SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant | | x | |

| Filed by a Party other than the Registrant | | ¨ | |

Check the appropriate box:

| ¨ Preliminary | | Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only |

| | | (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to 240.14a-11(c) or 240.14a-12 |

EXAR CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No. 14A: |

EXAR CORPORATION

48720 KATO ROAD

FREMONT, CALIFORNIA 94538

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 4, 2003

TO THE STOCKHOLDERS OF EXAR CORPORATION:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders ofEXAR CORPORATION, a Delaware corporation (the “Company”), will be held on Thursday, September 4, 2003 at 3:00 p.m. local time at the Company’s Corporate Headquarters, 48720 Kato Road, Fremont, California 94538, for the following purposes:

| | 1. | | To elect one (1) Director to hold office until the 2006 Annual Meeting of Stockholders or until a successor is duly elected and qualified, or until such Director’s earlier death, resignation or removal. |

| | 2. | | To approve an amendment to the Company’s 1996 Non-Employee Directors’ Stock Option Plan, as amended, to increase the aggregate number of shares of Common Stock authorized for issuance under such plan by 500,000 shares. |

| | 3. | | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on July 11, 2003 as the record date for the determination of Stockholders entitled to notice of and to vote at this Annual Meeting and at any adjournment or postponement thereof.

By Order of the Board of Directors

THOMAS R. MELENDREZ

Secretary

Fremont, California

July 28, 2003

ALL STOCKHOLDERSARECORDIALLYINVITEDTOATTENDTHEMEETINGINPERSON. WHETHERORNOTYOUEXPECTTOATTENDTHEMEETING,PLEASECOMPLETE,DATE,SIGNANDRETURNTHEENCLOSEDPROXYASPROMPTLYASPOSSIBLEINORDERTOENSUREYOURREPRESENTATIONATTHEMEETING. ARETURNENVELOPE (WHICHISPOSTAGEPREPAIDIFMAILEDINTHE UNITED STATES)ISENCLOSEDFORTHATPURPOSE. EVENIFYOUHAVEGIVENYOURPROXY,YOUMAYSTILLVOTEINPERSONIFYOUATTENDTHEMEETING. PLEASENOTE,HOWEVER,THATIFYOURSHARESAREHELDOFRECORDBYABROKER,BANKOROTHERNOMINEEANDYOUWISHTOVOTEATTHEMEETING,YOUMUSTOBTAINFROMTHERECORDHOLDERAPROXYISSUEDINYOURNAME.

EXAR CORPORATION

48720 KATO ROAD

FREMONT, CALIFORNIA 94538

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD SEPTEMBER 4, 2003

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board of Directors” or the “Board”) of Exar Corporation, a Delaware corporation (the “Company”), for use at the Annual Meeting of Stockholders to be held on September 4, 2003, at 3:00 p.m. local time (the “Annual Meeting”), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at the Company’s Corporate Headquarters, 48720 Kato Road, Fremont, California 94538. The Company intends to mail this proxy statement and accompanying proxy card on or about July 28, 2003 to all Stockholders entitled to vote at the Annual Meeting.

Solicitation

The Company will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy and any additional information furnished to Stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock beneficially owned by others to forward to such beneficial owners. The Company may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by Directors, officers or other regular employees of the Company or Georgeson Shareholder Communications, Inc. No additional compensation will be paid to Directors, officers or other regular employees for such services, but Georgeson Shareholder Communications, Inc. will be paid its customary fee, approximately $5,000, plus documented expenses, for solicitation services.

Voting Rights and Outstanding Shares

Only holders of record of Common Stock at the close of business on July 11, 2003 are entitled to notice of and to vote at the Annual Meeting. At the close of business on July 11, 2003, the Company had outstanding and entitled to vote 40,458,269 shares of Common Stock.

Each holder of record of Common Stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting.

Unless otherwise indicated, all information in this proxy statement reflects a two-for-one stock split effected on October 19, 2000 and a three-for-two stock split effected on February 15, 2000.

Quorum; Abstentions; Broker Non-Votes

Holders of a majority of the outstanding shares entitled to vote must be present, in person or by proxy, at the Annual Meeting in order to have the required quorum for the transaction of business. All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. If the shares present, in person and by proxy, at the meeting do not constitute the required quorum, the meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum.

1

Shares that are voted “FOR,” “AGAINST” or “WITHHELD” are treated as being present at the meeting for purposes of establishing a quorum. Shares that are voted “FOR,” “AGAINST” or “ABSTAIN” with respect to a matter will also be treated as shares entitled to vote (the “Votes Cast”) with respect to such matter.

While no definitive statutory or case law authority exists in Delaware as to the proper treatment of abstentions, the Company believes that abstentions should be counted for purposes of determining both (i) the presence or absence of a quorum for the transaction of business and (ii) the number of Votes Cast with respect to a proposal (other than the election of directors). In the absence of controlling precedent to the contrary, the Company intends to treat abstentions in this manner. Accordingly, abstentions will have the same effect as a vote “AGAINST” the proposal.

Broker non-votes (i.e., votes from shares held of record by brokers as to which the beneficial owners have given no voting instructions) will be counted for purposes of determining the presence or absence of a quorum for the transaction of business, but will not be counted for purposes of determining the number of Votes Cast with respect to the particular proposal on which the broker has expressly not voted. Accordingly, broker non-votes will not affect the outcome of the voting on a proposal that requires a majority of the Votes Cast (such as the approval of the amendment to the Company’s 1996 Non-Employee Directors’ Stock Option Plan). Thus, a broker non-vote will make a quorum more readily obtainable, but the broker non-vote will not otherwise affect the outcome of the vote on a proposal.

Voting Via the Internet or by Telephone

Most beneficial owners whose stock is held in street name receive instructions for granting proxies from their banks, brokers or other agents, rather than the Company’s proxy card.

A number of brokers and banks offer the means to grant proxies to vote shares by means of the telephone and Internet. If your shares are held in an account with a broker or bank participating in this or another similar program, you may grant a proxy to vote those shares telephonically or via the Internet by following the instructions shown on the instruction form received from your broker or bank.

The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to grant a proxy to vote their shares and to confirm that stockholders’ instructions have been recorded properly. Stockholders participating in these programs should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, that must be borne by the Stockholder.

Proxies; Revocability of Proxies

Whether or not you are able to attend the Annual Meeting, the Company urges you to submit your proxy, which is solicited by the Company’s Board of Directors and which when properly completed will be voted as you direct. In the event no directions are specified, such proxies will be voted “FOR” the nominee of the Board of Directors (Proposal 1), “FOR” the amendment to the 1996 Non-Employee Directors’ Stock Option Plan, as amended (Proposal 2) and in the discretion of the proxy holders as to any other matters that may properly come before the Annual Meeting. You are urged to give direction as to how to vote your shares. Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of the Company at the Company’s Corporate Headquarters, 48720 Kato Road, Fremont, California 94538, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

2

Stockholder Proposals

Proposals of Stockholders that are intended to be presented at the Company’s 2004 Annual Meeting of Stockholders must be received by the Company not later than March 31, 2004 in order to be included in the proxy statement and proxy relating to that Annual Meeting. In addition, any Stockholder who desires to make a proposal to be presented at the Company’s 2004 Annual Meeting of Stockholders must comply with the provisions relating to advance notice contained in the Company’s By-Laws.

PROPOSAL 1

ELECTION OF DIRECTOR

The Company’s Amended and Restated Certificate of Incorporation and By-Laws provide that the Board of Directors shall be divided into three classes, with each class having a three-year term. Vacancies on the Board of Directors may be filled by either (i) the affirmative vote of the holders of a majority of the voting power of the then-outstanding shares of voting stock of the Company voting together as a single class, or (ii) by a majority of the remaining Directors. A Director elected to fill a vacancy shall serve for the remainder of the full term of the class of Directors in which the vacancy occurred and until such Director’s successor is elected and qualified.

