SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

The Securities Exchange Act of 1934

For the month of January 2006

Commission File Number: 0-13742

Océ N.V.

(Translation of registrants name into English)

St. Urbanusweg 43, Venlo, The Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F: þ Form 40-F: ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes: ¨ No: þ

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| OCÉ N.V. |

| |

By: | | /s/ R.L. van Iperen |

| | | Chairman of the Board of Executive Directors |

| | | (Principal Executive Officer) |

Dated: January 31, 2006

EXHIBIT INDEX

| | |

Exhibit No.

| | Exhibit Name

|

| 99.1 | | Press Release issued January 30, 2006 |

| 99.2 | | Annual Report 2005 |

Exhibit 99.1

Océ N.V. confirms final results fiscal year 2005

Final results 2005

Dividend 2005

Annual General Meeting of Shareholders 2006

Final results 2005

Océ confirms that the final results under Dutch GAAP for the 2005 financial year are equal to the provisional results that were published on January 16, 2006. This means total revenues of € 2,677.3 million, operating income of € 110.1 million, net income of € 78.8 million and net earnings of € 0.92 per € 0.50 ordinary share.

The results under US GAAP will differ substantially from those under Dutch GAAP because the release of the pension provision in the Netherlands will, under US GAAP not be credited to the Statement of Operations in 2005 but in subsequent years.

Dividend 2005

As announced on January 16, 2006 it will be proposed to shareholders to adopt a dividend for the 2005 financial year of € 0.58 (2004: also € 0.58) per ordinary share of € 0.50 nominal. Upon adoption of this proposal the final dividend per ordinary share for 2005 will be € 0.43; the interim dividend amounted to € 0.15. It is proposed to pay out the final dividend fully in cash. The dividend will be made available for payment as from May 8, 2006. Shares in Océ N.V. will be listed “ex-dividend” as of April 24, 2006.

General Meeting of Shareholders

The Annual General Meeting of Shareholders will be held in Venlo on Thursday, April 20, 2006, commencing at 14.00 hrs. The agenda for this meeting will be available in printed form and also via the internet (www.investor.oce.com) as of March 23, 2006.

Annual Report 2005

The annual report will be published on the internet (www.investor.oce.com) on February 1, 2006 and will be available in printed form as of February 17, 2006.

January 30, 2006

Océ N.V.,Venlo, the Netherlands

| | |

| For further information: | | |

| |

| Investor Relations: | | Press: |

| |

| Pierre Vincent Senior VP Investor Relations | | Jan Hol, Senior VP Corporate Communications |

| Telephone +31 77 359 2240 | | Telephone + 31 77 359 2000 |

| E-mailinvestor@oce.com | | E-mailjan.hol@oce.com |

| | |

Océ N.V. P.O. Box 101, 5900 MA Venlo, the Netherlands Telephone # 31 77 359 2240 Océ investor information on Internet:http://www.investor.oce.com | |  |

Exhibit 99.2

OcéN.V.

Report for the financial year December 1, 2004

to November 30, 2005

Océ enables its customers to manage their documents efficiently and effectively by offering innovative print and document management products and services for professional environments.

More copies of the English translation of this Annual Report or of the Dutch language original version are available on request from OcéN.V.,

Corporate Communications Department

telephone [+31] 77 3594000

e-mail info@oce.com

The Annual Report as well as other publications such as press releases, presentations, speeches and other items related to the annual report can also be accessed via the corporate website [http://www.oce.com].

Profile

Océ: innovative by nature

Océ is one of the world’s leading suppliers of professional printing and document management systems. For offices, industry and the graphics market the company develops and manufactures systems for the production, distribution and management of documents, in colour and black and white, in small format and in wide format.

This relates to printers, scanners, peripheral equipment and printing media but also to document management software and innovative products in the areas of system integration, outsourcing of document management activities and leasing of machines.

Océ focuses primarily on professional environments in which its products are well-known for their productivity and reliability, ease of use and favourable ‘total cost of ownership’. The company has built a world-wide reputation as an innovative business in both a commercial and a technological respect.

Océ is commercially active in 80 countries and has its own sales and service establishments in over 30 countries. In Europe and the United States it also operates research and manufacturing facilities in various locations. In 2005 Océ, which employs more than 24,000 people, achieved revenues of € 2.7 billion and a net income of € 79 million.

Business modelOcé’s business model is based on close cooperation between sales and services and research & development. Thanks to the constant feedback of experience gained from ongoing, intensive contact with users, Océ is able to respond promptly and effectively to changing market requirements.

The company’s own sales and service organisation has attuned its activities as accurately as possible to the market segments that are of strategic relevance. In this way the broad product range and technology base of Océ and selected machines ofOEMS [Original Equipment Manufacturers] can be optimally deployed to meet customer needs. In a number of countries part of the product range is made available via specialised distributors.

Océ develops its basic technologies and most of its product concepts in its ownR&D facilities. In all cases this involves searching for ways of providing specific solutions for each customer’s current and future needs. The desire and the ability to develop totally new concepts to meet these needs is the source of the company’s broad and unique technology base. Océ’s innovative capabilities are also enhanced and strengthened through alliances with strategic partners and through cooperation with co-developers andOEMS for machines in the high, medium and low volume segments.

4

Profile

Board of Supervisory Directors

J.L. Brentjens,chairman

F.J. de Wit,vice-chairman

M. Arentsen

A. Baan

P. Bouw

J.V.H. Pennings

Board of Executive Directors

R.L. van Iperen,chairman

J. van den Belt

J.F. Dix

Staff Director | Company Secretary

Vacancy

Financial yearThe company’s financial year runs from December 1 to November 30.

Articles of AssociationThe present Articles of Association were confirmed by a notarial deed dated December 23, 2004. Océ N.V. is an international holding company within the meaning of Article 153, para. 3b, Book 2 of the Dutch Civil Code.

Registered office and commercial registryThe company has its registered office in Venlo, the Netherlands, and is registered in the Commercial Registry in Venlo under No. 12002283.

Head officeThe head office is at

St. Urbanusweg 43, Venlo, the Netherlands

P.O. Box 101, 5900MA Venlo, the Netherlands

telephone [+31] 77 3592222

fax [+31] 77 3544700

Océ on Internet: http://www.oce.com

e-mail info@oce.com

For general information about Océ:

telephone [+31] 77 3592000

5

Océ’s ambitions and strategy

| | | | |

Ambitions

| | Strategic objectives

| | Actions taken in 2005

|

| | |

| CustomersOcé aims to be one of the top-three suppliers in the strategically relevant market segment by offering a complete range of [full-line] document management products and services. | | To maintain its leading position in high-production transaction printing and to achieve this position in high-production document printing in both corporate and commercial environments. To remain a strong supplier of services in the area of document management and business services. To offer complementary products and imaging supplies which create full-line solutions. To strengthen its leading position in wide format printing. To achieve a leading position in high-production display graphics. | | The acquisition of Imagistics has strongly improved our distributive strength in North America and the United Kingdom. Océ now has nation-wide sales and service coverage in America. Distributive strength reinforced through organic expansion of and productivity increase in the sales organisations. Position in colour strengthened through introduction of the OcéCPS800 and the OcéCPS900 Platinum versions and the possibility of combining these machines to form production clusters. Launch of the OcéTCS500 colour printer. Black and white portfolio further strengthened in functionality and price. Expansion of Technical Document Systems in Japan through acquisition of machine population of Shacoh. Imaging Supplies now supplies a complete range for wide and small format media. |

| |

| |

|

| | |

| EmployeesOcé aims to offer an inspiring working environment. | | To be an attractive employer world-wide. In the Netherlands, to be one of the ten most attractive companies for graduates and one of the top-five for technical specialists. | | Successful continuation of the roll-out of competencies management, corporate leadership labs and Global Océ Professionals programme. Development and succession plan for senior management intensified. Campus recruitment started up. |

| |

| |

|

| | |

| ShareholdersOcé aims to achieve returns that give the company a top position in its sector of industry. | | To achieve a long term return on total assets [ROA] of 12% and a return on equity [ROE] of 18%.ROA is an internally focused measure; Océ studies replacement ofROA by an externally focused profitability indicator. To achieve average annual revenues growth of 10%, of which at least half is organic. | | Start made on restructuring plans in Europe and the United States. Next phase of cost reduction actions initiated as part ofoperational excellence[IT, purchasing and logistics]. Outsourcing of lease activities continued. |

| |

| |

|

| | |

| PartnersOcé aims to build up a network of partnerships that is one of the strongest in its sector of industry. | | To co-operate in the area of technology with the best specialists in the industry. To work together with high-quality suppliers and to contract out work to strong partners. To co-operate with partners in the market who contribute to the distribution of Océ products and standards. | | The strengthening of product portfolio through co-operation withOEM hardware and software partners. Cost savings on purchase of components. Co-operation with universities and top-class technology institutes. Next steps taken in the relocation of part of assembly activities to Central Europe and via outsourcing to the Far East. Continued outsourcing of lease activities to strong vendor lease partners. |

| |

| |

|

| | |

| SocietyOcé aims to do business in a way that contributes to the sustainable development of society. | | To implement the basic principles of theUN Global Compact. To minimise any unwanted effects of Océ products on the environment. | | Objective for improvement in sustainability formulated in more concrete terms. Further steps taken to boost sustainability awareness in the supply chain. |

| |

| |

|

6

Strategic perspective

Short term [1-3 years]

