UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4118

Fidelity Securities Fund

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | July 31 |

| |

Date of reporting period: | January 31, 2005 |

Item 1. Reports to Stockholders

Fidelity®

OTC

Portfolio

Semiannual Report

January 31, 2005

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | 3 | Ned Johnson's message to shareholders. |

Shareholder Expense Example | 4 | An example of shareholder expenses. |

Investment Changes | 5 | A summary of major shifts in the fund's investments over the past six months. |

Investments | 6 | A complete list of the fund's investments with their market values. |

Financial Statements | 15 | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | 19 | Notes to the financial statements. |

| | |

| | |

| | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent quarterly holdings report, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com/holdings.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Chairman's Message

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

During the past year or so, much has been reported about the mutual fund industry, and much of it has been more critical than I believe is warranted. Allegations that some companies have been less than forthright with their shareholders have cast a shadow on the entire industry. I continue to find these reports disturbing, and assert that they do not create an accurate picture of the industry overall. Therefore, I would like to remind everyone where Fidelity stands on these issues. I will say two things specifically regarding allegations that some mutual fund companies were in violation of the Securities and Exchange Commission's forward pricing rules or were involved in so-called "market timing" activities.

First, Fidelity has no agreements that permit customers who buy fund shares after 4 p.m. to obtain the 4 p.m. price. This is not a new policy. This is not to say that someone could not deceive the company through fraudulent acts. However, we are extremely diligent in preventing fraud from occurring in this manner - and in every other. But I underscore again that Fidelity has no so-called "agreements" that sanction illegal practices.

Second, Fidelity continues to stand on record, as we have for years, in opposition to predatory short-term trading that adversely affects shareholders in a mutual fund. Back in the 1980s, we initiated a fee - which is returned to the fund and, therefore, to investors - - to discourage this activity. Further, we took the lead several years ago in developing a Fair Value Pricing Policy to prevent market timing on foreign securities in our funds. I am confident we will find other ways to make it more difficult for predatory traders to operate. However, this will only be achieved through close cooperation among regulators, legislators and the industry.

Yes, there have been unfortunate instances of unethical and illegal activity within the mutual fund industry from time to time. That is true of any industry. When this occurs, confessed or convicted offenders should be dealt with appropriately. But we are still concerned about the risk of over-regulation and the quick application of simplistic solutions to intricate problems. Every system can be improved, and we support and applaud well thought out improvements by regulators, legislators and industry representatives that achieve the common goal of building and protecting the value of investors' holdings.

For nearly 60 years, Fidelity has worked very hard to improve its products and service to justify your trust. When our family founded this company in 1946, we had only a few hundred customers. Today, we serve more than 18 million customers including individual investors and participants in retirement plans across America.

Let me close by saying that we do not take your trust in us for granted, and we realize that we must always work to improve all aspects of our service to you. In turn, we urge you to continue your active participation with your financial matters, so that your interests can be well served.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2004 to January 31, 2005).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the share-holder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Beginning

Account Value

August 1, 2004 | Ending

Account Value

January 31, 2005 | Expenses Paid

During Period*

August 1, 2004

to January 31, 2005 |

Actual | $ 1,000.00 | $ 1,097.20 | $ 4.55 |

Hypothetical (5% return per year before expenses) | $ 1,000.00 | $ 1,020.87 | $ 4.38 |

* Expenses are equal to the Fund's annualized expense ratio of .86%; multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Semiannual Report

Investment Changes

Top Ten Stocks as of January 31, 2005 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Microsoft Corp. | 11.4 | 13.2 |

Dell, Inc. | 5.7 | 5.5 |

Intel Corp. | 5.5 | 3.8 |

Cisco Systems, Inc. | 4.7 | 0.2 |

Yahoo!, Inc. | 2.5 | 2.2 |

Nextel Communications, Inc. Class A | 2.2 | 2.1 |

Oracle Corp. | 1.9 | 0.3 |

QUALCOMM, Inc. | 1.7 | 0.0 |

Cognizant Technology Solutions Corp. Class A | 1.4 | 1.1 |

Amgen, Inc. | 1.2 | 0.0 |

| 38.2 | |

Top Five Market Sectors as of January 31, 2005 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Information Technology | 64.5 | 59.4 |

Health Care | 10.8 | 10.4 |

Consumer Discretionary | 9.7 | 11.0 |

Industrials | 3.7 | 6.1 |

Telecommunication Services | 3.6 | 4.5 |

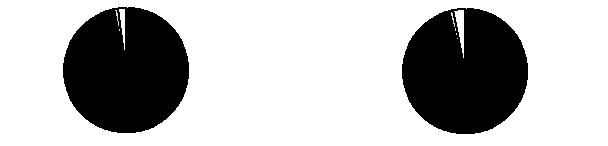

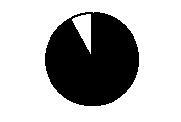

Asset Allocation (% of fund's net assets) |

As of January 31, 2005 * | As of July 31, 2004 ** |

| Stocks 97.7% | |  | Stocks 98.7% | |

| Short-Term

Investments and

Net Other Assets 2.3% | |  | Short-Term

Investments and

Net Other Assets 1.3% | |

* Foreign

investments | 6.9% | | ** Foreign

investments | 13.3% | |

Semiannual Report

Investments January 31, 2005 (Unaudited)

Showing Percentage of Net Assets

Common Stocks - 97.7% |

| Shares | | Value (Note 1) (000s) |

CONSUMER DISCRETIONARY - 9.7% |

Auto Components - 0.2% |

Keystone Automotive Industries, Inc. (a) | 574,300 | | $ 12,635 |

Hotels, Restaurants & Leisure - 1.1% |

Buffalo Wild Wings, Inc. (a) | 156,100 | | 6,320 |

Panera Bread Co. Class A (a)(d) | 820,880 | | 41,865 |

Penn National Gaming, Inc. (a) | 108,900 | | 7,143 |

Red Robin Gourmet Burgers, Inc. (a) | 365,100 | | 17,251 |

The Cheesecake Factory, Inc. (a) | 378,600 | | 12,255 |

| | 84,834 |

Household Durables - 0.3% |

LG Electronics, Inc. | 374,230 | | 25,739 |

Internet & Catalog Retail - 1.5% |

Amazon.com, Inc. (a) | 516,500 | | 22,323 |

Blue Nile, Inc. (d) | 546,500 | | 15,302 |

Drugstore.com, Inc. (a) | 1,014,900 | | 2,898 |

eBay, Inc. (a) | 731,900 | | 59,650 |

eDiets.com, Inc. (a) | 574,341 | | 2,481 |

Shopping.Com Ltd. | 387,700 | | 8,630 |

| | 111,284 |

Media - 3.4% |

Comcast Corp.: | | | |

Class A (a) | 1,173,500 | | 37,775 |

Class A (special) (a) | 1,194,600 | | 37,761 |

Cumulus Media, Inc. Class A (a) | 595,632 | | 8,244 |

EchoStar Communications Corp. Class A | 1,680,622 | | 51,276 |

Emmis Communications Corp. Class A (a) | 108,000 | | 1,898 |

Lamar Advertising Co. Class A (a) | 877,900 | | 37,732 |

NTL, Inc. (a) | 998,643 | | 67,938 |

XM Satellite Radio Holdings, Inc. Class A (a) | 502,700 | | 16,041 |

| | 258,665 |

Specialty Retail - 3.1% |

American Eagle Outfitters, Inc. | 337,100 | | 17,125 |

Big 5 Sporting Goods Corp. | 359,000 | | 9,829 |

Hot Topic, Inc. (a) | 2,051,000 | | 39,748 |

Rent-A-Center, Inc. (a) | 219,100 | | 5,366 |

Ross Stores, Inc. | 1,950,000 | | 55,809 |

Select Comfort Corp. (a) | 1,298,100 | | 25,404 |

Staples, Inc. | 1,676,700 | | 54,895 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