The Board of Directors is presently composed of six members. There are two Directors, Frank P. Carrubba and James E. Dykes, in the class whose terms of office expire in 2003. Mr. Dykes has indicated that he will not stand for re-election upon expiration of his current term in September 2003. Dr. Carrubba, the only nominee for election to this class, is currently a Director of the Company who was previously elected by the Stockholders. Dr. Carrubba is a member of the Audit and Compensation Committees. If elected at the Annual Meeting, Dr. Carrubba will serve until the 2006 Annual Meeting or until his successor is duly elected and qualified, or until his earlier death, resignation or removal.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominee named below. In the event that the nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as management may propose. Dr. Carrubba has agreed to serve if elected, and management has no reason to believe that he will be unable to serve. Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the meeting. Votes withheld from a nominee are counted for purposes of determining the presence or absence of a quorum, but have no other legal effect under Delaware law. See “INFORMATION CONCERNING SOLICITATION AND VOTING—Quorum; Abstentions; Broker Non-Votes.”

Set forth below is biographical information for Dr. Carrubba. There is no family relationship between any Director or Executive Officer of the Company.

Nominee for Election for a Three-Year Term Expiring at the 2006 Annual Meeting

FRANK P. CARRUBBA

Dr. Carrubba, age 66, joined the Company as a Director in August 1998. Dr. Carrubba served as Executive Vice President and Chief Technical Officer of Royal Philips Electronics N.V., headquartered in Eindhoven, The Netherlands, from 1991 to 1997. From 1982 to 1991, Dr. Carrubba was employed by Hewlett-Packard Company, where he was a member of the Group Management Committee and was Director of Hewlett-Packard Laboratories. Prior to joining Hewlett-Packard, he spent 22 years as a member of the technical staff at IBM Corporation’s Thomas J. Watson Research Laboratory in Yorktown Heights, New York. Dr. Carrubba was one of the original designers of the RISC Architecture, for which he was named “Inventor of the Year” by the Intellectual Property Owners in Washington, D.C. in 1992. Dr. Carrubba is also a Director of Coherent, Inc., a global leader in the design, manufacture and sale of lasers, and Gyration, Inc., creator of in-air cordless mice and

3

controllers for games, presentations and virtual reality. In June 2002, Dr. Carrubba was appointed Chairman of the Board of Accerra Corporation, a provider of secure online services for business communications, located in Santa Rosa, California.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF THE NAMED NOMINEE.

Directors Continuing in Office Until the 2004 Annual Meeting

DONALD L. CIFFONE, JR.

Mr. Ciffone, age 48, joined the Company as President and Chief Executive Officer in October 1996 and was appointed a Director at that time. Mr. Ciffone was appointed Chairman of the Board in April 2002. From August 1996 to October 1996, Mr. Ciffone was Executive Vice President of Toshiba America, the U.S. semiconductor subsidiary of Toshiba Semiconductor. Prior to joining Toshiba, he served from 1991 to 1996 in a variety of senior management positions, including Senior Vice President of the VLSI Product Divisions, at VLSI Technology, Inc. From 1978 to 1991, Mr. Ciffone held a variety of marketing and operations positions at National Semiconductor, Inc. Mr. Ciffone holds a B.A. from San Jose State University and an M.B.A. from Santa Clara University.

RONALD W. GUIRE

Mr. Guire, age 55, joined the Company in July 1984 and has been a Director since June 1985. He has served as Chief Financial Officer since May 1985 and Executive Vice President since July 1995. Mr. Guire was Chairman of the Board of Xetel Corporation, an electronics contract manufacturer, until May 2002. Mr. Guire was a partner in the certified public accounting firm of Graubart & Co. from 1979 until he joined Exar in July 1984. Mr. Guire holds a B.S. in Accounting from California College of Commerce.

Directors Continuing in Office Until the 2005 Annual Meeting

RAIMON L. CONLISK

Mr. Conlisk, age 81, joined the Company as a Director in August 1985, was appointed Vice Chairman of the Board in August 1990, served as Chairman of the Board from August 1994 to April 2002 and is currently serving as Vice Chairman. Mr. Conlisk has also served as a Director since 1991, and in December 1997 was appointed Chairman of the Board of SBE, Inc., a manufacturer of communications and computer products. From 1977 to 1999, Mr. Conlisk was President of Conlisk Associates, a management consulting firm serving high-technology companies in the United States and abroad. From 1991 to 1998, Mr. Conlisk served as a Director of Xetel Corporation, a contract manufacturer of electronic equipment. Mr. Conlisk was also President from 1984 to 1989, a Director from 1970, and Chairman from 1989 until retirement in June 1990, of Quantic Industries, Inc., a privately held manufacturer of electronic systems. From 1970 to 1973 and from 1987 to 1990, Mr. Conlisk served as a Director of the American Electronics Association.

RICHARD PREVITE

Mr. Previte, age 68, joined the Company as a Director in October 1999. He was a Director of Advanced Micro Devices, Inc., or AMD, from 1990 to April 2000, and Vice Chairman of the Board from 1999 to April 2000. Additionally, Mr. Previte served as Chairman of the Board of Vantis Corporation, a subsidiary of AMD, from 1997 to June 1999, and acted as Chief Executive Officer of Vantis Corporation from February 1999 to June 1999. Mr. Previte served as President of AMD from 1990 to 1999, Executive Vice President and Chief Operating Officer from 1989 to 1990, and Chief Financial Officer and Treasurer from 1969 to 1989. Most recently he was Chief Executive Officer and Chairman of the Board of MarketFusion, Inc., from January 2000 to April 2002.

4

Board Committees and Meetings

During the fiscal year ended March 31, 2003, the Board of Directors held eight meetings. The Board maintains an Audit Committee, a Compensation Committee, an Employee Option Administration Committee and a Corporate Governance and Nominating Committee. In addition, the Employee Option Administration Committee has delegated limited responsibilities to the Employee Option Administration Sub-Committee.

The Audit Committee, serving under a written charter adopted by the Board of Directors, reviews financial reports, information and other disclosures submitted by the Company to any regulatory agency or disclosed to the public, reviews the Company’s system of internal controls regarding finance and accounting and the Company’s auditing, accounting and financial reporting processes. The Committee’s primary duties and responsibilities are to: (i) serve as an independent and objective party to review the reliability and integrity of the Company’s financial reporting process and internal control system; (ii) review and appraise the independent accountants’ qualifications, independence and performance; and (iii) provide the Board with such information and materials as it may deem necessary to make the Board aware of significant financial matters that require the attention of the Board. The Audit Committee, which during the fiscal year ended March 31, 2003 was composed of Messrs. Carrubba, Conlisk, Dykes and Previte, held eight meetings during such fiscal year. Mr. Previte serves as Chairman of the Audit Committee. All members of the Audit Committee are independent (as currently defined under applicable law and the National Association of Securities Dealers listing standards).

The Compensation Committee assists the Board of Directors by reviewing, approving, modifying and administering the Company’s compensation plans, arrangements and programs. The Committee’s primary duties and responsibilities are to: (i) evaluate the performance of the Company’s President and CEO; (ii) review the performance of other Executive Officers; and (iii) review and approve or recommend to the Board compensation levels, policies and programs. The Compensation Committee, which during the fiscal year ended March 31, 2003 was composed of Messrs. Carrubba, Conlisk, Dykes and Previte, held four meetings during such fiscal year. Mr. Dykes serves as Chairman of the Compensation Committee.

The Employee Option Administration Committee administers the Company’s employee stock option plans, including the granting of any options under those plans. The Employee Option Administration Committee, which during the fiscal year ended March 31, 2003 was composed of Messrs. Conlisk and Dykes, held five meetings during such fiscal year. Mr. Conlisk serves as Chairman of the Employee Option Administration Committee. The Employee Option Administration Sub-Committee, composed of Messrs. Ciffone, as Chairman, and Guire, held ten meetings during such fiscal year. The Employee Option Administration Sub-Committee grants options within guidelines approved by the Employee Option Administration Committee to new employees, other than Company Section 16 insiders, as of the hire date in order to avoid option price fluctuations that might result if option grants are authorized subsequent to the hire date.

