UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04118

Fidelity Securities Fund

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | July 31 |

Date of reporting period: | January 31, 2024 |

Item 1.

Reports to Stockholders

|

| |

|

| |

|

| |

|

Contents

Top Holdings (% of Fund's net assets) | ||

| Microsoft Corp. | 12.9 | |

| Apple, Inc. | 11.2 | |

| Amazon.com, Inc. | 8.4 | |

| NVIDIA Corp. | 6.2 | |

| Alphabet, Inc. Class A | 6.0 | |

| Meta Platforms, Inc. Class A | 5.0 | |

| Alphabet, Inc. Class C | 2.9 | |

| Marvell Technology, Inc. | 2.6 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | 2.5 | |

| Netflix, Inc. | 2.0 | |

| 59.7 | ||

| Market Sectors (% of Fund's net assets) | ||

| Information Technology | 45.1 | |

| Communication Services | 18.8 | |

| Consumer Discretionary | 13.6 | |

| Health Care | 6.5 | |

| Energy | 4.9 | |

| Consumer Staples | 4.7 | |

| Industrials | 3.4 | |

| Financials | 2.1 | |

| Real Estate | 0.4 | |

| Materials | 0.1 | |

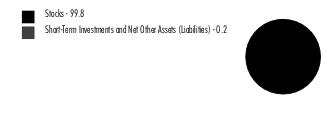

Asset Allocation (% of Fund's net assets) |

|

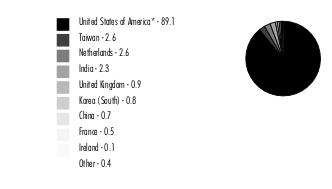

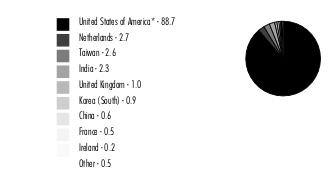

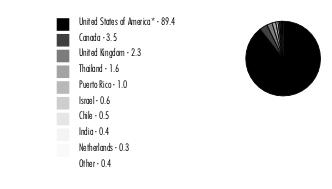

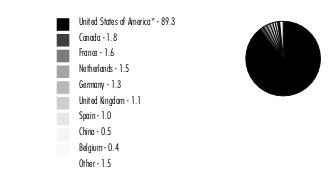

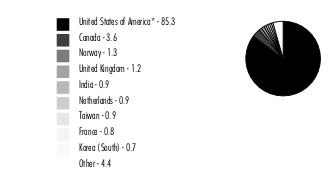

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| Common Stocks - 98.0% | |||

