2

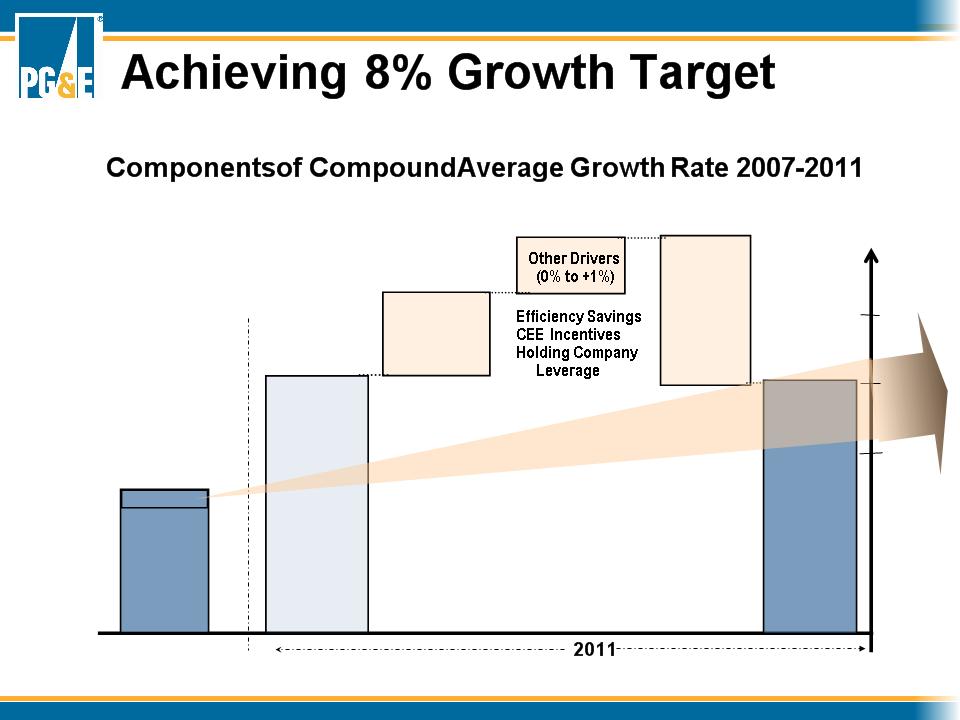

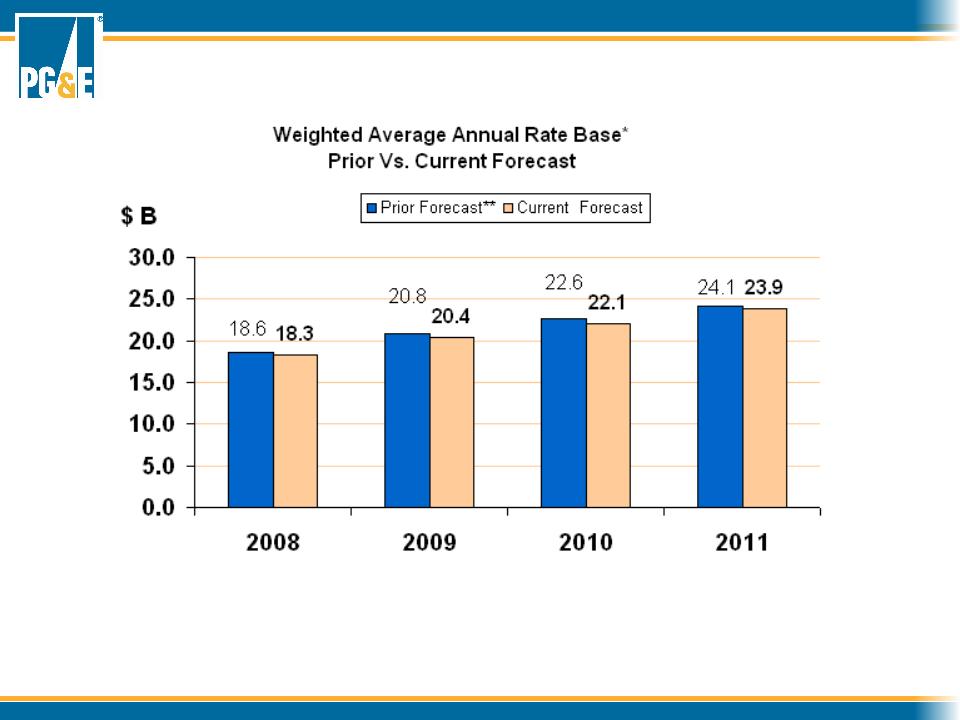

This presentation contains forward-looking statements regarding management’s guidance for PG&E Corporation’s 2008 and 2009 earnings per share from operations,

targeted compound average growth rate for earnings per share from operations over the 2007-2011 outlook period, as well as management’s projections regarding

Pacific Gas and Electric Company’s (Utility) capital expenditures, rate base and rate base growth. These statements are based on current expectations which

management believes are reasonable including that the Utility’s rate base averages $18.2 billion in 2008 and $20.3 billion in 2009, that the Utility earns at least its

authorized rate of return on equity, that the Utility’s ratemaking capital structure is maintained at 52 percent equity, and that the Utility is successful in implementing its

initiatives to become more efficient and reduce costs. Actual results may differ materially. Factors that could cause actual results to differ materially include:

§ the Utility’s ability to manage capital expenditures and operating costs within authorized levels and recover costs through rates in a timely manner;

§ the outcome of regulatory proceedings, including pending and future ratemaking proceedings at the California Public Utilities Commission (CPUC) and

the Federal Energy Regulatory Commission;

§ the adequacy and price of electricity and natural gas supplies, and the ability of the Utility to manage and respond to the volatility of the electricity and

natural gas markets;

§ the effect of weather, storms, earthquakes, fires, floods, disease, other natural disasters, explosions, accidents, mechanical breakdowns, acts of

terrorism, and other events or hazards on the Utility’s facilities and operations, its customers, and third parties on which the Utility relies;

§ the potential impacts of climate change on the Utility’s electricity and natural gas business;

§ changes in customer demand for electricity and natural gas resulting from unanticipated population growth or decline, general economic and financial

