Exhibit 99

PG&E Corporation: Customer Focused, Value Driven Goldman Sachs 6th Annual Power and Utility Conference Las Vegas, NV May 10-12, 2006

SLIDE 2 Cautionary Statement Regarding Forward-Looking Information This presentation contains forward-looking statements regarding management’s guidance for PG&E Corporation’s 2006 and 2007 earnings per share from operations, capital expenditures, Pacific Gas and Electric Company’s (Utility) rate base and rate base growth, anticipated costs and benefits from Transformation initiatives, anticipated electric resources, and targeted average annual growth rate for earnings per share from operations, over the 2006-2010 period. These statements are based on current expectations and various assumptions which management believes are reasonable, including that substantial capital investments are made in Utility business over the 2006-2010 period and that the Utility earns an authorized return on equity of 11.35%. These statements and assumptions are necessarily subject to various risks and uncertainties the realization or resolution of which are outside of management's control. Actual results may differ materially. Factors that could cause actual results to differ materially include: Unanticipated changes in operating expenses or capital expenditures, which may affect the Utility’s ability to earn its authorized rate of return; How the Utility manages its responsibility to procure electric capacity and energy for its customers; The adequacy and price of natural gas supplies, and the ability of the Utility to manage and respond to the volatility of the natural gas market for its customers; The operation of the Utility’s Diablo Canyon nuclear power plant, which could cause the Utility to incur potentially significant environmental costs and capital expenditures, and the extent to which the Utility is able to timely increase its spent nuclear fuel storage capacity at Diablo Canyon; Whether the Utility is able to recognize the anticipated cost benefits and savings to result from its efforts to improve customer service through implementation of specific initiatives to streamline business processes and deploy new technology; The outcome of proceedings pending at the Federal Energy Regulatory Commission and the California Public Utilities Commission (CPUC), including the Utility’s 2007 General Rate Case and the CPUC’s pending investigation into the Utility’s billing and collection practices; How the CPUC administers the capital structure, stand-alone dividend, and first priority conditions of the CPUC’s decisions permitting the establishment of holding companies for the California investor-owned electric utilities, and the outcome of the CPUC's new rulemaking proceeding concerning the relationship between the California investor-owned energy utilities and their holding companies and non-regulated affiliates; The impact of the recently adopted Energy Policy Act of 2005 and future legislative or regulatory actions or policies affecting the energy industry; ; Increased municipalization and other forms of bypass in the Utility’s service territory; and Other factors discussed in PG&E Corporation's and Pacific Gas and Electric Company’s SEC reports.

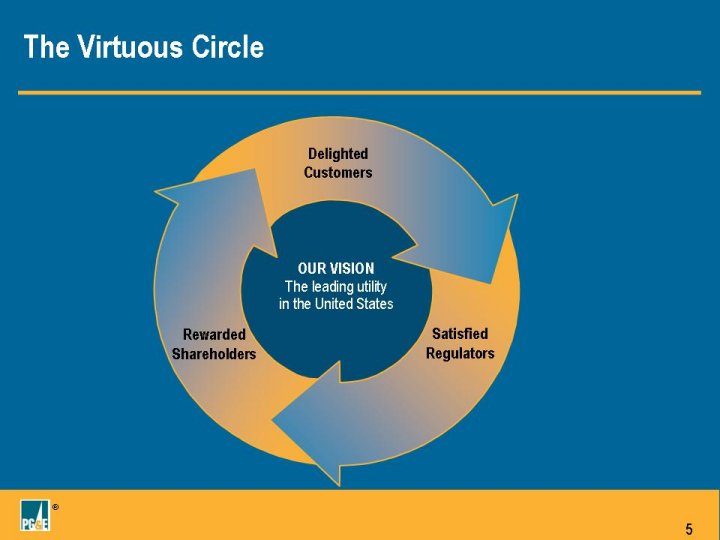

SLIDE 3 Strategic Direction Our vision The leading utility in the United States Our goals Delighted Energized Rewarded customers employees shareholders Our strategies Operational excellence Transformation Our values We act with integrity and communicate honestly and openly. We are passionate about meeting our customers’ needs and delivering for our shareholders. We are accountable for all of our own actions: these include safety, protecting the environment, and supporting our communities. We work together as a team and are committed to excellence and innovation. We respect each other and celebrate our diversity.

