UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4118

Fidelity Securities Fund

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | November 30 |

| |

Date of reporting period: | November 30, 2005 |

Item 1. Reports to Stockholders

Fidelity® Advisor

Aggressive Growth

Fund - Class A, Class T, Class B

and Class C

|

Annual Report

November 30, 2005

|

| Contents | | | | |

| |

| Chairman’s Message | | 4 | | Ned Johnson’s message to shareholders. |

| Performance | | 5 | | How the fund has done over time. |

| Management’s Discussion | | 7 | | The manager’s review of fund |

| | | | | performance, strategy and outlook. |

| Shareholder Expense | | 8 | | An example of shareholder expenses. |

| Example | | | | |

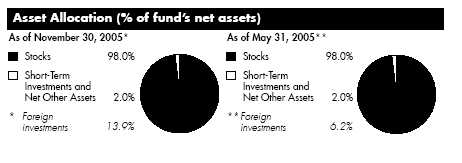

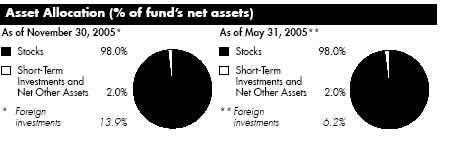

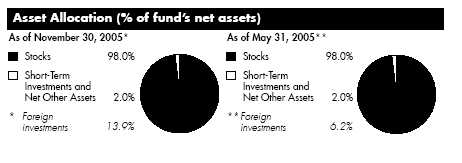

| Investment Changes | | 10 | | A summary of major shifts in the fund’s |

| | | | | investments over the past six months. |

| Investments | | 11 | | A complete list of the fund’s investments |

| | | | | with their market values. |

| Financial Statements | | 17 | | Statements of assets and liabilities, |

| | | | | operations, and changes in net assets, |

| | | | | as well as financial highlights. |

| Notes | | 26 | | Notes to the financial statements. |

| Report of Independent | | 34 | | |

| Registered Public | | | | |

| Accounting Firm | | | | |

| Trustees and Officers | | 35 | | |

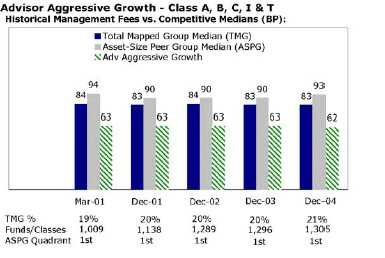

| Board Approval of | | 45 | | |

| Investment Advisory | | | | |

| Contracts and | | | | |

| Management Fees | | | | |

| | To view a fund’s proxy voting guidelines and proxy voting record for the 12 month period

ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange

Commission’s (SEC) web site at www.sec.gov. You may also call 1-877-208-0098 to request a free

copy of the proxy voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw Hill Companies,

Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks

of FMR Corp. or an affiliated company.

|

Annual Report 2

This report and the financial statements contained herein are submitted for the general information

of the shareholders of the fund. This report is not authorized for distribution to prospective investors

in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third

quarters of each fiscal year on Form N Q. Forms N Q are available on the SEC’s web site at

http://www.sec.gov. A fund’s Forms N Q may be reviewed and copied at the SEC’s Public Reference

Room in Washington, DC. Information regarding the operation of the SEC’s Public Reference

Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio hold

ings, view the most recent quarterly holdings report, semiannual report, or annual report on

Fidelity’s web site at http://www.advisor.fidelity.com.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

|

3 Annual Report

Chairman’s Message

(photograph of Edward C. Johnson 3d)

Dear Shareholder:

During the past year or so, much has been reported about the mutual fund industry, and much of it has been more critical than I believe is warranted. Allegations that some companies have been less than forthright with their shareholders have cast a shadow on the entire industry. I continue to find these reports disturbing, and assert that they do not create an accurate picture of the industry overall. Therefore, I would like to remind every one where Fidelity stands on these issues. I will say two things specifically regarding allegations that some mutual fund companies were in violation of the Securities and Exchange Commission’s forward pricing rules or were involved in so called “market timing” activities.

First, Fidelity has no agreements that permit customers who buy fund shares after 4 p.m. to obtain the 4 p.m. price. This is not a new policy. This is not to say that some one could not deceive the company through fraudulent acts. However, we are extremely diligent in preventing fraud from occurring in this manner and in every other. But I underscore again that Fidelity has no so called “agreements” that sanction illegal practices.

Second, Fidelity continues to stand on record, as we have for years, in opposition to predatory short term trading that adversely affects shareholders in a mutual fund. Back in the 1980s, we initiated a fee which is returned to the fund and, therefore, to investors to discourage this activity. Further, we took the lead several years ago in developing a Fair Value Pricing Policy to prevent market timing on foreign securities in our funds. I am confident we will find other ways to make it more difficult for predatory traders to operate. However, this will only be achieved through close cooperation among regulators, legislators and the industry.

Yes, there have been unfortunate instances of unethical and illegal activity within the mutual fund industry from time to time. That is true of any industry. When this occurs, confessed or convicted offenders should be dealt with appropriately. But we are still concerned about the risk of over regulation and the quick application of simplistic solutions to intricate problems. Every system can be improved, and we support and applaud well thought out improvements by regulators, legislators and industry representatives that achieve the common goal of building and protecting the value of investors’ holdings.

For nearly 60 years, Fidelity has worked very hard to improve its products and service to justify your trust. When our family founded this company in 1946, we had only a few hundred customers. Today, we serve more than 18 million customers including individual investors and participants in retirement plans across America.

Let me close by saying that we do not take your trust in us for granted, and we realize that we must always work to improve all aspects of our service to you. In turn, we urge you to continue your active participation with your financial matters, so that your interests can be well served.

Best regards,

/s/ Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report 4

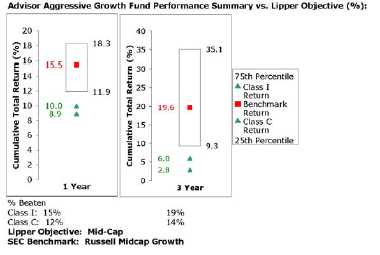

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class’ dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund’s returns do not reflect the deduction of taxes that a shareholder would pay on fund distribu tions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimburse ment not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns | | | | | | |

| Periods ended November 30, 2005 | | Past 1 | | Past 5 | | Life of |

| | | year | | years | | fundA |

| Class A (incl. 5.75% sales charge) | | 3.12% | | 0.36% | | 2.31% |

| Class T (incl. 3.50% sales charge) | | 5.22% | | 0.17% | | 2.12% |

| Class B (incl. contingent deferred | | | | | | |

| sales charge)B | | 3.49% | | 0.34% | | 2.09% |

| Class C (incl. contingent deferred | | | | | | |

| sales charge)C | | 7.48% | | 0.09% | | 1.87% |

A From November 13, 2000.

B Class B shares’ contingent deferred sales charges included in the past one year, past 5 year, and

life of fund total return figures are 5%, 2% and 1%, respectively.