Global strengthening of leading positions and improving growth and profitabilityOver the past year Océ has achieved strong growth in machine sales. A distinct improvement has also been booked in revenues from service. The purchase of Imagistics has further boosted the strength of the organisation, particularly in the important North American andUK markets. As a result Océ has now achieved nation-wide coverage in the American market for both sales and service operations, which will lead to substantial economies of scale. Océ is therefore focusing explicitly on offering a full-line product range. Thanks to its market-focused and even stronger organisation and its new products and services, Océ is well placed to raise the level of profitability and revenues.

To support this development over the short term, Océ will continue its efforts to improve operational efficiency. In the year ahead the emphasis will be on a further strengthening of efficiency, firstly by harnessing the economies of scale created through the integration of Imagistics and, secondly, by improving business processes and the related organisation structure. A definite role will be played here by an improvement in the purchasing processes, optimisation of theIT infrastructure and logistics and by raising the levels of efficiency in service activities.

��

For a number of activities Océ is increasingly working together with partners. The outsourcing of part of the assembly operations to Central Europe and the Far East is one example. At the same time, however, Océ continues to invest in the development of innovative products and services. In addition, the outsourcing of the lease activities will be completed and a further reduction in other working capital items will be achieved.

The ultimate aim of these activities is not only to supply increasingly better products and services to a growing circle of customers but also to boost the level of profitability.

Medium term [3-5 years]

Safeguarding strong positions in growth marketsOcé is expanding the positions it holds in growth markets and has launched numerous activities to safeguard its leading positions over the medium term. These include, for example, the strengthening of market shares in the Printing-on-Demand, Business Services and Display Graphics segments, as well as the positions that the company holds in colour, in software and in emerging markets, particularly those in Asia. Besides organic growth, various forms of co-operation with strong partners and also acquisitions will continuously play an important role.

Long term [> 5 years]

Expanding the position in document managementCustomers are increasingly asking for integrated solutions for document management processes. Océ already provides support to its customers by offering a growing number of services and solutions for the effective and efficient management of documents that have been produced on paper and in electronic form. Océ Business Services and Software & Professional Services are the company’s business groups that specifically respond to this demand, but the supply of integrated output management solutions also receives much attention as part of the company’s core activities.

One of Océ’s ambitions is to achieve a top-three position within selected segments of the document management market.

7

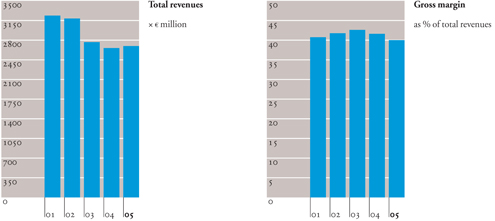

Key figures

| | | | | | | | |

| | | | |

| | | | | 2005

| | 2004

| | x € million

|

| | | | |

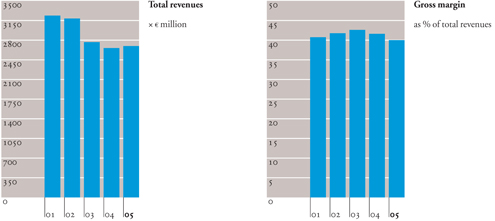

| Total revenues | | | | 2,677.3 | | 2,652.5 | | |

| | | | |

| | | Change on previous year [%] | | 0.9 | | –4.2 | | |

| | | | |

| | | Change [organically] | | –0.1 | | –0.1 | | |

| | | | |

| | | Non-recurring* | | 6.9 | | 10.6 | | |

| | | | |

| | | Recurring* | | –2.8 | | –3.6 | | |

| | | | |

| Gross margin | | | | 1,071.8 | | 1,103.4 | | |

| | | | |

| | | As % of total revenues | | 40.0 | | 41.6 | | |

| | | | |

| Operating income before impairment | | | | 110.7 | | 118.3 | | |

| | | | |

| Operating income[EBIT]** | | | | 110.1 | | 110.4 | | |

| | | | |

| | | Change on previous year [%] | | –0.2 | | –11.6 | | |

| | | | |

| | | As % of total revenues | | 4.1 | | 4.2 | | |

| | | | |

| | | As % of average balance sheet total [ROA] | | 4.8 | | 4.8 | | |

| | | | |

| Net income | | | | 78.8 | | 78.1 | | |

| | | | |

| | | Change on previous year [%] | | 1.0 | | 27.0 | | |

| | | | |

| | | As % of total revenues | | 2.9 | | 2.9 | | |

| | | | |

| Balance sheet total | | | | 2,819.5 | | 2,233.1 | | |

| | | | |

| | | Shareholders’ equity | | 780.8 | | 714.1 | | |

| | | | |

| | | Net capital expenditure on intangible | | | | | | |

| | | | |

| | | and tangible fixed assets | | 149.1 | | 122.7 | | |

| | | | |

| Cash flow before financing activities | | | | –507.5 | | 370.5 | | |

| | | | |

| Number of employees at November 30 | | | | 24,164 | | 21,315 | | employees |

| | | | |

| Ordinary net income | | As % of average ordinary Shareholders’ equity [ROE]*** | | 11.3 | | 11.3 | | |

| | | | |

| Per € 0.50 ordinary share | | Net income | | 0.92 | | 0.89 | | euro |

| | | | |

| | | Shareholders’ equity | | 8.65 | | 7.87 | | |

| | | | |

| | | Dividend | | 0.58 | | 0.58 | | |

| | | | |

| Number of € 0.50 ordinary shares | | Average number outstanding | | 83,698,244 | | 83,487,576 | | shares |

| | | | |

| | | Potential increase from conversion/options | | 970,609 | | 1,271,054 | | |

| | | |

| Diluted earnings per € 0.50 ordinary share | | 0.91 | | 0.88 | | euro |

| | | | |

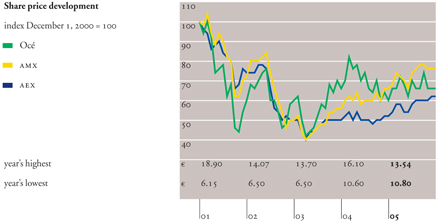

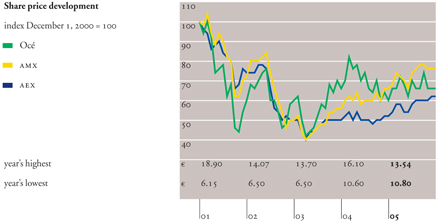

| | | Year’s highest/lowest | | 13.54/10.80 | | 16.10/10.60 | | |

| | | | |

| | | Year end | | 12.11 | | 11.25 | | |

| |

| | | * Non-recurring revenues: sales from machines, software and professional services. Recurring revenues: revenues from services, materials, rentals, interest and business services. |

| |

| | | ** EBITDA 2005 amounted to € 256 million. |

| |

| | | *** The definition ofROE has changed in 2004. |

8

Report of the Board of Supervisory Directors

To the Annual General Meeting of Shareholders of OcéN.V., Venlo.

