Focusing the Portfolio on Mobile Modular FEBRUARY 1, 2023 McGrath to Acquire Vesta Modular and Divest Adler Tank Rentals PAGE Exhibit 99.2

Safe Harbor PAGE This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements include: (1) the Vesta acquisition accelerating growth and profitability in the core modular business, including expanding geographic coverage and density, facilitating reach to new customers, and increasing proportion of long-term contracts, (2) anticipated accretion from both transactions in 2024 with ROIC exceeding cost of capital beyond 2024, and run-rate synergies of $8M per year, (3) anticipated $30M of value from Vesta’s net operating losses, (4) transaction multiples based on 2022 estimated EBITDA of Vesta and Adler, and (5) McGrath retaining financial flexibility for shareholder return and tuck-in acquisitions. These forward-looking statements also can be identified by terminology such as “anticipates,” “believes,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “plan,” “predict,” “project,” or “will,” or the negative of these terms. These forward-looking statements are not guarantees of future performance and are subject to significant risks and uncertainties that could cause our actual results to differ materially from those projected, including (a) problems arising to forestall the successful integration of the Vesta business, including the potential loss of any key employees of Vesta; (b) incurrence of unexpected costs, including exposure to any unrecorded liabilities or unidentified issues that the Company failed to discover during due diligence or that are not covered by insurance and (c) potential unfavorable accounting treatment and unexpected increases in taxes associated with the transactions. Other important factors that could cause actual results to differ materially from the Company’s expectations are disclosed under “Risk Factors” in the Company’s Form 10-K for 2021 and other SEC filings. These forward-looking statements speak only as of the date hereof. Except as otherwise required by law, we are under no duty to update or revise any of the forward-looking statements after the date of this presentation, whether as a result of new information, future events or otherwise. This presentation is not intended to be a recommendation to buy, sell or hold securities and does not constitute an offer for the sale of, or the solicitation of an offer to buy securities in any jurisdiction. Any such offer will only be made by means of a prospectus or offering memorandum, and in compliance with applicable securities laws.

