UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant☒

Filed by a Party other than the Registrant☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under § 240.14a-12 |

EXAR CORPORATION

|

(Name of Registrant as Specified in its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) | Title of each class of securities to which transaction applies: |

| | |

(2) | Aggregate number of securities to which transaction applies: |

| | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

(4) | Proposed maximum aggregate value of transaction: |

| | |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount previously paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

EXAR CORPORATION

48720 KATO ROAD

FREMONT, CALIFORNIA 94538

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 18, 2014

TO THE STOCKHOLDERS OF EXAR CORPORATION:

NOTICE IS HEREBY GIVEN that the 2014 Annual Meeting of Stockholders (the “Annual Meeting”) ofEXAR CORPORATION, a Delaware corporation (the “Company”), will be held on Thursday, September 18, 2014 at 2:00 p.m. local time at the Company’s Corporate Headquarters at 48720 Kato Road, Fremont, California 94538, for the following purposes:

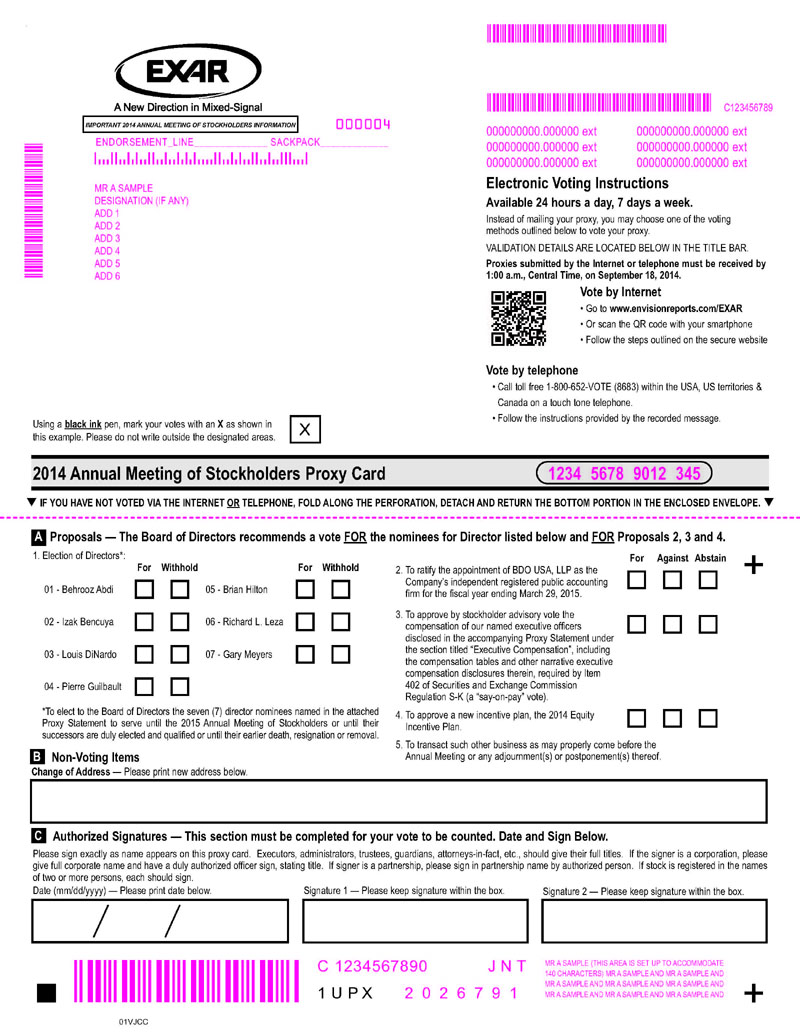

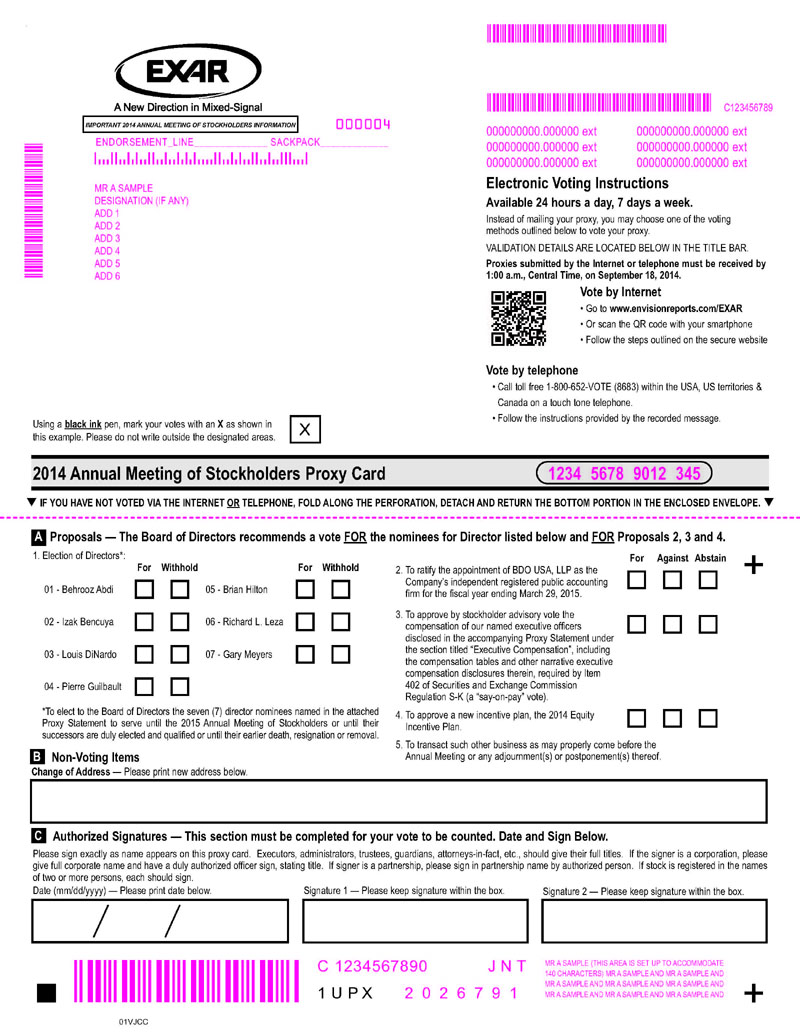

| | 1. | To elect to the Board of Directors the seven (7) director nominees named in the attached Proxy Statement to serve until the 2015 Annual Meeting of Stockholders or until their successors are duly elected and qualified or until their earlier death, resignation or removal. |

| | 2. | To ratify the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 29, 2015. |

| | 3. | To approve by stockholder advisory vote the compensation of our named executive officers disclosed in the accompanying Proxy Statement under the section titled “Executive Compensation”, including the compensation tables and other narrative executive compensation disclosures therein, required by Item 402 of Securities and Exchange Commission Regulation S-K (a “say-on-pay” vote). |

| | 4. | To approve a new incentive plan, the 2014 Equity Incentive Plan. |

| | 5. | To transact such other business as may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Company’s Board of Directors has fixed the close of business on July 21, 2014 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournment(s) or postponement(s) thereof.

All stockholders are cordially invited and encouraged to attend the Annual Meeting. Regardless of whether you plan to attend the Annual Meeting, please carefully read the accompanying Proxy Statement and vote your shares as promptly as possible so that your shares will be voted in accordance with your instructions. For specific voting instructions, please refer to the instructions on the enclosed proxy card or on the Notice of Internet Availability of Proxy Materials that was mailed to you.

| By Order of the Board of Directors |

| |

| |

| /s/ Thomas R. Melendrez |

| THOMAS R. MELENDREZ |

| Secretary |

Fremont, California July 25, 2014

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE SUBMIT YOUR PROXY AS PROMPTLY AS POSSIBLE BY FOLLOWING THE INSTRUCTIONS INCLUDED WITH THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS OR THE ENCLOSED PROXY CARD IN ORDER TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE ANNUAL MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE ANNUAL MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A LEGAL PROXY ISSUED IN YOUR NAME.

