of an investment will fluctuate. Shares, if redeemed, may be worth more or less than their original cost.

_______________

* Net of the 4.75% or 1% maximum initial sales charge for Class A and Class C shares, respectively.

** Excludes the effect of the 1% CDSC.

† Inception date.

| 2 | ||

Average Annual | ||||||||||

Class R Since Inception 4/30/03 * | Six Months * | One Year | Five Years | Ten Years | Class B Since Inception 4/22/96 | Class C Since Inception 5/27/99 | Class D Since Inception 9/21/93 | Class I Since Inception 11/30/01 | ||

Class A** | ||||||||||

| With Sales Charge | n/a | 6.51% | 8.64% | (6.01) | 2.83% | n/a | n/a | n/a | n/a | |

| Without Sales Charge | n/a | 11.91 | 14.00 | (5.09) | 3.33 | n/a | n/a | n/a | n/a | |

Class B** | ||||||||||

| With CDSC† | n/a | 6.47 | 8.14 | (6.04) | n/a | n/a | n/a | n/a | n/a | |

| Without CDSC | n/a | 11.47 | 13.14 | (5.81) | n/a | (0.47)% | n/a | n/a | n/a | |

Class C** | ||||||||||

| With Sales Charge | ||||||||||

and CDSCø | n/a | 9.75 | 11.43 | n/a | n/a | n/a | (6.39)% | n/a | n/a | |

| Without Sales Charge | ||||||||||

| and CDSC | n/a | 11.79 | 13.46 | n/a | n/a | n/a | (6.15) | n/a | n/a | |

Class D** | ||||||||||

| With 1% CDSC | n/a | 10.79 | 12.46 | n/a | n/a | n/a | n/a | n/a | n/a | |

| Without CDSC | n/a | 11.79 | 13.46 | (5.79) | n/a | n/a | n/a | 2.43% | n/a | |

Class I** | n/a | 12.13 | 14.45 | n/a | n/a | n/a | n/a | n/a | 3.39% | |

Class R** | ||||||||||

| With 1% CDSC | 1.01% | n/a | n/a | n/a | n/a | n/a | n/a | n/a | n/a | |

| Without CDSC | 2.01 | n/a | n/a | n/a | n/a | n/a | n/a | n/a | n/a | |

Lipper High Current | ||||||||||

Yield Average*** | 3.59 | 14.53 | 17.24 | 1.36 | 5.69 | 4.72## | 1.90 | 5.63### | 7.72 | |

Citigroup | ||||||||||

High Yield | ||||||||||

Bond Index*** | 3.79 | 19.78 | 26.36 | 3.29 | 6.92 | 6.07†† | 3.45††† | 6.85# | 12.48 | |

Net Asset Value Per Share | Dividend, Yield and Capital Gain Information Per Share | |||||||||

| 6/30/03 | 12/31/02 | 6/30/02 | For the Six Months Ended June 30, 2003 | |||||||

Dividends Paidøø | Yieldøøø | Capital Gain‡ | ||||||||

| Class A | $3.39 | $3.16 | $3.24 | $0.1391 | 6.61% | Realized | $0.064 | |||

| Class B | 3.40 | 3.17 | 3.25 | 0.1273 | 6.16 | Unrealized | 0.239 | ‡‡ | ||

| Class C | 3.41 | 3.17 | 3.25 | 0.1273 | 6.13 | |||||

| Class D | 3.41 | 3.17 | 3.25 | 0.1273 | 6.17 | |||||

| Class I | 3.39 | 3.16 | 3.24 | 0.1458 | 7.32 | |||||

| Class R | 3.39 | n/a | n/a | 0.0475 | 6.77 | |||||

(Continued on page 4.)

| 3 | ||

* | Returns for periods of less than one year are not annualized. |

** | Return figures reflect any change in price per share and assume the reinvestment of all distributions. Returns for Class A shares are calculated with and without the effect of the initial 4.75% maximum sales charge. Returns for Class B shares are calculated with and without the effect of the maximum 5% contingent deferred sales charge (“CDSC”), charged on redemptions made within one year of purchase, declining to 1% in the sixth year and 0% thereafter. Returns for Class C shares are calculated with and without the effect of the initial 1% maximum sales charge and the 1% CDSC that is charged on redemptions made within 18 months of purchase. Returns for Class D and R shares are calculated with and without the effect of the 1% CDSC, charged on certain redemptions made within one year of purchase. Returns for Class I shares are calculated without any sales charges. |

*** | The Citigroup High Yield Bond Index and the Lipper High Current Yield Average are unmanaged benchmarks that assume reinvestment of all distributions and exclude the effect of taxes and sales charges, and the Citigroup High Yield Bond Index also excludes the effect of fees. Investors cannot invest directly in an average or an index. |

ø | The CDSC is 1% for periods of 18 months or less. |

øø | Represents per share amount paid or declared during the six months ended June 30, 2003. In the case of Class R, for the period April 30, 2003 to June 30, 2003. |

øøø | Current yield, representing the annualized yield for the 30-day period ended June 30, 2003, has been computed in accordance with SEC regulations and will vary. |

† | The CDSC is 5% for periods of one year or less and 2% for the five-year period. |

†† | From April 30, 1996. |

††† | From May 31, 1999. |

# | From September 30, 1993. |

## | From April 25, 1996. |

### | From September 23, 1993. |

‡ | Information does not reflect effect of capital loss carryforwards that are available to offset these and future net realized capital gains. See Note 5 to Financial Statements. |

‡‡ | Represents the per share amount of net unrealized appreciation of portfolio securities as of June 30, 2003. |

| 4 | ||

|

Largest Purchases | Largest Sales |

Corporate Bonds: | Corporate Bonds: |

| Qwest Services 13.5%, due 12/15/2010* | Qwest 8.875%, due 3/15/2012** |

| Williams Companies 8.125%, due 3/15/2012* | Dollar Financial Group 10.875%, due 11/15/2006** |

| El Paso Production Holdings 7.75%, due 6/1/2013* | CSC Holdings 10.5%, due 5/15/2016** |

| Charter Communications 0% (11.75%), due 5/15/2011* | Hollywood Casino 11.25%, due 5/1/2007** |

| Houghton Mifflin 9.875%, due 2/1/2013* | Alliance Gaming 10%, due 8/1/2007** |

| Dynegy Holdings 8.75%, due 2/15/2012* | Lyondell Chemical 10.875%, due 5/1/2009** |

| Alliance Imaging 10.375%, due 4/15/2011* | Chesapeake Energy 8.375%, due 11/1/2008 |

| Calpine 8.625%, due 8/15/2010* | Fairchild Semiconductor 10.375%, due 10/1/2007** |