The Corporate Governance and Nominating Committee adopts and ensures compliance with ethical principles and governance standards applicable to the Company’s Directors and Executive Officers to ensure corporate integrity and responsibility. In the absence of Board of Directors action, the Corporate Governance and Nominating Committee interviews, evaluates, nominates and recommends individuals for membership on the Company’s Board of Directors and committees thereof. The Corporate Governance and Nominating Committee will consider nominees recommended by Stockholders. Such recommendations should be submitted to the attention of the Chairman of the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee which, during the fiscal year ended March 31, 2003, was composed of Messrs. Conlisk and Dykes, held three meetings during such fiscal year. Mr. Conlisk serves as Chairman of the Corporate Governance and Nominating Committee.

During the fiscal year ended March 31, 2003, each Board member attended at least 75% or more of the aggregate of the meetings of the Board and of the committees on which he served that were held during the period for which he was a Director or committee member, respectively.

5

The charters for each of the above committees, the Company’s Corporate Governance Principles, and Code of Ethics for Principal Executives, Executive Management and Senior Financial Officers are posted on the Company’s web site at www.exar.com.

PROPOSAL 2

APPROVAL OF THE 1996 NON-EMPLOYEE DIRECTORS’

STOCK OPTION PLAN, AS AMENDED

In July 1996 (the “Effective Date”), the Board of Directors adopted and the Stockholders subsequently approved the Company’s 1996 Non-Employee Directors’ Stock Option Plan (the “1996 Directors’ Stock Option Plan”) authorizing for issuance 150,000 shares of Common Stock. On June 25, 1998, the Board of Directors approved an amendment, which was subsequently approved by the Stockholders on September 10, 1998, increasing the number of shares authorized for issuance under the 1996 Directors’ Stock Option Plan by 100,000 shares to a total of 250,000 shares. The total shares authorized for issuance under the 1996 Directors’ Stock Option Plan prior to March 20, 2003 was 750,000 as adjusted to reflect share splits in calendar year 2000. On March 20, 2003, the Board of Directors approved an amendment, subject to Stockholder approval, to the 1996 Directors’ Stock Option Plan in order to increase the number of shares authorized for issuance under the 1996 Directors’ Stock Option Plan by 500,000 shares to a total of 1,250,000 shares.

As of May 31, 2003, options (net of cancelled and expired options) covering an aggregate of 93,297 shares of the Company’s Common Stock had been granted and only 24,286 shares (plus any shares that might in the future be returned to the 1996 Directors’ Stock Option Plan as a result of cancellation or expiration of options) remained available for future grant under the 1996 Directors’ Stock Option Plan. During the last fiscal year, under the 1996 Directors’ Stock Option Plan, the Company granted to all Non-Employee Directors as a group options to purchase 93,297 shares at exercise prices of $12.74 to $13.52 per share.

The purpose of the amendment to the 1996 Directors’ Stock Option Plan is to enable the Company to attract and retain the services of persons qualified to serve on the Board, to provide flexibility in the event of an increase in the number of Board members, and to continue to make grants in the manner previously made under the Company’s 1991 Non-Employee Directors’ Stock Option Plan, which terminated May 31, 1996.

Stockholders are requested in this Proposal 2 to approve the amendment to the 1996 Directors’ Stock Option Plan. The affirmative vote of a majority of the Votes Cast at the meeting will be required to approve the amendment to the 1996 Directors’ Stock Option Plan. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the Stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved. See “INFORMATION CONCERNING SOLICITATION AND VOTING—Quorum; Abstentions; Broker Non-Votes.”

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF THIS PROPOSAL 2.

The essential features of the 1996 Directors’ Stock Option Plan are outlined as follows:

General

The 1996 Directors’ Stock Option Plan provides for non-discretionary grants of nonstatutory stock options. Options granted under the 1996 Directors’ Stock Option Plan are not intended to qualify as incentive stock options as defined under Section 422 of the Code.

6

Purpose

The purpose of the 1996 Directors’ Stock Option Plan is to retain the services of persons now serving as Non-Employee Directors of the Company (as defined below), to secure and retain the services of persons capable of serving on the Board and to provide incentives for such persons to exert maximum efforts to promote the success of the Company.

Administration

The 1996 Directors’ Stock Option Plan is administered by the Board. The Board has the power to construe and interpret the provisions of the 1996 Directors’ Stock Option Plan and the options granted under it, and to establish, amend and revoke the rules for its administration. The Board is authorized to delegate administration of the 1996 Directors’ Stock Option Plan to a committee of not less than two members of the Board.

Eligibility

The 1996 Directors’ Stock Option Plan provides that options may be granted under this plan only to Non-Employee Directors of the Company. A “Non-Employee Director” is defined as a member of the Board who is not otherwise an employee of the Company or any affiliate. Four of the Company’s six current members of the Board (including Mr. Dykes, who is not going to stand for re-election in September 2003) are eligible to participate in the 1996 Directors’ Stock Option Plan.

Term of Options

Each option under the 1996 Directors’ Stock Option Plan is subject to the following terms and conditions:

Non-Discretionary Grants. Option grants under the 1996 Directors’ Stock Option Plan are non-discretionary and made solely in accordance with the express provisions of the 1996 Directors’ Stock Option Plan.

Each person who is first elected to the Board after the Effective Date, and who is not an employee of the Company or any affiliate, shall be granted, at the time of such election, an option to purchase 54,000 shares of Common Stock (the “Initial Grant”). Thereafter, on the date of each subsequent Annual Meeting following the Initial Grant, each Non-Employee Director who has continuously served as a Non-Employee Director for the preceding 12 months shall automatically be granted an option to purchase 22,500 additional shares (the “Annual Grant”). On April 13, 2000, the Board amended the 1996 Directors’ Stock Option Plan to provide that the Annual Grant to the Chairman of the Board be increased to twice the Annual Grant issued to each of the other Non-Employee Directors (i.e., 45,000 shares). The Board subsequently limited the Chairman’s Annual Grant to a Non-Employee Chairman upon Mr. Ciffone being elected Chairman of the Board.

Option Exercise. An Initial Grant becomes exercisable in three equal annual installments, on the first, second and third anniversaries of the date of grant, subject to the Non-Employee Director’s continued service to the Company through each applicable vesting date. Annual Grants made prior to September 11, 1998 became exercisable in four equal annual installments, on the first, second, third and fourth anniversaries of the date of grant. Annual Grants made on or after September 11, 1998 vest monthly in equal installments over a period of twelve (12) months after the date of grant. Such vesting is conditioned upon continued service to the Company. If a Non-Employee Director’s term as a member of the Board expires and such Non-Employee Director is not elected or appointed to an immediate subsequent term, all of such Non-Employee Director’s Annual Grants will immediately vest and become exercisable.

Exercise Price; Payment. The exercise price of options granted under the 1996 Directors’ Stock Option Plan (except for options granted pursuant to a fee deferral election discussed below) shall be equal to 100% of the fair market value of the Common Stock on the date each option is granted. The exercise price of options granted must be paid in cash at the time options are exercised.

7

Transferability; Term. Under the 1996 Directors’ Stock Option Plan, an option may not be transferred by the optionee, except by will, by the laws of descent and distribution, to a beneficiary designation (in a form satisfactory to the Company), or pursuant to certain domestic relations orders. No option granted under the 1996 Directors’ Stock Option Plan is exercisable by any person after the expiration of seven years from the date the option is granted.

Adjustment Provisions

If there is any change in the stock subject to the 1996 Directors’ Stock Option Plan or subject to any option granted under the 1996 Directors’ Stock Option Plan (through merger, consolidation, reorganization, recapitalization, stock dividend, dividend in property other than cash, stock split, liquidating dividend, combination of shares, exchange of shares, change in corporate structure or otherwise), the 1996 Directors’ Stock Option Plan and options outstanding thereunder will be appropriately adjusted as to the class and the maximum number of shares subject to the plan and the class, number of shares and price per share of stock subject to outstanding options.

Effect of Certain Corporate Events

In the event of certain specified types of mergers or other corporate reorganizations, all outstanding options under the plan shall become exercisable in full for a period of at least ten (10) days prior to such event. The acceleration of an option in the event of an acquisition or similar corporate event may be viewed as an antitakeover provision, which may have the effect of discouraging a proposal to acquire or otherwise obtain control of the Company.