C Class C shares’ contingent deferred sales charges included in the past one year, past 5 year, and

life of fund total return figures are 1%, 0% and 0%, respectively.

|

5 Annual Report

5

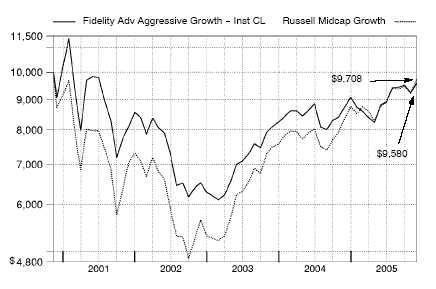

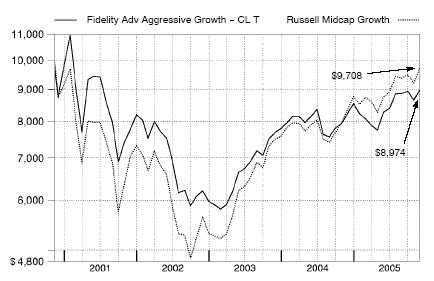

| | $10,000 Over Life of Fund

|

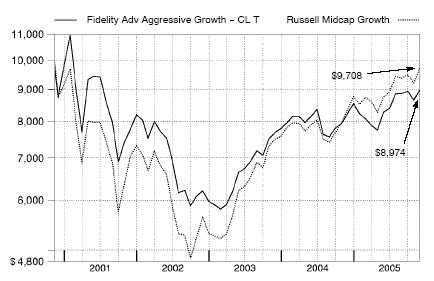

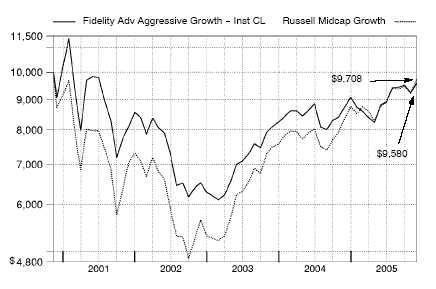

Let’s say hypothetically that $10,000 was invested in Fidelity® Advisor Aggressive Growth Fund Class T on November 13, 2000, when the fund started, and the current 3.50% sales charge was paid. The chart shows how the value of your investment would have changed, and also shows how the Russell Midcap® Growth Index performed over the same period.

Management’s Discussion of Fund Performance

Comments from Steven Calhoun, Portfolio Manager of Fidelity® Advisor Aggressive Growth Fund

Numerous events unfolded during the 12 month period ending November 30, 2005, that were major influences on the U.S. equity markets. Issues exerting downward pressure on stocks included higher levels of inflation, eight short term interest rate hikes by the Federal Reserve Board, exorbitant energy prices, and a Category 4 hurricane that devas tated both the city of New Orleans and several nearby oil production and refinery facilities. Grabbing most of the markets’ upbeat headlines was consistent strength in consumer spending, corporate earnings and gross domestic product (GDP). When all was said and done, investors demonstrated their conviction in the economy, pushing stocks higher across the board. By period end, the Standard & Poor’s 500SM Index, the NASDAQ Composite® Index and the Dow Jones Industrial AverageSM approached or exceeded four and a half year highs. For the 12 months overall, the S&P 500® was up 8.44%, the NASDAQ® rose 7.28% and the Dow advanced 6.07%, threatening to eclipse the 11,000 threshold for the first time since 2001.

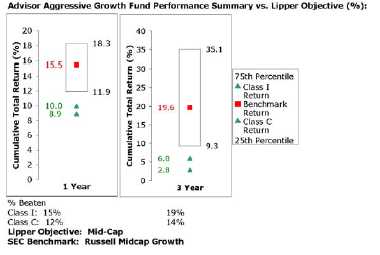

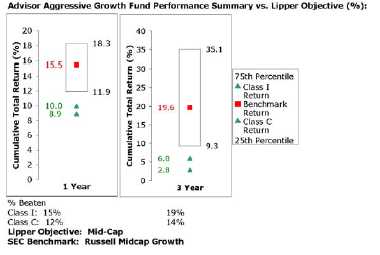

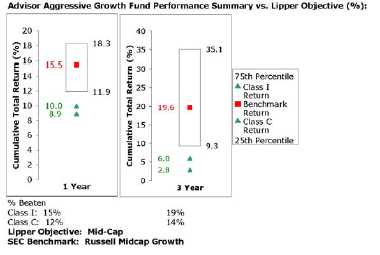

For the 12 months ending November 30, 2005, the fund’s Class A, Class T, Class B and Class C shares returned 9.41%, 9.04%, 8.49% and 8.48%, respectively (excluding sales charges), well behind the 16.20% return of the Russell Midcap® Growth Index and the 13.30% gain of the LipperSM Mid Cap Funds Average. Most of the underperformance versus the index occurred during the first half of the period, when several holdings in the phar maceuticals and biotechnology group particularly Biogen Idec and Ireland based Elan suffered steep declines. Questions about the safety of the companies’ jointly developed multiple sclerosis drug, Tysabri, and its voluntary withdrawal from the market early in 2005 hurt both stocks. I sold Elan and Biogen Idec shortly after taking over the fund in June. Elsewhere, Chinese online gaming stock Shanda Interactive Entertainment was one of my picks that didn’t work out. On the other hand, fund performance benefited from both an overweighting and stock selection in energy a sector I added to during the period. Biotechnology bellwether Genentech was by far the fund’s top contributor. Positive test results for a number of the company’s drugs fueled a strong advance in its stock, and I liquidated the position to lock in profits. Internet search engine Google was another strong contributor, its stock price lifted by several upward revisions in earnings growth.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, and (2) ongoing costs, including management fees, distribution and/or service (12b 1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (June 1, 2005 to November 30, 2005).

The first line of the table below for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | Expenses Paid |

| | | | | Beginning | | Ending | | During Period* |

| | | | | Account Value | | Account Value | | June 1, 2005 to |

| | | | | June 1, 2005 | | November 30, 2005 | | November 30, 2005 |

| Class A | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,087.80 | | $ | | 6.80 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,018.55 | | $ | | 6.58 |

| Class T | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,085.30 | | $ | | 8.10 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,017.30 | | $ | | 7.84 |

| Class B | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,082.30 | | $ | | 10.70 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,014.79 | | $ | | 10.35 |

| Class C | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,082.20 | | $ | | 10.70 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,014.79 | | $ | | 10.35 |

| Institutional Class | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,088.70 | | $ | | 5.50 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,019.80 | | $ | | 5.32 |

| |

| A 5% return per year before expenses | | | | | | | | |

* Expenses are equal to each Class’ annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one half year period).

| | | Annualized |

| | | Expense Ratio |

| Class A | | 1.30% |

| Class T | | 1.55% |

| Class B | | 2.05% |

| Class C | | 2.05% |

| Institutional Class | | 1.05% |

9 Annual Report

| Investment Changes | | | | |

| |

| |

| Top Ten Stocks as of November 30, 2005 | | | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| St. Jude Medical, Inc. | | 3.2 | | 0.0 |

| KB Home | | 2.6 | | 0.0 |

| Potash Corp. of Saskatchewan | | 2.5 | | 0.6 |

| Abercrombie & Fitch Co. Class A | | 2.1 | | 0.4 |

| D.R. Horton, Inc. | | 2.1 | | 0.0 |

| Google, Inc. Class A (sub. vtg.) | | 2.1 | | 0.7 |

| Urban Outfitters, Inc. | | 2.1 | | 0.0 |

| Ameritrade Holding Corp. | | 2.1 | | 0.3 |

| INAMED Corp. | | 2.0 | | 0.0 |

| Agrium, Inc. | | 2.0 | | 0.0 |

| | | 22.8 | | |

| Top Five Market Sectors as of November 30, 2005 | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Health Care | | 31.4 | | 29.2 |

| Information Technology | | 20.2 | | 26.9 |

| Consumer Discretionary | | 15.4 | | 17.1 |

| Energy | | 11.3 | | 7.3 |

| Materials | | 7.6 | | 3.2 |

Annual Report 10

| Investments November 30, 2005 | | |

| Showing Percentage of Net Assets | | | | | | |

| |

| Common Stocks 98.0% | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| CONSUMER DISCRETIONARY – 15.4% | | | | | | |

