UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4118

Fidelity Securities Fund

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | July 31 |

| |

Date of reporting period: | January 31, 2012 |

Item 1. Reports to Stockholders

Fidelity®

Blue Chip Growth

Fund

Semiannual Report

January 31, 2012

(Fidelity Cover Art)

Contents

Chairman's Message | (Click Here) | The Chairman's message to shareholders. |

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Investment Changes | (Click Here) | A summary of major shifts in the fund's investments over the past six months. |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to the financial statements. |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

(photo_of_James_C_Curvey)

Dear Shareholder:

Following a year marked by unusually high volatility, 2012 began with most major asset classes advancing steadily in January. For U.S. equities, it was the strongest start to a new year since 1997. International stocks fared even better, despite continued uncertainty related to the sovereign debt crisis in Europe. Investors have been acutely sensitive to the latest news, for better or worse, coming out of the eurozone and its impact on financial markets. As we look ahead, the unresolved debt crisis in Europe remains at the center of a series of risk factors, summarized below, that we believe have the greatest potential to influence the global investment landscape.

Deleveraging and the economy

In the euro-currency area, fiscal austerity among nations and debt deleveraging among financial companies loaded with sovereign debt are deflationary measures and serve to hinder economic growth in the short term. Such an economic and financial-market scenario has not been historically supportive of strong performance among riskier assets, and emerges at a time when many nations need a resurgent economy to assist them in closing their budget deficits and in building confidence among bond buyers to help them refinance their existing debt obligations.

Slowdown in China and Europe

China's economy is the second-largest in the world, and it has been the biggest contributor to global growth since the end of the last recession. Thus, the slower pace of domestic growth in China has led to lower demand for imports of commodities and other construction materials from the rest of the world. In addition, economic weakness in Europe and the broad-based global economic slowdown are putting pressure on China's export growth, which has been largely responsible for its breakneck pace of annual gross domestic product (GDP) growth during the past three decades.

Credit deterioration and contagion

The heightened macroeconomic risk and elevated credit risk swirling around certain European nations and financial institutions have caused many market participants to avoid purchases of or reduce exposure to short-term debt offerings by these issuers. With increased credit risk, there are growing concerns about the potential credit contraction and contagion from European issuers spreading to other financial markets.

We invite you to learn more by visiting us on the Internet or calling us by phone. It is our privilege to provide the resources you need to choose investments that are right for you.

Sincerely,

(The acting chairman's signature appears here.)

James C. Curvey

Acting Chairman

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2011 to January 31, 2012).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Semiannual Report

Shareholder Expense Example - continued

| Annualized

Expense Ratio | Beginning

Account Value

August 1, 2011 | Ending

Account Value

January 31, 2012 | Expenses Paid

During Period*

August 1, 2011 to January 31, 2012 |

Blue Chip Growth | .91% | | | |

Actual | | $ 1,000.00 | $ 977.40 | $ 4.52 |

HypotheticalA | | $ 1,000.00 | $ 1,020.56 | $ 4.62 |

Class K | .75% | | | |

Actual | | $ 1,000.00 | $ 977.90 | $ 3.73 |

HypotheticalA | | $ 1,000.00 | $ 1,021.37 | $ 3.81 |

Class F | .70% | | | |

Actual | | $ 1,000.00 | $ 978.30 | $ 3.48 |

HypotheticalA | | $ 1,000.00 | $ 1,021.62 | $ 3.56 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

Semiannual Report

Investment Changes (Unaudited)

Top Ten Stocks as of January 31, 2012 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Apple, Inc. | 9.8 | 8.1 |

Google, Inc. Class A | 4.5 | 4.7 |

McDonald's Corp. | 2.2 | 1.7 |

Exxon Mobil Corp. | 2.1 | 2.0 |

QUALCOMM, Inc. | 2.1 | 2.3 |

The Coca-Cola Co. | 1.9 | 1.8 |

Amazon.com, Inc. | 1.7 | 2.4 |

Philip Morris International, Inc. | 1.4 | 1.8 |

Green Mountain Coffee Roasters, Inc. | 1.3 | 0.9 |

Schlumberger Ltd. | 1.2 | 1.6 |

| 28.2 | |

Top Five Market Sectors as of January 31, 2012 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Information Technology | 33.3 | 33.8 |