CONSUMER DISCRETIONARY - continued |

Specialty Retail - continued |

Steiner Leisure Ltd. (a) | 413,700 | | $ 12,833 |

West Marine, Inc. (a) | 779,000 | | 18,392 |

| | 239,401 |

Textiles, Apparel & Luxury Goods - 0.1% |

Brown Shoe Co., Inc. | 75,600 | | 2,189 |

Warnaco Group, Inc. (a) | 390,000 | | 8,428 |

| | 10,617 |

TOTAL CONSUMER DISCRETIONARY | | 743,175 |

CONSUMER STAPLES - 0.5% |

Food & Staples Retailing - 0.5% |

Costco Wholesale Corp. | 821,700 | | 38,842 |

ENERGY - 1.7% |

Energy Equipment & Services - 1.0% |

Patterson-UTI Energy, Inc. | 4,195,600 | | 81,604 |

Oil & Gas - 0.7% |

Ashland, Inc. | 38,500 | | 2,363 |

Top Tankers, Inc. (e) | 1,763,200 | | 29,780 |

Valero Energy Corp. | 381,200 | | 19,834 |

| | 51,977 |

TOTAL ENERGY | | 133,581 |

FINANCIALS - 3.2% |

Capital Markets - 1.2% |

Ameritrade Holding Corp. (a) | 5,725,500 | | 74,031 |

Calamos Asset Management, Inc. Class A | 853,600 | | 21,562 |

| | 95,593 |

Commercial Banks - 2.0% |

Fifth Third Bancorp | 1,111,600 | | 51,656 |

Nara Bancorp, Inc. | 434,000 | | 8,658 |

Silicon Valley Bancshares (a) | 642,000 | | 28,017 |

Texas Capital Bancshares, Inc. (a) | 400,000 | | 9,484 |

Texas Regional Bancshares, Inc. Class A | 113,800 | | 3,522 |

UCBH Holdings, Inc. | 353,400 | | 15,574 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

FINANCIALS - continued |

Commercial Banks - continued |

Wachovia Corp. | 375,077 | | $ 20,573 |

Zions Bancorp | 181,800 | | 12,330 |

| | 149,814 |

TOTAL FINANCIALS | | 245,407 |

HEALTH CARE - 10.8% |

Biotechnology - 5.6% |

Affymetrix, Inc. (a) | 485,100 | | 19,967 |

Alkermes, Inc. (a) | 704,800 | | 8,930 |

Amgen, Inc. (a) | 1,526,600 | | 95,016 |

Biogen Idec, Inc. (a) | 968,100 | | 62,888 |

BioMarin Pharmaceutical, Inc. (a) | 1,377,600 | | 8,334 |

Celgene Corp. (a) | 799,800 | | 21,867 |

Cephalon, Inc. (a) | 486,900 | | 23,955 |

Enzon Pharmaceuticals, Inc. (a) | 804,900 | | 10,383 |

Gen-Probe, Inc. (a) | 143,000 | | 6,980 |

Genentech, Inc. (a) | 760,400 | | 36,279 |

ImmunoGen, Inc. (a) | 51,041 | | 356 |

Invitrogen Corp. (a) | 725,700 | | 49,863 |

MedImmune, Inc. (a) | 876,000 | | 20,722 |

Millennium Pharmaceuticals, Inc. (a) | 3,228,400 | | 29,734 |

ONYX Pharmaceuticals, Inc. (a) | 623,100 | | 18,095 |

OSI Pharmaceuticals, Inc. (a) | 181,000 | | 11,783 |

Seattle Genetics, Inc. (a) | 551,300 | | 3,264 |

| | 428,416 |

Health Care Equipment & Supplies - 1.3% |

American Medical Systems Holdings, Inc. (a) | 605,200 | | 23,766 |

Cytyc Corp. (a) | 484,000 | | 12,124 |

DENTSPLY International, Inc. | 283,650 | | 15,904 |

Respironics, Inc. (a) | 772,300 | | 44,716 |

| | 96,510 |

Health Care Providers & Services - 2.9% |

Accredo Health, Inc. (a) | 930,100 | | 27,698 |

Caremark Rx, Inc. (a) | 456,660 | | 17,855 |

Express Scripts, Inc. (a) | 501,500 | | 37,206 |

HealthSouth Corp. (a) | 86,700 | | 507 |

Henry Schein, Inc. (a) | 462,100 | | 31,451 |

Humana, Inc. (a) | 1,404,300 | | 48,125 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

HEALTH CARE - continued |

Health Care Providers & Services - continued |

IMPATH, Inc. (a) | 303,600 | | $ 1,312 |

PacifiCare Health Systems, Inc. (a) | 381,500 | | 23,474 |

Patterson Companies, Inc. (a) | 233,200 | | 10,862 |

Sun Healthcare Group, Inc. (a) | 11,300 | | 86 |

WebMD Corp. (a) | 3,213,300 | | 24,260 |

| | 222,836 |

Pharmaceuticals - 1.0% |

Elan Corp. PLC sponsored ADR (a) | 470,400 | | 12,668 |

Endo Pharmaceuticals Holdings, Inc. (a) | 2,011,800 | | 42,268 |

Sepracor, Inc. (a) | 19,600 | | 1,121 |

Teva Pharmaceutical Industries Ltd. sponsored ADR | 722,500 | | 20,757 |

| | 76,814 |

TOTAL HEALTH CARE | | 824,576 |

INDUSTRIALS - 3.7% |

Air Freight & Logistics - 0.2% |

Forward Air Corp. (a) | 275,000 | | 11,719 |

Airlines - 0.7% |

JetBlue Airways Corp. (a) | 1,693,156 | | 33,508 |

Ryanair Holdings PLC sponsored ADR (a) | 448,100 | | 20,985 |

| | 54,493 |

Building Products - 0.1% |

Trex Co., Inc. (a) | 230,100 | | 11,286 |

Commercial Services & Supplies - 1.7% |

Apollo Group, Inc. Class A (a) | 240,900 | | 18,836 |

Cintas Corp. | 1,127,200 | | 49,033 |

Herman Miller, Inc. | 1,371,000 | | 36,633 |

Monster Worldwide, Inc. (a) | 193,000 | | 6,039 |

Strayer Education, Inc. | 177,400 | | 19,044 |

| | 129,585 |

Machinery - 0.3% |

PACCAR, Inc. | 328,150 | | 23,187 |

Road & Rail - 0.5% |

Landstar System, Inc. (a) | 1,037,392 | | 36,080 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