SLIDE 4 Business Priorities 2006-2010 Advance business transformation Provide attractive shareholder returns Increase investment in utility infrastructure Implement an effective energy procurement plan Improve reputation through more effective communications Evaluate the evolving industry and related investment opportunities

SLIDE 5 The Virtuous Circle OUR VISION The leading utility in the United States Delighted Customers Satisfied Regulators Rewarded Shareholders

SLIDE 6 Transformation Phases Strategy/ Roadmap Preliminary Design & Analysis Detailed Design Build/ Test Implementation & Operational Handover Planned deployment of initiatives: 2005: 20 initiatives were fully or partial deployed 2006: 33 other initiatives will be fully or partially deployed

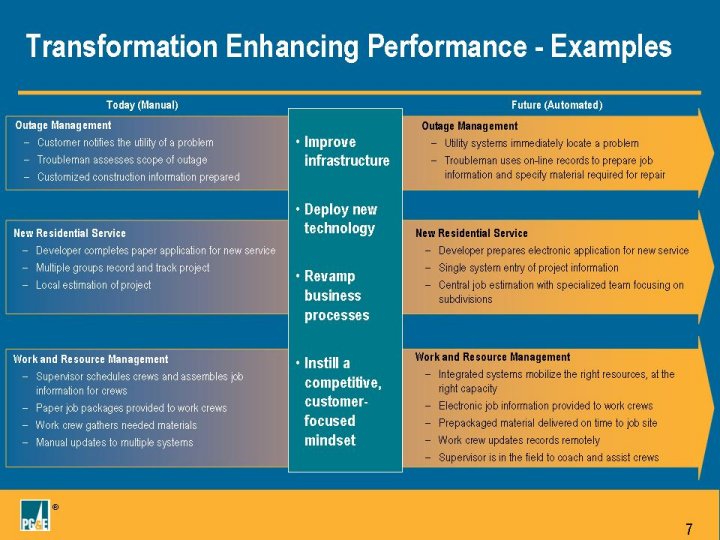

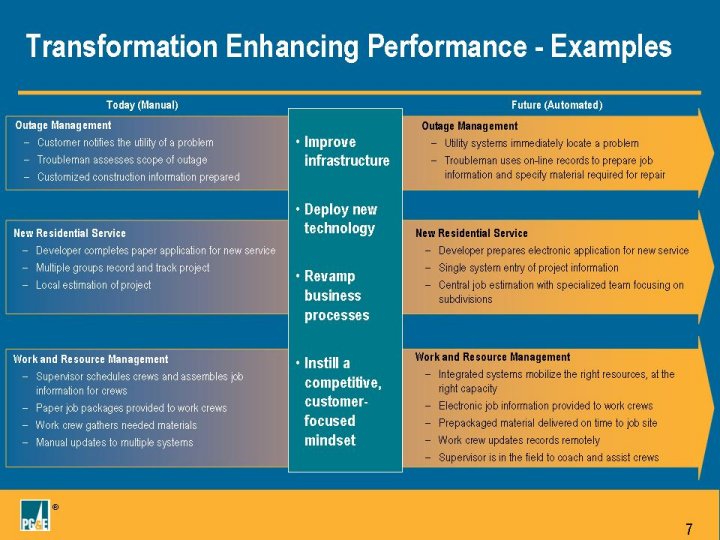

SLIDE 7 Transformation Enhancing Performance - Examples Today (Manual) Outage Management Customer notifies the utility of a problem Troubleman assesses scope of outage Customized construction information prepared New Residential Service Developer completes paper application for new service Multiple groups record and track project Local estimation of project Work and Resource Management Supervisor schedules crews and assembles job information for crews Paper job packages provided to work crews Work crew gathers needed materials Manual updates to multiple systems Improve infrastructure Deploy new technology Revamp business processes Instill a competitive, customer-focused mindset Future (Automated) Outage Management Utility systems immediately locate a problem Troubleman uses on-line records to prepare job information and specify material required for repair New Residential Service Developer prepares electronic application for new service Single system entry of project information Central job estimation with specialized team focusing on subdivisions Work and Resource Management Integrated systems mobilize the right resources, at the right capacity Electronic job information provided to work crews Prepackaged material delivered on time to job site Work crew updates records remotely Supervisor is in the field to coach and assist crews