Consumer Discretionary | 19.8 | 19.2 |

Consumer Staples | 11.6 | 10.6 |

Industrials | 10.8 | 9.4 |

Energy | 9.7 | 10.8 |

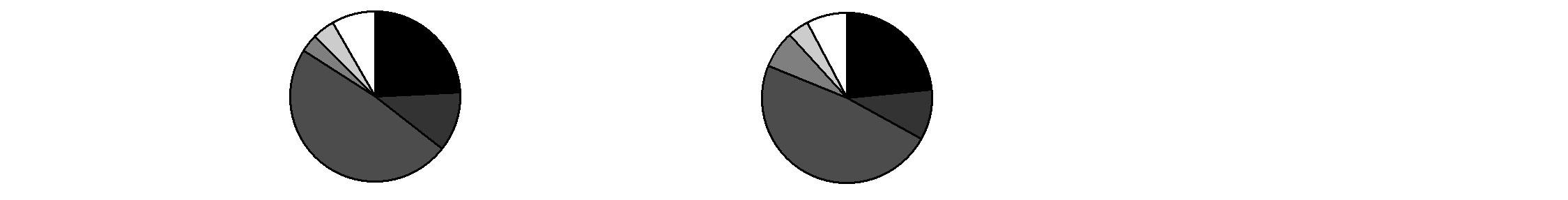

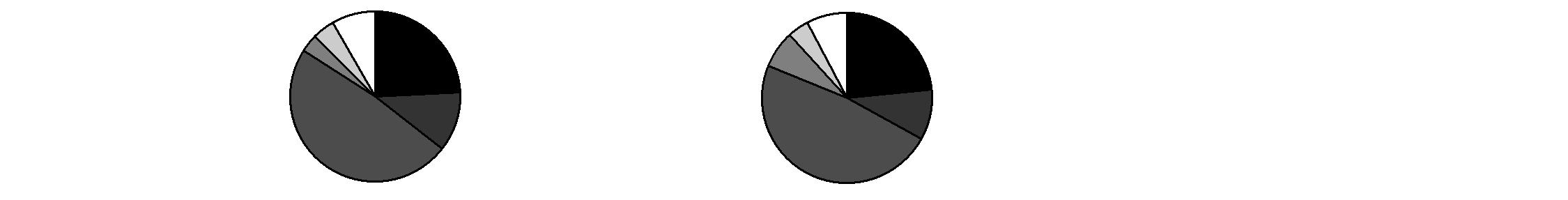

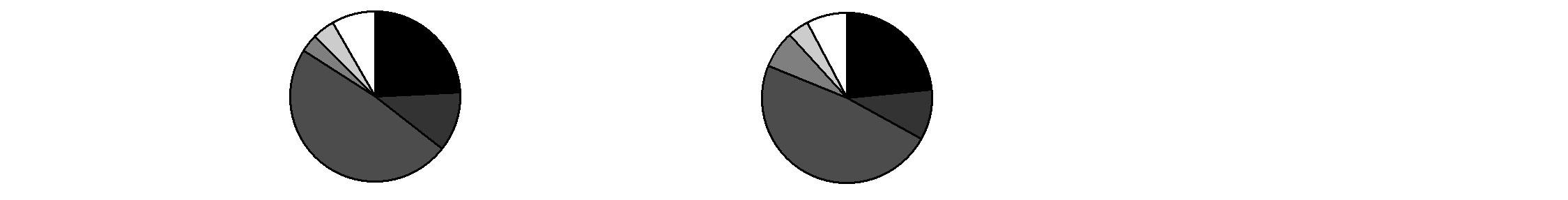

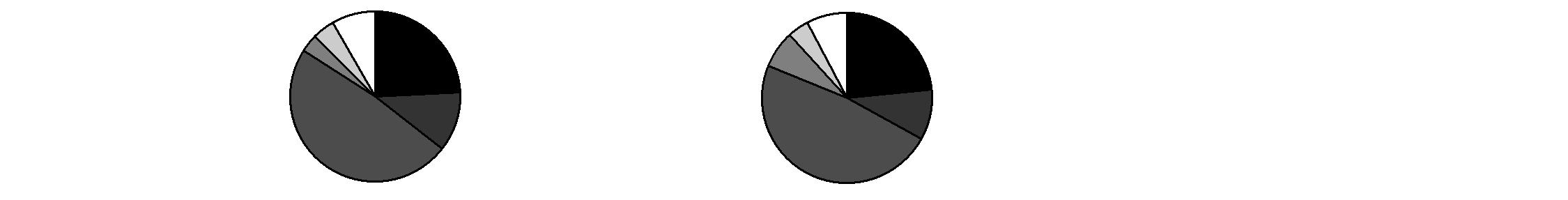

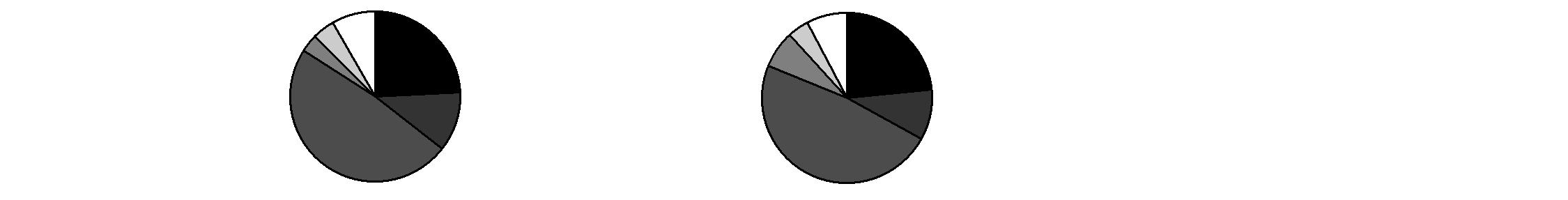

Asset Allocation (% of fund's net assets) |

As of January 31, 2012* | As of July 31, 2011** |

| Stocks 100.3% | |  | Stocks 99.6% | |

| Convertible

Securities 0.1% | |  | Convertible

Securities 0.2% | |

| Short-Term

Investments and

Net Other Assets (0.4)%† | |  | Short-Term

Investments and

Net Other Assets 0.2% | |

* Foreign investments | 11.4% | | ** Foreign investments | 13.0% | |

† Short-term Investments and Net Other Assets are not included in the pie chart.

Semiannual Report

Investments January 31, 2012 (Unaudited)

Showing Percentage of Net Assets

Common Stocks - 99.6% |

| Shares | | Value (000s) |

CONSUMER DISCRETIONARY - 19.1% |

Auto Components - 1.2% |

Autoliv, Inc. | 858,400 | | $ 54,156 |

Cooper Tire & Rubber Co. | 717,000 | | 10,798 |

Delphi Automotive PLC | 264,100 | | 7,086 |

Tenneco, Inc. (a) | 1,087,998 | | 34,925 |

TRW Automotive Holdings Corp. (a) | 1,372,200 | | 51,485 |

| | 158,450 |

Automobiles - 0.7% |

Hyundai Motor Co. | 75,033 | | 14,763 |

Kia Motors Corp. | 152,660 | | 9,174 |

Tesla Motors, Inc. (a)(d) | 2,673,354 | | 77,714 |

| | 101,651 |

Diversified Consumer Services - 0.2% |

New Oriental Education & Technology Group, Inc. sponsored ADR (a) | 1,217,400 | | 28,998 |