Annual ReportWe herewith present to you the Annual Report for 2005 which comprises the Annual Financial Statements for 2005 and was drawn up by the Board of Executive Directors. The Annual Financial Statements have been examined by the external auditors PricewaterhouseCoopers AccountantsN.V. who have issued an unqualified audit opinion that is set out on page 123 of this Annual Report. We have discussed the Annual Report with the Board of Executive Directors in the presence of the auditors. On the basis of those discussions we can state that the Annual Report provides the necessary basis for the release and discharge of our Board in respect of its accountability and its supervisory function.

We recommend that you adopt the Annual Financial Statements, including the dividend proposal, and that you grant a release and discharge to the Board of Executive Directors for its management and to the Board of Supervisory Directors for its supervision over such management during the past financial year.

Results and strategic positionOcé’s net income for the year under review amounted to € 79 million, which is equivalent to € 0.92 per ordinary share.

Total revenues, after adjustment for lease effects, increased by 2.1% on an organic basis which is particularly positive in combination with the fact that recurring revenues are now also picking up again.

Another important factor is that these improvements are occurring against an economic background that is still far from optimal. Further economic recovery is expected to strengthen this positive trend.

During the year under review the company focused its efforts on achieving a number of important preconditions that will enable it to benefit from the recovery that has now started to show through. One of those preconditions, the availability of a high-quality and competitive range, was fulfilled during the past year, and this will keep our full attention. This was reflected in particular in the increased demand for our new products. A second precondition, an efficient and cost-conscious organisation, is an ongoing task. Here again, with the support of drastic reorganisations, the targets for the past year were realised. Thirdly, a significant strengthening of distribution capabilities, has been given a vigorous impetus through the acquisition of Imagistics International Inc. On the American market in particular this has strengthened Océ’s position to an extent that could not otherwise have been achieved as quickly. Our consultations with the Board of Executive Directors about this acquisition convinced us that this acquisition was the right decision at the right moment.

9

Report of the Board of Supervisory Directors

SupervisionIn 2005 the Board of Supervisory Directors held seven meetings with the Board of Executive Directors. Aspects discussed at those meetings were the company’s strategy and the related strategic choices. Commercial and technological developments and the financial position of Océ were also discussed. A regular item on the agenda at meetings of our Board is an assessment of the risks and risk management systems, as is required under the Sarbanes-Oxley Act and the Dutch corporate governance code. Consultation was also held with the internal and external auditors. In addition, growth possibilities and potential acquisitions were discussed at various meetings.

At the meeting in January 2005 the number of shares to be granted in conformity with the share plan was determined, the targets for 2005 were discussed and the variable pay for 2004 was established on the basis of the previously set targets.

Prior to the meeting on July 6, 2005 the Board of Supervisory Directors paid a visit to theR&D facilities in Venlo, during which it was able to confirm that the company is well on track as regards its projects for the future including colour.

In August an extra meeting was devoted in full to the acquisition of Imagistics.

At each meeting time was also devoted to the feedback of the deliberations of the Audit Committee.

The Board of Supervisory Directors held two meetings at which the executive directors were not present in order to discuss the functioning of the Board of Supervisory Directors and its members. In our opinion the Board of Supervisory Directors complies with the independence requirements set by the Dutch corporate governance code.

The functioning of the Board of Executive Directors and its members was likewise discussed, as was the company’s top management structure, both now and for the future.

TheAudit Committeeheld six meetings in 2005 at which the internal and external auditors were also present. Members of the management attended these meetings when invited to do so. The Audit Committee’s main tasks comprise an extensive evaluation of the financial reporting before this is dealt with at the plenary meeting of the Board of Supervisory Directors, supervision of the effectiveness of the system of internal controls and an assessment of the company’s risk profile. To fulfil these tasks the committee discussed the annual results, including the annual reporting in accordance withUS stock exchange regulations [Form 20-F] and the quarterly results.

The committee also discussed the internal management and control systems, the financial reporting, compliance with the recommendations made by the auditors, the activities of the internal audit department, the activities, remuneration and independence of the external auditor, proposals in the area of tax planning andICT, and the company’s financing plan. Specific attention was devoted to the transition toIFRS with effect from December 1, 2005 and to the requirements set with regard to risk and risk control under the Sarbanes-Oxley Act and the Dutch corporate governance code.

TheRemuneration Committeemet twice during the year under review. The committee discussed the remuneration and bonuses of the Board of Executive Directors as well as the implementation of the remuneration policy for the Board of Executive Directors that had been approved by the General Meeting of Shareholders in 2004, including the share plan to replace the stock option plan.

The share plan and the remuneration package are dealt with in more detail on page 62 and further in the section on corporate governance.

TheSelection and Nomination Committeeheld two meetings during the year under review. This committee gave advise to the Supervisory Board on the selection, appointment and functioning of supervisory directors and executive directors.

10

Report of the Board of Supervisory Directors

Supervisory Board changesAt the General Meeting of Shareholders on April 15, 2005 Messrs. Brentjens and De Wit were reappointed. During 2005 the composition of the Board of Supervisory Directors was therefore unchanged.

Messrs. Pennings and Bouw are scheduled to retire by rotation from our Board in 2006. During their membership of the Supervisory Board Mr. Bouw and Mr. Pennings have, on the basis of their knowledge and experience, made a very great contribution to the way in which our Board functions and for this we owe them a tremendous debt of gratitude. As regards their successors, a proposal will be made to the Annual General Meeting of Shareholders on April 20, 2006. The agenda for that meeting will be published on March 23, 2006.

Océ has shown over the past year that its strategic decision to continue investing strongly in innovation and distributive strength is bearing fruit, even when the economic climate is not so favourable. We would therefore like to express our thanks to all Océ employees for the contribution they made to this performance. We have the fullest confidence in their ability to ensure that the targets that Océ has set for the future will be achieved.

Venlo, January 27, 2006

The Board of Supervisory Directors

J.L. Brentjens,chairman

F.J. de Wit,vice-chairman

M. Arentsen

A. Baan

P. Bouw

J.V.H. Pennings

In the section on corporate governance on pages 64 and 65 further details are given about the Board of Supervisory Directors, its profile, its committees and the remuneration of its members.

11

Report of the chairman of the Board of Executive Directors

2005 was an extremely important year for Océ. Looking at the strongly increased machine sales, the new products and the successful acquisition, we can see that during the year under review we gave concrete form to major elements of our strategy. The sales figures also show that, following a difficult period, we have again found the upward line. Although there is still a great deal of work ahead of us, this is the message that can be read in many places in this annual report and we are proud of that.

Strongly improved basic position

Our position has been strengthened over the past year through a series of important events and activities: the acquisition of Imagistics International Inc., which has made a substantial contribution to our distributive strength and to our portfolio, the addition of important new Océ machines to the range, which is now complete and competitive, the further sale of our lease portfolio and the increasing outsourcing of manufacturing activities to Asia. In a nutshell that is the picture of the year under review. Naturally, tough tasks still remain, such as a radical reduction in costs and the realisation of the synergy effects of the Imagistics acquisition, but that does not alter the fact that our company has grown considerably in strength over the past year.

Unique products

One of the principal factors underlying the growth in machine sales is the strength of our products. During the year we successfully made our presence felt on the market with a complete product range for all market segments in which we want to operate. In the past we were always able to offer a number of highly successful machines, many of which were pace-setters in their category. We can say that now we again have machines with those same unique qualities in the form of the OcéCPS800 and the OcéCPS900 Platinum, the Océ VarioPrint 2100 family, the Océ VarioStream 9000 family and, for wide format applications, the OcéTCS500. They will continue in the years ahead to set the standard for reliable, high-quality printing in the sectors that we serve. Thanks to the sales of machines we are also seeing a recovery in recurring revenues. However, the pace of this recovery is being slowed down because of the transition from analogue to digital machines, and in the forthcoming years, therefore, it will continue to be extremely important to keep boosting the level of machine sales whilst at the same time reducing costs further.

Greater distributive strength

Whilst the product range may have been the principal driver of the growth in machine sales, it did not form the full explanation for that growth. The economy during the year under review was still not in such a condition that it automatically lead to growth. The real explanation can be found in the expansion of our distributive strength on which we have been focusing our efforts for more than two years. Clearly, the intensive training of our sales representatives and the strengthening of the sales staff in the operating companies to include a large number of specialists are starting to bear fruit.

