| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-11(c) or§240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and0-11. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

McGRATH RENTCORP

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held December 12, 2024

To the Shareholders of McGrath RentCorp:

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of Shareholders (the “Annual Meeting”) of McGrath RentCorp, a California corporation (the “Company”), will be held virtually only at www.proxydocs.com/MGRC, on Thursday, December 12, 2024, at 2:00 p.m., PST. Shareholders will be able to listen, vote, and submit questions from any remote location that has internet connectivity. There will be no physical location for shareholders to attend. The Annual Meeting will be held for the following purposes:

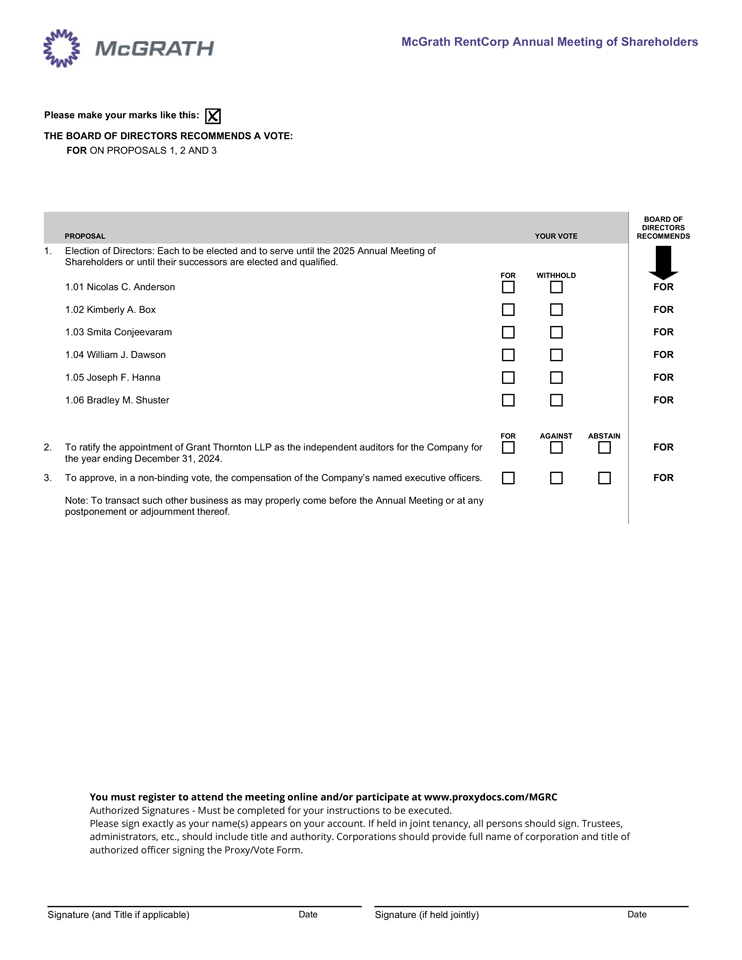

1. To elect six (6) directors of the Company, as specifically set forth in the attached proxy statement, to serve until the 2025 Annual Meeting of Shareholders or until their successors are elected and qualified;

2. To ratify the appointment of Grant Thornton LLP as the independent auditors for the Company for the year ending December 31, 2024;

3. To approve, in a non-binding vote, the compensation of the Company’s named executive officers; and

4. To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

The foregoing items of business are more fully described in the proxy statement which is attached and made a part hereof (the “Proxy Statement”).

The Board of Directors of the Company has fixed the close of business on October 22, 2024, as the record date for determining the shareholders entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof.

I M P O R T A N T

We are holding the Annual Meeting as a virtual meeting (via live audio webcast) format only. On behalf of the Board of Directors and management of the Company, we cordially invite you to attend the Annual Meeting by virtual presence by logging into our live webcast at: www.proxydocs.com/MGRC. Through this webcast, shareholders and proxyholders will be deemed to be present in person for purposes of conducting a vote at such meeting. In order to attend this webcast, you must register in advance at www.proxydocs.com/MGRC prior to the deadline of Thursday, December 12, 2024, at 1:00 p.m. Pacific Time, as more fully described in the accompanying Proxy Statement.

In accordance with rules established by the Securities and Exchange Commission, we are providing you access to our proxy materials over the Internet. Accordingly, we plan to mail a Notice of Internet Availability of Proxy Materials (the “Notice”) to our shareholders on or about October 31, 2024. The Notice will describe how to access and review our proxy materials, including our Proxy Statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2023. The Notice, as well as our proxy card, will also describe how you may submit your proxy electronically. If you received just a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice.

Whether or not you expect to attend the Annual Meeting via virtual presence, please vote your shares by following the instructions on the Notice, your proxy card or your voting instruction form, as applicable, as promptly as possible in order to ensure your representation at the Annual Meeting. Even if you have voted by proxy, you may still vote online if you attend the Annual Meeting via virtual presence. Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy card issued in your name from such broker, bank, or other nominee and register for the Annual Meeting in advance through our transfer agent, Computershare Trust Company, N.A. Once proof of your proxy power (legal proxy) has been obtained, send the proof reflecting your holdings along with your name and email address to legalproxy@betanxt.com to obtain your 12-digit control number. Registration must be received no later than 5:00 p.m., Eastern time, on Friday, December 6, 2024.

If you hold your shares in a brokerage account, your shares will not be voted in the election of directors or the non-binding, advisory vote on the compensation of the Company’s named executive officers unless you provide explicit instructions to your broker as to how you wish to vote your shares. Under the NASDAQ Stock Market rules governing discretionary voting of proxies by the exchange’s members, your broker is not permitted to vote shares with respect to non-routine matters such as the election of directors or the vote on compensation without voting instructions from the beneficial owner of such shares.

By Order of the Board of Directors, |

Gilda Malek |

| Vice President, General Counsel and Corporate Secretary |

Livermore, California

October 30, 2024

McGRATH RENTCORP

5700 Las Positas Road

Livermore, California 94551

PROXY STATEMENT

FOR 2024 ANNUAL MEETING OF SHAREHOLDERS

General Information

This proxy statement (this “Proxy Statement”) is made available to the shareholders of McGrath RentCorp, a California corporation (the “Company,” “we,” “us,” or “our”), in connection with the solicitation by the Board of Directors of the Company (the “Board of Directors” or the “Board”) of proxies in the accompanying form for use in voting at the 2024 Annual Meeting of Shareholders of the Company (the “Annual Meeting”) to be held on Thursday, December 12, 2024, at 2:00 p.m., PST, via virtual meeting only at www.proxydocs.com/MGRC, and any adjournment or postponement thereof. There will be no physical location for shareholders to attend. The shares represented by the proxies received, properly marked, dated, executed, and not revoked will be voted at the Annual Meeting.

This year, we are using the Internet as the primary means of delivery of proxy materials to our shareholders. We are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our shareholders of record with instructions on how to access the proxy materials online at www.proxydocs.com/MGRC. The Company expects to mail the Notice to shareholders on or about October 31, 2024.

The rules of the Securities and Exchange Commission (the “SEC”) require us to notify our shareholders of the availability of our proxy materials through the Internet.

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be held on Thursday, December 12, 2024

Our Proxy Statement and 2023 Annual Report to Shareholders are available at

www.proxydocs.com/MGRC

The following questions and answers provide important information about the Annual Meeting and this Proxy Statement:

When is the Annual Meeting?

The Annual Meeting will be held on Thursday, December 12, 2024, at 2:00 p.m., PST, via virtual meeting only. There will be no physical meeting to attend. All of the members of the Board of Directors and our entire management team will participate via virtual presence only.

How do I participate in the virtual Annual Meeting?

You will not be able to attend the Annual Meeting physically. You or your proxyholder may participate, vote, and ask questions at the Annual Meeting by visiting www.proxydocs.com/MGRC and using your 12-digit control number found on your Notice.

