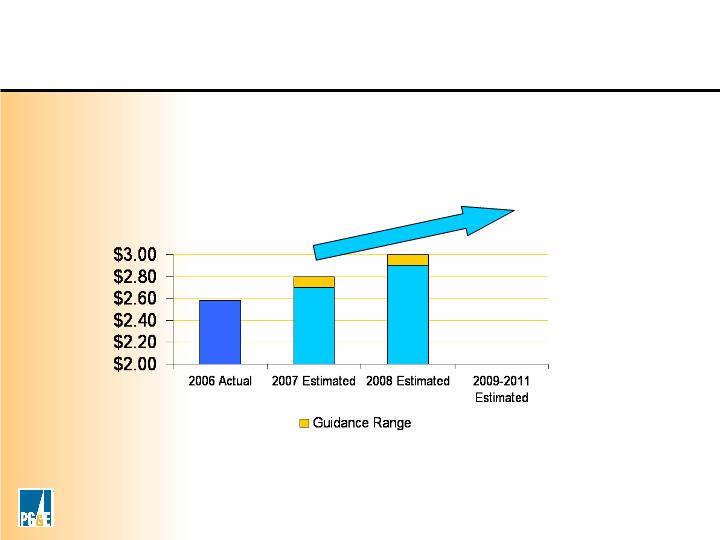

This presentation contains forward-looking statements regarding management’s guidance for PG&E Corporation’s 2007 and 2008 earnings per share from operations, targeted

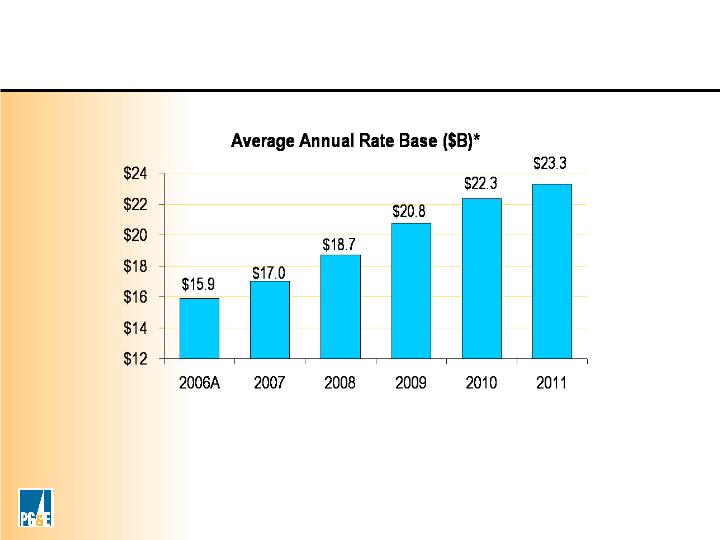

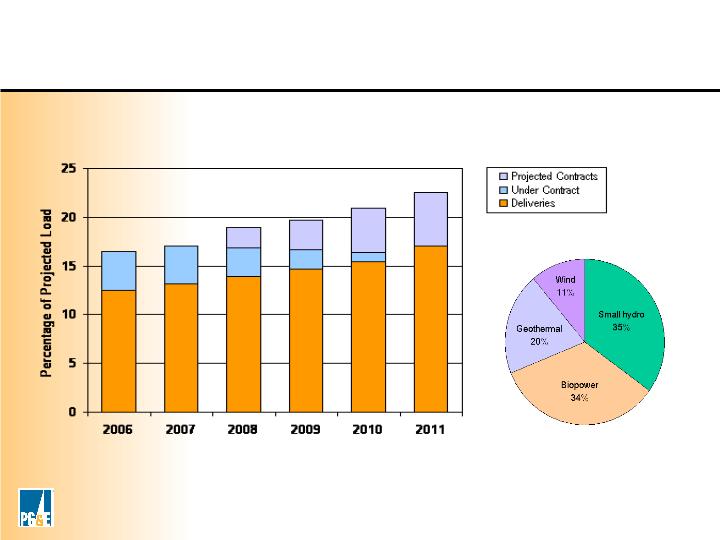

average annual growth rate for earnings per share from operations, anticipated dividend growth, as well as management’s projections regarding Pacific Gas and Electric