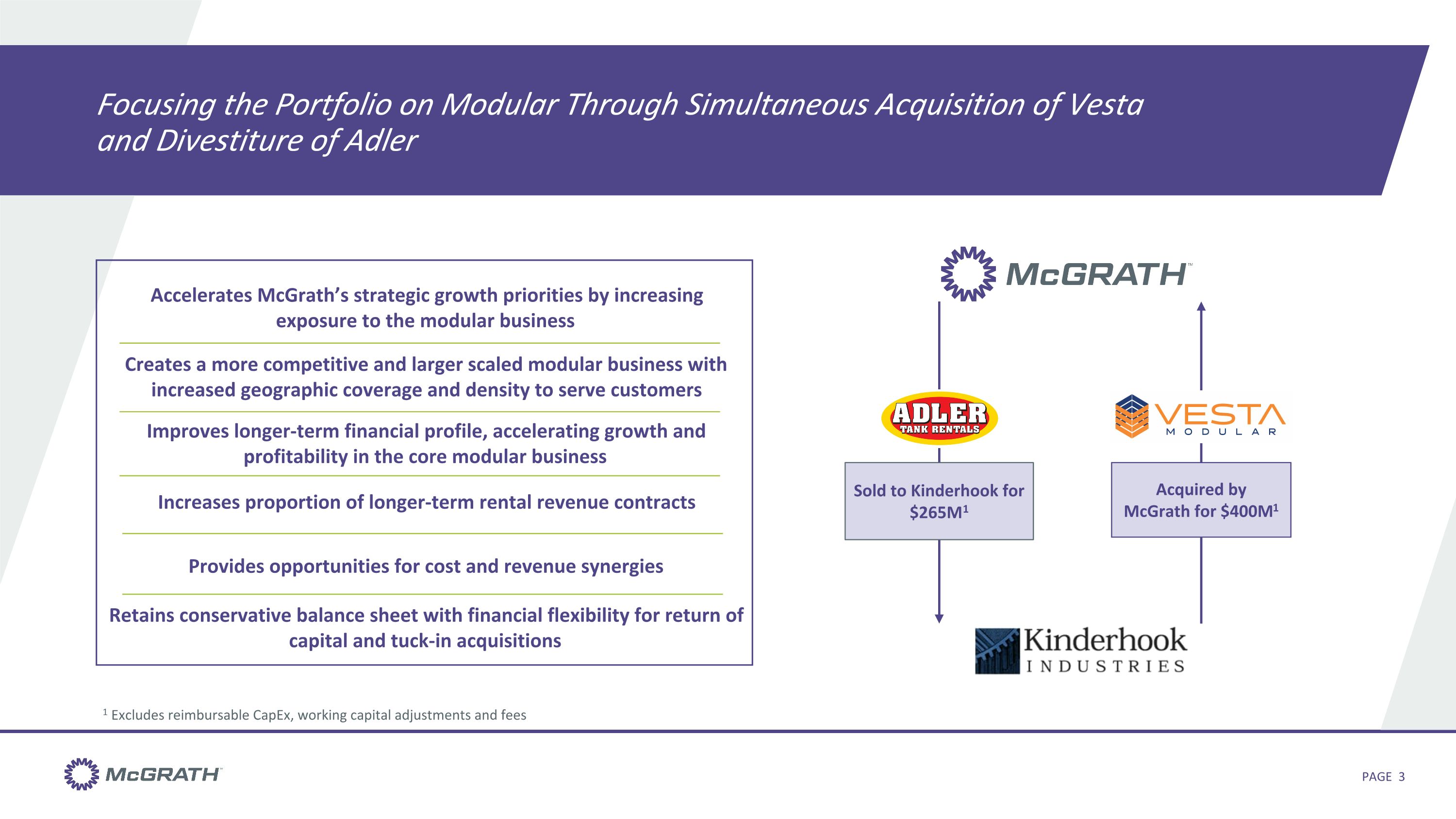

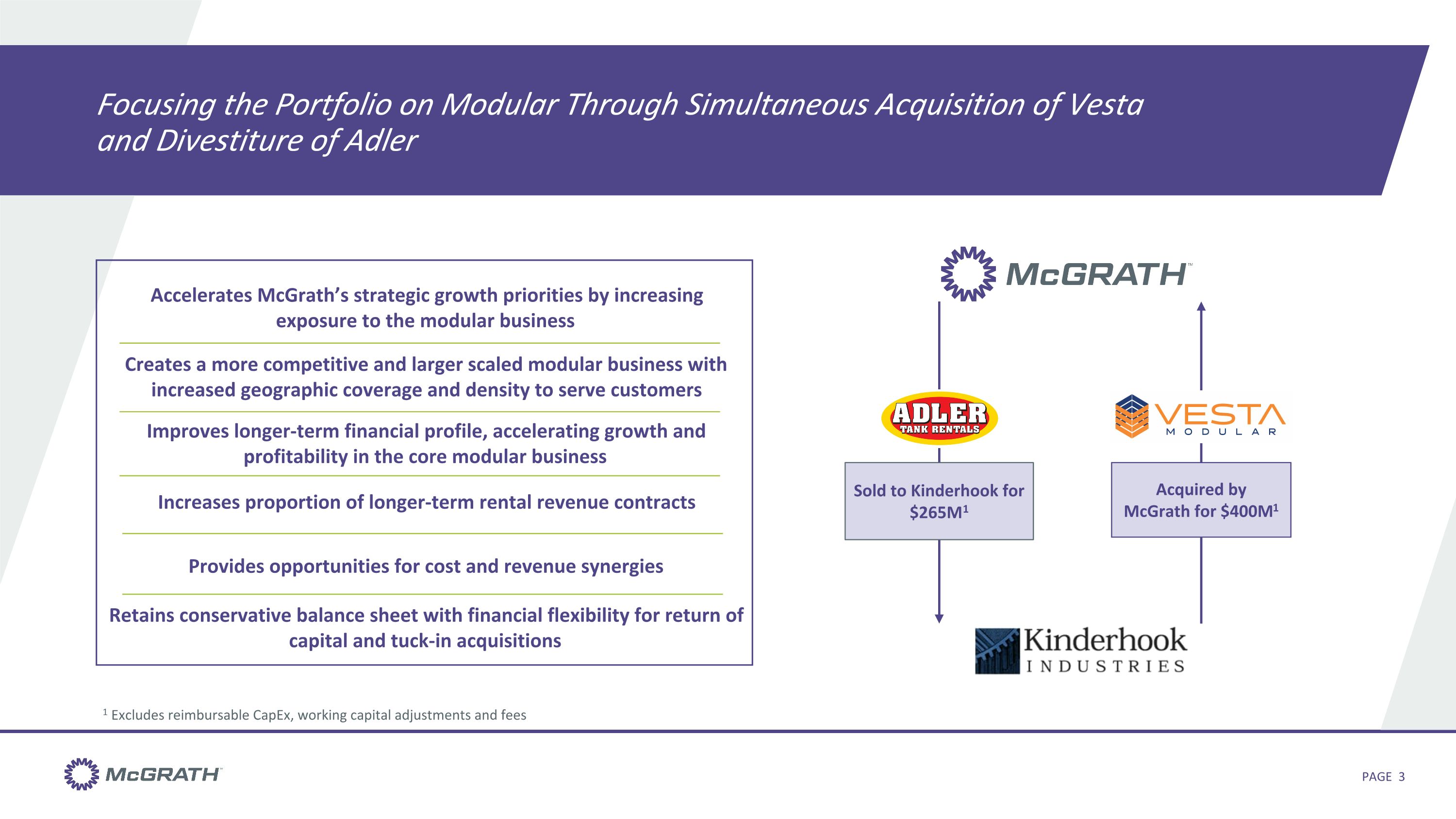

Focusing the Portfolio on Modular Through Simultaneous Acquisition of Vesta and Divestiture of Adler PAGE Sold to Kinderhook for $265M1 Acquired by McGrath for $400M1 1 Excludes reimbursable CapEx, working capital adjustments and fees Accelerates McGrath’s strategic growth priorities by increasing exposure to the modular business Creates a more competitive and larger scaled modular business with increased geographic coverage and density to serve customers Provides opportunities for cost and revenue synergies Improves longer-term financial profile, accelerating growth and profitability in the core modular business Increases proportion of longer-term rental revenue contracts Retains conservative balance sheet with financial flexibility for return of capital and tuck-in acquisitions