| AMI Semiconductor 10.75%, due 2/1/2013* | EchoStar DBS 9.375%, due 2/1/2009 |

Preferred Stocks: | Tembec Industries 7.75%, 3/15/2012** |

| CSC Holdings 11.75%* | |

| 5 | ||

Percent of | |||||||

Security | Value | Net Assets | |||||

| Qwest | $ | 15,946,750 | 2.0 | ||||

| El Paso | 14,724,625 | 1.8 | |||||

| Williams Companies | 14,313,000 | 1.8 | |||||

| Allied Waste North America | 13,797,437 | 1.7 | |||||

| Charter Communications | 13,012,875 | 1.6 | |||||

| Sinclair Broadcast Group | 12,004,437 | 1.5 | |||||

| Owens | 11,617,000 | 1.5 | |||||

| American Tower | 10,458,375 | 1.3 | |||||

| Georgia-Pacific | 9,946,313 | 1.2 | |||||

| Nextel Partners | 9,752,463 | 1.2 | |||||

Ratings§ June 30, 2003 | Weighted Average Maturity | ||

Moody’s | S&P | 7.43 years | |

| Baa/BBB | 0.4% | 2.2% | |

| Ba/BB | 21.0 | 24.3 | |

| B/B | 60.7 | 56.3 | |

| Caa/CCC | 12.2 | 14.1 | |

| Ca/CC | 1.6 | 0.5 | |

| Non-rated | 4.1 | 2.6 | |

| 6 | ||

Principal Amount | Value | ||||||

Corporate Bonds 95.3% | |||||||

Aerospace 1.8% | |||||||

| K&F Industries 9.625%, 12/15/2010 | $ | 3,600,000 | $ | 4,014,000 | |||

| L-3 Communications 6.125%, 7/15/2013* | 4,575,000 | 4,643,625 | |||||

| Sequa 9%, 8/1/2009 | 5,375,000 | 5,724,375 | |||||

| 14,382,000 | |||||||

Auto 2.1% | |||||||

| Dana 10.125%, 3/15/2010 | 5,075,000 | 5,620,562 | |||||

| Stoneridge 11.5%, 5/1/2012 | 3,575,000 | 4,021,875 | |||||

| Tenneco Automotive 10.25%, 7/15/2013* | 2,675,000 | 2,721,813 | |||||

| TRW Automotive Acquisition 11%, 2/15/2013* | 2,725,000 | 2,983,875 | |||||

| United Components 9.375%, 6/15/2013 | 1,775,000 | 1,850,437 | |||||

| 17,198,562 | |||||||

Broadcasting 3.3% | |||||||

| NextMedia Operating 10.75%, 7/1/2011 | 3,625,000 | 4,078,125 | |||||

| Paxson Communications 0% (12.25%†), 1/15/2009 | 6,750,000 | 5,670,000 | |||||

| Sinclair Broadcast Group 8%, 3/15/2012* | 4,025,000 | 4,276,562 | |||||

| Spanish Broadcasting Systems 9.625%, 11/1/2009 | 3,975,000 | 4,243,313 | |||||

| Sun Media 7.625%, 2/15/2013 (Canada) | 2,425,000 | 2,594,750 | |||||

| Young Broadcasting (Series B) 8.75%, 6/15/2007 | 5,121,000 | 5,223,420 | |||||

| 26,086,170 | |||||||

Building Products 1.8% | |||||||

| Associated Materials 9.75%, 4/15/2012 | 5,600,000 | 6,139,000 | |||||

| Reliant Resources 9.25%, 7/15/2010* | 4,450,000 | 4,494,500 | |||||

| Texas Industries 10.25%, 6/15/2011* | 3,600,000 | 3,780,000 | |||||

| 14,413,500 | |||||||

Cable 3.1% | |||||||

| Charter Communications: | |||||||

| 0% (9.92%†), 4/1/2011 | 4,650,000 | 3,080,625 | |||||

| 0% (11.75%†), 5/15/2011 | 19,475,000 | 9,932,250 | |||||

| Insight Communications 0% (12.25%†), 2/15/2011 | 8,050,000 | 6,721,750 | |||||

| Mediacom Broadband 11%, 7/15/2013 | 4,450,000 | 4,972,875 | |||||

| 24,707,500 | |||||||

Capital Goods 2.8% | |||||||

| Briggs & Stratton 8.875%, 3/15/2011 | 4,500,000 | 5,220,000 | |||||

| Joy Global 8.75%, 3/15/2012 | 3,575,000 | 3,932,500 | |||||

| NMHG Holding 10%, 5/15/2009 | 2,875,000 | 3,176,875 | |||||

| 7 | ||

Principal Amount | Value | ||||||

Capital Goods (continued) | |||||||

| Terex: | |||||||

| 8.875%, 4/1/2008 | $ | 2,900,000 | $ | 3,030,500 | |||

| 10.375%, 4/1/2011 | 1,825,000 | 2,025,750 | |||||

| Tyco International Group 6.375%, 10/15/2011 | 4,650,000 | 4,929,000 | |||||

| 22,314,625 | |||||||

Chemicals 5.2% | |||||||

| Arch Western Finance 6.75%, 7/1/2013 | 3,575,000 | 3,682,250 | |||||

| Equistar Chemicals 10.125%, 9/1/2008 | 2,525,000 | 2,613,375 | |||||

| FMC 10.25%, 11/1/2009 | 3,550,000 | 4,011,500 | |||||

| Huntsman ICI Chemicals 10.125%, 7/1/2009 | 3,700,000 | 3,570,500 | |||||

| International Specialty Holdings 10.625%, 12/15/2009 | 5,825,000 | 6,218,188 | |||||

| Lyondell Chemical 11.125%, 7/15/2012 | 5,475,000 | 5,639,250 | |||||

| Methanex 8.75%, 8/15/2012 | 4,450,000 | 5,006,250 | |||||

| Millennium America: | |||||||

| 9.25%, 6/15/2008 | 2,500,000 | 2,700,000 | |||||

| 7.625%, 11/15/2026 | 3,925,000 | 3,669,875 | |||||

| Rhodia 8.875%, 6/1/2011* | 4,500,000 | 4,680,000 | |||||

| 41,791,188 | |||||||

Consumer Products 0.9% | |||||||

| Jostens 12.75%, 5/1/2010 | 3,125,000 | 3,703,125 | |||||

| Remington Arms 10.5%, 2/1/2011* | 3,600,000 | 3,780,000 | |||||

| 7,483,125 | |||||||

Containers 3.3% | |||||||

| BWAY 10%, 10/15/2010* | 2,675,000 | 2,728,500 | |||||

| Crown European Holdings 10.875%, 3/1/2013 | 2,800,000 | 3,066,000 | |||||

| Graham Packaging: | |||||||

| 8.75%, 1/15/2008 | 3,575,000 | 3,575,000 | |||||

| 8.75%, 1/15/2008* | 1,775,000 | 1,775,000 | |||||

| Graphic Packaging 8.625%, 2/15/2012 | 3,475,000 | 3,561,875 | |||||

| Owens Brockway Glass Container: | |||||||

| 8.875%, 2/15/2009 | 3,900,000 | 4,251,000 | |||||

| 8.25%, 8/15/2013* | 2,700,000 | 2,835,000 | |||||

| Owens-Illinois 7.5%, 5/15/2010 | 4,600,000 | 4,531,000 | |||||

| 26,323,375 | |||||||

Diversified Telecommunications 2.4% | |||||||

| Qwest Services 13.5%, 12/15/2010* | 14,050,000 | 15,946,750 | |||||

| Sprint Capital 8.375%, 3/15/2012 | 2,850,000 | 3,418,914 | |||||

| 19,365,664 | |||||||

| 8 | ||

Principal Amount | Value | ||||||

Electric 1.5% | |||||||

| CMS Energy 9.875%, 10/15/2007 | $ | 1,775,000 | $ | 1,901,469 | |||

| MSW Energy Holdings 8.5%, 9/1/2010* | 3,600,000 | 3,717,000 | |||||

| Western Resources 9.75%, 5/1/2007 | 5,800,000 | 6,525,000 | |||||

| 12,143,469 | |||||||

Energy 8.9% | |||||||

| Citgo Petroleum 11.375%, 2/1/2011* | 3,625,000 | 4,060,000 | |||||

| Clark Refining & Marketing 8.875%, 11/15/2007 | 5,125,000 | 5,253,125 | |||||

| Dresser 9.375%, 4/15/2011 | 4,775,000 | 4,942,125 | |||||

| Dynegy Holdings 8.75%, 2/15/2012 | 7,175,000 | 6,708,625 | |||||

| El Paso 7.875%, 6/15/2012 | 6,150,000 | 5,727,187 | |||||

| El Paso Production Holdings 7.75%, 6/1/2013* | 8,975,000 | 8,997,438 | |||||

| Ferrellgas Partners 8.75%, 6/15/2012 | 4,500,000 | 4,905,000 | |||||

| Frontier Escrow 8%, 4/15/2013* | 2,250,000 | 2,362,500 | |||||

| Grant Prideco 9%, 12/15/2009 | 3,700,000 | 4,125,500 | |||||

| Gulfterra Energy Partners (Series B) 10.625%, 12/1/2012 | 3,625,000 | 4,205,000 | |||||