12

Report of the chairman of the Board of Executive Directors

By far the most important impulse for the greater distributive strength in the United States was formed by the acquisition of Imagistics International Inc. Imagistics boasts a strong distribution network in North America. It can count on around 60% of the businesses in the Fortune 1000 list as its customers, has a thorough knowledge of the American printer/ copier market and does good business there. Through this acquisition, which was largely financed by the proceeds from the sale of our lease portfolio, our financial activities have been converted into a healthy commercial activity with a specific and sustainable profit potential. This, without doubt, makes the acquisition the jewel in the crown of the year under review.

Employees form the basis

The statement that employees are the driving force behind the company may not be original, but that does not make it any less true. Océ employees have proved in recent years that they form a remarkably wide and resilient basis for the drastic changes that were needed within the company. Whilst retaining all the good characteristics of the traditional Océ approach [dedicated, close to the customer], the organisation has been transformed in recent years to make it more responsive to change and more flexible. On the basis of the core values that were chosen several years ago, our employees work on their self-development within the business and at the same time on the further growth of Océ. Training and education, as part of world-wide programmes, are not incidental activities but form an integral part of everyday work. At the same time the labour factor also represents more than one half of Océ’s costs. That is why we have decided, within the framework of a further cost reduction, to subject a number of business processes to critical scrutiny. As a result of this, around 500 jobs will be discontinued in Europe and 250 jobs in the United States.

Tight customer focus

With our complete and competitive range we are clearly showing that Océ belongs on the shortlists of preferred suppliers for wide format and small format applications and in both commercial and corporate printing environments. Less visible for the outside world, but no less important for all that, is the broad range of information, analysis, consultancy, software and professional services that we use to assist our customers in the choice, configuration and implementation of their systems and subsequently during the entire life cycle of the printing systems. When we talk about distribution, sales and service we are referring to the whole spectrum of the activities relating to the purchase of equipment. Tightly focused on the market and basing themselves in full on the customer’s requirements, a large group of Océ employees will have often been at work for quite some time even before a purchase decision is taken. For us, therefore, selling means the implementation of a complete solution in the customer’s environment. The main thrust in the years ahead will be to convince potential customers that Océ not only has the best but also the most cost-effective offerings. The cost price of our products obviously plays a role in this. That is why it is necessary for us to relocate a large proportion of our manufacturing operations to Asia. But the price that matters in the end is the ‘total cost of ownership’ and that comprises a great many more elements than simply the purchase price of the machine. That favourable ‘total cost of ownership’ is the key to Océ’s further growth.

13

Report of the chairman of the Board of Executive Directors

Strong partners

With its own research and product development and its own world-wide sales and service organisation, Océ has developed as an independent business from the very beginning and this is also a position that we emphatically wish to preserve. And yet Océ has grown through – and also thanks to – extensive and close cooperation with technological, financial and commercial partners. A substantial part of our technological strength is built on the ability to ask for and obtain the very best from our partner technology businesses and knowledge institutes in all phases of development and production. These partnerships are mostly of a long term nature. In the past few years, however, we have been able to welcome countless new partners who carry out manufacturing with us and for us in the Far East. Our experiences to date have been excellent and I am convinced that they will be excellent performers in their increasingly more prominent role.

Other important partners, especially following the amalgamation with Imagistics, are the suppliers from whom we source machines that will allow us to offer our customers complete solutions. Because of the complementary nature of the products, these partnerships work to the advantage of all concerned.

Last but not least are the partners to whom Océ owes an especially great debt of gratitude: the many local distributors who act as guardians of the Océ name in all places where we do not have our own sales organisation. They ensure that our machines are available everywhere in the world and they offer the same standard of service and support that we provide in the major European and American industrial centres. Not infrequently these partners, who regularly visit our training centres for education and refresher training, pave the way for our expansion in new territories.

Océ within society

Océ has sought throughout its entire history to strike the right balance between the needs of the company, its employees and the environmental effects of its manufacturing operations and products. Sustainability is part of our company’s genetic code. In recent years, in line with the increasingly clearer calls for corporate social responsibility, we have provided a detailed insight into our guiding principles and activities in this area. Our transparent sustainability report meanwhile comprises virtually all Océ activities.

A look ahead

The increased sales, the improved recurring revenues and the successful conversion of our financial activities into a healthy commercial activity provide the ingredients for a good recovery in our results. We saw the first signs of this during the year under review. We are therefore embarking on the year 2006 full of confidence and ambition.

I regard this largely as the success of the combined efforts of all Océ people, in all countries, at all levels and in all markets. But this success would not have been possible were it not for the confidence that our customers, our partners and our shareholders have placed in us. We would like to thank all of them for the efforts they made and the confidence they showed.

R.L. van Iperen,chairman

14

Océ and Imagistics: a strong combination on the American market

When Océ announced the proposed acquisition of Imagistics International Inc. on September 16, 2005, that fact in itself did not come as a surprise to many people. Océ had always sent out the message that the proceeds from the sale of the lease portfolio would preferably be used to boost the company’s distributive strength, specifically in the United States. For some people, however, it did come as a surprise that this related to a company which is hardly active in the areas in which Océ excels: wide format and [very] high volume. But it is specifically the complementary nature of the product offerings that makes the combination the ‘perfect fit’ from a strategic point of view. The two companies strengthen each other by working together in different segments of the printing and document management markets. The existing customers of Imagistics gain access to Océ’s extensive technology and knowledge base and, conversely, theOEM range and market knowledge of Imagistics significantly enrich the product portfolio of Océ as a whole.

Imagistics: we understand documents

The promise that Imagistics makes to its customers and potential customers is formulated in crystal-clear terms in its company motto: we understand documents. The word ‘understand’ has two meanings: an understanding of documents, their structure, their function, their use, but also a thorough knowledge of documents, how they have to be created, presented, processed and distributed.

Just as at Océ, documents form the core of the Imagistics business. And, just like Océ, the company seeks to make a contribution to improving the effectiveness of its customers’ business. The supply of equipment and service forms an important part of its activities. No less important, however, is the application in the customer’s business of the knowledge of document flows that Imagistics has built up during many years of practical experience. For customers this is the key to improving their efficiency, productivity and cost control.

Complete solutions

Imagistics, which has its headquarters in Trumbull, Connecticut, is active via its own direct sales and service establishments in all 50US states, the United Kingdom and parts of Canada. The company offers its customers complete solutions for document production, varying from stand-alone machines to complete networks for the low, medium and high volume. Imagistics sources the machines, following intensive in-house test cycles, from a few selected producers, including the machine supplier that Océ has also selected within the framework of the complete solutions that it offers for the low volume segment.

15

Océ and Imagistics: a strong combination on the American market

Océ and Imagistics: a strong combination on the American market. The amalgamation of the two businesses to form Océ Imagistics substantially boosts Océ’s presence and distributive strength in the corporate market in the United States. National and international customers of both companies can be excellently served in both Europe and the United States.

The product offerings of the two companies are complementary: Océ offers unsurpassed wide format, commercial and corporate printing systems based on its own, superior technology and Imagistics offers top-classOEM products in the high, medium and low volume segments. Océ Business Services offers document management services of a high standard; these can now also be offered to the customers of Imagistics.

Extensive distribution network

Imagistics employs more than 3,200 people, of whom almost 1,300 work in service and more than 1,200 in direct sales. Its customers include businesses that can be found in the Fortune 1000 list. Imagistics has a formidable distribution system and client network, strengthened by an excellent track record and intensive account management. In addition to its extensive distribution network in the United States and Canada, Imagistics is also active in the United Kingdom.

The activities of Imagistics comprise two main fields: on the one hand, copiers/multifunctionals [scan, copy, print] and, on the other, fax. The latter category is now rapidly losing ground as a stand-alone machine, whilst the former is gradually increasing in importance, partly also as a replacement for the fax machine.

Excellent basic position in the United States

As from January 1, 2006 the combination of Océ and Imagistics, operating under the name Océ Imagistics, has been able to offer a wide range of products to existing and new customers. The acquisition of Imagistics provides Océ with a unique opportunity to penetrate the office and printroom market in America. Océ’s revenues in the United States have grown to 1.7 billion dollars and thus account for around 43% of total revenues. The Océ Imagistics combination has given Océ an excellent basic position for further strong development in the United States, our biggest market.