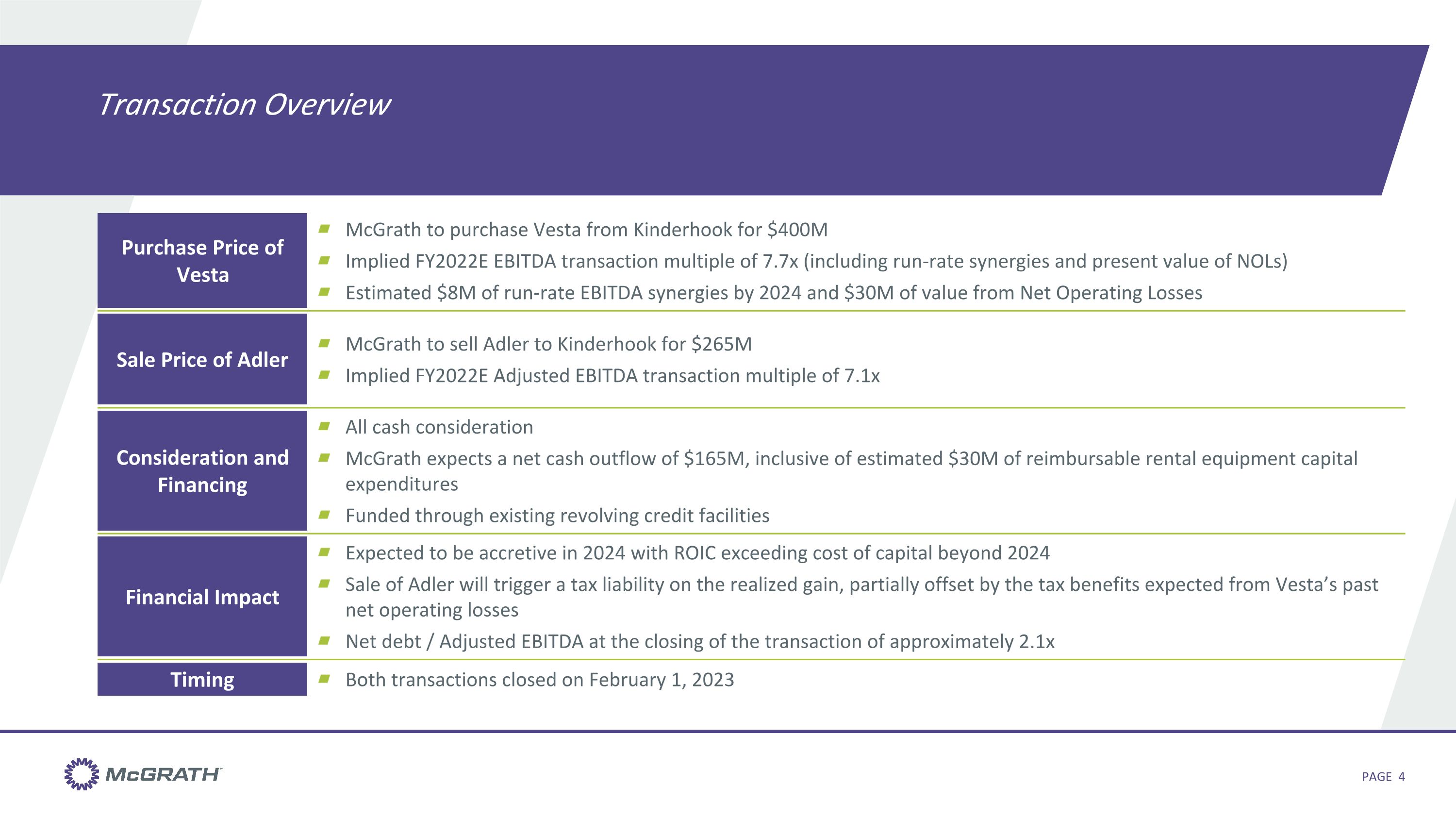

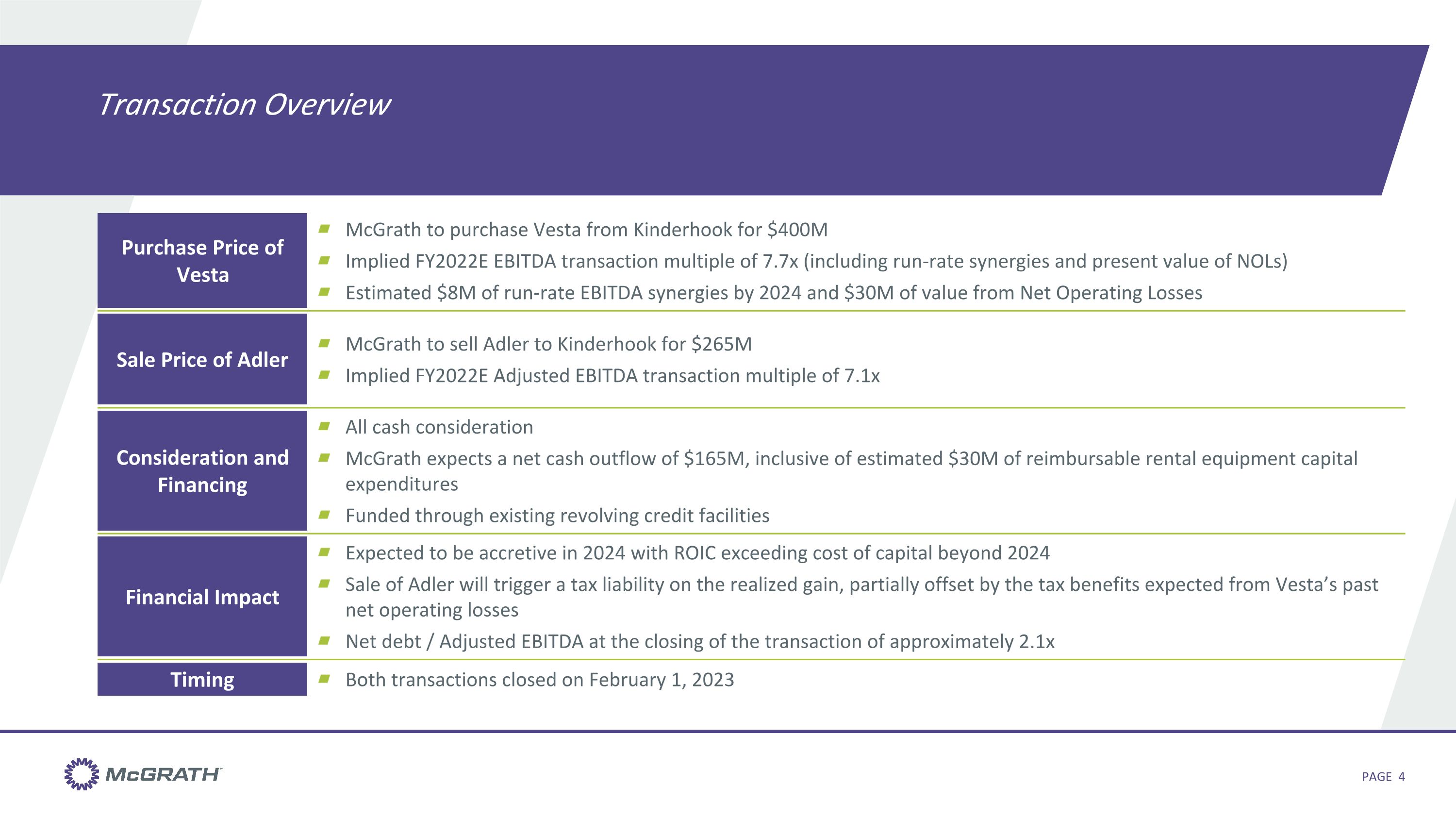

Transaction Overview PAGE Purchase Price of Vesta McGrath to purchase Vesta from Kinderhook for $400M Implied FY2022E EBITDA transaction multiple of 7.7x (including run-rate synergies and present value of NOLs) Estimated $8M of run-rate EBITDA synergies by 2024 and $30M of value from Net Operating Losses Sale Price of Adler McGrath to sell Adler to Kinderhook for $265M Implied FY2022E Adjusted EBITDA transaction multiple of 7.1x Consideration and Financing All cash consideration McGrath expects a net cash outflow of $165M, inclusive of estimated $30M of reimbursable rental equipment capital expenditures Funded through existing revolving credit facilities Financial Impact Expected to be accretive in 2024 with ROIC exceeding cost of capital beyond 2024 Sale of Adler will trigger a tax liability on the realized gain, partially offset by the tax benefits expected from Vesta’s past net operating losses Net debt / Adjusted EBITDA at the closing of the transaction of approximately 2.1x Timing Both transactions closed on February 1, 2023