Fee Deferral Election

Each Board member may elect to have a portion of his annual fee reduced each year in return for options to purchase Common Stock.

An election to defer annual fees must be filed with the Company prior to the commencement of the calendar year in which the fees to be deferred are earned (except for newly elected Non-Employee Directors who may file such an election within 30 days of being elected to the Board) and are irrevocable for that calendar year. The percentage of fees that may be deferred for a year is an amount equal to at least 25% but in no event more than 50% of the total annual fee.

Options granted pursuant to a fee deferral election will be granted on the first trading day in January of the calendar year for which the fee reduction election is to be in effect, or for new Non-Employee Directors, the first trading day of the month following the month in which such Non-Employee Director files such election. The number of shares of Common Stock subject to each option shall be equal to A / (B x 66 2/3%), where A is the fee deferral amount and B is the fair market value per share of Common Stock on the option grant date. The number of shares shall be rounded down to the nearest whole number.

The exercise price of each option granted pursuant to a fee deferral election shall be 33 1/3% of the fair market value of the Common Stock subject to such option on the date such option is granted. Such options shall become exercisable in installments on each date that fees would have been payable in cash had no deferral election been in effect, and shall terminate on the earlier of (i) seven years from the date the option was granted or (ii) three years following termination for any reason of his or her service as a Non-Employee Director.

Duration, Amendment and Termination

The Board may amend, suspend or terminate the 1996 Directors’ Stock Option Plan at any time or from time to time. No amendment will be effective unless approved by the Stockholders of the Company if such amendment requires Stockholder approval in order for the 1996 Directors’ Stock Option Plan to meet the

8

requirements of Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or Nasdaq or exchange listing requirements.

Participation in the 1996 Directors’ Stock Option Plan

The grant of options under the 1996 Directors’ Stock Option Plan to Non-Employee Directors is subject to the terms of the 1996 Directors’ Stock Option Plan and can only be determined at the time of election or appointment to the Board and on the date of each subsequent Annual Meeting following the Initial Grant. Accordingly, future awards are not determinable. No Executive Officers or employees are eligible to participate in the 1996 Directors’ Stock Option Plan. The following table sets forth information with respect to the grant of options to the current Non-Employee Directors that would have been made if the 1996 Directors’ Stock Option Plan had been adopted by the Stockholders on the first day of the last fiscal year and had remained in effect during all of the last fiscal year:

Identity of Group

| | Number of

Shares

Subject to

Options

Granted (#)

| | Dollar

Value ($)(1)

|

Donald L. Ciffone, Jr. Chairman, President and CEO | | N/A(2) | | N/A(2) |

Roubik Gregorian Executive Vice President and Chief Operating Officer | | N/A(2) | | N/A(2) |

Ronald W. Guire Executive Vice President, Chief Financial Officer and Assistant Secretary | | N/A(2) | | N/A(2) |

Thomas R. Melendrez General Counsel, Secretary and Vice President Business Development | | N/A(2) | | N/A(2) |

Steven W. Michael Vice President Operations and Reliability & QA | | N/A(2) | | N/A(2) |

All current Executive Officers as a group | | N/A(2) | | N/A(2) |

All current Non-Employee Directors as a group | | 90,000 | | 1,461,600 |

All other employees (including all current officers who are not Executive Officers) as a group | | N/A(2) | | N/A(2) |

| (1) | | For options, “dollar value” is equal to the aggregate exercise price of options that would have been granted under the 1996 Directors’ Stock Option Plan. As of May 31, 2003, the fair market value of a share of the Company’s Common Stock was $16.24. |

| (2) | | Not eligible to participate in the 1996 Directors’ Stock Option Plan, as amended. |

Certain Federal Income Tax Information

Stock options granted under the 1996 Directors’ Stock Option Plan are subject to federal income tax treatment pursuant to rules governing options that are not incentive stock options.

The following is only a summary of the effect of federal income taxation upon the optionee and the Company with respect to the grant and exercise of options under the 1996 Directors’ Stock Option Plan, does not purport to be complete and does not discuss the income tax laws of any state or foreign country in which an optionee may reside.

Options granted under the 1996 Directors’ Stock Option Plan are nonstatutory stock options. There are no tax consequences to the optionee or the Company by reason of the grant of a nonstatutory stock option. Upon exercise of a nonstatutory stock option, the optionee normally will recognize taxable ordinary income equal to the excess of the stock’s fair market value on the date of exercise over the option exercise price. The Company will generally be entitled to a deduction equal to the amount of ordinary income recognized by the optionee.

9

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of May 31, 2003:

| | • | | each Stockholder who is known by us to own beneficially more than 5% of our Common Stock; |

| | • | | each of our President and Chief Executive Officer and our other four most highly compensated Executive Officers as of March 31, 2003; |

| | • | | each of our Non-Employee Directors; and |

| | • | | all of our Non-Employee Directors and Executive Officers as a group. |

Unless otherwise indicated, to our knowledge, all persons listed below have sole voting and investment power with respect to their shares of our Common Stock, except to the extent authority is shared by spouses under applicable law. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”). Applicable percentage ownership is based on 40,379,536 shares of Common Stock outstanding as of May 31, 2003. In computing the number and percentage of shares beneficially owned by a person, shares of Common Stock subject to options currently exercisable, or exercisable within sixty (60) days of May 31, 2003, are counted as outstanding, while these shares are not counted as outstanding for computing the percentage ownership of any other person.

| | | Beneficial Ownership(1)

|

| | | Number of

Shares

| | Percent of

Total

|

Capital Group International, Inc.(2) 11100 Santa Monica Boulevard, Suite 1500 Los Angeles, California 90025-3384 | | 2,887,750 | | 7.15 |

T. Rowe Price Associates, Inc.(3) 100 E. Pratt Street Baltimore, Maryland 21202 | | 2,662,900 | | 6.59 |

Putnam Investments(4) One Post Office Square Boston, Massachusetts 02109 | | 2,286,700 | | 5.66 |

Royce and Associates, LLC(5) 1414 Avenue of the Americas New York, New York 10019 | | 2,116,900 | | 5.24 |

Donald L. Ciffone, Jr.(6) | | 1,264,070 | | 3.13 |

Roubik Gregorian(6) | | 593,243 | | 1.47 |

Ronald W. Guire(6) | | 453,808 | | 1.12 |

Thomas R. Melendrez(6) | | 170,394 | | * |

Stephen W. Michael(6) | | 226,497 | | * |

Raimon L. Conlisk(6) | | 219,116 | | * |

James E. Dykes(6) | | 146,660 | | * |

Frank P. Carrubba(6) | | 154,505 | | * |

Richard Previte(6) | | 118,652 | | * |

All Executive Officers and Non-Employee Directors as a group (11 persons)(6) | | 3,817,377 | | 9.45 |

| * | | Represents beneficial ownership of less than one percent of the Common Stock. |

| (1) | | This table is based upon information supplied by Executive Officers, Non-Employee Directors, and principal Stockholders and Schedules 13G and 13G(A) filed with the SEC. |