SLIDE 8 Anticipated Transformation Net Costs and Benefits Expense ($mm) 2006 2007 2008 2009 2010 Net Cost Range 86 115 6 Net Benefit Range -18 -137 -141 -142

SLIDE 9 Operational Performance Metrics 2005 EOY Actual 2006 YTD Actual 2006 YTD Target 2006 EOY Target Overall customer satisfaction (composite of J. D. Power residential and business customer surveys) 94.0 94.5 94.0 96.0 Timely bills (% billed within 35 days) 99.38% 99.53% 99.53% 99.51% Estimate of outage restoration time accuracy (% accurate) 47% 64% 50% 50% System Average Interruption Duration Index (yearly minutes per customer) 178.7 67.6 46.0 166.0 System Average Interruption Frequency Index (yearly interruptions per customer) 1.34 0.43 0.33 1.31 Energy availability 1 (composite of owned generation and procured energy availability) n/a 2.0 1.7 1.5 Telephone service level (% answered within 20 seconds) 75% 76% 73% 76% Expense per customer 2 ($ cost of operations per customer) $278 $75 $74 $283 Diablo Canyon performance index 3 (composite of plant performance metrics) 94.7 95.2 94.9 94.0 Employee Premier Survey index 4 (composite of employee satisfaction Premier survey metrics) 64% n/a n/a 68% Lost workday case rate (lost workday case rate per 100 employees) 1.04 0.47 0.45 0.88 (1) Metric is first applicable in 2006. (2) The reconciliation of non-GAAP cost of operations to operating and maintenance expense can be found in the Appendix and at www.pge-corp.com. (3) 2005 results have been restated to maintain consistency with the actual and target values based on the recently revised industry calculation methodology. (4) Based on an annual survey.

SLIDE 10 2007 GRC Utility requests $433 million revenue requirement (RRQ) increase over the projected authorized 2006 base RRQ. Intervenor Testimony Filed Division of Ratepayer Advocates (DRA) request is approximately $450 M below PG&E’s request. The Utility Reform Network (TURN) request is being analyzed but appears to be at least $500 M below PG&E’s request. Next Steps in the Schedule Hearings scheduled to begin on May 31, 2006 and conclude by July. Briefs and Reply Briefs to be filed July 27 - August 10

SLIDE 11 Capital Expenditure Outlook Capital expenditures average $2.5B per year for years 2006-2010: 2006 2007 2008 2009 2010 Cap Ex 2.5 2.8 2.6 2.4 2.2 Includes capital expenditure estimates for Contra Costa 8, Diablo Canyon Steam Generator Replacement Project, Humboldt Bay Power Plant, and PG&E SmartMeters(AMI)

SLIDE 12 Rate Base Growth 2006 2007 2008 2009 2010 Average Annual Rate Base ($B)* 15.9 17.4 18.6 19.9 20.7 * 2006-2010 rate base is not adjusted for the impact of the carrying cost credit that primarily results from the second series of the Energy Recovery Bonds. Earnings will be reduced by an amount equal to the deferred tax balance associated with the regulatory asset, multiplied by the utility's equity ratio and by its equity return. The carrying cost credit declines to zero when the taxes are fully paid in 2012.