Hotels, Restaurants & Leisure - 5.8% |

Arcos Dorados Holdings, Inc. | 1,324,400 | | 28,475 |

Bravo Brio Restaurant Group, Inc. (a) | 750,800 | | 14,453 |

Brinker International, Inc. | 684,000 | | 17,681 |

Chipotle Mexican Grill, Inc. (a) | 137,400 | | 50,466 |

Dunkin' Brands Group, Inc. (a) | 1,022,600 | | 28,275 |

Jubilant Foodworks Ltd. (a) | 533,088 | | 10,160 |

Las Vegas Sands Corp. | 1,322,900 | | 64,968 |

McDonald's Corp. | 3,034,930 | | 300,610 |

Panera Bread Co. Class A (a) | 254,800 | | 37,774 |

Starbucks Corp. | 3,173,500 | | 152,106 |

Wyndham Worldwide Corp. | 736,885 | | 29,299 |

Yum! Brands, Inc. | 842,100 | | 53,330 |

| | 787,597 |

Household Durables - 1.1% |

KB Home | 14,700 | | 133 |

Lennar Corp. Class A | 1,373,352 | | 29,513 |

Newell Rubbermaid, Inc. | 1,166,900 | | 21,553 |

PulteGroup, Inc. (a) | 3,706,900 | | 27,616 |

SodaStream International Ltd. (a) | 286,400 | | 10,938 |

Tempur-Pedic International, Inc. (a) | 451,700 | | 30,133 |

Toll Brothers, Inc. (a) | 1,238,800 | | 27,018 |

| | 146,904 |

Internet & Catalog Retail - 2.3% |

Amazon.com, Inc. (a) | 1,183,300 | | 230,081 |

Common Stocks - continued |

| Shares | | Value (000s) |

CONSUMER DISCRETIONARY - continued |

Internet & Catalog Retail - continued |

Groupon, Inc. Class A (a)(d) | 708,900 | | $ 14,454 |

Priceline.com, Inc. (a) | 135,500 | | 71,745 |

| | 316,280 |

Media - 0.4% |

Comcast Corp. Class A | 1,018,500 | | 27,082 |

Lions Gate Entertainment Corp. (a) | 1,900,000 | | 19,152 |

Pandora Media, Inc. | 35,800 | | 472 |

Time Warner Cable, Inc. | 174,500 | | 12,864 |

| | 59,570 |

Multiline Retail - 1.2% |

Dollar General Corp. (a) | 437,700 | | 18,650 |

Dollar Tree, Inc. (a) | 222,500 | | 18,870 |

Dollarama, Inc. | 322,234 | | 13,898 |

JCPenney Co., Inc. | 705,200 | | 29,301 |

Macy's, Inc. | 2,522,700 | | 84,990 |

| | 165,709 |

Specialty Retail - 3.1% |

Bed Bath & Beyond, Inc. (a) | 550,600 | | 33,421 |

Cia.Hering SA | 254,600 | | 6,120 |

Foot Locker, Inc. | 901,700 | | 23,661 |

Francescas Holdings Corp. (a) | 290,500 | | 6,440 |

Home Depot, Inc. | 1,077,900 | | 47,848 |

Limited Brands, Inc. | 2,439,500 | | 102,117 |

Lowe's Companies, Inc. | 1,236,200 | | 33,167 |

Ross Stores, Inc. | 386,400 | | 19,637 |

TJX Companies, Inc. | 1,792,540 | | 122,144 |

Tractor Supply Co. | 71,000 | | 5,735 |

Ulta Salon, Cosmetics & Fragrance, Inc. (a) | 390,800 | | 29,787 |

| | 430,077 |

Textiles, Apparel & Luxury Goods - 3.1% |

Arezzo Industria e Comercio SA | 1,681,000 | | 28,132 |

Carter's, Inc. (a) | 262,600 | | 11,008 |

Deckers Outdoor Corp. (a) | 257,100 | | 20,787 |

Fossil, Inc. (a) | 479,200 | | 45,548 |

Gitanjali Gems Ltd. | 1,983,811 | | 12,432 |

Liz Claiborne, Inc. (a)(d) | 2,485,111 | | 23,112 |

Michael Kors Holdings Ltd. | 1,535,500 | | 47,524 |

Michael Kors Holdings Ltd. | 1,237,675 | | 34,475 |

NIKE, Inc. Class B | 735,700 | | 76,505 |

Common Stocks - continued |

| Shares | | Value (000s) |

CONSUMER DISCRETIONARY - continued |

Textiles, Apparel & Luxury Goods - continued |

PVH Corp. | 829,000 | | $ 63,991 |

Ralph Lauren Corp. | 157,200 | | 23,894 |

Steven Madden Ltd. (a) | 232,050 | | 9,547 |

Under Armour, Inc. Class A (sub. vtg.) (a) | 87,000 | | 6,927 |

VF Corp. | 140,500 | | 18,474 |

| | 422,356 |

TOTAL CONSUMER DISCRETIONARY | | 2,617,592 |

CONSUMER STAPLES - 11.6% |

Beverages - 4.0% |

Anheuser-Busch InBev SA NV ADR | 285,600 | | 17,364 |

Beam, Inc. | 207,600 | | 10,860 |

Dr Pepper Snapple Group, Inc. | 772,300 | | 29,981 |

Monster Beverage Corp. (a) | 1,280,900 | | 133,867 |

PepsiCo, Inc. | 1,382,500 | | 90,789 |

The Coca-Cola Co. | 3,807,500 | | 257,120 |

| | 539,981 |

Food & Staples Retailing - 2.2% |

Costco Wholesale Corp. | 157,700 | | 12,974 |

CVS Caremark Corp. | 2,564,200 | | 107,055 |

Drogasil SA | 1,456,285 | | 12,086 |

Sun Art Retail Group Ltd. (a) | 977,500 | | 1,190 |

Wal-Mart Stores, Inc. | 1,079,200 | | 66,220 |

Whole Foods Market, Inc. | 1,387,000 | | 102,680 |

| | 302,205 |

Food Products - 2.0% |

Calbee, Inc. (d) | 408,300 | | 19,925 |

Danone | 396,900 | | 24,495 |

Diamond Foods, Inc. (d) | 920,300 | | 33,444 |

Green Mountain Coffee Roasters, Inc. (a)(d) | 3,368,965 | | 179,701 |

Kraft Foods, Inc. Class A | 105,900 | | 4,056 |

Mead Johnson Nutrition Co. Class A | 200,900 | | 14,885 |

Tata Global Beverages Ltd. | 1,377,900 | | 2,998 |

| | 279,504 |

Household Products - 0.5% |

Colgate-Palmolive Co. | 404,200 | | 36,669 |

Procter & Gamble Co. | 570,700 | | 35,977 |

| | 72,646 |

Common Stocks - continued |

| Shares | | Value (000s) |

CONSUMER STAPLES - continued |

Personal Products - 0.6% |

Estee Lauder Companies, Inc. Class A | 726,200 | | $ 42,069 |

Herbalife Ltd. | 735,731 | | 42,584 |

| | 84,653 |

Tobacco - 2.3% |

Altria Group, Inc. | 2,032,300 | | 57,717 |

Lorillard, Inc. | 564,400 | | 60,611 |

Philip Morris International, Inc. | 2,588,300 | | 193,527 |

| | 311,855 |

TOTAL CONSUMER STAPLES | | 1,590,844 |

ENERGY - 9.7% |

Energy Equipment & Services - 3.7% |

Baker Hughes, Inc. | 270,000 | | 13,265 |

Cameron International Corp. (a) | 153,600 | | 8,172 |

Dresser-Rand Group, Inc. (a) | 270,000 | | 13,832 |

Ensco International Ltd. ADR | 154,200 | | 8,117 |

Halliburton Co. | 3,896,700 | | 143,321 |

McDermott International, Inc. (a) | 1,482,100 | | 18,022 |

National Oilwell Varco, Inc. | 1,195,700 | | 88,458 |

Noble Corp. | 117,400 | | 4,090 |

Schlumberger Ltd. | 2,242,300 | | 168,554 |

Seadrill Ltd. | 956,200 | | 35,475 |

Transocean Ltd. (United States) | 91,100 | | 4,309 |

| | 505,615 |

Oil, Gas & Consumable Fuels - 6.0% |

Alpha Natural Resources, Inc. (a) | 3,210,899 | | 64,603 |

Anadarko Petroleum Corp. | 977,200 | | 78,880 |

Apache Corp. | 309,200 | | 30,574 |

Approach Resources, Inc. (a)(d) | 400,000 | | 14,052 |

Cabot Oil & Gas Corp. | 977,000 | | 31,166 |