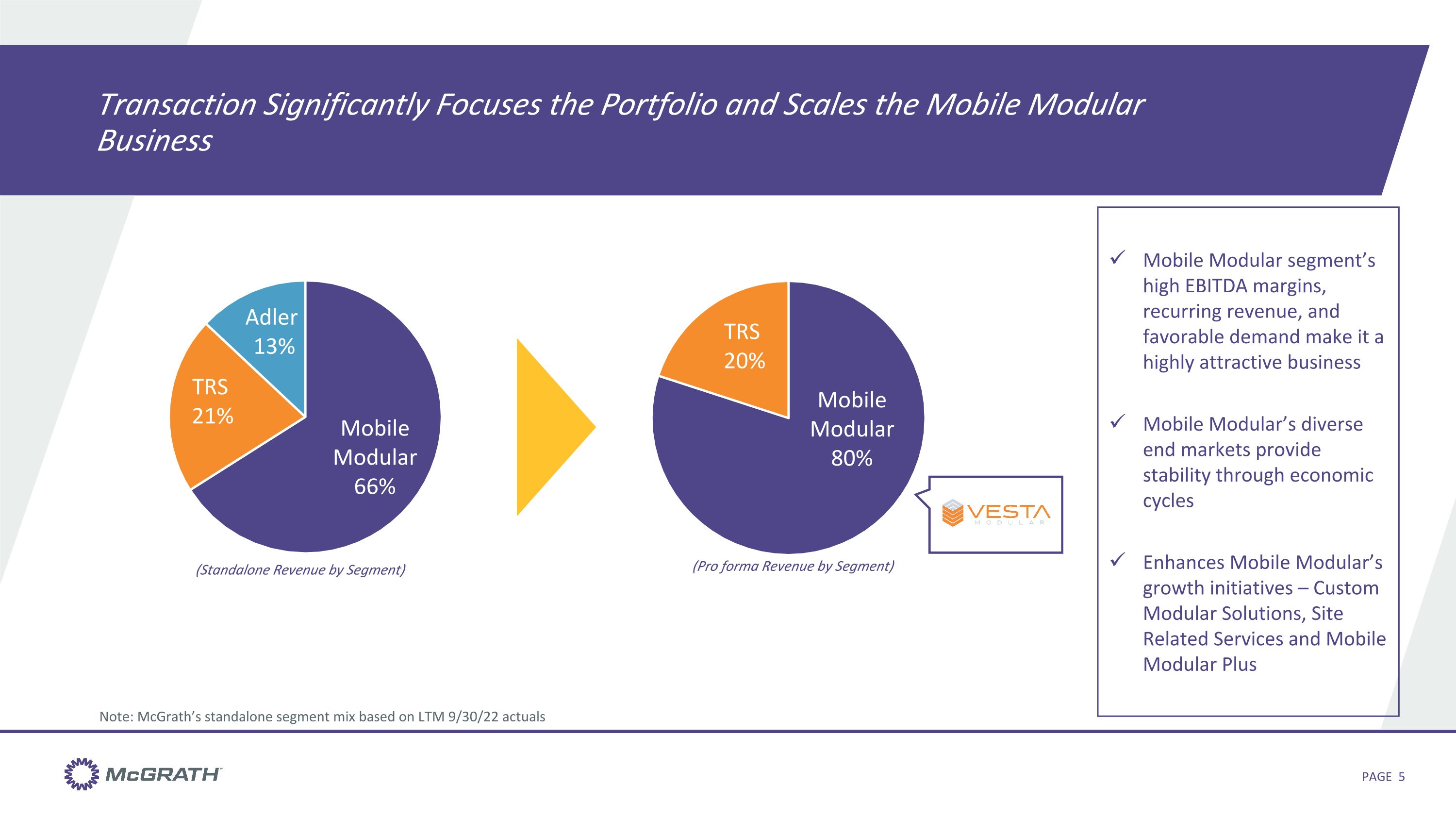

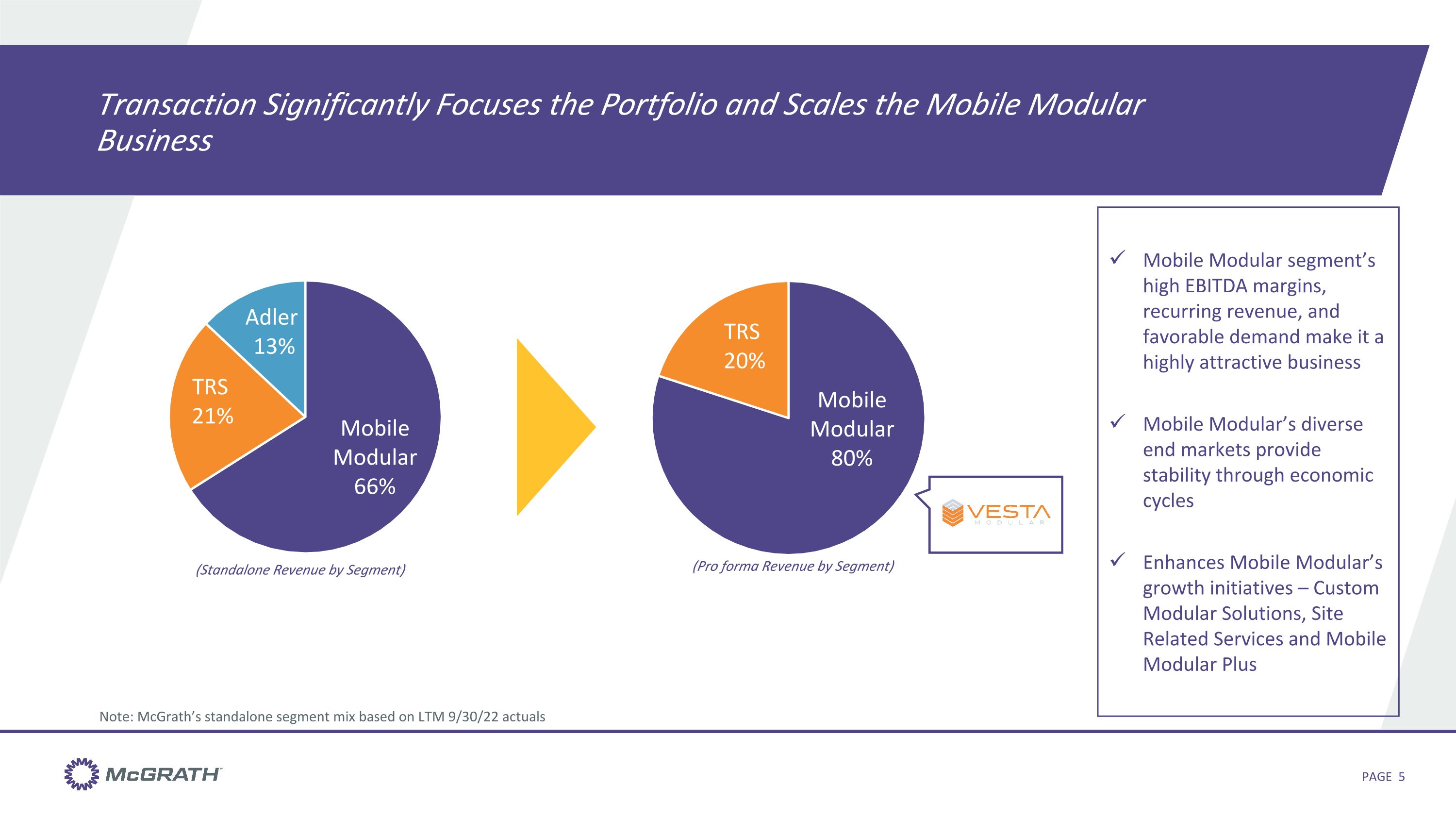

Transaction Significantly Focuses the Portfolio and Scales the Mobile Modular Business PAGE Note: McGrath’s standalone segment mix based on LTM 9/30/22 actuals Mobile Modular segment’s high EBITDA margins, recurring revenue, and favorable demand make it a highly attractive business Mobile Modular’s diverse end markets provide stability through economic cycles Enhances Mobile Modular’s growth initiatives – Custom Modular Solutions, Site Related Services and Mobile Modular Plus (Standalone Revenue by Segment) (Pro forma Revenue by Segment)

