SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of September 2005

Commission File Number: 0-13742

Océ N.V.

(Translation of registrants name into English)

St. Urbanusweg 43, Venlo, The Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| OCÉ N.V. |

| |

By: | | /s/ R.L.VAN IPEREN |

| | | R.L. van Iperen |

| | | Chairman of the Board of Executive Directors |

| | | (Principal Executive Officer) |

Dated: September 16, 2005

Exhibit Index

| | |

Exhibit No.

| | Description of Exhibit

|

| |

| 99.1 | | Press Release dated September 16, 2005 |

| |

| 99.2 | | Analyst/Investor Presentation - Acquisition of Imagistics International Inc., September 16, 2005, Venlo |

Exhibit 99.1

Océ to acquire Imagistics International Inc.

Venlo, the Netherlands, September 16, 2005 - Océ N.V., one of the world’s leading suppliers of high quality and innovative products and services for professional printing and document management services, and Imagistics International Inc., a direct sales and services provider of document imaging solutions, serving the USA, U.K. and Canada and headquartered in Trumbull, Connecticut, USA, today announced that they have entered into a definitive agreement for Océ to acquire all the outstanding shares of Imagistics for $ 42 per share in cash.

The Supervisory Board and the Board of Executive Directors of Océ have approved the transaction. Likewise, the Board of Directors of Imagistics has approved the transaction.

Rokus van Iperen, Chairman of the Board of Executive Directors of Océ: “This acquisition accomplishes Océ’s strategic goal to expand and strengthen distribution power, in particular in the US market. We believe that culturally and strategically Océ and Imagistics are an excellent fit. Both companies have a solid financial position, and both serve complementary segments of the printing and document management markets. As a result of this acquisition we will be even better positioned to offer a complete range of value added solutions and world class products and services to our customers.”

Marc Breslawsky, Chairman and CEO of Imagistics: “Together, Océ and Imagistics will make a powerful combination, as our companies clearly complement each other. Our customers will have comprehensive product coverage across all segments, all from one company, across the world. We expect that Océ and Imagistics will become a major force in the US office market, with superior growth prospects globally. I believe that this transaction is in the best interests of the employees, customers, suppliers and shareholders of Imagistics.”

The Imagistics management will play an important role in the new company. Marc Breslawsky will be nominated to join the Executive Board of Océ N.V. at the Annual Shareholders Meeting. Imagistics employs 3,400 people of which approximately 1,200 are in direct sales and 1,200 in service. In both Canada and the U.K. the company has 100 employees. This acquisition will enable Océ to gain a strong market position among Fortune 1000 companies in the USA, as well as regional midsize businesses and non-profit organisations.

| | |

| Océ N.V. | |  |

P.O. Box 101, 5900 MA Venlo, the Netherlands +31 77 359 2240 Océ investor information on Internet: http://investor.oce.com | |

Press release Océ N.V.

Business rationale for the combination

| | • | | The merger will substantially increase Océ’s distribution power and expand its presence in the United States corporate printing market. |

| | • | | As a result of the transaction superiour account coverage can be given to national and international customers in both the USA and Europe. |

| | • | | The two companies complement each others’ product offerings. Océ brings excellent wide format printers, high volume printing systems, software and services based on superior own technology. Imagistics brings best-of-breed product coverage in the high, mid and lower volume segments. The Océ portfolio of hardware and software perfectly complements the current Imagistics product line. |

| | • | | Océ Business Services provides world class document management services, which can be offered to the Imagistics customers. |

Economic rationale for the combination

| | • | | Imagistics shareholders will be paid $ 42 per share of common stock in cash. Total purchase price for 100 per cent of the shares will be approximately $ 685 million, representing an EV/Sales multiple of 1.3 and an EV/EBITDA multiple of 7.2. |

| | • | | The acquisition is expected to result in accelerated growth of revenues and profit. |

Under the terms of the definitive agreement, a subsidiary of Océ will commence a cash tender offer to acquire all of Imagistics’ outstanding common stock. Upon completion of the offer, Océ will effect a merger between this subsidiary and Imagistics in which the remaining Imagistics shareholders will receive $ 42 per share in cash. Consummation of the transaction is subject to certain conditions, including the valid tender of at least a majority of the outstanding shares of common stock of Imagistics on an as-if converted basis and the expiration of the Hart-Scott-Rodino waiting period. It is anticipated that the transaction will be completed during the fourth quarter of 2005. This tender offer is only launched in the USA.