To be admitted to the virtual Annual Meeting, you will need the 12-digit control number included on your Notice, or the instructions that accompanied your proxy materials, as applicable. The Annual Meeting will begin promptly at 2:00 p.m., PST. Online check-in will begin at 1:00 p.m., PST, and you should allow ample time for the online check-in procedures. If you have difficulty accessing the virtual Annual Meeting, please follow the instructions from your registration confirmation email.

1

If you hold shares through an intermediary, such as a bank, broker or other nominee, you will need to contact such bank, broker or other nominee to request a legal proxy and register for the Annual Meeting in advance through our transfer agent, Computershare Trust Company, N.A. (“Computershare”). Once proof of your proxy power (legal proxy) has been obtained, send the proof reflecting your holdings along with your name and email address to legalproxy@betanxt.com to obtain your 12-digit control number. Registration must be received no later than 5:00 p.m., EST, on Friday, December 6, 2024.

This year’s shareholders’ question and answer session will include questions submitted live during the Annual Meeting. You may submit a question in advance of the Annual Meeting by sending it via electronic mail to investor@mgrc.com. Questions may be submitted during the Annual Meeting through www.proxydocs.com/MGRC. We expect to respond to appropriate questions during the Annual Meeting, and may also respond to questions on an individual basis or by posting answers on our Investor Relations website after the meeting.

What matters will be considered at the Annual Meeting?

Shareholders will vote on the following items at the Annual Meeting:

| 1. | To elect six (6) directors of the Company, as specifically set forth in this Proxy Statement, to serve until the 2025 Annual Meeting of Shareholders or until their successors are elected and qualified (Proposal No. 1); |

| 2. | To ratify the appointment of Grant Thornton LLP as the independent auditors for the Company for the year ending December 31, 2024 (Proposal No. 2); |

| 3. | To approve, in a non-binding vote, the compensation of the Company’s named executive officers (Proposal No. 3); and |

| 4. | To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

How does the Board of Directors recommend that shareholders vote on these matters?

The Board of Directors believes that the election of the nominated directors, the ratification of the appointment of Grant Thornton LLP, and the approval on an advisory basis of the compensation of the Company’s named executive officers are in the best interests of the Company and its shareholders and, accordingly, recommends a vote “FOR” the approval of each of these proposals.

How are proxy materials being made available to shareholders?

The SEC adopted amendments to the proxy rules that change how companies must provide proxy materials. These rules are often referred to as “Notice and Access.” Under the Notice and Access model, a company may select either of the following two options for making proxy materials available to shareholders:

| • | the full set delivery option; or |

| • | the notice only option. |

Full Set Delivery Option

Under the full set delivery option, a company delivers all proxy materials to its shareholders as it would have done prior to the change in the rules. This can be by mail or, if a shareholder has previously agreed, by e-mail. In addition to delivering proxy materials to shareholders, a company must post all proxy materials on a publicly-accessible website and provide information to shareholders about how to access that website. The Company’s proxy materials are available on the following website: www.proxydocs.com/MGRC.

2

Notice Only Option

Under the notice only delivery option, a company must post all of its proxy materials on a publicly accessible website. However, instead of delivering its proxy materials to shareholders, the company instead delivers a one-page notice of internet availability of proxy materials which includes, among other matters:

| • | information regarding the date, time, and location of the Annual Meeting of Shareholders as well as the items to be considered at the meeting; |

| • | information regarding the website where the proxy materials are posted; and |

| • | various means by which a shareholder may request paper or e-mail copies of the proxy materials. |

A company may use a single method for all of its shareholders or use full set delivery for some while adopting the notice only option for others. The Company is required to comply with these Notice and Access rules in connection with its Annual Meeting and has elected to provide access to our proxy materials over the Internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because the Board of Directors is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the Annual Meeting. All shareholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about October 31, 2024, to all shareholders of record entitled to vote at the Annual Meeting.

What is the difference between a shareholder of record and a beneficial owner of shares held in street name?

Shareholder of Record. If your shares are registered directly in your name with the Company’s transfer agent, Computershare, then you are considered the shareholder of record with respect to those shares, and the Notice was sent directly to you by the Company.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,” and the Notice was forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares held in your account.

How do I vote?

To vote through the internet, go to www.proxydocs.com/MGRC to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice. You must cast your vote by 11:59 p.m., Eastern Time on December 11, 2024.

To vote using the proxy card, simply complete, sign and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

To vote over the telephone, dial toll-free 866.390.5401 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. You must cast your telephone vote by 11:59 p.m., Eastern Time on December 11, 2024.

3

What does it mean if I received more than one Notice?

If you received more than one Notice, it may mean that you hold shares registered in more than one account. Please follow the voting instructions on the Notices to ensure that all of your shares are voted. If you have any questions regarding your share information or address appearing on the Notice, you may call Computershare, the Company’s transfer agent, at (800) 962-4284 if you are a shareholder of record, or contact your brokerage firm, bank, broker-dealer, or other similar organization if you are a beneficial owner of shares held in “street name.”

Can I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may vote again on a later date by signing and returning a new proxy card with a later date or by attending the Annual Meeting and voting via online presence at our virtual meeting. However, your attendance at the Annual Meeting via online presence will not automatically revoke your proxy unless you vote again at the Annual Meeting or specifically request that your prior proxy be revoked by delivering a written notice of revocation to the Company’s Corporate Secretary at 5700 Las Positas Road, Livermore, California 94551 prior to the Annual Meeting. See “May I vote my shares via online presence at the virtual Annual Meeting?” below.

Who is entitled to vote?

The close of business on October 22, 2024, has been fixed as the record date (the “Record Date”) for determining the holders of shares of common stock of the Company, no par value (“Common Stock”), entitled to notice of and to vote at the Annual Meeting.

What constitutes a quorum?

As of the close of business on the Record Date, there were 24,551,184 shares of Common Stock outstanding and entitled to vote at the Annual Meeting. The presence at the Annual Meeting of a majority of these shares of Common Stock, either in person by online presence or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting.

How are votes counted and who will count the votes?

Each outstanding share of Common Stock on the Record Date is entitled to one vote on each matter properly brought before the Annual Meeting. However, in compliance with the General Corporation Law of the State of California, if a candidate nominated for election to the Board of Directors has had such candidate’s name placed in nomination prior to the shareholder vote and a shareholder gives notice, prior to the voting, of such shareholders’ intention to cumulate such shareholder’s votes, then (and only then) every shareholder voting for the election of directors will be entitled to cumulate such shareholder’s votes for the election of directors and give one candidate a number of votes equal to the number of directors to be elected (six) multiplied by the number of shares held or may distribute such shareholder’s votes on the same principle among as many candidates as the shareholder may select. If, in connection with the election of directors, cumulative voting is selected, then the six candidates receiving the highest number of affirmative votes shall be elected.

It is intended that shares represented by proxies in the accompanying form will be voted for the election of persons nominated by management. If votes are cast for any candidates other than those nominated by the Board of Directors, the persons authorized to vote shares represented by executed proxies in the enclosed form (if authority to vote for the election of Directors or for any particular nominee is not withheld) will have full discretion and authority to vote cumulatively and allocate votes among any or all of the nominees of the Board of Directors in such order and in such numbers as they may determine in their sole discretion, provided all the above-listed requirements for cumulative voting are met.

4

An automated system administered by BetaNXT will tabulate votes cast by proxy and Gilda Malek, the Company’s Vice President, General Counsel and Corporate Secretary, will act as the inspector of elections to tabulate votes cast via online presence at the Annual Meeting.

Is my vote confidential?

Proxy instructions, ballots, and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except:

| • | as necessary to meet applicable legal requirements; |

| • | to allow for the tabulation and certification of votes; and |

| • | to facilitate a successful proxy solicitation. |

Occasionally, shareholders provide written comments on their proxy cards, which may be forwarded to the Company’s management and the Board of Directors.