Chesapeake Energy Corp. | 365,500 | | 7,723 |

Chevron Corp. | 878,500 | | 90,556 |

EOG Resources, Inc. | 181,900 | | 19,307 |

EV Energy Partners LP | 216,100 | | 14,418 |

Exxon Mobil Corp. | 3,429,000 | | 287,144 |

Hess Corp. | 189,700 | | 10,680 |

HollyFrontier Corp. | 94,500 | | 2,773 |

Marathon Petroleum Corp. | 362,900 | | 13,870 |

Markwest Energy Partners LP | 94,300 | | 5,466 |

Common Stocks - continued |

| Shares | | Value (000s) |

ENERGY - continued |

Oil, Gas & Consumable Fuels - continued |

Occidental Petroleum Corp. | 1,140,900 | | $ 113,828 |

Range Resources Corp. | 193,600 | | 11,136 |

Valero Energy Corp. | 799,600 | | 19,182 |

| | 815,358 |

TOTAL ENERGY | | 1,320,973 |

FINANCIALS - 3.3% |

Capital Markets - 1.1% |

Morgan Stanley | 7,305,100 | | 136,240 |

Och-Ziff Capital Management Group LLC Class A | 1,445,800 | | 14,357 |

| | 150,597 |

Commercial Banks - 0.2% |

ICICI Bank Ltd. | 666,777 | | 12,097 |

Punjab National Bank | 133,123 | | 2,639 |

Wells Fargo & Co. | 321,000 | | 9,376 |

| | 24,112 |

Consumer Finance - 0.4% |

Discover Financial Services | 1,578,300 | | 42,898 |

Shriram Transport Finance Co. Ltd. | 1,042,803 | | 12,277 |

| | 55,175 |

Diversified Financial Services - 1.4% |

Citigroup, Inc. | 5,160,520 | | 158,531 |

JPMorgan Chase & Co. | 1,070,800 | | 39,941 |

| | 198,472 |

Real Estate Management & Development - 0.2% |

Parsvnath Developers Ltd. (a)(e) | 21,771,340 | | 25,986 |

TOTAL FINANCIALS | | 454,342 |

HEALTH CARE - 9.4% |

Biotechnology - 2.4% |

Alexion Pharmaceuticals, Inc. (a) | 699,400 | | 53,686 |

Alkermes PLC (a) | 917,100 | | 17,251 |

Amylin Pharmaceuticals, Inc. (a) | 1,832,100 | | 26,071 |

ARIAD Pharmaceuticals, Inc. (a) | 1,500,000 | | 22,125 |

Biogen Idec, Inc. (a) | 757,400 | | 89,313 |

Exelixis, Inc. (a) | 2,913,200 | | 15,498 |

Gilead Sciences, Inc. (a) | 426,900 | | 20,850 |

Common Stocks - continued |

| Shares | | Value (000s) |

HEALTH CARE - continued |

Biotechnology - continued |

InterMune, Inc. (a) | 262,900 | | $ 3,944 |

Medivation, Inc. (a) | 75,100 | | 4,161 |

ONYX Pharmaceuticals, Inc. (a) | 124,800 | | 5,109 |

Regeneron Pharmaceuticals, Inc. (a) | 197,900 | | 17,981 |

Spectrum Pharmaceuticals, Inc. (a)(d)(e) | 2,916,500 | | 41,035 |

Vertex Pharmaceuticals, Inc. (a) | 389,200 | | 14,381 |

ZIOPHARM Oncology, Inc. (a) | 526,800 | | 2,797 |

| | 334,202 |

Health Care Equipment & Supplies - 1.4% |

Baxter International, Inc. | 49,300 | | 2,735 |

Covidien PLC | 709,000 | | 36,514 |

Edwards Lifesciences Corp. (a) | 165,100 | | 13,649 |

Hologic, Inc. (a) | 1,613,500 | | 32,899 |

Insulet Corp. (a) | 100,000 | | 1,947 |

Intuitive Surgical, Inc. (a) | 36,400 | | 16,741 |

Mako Surgical Corp. (a) | 114,700 | | 4,104 |

The Cooper Companies, Inc. | 767,572 | | 55,373 |

William Demant Holding A/S (a) | 126,000 | | 10,435 |

Zeltiq Aesthetics, Inc. (d) | 1,052,500 | | 12,630 |

| | 187,027 |

Health Care Providers & Services - 2.8% |

Apollo Hospitals Enterprise Ltd. | 649,448 | | 7,872 |

Express Scripts, Inc. (a) | 2,236,780 | | 114,434 |

McKesson Corp. | 1,144,400 | | 93,520 |

Medco Health Solutions, Inc. (a) | 2,214,900 | | 137,368 |

UnitedHealth Group, Inc. | 510,200 | | 26,423 |

| | 379,617 |

Health Care Technology - 0.3% |

athenahealth, Inc. (a)(d) | 154,575 | | 8,993 |

Cerner Corp. (a) | 453,100 | | 27,589 |

| | 36,582 |

Life Sciences Tools & Services - 0.1% |

Illumina, Inc. (a) | 414,400 | | 21,449 |

Pharmaceuticals - 2.4% |

Abbott Laboratories | 323,800 | | 17,534 |

Allergan, Inc. | 126,100 | | 11,085 |

AVANIR Pharmaceuticals Class A (a)(d) | 1,464,000 | | 4,304 |

Bristol-Myers Squibb Co. | 205,200 | | 6,616 |

Elan Corp. PLC sponsored ADR (a) | 2,231,100 | | 30,365 |

Common Stocks - continued |

| Shares | | Value (000s) |

HEALTH CARE - continued |

Pharmaceuticals - continued |

Jazz Pharmaceuticals PLC (a) | 143,300 | | $ 6,663 |

Johnson & Johnson | 1,554,600 | | 102,464 |

Pfizer, Inc. | 473,100 | | 10,124 |

Questcor Pharmaceuticals, Inc. (a) | 910,800 | | 32,270 |

Salix Pharmaceuticals Ltd. (a) | 684,800 | | 33,007 |

Sanofi-aventis sponsored ADR | 437,400 | | 16,241 |

Shire PLC sponsored ADR | 182,000 | | 18,113 |

Valeant Pharmaceuticals International, Inc. (Canada) (a) | 733,200 | | 35,507 |

| | 324,293 |

TOTAL HEALTH CARE | | 1,283,170 |

INDUSTRIALS - 10.8% |

Aerospace & Defense - 3.5% |

Honeywell International, Inc. | 841,900 | | 48,864 |

Precision Castparts Corp. | 647,300 | | 105,950 |

The Boeing Co. | 2,051,200 | | 152,158 |

United Technologies Corp. | 2,098,300 | | 164,402 |

| | 471,374 |

Air Freight & Logistics - 1.1% |

United Parcel Service, Inc. Class B | 1,977,900 | | 149,628 |

Airlines - 0.3% |

United Continental Holdings, Inc. (a) | 1,378,700 | | 31,848 |

US Airways Group, Inc. (a) | 1,063,100 | | 8,973 |

| | 40,821 |

Building Products - 0.3% |

Armstrong World Industries, Inc. (a) | 768,200 | | 35,875 |

Owens Corning (a) | 263,000 | | 8,876 |

| | 44,751 |

Commercial Services & Supplies - 0.1% |

Swisher Hygiene, Inc. | 2,095,491 | | 7,355 |

Construction & Engineering - 0.3% |

Fluor Corp. | 761,900 | | 42,849 |

Electrical Equipment - 0.2% |

Polypore International, Inc. (a) | 822,700 | | 31,328 |

Common Stocks - continued |

| Shares | | Value (000s) |

INDUSTRIALS - continued |

Industrial Conglomerates - 1.2% |

Carlisle Companies, Inc. | 259,000 | | $ 12,362 |

Danaher Corp. | 2,862,300 | | 150,299 |

| | 162,661 |

Machinery - 3.2% |

Caterpillar, Inc. | 1,017,200 | | 110,997 |

Cummins, Inc. | 956,700 | | 99,497 |

Deere & Co. | 47,200 | | 4,066 |

Eaton Corp. | 319,300 | | 15,655 |

Ingersoll-Rand PLC | 588,300 | | 20,555 |

Jain Irrigation Systems Ltd. DVR (a) | 39,000 | | 29 |

Joy Global, Inc. | 1,016,700 | | 92,205 |

Manitowoc Co., Inc. | 1,076,900 | | 14,474 |