10

| (2) | | Based on a Schedule 13G(A) filed with the SEC on February 11, 2003. The Capital Group International, Inc. has sole voting power with respect to 2,144,250 shares and sole dispositive power with respect to 2,887,750 shares. Its wholly-owned subsidiary, Capital Guardian Trust Company, beneficially owns 2,803,240 shares, of which it has sole voting power with respect to 2,059,740 shares and sole dispositive power with respect to 2,803,240 shares. |

| (3) | | Based on a Schedule 13G filed with the SEC on January 30, 2003. Includes sole voting power with respect to 859,300 shares and sole dispositive power with respect to 2,662,900 shares. |

| (4) | | Based on a Schedule 13G filed with the SEC on February 14, 2003. Putnam Investments is the wholly- owned subsidiary of Marsh & McLennan Companies, Inc. Putnam Investments owns Putnam Investment Management, LLC which beneficially owns 2,218,900 of the shares owned by Putnam Investments, LLC and has shared dispositive power with respect to such shares. Putnam Investments, LLC also owns The Putnam Advisory Company, LLC which beneficially owns 67,800 of the shares reported as the aggregate amount beneficially owned by Putnam Investments, LLC and has shared dispositive power with respect to such shares. |

| (5) | | Based on a Schedule 13G(A) filed with the SEC on February 5, 2003. Includes sole voting power with respect to 2,116,900 shares and sole dispositive power with respect to 2,116,900 shares. |

| (6) | | Includes shares which certain Executive Officers and Non-Employee Directors have the right to acquire within 60 days after May 31, 2003, pursuant to outstanding options as follows: Donald L. Ciffone, Jr., 1,257,915 shares; Roubik Gregorian, 564,996 shares; Ronald W. Guire, 433,329 shares; Thomas R. Melendrez, 168,248 shares; Stephen W. Michael, 200,500 shares; Raimon L. Conlisk 215,716 shares; James E. Dykes, 134,160 shares; Frank P. Carrubba, 154,505 shares; Richard Previte, 118,652 shares; and all Non-Employee Directors and Executive Officers as a group, 3,707,382 shares. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s Directors and Executive Officers, and persons who own more than ten percent of a registered class of the Company’s equity securities to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, Directors and greater than ten percent Stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required during the fiscal year ended March 31, 2003, all of the Company’s Executive Officers, Non-Employee Directors and greater than ten percent Stockholders complied with applicable Section 16(a) filing requirements.

EXECUTIVE COMPENSATION

Compensation of Non-Employee Directors

Fees. In fiscal 2003, the Company paid fees to each of its Non-Employee Directors for their services as Directors. The Company paid to Frank P. Carrubba fees totaling $28,000 for his services as a Director. The Company paid Raimon L. Conlisk fees totaling $56,000, of which 50%, or $28,000, was deferred under the 1996 Directors’ Stock Option Plan (as defined below), for his services as a Director, including service as Vice Chairman of the Board of Directors. The Company paid to James E. Dykes fees totaling $28,000 for his services as a Director. The Company paid to Richard Previte fees totaling $28,000 for his services as a Director. In addition, the Company reimbursed all Directors for certain expenses incurred in connection with their services as Directors in accordance with Company policy.

11

Nonqualified Stock Options. Non-Employee Directors received periodic non-discretionary grants of nonqualified stock options to purchase shares of Common Stock of the Company under the 1996 Non-Employee Directors’ Stock Option Plan. The 1996 Directors’ Stock Option Plan provides that upon initial election to the Board, each Non-Employee Director is granted an option to purchase 54,000 shares of Common Stock and is automatically granted an option to purchase 22,500 additional shares on the date of each subsequent Annual Meeting following the Initial Grant. On April 13, 2000, the Board amended the 1996 Directors’ Stock Option Plan to provide that the Annual Grant to the Chairman of the Board be increased to twice the Annual Grant issued to each other Non-Employee Director. Subsequently, the Board limited the Chairman’s Annual Grant to a non-employee Chairman upon Mr. Ciffone’s being elected Chairman of the Board. In addition, the 1996 Directors’ Stock Option Plan provides that Non-Employee Directors may defer the payment of fees for their services as Directors and apply such deferrals to options to purchase shares of the Company’s Common Stock with exercise prices equal to 33-1/3% of the fair market value of the stock on the date the options are granted. For calendar year 2003, Mr. Conlisk elected to have 50% of his annual Director’s fee deferred. Options granted under the 1996 Directors’ Stock Option Plan are granted at fair market value. Initial option grants vest annually over a period of three (3) years. Annual options granted prior to September 11, 1998 vest in four (4) equal annual installments with the first installment exercisable on the first anniversary of the date of the option grant. Annual options granted on or after September 11, 1998 vest monthly in equal installments over a period of twelve (12) months from the date of grant. The maximum term of options granted under the 1996 Directors’ Stock Option Plan is seven (7) years. Prior to the adoption of the 1996 Directors’ Stock Option Plan, Non-Employee Directors received options under the 1991 Non-Employee Directors’ Stock Option Plan (the “1991 Directors’ Plan”) which was terminated as to future grants on May 31, 1996. At March 31, 2003, options to purchase 0 shares of Common Stock were outstanding under the 1991 Directors’ Plan and options to purchase 639,682 shares of Common Stock were outstanding under the 1996 Directors’ Stock Option Plan.

During fiscal 2003, options to purchase 93,297 shares of Common Stock were granted under the 1996 Directors’ Stock Option Plan to the Company’s Non-Employee Directors at an average exercise price of $13.19 per share. The exercise price of such options was equal to the fair market value of the Company’s Common Stock on the date of grant. During fiscal 2003, Non-Employee Directors exercised options to purchase 0 shares under the 1996 Directors’ Stock Option Plan for a net value realized of $0. During the same period, Non-Employee Directors exercised options to purchase 45,000 shares under the 1991 Directors’ Plan for a net value realized of $377,913.

12

Compensation of Executive Officers

SUMMARY COMPENSATION TABLE

The following table shows for the fiscal years ended March 31, 2003, 2002 and 2001 compensation awarded or paid to, or earned by, the Company’s Chairman, President and CEO, and its other four most highly compensated Executive Officers at March 31, 2003 (the “Named Executive Officers”):

Name and Principal Position

| | Year

| | Annual Compensation(1)

| | Long-Term Compensation Awards

| |

| | | Salary ($)(2)

| | Bonus ($)(3)

| | Securities

Underlying

Options (#)(4)

| | All Other Compensation ($)(5)

| |

Donald L. Ciffone, Jr. Chairman, President and CEO | | 2003 2002 2001 | | 651,540 651,540 600,737 | | 0 0 825,435 | | 137,500 175,000 1,050,000 | | 2,875 2,125 8,500 | (6) |

| | | | | |

Roubik Gregorian Executive Vice President and Chief Operating Officer | | 2003 2002 2001 | | 325,678 290,828 283,282 | | 0 0 308,000 | | 192,000 144,000 220,000 | | 4,500 7,500 15,500 | (7) (8) (9) |

| | | | | |

Ronald W. Guire Executive Vice President, Chief Financial Officer and Assistant Secretary | | 2003 2002 2001 | | 291,022 290,828 285,982 | | 0 0 304,000 | | 66,000 100,000 280,000 | | 2,125 2,125 8,500 | |

| | | | | |

Thomas R. Melendrez General Counsel, Secretary and Vice President Business Development | | 2003 2002 2001 | | 222,618 222,540 219,471 | | 0 0 145,216 | | 34,000 56,000 44,000 | | 2,125 6,710 8,500 | (10) |

| | | | | |

Stephen W. Michael Vice President, Operations and Reliability & QA | | 2003 2002 2001 | | 207,425 210,548 201,711 | | 0 0 175,000 | | 36,000 56,000 44,000 | | 2,125 2,125 8,500 | |

| (1) | | As permitted by rules promulgated by the SEC, no amounts are shown for “perquisites,” as such amounts for each Named Executive Officer do not exceed the lesser of 10% of the sum of such executive’s salary plus bonus or $50,000. |

| (2) | | Includes: (i) amounts earned but deferred at the election of the Named Executive Officer pursuant to the Company’s tax-qualified retirement plan, the Exar Corporation Savings Plan (the “401(k) Plan”); (ii) auto allowances; and (iii) the employee-paid portion of life insurance in excess of $50,000 in coverage benefits. |

| (3) | | The Company did not pay out cash incentives during fiscal year 2003. In lieu of a cash based incentive compensation program for the fiscal year ended March 31, 2003, the Company established the Fiscal Year 2003 Executive Stock Option Based Incentive Program and issued options under the 2000 Equity Incentive Plan in connection therewith. See “Option Grants in Last Fiscal Year” chart for details. |

| (4) | | Adjusted for the two-for-one stock split effected on October 19, 2000 and the three-for-two stock split effected on February 15, 2000. The Company has not granted any stock appreciation rights or made any restricted stock awards to any Named Executive Officer. |

| (5) | | Consists of matching contributions made for fiscal 2003, fiscal 2002 and fiscal 2001 by the Company for the benefit of each Named Executive Officer under its 401(k) Plan in the stated amounts. |

| (6) | | Includes $700 of Company-paid life insurance benefits. |

| (7) | | Includes $2,375 in cash for patent awards. |

| (8) | | Includes $5,375 in cash for patent awards. |

13

| (9) | | Includes $7,000 in cash for patent awards. |

| (10) | | Includes $4,585 in the form of options to purchase 200 shares of the Company’s Common Stock (based on the fair market value of the Company’s Common Stock on the date of the award) awarded in conformance with the Company’s practice, in recognition of Mr. Melendrez’ fifteen (15) years of service with the Company. |