| Shares | Value ($) (000s) | ||

| COMMUNICATION SERVICES - 18.2% | |||

| Diversified Telecommunication Services - 0.0% | |||

| Starry Group Holdings, Inc. Class A (a)(b) | 331,308 | 0 | |

| Entertainment - 2.0% | |||

| Electronic Arts, Inc. | 2,318 | 319 | |

| NetEase, Inc. ADR | 14,571 | 1,423 | |

| Netflix, Inc. (a) | 964,871 | 544,293 | |

| Take-Two Interactive Software, Inc. (a) | 11,474 | 1,892 | |

| 547,927 | |||

| Interactive Media & Services - 14.3% | |||

| Alphabet, Inc.: | |||

| Class A (a) | 11,523,714 | 1,614,472 | |

| Class C (a) | 5,453,401 | 773,292 | |

| Epic Games, Inc. (a)(b)(c) | 77,600 | 47,851 | |

| Meta Platforms, Inc. Class A | 3,410,809 | 1,330,693 | |

| Snap, Inc. Class A (a) | 1,212,300 | 19,263 | |

| Vimeo, Inc. (a) | 280,690 | 1,114 | |

| Yandex NV Series A (a)(b) | 2,813,567 | 36,014 | |

| 3,822,699 | |||

| Media - 1.9% | |||

| Charter Communications, Inc. Class A (a) | 398,739 | 147,817 | |

| Comcast Corp. Class A | 7,523,039 | 350,122 | |

| 497,939 | |||

| Wireless Telecommunication Services - 0.0% | |||

| T-Mobile U.S., Inc. | 90,500 | 14,591 | |

TOTAL COMMUNICATION SERVICES | 4,883,156 | ||

| CONSUMER DISCRETIONARY - 13.5% | |||

| Automobiles - 0.1% | |||

| Rivian Automotive, Inc. (a) | 12,976 | 199 | |

| Tesla, Inc. (a) | 90,325 | 16,917 | |

| 17,116 | |||

| Broadline Retail - 8.4% | |||

| Alibaba Group Holding Ltd. sponsored ADR | 6,312 | 456 | |

| Amazon.com, Inc. (a) | 14,453,683 | 2,243,212 | |

| ContextLogic, Inc. (a) | 4,887 | 21 | |

| Etsy, Inc. (a) | 136,437 | 9,081 | |

| Global-e Online Ltd. (a)(d) | 248,592 | 9,389 | |

| JD.com, Inc. Class A | 8,560 | 97 | |

| 2,262,256 | |||

| Hotels, Restaurants & Leisure - 0.7% | |||

| Airbnb, Inc. Class A (a) | 18,969 | 2,734 | |

| Churchill Downs, Inc. | 1,001,752 | 121,182 | |

| Domino's Pizza, Inc. | 28,529 | 12,160 | |

| Hilton Worldwide Holdings, Inc. | 76,465 | 14,602 | |

| Marriott International, Inc. Class A | 42,424 | 10,170 | |

| Wynn Resorts Ltd. | 121,571 | 11,480 | |

| Zomato Ltd. (a) | 7,745,200 | 13,007 | |

| 185,335 | |||

| Specialty Retail - 2.1% | |||

| Five Below, Inc. (a) | 559,336 | 100,378 | |

| Lowe's Companies, Inc. | 908,117 | 193,284 | |

| Ross Stores, Inc. | 1,803,608 | 253,010 | |

| thredUP, Inc. (a)(d) | 86,404 | 176 | |

| TJX Companies, Inc. | 195,054 | 18,513 | |

| 565,361 | |||

| Textiles, Apparel & Luxury Goods - 2.2% | |||

| Figs, Inc. Class A (a)(d) | 44,994 | 259 | |

| Kontoor Brands, Inc. | 5,808 | 340 | |

| lululemon athletica, Inc. (a) | 964,565 | 437,739 | |

| LVMH Moet Hennessy Louis Vuitton SE | 164,290 | 136,699 | |

| NIKE, Inc. Class B | 162,478 | 16,496 | |

| 591,533 | |||

TOTAL CONSUMER DISCRETIONARY | 3,621,601 | ||

| CONSUMER STAPLES - 4.7% | |||

| Beverages - 2.5% | |||

| Diageo PLC | 3,886,755 | 140,381 | |

| Keurig Dr. Pepper, Inc. | 8,310,476 | 261,281 | |

| Monster Beverage Corp. | 5,189,723 | 285,539 | |

| 687,201 | |||

| Consumer Staples Distribution & Retail - 0.7% | |||

| Costco Wholesale Corp. | 120,545 | 83,764 | |

| Dollar General Corp. | 430,400 | 56,843 | |

| Dollar Tree, Inc. (a) | 286,874 | 37,471 | |

| 178,078 | |||

| Food Products - 0.8% | |||

| Mondelez International, Inc. | 2,896,655 | 218,031 | |

| Personal Care Products - 0.7% | |||

| Estee Lauder Companies, Inc. Class A | 1,355,100 | 178,860 | |

| The Honest Co., Inc. (a) | 157,592 | 449 | |

| 179,309 | |||

TOTAL CONSUMER STAPLES | 1,262,619 | ||

| ENERGY - 4.9% | |||

| Energy Equipment & Services - 0.7% | |||

| Schlumberger Ltd. | 3,302,394 | 160,827 | |

| TGS ASA ADR | 2,753,862 | 26,933 | |

| 187,760 | |||

| Oil, Gas & Consumable Fuels - 4.2% | |||

| Cenovus Energy, Inc. (Canada) | 164,955 | 2,672 | |

| Diamondback Energy, Inc. | 51,218 | 7,874 | |

| EOG Resources, Inc. | 13,680 | 1,557 | |

| Exxon Mobil Corp. | 4,150,549 | 426,718 | |

| Hess Corp. | 1,035,169 | 145,472 | |

| Reliance Industries Ltd. | 12,103,017 | 415,638 | |

| Reliance Industries Ltd. GDR (e) | 1,775,932 | 123,250 | |

| 1,123,181 | |||

TOTAL ENERGY | 1,310,941 | ||

| FINANCIALS - 1.7% | |||

| Banks - 0.0% | |||

| Huntington Bancshares, Inc. | 81,593 | 1,039 | |

| Wintrust Financial Corp. | 43,763 | 4,244 | |

| 5,283 | |||

| Capital Markets - 0.1% | |||

| Coinbase Global, Inc. (a)(d) | 117,100 | 15,012 | |

| S&P Global, Inc. | 679 | 304 | |

| 15,316 | |||

| Financial Services - 1.6% | |||

| Ant International Co. Ltd. Class C (b)(c) | 10,036,067 | 18,165 | |

| Jio Financial Services Ltd. | 12,375,617 | 36,934 | |

| MasterCard, Inc. Class A | 818,790 | 367,825 | |

| PayPal Holdings, Inc. (a) | 170,153 | 10,439 | |

| 433,363 | |||

TOTAL FINANCIALS | 453,962 | ||

| HEALTH CARE - 6.5% | |||

| Biotechnology - 2.6% | |||

| Alnylam Pharmaceuticals, Inc. (a) | 1,107,121 | 191,432 | |

| Amgen, Inc. | 495,067 | 155,580 | |

| Arcutis Biotherapeutics, Inc. (a)(d) | 832,188 | 4,885 | |

| Argenx SE ADR (a) | 36,600 | 13,927 | |

| Ascendis Pharma A/S sponsored ADR (a) | 271,220 | 35,240 | |

| GenSight Biologics SA (a)(d) | 211,791 | 91 | |

| Ionis Pharmaceuticals, Inc. (a) | 31,614 | 1,625 | |

| Legend Biotech Corp. ADR (a) | 102,797 | 5,660 | |

| Regeneron Pharmaceuticals, Inc. (a) | 293,659 | 276,856 | |

| Trevena, Inc. (a)(d) | 17,806 | 11 | |

| 685,307 | |||

| Health Care Equipment & Supplies - 2.2% | |||

| Boston Scientific Corp. (a) | 2,163,600 | 136,869 | |

| DexCom, Inc. (a) | 598,063 | 72,575 | |

| Inspire Medical Systems, Inc. (a) | 287,754 | 60,679 | |

| Insulet Corp. (a) | 1,382,969 | 263,967 | |

| Neuronetics, Inc. (a) | 38,510 | 131 | |

| Outset Medical, Inc. (a) | 39,921 | 121 | |

| Pulmonx Corp. (a) | 26,049 | 346 | |

| Tandem Diabetes Care, Inc. (a) | 191,234 | 4,360 | |

| TransMedics Group, Inc. (a) | 419,700 | 35,998 | |

| 575,046 | |||

| Health Care Providers & Services - 0.1% | |||

| Humana, Inc. | 99,354 | 37,562 | |

| Health Care Technology - 0.0% | |||

| Certara, Inc. (a) | 222,626 | 3,598 | |

| Life Sciences Tools & Services - 1.2% | |||

| 10X Genomics, Inc. (a) | 285,175 | 11,883 | |

| Bruker Corp. | 2,385,519 | 170,588 | |

| Danaher Corp. | 505,500 | 121,275 | |

| Illumina, Inc. (a) | 38,780 | 5,546 | |

| Seer, Inc. (a) | 587,199 | 1,010 | |

| Thermo Fisher Scientific, Inc. | 21,900 | 11,804 | |

| 322,106 | |||

| Pharmaceuticals - 0.4% | |||

| AstraZeneca PLC sponsored ADR | 1,678,023 | 111,823 | |

| Elanco Animal Health, Inc. (a) | 88,545 | 1,305 | |

| TherapeuticsMD, Inc. (a)(d) | 6,826 | 15 | |

| 113,143 | |||

TOTAL HEALTH CARE | 1,736,762 | ||

| INDUSTRIALS - 2.9% | |||

| Aerospace & Defense - 0.7% | |||

| Space Exploration Technologies Corp.: | |||

| Class A (a)(b)(c) | 2,034,880 | 197,383 | |

| Class C (a)(b)(c) | 70,920 | 6,879 | |

| 204,262 | |||

| Commercial Services & Supplies - 0.0% | |||

| Veralto Corp. | 15,900 | 1,219 | |

| Construction & Engineering - 0.0% | |||

| Bowman Consulting Group Ltd. (a) | 6,421 | 202 | |

| Comfort Systems U.S.A., Inc. | 19,575 | 4,257 | |

| EMCOR Group, Inc. | 798 | 182 | |

| Sterling Construction Co., Inc. (a) | 58,036 | 4,359 | |

| 9,000 | |||

| Electrical Equipment - 1.4% | |||

| Vertiv Holdings Co. | 6,514,500 | 366,962 | |

| Ground Transportation - 0.1% | |||

| Canadian Pacific Kansas City Ltd. | 148,928 | 11,984 | |

| CSX Corp. | 285,633 | 10,197 | |

| 22,181 | |||

| Passenger Airlines - 0.0% | |||

| Wheels Up Experience, Inc.: | |||

| Class A (a)(d) | 80,274 | 266 | |

| rights (a)(b) | 11,102 | 0 | |

| rights (a)(b) | 11,102 | 0 | |

| rights (a)(b) | 11,103 | 0 | |

| 266 | |||

| Professional Services - 0.7% | |||

| Verisk Analytics, Inc. | 761,556 | 183,939 | |

TOTAL INDUSTRIALS | 787,829 | ||

| INFORMATION TECHNOLOGY - 45.1% | |||

| Communications Equipment - 0.3% | |||

| Arista Networks, Inc. (a) | 153,300 | 39,656 | |

| Cisco Systems, Inc. | 1,070,296 | 53,707 | |

| 93,363 | |||

| IT Services - 1.0% | |||

| Accenture PLC Class A | 50,000 | 18,194 | |

| Gartner, Inc. (a) | 400,282 | 183,105 | |

| MongoDB, Inc. Class A (a) | 95,812 | 38,375 | |

| Twilio, Inc. Class A (a) | 916 | 64 | |

| X Holdings Corp. Class A (b)(c) | 709,150 | 20,197 | |

| 259,935 | |||

| Semiconductors & Semiconductor Equipment - 16.1% | |||

| Advanced Micro Devices, Inc. (a) | 177,989 | 29,847 | |

| Alchip Technologies Ltd. | 229,000 | 28,411 | |

| Analog Devices, Inc. | 76,798 | 14,773 | |

| Applied Materials, Inc. | 351,416 | 57,738 | |

| Arm Holdings Ltd. ADR (d) | 216,900 | 15,328 | |

| ASML Holding NV (depository receipt) | 519,969 | 452,279 | |

| BE Semiconductor Industries NV | 1,486,400 | 224,568 | |

| Broadcom, Inc. | 85,700 | 101,126 | |

| Lam Research Corp. | 259,478 | 214,113 | |

| Marvell Technology, Inc. | 10,286,519 | 696,397 | |

| Micron Technology, Inc. | 457,800 | 39,256 | |

| NVIDIA Corp. | 2,684,345 | 1,651,597 | |

| NXP Semiconductors NV | 589,796 | 124,193 | |

| Skyworks Solutions, Inc. | 93,002 | 9,715 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | 5,865,692 | 662,589 | |

| 4,321,930 | |||

| Software - 15.6% | |||

| Adobe, Inc. (a) | 134,344 | 82,995 | |

| Atom Tickets LLC (a)(b)(c)(f) | 516,103 | 0 | |

| Autodesk, Inc. (a) | 180,048 | 45,698 | |

| Cadence Design Systems, Inc. (a) | 890,640 | 256,914 | |

| Dropbox, Inc. Class A (a) | 191,949 | 6,081 | |

| Dynatrace, Inc. (a) | 9,118 | 520 | |

| Intuit, Inc. | 298,857 | 188,677 | |

| Microsoft Corp. | 8,661,936 | 3,443,815 | |

| Roper Technologies, Inc. | 105,500 | 56,654 | |

| Salesforce, Inc. (a) | 8,549 | 2,403 | |

| Stripe, Inc. Class B (a)(b)(c) | 91,800 | 2,251 | |

| Synopsys, Inc. (a) | 169,195 | 90,240 | |

| 4,176,248 | |||

| Technology Hardware, Storage & Peripherals - 12.1% | |||

| Apple, Inc. | 16,253,780 | 2,997,197 | |

| Samsung Electronics Co. Ltd. | 4,151,080 | 225,559 | |

| Western Digital Corp. (a) | 284,421 | 16,283 | |

| 3,239,039 | |||

TOTAL INFORMATION TECHNOLOGY | 12,090,515 | ||

| MATERIALS - 0.1% | |||

| Chemicals - 0.1% | |||

| Linde PLC | 32,500 | 13,157 | |

| REAL ESTATE - 0.4% | |||

| Equity Real Estate Investment Trusts (REITs) - 0.4% | |||

| Equinix, Inc. | 124,660 | 103,439 | |

| TOTAL COMMON STOCKS (Cost $11,048,659) | 26,263,981 | ||

| Preferred Stocks - 1.3% | |||

| Shares | Value ($) (000s) | ||

| Convertible Preferred Stocks - 1.1% | |||

| COMMUNICATION SERVICES - 0.6% | |||

| Interactive Media & Services - 0.6% | |||

| ByteDance Ltd. Series E1 (a)(b)(c) | 130,752 | 28,913 | |

| Reddit, Inc.: | |||

| Series B(a)(b)(c) | 1,337,584 | 43,298 | |

| Series C(a)(b)(c) | 300,673 | 9,733 | |

| Series D(a)(b)(c) | 929,200 | 30,078 | |

| Series E(a)(b)(c) | 33,800 | 1,094 | |

| Series F(a)(b)(c) | 1,250,100 | 40,466 | |

| 153,582 | |||

| CONSUMER DISCRETIONARY - 0.0% | |||

| Hotels, Restaurants & Leisure - 0.0% | |||

| Discord, Inc. Series I (a)(b)(c) | 3,300 | 912 | |

| FINANCIALS - 0.0% | |||

| Financial Services - 0.0% | |||

| Circle Internet Financial Ltd. Series F (a)(b)(c) | 391,560 | 9,249 | |

| Tenstorrent Holdings, Inc. Series C1 (b)(c) | 79,348 | 4,632 | |

| 13,881 | |||

| INDUSTRIALS - 0.5% | |||

| Aerospace & Defense - 0.5% | |||

| Space Exploration Technologies Corp.: | |||

| Series G(a)(b)(c) | 62,037 | 60,176 | |

| Series H(a)(b)(c) | 65,670 | 63,700 | |

| 123,876 | |||

| INFORMATION TECHNOLOGY - 0.0% | |||

| Software - 0.0% | |||

| Stripe, Inc. Series H (a)(b)(c) | 315,830 | 7,744 | |

| TOTAL CONVERTIBLE PREFERRED STOCKS | 299,995 | ||

| Nonconvertible Preferred Stocks - 0.2% | |||

| CONSUMER DISCRETIONARY - 0.1% | |||

| Automobiles - 0.1% | |||

| Waymo LLC: | |||

| Series A2(a)(b)(c) | 103,940 | 5,440 | |

| Series B2(a)(b)(c) | 178,470 | 9,744 | |

| 15,184 | |||

| FINANCIALS - 0.1% | |||

| Financial Services - 0.1% | |||

| Circle Internet Financial Ltd. Series E (a)(b)(c) | 1,272,556 | 30,058 | |

| HEALTH CARE - 0.0% | |||

| Biotechnology - 0.0% | |||

| Castle Creek Biosciences, Inc. Series A4 (a)(b)(c) | 30,303 | 6,177 | |

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | 51,419 | ||

| TOTAL PREFERRED STOCKS (Cost $242,233) | 351,414 | ||

| Convertible Bonds - 0.3% | |||

Principal Amount (g) (000s) | Value ($) (000s) | ||

| FINANCIALS - 0.3% | |||

| Capital Markets - 0.3% | |||

Coinbase Global, Inc. 0.5% 6/1/26 (Cost $69,598) | 88,901 | 76,987 | |

| Money Market Funds - 0.4% | |||

| Shares | Value ($) (000s) | ||

| Fidelity Cash Central Fund 5.39% (h) | 83,805,032 | 83,822 | |

| Fidelity Securities Lending Cash Central Fund 5.39% (h)(i) | 37,401,069 | 37,405 | |

| TOTAL MONEY MARKET FUNDS (Cost $121,227) | 121,227 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.0% (Cost $11,481,717) | 26,813,609 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | (2,577) |

| NET ASSETS - 100.0% | 26,811,032 |

| (a) | Non-income producing |

| (b) | Level 3 security |

| (c) | Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $644,140,000 or 2.4% of net assets. |

| (d) | Security or a portion of the security is on loan at period end. |

| (e) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $123,250,000 or 0.5% of net assets. |

| (f) | Investment is owned by a wholly-owned subsidiary (Subsidiary) that is treated as a corporation for U.S. tax purposes. |

| (g) | Amount is stated in United States dollars unless otherwise noted. |

| (h) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (i) | Investment made with cash collateral received from securities on loan. |

| Additional information on each restricted holding is as follows: | ||

| Security | Acquisition Date | Acquisition Cost ($) (000s) |

| Ant International Co. Ltd. Class C | 5/16/18 | 38,251 |

| Atom Tickets LLC | 8/15/17 | 3,000 |

| ByteDance Ltd. Series E1 | 11/18/20 | 14,327 |

| Castle Creek Biosciences, Inc. Series A4 | 9/29/16 | 10,011 |

| Circle Internet Financial Ltd. Series E | 5/11/21 | 20,654 |

| Circle Internet Financial Ltd. Series F | 5/09/22 | 16,500 |

| Discord, Inc. Series I | 9/15/21 | 1,817 |

| Epic Games, Inc. | 7/13/20 - 3/29/21 | 61,546 |

| Reddit, Inc. Series B | 7/26/17 | 18,989 |

| Reddit, Inc. Series C | 7/24/17 | 4,743 |

| Reddit, Inc. Series D | 2/04/19 | 20,151 |

| Reddit, Inc. Series E | 5/18/21 | 1,436 |

| Reddit, Inc. Series F | 8/11/21 | 77,249 |

| Space Exploration Technologies Corp. Class A | 10/16/15 - 9/11/17 | 21,156 |

| Space Exploration Technologies Corp. Class C | 9/11/17 | 957 |

| Space Exploration Technologies Corp. Series G | 1/20/15 | 4,805 |

| Space Exploration Technologies Corp. Series H | 8/04/17 | 8,865 |

| Stripe, Inc. Class B | 5/18/21 | 3,684 |

| Stripe, Inc. Series H | 3/15/21 - 5/25/23 | 12,673 |

| Tenstorrent Holdings, Inc. Series C1 | 4/23/21 | 4,718 |

| Waymo LLC Series A2 | 5/08/20 | 8,925 |

| Waymo LLC Series B2 | 6/11/21 | 16,370 |

| X Holdings Corp. Class A | 10/27/21 | 54,255 |

| Affiliate (Amounts in thousands) | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 95,649 | 589,173 | 601,000 | 492 | - | - | 83,822 | 0.2% |

| Fidelity Securities Lending Cash Central Fund 5.39% | 411 | 304,377 | 267,383 | 138 | - | - | 37,405 | 0.2% |

| Total | 96,060 | 893,550 | 868,383 | 630 | - | - | 121,227 | |

| Valuation Inputs at Reporting Date: | ||||

Description (Amounts in thousands) | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Communication Services | 5,036,738 | 4,799,291 | - | 237,447 |