PACCAR, Inc. | 1,168,900 | | 51,665 |

WABCO Holdings, Inc. (a) | 642,400 | | 33,308 |

| | 442,451 |

Professional Services - 0.0% |

Manpower, Inc. | 98,200 | | 3,939 |

Road & Rail - 0.5% |

Union Pacific Corp. | 591,100 | | 67,569 |

Trading Companies & Distributors - 0.1% |

Mills Estruturas e Servicos de Engenharia SA | 827,400 | | 10,267 |

TOTAL INDUSTRIALS | | 1,474,993 |

INFORMATION TECHNOLOGY - 33.3% |

Communications Equipment - 2.3% |

Aruba Networks, Inc. (a) | 250,000 | | 5,545 |

Juniper Networks, Inc. (a) | 651,000 | | 13,625 |

Polycom, Inc. (a) | 746,800 | | 14,899 |

QUALCOMM, Inc. | 4,787,000 | | 281,571 |

Riverbed Technology, Inc. (a) | 200,600 | | 4,802 |

| | 320,442 |

Computers & Peripherals - 10.7% |

Apple, Inc. (a) | 2,929,600 | | 1,337,298 |

EMC Corp. (a) | 2,083,700 | | 53,676 |

Fusion-io, Inc. | 100,600 | | 2,325 |

NetApp, Inc. (a) | 383,500 | | 14,473 |

SanDisk Corp. (a) | 1,125,800 | | 51,652 |

| | 1,459,424 |

Common Stocks - continued |

| Shares | | Value (000s) |

INFORMATION TECHNOLOGY - continued |

Electronic Equipment & Components - 0.1% |

Aeroflex Holding Corp. (a) | 507,700 | | $ 6,433 |

Vishay Intertechnology, Inc. (a) | 791,900 | | 9,725 |

| | 16,158 |

Internet Software & Services - 6.8% |

Akamai Technologies, Inc. (a) | 1,433,700 | | 46,237 |

Baidu.com, Inc. sponsored ADR (a) | 334,600 | | 42,668 |

Bankrate, Inc. (d) | 600,500 | | 14,046 |

eBay, Inc. (a) | 2,021,440 | | 63,878 |

Facebook, Inc. Class B (f) | 636,167 | | 15,904 |

Google, Inc. Class A (a) | 1,049,467 | | 608,806 |

IAC/InterActiveCorp | 463,500 | | 19,963 |

INFO Edge India Ltd. | 293,110 | | 3,699 |

Rackspace Hosting, Inc. (a) | 1,616,200 | | 70,159 |

SINA Corp. (a)(d) | 478,900 | | 33,652 |

Velti PLC (a) | 1,398,000 | | 12,233 |

| | 931,245 |

IT Services - 2.3% |

Accenture PLC Class A | 477,700 | | 27,391 |

Cognizant Technology Solutions Corp. Class A (a) | 1,688,700 | | 121,164 |

International Business Machines Corp. | 36,100 | | 6,953 |

MasterCard, Inc. Class A | 413,400 | | 146,993 |

Teradata Corp. (a) | 216,600 | | 11,601 |

Visa, Inc. Class A | 26,400 | | 2,657 |

| | 316,759 |

Semiconductors & Semiconductor Equipment - 5.0% |

Applied Micro Circuits Corp. (a) | 377,944 | | 2,959 |

ASML Holding NV | 1,134,600 | | 48,776 |

Avago Technologies Ltd. | 2,001,400 | | 67,928 |

Broadcom Corp. Class A | 3,851,300 | | 132,254 |

Cirrus Logic, Inc. (a) | 827,128 | | 16,898 |

Cree, Inc. (a) | 473,200 | | 12,033 |

Cymer, Inc. (a) | 125,800 | | 6,264 |

Fairchild Semiconductor International, Inc. (a) | 514,500 | | 7,193 |

Freescale Semiconductor Holdings I Ltd. | 3,216,458 | | 51,367 |

Lam Research Corp. (a) | 263,900 | | 11,240 |

LSI Corp. (a) | 2,118,000 | | 16,033 |

Marvell Technology Group Ltd. (a) | 4,263,186 | | 66,207 |

Mellanox Technologies Ltd. (a) | 380,700 | | 13,960 |

NVIDIA Corp. (a) | 3,650,973 | | 53,925 |

NXP Semiconductors NV (a) | 6,216,400 | | 131,974 |

Common Stocks - continued |

| Shares | | Value (000s) |

INFORMATION TECHNOLOGY - continued |

Semiconductors & Semiconductor Equipment - continued |

ON Semiconductor Corp. (a) | 497,100 | | $ 4,325 |

Samsung Electronics Co. Ltd. | 7,550 | | 7,441 |

Siliconware Precision Industries Co. Ltd. sponsored ADR | 1,041,444 | | 5,884 |

Xilinx, Inc. | 563,200 | | 20,191 |

| | 676,852 |

Software - 6.1% |

BroadSoft, Inc. (a) | 644,600 | | 17,971 |

Check Point Software Technologies Ltd. (a) | 1,317,800 | | 74,179 |

Citrix Systems, Inc. (a) | 1,526,700 | | 99,556 |

Guidewire Software, Inc. | 28,500 | | 514 |

Informatica Corp. (a) | 655,700 | | 27,736 |

Jive Software, Inc. | 276,724 | | 4,109 |

Microsoft Corp. | 5,266,200 | | 155,511 |

Oracle Corp. | 5,461,300 | | 154,009 |

QLIK Technologies, Inc. (a) | 621,163 | | 17,517 |

Red Hat, Inc. (a) | 1,138,500 | | 52,792 |

salesforce.com, Inc. (a) | 1,283,165 | | 149,874 |

VMware, Inc. Class A (a) | 891,800 | | 81,395 |

Zynga, Inc. (d) | 344,300 | | 3,615 |

| | 838,778 |

TOTAL INFORMATION TECHNOLOGY | | 4,559,658 |

MATERIALS - 2.4% |

Chemicals - 1.5% |

CF Industries Holdings, Inc. | 178,900 | | 31,733 |

E.I. du Pont de Nemours & Co. | 751,800 | | 38,259 |

Eastman Chemical Co. | 58,200 | | 2,929 |

Kronos Worldwide, Inc. | 59,600 | | 1,372 |

LyondellBasell Industries NV Class A | 1,092,600 | | 47,091 |

Monsanto Co. | 357,500 | | 29,333 |

Rentech Nitrogen Partners LP | 347,300 | | 7,943 |

Sigma Aldrich Corp. | 41,000 | | 2,790 |

The Mosaic Co. | 715,200 | | 40,030 |

| | 201,480 |

Containers & Packaging - 0.2% |

Rock-Tenn Co. Class A | 526,000 | | 32,538 |

Metals & Mining - 0.7% |

Allegheny Technologies, Inc. | 280,700 | | 12,741 |

Common Stocks - continued |

| Shares | | Value (000s) |

MATERIALS - continued |

Metals & Mining - continued |

First Quantum Minerals Ltd. | 144,300 | | $ 3,160 |

Freeport-McMoRan Copper & Gold, Inc. | 1,694,800 | | 78,317 |

| | 94,218 |

TOTAL MATERIALS | | 328,236 |

TOTAL COMMON STOCKS (Cost $10,289,970) |

13,629,808

|

Preferred Stocks - 0.8% |

| | | |

Convertible Preferred Stocks - 0.1% |

HEALTH CARE - 0.1% |

Pharmaceuticals - 0.1% |

Merrimack Pharmaceuticals, Inc. Series G (f) | 2,142,858 | | 15,429 |

Nonconvertible Preferred Stocks - 0.7% |

CONSUMER DISCRETIONARY - 0.7% |

Automobiles - 0.7% |

Volkswagen AG | 512,800 | | 90,782 |

TOTAL PREFERRED STOCKS (Cost $73,958) |

106,211

|

Money Market Funds - 1.4% |

| | | |

Fidelity Cash Central Fund, 0.12% (b) | 24,583,592 | | 24,584 |

Fidelity Securities Lending Cash Central Fund, 0.12% (b)(c) | 174,210,828 | | 174,211 |

TOTAL MONEY MARKET FUNDS (Cost $198,795) |

198,795

|

Cash Equivalents - 0.0% |

| Maturity Amount (000s) | | Value (000s) |

Investments in repurchase agreements in a joint trading account at 0.2%, dated 1/31/12 due 2/1/12 (Collateralized by U.S. Government Obligations) #