| Hotels, Restaurants & Leisure 2.6% | | | | | | |

| Kerzner International Ltd. (a) | | 1,900 | | $ | | 123,519 |

| Penn National Gaming, Inc. (a) | | 15,067 | | | | 499,772 |

| Station Casinos, Inc. | | 6,600 | | | | 457,644 |

| | | | | | | 1,080,935 |

| Household Durables – 4.8% | | | | | | |

| D.R. Horton, Inc. | | 24,561 | | | | 870,442 |

| KB Home | | 15,400 | | | | 1,074,458 |

| | | | | | | 1,944,900 |

| Media – 1.1% | | | | | | |

| Getty Images, Inc. (a) | | 4,980 | | | | 454,624 |

| Specialty Retail – 6.9% | | | | | | |

| Abercrombie & Fitch Co. Class A | | 14,300 | | | | 876,876 |

| Best Buy Co., Inc. | | 13,950 | | | | 672,948 |

| Tiffany & Co., Inc. | | 10,600 | | | | 431,420 |

| Urban Outfitters, Inc. (a) | | 27,300 | | | | 842,478 |

| | | | | | | 2,823,722 |

| |

| TOTAL CONSUMER DISCRETIONARY | | | | | | 6,304,181 |

| |

| CONSUMER STAPLES 2.0% | | | | | | |

| Food & Staples Retailing – 2.0% | | | | | | |

| Whole Foods Market, Inc. | | 5,610 | | | | 826,241 |

| ENERGY 11.3% | | | | | | |

| Energy Equipment & Services – 4.4% | | | | | | |

| Baker Hughes, Inc. | | 7,800 | | | | 447,330 |

| ENSCO International, Inc. | | 9,300 | | | | 440,448 |

| Halliburton Co. | | 7,400 | | | | 471,010 |

| Weatherford International Ltd. (a) | | 6,830 | | | | 474,753 |

| | | | | | | 1,833,541 |

| Oil, Gas & Consumable Fuels – 6.9% | | | | | | |

| Arch Coal, Inc. | | 5,600 | | | | 431,424 |

| Chesapeake Energy Corp. | | 14,400 | | | | 416,880 |

| EOG Resources, Inc. | | 8,800 | | | | 631,400 |

| Peabody Energy Corp. | | 5,300 | | | | 417,958 |

| |

| |

| |

| |

| See accompanying notes which are an integral part of the financial statements. | | | | |

| |

| 11 | | | | Annual Report |

| Investments continued | | | | | | |

| |

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| ENERGY – continued | | | | | | |

| Oil, Gas & Consumable Fuels – continued | | | | | | |

| Range Resources Corp. | | 12,500 | | $ | | 465,500 |

| Ultra Petroleum Corp. (a) | | 8,500 | | | | 457,130 |

| | | | | | | 2,820,292 |

| |

| TOTAL ENERGY | | | | | | 4,653,833 |

| |

| FINANCIALS – 2.8% | | | | | | |

| Capital Markets 2.1% | | | | | | |

| Ameritrade Holding Corp. (a) | | 35,900 | | | | 838,624 |

| Diversified Financial Services – 0.6% | | | | | | |

| Indiabulls Financial Services Ltd. | | 3,553 | | | | 12,763 |

| Indiabulls Financial Services Ltd. GDR (e) | | 11,268 | | | | 40,451 |

| IntercontinentalExchange, Inc. | | 6,500 | | | | 209,950 |

| | | | | | | 263,164 |

| Real Estate 0.1% | | | | | | |

| Sinochem Hong Kong Holding Ltd. (a) | | 189,200 | | | | 32,938 |

| |

| TOTAL FINANCIALS | | | | | | 1,134,726 |

| |

| HEALTH CARE – 31.4% | | | | | | |

| Biotechnology – 6.8% | | | | | | |

| Alnylam Pharmaceuticals, Inc. (a) | | 15,100 | | | | 189,656 |

| Amgen, Inc. (a) | | 7,500 | | | | 606,975 |

| Celgene Corp. (a) | | 11,640 | | | | 709,109 |

| Martek Biosciences (a) | | 16,300 | | | | 427,223 |

| MedImmune, Inc. (a) | | 12,110 | | | | 434,870 |

| Protein Design Labs, Inc. (a) | | 15,170 | | | | 422,485 |

| | | | | | | 2,790,318 |

| Health Care Equipment & Supplies – 16.7% | | | | | | |

| Alcon, Inc. | | 2,900 | | | | 406,580 |

| American Medical Systems Holdings, Inc. (a) | | 44,800 | | | | 824,320 |

| China Medical Technologies, Inc. sponsored ADR | | 3,400 | | | | 106,182 |

| Cyberonics, Inc. (a) | | 23,500 | | | | 662,935 |

| INAMED Corp. (a) | | 10,000 | | | | 838,400 |

| Integra LifeSciences Holdings Corp. (a) | | 12,000 | | | | 438,480 |

| Kyphon, Inc. (a) | | 9,500 | | | | 403,655 |

| Mentor Corp. | | 13,300 | | | | 648,242 |

| NeuroMetrix, Inc. (a) | | 6,406 | | | | 199,163 |

| NuVasive, Inc. (a) | | 20,600 | | | | 354,320 |

| ResMed, Inc. (a) | | 1,300 | | | | 53,040 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks continued | | | | |

| | | Shares | | Value (Note 1) |

| |

| HEALTH CARE – continued | | | | |

| Health Care Equipment & Supplies – continued | | | | |

| St. Jude Medical, Inc. (a) | | 28,000 | | $ 1,337,560 |

| Ventana Medical Systems, Inc. (a) | | 15,120 | | 582,271 |

| | | | | 6,855,148 |

| Health Care Providers & Services – 4.6% | | | | |

| Caremark Rx, Inc. (a) | | 8,400 | | 431,676 |

| Covance, Inc. (a) | | 9,100 | | 432,614 |

| Humana, Inc. (a) | | 13,850 | | 634,746 |

| Sierra Health Services, Inc. (a) | | 5,200 | | 406,744 |

| | | | | 1,905,780 |

| Pharmaceuticals – 3.3% | | | | |

| Allergan, Inc. | | 5,300 | | 530,000 |

| Medicis Pharmaceutical Corp. Class A | | 13,500 | | 430,785 |

| Sepracor, Inc. (a) | | 7,150 | | 393,107 |

| | | | | 1,353,892 |

| |

| TOTAL HEALTH CARE | | | | 12,905,138 |

| |

| INDUSTRIALS – 7.3% | | | | |

| Air Freight & Logistics – 2.7% | | | | |

| Expeditors International of Washington, Inc. | | 9,500 | | 674,595 |

| UTI Worldwide, Inc. | | 4,581 | | 445,685 |

| | | | | 1,120,280 |

| Commercial Services & Supplies – 1.2% | | | | |

| Stericycle, Inc. (a) | | 7,770 | | 476,456 |

| Construction & Engineering – 1.2% | | | | |

| Quanta Services, Inc. (a) | | 34,600 | | 489,590 |

| Electrical Equipment – 1.0% | | | | |

| AMETEK, Inc. | | 10,100 | | 430,361 |

| Machinery – 1.2% | | | | |

| Deere & Co. | | 7,000 | | 485,450 |

| |

| TOTAL INDUSTRIALS | | | | 3,002,137 |

| |

| INFORMATION TECHNOLOGY – 20.2% | | | | |

| Communications Equipment – 4.4% | | | | |

| ADC Telecommunications, Inc. (a) | | 28,100 | | 574,083 |

| Comverse Technology, Inc. (a) | | 23,473 | | 615,227 |

See accompanying notes which are an integral part of the financial statements.