EXAR CORPORATION

48720 KATO ROAD

FREMONT, CALIFORNIA 94538

PROXY STATEMENT

FOR 2014 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 18, 2014

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON SEPTEMBER 18, 2014

This proxy statement (the “Proxy Statement”) and the Company’s 2014 Annual Report on Form 10-K (together with the Proxy Statement, the “Proxy Materials”) are available at www.envisionreports.com/EXAR. This website address contains the following documents: the Notice of Annual Meeting (the “Notice”), this Proxy Statement and a proxy card sample, and the Company’s 2014 Annual Report on Form 10-K. You are encouraged to access and review all of the important information contained in the Proxy Materials before voting.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why are these materials being made available to me?

The Board of Directors (the “Board of Directors” or the “Board”) of Exar Corporation, a Delaware corporation (the “Company”), is soliciting your proxy for use at the 2014 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Thursday, September 18, 2014, at 2:00 p.m. local time, or at any adjournment(s) or postponement(s) thereof, for the purposes set forth herein and in the Notice. The Annual Meeting will be held at the Company’s Corporate Headquarters at 48720 Kato Road, Fremont, California 94538.

Pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”), we may furnish the Proxy Materials by providing access to these documents over the Internet instead of mailing a printed copy of the Proxy Materials to stockholders. Accordingly, we are providing access to the Proxy Materials over the Internet and sending a Notice of Internet Availability of Proxy Materials (the “Availability Notice”) to many of our stockholders, which provides instructions for accessing the Proxy Materials on the website referred to above and in the Availability Notice or to request to receive, without charge, printed copies of the Proxy Materials by mail or electronically by email on an ongoing basis. We will also mail paper copies of the Proxy Materials to beneficial holders of at least 5,000 shares of our common stock, to stockholders who have specifically requested receipt of paper copies of the Proxy Materials and to registered holders.

The Availability Notice provides stockholders with instructions regarding how to view the Proxy Materials for the Annual Meeting over the Internet and how to instruct the Company to send future proxy materials to stockholders electronically by email. Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to its stockholders and will reduce the impact of the Company’s annual stockholders’ meetings on the environment. If a stockholder chooses to receive future proxy materials by email, the stockholder will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Any stockholder’s election to receive Proxy Materials by email will remain in effect until such stockholder revokes the request. Stockholders electing to receive Proxy Materials by email should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, which must be borne by the stockholder.

We intend to mail an Availability Notice and, if applicable, paper copies of the Proxy Materials on or about July 30, 2014 to all stockholders entitled to vote at the Annual Meeting.

What are the matters I am being asked to vote on?

There are four matters scheduled for a vote at the Annual Meeting:

| | ● | Proposal 1, the election of the seven (7) nominees for director named in Proposal 1 to serve until the 2015 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| | ● | Proposal 2, the ratification of the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 29, 2015; |

| | ● | Proposal 3, an advisory vote to approve the compensation of our named executive officers disclosed in this Proxy Statement under the section titled “Executive Compensation”, including the compensation tables and other narrative executive compensation disclosures therein, required by Item 402 of Securities and Exchange Commission Regulation S-K (a “say-on-pay” vote); and |

| | ● | Proposal 4, a new equity incentive plan, the 2014 Equity Incentive Plan. |

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on July 21, 2014 (the “Record Date”) will be entitled to vote at the Annual Meeting. On the Record Date, there were 47,291,239 shares of our common stock, par value $0.0001 (“Common Stock”), outstanding and entitled to vote and there were 278 holders of record of Common Stock. We had no shares of preferred stock outstanding on the Record Date.

Our stock transfer books will not be closed between the Record Date and the date of the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection at our executive offices for a period of ten (10) days before the Annual Meeting.

What is the quorum requirement?

Holders of record of a majority of the outstanding shares entitled to vote must be present, in person or by proxy, at the Annual Meeting in order to have the required quorum for the transaction of business. Abstentions and broker non-votes are counted as present for the purposes of determining the presence or absence of a quorum for the transaction of business.

If you are a record holder, your shares will only be counted towards the quorum if you submit a valid proxy or attend the Annual Meeting. If the shares present, in person or by proxy, at the Annual Meeting do not constitute the required quorum, the meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum.

What is a broker non-vote?

The term broker non-vote refers to shares held by a brokerage firm or other nominee (for the benefit of its client) that are represented at the meeting, but with respect to which such broker or nominee is not instructed to vote on a particular proposal and does not have discretionary authority to vote on that proposal. Brokers and nominees do not have discretionary voting authority on the election of directors and on certain other non-routine matters, and accordingly may not vote on such matters absent instructions from the beneficial holder. If you hold your shares in “street name” or through a broker it is important that you give your broker voting instructions. See “If I am a beneficial owner, how do I cast my vote?” below for more information.

Am I a stockholder of record?

If, at the close of business on the Record Date, your shares were registered directly in your name with our transfer agent, Computershare Investor Services, LLC, then you are a stockholder of record.

What if my shares are not registered directly in my name but are held in street name?

If, at the close of business on the Record Date, your shares were held in an account at a brokerage firm, bank or other nominee, then you are the beneficial owner of shares held in street name. The broker, bank or other nominee holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting, but as a beneficial owner you have the right to direct the broker, bank or other nominee on how to vote the shares in your account.

If I am a stockholder of record, how do I cast my vote?

If you are a stockholder of record, you can vote in person at the Annual Meeting. If you do not wish to vote in person or will not be attending the Annual Meeting and you received an Availability Notice, you may vote by proxy over the Internet. Alternatively, if you received a printed copy of the Proxy Materials by mail, you may also complete, sign and return the accompanying proxy card or vote your proxy over the telephone or Internet. If you vote by proxy, your vote must be received by 1:00 a.m. Central Time, on September 18, 2014 to be counted.

The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to grant a proxy to vote their shares and to confirm that stockholders’ instructions have been recorded properly. Stockholders participating in these programs should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, which must be borne by the stockholder.

If I am a beneficial owner, how do I cast my vote?

If you are a beneficial owner of shares held in street name, you should have received an Availability Notice or a printed copy of the Proxy Materials from the broker, bank or other nominee that is the record holder of your shares. Beneficial owners that received an Availability Notice or a printed copy of the Proxy Materials from the record holder should follow the instructions provided by the record holder to transmit their voting instructions to the broker, bank or other nominee. For a beneficial owner to vote in person at the Annual Meeting, the beneficial owner must obtain a valid legal proxy from the record holder. To request the required legal proxy form, follow the instructions provided by your broker, bank or other nominee or contact them.

If your shares are held in street name through a broker, certain rules affect how your shares are voted in connection with the election of directors. If you do not provide your broker with instructions on how to vote your shares, your broker may not vote your shares except in connection with matters deemed “routine” under such rules. Previously, the election of directors was considered to be a routine matter, and your broker was thus able to vote your shares without instructions from you. The election of directors is no longer considered to be a routine matter and your broker will no longer be able to vote on the election of directors without your instructions. Accordingly, if your broker sends a request for instructions on how to vote, you are requested to provide those instructions to your broker so that your vote can be counted.

How many votes do I have?

You have one vote for each share of Common Stock held on the Record Date on each matter to be voted upon at the Annual Meeting. Stockholders may not cumulate votes in the election of directors.

What types of votes are permitted on each proposal?

With regard to the election of directors (Proposal 1), votes may be cast in favor of or withheld from each nominee; votes that are withheld will be excluded entirely from the vote and will have no effect (other than for purposes of the Board’s majority vote policy described below).