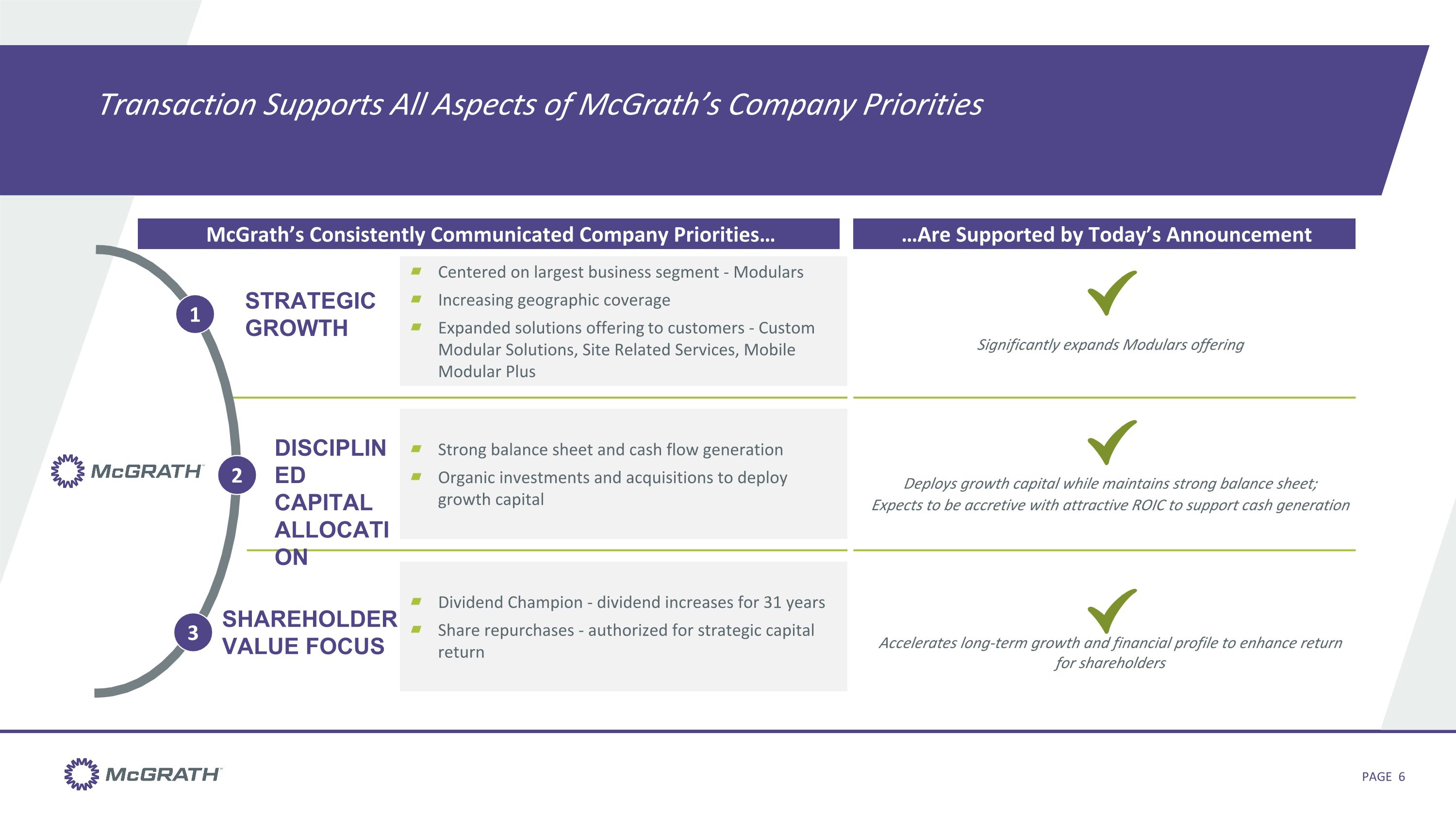

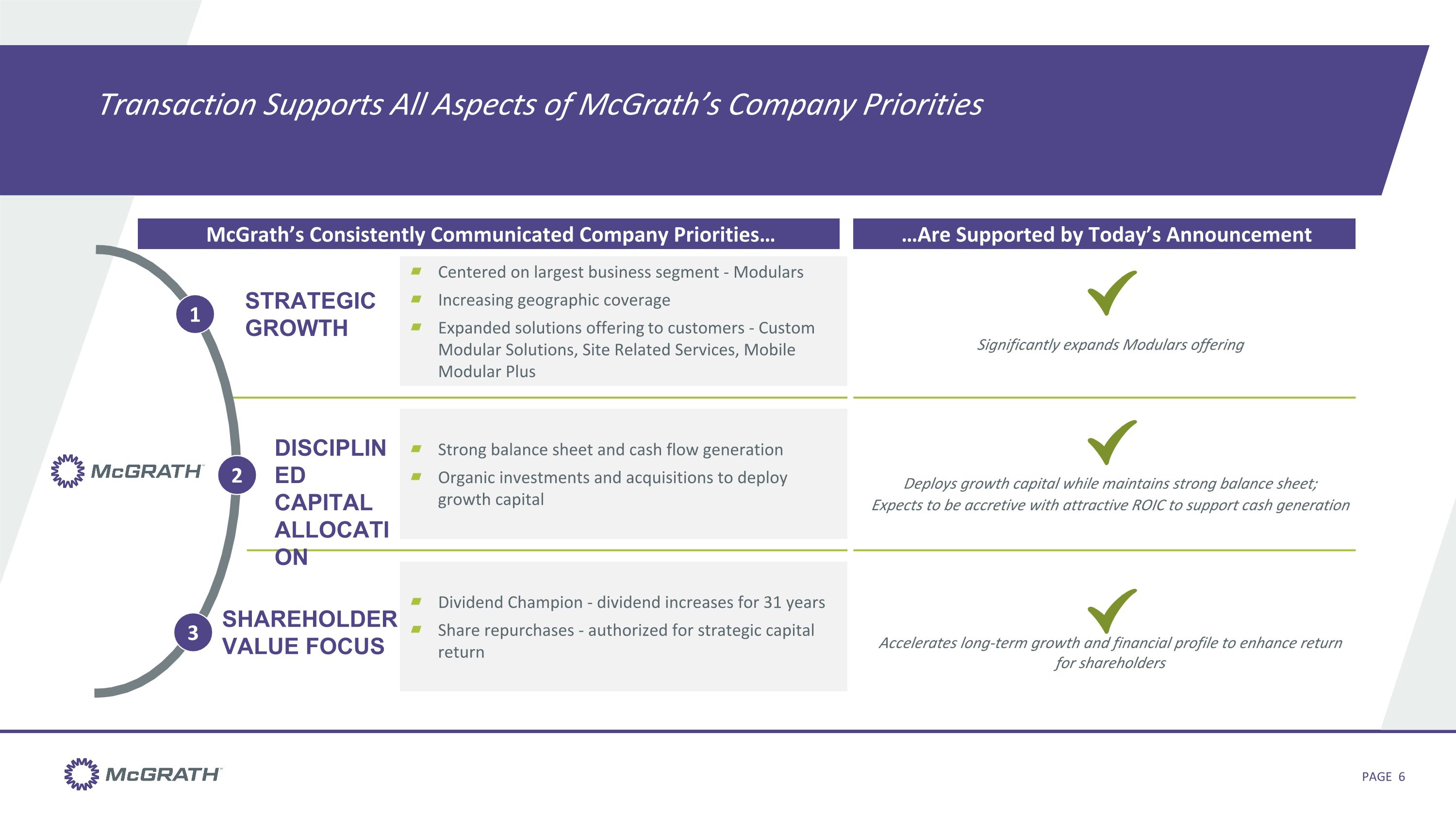

Centered on largest business segment - Modulars Increasing geographic coverage Expanded solutions offering to customers - Custom Modular Solutions, Site Related Services, Mobile Modular Plus Strong balance sheet and cash flow generation Organic investments and acquisitions to deploy �growth capital Dividend Champion - dividend increases for 31 years Share repurchases - authorized for strategic capital return Significantly expands Modulars offering Deploys growth capital while maintains strong balance sheet; Expects to be accretive with attractive ROIC to support cash generation Accelerates long-term growth and financial profile to enhance return for shareholders …Are Supported by Today’s Announcement Transaction Supports All Aspects of McGrath’s Company Priorities PAGE STRATEGIC GROWTH SHAREHOLDER VALUE FOCUS DISCIPLINED CAPITAL ALLOCATION 2 3 1 McGrath’s Consistently Communicated Company Priorities…

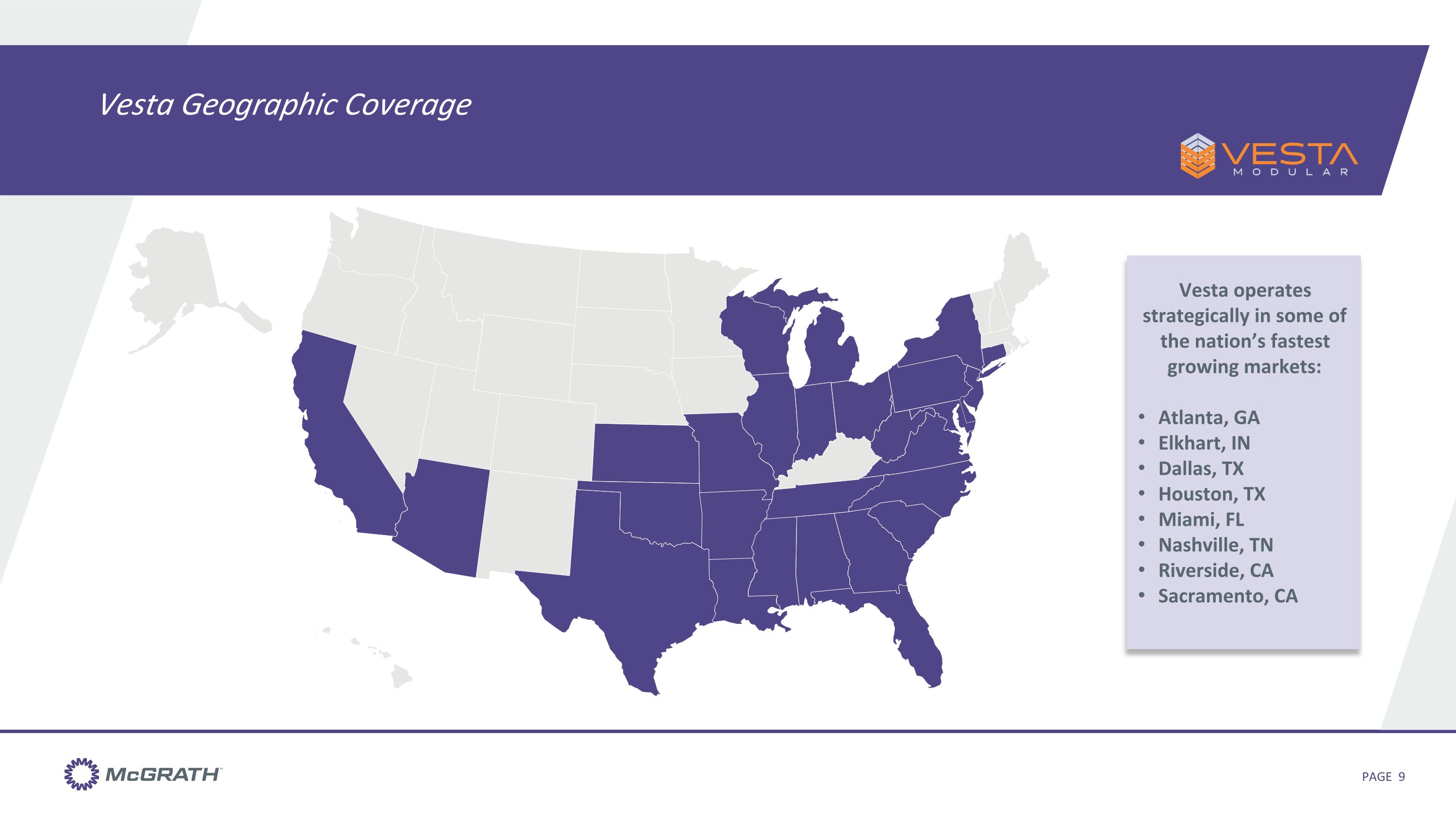

Vesta Modular Overview PAGE Business Overview Vesta is a provider of temporary and permanent modular space solutions, and facilitates modular building processes including design, construction, and installation of projects Scope of business includes both modular space leasing and modular construction services Vesta has 120+ employees to support its diverse base of 900+ customers in a variety of end markets; core end markets include education, industrial, construction, government, municipalities and retail sectors Vesta operates strategically-placed branches in some of the nation’s fastest growing markets – Atlanta, Dallas, Elkhart, Houston, Miami, Mobile, Nashville and Riverside Founded in 2014 and headquartered in Southfield, MI $129M 2022E Revenues 31 % 2022E EBITDA Margin $40M 2022E EBITDA ~6,000 Total Units ~ 7 years Average Fleet Age ~$220M Original Cost

