Exhibit 99

Certain information in this Supplemental Information Package contains Non-GAAP financial measures. These Non-GAAP financial measures are REIT industry financial measures that are not calculated in accordance with accounting principles generally accepted in the United States of America. Please see page 15 for a definition of these Non-GAAP financial measures and page 7 for the reconciliation of certain captions in the Supplemental Information Package to the statement of operations as reported in the Company’s filings with the SEC on Form 10-Q.

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 2 |

| Financial Highlights | | | | | | | | | | | | |

| (dollars in thousands except per share amounts) (unaudited) | | | | | | | | | |

| | | | | | | | | | |

| | | Three Months Ended | | | Six Months Ended | |

| | | June 30, 2023 | | | June 30, 2022 | | | June 30, 2023 | | | June 30, 2022 | |

| Operating Information | | | | | | | | | | | | | | | | |

| Number of Communities | | | | | | | | | | | 135 | | | | 130 | |

| Number of Sites | | | | | | | | | | | 25,729 | | | | 24,411 | |

| Rental and Related Income | | $ | 47,063 | | | $ | 42,229 | | | $ | 92,368 | | | $ | 83,806 | |

| Community Operating Expenses | | $ | 20,034 | | | $ | 18,923 | | | $ | 40,122 | | | $ | 36,994 | |

| Community NOI | | $ | 27,029 | | | $ | 23,306 | | | $ | 52,246 | | | $ | 46,812 | |

| Expense Ratio | | | 42.6 | % | | | 44.8 | % | | | 43.4 | % | | | 44.1 | % |

| Sales of Manufactured Homes | | $ | 8,227 | | | $ | 6,994 | | | $ | 15,529 | | | $ | 11,285 | |

| Number of Homes Sold | | | 91 | | | | 86 | | | | 174 | | | | 147 | |

| Number of Rentals Added | | | 304 | | | | 99 | | | | 534 | | | | 151 | |

| Net Loss | | $ | (403 | ) | | $ | (6,688 | ) | | $ | (1,904 | ) | | $ | (3,413 | ) |

| Net Loss Attributable to Common Shareholders | | $ | (4,418 | ) | | $ | (22,478 | ) | | $ | (9,715 | ) | | $ | (26,803 | ) |

| Adjusted EBITDA excluding Non-Recurring Other Expense | | $ | 25,270 | | | $ | 22,761 | | | $ | 48,731 | | | $ | 44,877 | |

| FFO Attributable to Common Shareholders | | $ | 12,043 | | | $ | (320 | ) | | $ | 22,683 | | | $ | 8,224 | |

| Normalized FFO Attributable to Common Shareholders | | $ | 13,049 | | | $ | 12,026 | | | $ | 24,769 | | | $ | 22,439 | |

| | | | | | | | | | | | | | | | | |

| Shares Outstanding and Per Share Data | | | | | | | | | | | | | | | | |

| Weighted Average Shares Outstanding | | | | | | | | | | | | | | | | |

| Basic and diluted | | | 61,236 | | | | 54,215 | | | | 60,186 | | | | 53,224 | |

| Net Loss Attributable to Common Shareholders per Share – | | | | | | | | | | | | | | | | |

| Basic and Diluted | | $ | (0.07 | ) | | $ | (0.41 | ) | | $ | (0.16 | ) | | $ | (0.50 | ) |

| FFO per Share – | | | | | | | | | | | | | | | | |

| Diluted | | $ | 0.19 | | | $ | (0.01 | ) | | $ | 0.37 | | | $ | 0.15 | |

| Normalized FFO per Share – | | | | | | | | | | | | | | | | |

| Diluted | | $ | 0.21 | | | $ | 0.22 | | | $ | 0.41 | | | $ | 0.41 | |

| Dividends per Common Share | | $ | 0.205 | | | $ | 0.20 | | | $ | 0.41 | | | $ | 0.40 | |

| | | | | | | | | | | | | | | | | |

| Balance Sheet | | | | | | | | | | | | | | | | |

| Total Assets | | | | | | | | | | $ | 1,393,869 | | | $ | 1,423,265 | |

| Total Liabilities | | | | | | | | | | $ | 756,002 | | | $ | 901,370 | |

| | | | | | | | | | | | | | | | | |

| Market Capitalization | | | | | | | | | | | | | | | | |

| Total Debt, Net of Unamortized Debt Issuance Costs | | | | | | | | | | $ | 726,862 | | | $ | 625,997 | |

| Equity Market Capitalization | | | | | | | | | | $ | 1,007,888 | | | $ | 965,386 | |

| Series D Preferred Stock | | | | | | | | | | $ | 265,032 | | | $ | 215,219 | |

| Total Market Capitalization | | | | | | | | | | $ | 1,999,782 | | | $ | 1,806,602 | |

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 3 |

| Consolidated Balance Sheets | | | | | | |

| (in thousands except per share amounts) | | | | | | |

| | | | | | | |

| | | June 30, | | | December 31, | |

| | | 2023 | | | 2022 | |

| | | (unaudited) | | | | |

| ASSETS | | | | | | | | |

| Investment Property and Equipment | | | | | | | | |

| Land | | $ | 89,604 | | | $ | 86,619 | |

| Site and Land Improvements | | | 862,276 | | | | 846,218 | |

| Buildings and Improvements | | | 35,869 | | | | 35,933 | |

| Rental Homes and Accessories | | | 478,595 | | | | 422,818 | |

| Total Investment Property | | | 1,466,344 | | | | 1,391,588 | |

| Equipment and Vehicles | | | 27,743 | | | | 26,721 | |

| Total Investment Property and Equipment | | | 1,494,087 | | | | 1,418,309 | |

| Accumulated Depreciation | | | (389,012 | ) | | | (363,098 | ) |

| Net Investment Property and Equipment | | | 1,105,075 | | | | 1,055,211 | |

| | | | | | | | | |

| Other Assets | | | | | | | | |

| Cash and Cash Equivalents | | | 41,484 | | | | 29,785 | |

| Marketable Securities at Fair Value | | | 36,701 | | | | 42,178 | |

| Inventory of Manufactured Homes | | | 61,054 | | | | 88,468 | |

| Notes and Other Receivables, net | | | 75,491 | | | | 67,271 | |

| Prepaid Expenses and Other Assets | | | 15,033 | | | | 20,011 | |

| Land Development Costs | | | 35,837 | | | | 23,250 | |

| Investment in Joint Venture | | | 23,194 | | | | 18,422 | |

| Total Other Assets | | | 288,794 | | | | 289,385 | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | 1,393,869 | | | $ | 1,344,596 | |

| | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | |

| Liabilities | | | | | | | | |

| Mortgages Payable, net of unamortized debt issuance costs | | $ | 444,797 | | | $ | 508,938 | |

| Other Liabilities | | | | | | | | |

| Accounts Payable | | | 6,704 | | | | 6,387 | |

| Loans Payable, net of unamortized debt issuance costs | | | 182,434 | | | | 153,531 | |

| Series A Bonds, net of unamortized debt issuance costs | | | 99,631 | | | | 99,207 | |

| Accrued Liabilities and Deposits | | | 13,318 | | | | 16,852 | |

| Tenant Security Deposits | | | 9,118 | | | | 8,485 | |

| Total Other Liabilities | | | 311,205 | | | | 284,462 | |

| Total Liabilities | | | 756,002 | | | | 793,400 | |

| | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES | | | | | | | | |

| | | | | | | | | |

| Shareholders’ Equity: | | | | | | | | |

| Series D- 6.375% Cumulative Redeemable Preferred Stock, $0.10 par value per share; 13,700 and 9,300 shares authorized as of June 30, 2023 and December 31, 2022, respectively; 10,601 and 9,015 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | | | 265,032 | | | | 225,379 | |

| Common Stock- $0.10 par value per share: 153,714 and 154,048 shares authorized as of June 30, 2023 and December 31, 2022, respectively; 63,072 and 57,595 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | | | 6,307 | | | | 5,760 | |

| Excess Stock- $0.10 par value per share: 3,000 shares authorized; no shares issued or outstanding as of June 30, 2023 and December 31, 2022 | | | -0- | | | | -0- | |

| Additional Paid-In Capital | | | 389,736 | | | | 343,189 | |

| Undistributed Income (Accumulated Deficit) | | | (25,364 | ) | | | (25,364 | ) |

| Total UMH Properties, Inc. Shareholders’ Equity | | | 635,711 | | | | 548,964 | |

| Non-Controlling Interest in Consolidated Subsidiaries | | | 2,156 | | | | 2,232 | |

| Total Shareholders’ Equity | | | 637,867 | | | | 551,196 | |

| | | | | | | | | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | $ | 1,393,869 | | | $ | 1,344,596 | |