Consumer Discretionary | 3,637,697 | 3,471,798 | 149,803 | 16,096 |

Consumer Staples | 1,262,619 | 1,122,238 | 140,381 | - |

Energy | 1,310,941 | 895,303 | 415,638 | - |

Financials | 497,901 | 398,863 | 36,934 | 62,104 |

Health Care | 1,742,939 | 1,736,762 | - | 6,177 |

Industrials | 911,705 | 583,567 | - | 328,138 |

Information Technology | 12,098,259 | 11,814,097 | 253,970 | 30,192 |

Materials | 13,157 | 13,157 | - | - |

Real Estate | 103,439 | 103,439 | - | - |

| Corporate Bonds | 76,987 | - | 76,987 | - |

| Money Market Funds | 121,227 | 121,227 | - | - |

| Total Investments in Securities: | 26,813,609 | 25,059,742 | 1,073,713 | 680,154 |

| (Amounts in thousands) | |||

| Investments in Securities: | |||

| Industrials | |||

| Beginning Balance | $ | 274,013 | |

| Net Realized Gain (Loss) on Investment Securities | - | ||

| Net Unrealized Gain (Loss) on Investment Securities | 54,125 | ||

| Cost of Purchases | - | ||

| Proceeds of Sales | - | ||

| Amortization/Accretion | - | ||

| Transfers into Level 3 | - | ||

| Transfers out of Level 3 | - | ||

| Ending Balance | $ | 328,138 | |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at January 31, 2024 | $ | 54,125 | |

| Other Investments in Securities | |||

| Beginning Balance | $ | 417,342 | |

| Net Realized Gain (Loss) on Investment Securities | - | ||

| Net Unrealized Gain (Loss) on Investment Securities | (25,922) | ||

| Cost of Purchases | - | ||

| Proceeds of Sales | - | ||

| Amortization/Accretion | - | ||

| Transfers into Level 3 | - | ||

| Transfers out of Level 3 | (39,404) | ||

| Ending Balance | $ | 352,016 | |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at January 31, 2024 | $ | (25,922) | |

| The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Cost of purchases and proceeds of sales may include securities received and/or delivered through in-kind transactions, corporate actions or exchanges. Transfers into Level 3 were attributable to a lack of observable market data resulting from decreases in market activity, decreases in liquidity, security restructurings or corporate actions. Transfers out of Level 3 were attributable to observable market data becoming available for those securities. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's consolidated Statement of Operations. | |||

| Consolidated Statement of Assets and Liabilities | ||||

| Amounts in thousands (except per-share amounts) | January 31, 2024 (Unaudited) | |||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $35,907) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $11,360,490) | $ | 26,692,382 | ||

Fidelity Central Funds (cost $121,227) | 121,227 | |||

| Total Investment in Securities (cost $11,481,717) | $ | 26,813,609 | ||

| Receivable for investments sold | 260,505 | |||

| Receivable for fund shares sold | 12,581 | |||

| Dividends receivable | 3,211 | |||

| Interest receivable | 74 | |||

| Distributions receivable from Fidelity Central Funds | 149 | |||

| Prepaid expenses | 21 | |||

| Other receivables | 470 | |||

Total assets | 27,090,620 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 177,754 | ||

| Payable for fund shares redeemed | 18,783 | |||

| Accrued management fee | 14,925 | |||

| Other affiliated payables | 2,526 | |||

| Deferred taxes | 27,590 | |||

| Other payables and accrued expenses | 629 | |||

| Collateral on securities loaned | 37,381 | |||

| Total Liabilities | 279,588 | |||

| Net Assets | $ | 26,811,032 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 11,256,210 | ||

| Total accumulated earnings (loss) | 15,554,822 | |||

| Net Assets | $ | 26,811,032 | ||

| Net Asset Value and Maximum Offering Price | ||||

| OTC : | ||||

Net Asset Value, offering price and redemption price per share ($19,899,109 ÷ 1,056,878 shares) | $ | 18.83 | ||

| Class K : | ||||

Net Asset Value, offering price and redemption price per share ($6,911,923 ÷ 358,804 shares) | $ | 19.26 | ||

| Consolidated Statement of Operations | ||||

| Amounts in thousands | Six months ended January 31, 2024 (Unaudited) | |||

| Investment Income | ||||

| Dividends | $ | 78,907 | ||

| Interest | 3,770 | |||

| Income from Fidelity Central Funds (including $138 from security lending) | 630 | |||

| Total Income | 83,307 | |||

| Expenses | ||||

| Management fee | ||||

| Basic fee | $ | 71,146 | ||

| Performance adjustment | 4,784 | |||

| Transfer agent fees | 13,425 | |||

| Accounting fees | 891 | |||

| Custodian fees and expenses | 175 | |||

| Independent trustees' fees and expenses | 71 | |||

| Registration fees | 59 | |||

| Audit | 105 | |||

| Legal | 23 | |||

| Interest | 258 | |||

| Miscellaneous | 47 | |||

| Total expenses before reductions | 90,984 | |||

| Expense reductions | (1,069) | |||

| Total expenses after reductions | 89,915 | |||

| Net Investment income (loss) | (6,608) | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers (net of foreign taxes of $479) | 666,021 | |||

| Foreign currency transactions | (203) | |||

| Total net realized gain (loss) | 665,818 | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers(net of increase in deferred foreign taxes of $4,858) | 1,542,098 | |||

| Assets and liabilities in foreign currencies | (48) | |||

| Total change in net unrealized appreciation (depreciation) | 1,542,050 | |||

| Net gain (loss) | 2,207,868 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 2,201,260 | ||

| Consolidated Statement of Changes in Net Assets | ||||

| Amount in thousands | Six months ended January 31, 2024 (Unaudited) | Year ended July 31, 2023 | ||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | (6,608) | $ | 11,206 |

| Net realized gain (loss) | 665,818 | (82,947) | ||

| Change in net unrealized appreciation (depreciation) | 1,542,050 | 4,547,283 | ||

| Net increase (decrease) in net assets resulting from operations | 2,201,260 | 4,475,542 | ||

| Distributions to shareholders | (16,461) | (782,062) | ||

| Share transactions - net increase (decrease) | (800,509) | (600,071) | ||

| Total increase (decrease) in net assets | 1,384,290 | 3,093,409 | ||

| Net Assets | ||||

| Beginning of period | 25,426,742 | 22,333,333 | ||

| End of period | $ | 26,811,032 | $ | 25,426,742 |

| Fidelity® OTC Portfolio |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 17.29 | $ | 14.74 | $ | 20.67 | $ | 15.61 | $ | 12.45 | $ | 12.50 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | (.01) | - C | (.07) | (.06) | (.01) | (.01) | ||||||

| Net realized and unrealized gain (loss) | 1.56 | 3.07 | (3.60) | 6.21 | 4.14 | .75 | ||||||

| Total from investment operations | 1.55 | 3.07 | (3.67) | 6.15 | 4.13 | .74 | ||||||

| Distributions from net investment income | (.01) | - | - | (.01) | - | - | ||||||

| Distributions from net realized gain | - | (.52) | (2.26) | (1.08) | (.97) | (.79) | ||||||

| Total distributions | (.01) | (.52) | (2.26) | (1.09) | (.97) | (.79) | ||||||

| Net asset value, end of period | $ | 18.83 | $ | 17.29 | $ | 14.74 | $ | 20.67 | $ | 15.61 | $ | 12.45 |

Total Return D,E | 8.97% | 21.63% | (20.30)% | 41.90% | 35.79% | 6.43% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | .76% H | .79% | .81% | .80% | .87% | .88% | ||||||

| Expenses net of fee waivers, if any | .75% H | .79% | .81% | .80% | .87% | .88% | ||||||

| Expenses net of all reductions | .75% H | .78% | .81% | .80% | .87% | .88% | ||||||

| Net investment income (loss) | (.08)% H | .03% | (.37)% | (.33)% | (.07)% | (.10)% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 19,899 | $ | 18,890 | $ | 16,626 | $ | 22,273 | $ | 16,817 | $ | 13,166 |

Portfolio turnover rate I | 21% H | 15% J | 32% J | 28% J | 48% J | 34% J |

| Fidelity® OTC Portfolio Class K |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 17.69 | $ | 15.06 | $ | 21.06 | $ | 15.88 | $ | 12.64 | $ | 12.67 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | - C | .02 | (.05) | (.05) | - C | - C | ||||||

| Net realized and unrealized gain (loss) | 1.59 | 3.13 | (3.68) | 6.33 | 4.21 | .76 | ||||||

| Total from investment operations | 1.59 | 3.15 | (3.73) | 6.28 | 4.21 | .76 | ||||||

| Distributions from net investment income | (.02) | - | - | (.01) | - C | - | ||||||

| Distributions from net realized gain | - | (.52) | (2.27) | (1.09) | (.97) | (.79) | ||||||

| Total distributions | (.02) | (.52) | (2.27) | (1.10) | (.97) | (.79) | ||||||

| Net asset value, end of period | $ | 19.26 | $ | 17.69 | $ | 15.06 | $ | 21.06 | $ | 15.88 | $ | 12.64 |

Total Return D,E | 8.97% | 21.71% | (20.21)% | 42.05% | 35.94% | 6.50% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | .67% H | .70% | .73% | .72% | .78% | .79% | ||||||

| Expenses net of fee waivers, if any | .66% H | .69% | .73% | .71% | .78% | .79% | ||||||

| Expenses net of all reductions | .66% H | .69% | .73% | .71% | .78% | .78% | ||||||

| Net investment income (loss) | .01% H | .12% | (.29)% | (.25)% | .03% | (.01)% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 6,912 | $ | 6,536 | $ | 5,707 | $ | 8,072 | $ | 7,074 | $ | 6,752 |

Portfolio turnover rate I | 21% H | 15% J | 32% J | 28% J | 48% J | 34% J |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Asset Type | Fair Value | Valuation Technique(s) | Unobservable Input | Amount or Range/Weighted Average | Impact to Valuation from an Increase in InputA |

| Equities | $680,154 | Market comparable | Enterprise value/EBITDA multiple (EV/EBITDA) | 15.5 - 17.5 / 17.2 | Increase |

| Enterprise value/Revenue multiple (EV/R) | 3.0 - 15.0 / 5.7 | Increase | |||

| Market approach | Transaction price | $59.45 - $215.03 / $115.27 | Increase | ||

| Discount rate | 20.0% - 42.5% / 26.7% | Decrease | |||

| Premium rate | 45.0% | Increase | |||

| Recovery value | Recovery value | $0.00 | Increase | ||

| Black scholes | Discount rate | 4.0% - 4.3% / 4.1% | Increase | ||

| Volatility | 70.0% - 85.0% / 79.4% | Increase | |||

| Term | 2.0 - 5.0 / 4.0 | Increase | |||

| Book value | Book value | 1.8 | Increase |

| Fidelity OTC Portfolio | $444 |

| Gross unrealized appreciation | $15,776,501 |

| Gross unrealized depreciation | (499,962) |

| Net unrealized appreciation (depreciation) | $15,276,539 |

| Tax cost | $11,537,070 |

Short-term | $(150,119) |

Long-term | (120,995) |

| Total capital loss carryforward | $(271,114) |

| $ Amount | % of Net Assets | |

| Fidelity OTC Portfolio | -A | -B |

| Purchases ($) | Sales ($) | |

| Fidelity OTC Portfolio | 2,591,236 | 3,417,595 |

| Shares | Total net realized gain or loss ($) | Total Proceeds ($) | Participating classes | |

| Fidelity OTC Portfolio | 8,690 | 80,520 | 126,282 | Class K |

| % of Class-Level Average Net Assets | |

| OTC | .1300 |

| Amount | % of Class-Level Average Net AssetsA | |

| OTC | $12,090 | .13 |

| Class K | 1,335 | .04 |

| $13,425 |

| % of Average Net Assets | |

| Fidelity OTC Portfolio | .0071 |

| % of Average Net Assets | |

| Fidelity OTC Portfolio | .01 |

| Maximum Management Fee Rate % | |

| OTC | .68 |

| Class K | .59 |

| Performance Adjustment Index | |

| Fidelity OTC Portfolio | Nasdaq Composite Index |

| Amount | |

| Fidelity OTC Portfolio | $ 31 |

| Borrower or Lender | Average Loan Balance | Weighted Average Interest Rate | Interest Expense | |

| Fidelity OTC Portfolio | Borrower | $15,181 | 5.57% | $253 |

| Purchases ($) | Sales ($) | Realized Gain (Loss) ($) | |

| Fidelity OTC Portfolio | 125,299 | 101,997 | 14,931 |

| Amount | |

| Fidelity OTC Portfolio | $20 |

| Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End | |

| Fidelity OTC Portfolio | $15 | $-A | $- |

| Average Loan Balance | Weighted Average Interest Rate | Interest Expense | |

| Fidelity OTC Portfolio | $3,803 | 5.83% | $5 |

Six months ended January 31, 2024 | Year ended July 31, 2023 | |

| Fidelity OTC Portfolio | ||

| Distributions to shareholders | ||

| OTC | $ 10,723 | $584,667 |

| Class K | 5,738 | 197,395 |

Total | $16,461 | $782,062 |

| Shares | Shares | Dollars | Dollars | |

Six months ended January 31, 2024 | Year ended July 31, 2023 | Six months ended January 31, 2024 | Year ended July 31, 2023 | |

| Fidelity OTC Portfolio | ||||

| OTC | ||||

| Shares sold | 36,836 | 80,927 | $640,275 | $1,192,342 |

| Reinvestment of distributions | 566 | 38,691 | 9,899 | 545,928 |

| Shares redeemed | (72,995) | (154,879) | (1,267,815) | (2,208,386) |

| Net increase (decrease) | (35,593) | (35,261) | $(617,641) | $(470,116) |

| Class K | ||||

| Shares sold | 10,640 | 22,556 | $191,918 | $339,915 |

| Reinvestment of distributions | 321 | 13,689 | 5,738 | 197,395 |

| Shares redeemed | (21,674) | (45,781) | (380,524) | (667,265) |

| Net increase (decrease) | (10,713) | (9,536) | $(182,868) | $(129,955) |

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2023 to January 31, 2024). |

