4th Quarter 2018 Earnings February 20, 2019

Safe Harbor This presentation is intended to be disclosure through methods reasonably designed to provide broad, non- exclusionary distribution to the public in compliance with the SEC's Fair Disclosure Regulation. This presentation contains certain ''forward-looking'' statements made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, the statements in this presentation regarding our expectations with respect to our 2019 financial performance, as well as other statements related to the company’s expectations regarding the performance of its business, growth, improvement of operational performance, and the performance of and synergies from the recently acquired Byram Healthcare and Halyard businesses. Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from those projected or contemplated in the forward-looking statements. Investors should refer to Owens & Minor’s Annual Report on Form 10-K for the year ended December 31, 2017, filed with the SEC including the sections captioned “Cautionary Note Regarding Forward-Looking Statements” and “Item 1A. Risk Factors,” and subsequent quarterly reports on Form 10-Q and current reports on Form 8-K filed with or furnished to the SEC, for a discussion of certain known risk factors that could cause the company’s actual results to differ materially from its current estimates. These filings are available at www.owens- minor.com. Given these risks and uncertainties, Owens & Minor can give no assurance that any forward- looking statements will, in fact, transpire and, therefore, cautions investors not to place undue reliance on them. Owens & Minor specifically disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Owens & Minor uses its web site, www.owens-minor.com, as a channel of distribution for material company information, including news releases, investor presentations and financial information. This information is routinely posted and accessible under the Investor Relations section. This presentation contains non-GAAP financial measures related to the Company’s performance. You can find a reconciliation of these non-GAAP financial measures to their most comparable GAAP financial measure in the Appendix to this presentation. 2

2018 Highlights . Revenue . Growth of 6.4% for 2018 driven by contributions from Byram and Halyard . Global Solutions . Efficiency improvement and operating performance are top priorities . Byram continues to exceed our expectations . Global Products . Halyard revenue growth on track . Net Income per Share . Adjusted fourth quarter expectations achieved excluding costs associated with exit of former CEO 3

Global Solutions Segment Results (S in millions) 2018 2017 Net revenue $9,188.1 $9,186.0 Operating Income 104.1 141.1 . Byram, acquired in August 2017, contributed $340 million to annual revenue growth . Results negatively affected by: . Continuing distribution margin pressure . Warehouse inefficiencies in certain facilities . Increased expenses incurred to develop new customer solutions . Executive severance expenses 4

Global Products Segment Results (S in millions) 2018 2017 Net revenue $1,111.3 $504.0 Operating Income 75.7 38.5 . Results reflect Halyard revenue contribution of $664 million . Operating income increase driven primarily by Halyard contributions 5