market conditions, changes in technology including the development of alternative energy sources, or other reasons;

§ operating performance of the Utility’s Diablo Canyon nuclear generating facilities (Diablo Canyon), the occurrence of unplanned outages at Diablo

Canyon, or the temporary or permanent cessation of operations at Diablo Canyon;

§ whether the Utility is able to maintain the cost efficiencies it has recognized from the completed initiatives to improve its business processes and

customer service, and identify and successfully implement additional cost saving measures;

§ whether the Utility incurs substantial unanticipated expense to improve the safety and reliability of its electric and natural gas systems;

§ whether the Utility is able to achieve the CPUC’s energy efficiency targets and timely recognize any incentives the Utility may earn;

§ the impact of changes in federal or state laws, or their interpretation, on energy policy and the regulation of utilities and their holding companies;

§ the impact of changing wholesale electric or gas market rules, including the California Independent System Operator’s new rules to restructure the

California wholesale electricity market;

§ how the CPUC administers the conditions imposed on PG&E Corporation when it became the Utility’s holding company;

§ the extent to which PG&E Corporation or the Utility incurs costs and liabilities in connection with litigation that are not recoverable through rates, from

third parties, or through insurance recoveries;

§ the ability of PG&E Corporation and/or the Utility to access capital markets and other sources of credit in a timely manner on favorable terms;

§ the impact of environmental laws and regulations and the costs of compliance and remediation;

§ the effect of municipalization, direct access, community choice aggregation, or other forms of bypass;

§ the impact of changes in federal or state tax laws, policies or regulations; and

§ other risks and factors disclosed in PG&E Corporation’s and the Utility’s 2007 Annual Report on Form 10-K and other reports filed with the SEC.

Cautionary Language Regarding

Forward-Looking Statements