How are abstentions and broker “non-votes” treated?

Under the General Corporation Law of the State of California, an abstaining vote and a broker “non-vote” are counted as present and are, therefore, included for purposes of determining whether a quorum is present at the Annual Meeting. However, abstentions are not included in determining the number of shares voting on the proposals submitted to shareholders. Generally, a broker “non-vote” occurs when a nominee (such as a brokerage firm, bank, broker-dealer, or other similar organization) holding shares for a beneficial owner in “street name” does not vote on a particular matter because the nominee does not have discretionary voting power with respect to that matter and has not received voting instructions from the beneficial owner. Broker “non-votes,” and shares as to which proxy authority has been withheld with respect to any matter, are not deemed to be entitled to vote for purposes of determining whether shareholders’ approval of that matter has been obtained.

What is the voting requirement to approve each of the proposals?

With respect to Proposal No. 1 of this Proxy Statement, a plurality of the votes cast is required for the election of directors. This means that the director nominee with the most votes for a particular slot is elected for that slot. You may vote “FOR” or “WITHHELD” with respect to the election of directors, unless prior to the vote on the election of directors a shareholder has validly given notice of its intent to cumulate votes, in which case you may allocate votes (six per share of Common Stock held) among all director nominees. In the absence of cumulative voting, only votes “FOR” or “WITHHELD” are counted in determining whether a plurality has been cast in favor of a director. Abstentions and broker “non-votes,” if any, will have no effect on this proposal. Brokerage firms, banks, broker-dealers, and other nominees holding shares for holders who have not given specific voting instructions are not permitted to vote in their discretion with respect to Proposal No. 1. If you do not instruct your broker how to vote, your broker may not vote with respect to this proposal and these votes will be counted as broker “non-votes,” as is described in “What happens if I do not give specific voting instructions?” below. Our Corporate Governance Guidelines set forth our procedures if a director-nominee is elected, but receives a majority of “WITHHELD” votes. In an uncontested election, any director nominee who receives a greater number of votes “WITHHELD” from his or her election than votes “FOR” such election is required to tender his or her resignation following certification of the shareholder vote. The Corporate Governance and Nominating Committee is required to make recommendations to the Board of Directors with respect to any such letter of resignation. The Board of Directors is required to take action with respect to this recommendation within 90 days following certification of the shareholder vote and to disclose its decision-making process.

With respect to Proposal No. 2 of this Proxy Statement, the affirmative vote of a majority of the shares of Common Stock present or represented and entitled to vote at the Annual Meeting is required. You may vote

5

“FOR” or “AGAINST” with respect to the appointment of Grant Thornton LLP as the independent auditors for the Company for the year ending December 31, 2024. Abstentions will have the same effect as voting against this proposal. Because the ratification of auditors is considered a “routine” matter for which brokers may vote in the absence of shareholder direction, there will not be any broker “non-votes” on this proposal.

With respect to Proposal No. 3 of this Proxy Statement, the affirmative vote of a majority of the shares of Common Stock present or represented and entitled to vote at the Annual Meeting is required for approval, on an advisory basis, of the compensation of the Company’s named executive officers. You may vote “FOR” or “AGAINST” with respect to approval of the compensation of the Company’s named executive officers. Abstentions will have the same effect as voting against this proposal. Broker “non-votes,” if any, will have no effect on this proposal.

What happens if I do not give specific voting instructions?

For Shares Directly Registered in the Name of the Shareholder: If you return your signed proxy but do not indicate your voting preferences, the Company will vote on your behalf “FOR” the election of the nominated directors, “FOR” the ratification of the appointment of Grant Thornton LLP and “FOR” approval of the compensation of the Company’s named executive officers. If any other matter properly comes before the shareholders for a vote at the Annual Meeting, the proxyholders will vote your shares in accordance with their best judgment.

For Shares Registered in the Name of a Brokerage Firm, Bank, Broker-Dealer or Other Similar Organization: If your shares are held in street name, your brokerage firm, bank, broker-dealer, or nominee will ask you how you want your shares to be voted. If you provide voting instructions, your shares must be voted as you direct. If you do not furnish voting instructions with respect to shares registered in the name of organizations that are not governed by FINRA Rule 2251, those shares will not be voted at the meeting because such organizations do not have discretionary voting power. If you do not furnish voting instructions to brokerage firms that are governed by FINRA Rule 2251, one of two things can happen, depending upon whether a proposal is “routine.” Under FINRA Rule 2251, brokerage firms, banks, broker-dealers, and other similar organizations have the discretion to cast votes on routine matters, such as the ratification of the appointment of an independent auditor (as requested in Proposal No. 2), without voting instructions from their clients. Brokerage firms, banks, broker-dealers, and other similar organizations are not permitted, however, to cast votes on “non-routine” matters, such as the election of directors (as requested in Proposal No. 1) or votes on the compensation of the Company’s named executive officers (as requested in Proposal No. 3), without such voting instructions.

May I vote my shares via online presence at the virtual Annual Meeting?

For Shares Directly Registered in the Name of the Shareholder: Yes. To be admitted to the virtual Annual Meeting, and to vote via online presence at the Annual Meeting, you will need the 12-digit control number included on your Notice.

For Shares Registered in the Name of a Brokerage Firm or Bank: Yes, but in order to do so you will need to contact such bank, broker, or other nominee to request a legal proxy and register for the Annual Meeting in advance through our transfer agent, Computershare. Once proof of your proxy power (legal proxy) has been obtained, send the proof reflecting your holdings along with your name and email address to legalproxy@computershare.com to obtain your 12-digit control number. Registration must be received no later than 5:00 p.m., EST, on Friday, December 6, 2024.

Your online attendance at the Annual Meeting in and of itself will not automatically revoke a proxy that was submitted earlier by mail.

6

Where can I find the voting results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting. The final voting results will be tallied by the inspector of elections and reported in a current report on Form 8-K to be filed by the Company within four business days following the date of the Annual Meeting.

Who pays for this proxy solicitation?

The Company will bear the entire cost of soliciting proxies, including the costs of preparing, assembling, printing, and mailing this Proxy Statement, the proxy, and any additional soliciting material furnished to shareholders by the Company. Arrangements will be made with brokerage firms, banks, broker-dealers, nominees, and fiduciaries to send proxies and proxy materials to the beneficial owners of our Common Stock, and these entities may be reimbursed by the Company for their expenses. Proxies may be solicited by directors, officers, or employees of the Company in person or by telephone, e-mail, or other means. No additional compensation will be paid to such individuals for these services.

What is the deadline for receipt of shareholder proposals?

Our Annual Meeting is being held later in calendar year 2024 than prior years as a result of our previously announced merger with WillScot Mobile Mini Holdings Corp., which has since been mutually terminated as previously announced and reported on our Current Report on Form 8-K filed with the SEC on September 18, 2024. We plan to return to our regular annual meeting schedule in 2025, including with respect to deadlines for shareholder proposals and director nominations, and we expect that our 2025 annual meeting of shareholders (the “2025 Annual Meeting”) will be held in June 2025. If the timing of the 2025 Annual Meeting changes, we will announce such change in advance in a Quarterly Report on Form 10-Q or a Current Report on Form 8-K.

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), shareholders may present proper proposals for inclusion in our proxy statement and for consideration at our next annual meeting of shareholders. As we expect our 2025 Annual Meeting to convene more than 30 days before the anniversary of the Annual Meeting, to be eligible for inclusion in our 2025 proxy statement, a shareholder’s proposal received by us must otherwise comply with Rule 14a-8 under the Exchange Act, and must be received by us by a reasonable time before we begin to print and send our proxy materials for the 2025 Annual Meeting. While our Board of Directors will consider shareholder proposals that are properly brought before the 2025 Annual Meeting, we reserve the right to omit from our 2025 proxy statement shareholder proposals that we are not required to include under the Exchange Act, including Rule 14a-8 thereunder. We will announce the specific date by which such proposals must be received by us in a Quarterly Report on Form 10-Q or a Current Report on Form 8-K.