Notice to Investors

This announcement is neither an offer to purchase nor a solicitation of an offer to sell securities. The tender offer for outstanding shares of Imagistics described in this press release has not commenced. At the time the offer is commenced, Océ’s subsidiary will file a tender offer statement with the US Securities and Exchange Commission and Imagistics will file a solicitation and recommendation statement with respect to the offer. The tender offer statement (including an offer to purchase, a related letter of transmittal and other offer documents) and the solicitation/recommendation statement will contain important information that should be read carefully before any decision is made with respect to the tender offer. These materials will be made available to Imagistics’ shareholders at no expense to them. In addition, these materials (and all other offer documents filed with the SEC) will be available at no charge on the SEC’s website (www.sec.gov).

| | |

| | September 16, 2005 Page 2 |

Press release Océ N.V.

Forward-looking statements

This report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements, which may be expressed in a variety of ways, including the use of future or present tense language, refer to future events. Océ has based these forward-looking statements on its current expectations and projections about future events. Océ’s expectations and projections may change and Océ’s actual results, performance or achievements could be significantly different from the results expressed in or implied by these forward-looking statements based on various important factors, risks and uncertainties which are neither manageable nor foreseeable by Océ (and some of which are beyond Océ’s control).

When considering these forward-looking statements, you should keep in mind these risks, uncertainties and other cautionary statements made in this report or in Océ’s other annual or periodic filings made with the United States Securities and Exchange Commission. In the light of these risks, uncertainties and assumptions, the forward-looking events discussed in this report might not occur.

These factors, risks and uncertainties include, but are not limited to changes in economic and business conditions, customer demand in competitive markets, the successful introduction of new products and services into the markets, developments in technology, adequate pricing of products and services, competitive pricing pressures within Océ’s markets, the financing of Océ’s business activities, efficient and cost-effective operations, changes in foreign currency exchange rates, fluctuations in interest rates, political uncertainties, changes in governmental regulations and laws, tax rates, successful acquisitions, joint ventures and disposals and the effects of recent or further terrorist attacks and the war on terrorism.

For a more detailed discussion of the factors, risks and uncertainties that may affect Océ’s actual results, performance or achievements, you should refer to pages 69 to 73 of the annual report for 2004, Océ’s Annual Report on Form 20-F and any other filings made by Océ with the United States Securities and Exchange Commission.

Océ’s forward-looking statements speak only as of the date on which the statements are made, and Océ is under no obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events or otherwise.

September 16, 2005

Océ N.V.

Venlo, the Netherlands

For further information:

Investor Relations:

Pierre Vincent

Senior Vice President Investor Relations

Venlo, the Netherlands

Telephone +31 77 359 2240

E-mail investor@oce.com

Press:

Paul Hollaar

Vice President Corporate Communications

Venlo, the Netherlands

Telephone + 31 77 359 2000

| | |

| | September 16, 2005 Page 3 |

Exhibit 99.2

Océ Printing for Professionals

Acquisition of Imagistics International Inc. Analyst/Investor presentation

16 September 2005, Venlo

9/16/2005

Disclaimer

Forward-looking statements

This report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended [referred to hereafter as the Securities Act], and Section 21E of the Securities Exchange Act of 1934, as amended [referred to hereafter as the Exchange Act]. These forward-looking statements, which may be expressed in a variety of ways, including the use of future or present tense language, refer to future events. Océ has based these forward-looking statements on its current expectations and projections about future events.

Océ’s expectations and projections may change and Océ’s actual results, performance or achievements could be significantly different from the results expressed in or implied by these forward-looking statements based on various important factors, risks and uncertainties [some of which are beyond Océ’s control] and which are neither manageable nor foreseeable by Océ. When considering these forward-looking statements, you should keep in mind these risks, uncertainties and other cautionary statements made in this presentation or Océ’s annual or periodic reports filed with the United States Securities and Exchange Commission. In view of these risks, uncertainties and assumptions, the forward-looking events presented today might not occur.

These factors, risks and uncertainties, which include, but are not limited to, changes in economic and business conditions, customer demand in competitive markets, the successful introduction of new products and services into the markets, developments in technology, adequate pricing of products and services, competitive pricing pressures within Océ’s markets, the financing of Océ’s activities, efficient and cost-effective operations, changes in foreign currency exchange rates, fluctuations in interest rates, uncertainty of political situations, changes in governmental regulations and laws, tax rates, successful acquisitions, joint ventures and disposals and the effects of recent and potential future terrorists attacks and the war on terrorism.

For a more detailed discussion of the risks, uncertainties and other factors that may affect Océ’s actual results, performance or achievements, you should refer to pages 69 to 73 of the Annual Report for 2004, to pages 6 to 11, 56 and 57 of Océ’s 2004 Annual Report on Form 20-F and any other filings made by Océ with the United States Securities and Exchange Commission.

Océ’s forward-looking statements speak only as of the date on which the statements are made, and Océ undertakes no obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events or otherwise.