Annualized Expense Ratio- A | Beginning Account Value August 1, 2023 | Ending Account Value January 31, 2024 | Expenses Paid During Period- C August 1, 2023 to January 31, 2024 | |||||||

| Fidelity® OTC Portfolio | ||||||||||

| Fidelity® OTC Portfolio | .75% | |||||||||

| Actual | $ 1,000 | $ 1,089.70 | $ 3.94 | |||||||

Hypothetical-B | $ 1,000 | $ 1,021.37 | $ 3.81 | |||||||

Class K ** | .66% | |||||||||

| Actual | $ 1,000 | $ 1,089.70 | $ 3.47 | |||||||

Hypothetical-B | $ 1,000 | $ 1,021.82 | $ 3.35 | |||||||

Annualized Expense Ratio- A | Expenses Paid | |||||

| Fidelity® OTC Portfolio | ||||||

| Class K | .63% | |||||

| Actual | $ 3.31 | |||||

Hypothetical- B | $ 3.20 | |||||

| A Annualized expense ratio reflects expenses net of applicable fee waivers. | ||||||

| B 5% return per year before expenses |

- Highly liquid investments - cash or convertible to cash within three business days or less

- Moderately liquid investments - convertible to cash in three to seven calendar days

- Less liquid investments - can be sold or disposed of, but not settled, within seven calendar days

- Illiquid investments - cannot be sold or disposed of within seven calendar days

|

Contents

Top Holdings (% of Fund's net assets) | ||

| Equity Lifestyle Properties, Inc. | 1.9 | |

| American Tower Corp. | 1.9 | |

| Prologis, Inc. | 1.8 | |

| Crown Castle, Inc. | 1.3 | |

| Welltower, Inc. | 1.2 | |

| Equinix, Inc. | 1.2 | |

| Ventas, Inc. | 0.9 | |

| Public Storage | 0.9 | |

| Essex Property Trust, Inc. | 0.8 | |

| Annaly Capital Management, Inc. Series F, CME Term SOFR 3 Month Index + 4.990% 6.95% | 0.8 | |

| 12.7 | ||

| Top REIT Sectors (% of Fund's net assets) | ||

| REITs - Diversified | 17.1 | |

| REITs - Mortgage | 8.0 | |

| REITs - Apartments | 5.7 | |

| REITs - Health Care | 5.3 | |

| REITs - Management/Investment | 4.4 | |

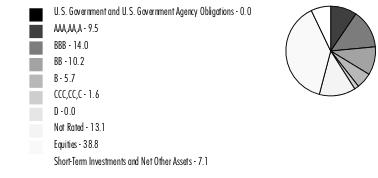

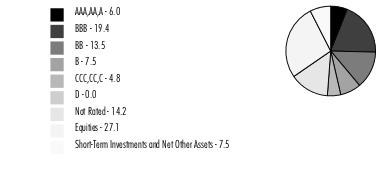

Quality Diversification (% of Fund's net assets) |

|

Percentages shown as 0.0% may reflect amounts less than 0.05%. |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

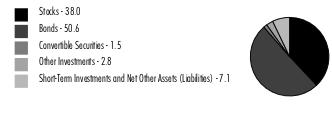

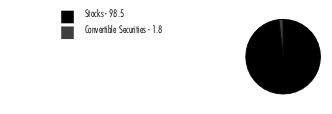

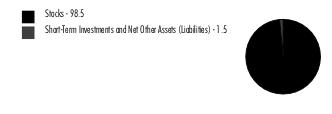

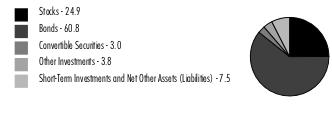

Asset Allocation (% of Fund's net assets) |

|

| Common Stocks - 21.1% | |||

| Shares | Value ($) | ||

| FINANCIALS - 0.6% | |||

| Mortgage Real Estate Investment Trusts - 0.6% | |||

| Great Ajax Corp. (a)(b) | 1,663,364 | 9,797,214 | |

| MFA Financial, Inc. (a) | 1,231,885 | 13,636,967 | |

| Rithm Capital Corp. | 385,699 | 4,126,979 | |

| 27,561,160 | |||

| INDUSTRIALS - 0.1% | |||

| Construction & Engineering - 0.1% | |||

| Willscot Mobile Mini Holdings (c) | 58,900 | 2,785,970 | |

| INFORMATION TECHNOLOGY - 0.0% | |||

| IT Services - 0.0% | |||

| Cyxtera Technologies, Inc. Class A (a)(c)(d) | 740,700 | 7 | |

| REAL ESTATE - 20.4% | |||

| Equity Real Estate Investment Trusts (REITs) - 20.3% | |||

| Acadia Realty Trust (SBI) | 510,426 | 8,707,868 | |

| American Homes 4 Rent Class A | 621,100 | 21,769,555 | |

| American Tower Corp. | 450,100 | 88,062,065 | |

| AvalonBay Communities, Inc. | 114,200 | 20,442,942 | |

| Crown Castle, Inc. | 541,210 | 58,585,983 | |

| CubeSmart | 325,200 | 14,055,144 | |

| Digital Realty Trust, Inc. | 74,400 | 10,450,224 | |

| Easterly Government Properties, Inc. (a) | 998,900 | 12,266,492 | |

| EastGroup Properties, Inc. | 55,600 | 9,865,108 | |

| Elme Communities (SBI) | 755,647 | 10,941,769 | |

| Equinix, Inc. | 65,000 | 53,935,050 | |

| Equity Lifestyle Properties, Inc. | 1,311,596 | 88,781,917 | |

| Equity Residential (SBI) | 96,200 | 5,790,278 | |

| Essex Property Trust, Inc. | 159,900 | 37,299,873 | |

| Extra Space Storage, Inc. | 163,149 | 23,565,242 | |

| Gaming & Leisure Properties | 304,746 | 13,911,655 | |

| Healthcare Trust of America, Inc. | 186,360 | 3,002,260 | |

| Invitation Homes, Inc. | 544,100 | 17,917,213 | |

| Kimco Realty Corp. | 201,400 | 4,068,280 | |

| Lamar Advertising Co. Class A | 150,700 | 15,775,276 | |

| LXP Industrial Trust (REIT) | 3,254,074 | 29,579,533 | |

| Mid-America Apartment Communities, Inc. | 221,706 | 28,019,204 | |

| NNN (REIT), Inc. | 52,100 | 2,101,714 | |

| Postal Realty Trust, Inc. | 878,500 | 12,386,850 | |

| Prologis, Inc. | 641,130 | 81,224,760 | |

| Public Storage | 141,500 | 40,071,385 | |

| Realty Income Corp. | 389,382 | 21,178,487 | |

| Retail Value, Inc. (c)(d) | 274,131 | 3 | |

| Rexford Industrial Realty, Inc. | 67,700 | 3,560,343 | |

| RLJ Lodging Trust | 407,900 | 4,723,482 | |

| Sabra Health Care REIT, Inc. | 604,175 | 8,059,695 | |

| SITE Centers Corp. | 1,379,438 | 18,374,114 | |

| Sunstone Hotel Investors, Inc. | 161,900 | 1,727,473 | |

| Terreno Realty Corp. | 263,828 | 15,758,446 | |

| UDR, Inc. | 392,200 | 14,127,044 | |

| UMH Properties, Inc. | 335,723 | 5,072,775 | |

| Ventas, Inc. | 892,186 | 41,388,509 | |

| VICI Properties, Inc. | 739,000 | 22,258,680 | |

| Welltower, Inc. | 654,600 | 56,629,446 | |

| Weyerhaeuser Co. | 147,500 | 4,833,575 | |

| 930,269,712 | |||

| Real Estate Management & Development - 0.1% | |||

| Cushman & Wakefield PLC (c) | 201,400 | 2,118,728 | |

| Digitalbridge Group, Inc. (a) | 76,688 | 1,506,152 | |

| 3,624,880 | |||

TOTAL REAL ESTATE | 933,894,592 | ||

| TOTAL COMMON STOCKS (Cost $740,818,654) | 964,241,729 | ||

| Preferred Stocks - 17.7% | |||

| Shares | Value ($) | ||

| Convertible Preferred Stocks - 0.8% | |||

| FINANCIALS - 0.3% | |||

| Mortgage Real Estate Investment Trusts - 0.3% | |||

| Great Ajax Corp. 7.25% (b) | 611,442 | 15,212,677 | |

| REAL ESTATE - 0.5% | |||

| Equity Real Estate Investment Trusts (REITs) - 0.5% | |||

| LXP Industrial Trust (REIT) Series C, 6.50% | 440,102 | 20,263,995 | |

| RLJ Lodging Trust Series A, 1.95% | 31,585 | 789,625 | |

| 21,053,620 | |||

| TOTAL CONVERTIBLE PREFERRED STOCKS | 36,266,297 | ||

| Nonconvertible Preferred Stocks - 16.9% | |||

| ENERGY - 0.7% | |||

| Oil, Gas & Consumable Fuels - 0.7% | |||

| Enbridge, Inc.: | |||

| Series 1, 5 year U.S. Treasury Index + 3.140% 5.949%(e)(f) | 498,275 | 10,722,878 | |

| Series L, 5 year U.S. Treasury Index + 3.150% 4.959%(e)(f) | 111,400 | 2,226,886 | |

| Energy Transfer LP 7.60% (e) | 525,651 | 13,151,788 | |

| Global Partners LP: | |||

| 3 month U.S. LIBOR + 6.770% 9.75%(e)(f) | 161,507 | 4,260,361 | |

| Series B, 9.50% | 67,800 | 1,769,587 | |

| 32,131,500 | |||

| FINANCIALS - 7.9% | |||

| Mortgage Real Estate Investment Trusts - 7.9% | |||

| AGNC Investment Corp.: | |||

| 6.125%(e) | 930,100 | 21,476,009 | |

| 6.875%(e) | 673,972 | 16,566,232 | |

| Series C, CME Term SOFR 3 Month Index + 5.110% 7.00%(e)(f) | 653,202 | 16,708,907 | |

| Series E, 6.50%(e) | 1,202,034 | 29,221,447 | |

| Series G, 7.75%(e) | 320,000 | 7,267,200 | |

| Annaly Capital Management, Inc.: | |||

| 6.75%(e) | 192,992 | 4,815,150 | |

| Series F, CME Term SOFR 3 Month Index + 4.990% 6.95%(e)(f) | 1,452,443 | 37,037,297 | |

| Series G, CME Term SOFR 3 Month Index + 4.430% 6.50%(e)(f) | 1,069,599 | 26,857,631 | |