The types of votes permitted for Proposal 2, the ratification of the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 29, 2015, Proposal 3, the say-on-pay vote, and Proposal 4, the approval of the 2014 Equity Incentive Plan, are a vote “For” or “Against” or to abstain.

How many votes are needed to approve each proposal?

For Proposal 1, directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the Annual Meeting, meaning that the seven (7) nominees for election to the Board who receive the highest number of affirmative votes shall be elected as directors. You may not vote for more than seven (7) nominees, and the proxies solicited by this Proxy Statement may not be voted for more than seven (7) nominees. The election of directors is not a matter on which a broker or other nominee is empowered to vote and therefore there may be broker non-votes on Proposal 1; however, broker non-votes and withheld votes will have no effect on the outcome of the election of candidates for director. Notwithstanding the foregoing, the Board of Directors has adopted a policy that, in an uncontested election, any person elected to the Board who did not receive the affirmative vote of at least a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting of stockholders shall immediately submit his or her resignation to the Board. The Board will then accept or reject such resignation as it shall deem advisable and in the best interests of our stockholders. Should any nominee(s) become unavailable to serve before the Annual Meeting, the proxies will be voted by the proxy holders for such other person(s) as may be designated by our Board of Directors or for such lesser number of nominees as may be prescribed by the Board of Directors. Votes cast for the election of any nominee who has become unavailable will be disregarded.

The other matters submitted for stockholder approval at the Annual Meeting will be decided by the affirmative vote of the holders of a majority of shares present in person or represented by proxy and voting on such matter. Only “FOR” and “AGAINST” votes are counted for purposes of determining the votes received in connection with such proposals, and therefore broker non-votes and abstentions have no effect on determining whether the affirmative vote constituted a majority of the shares present in person or represented by proxy and voting on such matter. Note, however, that Proposal 3 is an advisory vote and, as such, the result of voting on that proposal is non-binding on the Company. However, the Board of Directors and the Compensation Committee value the opinions of our stockholders and will consider the outcome of that vote when making future compensation decisions for our named executive officers.

Broker non-votes are excluded from the “for,” “against” and “abstain” counts, and instead are reported simply as “broker non-votes.”

How are votes counted?

All votes will be tabulated by the inspector of elections appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

What if I vote by proxy but do not make specific choices?

If you complete the proxy voting procedures but do not specify how you want to vote your shares, your shares will be voted “For” Proposals 1 – 4. Your proxy will vote your shares using his or her best judgment with respect to any other matters properly presented for a vote at the meeting.

Can I change my vote after submitting my proxy?

Yes, you can revoke your proxy at any time before the final vote at the Annual Meeting. You may revoke your proxy in any one of the following ways:

| | ● | It may be revoked by filing a written notice of revocation or a duly executed proxy card bearing a later date with the Secretary of the Company at our corporate headquarters, 48720 Kato Road, Fremont, California 94538. |

| | ● | If you choose to vote over the Internet or by telephone until the voting deadline, you can change your vote by voting again using the same method used for the original vote (i.e., over the Internet or by telephone) so long as you retain the voter control number from your Availability Notice or proxy card. |

| | ● | If you vote over the Internet or by telephone pursuant to instructions from your bank or broker, those instructions should inform you how to revoke your proxy or change your vote. |

If you are a record holder, your proxy may also be revoked by attending the Annual Meeting and voting in person; however, attendance at the Annual Meeting will not, by itself, revoke a proxy. If you are a beneficial owner and desire to revoke your proxy and vote in person at the Annual Meeting, you must follow the instructions from your broker or bank to revoke your proxy and obtain a proxy from the record holder. See “If I am a beneficial owner, how do I cast my vote?” above for more information.

What does it mean if I receive more than one Availability Notice or printed copy of the Proxy Materials?

If you receive more than one Availability Notice or printed copy of the Proxy Materials, your shares are registered in more than one name or are registered in different accounts. Please follow the voting instructions included in each to ensure that all of your shares are voted.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Form 8-K filed with the SEC within four (4) business days following the Annual Meeting.

When are stockholder proposals due for the 2015 Annual Meeting of Stockholders?

Proposals of stockholders that are intended to be presented at the Company’s 2015 Annual Meeting of Stockholders must be received by the Company not later than March 27, 2015 in order to be included in the proxy statement and proxy relating to that annual meeting. Further, a stockholder proposal that is not submitted for inclusion in the proxy statement for the Company’s 2015 Annual Meeting of Stockholders, but is instead sought to be presented in such stockholder’s own proxy statement at the Company’s 2015 Annual Meeting of Stockholders, must be submitted in accordance with the Company’s Bylaws and the proposal must be received by the Company not earlier than April 8, 2015 and not later than May 8, 2015. Proposals received before April 8, 2015 or after May 8, 2015 will be considered untimely and may not be presented at the Company’s 2015 Annual Meeting of Stockholders. In addition, the Proxy solicited by the Board of Directors for the 2015 Annual Meeting of Stockholders will confer discretionary authority to vote on any stockholder proposal presented at that annual meeting, unless the Company receives notice of such proposal before June 10, 2015.

You are advised to review our Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. Our Bylaws are available in the Investors section of our corporate website, www.exar.com, under the Corporate Governance tab.

Who is paying for this proxy solicitation?

We will bear the entire cost of solicitation, including the preparation, assembly, Internet hosting, printing and mailing of the Proxy Materials and any additional solicitation materials furnished to stockholders. The original solicitation of proxies by mail may be supplemented by a solicitation by telephone, telegram, or other means by directors, officers or employees. Such individuals, however, will not be compensated by us for those services.

These materials are being sent to brokers, nominees and other stockholders of record by U.S. mail or by courier, or by electronic mail if so requested. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names but that are beneficially owned by others so that they may forward these solicitation materials to such beneficial owners. In addition, we may reimburse such persons for their costs in forwarding these solicitation materials to such beneficial owners.

We have also engaged Alliance Advisors to assist it in the solicitation of proxies, and expect to pay Alliance Advisors approximately $10,000 for its services plus designated out of pocket expenses.

What is “householding” of the Company’s Proxy Materials?

The SEC adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for annual reports and proxy statements or Notices of Internet Availability of Proxy Materials, as applicable, with respect to two or more security holders sharing the same address by delivering a single annual report and proxy statement or Notice of Internet Availability of Proxy Materials, as applicable, addressed to those security holders. This process, which is commonly referred to as “householding,” potentially means extra convenience for security holders and cost savings for companies.

Brokers with account holders who are Company stockholders will be “householding” the Company’s Proxy Materials. A single annual report and proxy statement or Notice of Internet Availability of Proxy Materials, as applicable, will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker or the Company that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate annual report and proxy statement or Notice of Internet Availability of Proxy Materials, as applicable, please notify your broker and direct your written request to Exar Corporation, Attention: Investor Relations M/S 210, 48720 Kato Road, Fremont, California 94538, or contact the Company directly at (510) 668-7201.

Stockholders who currently receive multiple copies of the annual report and proxy statement or Notice of Internet Availability of Proxy Materials at their address and would like to request “householding” of their communications should contact their broker.

CORPORATE GOVERNANCE AND BOARD MATTERS

Our Board of Directors currently consists of seven (7) members, each serving for a term of one year expiring at the Annual Meeting: Messrs. Behrooz Abdi, Izak Bencuya, Louis DiNardo, Pierre Guilbault, Brian Hilton, Richard L. Leza and Gary Meyers.

The Board believes that good corporate governance is essential to ensure that the Company is managed for the long-term benefit of our stockholders. The Board and management have undertaken a comprehensive and continuous effort to regularly review and enhance our governance policies and practices. In conducting this review, we look to suggestions by various authorities on corporate governance, the practices of other public companies or our peer group, the provisions of the Sarbanes-Oxley Act of 2002 and Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010, various new and proposed rules of the SEC and the listing standards of the New York Stock Exchange referred to in this Proxy Statement as “NYSE”.