2

9/16/2005

Agenda

Summary of the Deal Strategic Context Imagistics International Inc. Strategic Fit Integration Financials Conclusions

3 9/16/2005

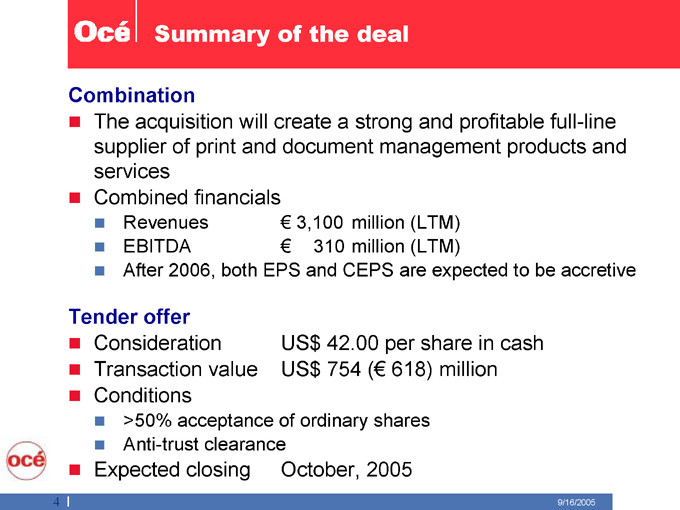

Summary of the deal

Combination

The acquisition will create a strong and profitable full-line supplier of print and document management products and services Combined financials

Revenues €3,100 million (LTM) EBITDA € 310 million (LTM)

After 2006, both EPS and CEPS are expected to be accretive

Tender offer

Consideration US$ 42.00 per share in cash Transaction value US$ 754 (€618) million Conditions