INDUSTRIALS - continued |

Trading Companies & Distributors - 0.2% |

Rush Enterprises, Inc. Class A (a)(e) | 1,104,395 | | $ 16,809 |

TOTAL INDUSTRIALS | | 283,159 |

INFORMATION TECHNOLOGY - 64.5% |

Communications Equipment - 11.7% |

Alcatel SA sponsored ADR (a)(d) | 2,145,100 | | 30,718 |

Alvarion Ltd. (a) | 1,376,500 | | 14,233 |

Andrew Corp. (a) | 1,089,800 | | 14,233 |

Arris Group, Inc. (a) | 758,596 | | 4,696 |

Avaya, Inc. (a) | 500,000 | | 7,175 |

Carrier Access Corp. (a)(e) | 1,968,400 | | 14,527 |

CIENA Corp. (a) | 6,582,600 | | 16,786 |

Cisco Systems, Inc. (a) | 20,015,400 | | 361,078 |

Comverse Technology, Inc. (a) | 1,909,100 | | 42,668 |

Enterasys Networks, Inc. (a) | 9,256,700 | | 13,052 |

Ixia (a) | 360,600 | | 5,597 |

Juniper Networks, Inc. (a) | 3,195,400 | | 80,300 |

Motorola, Inc. | 4,659,230 | | 73,336 |

Nokia Corp. sponsored ADR | 1,068,300 | | 16,324 |

Polycom, Inc. (a) | 748,626 | | 12,936 |

Powerwave Technologies, Inc. (a) | 883,700 | | 6,955 |

QUALCOMM, Inc. | 3,538,500 | | 131,774 |

Research In Motion Ltd. (a) | 578,900 | | 41,198 |

Sonus Networks, Inc. (a) | 1,946,600 | | 11,933 |

| | 899,519 |

Computers & Peripherals - 10.9% |

Apple Computer, Inc. (a) | 1,127,100 | | 86,674 |

Avid Technology, Inc. (a) | 152,100 | | 9,590 |

Dell, Inc. (a) | 10,408,700 | | 434,667 |

Diebold, Inc. | 848,600 | | 45,689 |

EMC Corp. (a) | 3,165,200 | | 41,464 |

Hutchinson Technology, Inc. (a) | 646,787 | | 22,832 |

Maxtor Corp. (a) | 2,708,000 | | 12,809 |

Network Appliance, Inc. (a) | 244,900 | | 7,798 |

Seagate Technology | 4,774,000 | | 80,776 |

Sun Microsystems, Inc. (a) | 11,574,345 | | 50,464 |

Western Digital Corp. (a) | 4,089,000 | | 44,039 |

| | 836,802 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

INFORMATION TECHNOLOGY - continued |

Electronic Equipment & Instruments - 1.6% |

CDW Corp. | 472,200 | | $ 27,624 |

DDi Corp. (a) | 519,189 | | 1,251 |

Flextronics International Ltd. (a) | 2,097,900 | | 29,685 |

Hon Hai Precision Industries Co. Ltd. | 4,613,794 | | 20,265 |

Molex, Inc. | 503,400 | | 14,458 |

Nano-Proprietary, Inc. (a) | 2,213,900 | | 4,649 |

Solectron Corp. (a) | 5,257,900 | | 26,132 |

Universal Display Corp. (a) | 69,900 | | 527 |

| | 124,591 |

Internet Software & Services - 3.3% |

Akamai Technologies, Inc. (a) | 1,272,200 | | 16,666 |

Google, Inc. Class A (sub. vtg.) | 203,400 | | 39,791 |

Marchex, Inc. Class B | 2,300 | | 41 |

Vignette Corp. (a) | 3,278,200 | | 4,294 |

Yahoo!, Inc. (a) | 5,374,116 | | 189,223 |

| | 250,015 |

IT Services - 2.0% |

Cognizant Technology Solutions Corp. Class A (a) | 2,861,600 | | 108,455 |

Infosys Technologies Ltd. sponsored ADR | 246,300 | | 16,266 |

Paychex, Inc. | 497,400 | | 15,166 |

Syntel, Inc. | 799,300 | | 13,436 |

| | 153,323 |

Semiconductors & Semiconductor Equipment - 17.0% |

Agere Systems, Inc.: | | | |

Class A (a) | 16,484,211 | | 23,737 |

Class B (a) | 16,413,400 | | 23,635 |

Altera Corp. (a) | 585,400 | | 11,240 |

Analog Devices, Inc. | 1,654,300 | | 59,373 |

Applied Materials, Inc. (a) | 5,917,000 | | 94,080 |

ATI Technologies, Inc. (a) | 826,700 | | 14,342 |

ATMI, Inc. (a) | 1,341,111 | | 30,483 |

FEI Co. (a) | 964,500 | | 19,444 |

Freescale Semiconductor, Inc.: | | | |

Class A | 1,934,100 | | 33,073 |

Class B (a) | 1,215,334 | | 21,232 |

Integrated Circuit Systems, Inc. (a) | 1,287,600 | | 24,464 |

Intel Corp. | 18,833,400 | | 422,810 |

Intersil Corp. Class A | 679,900 | | 10,083 |

KLA-Tencor Corp. (a) | 371,300 | | 17,173 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

INFORMATION TECHNOLOGY - continued |

Semiconductors & Semiconductor Equipment - continued |

Linear Technology Corp. | 1,183,500 | | $ 44,665 |

Marvell Technology Group Ltd. (a) | 1,657,600 | | 55,447 |

Maxim Integrated Products, Inc. | 1,205,400 | | 47,023 |

Microchip Technology, Inc. | 1,186,300 | | 30,903 |

Mindspeed Technologies, Inc. (a) | 2,969,033 | | 6,903 |

National Semiconductor Corp. | 2,783,800 | | 47,130 |

NVIDIA Corp. (a) | 1,867,600 | | 42,805 |

Omnivision Technologies, Inc. (a)(d) | 490,000 | | 7,953 |

PMC-Sierra, Inc. (a) | 1,171,100 | | 12,039 |

Samsung Electronics Co. Ltd. | 131,350 | | 63,340 |

Silicon Laboratories, Inc. (a) | 1,259,200 | | 42,939 |

STATS ChipPAC Ltd. ADR (a)(d) | 2,802,270 | | 16,085 |

Texas Instruments, Inc. | 2,151,100 | | 49,927 |

Vitesse Semiconductor Corp. (a) | 3,950,000 | | 11,455 |

Xilinx, Inc. | 610,200 | | 17,812 |

| | 1,301,595 |

Software - 18.0% |

Activision, Inc. (a) | 100,000 | | 2,260 |

BEA Systems, Inc. (a) | 4,253,943 | | 36,244 |

FileNET Corp. (a) | 1,204,882 | | 26,929 |

Intuit, Inc. (a) | 355,900 | | 13,880 |

Jack Henry & Associates, Inc. | 384,109 | | 7,986 |

Kronos, Inc. (a) | 253,500 | | 13,631 |

Lawson Software, Inc. (a) | 2,646,700 | | 17,336 |

Microsoft Corp. | 33,281,800 | | 874,640 |

Oracle Corp. (a) | 10,796,200 | | 148,664 |

Quest Software, Inc. (a) | 1,691,100 | | 24,014 |

Red Hat, Inc. (a) | 3,103,900 | | 33,677 |

Siebel Systems, Inc. (a) | 5,095,494 | | 44,382 |

Symantec Corp. (a) | 3,643,400 | | 85,073 |

Take-Two Interactive Software, Inc. (a) | 595,300 | | 20,984 |

TIBCO Software, Inc. (a) | 1,808,300 | | 19,873 |

WatchGuard Technologies, Inc. (a) | 1,237,200 | | 5,023 |

| | 1,374,596 |

TOTAL INFORMATION TECHNOLOGY | | 4,940,441 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

MATERIALS - 0.0% |

Containers & Packaging - 0.0% |

Anchor Glass Container Corp. (a) | 161,305 | | $ 960 |

TELECOMMUNICATION SERVICES - 3.6% |

Diversified Telecommunication Services - 0.1% |

AboveNet, Inc. (a) | 99,200 | | 2,976 |

Wireless Telecommunication Services - 3.5% |

American Tower Corp. Class A (a) | 1,701,900 | | 30,838 |

Nextel Communications, Inc. Class A (a) | 5,953,900 | | 170,817 |

Nextel Partners, Inc. Class A (a) | 487,200 | | 9,690 |

NII Holdings, Inc. (a) | 1,072,600 | | 57,706 |

| | 269,051 |

TOTAL TELECOMMUNICATION SERVICES | | 272,027 |

TOTAL COMMON STOCKS (Cost $6,992,618) | 7,482,168 |

Money Market Funds - 3.2% |

| | | |

Fidelity Cash Central Fund, 2.31% (b) | 166,719,431 | | 166,719 |

Fidelity Securities Lending Cash Central Fund, 2.29% (b)(c) | 78,532,300 | | 78,532 |