Shareholders may propose director candidates for consideration by our Corporate Governance and Nominating Committee. In addition to being timely submitted to the Compliance Officer of the Company at our principal executive offices by the deadline described below, any such proposal must include all of the required information listed under “Shareholder Recommendations for Membership on our Board of Directors.” As we expect our 2025 Annual Meeting to convene more than 30 days before the anniversary of the Annual Meeting, any shareholder director nominee intended to be presented at the 2025 Annual Meeting must be received by the Compliance Officer by a reasonable time before we begin to print and send our proxy materials for the 2025 Annual Meeting. We will announce the specific date by which such shareholder director nominees must be received by us in a Quarterly Report on Form 10-Q or a Current Report on Form 8-K.

Shareholders are advised to review our bylaws, which contain additional requirements with respect to advance notice of shareholder proposals and director nominations.

In addition to satisfying the requirements under our bylaws, to comply with the universal proxy rules, shareholders who intend to solicit proxies in support of director nominees other than those nominated by us must provide timely notice in the manner prescribed by, and that sets forth the information required by, Rule 14a-19 under the Exchange Act.

7

Householding of Annual Meeting Materials

To the extent we deliver paper copies of our annual report to security holders, Proxy Statement, or Notice, as applicable, the SEC rules allow us to deliver a single copy of such proxy materials to any household at which two or more shareholders reside, if we believe the shareholders are members of the same family.

We will promptly deliver, upon oral or written request, a separate copy of our annual report to security holders, proxy statement, or Notice to any shareholder residing at the same address as another shareholder and currently receiving only one copy of such proxy materials who wishes to receive his or her own copy. Similarly, multiple shareholders residing at the same residence that are currently receiving separate copies of our annual report to security holders, proxy statement or Notice may request that a single copy of such proxy materials be delivered. We will promptly deliver a separate copy of these documents without charge to you upon written request to McGrath RentCorp, 5700 Las Positas Road, Livermore, California 94551 Attn: Investor Relations. If you want to receive separate copies of our proxy materials in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your brokerage firm, bank, broker-dealer, or other nominee who is a record holder, or you may contact us at the address listed above.

Financial and Other Information

We are required to file annual, quarterly, and current reports, proxy statements and other reports with the SEC. Copies of these filings are available through our Internet website at www.mgrc.com under the Investors section or the SEC’s website at www.sec.gov. We will furnish copies of our SEC filings (without exhibits), including our annual report on Form 10-K for the fiscal year ended December 31, 2023, and filed with the SEC on February 21, 2024, as amended on Form 10-K/A filed with the SEC on April 16, 2024 (the “2023 Annual Report”), without charge to any shareholder upon written request to McGrath RentCorp, 5700 Las Positas Road, Livermore, California 94551 Attn: Investor Relations.

8

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Company’s bylaws authorize the number of directors to be not less than five (5) and not more than nine (9). The Board of Directors is currently fixed at six (6) directors and composed of the following directors whose terms will expire upon the election and qualification of directors at the Annual Meeting: Nicolas C. Anderson, Kimberly A. Box, Smita Conjeevaram, William J. Dawson, Joseph F. Hanna, and Bradley M. Shuster. At each Annual Meeting of shareholders, directors will be elected for full terms of one year to succeed those directors whose terms are expiring.

At the 2024 Annual Meeting, the shareholders will elect six (6) directors. Messrs. Anderson, Dawson, Hanna, and Shuster and Mses. Box and Conjeevaram each have been nominated to serve a one-year term, until the Annual Meeting of Shareholders to be held in 2025, until their successors are elected or appointed and qualified, or until their earlier death, resignation, or removal. The Board of Directors has no reason to believe that any of Messrs. Anderson, Dawson, Hanna, or Shuster or Mses. Box or Conjeevaram will be unable or unwilling to serve as a nominee or as a director if elected.

Nominees

The names of the nominees and certain information about them as of October 22, 2024, are set forth below.

Name of Nominee | Age | Principal Occupation | Director Since | |||||

Nicolas C. Anderson | 40 | Managing Partner of Elm Grove Partners and Chief Executive Officer of ArcherHall | 2022 | |||||

Kimberly A. Box | 64 | Former President and Chief Executive Officer of Gatekeeper Innovation, Inc. | 2018 | |||||

Smita Conjeevaram | 63 | Former Chief Financial Officer of Fortress Investment Group LLC | 2021 | |||||

William J. Dawson | 70 | Former Chief Financial Officer of Adamas Pharmaceuticals, Inc. | 1998 | |||||

Joseph F. Hanna | 61 | Chief Executive Officer and President of the Company | 2017 | |||||

Bradley M. Shuster | 69 | Chairman of the Board of Directors of the Company and Executive Chairman and Chairman of the Board of NMI Holdings, Inc. | 2017 | |||||

Nicolas C. Anderson was elected a director of the Company in December 2022. He is the founder and Managing Partner of Elm Grove Partners, an entrepreneurial private equity firm specializing in control investments in established lower middle-market companies. Since 2013, Mr. Anderson has had primary responsibility for raising equity capital and debt financing, as well as leading investment analysis for potential acquisitions. He also serves as Chief Executive Officer of ArcherHall, an Elm Grove Partners portfolio company that provides data and document management services to law firms. Under his leadership, ArcherHall, has transformed from a local legal copy business into one of the largest independent digital forensics firms in the United States. Previously, Mr. Anderson worked at JPMorgan in New York, as well as at two boutique investment banks. During his Wall Street career, he worked on transactions totaling over a billion dollars, including equipment lease financing, mortgage-backed securities, and other complex securitizations, alongside traditional debt and equity financing. He held the Series 7 and Series 63 securities licenses. Mr. Anderson currently serves on the board of the Bank of Marin (NASDAQ: BMRC), where he is chair of the Audit Committee and a member of both the Compensation Committee and the Nominating and Governance Committee. He is also on the board of YMCA of Superior California, serving on both its Audit and Finance Committees. Previously, he served on the board of American River Bank (NASDAQ: AMRB), where he chaired the Directors Loan Committee and was a member of the Nominating and Audit Committees, as well as a special committee focused on M&A opportunities. Mr. Anderson received an AB in Economics from Harvard University and an MBA with Distinction from Harvard Business School.

9

As an experienced public company independent director, chief executive, private equity investor, and entrepreneur, Mr. Anderson brings valuable leadership in finance to the Board of Directors.

Kimberly A. Box was elected a director of the Company in 2018 and currently serves as Chair, Compensation Committee. Ms. Box was previously the President and Chief Executive Officer of Gatekeeper Innovation, Inc., a healthcare company that creates products to keep medications safe. She joined the company in 2016. Prior to joining Gatekeeper Innovation, Ms. Box enjoyed a successful 29-year career with Hewlett Packard (NYSE: HPQ), holding various executive positions, the most recent being Vice President Global IT Services, a position she held until 2009 when she left Hewlett Packard. Ms. Box also serves on the Board of Directors of Applied Science, Inc. (“ASI”) and formerly American River Bank (NASDAQ: AMRB) until it was acquired in 2021. Ms. Box holds a Bachelor of Science in Business Administration with a concentration in Management and a minor in Computer Science from California State University, Chico. She also completed the Executive Development Program at The Wharton School of the University of Pennsylvania and has a NACD Directorship Certification™ (2021) and a CERT in Cybersecurity Oversight from the Software Engineering Institute at Carnegie Mellon University (2022). Ms. Box is on the NACD Northern California Chapter board and recently served as the Chair, and was named to the NACD Directorship 100™, an annual recognition of the leading corporate directors who significantly impact boardroom practices and performance.