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 4 |

| Consolidated Statements of Income (Loss) | | | | | | | | | |

| (in thousands except per share amounts) (unaudited) | | | | | | |

| | | | | | | |

| | | Three Months Ended | | | Six Months Ended | |

| | | June 30, 2023 | | | June 30, 2022 | | | June 30, 2023 | | | June 30, 2022 | |

| INCOME: | | | | | | | | | | | | | | | | |

| Rental and Related Income | | $ | 47,063 | | | $ | 42,229 | | | $ | 92,368 | | | $ | 83,806 | |

| Sales of Manufactured Homes | | | 8,227 | | | | 6,994 | | | | 15,529 | | | | 11,285 | |

| TOTAL INCOME | | | 55,290 | | | | 49,223 | | | | 107,897 | | | | 95,091 | |

| | | | | | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | | | | | |

| Community Operating Expenses | | | 20,034 | | | | 18,923 | | | | 40,122 | | | | 36,994 | |

| Cost of Sales of Manufactured Homes | | | 5,740 | | | | 4,837 | | | | 10,725 | | | | 7,820 | |

| Selling Expenses | | | 1,665 | | | | 1,214 | | | | 3,477 | | | | 2,369 | |

| General and Administrative Expenses | | | 5,181 | | | | 4,300 | | | | 10,163 | | | | 8,198 | |

| Depreciation Expense | | | 13,751 | | | | 11,984 | | | | 27,124 | | | | 23,701 | |

| TOTAL EXPENSES | | | 46,371 | | | | 41,258 | | | | 91,611 | | | | 79,082 | |

| | | | | | | | | | | | | | | | | |

| OTHER INCOME (EXPENSE): | | | | | | | | | | | | | | | | |

| Interest Income | | | 1,217 | | | | 1,068 | | | | 2,355 | | | | 1,978 | |

| Dividend Income | | | 531 | | | | 721 | | | | 1,237 | | | | 1,501 | |

| Gain (Loss) on Sales of Marketable Securities, net | | | (1 | ) | | | -0- | | | | (43 | ) | | | 30,721 | |

| Decrease in Fair Value of Marketable Securities | | | (2,548 | ) | | | (10,044 | ) | | | (4,943 | ) | | | (41,794 | ) |

| Other Income | | | 288 | | | | 196 | | | | 616 | | | | 416 | |

| Loss on Investment in Joint Venture | | | (175 | ) | | | (136 | ) | | | (480 | ) | | | (257 | ) |

| Interest Expense | | | (8,639 | ) | | | (6,414 | ) | | | (16,969 | ) | | | (11,901 | ) |

| TOTAL OTHER INCOME (EXPENSE) | | | (9,327 | ) | | | (14,609 | ) | | | (18,227 | ) | | | (19,336 | ) |

| | | | | | | | | | | | | | | | | |

| Loss before Gain (Loss) on Sales of Investment Property and Equipment | | | (408 | ) | | | (6,644 | ) | | | (1,941 | ) | | | (3,327 | ) |

| Gain (Loss) on Sales of Investment Property and Equipment | | | 5 | | | | (44 | ) | | | 37 | | | | (86 | ) |

| NET LOSS | | | (403 | ) | | | (6,688 | ) | | | (1,904 | ) | | | (3,413 | ) |

| | | | | | | | | | | | | | | | | |

| Preferred Dividends | | | (4,051 | ) | | | (7,600 | ) | | | (7,887 | ) | | | (15,200 | ) |

| Loss Attributable to Non-Controlling Interest | | | 36 | | | | -0- | | | | 76 | | | | -0- | |

| Redemption of Preferred Stock | | | -0- | | | | (8,190 | ) | | | -0- | | | | (8,190 | ) |

| | | | | | | | | | | | | | | | | |

NET LOSS ATTRIBUTABLE TO COMMON SHAREHOLDERS | | $ | (4,418 | ) | | $ | (22,478 | ) | | $ | (9,715 | ) | | $ | (26,803 | ) |

| | | | | | | | | | | | | | | | | |

NET LOSS ATTRIBUTABLE TO COMMON SHAREHOLDERS PER SHARE – | | | | | | | | | | | | | | | | |

| Basic and Diluted | | $ | (0.07 | ) | | $ | (0.41 | ) | | $ | (0.16 | ) | | $ | (0.50 | ) |

| | | | | | | | | | | | | | | | | |

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: | | | | | | | | | | | | | | | | |

| Basic and Diluted | | | 61,236 | | | | 54,215 | | | | 60,186 | | | | 53,224 | |

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 5 |

| Consolidated Statements of Cash Flows | | | | | | |

| (in thousands) (unaudited) | | | |

| | | | |

| | | Six Months Ended | |

| | | June 30, 2023 | | | June 30, 2022 | |

| | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | |

| Net Loss | | $ | (1,904 | ) | | $ | (3,413 | ) |

| Non-Cash Items Included in Net Loss: | | | | | | | | |

| Depreciation | | | 27,124 | | | | 23,701 | |

| Amortization of Financing Costs | | | 1,056 | | | | 939 | |

| Stock Compensation Expense | | | 2,999 | | | | 2,301 | |

| Provision for Uncollectible Notes and Other Receivables | | | 797 | | | | 611 | |

| (Gain) Loss on Sales of Marketable Securities, net | | | 43 | | | | (30,721 | ) |

| Decrease in Fair Value of Marketable Securities | | | 4,943 | | | | 41,794 | |

| (Gain) Loss on Sales of Investment Property and Equipment | | | (37 | ) | | | 86 | |

| Changes in Operating Assets and Liabilities: | | | | | | | | |

| Inventory of Manufactured Homes | | | 27,414 | | | | (22,333 | ) |

| Notes and Other Receivables, net of notes acquired with acquisitions | | | (9,017 | ) | | | (4,912 | ) |

| Prepaid Expenses and Other Assets | | | 1,591 | | | | (1,555 | ) |

| Accounts Payable | | | 317 | | | | 298 | |

| Accrued Liabilities and Deposits | | | (3,534 | ) | | | (1,614 | ) |

| Tenant Security Deposits | | | 633 | | | | 233 | |

| Net Cash Provided by Operating Activities | | | 52,425 | | | | 5,415 | |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

| Purchase of Manufactured Home Communities | | | (3,679 | ) | | | (17,306 | ) |

| Purchase of Investment Property and Equipment | | | (74,604 | ) | | | (28,646 | ) |

| Proceeds from Sales of Investment Property and Equipment | | | 1,332 | | | | 1,887 | |

| Additions to Land Development Costs | | | (12,587 | ) | | | (8,733 | ) |

| Purchase of Marketable Securities | | | (11 | ) | | | (10 | ) |

| Proceeds from Sales of Marketable Securities | | | 502 | | | | 55,752 | |

| Investment in Joint Venture | | | (4,772 | ) | | | (2,073 | ) |

| Net Cash Provided by (Used in) Investing Activities | | | (93,819 | ) | | | 871 | |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

| Proceeds from Mortgages | | | -0- | | | | 25,643 | |

| Net Proceeds from Short-Term Borrowings | | | 29,527 | | | | 11,493 | |

| Principal Payments of Mortgages and Loans | | | (64,583 | ) | | | (8,787 | ) |

| Proceeds from Bond Issuance | | | -0- | | | | 102,670 | |

| Financing Costs on Debt | | | (814 | ) | | | (5,285 | ) |

| Proceeds from At-The-Market Preferred Equity Program, net of offering costs | | | 34,600 | | | | -0- | |

| Proceeds from At-The-Market Common Equity Program, net of offering costs | | | 78,447 | | | | 58,236 | |

| Proceeds from Issuance of Common Stock in the DRIP, net of dividend reinvestments | | | 3,197 | | | | 1,498 | |

| Proceeds from Exercise of Stock Options | | | 550 | | | | 3,213 | |

| Preferred Dividends Paid | | | (7,887 | ) | | | (15,200 | ) |

| Common Dividends Paid, net of dividend reinvestments | | | (23,331 | ) | | | (19,780 | ) |

| Net Cash Provided by Financing Activities | | | 49,706 | | | | 153,701 | |

| | | | | | | | | |

| NET INCREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | | | 8,312 | | | | 159,987 | |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF PERIOD | | | 40,876 | | | | 125,026 | |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD | | $ | 49,188 | | | $ | 285,013 | |