>50% acceptance of ordinary shares Anti-trust clearance

Expected closing October, 2005

4 9/16/2005

Strategic Objectives

Océ strives for a Top 3 position in the selected strategic market segments

Technical Documents

Display Graphics

Productive Printing in Corporate and Commercial segments

Océ aims for a leading position in document-related Business Services

Financial objectives RoA = 12% RoE = 18%

5 9/16/2005

Digital Document Systems

Strategic Actions

Investments in distribution

Expansion of direct sales force

Acquisitions/partnerships in distribution

Investments in competitive product portfolio

R&D activities in colour, software and HV-B/W

Outsourcing of manufacturing to Asia

OEM partnerships for full-line portfolio

Higher added value solutions in Business Services

Operational excellence

Cost reduction in IT, Logistics and Purchasing

Reduction of working capital

Continuing emphasis on costs of sales & services and support functions

9/16/2005

6

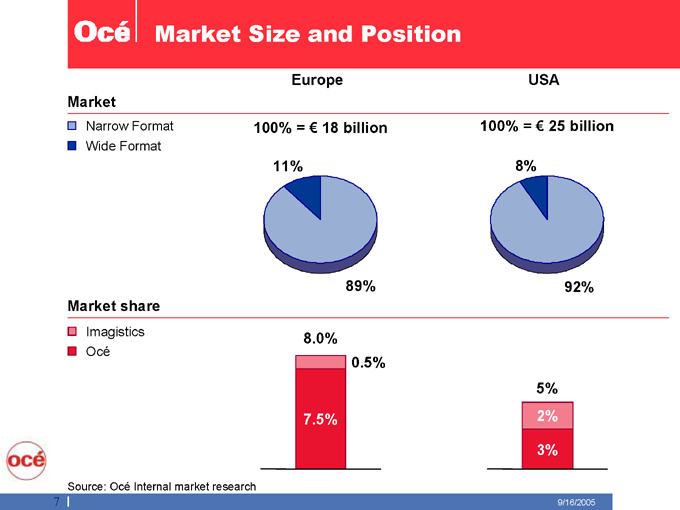

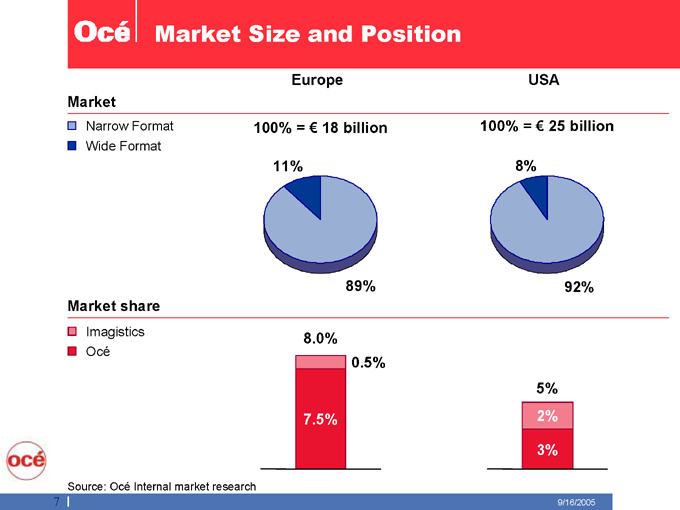

Market Size and Position

Market

Narrow Format Wide Format

Market share

Imagistics Océ

Europe

100% = €18 billion

11%

USA

100% = €25 billion

8%

89% 92%

8.0% 0.5%

5% 7.5% 2% 3%

Source: Océ Internal market research

9/16/2005

7

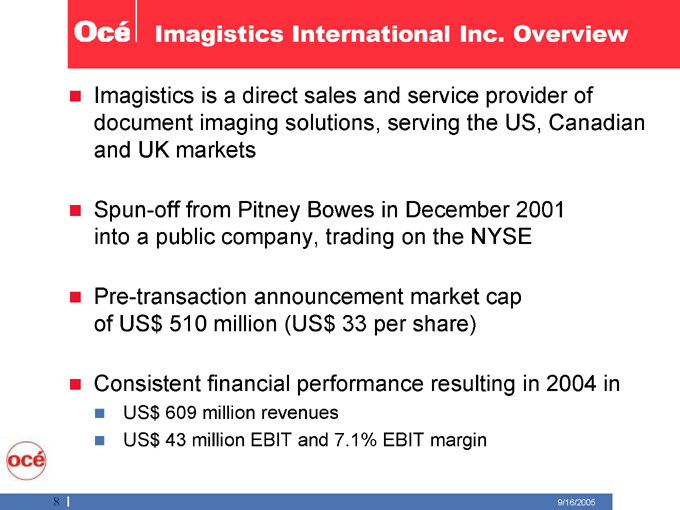

Imagistics International Inc. Overview

Imagistics is a direct sales and service provider of document imaging solutions, serving the US, Canadian and UK markets

Spun-off from Pitney Bowes in December 2001 into a public company, trading on the NYSE

Pre-transaction announcement market cap of US$ 510 million (US$ 33 per share)

Consistent financial performance resulting in 2004 in

US$ 609 million revenues

US$ 43 million EBIT and 7.1% EBIT margin

8 9/16/2005

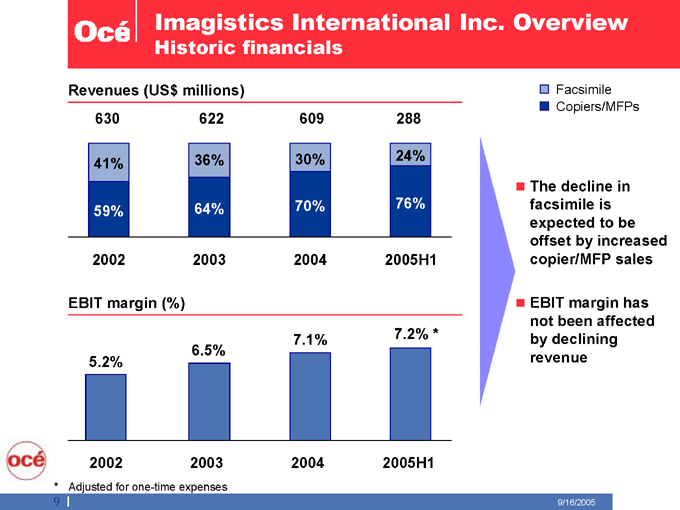

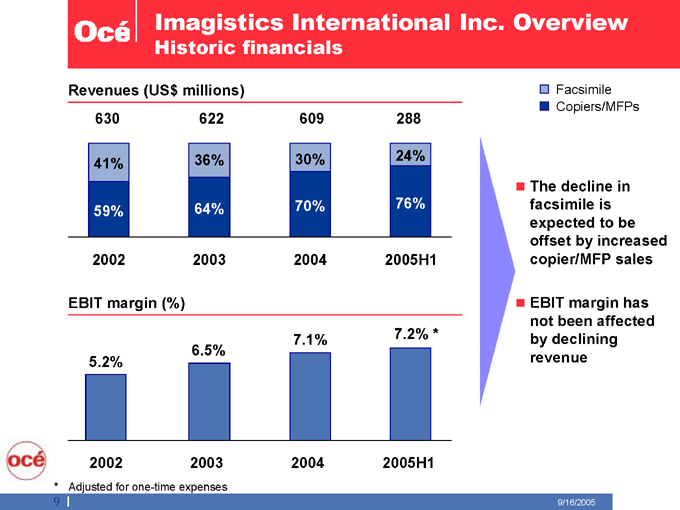

Imagistics International Inc. Overview

Historic financials

Revenues (US$ millions)

630 622 609 288

36% 30% 24% 41%

64% 70% 76% 59%

2002 2003 2004 2005H1

EBIT margin (%)

7.1% 7.2% * 6.5% 5.2%

2002 2003 2004 2005H1

* Adjusted for one-time expenses

Facsimile Copiers/MFPs

The decline in facsimile is expected to be offset by increased copier/MFP sales

EBIT margin has not been affected by declining revenue

9 9/16/2005

Imagistics International Inc. Overview

Organization and portfolio

Nation-wide direct sales and service organization in US

3,400 employees in total, including

1,200 sales 1,200 service

Operations in Canada and UK (100 employees per OPCO)