With her diverse cross-industry experience in the information technology and healthcare industries, Ms. Box brings a unique perspective and valuable experience to the Board of Directors. Additionally, Ms. Box’s special skills include experience with global leadership, digital transformation, mergers and acquisitions, strategic leadership, IT systems and cybersecurity, managed outsourced services, and community engagement. Ms. Box also has ample public board and committee chair experience.

Smita Conjeevaram was elected a director of the Company in January 2021 and currently serves as Chair, Corporate Governance and Nominating Committee. Ms. Conjeevaram previously served as Chief Financial Officer of Credit Hedge Funds & Deputy Chief Financial Officer of the Credit Funds for Fortress Investment Group LLC from 2010 to 2013. She also previously served as Chief Financial Officer for Everquest Financial LLC; Strategic Value Partners, LLC; ESL Investments, Inc.; and Sentinel Advisors, LLC. She is a CPA with experience at Price Waterhouse as Manager, International Tax—Financial Services Group and at Ernst & Young as Senior, General Tax. Ms. Conjeevaram serves on the Board of Directors of SS&C Technologies Holdings, Inc. (NASDAQ: SSNC), SkyWest, Inc. (NASDAQ: SKYW), and WisdomTree Investments, Inc. (NYSE: WT). Ms. Conjeevaram has a B.S., Accounting and Business Administration, Magna Cum Laude, from Butler University, Indianapolis, Indiana and a B.A., Economics from Ethiraj College, Madras, India.

Ms. Conjeevaram’s leadership in the financial industry as well as her accounting and compliance background bring significant and valuable experience to the Board of Directors. Additionally, Ms. Conjeevaram’s special skills include experience in the technology industry; investment, finance, and accounting; and risk management. She also has extensive public board and committee member experience and is an Audit Committee financial expert per the listing standards of the NASDAQ Stock Market. The Company and Ms. Conjeevaram believe that she has sufficient time and attention to devote to her responsibilities as a director of the Company.

William J. Dawson was elected a director of the Company in 1998 and currently serves as Chair, Audit Committee. Mr. Dawson previously served as the Chief Financial Officer at Adamas Pharmaceuticals, Inc. (NASDAQ: ADMS), a specialty pharmaceutical company, from 2014 until his retirement in 2017, where he consulted in 2013 until he joined as CFO in 2014. He also previously served as Chief Financial Officer at Catalyst Biosciences, Inc., a then privately-held biotechnology company, for two years from 2010 to 2012 and he was Vice President, Finance and Chief Financial Officer of Cerus Corporation (NASDAQ: CERS), a publicly held biopharmaceutical company, from August 2004 to April 2009. Prior to joining Cerus, he spent a total of 26 years in senior financial positions at companies in biotechnology, healthcare services and information technology, investment banking, energy, and transportation. As an investment banker, Mr. Dawson assisted in

10

three public equity offerings for the Company, beginning with its initial public offering in 1984. Mr. Dawson received an A.B. in Mechanical Engineering from Stanford University and an M.B.A. from Harvard Business School.

With his wealth of experience in financial and strategic transactions, as well as his experiences in the transportation, technology, and energy industries, and as Chief Financial Officer of publicly traded companies, Mr. Dawson provides significant value to the Board of Directors. Additionally, Mr. Dawson’s special skills include experience with mergers and acquisitions; finance, accounting, and SEC filings; capital markets; business development; IT systems and cybersecurity; strategic and corporate development; stockholder engagement; and philanthropic and community engagement. Mr. Dawson also has extensive public board and committee chair experience and is an Audit Committee financial expert per the listing standards of the NASDAQ Stock Market.

Joseph F. Hanna was appointed President, Chief Executive Officer and a director of the Company in February 2017 after serving 14 years in positions of progressive responsibility. Mr. Hanna served as the Chief Operating Officer of the Company from 2007 to 2017. From 2005 to 2007, he served as Senior Vice President of Operations, and he joined the Company in 2003 as Vice President of Operations. Mr. Hanna has been instrumental in developing and driving the strategic product and geographic expansion of the Company’s varied rental businesses throughout his tenure. He is well qualified to serve as Chief Executive Officer and as a member of the Board of Directors because of his deep institutional knowledge of the Company, its products, services, strategies, and customers. Mr. Hanna also serves as a member of the Board of Directors of Janus International Group (NYSE: JBI), the leading global provider of self-storage and commercial industrial doors, relocatable storage units, facility automation solutions, and door replacement and self-storage restoration services, since January 2024. Previously Mr. Hanna held various sales and operational leadership positions at SMC Corporation of America (a subsidiary of SMC Corporation, Tokyo, Japan). His prior experience also includes serving as an officer in the United States Army. Mr. Hanna received a B.S. in Electrical Engineering from the United States Military Academy, West Point, New York.

Bradley M. Shuster was elected a director of the Company in 2017 and Chairman of the Board in 2021. He previously held the position of Vice-Chairman from 2020 to 2021. Mr. Shuster has served as Executive Chairman and Chairman of the Board of NMI Holdings, Inc. (NASDAQ: NMIH) since January 2019. Mr. Shuster founded National MI and served as Chairman and Chief Executive Officer of the company from 2012 to 2018. Prior to founding National MI, Mr. Shuster was a senior executive of The PMI Group, Inc. (NYSE: PMI), where he served as Chief Executive Officer of PMI Capital Corporation. Before joining PMI in 1995, Mr. Shuster was a partner at Deloitte LLP, where he served as partner-in-charge of Deloitte’s Northern California Insurance and Mortgage Banking practices. He also serves as an independent director of WaFd, Inc. (NASDAQ: WAFD). He holds a B.S. from the University of California, Berkeley and an M.B.A. from the University of California, Los Angeles. Mr. Shuster has received both CPA and CFA certifications. Additionally, Mr. Shuster completed the National Association of Corporate Directors Cyber-Risk Oversight Program, earning the CERT Certificate in Cybersecurity Oversight.

With his extensive experience in the financial sector, as well as his experiences as Executive Chairman and as a senior executive of various publicly traded companies, Mr. Shuster provides significant value to the Board of Directors. Additionally, Mr. Shuster’s special skills include experience with mergers and acquisitions; finance, accounting, and investments; business development and operations; strategic and corporate development; and stockholder engagement. Mr. Shuster also has extensive public board and committee chair experience and is an Audit Committee financial expert per the listing standards of the NASDAQ Stock Market.

Required Vote

The nominees will be elected by a plurality of the votes cast. Abstentions and broker “non-votes,” if any, will not be counted toward the nominees’ total. However, under our Corporate Governance Guidelines, in an uncontested election, any nominee for director who receives a greater number of votes “WITHHELD” from his

11

or her election than votes “FOR” such election (a “Majority Withheld Vote”) is required to tender his or her resignation following certification of the shareholder vote.

If prior to the vote on the election of directors a shareholder has validly given notice of its intent to cumulate votes, you will have six votes per share of Common Stock held which you may allocate among the director nominees. In such an event, the six nominees receiving the highest number of votes “FOR” will be elected to the Board.

If a nominee for director is required to tender his or her resignation pursuant to our Corporate Governance Guidelines, then the Corporate Governance and Nominating Committee shall consider the tendered resignation and recommend to the Board of Directors whether to accept it. The Board of Directors will act on the Corporate Governance and Nominating Committee’s recommendation within 90 days following certification of the shareholder vote. The Board of Directors will promptly disclose its decision whether to accept or reject the director’s resignation offer (and the reasons for rejecting the resignation offer, if applicable) in a current report on Form 8-K filed by the Company with the SEC.