TOTAL MONEY MARKET FUNDS (Cost $245,251) | | 245,251 |

TOTAL INVESTMENT PORTFOLIO - 100.9% (Cost $7,237,869) | | 7,727,419 |

NET OTHER ASSETS - (0.9)% | | (65,733) |

NET ASSETS - 100% | $ 7,661,686 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

(c) Includes investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

(e) Affiliated company |

An affiliated company is a company in which the fund has ownership of at least 5% of the voting securities. Companies which are affiliates of the fund at period-end are noted in the fund's Schedule of Investments. Transactions during the period with companies which are or were affiliates are as follows: |

Affiliates

(Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Value,

end of

period |

24/7 Real Media, Inc. | $ 6,713 | $ 7,257 | $ 10,999 | $ - | $ - |

Carrier Access Corp. | - | 19,282 | - | - | 14,527 |

eDiets.com, Inc. | 3,208 | - | 2,218 | - | - |

Homestore, Inc. | 27,581 | 16,819 | 35,800 | - | - |

Redback Networks, Inc. | 15,289 | - | 13,429 | - | - |

Rush Enterprises, Inc. Class A | - | 18,460 | 4,508 | - | 16,809 |

Time Warner Telecom, Inc. Class A | 32,301 | 166 | 28,716 | - | - |

Top Tankers, Inc. | 1,987 | 22,221 | - | 345 | 29,780 |

WatchGuard Technologies, Inc. | 6,848 | 4,362 | 4,158 | - | - |

Wet Seal, Inc. Class A | 7,768 | - | 2,746 | - | - |

Total | $ 101,695 | $ 88,567 | $ 102,574 | $ 345 | $ 61,116 |

Income Tax Information |

At July 31, 2004, the fund had a capital loss carryforward of approximately $5,419,239,000 of which $4,169,344,000 and $1,249,895,000 will expire on July 31, 2010 and 2011, respectively. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements

Statement of Assets and Liabilities

Amounts in thousands (except per-share amount) | January 31, 2005 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $77,173) (cost $7,237,869) - See accompanying schedule | | $ 7,727,419 |

Foreign currency held at value (cost $157) | | 166 |

Receivable for investments sold | | 99,411 |

Receivable for fund shares sold | | 8,031 |

Dividends receivable | | 2,484 |

Interest receivable | | 277 |

Prepaid expenses | | 26 |

Other affiliated receivables | | 30 |

Other receivables | | 599 |

Total assets | | 7,838,443 |

| | |

Liabilities | | |

Payable for investments purchased | $ 80,181 | |

Payable for fund shares redeemed | 12,405 | |

Accrued management fee | 3,761 | |

Other affiliated payables | 1,788 | |

Other payables and accrued expenses | 90 | |

Collateral on securities loaned, at value | 78,532 | |

Total liabilities | | 176,757 |

| | |

Net Assets | | $ 7,661,686 |

Net Assets consist of: | | |

Paid in capital | | $ 12,082,479 |

Accumulated net investment loss | | (3,909) |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (4,906,476) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 489,592 |

Net Assets, for 232,252 shares outstanding | | $ 7,661,686 |

Net Asset Value, offering price and redemption price per share ($7,661,686 ÷ 232,252 shares) | | $ 32.99 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Operations

Amounts in thousands | Six months ended January 31, 2005 (Unaudited) |

| | |

Investment Income | | |

Dividends (including $345 received from affiliated issuers) | | $ 16,021 |

Special Dividends | | 106,284 |

Interest | | 647 |

Security lending | | 330 |

Total income | | 123,282 |

| | |

Expenses | | |

Management fee

Basic fee | $ 23,517 | |

Performance adjustment | (1,057) | |

Transfer agent fees | 9,038 | |

Accounting and security lending fees | 580 | |

Non-interested trustees' compensation | 22 | |

Appreciation in deferred trustee compensation account | 3 | |

Custodian fees and expenses | 183 | |

Registration fees | 63 | |

Audit | 42 | |

Legal | 16 | |

Interest | 2 | |

Miscellaneous | 18 | |

Total expenses before reductions | 32,427 | |

Expense reductions | (866) | 31,561 |

Net investment income (loss) | | 91,721 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities (including realized gain (loss) of $(79,763) from affiliated issuers) | 531,675 | |

Foreign currency transactions | 27 | |

Total net realized gain (loss) | | 531,702 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 77,193 | |

Assets and liabilities in foreign currencies | 56 | |

Total change in net unrealized appreciation (depreciation) | | 77,249 |

Net gain (loss) | | 608,951 |

Net increase (decrease) in net assets resulting from operations | | $ 700,672 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

Amounts in thousands | Six months ended January 31, 2005 (Unaudited) | Year ended

July 31,

2004 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 91,721 | $ (41,667) |

Net realized gain (loss) | 531,702 | 1,268,916 |

Change in net unrealized appreciation (depreciation) | 77,249 | (703,476) |

Net increase (decrease) in net assets resulting

from operations | 700,672 | 523,773 |

Distributions to shareholders from net investment income | (95,497) | - |

Share transactions

Proceeds from sales of shares | 788,333 | 2,620,488 |

Reinvestment of distributions | 94,057 | - |

Cost of shares redeemed | (1,147,881) | (2,863,293) |

Net increase (decrease) in net assets resulting from share transactions | (265,491) | (242,805) |

Total increase (decrease) in net assets | 339,684 | 280,968 |

| | |

Net Assets | | |

Beginning of period | 7,322,002 | 7,041,034 |

End of period (including accumulated net investment loss of $3,909 and accumulated net investment loss of $133, respectively) | $ 7,661,686 | $ 7,322,002 |

Other Information Shares | | |

Sold | 24,589 | 82,028 |

Issued in reinvestment of distributions | 2,762 | - |

Redeemed | (35,733) | (89,916) |

Net increase (decrease) | (8,382) | (7,888) |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

| Six months ended January 31, 2005 | Years ended July 31, |

| (Unaudited) | 2004 | 2003 | 2002 | 2001 | 2000 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 30.43 | $ 28.33 | $ 23.46 | $ 32.96 | $ 69.82 | $ 51.53 |

Income from Investment Operations | | | | | | |

Net investment income (loss) D | .39 E | (.17) | (.17) | (.24) | (.18) | (.27) |

Net realized and unrealized gain (loss) | 2.58 | 2.27 | 5.04 | (9.26) | (24.02) | 24.07 |

Total from investment operations | 2.97 | 2.10 | 4.87 | (9.50) | (24.20) | 23.80 |

Distributions from net investment income | (.41) | - | - | - | - | - |

Distributions from net realized gain | - | - | - | - | (12.66) | (5.51) |

Total distributions | (.41) | - | - | - | (12.66) | (5.51) |

Net asset value, end of period | $ 32.99 | $ 30.43 | $ 28.33 | $ 23.46 | $ 32.96 | $ 69.82 |

Total Return B, C | 9.72% | 7.41% | 20.76% | (28.82)% | (42.79)% | 50.05% |

Ratios to Average Net Assets F | | | | | |

Expenses before expense reductions | .86% A | .91% | 1.18% | 1.14% | .97% | .76% |

Expenses net of voluntary waivers, if any | .86% A | .91% | 1.18% | 1.14% | .97% | .76% |

Expenses net of all reductions | .84% A | .89% | 1.12% | 1.09% | .94% | .75% |

Net investment income (loss) | 2.43% A, E | (.53)% | (.71)% | (.81)% | (.40)% | (.43)% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 7,662 | $ 7,322 | $ 7,041 | $ 5,911 | $ 8,802 | $ 14,548 |

Portfolio turnover rate | 94% A | 61% | 116% | 120% | 219% | 196% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Investment income per share reflects a special dividend which amounted to $.45 per share. Excluding the special dividend, the ratio of net investment income to average net assets would have been (.39)%.

F Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Notes to Financial Statements

For the period ended January 31, 2005 (Unaudited)

(Amounts in thousands except ratios)

1. Significant Accounting Policies.

Fidelity OTC Portfolio (the fund) is a fund of Fidelity Securities Fund (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Net asset value per share (NAV calculation) is calculated as of the close of business of the New York Stock Exchange, normally 4:00 p.m. Eastern time. Equity securities, including restricted securities, for which market quotations are available are valued at the last sale price or official closing price (closing bid price or last evaluated quote if no sale has occurred) on the primary market or exchange on which they trade. If prices are not readily available or do not accurately reflect fair value for a security, or if a security's value has been materially affected by events occurring after the close of the exchange or market on which the security is principally traded, that security may be valued by another method that the Board of Trustees believes accurately reflects fair value. A security's valuation may differ depending on the method used for determining value. Price movements in futures contracts and ADRs, market and trading trends, the bid/ask quotes of brokers and off-exchange institutional trading may be reviewed in the course of making a good faith determination of a security's fair value. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued on the basis of amortized cost. Investments in open-end investment companies are valued at their net asset value each business day.

Foreign Currency. The fund uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except ratios)

1. Significant Accounting Policies - continued

Investment Transactions and Income. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. Large, non-recurring dividends recognized by the fund are presented separately on the Statement of Operations as "Special Dividends" and the impact of these dividends is presented in the Financial Highlights. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among the funds in the trust.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), non-interested Trustees must defer receipt of a portion of, and may elect to defer receipt of an additional portion of, their annual compensation. Deferred amounts are treated as though equivalent dollar amounts had been invested in shares of the fund or are invested in a cross-section of other Fidelity funds, and are marked-to-market. Deferred amounts remain in the fund until distributed in accordance with the Plan.

Income Tax Information and Distributions to Shareholders. Each year, the fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on the fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Semiannual Report

1. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

Book-tax differences are primarily due to foreign currency transactions, net operating losses, capital loss carryforwards and losses deferred due to wash sales and excise tax regulations.

The federal tax cost of investments and unrealized appreciation (depreciation) as of period end were as follows:

Unrealized appreciation | $ 1,011,942 | |

Unrealized depreciation | (543,068) | |

Net unrealized appreciation (depreciation) | $ 468,874 | |

Cost for federal income tax purposes | $ 7,258,545 | |

2. Operating Policies.

Repurchase Agreements. Fidelity Management & Research Company (FMR) has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts. These accounts are then invested in repurchase agreements that are collateralized by U.S. Treasury or Government obligations. The fund may also invest directly with institutions, in repurchase agreements that are collateralized by commercial paper obligations and corporate obligations. Collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. Collateral is marked-to-market daily and maintained at a value at least equal to the principal amount of the repurchase agreement (including accrued interest).

3. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and U.S. government securities, aggregated $3,519,068 and $3,871,144, respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the fund with investment management related services for which the fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .35% of the fund's average net assets and a group fee rate that averaged .27% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except ratios)

4. Fees and Other Transactions with Affiliates - continued

Management Fee - continued

subject to a performance adjustment (up to a maximum of ±.20% of the fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the fund's relative investment performance as compared to an appropriate benchmark index. For the period, the total annualized management fee rate, including the performance adjustment, was .60% of the fund's average net assets.

Transfer Agent Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, is the fund's transfer, dividend disbursing and shareholder servicing agent. FSC receives account fees and asset-based fees that vary according to account size and type of account. FSC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period, the transfer agent fees were equivalent to an annualized rate of .24% of average net assets.

Accounting and Security Lending Fees. FSC maintains the fund's accounting records. The accounting fee is based on the level of average net assets for the month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Central Funds. The fund may invest in affiliated Central Funds managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR. The Central Funds are open-end investment companies available only to investment companies and other accounts managed by FMR and its affiliates. The Central Funds seek preservation of capital and current income and do not pay a management fee. Income distributions earned by the fund are recorded as income in the accompanying financial statements and totaled $635 for the period.

Brokerage Commissions. The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $595 for the period.

Interfund Lending Program. Pursuant to an Exemptive Order issued by the SEC, the fund, along with other registered investment companies having management contracts with FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the funds to borrow from, or lend money to, other participating funds. At period end, there were no interfund loans outstanding. The fund's activity in this program during the period was as follows:

Borrower or Lender | Average Daily Loan Balance | Weighted Average Interest Rate | Interest Expense |

Borrower | $ 27,227 | 2.14% | $ 2 |

Semiannual Report

5. Committed Line of Credit.

The fund participates with other funds managed by FMR in a $4.2 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The fund has agreed to pay commitment fees on its pro rata portion of the line of credit. During the period, there were no borrowings on this line of credit.

6. Security Lending.

The fund lends portfolio securities from time to time in order to earn additional income. The fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. Cash collateral is invested in cash equivalents. The value of loaned securities and cash collateral at period end are disclosed on the fund's Statement of Assets and Liabilities.

7. Bank Borrowings.

The fund is permitted to have bank borrowings for temporary or emergency purposes to fund shareholder redemptions. The fund has established borrowing arrangements with certain banks. The interest rate on the borrowings is the bank's base rate, as revised from time to time. The average daily loan balance during the period amounted to $5,484. The weighted average interest rate was 2.06%. At period end, there were no bank borrowings outstanding.

8. Expense Reductions.

Many of the brokers with whom FMR places trades on behalf of the fund provided services to the fund in addition to trade execution. These services included payments of certain expenses on behalf of the fund totaling $797 for the period. In addition, through arrangements with the fund's custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce the fund's expenses. During the period, these credits reduced the fund's custody and transfer agent expenses by $1 and $68, respectively.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except ratios)

9. Other.

The fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, the fund may also enter into contracts that provide general indemnifications. The fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the fund. The risk of material loss from such claims is considered remote.

Semiannual Report

Managing Your Investments

Fidelity offers several ways to conveniently manage your personal investments via your telephone or PC. You can access your account information, conduct trades and research your investments 24 hours a day.

By Phone

Fidelity Automated Service Telephone provides a single toll-free number to access account balances, positions, quotes and trading. It's easy to navigate the service, and on your first call, the system will help you create a personal identification number (PIN) for security.

(phone_graphic)Fidelity Automated

Service Telephone (FAST®)

1-800-544-5555

Press

1 For mutual fund and brokerage trading.

2 For quotes.*

3 For account balances and holdings.

4 To review orders and mutual

fund activity.

5 To change your PIN.

*0 To speak to a Fidelity representative.

By PC

Fidelity's web site on the Internet provides a wide range of information, including daily financial news, fund performance, interactive planning tools and news about Fidelity products and services.

(computer_graphic)Fidelity's Web Site

www.fidelity.com

* When you call the quotes line, please remember that a fund's yield and return will vary and, except for money market funds, share price will also vary. This means that you may have a gain or loss when you sell your shares. There is no assurance that money market funds will be able to maintain a stable $1 share price; an investment in a money market fund is not insured or guaranteed by the U.S. government. Total returns are historical and include changes in share price, reinvestment of dividends and capital gains, and the effects of any sales charges.

Semiannual Report

To Visit Fidelity

For directions and hours,

please call 1-800-544-9797.