Offering

MFPs in segments 1 to 5 Printers in segments 1 to 5 Fax machines

Primary suppliers

Konica Minolta Toshiba Sharp

10 9/16/2005

Imagistics International Inc. Overview

Customers

Addresses various target customer segments

Major national accounts and large governmental organizations Mid size and regional business and educational organizations Business product centers for local businesses

Has created many longstanding customer relationships during the last 35 years of which many are Fortune 1000 companies

Competes successfully with other major office equipment distributors (Xerox, Ikon, GIS) as well as local businesses

11 9/16/2005

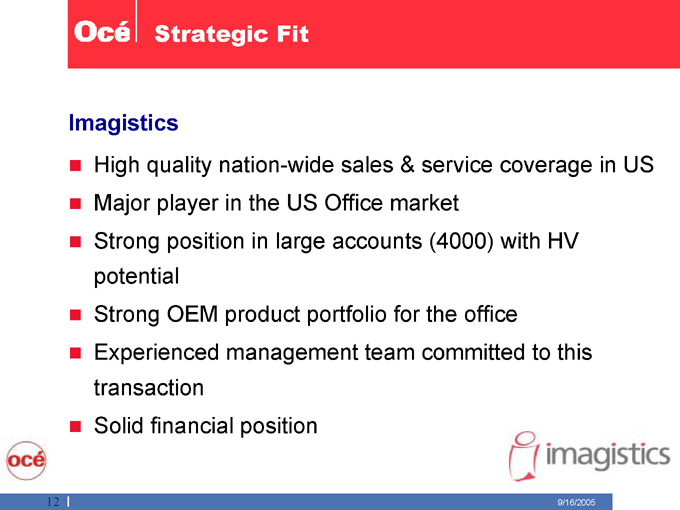

Strategic Fit

Imagistics

High quality nation-wide sales & service coverage in US Major player in the US Office market Strong position in large accounts (4000) with HV potential Strong OEM product portfolio for the office Experienced management team committed to this transaction Solid financial position

12 9/16/2005

Strategic Fit

Océ

Leading position in Wide Format and Continuous Feed printing in Europe and US

Excellent HW and SW portfolio for Document Production Center Major player in Europe in Document Production Center Strong market position in Business Services in Europe and US

Solid financial position

13 9/16/2005

Strategic Fit

Combination creates a strong international full-line supplier of print and document management products and services

Strong sales and service network fully covering US and Europe Enables optimal support for existing and new national and international accounts Good position in Corporate and Commercial accounts both in Fortune 1000 and larger regional companies One of the broadest and strongest product portfolios of copying and printing equipment, document management software and business services

14 9/16/2005

Integration

Key members of Imagistics’ management have agreed to stay with the company post transaction

Marc Breslawsky will become CEO of Océ USA Holding as of January 1, 2006

Joe Skrzypczak will become CEO of Océ Imagistics as of January 1, 2006

Good cultural fit between the two companies

High integrity and strong loyalty to the company

Long-term customer relationships

Well established corporate processes

Océ Imagistics will combine OEM based LV-MV-HV business together with Océ’s HV-VHV business Both companies will run separately, and prepare detailed integration plans until January 1, 2006

