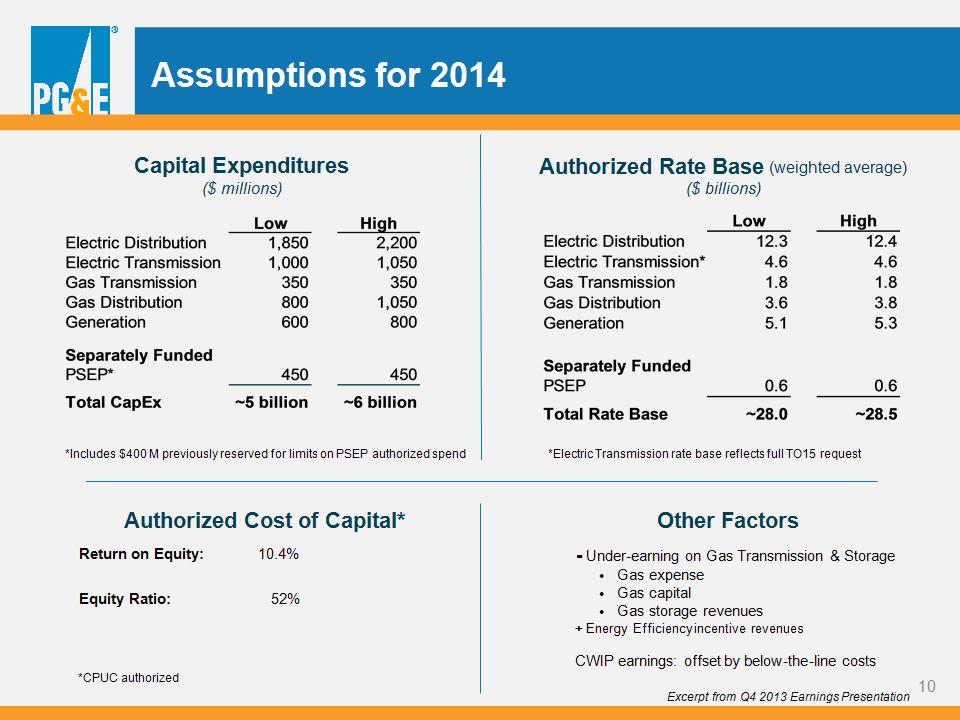

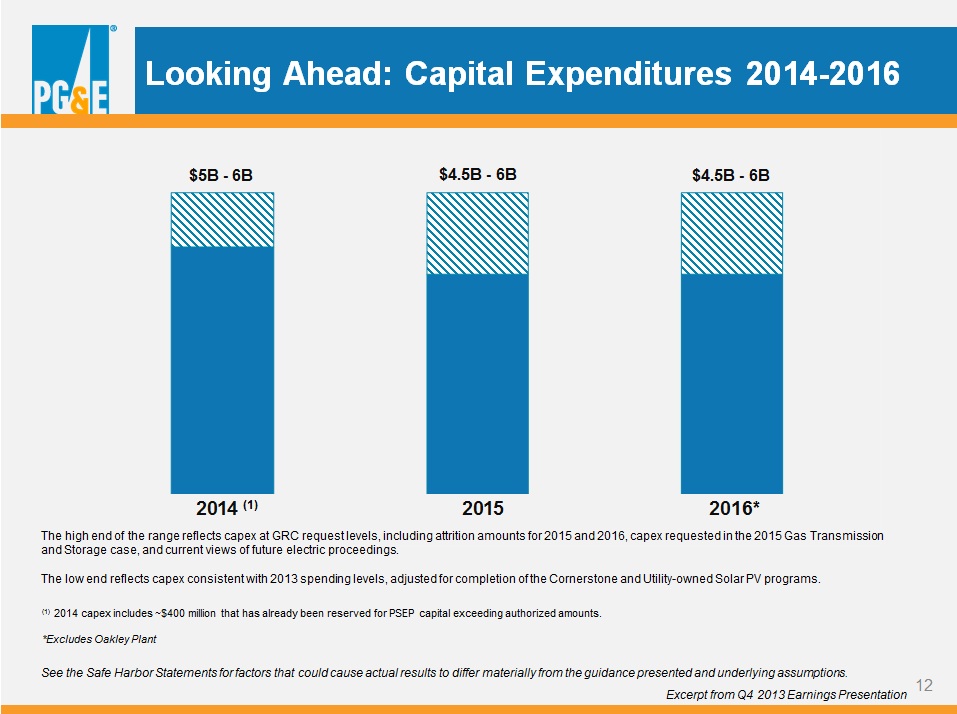

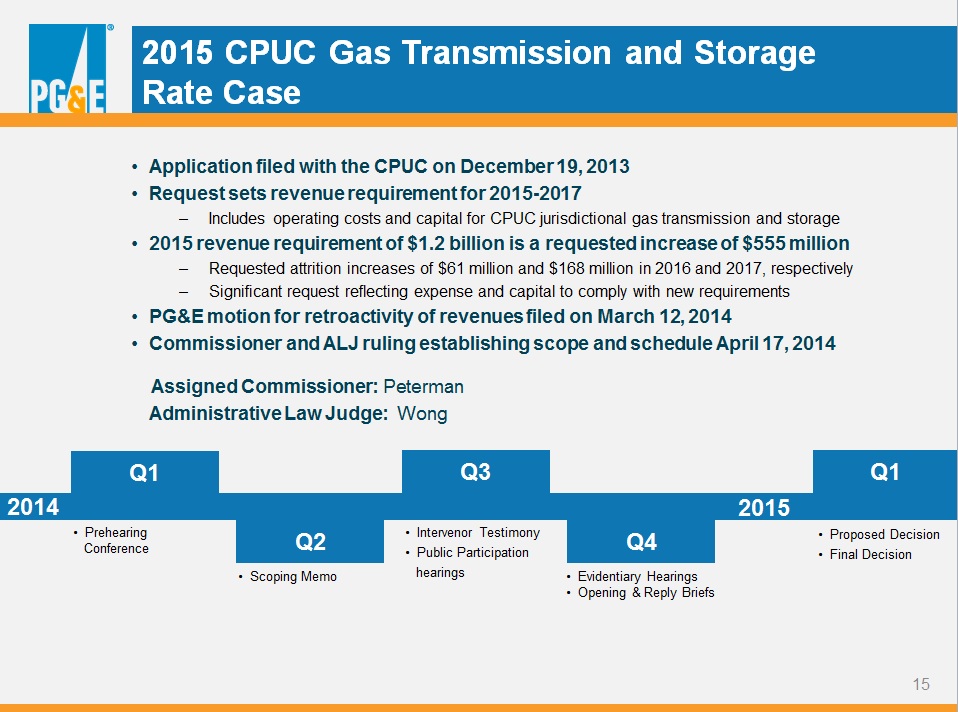

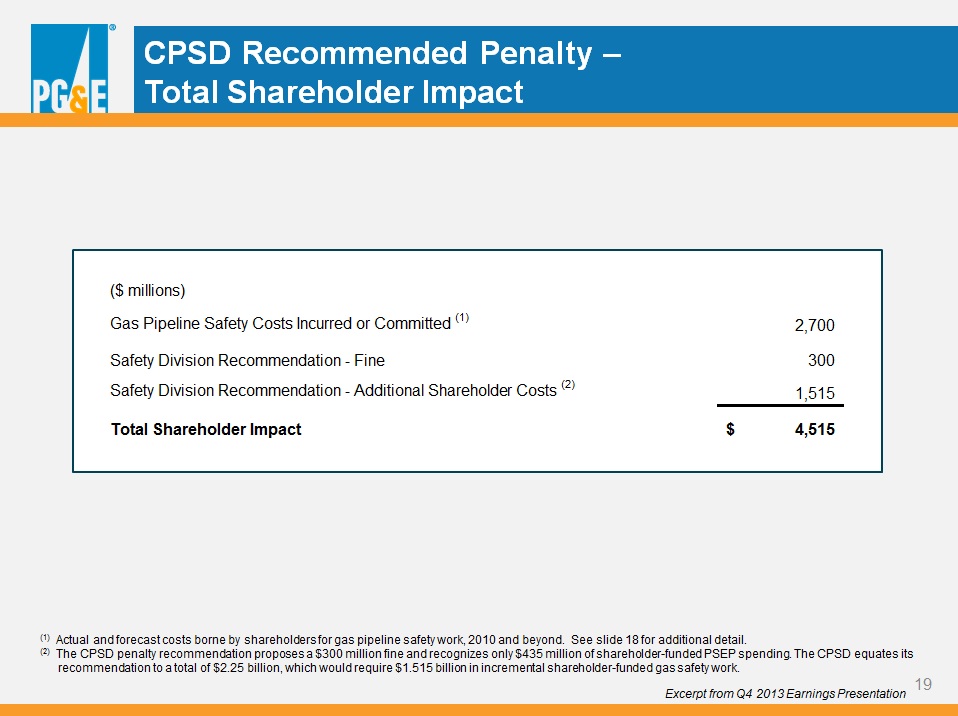

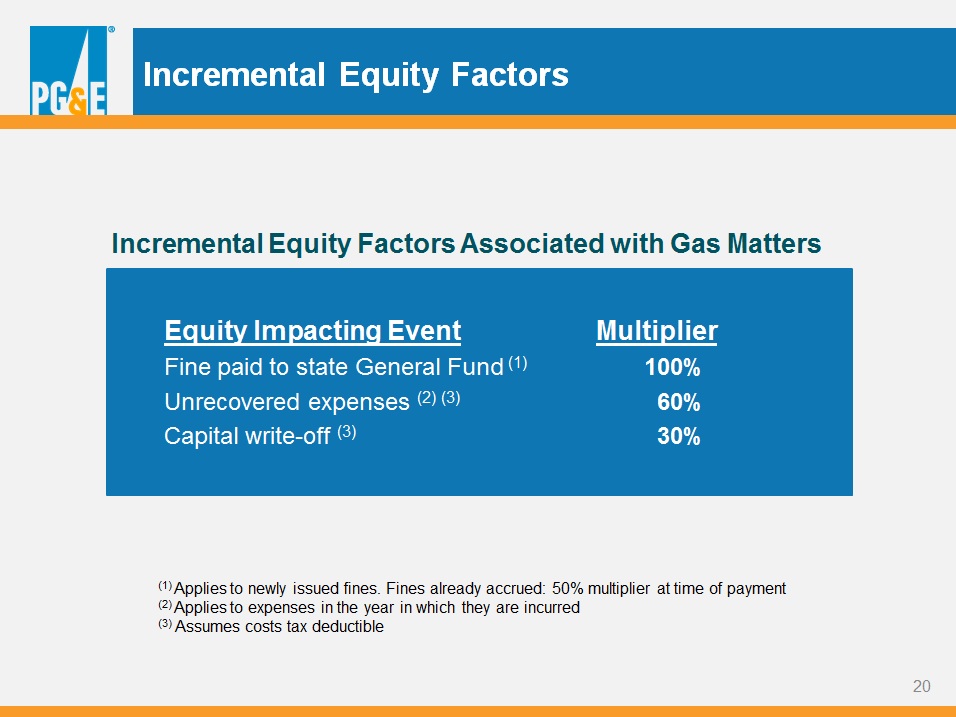

CONFIDENTIAL DRAFT * Safe Harbor Statements Management’s statements and assumptions regarding the estimated ranges of pipeline-related expenses, capital expenditures, rate base, costs, equity issuances, general earnings sensitivities, and other factors that can affect PG&E Corporation’s 2014 financial results, constitute forward-looking statements that are necessarily subject to various risks and uncertainties. These statements reflect management’s judgment and opinions which are based on current expectations and various forecasts, estimates, and projections, the realization or resolution of which may be outside of management’s control. PG&E Corporation and Pacific Gas and Electric Company (“Utility”) are not able to predict all the factors that may affect future results. Some of the factors that could cause actual results to differ materially include: when and how the pending CPUC investigations and enforcement matters related to the Utility’s natural gas system operating practices and the San Bruno accident are concluded, including the ultimate amount of fines the Utility will be required to pay to the State General Fund, the ultimate amount of pipeline-related costs the Utility will not recover through rates; whether the CPUC appoints a monitor to oversee the Utility’s natural gas operations; and the cost of any remedial actions the Utility may be ordered to perform; developments that may occur in the federal criminal