13 Annual Report

| Investments continued | | | | | | |

| |

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| INFORMATION TECHNOLOGY – continued | | | | | | |

| Communications Equipment – continued | | | | | | |

| Corning, Inc. (a) | | 6,170 | | $ | | 124,943 |

| Ixia (a) | | 35,796 | | | | 493,269 |

| | | | | | | 1,807,522 |

| Computers & Peripherals – 1.1% | | | | | | |

| Sun Microsystems, Inc. (a) | | 112,300 | | | | 423,371 |

| Internet Software & Services – 3.1% | | | | | | |

| Google, Inc. Class A (sub. vtg.) (a) | | 2,100 | | | | 850,479 |

| VeriSign, Inc. (a) | | 19,600 | | | | 435,708 |

| | | | | | | 1,286,187 |

| Semiconductors & Semiconductor Equipment – 6.0% | | | | | | |

| ARM Holdings PLC sponsored ADR | | 73,300 | | | | 461,057 |

| ASML Holding NV (NY Shares) (a) | | 36,900 | | | | 707,004 |

| Microchip Technology, Inc. | | 17,570 | | | | 586,135 |

| National Semiconductor Corp. | | 17,600 | | | | 455,488 |

| PMC-Sierra, Inc. (a) | | 34,030 | | | | 267,816 |

| | | | | | | 2,477,500 |

| Software 5.6% | | | | | | |

| Activision, Inc. (a) | | 31,210 | | | | 415,405 |

| Citrix Systems, Inc. (a) | | 14,670 | | | | 398,144 |

| Cognos, Inc. (a) | | 12,500 | | | | 417,935 |

| Hyperion Solutions Corp. (a) | | 8,732 | | | | 462,359 |

| Shanda Interactive Entertainment Ltd. sponsored ADR (a)(d) | | 35,100 | | | | 599,859 |

| | | | | | | 2,293,702 |

| |

| TOTAL INFORMATION TECHNOLOGY | | | | | | 8,288,282 |

| |

| MATERIALS 7.6% | | | | | | |

| Chemicals – 6.6% | | | | | | |

| Agrium, Inc. | | 41,100 | | | | 837,186 |

| Monsanto Co. | | 11,400 | | | | 835,278 |

| Potash Corp. of Saskatchewan | | 14,100 | | | | 1,027,235 |

| | | | | | | 2,699,699 |

| Construction Materials 1.0% | | | | | | |

| Martin Marietta Materials, Inc. | | 5,800 | | | | 435,638 |

| |

| TOTAL MATERIALS | | | | | | 3,135,337 |

| |

| TOTAL COMMON STOCKS | | | | | | |

| (Cost $38,478,860) | | | | 40,249,875 |

See accompanying notes which are an integral part of the financial statements.

| Money Market Funds 1.8% | | | | | | | | |

| | | Shares | | | | Value (Note 1) |

| Fidelity Cash Central Fund, 4.08% (b) | | 505,186 | | | | | | $ 505,186 |

| Fidelity Securities Lending Cash Central Fund, 4.09% (b)(c) | | 234,500 | | | | | | 234,500 |

| TOTAL MONEY MARKET FUNDS | | | | | | | | |

| (Cost $739,686) | | | | | | | | 739,686 |

| TOTAL INVESTMENT PORTFOLIO 99.8% | | | | | | | | |

| (Cost $39,218,546) | | | | | | 40,989,561 |

| |

| NET OTHER ASSETS – 0.2% | | | | | | | | 97,262 |

| NET ASSETS 100% | | | | | | $ 41,086,823 |

Legend

(a) Non-income producing

(b) Affiliated fund that is available only to

investment companies and other

accounts managed by Fidelity

Investments. The rate quoted is the

annualized seven-day yield of the fund

at period end. A complete unaudited

listing of the fund’s holdings as of its

most recent quarter end is available

upon request.

|

(c) Investment made with cash collateral

received from securities on loan.

(d) Security or a portion of the security is on

loan at period end.

(e) Security exempt from registration under

Rule 144A of the Securities Act of 1933.

These securities may be resold in

transactions exempt from registration,

normally to qualified institutional buyers.

At the period end, the value of these

securities amounted to $40,451 or 0.1%

of net assets.

|

Affiliated Central Funds

Information regarding income received by the fund from the affiliated Central funds during the period is as follows:

| Fund | | | | Income received |

| Fidelity Cash Central Fund | | | $ | 31,473 |

| Fidelity Securities Lending Cash Central Fund | | | | 13,012 |

| Total | | | $ | 44,485 |

See accompanying notes which are an integral part of the financial statements.

15 Annual Report

Investments continued

Other Information

Distribution of investments by country of issue, as a percentage of total net assets, is as follows:

| United States of America | | 86.1% |

| Canada | | 6.7% |

| Netherlands | | 1.7% |

| China | | 1.5% |

| United Kingdom | | 1.1% |

| British Virgin Islands | | 1.1% |

| Switzerland | | 1.0% |

| Others (individually less than 1%) . | | 0.8% |

| | | 100.0% |

Income Tax Information

At November 30, 2005, the fund had a capital loss carryforward of approximately $4,868,687 all of which will expire on November 30, 2010.

See accompanying notes which are an integral part of the financial statements.

Annual Report 16

| Financial Statements | | | | | | | | |

| |

| |

| Statement of Assets and Liabilities | | | | | | | | |

| | | | | | | November 30, 2005 |

| |

| Assets | | | | | | | | |

| Investment in securities, at value (including securities | | | | | | | | |

| loaned of $229,006) See accompanying schedule: | | | | | | | | �� |

| Unaffiliated issuers (cost $38,478,860) | | $ | | 40,249,875 | | | | |

| Affiliated Central Funds (cost $739,686) | | | | 739,686 | | | | |

| Total Investments (cost $39,218,546) | | | | | | $ | | 40,989,561 |

| Receivable for investments sold | | | | | | | | 1,186,148 |

| Receivable for fund shares sold | | | | | | | | 19,576 |

| Dividends receivable | | | | | | | | 10,260 |

| Interest receivable | | | | | | | | 3,679 |

| Prepaid expenses | | | | | | | | 223 |

| Receivable from investment adviser for expense | | | | | | | | |

| reductions | | | | | | | | 2,639 |

| Other receivables | | | | | | | | 7,105 |

| Total assets | | | | | | | | 42,219,191 |

| |

| Liabilities | | | | | | | | |

| Payable to custodian bank | | $ | | 15,305 | | | | |

| Payable for investments purchased | | | | 721,481 | | | | |

| Payable for fund shares redeemed | | | | 71,871 | | | | |

| Accrued management fee | | | | 21,212 | | | | |

| Distribution fees payable | | | | 22,525 | | | | |

| Other affiliated payables | | | | 12,992 | | | | |

| Other payables and accrued expenses | | | | 32,482 | | | | |

| Collateral on securities loaned, at value | | | | 234,500 | | | | |

| Total liabilities | | | | | | | | 1,132,368 |

| |

| Net Assets | | | | | | $ | | 41,086,823 |

| Net Assets consist of: | | | | | | | | |

| Paid in capital | | | | | | $ | | 44,331,194 |

| Accumulated undistributed net realized gain (loss) on | | | | | | | | |

| investments and foreign currency transactions | | | | | | | | (5,015,392) |

| Net unrealized appreciation (depreciation) on | | | | | | | | |

| investments and assets and liabilities in foreign | | | | | | | | |

| currencies | | | | | | | | 1,771,021 |

| Net Assets | | | | | | $ | | 41,086,823 |

See accompanying notes which are an integral part of the financial statements.