| Premcor Refining Group 9.5%, 2/1/2013 | 2,700,000 | 2,997,000 | |||||

| Universal Compression 7.25%, 5/15/2010* | 2,925,000 | 3,042,000 | |||||

| Williams Companies: | |||||||

| 8.625%, 6/1/2010 | 2,375,000 | 2,493,750 | |||||

| 8.125%, 3/15/2012 | 11,475,000 | 11,819,250 | |||||

| 71,638,500 | |||||||

Environmental 1.7% | |||||||

| Allied Waste North America 10%, 8/1/2009 | 12,925,000 | 13,797,437 | |||||

Finance 1.7% | |||||||

| Corrections Corporation of America 7.5%, 5/1/2011 | 4,050,000 | 4,252,500 | |||||

| LaBranche 12%, 3/2/2007 | 1,100,000 | 1,259,500 | |||||

| Western Financial Bank 9.625%, 5/15/2012 | 7,325,000 | 7,947,625 | |||||

| 13,459,625 | |||||||

Food and Beverage 1.6% | |||||||

| Del Monte 8.625%, 12/15/2012* | 3,575,000 | 3,807,375 | |||||

| Dole Food: | |||||||

| 7.25%, 6/15/2010* | 2,750,000 | 2,770,625 | |||||

| 8.875%, 3/15/2011* | 1,350,000 | 1,437,750 | |||||

| Smithfield Foods 7.75%, 5/15/2013* | 4,500,000 | 4,848,750 | |||||

12,864,500 | |||||||

| 9 | ||

Principal Amount | Value | ||||||

Food and Drug 1.5% | |||||||

| Rite Aid: | |||||||

| 9.5%, 2/15/2011* | $ | 4,500,000 | $ | 4,860,000 | |||

| 7.7%, 2/15/2027 | 3,625,000 | 3,008,750 | |||||

| Roundy’s (Series B) 8.875%, 6/15/2012 | 3,825,000 | 4,016,250 | |||||

| 11,885,000 | |||||||

Gaming 3.3% | |||||||

| Ameristar Casinos 10.75%, 2/15/2009 | 6,025,000 | 6,860,969 | |||||

| Isle of Capri Casinos 8.75%, 4/15/2009 | 4,300,000 | 4,601,000 | |||||

| Mandalay Resort Group 9.375%, 2/15/2010 | 3,400,000 | 3,859,000 | |||||

| Park Place Entertainment 9.375%, 2/15/2007 | 3,525,000 | 3,912,750 | |||||

| Station Casinos 9.875%, 7/1/2010 | 3,575,000 | 3,950,375 | |||||

| Venetian Casino Resort 11%, 6/15/2010 | 2,825,000 | 3,199,312 | |||||

| 26,383,406 | |||||||

Health Care Facilities and Supplies 3.0% | |||||||

| Alaris Medical Systems: | |||||||

| 0% (11.125%†, 8/1/2008 | 5,350,000 | 5,671,000 | |||||

| 7.25%, 7/1/2011 | 900,000 | 915,750 | |||||

| Alliance Imaging 10.375%, 4/15/2011 | 5,500,000 | 5,775,000 | |||||

| IASIS Healthcare 13%, 10/15/2009 | 3,550,000 | 3,958,250 | |||||

| Medex 8.875%, 5/15/2013* | 3,550,000 | 3,700,875 | |||||

| Province Healthcare 7.5%, 6/1/2013 | 4,025,000 | 3,984,750 | |||||

| 24,005,625 | |||||||

Home Builders 1.9% | |||||||

| Beazer Homes USA 8.375%, 4/15/2012 | 3,650,000 | 4,060,625 | |||||

| D.R. Horton 8%, 2/1/2009 | 1,425,000 | 1,592,437 | |||||

| K. Hovnanian Enterprises 8.875%, 4/1/2012 | 3,975,000 | 4,362,562 | |||||

| KB Home 9.5%, 2/15/2011 | 4,350,000 | 4,942,688 | |||||

| 14,958,312 | |||||||

Industrials 0.4% | |||||||

| Apogent Technologies 6.5%, 5/15/2013* | 3,125,000 | 3,242,187 | |||||

Leisure 1.6% | |||||||

| AMC Entertainment 9.5%, 2/1/2011 | 5,350,000 | 5,564,000 | |||||

| Bally Total Fitness Holdings 10.5%, 7/15/2011* | 2,675,000 | 2,688,375 | |||||

| Six Flags 8.875%, 2/1/2010 | 4,950,000 | 4,776,750 | |||||

| 13,029,125 | |||||||

| 10 | ||

Principal Amount | Value | ||||||

Lodging 2.8% | |||||||

| Felcore Lodging 10%, 9/15/2008 | $ | 5,250,000 | $ | 5,446,875 | |||

| John Q. Hammons Hotels (Series B) 8.875%, 5/15/2012 | 5,000,000 | 5,275,000 | |||||

| Host Marriot (Series I) 9.5%, 1/15/2007 | 6,250,000 | 6,750,000 | |||||

| MeriStar Hospitality 9.125%, 1/15/2011 | 4,750,000 | 4,678,750 | |||||

| 22,150,625 | |||||||

Metals and Mining 2.0% | |||||||

| Hexcel 9.75%, 1/15/2009 | 3,600,000 | 3,600,000 | |||||

| Earle M. Jorgesen 9.75%, 6/1/2012 | 3,050,000 | 3,248,250 | |||||

| Steel Dynamics 9.5%, 3/15/2009 | 3,300,000 | 3,473,250 | |||||

| UCAR Finance 10.25%, 2/15/2012 | 3,600,000 | 3,546,000 | |||||

| United States Steel 10.75%, 8/1/2008 | 1,850,000 | 1,951,750 | |||||

| 15,819,250 | |||||||

Oil and Gas Producers 2.0% | |||||||

| Chesapeake Energy 8.375%, 11/1/2008 | 4,800,000 | 5,220,000 | |||||

| Encore Acquisition 8.375%, 6/15/2012 | 2,650,000 | 2,848,750 | |||||

| Grey Wolf 8.875%, 7/1/2007 | 748,000 | 774,180 | |||||

| Magnum Hunter Resources 9.6%, 3/15/2012 | 2,000,000 | 2,210,000 | |||||

| Plains Exploration & Production 8.75%, 7/1/2012 | 1,775,000 | 1,908,125 | |||||