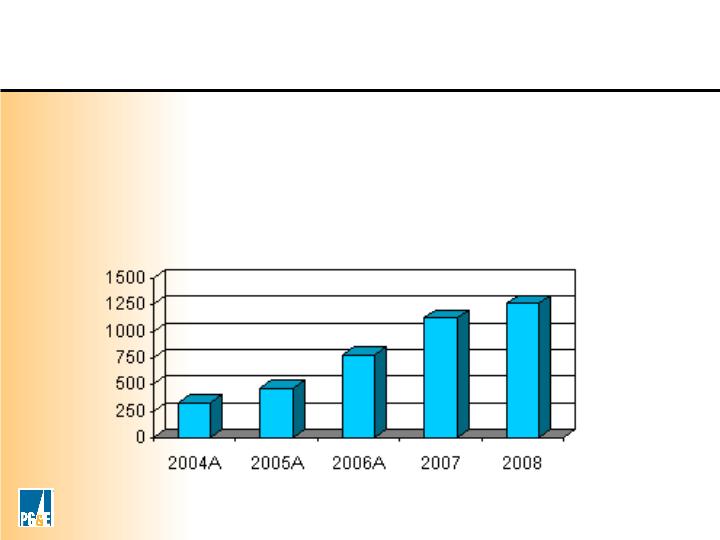

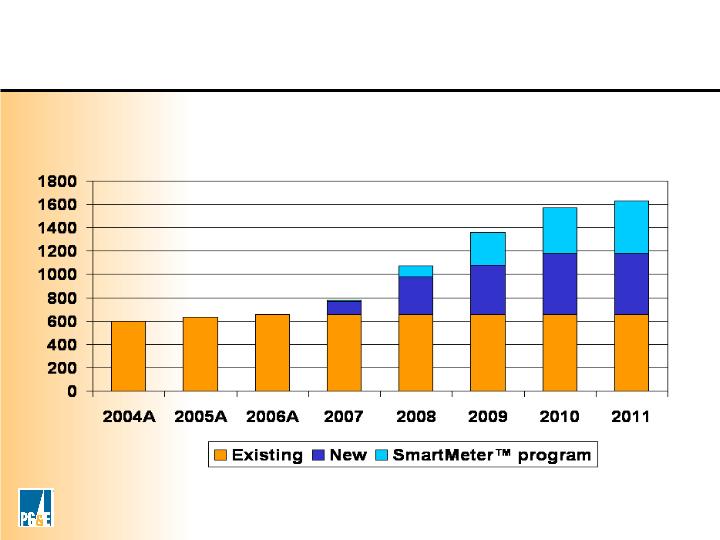

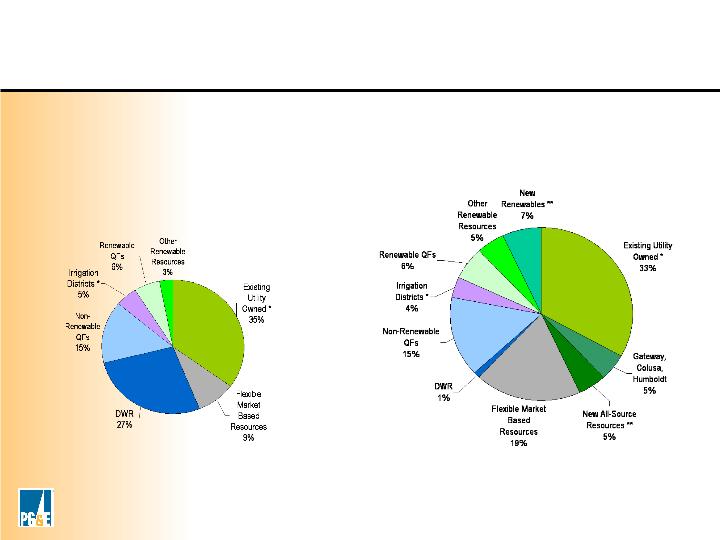

Company’s (Utility) capital expenditures, rate base and rate base growth, future electricity resources, and energy efficiency funding levels. These statements are based on

current expectations and various assumptions which management believes are reasonable, including that substantial capital investments are made in Utility business over the

2007-2011 period, Utility rate base averages $17 billion in 2007 and $18.7 billion in 2008, that the Utility earns at least its authorized rate of return on equity, and that theUtility’s ratemaking capital structure is maintained at 52 percent equity. These statements and assumptions are necessarily subject to various risks and uncertainties, the

realization or resolution of which are outside of management's control. Actual results may differ materially. Factors that could cause actual results to differ materially include:

•

Utility’s ability to timely recover costs through rates;

•

the outcome of regulatory proceedings, including ratemaking proceedings pending at the California Public Utilities Commission (CPUC) and the Federal Energy Regulatory

Commission;

•

the adequacy and price of electricity and natural gas supplies, and the ability of the Utility to manage and respond to the volatility of the electricity and natural gas markets;

•

the effect of weather, storms, earthquakes, fires, floods, disease, other natural disasters, explosions, accidents, mechanical breakdowns, acts of terrorism, and other events or

hazards that could affect the Utility’s facilities and operations, its customers, and third parties on which the Utility relies;

•

the potential impacts of climate change on the Utility’s electricity and natural gas business;

•

changes in customer demand for electricity and natural gas resulting from unanticipated population growth or decline, general economic and financial market conditions,

changes in technology including the development of alternative energy sources, or other reasons;

•

operating performance of the Utility’s Diablo Canyon nuclear generating facilities (Diablo Canyon), the occurrence of unplanned outages at Diablo Canyon, or the temporary

or permanent cessation of operations at Diablo Canyon;

•

the ability of the Utility to recognize benefits from its initiatives to improve its business processes and customer service;

•

the ability of the Utility to timely complete its planned capital investment projects;

•

the impact of changes in federal or state laws, or their interpretation, on energy policy and the regulation of utilities and their holding companies;

•

the impact of changing wholesale electric or gas market rules, including the California Independent System Operator’s new rules to restructure the California wholesale

electricity market;

•

how the CPUC administers the conditions imposed on PG&E Corporation when it became the Utility’s holding company;

•

the extent to which PG&E Corporation or the Utility incur costs and liabilities in connection with pending litigation that are not recoverable through rates, from third parties, or

through insurance recoveries;

•

thee ability of PG&E Corporation and/or the Utility to access capital markets and other sources of credit;

•

the impact of environmental laws and regulations and the costs of compliance and remediation;

•

the effect of municipalization, direct access, community choice aggregation, or other forms of bypass, and

•

other risks and factors disclosed in PG&E Corporation’s and Pacific Gas and Electric Company’s SEC reports.

Cautionary Statement Regarding Forward-Looking

Information