SLIDE 13 Potential Additional Capital Expenditures Potential additional capital expenditures related to the following possible projects are not included in the capital expenditure projections: 657 MW utility-owned generation submitted to the CPUC for approval as part of the Long-Term procurement plan Electric transmission system upgrades and expansion (e.g., Sea Breeze, Tehachapi) Gas transmission system upgrades and expansion

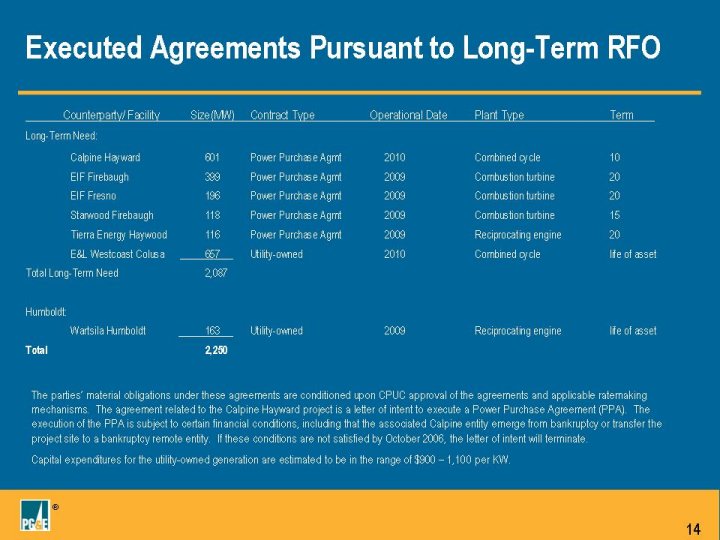

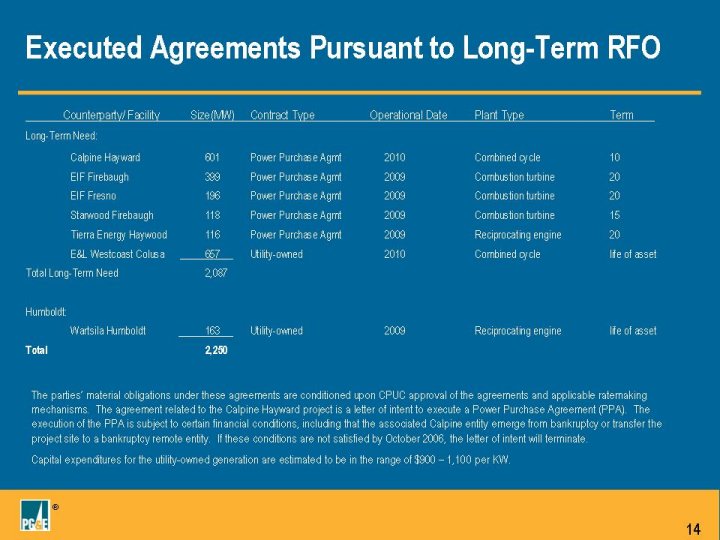

SLIDE 14 Executed Agreements Pursuant to Long-Term RFO Counterparty/ Facility Size(MW) Contract Type Operational Date Plant Type Term Long-Term Need: Calpine Hayward 601 Power Purchase Agmt 2010 Combined cycle 10 EIF Firebaugh 399 Power Purchase Agmt 2009 Combustion turbine 20 EIF Fresno 196 Power Purchase Agmt 2009 Combustion turbine 20 Starwood Firebaugh 118 Power Purchase Agmt 2009 Combustion turbine 15 Tierra Energy Haywood 116 Power Purchase Agmt 2009 Reciprocating engine 20 E&L Westcoast Colusa 657 Utility-owned 2010 Combined cycle life of asset Total Long-Term Need 2,087 Humboldt: Wartsila Humboldt 163 Utility-owned 2009 Reciprocating engine life of asset Total 2,250 The parties’ material obligations under these agreements are conditioned upon CPUC approval of the agreements and applicable ratemaking mechanisms. The agreement related to the Calpine Hayward project is a letter of intent to execute a Power Purchase Agreement (PPA). The execution of the PPA is subject to certain financial conditions, including that the associated Calpine entity emerge from bankruptcy or transfer the project site to a bankruptcy remote entity. If these conditions are not satisfied by October 2006, the letter of intent will terminate. Capital expenditures for the utility-owned generation are estimated to be in the range of $900 - 1,100 per KW.