Any director who tenders his or her resignation pursuant to this provision shall not participate in the Corporate Governance and Nominating Committee recommendation, or the Board of Directors’ action, regarding whether to accept the resignation offer.

If all members of the Corporate Governance and Nominating Committee receive a Majority Withheld Vote at the same election, then the independent directors who did not receive a Majority Withheld Vote shall appoint a committee among themselves to consider the resignation offers and recommend to the Board of Directors whether to accept them; provided, however, that if the only directors who did not receive a Majority Withheld Vote in the same election constitute three or fewer directors, then all directors may participate in the action regarding whether to accept the resignation offers.

Each nominee elected as a director will continue in office until his or her successor has been elected and qualified, or until his or her earlier death, resignation, or retirement.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF EACH OF THE NOMINEES NAMED ABOVE.

12

EXECUTIVE OFFICERS AND DIRECTORS

The following table sets forth certain information with respect to the executive officers and directors of the Company as of October 22, 2024:

Name | Age | Position Held with the Company | ||||

Joseph F. Hanna | 61 | Chief Executive Officer, President and Director | ||||

Keith E. Pratt | 61 | Executive Vice President, Chief Financial Officer and Assistant Corporate Secretary | ||||

David M. Whitney | 60 | Vice President, Principal Accounting Officer and Corporate Controller | ||||

Tara Wescott | 50 | Vice President, Human Resources | ||||

Gilda Malek | 56 | Vice President, General Counsel and Corporate Secretary | ||||

Kristina Van Trease | 55 | Senior Vice President, Chief Strategy Officer | ||||

Philip B. Hawkins | 49 | Senior Vice President, Mobile Modular | ||||

John P. Skenesky | 58 | Vice President, TRS-RenTelco | ||||

John P. Lieffrig | 60 | Vice President, Portable Storage | ||||

Nicolas C. Anderson(1)(2) | 40 | Director | ||||

Kimberly A. Box(1)(3) | 64 | Director | ||||

Smita Conjeevaram(2)(3) | 63 | Director | ||||

William J. Dawson(1)(2) | 70 | Director | ||||

Bradley M. Shuster(1)(3) | 69 | Chairman of the Board of Directors | ||||

| (1) | Member of the Compensation Committee |

| (2) | Member of the Audit Committee |

| (3) | Member of the Corporate Governance and Nominating Committee |

Nicolas C. Anderson, Kimberly A. Box, Smita Conjeevaram, William J. Dawson, Joseph F. Hanna, and Bradley M. Shuster are nominees to the Board of Directors and their descriptions appear under “Proposal No. 1: Election of Directors—Nominees.”

Keith E. Pratt was appointed Executive Vice President of the Company in February 2017. He was appointed Senior Vice President in June 2007 and joined the Company in January 2006 as Vice President and was appointed Chief Financial Officer in March 2006. Prior to joining the Company, he was with Advanced Fibre Communications (“AFC”), a public telecommunications equipment company in Petaluma, California, where he served as Senior Vice President and Chief Financial Officer. Mr. Pratt served as Chief Financial Officer from 1999 until AFC was acquired by Tellabs, Inc. at the end of 2004. He also served as Director of Corporate Development at AFC from 1997 to 1999 prior to becoming Chief Financial Officer. Prior to Mr. Pratt joining AFC, he served as Director, Strategy & Business Development Group at Pacific Telesis Group, Inc. from 1995 to 1997. Mr. Pratt has an undergraduate degree from Cambridge University in Production Engineering and an M.B.A. from Stanford University.

David M. Whitney joined the Company as its Corporate Controller in 2000 and was appointed Vice President and Principal Accounting Officer in March 2006. Previously, he was Manager of Regional Accounting for The Permanente Medical Group in Oakland, California. Mr. Whitney holds a B.S. in Accounting from California State University at Hayward and is a Certified Public Accountant.

Tara Wescott joined the Company in 2020 as Vice President, Human Resources. Prior to joining the Company, Ms. Wescott held various senior executive leadership roles in Human Resources between 2000-2020 at Macy’s Inc., including leading Human Resources for Macys.com and Macy’s Technology. Ms. Wescott graduated from California State University, East Bay with a B.S. in Business Administration with a concentration in Marketing.

13

Gilda Malek joined the Company in 2023 as Vice President, General Counsel and Corporate Secretary. In her role, Ms. Malek oversees our legal, safety and real estate functions. Prior to joining the Company, Ms. Malek served as Deputy General Counsel at Confluent, a SaaS company, for nearly two years. Prior to Confluent, Ms. Malek worked at AECOM, a global infrastructure firm, in various leadership roles in the company’s Legal Department between 2007 and 2020. Responsibilities included subsidiary General Counsel, division Chief Counsel and Corporate Deputy General Counsel. Ms. Malek received her J.D. from University of San Francisco, School of Law, and her B.A. in Political Science from University of California, Irvine.

Kristina Van Trease was appointed Senior Vice President, Chief Strategy Officer in December of 2023. She previously served as Senior Vice President, Strategy and Business Development, and earlier as Vice President and Division Manager of Adler Tank Rentals, a former division of the Company, from August 2016 through January 2022. Prior to that, Ms. Van Trease was responsible for the startup of our Mobile Modular Portable Storage business and served as Vice President and Division Manager of the business from June 2009 to August 2016. From July 2007 through June 2009, she served as our Director of Corporate Development. She joined the Company in 1992 and has served in corporate management roles as well as sales and management positions for the Company’s TRS-RenTelco division. Ms. Van Trease received a B.S. in Business Administration with a concentration in Marketing from San Jose State University.

Philip B. Hawkins was appointed Senior Vice President and Division Manager, Mobile Modular in January of 2022. In addition to his existing oversight of Enviroplex, Inc. since June 2019, he also oversees Kitchens to Go by Mobile Modular as of April 2021. He previously served as Vice President and Division Manager of Mobile Modular from November 2011 through December 2021 and as Vice President and Division Manager of TRS-RenTelco from June 2007 to November 2011. Mr. Hawkins also held the role of Manager, Corporate Financial Planning and Analysis from June 2004 to June 2007. Prior to that, Mr. Hawkins was a Senior Business Analyst for Technology Rentals and Services (TRS), an electronics equipment rental division of CIT Technologies Corporation, from December 2003 until TRS was acquired by the Company in June 2004. He previously served as Director of Portfolio Management and held other leadership roles with Dell Financial Services from April 1999 to December 2003. Mr. Hawkins received B.S. degrees in Accounting, Finance and Computer Information Systems from Arizona State University.

John P. Skenesky was appointed Vice President and Division Manager of TRS-RenTelco in November 2011. He previously served as the division’s Director of Sales and Product Management from June 2007 to November 2011 and Director of Operations and Product Management from June 2004 to June 2007. Mr. Skenesky joined the Company in 1995 and served in branch management and sales roles for the RenTelco division. Prior to joining the Company, Mr. Skenesky served in lab and product management roles at Genstar Rentals from 1991 to 1994. He also served in the United States Navy from 1984 to 1990 as an electronics technician on submarines. Mr. Skenesky received an M.B.A. from Texas Christian University in 2007.

John P. Lieffrig joined the Company and was appointed Vice President and Division Manager of Mobile Modular Portable Storage in August 2016. He previously served as Vice President Sales North America for Modular Space Corporation from 2005 to 2015. Mr. Lieffrig has held several executive leadership roles with equipment rental and business-to-business service organizations, including Aramark Corporation from 2002 to 2005 and GE Capital from 1988 to 2002. He also served on the Modular Building Institute Board of Directors for eight years and was elected President in 2013. Mr. Lieffrig received B.A. degrees in Business Administration and Marketing from Carthage College.

Each executive officer of the Company serves at the pleasure of the Board of Directors.