Corporate Governance Principles and Code of Ethics

Our Board has adopted Corporate Governance Principles that guide its actions with respect to, among other things, the composition of the Board and its decision-making processes, Board meetings and the involvement of management, the Board’s standing committees and procedures for appointing members of the committees, and its performance evaluation of our Chief Executive Officer. In addition, the Board has adopted a Code of Business Conduct and Ethics, referred to in this proxy statement as the Code of Ethics, which applies to all of our employees, directors and officers, and a Code of Ethics for Principal Executives, Executive Management and Senior Financial Officers. The Code of Ethics and Code of Ethics for Principal Executives, Executive Management and Senior Financial Officers, as applied to our principal executive officer, principal financial officer and principal accounting officer, constitutes our “code of ethics” within the meaning of Section 406 of the Sarbanes-Oxley Act and is our “code of conduct” within the meaning of the listing standards of the NYSE. These documents are reviewed and revised on a periodic basis and are available in the Investors section of our corporate website, www.exar.com, under the Corporate Governance tab. Stockholders may obtain a copy of any of these documents free of charge by submitting a written request to: Exar Corporation, 48720 Kato Road, Fremont, California 94538, Attn: Investor Relations, M/S 210. We intend to post any amendments to the codes and policy, as well as any waivers that are required to be disclosed by the rules of the SEC or the NYSE, on the Company’s website or by filing a Form 8-K.

Director Independence

Our Corporate Governance Principles provide that a majority of the Board and all members of the Audit, Compensation and Corporate Governance and Nominating Committees of the Board will be independent. On an annual basis, each director and executive officer is obligated to complete a director and officer questionnaire that requires disclosure of any transactions with the Company in which a director or executive officer, or any member of his or her immediate family, has a direct or indirect interest. Following completion of these questionnaires, the Board, with the assistance of the Corporate Governance and Nominating Committee, makes an annual determination as to the independence of each director using the current standards for “independence” established by the SEC and the NYSE, additional criteria set forth in our Corporate Governance Principles and consideration of any other material relationship a director may have with the Company.

The Board determined that each of Messrs. Abdi, Bencuya, Hilton, Leza and Meyers is an “independent director” under applicable SEC rules and the NYSE listing standards. Mr. DiNardo, as our full-time President and Chief Executive Officer, is not an independent director. In making its independence determination with respect to Mr. Guilbault, the Board evaluated ordinary course transactions during the last three fiscal years between us and our largest distributor, Future Electronics, Inc. (“Future”), of which Mr. Guilbault serves as an executive officer. The Board determined that, as a result of our business relationship with Future, Mr. Guilbault is not an “independent director” under the listing standards of the NYSE.

As a result of the foregoing, a majority of the Board and all directors serving on the Audit Committee, Corporate Governance and Nominating Committee, and the Compensation Committee are independent directors under applicable SEC rules and the NYSE listing standards.

Board Committees and Meetings

During fiscal year 2014, the Board of Directors held fourteen (14) meetings and acted by written consent three (3) times. During fiscal year 2014, each incumbent director attended at least 75% of the aggregate of (i) the total number of meetings of the Board (held during the period for which such person was a director) and (ii) the total number of meetings held by all committees of the Board on which such director served (during the periods that such director served on such committees). Members of the Board and its committees also consulted informally with management from time to time, and the independent directors met in executive session regularly without the presence of management or other non-independent directors.

The Board of Directors maintains three standing committees: an Audit Committee, a Compensation Committee and a Corporate Governance and Nominating Committee. Each committee serves under a written charter adopted by the Board which is reviewed annually by the committee and revised by the Board from time to time, as appropriate. The current charters for the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee and information concerning direct communication with Non-Employee Directors are available in the Investors section of our corporate website, www.exar.com, under the Corporate Governance tab. The Board committees are reviewed at least annually at the Board meeting that follows the Annual Meeting, and the composition and/or chairs of one or more committees may change at that time or at such other time as the Board determines to make any such changes.

Audit Committee

The Audit Committee currently consists of four (4) directors: Messrs. Hilton (Chair), Abdi, Bencuya and Meyers. The Audit Committee reviews financial reports, the Company’s system of internal control over financial reporting and the Company’s auditing, accounting and financial processes. The Audit Committee’s primary duties and responsibilities as described in its charter are to: (i) appoint our independent registered public accounting firm, evaluate our independent registered public accounting firm’s qualifications, independence and performance and approve the compensation of our independent registered public accounting firm, (ii) review and discuss with management and our independent registered public accounting firm the Company’s audited financial statements and the effectiveness of the Company’s internal control over financial reporting; (iii) review and pre-approve any proposed related-party transactions and/or affiliated transactions and (iv) oversee our risk management process. The Audit Committee held six (6) meetings and did not act by written consent during fiscal year 2014. The Board of Directors has determined that Mr. Hilton is an “audit committee financial expert” as defined by Item 407 of SEC Regulation S-K, that each Audit Committee member has sufficient knowledge in reading and understanding the Company financial statements to serve on the Audit Committee and that each member of the Audit Committee is an “independent director” as currently defined under the NYSE listing standards and is “independent” as that term is defined in SEC Rule 10A-3.

Compensation Committee

The Compensation Committee currently consists of three (3) Directors: Messrs. Bencuya (Chair), Leza and Meyers. The Compensation Committee assists the Board of Directors by reviewing, approving, modifying and administering the Company’s compensation plans, arrangements and programs.

Pursuant to its charter, the Compensation Committee’s primary responsibilities include the following:

| | ● | evaluating the performance of, and reviewing and approving the compensation of, the Company’s Chief Executive Officer and President; |

| | ● | evaluating the performance of and reviewing and approving the levels of compensation for each employee who (i) is a corporate officer of the Company, (ii) is a Vice President and reports directly to the Chief Executive Officer and President or is a Section 16 Insider, or (iii) has a base salary rate of $215,000 or more per year; |

| | ● | reviewing and advising the Board of Directors concerning regional, industry-wide, and peer group compensation practices and trends in order to assess the adequacy and competitiveness within the industry of the Company’s executive compensation programs; |

| | ● | reviewing and recommending for adoption by the Board of Directors equity compensation plans, incentive and bonus programs, retirement plans, deferred compensation plans, and other similar plans and programs, and reviewing and recommending amendments to any such plans or programs; and |

| | ● | administering the Company’s equity compensation plans, incentive and bonus programs, retirement plans, deferred compensation plans, and other similar plans and programs. |

The Compensation Committee held eight (8) meetings and acted by written consent one (1) time during fiscal year 2014. The Board of Directors has determined that each member of the Compensation Committee is an “independent director” as currently defined under the NYSE listing standards.

The Compensation Committee has delegated to the Chief Executive Officer the authority to make any applicable option grants to new employees (other than executive officers) using grant levels previously approved by the Compensation Committee. Generally, grants approved by the Compensation Committee or the Chief Executive Officer do not become effective until the first trading day of the month following the month in which the grant was approved. The Compensation Committee has implemented this process to help ensure that option grants are done on a regular and consistent basis without regard to stock price performance or the Company’s release of material information. The Company’s executive officers, including the Named Executive Officers (as identified below), do not have any role in determining the form or amount of compensation paid to the Company’s Named Executive Officers and the Company’s other executive officers. However, the Compensation Committee does consider the recommendations of the Company’s Chief Executive Officer and President in setting compensation levels for the Company’s other executive officers.