15 9/16/2005

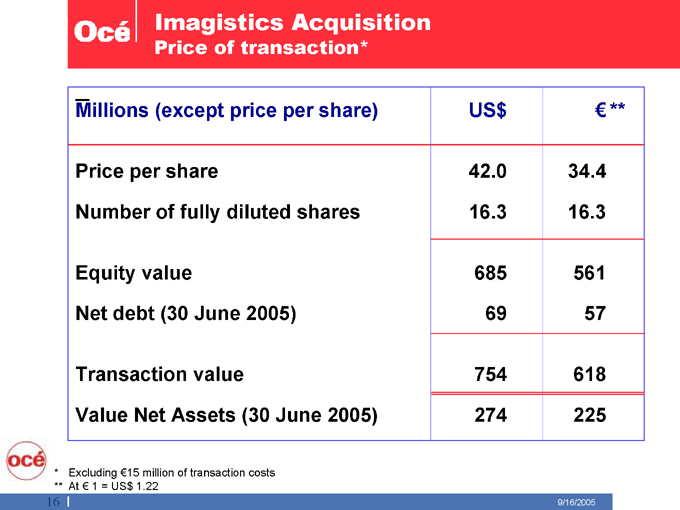

Imagistics Acquisition

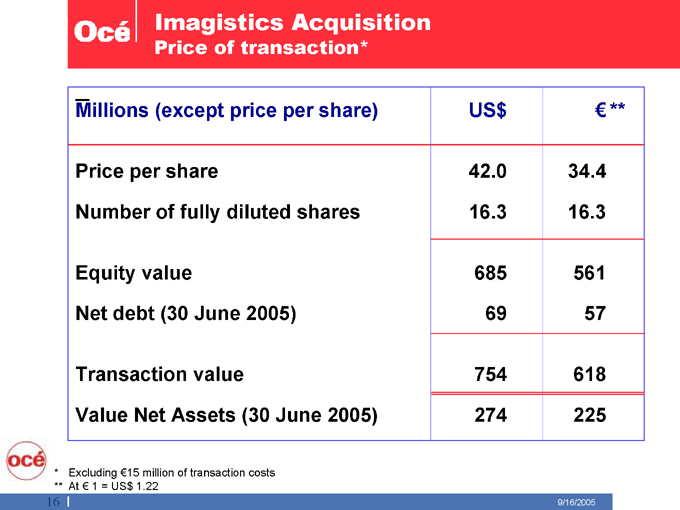

Price of transaction*

Millions (except price per share) US$ €**

Price per share 42.0 34.4 Number of fully diluted shares 16.3 16.3

Equity value 685 561 Net debt (30 June 2005) 69 57

Transaction value 754 618 Value Net Assets (30 June 2005) 274 225

* Excluding €15 million of transaction costs

** At €1 = US$ 1.22

16 9/16/2005

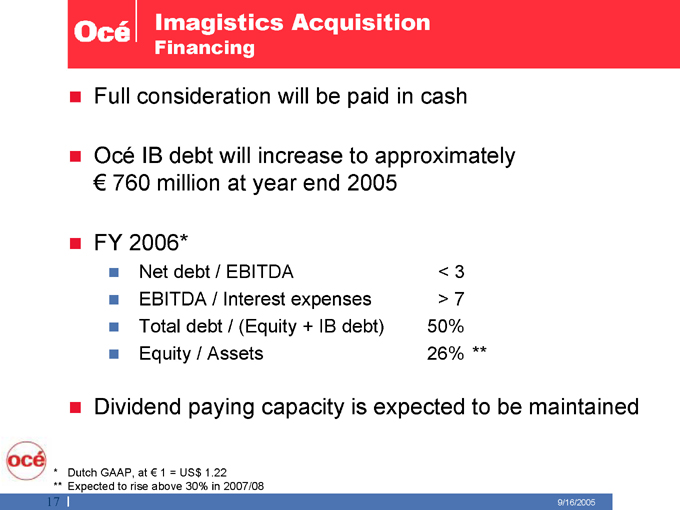

Imagistics Acquisition

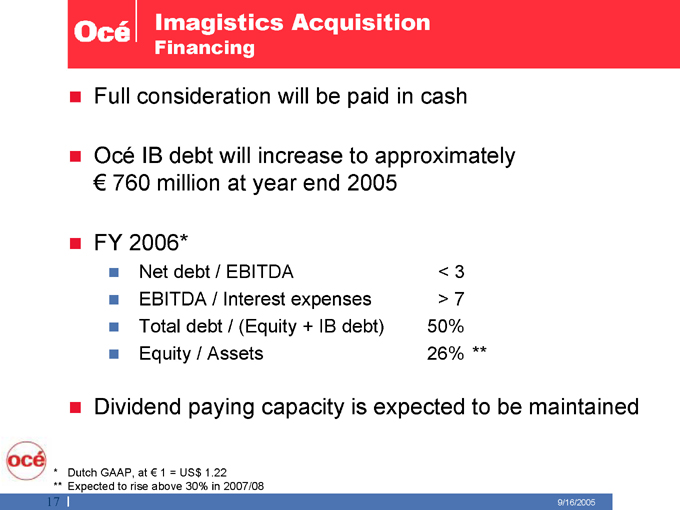

Financing

Full consideration will be paid in cash

Océ IB debt will increase to approximately

€760 million at year end 2005

FY 2006*

Net debt / EBITDA < 3

EBITDA / Interest expenses > 7

Total debt / (Equity + IB debt) 50%

Equity / Assets 26% **

Dividend paying capacity is expected to be maintained

* Dutch GAAP, at €1 = US$ 1.22