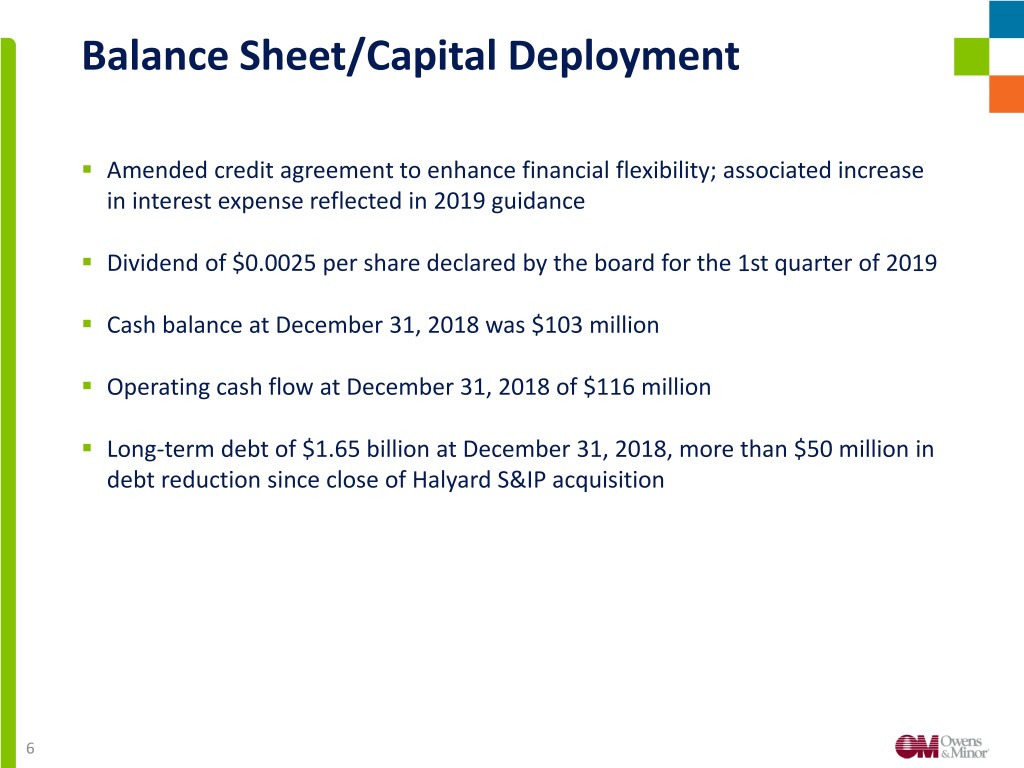

Balance Sheet/Capital Deployment . Amended credit agreement to enhance financial flexibility; associated increase in interest expense reflected in 2019 guidance . Dividend of $0.0025 per share declared by the board for the 1st quarter of 2019 . Cash balance at December 31, 2018 was $103 million . Operating cash flow at December 31, 2018 of $116 million . Long-term debt of $1.65 billion at December 31, 2018, more than $50 million in debt reduction since close of Halyard S&IP acquisition 6

2019 Guidance & Modeling Assumptions For 2019, the company expects adjusted net income per share to be in a range of $0.60 - $0.75 per share Modeling1 Full Year 2019 Revenue Flat compared to 2018 Gross Margin 15.3-15.4% DS&A 13.7-13.8% Interest expense $100-110m Capital Expenditures $55-65m Adj. Effective Tax Rate ~29% 1. Modeling Parameters are assumptions used for initial adjusted EPS guidance for 2019, and the Company undertakes no obligation to update such assumptions/modeling parameters subsequent to the date of this presentation (February 20, 2019). Excludes acquisition-related and exit & realignment charges. 7