OPTION GRANTS IN LAST FISCAL YEAR

In fiscal 2003, the Company granted nonqualified stock options to its Named Executive Officers under the 2000 Equity Incentive Plan, as amended and restated (the “2000 Plan”). The following tables show for the fiscal year ended March 31, 2003 certain information regarding options granted to, exercised by, and held at year-end by, the Named Executive Officers:

Name

| | Number of

Securities

Underlying

Options

Granted(1)

| | | % of Total

Options

Granted to

Employees

in Fiscal

Year(2)

| | Exercise

Price

($/Sh)(3)

| | Expiration

Date

| | Potential Realizable

Value at Assumed Annual

Rates of Stock Price

Appreciation for

Option Term(4)

|

| | | | | | 5% ($)

| | 10% ($)

|

Donald L. Ciffone, Jr. | | 100,000 37,500 | (5) | | 6.98 2.62 | | 20.73 12.32 | | 04/01/09 12/05/09 | | 843,716 188,080 | | 1,966,216 438,307 |

| | |

|

| | | | | | | |

| |

|

| | | 137,500 | | | | | | | | | 1,031,796 | | 2,404,523 |

| | | | | | |

Roubik Gregorian | | 100,000 80,000 12,000 | (5) | | 6.98 5.58 0.84 | | 24.38 13.52 12.32 | | 05/17/09 09/05/09 12/05/09 | | 992,307 440,320 60,186 | | 2,312,498 1,026,132 140,258 |

| | |

|

| | | | | | | |

| |

|

| | | 192,000 | | | | | | | | | 1,492,813 | | 3,478,888 |

| | | | | | |

Ronald W. Guire | | 56,000 10,000 | (5) | | 3.91 0.70 | | 13.52 12.32 | | 09/05/09 12/05/09 | | 308,224 50,155 | | 718,293 116,882 |

| | |

|

| | | | | | | |

| |

|

| | | 66,000 | | | | | | | | | 358,379 | | 835,175 |

| | | | | | |

Thomas R. Melendrez | | 28,000 6,000 | (5) | | 1.95 0.42 | | 13.52 12.32 | | 09/05/09 12/05/09 | | 154,112 30,093 | | 359,146 70,129 |

| | |

|

| | | | | | | |

| |

|

| | | 34,000 | | | | | | | | | 184,205 | | 429,275 |

| | | | | | |

Stephen W. Michael | | 30,000 6,000 | (5) | | 2.09 0.42 | | 13.52 12.32 | | 09/05/09 12/05/09 | | 165,120 30,093 | | 384,800 70,129 |

| | |

|

| | | | | | | |

| |

|

| | | 36,000 | | | | | | | | | 195,213 | | 454,929 |

| (1) | | Options generally vest 25% per year on the anniversary date of the grant. However, the options granted on December 5, 2002 in connection with the 2004 Executive Special Stock Based Incentive Program for the fiscal period ending March 31, 2004 vest monthly in equal increments over a twelve-month period commencing April 1, 2003. Options granted on December 5, 2001 in connection with the 2003 Executive Stock Option Based Incentive Program for the fiscal period ended March 31, 2003 vested monthly in equal increments over a twelve-month period commencing April 1, 2002. All of the options will become fully vested immediately prior to, and the time during which the stock option may be exercised shall be accelerated upon, a change in control of the Company as defined in the 1997 Equity Incentive Plan and 2000 Plan. Outstanding options that have not been exercised prior to a change in control event shall terminate on the date of such event unless the options are assumed by the successor corporation. |

| (2) | | Based on options to purchase an aggregate of 1,433,593 shares of the Company’s Common Stock granted to employees of the Company in fiscal year 2003, including the Named Executive Officers. |

14

| (3) | | The exercise price of the options was equal to the fair market value of the Company’s Common Stock on the date of grant. |

| (4) | | The potential realizable value is based on the term of the option at the time of grant (which is generally seven (7) years). The potential realizable value is calculated by assuming that the stock price on the date of grant appreciates at the indicated rate for the entire term of the option and that the option is exercised and sold on the last day of its term at the appreciated price. These amounts represent certain assumed rates of appreciation, in accordance with rules of the SEC, and do not reflect the Company’s estimate or projection of future stock price performance. Actual gains, if any, are dependent on the actual future performance of the Company’s Common Stock, and no gain to the optionee is possible unless the stock price increases over the option term, which will benefit all Stockholders. |

| (5) | | In lieu of a cash based incentive program for fiscal year 2004, the Company granted a total of 199,115 stock options to eligible employees under the Fiscal Year 2004 Executive Special Stock Based Incentive Program and the Fiscal Year 2004 Key Employee Special Stock Based Incentive Program in December 2002 with an exercise price equal to the fair market value of the Company’s Common Stock on the date of the grant ($12.32), of which 71,500 stock options were granted to the Named Executive Officers. These options vest monthly in equal increments over a twelve-month period commencing on April 1, 2003. |

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

Name

| | Number of

Shares

Acquired on

Exercise (#)

| | Value

Realized ($)(1)

| | Number of Securities

Underlying Unexercised

Options at FY-End (#)

| | Value of Unexercised In-the-Money Options at FY-End ($)(2)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Donald L. Ciffone, Jr. | | 75,000 | | 1,205,196 | | 1,048,193 | | 605,555 | | 905,490 | | 24,488 |

Roubik Gregorian | | 100,000 | | 1,708,334 | | 486,996 | | 452,000 | | 1,982,155 | | 12,750 |

Ronald W. Guire | | — | | — | | 388,746 | | 308,500 | | 1,140,762 | | 9,818 |

Thomas R. Melendrez | | 20,448 | | 113,552 | | 192,534 | | 109,750 | | 864,055 | | 4,904 |

Stephen W. Michael | | 24,000 | | 109,671 | | 200,500 | | 112,496 | | 903,335 | | 5,100 |

| (1) | | Represents the fair market value of the Company’s Common Stock on the date of exercise (based on the closing sales price reported on the Nasdaq Stock Market or the actual sales price if the shares were sold by the optionee simultaneously with the exercise) less the exercise price, without taking into account any taxes that may be payable in connection with the transaction. |

| (2) | | Represents the fair market value of the Company’s Common Stock at March 31, 2003 ($12.71) less the exercise price of the options. |

15

EQUITY COMPENSATION PLAN SUMMARY

Plan

| | Number of securities

to be issued upon

exercise of

outstanding options

as of March 31, 2003

| | Weighted average

exercise price of

outstanding options

| | Number of securities

remaining available

for future issuance

under equity

compensation plans

as of March 31, 2003

|

Equity compensation plans approved by Stockholders(1) | | 5,925,475 | | $ | 18.83 | | 419,150 |

Equity compensation plans not approved by Stockholders(2) | | 4,558,492 | | $ | 27.19 | | 1,136,459 |

| | |

| | | | |

|

Totals | | 10,483,967 | | | | | 1,555,609 |

| | |

| | | | |

|

| (1) | | Includes the 1991 Stock Option Plan (options to purchase 420,868 shares with a weighted average exercise price per share of $5.63), 1996 Non-Employee Directors’ Stock Option Plan (options to purchase 639,682 shares with a weighted average exercise price per share of $20.38), and the 1997 Equity Incentive Plan (options to purchase 4,864,925 shares with a weighted average exercise price per share of $19.76). |

| (2) | | Consists of the 2000 Equity Incentive Plan. In September 2000, the Board of Directors (“Board”) approved the 2000 Equity Incentive Plan (the “2000 Plan”). The 2000 Plan is administered by our Board or a committee of the Board (“Committee”) and provides for the grant of non-statutory options, stock bonuses, rights to purchase restricted stock, or a combination of the foregoing (collectively “Stock Awards”) to employees and consultants in our service or in the service of our affiliates. There are 5,700,000 shares of our common stock reserved under the 2000 Plan, and 797,359 shares remain for future issuance thereunder as of May 31, 2003. |