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 6 |

| Reconciliation of Net Loss to Adjusted EBITDA and Net Loss Attributable to Common Shareholders to FFO and Normalized FFO |

| (in thousands) (unaudited) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | Three Months Ended | | | Six Months Ended | |

| | | June 30, 2023 | | | June 30, 2022 | | | June 30, 2023 | | | June 30, 2022 | |

| Reconciliation of Net Loss to Adjusted EBITDA | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net Loss | | $ | (403 | ) | | $ | (6,688 | ) | | $ | (1,904 | ) | | $ | (3,413 | ) |

| Interest Expense | | | 8,639 | | | | 6,414 | | | | 16,969 | | | | 11,901 | |

| Franchise Taxes | | | 100 | | | | 96 | | | | 201 | | | | 192 | |

| Depreciation Expense | | | 13,751 | | | | 11,984 | | | | 27,124 | | | | 23,701 | |

| Depreciation Expense from Unconsolidated Joint Venture | | | 166 | | | | 86 | | | | 325 | | | | 167 | |

| Decrease in Fair Value of Marketable Securities | | | 2,548 | | | | 10,044 | | | | 4,943 | | | | 41,794 | |

| (Gain) Loss on Sales of Marketable Securities, net | | | 1 | | | | -0- | | | | 43 | | | | (30,721 | ) |

| Adjusted EBITDA | | | 24,802 | | | | 21,936 | | | | 47,701 | | | | 43,621 | |

| Non- Recurring Other Expense (2) | | | 468 | | | | 825 | | | | 1,030 | | | | 1,256 | |

Adjusted EBITDA without Non-recurring Other Expense | | $ | 25,270 | | | $ | 22,761 | | | $ | 48,731 | | | $ | 44,877 | |

| | | | | | | | | | | | | | | | | |

| Reconciliation of Net Loss Attributable to Common Shareholders to Funds from Operations | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net Loss Attributable to Common Shareholders | | $ | (4,418 | ) | | $ | (22,478 | ) | | $ | (9,715 | ) | | $ | (26,803 | ) |

| Depreciation Expense | | | 13,751 | | | | 11,984 | | | | 27,124 | | | | 23,701 | |

| Depreciation Expense from Unconsolidated Joint Venture | | | 166 | | | | 86 | | | | 325 | | | | 167 | |

| (Gain) Loss on Sales of Investment Property and Equipment | | | (5 | ) | | | 44 | | | | (37 | ) | | | 86 | |

| Decrease in Fair Value of Marketable Securities | | | 2,548 | | | | 10,044 | | | | 4,943 | | | | 41,794 | |

| (Gain) Loss on Sales of Marketable Securities, net | | | 1 | | | | -0- | | | | 43 | | | | (30,721 | ) |

Funds from Operations Attributable to Common Shareholders (“FFO”) | | | 12,043 | | | | (320 | ) | | | 22,683 | | | | 8,224 | |

| | | | | | | | | | | | | | | | | |

| Adjustments: | | | | | | | | | | | | | | | | |

| Redemption of Preferred Stock (1) | | | -0- | | | | 10,988 | | | | -0- | | | | 12,020 | |

| Amortization of Financing Costs (1) | | | 538 | | | | 533 | | | | 1,056 | | | | 939 | |

| Non- Recurring Other Expense (2) | | | 468 | | | | 825 | | | | 1,030 | | | | 1,256 | |

Normalized Funds from Operations Attributable to Common Shareholders (“Normalized FFO”) (1) | | $ | 13,049 | | | $ | 12,026 | | | $ | 24,769 | | | $ | 22,439 | |

(1) Normalized FFO as previously reported for the three and six months ended June 30, 2022, was $8,695 and $17,670, respectively. During 2022, the Company incurred the carrying cost of excess cash for the redemption of preferred stock. Additionally, due to the change in sources of capital, amortization expense is expected to become more significant and is therefore included as an adjustment to Normalized FFO for the three and six months ended June 30, 2023 and 2022. After making these adjustments for the three and six months ended June 30, 2022, Normalized FFO was $12,026 and $22,439, respectively.

(2) Consists of special bonus and restricted stock grants for the August 2020 groundbreaking Fannie Mae financing, which are being expensed over the vesting period ($431 and $862, respectively) and non-recurring expenses for the joint venture with Nuveen ($3 and $50, respectively), one-time legal fees ($30 and $50, respectively), fees related to the establishment of the UMH OZ Fund, LLC ($4 and $37, respectively), and costs associated with an acquisition that was not completed ($0 and $31, respectively) for the three and six months ended June 30, 2023. Consists of special bonus and restricted stock grants for the August groundbreaking Fannie Mae financing, which are being expensed over the vesting period ($431 and $862, respectively) and non-recurring expenses for the joint venture with Nuveen ($52), early extinguishment of debt ($193) and one-time legal fees ($149) for the three and six months ended June 30, 2022.

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 7 |

| Market Capitalization, Debt and Coverage Ratios | | | | | | | | | |

| (in thousands except per share amounts) (unaudited) | | | | | | | | | |

| | | | | | | | | | |

| | | Six Months Ended | | | Year Ended | |

| | | June 30, 2023 | | | June 30, 2022 | | | December 31, 2022 | |

| Shares Outstanding | | | 63,072 | | | | 54,665 | | | | 57,595 | |

| Market Price Per Share | | $ | 15.98 | | | $ | 17.66 | | | $ | 16.10 | |

| Equity Market Capitalization | | $ | 1,007,888 | | | $ | 965,386 | | | $ | 927,298 | |

| Total Debt | | | 726,862 | | | | 625,997 | | | | 761,676 | |

| Preferred | | | 265,032 | | | | 215,219 | | | | 225,379 | |

| Total Market Capitalization | | $ | 1,999,782 | | | $ | 1,806,602 | | | $ | 1,914,353 | |

| | | | | | | | | | | | | |

| Total Debt | | $ | 726,862 | | | $ | 625,997 | | | $ | 761,676 | |

| Less: Cash and Cash Equivalents | | | (41,484 | ) | | | (275,807 | ) | | | (29,785 | ) |

| Net Debt | | | 685,378 | | | | 350,190 | | | | 731,891 | |

| Less: Marketable Securities at Fair Value (“Securities”) | | | (36,701 | ) | | | (46,932 | ) | | | (42,178 | ) |

| Net Debt Less Securities | | $ | 648,677 | | | $ | 303,258 | | | $ | 689,713 | |

| | | | | | | | | | | | | |

| Interest Expense | | $ | 16,969 | | | $ | 11,901 | | | $ | 26,439 | |

| Capitalized Interest | | | 2,699 | | | | 712 | | | | 2,730 | |

| Preferred Dividends | | | 7,887 | | | | 15,200 | | | | 23,221 | |

| Total Fixed Charges | | $ | 27,555 | | | $ | 27,813 | | | $ | 52,390 | |

| | | | | | | | | | | | | |

| Adjusted EBITDA excluding Non-Recurring Other Expense | | $ | 48,731 | | | $ | 44,877 | | | $ | 89,926 | |

| | | | | | | | | | | | | |

| Debt and Coverage Ratios | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net Debt / Total Market Capitalization | | | 34.3 | % | | | 19.4 | % | | | 38.2 | % |

| | | | | | | | | | | | | |

| Net Debt Plus Preferred / Total Market Capitalization | | | 47.5 | % | | | 31.3 | % | | | 50.0 | % |

| | | | | | | | | | | | | |

| Net Debt Less Securities / Total Market Capitalization | | | 32.4 | % | | | 16.8 | % | | | 36.0 | % |

| | | | | | | | | | | | | |

| Net Debt Less Securities Plus Preferred / Total Market Capitalization | | | 45.7 | % | | | 28.7 | % | | | 47.8 | % |

| | | | | | | | | | | | | |

| Interest Coverage | | | 2.5 | x | | | 3.6 | x | | | 3.1 | x |

| | | | | | | | | | | | | |

| Fixed Charge Coverage | | | 1.8 | x | | | 1.6 | x | | | 1.7 | x |

| | | | | | | | | | | | | |

| Net Debt / Adjusted EBITDA excluding Non-Recurring Other Expense | | | 7.0 | x | | | 3.9 | x | | | 8.1 | x |

| | | | | | | | | | | | | |

| Net Debt Less Securities / Adjusted EBITDA excluding Non-Recurring Other Expense | | | 6.7 | x | | | 3.4 | x | | | 7.7 | x |

| | | | | | | | | | | | | |

| Net Debt Plus Preferred / Adjusted EBITDA excluding Non-Recurring Other Expense | | | 9.8 | x | | | 6.3 | x | | | 10.6 | x |

| | | | | | | | | | | | | |

| Net Debt Less Securities Plus Preferred / Adjusted EBITDA excluding Non-Recurring Other Expense | | | 9.4 | x | | | 5.8 | x | | | 10.2 | x |