The combined new company is headed by Joseph D. Skrzypczak, President andCEO of Océ Imagistics, Inc. The former President andCEO of Imagistics International Inc., Marc C. Breslawsky, has joined the Board of Océ-USA Holding, Inc.

16

Report of the Board of Executive Directors

The Board of Executive Directors of OcéN.V.

From left to right: J.F. Dix,

R.L. van Iperen,chairman and J. van den Belt.

18

Financial review

Results

In 2005 the results were influenced by the following factors:

| • | | Revenues from leases [interest and book profits on the sale of the existing lease portfolio] were € 58 million lower than in 2004. For the 2005 financial year, therefore, the operating income excluding lease activities, or the commercial operating income net of lease effects, serves as a better yardstick for assessing the operational performance than the total operating income. |

| • | | At the end of October 2005 Imagistics International Inc. was acquired for a consideration of € 638 million. The results of Imagistics for November 2005 have been consolidated into Océ’s results which had a positive effect of € 37 million on revenues. The impact on operating income was negligible which is particularly due to exceptional costs that were incurred in November and to the amortisation of goodwill and intangible assets obtained as a result of the acquisition. |

| • | | In the fourth quarter of 2005 Océ announced plans to achieve a further reduction in costs and this will result in the loss of some 500 jobs in Europe. Measures have also been taken to boost profitability in the United States. In part, these actions will run in parallel with the integration of Imagistics. In 2005 a total provision of € 33 million was taken to cover these effects in Europe and the United States. |

Océ also reached agreement with its social partners in the Netherlands that pensions in the Netherlands will be based on a ‘career average’ system. In consequence an amount of € 68 million was released from the pension provision and credited to 2005 earnings.

Net exceptional items credited to operating income therefore amounted to € 35 million in 2005.

| • | | During 2005 theUS dollar was slightly weaker on average than in 2004. However, the exchange rate of theUS dollar at the 2005 year end was substantially higher than at the 2004 year end. Compared to the result for 2004, this had the following impact on income and on the balance sheet: |

| | | | | |

Translation result | | +0.5 | | x | € million |

Transaction result | | –1.6 | | | |

Net influence of hedging | | | | | |

[2004 versus 2005] | | –7.6 | | | |

| | |

| | | |

Total influence of exchange rates on operating income | | –8.7 | | | |

On the balance sheet the translation result was:

| | | | | |

Total assets | | +83.8 | | x | € million |

Total Shareholders’ equity | | +36.6 | | | |

19

Financial review

Revenues in 2005 [including Imagistics] amounted to € 2,677 million [2004: € 2,652 million]. On an organic basis revenues remained practically the same as in 2004. Excluding lease effects, revenues increased on an organic basis by 2.1%.

Excluding lease effects revenues from printing systems [non-recurring] showed an organic increase of 10.5% which was largely attributable to colour products.

Recurring revenues [from services, media, rentals, interest and business services] decreased organically by 1.1% [excluding lease effects] compared to 2004. During the second half of the year the trend in recurring revenues started to move in a positive direction; in the fourth quarter an organic increase was achieved.

The gross margin [40%] was lower than in the previous year [41.6%]. This decrease was due almost entirely to lower income from leases.

Operating expenses [excluding exceptional items] were slightly higher as a result of the consolidation of Imagistics. On a comparable basis, i.e. excluding the additional operating expenses of Imagistics and excluding exceptional items, these expenses were 1.4% lower than in 2004. Cost control was again an important focus of attention in 2005 and will remain so in the future.

Operating income was € 110.1 million [2004: € 110.4 million].

As a result of slightly lower financial expense [net] and income taxes, net income was € 0.8 million higher than in 2004.

The acquisition of Imagistics brought an increase in total assets from € 2,233 million at the end of 2004 to € 2,819 million at the end of 2005.

Free cash flow, excluding the acquisition of Imagistics, amounted to € 131 million [2004: € 370 million].

As a result of the acquisition of Imagistics, net debt [interest-bearing loans less cash and cash equivalents] amounted to € 754 million at the end of 2005 [end 2004: € 168 million].

Group equity increased from € 752 million at the end of 2004 to € 818 million at the end of 2005.

The solvency ratio [Group equity as a percentage of total assets] was 29%, which is below the sought after minimum level of 30%. This is not surprising, since the acquisition of Imagistics brings an increase of € 768 million in total assets, whilst there is no change in Group equity. Net interest-bearing debt as a percentage of the aggregate total of Group equity plus net interest-bearing debt [gearing] amounted to 48%.

The solvency ratio and the gearing show that, following the acquisition of Imagistics, the balance sheet of Océ remains solid.

In Digital Document Systems [DDS] revenues [excluding lease effects] showed an organic increase of 1.4%. The organic growth in non-recurring revenues [excluding lease effects] continued [+10.5%]. Recurring revenues [excluding lease effects] were 1.8% lower than in 2004 on an organic basis.

In Wide Format Printing Systems [WFPS] revenues [excluding lease effects] increased by 3.6% on an organic basis.WFPS had an excellent year and booked organic growth in both non-recurring and recurring revenues of 10.3% and 0.6% respectively. The increased revenues from service, ink cartridges and toner made a particularly substantial contribution to the organic revenues growth ofWFPS.