** Expected to rise above 30% in 2007/08

17 9/16/2005

Imagistics Acquisition

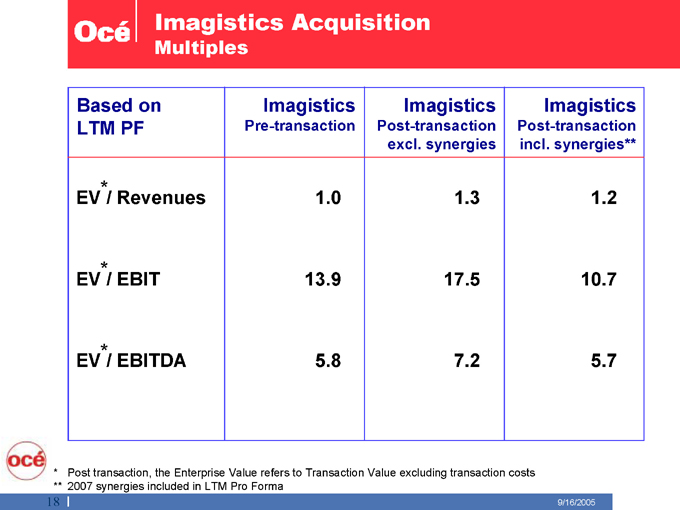

Multiples

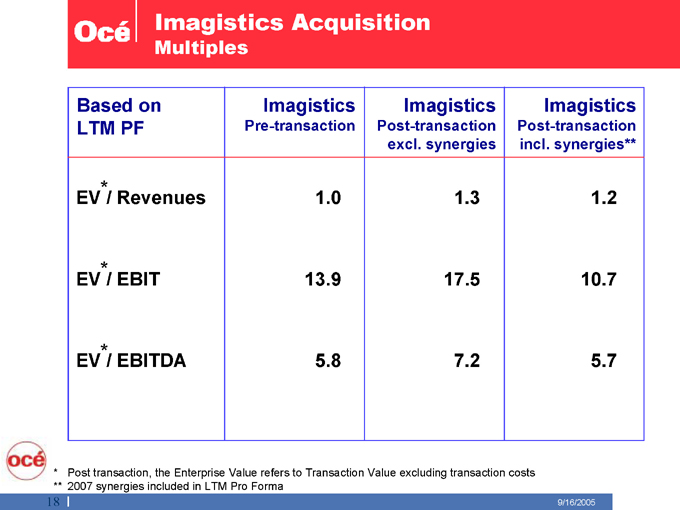

Based on LTM PF Imagistics Pre-transaction Imagistics Post-transaction excl. synergies Imagistics Post-transaction incl. synergies**

EV* / Revenues 1.0 1.3 1.2

EV* / EBIT 13.9 17.5 10.7

EV* / EBITDA 5.8 7.2 5.7

* Post transaction, the Enterprise Value refers to Transaction Value excluding transaction costs

** 2007 synergies included in LTM Pro Forma

18

9/16/2005

Imagistics Acquisition

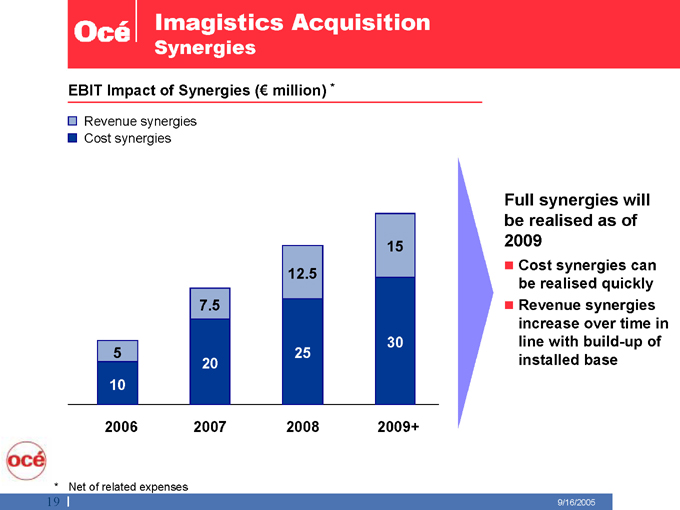

Synergies

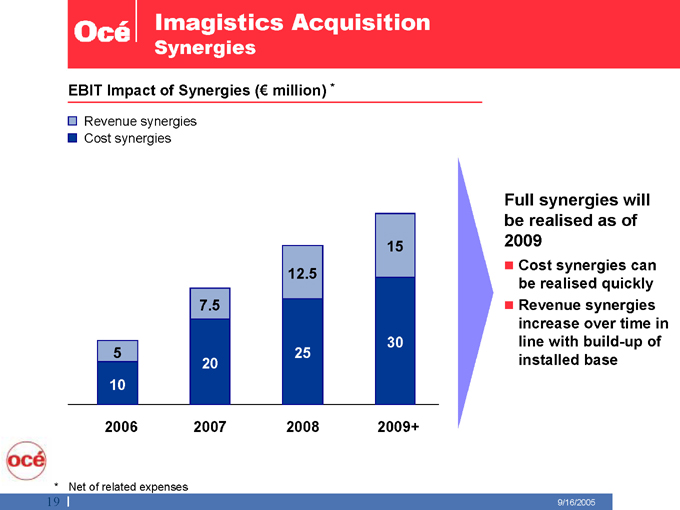

EBIT Impact of Synergies (€million) *

Revenue synergies Cost synergies

Full synergies will be realised as of 2009

Cost synergies can be realised quickly Revenue synergies increase over time in line with build-up of installed base