| Westport Resources 8.25%, 11/1/2011 | 2,750,000 | 3,025,000 | |||||

| 15,986,055 | |||||||

Oil Equipment 0.1% | |||||||

| Key Energy 8.375%, 3/1/2008 | 875,000 | 953,750 | |||||

Paper and Forest Products 5.3% | |||||||

Ainsworth Lumber 12.5%, 7/15/2007 (Canada) | 3,800,000 | 4,313,000 | |||||

| Buckeye Technologies 8%, 10/15/2010 | 3,550,000 | 3,337,000 | |||||

| Fibermark 10.75%, 4/15/2011 | 3,125,000 | 3,140,625 | |||||

| Georgia-Pacific: | |||||||

| 8.125%, 5/15/2011 | 6,175,000 | 6,375,688 | |||||

| 8.875%, 5/15/2031 | 3,625,000 | 3,570,625 | |||||

| Jefferson Smurfit: | |||||||

| 8.25%, 10/1/2012 | 3,625,000 | 3,905,937 | |||||

| 7.5%, 6/1/2013* | 4,450,000 | 4,561,250 | |||||

| Longview Fibre 10%, 1/15/2009 | 3,600,000 | 4,014,000 | |||||

| Norampac 6.75%, 6/1/2013* | 3,150,000 | 3,323,250 | |||||

| Potlatch 10%, 7/15/2011 | 3,800,000 | 4,237,000 | |||||

| Riverwood International 10.875%, 4/1/2008 | 1,900,000 | 1,957,000 | |||||

| 42,735,375 | |||||||

Property and Real Estate Development 0.5% | |||||||

| Forest City Enterprises 7.625%, 6/1/2015 | 3,575,000 | 3,767,156 | |||||

| 11 | ||

Principal Amount | Value | ||||||

Publishing 4.9% | |||||||

| American Media Operations 10.25%, 5/1/2009 | $ | 2,650,000 | $ | 2,875,250 | |||

| Dex Media East 12.125%,11/15/2012 | 4,475,000 | 5,314,062 | |||||

| R.H. Donnelley Financial: | |||||||

| 8.875%, 12/15/2010* | 1,775,000 | 1,970,250 | |||||

| 10.875%, 12/15/2012* | 3,550,000 | 4,153,500 | |||||

| Garden State Newspapers 8.75%, 10/1/2009 | 3,925,000 | 4,072,188 | |||||

| Houghton Mifflin 9.875%, 2/1/2013* | 6,225,000 | 6,785,250 | |||||

| Moore North America Finance 7.875%, 1/15/2011* | 2,700,000 | 2,828,250 | |||||

| Primedia 8.875%, 5/15/2011 | 5,400,000 | 5,710,500 | |||||

Quebecor Media 11.125%, 7/15/2011 (Canada) | 4,525,000 | 5,203,750 | |||||

| 38,913,000 | |||||||

Restaurants 0.5% | |||||||

| Domino’s 8.25%, 7/1/2011* | 1,775,000 | 1,841,563 | |||||

| Tricon Global Restaurants 8.875%, 4/15/2011 | 1,775,000 | 2,112,250 | |||||

| 3,953,813 | |||||||

Satellite 1.4% | |||||||

| DirecTV Holdings 8.375%, 3/15/2013* | 1,950,000 | 2,184,000 | |||||

| EchoStar DBS 9.375%, 2/1/2009 | 5,575,000 | 5,972,219 | |||||

| PanAmSat 8.5%, 2/1/2012 | 2,750,000 | 2,990,625 | |||||

| 11,146,844 | |||||||

Services 6.8% | |||||||

| Alderwoods Group 11%, 1/2/2007 | 3,878,300 | 3,946,170 | |||||

| Hollywood Entertainment 9.625%, 3/15/2011 | 4,625,000 | 5,081,719 | |||||

| Iron Mountain 8.625%, 4/1/2013 | 2,900,000 | 3,117,500 | |||||

| Mail-Well: | |||||||

| 8.75%, 12/15/2008 | 1,775,000 | 1,686,250 | |||||

| 9.625%, 3/15/2012 | 3,650,000 | 3,859,875 | |||||

| Mobile Mini 9.5%, 7/1/2013* | 1,350,000 | 1,404,000 | |||||

| NBC Acquisition 10.75, 2/15/2009 | 6,600,000 | 6,633,000 | |||||

| Perry-Judd 10.625%, 12/15/2007 | 3,925,000 | 4,101,625 | |||||

| Rent-A-Center 7.5%, 5/1/2010* | 1,825,000 | 1,925,375 | |||||

| Service Corp. International 7.2%, 6/1/2006 | 6,200,000 | 6,262,000 | |||||

| Stewart Enterprises 10.75%, 7/1/2008 | 2,790,000 | 3,124,800 | |||||

| United Rentals: | |||||||

| 10.75%, 4/15/2008 | 2,750,000 | 3,018,125 | |||||

| 9.25%, 1/15/2009 (Series B) | 3,600,000 | 3,564,000 | |||||

| URS 11.5%, 9/15/2009 | 1,800,000 | 1,926,000 | |||||

| Williams Scotsman 9.875%, 6/1/2007 | 5,275,000 | 5,195,875 | |||||

| 54,846,314 | |||||||

| 12 | ||

Principal Amount | Value | ||||||

Stores 2.1% | |||||||

| Central Garden & Pet 9.125%, 2/1/2013 | $ | 2,675,000 | $ | 2,862,250 | |||

| CSK Auto 12%, 6/15/2006 | 6,150,000 | 6,857,250 | |||||

| The Gap 10.55%, 12/15/2008 | 2,675,000 | 3,263,500 | |||||

| United Auto Group 9.625%, 3/15/2012 | 3,350,000 | 3,601,250 | |||||

| 16,584,250 | |||||||

Technology 3.5% | |||||||

| AMI Semiconductor 10.75%, 2/1/2013* | 5,475,000 | 6,214,125 | |||||

| Amkor Technology: | |||||||

| 10.5%, 5/1/2009 | 5,900,000 | 5,988,500 | |||||

| 7.75%, 5/15/2013 | 1,800,000 | 1,719,000 | |||||

| Lucent Technologies 7.25%, 7/15/2006 | 5,350,000 | 5,095,875 | |||||

Nortel Networks 6.125%, 2/15/2006 (Canada) | 3,625,000 | 3,534,375 | |||||

| Thomas & Betts 7.25%, 6/1/2013 | 3,800,000 | 3,819,000 | |||||

| Xerox 7.625%, 6/15/2013 | 1,875,000 | 1,886,719 | |||||

| 28,257,594 | |||||||

Textile and Apparel 0.8% | |||||||

| Russell 9.25%, 5/1/2010 | 5,575,000 | 6,104,625 | |||||

Transportation 0.3% | |||||||

| Offshore Logistics 6.125%, 6/15/2013* | 2,225,000 | 2,241,688 | |||||

Utilities 2.4% | |||||||

| AES: | |||||||

| 9.375%, 9/15/2010 | 1,037,000 | 1,047,370 | |||||

| 8.75%, 5/15/2013* | 5,400,000 | 5,643,000 | |||||

| Calpine 8.625%, 8/15/2010 | 8,000,000 | 6,040,000 | |||||

| Midland Funding 11.75%, 7/23/2005 | 4,450,000 | 4,828,250 | |||||

| National Waterworks (Series B) 10.5%, 12/1/2012 | 1,775,000 | 1,972,469 | |||||

| 19,531,089 | |||||||

Wireless 3.8% | |||||||

| Alamosa Holdings 13.625%, 8/15/2011 | 3,575,000 | 3,020,875 | |||||

| Dobson Communications 10.875%, 7/1/2010 | 3,575,000 | 3,878,875 | |||||

| Dobson/Sygnet Communications 12.25%, 12/15/2008 | 4,025,000 | 4,326,875 | |||||