(Cost $7,306) | $ 7,306 | | $ 7,306 |

TOTAL INVESTMENT PORTFOLIO - 101.8% (Cost $10,570,029) | | 13,942,120 |

NET OTHER ASSETS (LIABILITIES) - (1.8)% | | (252,683) |

NET ASSETS - 100% | $ 13,689,437 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

(e) Affiliated company |

(f) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $31,333,000 or 0.2% of net assets. |

Additional information on each restricted holding is as follows: |

Security | Acquisition Date | Acquisition Cost (000s) |

Facebook, Inc. Class B | 3/31/11 - 5/19/11 | $ 15,909 |

Merrimack Pharmaceuticals, Inc. Series G | 3/31/11 | $ 15,000 |

Repurchase Agreement / Counterparty | Value

(000s) |

$7,306,000 due 2/01/12 at 0.20% |

BNP Paribas Securities Corp. | $ 3,854 |

Barclays Capital, Inc. | 2,050 |

Merrill Lynch, Pierce, Fenner & Smith, Inc. | 1,402 |

| $ 7,306 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned

(Amounts in thousands) |

Fidelity Cash Central Fund | $ 20 |

Fidelity Securities Lending Cash Central Fund | 1,207 |

Total | $ 1,227 |

Other Affiliated Issuers |

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows: |

Affiliate

(Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Value,

end of

period |

Parsvnath Developers Ltd. | $ 22,924 | $ - | $ - | $ - | $ 25,986 |

Spectrum Pharmaceuticals, Inc. | - | 42,886 | - | - | 41,035 |

Total | $ 22,924 | $ 42,886 | $ - | $ - | $ 67,021 |

Other Information |

The following is a summary of the inputs used, as of January 31, 2012, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the tables below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description

(Amounts in thousands) | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

Equities: | | | | |

Consumer Discretionary | $ 2,708,374 | $ 2,673,899 | $ 34,475 | $ - |

Consumer Staples | 1,590,844 | 1,590,844 | - | - |

Energy | 1,320,973 | 1,320,973 | - | - |

Financials | 454,342 | 439,606 | 14,736 | - |

Health Care | 1,298,599 | 1,283,170 | - | 15,429 |

Industrials | 1,474,993 | 1,474,993 | - | - |

Information Technology | 4,559,658 | 4,543,754 | - | 15,904 |

Materials | 328,236 | 328,236 | - | - |

Money Market Funds | 198,795 | 198,795 | - | - |

Cash Equivalents | 7,306 | - | 7,306 | - |

Total Investments in Securities: | $ 13,942,120 | $ 13,854,270 | $ 56,517 | $ 31,333 |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value: |

(Amounts in thousands) | |

Investments in Securities: | |

Beginning Balance | $ 45,904 |

Total Realized Gain (Loss) | - |

Total Unrealized Gain (Loss) | 429 |

Cost of Purchases | - |

Proceeds of Sales | (15,000) |

Amortization/Accretion | - |

Transfers in to Level 3 | - |

Transfers out of Level 3 | - |

Ending Balance | $ 31,333 |

The change in unrealized gain (loss) for the period attributable to Level 3 securities held at January 31, 2012 | $ 429 |

The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations. |

Distribution of investments by country of issue, as a percentage of total net assets, is as follows: (Unaudited) |

United States of America | 88.6% |

Netherlands | 1.8% |

Curacao | 1.2% |

Bermuda | 1.2% |

Ireland | 1.1% |

Cayman Islands | 1.0% |

Others (Individually Less Than 1%) | 5.1% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Assets and Liabilities

Amounts in thousands (except per-share amounts) | January 31, 2012 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $169,658 and repurchase agreements of $7,306) - See accompanying schedule: Unaffiliated issuers (cost $10,297,496) | $ 13,676,304 | |

Fidelity Central Funds (cost $198,795) | 198,795 | |

Other affiliated issuers (cost $73,738) | 67,021 | |

Total Investments (cost $10,570,029) | | $ 13,942,120 |

Receivable for investments sold | | 194,706 |

Receivable for fund shares sold | | 9,592 |

Dividends receivable | | 4,244 |

Distributions receivable from Fidelity Central Funds | | 378 |

Prepaid expenses | | 34 |

Other receivables | | 689 |

Total assets | | 14,151,763 |

| | |

Liabilities | | |

Payable to custodian bank | $ 267 | |

Payable for investments purchased | 211,859 | |

Payable for fund shares redeemed | 65,123 | |

Accrued management fee | 8,291 | |

Other affiliated payables | 2,058 | |

Other payables and accrued expenses | 517 | |

Collateral on securities loaned, at value | 174,211 | |

Total liabilities | | 462,326 |

| | |

Net Assets | | $ 13,689,437 |

Net Assets consist of: | | |

Paid in capital | | $ 10,655,223 |

Accumulated net investment loss | | (10,745) |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (327,145) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 3,372,104 |

Net Assets | | $ 13,689,437 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Assets and Liabilities - continued

Amounts in thousands (except per-share amounts) | January 31, 2012 (Unaudited) |

| | |

Blue Chip Growth:

Net Asset Value, offering price and redemption price per share ($10,561,581 ÷ 233,276 shares) | | $ 45.28 |

| | |

Class K:

Net Asset Value, offering price and redemption price per share ($1,856,005 ÷ 40,960 shares) | | $ 45.31 |

| | |

Class F:

Net Asset Value, offering price and redemption price per share ($1,271,851 ÷ 28,046 shares) | | $ 45.35 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Operations

Amounts in thousands | Six months ended January 31, 2012 (Unaudited) |

| | |

Investment Income | | |

Dividends | | $ 69,082 |

Income from Fidelity Central Funds | | 1,227 |

Total income | | 70,309 |

| | |

Expenses | | |

Management fee

Basic fee | $ 36,841 | |

Performance adjustment | 7,741 | |

Transfer agent fees | 11,888 | |

Accounting and security lending fees | 721 | |

Custodian fees and expenses | 414 | |

Independent trustees' compensation | 45 | |

Registration fees | 108 | |

Audit | 60 | |

Legal | 34 | |

Interest | 4 | |

Miscellaneous | 60 | |

Total expenses before reductions | 57,916 | |

Expense reductions | (195) | 57,721 |

Net investment income (loss) | | 12,588 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | (279,753) | |

Foreign currency transactions | 164 | |

Total net realized gain (loss) | | (279,589) |

Change in net unrealized appreciation (depreciation) on: Investment securities | (80,602) | |

Assets and liabilities in foreign currencies | 12 | |

Total change in net unrealized appreciation (depreciation) | | (80,590) |

Net gain (loss) | | (360,179) |

Net increase (decrease) in net assets resulting from operations | | $ (347,591) |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Changes in Net Assets

Amounts in thousands | Six months ended January 31, 2012 (Unaudited) | Year ended