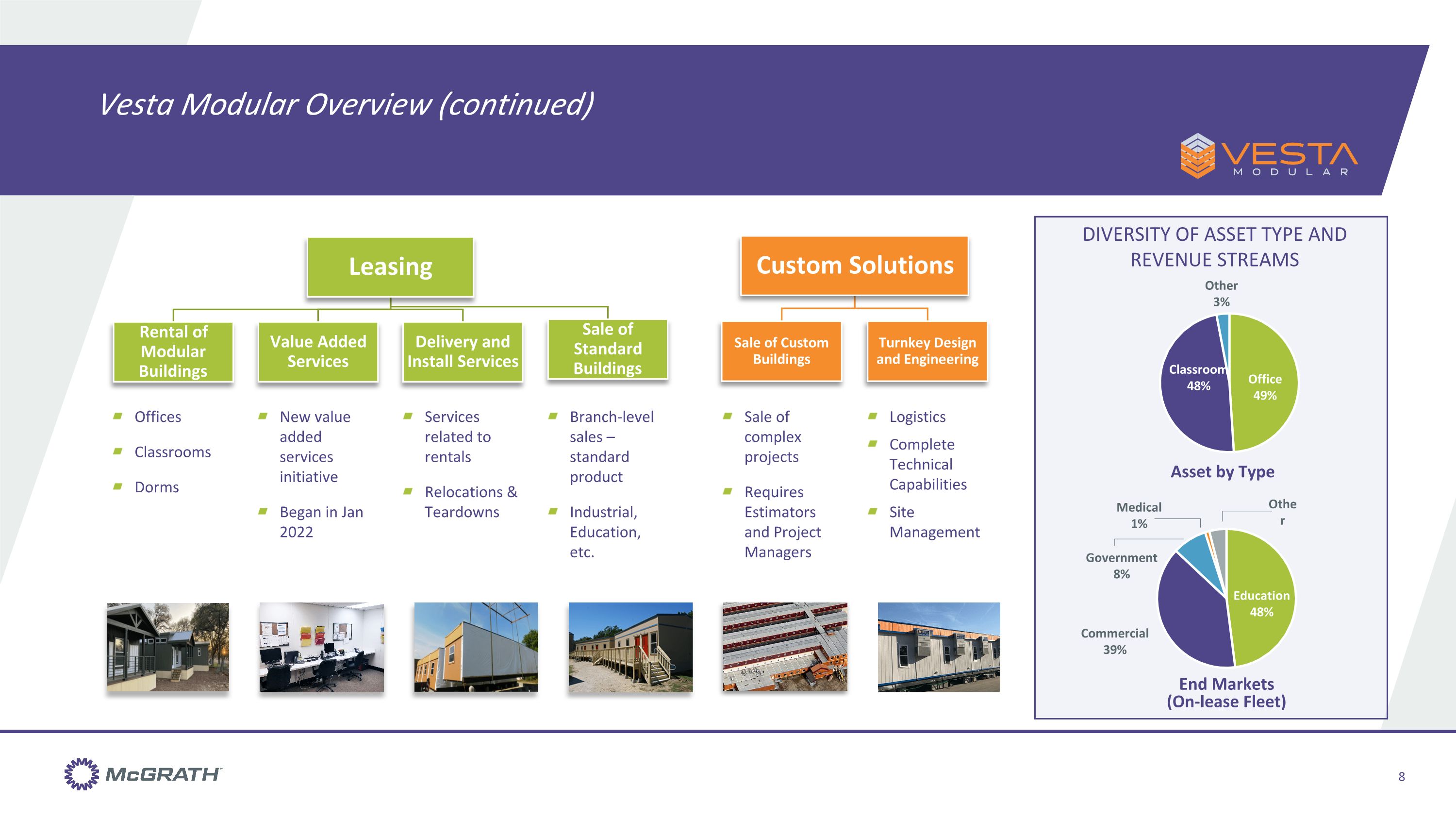

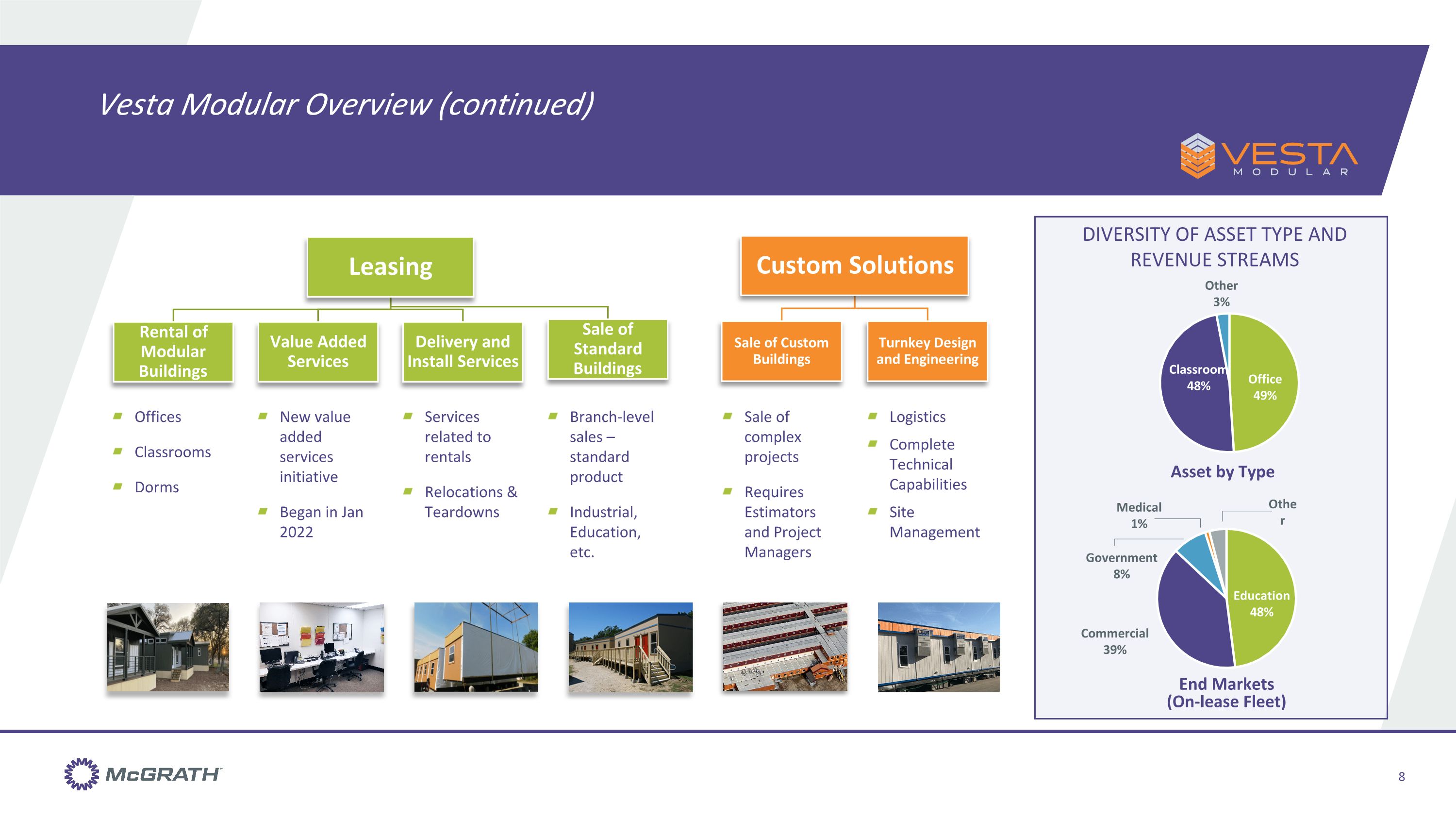

Vesta Modular Overview (continued) Leasing Rental of Modular Buildings Value Added Services Delivery and Install Services Sale of Standard Buildings End Markets (On-lease Fleet) Asset by Type Diversity of Asset Type and Revenue Streams Offices Classrooms Dorms New value added services initiative Began in Jan 2022 Services related to rentals Relocations & Teardowns Branch-level sales – standard product Industrial, Education, etc. Custom Solutions Sale of Custom Buildings Turnkey Design and Engineering Sale of complex projects Requires Estimators and Project Managers Logistics Complete Technical Capabilities Site Management