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 8 |

| Debt Analysis | | | | | | | | | |

| (dollars in thousands) (unaudited) | | | | | | |

| | | | | | | |

| | | Six Months Ended | | | Year Ended | |

| | | June 30, 2023 | | | June 30, 2022 | | | December 31, 2022 | |

| Debt Outstanding | | | | | | | | | | | | |

| Mortgages Payable: | | | | | | | | | | | | |

| Fixed Rate Mortgages | | $ | 449,126 | | | $ | 473,559 | | | $ | 513,709 | |

| Unamortized Debt Issuance Costs | | | (4,329 | ) | | | (4,748 | ) | | | (4,771 | ) |

| | | | | | | | | | | | | |

| Mortgages, Net of Unamortized Debt Issuance Costs | | $ | 444,797 | | | $ | 468,811 | | | $ | 508,938 | |

| Loans Payable: | | | | | | | | | | | | |

| Unsecured Line of Credit | | $ | 100,000 | | | $ | 25,000 | | | $ | 75,000 | |

| Other Loans Payable | | | 83,753 | | | | 33,438 | | | | 79,226 | |

| | | | | | | | | | | | | |

| Total Loans Before Unamortized Debt Issuance Costs | | | 183,753 | | | | 58,438 | | | | 154,226 | |

| Unamortized Debt Issuance Costs | | | (1,319 | ) | | | (63 | ) | | | (695 | ) |

| | | | | | | | | | | | | |

| Loans, Net of Unamortized Debt Issuance Costs | | $ | 182,434 | | | $ | 58,375 | | | $ | 153,531 | |

| Bonds Payable: | | | | | | | | | | | | |

| Series A Bonds | | $ | 102,670 | | | $ | 102,670 | | | $ | 102,670 | |

| Unamortized Debt Issuance Costs | | | (3,039 | ) | | | (3,859 | ) | | | (3,463 | ) |

| | | | | | | | | | | | | |

| Bonds, Net of Unamortized Debt Issuance Costs | | $ | 99,631 | | | $ | 98,811 | | | $ | 99,207 | |

| | | | | | | | | | | | | |

| Total Debt, Net of Unamortized Debt Issuance Costs | | $ | 726,862 | | | $ | 625,997 | | | $ | 761,676 | |

| | | | | | | | | | | | | |

| % Fixed/Floating | | | | | | | | | | | | |

| Fixed | | | 75.0 | % | | | 90.8 | % | | | 80.0 | % |

| Floating | | | 25.0 | % | | | 9.2 | % | | | 20.0 | % |

| Total | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | |

| Weighted Average Interest Rates (1) | | | | | | | | | | | | |

| Mortgages Payable | | | 3.88 | % | | | 3.77 | % | | | 3.93 | % |

| Loans Payable | | | 7.42 | % | | | 3.69 | % | | | 6.76 | % |

| Bonds Payable | | | 4.72 | % | | | 4.72 | % | | | 4.72 | % |

| Total Average | | | 4.88 | % | | | 3.92 | % | | | 4.60 | % |

| | | | | | | | | | | | | |

| Weighted Average Maturity (Years) | | | | | | | | | | | | |

| Mortgages Payable | | | 5.2 | | | | 4.9 | | | | 5.1 | |

| | (1) | Weighted average interest rates do not include the effect of unamortized debt issuance costs. |

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 9 |

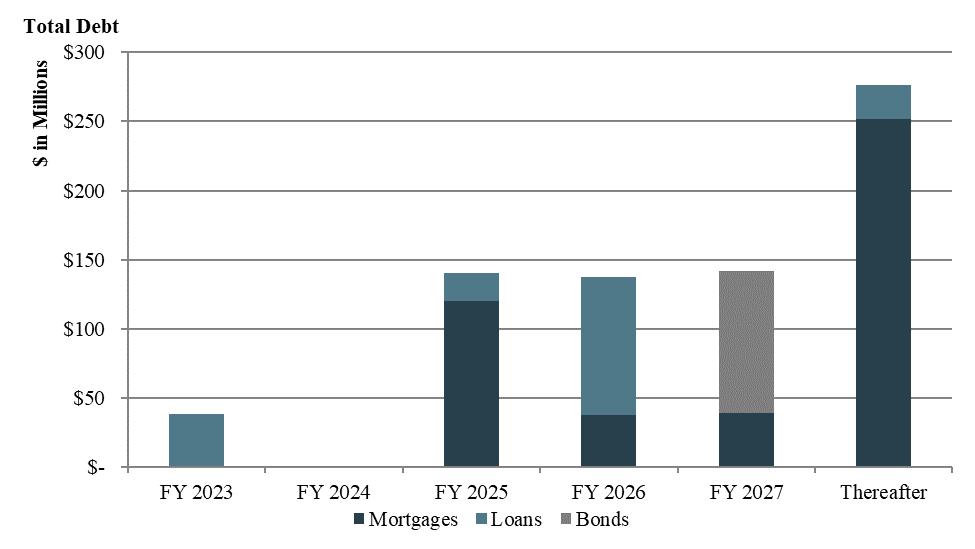

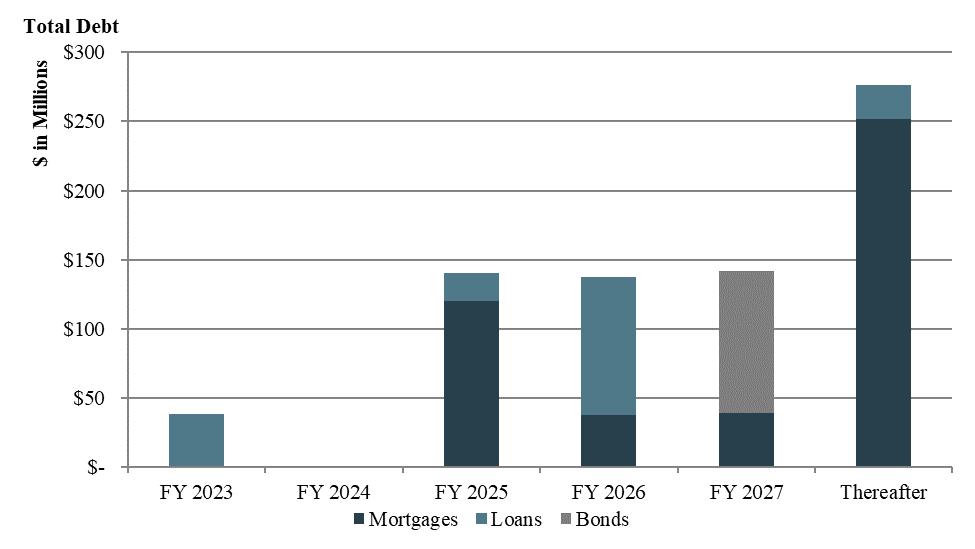

Debt Maturity

(in thousands) (unaudited)

| As of June 30, 2023: | | | | | | | | | | | | | | | |

| Year Ended | | Mortgages | | | Loans | | | Bonds | | | Total | | | % of Total | |

| 2023 | | $ | -0- | | | $ | 38,763 | | | $ | -0- | | | $ | 38,763 | | | | 5.3 | % |