July 31,

2011 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 12,588 | $ (4,517) |

Net realized gain (loss) | (279,589) | 1,562,158 |

Change in net unrealized appreciation (depreciation) | (80,590) | 1,651,657 |

Net increase (decrease) in net assets resulting

from operations | (347,591) | 3,209,298 |

Distributions to shareholders from net investment income | (15,666) | (2,405) |

Distributions to shareholders from net realized gain | (480,840) | (12,451) |

Total distributions | (496,506) | (14,856) |

Share transactions - net increase (decrease) | 143,086 | (352,214) |

Total increase (decrease) in net assets | (701,011) | 2,842,228 |

| | |

Net Assets | | |

Beginning of period | 14,390,448 | 11,548,220 |

End of period (including accumulated net investment loss of $10,745 and accumulated net investment loss of $7,667, respectively) | $ 13,689,437 | $ 14,390,448 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Blue Chip Growth

| Six months ended January 31, 2012 | Years ended July 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 48.17 | $ 37.63 | $ 31.97 | $ 39.06 | $ 46.88 | $ 41.54 |

Income from Investment Operations | | | | | | |

Net investment income (loss) D | .03 | (.03) | .04 | .27 | .35 | .32 |

Net realized and unrealized gain (loss) | (1.28) | 10.61 | 5.80 | (6.36) | (2.89) | 6.19 |

Total from investment operations | (1.25) | 10.58 | 5.84 | (6.09) | (2.54) | 6.51 |

Distributions from net investment income | (.04) | (.00) H, I | (.18) | (.29) | (.33) | (.24) |

Distributions from net realized gain | (1.60) | (.04) I | - | (.71) | (4.95) | (.93) |

Total distributions | (1.64) | (.04) | (.18) | (1.00) | (5.28) | (1.17) |

Net asset value, end of period | $ 45.28 | $ 48.17 | $ 37.63 | $ 31.97 | $ 39.06 | $ 46.88 |

Total Return B, C | (2.26)% | 28.12% | 18.29% | (15.85)% | (6.30)% | 16.02% |

Ratios to Average Net Assets E, G | | | | | |

Expenses before reductions | .91% A | .94% | .94% | .76% | .58% | .60% |

Expenses net of fee waivers, if any | .91% A | .94% | .94% | .76% | .58% | .60% |

Expenses net of all reductions | .91% A | .92% | .93% | .76% | .57% | .59% |

Net investment income (loss) | .16% A | (.06)% | .10% | .93% | .81% | .72% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 10,562 | $ 12,024 | $ 10,295 | $ 9,691 | $ 13,349 | $ 18,616 |

Portfolio turnover rate F | 100% A | 132% | 135% | 134% | 82% | 87% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount represents less than $.01 per share.

I The amount shown reflects certain reclassifications related to book to tax differences.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class K

| Six months ended January 31, 2012 | Years ended July 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 G |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 48.21 | $ 37.66 | $ 32.01 | $ 39.07 | $ 41.81 |

Income from Investment Operations | | | | | |

Net investment income (loss) D | .07 | .05 | .11 | .32 | .10 |

Net realized and unrealized gain (loss) | (1.30) | 10.62 | 5.79 | (6.33) | (2.84) |

Total from investment operations | (1.23) | 10.67 | 5.90 | (6.01) | (2.74) |

Distributions from net investment income | (.08) | (.05) J | (.25) | (.34) | - |

Distributions from net realized gain | (1.60) | (.07) J | - | (.71) | - |

Total distributions | (1.67) I | (.12) | (.25) | (1.05) | - |

Net asset value, end of period | $ 45.31 | $ 48.21 | $ 37.66 | $ 32.01 | $ 39.07 |

Total Return B, C | (2.21)% | 28.37% | 18.48% | (15.61)% | (6.55)% |

Ratios to Average Net Assets E, H | | | | |

Expenses before reductions | .75% A | .77% | .75% | .53% | .41% A |

Expenses net of fee waivers, if any | .75% A | .77% | .75% | .53% | .41% A |

Expenses net of all reductions | .75% A | .76% | .74% | .52% | .41% A |

Net investment income (loss) | .32% A | .11% | .30% | 1.16% | 1.09% A |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 1,856,005 | $ 1,454,854 | $ 931,601 | $ 590,673 | $ 93 |

Portfolio turnover rate F | 100% A | 132% | 135% | 134% | 82% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period May 9, 2008 (commencement of sale of shares) to July 31, 2008.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Total distributions of $1.67 per share is comprised of distributions from net investment income of $.076 and distributions from net realized gain of $1.598 per share.

J The amount shown reflects certain reclassifications related to book to tax differences.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class F

| Six months ended January 31, 2012 | Years ended July 31, |

| (Unaudited) | 2011 | 2010 | 2009 G |

Selected Per-Share Data | | | | |

Net asset value, beginning of period | $ 48.24 | $ 37.69 | $ 31.98 | $ 29.16 |

Income from Investment Operations | | | | |

Net investment income (loss) D | .08 | .07 | .13 | - I |

Net realized and unrealized gain (loss) | (1.29) | 10.61 | 5.80 | 2.82 |

Total from investment operations | (1.21) | 10.68 | 5.93 | 2.82 |

Distributions from net investment income | (.08) | (.06) K | (.22) | - |

Distributions from net realized gain | (1.60) | (.08) K | - | - |

Total distributions | (1.68) | (.13) J | (.22) | - |

Net asset value, end of period | $ 45.35 | $ 48.24 | $ 37.69 | $ 31.98 |

Total Return B, C | (2.17)% | 28.41% | 18.59% | 9.67% |

Ratios to Average Net Assets E, H | | | | |

Expenses before reductions | .70% A | .72% | .70% | .51% A |

Expenses net of fee waivers, if any | .70% A | .72% | .70% | .51% A |

Expenses net of all reductions | .70% A | .71% | .68% | .51% A |

Net investment income (loss) | .37% A | .16% | .35% | (.05)% A |

Supplemental Data | | | | |

Net assets, end of period (000 omitted) | $ 1,271,851 | $ 911,556 | $ 321,409 | $ 261 |

Portfolio turnover rate F | 100% A | 132% | 135% | 134% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period June 26, 2009 (commencement of sale of shares) to July 31, 2009.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

J Total distributions of $.13 per share is comprised of distributions from net investment income of $.058 and distributions from net realized gain of $.076 per share.

K The amount shown reflects certain reclassifications related to book to tax differences.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Notes to Financial Statements

For the period ended January 31, 2012 (Unaudited)

(Amounts in thousands except percentages)

1. Organization.

Fidelity Blue Chip Growth Fund (the Fund) is a fund of Fidelity Securities Fund (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Blue Chip Growth, Class K and Class F shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class F shares of the Fund are only available for purchase by mutual funds for which Fidelity Management & Research Company (FMR) or an affiliate serves as investment manager. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions may also differ by class.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by FMR and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC web site or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except percentages)

3. Significant Accounting Policies - continued

the financial statements. The following summarizes the significant accounting policies of the Fund:

Security Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Fund uses independent pricing services approved by the Board of Trustees to value its investments. When current market prices or quotations are not readily available or reliable, valuations may be determined in good faith in accordance with procedures adopted by the Board of Trustees. Factors used in determining value may include market or security specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The value used for net asset value (NAV) calculation under these procedures may differ from published prices for the same securities.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of January 31, 2012, as well as a roll forward of Level 3 securities, is included at the end of the Fund's Schedule of Investments. Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when significant market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-traded funds (ETFs) and certain indexes as well as quoted prices for similar securities are used and are categorized as Level 2 in the hierarchy in these circumstances. Utilizing these techniques may result in transfers between Level 1 and Level 2. For restricted equity securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and are categorized as Level 3 in the hierarchy.