prosecution of the Utility for alleged violations of the Natural Gas Pipeline Safety Act, including whether federal prosecutors seek a superseding indictment to bring additional charges or fines against the Utility and whether the Utility is convicted and the amount of any criminal fines or penalties imposed, or whether additional investigations are commenced relating to the Utility’s natural gas operating practices or specific incidents; whether PG&E Corporation and the Utility are able to repair the reputational harm that they have suffered, and may suffer in the future, due to the negative publicity about the San Bruno accident, the CPUC investigations and their final outcomes, the federal criminal prosecution of the Utility and its final outcome, and the ongoing work to remove encroachments from transmission pipeline rights-of-way; the outcomes of pending ratemaking proceedings and whether the cost and revenue forecasts assumed in such outcomes prove to be accurate; higher electricity procurement costs and whether the Utility is able to recover such higher costs timely; the amount and timing of additional common stock issuances by PG&E Corporation, the proceeds of which are contributed as equity to maintain the Utility’s authorized capital structure as the Utility incurs charges and costs that it cannot recover through rates, including costs and fines associated with natural gas matters and the pending investigations; the ability of PG&E Corporation and the Utility to access capital markets and other sources of debt and equity financing in a timely manner on acceptable terms; changes in credit ratings which could result in increased borrowing costs especially if PG&E Corporation or the Utility were to lose its investment grade credit ratings; the impact of federal or state laws or regulations, or their interpretation, on energy policy and the regulation of utilities and their holding companies, including how the CPUC interprets and enforces the financial and other conditions imposed on PG&E Corporation when it became the Utility’s holding company, and whether the ultimate outcome of the pending investigations relating to the Utility’s natural gas operations affects the Utility’s ability to make distributions to PG&E Corporation, and, in turn, PG&E Corporation’s ability to pay dividends; the outcome of federal or state tax audits and the impact of any changes in federal or state tax laws, policies, regulations, or their interpretation; the impact of changes in GAAP, standards, rules, or policies, including those related to regulatory accounting, and the impact of changes in their interpretation or application; and the other factors disclosed in PG&E Corporation’s and the Utility’s joint 2013 Annual Report and Quarterly Report on Form 10-Q for the quarter ended March 31, 2014. This presentation is not complete without the accompanying statements made by management during the webcast conference call held on May 1, 2014. This presentation, including Appendices, and the accompanying press release were attached to PG&E Corporation’s Current Report on Form 8-K that was furnished to the Securities and Exchange Commission on May 1, 2014 and, along with the replay of the conference call, is also available on PG&E Corporation’s website at www.pge-corp.com.