17 Annual Report

| Financial Statements continued | | | | | | |

| |

| Statement of Assets and Liabilities continued | | | | |

| | | | | November 30, 2005 |

| |

| Calculation of Maximum Offering Price | | | | | | |

| Class A: | | | | | | |

| Net Asset Value and redemption price per share | | | | | | |

| ($7,206,274 ÷ 765,380 shares) | | | | $ | | 9.42 |

| Maximum offering price per share (100/94.25 of $9.42) | | . | | $ | | 9.99 |

| Class T: | | | | | | |

| Net Asset Value and redemption price per share | | | | | | |

| ($16,331,474 ÷ 1,757,820 shares) | | | | $ | | 9.29 |

| Maximum offering price per share (100/96.50 of $9.29) | | . | | $ | | 9.63 |

| Class B: | | | | | | |

| Net Asset Value and offering price per share | | | | | | |

| ($9,236,782 ÷ 1,018,397 shares)A | | | | $ | | 9.07 |

| Class C: | | | | | | |

| Net Asset Value and offering price per share | | | | | | |

| ($7,790,540 ÷ 857,606 shares)A | | | | $ | | 9.08 |

| Institutional Class: | | | | | | |

| Net Asset Value, offering price and redemption price per | | | | |

| ��share ($521,753 ÷ 54,546 shares) | | | | $ | | 9.57 |

| |

| A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | | | | |

See accompanying notes which are an integral part of the financial statements.

Annual Report 18

| Statement of Operations | | | | | | |

| | | | | Year ended November 30, 2005 |

| |

| Investment Income | | | | | | |

| Dividends | | | | $ | | 179,184 |

| Special dividends | | | | | | 25,350 |

| Interest | | | | | | 174 |

| Income from affiliated Central Funds (including $14,741 | | | | |

| from security lending) | | | | | | 44,485 |

| Total income | | | | | | 249,193 |

| |

| Expenses | | | | | | |

| Management fee | | $ | | 248,991 | | |

| Transfer agent fees | | | | 163,113 | | |

| Distribution fees | | | | 267,185 | | |

| Accounting and security lending fees | | | | 19,495 | | |

| Independent trustees’ compensation | | | | 184 | | |

| Custodian fees and expenses | | | | 24,524 | | |

| Registration fees | | | | 52,965 | | |

| Audit | | | | 40,084 | | |

| Legal | | | | 678 | | |

| Miscellaneous | | | | 1,794 | | |

| Total expenses before reductions | | | | 819,013 | | |

| Expense reductions | | | | (150,331) | | 668,682 |

| |

| Net investment income (loss) | | | | | | (419,489) |

| Realized and Unrealized Gain (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

| Unaffiliated issuers | | | | 6,396,199 | | |

| Foreign currency transactions | | | | (848) | | |

| Total net realized gain (loss) | | | | | | 6,395,351 |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment securities | | | | (2,534,840) | | |

| Assets and liabilities in foreign currencies | | | | (52) | | |

| Total change in net unrealized appreciation | | | | | | |

| (depreciation) | | | | | | (2,534,892) |

| Net gain (loss) | | | | | | 3,860,459 |

| Net increase (decrease) in net assets resulting from | | | | | | |

| operations | | | | $ | | 3,440,970 |

See accompanying notes which are an integral part of the financial statements.

19 Annual Report

| Financial Statements continued | | | | | | | | |

| |

| |

| Statement of Changes in Net Assets | | | | | | | | |

| | | | | Year ended | | | | Year ended |

| | | | | November 30, | | | | November 30, |

| | | | | 2005 | | | | 2004 |

| Increase (Decrease) in Net Assets | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income (loss) | | $ | | (419,489) | | $ | | (559,618) |

| Net realized gain (loss) | | | | 6,395,351 | | | | 3,516,046 |

| Change in net unrealized appreciation (depreciation) . | | | | (2,534,892) | | | | (473,553) |

| Net increase (decrease) in net assets resulting | | | | | | | | |

| from operations | | | | 3,440,970 | | | | 2,482,875 |

| Share transactions - net increase (decrease) | | | | (3,060,326) | | | | 4,161,402 |

| Total increase (decrease) in net assets | | | | 380,644 | | | | 6,644,277 |

| |

| Net Assets | | | | | | | | |

| Beginning of period | | | | 40,706,179 | | | | 34,061,902 |

| End of period | | $ | | 41,086,823 | | $ | | 40,706,179 |

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights Class A | | | | | | | | | | | | | | | | |

| Years ended November 30, | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 | | | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of | | | | | | | | | | | | | | | | | | |

| period | | $ 8.61 | | $ | | 8.02 | | $ | | 6.47 | | $ | | 8.08 | | $ | | 9.05 |

| Income from Investment | | | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | | | | | | | |

| (loss)C | | (.06)D | | | | (.09) | | | | (.06) | | | | (.08) | | | | (.01) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | |

| gain (loss) | | 87 | | | | .68 | | | | 1.61 | | | | (1.53) | | | | (.95) |

| Total from investment | | | | | | | | | | | | | | | | | | |

| operations | | 81 | | | | .59 | | | | 1.55 | | | | (1.61) | | | | (.96) |

| Distributions from net realized | | | | | | | | | | | | | | | | | | |

| gain | | — | | | | — | | | | — | | | | — | | | | (.01) |

| Net asset value, end of period | | $ 9.42 | | $ | | 8.61 | | $ | | 8.02 | | $ | | 6.47 | | $ | | 8.08 |

| Total ReturnA,B | | 9.41% | | | | 7.36% | | | | 23.96% | | | | (19.93)% | | | | (10.62)% |

| Ratios to Average Net AssetsE | | | | | | | | | | | | | | | | | | |

| Expenses before reductions . | | 1.60% | | | | 1.90% | | | | 2.25% | | | | 2.05% | | | | 2.06% |

| Expenses net of fee waivers, | | | | | | | | | | | | | | | | | | |

| if any | | 1.33% | | | | 1.50% | | | | 1.54% | | | | 1.69% | | | | 1.75% |

| Expenses net of all | | | | | | | | | | | | | | | | | | |

| reductions | | 1.25% | | | | 1.45% | | | | 1.47% | | | | 1.49% | | | | 1.71% |

| Net investment income (loss) | | (.63)%D | | | | (1.03)% | | | | (.89)% | | | | (1.07)% | | | | (.14)% |

| Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | | | | | | | | | | | | | | | | | |

| (000 omitted) | | $ 7,206 | | $ | | 6,227 | | $ | | 4,177 | | $ | | 2,620 | | $ | | 3,320 |

| Portfolio turnover rate | | 213% | | | | 94% | | | | 158% | | | | 473% | | | | 481% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Investment income per share reflects a special dividend which amounted to $.01 per share. Excluding the special dividend, the ratio of net

investment income to average net assets would have been (.69)%.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but

prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net

expenses paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

21 Annual Report

| Financial Highlights Class T | | | | | | | | |

| Years ended November 30, | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| Selected Per Share Data | | | | | | | | | | |

| Net asset value, beginning of | | | | | | | | | | |

| period | | $ 8.52 | | $ 7.95 | | $ 6.43 | | $ 8.06 | | $ 9.05 |

| Income from Investment | | | | | | | | | | |

| Operations | | | | | | | | | | |

| Net investment income | | | | | | | | | | |

| (loss)C | | (.08)D | | (.11) | | (.08) | | (.10) | | (.03) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) | | 85 | | .68 | | 1.60 | | (1.53) | | (.95) |

| Total from investment | | | | | | | | | | |

| operations | | 77 | | .57 | | 1.52 | | (1.63) | | (.98) |

| Distributions from net realized | | | | | | | | | | |

| gain | | — | | — | | — | | — | | (.01) |

| Net asset value, end of period | | $ 9.29 | | $ 8.52 | | $ 7.95 | | $ 6.43 | | $ 8.06 |

| Total ReturnA,B | | 9.04% | | 7.17% | | 23.64% | | (20.22)% | | (10.84)% |

| Ratios to Average Net AssetsE | | | | | | | | | | |

| Expenses before reductions . | | 1.93% | | 2.25% | | 2.47% | | 2.16% | | 2.30% |