| 2024 | | | -0- | | | | -0- | | | | -0- | | | | -0- | | | | 0.0 | % |

| 2025 | | | 120,526 | | | | 20,000 | | | | -0- | | | | 140,526 | | | | 19.1 | % |

| 2026 | | | 37,724 | | | | 100,000 | (1) | | | -0- | | | | 137,724 | | | | 18.7 | % |

| 2027 | | | 39,463 | | | | -0- | | | | 102,670 | (2) | | | 142,133 | | | | 19.3 | % |

| Thereafter | | | 251,413 | | | | 24,990 | | | | -0- | | | | 276,403 | | | | 37.6 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Total Debt Before Unamortized Debt Issuance Cost | | | 449,126 | | | | 183,753 | | | | 102,670 | | | | 735,549 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Unamortized Debt Issuance Cost | | | (4,329 | ) | | | (1,319 | ) | | | (3,039 | ) | | | (8,687 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Total Debt, Net of Unamortized Debt Issuance Costs | | $ | 444,797 | | | $ | 182,434 | | | $ | 99,631 | | | $ | 726,862 | | | | | |

| | (1) | Represents $100.0 million balance outstanding on the Company’s Line of Credit due November 7, 2026, with an additional one-year option. |

| | (2) | Represents $102.7 million balance outstanding of the Company’s Series A Bonds due February 28, 2027. |

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 10 |

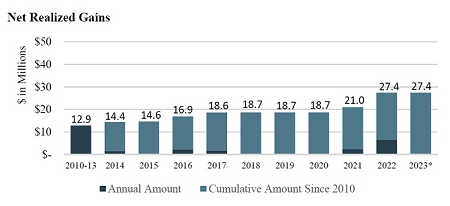

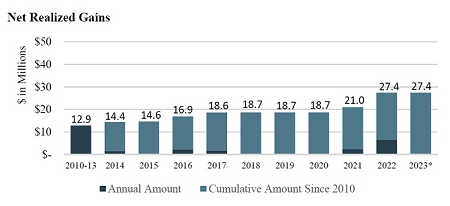

Securities Portfolio Performance

(in thousands)

| Year Ended | | Securities Available for Sale | | | Dividend Income | | | Net Realized Gain (Loss) on Sale of Securities | | | Net Realized Gain (Loss) on Sale of Securities & Dividend Income | |

| 2010 | | $ | 28,757 | | | $ | 1,763 | | | $ | 2,028 | | | $ | 3,791 | |

| 2011 | | | 43,298 | | | | 2,512 | | | | 2,693 | | | | 5,205 | |

| 2012 | | | 57,325 | | | | 3,244 | | | | 4,093 | | | | 7,337 | |

| 2013 | | | 59,255 | | | | 3,481 | | | | 4,056 | | | | 7,537 | |

| 2014 | | | 63,556 | | | | 4,066 | | | | 1,543 | | | | 5,609 | |

| 2015 | | | 75,011 | | | | 4,399 | | | | 204 | | | | 4,603 | |

| 2016 | | | 108,755 | | | | 6,636 | | | | 2,285 | | | | 8,921 | |

| 2017 | | | 132,964 | | | | 8,135 | | | | 1,747 | | | | 9,882 | |

| 2018 | | | 99,596 | | | | 10,367 | | | | 20 | | | | 10,387 | |

| 2019 | | | 116,186 | | | | 7,535 | | | | -0- | | | | 7,535 | |

| 2020 | | | 103,172 | | | | 5,729 | | | | -0- | | | | 5,729 | |

| 2021 | | | 113,748 | | | | 5,098 | | | | 2,342 | | | | 7,440 | |

| 2022 | | | 42,178 | | | | 2,903 | | | | 6,394 | | | | 9,297 | |

| 2023* | | | 36,701 | | | | 1,237 | | | | (43 | ) | | | 1,194 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | $ | 67,105 | | | $ | 27,362 | | | $ | 94,467 | |

*For the six months ended June 30, 2023.

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 11 |

Property Summary and Snapshot

(unaudited)

| | | June 30, 2023 | | | June 30, 2022 | | | % Change | |

| | | | | | | | | | |

| Communities | | | 135 | | | | 130 | | | | 3.8 | % |

| Developed Sites | | | 25,729 | | | | 24,411 | | | | 5.4 | % |

| Occupied | | | 22,096 | | | | 20,852 | | | | 6.0 | % |

| Occupancy % | | | 85.9 | % | | | 85.4 | % | | | 50 | bps |

| Total Rentals | | | 9,632 | | | | 8,857 | | | | 8.8 | % |

| Occupied Rentals | | | 9,048 | | | | 8,380 | | | | 8.0 | % |

| Rental Occupancy % | | | 93.9 | % | | | 94.6 | % | | | (70 | bps) |

| Monthly Rent Per Site | | $ | 509 | | | $ | 489 | | | | 4.1 | % |

| Monthly Rent Per Home Rental Including Site | | $ | 905 | | | $ | 844 | | | | 7.2 | % |

| State | | Number | | | Total Acreage | | | Developed Acreage | | | Vacant Acreage | | | Total Sites | | | Occupied Sites | | | Occupancy Percentage | | | Monthly Rent Per Site | | | Total Rentals | | | Occupied Rentals | | | Rental Occupancy Percentage | | | Monthly Rent Per Home Rental | |

| | | | | | (1) | | | | | | (1) | | | | | | | | | | | | | | | | | | | | | | | | (2) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Alabama | | | 2 | | | | 69 | | | | 62 | | | | 7 | | | | 330 | | | | 136 | | | | 41.2 | % | | $ | 187 | | | | 102 | | | | 98 | | | | 96.1 | % | | $ | 1,018 | |

| Georgia | | | 1 | | | | 26 | | | | 26 | | | | -0- | | | | 118 | | | | -0- | | | | 0.0 | % | | | N/A | | | | -0- | | | | -0- | | | | N/A | | | | N/A | |

| Indiana | | | 14 | | | | 1,105 | | | | 893 | | | | 212 | | | | 4,018 | | | | 3,534 | | | | 88.0 | % | | $ | 466 | | | | 1,870 | | | | 1,750 | | | | 93.6 | % | | $ | 895 | |

| Maryland | | | 1 | | | | 77 | | | | 10 | | | | 67 | | | | 63 | | | | 62 | | | | 98.4 | % | | $ | 590 | | | | -0- | | | | -0- | | | | N/A | | | | N/A | |

| Michigan | | | 4 | | | | 241 | | | | 222 | | | | 19 | | | | 1,081 | | | | 881 | | | | 81.5 | % | | $ | 481 | | | | 336 | | | | 315 | | | | 93.8 | % | | $ | 916 | |

| New Jersey | | | 5 | | | | 390 | | | | 226 | | | | 164 | | | | 1,266 | | | | 1,220 | | | | 96.4 | % | | $ | 683 | | | | 46 | | | | 43 | | | | 93.5 | % | | $ | 1,194 | |

| New York | | | 8 | | | | 698 | | | | 323 | | | | 375 | | | | 1,365 | | | | 1,159 | | | | 84.9 | % | | $ | 605 | | | | 466 | | | | 425 | | | | 91.2 | % | | $ | 1,046 | |

| Ohio | | | 38 | | | | 2,043 | | | | 1,516 | | | | 527 | | | | 7,251 | | | | 6,257 | | | | 86.3 | % | | $ | 467 | | | | 2,827 | | | | 2,667 | | | | 94.3 | % | | $ | 862 | |

| Pennsylvania | | | 53 | | | | 2,409 | | | | 1,890 | | | | 519 | | | | 7,978 | | | | 6,859 | | | | 86.0 | % | | $ | 536 | | | | 2,982 | | | | 2,787 | | | | 93.5 | % | | $ | 913 | |

| South Carolina | | | 2 | | | | 63 | | | | 55 | | | | 8 | | | | 319 | | | | 196 | | | | 61.4 | % | | $ | 207 | | | | 119 | | | | 109 | | | | 91.6 | % | | $ | 940 | |

| Tennessee | | | 7 | | | | 544 | | | | 316 | | | | 228 | | | | 1,940 | | | | 1,792 | | | | 92.4 | % | | $ | 520 | | | | 884 | | | | 854 | | | | 96.6 | % | | $ | 922 | |