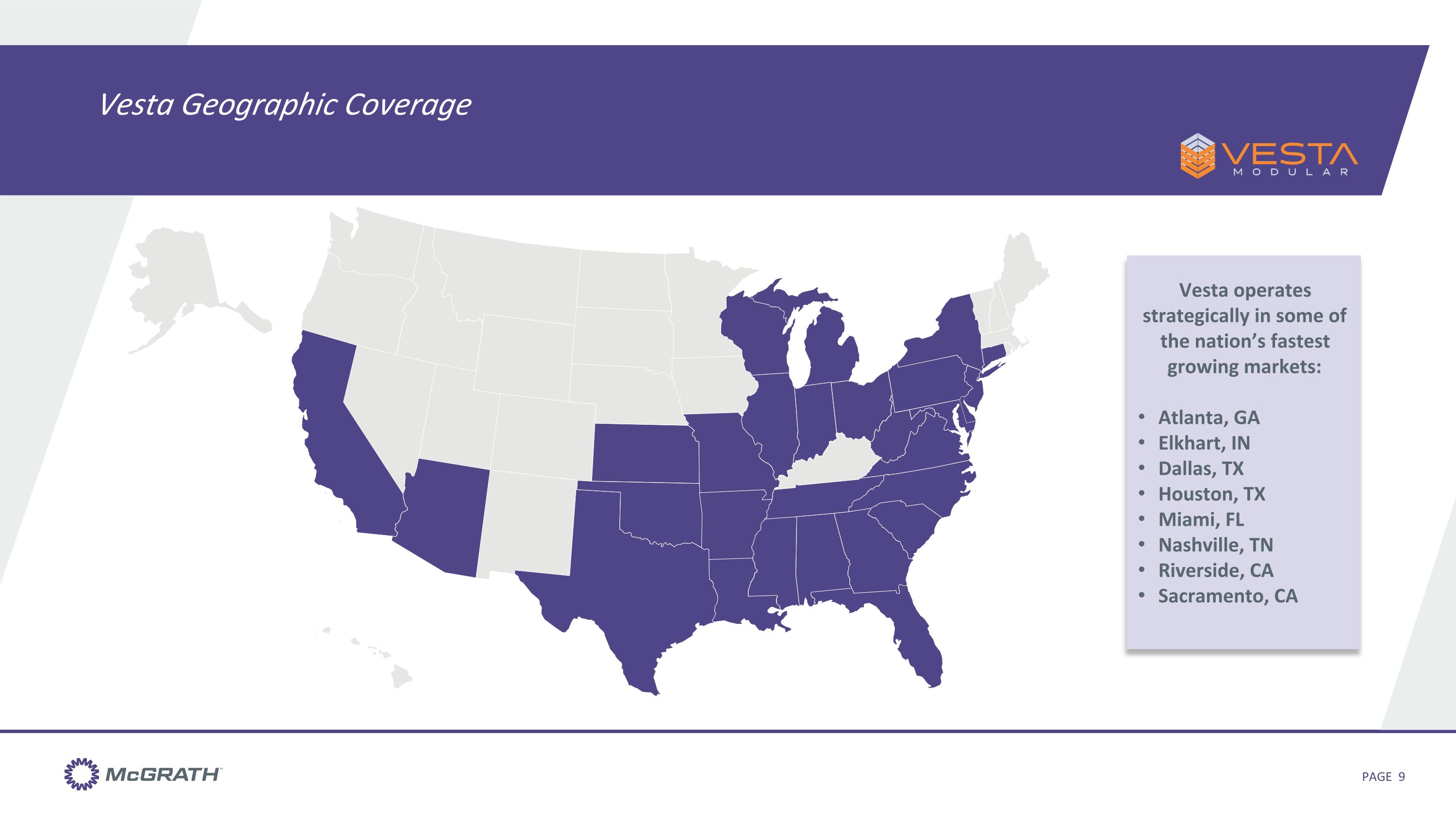

Vesta Geographic Coverage PAGE Vesta operates strategically in some of the nation’s fastest growing markets: Atlanta, GA Elkhart, IN Dallas, TX Houston, TX Miami, FL Nashville, TN Riverside, CA Sacramento, CA