| Arbor Realty Trust, Inc.: | |||

| Series D, 6.375% | 126,100 | 2,282,410 | |

| Series F, 6.25%(e) | 447,536 | 8,283,891 | |

| Chimera Investment Corp.: | |||

| Series B, 8.00%(e) | 673,204 | 16,305,001 | |

| Series C, 7.75%(e) | 1,108,086 | 22,726,844 | |

| Dynex Capital, Inc. Series C 6.90% (e) | 298,683 | 7,147,484 | |

| Ellington Financial LLC 6.75% (e) | 212,370 | 5,113,870 | |

| MFA Financial, Inc.: | |||

| 6.50%(e) | 838,551 | 17,869,522 | |

| Series B, 7.50% | 211,532 | 4,370,251 | |

| PennyMac Mortgage Investment Trust: | |||

| 6.75% | 217,700 | 4,266,920 | |

| 8.125%(e) | 388,754 | 9,302,883 | |

| Series B, 8.00%(e) | 597,708 | 14,135,794 | |

| Rithm Capital Corp.: | |||

| 7.125%(e) | 1,023,942 | 24,410,777 | |

| Series A, 7.50%(e) | 505,904 | 12,278,290 | |

| Series C, 6.375%(e) | 1,074,554 | 23,554,224 | |

| Series D, 7.00%(e) | 151,200 | 3,465,504 | |

| Two Harbors Investment Corp.: | |||

| Series A, 8.125%(e) | 363,526 | 8,161,159 | |

| Series B, 7.625%(e) | 776,859 | 16,951,063 | |

| 360,575,760 | |||

| REAL ESTATE - 8.3% | |||

| Equity Real Estate Investment Trusts (REITs) - 6.5% | |||

| Agree Realty Corp. 4.375% | 259,800 | 4,824,486 | |

| American Homes 4 Rent: | |||

| 6.25% | 98,905 | 2,467,680 | |

| Series G, 5.875% | 249,550 | 5,905,601 | |

| Armada Hoffler Properties, Inc. 6.75% | 255,050 | 5,993,675 | |

| Ashford Hospitality Trust, Inc.: | |||

| Series F, 7.375% | 68,007 | 829,685 | |

| Series H, 7.50% | 121,265 | 1,520,663 | |

| Series I, 7.50% | 71,209 | 865,189 | |

| Braemar Hotels & Resorts, Inc. Series D, 8.25% | 173,050 | 3,668,660 | |

| Cedar Realty Trust, Inc.: | |||

| 7.25% | 126,972 | 1,855,061 | |

| Series C, 6.50% | 291,600 | 3,761,611 | |

| Centerspace Series C, 6.625% | 317,300 | 7,754,812 | |

| CTO Realty Growth, Inc. 6.375% | 120,000 | 2,498,400 | |

| DiamondRock Hospitality Co. 8.25% | 448,231 | 11,407,479 | |

| Digital Realty Trust, Inc.: | |||

| 5.25% | 32,900 | 744,856 | |

| Series L, 5.20% | 33,700 | 759,598 | |

| Gladstone Commercial Corp.: | |||

| 6.625% | 157,675 | 3,364,785 | |

| Series G, 6.00% | 516,000 | 9,977,376 | |

| Gladstone Land Corp. Series D, 5.00% | 30,000 | 716,577 | |

| Global Medical REIT, Inc. Series A, 7.50% | 150,848 | 3,725,946 | |

| Global Net Lease, Inc.: | |||

| 7.50% | 821,484 | 18,031,574 | |

| Series A, 7.25% | 509,695 | 10,678,110 | |

| Series B 6.875% | 294,000 | 6,088,740 | |

| Series E, 7.375% | 379,839 | 8,109,563 | |

| Healthcare Trust, Inc.: | |||

| 7.125% | 190,000 | 2,886,100 | |

| Series A 7.375% | 364,800 | 5,807,616 | |

| Hudson Pacific Properties, Inc. Series C, 4.75% | 686,200 | 9,792,074 | |

| Kimco Realty Corp.: | |||

| 5.125% | 49,000 | 1,153,460 | |

| Series M, 5.25% | 58,100 | 1,366,512 | |

| National Storage Affiliates Trust Series A, 6.00% | 101,375 | 2,379,271 | |

| Pebblebrook Hotel Trust: | |||

| 6.30% | 281,697 | 6,002,963 | |

| 6.375% | 372,994 | 7,948,539 | |

| 6.375% | 666,800 | 13,869,440 | |

| Series H, 5.70% | 717,200 | 13,720,036 | |

| Pennsylvania (REIT): | |||

| Series B, 7.375%(c) | 99,385 | 43,306 | |

| Series C, 7.20%(c) | 50,325 | 21,801 | |

| Series D, 6.875%(c) | 150,100 | 64,798 | |

| Prologis, Inc. Series Q, 8.54% | 93,396 | 5,118,288 | |

| Public Storage: | |||

| 4.00% | 47,800 | 910,590 | |

| 4.00% | 244,200 | 4,622,706 | |

| Series F, 5.15% | 25,800 | 635,712 | |

| Series G, 5.05% | 43,800 | 1,077,480 | |

| Series I, 4.875% | 75,000 | 1,756,500 | |

| Series J, 4.70% | 529,337 | 11,587,187 | |

| Series K, 4.75% | 592,462 | 13,146,732 | |

| Series L, 4.625% | 235,900 | 5,208,672 | |

| Series M, 4.125% | 53,000 | 1,040,920 | |

| Series S, 4.10% | 200,000 | 3,890,000 | |

| Realty Income Corp. 6.00% | 121,125 | 3,040,250 | |

| Regency Centers Corp.: | |||

| 5.875% | 69,225 | 1,721,626 | |

| Series A, 6.25% | 281,325 | 7,010,619 | |

| Rexford Industrial Realty, Inc.: | |||

| Series B, 5.875% | 98,400 | 2,270,088 | |

| Series C, 5.625% | 78,225 | 1,701,394 | |

| Saul Centers, Inc.: | |||

| Series D, 6.125% | 82,775 | 1,895,399 | |

| Series E, 6.00% | 76,841 | 1,771,953 | |

| SITE Centers Corp. 6.375% | 124,200 | 2,906,280 | |

| Sotherly Hotels, Inc.: | |||

| Series B, 8.00% | 67,250 | 1,294,563 | |

| Series C, 7.875% | 107,000 | 2,069,380 | |

| Summit Hotel Properties, Inc.: | |||

| Series E, 6.25% | 457,602 | 9,802,384 | |

| Series F, 5.875% | 377,000 | 7,634,250 | |

| Sunstone Hotel Investors, Inc.: | |||

| Series H, 6.125% | 180,000 | 3,888,000 | |

| Series I, 5.70% | 240,000 | 4,800,000 | |

| UMH Properties, Inc. Series D, 6.375% | 694,525 | 15,974,075 | |

| Vornado Realty Trust: | |||

| Series L, 5.40% | 30,100 | 499,209 | |

| Series M, 5.25% | 2,000 | 31,820 | |

| 297,912,120 | |||

| Real Estate Management & Development - 1.8% | |||

| Brookfield Property Partners LP: | |||

| 5.75% | 43,000 | 499,660 | |

| 6.50% | 34,125 | 457,275 | |

| Digitalbridge Group, Inc.: | |||

| Series H, 7.125% | 942,305 | 21,795,515 | |

| Series I, 7.15% | 1,074,492 | 24,890,607 | |

| Series J, 7.15% | 1,362,346 | 31,347,581 | |

| Seritage Growth Properties Series A, 7.00% | 91,986 | 2,239,859 | |

| 81,230,497 | |||

TOTAL REAL ESTATE | 379,142,617 | ||

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | 771,849,877 | ||

| TOTAL PREFERRED STOCKS (Cost $874,271,341) | 808,116,174 | ||

| Corporate Bonds - 25.8% | |||

Principal Amount (g) | Value ($) | ||

| Convertible Bonds - 0.7% | |||

| FINANCIALS - 0.7% | |||

| Mortgage Real Estate Investment Trusts - 0.7% | |||

| MFA Financial, Inc. 6.25% 6/15/24 | 9,700,000 | 9,699,970 | |

| PennyMac Corp. 5.5% 11/1/24 | 13,601,000 | 13,226,973 | |

| Redwood Trust, Inc. 5.625% 7/15/24 | 3,631,000 | 3,576,530 | |

| Two Harbors Investment Corp. 6.25% 1/15/26 | 4,896,000 | 4,602,240 | |

| 31,105,713 | |||

| Nonconvertible Bonds - 25.1% | |||

| COMMUNICATION SERVICES - 0.1% | |||

| Media - 0.1% | |||

| Lamar Media Corp. 4% 2/15/30 | 5,875,000 | 5,376,213 | |

| CONSUMER DISCRETIONARY - 3.4% | |||

| Hotels, Restaurants & Leisure - 1.9% | |||

| Caesars Entertainment, Inc. 8.125% 7/1/27 (h) | 17,465,000 | 17,923,386 | |

| Hilton Domestic Operating Co., Inc.: | |||

| 3.625% 2/15/32(h) | 13,965,000 | 11,988,680 | |

| 4% 5/1/31(h) | 12,000,000 | 10,785,683 | |

| Hilton Grand Vacations Borrower Escrow LLC 4.875% 7/1/31 (h) | 18,265,000 | 16,197,417 | |

| Hyatt Hotels Corp. 5.75% 1/30/27 | 5,000,000 | 5,114,209 | |

| Marriott Ownership Resorts, Inc. 4.5% 6/15/29 (h) | 15,960,000 | 14,347,721 | |

| Sugarhouse HSP Gaming Prop Mezz LP/Sugarhouse HSP Gaming Finance Corp. 5.875% 5/15/25 (h) | 8,000,000 | 7,902,720 | |

| Times Square Hotel Trust 8.528% 8/1/26 (h) | 2,543,621 | 2,541,991 | |

| 86,801,807 | |||

| Household Durables - 1.5% | |||

| Adams Homes, Inc. 7.5% 2/15/25 (h) | 2,439,000 | 2,422,782 | |

| Ashton Woods U.S.A. LLC/Ashton Woods Finance Co. 6.625% 1/15/28 (h) | 7,925,000 | 7,808,113 | |

| Century Communities, Inc.: | |||

| 3.875% 8/15/29(h) | 13,005,000 | 11,701,279 | |

| 6.75% 6/1/27 | 4,670,000 | 4,704,749 | |

| LGI Homes, Inc. 4% 7/15/29 (h) | 13,310,000 | 11,388,297 | |

| M/I Homes, Inc. 3.95% 2/15/30 | 17,070,000 | 15,149,625 | |

| New Home Co., Inc. 8.25% 10/15/27 (h)(i) | 4,680,000 | 4,352,400 | |

| TRI Pointe Homes, Inc. 5.25% 6/1/27 | 11,458,000 | 11,265,620 | |

| 68,792,865 | |||

TOTAL CONSUMER DISCRETIONARY | 155,594,672 | ||

| ENERGY - 0.2% | |||

| Oil, Gas & Consumable Fuels - 0.2% | |||

| EG Global Finance PLC 12% 11/30/28 (h) | 10,000,000 | 10,569,800 | |

| FINANCIALS - 0.4% | |||

| Financial Services - 0.4% | |||

| Brixmor Operating Partnership LP: | |||

| 2.5% 8/16/31 | 9,000,000 | 7,507,644 | |

| 4.05% 7/1/30 | 4,000,000 | 3,740,790 | |

| 4.125% 5/15/29 | 1,872,000 | 1,777,522 | |

| Rexford Industrial Realty LP 2.15% 9/1/31 | 6,188,000 | 4,977,232 | |

| 18,003,188 | |||

| HEALTH CARE - 0.5% | |||

| Health Care Providers & Services - 0.5% | |||

| Sabra Health Care LP: | |||

| 3.9% 10/15/29 | 989,000 | 894,948 | |

| 5.125% 8/15/26 | 20,264,000 | 19,960,791 | |

| 20,855,739 | |||

| INDUSTRIALS - 0.1% | |||

| Commercial Services & Supplies - 0.1% | |||

| Williams Scotsman, Inc. 6.125% 6/15/25 (h) | 3,240,000 | 3,231,900 | |

| REAL ESTATE - 20.4% | |||

| Equity Real Estate Investment Trusts (REITs) - 17.4% | |||

| Agree LP: | |||

| 2.6% 6/15/33 | 6,100,000 | 4,828,250 | |

| 2.9% 10/1/30 | 1,500,000 | 1,296,669 | |

| 4.8% 10/1/32 | 1,288,000 | 1,225,096 | |

| American Homes 4 Rent LP: | |||

| 2.375% 7/15/31 | 9,000,000 | 7,398,034 | |

| 3.625% 4/15/32 | 27,000,000 | 24,105,340 | |

| 4.9% 2/15/29 | 13,000,000 | 12,899,420 | |

| 5.5% 2/1/34 | 6,000,000 | 6,061,594 | |

| American Tower Corp.: | |||

| 2.7% 4/15/31 | 2,000,000 | 1,714,197 | |

| 3.8% 8/15/29 | 23,000,000 | 21,701,087 | |

| 4.05% 3/15/32 | 27,000,000 | 25,226,864 | |

| 5.55% 7/15/33 | 18,000,000 | 18,488,295 | |

| 5.65% 3/15/33 | 20,000,000 | 20,657,793 | |

| 5.9% 11/15/33 | 5,000,000 | 5,275,544 | |

| Boston Properties, Inc.: | |||

| 3.25% 1/30/31 | 8,000,000 | 6,886,448 | |

| 6.75% 12/1/27 | 37,000 | 38,673 | |

| CBL & Associates LP: | |||

| 4.6%(d)(j) | 18,229,000 | 2 | |

| 5.25%(d)(j) | 11,371,000 | 1 | |

| 5.95%(d)(j) | 10,317,000 | 1 | |

| Crown Castle, Inc.: | |||

| 2.1% 4/1/31 | 4,000,000 | 3,256,161 | |

| 2.25% 1/15/31 | 14,000,000 | 11,568,622 | |

| 2.5% 7/15/31 | 10,000,000 | 8,333,526 | |

| 3.8% 2/15/28 | 2,000,000 | 1,901,786 | |

| 5% 1/11/28 | 3,000,000 | 2,984,861 | |

| 5.1% 5/1/33 | 30,000,000 | 29,632,607 | |

| CTR Partnership LP/CareTrust Capital Corp. 3.875% 6/30/28 (h) | 21,865,000 | 19,925,793 | |