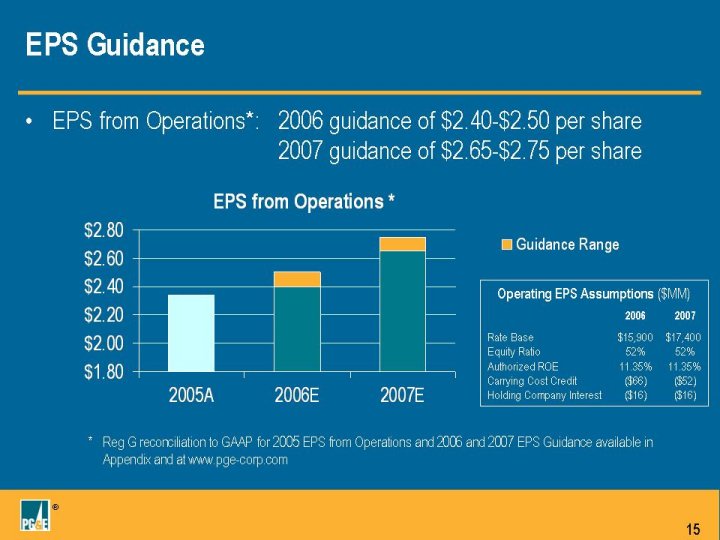

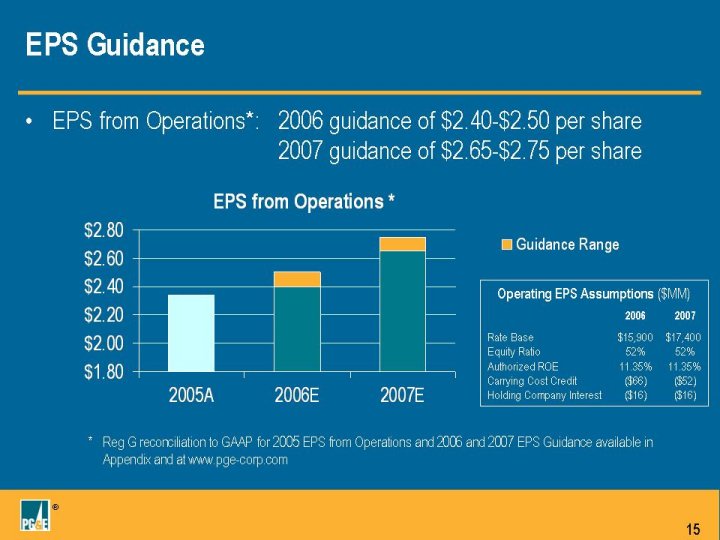

SLIDE 15 EPS Guidance EPS from Operations*: 2006 guidance of $2.40-$2.50 per share 2007 guidance of $2.65-$2.75 per share 2005A 2006E 2007E Low 2.4 2.65 Guidance Range 0.1 0.1 Actual 2.34 Operating EPS Assumptions ($MM) 2006 2007 Rate Base $15,900 $17,400 Equity Ratio 52% 52% Authorized ROE 11.35% 11.35% Carrying Cost Credit ($66) ($52) Holding Company Interest ($16) ($16) * Reg G reconciliation to GAAP for 2005 EPS from Operations and 2006 and 2007 EPS Guidance available in Appendix and at www.pge-corp.com

SLIDE 16 EPS Growth EPS from operations growth targeted to average approximately 7.5% annually 2006-2010 Places us near the top of comparable companies Actual growth rate will depend on infrastructure investments Five-Year Estimated Earnings Growth PCG AEE AEP CNP ED ETR FPL NI PNW PGN SO TE XEL Earnings Estimate 0.075 0.06 0.03 0.07 0.04 0.07 0.06 0.03 0.07 0.04 0.05 0.06 0.04 Source for comparator companies: Zacks Investment Research, Inc. survey of analyst estimates (April 28, 2006).