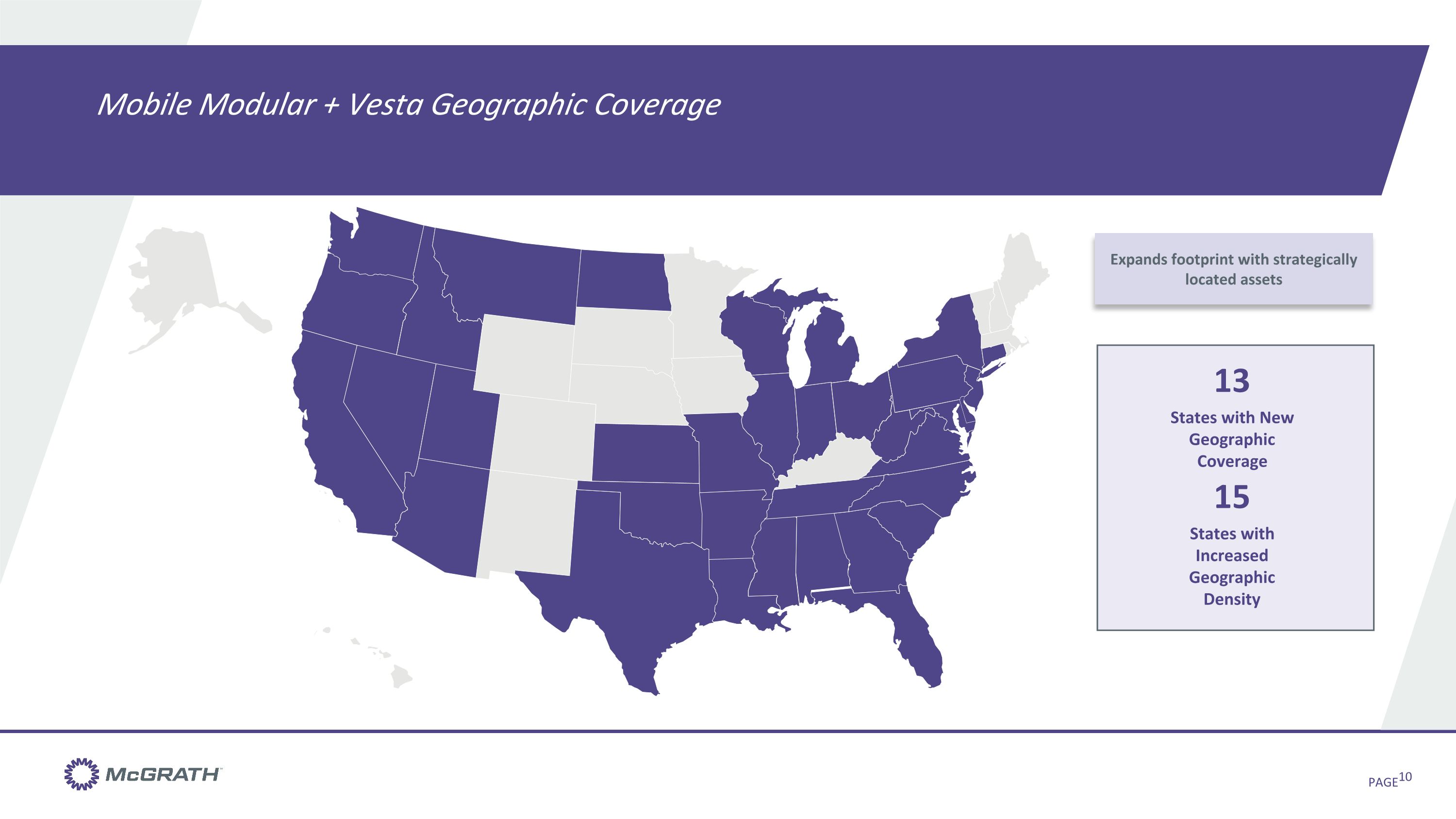

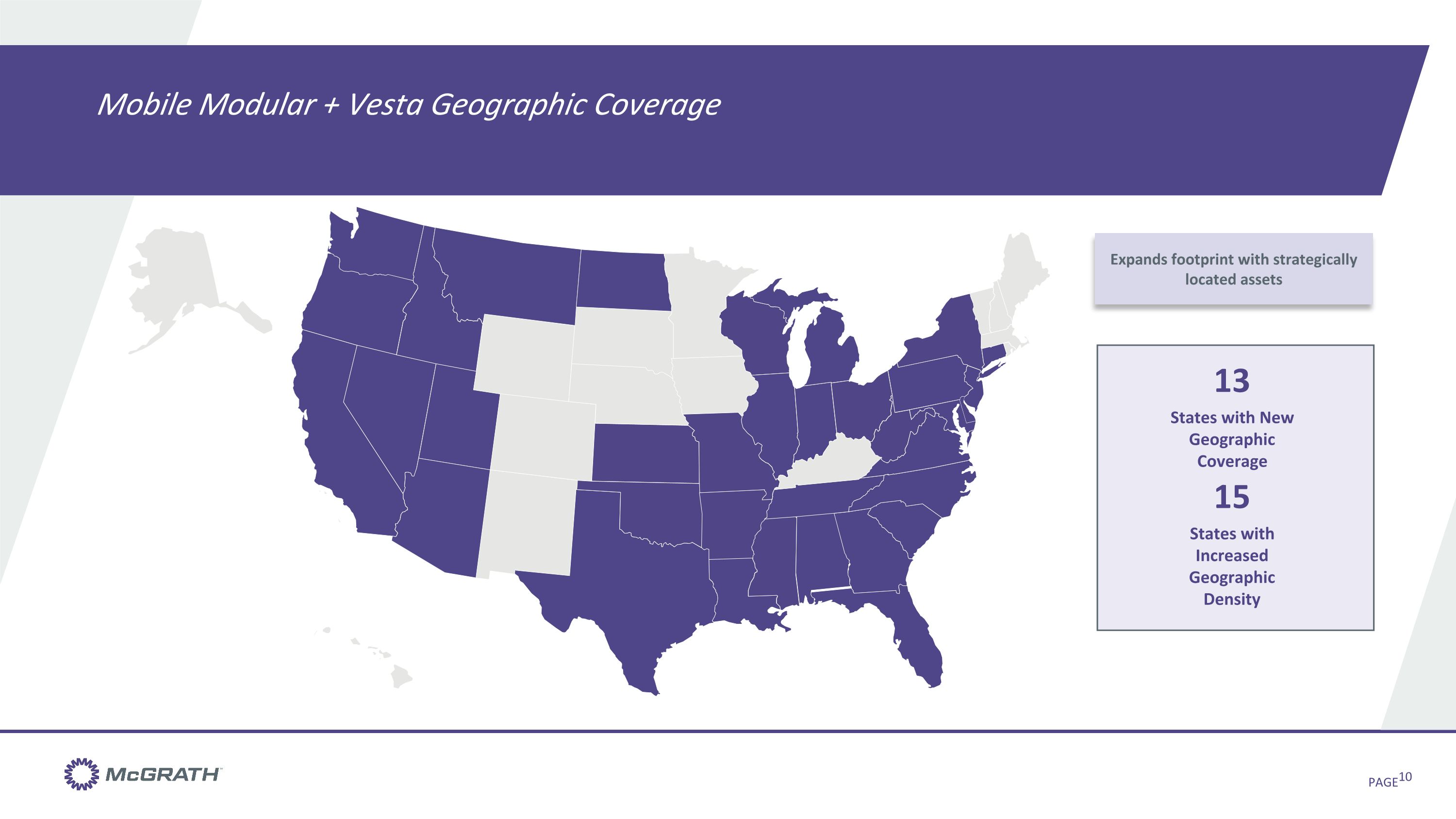

Mobile Modular + Vesta Geographic Coverage PAGE Expands footprint with strategically located assets 13 States with New Geographic Coverage 15 States with Increased Geographic Density

Significant Synergy Opportunities PAGE McGrath anticipates it can achieve run-rate synergies of $8M per year or more once Vesta is fully integrated Revenue Synergy Opportunities Improved combined fleet utilization Cost Synergy Opportunities Real estate & yard consolidation Higher market penetration through expanded geographic coverage Better penetration of services offering (Mobile Modular Plus & Site Related Services) Portable Storage container growth in new markets SG&A efficiencies in key support functions Purchasing savings and best practices Project management cost efficiencies for complex projects

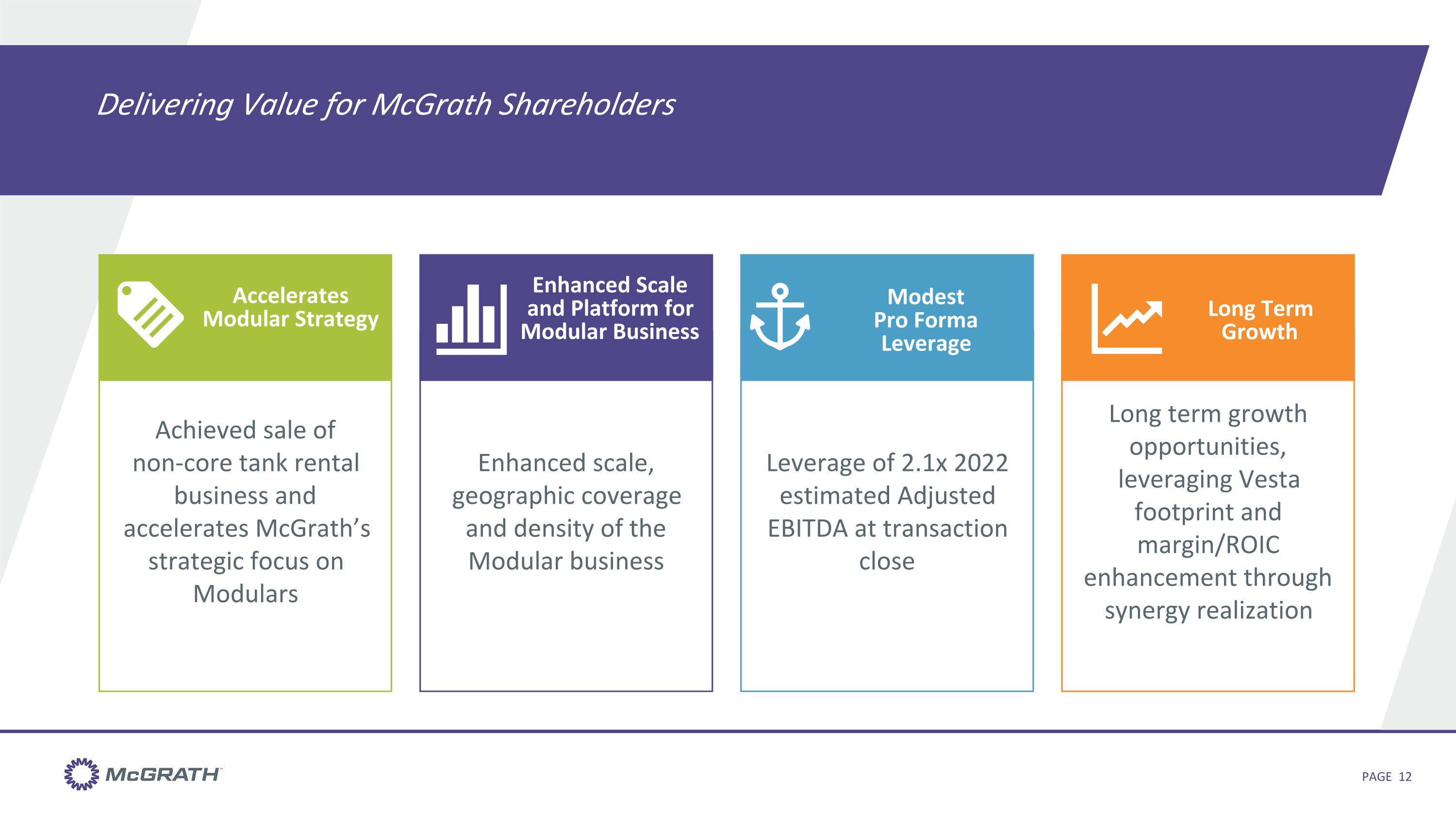

Delivering Value for McGrath Shareholders PAGE Achieved sale of non-core tank rental business and accelerates McGrath’s strategic focus on Modulars Enhanced scale, geographic coverage and density of the Modular business Leverage of 2.1x 2022 estimated Adjusted EBITDA at transaction close Long term growth opportunities, leveraging Vesta footprint and margin/ROIC enhancement through synergy realization Enhanced Scale and Platform for Modular Business Accelerates Modular Strategy Modest Pro Forma Leverage Long Term Growth