14

Characteristics of Director Nominees

The chart below details our Board of Directors’ diversity composition by various characteristics as defined by the NASDAQ Stock Market board diversity and disclosure Rule 5605(f). For more information regarding our philosophy concerning the diversity and recruitment of our directors, see “Qualifications of Directors and Assessment of Diversity” in this Proxy Statement. This table includes information only on our director nominees.

Board Diversity Matrix as of October 22, 2024 | ||||||||||||||||

Total Number of Directors |

| 6 |

| |||||||||||||

Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||||

Part I: Gender Identity |

| |||||||||||||||

Directors | 2 | 4 | ||||||||||||||

Part II: Demographic Background |

| |||||||||||||||

African American or Black | 1 | |||||||||||||||

Alaskan Native or Native American | ||||||||||||||||

Asian | 1 | |||||||||||||||

Hispanic or Latinx | ||||||||||||||||

Native Hawaiian or Pacific Islander | ||||||||||||||||

White | 1 | 3 | ||||||||||||||

Two or More Races or Ethnicities | ||||||||||||||||

LGBTQ | ||||||||||||||||

Did Not Disclose Demographic Background | ||||||||||||||||

Corporate Governance Overview

Our Board of Directors is committed to strong and effective corporate governance, and, as a result, it regularly monitors our corporate governance policies and practices to ensure compliance with applicable laws, regulations, and rules, as well as best practices.

Our corporate governance program features the following:

| • | We have an independent Chairman of the Board of Directors; |

| • | All of our directors, other than our Chief Executive Officer, are independent; |

| • | All of our directors are up for re-election annually; |

| • | Two of our six director nominees are women; additionally, two of our nominees are diverse representatives from under-represented communities (as those communities are defined pursuant to California AB 979); |

| • | Each director attended at least 75% of the aggregate total number of Board meetings and the total number of meetings of Board committees on which such director served during the time he or she served on the Board or committees in 2023; |

| • | We have no shareholder rights plan in place; |

| • | Our Board committees regularly review and update, as necessary, the committee charters, which clearly establish the roles and responsibilities of each such committee, and such charters are posted on our website for review; |

| • | Our Board generally has an executive session among our non-employee and independent directors after every board meeting; |

| • | The majority of our Audit Committee members qualify as Audit Committee financial experts; |

| • | Our Board enjoys unrestricted access to the Company’s management, employees, and professional advisers; |

| • | We have a code of business conduct and ethics that is reviewed regularly for best practices and is posted on our website for review; |

15

| • | We have a clear set of corporate governance guidelines that are reviewed regularly for best practices and posted on our website for review; |

| • | We are committed to corporate and social responsibility; |

| • | We have no supermajority voting provisions in our charter documents; |

| • | We have a compensation recoupment policy; |

| • | Our insider trading policy prohibits hedging, pledging or engaging in derivative actions relating to our stock by all employees, officers, and directors; |

| • | Our Board performs an annual self-assessment to evaluate its effectiveness in fulfilling its obligations; |

| • | We conduct an annual say-on-pay vote; |

| • | Board and Chief Executive Officer succession planning is a focus and continual Board discussion topic; |

| • | Our corporate governance documents do not contain a supermajority standard for the approval of a merger or a business combination, which transaction requires the affirmative vote of a majority of the outstanding shares; |

| • | We had no related party transactions as defined by the Securities and Exchange Commission in 2023; and |

| • | We have a stock ownership and holdback requirement to ensure that our executive officers remain aligned with the interests of the Company and our shareholders. |

Director Independence

The Board of Directors has determined that the five (5) non-employee directors on the Board of Directors, consisting of Messrs. Anderson, Dawson, and Shuster and Mses. Box and Conjeevaram, are “independent,” as defined in the listing standards of the NASDAQ Stock Market and regulations of the SEC and that Elizabeth Fetter, who resigned from our Board of Directors effective August 1, 2024, was independent during her service on our Board. Mr. Hanna, as an executive officer of the Company, is not considered independent. In making these determinations, our Board of Directors considered transactions and relationships between each director and his or her immediate family and the Company and our subsidiaries, including those reported in the section below captioned “Certain Relationships and Related Transactions.” The purpose of this review was to determine whether any such relationships or transactions were material and, therefore, inconsistent with a determination that such a director is independent. As a result of this review, the Board of Directors affirmatively determined, based on its understanding of such transactions and relationships, that the five (5) non-employee directors are independent of the Company and, therefore, a majority of the members of our Board of Directors are independent under the applicable listing standards of the NASDAQ Stock Market.

Leadership Structure of the Board of Directors

Our Board of Directors is currently comprised of five (5) independent directors and one (1) management director. Our Corporate Governance Guidelines state that the Board of Directors should remain free to decide whether the Chairman and Chief Executive Officer positions should be held by the same person. This allows the Board of Directors to determine the best arrangement for the Company and its shareholders, given changing circumstances of the Company and the composition of the Board of Directors. Currently, the positions are separated. Mr. Hanna, our Chief Executive Officer, is a seasoned leader with over 20 years of management and operational experience in the Company, and he clearly understands and drives our strategic growth and interacts well with the Chairman of the Board and the other directors. Mr. Shuster, our non-executive chairman, has extensive experience as a senior executive of a public company and substantial experience on other public boards

16

of directors and board committees. Additionally, he is experienced in the fields of mergers and acquisitions; finance, accounting, and investments; business development and operations; strategic and corporate development; stockholder engagement; and is an Audit Committee Financial Expert per the listing standards of the NASDAQ Stock Market, which is coupled with his deep knowledge of our Company. We believe our current leadership structure is optimal at this time.

Board Succession

Our Board of Directors is committed to adding new directors to infuse new ideas and fresh perspectives in the boardroom. As part of our board’s succession planning, the Corporate Governance and Nominating Committee and our Board of Directors regularly review the composition of the Board of Directors and assess the balance of knowledge, experience, skills, expertise, tenure, and diversity that is appropriate for the Board of Directors and the Company.

Board Tenure

Our Board of Directors recognizes that its current members have served on the Board of Directors for various tenures, with the shortest tenure being approximately two years but with other directors serving for greater than 10 years. Our Board of Directors believes that the Board represents a balance of industry, technical and financial experiences, which provide effective guidance and oversight to management. Our governance policies reflect our belief that directors should not be subject to term limits. While term limits could facilitate fresh ideas and viewpoints being consistently brought to the Board of Directors, we believe they are counterbalanced by the disadvantage of causing the loss of a director who, over a period of time, has developed insight into our strategies, operations, and risks and continues to provide valuable contributions to board deliberations. Nonetheless, our Board of Directors is committed to adding new directors to infuse new ideas and fresh perspectives in the boardroom. In the past several years, four new directors have joined our Board of Directors, with the latest, Mr. Anderson, joining our Board in 2022, and three long-serving directors retired or resigned. Our Nominating and Corporate Governance Committee will continue to prioritize diversity of background, as well as diversity from underrepresented communities, in future Board searches.

Shareholder Engagement

Our Board of Directors and management focus on creating long-term, sustainable shareholder value. Key to this goal is shareholder engagement at conferences and in one-on-one meetings to discuss our financial performance, corporate governance practices, executive compensation programs, and other matters. Our conversations with shareholders allow us to better understand our shareholders’ perspectives and provide us with useful feedback to calibrate our priorities.

Meetings and Committees of the Board of Directors

The Board of Directors met five (5) times in 2023. No director attended fewer than 75% of either (i) the total number of meetings of the Board of Directors held in 2023, or (ii) the total number of meetings of the committees of the Board of Directors held in 2023 on which he or she served. All then in office attended the 2023 Annual Meeting of Shareholders via virtual participation. The standing committees of the Board of Directors currently consist of the Compensation Committee, the Audit Committee, and the Corporate Governance and Nominating Committee.