| CubeSmart LP 4.375% 2/15/29 | 12,000,000 | 11,677,208 | |

| EPR Properties: | |||

| 3.6% 11/15/31 | 2,000,000 | 1,672,732 | |

| 4.95% 4/15/28 | 8,000,000 | 7,686,900 | |

| Equinix, Inc.: | |||

| 3.2% 11/18/29 | 10,000,000 | 9,143,259 | |

| 3.9% 4/15/32 | 22,000,000 | 20,359,261 | |

| Global Net Lease, Inc. / Global Net Lease Operating Partnership LP 3.75% 12/15/27 (h) | 5,075,000 | 4,305,231 | |

| GLP Capital LP/GLP Financing II, Inc.: | |||

| 4% 1/15/30 | 3,000,000 | 2,733,591 | |

| 4% 1/15/31 | 2,000,000 | 1,779,387 | |

| 5.3% 1/15/29 | 19,193,000 | 18,908,965 | |

| 5.375% 4/15/26 | 8,000,000 | 7,972,848 | |

| Hudson Pacific Properties LP 4.65% 4/1/29 | 6,000,000 | 5,302,469 | |

| Invitation Homes Operating Partnership LP: | |||

| 4.15% 4/15/32 | 35,000,000 | 32,125,149 | |

| 5.5% 8/15/33 | 23,000,000 | 23,165,214 | |

| Kimco Realty OP, LLC: | |||

| 4.6% 2/1/33 | 9,000,000 | 8,661,646 | |

| 6.4% 3/1/34 | 9,424,000 | 10,195,960 | |

| Kite Realty Group LP 5.5% 3/1/34 | 7,000 | 6,969 | |

| LXP Industrial Trust (REIT): | |||

| 2.375% 10/1/31 | 7,500,000 | 6,042,195 | |

| 2.7% 9/15/30 | 1,422,000 | 1,196,315 | |

| MPT Operating Partnership LP/MPT Finance Corp.: | |||

| 3.5% 3/15/31 | 6,000,000 | 3,678,232 | |

| 4.625% 8/1/29 | 19,835,000 | 13,411,691 | |

| 5% 10/15/27 | 5,000,000 | 3,784,443 | |

| Necessity Retail REIT, Inc./American Finance Operating Partnership LP 4.5% 9/30/28 (h) | 13,405,000 | 11,343,082 | |

| NNN (REIT), Inc. 5.6% 10/15/33 | 9,575,000 | 9,793,570 | |

| Omega Healthcare Investors, Inc.: | |||

| 3.25% 4/15/33 | 18,000,000 | 14,531,721 | |

| 3.375% 2/1/31 | 5,000,000 | 4,286,612 | |

| 4.5% 4/1/27 | 6,752,000 | 6,567,717 | |

| 4.95% 4/1/24 | 2,866,000 | 2,860,403 | |

| Park Intermediate Holdings LLC 4.875% 5/15/29 (h) | 7,000,000 | 6,413,750 | |

| Phillips Edison Grocery Center 2.625% 11/15/31 | 12,500,000 | 10,199,513 | |

| Prologis LP 5.125% 1/15/34 | 5,000,000 | 5,078,191 | |

| Public Storage: | |||

| 5.1% 8/1/33 | 10,000,000 | 10,190,819 | |

| 5.35% 8/1/53 | 5,000,000 | 5,126,611 | |

| Realty Income Corp.: | |||

| 3.4% 1/15/30 | 12,000,000 | 11,051,303 | |

| 4% 7/15/29 | 3,000,000 | 2,876,698 | |

| 4.875% 6/1/26 | 436,000 | 435,880 | |

| 5.625% 10/13/32 | 5,000,000 | 5,189,265 | |

| RLJ Lodging Trust LP: | |||

| 3.75% 7/1/26(h) | 4,000,000 | 3,780,005 | |

| 4% 9/15/29(h) | 4,835,000 | 4,279,126 | |

| Safehold Operating Partnership LP: | |||

| 2.8% 6/15/31 | 7,000,000 | 5,825,903 | |

| 2.85% 1/15/32 | 15,250,000 | 12,584,376 | |

| SBA Communications Corp.: | |||

| 3.125% 2/1/29 | 25,000,000 | 22,280,823 | |

| 3.875% 2/15/27 | 5,000,000 | 4,771,605 | |

| Simon Property Group LP 6.25% 1/15/34 | 10,000,000 | 10,821,335 | |

| Sun Communities Operating LP: | |||

| 2.7% 7/15/31 | 9,000,000 | 7,475,669 | |

| 4.2% 4/15/32 | 11,439,000 | 10,388,773 | |

| 5.5% 1/15/29 | 9,000,000 | 9,086,001 | |

| 5.7% 1/15/33 | 17,750,000 | 17,913,150 | |

| UDR, Inc. 3% 8/15/31 | 1,500,000 | 1,307,031 | |

| Uniti Group LP/Uniti Fiber Holdings, Inc./CSL Capital LLC 6% 1/15/30 (h) | 18,035,000 | 11,948,188 | |

| Uniti Group LP/Uniti Group Finance, Inc./CSL Capital LLC: | |||

| 6.5% 2/15/29(h) | 27,505,000 | 19,401,829 | |

| 10.5% 2/15/28(h) | 7,000,000 | 7,125,657 | |

| Ventas Realty LP: | |||

| 2.5% 9/1/31 | 1,500,000 | 1,232,333 | |

| 4.4% 1/15/29 | 17,000,000 | 16,489,320 | |

| VICI Properties LP: | |||

| 4.75% 2/15/28 | 5,000,000 | 4,895,792 | |

| 5.125% 5/15/32 | 38,000,000 | 36,313,883 | |

| VICI Properties LP / VICI Note Co. 4.625% 12/1/29 (h) | 26,000,000 | 24,604,320 | |

| Vornado Realty LP 3.4% 6/1/31 | 6,000,000 | 4,730,297 | |

| Welltower OP LLC: | |||

| 4% 6/1/25 | 5,000,000 | 4,918,176 | |

| 4.125% 3/15/29 | 3,000,000 | 2,903,898 | |

| WP Carey, Inc.: | |||

| 2.45% 2/1/32 | 2,000,000 | 1,633,984 | |

| 3.85% 7/15/29 | 3,000,000 | 2,822,187 | |

| XHR LP: | |||

| 4.875% 6/1/29(h) | 10,000,000 | 9,223,100 | |

| 6.375% 8/15/25(h) | 4,250,000 | 4,251,400 | |

| 798,169,625 | |||

| Real Estate Management & Development - 3.0% | |||

| CBRE Group, Inc. 5.95% 8/15/34 | 27,250,000 | 28,192,903 | |

| CoStar Group, Inc. 2.8% 7/15/30 (h) | 2,000,000 | 1,717,968 | |

| Cushman & Wakefield U.S. Borrower LLC 6.75% 5/15/28 (h) | 11,165,000 | 11,012,263 | |

| Digital Realty Trust LP: | |||

| 3.6% 7/1/29 | 5,000,000 | 4,687,659 | |

| 3.7% 8/15/27 | 5,000,000 | 4,836,061 | |

| 5.55% 1/15/28 | 12,000,000 | 12,269,314 | |

| Essex Portfolio LP: | |||

| 2.55% 6/15/31 | 2,000,000 | 1,674,709 | |

| 2.65% 3/15/32 | 3,000,000 | 2,508,605 | |

| Extra Space Storage LP: | |||

| 2.55% 6/1/31 | 2,000,000 | 1,671,789 | |

| 5.4% 2/1/34 | 5,000,000 | 4,998,940 | |

| 5.5% 7/1/30 | 5,000,000 | 5,113,249 | |

| 5.9% 1/15/31 | 9,000,000 | 9,356,901 | |

| Forestar Group, Inc.: | |||

| 3.85% 5/15/26(h) | 8,000,000 | 7,598,960 | |

| 5% 3/1/28(h) | 5,000,000 | 4,717,851 | |

| Howard Hughes Corp.: | |||

| 4.125% 2/1/29(h) | 5,295,000 | 4,775,283 | |

| 5.375% 8/1/28(h) | 2,515,000 | 2,409,401 | |

| Kennedy-Wilson, Inc.: | |||

| 4.75% 3/1/29 | 17,075,000 | 14,295,190 | |

| 4.75% 2/1/30 | 8,130,000 | 6,602,454 | |

| 5% 3/1/31 | 6,960,000 | 5,550,600 | |

| Taylor Morrison Communities, Inc./Monarch Communities, Inc. 5.875% 6/15/27 (h) | 1,798,000 | 1,782,393 | |

| 135,772,493 | |||

TOTAL REAL ESTATE | 933,942,118 | ||

| TOTAL NONCONVERTIBLE BONDS | 1,147,573,630 | ||

| TOTAL CORPORATE BONDS (Cost $1,199,497,612) | 1,178,679,343 | ||

| Asset-Backed Securities - 1.6% | |||

Principal Amount (g) | Value ($) | ||

| American Homes 4 Rent Series 2015-SFR2: | |||

| Class E, 6.07% 10/17/52 (h) | 8,259,000 | 8,271,474 | |

| Class XS, 0% 10/17/52 (d)(e)(h)(k) | 4,459,092 | 45 | |

| Capital Trust RE CDO Ltd. Series 2005-1A Class D, CME Term SOFR 1 Month Index + 1.610% 3.3464% 3/20/50 (d)(e)(f)(h) | 2,250,000 | 0 | |

| Home Partners of America Trust: | |||

| Series 2019-2 Class F, 3.866% 10/19/39 (h) | 2,760,918 | 2,427,514 | |

| Series 2021-1 Class F, 3.325% 9/17/41 (h) | 6,602,670 | 5,159,786 | |

| Series 2021-2 Class G, 4.505% 12/17/26 (h) | 27,719,380 | 24,350,608 | |

| Series 2021-3 Class F, 4.242% 1/17/41 (h) | 9,923,336 | 8,509,590 | |

| New Residential Mortgage Loan Trust Series 2022-SFR2 Class E1, 4% 9/4/39 (h) | 2,900,000 | 2,593,352 | |

| Retained Vantage Data Ctrs Iss Series 2023-2A Class A2, 5.05% 9/15/48 (h) | 4,000,000 | 3,684,219 | |

| Tricon American Homes Series 2018-SFR1 Class F, 4.96% 5/17/37 (h) | 8,282,000 | 8,124,228 | |

| Tricon Residential 2023-Sfr1 T Series 2023-SFR1: | |||

| Class D, 5.1% 7/17/40 (h) | 5,000,000 | 4,823,097 | |

| Class E, 7.977% 7/17/40 (h) | 2,000,000 | 2,051,039 | |

| Tricon Residential Trust Series 2021-SFR1 Class G, 4.133% 7/17/38 (h) | 3,000,000 | 2,705,193 | |

| TOTAL ASSET-BACKED SECURITIES (Cost $80,819,580) | 72,700,145 | ||

| Collateralized Mortgage Obligations - 0.0% | |||

Principal Amount (g) | Value ($) | ||

| U.S. Government Agency - 0.0% | |||

| Fannie Mae REMIC Trust: | |||

| Series 2002-W1 subordinate REMIC pass thru certificates, Class 3B3, 3.6522% 2/25/42 (d)(e)(h) | 21,139 | 9,052 | |

| Series 2003-W10 subordinate REMIC pass thru certificates, Class 2B3, 3.8636% 6/25/43 (d)(e)(h) | 36,388 | 26,447 | |