| Expenses net of fee waivers, | | | | | | | | | | |

| if any | | 1.58% | | 1.75% | | 1.79% | | 1.92% | | 2.00% |

| Expenses net of all | | | | | | | | | | |

| reductions | | 1.50% | | 1.71% | | 1.72% | | 1.72% | | 1.96% |

| Net investment income (loss) | | (.88)%D | | (1.28)% | | (1.14)% | | (1.29)% | | (.39)% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period | | | | | | | | | | |

| (000 omitted) | | $16,331 | | $15,101 | | $12,458 | | $10,511 | | $14,165 |

| Portfolio turnover rate | | 213% | | 94% | | 158% | | 473% | | 481% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Investment income per share reflects a special dividend which amounted to $.01 per share. Excluding the special dividend, the ratio of net

investment income to average net assets would have been (.94)%.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but

prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net

expenses paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights Class B | | | | | | | | | | | | | | | | |

| Years ended November 30, | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 | | | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of | | | | | | | | | | | | | | | | | | |

| period | | $ 8.36 | | $ | | 7.84 | | $ | | 6.37 | | $ | | 8.02 | | $ | | 9.05 |

| Income from Investment | | | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | | | | | | | |

| (loss)C | | (.12)D | | | | (.14) | | | | (.11) | | | | (.13) | | | | (.08) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | |

| gain (loss) | | 83 | | | | .66 | | | | 1.58 | | | | (1.52) | | | | (.94) |

| Total from investment | | | | | | | | | | | | | | | | | | |

| operations | | 71 | | | | .52 | | | | 1.47 | | | | (1.65) | | | | (1.02) |

| Distributions from net realized | | | | | | | | | | | | | | | | | | |

| gain | | — | | | | — | | | | — | | | | — | | | | (.01) |

| Net asset value, end of period | | $ 9.07 | | $ | | 8.36 | | $ | | 7.84 | | $ | | 6.37 | | $ | | 8.02 |

| Total ReturnA,B | | 8.49% | | | | 6.63% | | | | 23.08% | | | | (20.57)% | | | | (11.29)% |

| Ratios to Average Net AssetsE | | | | | | | | | | | | | | | | | | |

| Expenses before reductions . | | 2.35% | | | | 2.67% | | | | 2.92% | | | | 2.73% | | | | 2.86% |

| Expenses net of fee waivers, | | | | | | | | | | | | | | | | | | |

| if any | | 2.09% | | | | 2.25% | | | | 2.25% | | | | 2.43% | | | | 2.50% |

| Expenses net of all | | | | | | | | | | | | | | | | | | |

| reductions | | 2.00% | | | | 2.21% | | | | 2.18% | | | | 2.23% | | | | 2.46% |

| Net investment income (loss) | | (1.38)%D | | | | (1.78)% | | | | (1.60)% | | | | (1.81)% | | | | (.89)% |

| Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | | | | | | | | | | | | | | | | | |

| (000 omitted) | | $ 9,237 | | $ | | 9,593 | | $ | | 8,422 | | $ | | 6,262 | | $ | | 8,038 |

| Portfolio turnover rate | | 213% | | | | 94% | | | | 158% | | | | 473% | | | | 481% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Investment income per share reflects a special dividend which amounted to $.01 per share. Excluding the special dividend, the ratio of net

investment income to average net assets would have been (1.44)% .

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but

prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net

expenses paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

23 Annual Report

| Financial Highlights Class C | | | | | | | | | | | | | | | | |

| Years ended November 30, | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 | | | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of | | | | | | | | | | | | | | | | | | |

| period | | $ 8.37 | | $ | | 7.85 | | $ | | 6.38 | | $ | | 8.03 | | $ | | 9.05 |

| Income from Investment | | | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | | | | | | | |

| (loss)C | | (.12)D | | | | (.14) | | | | (.11) | | | | (.13) | | | | (.08) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | |

| gain (loss) | | 83 | | | | .66 | | | | 1.58 | | | | (1.52) | | | | (.93) |

| Total from investment | | | | | | | | | | | | | | | | | | |

| operations | | 71 | | | | .52 | | | | 1.47 | | | | (1.65) | | | | (1.01) |

| Distributions from net realized | | | | | | | | | | | | | | | | | | |

| gain | | — | | | | — | | | | — | | | | — | | | | (.01) |

| Net asset value, end of period | | $ 9.08 | | $ | | 8.37 | | $ | | 7.85 | | $ | | 6.38 | | $ | | 8.03 |

| Total ReturnA,B | | 8.48% | | | | 6.62% | | | | 23.04% | | | | (20.55)% | | | | (11.18)% |

| Ratios to Average Net AssetsE | | | | | | | | | | | | | | | | | | |

| Expenses before reductions . | | 2.34% | | | | 2.52% | | | | 2.77% | | | | 2.58% | | | | 2.79% |

| Expenses net of fee waivers, | | | | | | | | | | | | | | | | | | |

| if any | | 2.09% | | | | 2.25% | | | | 2.25% | | | | 2.36% | | | | 2.50% |

| Expenses net of all | | | | | | | | | | | | | | | | | | |

| reductions | | 2.01% | | | | 2.21% | | | | 2.18% | | | | 2.16% | | | | 2.46% |

| Net investment income (loss) | | (1.38)%D | | | | (1.78)% | | | | (1.61)% | | | | (1.74)% | | | | (.89)% |

| Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | | | | | | | | | | | | | | | | | |

| (000 omitted) | | $ 7,791 | | $ | | 9,136 | | $ | | 8,427 | | $ | | 6,636 | | $ | | 8,532 |

| Portfolio turnover rate | | 213% | | | | 94% | | | | 158% | | | | 473% | | | | 481% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Investment income per share reflects a special dividend which amounted to $.01 per share. Excluding the special dividend, the ratio of net

investment income to average net assets would have been (1.44)% .

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but

prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net

expenses paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights Institutional Class | | | | | | | | | | | | |

| Years ended November 30, | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 | | | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of | | | | | | | | | | | | | | | | | | | | |

| period | | $ | | 8.73 | | $ | | 8.10 | | $ | | 6.52 | | $ | | 8.11 | | $ | | 9.06 |

| Income from Investment | | | | | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | | | | | | | | | |

| (loss)B | | | | (.03)C | | | | (.07) | | | | (.04) | | | | (.05) | | | | .01 |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) | | | | 87 | | | | .70 | | | | 1.62 | | | | (1.54) | | | | (.95) |

| Total from investment | | | | | | | | | | | | | | | | | | | | |

| operations | | | | 84 | | | | .63 | | | | 1.58 | | | | (1.59) | | | | (.94) |

| Distributions from net realized | | | | | | | | | | | | | | | | | | | | |

| gain | | | | — | | | | — | | | | — | | | | — | | | | (.01) |

| Net asset value, end of period | | $ | | 9.57 | | $ | | 8.73 | | $ | | 8.10 | | $ | | 6.52 | | $ | | 8.11 |

| Total ReturnA | | | | 9.62% | | | | 7.78% | | | | 24.23% | | | | (19.61)% | | | | (10.39)% |

| Ratios to Average Net AssetsD | | | | | | | | | | | | | | | | | | | | |

| Expenses before reductions . | | | | 1.28% | | | | 1.35% | | | | 1.61% | | | | 1.43% | | | | 1.73% |

| Expenses net of fee waivers, | | | | | | | | | | | | | | | | | | | | |

| if any | | | | 1.09% | | | | 1.25% | | | | 1.25% | | | | 1.27% | | | | 1.50% |

| Expenses net of all | | | | | | | | | | | | | | | | | | | | |

| reductions | | | | 1.01% | | | | 1.20% | | | | 1.18% | | | | 1.07% | | | | 1.46% |

| Net investment income (loss) | | | | (.38)%C | | | | (.78)% | | | | (.61)% | | | | (.64)% | | | | .11% |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | | | | | | | | | | | | | | | | | | | |

| (000 omitted) | | $ | | 522 | | $ | | 648 | | $ | | 579 | | $ | | 513 | | $ | | 761 |

| Portfolio turnover rate | | | | 213% | | | | 94% | | | | 158% | | | | 473% | | | | 481% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Calculated based on average shares outstanding during the period.