Arizona

7001 West Ray Road

Chandler, AZ

7373 N. Scottsdale Road

Scottsdale, AZ

California

815 East Birch Street

Brea, CA

1411 Chapin Avenue

Burlingame, CA

851 East Hamilton Avenue

Campbell, CA

19200 Von Karman Avenue

Irvine, CA

601 Larkspur Landing Circle

Larkspur, CA

10100 Santa Monica Blvd.

Los Angeles, CA

27101 Puerta Real

Mission Viejo, CA

73-575 El Paseo

Palm Desert, CA

251 University Avenue

Palo Alto, CA

123 South Lake Avenue

Pasadena, CA

16995 Bernardo Ctr. Drive

Rancho Bernardo, CA

1740 Arden Way

Sacramento, CA

7676 Hazard Center Drive

San Diego, CA

8 Montgomery Street

San Francisco, CA

3793 State Street

Santa Barbara, CA

21701 Hawthorne Boulevard

Torrance, CA

2001 North Main Street

Walnut Creek, CA

6300 Canoga Avenue

Woodland Hills, CA

Colorado

1625 Broadway

Denver, CO

9185 East Westview Road

Littleton, CO

Connecticut

48 West Putnam Avenue

Greenwich, CT

265 Church Street

New Haven, CT

300 Atlantic Street

Stamford, CT

29 South Main Street

West Hartford, CT

Delaware

222 Delaware Avenue

Wilmington, DE

Florida

4400 N. Federal Highway

Boca Raton, FL

121 Alhambra Plaza

Coral Gables, FL

2948 N. Federal Highway

Ft. Lauderdale, FL

1907 West State Road 434

Longwood, FL

8880 Tamiami Trail, North

Naples, FL

3501 PGA Boulevard

West Palm Beach, FL

3550 Tamiami Trail, South

Sarasota, FL

1502 N. Westshore Blvd.

Tampa, FL

Georgia

3445 Peachtree Road, N.E.

Atlanta, GA

1000 Abernathy Road

Atlanta, GA

Illinois

One North LaSalle Street

Chicago, IL

875 North Michigan Ave.

Chicago, IL

1415 West 22nd Street

Oak Brook, IL

1700 East Golf Road

Schaumburg, IL

3232 Lake Avenue

Wilmette, IL

Indiana

4729 East 82nd Street

Indianapolis, IN

Kansas

5400 College Boulevard

Overland Park, KS

Maine

Three Canal Plaza

Portland, ME

Maryland

7315 Wisconsin Avenue

Bethesda, MD

One W. Pennsylvania Ave.

Towson, MD

Massachusetts

801 Boylston Street

Boston, MA

155 Congress Street

Boston, MA

300 Granite Street

Braintree, MA

44 Mall Road

Burlington, MA

405 Cochituate Road

Framingham, MA

416 Belmont Street

Worcester, MA

Michigan

500 E. Eisenhower Pkwy.

Ann Arbor, MI

280 Old N. Woodward Ave.

Birmingham, MI

43420 Grand River Avenue

Novi, MI

29155 Northwestern Hwy.

Southfield, MI

Minnesota

7600 France Avenue South

Edina, MN

Missouri

8885 Ladue Road

Ladue, MO

Nevada

2225 Village Walk Drive

Henderson, NV

Semiannual Report

New Jersey

150 Essex Street

Millburn, NJ

56 South Street

Morristown, NJ

396 Route 17, North

Paramus, NJ

3518 Route 1 North

Princeton, NJ

530 Highway 35

Shrewsbury, NJ

New York

1055 Franklin Avenue

Garden City, NY

37 West Jericho Turnpike

Huntington Station, NY

1271 Avenue of the Americas

New York, NY

61 Broadway

New York, NY

350 Park Avenue

New York, NY

200 Fifth Avenue

New York, NY

733 Third Avenue

New York, NY

11 Penn Plaza

New York, NY

2070 Broadway

New York, NY

1075 Northern Blvd.

Roslyn, NY

North Carolina

4611 Sharon Road

Charlotte, NC

Ohio

3805 Edwards Road

Cincinnati, OH

28699 Chagrin Boulevard

Woodmere Village, OH

1324 Polaris Parkway

Columbus, OH

Oregon

16850 SW 72nd Avenue

Tigard, OR

Pennsylvania

600 West DeKalb Pike

King of Prussia, PA

1735 Market Street

Philadelphia, PA

12001 Perry Highway

Wexford, PA

Rhode Island

47 Providence Place

Providence, RI

Tennessee

6150 Poplar Avenue

Memphis, TN

Texas

10000 Research Boulevard

Austin, TX

4001 Northwest Parkway

Dallas, TX

12532 Memorial Drive

Houston, TX

2701 Drexel Drive

Houston, TX

6500 N. MacArthur Blvd.

Irving, TX

6005 West Park Boulevard

Plano, TX

14100 San Pedro

San Antonio, TX

1576 East Southlake Blvd.

Southlake, TX

19740 IH 45 North

Spring, TX

Utah

215 South State Street

Salt Lake City, UT

Virginia

1861 International Drive

McLean, VA

Washington

411 108th Avenue, N.E.

Bellevue, WA

1518 6th Avenue

Seattle, WA

Washington, DC

1900 K Street, N.W.

Washington, DC

Wisconsin

595 North Barker Road

Brookfield, WI

Fidelity Brokerage Services, Inc., 100 Summer St., Boston, MA 02110 Member NYSE/SIPC

Semiannual Report

To Write Fidelity

We'll give your correspondence immediate attention and send you written confirmation upon completion of your request.

(letter_graphic)Making Changes

To Your Account

(such as changing name, address, bank, etc.)

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0002

(letter_graphic)For Non-Retirement

Accounts

Buying shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0003

Overnight Express

Fidelity Investments

Attn: Distribution Services

100 Crosby Parkway - KC1H

Covington, KY 41015

Selling shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0035

Overnight Express

Fidelity Investments

Attn: Distribution Services

100 Crosby Parkway - KC1H

Covington, KY 41015

General Correspondence

Fidelity Investments

P.O. Box 500

Merrimack, NH 03054-0500

(letter_graphic)For Retirement

Accounts

Buying shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0003

Selling shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0035

Overnight Express

Fidelity Investments

Attn: Distribution Services

100 Crosby Parkway - KC1H

Covington, KY 41015

General Correspondence

Fidelity Investments

P.O. Box 500

Merrimack, NH 03054-0500

Semiannual Report

Semiannual Report

Semiannual Report

Semiannual Report

Investment Adviser

Fidelity Management & Research Company

Boston, MA

Investment Sub-Advisers

FMR Co., Inc.

Fidelity Management & Research

(Far East) Inc.

Fidelity Management & Research

(U.K.) Inc.

Fidelity Investments Japan Limited

Fidelity International Investments

Advisors

Fidelity International Investments

Advisors (U.K.) Limited

General Distributor

Fidelity Distributors Corporation

Boston, MA

Transfer and Shareholder

Servicing Agent

Fidelity Service Company, Inc.

Boston, MA

Custodian

Brown Brothers Harriman & Co.

Boston, MA

The Fidelity Telephone Connection

Mutual Fund 24-Hour Service

Exchanges/Redemptions

and Account Assistance 1-800-544-6666

Product Information 1-800-544-6666

Retirement Accounts 1-800-544-4774

(8 a.m. - 9 p.m.)