20

Financial review

Table 1

| | | | | | | | | | | | |

| Information by Strategic Business Unit | | Wide Format Printing

Systems

| | Digital Document Systems

| | total

|

| x € million | | 2005

| | 2004

| | 2005

| | 2004

| | 2005

| | 2004

|

Revenues | | 834 | | 818 | | 1,843 | | 1,834 | | 2,677 | | 2,652 |

Operating income [EBIT] | | 71 | | 55 | | 39 | | 55 | | 110 | | 110 |

Assets | | 638 | | 617 | | 2,181 | | 1,616 | | 2,819 | | 2,233 |

| | | | | | | | | | | | | |

Table 2

| | | | | | | | | | | | |

| Quarterly revenues | | 2005

| | 2004

|

| x € million | | recurring

| | non-recurring

| | total

| | recurring

| | non-recurring

| | total

|

First quarter | | 448 | | 175 | | 623 | | 480 | | 142 | | 622 |

Second quarter | | 461 | | 179 | | 640 | | 496 | | 186 | | 682 |

Third quarter | | 464 | | 185 | | 649 | | 473 | | 173 | | 646 |

Fourth quarter | | 510 | | 255 | | 765 | | 468 | | 234 | | 702 |

| | |

| |

| |

| |

| |

| |

|

Total | | 1,883 | | 794 | | 2,677 | | 1,917 | | 735 | | 2,652 |

| | | | | | | | | | | | | |

Table 3

| | | | | | | | | | | | |

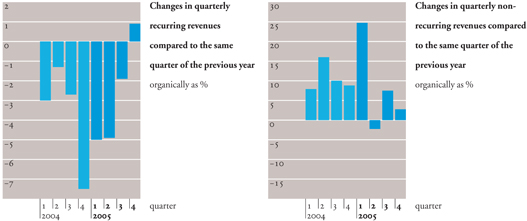

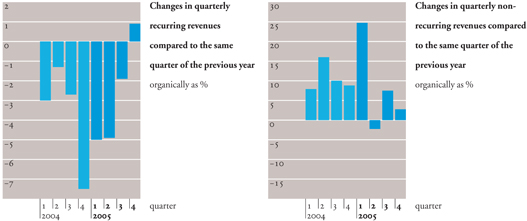

Changes [organically] in quarterly revenues compared to the same

quarter of the previous year; changesinclude the effects of the sale of

the lease portfolio | | 2005

| | 2004

|

| as % | | recurring

| | non-recurring

| | total

| | recurring

| | non-recurring

| | total

|

First quarter | | –5.0 | | +24.8 | | +1.8 | | –3.0 | | +7.9 | | –0.7 |

Second quarter | | –4.8 | | –2.2 | | –4.1 | | –1.3 | | +16.0 | | +2.9 |

Third quarter | | –1.8 | | +7.4 | | +0.6 | | –2.7 | | +10.0 | | +0.4 |

Fourth quarter | | +0.7 | | +2.8 | | +1.4 | | –7.5 | | +8.8 | | –2.7 |

| | | | | | | | | | | | | |

Table 4

| | | | | | | | |

| Revenues by geographical area | | 2005

| | 2004

|

| | | x € million

| | as %

| | x € million

| | as %

|

United States | | 931 | | 35 | | 925 | | 35 |

Germany | | 323 | | 12 | | 333 | | 13 |

The Netherlands | | 289 | | 11 | | 291 | | 11 |

France | | 195 | | 7 | | 191 | | 7 |

United Kingdom | | 182 | | 7 | | 180 | | 7 |

Rest of Europe | | 541 | | 20 | | 534 | | 20 |

Countries outside Europe and the United States | | 216 | | 8 | | 198 | | 7 |

| | |

| |

| |

| |

|

Total | | 2,677 | | 100 | | 2,652 | | 100 |

21

Financial review

Dividend

We propose, as in 2004, to distribute a dividend of € 0.58 per ordinary share of € 0.50 nominal for the 2005 financial year. This dividend involves an amount of € 48.6 million [2004: € 48.4 million]. If the General Meeting of Shareholders adopts this proposal the final dividend will amount to € 0.43; the interim dividend amounted to € 0.15.

It is proposed to distribute the final dividend fully in cash. The payout ratio, which amounts to 63% of net income [2004: 65%], is higher than the standard set in the dividend policy [33%].

Prospects

The Board of Executive Directors takes the view that it is too early to give a forecast for 2006. However, we do expect that the results will be favourably influenced by the increase in revenues, both on an organic basis and as a result of the acquisition of Imagistics.

Savings derived from the integration of Imagistics and the restructuring operations in Europe and the United States will lead to a gradual reduction in operating expenses during the year. These will be offset by extra investments inR&D, amortisation on intangible assets and lower revenues from leases.

Finance

RevenuesIn 2005 revenues amounted to € 2,677 million [2004: € 2,652 million].

Non-recurring revenues increased by 8.1% and amounted to € 794 million [2004: € 735 million]. Recurring revenues decreased in 2005 by 1.8% and amounted to € 1,883 million [2004: € 1,917 million].

On an organic basis revenues in 2005, including lease effects, were the same as in 2004.

Excluding lease effects, revenues increased organically by 2.1%.

Excluding lease effects, non-recurring revenues increased organically by 10.5%, whilst recurring revenues showed an organic decrease of 1.1%.

Gross marginThe gross margin decreased from 41.6% in 2004 to 40.0% in 2005.

For the greater part this decrease is attributable to lower revenues from leases [interest receivables and profit on the sale of the lease portfolio]. In 2005 these were € 58.2 million lower than in 2004 and the whole of this amount is deducted from the gross margin. If adjusted for lease revenues, the gross margin decreased from 39.3% in 2004 to 39.1% in 2005.

22

Financial review

Table 5

Commercial and financial activities

| | | | | | | | |

| | | | | 2005

| | 2004

| | x € million |

Commercial | | | | | | | | |

| | | Revenues | | 2,641 | | 2,584 | | |

| | | Gross margin | | 1,036 | | 1,035 | | |

| | | Operating income [EBIT] | | 92 | | 62 | | |

| | | Financial expenses [net] | | 5 | | –1 | | |

| | | Result before taxation | | 87 | | 63 | | |

| | | Income taxes | | 12 | | 8 | | |

| | | Result after taxation | | 75 | | 55 | | |

| | | Net income | | 74 | | 53 | | |

| | | | |

| | | Shareholders’ equity | | 728 | | 652 | | |

| | | Minority interest | | 37 | | 38 | | |

| | | | |

| |

| | |

| | | Group equity | | 765 | | 690 | | |

| | | Interest-bearing liabilities | | 606 | | 169 | | |

| | | Provisions and other liabilities | | 1,098 | | 962 | | |

| | | | |

| |

| | |

| | | Balance sheet total | | 2,469 | | 1,821 | | |

| | | Commercial operating income excluding the profit on the sale of the lease portfolio and exceptional items [release pension provision and reorganisation costs 2005] | | 52 | | 31 | | |

Ratios | | | | | | | | |

| | | Operating income as % of average balance sheet total [excluding Imagistics] | | 5.2 | | 3.7 | | |

| | | Net income as % of average shareholders’ equity | | 10.9 | | 8.5 | | |

| | | Shareholders’ equity as % of balance sheet total | | 29.5 | | 35.8 | | |

Financial | | | | | | | | |

| | | Interest from finance lease | | 36 | | 68 | | |

| | | General administrative and selling expenses | | 18 | | 20 | | |

| | | Operating income [EBIT] | | 18 | | 48 | | |

| | | Financial expenses [net] | | 13 | | 19 | | |

| | | Result before taxation | | 5 | | 29 | | |

| | | Income taxes | | — | | 4 | | |

| | | Result after taxation | | 5 | | 25 | | |

| | | Net income | | 5 | | 25 | | |

| | | | |

| | | Shareholders’ equity | | 53 | | 62 | | |

| | | Interest-bearing liabilities | | 290 | | 312 | | |

| | | Provisions and other liabilities | | 7 | | 38 | | |

| | | | |

| |

| | |

| | | Balance sheet total | | 350 | | 412 | | |

Ratios | | | | | | | | |

| | | Operating income as % of average balance sheet total [excluding Imagistics] | | 5.0 | | 7.6 | | |

| | | Net income as % of average shareholders’ equity | | 9.0 | | 26.1 | | |

| | | Shareholders’ equity as % of balance sheet total | | 15.0 | | 15.0 | | |

23

Financial review

Operating expensesOperating expenses [before exceptional items] increased by € 4 million to € 997 million. As a percentage of total revenues these expenses were 37.2%, practically the same as in 2004 [37.4%]. The increase in absolute terms is due to the consolidation of the results of Imagistics for November 2005. Without this consolidation, operating expenses [excluding exceptional items] declined. This was achieved without making concessions with regard to the costs of Research & Development and the investments in distributive strength. In view of the foregoing, the focus on cost control was also successful in 2005.

Financial expenses [net]Financial expenses [net] amounted to € 17.8 million, which was virtually the same as in 2004 [€ 18.1 million]. In the fourth quarter financing costs increased considerably because of the acquisition of Imagistics. In consequence, interest-bearing financing has increased strongly. At the end of 2005 net debt stood at € 754 million whilst at the end of the third quarter of 2005 it amounted to € 202 million.

Income taxesIn 2005 the effective tax rate was 12.7% [2004: 13.2%].

Over the past two years, apart from the fact that more income has been achieved in countries with a relatively low tax rate, a role has also been played by exceptional factors. In 2004 this related to the definitive settlement of tax risks, which resulted in the release of provisions. In 2005 anR&D tax credit was included in the second half of the year.

Net incomeNet income amounted to € 78.8 million [2004: € 78.1 million]. As a percentage of total revenues, net income amounted to 2.9 % [2004: 2.9%]. Basic earnings per share, calculated on the basis of the weighted average number of ordinary shares outstanding, were € 0.92 [2004: € 0.89].

Results of commercial and financial activities

Table 5 on page 23 shows the results of the commercial and financial activities separately. A five year overview of these results can be found in table 7 on page 25.

The revenues from financial activities consist of the interest receivables from financial leases. The costs consist of the selling and administration costs and the costs of financing the lease portfolio. The sale of the lease portfolio has meant that interest receivables from leases have decreased in recent years. In 2004 this item amounted to € 68 million; in 2005 it stood at € 36 million.

The commercial operating income is the total operating income excluding the financial results described above.