| Nextel Communications 12%, 11/1/2008 | 4,450,000 | 4,806,000 | |||||

| Nextel Partners: | |||||||

| 9.375%, 11/15/2009 | 4,950,000 | 5,339,813 | |||||

| 12.5%, 11/15/2009 | 3,905,000 | 4,412,650 | |||||

| Triton PCS 8.5%, 6/1/2013* | 4,500,000 | 4,860,000 | |||||

| 30,645,088 | |||||||

| 13 | ||

Principal Amount, Shares or Warrants | Value | ||||||

Wireless Tower 2.3% | |||||||

| American Tower 9.375%, 2/1/2009 | $ | 8,025,000 | $ | 8,105,250 | |||

| American Tower Escrow 0%, 8/1/2008 | 3,125,000 | 2,031,250 | |||||

| Crown Castle International 10.75%, 8/1/2011 | 4,475,000 | 4,900,125 | |||||

| SBA Communications 10.25%, 2/1/2009 | 3,700,000 | 3,422,500 | |||||

| 18,459,125 | |||||||

Total Corporate Bonds (Cost $707,646,511) | 763,568,536 | ||||||

Preferred Stocks 2.0% | |||||||

Broadcasting 1.3% | |||||||

| Paxson Communications 14.25% | 28,700 | shs. | 2,834,125 | ||||

| Sinclair Capital 11.625% | 73,250 | 7,727,875 | |||||

| 10,562,000 | |||||||

Cable 0.7% | |||||||

| CSC Holdings 11.75% | 55,000 | 5,665,000 | |||||

Total Preferred Stocks (Cost $15,831,877) | 16,227,000 | ||||||

Warrants | |||||||

Wireless Tower | |||||||

| American Tower*‡(Cost $238,723) | 3,125 | wts. | 321,875 | ||||

Repurchase Agreement 1.0% | |||||||

| State Street Bank & Trust 0.93%, dated 6/30/2003, maturing 7/1/2003 in the amount of $8,000,207, collateralized by: $7,255,000 US Treasury Bonds 10.375%, 11/15/2009,with a fair market value of $8,243,494 (Cost $8,000,000) | $ | 8,000,000 | 8,000,000 | ||||

Total Investments 98.3% (Cost $731,717,111) | 788,117,411 | ||||||

Other Assets Less Liabilities 1.7% | 13,327,190 | ||||||

Net Assets 100.0% | $ | 801,444,601 | |||||

| 14 | ||

Assets: | ||||||||

| Investments, at value: | ||||||||

| Corporate bonds (cost $707,646,511) | $ | 763,568,536 | ||||||

| Preferred stocks and warrants (cost $16,070,600) | 16,548,875 | |||||||

| Repurchase agreement (cost $8,000,000) | 8,000,000 | $ | 788,117,411 | |||||

| Cash | 3,178,525 | |||||||

| Receivable for securities sold | 17,218,721 | |||||||

| Receivable for dividends and interest | 15,556,187 | |||||||

| Receivable for shares of Beneficial Interest sold | 1,090,624 | |||||||

| Expenses prepaid to shareholder service agent | 337,422 | |||||||

| Other | 61,476 | |||||||

Total Assets | 825,560,366 | |||||||

Liabilities: | ||||||||

| Payable for securities purchased | 11,295,953 | |||||||

| Payable for shares of Beneficial Interest repurchased | 9,530,310 | |||||||

| Dividends payable | 2,231,389 | |||||||

| Distribution and service fees payable | 478,063 | |||||||

| Management fee payable | 436,191 | |||||||

| Accrued expenses and other | 143,859 | |||||||

Total Liabilities | 24,115,765 | |||||||

Net Assets | $ | 801,444,601 | ||||||

Composition of Net Assets: | ||||||||

| Shares of Beneficial Interest, at par (unlimited shares authorized; | ||||||||

| $0.001 par value; 235,793,043 shares outstanding): | ||||||||

| Class A | $ | 78,266 | ||||||

| Class B | 98,419 | |||||||

| Class C | 17,525 | |||||||

| Class D | 40,340 | |||||||

| Class I | 1,243 | |||||||

| Class R | — | |||||||

| Additional paid-in capital | 2,242,791,533 | |||||||

| Dividends in excess of net investment income | (4,391,337 | ) | ||||||

| Accumulated net realized loss | (1,493,591,688 | ) | ||||||

| Net unrealized appreciation of investments | 56,400,300 | |||||||

Net Assets | $ | 801,444,601 | ||||||

| 15 | ||

Net Asset Value Per Share: | ||

Class A | ($265,482,327 ÷ 78,266,047) | $3.39 |

Class B | ($334,698,493 ÷ 98,419,018) | $3.40 |

Class C | ($59,677,351 ÷ 17,524,633) | $3.41 |

Class D | ($137,368,503 ÷ 40,339,679) | $3.41 |

Class I | ($4,216,400 ÷ 1,243,216) | $3.39 |

Class R | ($1,527 ÷ 450) | $3.39 |

| 16 | ||

Investment Income: | ||||

| Interest | $ | 35,826,395 | ||

| Dividends | 1,004,875 | |||

Total Investment Income | 36,831,270 | |||

Expenses: | ||||

| Distribution and service fees | 2,910,530 | |||

| Management fees | 2,562,151 | |||

| Shareholder account services | 1,293,527 | |||

| Custody and related services | 119,076 | |||

| Shareholder reports and communications | 35,952 | |||

| Registration | 35,684 | |||

| Auditing and legal fees | 33,851 | |||

| Trustees’ fees and expenses | 18,259 | |||

| Miscellaneous | 25,477 | |||

Total Expenses | 7,034,507 | |||

Net Investment Income | 29,796,763 | |||

Net Realized and Unrealized Gain on Investments: | ||||

| Net realized gain on investments | 15,124,821 | |||

| Net change in unrealized appreciation of investments | 43,507,460 | |||

Net Gain on Investments | 58,632,281 | |||

Increase in Net Assets from Operations | $ | 88,429,044 | ||

| 17 | ||

Six Months Ended June 30, 2003 | Year Ended December 31, 2002 | ||||||

Operations: | |||||||

| Net investment income | $ | 29,796,763 | $ | 74,145,622 | |||

| Net realized gain (loss) on investments | 15,124,821 | (278,644,475 | ) | ||||

| Net change in unrealized appreciation/depreciation of investments | 43,507,460 | 140,023,552 | |||||

Increase (Decrease) in Net Assets from Operations | 88,429,044 | (64,475,301 | ) | ||||

Distributions to Shareholders: | |||||||

| Net investment income: | |||||||

| Class A | (10,593,878 | ) | (25,094,875 | ) | |||

| Class B | (11,795,375 | ) | (30,234,991 | ) | |||

| Class C | (1,977,135 | ) | (4,985,089 | ) | |||

| Class D | (4,896,221 | ) | (13,082,393 | ) | |||

| Class I | (155,659 | ) | (176,687 | ) | |||

| Class R | (19 | ) | — | ||||

| Dividends in excess of net investment income: | |||||||

| Class A | (884,255 | ) | — | ||||

| Class B | (984,542 | ) | — | ||||

| Class C | (165,029 | ) | — | ||||

| Class D | (408,681 | ) | — | ||||

| Class I | (12,993 | ) | — | ||||

| Class R | (2 | ) | — | ||||

| Return of Capital: | |||||||

| Class A | — | (5,170,083 | ) | ||||

| Class B | — | (6,862,779 | ) | ||||

| Class C | — | (1,133,273 | ) | ||||

| Class D | — | (2,952,344 | ) | ||||

| Class I | — | (38,772 | ) | ||||

Decrease in Net Assets from Distributions | (31,873,789 | ) | (89,731,286 | ) | |||

| 18 | ||

Six Months Ended June 30, 2003 | Year Ended December 31, 2002 | ||||||

Transactions in Shares of Beneficial Interest: | |||||||

| Net proceeds from sales of shares | $ | 62,722,463 | $ | 87,119,250 | |||

| Investment of dividends | 15,655,037 | 42,204,942 | |||||

| Exchanges from associated funds | 77,391,664 | 153,885,872 | |||||

| Total | 155,769,164 | 283,210,064 | |||||

| Cost of shares repurchased | (99,038,229 | ) | (328,822,348 | ) | |||

| Exchanged into associated funds | (84,108,752 | ) | (167,256,417 | ) | |||

| Total | (183,146,981 | ) | (496,078,765 | ) | |||

Decrease in Net Assets from Transactions | |||||||

in Shares of Beneficial Interest | (27,377,817 | ) | (212,868,701 | ) | |||

Increase (Decrease) in Net Assets | 29,177,438 | (367,075,288 | ) | ||||

Net Assets: | |||||||

| Beginning of period | 772,267,163 | 1,139,342,451 | |||||

End of Period (net of dividends in excess of net investment income of $4,391,337 and $18,100,082, respectively) | $ | 801,444,601 | $ | 772,267,163 | |||