Except in the case of a deferred salary option, options are granted with an exercise price not less than the fair market value of our common stock on the date of grant. The Board or Committee determines when options granted under the 2000 Plan may be exercised. The 2000 Plan provides that vested options may generally be exercised for (a) three (3) months after termination of service other than due to death or disability, (b) 12 months after termination of service as a result of disability, or (c) 18 months after termination of service as a result of death. The 2000 Plan permits options to be exercised with cash, other shares of our common stock, according to a deferred payment arrangement, or any other form of legal consideration acceptable to the Board or Committee. The Board or Committee has the ability to select employees to participate in a program that allows them to make an irrevocable election to apply a portion of their base salary (minimum of $5,000 and a maximum of $50,000) to the acquisition of an option to purchase shares of our common stock. The exercise price per share of a deferred salary option would equal 33 1/3% of the fair market value of our common stock on the date such deferred salary option is granted.

The Board or Committee determines the purchase price of restricted stock as well as the permissible form of consideration to be paid for such stock. The Board or Committee may award eligible participants stock pursuant to a stock bonus agreement in consideration for past services actually rendered to us or rendered for our benefit. Shares of our common stock sold or awarded under the 2000 Plan may be subject to a repurchase option in our favor, which will lapse at such times as the Board or Committee may determine. We may exercise such repurchase option for any or all the unvested shares held by the purchaser upon his or her termination of service with us.

In the event of (a) a dissolution or liquidation, (b) a merger or consolidation in which we are not the surviving corporation, (c) a reverse merger in which we are the surviving corporation, but the shares of our Common Stock outstanding immediately preceding the merger are converted into other property, or (d) any other capital reorganization in which more than 50% of our shares entitled to vote are exchanged, excluding in each case a capital reorganization in which the purpose is to change the state of our incorporation, the 2000 Plan provides that each outstanding Stock Award will fully vest and become exercisable for a period of at least 10 days. Outstanding Stock Awards that are not exercised prior to the occurrence of any of the listed events will terminate on the date of such event, unless the successor corporation assumes such awards.

16

| Employment | | and Change of Control Arrangements |

On June 24, 1999, the Board of Directors adopted the Executive Officers’ Change of Control Severance Benefit Plan (the “Severance Plan”). The following individuals are eligible to receive benefits under the Severance Plan: Group I, consisting of Donald L. Ciffone, Jr., Michael J. Class, Roubik Gregorian and Ronald W. Guire; and Group II, consisting of Thomas R. Melendrez, Stephen W. Michael, Susan Hardman, and Bahram Ghaderi. The Board of Directors or the Compensation Committee may, in their sole discretion, designate additional employees as eligible to receive benefits under the Severance Plan. The Severance Plan provides that an eligible employee will receive benefits if the employee’s employment is involuntarily terminated without “cause” or if the employee voluntarily terminates his or her employment for “good reason,” in either case within thirteen (13) months following the effective date of a change of control of the Company. Employees in Group I will receive a lump sum payment equal to two (2) times the employee’s annual base salary. Employees in Group II will receive a lump sum payment equal to the greater of (a) one year’s base salary, or (b) one month’s base salary for each complete year of service the employee has provided to the Company, up to a maximum of two (2) times the employee’s annual base salary. In order to receive benefits under the Severance Plan, an employee must execute a release of all claims that the employee may have against the Company and its successors and assigns.

In December 2000, the Company entered into an Executive Employment Agreement with Mr. Ciffone. The Employment Agreement was subsequently amended and restated in June 2001 and March and June 2003. The Employment Agreement provides for: (i) a four (4) year term ending on March 31, 2005; (ii) an annual base salary of $615,000 commencing July 1, 2000, subject to annual discretionary increases by the Board; (iii) a 75% target award percentage under the Company’s Executive Compensation Incentive Program for the fiscal year ending March 31, 2002 and continuing through and including fiscal year ending March 31, 2005; (iv) life insurance coverage in the amount of $1,000,000, executive health reimbursement of $10,000 each fiscal year, four (4) weeks’ paid vacation, professional services reimbursement of $10,000 each fiscal year, and a monthly auto allowance of $3,000; (v) certain severance benefits under the Severance Plan, including upon termination within 13 months of a change in control; (vi) an initial option grant of 300,000 shares of Common Stock (granted on December 6, 2000), which vests ratably on each monthly anniversary date from the grant date as to 1/36 of the option shares of Common Stock subject to the option, and subsequent grants of an option to purchase 100,000 shares of Common Stock on each of April 1, 2001 and April 1, 2002, an option to purchase 200,000 shares on April 1, 2003, and an option to purchase 100,000 shares on April 1, 2004, which options shall vest ratably on each monthly anniversary date of the grant date as to 1/36 of the shares of Common Stock subject to the option. The December 2000, April 2000, April 2002 and April 2003 option grants were granted under the 2000 Plan, and the Company intends to grant the additional options in April 2004 under the 2000 Plan. The Employment Agreement further provides that Mr. Ciffone shall become a part-time employee of the Company if Mr. Ciffone’s full-time employment or status as Chairman of the Board shall terminate under certain circumstances prior to the 2007 Annual Meeting of Stockholders.

In December 2000, the Board of Directors approved certain letter agreements that may be entered into with the following Executive Officers and Directors: Donald L. Ciffone, Jr., Michael J. Class, Roubik Gregorian, Ronald W. Guire, Frank P. Carrubba, Raimon L. Conlisk, James E. Dykes, Richard Previte, Thomas R. Melendrez, Stephen W. Michael and Susan Hardman. The letter agreements provided each individual with the right to exercise outstanding options granted to him or her under any of the Company’s stock plans with a promissory note in lieu of cash in the event that the individual’s employment or service to the Company is terminated without cause during a period of time during which such individual is restricted from disposing of his or her shares as a result of certain accounting or securities law restrictions in connection with a change of control. No options were exercised in connection with the letter agreements. In August 2002, the aforementioned letter agreements with each of the foregoing Executive Officers and Directors were terminated.

17

REPORT OF THE COMPENSATION COMMITTEE AND OF THE

EMPLOYEE OPTION ADMINISTRATION COMMITTEE

OF THE BOARD OF DIRECTORS 1

During fiscal 2003, the Compensation Committee of the Board of Directors (the “Compensation Committee”) consisted of Messrs. Carrubba, Conlisk, Dykes and Previte, none of whom is an officer or an employee of the Company. Mr. Dykes serves as Chairman of the Committee. The Compensation Committee evaluates the performance of the Company’s President and CEO, reviews the performance of other Executive Officers and reviews and approves or recommends to the Board compensation levels, policies and programs. The Employee Option Administration Committee of the Board of Directors (the “Option Committee”) consists of Messrs. Conlisk and Dykes, the former of whom serves as Chairman of the Committee. The Option Committee administers the Company’s employee stock option plans, including the granting of any options thereunder.

General Compensation Policy

Compensation Philosophy. The Compensation Committee and the Option Committee (the “Committees”) believe that the Company’s overall compensation program should relate to creating Stockholder value. Accordingly, the compensation program is designed to attract and retain talented executives and technical personnel, to reward achievement of the Company’s short-term and long-term performance goals, to link executive compensation to Stockholder interests through equity-based plans, and to recognize and reward individual contributions to operating group and Company-wide performance objectives.

Components of Executive Compensation. During fiscal 2003, compensation for the Company’s Executive Officers consisted of base salary, participation in an annual stock based incentive compensation program and longer-term equity incentives. The Committee calibrated each component to a competitive market position based on executive compensation surveys, reports from third party compensation specialists and other relevant information. The Company also offers to its Executive Officers participation (with all other eligible employees of the Company) in its 401(k) Plan, an auto allowance for Executive Officers, and certain other benefits available generally to employees of the Company.