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $37,396) | 35,499 | ||

| Commercial Mortgage Securities - 23.9% | |||

Principal Amount (g) | Value ($) | ||

| BANK sequential payer: | |||

| Series 2022-BNK42 Class D, 2.5% 6/15/55 (h) | 2,000,000 | 1,290,863 | |

| Series 2022-BNK42, Class A5, 4.493% 6/15/55 (e) | 15,000,000 | 14,583,636 | |

| Series 2022-BNK43 Class A5, 4.399% 8/15/55 | 10,485,000 | 10,101,661 | |

| Series 2022-BNK44, Class A5, 5.9367% 11/15/55 (e) | 15,900,000 | 16,913,622 | |

| Bank sequential payer Series 2023-BNK46 Class A4, 5.745% 8/15/56 | 1,409,000 | 1,498,925 | |

| BANK: | |||

| Series 2017-BNK8 Class E, 2.8% 11/15/50 (h) | 11,374,393 | 4,094,784 | |

| Series 2020-BN30 Class MCDG, 3.0155% 12/15/53 (d)(e) | 2,000,000 | 802,909 | |

| Series 2021-BN38 Class C, 3.3246% 12/15/64 (e) | 3,505,000 | 2,592,379 | |

| Series 2022-BNK41, Class C, 3.9165% 4/15/65 (e) | 4,433,000 | 3,451,440 | |

| Series 2022-BNK42 Class C, 4.7222% 6/15/55 (e) | 6,500,000 | 5,519,036 | |

| Series 2022-BNK44 Class A/S, 5.7452% 11/15/55 (e) | 5,000,000 | 5,131,784 | |

| Bank Series 2023-BNK46 Class A/S, 6.385% 8/15/56 | 5,000,000 | 5,351,406 | |

| Bank of America Commercial Mortgage Trust Series 2016-UB10 Class C, 4.9856% 7/15/49 (e) | 3,030,000 | 2,829,971 | |

| Bank5 2023-5Yr3 Series 2023-5YR3: | |||

| Class A/S, 7.3154% 9/15/56 (e) | 1,500,000 | 1,615,639 | |

| Class B, 7.5592% 9/15/56 (e) | 2,000,000 | 2,120,369 | |

| Bank5 2023-5Yr4 Series 2023-5YR4 Class A/S, 7.274% 12/15/56 (e) | 5,000,000 | 5,365,557 | |

| BBCMS Mortgage Trust: | |||

| sequential payer: | |||

Series 2022-C17: | |||

| Class C, 5.45% 9/15/55 | 2,000,000 | 1,779,802 | |

| Class D, 2.5% 9/15/55 (h) | 2,000,000 | 1,203,634 | |

Series 2023-C19 Class A5, 5.451% 4/15/56 | 22,500,000 | 23,475,593 | |

Series 2023-C20 Class A5, 5.576% 7/15/56 | 24,250,000 | 25,573,359 | |

Series 2023-C21 Class A/S, 6.5061% 9/15/56 (e) | 7,000,000 | 7,460,846 | |

Series 2023-C22: | |||

| Class A/S, 7.3636% 11/15/56 | 10,000,000 | 11,594,956 | |

| Class B, 7.3636% 11/15/56 (e) | 10,000,000 | 11,224,744 | |

| Series 2020-C6 Class C, 3.045% 2/15/53 | 1,129,000 | 897,129 | |

| Series 2020-C7 Class C, 3.7154% 4/15/53 (e) | 2,067,000 | 1,515,533 | |

| Series 2022-C16 Class C, 4.6% 6/15/55 (e) | 5,250,000 | 4,325,868 | |

| Series 2023-5C23 Class A/S, 7.7032% 12/15/56 | 2,500,000 | 2,677,679 | |

| Series 2023-C21 Class B, 6.5061% 9/15/56 | 7,000,000 | 7,308,403 | |

| Benchmark 2023-V3 Mtg Trust Series 2023-V3 Class A/S, 7.0967% 7/15/56 | 10,000,000 | 10,639,061 | |

| Benchmark Mortgage Trust: | |||

| sequential payer: | |||

Series 2019-B14: | |||

| Class 225D, 3.4041% 12/15/62 (e)(h) | 3,427,000 | 69,527 | |

| Class 225E, 3.4041% 12/15/62 (d)(e)(h) | 5,141,000 | 51,348 | |

Series 2021-B28 Class A5, 2.2237% 8/15/54 | 500,000 | 413,019 | |

Series 2022-B34 Class A5, 3.786% 4/15/55 | 10,168,402 | 9,061,639 | |

Series 2022-B35 Class A5, 4.5925% 5/15/55 (e) | 12,302,000 | 11,574,030 | |

Series 2022-B36 Class A5, 4.4699% 7/15/55 | 4,900,000 | 4,750,686 | |

Series 2023-B38 Class A4, 5.5246% 4/15/56 | 21,000,000 | 21,940,672 | |

Series 2023-B39 Class A5, 5.7536% 7/15/56 | 5,000,000 | 5,312,310 | |

Series 2023-C5 Class A5, 5.7653% 6/15/56 | 22,850,000 | 24,285,693 | |

| Series 2020-B18 Class AGNG, 4.5348% 7/15/53 (e)(h) | 11,379,000 | 9,960,176 | |

| Series 2022-B32 Class A5, 3.0019% 1/15/55 | 9,618,000 | 8,103,111 | |

| Series 2022-B35 Class C, 4.4444% 5/15/55 (e) | 7,000,000 | 5,267,943 | |

| Series 2022-B36: | |||

Class C, 5.1189% 7/15/55 (e) | 2,000,000 | 1,478,800 | |

Class D, 2.5% 7/15/55 (h) | 3,828,000 | 2,132,284 | |

| Series 2023-B39 Class B, 6.192% 7/15/56 (h) | 5,000,000 | 5,187,804 | |

| Series 2023-C5 Class B, 6.697% 6/15/56 (e) | 4,750,000 | 5,063,771 | |

| Series 2023-V2 Class A/S, 6.5374% 5/15/55 | 4,200,000 | 4,360,312 | |

| BMO Mortgage Trust: | |||

| sequential payer Series 2023-C6 Class A5, 5.9562% 9/15/56 | 14,000,000 | 15,073,608 | |

| Series 2023-5C1 Class A/S, 7.1177% 8/15/56 (e) | 3,500,000 | 3,718,342 | |

| Series 2023-5C2 Class A5, 7.4855% 11/15/56 (e) | 10,000,000 | 10,749,692 | |

| Series 2023-C6 Class A/S, 6.5504% 9/15/56 (e) | 5,000,000 | 5,430,897 | |

| Series 2023-C7 Class A/S, 6.6738% 12/15/56 (e) | 5,000,000 | 5,471,051 | |

| BX Commercial Mortgage Trust: | |||

| floater: | |||

Series 2019-IMC Class G, CME Term SOFR 1 Month Index + 3.640% 8.9793% 4/15/34 (e)(f)(h) | 5,181,000 | 5,106,764 | |

Series 2019-XL: | |||

| Class G, CME Term SOFR 1 Month Index + 2.410% 7.7476% 10/15/36 (e)(f)(h) | 13,391,750 | 13,257,835 | |

| Class J, CME Term SOFR 1 Month Index + 2.760% 8.0976% 10/15/36 (e)(f)(h) | 15,217,550 | 14,790,938 | |

Series 2021-ACNT Class G, CME Term SOFR 1 Month Index + 3.400% 8.7425% 11/15/38 (e)(f)(h) | 15,581,000 | 14,995,083 | |

Series 2021-CIP Class F, CME Term SOFR 1 Month Index + 3.330% 8.6665% 12/15/38 (e)(f)(h) | 7,790,000 | 7,584,505 | |

Series 2021-PAC Class G, CME Term SOFR 1 Month Index + 3.060% 8.3936% 10/15/36 (e)(f)(h) | 17,232,000 | 16,456,551 | |

Series 2021-SOAR Class J, CME Term SOFR 1 Month Index + 3.860% 9.1985% 6/15/38 (e)(f)(h) | 17,644,334 | 17,139,235 | |

Series 2021-VINO Class G, CME Term SOFR 1 Month Index + 4.060% 9.3998% 5/15/38 (e)(f)(h) | 12,077,382 | 11,763,764 | |

Series 2021-VOLT: | |||

| Class F, CME Term SOFR 1 Month Index + 2.510% 7.8476% 9/15/36 (e)(f)(h) | 10,000,000 | 9,801,545 | |

| Class G, CME Term SOFR 1 Month Index + 2.960% 8.2976% 9/15/36 (e)(f)(h) | 5,000,000 | 4,813,850 | |

Series 2022-LBA6: | |||

| Class F, CME Term SOFR 1 Month Index + 3.350% 8.6832% 1/15/39 (e)(f)(h) | 6,200,000 | 6,055,695 | |

| Class G, CME Term SOFR 1 Month Index + 4.200% 9.5332% 1/15/39 (e)(f)(h) | 11,340,000 | 11,037,322 | |

| Series 2019-OC11 Class E, 4.0755% 12/9/41 (e)(h) | 22,521,000 | 19,362,105 | |

| Series 2020-VIVA Class E, 3.667% 3/11/44 (e)(h) | 20,898,990 | 17,085,033 | |

| BX Commercial Mortgage Trust 2024-Xl4 floater Series 2024-XL4: | |||

| Class D, CME Term SOFR 1 Month Index + 3.130% 0% 2/15/39 (e)(f)(h) | 10,000,000 | 10,013,000 | |

| Class E, CME Term SOFR 1 Month Index + 4.180% 9.1881% 2/15/39 (e)(f)(h) | 5,000,000 | 4,987,500 | |

| BX Trust floater Series 2022-VAMF Class F, CME Term SOFR 1 Month Index + 3.290% 8.6322% 1/15/39 (e)(f)(h) | 4,367,000 | 4,062,443 | |

| BXP Trust Series 2021-601L Class E, 2.868% 1/15/44 (e)(h) | 5,754,000 | 3,219,601 | |

| CD Mortgage Trust Series 2017-CD3 Class D, 3.25% 2/10/50 (d)(h) | 3,353,000 | 1,118,634 | |

| Citigroup Commercial Mortgage Trust: | |||

| sequential payer: | |||

Series 2019-C7 Class A4, 3.102% 12/15/72 | 4,820,000 | 4,348,320 | |

Series 2023-V2 Class A3, 6.0475% 10/12/40 (e)(h) | 5,000,000 | 5,055,578 | |

| Series 2022-GC48 Class E, 2.5% 6/15/55 (h) | 2,000,000 | 1,093,201 | |

| Series 2023-PRM3: | |||

Class B, 6.5717% 7/10/28 (e)(h) | 5,000,000 | 5,080,367 | |

Class C, 6.5717% 7/10/28 (e)(h) | 5,500,000 | 5,453,323 | |

| Series 2023-SMRT Class C, 6.0475% 10/12/40 (e)(h) | 9,750,000 | 9,784,641 | |

| COMM Mortgage Trust: | |||

| floater Series 2018-HCLV: | |||

Class F, CME Term SOFR 1 Month Index + 3.340% 8.679% 9/15/33 (e)(f)(h) | 4,265,000 | 2,066,474 | |