| 19 | ||

| 20 | ||

| 21 | ||

| 22 | ||

| 23 | ||

Six Months Ended June 30, 2003 | Year Ended December 31, 2002 | ||||||||||||

Class A | Shares | Amount | Shares | Amount | |||||||||

| Net proceeds from sales of shares | 14,216,454 | $ | 46,089,698 | 17,930,305 | $ | 60,177,774 | |||||||

| Investment of dividends | 1,824,561 | 5,976,756 | 4,432,853 | 15,003,047 | |||||||||

| Exchanged from associated funds | 17,435,329 | 57,185,042 | 36,604,195 | 124,306,343 | |||||||||

| Total | 33,476,344 | 109,251,496 | 58,967,353 | 199,487,164 | |||||||||

| Cost of shares repurchased | (13,099,175 | ) | (42,649,134 | ) | (38,955,369 | ) | (129,947,111 | ) | |||||

| Exchanged into associated funds | (22,573,018 | ) | (74,840,133 | ) | (36,708,336 | ) | (125,613,955 | ) | |||||

| Transferred to Class I | — | — | (429,452 | ) | (1,537,439 | ) | |||||||

| Total | (35,672,193 | ) | (117,489,267 | ) | (76,093,157 | ) | (257,098,505 | ) | |||||

| Decrease | (2,195,849 | ) | $ | (8,237,771 | ) | (17,125,804 | ) | $ | (57,611,341 | ) | |||

Class B | Shares | Amount | Shares | Amount | |||||||||

| Net proceeds from sales of shares | 1,508,708 | $ | 4,960,199 | 3,002,442 | $ | 10,382,609 | |||||||

| Investment of dividends | 1,670,987 | 5,492,735 | 4,544,944 | 15,426,073 | |||||||||

| Exchanged from associated funds | 4,489,469 | 14,721,328 | 6,171,696 | 20,848,044 | |||||||||

| Total | 7,669,164 | 25,174,262 | 13,719,082 | 46,656,726 | |||||||||

| Cost of shares repurchased | (10,323,643 | ) | (33,838,620 | ) | (32,329,264 | ) | (107,962,462 | ) | |||||

| Exchanged into associated funds | (1,991,233 | ) | (6,437,928 | ) | (8,761,771 | ) | (29,124,328 | ) | |||||

| Total | (12,314,876 | ) | (40,276,548 | ) | (41,091,035 | ) | (137,086,790 | ) | |||||

| Decrease | (4,645,712 | ) | $ | (15,102,286 | ) | (27,371,953 | ) | $ | (90,430,064 | ) | |||

Class C | Shares | Amount | Shares | Amount | |||||||||

| Net proceeds from sales of shares | 2,688,111 | $ | 8,862,099 | 3,292,105 | $ | 11,358,137 | |||||||

| Investment of dividends | 315,395 | 1,037,763 | 849,964 | 2,884,232 | |||||||||

| Exchanged from associated funds | 689,384 | 2,266,507 | 1,007,375 | 3,338,090 | |||||||||

| Total | 3,692,890 | 12,166,369 | 5,149,444 | 17,580,459 | |||||||||

| Cost of shares repurchased | (2,282,739 | ) | (7,478,039 | ) | (8,322,551 | ) | (27,902,662 | ) | |||||

| Exchanged into associated funds | (504,724 | ) | (1,646,666 | ) | (1,454,829 | ) | (4,803,541 | ) | |||||

| Total | (2,787,463 | ) | (9,124,705 | ) | (9,777,380 | ) | (32,706,203 | ) | |||||

| Increase (decrease) | 905,427 | $ | 3,041,664 | (4,627,936 | ) | $ | (15,125,744 | ) | |||||

| 24 | ||

Six Months Ended June 30, 2003 | Year Ended December 31, 2002 | ||||||||||||

Class D | Shares | Amount | Shares | Amount | |||||||||

| Net proceeds from sales of shares | 565,161 | $ | 1,849,626 | 1,020,753 | $ | 3,506,232 | |||||||

| Investment of dividends | 907,311 | 2,982,935 | 2,555,045 | 8,685,745 | |||||||||

| Exchanged from associated funds | 981,980 | 3,218,787 | 1,579,528 | 5,393,395 | |||||||||

| Total | 2,454,452 | 8,051,348 | 5,155,326 | 17,585,372 | |||||||||

| Cost of shares repurchased | (4,510,978 | ) | (14,807,097 | ) | (18,723,603 | ) | (62,904,400 | ) | |||||

| Exchanged into associated funds | (357,701 | ) | (1,184,025 | ) | (2,283,321 | ) | (7,714,593 | ) | |||||

| Total | (4,868,679 | ) | (15,991,122 | ) | (21,006,924 | ) | (70,618,993 | ) | |||||

| Decrease | (2,414,227 | ) | $ | (7,939,774 | ) | (15,851,598 | ) | $ | (53,033,621 | ) | |||

Class I | Shares | Amount | Shares | Amount | |||||||||

| Net proceeds from sales of shares | 295,870 | $ | 959,341 | 501,912 | $ | 1,694,498 | |||||||

| Investment of dividends | 50,302 | 164,831 | 63,111 | 205,845 | |||||||||

| Transferred from Class A | — | — | 429,452 | 1,537,439 | |||||||||

| Total | 346,172 | 1,124,172 | 994,475 | 3,437,782 | |||||||||

| Cost of shares repurchased | (79,565 | ) | (265,339 | ) | (32,264 | ) | (105,713 | ) | |||||

| Increase | 266,607 | $ | 858,833 | 962,211 | $ | 3,332,069 | |||||||

April 30, 2003 * | |||||||||||||

Class R | Shares |

|

| Amount | |||||||||

| Net proceeds from sales of shares | 445 | $ | 1,500 | ||||||||||

| Investment of dividends | 5 | 17 | |||||||||||

| Increase | 450 | $ | 1,517 | ||||||||||

| 25 | ||

| CLASS A | |||||||||||||||||||

Six Months | Year Ended December 31 | ||||||||||||||||||

Ended | |||||||||||||||||||

6/30/03 | 2002 | 2001ø | 2000 | 1999 | 1998 | ||||||||||||||

Per Share Data: | |||||||||||||||||||

Net Asset Value, Beginning of Period | $ | 3.16 | $ | 3.69 | $ | 4.99 | $ | 6.26 | $ | 6.95 | $ | 7.55 | |||||||

Income (Loss) from Investment Operations: | |||||||||||||||||||

| Net investment income | 0.13 | 0.28 | 0.47 | 0.64 | 0.69 | 0.70 | |||||||||||||

| Net realized and unrealized gain (loss) on investments | 0.24 | (0.47 | ) | (1.21 | ) | (1.21 | ) | (0.68 | ) | (0.59 | ) | ||||||||

Total from Investment Operations | 0.37 | (0.19 | ) | (0.74 | ) | (0.57 | ) | 0.01 | 0.11 | ||||||||||

Less Distributions: | |||||||||||||||||||

| Dividends from net investment income | (0.13 | ) | (0.28 | ) | (0.47 | ) | (0.64 | ) | (0.70 | ) | (0.69 | ) | |||||||

| Dividends in excess of net investment income | (0.01 | ) | — | — | (0.02 | ) | — | — | |||||||||||

| Return of capital | — | (0.06 | ) | (0.09 | ) | (0.04 | ) | — | — | ||||||||||

| Distributions from net realized capital gains | — | — | — | — | — | (0.02 | ) | ||||||||||||