Pursuant to its charter, the Compensation Committee is authorized to retain, and to approve the fees of, such independent compensation consultants and other outside experts or advisors as it believes to be necessary or appropriate to carry out its duties. For a description of the Compensation Committee’s processes and procedures for determining the compensation levels for our executive officers, please see the “Compensation Discussion and Analysis” section below.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee currently consists of three (3) Directors: Messrs. Leza (Chair), Abdi and Hilton. The Corporate Governance and Nominating Committee adopts and reviews compliance with ethical principles and governance standards applicable to the Company’s directors and executive officers to ensure corporate integrity and responsibility. The Corporate Governance and Nominating Committee also interviews, evaluates, nominates and recommends individuals for membership on the Company’s Board of Directors and committees thereof. The Corporate Governance and Nominating Committee held five (5) meetings and did not act by written consent during fiscal year 2014. The Board of Directors has determined that each member of the Corporate Governance and Nominating Committee is an “independent director” as currently defined under the NYSE listing standards.

If the Corporate Governance and Nominating Committee chooses to identify new director candidates for Board membership, it is authorized to retain, and to approve the fees of, third party director search firms to help identify prospective Director nominees. The Corporate Governance and Nominating Committee has not formally adopted any specific, minimum qualifications that must be met by each candidate for the Board of Directors, nor are there specific qualities or skills that are necessary for one or more of the members of the Board of Directors to possess. The Corporate Governance and Nominating Committee believes that candidates and nominees must possess characteristics that will provide us with a Board comprised of directors who (i) are predominantly independent, (ii) are of high integrity, (iii) have or have had experience in positions with a high degree of professional or industry responsibility, (iv) are or were leaders in the companies or institutions with which they are or were affiliated, (v) have qualifications that will increase overall Board effectiveness, (vi) have the ability and willingness to commit sufficient time to the Board and (vii) meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to audit committee members.

As provided in our Corporate Governance Principles, the Board is committed to diversified membership, seeking members from diverse professional backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity and do not have professional commitments which might otherwise unreasonably interfere with the demands and duties needed to fully consider Company related matters or conflict with our interests. We believe our directors should possess the highest personal and professional integrity and values, and be committed to representing the long-term interests of our stockholders. While we have not prescribed specific standards for considering diversity among director nominees, we have determined it is desirable for the Board as a whole to encompass a range of talent, perspectives, background, skills and professional experience, enabling it to provide sound guidance with respect to the Company’s operations and interests. We expect our directors to possess high personal and professional ethics, practical wisdom, sound judgment, an inquisitive disposition and business acumen. We also endeavor to have a Board that reflects a range of experiences at policy making levels, as well as executive-level experience in areas and industries that are important to our business. We generally seek directors with strong reputations and experience in areas relevant to our strategy and operations, particularly in industries and markets that we serve as well as key geographic markets where we operate. We typically seek directors with experience in significant leadership positions, industry-specific knowledge, experience and insight and an understanding of finance and financial reporting processes. In addition to such experience, we believe our directors should possess other key individual characteristics and attributes that are important to an effective board. We believe it important for our directors to possess the aptitude or experience to understand fully the legal responsibilities of a director and the governance processes of a public company, as well as the personal qualities to be able to make a substantial active contribution to Board deliberations, including intelligence and wisdom, self-assuredness and interpersonal skills, courage, commitment, the willingness to ask a difficult question and the ability to engage management and each other in a collaborative and constructive fashion.

The Board has adopted a retirement age policy of 70 years of age, provided that the Board may choose to waive this policy in the case of any director or nominee as the Board shall deem appropriate and in the best interests of the Company’s stockholders.

In order to identify and evaluate nominees for director, the Corporate Governance and Nominating Committee regularly reviews the current composition and size of the Board of Directors, reviews qualifications of nominees, evaluates the performance of the Board of Directors as a whole and, commencing with fiscal year 2015, committee members separately, and evaluates the performance and qualifications of individual members of the Board of Directors eligible for re-election at the annual meeting of stockholders. In doing so, the Corporate Governance and Nominating Committee considers such factors as character, diversity, skills, judgment, independence, industry experience, professional expertise, corporate experience, length of service, other commitments and the like, and the general needs of the Board, including applicable independence requirements. The Corporate Governance and Nominating Committee considers each individual candidate both in the context of the current composition of the Board and the evolving needs of our business. The Corporate Governance and Nominating Committee uses the same process for evaluating all nominees, regardless of the original source of the nomination.

The Corporate Governance and Nominating Committee will consider recommendations for candidates to the Board of Directors from stockholders. A stockholder that desires to recommend a candidate for election to the Board of Directors shall direct the recommendation in writing to Exar Corporation, attention Secretary, 48720 Kato Road, Fremont, California 94538. In evaluating such recommendations, the Corporate Governance and Nominating Committee seeks to achieve a balance of knowledge, experience and capability on the Board and to address the membership criteria set forth above. A stockholder that desires to nominate a candidate for election to the Board of Directors shall direct the nomination in writing to Exar Corporation, attention Secretary, 48720 Kato Road, Fremont, California 94538, on a timely basis in accordance with the Company’s Bylaws, and must include the candidate’s name, age, home and business contact information, detailed biographical data and qualifications, including principal occupation or employment; the class and number of shares of the Company that are beneficially owned by the candidate; a description of all arrangements or understandings between the stockholder and the candidate and any other person or persons (naming such person or persons) pursuant to which the nomination is to be made by the stockholder; information regarding any relationships between the candidate and the Company within the last three years; information regarding the recommending person’s name, address and ownership of Company stock; a statement from the recommending stockholder in support of the candidate; references, particularly within the context of the criteria for Board membership, including issues of character, diversity, skills, judgment, independence, industry experience, professional expertise, corporate experience, length of service, other commitments and the like; a written indication by the candidate of her/his consent to be named in the proxy statement, if nominated, and to serve, if elected; and any other information relating to the stockholder or to the candidate that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, or the Company’s Bylaws.

Policy Regarding Director Attendance at Annual Meetings of Stockholders

Under our Corporate Governance Principles, the Company requires all incumbent directors and nominees for election to the Board to attend each annual meeting of stockholders. All of the Company’s then serving directors attended the 2013 Annual Meeting of Stockholders held on September 5, 2013.

Stockholder Communications with the Board of Directors

Any stockholder or interested party that desires to communicate directly with the Board of Directors or one or more of its members concerning the affairs of the Company shall direct the communication in written correspondence by letter to Exar Corporation, attention Secretary, 48720 Kato Road, Fremont, California 94538. When such communication is intended for individual members of the Board of Directors, the intended recipients shall be clearly indicated in bold type at the beginning of the letter. Alternatively, a stockholder may communicate with the non-employee members of the Board via the Investors section of our corporate website at ir.exar.com under the Info Request link.

Board Leadership Structure

As provided in our Corporate Governance Principles, our policy as to whether the role of the Chairman and the Chief Executive Officer should be separate is to adopt the practice that best serves the stockholders’ interests and our needs at any particular time. We currently separate the roles of Chief Executive Officer and Chairman as we believe this structure enhances the Board’s oversight of, and independence from, Company management, the ability of the Board to carry out its roles and responsibilities on behalf of our stockholders and our overall corporate governance structure. By separating the roles of Chief Executive Officer and Chairman, the Chief Executive Officer is able to focus his time and energy on managing the Company and leverage the experience and perspective of our Chairman, who is well positioned to provide our Chief Executive Officer with guidance, advice and counsel regarding our business, operations and strategy. We believe that our separate Chief Executive Officer/Chairman structure is the most appropriate and effective leadership structure for the Company and our stockholders at this time. At the regularly scheduled executive sessions of the non-management independent directors, Mr. Richard L. Leza, as chairman of the board, has been chosen as the director to preside.

Board Oversight of Risk Management

The Board believes that evaluating how the executive team manages the various risks confronting us is one of its most important areas of oversight. The Board believes an effective risk management system will timely identify the material risks that we face, communicate necessary information with respect to material risks to senior executives and, as appropriate, to the Board or relevant Board committee, implement appropriate and responsive risk management strategies consistent with our risk profile, and integrate prudent risk management into our decision-making.