Semiannual Report

3. Significant Accounting Policies - continued

Security Valuation - continued

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value each business day and are categorized as Level 1 in the hierarchy. Short-term securities with remaining maturities of sixty days or less may be valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

New Accounting Pronouncements. In May 2011, the Financial Accounting Standards Board issued Accounting Standard Update No. 2011-04, Fair Value Measurement (Topic 820) - Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. The update is effective during interim and annual periods beginning after December 15, 2011 and will result in additional disclosure for transfers between levels as well as expanded disclosure for securities categorized as Level 3 under the fair value hierarchy.

In December 2011, the Financial Accounting Standards Board issued Accounting Standard Update No. 2011-11, Disclosures about Offsetting Assets and Liabilities. The update creates new disclosure requirements requiring entities to disclose both gross and net information for derivatives and other financial instruments that are either offset in the Statement of Assets and Liabilities or subject to an enforceable master netting arrangement or similar agreement. The disclosure requirements are effective for interim and annual reporting periods beginning on or after January 1, 2013. Management is currently evaluating the impact of the update's adoption on the Fund's financial statement disclosures.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except percentages)

3. Significant Accounting Policies - continued

Investment Transactions and Income - continued

calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The Fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), independent Trustees may elect to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees are included in the accompanying Statement of Assets and Liabilities.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company, including distributing substantially all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. A fund's tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain

Semiannual Report

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

distributions are determined in accordance with income tax regulations, which may differ from GAAP. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), partnerships, deferred trustees compensation, capital loss carryforwards and losses deferred due to wash sales and excise tax regulations.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 3,603,984 |

Gross unrealized depreciation | (282,015) |

Net unrealized appreciation (depreciation) on securities and other investments | $ 3,321,969 |

| |

Tax cost | $ 10,620,151 |

The Fund intends to elect to defer to its fiscal year ending July 31, 2012 approximately $7,175 of currency losses recognized during the period November 1, 2010 to July 31, 2011.

4. Operating Policies.

Repurchase Agreements. FMR has received an Exemptive Order from the SEC which permits the Fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The Fund may also invest directly with institutions in repurchase agreements. Repurchase agreements are collateralized by government or non-government securities. Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The Fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except percentages)

4. Operating Policies - continued

Restricted Securities - continued

these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $6,661,058 and $6,910,054, respectively.

6. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and an annualized group fee rate that averaged .26% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of ± .20% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of Blue Chip Growth as compared to an appropriate benchmark index. For the period, the total annualized management fee rate, including the performance adjustment, was .68% of the Fund's average net assets.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of FMR, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of Blue Chip Growth. FIIOC receives an asset-based fee of Class K's average net assets. FIIOC receives no fees for providing transfer agency services to Class F. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period, transfer agent fees for each class were as follows:

| Amount | % of

Average

Net Assets* |

Blue Chip Growth | $ 11,490 | .22 |

Class K | 398 | .05 |

| $ 11,888 | |

* Annualized

Semiannual Report

6. Fees and Other Transactions with Affiliates - continued

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $200 for the period.

Interfund Lending Program. Pursuant to an Exemptive Order issued by the SEC, the Fund, along with other registered investment companies having management contracts with FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the funds to borrow from, or lend money to, other participating affiliated funds. At period end, there were no interfund loans outstanding. The Fund's activity in this program during the period for which loans were outstanding was as follows:

Borrower or Lender | Average Loan

Balance | Weighted Average Interest Rate | Interest

Expense |

Borrower | $ 9,128 | .34% | $ 4 |

7. Committed Line of Credit.

The Fund participates with other funds managed by FMR or an affiliate in a $4.0 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $19 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, there were no borrowings on this line of credit.

8. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. If the

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except percentages)

8. Security Lending - continued

borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. The value of securities loaned to FCM at period end was $5,075. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $1,207, including $38 from securities loaned to FCM.

9. Expense Reductions.

Many of the brokers with whom FMR places trades on behalf of the Fund provided services to the Fund in addition to trade execution. These services included payments of certain expenses on behalf of the Fund totaling $195 for the period.

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| Six months ended

January 31,

2012 | Year ended

July 31,

2011 |

From net investment income | | |

Blue Chip Growth | $ 10,644 | $ 670 |

Class K | 2,860 | 1,165 |

Class F | 2,162 | 570 |

Total | $ 15,666 | $ 2,405 |

From net realized gain | | |

Blue Chip Growth | $ 397,249 | $ 9,690 |

Class K | 51,295 | 1,750 |

Class F | 32,296 | 1,011 |

Total | $ 480,840 | $ 12,451 |

Semiannual Report

11. Share Transactions.

Transactions for each class of shares were as follows:

| Shares | Dollars |

| Six months ended January 31,

2012 | Year ended

July 31,

2011 | Six months ended January 31,

2012 | Year ended

July 31,

2011 |

Blue Chip Growth | | | | |

Shares sold | 19,730 | 42,281 | $ 854,739 | $ 1,904,203 |

Reinvestment of distributions | 9,668 | 232 | 399,688 | 10,166 |

Shares redeemed | (45,734) | (66,514) | (1,960,580) | (2,974,498) |

Net increase (decrease) | (16,336) | (24,001) | $ (706,153) | $ (1,060,129) |

Class K | | | | |

Shares sold | 14,396 | 13,902 | $ 619,145 | $ 625,856 |

Reinvestment of distributions | 1,309 | 70 | 54,155 | 2,916 |

Shares redeemed | (4,924) | (8,528) | (214,700) | (379,087) |

Net increase (decrease) | 10,781 | 5,444 | $ 458,600 | $ 249,685 |

Class F | | | | |

Shares sold | 9,544 | 12,501 | $ 409,652 | $ 558,704 |

Reinvestment of distributions | 832 | 38 | 34,458 | 1,580 |

Shares redeemed | (1,226) | (2,171) | (53,471) | (102,054) |

Net increase (decrease) | 9,150 | 10,368 | $ 390,639 | $ 458,230 |

12. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

At the end of the period, the Fidelity Freedom Funds® and Fidelity Freedom K® Funds were the owners of record, in the aggregate, of approximately 23% of the total outstanding shares of the Fund.

Semiannual Report

Managing Your Investments

Fidelity offers several ways to conveniently manage your personal investments via your telephone or PC. You can access your account information, conduct trades and research your investments 24 hours a day.

By Phone

Fidelity Automated Service Telephone provides a single toll-free number to access account balances, positions, quotes and trading. It's easy to navigate the service, and on your first call, the system will help you create a personal identification number (PIN) for security.

(phone graphic)Fidelity Automated

Service Telephone (FAST®)

1-800-544-5555

Press

1 For mutual fund and brokerage trading.

2 For quotes.*

3 For account balances and holdings.

4 To review orders and mutual

fund activity.

5 To change your PIN.

*0 To speak to a Fidelity representative.

By PC

Fidelity's web site on the Internet provides a wide range of information, including daily financial news, fund performance, interactive planning tools and news about Fidelity products and services.

(computer graphic)Fidelity's Web Site

www.fidelity.com

* When you call the quotes line, please remember that a fund's yield and return will vary and, except for money market funds, share price will also vary. This means that you may have a gain or loss when you sell your shares. There is no assurance that money market funds will be able to maintain a stable $1 share price; an investment in a money market fund is not insured or guaranteed by the U.S. government. Total returns are historical and include changes in share price, reinvestment of dividends and capital gains distributions, and the effects of any sales charges.

Semiannual Report

To Visit Fidelity

For directions and hours,

please call 1-800-544-9797.

Arizona

7001 West Ray Road

Chandler, AZ