Total Distributions | (0.14 | ) | (0.34 | ) | (0.56 | ) | (0.70 | ) | (0.70 | ) | (0.71 | ) | |||||||

Net Asset Value, End of Period | $ | 3.39 | $ | 3.16 | $ | 3.69 | $ | 4.99 | $ | 6.26 | $ | 6.95 | |||||||

Total Return: | 11.91 | % | (5.35) | % | (15.91) | % | (10.02) | % | 0.09 | % | 1.32 | % | |||||||

Ratios/Supplemental Data: | |||||||||||||||||||

| Net assets, end of period (000s omitted) | $ | 265,482 | $ | 254,191 | $ | 360,394 | $ | 584,944 | $ | 923,395 | $ | 1,050,340 | |||||||

| Ratio of expenses to average net assets | 1.30% | † | 1.31% | 1.16% | 1.09% | 1.08% | 1.10% | ||||||||||||

| Ratio of net investment income to average net assets | 8.05% | † | 8.53% | 10.61% | 11.08% | 10.30% | 9.46% | ||||||||||||

| Portfolio turnover rate | 75.80% | 117.82% | 53.04% | 27.45% | 40.60% | 35.34% | |||||||||||||

| 26 | ||

| CLASS B | |||||||||||||||||||

| Six Months | Year Ended December 31 | ||||||||||||||||||

Ended | |||||||||||||||||||

6/30/03 | 2002 | 2001ø | 2000 | 1999 | 1998 | ||||||||||||||

Per Share Data: | |||||||||||||||||||

Net Asset Value, Beginning of Period | $ | 3.17 | $ | 3.70 | $ | 5.00 | $ | 6.26 | $ | 6.95 | $ | 7.55 | |||||||

Income (Loss) from Investment Operations: | |||||||||||||||||||

| Net investment income | 0.12 | 0.26 | 0.43 | 0.59 | 0.64 | 0.64 | |||||||||||||

| Net realized and unrealized gain (loss) on investments | 0.24 | (0.48 | ) | (1.21 | ) | (1.20 | ) | (0.68 | ) | (0.59 | ) | ||||||||

Total from Investment Operations | 0.36 | (0.22 | ) | (0.78 | ) | (0.61 | ) | (0.04 | ) | 0.05 | |||||||||

Less Distributions: | |||||||||||||||||||

| Dividends from net investment income | (0.12 | ) | (0.25 | ) | (0.43 | ) | (0.59 | ) | (0.65 | ) | (0.63 | ) | |||||||

| Dividends in excess of net investment income | (0.01 | ) | — | — | (0.02 | ) | — | — | |||||||||||

| Return of capital | — | (0.06 | ) | (0.09 | ) | (0.04 | ) | — | .— | ||||||||||

| Distributions from net realized capital gains | — | — | — | — | — | (0.02 | ) | ||||||||||||

Total Distributions | (0.13 | ) | (0.31 | ) | (0.52 | ) | (0.65 | ) | (0.65 | ) | (0.65 | ) | |||||||

Net Asset Value, End of Period | $ | 3.40 | $ | 3.17 | $ | 3.70 | $ | 5.00 | $ | 6.26 | $ | 6.95 | |||||||

Total Return: | 11.47 | % | (6.07) | % | (16.58) | % | (10.66) | % | (0.69) | % | 0.57 | % | |||||||

Ratios/Supplemental Data: | |||||||||||||||||||

| Net assets, end of period (000s omitted) | $ | 334,698 | $ | 326,688 | $ | 483,041 | $ | 723,751 | $ | 1,073,910 | $ | 1,037,994 | |||||||

| Ratio of expenses to average net assets | 2.05% | † | 2.06% | 1.91% | 1.84% | 1.83% | 1.85% | ||||||||||||

| Ratio of net investment income to average net assets | 7.30% | † | 7.78% | 9.86% | 10.33% | 9.55% | 8.71% | ||||||||||||

| Portfolio turnover rate | 75.80% | 117.82% | 53.04% | 27.45% | 40.60% | 35.34% | |||||||||||||

| 27 | ||

| CLASS C | ||||||||||||||||

Six Months | Year Ended December 31, | |||||||||||||||

Ended | 5/27/99†† to | |||||||||||||||

6/30/03 | 2002 | 2001ø | 2000 | 12/31/99 | ||||||||||||

Per Share Data: | ||||||||||||||||

Net Asset Value, Beginning of Period | $ | 3.17 | $ | 3.70 | $ | 5.00 | $ | 6.27 | $ | 6.75 | ||||||

Income (Loss) from Investment Operations: | ||||||||||||||||

| Net investment income | 0.12 | 0.26 | 0.43 | 0.59 | 0.32 | |||||||||||

| Net realized and unrealized gain (loss) on investments | 0.25 | (0.48 | ) | (1.21 | ) | (1.21 | ) | (0.41 | ) | |||||||

Total from Investment Operations | 0.37 | (0.22 | ) | (0.78 | ) | (0.62 | ) | (0.09 | ) | |||||||

Less Distributions: | ||||||||||||||||

| Dividends from net investment income | (0.12 | ) | (0.25 | ) | (0.43 | ) | (0.59 | ) | (0.39 | ) | ||||||

| Dividends in excess of net investment income | (0.01 | ) | — | — | (0.02 | ) | — | |||||||||

| Return of capital | — | (0.06 | ) | (0.09 | ) | (0.04 | ) | — | ||||||||

Total Distributions | (0.13 | ) | (0.31 | ) | (0.52 | ) | (0.65 | ) | (0.39 | ) | ||||||

Net Asset Value, End of Period | $ | 3.41 | $ | 3.17 | $ | 3.70 | $ | 5.00 | $ | 6.27 | ||||||

Total Return: | 11.79 | % | (6.08) | % | (16.59) | % | (10.81) | % | (1.71) | % | ||||||

Ratios/Supplemental Data: | ||||||||||||||||

| Net assets, end of period (000s omitted) | $ | 59,677 | $ | 52,709 | $ | 78,721 | $ | 87,204 | $ | 51,815 | ||||||

| Ratio of expenses to average net assets | 2.05% | † | 2.06% | 1.91% | 1.84% | 1.81% | † | |||||||||

| Ratio of net investment income to average net assets | 7.30% | † | 7.78% | 9.86% | 10.33% | % | 9.78% | † | ||||||||

| Portfolio turnover rate | 75.80% | 117.82% | 53.04% | 27.45% | 40.60% | * | ||||||||||

| 28 | ||

CLASS D | |||||||||||||||||||

Six Months | Year Ended December 31, | ||||||||||||||||||

Ended | |||||||||||||||||||

6/30/03 | 2002 | 2001ø | 2000 | 1999 | 1998 | ||||||||||||||

Per Share Data: | |||||||||||||||||||

Net Asset Value, Beginning of Period | $ | 3.17 | $ | 3.70 | $ | 5.00 | $ | 6.27 | $ | 6.95 | $ | 7.55 | |||||||

Income (Loss) from Investment Operations: | |||||||||||||||||||

| Net investment income | 0.12 | 0.26 | 0.43 | 0.59 | 0.64 | 0.64 | |||||||||||||

| Net realized and unrealized gain (loss) on investments | 0.25 | (0.48 | ) | (1.21 | ) | (1.21 | ) | (0.67 | ) | (0.59 | ) | ||||||||

Total from Investment Operations | 0.37 | (0.22 | ) | (0.78 | ) | (0.62 | ) | (0.03 | ) | 0.05 | |||||||||