C Investment income per share reflects a special dividend which amounted to $.01 per share. Excluding the special dividend, the ratio of net

investment income to average net assets would have been (.44)%.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but

prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net

expenses paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

25 Annual Report

Notes to Financial Statements

For the period ended November 30, 2005

1. Significant Accounting Policies.

Fidelity Advisor Aggressive Growth Fund (the fund) is a fund of Fidelity Securities Fund (the trust) and is authorized to issue an unlimited number of shares. The trust is regis tered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open end management investment company organized as a Massachusetts business trust.

The fund offers Class A, Class T, Class B, Class C and Institutional Class shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase. Investment income, realized and unrealized capital gains and losses, the common expenses of the fund, and certain fund level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions also differ by class.

The fund may invest in affiliated money market central funds (Money Market Central Funds) which are open end investment companies available to investment companies and other accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require manage ment to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Investments are valued and net asset value (NAV) per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Wherever possible, the fund uses independent pricing services approved by the Board of Trustees to value its investments.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price. Investments in open end mutual funds are valued at their closing net asset value each business day. Short term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accordance with procedures adopted by the Board of Trustees. For example, when developments occur between the close of a

| 1. Significant Accounting Policies continued |

Security Valuation - continued | | |

market and the close of the NYSE that may materially affect the value of some or all of the securities, or when trading in a security is halted, those securities may be fair valued. Factors used in the determination of fair value may include monitoring news to identify significant market or security specific events such as changes in the value of U.S. securi ties market, reviewing developments in foreign markets and evaluating the performance of ADRs, futures contracts and exchange traded funds. Because the fund’s utilization of fair value pricing depends on market activity, the frequency with which fair value pricing is used can not be predicted and may be utilized to a significant extent. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities.

Foreign Currency. The fund uses foreign currency contracts to facilitate transactions in foreign denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts’ terms.

Foreign denominated assets, including investment securities, and liabilities are trans lated into U.S. dollars at the exchange rate at period end. Purchases and sales of invest ment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transac tion date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex dividend date, except for certain dividends from foreign securities where the ex dividend date may have passed, which are recorded as soon as the fund is informed of the ex dividend date. Non cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. Large, non recurring dividends recognized by the fund are presented separately on the Statement of Operations as “Special Dividends” and the impact of these dividends to net investment income per share is presented in the Financial Highlights. Interest income is accrued as earned. Interest income includes coupon interest and

27 Annual Report

Notes to Financial Statements continued

1. Significant Accounting Policies continued

Investment Transactions and Income continued

amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each fund in the trust.

Income Tax Information and Distributions to Shareholders. Each year, the fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on the fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distribu tions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Capital accounts within the financial statements are adjusted for permanent book tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book tax differences will reverse in a subsequent period.

Book tax differences are primarily due to foreign currency transactions, net operating losses, capital loss carryforwards and losses deferred due to wash sales.

The tax basis components of distributable earnings and the federal tax cost as of period end were as follows:

| Unrealized appreciation | | $ | | 3,856,048 |

| Unrealized depreciation | | | | (2,231,737) |

| Net unrealized appreciation (depreciation) | | | | 1,624,311 |

| Capital loss carryforward | | | | (4,868,687) |

| |

| Cost for federal income tax purposes | | $ | | 39,365,250 |

| |

| |

| 2. Operating Policies. | | | | |

Repurchase Agreements. Fidelity Management & Research Company (FMR) has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The fund may also invest directly with institutions in repurchase agreements.

2. Operating Policies continued

Repurchase Agreements continued

Repurchase agreements are collateralized by government or non government securities. Collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

Restricted Securities. The fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transac tions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the fund’s Schedule of Investments.

3. Purchases and Sales of Investments.

Purchases and sales of securities, other than short term securities and U.S. government securities, aggregated $83,741,320 and $86,961,259, respectively.

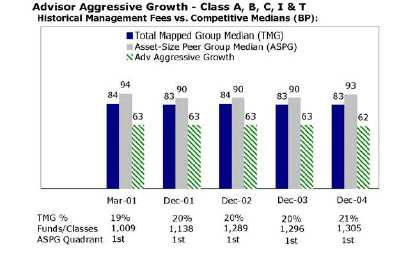

4. Fees and Other Transactions with Affiliates.

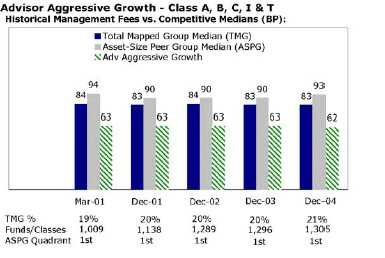

Management Fee. FMR and its affiliates provide the fund with investment manage ment related services for which the fund pays a monthly management fee. The manage ment fee is the sum of an individual fund fee rate that is based on an annual rate of .35% of the fund’s average net assets and a group fee rate that averaged .27% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the period, the total annual man agement fee rate was .62% of the fund’s average net assets.

Distribution and Service Plan. In accordance with Rule 12b 1 of the 1940 Act, the fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of FMR, separate Distribution and Service Fees, each of which is based on an annual percentage of each class’ average net assets. In addition, FDC may pay financial intermediaries for selling shares of the fund and providing shareholder support services. For the period, the

29 Annual Report

| Notes to Financial Statements continued | | |

| |

| 4. Fees and Other Transactions with Affiliates continued |

Distribution and Service Plan continued | | |

Distribution and Service Fee rates and the total amounts paid to and retained by FDC were as follows:

| | | Distribution | | Service | | | | Paid to | | | | Retained |

| | | Fee | | Fee | | | | FDC | | | | by FDC |

| Class A | | 0% | | .25% | | $ | | 16,640 | | $ | | 84 |

| Class T | | 25% | | .25% | | | | 78,040 | | | | 55 |

| Class B | | 75% | | .25% | | | | 91,900 | | | | 68,924 |

| Class C | | 75% | | .25% | | | | 80,605 | | | | 9,071 |

| | | | | | | $ | | 267,185 | | $ | | 78,134 |

Sales Load. FDC receives a front end sales charge of up to 5.75% for selling Class A shares, and 3.50% for selling Class T shares, some of which is paid to financial intermedi aries for selling shares of the fund. FDC receives the proceeds of contingent deferred sales charges levied on Class A, Class T, Class B, and Class C redemptions. These charges depend on the holding period. The deferred sales charges range from 5% to 1% for Class B, 1% for Class C, and .25% for certain purchases of Class A and Class T shares.

For the period, sales charge amounts retained by FDC were as follows:

| | |

| | | | | Retained |

| | | | | by FDC |

| Class A | | | $ | 9,510 |

| Class T | | | | 12,616 |

| Class B* | | | | 37,989 |

| Class C* | | | | 1,521 |

| | | $ | | 61,636 |

* When Class B and Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of FMR, is the transfer, dividend disbursing and shareholder servic ing agent for each class of the fund. FIIOC receives account fees and asset based fees that vary according to the account size and type of account of the shareholders of the respective classes of the fund. FIIOC pays for typesetting, printing and mailing of share holder reports, except proxy statements. For the period the total transfer agent fees paid

| 4. Fees and Other Transactions with Affiliates continued |

| |

| Transfer Agent Fees continued | | | | |

| |

| by each class to FIIOC, were as follows: | | | | |

| | | | | | | % of Average |

| | | | | Amount | | Net Assets |

| Class A | | $ | | 25,250 | | .38 |

| Class T | | | | 71,752 | | .46 |

| Class B | | | | 34,699 | | .38 |

| Class C | | | | 29,674 | | .37 |

| Institutional Class | | | | 1,738 | | .31 |

| | | $ | | 163,113 | | |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, maintains the fund’s accounting records. The accounting fee is based on the level of average net assets for the month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Affiliated Central Funds. The fund may invest in Money Market Central Funds which seek preservation of capital and current income and are managed by Fidelity Invest ments Money Management, Inc. (FIMM), an affiliate of FMR.