Compensation Committee

The Compensation Committee held four (4) meetings in 2023. The Compensation Committee currently consists of Messrs. Anderson, Dawson, and Shuster and Ms. Box. Ms. Box serves as its Chair. Ms. Fetter was a member of the Compensation Committee until her resignation from our Board and all committees on which she

17

served effective August 1, 2024. The Board of Directors has determined that all current members of the Compensation Committee are “independent,” as defined in the listing standards of the NASDAQ Stock Market and SEC regulations. In addition, the Board of Directors has determined that all current members of the Compensation Committee qualify as “non-employee directors” within the meaning of SEC Rule 16b-3 as promulgated under the Exchange Act, and as “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

The Board of Directors adopted and approved a charter for the Compensation Committee. A copy of this charter is posted on our website at www.mgrc.com under the Investors section. The functions of the Compensation Committee, which are discussed in detail in its charter, are to (a) evaluate executive officer and director compensation policies, goals, plans, and programs; (b) determine the cash and non-cash compensation of the executive officers of the Company; (c) review and oversee the Company’s equity-based and other incentive compensation plans for employees; (d) evaluate the performance of the Company’s executive officers; and (e) direct and review the production of any reports required by the applicable rules and regulations of the SEC.

Compensation decisions for the executive officers of the Company are made by the Compensation Committee after the review by the Board of Directors. The Compensation Committee directs the Chief Executive Officer to develop the incentive compensation guidelines for the other executive officers and to recommend the incentive compensation bonuses for each of the other executive officers, subject to approval by the Compensation Committee. Compensation decisions for directors are made by the Board of Directors based on recommendations from the Compensation Committee.

Audit Committee

The Audit Committee held five (5) meetings in 2023. The Audit Committee currently consists of Messrs. Anderson and Dawson and Ms. Conjeevaram. Mr. Dawson serves as its Chair. Ms. Fetter was a member of the Audit Committee until her resignation from our Board and all committees on which she served effective August 1, 2024. After considering transactions and relationships between each member of the Audit Committee or his or her immediate family and the Company and its subsidiaries and reviewing the qualifications of the members of the Audit Committee, the Board of Directors has determined that all current members of the Audit Committee are “independent,” as defined in the listing standards of the NASDAQ Stock Market and SEC regulations. The Board of Directors has also determined that all current members of the Audit Committee are financially literate and have the requisite financial sophistication, as required by the listing standards of the NASDAQ Stock Market. Furthermore, the Board of Directors has determined that Messrs. Anderson and Dawson and Ms. Conjeevaram, as well as Ms. Fetter (during her tenure on the Audit Committee), each qualify as Audit Committee financial experts, as defined by the applicable SEC rules, pursuant to the fact that, among other things, Mr. Dawson was the Chief Financial Officer at several public and private companies, including the Chief Financial Officer of Adamas Pharmaceuticals, Inc.; Mr. Anderson is currently Managing Partner of Elm Grove Partners, a private equity firm, and is also Chief Executive Officer of ArcherHall; Ms. Conjeevaram is a CPA and has served in the capacity of Chief Financial Officer for four privately held financial and investment firms and is also an experienced independent director and audit committee member; and Ms. Fetter has served as the CEO of three public companies, served as a divisional CFO, taught finance and accounting at the graduate level, and served as a financial expert on other boards; and in those respective capacities each has acquired the relevant experience and expertise and has the attributes set forth in the applicable rules as being required for an Audit Committee financial expert.

The Board of Directors adopted and approved a charter for the Audit Committee. A copy of this charter is posted on our website at www.mgrc.com under the Investors section. The functions of the Audit Committee, which are discussed in detail in its charter, are to (a) oversee the engagement, replacement, compensation, qualification, independence, and performance of the Company’s independent auditors; (b) oversee the conduct of the Company’s accounting and financial reporting processes and the integrity of the Company’s audited financial statements and other financial reports; (c) oversee the performance of the Company’s internal accounting,

18

financial, and disclosure controls function; and (d) oversee the Company’s compliance with its policies and other legal requirements as such compliance relates to the integrity of the Company’s financial reporting. The Audit Committee has also established procedures for (a) the receipt, retention, and treatment of complaints received by us regarding accounting, internal accounting controls, or auditing matters, and (b) the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. The Audit Committee also oversees the preparation of a report for inclusion in our annual proxy statements and is charged with the other duties and responsibilities listed in its charter. For details, see “Report of the Audit Committee of the Board of Directors” in this Proxy Statement. The Audit Committee is a separately designated standing audit committee as defined in Section 3(a)(58)(A) of the Exchange Act.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee held two (2) meetings in 2023. The Corporate Governance and Nominating Committee consists of Mr. Shuster and Mses. Box and Conjeevaram. Ms. Conjeevaram serves as its Chair. Our Board of Directors has determined that all current members of the Corporate Governance and Nominating Committee are “independent,” as defined in the listing standards of the NASDAQ Stock Market and SEC regulations.

The Board of Directors adopted and approved a charter for the Corporate Governance and Nominating Committee. A copy of this charter is posted on our website at www.mgrc.com under the Investors section. The functions of the Corporate Governance and Nominating Committee, which are discussed in detail in its charter, are to assist the Board of Directors in all matters relating to (a) the establishment, implementation, and monitoring of policies and processes regarding the recruitment and nomination of candidates to the Board of Directors and committees of the Board of Directors; (b) the review and making of recommendations to the Board of Directors regarding the composition and structure of the Board of Directors and committees of the Board of Directors; (c) the development, evaluation, and monitoring of the Company’s corporate governance processes and principles; (d) the development and implementation of, and monitoring of compliance with, the Company’s Code of Business Conduct and Ethics and making recommendations to the Board of Directors of revisions to the Code of Business Conduct and Ethics from time to time, as appropriate; and (e) the administration of the Board of Directors’ annual self-evaluation process and the sharing of the results thereof with the Board of Directors for discussion and deliberation.

Environmental, Social and Governance Matters

We believe that sound corporate citizenship and attention to environmental, social, and governance (“ESG”) principles are essential to our success. Wherever possible, the products, services, and practices of the Company are designed to promote the ESG principles. We are committed to operating with integrity, contributing to the local communities surrounding our offices and facilities, promoting diversity, developing our employees, focusing on sustainability, and being thoughtful environmental stewards.

Our Board provides oversight of management’s efforts around these ESG topics, including risk oversight of ESG-related matters, and is committed to supporting the Company’s efforts to operate as a sound corporate citizen. Company management provides updates to the Board on the Company’s work in ESG during each quarterly Board meeting and the Board discusses the same. Additionally, the Charter for our Corporate Governance and Nominating Committee also provides that this committee is specially designated to oversee ESG matters.

We believe that an integrated approach to business strategy, corporate governance, and corporate citizenship creates long-term value. Among the ways in which we have demonstrated our commitment to ESG matters are the following:

| • | Commitment to minimizing adverse impacts on the environment through energy management programs, including high-efficiency HVAC and energy systems, responsible use of limited available land, and use of natural light. |

19

| • | When possible, the Company uses recycled building materials and construction components that can be further recycled on its modular building products. |

| • | Creation of a strong corporate culture that promotes the highest standards of ethics and compliance for our business, including a Code of Business Conduct and Ethics that sets forth principles to guide employee, designated executive, and non-employee director conduct. |

| • | Company and employee commitment to the local communities where our facilities are located, including supporting various non-profits, charities, and other community programs, and, from time to time, providing support through the McGrath Cares fund. |

| • | Equal employment opportunity hiring practices, policies, and management of employees. |

| • | Anti-harassment policy that prohibits hostility or aversion towards individuals in protected categories, prohibits sexual harassment in any form, details how to report and respond to harassment issues, and strictly prohibits retaliation against any employee for reporting harassment. |

| • | Commitment to fostering and promoting a diverse workforce and a collaborative work environment. |

The Role of the Board of Directors in the Oversight of Risk