TDD Service 1-800-544-0118

for the deaf and hearing impaired

(9 a.m. - 9 p.m. Eastern time)

Fidelity Automated Service

Telephone (FAST®) (automated graphic) 1-800-544-5555

(automated graphic) Automated line for quickest service

(Fidelity Investment logo)(registered trademark)

Corporate Headquarters

82 Devonshire St., Boston, MA 02109

www.fidelity.com

OTC-USAN-0305

1.789288.101

Fidelity®

Leveraged Company Stock

Fund

Semiannual Report

January 31, 2005

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | 3 | Ned Johnson's message to shareholders. |

Shareholder Expense Example | 4 | An example of shareholder expenses. |

Investment Changes | 5 | A summary of major shifts in the fund's investments over the last six months. |

Investments | 6 | A complete list of the fund's investments with their market values. |

Financial Statements | 15 | Statements of assets and liabilities, operations, and changes in net assets,

as well as financial highlights. |

Notes | 19 | Notes to the financial statements. |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent quarterly holdings report, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com/holdings.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Chairman's Message

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

During the past year or so, much has been reported about the mutual fund industry, and much of it has been more critical than I believe is warranted. Allegations that some companies have been less than forthright with their shareholders have cast a shadow on the entire industry. I continue to find these reports disturbing, and assert that they do not create an accurate picture of the industry overall. Therefore, I would like to remind everyone where Fidelity stands on these issues. I will say two things specifically regarding allegations that some mutual fund companies were in violation of the Securities and Exchange Commission's forward pricing rules or were involved in so-called "market timing" activities.

First, Fidelity has no agreements that permit customers who buy fund shares after 4 p.m. to obtain the 4 p.m. price. This is not a new policy. This is not to say that someone could not deceive the company through fraudulent acts. However, we are extremely diligent in preventing fraud from occurring in this manner - and in every other. But I underscore again that Fidelity has no so-called "agreements" that sanction illegal practices.

Second, Fidelity continues to stand on record, as we have for years, in opposition to predatory short-term trading that adversely affects shareholders in a mutual fund. Back in the 1980s, we initiated a fee - which is returned to the fund and, therefore, to investors - - to discourage this activity. Further, we took the lead several years ago in developing a Fair Value Pricing Policy to prevent market timing on foreign securities in our funds. I am confident we will find other ways to make it more difficult for predatory traders to operate. However, this will only be achieved through close cooperation among regulators, legislators and the industry.

Yes, there have been unfortunate instances of unethical and illegal activity within the mutual fund industry from time to time. That is true of any industry. When this occurs, confessed or convicted offenders should be dealt with appropriately. But we are still concerned about the risk of over-regulation and the quick application of simplistic solutions to intricate problems. Every system can be improved, and we support and applaud well thought out improvements by regulators, legislators and industry representatives that achieve the common goal of building and protecting the value of investors' holdings.

For nearly 60 years, Fidelity has worked very hard to improve its products and service to justify your trust. When our family founded this company in 1946, we had only a few hundred customers. Today, we serve more than 18 million customers including individual investors and participants in retirement plans across America.

Let me close by saying that we do not take your trust in us for granted, and we realize that we must always work to improve all aspects of our service to you. In turn, we urge you to continue your active participation with your financial matters, so that your interests can be well served.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2004 to January 31, 2005).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning

Account Value

August 1, 2004 | Ending

Account Value

January 31, 2005 | Expenses Paid

During Period*

August 1, 2004

to January 31, 2005 |

Actual | $ 1,000.00 | $ 1,187.40 | $ 4.80 |

Hypothetical (5% return per year before expenses) | $ 1,000.00 | $ 1,020.82 | $ 4.43 |

* Expenses are equal to the Fund's annualized expense ratio of .87%; multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Semiannual Report

Investment Changes

Top Ten Stocks as of January 31, 2005 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Teekay Shipping Corp. | 6.2 | 6.9 |

AES Corp. | 6.0 | 6.4 |

General Maritime Corp. | 5.6 | 5.6 |

Forest Oil Corp. | 4.7 | 4.1 |

Nextel Communications, Inc. Class A | 3.4 | 3.5 |

Qwest Communications International, Inc. | 3.0 | 3.6 |

Range Resources Corp. | 2.8 | 3.5 |

Tyco International Ltd. | 2.7 | 4.2 |

CMS Energy Corp. | 2.5 | 3.0 |

DaVita, Inc. | 2.1 | 2.2 |

| 39.0 | |

Top Five Market Sectors as of January 31, 2005 |

| % of fund's net assets | % of fund's net assets

6 months ago |

Energy | 34.1 | 31.6 |

Industrials | 11.1 | 10.1 |

Materials | 10.8 | 8.0 |

Telecommunication Services | 9.3 | 12.1 |

Utilities | 8.7 | 9.4 |

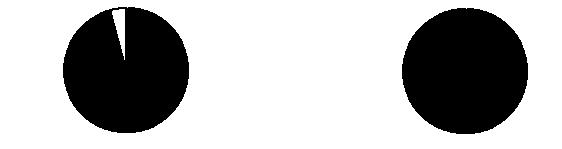

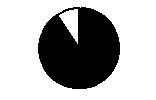

Asset Allocation (% of fund's net assets) |

As of January 31, 2005 * | As of July 31, 2004 ** |

| Stocks 93.6% | |  | Stocks 96.4% | |

| Convertible

Securities 0.0% | |  | Bonds 0.3% | |

| Other Investments 0.9% | |  | Convertible

Securities 0.1% | |

| Short-Term

Investments and

Net Other Assets 5.5% | |  | Other Investments 1.2% | |

| | |  | Short-Term

Investments and

Net Other Assets 2.0% | |

* Foreign

investments | 20.8% | | ** Foreign

investments | 19.7% | |

Semiannual Report

Investments January 31, 2005 (Unaudited)

Showing Percentage of Net Assets

Common Stocks - 93.3% |

| Shares | | Value (Note 1) (000s) |

CONSUMER DISCRETIONARY - 8.1% |

Auto Components - 0.8% |

Dana Corp. | 204,100 | | $ 3,239 |

Tenneco Automotive, Inc. (a) | 135,500 | | 2,187 |

TRW Automotive Holdings Corp. | 618,100 | | 12,300 |

| | 17,726 |

Hotels, Restaurants & Leisure - 1.2% |

Centerplate, Inc. unit | 363,005 | | 4,937 |

Friendly Ice Cream Corp. (a)(e) | 423,400 | | 3,696 |

Six Flags, Inc. (a) | 1,951,100 | | 8,351 |

Sunterra Corp. (a)(d) | 342,900 | | 4,735 |

Wyndham International, Inc. Class A (a) | 4,877,800 | | 4,634 |

| | 26,353 |

Household Durables - 0.0% |

Juno Lighting, Inc. | 3,600 | | 144 |

Leisure Equipment & Products - 0.4% |

Alliance Gaming Corp. (a)(d) | 896,000 | | 8,933 |

Media - 4.7% |

Cablevision Systems Corp. - NY Group Class A (a) | 242,900 | | 6,653 |

Charter Communications, Inc. Class A (a)(d) | 6,307,871 | | 10,156 |

Gray Television, Inc. | 622,300 | | 8,998 |

Liberty Media International, Inc. Class A (a) | 11,987 | | 543 |

News Corp. Class A | 180,888 | | 3,075 |

NTL, Inc. (a) | 625,907 | | 42,580 |

Spanish Broadcasting System, Inc. Class A (a) | 209,400 | | 2,152 |

The DIRECTV Group, Inc. (a) | 619,645 | | 9,326 |

The Reader's Digest Association, Inc. (non-vtg.) | 752,900 | | 12,137 |

Time Warner, Inc. (a) | 277,400 | | 4,993 |

UnitedGlobalCom, Inc. Class A (a) | 582,912 | | 5,695 |

| | 106,308 |

Specialty Retail - 1.0% |

AutoNation, Inc. (a) | 247,600 | | 4,714 |

Gap, Inc. | 758,200 | | 16,688 |

| | 21,402 |

TOTAL CONSUMER DISCRETIONARY | | 180,866 |

CONSUMER STAPLES - 2.7% |

Food & Staples Retailing - 2.0% |

Koninklijke Ahold NV sponsored ADR (a)(d) | 2,756,800 | | 22,799 |

Kroger Co. (a) | 371,300 | | 6,349 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