Total as of June 30, 2023 | | | 135 | | | | 7,665 | | | | 5,539 | | | | 2,126 | | | | 25,729 | | | | 22,096 | | | | 85.9 | % | | $ | 509 | | | | 9,632 | | | | 9,048 | | | | 93.9 | % | | $ | 905 | |

| | (1) | Total and Vacant Acreage of 220 for Mountain View Estates and 61 for Struble Ridge are included in the above summary. |

| | (2) | Includes home and site rent charges. |

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 12 |

| Same Property Statistics | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) (unaudited) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Six Months Ended | |

| | | June 30, 2023 | | | June 30, 2022 | | | Change | | | % Change | | | June 30, 2023 | | | June 30, 2022 | | | Change | | | % Change | |

| Community Net Operating Income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Rental and Related Income | | $ | 45,488 | | | $ | 41,716 | | | $ | 3,772 | | | | 9.0 | % | | $ | 89,303 | | | $ | 83,008 | | �� | $ | 6,295 | | | | 7.6 | % |

| Community Operating Expenses | | | 18,255 | | | | 17,521 | | | | 734 | | | | 4.2 | % | | | 36,700 | | | | 34,799 | | | | 1,901 | | | | 5.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Community NOI | | $ | 27,233 | | | $ | 24,195 | | | $ | 3,038 | | | | 12.6 | % | | $ | 52,603 | | | $ | 48,209 | | | $ | 4,394 | | | | 9.1 | % |

| | | June 30, 2023 | | | June 30, 2022 | | | Change | |

| | | | | | | | | | |

| Total Sites | | | 23,923 | | | | 23,904 | | | | 0.1 | % |

| Occupied Sites | | | 21,020 | | | | 20,568 | | | | 452 sites, 2.2 | % |

| Occupancy % | | | 87.9 | % | | | 86.0 | % | | | 190 bps | |

| Number of Properties | | | 126 | | | | 126 | | | | N/A | |

| Total Rentals | | | 9,457 | | | | 8,756 | | | | 8.0 | % |

| Occupied Rentals | | | 8,895 | | | | 8,291 | | | | 7.3 | % |

| Rental Occupancy | | | 94.1 | % | | | 94.7 | % | | | (60bps | ) |

| Monthly Rent Per Site | | $ | 514 | | | $ | 491 | | | | 4.7 | % |

| Monthly Rent Per Home Including Site | | $ | 902 | | | $ | 843 | | | | 7.0 | % |

Same Property includes all properties owned as of January 1, 2022, with the exception of Memphis Blues and Duck River Estates.

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 13 |

| Acquisitions Summary | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Year of Acquisition | | | Number of Communities | | | Sites | | | Occupancy % at Acquisition | | | Purchase Price | | | Price Per Site | | | Total Acres | |

| 2020 | | | 2 | | | 310 | | | | 64 | % | | $ | 7,840 | | | $ | 25 | | | | 48 | |

| 2021 | | | 3 | | | 543 | | | | 59 | % | | $ | 18,300 | | | $ | 34 | | | | 113 | |

| 2022 | | | 7 | | | 1,486 | | | | 66 | % | | $ | 86,223 | | | $ | 58 | | | | 461 | |

| 2023 | | | 1 | | | 118 | | | | -0- | % | | $ | 3,650 | | | $ | 31 | | | | 26 | |

| 2023 Acquisitions | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Community | | Date of Acquisition | | | State | | | Number of Sites | | | Purchase Price | | | Number of Acres | | | Occupancy | |

| Mighty Oak | | January 19, 2023 | | | | GA | | | | 118 | | | $ | 3,650 | | | | 26 | | | | -0- | % |

| Total 2023 to Date | | | | | | | | | | 118 | | | $ | 3,650 | | | | 26 | | | | -0- | % |

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 14 |

Definitions

Investors and analysts following the real estate industry utilize funds from operations available to common shareholders (“FFO”), normalized funds from operations available to common shareholders (“Normalized FFO”), community NOI, same property NOI, and earnings before interest, taxes, depreciation, amortization and acquisition costs (“Adjusted EBITDA excluding Non-Recurring Other Expense”), variously defined, as supplemental performance measures. While the Company believes net income (loss) available to common shareholders, as defined by accounting principles generally accepted in the United States of America (U.S. GAAP), is the most appropriate measure, it considers Community NOI, Same Property NOI, Adjusted EBITDA excluding Non-Recurring Other Expense, FFO and Normalized FFO, given their wide use by and relevance to investors and analysts, appropriate supplemental performance measures. FFO, reflecting the assumption that real estate asset values rise or fall with market conditions, principally adjusts for the effects of U.S. GAAP depreciation and amortization of real estate assets. FFO also adjusts for the effects of the change in the fair value of marketable securities and gains and losses realized on marketable securities. Normalized FFO reflects the same assumptions as FFO except that it also adjusts for certain one-time charges. Community NOI and Same Property NOI provide a measure of rental operations and do not factor in depreciation and amortization and non-property specific expenses such as general and administrative expenses. Adjusted EBITDA excluding Non-Recurring Other Expense provides a tool to further evaluate the ability to incur and service debt and to fund dividends and other cash needs. In addition, Community NOI, Same Property NOI, Adjusted EBITDA excluding Non-Recurring Other Expense, FFO and Normalized FFO are commonly used in various ratios, pricing multiples, yields and returns and valuation of calculations used to measure financial position, performance and value.

FFO, as defined by The National Association of Real Estate Investment Trusts (“NAREIT”), is calculated to be equal to net income (loss) applicable to common shareholders, as defined by U.S. GAAP, excluding gains or losses from sales of previously depreciated real estate assets, impairment charges related to depreciable real estate assets, the change in the fair value of marketable securities, and the gain or loss on the sale of marketable securities plus certain non-cash items such as real estate asset depreciation and amortization. Included in the NAREIT FFO White Paper - 2018 Restatement, is an option pertaining to assets incidental to our main business in the calculation of NAREIT FFO to make an election to include or exclude gains and losses on the sale of these assets, such as marketable equity securities, and include or exclude mark-to-market changes in the value recognized on these marketable equity securities. In conjunction with the adoption of the FFO White Paper - 2018 Restatement, for all periods presented, we have elected to exclude the gains and losses realized on marketable securities and change in the fair value of marketable securities from our FFO calculation. NAREIT created FFO as a non-GAAP supplemental measure of REIT operating performance.

Normalized FFO is calculated as FFO excluding amortization and certain one-time charges.

Normalized FFO per Diluted Common Share is calculated using diluted weighted shares outstanding of 61.8 million and 60.8 million shares for the three and six months ended June 30, 2023, respectively, and 55.2 million and 54.2 million shares for the three and six months ended June 30, 2022, respectively. Common stock equivalents resulting from stock options in the amount of 524,000 and 658,000 for the three and six months ended June 30, 2023, respectively, and 955,000 and 1.0 million shares for the three and six months ended June 30, 2022, respectively, were excluded from the computation of Diluted Net Loss per Share as their effect would have been anti-dilutive.

Community NOI is calculated as rental and related income less community operating expenses such as real estate taxes, repairs and maintenance, community salaries, utilities, insurance and other expenses.

Same Property NOI is calculated as Community NOI, using all properties owned as of January 1, 2022, with the exception of Memphis Blues and Duck River Estates.

Adjusted EBITDA excluding Non-Recurring Other Expense is calculated as net income (loss) plus interest expense, franchise taxes, depreciation, the change in the fair value of marketable securities and the gain (loss) on sales of marketable securities, adjusted for non-recurring other expenses.

Community NOI, Same Property NOI, Adjusted EBITDA excluding Non-Recurring Other Expense, FFO and Normalized FFO do not represent cash generated from operating activities in accordance with U.S. GAAP and are not necessarily indicative of cash available to fund cash needs, including the repayment of principal on debt and payment of dividends and distributions. Community NOI, Same Property NOI, Adjusted EBITDA excluding Non-Recurring Other Expense, FFO and Normalized FFO should not be considered as substitutes for net income (loss) applicable to common shareholders (calculated in accordance with U.S. GAAP) as a measure of results of operations, or cash flows (calculated in accordance with U.S. GAAP) as a measure of liquidity. Community NOI, Same Property NOI, Adjusted EBITDA excluding Non-Recurring Other Expense, FFO and Normalized FFO as currently calculated by the Company may not be comparable to similarly titled, but variously calculated, measures of other REITs.