The commercial operating income excluding exceptional items and profit on the sale of the lease portfolio provides the best picture of the development of Océ’s core activities.

| | | | |

x € million | | 2005

| | 2004

|

Commercial operating income | | 92 | | 62 |

Exceptional items [release pension provision and reorganisation costs 2005] | | –35 | | — |

Profit on the sale of the lease portfolio | | –5 | | –31 |

| | |

| |

|

Commercial operating income excluding profit on sale lease portfolio and exceptional items | | 52 | �� | 31 |

24

Financial review

Table 6

| | | | | | |

| Statement of cash flow* | | 2005

| | 2004

| | x € million |

Cash flow from operations | | 164 | | 137 | | |

Cash flow from investment activities | | –671 | | 233 | | |

| | |

| |

| | |

Free cash flow [before financing activities] | | –507 | | 370 | | |

| | | |

Financing activities | | 340 | | –114 | | |

Exchange rate effects | | –3 | | 1 | | |

| | |

| |

| | |

Change in cash and cash equivalents | | –170 | | 257 | | |

| | | | | | | |

Table 7

| | | | | | | | | | | | |

| Commercial versus financial results | | 2005

| | 2004

| | 2003

| | 2002

| | 2001**

| | x € million |

| | | | | | |

Operating income [EBIT] | | | | | | | | | | | | |

Commercial | | 92 | | 62 | | 56 | | 142 | | 135 | | |

Financial | | 18 | | 48 | | 69 | | 84 | | 90 | | |

| | |

| |

| |

| |

| |

| | |

Total | | 110 | | 110 | | 125 | | 226 | | 225 | | |

| | | | | | |

Net income | | | | | | | | | | | | |

Commercial | | 74 | | 53 | | 36 | | 86 | | 79 | | |

Financial | | 5 | | 25 | | 25 | | 27 | | 26 | | |

| | |

| |

| |

| |

| |

| | |

Total | | 79 | | 78 | | 61 | | 113 | | 105 | | |

| | | | | | |

Return on total Assets as % [ROA] | | | | | | | | | | | | |

Commercial | | | | | | | | | | | | |

| excluding Imagistics | | 5.2 | | 3.7 | | 3.2 | | 7.5 | | 6.8 | | |

| including Imagistics | | 4.8 | | — | | — | | — | | — | | |

Financial | | 5.0 | | 7.6 | | 7.5 | | 7.6 | | 7.5 | | |

| | | | | | | | | | | | | |

| | | | | | |

Total [excl. Imagistics] | | 5.2 | | 4.8 | | 4.7 | | 7.5 | | 7.1 | | |

| | | | | | |

Net income as % of average shareholders’ equity | | | | | | | | | | | | |

Commercial | | 10.9 | | 8.5 | | 5.9 | | 12.4 | | 10.0 | | |

Financial | | 9.0 | | 26.1 | | 18.3 | | 16.1 | | 14.6 | | |

| | | | | | | | | | | | | |

| | | | | | |

Total | | 10.7 | | 10.9 | | 8.3 | | 13.1 | | 10.9 | | |

| * | For details see pages 82 and 83. |

| ** | Before extraordinary items. |

25

Financial review

Now that almost two thirds of the lease portfolio has been sold to third parties and the proceeds from this sale have been invested in productive [core] activities, i.e. in the acquisition of Imagistics, the relative importance and the absolute size of this commercial income will increase strongly.

For this reason the breakdown of the result between commercial and financial activities will no longer be made with effect from 2006.

To enable a comparison of the results of 2005 with those of 2004, however, this split is still highly relevant.

In 2004 the operating income from commercial activities was positively influenced by a profit of € 31 million on the sale of part of the lease portfolio. Operating income of the commercial activities, excluding the profit on the sale of the lease portfolio, likewise amounted to € 31 million. In 2005 the profit on the sale of the lease portfolio amounted to € 5 million whilst exceptional items amounted to € 35 million. Operating income of the commercial activities, excluding the profit on the sale of the lease portfolio and exceptional items amounted to € 52 million.

Use of funds and finance

Gross capital expenditureIn 2005 Océ’s gross capital expenditure on property, plant and equipment amounted to € 96 million [2004: € 87 million]. Depreciation and divestments together amounted to € 99 million [2004: € 98 million].

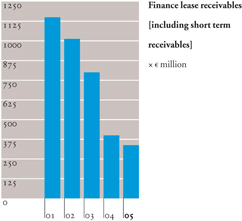

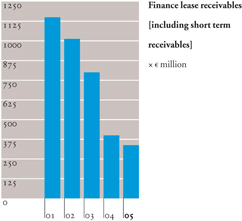

Rental equipment and finance lease receivablesThe book value of rental equipment increased by € 66 million to € 124 million. Of this increase € 50 million resulted from the integration of Imagistics, but for the first time in many years the value of rental machines increased. This reflects the higher placements of printing systems.

The capitalised value of finance leases [including short term receivables] decreased from € 403 million in 2004 to € 343 million in 2005. This was due to the sale of the existing lease portfolio and to the placing of new leases with third parties. The aggregate value of rental equipment and finance lease receivables amounted to 16.6% of the balance sheet total [2004: 20.7%].

The balance sheet value of rental equipment is calculated on the basis of manufacturing cost plus the cost of ensuring that the machine can operate effectively when installed with the customer, less straight line depreciation. Finance lease receivables are valued at the net present value of the contracted lease instalments plus the net present value of residual value.

Interest-bearing capitalAt the 2005 year end the interest-bearing capital amounted to € 896 million [2004 year end: € 481 million]. Over the past three years the proceeds from the sale of leases have been used to reduce net debt and for this reason it was necessary to finance the acquisition of Imagistics by taking out new credit facilities. It can be seen however that the purchase was effectively paid in full from the accumulated proceeds of outsourcing leases.

Group equityGroup equity increased from € 752 million in 2004 to € 818 million in 2005. The composition of Group equity was influenced by the distribution of dividends charged to the General reserve [– € 50 million], exchanges rate changes [+ € 37 million] and an addition from net income [+ € 79 million]. Group equity as a percentage of the balance sheet total amounted to 29.0% [2004: 33.7%]. This percentage is lower than Océ’s sought after target of 30%. Shareholders’ equity does not increase in the event of an acquisition, whilst the balance sheet total does, and so this reduction in the ratio is fully understandable and in no way alarming. On the contrary, despite the strong increase in assets, the ratio is very close to the minimum that Océ seeks to achieve and this ratio is expected to move above the 30% level in the next 2 to 3 years.

Shareholders’ equity per ordinary share, calculated on the basis of the number of ordinary shares outstanding at the end of the financial year, amounted to € 8.65 [2004: € 7.87].

26

Financial review

Cash flowThe cash flow from operational activities amounted to € 164 million [2004: € 137 million].

The cash flow from investment activities amounted to € 671 million negative [2004: € 233 million positive].

For the greater part, investment activities centred on the acquisition of Imagistics [€ 638 million]. In addition, the sale of the lease portfolio [€ 66 million] was substantially lower than in 2004 [€ 312 million].

Due to the above, free cash flow amounted to € 507 million negative. Excluding the expenditure on the acquisition of Imagistics, free cash flow amounted to € 131 million positive.

The cash flow from financing activities was € 340 million positive [2004: € 114 million negative], whilst cash and cash equivalents decreased by € 170 million.

The dividend paid in cash to holders of ordinary shares was € 48.3 million and the dividend paid in cash to holders of preference shares amounted to € 3.6 million.

Credit facilitiesTo finance the acquisition of Imagistics the Océ Group took out bridging loans amounting toUS dollar 1 billion for a maximum period of nine months. The multi-year stand by credit facilities with the relevant banks were partly frozen for the duration of these bridging loans. At the end of the financial year stand by facilities amounting to € 90 million were also available to the Océ Group. During the 2006 financial year the bridging loans will be replaced by permanent loans.

Finance leases

An essential element in Océ’s sales concept is that customers can find the complete solution for their needs, including their financing requirements, via one single point of contact. Lease programmes therefore form – and will continue to form – an indispensable component of Océ’s offerings to its customers; more than 58% of the sales of machines are financed via finance leases.

In 2003 Océ started outsourcing its lease activities, largely to specialised lease companies. Via this outsourcing the specialised know-how available to the lease partners is used to leverage the commercial potential of leasing to the full. Together with these partners new lease programmes are developed and brought to market.

The outsourcing of the lease activities also allows Océ to focus investments on its core activities and improve the return on invested capital.

Even after outsourcing, Océ continues to be the face that is presented to the customer. Outside of the United States, i.e. in Europe and the rest of the world, theprivate labelmodel is therefore used so that the lease partners operate under the name ‘Océ Finance’. Theone-stop shopping conceptis maintained and Océ’s brand name is used to full effect.