In carrying out this critical responsibility, the Board is advised periodically by key members of management with primary responsibility for risk management, including our Chief Executive Officer, Chief Financial Officer and General Counsel, and periodically reviews risks associated with our strategic plan. The Board also exercises its risk oversight responsibilities through its various committees. The Board has designated the Audit Committee with primary responsibility over evaluating and monitoring our overall risk management processes. Among its duties, the Audit Committee is charged with discussing policies with respect to risk assessment and risk management and the steps management has taken to monitor and control such exposure. The Audit Committee reviews with management our policies with respect to risk assessment and management of risks that may be material to the Company, our system of disclosure controls and system of internal controls over financial reporting (which are audited by an independent third party), and our compliance with legal and regulatory requirements. In addition, the Audit Committee meets regularly with management, including our finance and accounting personnel, and in private sessions with our independent registered public accounting firm, where aspects of risk management are discussed. The Audit Committee makes periodic reports to the Board regarding such briefings, as well as the Audit Committee’s own analysis and conclusions regarding the adequacy of our risk management processes. While our Audit Committee has primary responsibility for overseeing enterprise risk management, each of our other Board committees also considers risk within its area of responsibility. For example, our Corporate Governance and Nominating Committee reviews risks related to legal and regulatory compliance as they relate to corporate governance structure and processes, and our Compensation Committee reviews risks related to compensation matters. Our Board is periodically apprised by the committee chairs of significant risks and management’s responses to those risks.

Our management is responsible for day-to-day risk management. Our finance and legal teams serve as the primary monitoring and testing function for company-wide policies and procedures, and manage the day-to-day oversight of the risk management strategy for our ongoing business. This oversight includes identifying, evaluating, and addressing potential risks that may exist at the enterprise, strategic, financial, operational, and compliance and reporting levels. In addition, the Board encourages management to promote a corporate culture that incorporates risk management into our corporate strategy and day-to-day business operations. Each of our Chief Executive Officer, Chief Financial Officer and General Counsel have primary responsibility for and oversight of certain aspects of risk management and report to the Board on such matters. The Board also continually works, with the input of our executive officers, to assess and analyze the most likely areas of future risk for the Company. We believe that the division of risk management responsibilities described above is an effective approach for addressing the risks facing the Company and that our Board leadership structure supports this approach.

Risk Assessment of Compensation Policies and Practices

Our compensation programs throughout the organization are designed to maintain an appropriate balance between long-term and short-term incentives by utilizing a combination of compensation components, including base salary, annual incentive awards, and long-term equity awards. Although not all employees in the organization have compensation comprised of all three of those components, the compensation programs are generally structured so that any short-term cash incentives are not likely to constitute the predominant element of an employee’s total compensation package and that other components will serve to balance any incentive to take inappropriate risks that short-term cash compensation opportunities may otherwise encourage. For a discussion of the primary components of the compensation packages for the Company’s executive officers, please see the section below entitled “Executive Compensation—Compensation Discussion and Analysis.”

In general, our incentive compensation programs are designed to reward eligible employees who commit to and deliver on goals which are intended to be challenging yet provide them a reasonable opportunity to reach the baseline amounts, while requiring meaningful growth to reach the target level and substantial growth to reach the maximum level. The amount of growth required to reach the maximum level of compensation is intended to be achievable within the context of our normal business planning cycle and we do not believe it to be at such an aggressive level that it would induce eligible employees to take inappropriate risks that could threaten our financial and operating stability. While a number of employees participate in performance-based incentive plans, we believe that those plans are structured in a manner that encourages the participating employees to remain focused on both the short- and long-term operational and financial goals of the Company in several key respects. For example, our sales employees are included in annual sales commission incentive plans that are subject to in-line and cross functional review during both the design stage and the incentive payment process. Payments are based upon the achievement of current quarter qualified design wins and revenue numbers against established targets. In order to help ensure that payments are made only on qualified transactions, the quarterly payment amount is based on net revenue (less customer returns).

A significant portion of the compensation provided to our executive officers and other senior employees is in the form of long-term equity awards that are important to help further align the interests of the recipient with those of our stockholders. We believe that these awards do not encourage unnecessary or excessive risk taking because the ultimate value of the awards is tied to our stock price. These equity awards are subject to long-term vesting schedules to help ensure that recipients have significant value tied to our long-term and sustained stock price performance.

Based on these considerations, we do not believe that our compensation programs create risks that are reasonably likely to have a material adverse effect on the Company.

Summary of Non-Employee Director Compensation

Compensation for members of the Company’s Board of Directors who are not also employed by the Company or any of its subsidiaries, referred to herein as “Non-Employee Directors,” during fiscal year 2014 generally consisted of cash retainers and an annual equity award. The compensation paid to Mr. DiNardo, who served as the Company’s Chief Executive Officer and President during fiscal year 2014, is presented below in the Summary Compensation Table and the related explanatory tables within the “Executive Compensation” section below.

Cash Retainers.

Under the current compensation program for Non-Employee Directors, the annual retainer for each Non-Employee Director is $40,000. The Chair of the Board receives an additional $20,000 annual retainer; the Chair of the Audit Committee receives an additional $20,000 annual retainer; the Chair of the Compensation Committee receives an additional $10,000 annual retainer; and the Chair of the Corporate Governance and Nominating Committee receives an additional $6,000 annual retainer.

In addition, each member of the Audit Committee (other than the Chair) receives an additional annual retainer of $8,000; each member of the Compensation Committee (other than the Chair) receives an additional annual retainer of $4,000; and each member of the Corporate Governance and Nominating Committee (other than the Chair) receives an additional annual retainer of $3,000.

We also reimburse Non-Employee Directors for documented expenses for travel and professional education incurred in connection with their duties as directors of the Company.

Equity Awards.

Under the current compensation program for Non-Employee Directors, on the first trading day of the month following a Non-Employee Director’s initial election or appointment to the Board of Directors, the Non-Employee Director will receive, subject to prior approval by the Board of Directors or the Compensation Committee, an option to purchase 40,000 shares of our Common Stock. This initial option will have an exercise price equal to the closing price of our Common Stock on the grant date and will vest in four equal annual installments over the four-year period following the grant date. In addition, on the first trading day of the month following such Non-Employee Director’s initial election or appointment to the Board of Directors, the Non-Employee Director will receive, subject to prior approval by the Board of Directors or the Compensation Committee, 28,000 restricted stock units (with the first 7,000 of such restricted stock units subject to proration based on the amount of time elapsed since the most recent annual meeting of stockholders). This initial restricted stock unit award will vest in four annual installments of 7,000 units each on, with respect to each year, the earlier to occur of the anniversary of the grant date or the annual meeting of stockholders that occurs in such year (with the first such installment, in the case of a prorated award, consisting of the prorated portion of the first 7,000 units).

The program also provides that each Non-Employee Director continuing in office following an annual meeting of stockholders will be granted upon the first trading day of the month following the annual meeting date and subject to prior approval by the Board of Directors or the Compensation Committee an option to purchase 10,000 shares of Common Stock that will vest in one installment four years after the grant date. Furthermore, each Non-Employee Director continuing in office after an annual meeting of stockholders will, subject to prior approval by the Board of Directors or the Compensation Committee, receive 7,000 restricted stock units upon the first trading day of the month following the annual meeting date. This restricted stock unit award will vest in full upon the earlier of the fourth anniversary of the grant date or the annual meeting of stockholders that occurs in the fourth year following such grant date. A Non-Employee Director serving as Chair of the Board of Directors as of an annual meeting date will receive an additional 2,500 restricted stock units upon the first trading day of the month following the annual meeting date. The Chair restricted stock unit award will vest upon the earlier of the first anniversary of the grant date or the next annual meeting of stockholders following such grant date. Non-Employee Directors are also eligible to receive discretionary grants under the Company’s stock incentive plans as approved by the Board of Directors or the Compensation Committee.