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 15 |

Press Release Dated August 8, 2023

| FOR IMMEDIATE RELEASE | August 8, 2023 |

| | Contact: Nelli Madden |

| | 732-577-9997 |

UMH PROPERTIES, INC. REPORTS RESULTS FOR THE SECOND QUARTER ENDED

JUNE 30, 2023

FREEHOLD, NJ, August 8, 2023........ UMH Properties, Inc. (NYSE:UMH) (TASE:UMH) reported Total Income for the quarter ended June 30, 2023 of $55.3 million as compared to $49.2 million for the quarter ended June 30, 2022, representing an increase of 12.3%. Net Loss Attributable to Common Shareholders amounted to $4.4 million or $0.07 per diluted share for the quarter ended June 30, 2023 as compared to a Net Loss of $22.5 million or $0.41 per diluted share for the quarter ended June 30, 2022. Normalized Funds from Operations Attributable to Common Shareholders (“Normalized FFO”), was $13.0 million or $0.21 per diluted share for the quarter ended June 30, 2023, as compared to $12.0 million or $0.22 per diluted share for the quarter ended June 30, 2022, and $11.7 million or $0.20 for the quarter ended March 31, 2023, representing a 4.5% per diluted share increase sequentially.

A summary of significant financial information for the three and six months ended June 30, 2023 and 2022 is as follows (in thousands except per share amounts):

| | | Three Months Ended | |

| | | June 30, | |

| | | 2023 | | | 2022 | |

| | | | | | | |

| Total Income | | $ | 55,290 | | | $ | 49,223 | |

| Total Expenses | | $ | 46,371 | | | $ | 41,258 | |

| Net Loss Attributable to Common Shareholders | | $ | (4,418 | ) | | $ | (22,478 | ) |

| Net Loss Attributable to Common Shareholders per Diluted Common Share | | $ | (0.07 | ) | | $ | (0.41 | ) |

| FFO (1) | | $ | 12,043 | | | $ | (320 | ) |

| FFO (1) per Diluted Common Share | | $ | 0.19 | | | $ | (0.01 | ) |

| Normalized FFO (1) | | $ | 13,049 | | | $ | 12,026 | |

| Normalized FFO (1) per Diluted Common Share | | $ | 0.21 | | | $ | 0.22 | |

| Diluted Weighted Average Shares Outstanding | | | 61,236 | | | | 54,215 | |

| | | Six Months Ended | |

| | | June 30, | |

| | | 2023 | | | 2022 | |

| | | | | | | |

| Total Income | | $ | 107,897 | | | $ | 95,091 | |

| Total Expenses | | $ | 91,611 | | | $ | 79,082 | |

| Net Loss Attributable to Common Shareholders | | $ | (9,715 | ) | | $ | (26,803 | ) |

| Net Loss Attributable to Common Shareholders per Diluted Common Share | | $ | (0.16 | ) | | $ | (0.50 | ) |

| FFO (1) | | $ | 22,683 | | | $ | 8,224 | |

| FFO (1) per Diluted Common Share | | $ | 0.37 | | | $ | 0.15 | |

| Normalized FFO (1) | | $ | 24,769 | | | $ | 22,439 | |

| Normalized FFO (1) per Diluted Common Share | | $ | 0.41 | | | $ | 0.41 | |

| Diluted Weighted Average Shares Outstanding | | | 60,186 | | | | 53,224 | |

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 16 |

A summary of significant balance sheet information as of June 30, 2023 and December 31, 2022 is as follows (in thousands):

| | | June 30, 2023 | | | December 31, 2022 | |

| | | | | | | |

| | | | | | | |

| Gross Real Estate Investments | | $ | 1,466,344 | | | $ | 1,391,588 | |

| Total Assets | | $ | 1,393,869 | | | $ | 1,344,596 | |

| Mortgages Payable, net | | $ | 444,797 | | | $ | 508,938 | |

| Loans Payable, net | | $ | 182,434 | | | $ | 153,531 | |

| Bonds Payable, net | | $ | 99,631 | | | $ | 99,207 | |

| Total Shareholders’ Equity | | $ | 637,867 | | | $ | 551,196 | |

Samuel A. Landy, President and CEO, commented on the results of the second quarter of 2023.

“We are pleased to announce another solid quarter of operating results. During the quarter, we:

| ● | Increased Rental and Related Income by 11.4%; |

| ● | Increased Sales of Manufactured Homes by 17.6%; |

| ● | Increased Community Net Operating Income (“NOI”) by 16.0%; |

| ● | Increased Same Property NOI by 12.6%; |

| ● | Increased Same Property Occupancy by 190 basis points from 86.0% to 87.9%; |

| ● | Improved our Same Property expense ratio from 42.0% in the second quarter of 2022 to 40.1% at quarter end; |

| ● | Increased our rental home portfolio by 304 homes from March 31, 2023 and 534 homes from yearend 2022 to approximately 9,600 total rental homes, representing an increase of 5.9%; |

| ● | Entered into a $25 million term loan and a $25 million line of credit secured by rental homes and their leases; |

| ● | Issued and sold approximately 2.9 million shares of Common Stock through our At-the-Market Sale Programs at a weighted average price of $15.61 per share, generating gross proceeds of $45.1 million and net proceeds of $44.2 million, after offering expenses; |

| ● | Issued and sold approximately 712,000 shares of Series D Preferred Stock through our At-the-Market Sale Program at a weighted average price of $21.85 per share, generating gross proceeds of $15.6 million and net proceeds of $15.3 million, after offering expenses; |

| ● | Subsequent to quarter end, expanded our revolving line of credit from $20 million to $35 million; |

| ● | Subsequent to quarter end, paid down approximately $35 million on our floorplan inventory financing revolving lines of credit; |

| ● | Subsequent to quarter end, issued and sold approximately 2.1 million shares of Common Stock through our At-the-Market Sale Program at a weighted average price of $16.23 per share, generating gross proceeds of $34.8 million and net proceeds of $34.3 million, after offering expenses; and |

| ● | Subsequent to quarter end, issued and sold approximately 351,000 shares of Series D Preferred Stock through our At-the-Market Sale Program at a weighted average price of $21.55 per share, generating gross proceeds of $7.6 million and net proceeds of $7.5 million, after offering expenses.” |

Mr. Landy stated, “UMH occupancy and revenue growth are meeting our expectations. Our communities are experiencing strong demand which is translating to increased occupancy, revenue, and NOI growth. The strength of our operating results has increased our bottom line results as evidenced by our sequential Normalized FFO growth. Normalized FFO for the second quarter of 2023 was $0.21 per share as compared to $0.20 per share in the first quarter.”

During 2023, same property NOI increased by 12.6% for the quarter and 9.1% for the first six months, compared to the corresponding prior year periods. This increase was driven by an increase in rental and related income of 9.0% and 7.6% for the three and six months, respectively, partially offset by an increase in same property expenses of 4.2% and 5.5%, respectively. The growth in rental and related income is primarily attributed to a strong increase in occupancy of 452 units and rental rate increases of 4.7%. Same property occupancy is now 87.9% as compared to 86.0% last year, representing an increase of 190 basis points.”

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 17 |

“We have made substantial progress obtaining, setting up and filling our inventory homes. Our inventory levels were higher than usual which resulted in increased carrying costs, including the high rate interest expense associated with our floorplan lines. We have been reducing the balance on the floorplan lines and subsequent to quarter end, we have paid down approximately $35.0 million on these lines, the current balance is approximately $4.1 million. We continued to reduce our inventory and year to date, we have sold 82 new homes versus 59 in the prior year and converted over 600 new homes to occupied rentals. This has contributed to a $47.0 million increase in cash flows from operating activities for the six months ended June 30, 2023.”

“Our sales for the quarter increased from $7.0 million to $8.2 million, representing an increase of 17.6%. Year to date, sales have increased from $11.3 million to $15.5 million, representing an increase of 37.6%.”

“UMH continues to execute on our long-term business plan. We maintain a strong balance sheet to ensure that we can execute our plan. We raise capital by issuing a combination of equity, debt and perpetual preferred equity to invest in value-add acquisitions, expansions, and greenfield development. These investments take time to become accretive but allow us to generate excellent long-term returns, in excess of what is available in the stabilized acquisition market. We analyze every investment with a long-term view. This strategy has allowed us to build a first-class portfolio of manufactured housing communities that deliver shareholders a resilient and growing dividend, greater scale, and improved net asset value per share.”