Less Distributions: | |||||||||||||||||||

| Dividends from net investment income | (0.12 | ) | (0.25 | ) | (0.43 | ) | (0.59 | ) | (0.65 | ) | (0.63 | ) | |||||||

| Dividends in excess of net investment income | (0.01 | ) | — | — | (0.02 | ) | — | — | |||||||||||

| Return of capital | — | (0.06 | ) | (0.09 | ) | (0.04 | ) | — | — | ||||||||||

| Distributions from net realized capital gains | — | — | — | — | — | (0.02 | ) | ||||||||||||

Total Distributions | (0.13 | ) | (0.31 | ) | (0.52 | ) | (0.65 | ) | (0.65 | ) | (0.65 | ) | |||||||

Net Asset Value, End of Period | $ | 3.41 | $ | 3.17 | $ | 3.70 | $ | 5.00 | $ | 6.27 | $ | 6.95 | |||||||

Total Return: | 11.79 | % | (6.08) | % | (16.59) | % | (10.81) | % | (0.54) | % | 0.57 | % | |||||||

Ratios/Supplemental Data: | |||||||||||||||||||

| Net assets, end of period (000s omitted) | $ | 137,369 | $ | 135,595 | $ | 217,133 | $ | 369,286 | $ | 656,727 | $ | 769,828 | |||||||

| Ratio of expenses to average net assets | 2.05% | † | 2.06% | 1.91% | 1.84% | 1.83% | 1.85% | ||||||||||||

| Ratio of net investment incometo average net | 7.30% | † | 7.78% | 9.86% | 10.33% | 9.55% | 8.71% | ||||||||||||

| Portfolio turnover rate | 75.80% | 117.82% | 53.04% | 27.45% | 40.60% | 35.34% | |||||||||||||

| 29 | ||

| CLASS I | CLASS R | ||||||||||||

Six Months Ended 6/30/03 | Year Ended 12/31/02 | 11/30/01†† to 12/31/01ø | 4/30/03 †† to 06/30/03 | ||||||||||

Per Share Data: | |||||||||||||

Net Asset Value, Beginning of Period | $ | 3.16 | $ | 3.69 | $ | 3.77 | $ | 3.37 | |||||

Income (Loss) from Investment Operations: | |||||||||||||

| Net investment income | 0.14 | 0.29 | 0.02 | 0.04 | |||||||||

| Net realized and unrealized gain (loss) on investments | 0.24 | (0.47 | ) | (0.05 | ) | 0.03 | |||||||

Total from Investment Operations | 0.38 | (0.18 | ) | (0.03 | ) | 0.07 | |||||||

Less Distributions: | |||||||||||||

| Dividends from net investment income | (0.14 | ) | (0.29 | ) | (0.01 | ) | (0.04 | ) | |||||

| Dividends in excess of net investment income | (0.01 | ) | — | — | (0.01 | ) | |||||||

| Return of capital | — | (0.06 | ) | (0.04 | ) | — | |||||||

Total Distributions | (0.15 | ) | (0.35 | ) | (0.05 | ) | (0.05 | ) | |||||

Net Asset Value, End of Period | $ | 3.39 | $ | 3.16 | $ | 3.69 | $ | 3.39 | |||||

Total Return: | 12.13 | % | (5.02) | % | (0.91) | % | �� | 2.01 | % | ||||

Ratios/Supplemental Data: | |||||||||||||

| Net assets, end of period (000s omitted) | $ | 4,216 | $ | 3,085 | $ | 53 | $ | 2 | |||||

| Ratio of expenses to average net assets | 0.90% | † | 0.93% | 0.78% | † | 1.62% | †† | ||||||

| Ratio of net investment income to average net assets | 8.44% | † | 8.91% | 11.48% | † | 7.61% | † | ||||||

| Portfolio turnover rate | 75.80% | 117.82% | 53.04% | ** | 75.80% | ‡ | |||||||

| Without expense reimbursements:‡‡ | |||||||||||||

| Ratio of expenses to average net assets | 0.98% | 1.43% | † | ||||||||||

| Ratio of net investment income to average net assets | 8.86% | 10.83% | † | ||||||||||

| † | Annualized. | |

| †† | Commencement of offering of shares. | |

| * | For the year ended December 31, 1999. | |

| ** | For the year ended December 31, 2001. | |

| ‡ | For the six months ended June 30, 2003. | |

| ‡‡ | The Manager, at its discretion, reimbursed certain expenses of Class I shares. | |

| ø | As required, effective January 1, 2001, the Fund adopted the provisions of the AICPA Audit and Accounting Guide for Investment Companies and began amortizing premium on debt securities. The effect of this change for the year ended December 31, 2001, was to decrease net investment income per share by $0.01 for Classes A, B, C and D, decrease net realized and unrealized loss on investments per share by $0.01 for Classes A, B, C and D, and decrease the ratios of net investment income to average net assets from 10.77% to 10.61% for Class A, from 10.02% to 9.86% for Classes B, C, and D, and from 11.53% to 11.48% for Class I. The effect of this change per share for Class I was less than $0.01. The ratios for periods prior to January 1, 2001, have not been restated. |

| 30 | ||

| 31 | ||

| Robert B. Catell 3, 4 | William C. Morris 1 | ||

• Chairman and Chief Executive Officer, KeySpan Corporation | • Chairman of the Board, J. & W. Seligman & Co. Incorporated • Chairman, Carbo Ceramics Inc | ||

| John R. Galvin 2, 4 | Leroy C. Richie 2, 4 | ||

• Dean Emeritus, Fletcher School of Law and Diplomacy at Tufts University | • Chairman and CEO, Q Standards Worldwide, Inc. • Director, Kerr-McGee Corporation | ||

| Paul C. Guidone 1 | Robert L. Shafer 3, 4 | ||

• Chief Investment Officer, J. & W. Seligman & Co. Incorporated | • Retired Vice President, Pfizer Inc. | ||

Alice S. Ilchman 3, 4 | James N. Whitson 2, 4 | ||

• Director Emerita, Sarah Lawrence College • Trustee, Committee for Economic Development | • Director, C-SPAN • Director, CommScope, Inc. | ||

| Frank A. McPherson 3, 4 | Brian T. Zino 1 | ||

• Director, ConocoPhillips Inc. • Director, Integris Health | • President, J. & W. Seligman & Co. Incorporated • Chairman, Seligman Data Corp. • Chairman, ICI Mutual Insurance Company • Member of the Board of Governors, Investment Company Institute | ||

| John E. Merow 2, 4 | |||

• Director, Commonwealth Industries, Inc. • Trustee, New York-Presbyterian Hospital • Retired Chairman and Senior Partner, Sullivan & Cromwell LLP, Law Firm | |||

| Betsy S. Michel 2, 4 | |||

• Trustee, The Geraldine R. Dodge Foundation | Member: 1 Executive Committee 2 Audit Committee 3 Trustee Nominating Committee 4 Board Operations Committee | ||

| William C. Morris | Thomas G. Rose | |

Chairman | Vice President | |

| Brian T. Zino | Lawrence P. Vogel | |

President and Chief Executive Officer | Vice President and Treasurer | |

| Kendall C. Peterson | Frank J. Nasta | |

Vice President | Secretary |

| 32 | ||

100 Park Avenue • New York, NY 10017

www.seligman.com

www.seligman.com

(on-line account information available)

(800) 445-1777 Retirement Plan Services

(212) 682-7600 Outside the United States

(800) 622-4597 24-Hour Automated

Telephone Access Service

| By: |  |

| Brian T. Zino | |

| President and Chief Executive Officer | |

| Date: | August 22, 2003 |

| By: |  |

| Brian T. Zino | |

| President and Chief Executive Officer | |

| Date: | August 22, 2003 |

| By: | /S/ LAWRENCE P. VOGEL |

| Lawrence P. Vogel | |

| Vice President, Treasurer and Chief Financial Officer |