CONSUMER STAPLES - continued |

Food & Staples Retailing - continued |

Pathmark Stores, Inc. (a) | 1,297,047 | | $ 6,148 |

Safeway, Inc. (a) | 445,700 | | 8,401 |

| | 43,697 |

Food Products - 0.4% |

Kellogg Co. | 184,900 | | 8,254 |

Personal Products - 0.3% |

Revlon, Inc. Class A (a) | 3,225,199 | | 7,740 |

TOTAL CONSUMER STAPLES | | 59,691 |

ENERGY - 34.1% |

Energy Equipment & Services - 4.8% |

Grant Prideco, Inc. (a) | 606,300 | | 11,883 |

Grey Wolf, Inc. (a) | 6,220,200 | | 32,967 |

Hanover Compressor Co. (a) | 451,500 | | 6,402 |

Nabors Industries Ltd. (a) | 163,100 | | 8,220 |

Petroleum Geo-Services ASA ADR (a)(d) | 296,153 | | 20,568 |

Pride International, Inc. (a) | 484,300 | | 11,328 |

Rowan Companies, Inc. | 321,100 | | 9,042 |

Universal Compression Holdings, Inc. (a) | 184,700 | | 7,189 |

| | 107,599 |

Oil & Gas - 29.3% |

Burlington Resources, Inc. | 709,500 | | 31,012 |

Chesapeake Energy Corp. | 2,434,100 | | 42,767 |

Comstock Resources, Inc. (a) | 311,800 | | 7,315 |

Forest Oil Corp. (a)(e) | 3,133,300 | | 105,561 |

Frontier Oil Corp. | 578,600 | | 16,183 |

Frontline Ltd. (d) | 185,300 | | 9,230 |

Frontline Ltd. (NY Shares) | 603,900 | | 30,648 |

General Maritime Corp. (a)(e) | 2,738,500 | | 125,697 |

Houston Exploration Co. (a) | 89,200 | | 4,836 |

OMI Corp. (d) | 2,725,200 | | 47,691 |

Overseas Shipholding Group, Inc. | 123,200 | | 6,876 |

Range Resources Corp. | 2,814,300 | | 62,449 |

Ship Finance International Ltd. (d) | 156,252 | | 3,556 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

ENERGY - continued |

Oil & Gas - continued |

Teekay Shipping Corp. | 3,096,000 | | $ 137,375 |

Valero Energy Corp. | 455,200 | | 23,684 |

| | 654,880 |

TOTAL ENERGY | | 762,479 |

FINANCIALS - 2.6% |

Consumer Finance - 0.5% |

Metris Companies, Inc. | 937,300 | | 11,154 |

Insurance - 1.7% |

American Financial Group, Inc., Ohio | 1,002,800 | | 30,876 |

UnumProvident Corp. | 423,700 | | 7,275 |

| | 38,151 |

Thrifts & Mortgage Finance - 0.4% |

Capital Crossing Bank (a) | 258,800 | | 8,282 |

TOTAL FINANCIALS | | 57,587 |

HEALTH CARE - 3.6% |

Health Care Equipment & Supplies - 0.3% |

Baxter International, Inc. | 184,700 | | 6,235 |

Health Care Providers & Services - 2.1% |

Carriage Services, Inc. (a) | 14,700 | | 73 |

DaVita, Inc. (a) | 1,151,600 | | 48,321 |

| | 48,394 |

Pharmaceuticals - 1.2% |

Elan Corp. PLC sponsored ADR (a) | 987,700 | | 26,599 |

TOTAL HEALTH CARE | | 81,228 |

INDUSTRIALS - 11.1% |

Aerospace & Defense - 0.4% |

BE Aerospace, Inc. (a) | 365,424 | | 3,943 |

Goodrich Corp. | 133,700 | | 4,586 |

| | 8,529 |

Air Freight & Logistics - 0.2% |

Park-Ohio Holdings Corp. (a) | 162,411 | | 4,007 |

Airlines - 2.2% |

America West Holding Corp. Class B (a)(d) | 800,600 | | 4,011 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

INDUSTRIALS - continued |

Airlines - continued |

AMR Corp. (a)(d) | 2,514,530 | | $ 21,625 |

Delta Air Lines, Inc. (a)(d) | 3,927,450 | | 21,169 |

Northwest Airlines Corp. (a)(d) | 455,100 | | 3,363 |

| | 50,168 |

Building Products - 2.6% |

American Standard Companies, Inc. (a) | 713,200 | | 28,557 |

Lennox International, Inc. | 230,700 | | 4,605 |

Royal Group Technologies Ltd. (sub. vtg.) (a) | 564,700 | | 5,073 |

York International Corp. | 536,700 | | 19,493 |

| | 57,728 |

Commercial Services & Supplies - 1.3% |

Allied Waste Industries, Inc. (a) | 889,800 | | 7,394 |

Clean Harbors, Inc. (a)(d) | 140,200 | | 2,641 |

Corrections Corp. of America (a) | 479,200 | | 19,690 |

| | 29,725 |

Construction & Engineering - 0.1% |

Integrated Electrical Services, Inc. (a) | 326,200 | | 1,298 |

Industrial Conglomerates - 2.7% |

Tyco International Ltd. | 1,646,200 | | 59,494 |

Machinery - 1.0% |

Navistar International Corp. (a) | 234,000 | | 9,107 |

SPX Corp. | 180,200 | | 7,550 |

Terex Corp. (a) | 82,700 | | 3,560 |

Thermadyne Holdings Corp. (a) | 64,900 | | 833 |

Timken Co. | 92,800 | | 2,391 |

| | 23,441 |

Marine - 0.1% |

Golden Ocean Group Ltd. (a)(d) | 2,067,600 | | 1,218 |

Road & Rail - 0.5% |

Central Freight Lines, Inc. (a)(e) | 973,340 | | 6,103 |

Kansas City Southern (a) | 326,700 | | 5,704 |

| | 11,807 |

TOTAL INDUSTRIALS | | 247,415 |

INFORMATION TECHNOLOGY - 3.2% |

Communications Equipment - 0.2% |

Motorola, Inc. | 244,900 | | 3,855 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

INFORMATION TECHNOLOGY - continued |

Electronic Equipment & Instruments - 0.9% |

DDi Corp. (a)(d) | 2,071,300 | | $ 4,992 |

Merix Corp. (a) | 385,000 | | 3,550 |

Solectron Corp. (a) | 475,100 | | 2,361 |

Viasystems Group, Inc. (a) | 95,400 | | 1,145 |

Viasystems Group, Inc. (a)(h) | 625,780 | | 7,509 |

| | 19,557 |

Semiconductors & Semiconductor Equipment - 2.1% |

Atmel Corp. (a) | 1,776,500 | | 5,436 |

Conexant Systems, Inc. (a) | 927,700 | | 1,521 |

Fairchild Semiconductor International, Inc. (a) | 200,000 | | 2,854 |

Freescale Semiconductor, Inc.: | | | |

Class A | 287,500 | | 4,916 |

Class B (a) | 27,040 | | 472 |

ON Semiconductor Corp. (a) | 8,789,700 | | 32,170 |

| | 47,369 |

TOTAL INFORMATION TECHNOLOGY | | 70,781 |

MATERIALS - 10.8% |

Chemicals - 4.1% |

Celanese Corp. Class A | 106,300 | | 1,715 |

Crompton Corp. | 2,974,200 | | 34,649 |

Great Lakes Chemical Corp. | 813,000 | | 21,504 |

NOVA Chemicals Corp. | 454,800 | | 20,515 |

Rhodia SA ADR (d) | 5,081,400 | | 12,958 |