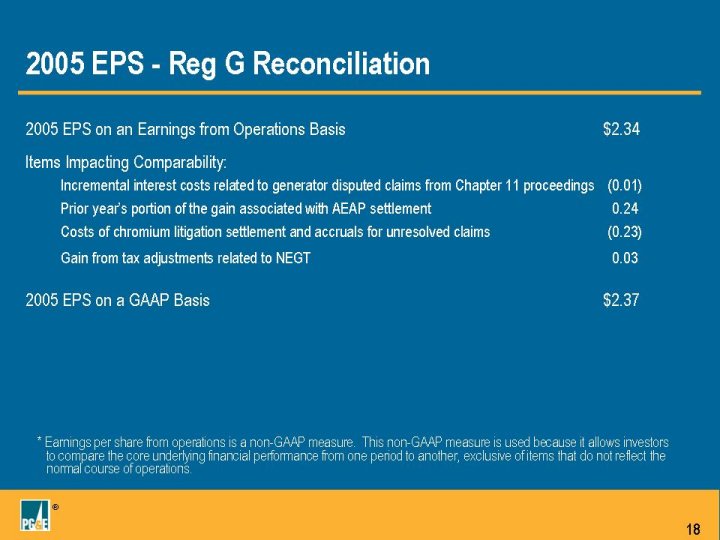

SLIDE 18 2005 EPS - Reg G Reconciliation 2005 EPS on an Earnings from Operations Basis $2.34 Items Impacting Comparability: Incremental interest costs related to generator disputed claims from Chapter 11 proceedings (0.01) Prior year’s portion of the gain associated with AEAP settlement 0.24 Costs of chromium litigation settlement and accruals for unresolved claims (0.23) Gain from tax adjustments related to NEGT 0.03 2005 EPS on a GAAP Basis $2.37 * Earnings per share from operations is a non-GAAP measure. This non-GAAP measure is used because it allows investors to compare the core underlying financial performance from one period to another, exclusive of items that do not reflect the normal course of operations.

SLIDE 19 EPS Guidance - Reg G Reconciliation 2006 Low High EPS Guidance on an Earnings from Operations Basis* $2.40 $2.50 Estimated Items Impacting Comparability 0.00 0.00 EPS Guidance on a GAAP Basis $2.40 $2.50 2007 Low High EPS Guidance on an Earnings from Operations Basis* $2.65 $2.75 Estimated Items Impacting Comparability 0.00 0.00 EPS Guidance on a GAAP Basis $2.65 $2.75 Earnings per share from operations is a non-GAAP measure. This non-GAAP measure is used because it allows investors to compare the core underlying financial performance from one period to another, exclusive of items that do not reflect the normal course of operations.

SLIDE 20 Cost of Operations - Reg G Reconciliation The reconciliation of non-GAAP cost of operations to Operating and Maintenance Expense is: 2005 2006 2006 2006 EOY Actual YTD Actual YTD Target EOY Target External GAAP Operating and Maintenance Expense $3,399 $862 $871 $3,552 Public Purpose and Other Balancing Account Programs (360) (90) (99) (568) Property Taxes (172) (44) (45) (184) Franchise Fees & Uncollectible Expense (123) (31) (44) (171) Chromium Litigation (154) - - - Other (50) - - - Cost of Operations $2,540 $697 $683 $2,629 Cost of Operations/9.3M Customers $278 $75 $74 $283 * Total expense per customer is a non-GAAP measure. This non-GAAP measure is used because it is an indicator of overall efficiency and productivity in delivering energy to PG&E customers.