Each of the grants of restricted stock units and stock options to the Non-Employee Directors as described above will be made in accordance with our equity grant practices and will vest, in full or in part, upon a change of control of the Company or certain other corporate transactions that result in termination of the director’s service on the Board of Directors. The equity awards granted to our Non-Employee Directors during fiscal year 2014 are described in footnote (3) to the Director Compensation Table below. Each of these awards was granted under, and is subject to the terms of, the Company’s 2006 Equity Incentive Plan (the “2006 Plan”). The Board of Directors or the Compensation Committee administers the 2006 Plan as to Non-Employee Director awards.

Director Compensation Table—Fiscal Year 2014

The following table presents information regarding the compensation paid for fiscal year 2014 to the Non-Employee Directors. As noted above, the compensation paid to Mr. DiNardo, who served as the Company’s Chief Executive Officer and President during fiscal year 2014, is presented below in the Summary Compensation Table and the related explanatory tables within the “Executive Compensation” section below.

Name | | Fees Earned or Paid in Cash

($) | | | Stock Awards

($)(1)(2)(3) | | | Option Awards

($)(1)(2)(3) | | | Non-Equity Incentive Plan Compensation

($) | | | Change in Pension Value and Nonqualified Deferred Compensation Earnings

($) | | | All Other Compensation

($) | | | Total

($) | |

(a) | | (b) | | | (c) | | | (d) | | | (e) | | | (f) | | | (g) | | | (h) | |

Behrooz Abdi | | | 51,000 | | | | 94,780 | | | | 38,133 | | | | — | | | | — | | | | — | | | | 183,913 | |

Izak Bencuya | | | 58,000 | | | | 94,780 | | | | 38,133 | | | | — | | | | — | | | | — | | | | 190,913 | |

Pierre Guilbault | | | 40,000 | | | | 94,780 | | | | 38,133 | | | | — | | | | — | | | | — | | | | 172,913 | |

Brian Hilton | | | 63,000 | | | | 94,780 | | | | 38,133 | | | | — | | | | — | | | | — | | | | 195,913 | |

Richard L. Leza | | | 70,000 | | | | 128,630 | | | | 212,720 | | | | — | | | | — | | | | — | | | | 411,350 | |

Gary Meyers | | | 52,000 | | | | 94,780 | | | | 38,133 | | | | — | | | | — | | | | — | | | | 184,913 | |

(1) | The amounts reported in Columns (c) and (d) of the table above for fiscal year 2014 reflect the fair value on the grant date of the stock awards and option awards, respectively, granted to our Non-Employee Directors during fiscal year 2014. These values have been determined under the principles used to calculate the grant-date fair value of equity awards for purposes of our financial statements. For a discussion of the assumptions and methodologies used to value the awards reported in Column (c) and Column (d), please see the discussion ofstock awards and option awards contained under the section entitled “Stock-Based Compensation” beginning on page 79of our Annual Report on Form 10-K for fiscal year 2014 filed with the SEC on June 11, 2014. |

(2) | The following table presents the number of outstanding and unexercised option awards and the number ofunvested stock awards held by each of the Non-Employee Directors as of March 30, 2014. |

Director | Number of Shares Subject to

Outstanding Options as of 3/30/14 | Number of Unvested Restricted

Stock Units as of 3/30/14 |

Behrooz Abdi | 50,000 | | 28,000 |

Izak Bencuya | 74,000 | | 28,000 |

Pierre Guilbault | 84,852 | | 28,000 |

Brian Hilton | 93,200 | | 28,000 |

Richard L. Leza | 104,000 | | 30,500 |

Gary Meyers | 62,000 | | 28,000 |

(3) | As described above, we granted Messrs. Abdi, Bencuya, Guilbault, Hilton and Meyers an award of restricted stock units on October 1, 2013 following our 2013 Annual Meeting of Stockholders. The awards to each of these Non-Employee Directors consisted of 7,000 restricted stock units and had a grant-date fair value of $94,780. On the same date, we granted Mr. Leza 9,500 restricted stock units which had a grant-date fair value of $128,630. |

Messrs. Abdi, Bencuya, Guilbault, Hilton, Leza and Meyers were granted stock options on October 1, 2013. The stock option grants to each of these Non-Employee Directors consisted of 10,000 shares and had a grant-date fair value of $38,133. On March 3, 2014, we granted to Mr. Leza 54,000 stock options, which had a grant-date fair value of $174,587, in recognition of exceptional contributions made and services expected to be rendered.

For these purposes, the “grant-date fair value” of an award is the fair value on the grant date determined under the principles used to calculate the grant-date fair value of equity awards for purposes of our financial statements. See footnote (1) above for the assumptions and methodologies used to value these awards.

Director Stock Ownership Guidelines

In May 2007, the Board adopted the following stock ownership guidelines for its directors:

Director candidates who have agreed to stand for election by the stockholders or for appointment by the Board of Directors to fill a vacancy are asked to purchase a nominal number of shares of our Common Stock (at least 1,000 shares). The shares should normally be acquired as follows:

| | 1. | In the case of appointment by the Board of Directors to fill a vacancy on the Board of Directors, either before or within 30 days following such appointment; or |

| | 2. | In the case where a new candidate is to stand for election by the stockholders, the Common Stock should be purchased upon nomination by the Board of Directors to stand for election by the stockholders. |

Within three years of becoming a director, each director is expected to accumulate and thereafter continue to hold a minimum of 14,500 shares of our Common Stock. Restricted stock and shares issued upon distribution pursuant to restricted stock units are applied toward this goal. The shares must be held by the director as an individual or as part of a family trust. Shares subject to outstanding and unexercised options do not count for purposes of this stock ownership requirement.

It is intended that directors hold, through outright ownership and through equity award grants, a meaningful number of shares of our Common Stock and that the guidelines be flexible in appropriate circumstances in order to avoid foreclosing the appointment of viable candidates for the Board of Directors. We believe that each current director who has served on the Board for at least three years is in compliance with these ownership guidelines.

PROPOSAL 1

ELECTION OF DIRECTORS

The size of the Board of Directors is currently fixed at seven (7) directors, and the Board of Directors is presently composed of seven (7) members with no vacancies. The term of office for each of our directors expires at the Annual Meeting.

The Board of Directors, upon the recommendation of the Corporate Governance and Nominating Committee, has nominated Messrs. Behrooz Abdi, Izak Bencuya, Louis DiNardo, Pierre Guilbault, Brian Hilton, Richard L. Leza, and Gary Meyers for election to the Board at the Annual Meeting. Each of the nominees is a current director who was elected by our stockholders at the 2013 Annual Meeting of Stockholders. If elected at the Annual Meeting, each of the nominees will serve as a director for a term of one year expiring at the 2015 Annual Meeting of Stockholders, or until his successor is duly elected and qualified or until his earlier death, resignation or removal. Each individual nominated for election has agreed to serve if elected, and we have no reason to believe that any nominee will be unable to serve if elected. If each of the nominees above are elected at the Annual Meeting, the Board of Directors following the Annual Meeting will be comprised of seven (7) members with no vacancies.

There is no family relationship between any of our directors or executive officers and there are no arrangements or understandings between any of our directors and any other person pursuant to which such director was or is to be selected as a director (other than such arrangements or understandings with such directors acting solely in their capacities as such).