APPENDIX 8

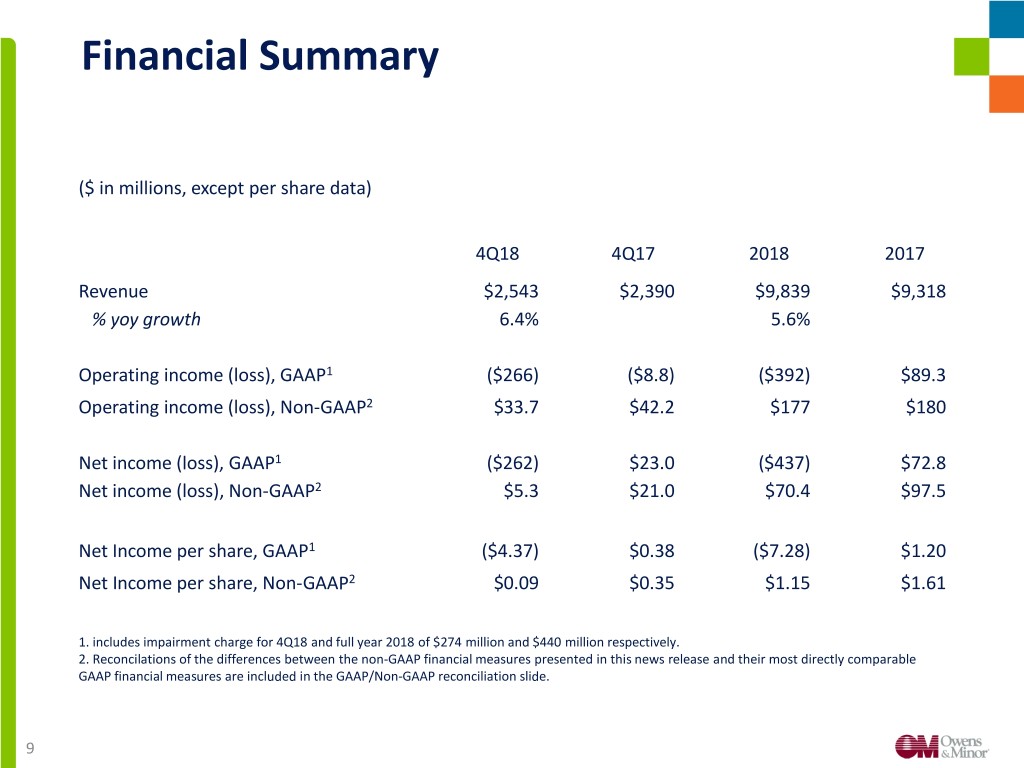

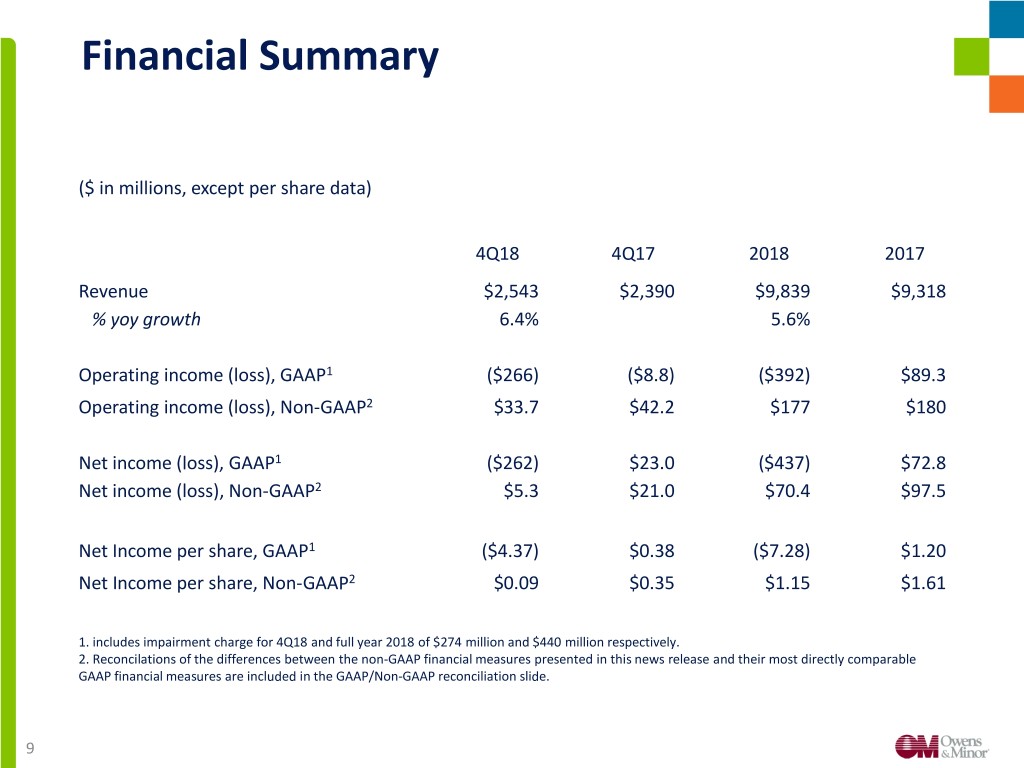

Financial Summary ($ in millions, except per share data) 4Q18 4Q17 2018 2017 Revenue $2,543 $2,390 $9,839 $9,318 % yoy growth 6.4% 5.6% Operating income (loss), GAAP1 ($266) ($8.8) ($392) $89.3 Operating income (loss), Non-GAAP2 $33.7 $42.2 $177 $180 Net income (loss), GAAP1 ($262) $23.0 ($437) $72.8 Net income (loss), Non-GAAP2 $5.3 $21.0 $70.4 $97.5 Net Income per share, GAAP1 ($4.37) $0.38 ($7.28) $1.20 Net Income per share, Non-GAAP2 $0.09 $0.35 $1.15 $1.61 1. includes impairment charge for 4Q18 and full year 2018 of $274 million and $440 million respectively. 2. Reconcilations of the differences between the non-GAAP financial measures presented in this news release and their most directly comparable GAAP financial measures are included in the GAAP/Non-GAAP reconciliation slide. 9