SLIDE 21 Definitions of Operational Performance Metrics Overall Customer Satisfaction. PG&E measures residential and business customer satisfaction with annual industry wide surveys conducted by J.D. Power and Associates, as well as with proprietary studies using the same survey in intervening quarters. The overall customer satisfaction metric represents the year-to-date average of the residential and business overall customer satisfaction scores from both the J.D. Powers-administered and proprietary surveys. The metric is calculated by first averaging the available residential and business satisfaction scores (each with 50% weighting) in each quarter and then averaging all available quarterly composite scores for the final year-to-date metric value. Timely Bills. Measures the percentage of bills that have been issued timely to customers (i.e., within 35 days of the last scheduled meter read). Estimated Time of Outage Restoration Accuracy. The percentage of outage occurrences, weighted by customers affected, where the majority of customers have been given accurate outage duration information in the early stages of an outage. If the actual time of outage restoration does not occur within the two-hour window given to customers, the measure is considered “missed” for the customers affected by that outage. System Average Interruption Duration Index. SAIDI is an indicator of system reliability that measures the average outage time (in minutes) that a customer experiences in a year (Total customer interruption durations/ Total number of customer served). System Average Interruption Frequency Index. SAIFI is an indicator of system reliability that measures the average number of interruptions that a customer experiences in a year (Total number of customer interruptions/ Total number of customers served) Combined Energy Availability. Comprised of two, equally-weighted principal components: a generation availability (GA) component and an energy procurement (EP) component, expressed on a scale of 0 to 2 (with 2 representing the greatest energy availability). The GA component is the annual average percentage of PG&E’s total hydroelectric, fossil (excluding Hunters Point) and nuclear generation capacity that is physically capable of producing power. The GA component captures losses of capacity attributed to equipment failures or planned maintenance, including transmission-related events which constrain generation output. The 0.5 to 2 scale for the GA component spans between 83.57% and 89.57% availability. The EP component measures whether sufficient resources are in place to meet load requirements and to maximize the availability of ancillary services to the CAISO in order for the CAISO to maintain system reliability and to minimize the frequency of CAISO stage alerts in PG&E’s service area. The Combined Energy Availability score could be impacted by either the EP component or the GA component

SLIDE 22 Definitions of Operational Performance Metrics (continued) Telephone Service Level. Measures the percent of customer calls that have been either (1) completed by automated voice response systems for self-service, or (2) answered in 20 seconds or less by customer service representatives. Total Expense per Customer. Measures the average annual cost of operations per customer and includes all budget expense items, including business unit and corporate service department expenses, casualty, benefits, severance, and insurance. This metric excludes capital-related costs such as depreciation and interest, and the commodity costs of gas and electricity. The denominator is defined as the total average number of active gas and electric customer accounts for the year. This metric is an indicator of overall efficiency and productivity in delivering energy to PG&E customers. Diablo Canyon Composite Performance Index. Performance Index is intended to provide a quantitative indication of plant performance in the areas of nuclear plant safety and reliability, and plant efficiency. Employee Premier Survey Index. Provides a comprehensive indicator of employee satisfaction that is derived by averaging the percentage of favorable responses from all 40 core survey items within the Premier survey. Lost Workday Case Rate. Measures the number of non-fatal injury and illness cases that (1) satisfy OSHA requirements for recordability, (2) occur in the current year, and (3) result in at least one day away from work. The rate measures how frequently new lost workday cases occur for every 200,000 hours worked, or for approximately every 100 employees.

SLIDE 23 Key Pending Regulatory Proceedings Pending approval Completion of CC8 Decision expected Q2 2006 Advanced Metering Infrastructure Decision expected 7/06 2007 GRC Decision expected 12/06 Electric Transmission Owner 8 Settlement Decision expected Q3 2006 Generation LT RFO & Humboldt Bay PP Decision expected end of 2006 Cost of Capital Waiver Application Decision expected Q3 2006 Pending investigation Billing and Collection OII Decision expected Q4 2006 Anticipated filings Gas Transmission rates (post 2007) Filing expected late 2006

SLIDE 24 Expected 2007 GRC Timeline File Application Filed on December 2, 2005 Prehearing Conference Held on January 23, 2006 Intervenor testimony April 28 Evidentiary hearings May 31 - July 7 Briefs and reply briefs July 27 - August 10 ALJ proposed decision November 14 Final commission order December 14 Proposed Performance Incentive Mechanism will be handled in a separate phase, with a decision in April 2007.