The following table sets forth certain information as of the Record Date concerning our current directors:

Name | | Age | | Director

Since | | Position with Exar | | Audit

Committee | | Compensation

Committee | | Corporate Governance and Nominating Committee | | Independence |

Behrooz Abdi | | 53 | | 2012 | | Director | | X | | | | X | | Y |

Izak Bencuya | | 60 | | 2009 | | Director | | X | | C | | | | Y |

Louis DiNardo | | 54 | | 2012 | | Chief Executive Officer and President, Director | | | | | | | | N |

Pierre Guilbault | | 60 | | 2007 | | Director | | | | | | | | N |

Brian Hilton | | 71 | | 2007 | | Director | | C | | | | X | | Y |

Richard L. Leza | | 67 | | 2006 | | Chairman of Board | | | | X | | C | | Y |

Gary Meyers | | 49 | | 2008 | | Director | | X | | X | | | | Y |

A brief description of the principal occupation, position and business experience, including other public company directorships, for at least the past five years of each of our current directors is set forth below (each of whom has been nominated for re-election to the Board). Each director’s biographical information includes a description of the primary experience, qualifications, attributes or skills that qualify the director to serve on the Company’s Board of Directors at this time.

Directors Standing for Re-election

BEHROOZ ABDI

Mr. Abdi became a director on September 26, 2012. Mr. Abdi has been providing executive leadership and funding to various early stage companies focused on clean energy technologies, semiconductors, mobile applications, and related services since December 2011. As of October 24, 2012, Mr. Abdi is Chief Executive Officer and President of InvenSense Inc., a publicly traded company providing MotionTracking™ devices for consumer electronics products. He currently serves as a director at Tabula Inc., a privately held company. From November 2009 to December 2011, Mr. Abdi served as Executive Vice President at NetLogic Microsystems Inc., a provider of high performance intelligent semiconductor solutions for next generation networks (acquired by Broadcom Corporation). From November 2007 to November 2009, Mr. Abdi was President and CEO at RMI Corporation, a software and support company. From March 2004 to November 2007, he was Senior Vice President and General Manager for Qualcomm Incorporated, a company providing 3G and next-generation mobile technologies. From July 1985 to December 2004, Mr. Abdi served in a number of executive management and engineering positions with Motorola Inc., a company providing integrated communications and embedded electronic solutions. He holds a B.S.E.E. from Montana State University and M.S.E.E. from Georgia Institute of Technology. Among other qualifications, Mr. Abdi brings extensive technological experience, knowledge and background in the clean energy technologies, semiconductor and mobile applications industries and related fields, to the Board of Directors.

IZAK BENCUYA

Izak Bencuya became a director of the Company in February 2009. Dr. Bencuya is an independent consultant on Energy and Power Management in Alternative Energy Applications. Dr. Bencuya was the Chief Executive Officer of Deeya Energy, a cleantech company dedicated to developing and manufacturing electrical energy storage systems, from June 2008 until April 2010. He worked for 13 years at National Semiconductor and then was the Executive Vice President of Fairchild Semiconductor and the General Manager of the Functional Power Products Group in San Jose, California until the end of 2007. Dr. Bencuya has over 25 years of power semiconductor industry experience. He began his career at Yale University where he researched ultra thin oxide MOS devices. Dr. Bencuya later worked at GTE Laboratories and Siliconix in various research and management roles to develop and market leading edge Power Devices, such as MOSFETs, IGBTs and SITs. He joined Fairchild Semiconductor in 1994 to start the Power Products business which grew to be a $950 million annual revenue business under his leadership providing Power Semiconductor solutions for all power supply applications in the computing, communications, industrial, consumer and automotive markets. Dr. Bencuya has a B.S. in Electrical Engineering from Bogazici University in Istanbul, Turkey and an M.S. and PhD in Engineering and Applied Science from Yale University. He is a member of the IEEE Electron Device Society. Dr. Bencuya holds 22 patents and has been published extensively in the electronics field. Among other qualifications, Dr. Bencuya brings extensive technological experience, knowledge and background in the semiconductor industry and related fields, to the Board of Directors.

LOUIS DINARDO

Louis DiNardo became a director of the Company in January 2012, when he became our Chief Executive Officer and President. In August 2013, Mr. DiNardo was elected to the board of directors of Quantum Corporation, where he currently serves as Chair of Quantum’s Corporate Governance and Nominating Committee. Prior to joining Exar, he was a Partner at Crosslink Capital, a stage-independent venture capital and growth equity firm based in San Francisco, which he joined in January of 2008 and focused on semiconductor and alternative energy technology investment in private companies. Mr. DiNardo was a partner at VantagePoint Venture Partners from January of 2007 through January of 2008. Mr. DiNardo was President and Chief Operating Officer at Intersil Corporation from January 2005 through October 2006. Prior to his promotion, Mr. DiNardo held the position of Executive Vice President of the Power Management Business at Intersil. He held the position of President and Chief Executive Officer, as well as Co-Chairman of the Board of Directors at Xicor Corporation, a public company, from 2000 until Intersil acquired the company in July of 2004. Mr. DiNardo spent thirteen years at Linear Technology where he was Vice President of Worldwide Marketing and General Manager of the Mixed-Signal Business Unit. He began his career in the semiconductor industry at Analog Devices Incorporated where he served for eight years in a variety of technical and management roles. Mr. DiNardo holds a B.A. from Ursinus College, 1981. Among other qualifications, Mr. DiNardo brings extensive experience as an executive and board member of technology companies, as well as his commitment and operational knowledge as our Chief Executive Officer and President, to the Board of Directors.

PIERRE GUILBAULT

Pierre Guilbault became a director of the Company upon the acquisition of Sipex Corporation (“Sipex”) by the Company in August 2007. Mr. Guilbault served as a member of Sipex’s board of directors from September 2006 to August 2007. He has been with Future Electronics Inc. (“Future”), the Company’s largest distributor and an affiliate of the Company’s largest stockholder, since October 2002 as Executive Vice President and Chief Financial Officer. Prior to joining Future, Mr. Guilbault was Executive Vice President and Chief Financial Officer of My Virtual Model, Motion International Inc. and Steinberg, Inc. Mr. Guilbault became a Chartered Accountant in 1981 and earned a bachelor’s degree in Business Administration from University of Quebec at Montreal. Among other qualifications, Mr. Guilbault brings extensive finance experience in both high-technology and other industries as well as related international business experience (in particular in Canada), including service as a public company chief financial officer, to the Board of Directors.

BRIAN HILTON

Brian Hilton became a director of the Company through the acquisition of Sipex by the Company in August 2007. Mr. Hilton served as a member of Sipex’s board of directors from July 2004 to August 2007 and as the Chairman of the board of directors of Sipex from October 2006 to August 2007. He has over 35 years of experience in the semiconductor industry. Mr. Hilton has been retired since 2002. From 1997 to 2002, Mr. Hilton was President of Avnet Electronics Marketing, a global electronics distributor. In this role, Mr. Hilton was responsible for building Avnet’s Asian business and expanding its presence in Europe, the Middle East and Africa. Prior to Avnet, Mr. Hilton spent 30 years at Motorola, Inc., reaching the position of Corporate Vice President and Director of Worldwide Sales and Marketing for Motorola Semiconductor Products Sector (“SPS”). From 1979 to 1981, Mr. Hilton served as Vice President Finance & Administration for Motorola SPS. From 1976 to 1978, Mr. Hilton served as the Vice President and Corporate Controller for Motorola Canada Limited. From 1969 to 1971, Mr. Hilton served as Division Controller for the Motorola Automotive Products Division. From 1964 to 1967, Mr. Hilton participated in the General Motors financial management program. Mr. Hilton currently serves as a director of Border States Electric. Mr. Hilton graduated with a BA from the University of Manitoba. Among other qualifications, Mr. Hilton brings extensive finance and accounting experience in both high-technology and other industries, in particular strong channel experience, to the Board of Directors.

RICHARD L. LEZA