Class G, CME Term SOFR 1 Month Index + 5.350% 10.6853% 9/15/33 (e)(f)(h) | 4,265,000 | 1,638,048 | |

| sequential payer Series 2013-LC6 Class E, 3.5% 1/10/46 (h) | 4,741,000 | 4,290,605 | |

| Series 2012-CR1: | |||

Class D, 5.3084% 5/15/45 (e)(h) | 1,469,506 | 1,139,425 | |

Class G, 2.462% 5/15/45 (d)(h) | 1,614,664 | 30,368 | |

| Series 2014-UBS2 Class D, 5.1241% 3/10/47 (e)(h) | 3,713,000 | 3,078,578 | |

| Series 2017-CD4 Class D, 3.3% 5/10/50 (h) | 2,769,000 | 1,812,534 | |

| Series 2019-CD4 Class C, 4.3497% 5/10/50 (e) | 3,000,000 | 2,277,992 | |

| COMM Trust Series 2017-COR2 Class D, 3% 9/10/50 (h) | 2,769,000 | 2,057,505 | |

| Commercial Mortgage Trust pass-thru certificates Series 2012-CR2: | |||

| Class E, 4.6861% 8/15/45 (e)(h) | 2,246,651 | 2,182,622 | |

| Class F, 4.25% 8/15/45 (h) | 2,000,000 | 1,620,000 | |

| Credit Suisse Commercial Mortgage Trust floater Series 2021-SOP2 Class F, CME Term SOFR 1 Month Index + 4.330% 9.6645% 6/15/34 (f)(h) | 7,120,000 | 3,244,252 | |

| Credit Suisse Mortgage Trust: | |||

| floater Series 2021-BPNY Class A, CME Term SOFR 1 Month Index + 3.820% 9.1629% 8/15/26 (e)(f)(h) | 18,000,000 | 16,008,295 | |

| Series 2021-BRIT Class A, CME Term SOFR 1 Month Index + 3.570% 8.9067% 5/15/26 (e)(f)(h) | 8,146,318 | 7,397,845 | |

| CSAIL Commercial Mortgage Trust: | |||

| sequential payer Series 2019-C15 Class A4, 4.0529% 3/15/52 | 9,425,000 | 8,956,059 | |

| Series 2017-C8 Class D, 4.5627% 6/15/50 (e)(h) | 4,297,000 | 3,160,163 | |

| DBUBS Mortgage Trust Series 2011-LC3A Class D, 5.5358% 8/10/44 (e)(h) | 2,829,691 | 2,520,321 | |

| DTP Commercial Mortgage Trust 2023-Ste2 sequential payer Series 2023-STE2 Class C, 6.6891% 1/15/41 (e)(h) | 8,800,000 | 8,694,896 | |

| ELP Commercial Mortgage Trust floater Series 2021-ELP Class J, CME Term SOFR 1 Month Index + 3.720% 9.0634% 11/15/38 (e)(f)(h) | 15,430,040 | 14,689,432 | |

| GS Mortgage Securities Trust: | |||

| floater: | |||

Series 2018-RIVR Class G, CME Term SOFR 1 Month Index + 2.640% 8.231% 7/15/35 (e)(f)(h) | 3,808,000 | 336,456 | |

Series 2019-70P Class E, CME Term SOFR 1 Month Index + 2.310% 7.8985% 10/15/36 (e)(f)(h) | 7,437,000 | 6,875,460 | |

| sequential payer: | |||

Series 2019-GSA1 Class A4, 3.0479% 11/10/52 | 7,000,000 | 6,303,554 | |

Series 2023-SHIP: | |||

| Class D, 6.273% 9/10/38 (e)(h) | 9,000,000 | 8,830,678 | |

| Class E, 7.4336% 9/10/38 (e)(h) | 15,000,000 | 14,735,946 | |

| Series 2011-GC5: | |||

Class C, 5.2983% 8/10/44 (e)(h) | 8,899,000 | 6,574,910 | |

Class D, 5.2983% 8/10/44 (e)(h) | 2,733,635 | 986,232 | |

Class E, 5.2983% 8/10/44 (e)(h) | 8,138,000 | 906,222 | |

Class F, 4.5% 8/10/44 (d)(h) | 7,897,000 | 23,691 | |

| Series 2012-GCJ9: | |||

Class D, 4.7543% 11/10/45 (e)(h) | 4,531,578 | 4,128,449 | |

Class E, 4.7543% 11/10/45 (d)(e)(h) | 1,908,000 | 1,589,059 | |

| Hilton U.S.A. Trust Series 2016-HHV Class F, 4.3333% 11/5/38 (e)(h) | 20,270,000 | 18,622,507 | |

| IMT Trust Series 2017-APTS Class EFX, 3.6132% 6/15/34 (e)(h) | 9,213,000 | 8,997,386 | |

| Independence Plaza Trust Series 2018-INDP Class E, 4.996% 7/10/35 (h) | 2,896,000 | 2,680,518 | |

| JPMBB Commercial Mortgage Securities Trust: | |||

| Series 2014-C23 Class UH5, 4.7094% 9/15/47 (d)(h) | 8,640,000 | 7,033,678 | |

| Series 2014-C26 Class D, 4.0107% 1/15/48 (e)(h) | 2,398,000 | 2,039,913 | |

| JPMDB Commercial Mortgage Securities Trust: | |||

| sequential payer Series 2019-COR6 Class A4, 3.0565% 11/13/52 | 8,000,000 | 6,664,805 | |

| Series 2018-C8 Class D, 3.4226% 6/15/51 (e)(h) | 1,698,000 | 1,143,283 | |

| JPMorgan Chase Commercial Mortgage Securities Trust: | |||

| sequential payer Series 2021-1MEM Class E, 2.742% 10/9/42 (e)(h) | 9,552,000 | 5,527,368 | |

| Series 2011-C3: | |||

Class E, 5.7097% 2/15/46 (d)(e)(h) | 13,774,000 | 5,716,348 | |

Class G, 4.409% 2/15/46 (e)(h) | 4,671,000 | 537,072 | |

Class H, 4.409% 2/15/46 (d)(e)(h) | 7,077,000 | 489,268 | |

| Series 2012-CBX: | |||

Class E, 4.8459% 6/15/45 (e)(h) | 4,370,619 | 3,867,998 | |

Class F, 4% 6/15/45 (d)(h) | 8,192,000 | 6,553,600 | |

Class G 4% 6/15/45 (d)(h) | 4,044,000 | 2,749,920 | |

| Series 2013-LC11: | |||

Class D, 4.2992% 4/15/46 (e) | 7,722,000 | 3,448,414 | |

Class E, 3.25% 4/15/46 (e)(h) | 472,000 | 128,063 | |

Class F, 3.25% 4/15/46 (e)(h) | 2,518,000 | 156,116 | |

| Series 2014-DSTY Class E, 3.9314% 6/10/27 (d)(e)(h) | 8,161,000 | 19,905 | |

| Series 2018-AON Class F, 4.767% 7/5/31 (e)(h) | 5,039,000 | 1,053,667 | |

| Series 2020-NNN Class FFX, 4.6254% 1/16/37 (d)(h) | 2,000,000 | 642,687 | |

| KNDR Trust floater Series 2021-KIND Class F, CME Term SOFR 1 Month Index + 4.060% 9.3975% 8/15/38 (e)(f)(h) | 7,096,315 | 6,572,750 | |

| Merit floater Series 2021-STOR Class J, CME Term SOFR 1 Month Index + 4.060% 9.3985% 7/15/38 (e)(f)(h) | 3,476,000 | 3,365,182 | |

| MHC Commercial Mortgage Trust floater Series 2021-MHC Class G, CME Term SOFR 1 Month Index + 3.310% 8.6484% 4/15/38 (e)(f)(h) | 13,087,315 | 12,858,293 | |

| MHP Commercial Mortgage Trust floater Series 2022-MHIL: | |||

| Class F, CME Term SOFR 1 Month Index + 3.250% 8.5924% 1/15/27 (e)(f)(h) | 3,924,498 | 3,804,130 | |

| Class G, CME Term SOFR 1 Month Index + 3.950% 9.2907% 1/15/27 (e)(f)(h) | 13,149,119 | 12,699,681 | |

| Mira Trust 2023-Mile sequential payer Series 2023-MILE Class B, 7.2026% 6/10/38 (h) | 4,200,000 | 4,310,447 | |

| Morgan Stanley BAML Trust: | |||

| Series 2012-C6 Class D, 4.5725% 11/15/45 (e)(h) | 2,000,000 | 1,620,040 | |

| Series 2012-C6, Class F, 4.5725% 11/15/45 (e)(h) | 2,500,000 | 1,200,300 | |

| Series 2013-C12 Class D, 6.2365% 10/15/46 (e)(h) | 5,670,988 | 4,735,502 | |

| Series 2013-C13 Class E, 5.1684% 11/15/46 (e)(h) | 2,740,911 | 2,469,397 | |

| Series 2013-C9: | |||

Class C, 3.8559% 5/15/46 (e) | 3,302,000 | 2,520,218 | |

Class D, 3.9439% 5/15/46 (e)(h) | 5,137,000 | 3,666,277 | |

| Morgan Stanley Capital I Trust: | |||

| Series 2011-C2: | |||

Class D, 5.385% 6/15/44 (e)(h) | 2,804,868 | 2,595,303 | |

Class F, 5.385% 6/15/44 (d)(e)(h) | 4,440,000 | 1,826,151 | |

Class XB, 0.5055% 6/15/44 (e)(h)(k) | 27,974,438 | 96,017 | |

| Series 2011-C3: | |||

Class E, 5.1087% 7/15/49 (e)(h) | 1,182,551 | 1,154,102 | |

Class F, 5.1087% 7/15/49 (e)(h) | 5,624,050 | 5,061,482 | |

Class G, 5.1087% 7/15/49 (e)(h) | 5,049,500 | 4,304,996 | |

| Series 2015-MS1 Class D, 4.1571% 5/15/48 (e)(h) | 10,833,000 | 6,788,720 | |

| Series 2016-BNK2 Class C, 3% 11/15/49 (h) | 2,966,000 | 1,368,998 | |

| Series 2017-H1 Class C, 4.281% 6/15/50 | 2,470,594 | 2,190,578 | |

| Series 2018-H4 Class A4, 4.31% 12/15/51 | 14,240,929 | 13,805,923 | |

| Series 2020-L4, Class C, 3.536% 2/15/53 | 2,765,000 | 2,071,258 | |

| MSJP Commercial Securities Mortgage Trust Series 2015-HAUL Class E, 5.0127% 9/5/47 (e)(h) | 1,500,000 | 989,416 | |

| MSWF Commercial Mortgage Trust sequential payer: | |||

| Series 2023-1: | |||

Class A5, 5.752% 5/15/56 | 16,000,000 | 16,952,125 | |

Class B, 6.9056% 5/15/56 (e) | 3,750,000 | 4,016,187 | |

| Series 2023-2: | |||

Class AS, 6.491% 12/15/56 | 10,000,000 | 10,799,726 | |

Class B, 7.1101% 12/15/56 (e) | 10,000,000 | 10,943,462 | |

| Natixis Commercial Mortgage Securities Trust: | |||

| floater Series 2018-FL1 Class WAN2, CME Term SOFR 1 Month Index + 3.790% 9.1302% 6/15/35 (d)(e)(f)(h) | 651,000 | 32,550 | |

| Series 2020-2PAC Class AMZ3, 3.6167% 1/15/37 (d)(e)(h) | 2,502,675 | 1,670,209 | |

| Open Trust 2023-Air sequential payer Series 2023-AIR Class D, CME Term SOFR 1 Month Index + 6.680% 12.0169% 10/15/28 (e)(f)(h) | 9,459,358 | 9,494,863 | |

| OPG Trust floater Series 2021-PORT: | |||

| Class G, CME Term SOFR 1 Month Index + 2.510% 7.8465% 10/15/36 (e)(f)(h) | 4,588,063 | 4,393,070 | |

| Class J, CME Term SOFR 1 Month Index + 3.460% 8.7945% 10/15/36 (e)(f)(h) | 8,217,564 | 7,644,713 | |

| PKHL Commercial Mortgage Trust floater Series 2021-MF: | |||

| Class E, CME Term SOFR 1 Month Index + 2.710% 8.0765% 7/15/38 (e)(f)(h) | 500,000 | 381,285 | |

| Class G, CME Term SOFR 1 Month Index + 4.460% 9.7985% 7/15/38 (d)(e)(f)(h) | 5,944,000 | 3,705,667 | |

| Prima Capital CRE Securitization Ltd. Series 2020-8A Class C, 3% 12/26/70 (h) | 9,277,000 | 7,248,120 | |

| Prima Capital Ltd. floater Series 2021-9A Class C, CME Term SOFR 1 Month Index + 2.460% 7.7993% 12/15/37 (e)(f)(h) | 5,000,000 | 4,835,079 | |

| Providence Place Group Ltd. Partnership Series 2000-C1 Class A2, 7.75% 7/20/28 (h) | 2,565,448 | 2,640,457 | |

| SG Commercial Mortgage Securities Trust Series 2020-COVE Class F, 3.8518% 3/15/37 (e)(h) | 5,000,000 | 4,335,891 | |