The Money Market Central Funds do not pay a management fee.

Brokerage Commissions. The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $2,250 for the period.

5. Committed Line of Credit.

|

The fund participates with other funds managed by FMR in a $4.2 billion credit facility (the “line of credit”) to be utilized for temporary or emergency purposes to fund share holder redemptions or for other short term liquidity purposes. The fund has agreed to pay commitment fees on its pro rata portion of the line of credit. During the period, there were no borrowings on this line of credit.

The fund lends portfolio securities from time to time in order to earn additional income. The fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the fund

31 Annual Report

Notes to Financial Statements continued

6. Security Lending continued

and any additional required collateral is delivered to the fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insol vency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. Cash collateral is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the fund’s Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less fees and expenses associated with the loan, plus any premium payments that may be received on the loan of certain types of securities.

FMR voluntarily agreed to reimburse each class to the extent annual operating expenses exceeded certain levels of average net assets as noted in the table below. Some expenses, for example interest expense, are excluded from this reimbursement.

The following classes were in reimbursement during the period:

| | | | |

| | | Expense | | | | Reimbursement |

| | | Limitations | | | | from adviser |

| Class A | | 1.50% - 1.30%* | | $ | | 17,727 |

| Class T | | 1.75% - 1.55%* | | | | 53,916 |

| Class B | | 2.25% - 2.05%* | | | | 24,000 |

| Class C | | 2.25% - 2.05%* | | | | 20,183 |

| Institutional Class | | 1.25% - 1.05%* | | | | 1,073 |

| | | | | | | | | $ | | 116,899 |

| * Expense limitation in effect at period end. | | | | | | | | | | |

Many of the brokers with whom FMR places trades on behalf of the fund provided services to the fund in addition to trade execution. These services included payments of certain expenses on behalf of the fund totaling $33,432 for the period.

The fund’s organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the perfor mance of their duties to the fund. In the normal course of business, the fund may also enter into contracts that provide general indemnifications. The fund’s maximum expo sure under these arrangements is unknown as this would be dependent on future claims that may be made against the fund. The risk of material loss from such claims is considered remote.

| 9. Share Transactions. | | | | | | | | | | |

| |

| Transactions for each class of shares were as follows: | | | | | | | | |

| |

| | | Shares | | | | Dollars |

| Years ended November 30, | | 2005 | | 2004 | | | | 2005 | | | | 2004 |

| Class A | | | | | | | | | | | | |

| Shares sold | | 270,002 | | 377,272 | | $ | | 2,351,220 | | $ | | 3,139,679 |

| Shares redeemed | | (227,735) | | (175,236) | | | | (2,008,944) | | | | (1,453,350) |

| Net increase (decrease) . | | 42,267 | | 202,036 | | $ | | 342,276 | | $ | | 1,686,329 |

| Class T | | | | | | | | | | | | |

| Shares sold | | 613,840 | | 758,262 | | $ | | 5,303,116 | | $ | | 6,209,847 |

| Shares redeemed | | (628,481) | | (552,792) | | | | (5,486,557) | | | | (4,525,646) |

| Net increase (decrease) . | | (14,641) | | 205,470 | | $ | | (183,441) | | $ | | 1,684,201 |

| Class B | | | | | | | | | | | | |

| Shares sold | | 183,867 | | 359,634 | | $ | | 1,559,053 | | $ | | 2,916,093 |

| Shares redeemed | | (313,200) | | (286,300) | | | | (2,654,466) | | | | (2,305,579) |

| Net increase (decrease) . | | (129,333) | | 73,334 | | $ | | (1,095,413) | | $ | | 610,514 |

| Class C | | | | | | | | | | | | |

| Shares sold | | 159,513 | | 368,284 | | $ | | 1,357,035 | | $ | | 2,975,514 |

| Shares redeemed | | (393,180) | | (350,351) | | | | (3,315,155) | | | | (2,819,767) |

| Net increase (decrease) . | | (233,667) | | 17,933 | | $ | | (1,958,120) | | $ | | 155,747 |

| Institutional Class | | | | | | | | | | | | |

| Shares sold | | 10,062 | | 22,481 | | $ | | 90,084 | | $ | | 187,161 |

| Shares redeemed | | (29,827) | | (19,658) | | | | (255,712) | | | | (162,550) |

| Net increase (decrease) . | | (19,765) | | 2,823 | | $ | | (165,628) | | $ | | 24,611 |

33 Annual Report

Report of Independent Registered Public Accounting Firm

To the Trustees of Fidelity Securities Fund and the Shareholders of Fidelity Advisor Aggressive Growth Fund:

In our opinion, the accompanying statement of assets and liabilities, including the sched ule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Fidelity Advisor Aggressive Growth Fund (a fund of Fidelity Securities Fund) at Novem ber 30, 2005 and the results of its operations, the changes in its net assets and the financial highlights for the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fidelity Advisor Aggressive Growth Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at November 30, 2005 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

PricewaterhouseCoopers LLP

Boston, Massachusetts

January 17, 2006

|

Trustees and Officers

The Trustees, Members of the Advisory Board, and executive officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund’s activities, review contractual arrangements with companies that provide services to the fund, and review the fund’s performance. Except for William O. McCoy, each of the Trustees oversees 326 funds advised by FMR or an affiliate. Mr. McCoy oversees 328 funds advised by FMR or an affiliate.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instru ment signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) (Independent Trustee), shall retire not later than the last day of the calendar year in which his or her 72nd birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. The executive officers and Advisory Board Members hold office without limit in time, except that any officer and Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund’s Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-877-208-0098.

Correspondence intended for each Trustee who is an interested person may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

| | Name, Age; Principal Occupation

Edward C. Johnson 3d (75)

|

Year of Election or Appointment: 1984

Mr. Johnson is Chairman of the Board of Trustees. Mr. Johnson serves as Chief Executive Officer, Chairman, and a Director of FMR Corp.; a Di rector and Chairman of the Board and of the Executive Committee of FMR; Chairman and a Director of Fidelity Management & Research (Far East) Inc.; Chairman and a Director of Fidelity Investments Money Man agement, Inc.; and Chairman (2001 present) and a Director (2000 present) of FMR Co., Inc.

35 Annual Report

Trustees and Officers - continued

| | Name, Age; Principal Occupation

Stephen P. Jonas (52)

|

Year of Election or Appointment: 2005

Mr. Jonas is Senior Vice President of Advisor Aggressive Growth (2005 present). He also serves as Senior Vice President of other Fidelity funds (2005 present). Mr. Jonas is Executive Director of FMR

(2005 present). Previously, Mr. Jonas served as President of Fidelity En terprise Operations and Risk Services (2004 2005), Chief Administra tive Officer (2002 2004), and Chief Financial Officer of FMR Co. (1998 2000). Mr. Jonas has been with Fidelity Investments since 1987 and has held various financial and management positions including Chief Financial Officer of FMR. In addition, he serves on the Boards of Boston Ballet (2003 present) and Simmons College (2003 present).

Year of Election or Appointment: 2003

Mr. Reynolds is a Director (2003 present) and Chief Operating Officer (2002 present) of FMR Corp. He also serves on the Board at Fidelity Investments Canada, Ltd. (2000 present). Previously, Mr. Reynolds served as President of Fidelity Investments Institutional Retirement Group (1996 2000).