In the United States Océ operates via its own captive lease company, Océ-Financial Services, Inc. Under this concept new lease contracts are concluded in the name of the Océ captive financing company and are then bundled together and sold to an external partner. All the ‘risks and rewards’ are transferred but Océ continues to be responsible for invoicing and debt collection activities.

27

‘A healthy sort of tension exists between us andR&D’

Océ’s Business Units and its technology base are two exponents of the same philosophy: they aim to provide the customer with the best possible solution. The success of that philosophy has proved itself again and again. The vision of the Business Units is reflected in this interview with Tom Egelund [WFPS] and Michel Frequin [DDS].

Market The Business Units andR&D each have their own responsibilities and roles, but as part of the Océ business their activities are fully complementary. Océ is market-focused, but the business has no monopoly on knowledge of the market.R&D, too, has opened its doors wide to the market. And that is a must.

Obviously there is a difference in the way we look at the market. We sometimes place the emphasis on different areas, for instance when we look at which product/ market combinations need to be developed for the future.

Capacity In the way we work together there is a certain degree of healthy tension. You need that, as otherwise special things would not happen. And, of course, we sometimes askR&D to do more than they can handle which is part of that tension. But those wishes are not always in the area of innovation. For us the most important aspects, basically, are time-to-market in combination with innovative functionalities in our printers. For us that cannot

28

happen fast enough which places enormous demands onR&D capacity. And that has its limits, so you have to make clever use of it, for example by developing and applying standards wherever possible. It is certainly a dilemma. On the one hand we feel that our own technology is extremely important and we also have many top-class examples of that in-house. On the other hand, too much in-house technology can also limit you in your time-to-market.

Choices If you list our classic wishes, you will see three things: time-to-market, functionality and cost price. The market is constantly changing in all these areas and our aim at all times is at least to keep pace with other suppliers. In that way we can translate the total cost of ownership into an excellent market proposition. Then we are faced with choices. We can opt for a fast introduction followed a little later by full functionality. In fact, if you talk to customers you find that for them functionality hardly ever comes first. They see reliability and the dedication of the people as much more important. Naturally at a certain moment you have to be able to offer all the functionality that the market is asking for. It is your admission ticket, the requirement you have to meet to be allowed to play the game. But you win the game on the basis of other things: uptime, reliability, total cost of ownership. And as regards those aspects we can still make substantial steps forward.

In terms of cost price steps forward are also being taken. The fact that we are now also manufacturing in Asia is extremely important.

Extras We’ve definitely got no complaints about the activities ofR&D Just look at the products that we’ve been able to add to our portfolio in recent years. At most the tension occasionally arises because of the choices that are made. For instance, making successful machines suitable for countries that are showing significant growth-rates. That does happen, but sometimes at a late stage. We are a true multinational, European in Europe, American in the United States and Japanese in Japan, and that should be reflected in the way we think and act. In addition to technology we would also like to see new services being developed. Océ Business Services is still developing well, but expansion there means developing new, knowledge-intensive services. Pure innovation for which we needR&D And then, of course, there is the theme of colour which is growing in importance every day, for both DDS andWFPS. Right across the market there is an increasing demand for colour, and so we have to invest intensively in colour. And we are doing that. Our own technology, both for small and wide format, will play an important role here.

Speed We hold major technological trump cards and we have to play them well. It’s a combined task for us andR&D. At the point where market and technology come together, new product/market combinations are being created. It is essential for us to keep up the speed that the rapidly changing market is asking of us.

29

The world of Océ | Digital Document Systems

| | | | | | |

| | | |

| | | Customer segments | | Products and services | | Competitors |

| |

| |

| |

|

| Corporate Printing | | Segments in which Océ operates: Data centres Central repro departments Extensive office environments | | Office and departmental printers, black and white and colour. [Very] high volume printers/copiers, black and white and colour. Production printers, black and white and colour, cutsheet and continuous feed. High speed scanners. Workflow software for the management of printing solutions. Financial services. | | Canon IBM Kodak Konica Minolta Kyocera Mita Ricoh Xerox |

| | | Specifically in the sectors: Financial institutions Telecom and utility companies Government and education Trade, transport, industry and consultancy | | | |

| |

| |

| |

|

Commercial Printing | | Marketing Services General and specialised printing works Digital print providers Reprographic businesses [quick printers and copy shops] | | [Very] high volume printers/copiers, black and white and colour. Production printers, black and white and colour, cutsheet and continuous feed. Workflow software for the management of printing solutions. Financial services. | | Canon HP [Indigo] IBM Kodak Ricoh Xerox |

| |

| |

| |

|

Océ Business Services | | All customer segments of:Corporate Printing Technical Document Systems | | Taking over and carrying out [outsourcing] of document management processes by Océ for both wide and small format applications. | | IKON Pitney Bowes Xerox Local Suppliers |

| |

| |

| |

|

| | | |

| Software & Professional Services* | | All customer segments of:Corporate Printing Commercial Printing Technical Document Systems Display Graphic Systems Océ Business Services | | Integrated document management systems: input and output management software, document workflow software, document archiving software. Professional services: training, consultancy, implementation, support. | | Canon Hewlett-Packard IBM Kodak PLP Digital Systems Seal Systems Xerox |

| |

| | | * The results of the business group Software & Professional Services are integrated in those of the business groups Corporate Printing, Commercial Printing, Technical Document Systems and Display Graphics Systems. |

30

The world of Océ | Wide Format Printing Systems

| | | | | | |

| | | Customer segments | | Products and services | | Competitors |

| |

| |

| |

|

| Technical Document Systems | | Print-for-use Construction companies Architectural and engineering offices Industrial companies Utility companies Telecom businesses Government | | Wide format production printers for workgroup and office environments, in both black and white and colour. Wide format scanners. Print management and distribution software. Financial services. | | Fuji Xerox Hewlett-Packard KIP Ricoh Xerox |

| | | |

| | Print-for-pay Reprographic businesses Digital print providers

| |

| |

|

Display Graphics Systems | | Print-for-use Corporate and retail in-house printing Printing works Advertising and design agencies | | Wide format production printers [roll-to- roll and flatbed] for indoor and outdoor applications. Print workflow software. Financial services. | | Durst Epson Hewlett-Packard/Scitex Mimaki Mutoh Nur Vutek |

| | | Print-for-pay Digital print providers Reprographic businesses Photo processing laboratories Silkscreen printers | | | | |

| |

| |

| |

|

Imaging Supplies | | All customer segments of:Technical Document Systems Display Graphics Systems Corporate Printing Commercial Printing Océ Business Services | | Wide format media. Display graphics media and inks. Print media for office and for commercial graphics applications [business graphics media]. | | 3M Corporate Express Hewlett-Packard Intelicoat Paperlinx Sihl Xerox |

31

Commercial developments | Digital Document Systems

| | | | | | | | | | |

Results of Digital Document Systems | | x € million | | 2005

| | 2004

| | changes as %

| | organic as %

|

| | | Revenues | | 1,843 | | 1,834 | | +0.5 | | –1.1 |

| | | Non-recurring | | 526 | | 487 | | +8.3 | | +6.4 |

| | | Recurring | | 1,317 | | 1,347 | | –2.3 | | –3.8 |

| | | Operating income [EBIT] | | 39 | | 55 | | –29.0 | | — |

General

The Strategic Business Unit Digital Document Systems [DDS] focuses on document output and printing solutions for user environments with an intensive document flow.DDS comprises four business groups.

TheCorporate Printingbusiness group supplies integral solutions for document output management to corporate data centres, central repro departments and office environments, in which the emphasis is on providing support for the core processes [print-for-use]. The customers served by this business group include financial institutions, telecom companies, energy suppliers, government authorities, educational institutions and businesses engaged in trade and industry.

The customer base served by theCommercial Printingbusiness group includes marketing service businesses, digital printing firms, specialised printshops and reprographic businesses, most of which use commercial applications [print-for-pay].

TheOcé Business Servicesbusiness group uses the products and services ofDDS andWFPS to take over from customers all their activities in the area of document processing, printing and copying [complete outsourcing] so as to optimise their printing and document management processes.

TheSoftware & Professional Servicesbusiness group serves Océ customers in all target groups by providing them with software products and project services to support the implementation and use of digital solutions.

Corporate Printing