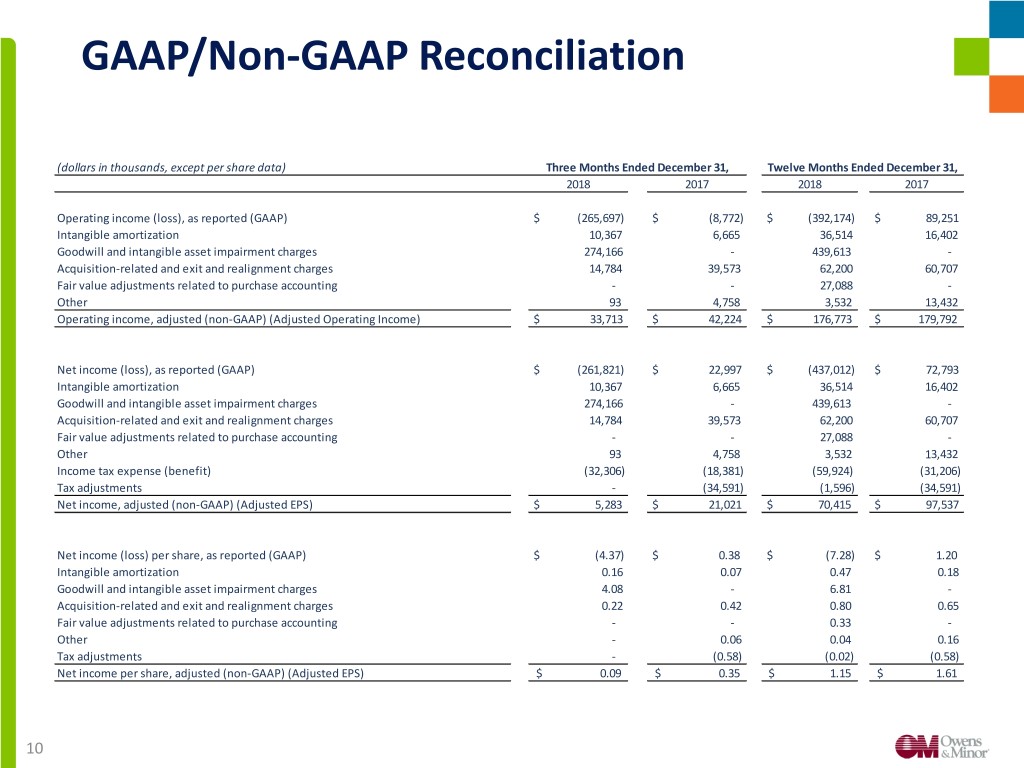

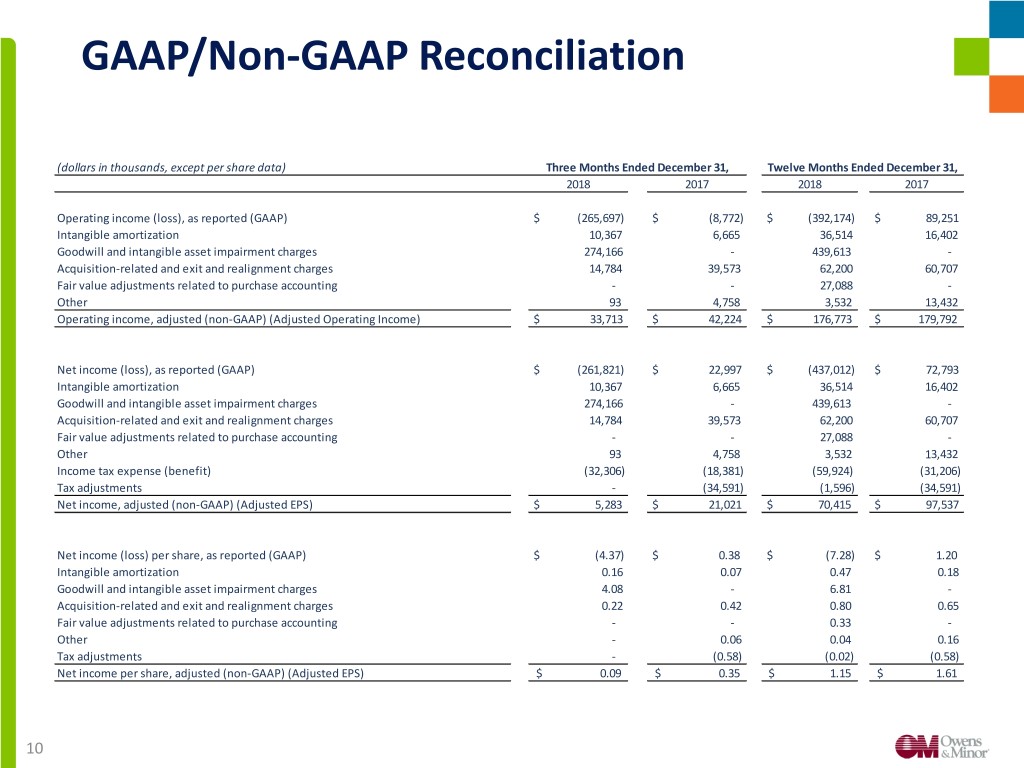

GAAP/Non-GAAP Reconciliation (dollars in thousands, except per share data) Three Months Ended December 31, Twelve Months Ended December 31, 2018 2017 2018 2017 Operating income (loss), as reported (GAAP) $ (265,697) $ (8,772) $ (392,174) $ 89,251 Intangible amortization 10,367 6,665 36,514 16,402 Goodwill and intangible asset impairment charges 274,166 - 439,613 - Acquisition-related and exit and realignment charges 14,784 39,573 62,200 60,707 Fair value adjustments related to purchase accounting - - 27,088 - Other 93 4,758 3,532 13,432 Operating income, adjusted (non-GAAP) (Adjusted Operating Income) $ 33,713 $ 42,224 $ 176,773 $ 179,792 Net income (loss), as reported (GAAP) $ (261,821) $ 22,997 $ (437,012) $ 72,793 Intangible amortization 10,367 6,665 36,514 16,402 Goodwill and intangible asset impairment charges 274,166 - 439,613 - Acquisition-related and exit and realignment charges 14,784 39,573 62,200 60,707 Fair value adjustments related to purchase accounting - - 27,088 - Other 93 4,758 3,532 13,432 Income tax expense (benefit) (32,306) (18,381) (59,924) (31,206) Tax adjustments - (34,591) (1,596) (34,591) Net income, adjusted (non-GAAP) (Adjusted EPS) $ 5,283 $ 21,021 $ 70,415 $ 97,537 Net income (loss) per share, as reported (GAAP) $ (4.37) $ 0.38 $ (7.28) $ 1.20 Intangible amortization 0.16 0.07 0.47 0.18 Goodwill and intangible asset impairment charges 4.08 - 6.81 - Acquisition-related and exit and realignment charges 0.22 0.42 0.80 0.65 Fair value adjustments related to purchase accounting - - 0.33 - Other - 0.06 0.04 0.16 Tax adjustments - (0.58) (0.02) (0.58) Net income per share, adjusted (non-GAAP) (Adjusted EPS) $ 0.09 $ 0.35 $ 1.15 $ 1.61 10