UMH Properties, Inc. will host its Second Quarter 2023 Financial Results Webcast and Conference Call. Senior management will discuss the results, current market conditions and future outlook on Wednesday, August 9, 2023, at 10:00 a.m. Eastern Time.

The Company’s 2023 second quarter financial results being released herein will be available on the Company’s website at www.umh.reit in the “Financials” section.

To participate in the webcast, select the webcast icon on the homepage of the Company’s website at www.umh.reit, in the Upcoming Events section. Interested parties can also participate via conference call by calling toll free 877-513-1898 (domestically) or 412-902-4147 (internationally).

The replay of the conference call will be available at 12:00 p.m. Eastern Time on Wednesday, August 9, 2023, and can be accessed by dialing toll free 877-344-7529 (domestically) and 412-317-0088 (internationally) and entering the passcode 2526307. A transcript of the call and the webcast replay will be available at the Company’s website, www.umh.reit.

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 135 manufactured home communities containing approximately 25,700 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland, Michigan, Alabama, South Carolina and Georgia. UMH also has an ownership interest in and operates two communities in Florida, containing 363 sites, through its joint venture with Nuveen Real Estate.

Certain statements included in this press release which are not historical facts may be deemed forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements are based on the Company’s current expectations and involve various risks and uncertainties. Although the Company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can provide no assurance those expectations will be achieved. The risks and uncertainties that could cause actual results or events to differ materially from expectations are contained in the Company’s annual report on Form 10-K and described from time to time in the Company’s other filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events, or otherwise.

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 18 |

Note:

| (1) | Non-GAAP Information: We assess and measure our overall operating results based upon an industry performance measure referred to as Funds from Operations Attributable to Common Shareholders (“FFO”), which management believes is a useful indicator of our operating performance. FFO is used by industry analysts and investors as a supplemental operating performance measure of a REIT. FFO, as defined by The National Association of Real Estate Investment Trusts (“NAREIT”), represents net income (loss) attributable to common shareholders, as defined by accounting principles generally accepted in the United States of America (“U.S. GAAP”), excluding gains or losses from sales of previously depreciated real estate assets, impairment charges related to depreciable real estate assets, the change in the fair value of marketable securities, and the gain or loss on the sale of marketable securities plus certain non-cash items such as real estate asset depreciation and amortization. Included in the NAREIT FFO White Paper - 2018 Restatement, is an option pertaining to assets incidental to our main business in the calculation of NAREIT FFO to make an election to include or exclude gains and losses on the sale of these assets, such as marketable equity securities, and include or exclude mark-to-market changes in the value recognized on these marketable equity securities. In conjunction with the adoption of the FFO White Paper - 2018 Restatement, for all periods presented, we have elected to exclude the gains and losses realized on marketable securities investments and the change in the fair value of marketable securities from our FFO calculation. NAREIT created FFO as a non-U.S. GAAP supplemental measure of REIT operating performance. We define Normalized Funds from Operations Attributable to Common Shareholders (“Normalized FFO”), as FFO excluding amortization and certain one-time charges. FFO and Normalized FFO should be considered as supplemental measures of operating performance used by REITs. FFO and Normalized FFO exclude historical cost depreciation as an expense and may facilitate the comparison of REITs which have a different cost basis. However, other REITs may use different methodologies to calculate FFO and Normalized FFO and, accordingly, our FFO and Normalized FFO may not be comparable to all other REITs. The items excluded from FFO and Normalized FFO are significant components in understanding the Company’s financial performance. |

FFO and Normalized FFO (i) do not represent Cash Flow from Operations as defined by U.S. GAAP; (ii) should not be considered as alternatives to net income (loss) as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity.

The diluted weighted shares outstanding used in the calculation of FFO per Diluted Common Share and Normalized FFO per Diluted Common Share were 61.8 million and 60.8 million shares for the three and six months ended June 30, 2023, respectively, and 55.2 million and 54.2 million shares for the three and six months ended June 30, 2022, respectively. Common stock equivalents resulting from stock options in the amount of 524,000 and 658,000 shares for the three and six months ended June 30, 2023, respectively, were excluded from the computation of the Diluted Net Loss per Share as their effect would be anti-dilutive. Common stock equivalents resulting from stock options in the amount of 955,000 and 1.0 million shares for the three and six months ended June 30, 2022, respectively, were excluded from the computation of the Diluted Net Loss per Share as their effect would be anti-dilutive.

The reconciliation of the Company’s U.S. GAAP net loss to the Company’s FFO and Normalized FFO for the three and six months ended June 30, 2023 and 2022 are calculated as follows (in thousands):

| | | Three Months Ended | | | Six Months Ended | |

| | | 6/30/23 | | | 6/30/22 | | | 6/30/23 | | | 6/30/22 | |

| Net Loss Attributable to Common Shareholders | | $ | (4,418 | ) | | $ | (22,478 | ) | | $ | (9,715 | ) | | $ | (26,803 | ) |

| Depreciation Expense | | | 13,751 | | | | 11,984 | | | | 27,124 | | | | 23,701 | |

| Depreciation Expense from Unconsolidated Joint Venture | | | 166 | | | | 86 | | | | 325 | | | | 167 | |

| (Gain) Loss on Sales of Depreciable Assets | | | (5 | ) | | | 44 | | | | (37 | ) | | | 86 | |

| Decrease in Fair Value of Marketable Securities | | | 2,548 | | | | 10,044 | | | | 4,943 | | | | 41,794 | |

| (Gain) Loss on Sales of Marketable Securities, net | | | 1 | | | | -0- | | | | 43 | | | | (30,721 | ) |

| FFO Attributable to Common Shareholders | | | 12,043 | | | | (320 | ) | | | 22,683 | | | | 8,224 | |

| Redemption of Preferred Stock (2) | | | -0- | | | | 10,988 | | | | -0- | | | | 12,020 | |

| Amortization of Financing Costs(2) | | | 538 | | | | 533 | | | | 1,056 | | | | 939 | |

| Non-Recurring Other Expense (3) | | | 468 | | | | 825 | | | | 1,030 | | | | 1,256 | |

| Normalized FFO Attributable to Common Shareholders (2) | | $ | 13,049 | | | $ | 12,026 | | | $ | 24,769 | | | $ | 22,439 | |

| (2) | Normalized FFO as previously reported for the three and six months ended June 30, 2022, was $8,695, or $0.16 per diluted share and $17,670, or $0.33 per diluted share, respectively. During 2022, the Company incurred the carrying cost of excess cash for the redemption of preferred stock. Additionally, due to the change in sources of capital, amortization expense is expected to become more significant and is therefore included as an adjustment to Normalized FFO for the three and six months ended June 30, 2023 and 2022. After making these adjustments for the three and six months ended June 30, 2022, Normalized FFO was $12,026, or $0.22 per diluted share and $22,439, or $0.41 per diluted share, respectively. |

| (3) | Consists of special bonus and restricted stock grants for the August 2020 groundbreaking Fannie Mae financing, which are being expensed over the vesting period ($431 and $862, respectively) and non-recurring expenses for the joint venture with Nuveen ($3 and $50, respectively), one-time legal fees ($30 and $50, respectively), fees related to the establishment of the UMH OZ Fund, LLC ($4 and $37, respectively), and costs associated with an acquisition that was not completed ($0 and $31, respectively) for the three and six months ended June 30, 2023. Consists of special bonus and restricted stock grants for the August groundbreaking Fannie Mae financing, which are being expensed over the vesting period ($431 and $862, respectively) and non-recurring expenses for the joint venture with Nuveen ($52), early extinguishment of debt ($193) and one-time legal fees ($149) for the three and six months ended June 30, 2022. |

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 19 |

The following are the cash flows provided by (used in) operating, investing and financing activities for the six months ended June 30, 2023 and 2022 (in thousands):

| | | 2023 | | | 2022 | |

| Operating Activities | | $ | 52,425 | | | $ | 5,415 | |

| Investing Activities | | | (93,819 | ) | | | 871 | |

| Financing Activities | | | 49,706 | | | | 153,701 | |

# # # #

| | UMH Properties, Inc. | Second Quarter FY 2023 Supplemental Information 20 |