Cash-Based Compensation

Base Salary. The Compensation Committee determines the base salary of the President and CEO and reviews and approves base salaries for each of the Company’s other Executive Officers annually in connection with annual performance reviews. In adjusting base salaries, the Compensation Committee examines both qualitative and quantitative factors relating to corporate and individual performance. In many instances, the qualitative factors necessarily involve a subjective assessment by the Committee. The Committee neither bases its considerations on any single performance factor nor does it specifically assign relative weights to factors but rather considers a mix of factors and evaluates individual performance against that mix both in absolute terms and in relation to other Company executives. Generally, in approving salary adjustments for Executive Officers (other than the President and CEO), the Committee considers the evaluation and recommendations of the Company’s President and CEO.

The Compensation Committee reviews an independent survey of compensation of Executive Officers of other high technology companies to enable it to set base salaries based on each Executive Officer’s level of responsibility and within the parameters of companies of comparable size in the Company’s industry. The survey

| 1 | | This section is not “soliciting material,” is not deemed filed with the SEC, and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

18

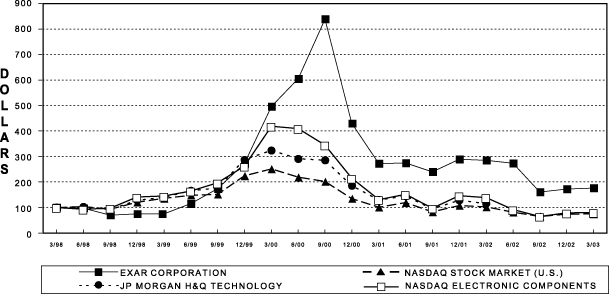

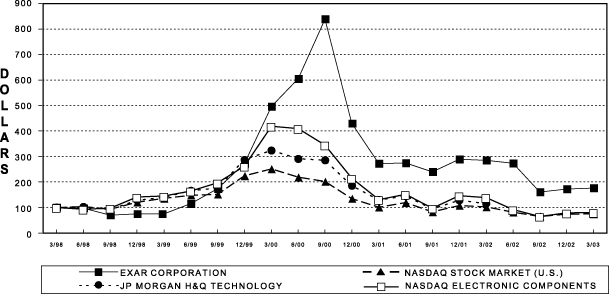

includes a broader group of technology companies than those companies included in the Nasdaq Electronic Components Index used in the performance measurement comparison graph included in this proxy statement. Generally, base salaries paid to Executive Officers for fiscal 2003 were set at levels within the top half of salaries paid to executives under the independent survey. This is consistent with the Committee’s objective of attracting and retaining executives whose skills and potential rank above the norm.

In addition to individual and corporate performance, the factors considered in determining merit adjustments include relative salaries and responsibilities in the Company, the size of the Company’s incentive payment allocation, which considers factors such as inflation and the competitive environment relative to other technology companies, independent survey data, number of years with the Company and anticipated future responsibilities of each individual within the next year. For fiscal 2003, consistent with the principles discussed herein, the Compensation Committee, at the recommendation of management, decided to forego an annual salary merit adjustment for the Company’s Executive Officers.

Annual Incentive Compensation Opportunities. The Company maintains annual incentive compensation programs (cash, option and/or a combination thereof) to reward Executive Officers and other selected senior management and technical personnel for attaining defined performance goals. The programs are designed to attract and motivate employees, and they are closely tied to corporate performance to enhance Stockholder value and encourage profit and revenue growth. For Executive Officers, incentive compensation payments are based primarily on Company-wide performance targets, as well as personal performance measured against agreed-objectives. For selected senior management and technical personnel, Company-wide performance is a factor, and significant weight also is given to individual performance and the performance of particular operating groups within the Company. The programs are periodically reviewed with an executive compensation firm to ensure they are competitive and designed to achieve the performance intended.

Executive Officer Incentive Compensation Program. In December 2001, the Compensation Committee approved the Fiscal Year 2003 Executive Stock Option Based Incentive Program as the most appropriate employee motivation and retention program given the existing and anticipated market conditions and planned operating budget considerations. Such constraints, in the view of the Compensation Committee, argued against use of a cash based incentive compensation program, an incentive arrangement historically relied upon. Stock options granted under the Fiscal Year 2003 Executive Stock Option Based Incentive Program have a grant term of seven years and vest in equal amounts over a twelve-month period beginning April 2002.

Key Employee Incentive Compensation Program. In December 2001, the Compensation Committee approved the Fiscal Year 2003 Key Employee Stock Option Based Incentive Program as the most appropriate employee motivation and retention program given the existing and anticipated market conditions and planned operating budget considerations. Such constraints, in the view of the Compensation Committee, argued against use of a cash based incentive compensation program, an incentive arrangement historically relied upon. Stock options granted under the Fiscal Year 2003 Key Employee Stock Option Based Incentive Program have a grant term of seven years and vest in equal amounts over a twelve-month period beginning April 2002.

Equity Incentives

The Company utilizes its 1997 Plan and its 2000 Plan to further align the interests of Stockholders and management by providing Executive Officers and other employees with a significant economic interest in the long-term appreciation of the Company’s stock. The 1997 Plan permits the grant of both incentive and nonstatutory stock options. The 2000 Plan does not permit the grant of incentive stock options. A maximum of 40% of the total number of shares reserved under the 2000 Plan may be granted to Executive Officers of the Company. Generally, options under the 1997 Plan and the 2000 Plan are granted with exercise prices equal to 100% of the fair market value of the underlying stock on the date of grant and have terms of seven (7) years, although options may be granted with terms of up to ten years. Under the 1997 Plan and the 2000 Plan, selected employees, including Executive Officers and senior management and technical personnel, may defer a portion of

19

their base salary and apply such deferred salary to options to purchase shares of the Company’s Common Stock with exercise prices set at a discount to the fair market value of the stock with the aggregate of such discounts equal to the aggregate amount of the base salary so deferred. Options, other than deferred compensation options, are subject to vesting over four years. This vesting schedule is designed to motivate option holders to achieve stated objectives, thereby aiding the Company’s efforts to maximize revenue and profit together with shareholder value, and to encourage individuals to remain with the Company for the long-term. In determining the number of shares subject to an option to be granted to an Executive Officer, the Option Committee takes into account the Executive Officer’s position and level of responsibility with the Company, the Executive Officer’s existing stock and unvested option holdings, the potential reward to the Executive Officer if the stock price appreciates in the public market, and the competitiveness of the Executive Officer’s overall compensation arrangements, including stock options. Outstanding performance by an individual may also be taken into consideration. Option grants may also be made to new Executive Officers upon commencement of employment and, on occasion, to Executive Officers in connection with a significant change in job responsibility. The Option Committee may grant options taking into account multiple year periods. In fiscal 2003, based on the factors described above, the Option Committee granted options to purchase an aggregate of 447,000 shares of Common Stock to the Company’s Executive Officers, excluding grants to the Company’s CEO.

Additional long-term equity incentives are provided through the Company’s Employee Stock Participation Plan in which all eligible employees, including eligible Executive Officers of the Company, may purchase stock of the Company, subject to specified limits, at 85% of fair market value.

CEO Compensation

The Compensation Committee uses the same procedures described above for setting the annual salary, bonus and stock option award for Mr. Ciffone, our Chairman, President and Chief Executive Officer. Mr. Ciffone’s compensation package for fiscal 2003 consisted of $651,540 annual base salary, and 100,000 shares of the Company’s Common Stock granted in connection with his Executive Employment Agreement, in addition to other benefits detailed therein, and an additional 37,500 shares of the Company’s Common Stock was granted in connection with the 2004 Executive Special Stock Based Incentive Program. Stock options granted under the 2004 Executive Special Stock Based Incentive Program have a grant term of seven years and vest in equal amounts over a twelve-month period beginning April 2002.

Mr. Ciffone has an Executive Employment Agreement with the Company which is discussed under “Executive Compensation—Employment and Change of Control Arrangements.”

Section 162(m) Policy