5 10

7.5

20

12.5

25

15

30

2006

2007

2008

2009+

* Net of related expenses

19

9/16/2005

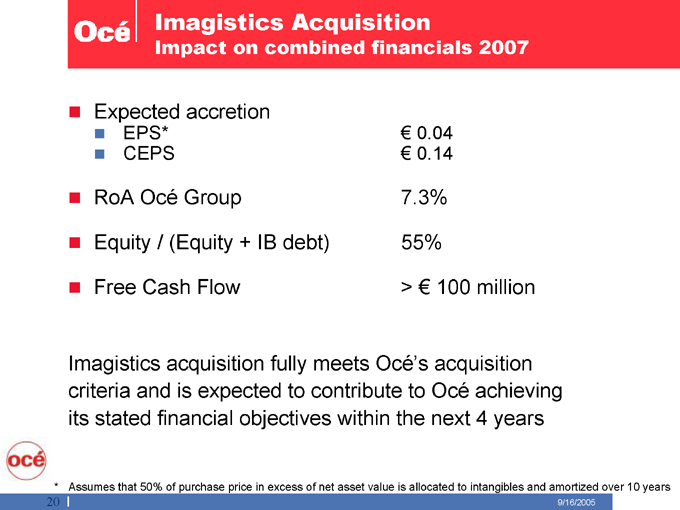

Imagistics Acquisition

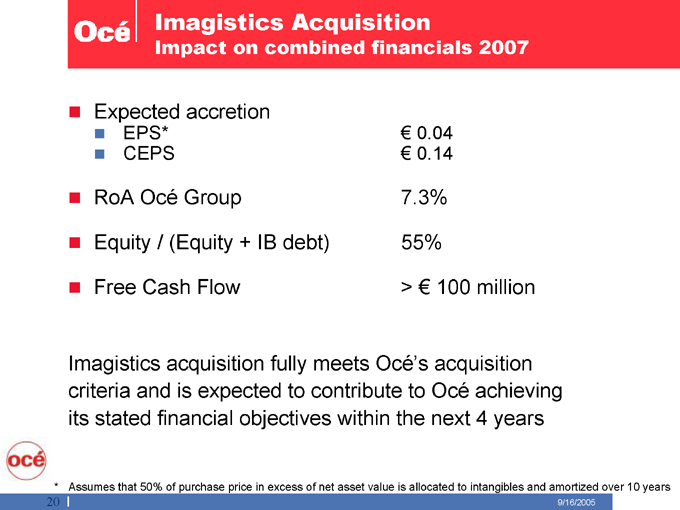

Impact on combined financials 2007

Expected accretion

EPS* €0.04 CEPS €0.14

RoA Océ Group 7.3% Equity / (Equity + IB debt) 55%

Free Cash Flow > €100 million

Imagistics acquisition fully meets Océ’s acquisition criteria and is expected to contribute to Océ achieving its stated financial objectives within the next 4 years

* Assumes that 50% of purchase price in excess of net asset value is allocated to intangibles and amortized over 10 years

20 9/16/2005

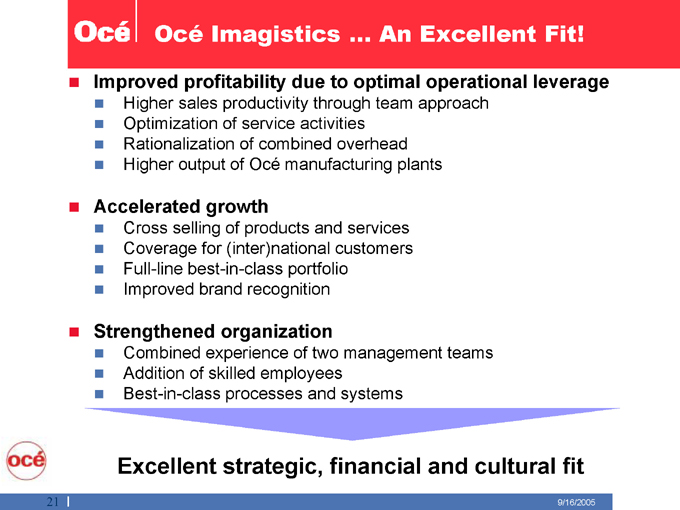

Océ Imagistics An Excellent Fit!

Improved profitability due to optimal operational leverage

Higher sales productivity through team approach Optimization of service activities Rationalization of combined overhead Higher output of Océ manufacturing plants

Accelerated growth

Cross selling of products and services Coverage for (inter)national customers Full-line best-in-class portfolio Improved brand recognition

Strengthened organization

Combined experience of two management teams Addition of skilled employees Best-in-class processes and systems

Excellent strategic, financial and cultural fit

21

9/16/2005

Printing for Professionals

22